Supporting Statement A Petroleum Marketing Program July2019

Supporting Statement A Petroleum Marketing Program July2019.docx

Petroleum Marketing Program

OMB: 1905-0174

Supporting Statement for Petroleum Marketing Program

Part A: Justification

Form EIA-14, Refiners’

Monthly Cost Report Form

EIA-182, Domestic Crude Oil First Purchase Report

Form

EIA-782A, Refiners’/Gas Plant Operators’ Monthly

Petroleum Product Sales Report

Form

EIA-782C, Monthly Report of Prime Supplier Sales of Petroleum

Products Sold for Local Consumption

Form

EIA-821, Annual Fuel Oil and Kerosene Sales Report

Form

EIA-856, Monthly Foreign Crude Oil Acquisition Report

Form

EIA-863, Petroleum Product Sales Identification Survey

Form

EIA-877, Winter Heating Fuels Telephone Survey

Form

EIA-878, Motor Gasoline Price Survey

Form

EIA-888, On-Highway Diesel Fuel Price Survey

July

2019

Independent

Statistics & Analysis www.eia.gov

U.S.

Department of Energy Washington,

DC 20585

Table of Contents

Background on Petroleum Marketing Program (PMP) 1

Crude Oil Acquisition Costs and Volumes Acquired 3

Petroleum Product Prices and Sales Volumes 3

End-User Prices for Petroleum Products 4

Companies Engaged in Petroleum Product Sales 4

Uses of Data in Recurring EIA Publications 5

Fuel Oil and Kerosene Sales (FOKS) 5

International Energy Outlook (IEO) 5

A.2.1. Overview of Data Uses 7

A.2.2. Overview of Data Collections 8

A.2.2.1. Individual Form Data Uses and Modifications 8

A.2.2.2. Federal Agency Data Users 9

A.2.2.3. State Agency Data Users 11

A.2.2.4 Details on the Use and Purpose for Each Form 12

A.2.2.4.1 Monthly Crude Oil Surveys (EIA-14, EIA-182, and EIA-856) 12

A.2.2.4.2 Monthly Petroleum Product Survey (EIA-782A and EIA-782C) 15

A.2.2.4.3 Annual Petroleum Product Survey (EIA-821) 17

A.2.2.4.4 Weekly Petroleum Product Survey (EIA-877, EIA-878, and EIA-888) 18

A.2.2.4.5 Petroleum Marketing Frame (EIA-863) 21

A.4. Efforts to Identify Duplication 22

A.4.1. Analysis of Similar Existing Information 22

A.4.1.1 Monthly Crude Oil Surveys (EIA-14, EIA-182, and EIA-856) 23

A.4.1.2 Monthly Petroleum Product Surveys (EIA-782A and EIA-782C) 25

A.4.1.3 Annual Fuel Oil and Kerosene Sales Report (EIA-821) 26

A.4.1.4 Weekly Petroleum Product Surveys (EIA-877, EIA-878, and EIA-888) 27

Assessment of Data Quality in Third-Party Data 28

Station-level research results 29

Point-in-Time analysis comparing EIA-878, OPIS, and GasBuddy 29

A.4.2. Inadequacies of Similar Data 30

A.5. Provisions for Reducing Burden on Small Businesses 31

A.6. Consequences of Less-Frequent Reporting 32

A.7. Compliance with 5 CFR 1320.5 33

A.8. Summary of Consultations Outside of the Agency 33

A.9. Payments or Gifts to Respondents 34

A.10. Provisions for Protection of Information 34

A.11. Justification for Sensitive Questions 35

A.12. Estimate of Respondent Burden Hours and Cost 36

A.13. Annual Cost to the Federal Government 36

A.15. Reasons for Changes in Burden 38

A.16. Collection, Tabulation, and Publication Plans 38

A.17. OMB Number and Expiration Date 39

A.18. Certification Statement 39

Introduction

The U.S. Energy Information Administration (EIA) is the statistical and analytical agency within the Department of Energy (DOE). The EIA mission is to collect, analyze, and disseminate independent and impartial energy information to promote sound policymaking, efficient markets, and public understanding of energy and its interaction with the economy and the environment. EIA is the Nation’s premier source of energy information and, by law, its data, analyses, and forecasts are independent of approval by any other officer or employee of the United States Government. EIA conducts a relevant, reliable, and timely data collection program that covers the full spectrum of energy sources, end uses, and energy flows; generates short- and long-term domestic and international energy projections; and performs informative energy analyses. EIA communicates its statistical and analytical products primarily through its website and customer contact center.

To meet this obligation, EIA’s Office of Petroleum and Biofuels Statistics (PBS) Petroleum Marketing Statistics Team conducts surveys that collect information about petroleum marketing industry activities from entities marketing crude oil and petroleum products. EIA is requesting a 3-year extension with changes for ten surveys designed to collect this information. The only changes to this ICR are as follows:

Form EIA-863, “Petroleum Product Sales Identification Survey” – Expanding the frame file to include individually-owned retail outlets. No change to the form.

Form EIA-877, “Winter Heating Fuels Telephone Survey” – Protect price data under the Confidential Information Protection and Statistical Efficiency Act of 2018 (CIPSEA). Reselect the propane and heating oil samples from newly constructed frames.

Table A1: Petroleum Marketing Program (PMP) Data Collection Forms

Form EIA-14 |

Refiners’ Monthly Cost Report |

Form EIA-182 |

Domestic Crude Oil First Purchase Report |

Form EIA-782A |

Refiners’/Gas Plant Operators’ Monthly Petroleum Product Sales Report |

Form EIA‑782C |

Monthly Report of Prime Supplier Sales of Petroleum Products Sold for Local Consumption |

Form EIA‑821 |

Annual Fuel Oil and Kerosene Sales Report |

Form EIA‑856 |

Monthly Foreign Crude Oil Acquisition Report |

Form EIA‑863 |

Petroleum Product Sales Identification Survey |

Form EIA-877 |

Winter Heating Fuels Telephone Survey |

Form EIA-878 |

Motor Gasoline Price Survey |

Form EIA-888 |

On-Highway Diesel Fuel Price Survey |

The information collection in this supporting statement has been reviewed in light of applicable Information Quality Guidelines. It has been determined that the information will be collected, maintained, and used in a manner consistent with the Office of Management and Budget (OMB) and DOE’s Information Quality Guidelines.

Background on Petroleum Marketing Program (PMP)

