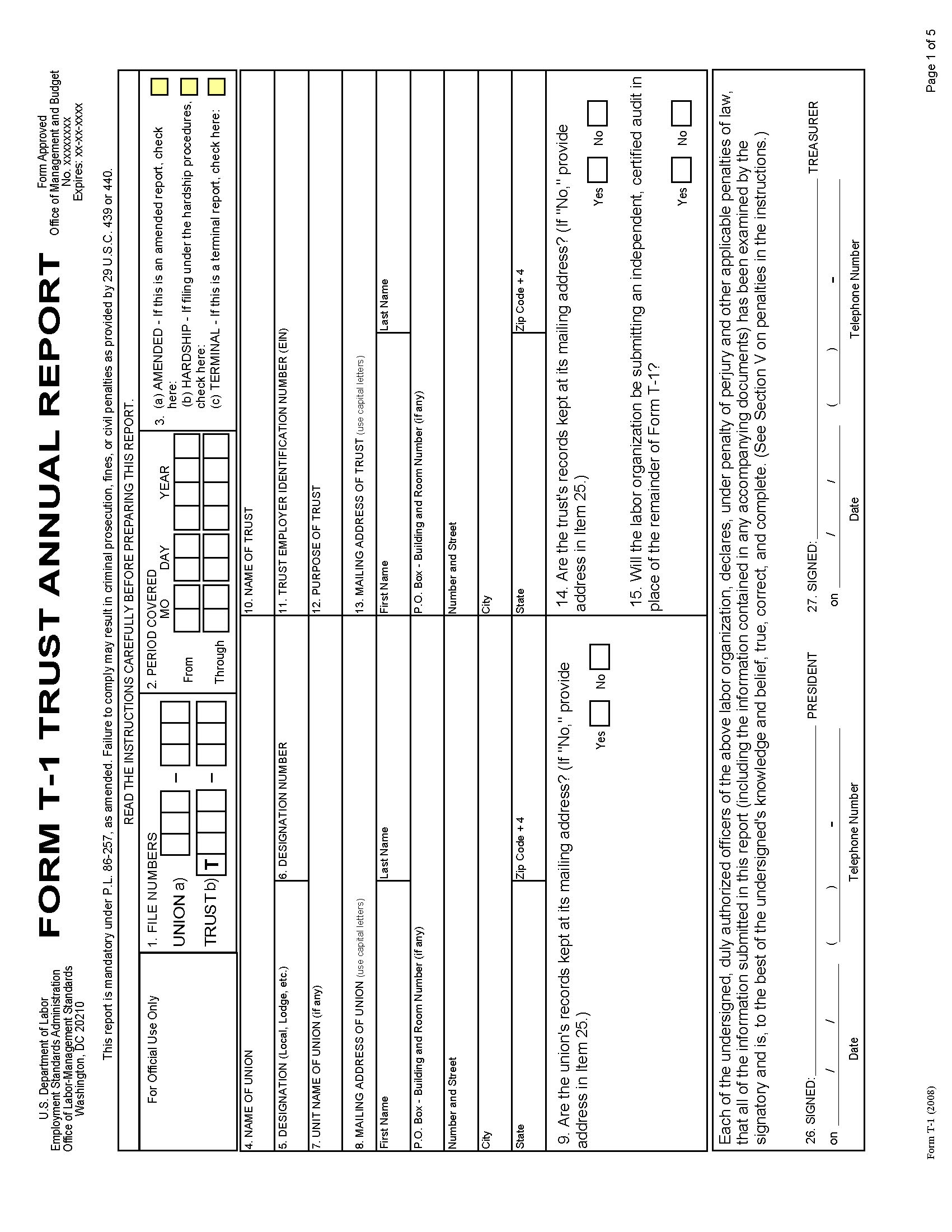

T-1 Form T-1 Trust Annual Report

Labor Organization and Auxiliary Reports

Form T-1 Instr 08-21-08 PM - New Numbers

Labor Organization and Auxiliary Reports

OMB: 1245-0003

10

Public reporting burden for this collection of information is estimated to average 135.41 hours per response in the first year, 97.98 hours per response in the second year, and 97.98 hours per response in the third year. This includes the time for reviewing instructions, searching existing data sources, gathering and maintaining data needed, and completing and reviewing the collection of information. Persons are not required to respond to the collection of information unless it displays a currently valid OMB control number. Reporting of this information is mandatory and is required by the Labor-Management Reporting and Disclosure Act of 1959, as amended, for the purpose of public disclosure. As this is public information, there are no assurances of confidentiality. If you have any comments regarding this estimate or any other aspect of this information collection, including suggestions for reducing this burden, please send them to the U.S. Department of Labor, Employment Standards Administration, Office of Labor-Management Standards, Division of Interpretations and Standards, Room N-5609, 200 Constitution Avenue, NW, Washington, DC 20210.

INSTRUCTIONS FOR FORM T-1

TRUST ANNUAL REPORT

GENERAL INSTRUCTIONS

I. Who Must File

Every labor organization subject to the Labor-Management Reporting and Disclosure Act, as amended (LMRDA), the Civil Service Reform Act (CSRA), or the Foreign Service Act (FSA), with total annual receipts of $250,000 or more (labor organization), must file Form T-1 each year for each trust in which it is interested, as defined in the LMRDA at 29 U.S.C. 402(l), if the following conditions exist:

The trust is a trust defined by section 3(l) of the LMRDA, that is, the trust is a trust or other fund or organization (1) that was created or established by a labor organization or a labor organization appoints or selects a member to the trust’s governing board; and (2) the trust has as a primary purpose to provide benefits to the members of the labor organization or their beneficiaries (29 U.S.C. 402(l)); and the labor organization alone, or in combination with other labor organizations, either

appoints or selects a majority of the members of the trust’s governing board; or

contributes greater than 50% of the trust's receipts during the one-year reporting period.

Any contributions made pursuant to a collective bargaining agreement shall be considered the labor organization’s contributions.

No Form T-1 should be filed for any trust that meets the statutory definition of a labor organization and already files a Form LM-2, LM-3, or LM-4, nor should a report be filed for any entity that is