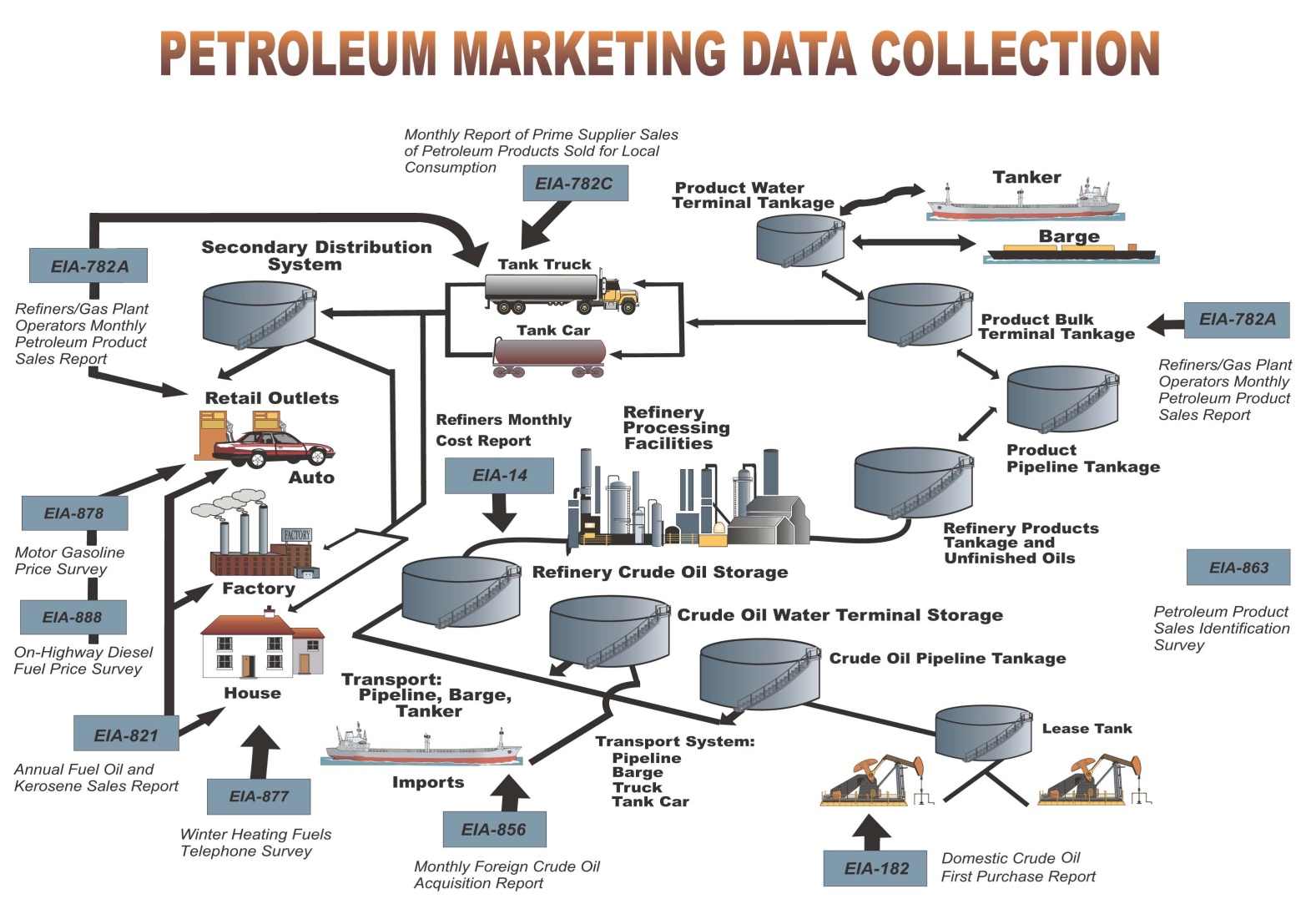

The

Petroleum Marketing Program (PMP) collects and publishes data on the

nature, structure, and efficiency of petroleum markets at the

national, regional, and state levels. The following diagram displays

the points of data collection in the petroleum distribution chain for

the surveys in the PMP. Through integration of ten surveys, EIA

monitors petroleum volumes and prices as the commodity moves through

the various stages from acquisition or importation of the crude oil

to refining to create the finished petroleum products that are sold

either in wholesale markets or through retail outlets directly to the

consumers. The

program conducts three sub-groups of surveys. Each of these groups of

surveys has its own sampling frame. The

Petroleum Marketing Data Collection diagram illustrates the

relationships across the surveys from upstream processing of crude

oil to the downstream marketing of the refined petroleum products.

There are three weekly surveys, five monthly surveys, one annual

survey, and one quadrennial survey. These surveys collect information

on the processes and uses of the petroleum products within all

segments of the upstream and downstream markets.

These ten surveys represent four sub-groups:

The first sub-group of surveys includes Forms EIA-14, EIA-182, and EIA-856. These surveys collect data on crude oil acquisition costs and crude oil volumes from first purchasers, importers and refiners.

The second sub-group of surveys includes Forms EIA-782A, EIA-782C, and EIA-821. These surveys collect data on refined petroleum product sales volumes and/or prices from refiners, importers, and petroleum product distributors at the end-use sector level.

The third sub-group of surveys includes Forms EIA-877, EIA-878, and EIA-888. These three telephone weekly surveys collect retail price data for No. 2 heating oil, propane, finished motor gasoline and low-sulfur on-highway No. 2 diesel fuels. The data reported on the three weekly surveys are point-in-time estimates. More information is available about these point-in-time estimates in Supporting Statement Part B.

Form EIA-863 collects size, sales type (wholesale and retail), and location data on companies engaged in sales of No. 2 distillate, finished motor gasoline, residual fuel, and propane. This survey is the sampling frame for several surveys in the Petroleum Marketing Program including Forms EIA-821 and EIA-877. It also supports the sample designs for Forms EIA-878 and EIA-888 by providing a measure of size and distribution of firms that have retail sales of gasoline and diesel fuel.

Crude Oil Acquisition Costs and Volumes Acquired

The Refiners’ Monthly Cost Report (Form EIA-14) is a mandatory monthly census of firms who own or control refining operations in the United States and its territories/possessions. Firms report the total volume of crude oil acquired in thousands of barrels during the month and all costs associated with its acquisition and transport to the refinery in thousands of dollars. Data are reported by Petroleum Administration for Defense Districts (PADD) for all domestic and imported crude oil purchases.

Form EIA-182, the Domestic Crude Oil First Purchase Report, is a mandatory monthly census of firms that take or retain ownership (equity not custody) of domestic crude oil leaving the lease on which it was produced for sale within the United States including the Outer Continental Shelf. Firms report, by stream, the volume in barrels and the weighted average cost per barrel for purchases they made in the reference month.

Form EIA-856, the Monthly Foreign Crude Oil Acquisition Report, is a mandatory monthly census of two populations. The first population is comprised of firms that reported data as of June 1982 on the Transfer Pricing Report (ERA-51). The second population is comprised of firms acquiring more than 500,000 barrels of foreign crude oil for importation to the United States and its territories/possessions during the reporting month. Firms report country of origin, volume acquired in barrels, and cost for each acquisition made in the reference month.

Petroleum Product Prices and Sales Volumes

Form EIA-782A, the Refiners’/Gas Plant Operators’ Monthly Petroleum Product Sales Report, is a mandatory monthly census of firms who either directly, or indirectly - e.g. through a subsidiary company - control a refinery or a gas plant located in the United States. Firms submit their sales volumes, measured in thousands of gallons, and the average selling price per gallon, excluding taxes, for each of the selected finished petroleum products by state, sales type, and user category. The petroleum products are motor gasoline (by formulation and grade), No. 2 diesel fuel (by sulfur content), No. 2 fuel oil, propane, No. 1 distillate, kerosene, aviation gasoline, kerosene-type jet fuel, No. 4 fuel oil, and residual fuel oil (by sulfur content).

Retail sales of gasoline are partitioned into sales through company-operated retail outlets and direct sales to other end-users, while wholesales, or sales for resale, are partitioned into dealer tank wagon (DTW) sales, rack sales, and bulk sales. DTW sales are defined as sales priced on a delivered basis to a retail outlet. Rack sales are defined as truckload sales or smaller where the title transfers at a terminal rack loading facility. Bulk sales are individual sales transactions that exceed the size of a truckload (for example, barge, railcar, or pipeline loads).

Retail sales of No. 2 distillates and propane are partitioned by customer type. The categories include: residential sales, commercial/institutional sales, industrial sales, sales through company-operated retail outlets, petrochemical sales (propane only), and sales to other end-users. In contrast to the differentiation of gasoline wholesales, No. 2 distillates and propane wholesales are reported as a group.

Form EIA-782C, the Monthly Report of Prime Supplier Sales of Petroleum Products Sold for Local Consumption, is a mandatory monthly census of petroleum product suppliers who make the first sale of specified petroleum products and then deliver that product into a state for consumption in that state. Firms report by state on their monthly sales in thousands of gallons for finished motor gasoline (by formulation and grade), No. 2 diesel fuel (by sulfur content), No. 2 fuel oil, propane, No. 1 distillate, kerosene, aviation gasoline, kerosene-type jet fuel, No. 4 fuel oil, and residual fuel oil (by sulfur content).

Form EIA-821, the Annual Fuel Oil and Kerosene Sales Report, is a mandatory annual sample survey of companies that deliver or sell distillate, residual fuel oils, and kerosene. Firms report annual sales volume in gallons by state of destination by product type and by energy end use - residential, commercial, industrial, oil company, railroad, vessel bunkering, farm, military, on-highway, off-highway, electric power, and other uses. Annual sales are reported for kerosene, distillates by type of distillate - No. 1 fuel oil, No. 2 fuel oil, No. 2 ultra-low sulfur diesel, No. 2 low sulfur diesel, No. 2 high sulfur diesel, No. 4 fuel oil, and residual fuel oil.

End-User Prices for Petroleum Products

Form EIA-877, the Winter Heating Fuels Telephone Survey, is a mandatory sample survey by telephone of No. 2 heating oil and propane dealers in 38 Eastern, Midwestern, Gulf Coast, and Rocky Mountain states. During the heating season from October to March, sample dealers report each week on their residential prices for No. 2 heating oil and propane as of the reference day for each of the states for which they were sampled. During the first telephone call at the beginning of the heating season, sampled dealers report their annual sales volume in thousands of gallons for each of the states for which they were sampled for the 12-month period from September 1 to August 31.

Form EIA-878, the Motor Gasoline Price Survey is a mandatory sample survey of retail outlets selling motor gasoline that collects information mainly by telephone but also by email. Each week, sampled outlets report the retail pump price of regular, midgrade, and premium grades of cash only, self-service unleaded gasoline - including taxes.

Form EIA-888, the On-Highway Diesel Fuel Price Survey, is a mandatory sample survey of retail outlets selling on-highway motor vehicle diesel fuel that collections information mainly by telephone but also by email and web retrievals. Each week, sampled outlets report the retail pump price of cash only, self-service, on-highway motor vehicle diesel fuel - including taxes.

Companies Engaged in Petroleum Product Sales

Form EIA-863, the Petroleum Product Sales Identification Survey, is a mandatory census of (1) resellers and retailers of No. 2 distillate, motor gasoline, propane, and residual fuel oil and (2) companies that sell kerosene, No. 1 distillate, crude oil, other Liquefied Petroleum Gas (LPG), No. 4 fuel oil, aviation gasoline, jet fuel, or other petroleum products. The census occurs every four years and is used as the frame for drawing the samples for Forms EIA-821, EIA-877, EIA-878, EIA-888, and EIA-886, “Annual Survey of Alternative Fueled Vehicle Suppliers and Users” (propane only). Form EIA-821 respondents are not required to report on Form EIA-863 because their annual sales data are collected on Form EIA-821.

Uses of Data in Recurring EIA Publications

EIA publishes the following petroleum publications which contain data from the surveys in the PMP:

Annual Petroleum Supply Annual (PSA), Volume 1

Petroleum Supply Annual (PSA), Volume 2

Fuel Oil and Kerosene Sales (FOKS)

Monthly Petroleum Marketing Monthly (PMM)

Petroleum Supply Monthly (PSM)

Weekly Gasoline and Diesel Fuel Update (GDFU)

Heating Oil and Propane Update (HOPU)

Weekly Petroleum Status Report (WPSR)

The following EIA publications integrate data from the PMP with other data sources:

Annual Annual Energy Review (AER)

International Energy Outlook (IEO)

State Energy Data System (SEDS)

U.S Crude Oil, Natural Gas, and Natural Gas Liquids Reserves Report

Monthly Monthly Energy Review (MER)

Short-Term Energy Outlook (STEO)

Other Today in Energy

A.1. Legal Justification

The authority for this mandatory data collection is provided by the following provisions:

15 U.S.C. 772(b) states:

"All persons owning or operating facilities or business premises who are engaged in any phase of energy supply or major energy consumption shall make available to the Administrator such information and periodic reports, records, documents, and other data, relating to the purposes of this Act, including full identification of all data and projections as to source, time and methodology of development; as the Administrator may prescribe by regulation or order as necessary or appropriate for the proper exercise of functions under this chapter."

15 U.S.C. 764(b) states that to the extent authorized by subsection (a), the Administrator shall:

(1) advise the President and the Congress with respect to the establishment of a comprehensive national energy policy in relation to the energy matters for which the Administration has responsibility, and, in coordination with the Secretary of State, the integration of domestic and foreign policies relating to energy resource management;

(2) assess the adequacy of energy resources to meet demands in the immediate and longer range future for all sectors of the economy and for the general public;

(3) develop effective arrangements for the participation of State and local governments in the resolution of energy problems;

(4) develop plans and programs for dealing with energy production shortages; …

(5) promote stability in energy prices to the consumer, promote free and open competition in all aspects of the energy field, prevent unreasonable profits within the various segments of the energy industry, and promote free enterprise;

(6) assure that energy programs are designed and implemented in a fair and efficient manner so as to minimize hardship and inequity while assuring that the priority needs of the Nation are met;

(9) collect, evaluate, assemble, and analyze energy information on reserves, production, demand, and related economic data;

(12) perform such other functions as may be prescribed by law."

As the authority for invoking subsection (b), above, 15 U.S.C. 764(a) states:

”Subject to the provisions and procedures set forth in this Act, the [Secretary] shall be responsible for such actions as are taken to assure that adequate provision is made to meet the energy needs of the Nation. To that end, he shall make such plans and direct and conduct such programs related to the production, conservation, use, control, distribution, rationing, and allocation of all forms of energy as are appropriate in connection with only those authorities or functions-

(1) specifically transferred to or vested in him by or pursuant to this chapter;

(3) otherwise specifically vested in the Administrator by the Congress."

Additional authority for this information collection is provided by 15 U.S.C. 790(a) which states;

“It shall be the duty of the Director to establish a National Energy Information System… [which] shall contain such information as is required to provide a description of and facilitate analysis of energy supply and consumption within and affecting the United States on the basis of such geographic areas and economic sectors as may be appropriate… to meet adequately the needs of…”

(1) the Department of Energy in carrying out its lawful functions;

(2) the Congress;

(3) other officers and employees of the United States in whom have been vested, or to whom have been delegated energy-related policy decision-making responsibilities;

(4) the States to the extent required by the Natural Gas Act [15 U.S.C. 717 et seq.] and the Federal Power Act [16 U.S.C. 791a et seq.].

"At a minimum, the System shall contain such energy information as is necessary to carry out the Administration's statistical and forecasting activities, and shall include… such energy information as is required to define and permit analysis of;

(1) the institutional structure of the energy supply system including patterns of ownership and control of mineral fuel and non-mineral energy resources and the production, distribution, and marketing of mineral fuels and electricity;

(2) the consumption of mineral fuels, non-mineral energy resources, and electricity by such classes, sectors, and regions as may be appropriate for the purposes of this chapter;

(5) industrial, labor, and regional impacts of changes in patterns of energy supply and consumption;

(6) international aspects, economic and otherwise, of the evolving energy situation; and

(7) long-term relationships between energy supply and consumption in the United States and world communities.”

In addition, these surveys partially satisfy the requirements in Section 507, Part A, Title V of the Energy Policy and Conservation Act of 1975 (42 U.S.C. 6385) as amended by the Energy Emergency Preparedness Act of 1982, P.L. 97-229, which states:

“The President or his delegate shall, pursuant to authority otherwise available to the President or his delegate under any other provision of law, collect information on the pricing, supply, and distribution of petroleum products by product category at the wholesale and retail levels, on a State-by-State basis, which was collected as of September 1, 1981, by the Energy Information Administration.”

Sections 252 through 254 of the Energy Policy and Conservation Act of 1975 (P.L. 94-163) (EPCA) provide for the U.S. participation in the IEA (International Energy Agency) through its Emergency Allocation System and its special information systems. The EPCA provides additional authority for collection of Form EIA-856 data as provided in 42 U.S.C. 6274 (a)(1) which states:

“Except as provided in subsections (b) and (c), the Secretary, after consultation with the Attorney General, may provide to the Secretary of State, and the Secretary of State may transmit to the International Energy Agency established by the international energy program, the information and data related to the energy industry certified by the Secretary of State as required to be submitted under the international energy program.”

In addition, Section 407(a)(3) of the Energy Policy Act of 1992 (P.L. 102-486) (EPACT) (42 U.S.C. 13233) requires the Energy Information Administration to establish a data collection program which collects cost data on alternative fuels. EPACT provides additional authority for collection of EIA-782A data on propane sales as provided by Section 407(a)(3) which states:

(a) “Not later than one year after the date of enactment of this Act, the Secretary, through the Energy Information Administration, and in cooperation with appropriate State, regional, and local authorities, shall establish a data collection program to be conducted in at least 5 geographically and climatically diverse regions of the United States for the purposes of collecting data which would be useful to persons seeking to manufacture, convert, sell, own, or operate alternative fueled vehicles or alternative fueling facilities. Such data shall include-...

(3)…cost, performance, environmental, energy, and safety data on alternative fuels and alternative fueled vehicles.”

A.2. Needs and Uses of Data

A.2.1. Overview of Data Uses

The purpose of the PMP is to provide a set of basic data pertaining to the nature, structure, and operating efficiency of petroleum markets. Adequate evaluation of market behavior requires price, demand (or sales), product supply, and market distribution data. Specifically, these data collection efforts support the following points:

The program meets DOE legislative mandates and user community data needs. These responsibilities are delineated in the Federal Energy Administration Act of 1974, as amended by FEAA, Public Law 93-275, and the Energy Policy and Conservation Act of 1975 as amended by the Energy Emergency Preparedness Act of 1982, P.L. 97-229. General energy data collection responsibilities involve the requirements to collect information on the institutional structure of the energy supply system; the production, distribution, marketing and consumption of energy commodities; and the international aspects of the energy situation. EIA is also explicitly directed to collect energy price data and to collect such data - i.e., both supply and price data - with particular reference for publishing at the state geographic level.

The data EIA collects are used to address significant energy industry issues. For example, in line with its mandated responsibility to collect data that adequately assess supply conditions in downstream petroleum markets, EIA evaluates the significance of a number of important issues related to the energy industry and in particular the petroleum industry. EIA data is used by various departmental units within the Department of Energy to analyze issues such as divestitures, mergers, withdrawals from a geographic or product markets, predatory practices, and refiner product margins depending on facts and circumstances in certain events. According to the significant users within Congress, the Executive Branch, and among the states, the data collected by the surveys in the Petroleum Marking Program are essential to address these issues.

EIA must collect some data at the state level. Congressional and state users have emphasized their need for such data. EIA’s collection of these data is consistent with its mandated responsibilities to collect specific product information for appropriate geographic areas and economic sectors, to act as a central clearing house, and to disseminate relevant information to the states. In addition, EIA has a continuing mission to minimize the industry burden that might be caused by the institution of a large number of individual and disparate state data collection systems.

Alternative data sources do not adequately satisfy the needs of EIA and its user communities. Accurate, meaningful, and independent price, supply, and demand statistics are essential to describe and measure phenomena in the marketplace. It is necessary that this information be collected by an unbiased, independent source if the data are to be credible.

EIA maintains that the data collected on these forms are unique. While somewhat similar or related data may be available from private and/or industry sources, as well as from other federal agencies, such data are not reasonable alternatives for the data provided by the surveys in the PMP in frequency or scope

The information to be collected will provide weekly, monthly, and annual time series data on volumes and sales of crude oil (both imported and domestic) and petroleum products for the petroleum marketing industry.

A.2.2. Overview of Data Collections

A.2.2.1. Individual Form Data Uses and Modifications

EIA is the only independent source of petroleum price and distribution data covering all energy sources, key products, markets, and end-use sectors at the state level. The most frequent users of the Petroleum Marketing Program data include Congress, government agencies, industry analysts, and trade publications.

Federal and state government agencies are frequent and regular users of petroleum product supply, marketing, and distribution data. For example, Form EIA-782 data are utilized by many states in developing and managing their energy programs. Petroleum data offers government and industry analysts a base to analyze and develop an understanding of energy production, flow, use, and markets. Because a wide variety of energy production and consumption patterns exist among governments and industries, the needs for and uses of petroleum data vary and include:

Prices - petroleum prices, including crude oil, motor gasoline, residual fuel oil, distillate fuel oil, kerosene, propane, and aviation fuels.

Supplies - the availability of petroleum supplies, including crude oil and finished products.

Consumption - petroleum consumption by end-use sectors, including residential and commercial, industrial, transportation, and utilities.

Imports - petroleum imports, including crude oil and refined products.

Production - field production of crude oil, stock withdrawals of crude oil and petroleum products, and ending stocks.

A partial list of Federal and State data users, including many agencies which are mentioned below.

A.2.2.2. Federal Agency Data Users

Federal agencies which use data from PMP include:

U.S. Census Bureau

U.S. Commodity Futures Trading Commission (CFTC)

U.S. Department of Commerce’s Bureau of Economic Analysis (BEA)

U.S. Department of Energy (DOE)’s Office of Energy Efficiency and Renewable Energy (EERE), Federal Weatherization Program (WAP)

U.S. Department of Interior (DOI)’s Congressional Joint Committee on Taxation and the Bureau of Ocean Energy Management

U.S. Department of Labor (DOL)’s Bureau of Labor Statistics (BLS)

U.S. Department of Treasury’s Internal Revenue Service

These federal agencies utilize PMP forms in the following manner:

U.S. Census Bureau

Data from Form EIA-182 are integrated into Section 18: Forestry, Fishing and Minerals of the Statistical Abstract of the United States and published by the U.S. Census Bureau.

U.S. Commodity Futures Trading Commission (CFTC)

U.S. Commodity Futures Trading Commission (CFTC) uses Form EIA-182 data to estimate deliverable supplies in the cash and futures trading markets for crude oil futures contracts. Estimates are generated for separate categories of purchasers of domestic crude oil.

U.S. Department of Commerce’s Bureau of Economic Analysis (BEA)

Data collected on Form EIA-821 on the quantity of kerosene and fuel oil sold by end-use category are used by the Department of Commerce’s Bureau of Economic Analysis in estimating personal consumption expenditures (PCE) of these fuels by broad consuming categories in the annual I-O accounts. The Balance of Payments Division at the BEA uses total crude oil import prices and quantities from Form EIA-856 for BEA’s goods projections for the advance estimate of Gross Domestic Product (GDP). BEA uses Form EIA-782 to prepare estimates of the gasoline and oil component of personal consumption expenditures, PCE (a major component of GDP). BEA uses Form EIA-14 data to determine the costs of crude oil to refiners for calculating the U.S. GDP. These data are used as an index to adjust the cost of crude oil in BEA’s model.

U.S. Department of Energy (DOE)’s Office of Energy Efficiency and Renewable Energy (EERE), Federal Weatherization Program (WAP)

These data are used to allocate federal energy block grants to the states. An example of this process is the Federal Weatherization Program (WAP) administered by EERE. DOE provides funding to states, U.S. overseas territories, and Indian tribal governments, which manage the day-to-day details of the program (DOE WAP, Oregon Low-Income Weatherization Assistance Program). These governments fund a network of local community action agencies, nonprofit organizations, and local governments that provide these weatherization services in every state, the District of Columbia, U.S. territories, and among Native American tribes.

U.S. Department of Labor (DOL)’s Bureau of Labor Statistics (BLS)

BLS uses Form EIA‑856 data as a primary input for calculating the price indices for foreign crude oil as a component of the U.S. Import Price Index.

U.S. Department of Treasury’s Internal Revenue Service (IRS)

The Joint Committee on Taxation and the IRS use the data to validate severance tax receipts, which are a major component of federal excise tax receipts. In addition, estimates based on Form EIA-182 data are used in fiscal projections and economic forecasts. The only available alternative is IRS data, which are not available for three to six months after Form EIA-182 data are published. Data reported on Form EIA-182 have also been used extensively by the Joint Committee on Taxation and the IRS in analyzing the economic effects of possible oil supply disruptions, as well as various tax proposals.

The IRS relies on data obtained from Form EIA-182 to publish notices required under the Internal Revenue Code in order to calculate the available amount of the non-conventional source fuel credit under Section 45K of the Code. The tax credit is subject to an annual adjustment and potential phase-out, calculated by the IRS’s determination of the annual average wellhead price per barrel for all domestic crude oil. The domestic crude oil first purchase price is also used to determine the available percentage depletion under Section 613A and the enhanced oil recovery credit under Section 43. Form EIA-182 data are the only source of information available to the IRS for these purposes and are critical to the proper administration of these Code sections.

U.S. Environmental Protection Agency (EPA)

The U.S. Environmental Protection Agency (EPA) and the petroleum industry used Form EIA-821 data during the 1990’s to analyze the impact on end-use consumption patterns of new EPA regulations to lower the sulfur content of diesel fuel oil.

U.S. Federal Trade Commission (FTC)

The Federal Trade Commission (FTC) uses Form EIA-14, 782A and 782C data to evaluate the effects of proposed mergers and also to determine whether certain oil producers, refiners, transporters, marketers, physical or financial traders, or others (1) have engaged in or are engaging in practices that have lessened or may lessen competition; (2) have engaged or are engaging in manipulation in the production, refining, transportation, distribution, or wholesale supply of crude oil or petroleum products; or (3) have provided false or misleading information related to the wholesale price of crude oil or petroleum products to a federal department or agency.

U.S. General Services Administration (GSA)

The General Services Administration (GSA) Federal Supply Service uses Form EIA-888 data as an indicator to determine when carriers should be allowed relief from sudden or unexpected increases in fuel prices. Pursuant to the National Rules Tender No. 100 D, the GSA Freight Program Management Office requires the use of Form EIA-888 data to calculate a 52 week moving average of the published Monday price as the baseline for the Neutral Range when issuing a Standard Tender of Service notice. In addition to the standard tender of service notices, GSA has agreements with customers that supplement government fuel contracts. These agreements, or fuel policies, allow companies to raise their rates or get a discount depending on the cost of diesel as measured by Form EIA-888. Fuel policies for civilian government shipping contracts are revised every six months and are based on the previous 52 weeks of published Form EIA-888 data.

U.S. Postal Service (USPS)

The U.S. Postal Service (USPS) uses EIA’s diesel price projections in a 2018 fuel cost and consumption strategy report, and this projection utilizes Form EIA-888 data.

Other Federal Agencies

The Propane Education and Research Enhancement Act of 2014 requires that the Secretary of Commerce use "the refiner price to end users of consumer grade propane, as published by the Energy Information Administration" in propane price analysis to be shared with the public.

A 2014 testimony by Melanie Kenderdine, Director of the Office of Energy Policy and Systems Analysis and Energy Counselor, U.S. Department of Energy to the Senate Committee on Energy and Natural Resources entitled “Short On Gas: A Look Into The Propane Shortages This Winter” highlighted the issues faced in analyzing the propane market. This prompted EIA to expand the number of state-level propane prices for the 2014/15 heating season, which strongly improved the robustness of the data collected for analysis of propane markets.

A.2.2.3. State Agency Data Users

According to officials from state agencies, an important aspect of the utility of EIA data is in developing and managing state energy programs. For example, EIA-782 data allows states to identify the prime suppliers of refined petroleum products into their state so that they can plan energy emergency response programs and assess the tightness of wholesale and retail market conditions in their state.

State agencies which use data from PMP include:

Connecticut’s Department of Energy & Environmental Protection

Delaware Energy Office in the State’s Division of Clean Energy and Climate

Illinois’ Energy Office in the Department of Commerce and Economic Opportunity

Massachusetts’ Department of Energy Resources

New Hampshire’s Office of Energy and Planning

New Jersey’s Office of Clean Energy

Specific examples of state agency data use are discussed below.

A.2.2.4 Details on the Use and Purpose for Each Form

A.2.2.4.1 Monthly Crude Oil Surveys (EIA-14, EIA-182, and EIA-856)

EIA-14, “Refiners’ Monthly Cost Report”

Form EIA-14 is a mandatory survey of refiners and collects data used to measure the acquisition cost of crude oil. These data are widely used for the following purposes:

Projecting crude oil and petroleum product prices

As an input component for calculation of the Gross Domestic Product (GDP)

Monitoring current national price levels

Performing market analyses

The data serve as the most reliable and accurate indicators of price paid by U.S. refiners for crude oil. Volume weighted monthly average price estimates at the U.S. and Petroleum Administration for Defense Districts (PADD) are compared to a company’s monthly average crude oil cost and as a key variable in models used to forecast future price trends.

Congress and government agencies - federal, state and local - use aggregate statistics based on EIA-14 data, in conjunction with EIA’s other petroleum price data, to monitor current national price levels and to benchmark their state data. The data are also used to meet state and congressional requirements for price projections and to determine the impact on national or state crude oil demand. The data are also used for planning/purchasing offices of a number of oil corporations. These statistics serve as a reliable and accurate indicator of crude oil acquisition price paid by U.S. refiners. These price indicators are used to compare a company’s average purchasing price to the U.S. and PADD average price, and as a key variable in models used to forecast future price trends. EIA‑14 statistics are also used throughout the industry as a basis for adjusting prices in escalator clauses in contracts.

The importance and usefulness of EIA‑14 data to the industry are demonstrated by the frequent appearance of these data in industry newsletters, trade journals and the general press. Form EIA-14 data are republished or quote in articles in journals and publications, including:

WTRG Economics Oil Price and History Analysis use both Refiner Acquisition Cost of Crude Oil and Domestic First Purchase in its analysis.

The Oil and Gas Journal references the Refiner Acquisition Cost of Crude Oil.

The Refiner Acquisition Cost used in analysis in EIA Today article, April 6, 2012, on “Regional differences for cost of crude oil to refiners widen in 2011”

Bloomberg references the Imported Refiners’ Acquisition Cost of Crude Oil.

Form EIA-182, “Domestic Crude Oil First Purchase Report”

Form EIA‑182, Domestic Crude Oil First Purchase Report, is a mandatory survey conducted monthly to collect detailed information on the wellhead price of domestic crude oil. This survey collects the average cost per barrel of crude oil and the total volume purchased of requested crude streams in a state. A weighted average first purchase price is then calculated from the cost and volume data. EIA‑182 data have a variety of users, including federal and state government agencies, private industry firms and universities. The data are used for the following purposes:

Revenue and tax credits – e.g., calculating income tax credits and verifying futures, spot and posted prices, and revenues.

Industry and market analysis – e.g., measuring the level of industry concentration and the distribution of ownership of domestic crude oil and monitoring the petroleum refining industry.

Policy analysis and forecasting – e.g., emergency preparedness planning; evaluating legislative, administrative, and regulatory issues pertaining to domestic crude oil markets; forecasting prices downstream for refined products at the refinery gate and subsequent wholesale and retail sales; and for forecasting tax revenues, state-level production volumes and prices in the MER and the STEO.

Crude oil data from Form EIA-182 are used frequently by Congress and federal agencies, including: the Office of Petroleum, Natural Gas and Biofuels Analysis and the Office of Energy Markets and Financial Analysis at EIA; the IRS at the Treasury Department; Bureau of Economic Analysis (BEA), the U.S. Census Bureau; and the Congressional Joint Committee on Taxation at the Department of Interior; and the Commodities Futures Trading Commission.

EIA uses the data primarily for forecasting revenues and production of crude oil, monitoring key energy markets, and conducting economic analyses and projections. The Office of Oil, Gas, and Coal Supply Statistics of EIA inputs state level EIA-182 data to a forecasting model to project U.S. production levels and associated prices for domestic crude. EIA publishes the crude oil first purchase price data in the MER, PMM, PSM, PSA, and AER.

For example, EIA publishes monthly and annual U.S. crude oil production estimates in the Petroleum Supply Monthly, Petroleum Supply Annual, and Petroleum Navigator. In order to make these monthly estimates, EIA relies on Forms EIA-914, “Monthly Crude Oil, Lease Condensate, and Natural Gas Production Report” on external data sources (from states) and EIA-182 first purchaser volume data to calculate estimates.

The initial estimates of U.S. Petroleum Administration for Defense District (PADD) and state crude oil production for the current reference month published in the Petroleum Supply Monthly (PSM) and Petroleum Navigator are based on: (a) Form EIA-914, “Monthly Crude Oil, Lease Condensate, and Natural Gas Production Report,” (b) crude oil production data from State Government agencies and the Department of the Interior, Bureau of Safety and Environmental Enforcement (BSEE) and, (c) first purchase data (volume) reported on Form EIA-182, “Domestic Crude Oil First Purchase Report.”

EIA calculates an estimate for half of the producing states by using the lagged average ratio of the state reported data to Form EIA-182 data, applied to the current Form EIA-182 data. Thus, there are three parameters involved in making the estimates: the state data from State Government agencies, Form EIA-182 data, and the average ratio between these two over a lagged 6-month period. In this method the lagged average ratio has the biggest influence on the level of production, while the current EIA-182 data have the biggest influence on the trend.

Estimated barrels of crude oil production per dayi = FPi * AvgRatioi-L

Where FPi = First purchase in barrels of crude oil per day, from EIA-182 survey for month i

AvgRatioi-L

= 1∕6

*

Statej

/

FPj)

Statej

/

FPj)

Statej = Barrels of crude production per day from state agency for month j

L= lag in months for the state.

Some state agencies use data from Form EIA-182. Below are a few examples:

North Dakota State Government Labor Market Information Center

Virginia’s Department of Mines, Minerals and Energy

Wyoming State Geological Survey

EIA data from Form EIA-182 are initially published monthly in the PMM and often reprinted or cited in articles in numerous publications and journals, including articles in the five major newspapers – Los Angeles Times, New York Times, USA Today, Wall Street Journal, and Washington Post.

EIA-856, “Monthly Foreign Crude Oil Acquisition Report”

Foreign crude oil prices and volumes are key components of the U.S. balance of trade picture, and are necessary for evaluating the impacts of oil market trends on the U.S. economy and future product wholesale and retail prices. Form EIA-856 provides comprehensive information not available from other sources and it continues to be the only source of U.S. crude oil imports which gathers information on cargo-level prices and actual gravities associated with specific crude types. Form EIA-856 data are essential in evaluating any impacts to the petroleum industry as a result of changes in the quality of U.S. imports due to trade embargoes, supply shortages, or cut-offs such as those experienced during the Persian Gulf crisis.

Form EIA-856 data are used by BEA, BLS, EIA, other federal agencies for the purposes of analysis and forecasting. For example:

Form EIA-856 data have been used in numerous studies. For example, the Balance of Payments Division at the BEA uses the total crude oil import prices and quantities from this survey for BEA’s goods projections for the advance estimate of Gross Domestic Product (GDP).

DOE uses Form EIA-856 data to support their legislatively mandated responsibilities, some of which reside in the areas of modeling and forecasting. For example, in an effort to alleviate confusion about the difference between imported refiners acquisition cost and the prices for premium crudes typically reported in the media, EIA’s Office of Petroleum, Gas & Biofuels Analysis used crude oil prices collected on Form EIA-856 to forecast the world oil price path for imported light sweet crude.

EIA integrates Form EIA-856 data in several recurring publications - the PMM, MER, and AER.

DOE’s Office of Strategic Petroleum Reserve has used Form EIA-856 data to assess the types of crude oil imported into the United States and to determine the appropriate crude streams to store in the Strategic Petroleum Reserve.

Form EIA-856 data were used to assess the impact to the U.S. economy of the trade embargo on Iraq and cut-off of Kuwait oil as a result of Iraq’s invasion of Kuwait. EIA Administrator, as well as the staff of the Secretary of Energy, analyzed EIA-856 data by the API gravity/sulfur content of U.S. crude oil imports to evaluate the impacts of the loss of high API gravity Iraqi crude on the petroleum industry.

Additional examples of international and industry uses of Form EIA-856 include:

The data are also frequently used by petroleum analysts, consultants, and investment bankers to assess their company’s crude oil purchasing performance relative to the industry average, and on forecasting the cost of various foreign crude oil streams.

These data are used to perform the important function of providing the U.S. data submissions to the International Energy Agency (IEA). The IEA is an intergovernmental organization with binding commitments from 20 signatory nations. The Standing Group on the Oil Market within the IEA is responsible for tracking developments in the international oil market to ensure energy security. Two IEA requirements, which were established in June of 1979, are supported by data collected on Form EIA‑856.

The first requirement is to maintain the Crude Oil Import Register of oil imported into the United States on a cargo-by-cargo basis. The second requirement is to produce a monthly price report of average prices and total volumes of imported oil for selected crude streams. The United States agreed at the November 10, 1981 meeting of the International Energy Agency Governing Board to extend the IEA agreement. The Crude Oil Import Register and the monthly price report allow the United States to fulfill this multinational obligation. The statistically reliable information is originally published in the PMM and republished in other EIA publications, journals and other publications.

A.2.2.4.2 Monthly Petroleum Product Survey (EIA-782A and EIA-782C)

EIA-782A, “Refiners'/Gas Plant Operators' Monthly Petroleum Product Sales Report” and EIA-782C, “Monthly Report of Prime Supplier Sales of Petroleum Products Sold for Local Consumption”

Data gathered by Form EIA‑782 are used to track, review, and analyze petroleum product supply, marketing, and distribution; and to anticipate and respond to potential supply disruptions or market structure changes.

Form EIA‑782A is a mandatory survey conducted on a monthly basis to collect state level price and volume information from refiners and gas plant operators on 14 selected petroleum products’ price, supply, and market distribution on an end-use-sector basis. Form EIA-782C is a mandatory survey administered on a monthly basis to collect data on the sales of selected petroleum products by prime suppliers delivered into states for local consumption. A prime supplier is defined as a firm that produces, imports, or transports any of the 14 selected petroleum products across state boundaries and local marketing areas and sells the product to local distributors, local retailers, or end users.

The refiner sales volumes collected on Form EIA-782A are related to the prime supplier sales volumes collected on Form EIA-782C, but conceptual differences exist that cause variations between these data. In general, EIA-782A volumes reflect refiners’ sales of petroleum products into all secondary and tertiary markets to non-refiners, while EIA-782C volumes are designed to measure prime suppliers’ sales into the local market for final consumption.

The 1982 passage of the Energy Emergency Preparedness Act, and numerous subsequent requests for analyses using EIA-782 data during energy emergencies, attests to the Congressional interest in having access to reliable and timely petroleum marketing data at the state level.

During the process to determine the funding, EIA-782 data is used in the State Energy Data System (SEDS). SEDS is EIA’s source for comprehensive state energy statistics. Included are estimates of energy production, consumption, prices, and expenditures broken down by energy source and sector.

Form EIA-782A and Form EIA-782C data are used to:

Evaluate the effects and impacts of energy prices on state-level cost-of-living.

Predict the consequences to state economies of future energy supply disruptions or market changes.

Respond to Congressional inquiries regarding petroleum product seasonal price trends.

The value states place on these data is not confined to the formulation and implementation of energy policies. These data are also used in investigative hearings, statistical applications, analysis, forecasting, and responding to constituents. State Energy Offices use Form EIA-782 data to:

Analyze and forecast demand for refined petroleum products and long term planning.

Analyze and forecast petroleum product prices.

Compare sales volumes and prices in their state compared with other state data. The data are used in emergency management to track major suppliers in case of fuel shortages.

Compare consumption of refined petroleum products and national consumption on a monthly basis.

Determine the amount of diesel and distillate produced by state.

Establish state-level fuel tax rates.

Investigate price increases of refined petroleum products during periods of supply instability.

Obtain historical data for crisis intervention.

Track the economy of the state versus the nation based on gasoline consumption.

Track petroleum product demand for short-term forecasting. The data are also used to make projections of monthly supply for emergency management purposes.

Through conducting the above analyses, each state is able to establish a baseline showing the amounts and patterns of energy supply, distribution, and use over time. Having formulated a baseline, each state is favorably positioned to analyze and develop emergency energy contingency plans and other policy alternatives. State officials concur that if an oil shortage occurred, Form EIA-782 derived database would serve as a reliable historical reference-point from which to measure and respond to the resulting changes that would occur in the supply and consumption of crude oil and petroleum products.

Petroleum industry analysts regularly use Form EIA-782 published data available on EIA’s website to perform market trend analyses and planning. These data are frequently used to:

Establish contract pricing formulas for fuel oil and military marketing contracts.

Oversee sales to airlines and sales of jet-propulsion fuel to the military.

Input into energy models, to project U.S. energy market futures, and to try and simulate interaction between markets.

Form EIA-782 data may also be shared with universities via formal data sharing agreements for data analysis. Form EIA-782 data are initially published in the PMM and used in the STEO and AEO. These data are reprinted or cited in articles in numerous publications and journals, including articles in the five major newspapers – Los Angeles Times, New York Times, USA Today, Wall Street Journal, and Washington Post.

A.2.2.4.3 Annual Petroleum Product Survey (EIA-821)

EIA-821, “Annual Fuel Oil and Kerosene Sales Report”

Form EIA‑821 survey collects annual sales volumes of distillate and residual fuel oils and kerosene of end-use categories at the state level. The widespread use of these data became apparent when EIA discontinued the predecessor survey, Form EIA‑172, after collecting data for reference year 1982. Form EIA-821 was established to collect data beginning with reference year 1984 after receiving numerous letters from state governors, Congress, trade associations, oil companies, trade publications, and industry analysts citing their need for the data. A number of state agencies previously asserted that discontinuance of the data would have broad, adverse effects on their state energy or air quality programs.

Aggregated data collected on Form EIA-821 on the quantity of kerosene and fuel oil sold for end-use category are used by all levels of government – federal, state and local government. Numerous government agencies use data collected on Form EIA-821 for energy policy, forecasting, and consumption analysis programs. State agencies, including energy offices and environmental agencies, also use Form EIA‑821 data for energy planning, analysis, and information dissemination.

Form EIA-821 collects annual sales volumes of distillate and residual fuel oils and kerosene by a variety of end-use categories at the state level. These data are used by the Federal Government for energy policy activities, and for forecasting and consumption programs to determine current and projected fuel oil needs on a national, regional, and state basis. Aggregations of these data are also used by Congress, state government agencies and petroleum industry analysts for a variety of analytic studies.

Within EIA, the Office of Petroleum and Biofuels Statistics uses end-use data for a variety of statistical analyses. The Office of Survey Development and Statistical Integration enters the data into the State Energy Data System’s (SEDS) end-use consumption data base for all fuels categorized by state. SEDS supplier regional historical data for EIA’s demand-side forecasting models. Aggregate data are included in several DOE publications, including the Fuel Oil and Kerosene Sales, the State Energy Data Report, and the Annual Energy Review. This published information is used by federal, state and petroleum industry analysts to determine marketing patterns to evaluate end-use consumption patterns, and to analyze how changes in fuel oil supplies affect economic conditions at the state, regional and national level.

Federal agencies have demonstrated practical applications for Form EIA-821 data. The Administration for Children and Families currently uses Form EIA-821 data to calculate allocations of approximately 1.2 billion dollars annually to the Low Income Housing Energy Assistance Program. These data have been determined by Congress to be vital for the allocation of funds towards the Low Income Housing Energy Assistance Program. Additionally, the Internal Revenue Service currently uses the data to determine taxes on products such as diesel fuel and kerosene.

In 1991, the National Oceanic and Atmospheric Administration used the data to determine whether to assess a fuel tax on ocean-going vessels. The U.S. Environmental Protection Agency (EPA) and the petroleum industry used Form EIA-821 data during the 1990’s to analyze the impact on end-use consumption patterns of new EPA regulations to lower the sulfur content of diesel fuel oil.

Petroleum companies are frequent users of the volume information published annually from Form EIA-821. Along with the DOE publications, these data are also republished in the American Petroleum Institute publication Basic Petroleum Data Book, Petroleum Industry Statistics, widely used by industry analysts. The American Petroleum Institute uses Form EIA-821 data for analyzing total distribution sales of No. 2 distillate by end-use.

State energy offices also widely use Form EIA-821 data for energy planning, analysis, and information dissemination. Many states claim that discontinuance of the data would have broad, adverse effects on their state energy programs. The following are several examples of how states use EIA-821 data:

The California Air Resources Board and South Coast Air Quality Management Commission use Form EIA-821 data to analyze No. 2 diesel fuel consumption patterns in California, to estimate the environmental effects of lowering sulfur and aromatic content of No. 2 diesel fuel.

Connecticut uses Form EIA-821 data to evaluate energy use patterns, conservation and fuel switching among sources.

Massachusetts uses the data on an annual basis to forecast energy demands and future prices.

Michigan uses Form EIA-821 data extensively to estimate sulfur dioxide (SO2) emissions from all end use sectors utilizing No. 1 distillate, No. 2 distillate and/or residual fuel. The Michigan Department of Natural Resources needs data on sales of No. 2 diesel fuel separated into two categories of less than or equal to .05% sulfur and greater than .05% sulfur. Michigan requires low sulfur fuels in certain geographic areas as an alternative to installing pollution control devices to reduce SO2 emissions. In addition to SO2 emissions estimates, Michigan also uses the data to evaluate the effectiveness of their state regulations on low sulfur fuels.

Minnesota uses the data for energy analyses and information dissemination activities.

New York develops, reviews, and updates a comprehensive, long-range State Energy Master Plan using Form EIA-821 data. New York also uses the data to develop state end-use energy accounts, for the New York Annual Energy Review, as well as a variety of energy analyses and assessments.

Wisconsin uses Form EIA-821 data to inform the Governor and Legislature of energy usage within the state. They also prepare a detailed forecast of future state energy usage by economic sector.

Other States, including Ohio, Arkansas, Vermont and Illinois have also forwarded correspondence to EIA stating strong support and genuine need for the data reported on Form EIA-821.

EIA initially publishes Form EIA-821 data in the annual Fuel Oil and Kerosene Sales (FOKS) Report. These data are reprinted or cited in various publications and journals, including articles from the five major newspapers – Los Angeles Times, New York Times, USA Today, Wall Street Journal, and Washington Post.

A.2.2.4.4 Weekly Petroleum Product Survey (EIA-877, EIA-878, and EIA-888)

EIA-877, “Winter Heating Fuels Telephone Survey”

Form EIA-877, “Winter Heating Fuels Telephone Survey” is designed to collect data on retail prices of No. 2 heating oil and propane during the heating season (October 1 to March 31) for 38 states in the Eastern, Midwestern, Gulf Coast, Rocky Mountain States; and the District of Columbia through the State Heating Oil and Propane Program (SHOPP). SHOPP is a joint data collection effort between large heating oil and propane consuming states in the United States and EIA. The current survey is a continuation of a program initiated in the 1990-91 heating season in response to congressional requests for concise, timely price information on distillate fuel oil and propane. Prior to 1990, states collected heating oil data.

SHOPP provides state and federal governments, the press, policy makers, consumers, analysts, and others with up-to-date information on retail heating fuels prices during the heating season. Because of supply and price instability in heating fuel markets, there is a need for communication between heating fuel marketers and the government. The data has been used by congressional committees, federal and state governments, and industry analysts to assess the hardships experienced by heating oil and propane users during periods of critical short supplies. For example, data were used in the winters of 1989 and 1999 in the Northeast and Mid-Continent regions to evaluate supply shortages and price increases for both heating oil and propane due to severe weather. EIA responded to this need for timely information by implementing Form EIA-877 to collect state level, weekly information during the heating season on the price of No. 2 heating oil and propane from a sample of suppliers. The need for this information was expressed previously in Congressional hearings and meetings with state energy office officials, petroleum industry leaders and trade associations.

These data are published in the Heating Oil and Propane Update (HOPU) and are reprinted or cited in articles in numerous publications and journals, including articles in the five major newspapers – Los Angeles Times, New York Times, USA Today, Wall Street Journal, and Washington Post. Radio spots featuring weekly prices are also made available at www.eia.gov/radio/ for use by radio stations across the country such as Ozark Radio News, 94.1 The Lake WSNW, and Sky 96.3 WRBN-FM.

EIA-878, “Motor Gasoline Price Survey”

Form EIA-878 collects, on a weekly basis, the retail price by grade of unleaded gasoline, self-service, cash only, including all taxes. The data may be collected on a more frequent basis during emergency situations such as war, common disasters, severe price fluctuations, and other supply shortages. In such an emergency situation EIA will notify OMB prior to initiating efforts to collect the data more frequently. EIA will follow subsequent OMB guidance regarding accounting of the additional burden hours incurred.

Congress, government officials, and transportation industry leaders use EIA data in order to measure rapid price increases at both regional and national levels. For example, during the 1991 Iraq War, the data were used by Congress and federal officials to monitor the retail price of gasoline on a daily basis. In addition, Form EIA-878 data provide weekly information on retail market conditions and on the price impacts of "clean fuel programs" mandated by the Clean Air Act Amendments of 1990 to government, industry, and the public. In 2005 these data were used to monitor the effect of Hurricane Katrina on the retail gasoline market. During Hurricane Sandy in 2012, these data were used to provide daily information to senior officials on the availability of gasoline in the affected New York metropolitan area.

Retail gasoline price estimates are released for nine states and ten cities, in addition to the five PADD and three sub-PADD areas, and the United States. EIA also uses Form EIA-878 price data each spring for STEO’s Summer Transportation Fuels Outlook, e.g., the 2012 Summer Transportation Fuels Outlook (PDF). These data are relied upon by the press, industry, the media, and government as a measure of retail prices of reformulated and conventional gasoline. Every major newspaper has cited and published retail gasoline price data from Form EIA-878 in stories concerning retail gasoline prices. The data are published in all the major wire services including Reuters Ltd, Bloomberg News, Dow Jones, and Associated Press. U.S. price estimates for regular grade gasoline are regularly quoted on the CBS and NBC television news networks. Form EIA-878 data are published in the Washington Daybook - Economic Reports.

These data are initially published in the Gasoline and Diesel Fuel Update (GDFU) and are reprinted or cited in articles in numerous journals and publications, including articles in the five major newspapers – Los Angeles Times, New York Times, USA Today, Wall Street Journal, and Washington Post. Price information are also available on a toll-free hotline number, via email, and via recorded audio files and scripts for radio republication.

EIA-888, “On-Highway Diesel Fuel Price Survey"

Form EIA-888, On-Highway Diesel Fuel Price collects the retail price of on-highway diesel fuel, self-service, cash only, including all taxes each week. The data may be collected on a more frequent basis during emergency situations such as war, common disasters, severe price fluctuations, and other supply shortages. In such an emergency situation EIA will notify OMB prior to initiating efforts to collect the data more frequently. EIA follows OMB guidance regarding notification of a material change that warrants an increase in the frequency of collection due to a natural disaster or major supply disruption to account for the additional burden hours incurred.

These data are used by Congress, federal and state officials, and transportation industry leaders to monitor the retail price of on-highway diesel fuel, including the following two examples. Shipping contracts with the federal government, both military and civilian, require the use of Form EIA-888 data as the price mechanism for calculating fuel surcharges. The General Services Administration (GSA) Federal Supply Service uses Form EIA-888 data as an indicator to determine when carriers should be allowed relief from sudden or unexpected increases in fuel prices, as discussed above. Additionally, the Military Surface Deployment and Distribution Command requires its shippers, transportation officers and transportation service providers to use Form EIA-888 data for calculating fuel-related rate adjustments.

Form EIA-888 data are used to provide weekly information on retail market conditions to both government and industry. Form data are routinely relied upon by the press, industry, and government as a measure of change in the fuel costs for transportation and shipping contracts. Form EIA-888 data has generally been adopted by the majority of the private trucking firms and shippers as the price adjustment mechanism in fuel surcharge formulas.

The national, regional, and State of California retail diesel fuel price estimates from Form EIA-888 are accessed daily by motor carriers, both haulers and bus companies, shippers, and other members of the public via accessing EIA’s website or subscribing to the diesel listserv for email and/or text messages of the data.

Form EIA-888 data are also published on a weekly and monthly basis in trucking industry newsletters, including the American Trucking Association and The Journal of Commerce. The national and regional prices are broadcast twice per day on Interstate Radio Network, a radio network with 40 affiliates with coverage of 95 percent of the continental United States. Form EIA-888 data are also analyzed and used by the National Industrial Transportation League, the National Association of Truck Stop Operators, and the American Moving and Storage Association. Form EIA-888 data are routinely quoted on the wire services - Reuters Ltd, Bloomberg News, Dow Jones, and the Associated Press - and in articles in the five major newspapers – Los Angeles Times, New York Times, USA Today, Wall Street Journal, and Washington Post.

A.2.2.4.5 Petroleum Marketing Frame (EIA-863)

EIA-863, “Petroleum Product Sales Identification Survey”

Form EIA‑863 collects information on size, type and geographic location of fuel oil-related businesses to form an attribute sampling frame for use by EIA sample surveys. The list of companies, their operational status, volumetric data, and information on their corporate relationships together serve wholly or partially as the sampling frame for the following EIA surveys:

Form EIA‑821, “Annual Fuel Oil and Kerosene Sales Report”

Form EIA-877, “Winter Heating Fuels Telephone Survey”

Form EIA-886, “Annual Survey of Alternative Fueled Vehicle Suppliers and Users” (propane only)

Form EIA-888, “On-Highway Diesel Fuel Price Survey”

The data are used by EIA for the following purposes:

To develop a comprehensive frame file for sampling. The information is also used to identify births (new companies including sales and mergers) and deaths (companies going out of business) in the universe, as well as updates to mailing addresses and contact information.

To produce volumetric state-level data necessary for efficient use of stratified or probability proportional to size sampling. These sampling methods yield substantial reductions in respondent burden and reduce sampling error in the weekly, monthly, and annual sample surveys.

To produce aggregate data to determine aggregate population estimates. These estimates are used to design efficient samples and estimators, and to measure previous sample deterioration and changes in the distribution of the population.

To identify relationships between parent/subsidiary and thus avoid both under reporting and double counting, and to minimize sample sizes and respondent burden.

To update company-level profiles and detail which allow for sample rotation to minimize respondent burden.

To review edit and imputation procedures and methodologies in the weekly, monthly, and annual sample surveys, and testing those methodologies. The data are also directly used for editing and imputation procedures as a benchmark for new sample members and for non-respondents.

The petroleum surveys require a respondent frame that is updated frequently because of the high turnover rate and ongoing changes in the petroleum industry. Previous EIA-863 data have shown a turnover rate of roughly 25 percent in the frame between survey cycles, without including ongoing updates made from Form EIA-782A, an annual petroleum marketing survey to align the larger petroleum sellers. For any survey, it is necessary that the frame be both comprehensive and up-to-date for unbiased and efficient sampling. Lack of identification of out-of-scope and out-of-business firms greatly increases sample sizes, respondent burden, and data error, as well as government costs for nonresponse follow-up. The high birth and death rate of fuel oil dealers means that samples deteriorate rapidly over time and must be updated frequently to ensure accuracy. Additional information regarding the frame and sampling plan is available in Supporting Statement B.

A.3. Use of Technology

In an effort to reduce respondent burden and to provide for timelier processing of filings, EIA offers mixed-mode data collection. The weekly surveys use the following modes of data collection.

Form EIA-877 collects data via telephone and other electronic modes. For example, several larger companies with multiple outlets in the sample can send data directly to EIA via secure file transfer in an Excel spreadsheet or other tabular format. This saves time for the personnel at each of the individual outlets.

Forms EIA-878 and EIA-888 utilize computer-assisted telephone interviewing (CATI), facsimile, email, web survey, and manual retrieval of data from company websites as modes of collecting data. In addition, Form EIA-878 utilizes Text/SMS messaging to report weekly price data.

The remaining surveys in the PMP are conducted via paper and electronic modes. Respondents submit data via secure file transfer, facsimile, electronic modes, and U.S. mail. EIA accepts electronic records from respondents provided such reports are prepared and transmitted to EIA in the same format as the data collection form. As part of data collection enhancements, EIA introduced an Electronic Data Extraction System (EDES) on some of these surveys. This technology will allow electronic extraction of the information submitted via Excel spreadsheets. EDES will reduce manual data entry and keying errors; therefore, reducing program costs, reporting burden, and non-sampling errors.

A.4. Efforts to Identify Duplication

EIA conducted extensive reviews to ensure its petroleum marketing surveys do not duplicate data available from other sources. In addition, EIA petroleum data analysts with subject matter expertise review these survey forms. As changes are proposed to the petroleum marketing survey forms, EIA conducts extensive review processes to ensure the avoidance of the unnecessary collection of data. Numerous efforts have been made to identify, through discussions with trade associations, private companies, and other government offices, potential duplication of data, data that is no longer necessary, or data that can be collected more efficiently by another survey.

EIA reviewed known sources of data relating to petroleum marketing and found no other sources to be comprehensive or detailed enough to replace the data collections currently utilized by the federal government. EIA determined that other sources are not sufficient to replace or approximate the information collected because of differences in classification, or due to the lack of universe estimation procedures.

A.4.1. Analysis of Similar Existing Information

EIA evaluated all known sources of data relating to the petroleum marketing industry and found no other source as comprehensive, timely, or detailed, to replace these proposed EIA data collection activities. EIA determined that other sources cannot replace or even approximate the information proposed for collection here because of differences in classification, inconsistency, incompleteness, unavailability, or lack of universal coverage. Some of the data collections complement, rather than duplicate, other federal agency data collections. These combined efforts capture the entire petroleum marketing industry and minimize industry burden.

The three weekly surveys collect different petroleum products – Form EIA-877 collects residential winter heating fuels prices; Form EIA-878 collects retail motor gasoline prices; and Form EIA-888 collects retail on-highway diesel fuel prices. The Gasoline and Diesel Fuel Update webpage, available at https://www.eia.gov/petroleum/gasdiesel/, provides price data from both Forms EIA-878 and EIA-878. This information product consistently remains one of the top viewed information products on EIA’s website. The Gasoline and Diesel Fuel Update webpage received over 3.8 million visits in 2018, 3.3 million visits in 2017, and 3.6 million visits in 2016.

The graph below shows the historical pageviews for this weekly retail price data from EIA’s website.

The following monthly surveys are used to monitor crude oil and refined products from the wellhead to ultimate consumption – Form EIA-182 collects wellhead data; Form EIA-856 collects crude oil imports data; Form EIA-14 collects data on crude oil as it enters the refinery stage; Form EIA-782A collects data on the sales of the finished products; and Form EIA-782C collects data on the volume of delivered finished products.

The following are explanations regarding the collection of similar data and the reasons why these similarities are not duplicative collections. This includes comparison across petroleum marketing surveys for the (a) monthly crude oil surveys; (b) monthly petroleum products surveys; (c) monthly petroleum product surveys with the annual fuel oil and kerosene survey; and (d) weekly surveys.

Several sources of administrative or third-party data are used for publication, data validation, frame maintenance, and analysis.

A.4.1.1 Monthly Crude Oil Surveys (EIA-14, EIA-182, and EIA-856)

Forms EIA-14, EIA-182 and EIA-856 all collect data on crude oil yet do not duplicate efforts. Form EIA-182 collects domestic wellhead prices, Form EIA-856 collects foreign crude oil prices, and Form EIA-14 collects the average price domestic and imported crude oil at the refinery gate.

Form EIA-182 is designed to collect data on the value and volume associated with the physical and financial transfer of domestic crude oil from the property on which it was produced. EIA-182 data are used to represent the initial market value of domestically produced crude oil. Similarly, the data from Form EIA-856, “Monthly Foreign Crude Oil Acquisition Report” are used to represent the initial value of imported oil. Form EIA-14, “Refiners’ Monthly Cost Report,” provides the only source of comprehensive, current period-weighted costs of crude oil as it is booked into the refinery. Forms EIA-182 and EIA-856 share a relationship with Form EIA-14 data which includes costs that accrue subsequent to the first purchase - e.g., transportation, storage, resale markups and markdowns, et cetera.

Below is a comparison of Form EIA-182 with other data sources:

Similar statistics to those obtained from Form EIA-182 are published in Platt’s Oilgram and Petroleum Intelligence Weekly both of which focus on what refiners and resellers are asking publicly for crude, e.g., posted prices and spot prices. By comparison, these publications do not provide data on sales of equity and non-equity crude oil, or what the sale transaction price and quantity of oil was. If no sale transaction occurs at the offered price, the posted price is reported as the spot price at the time the trading market closed.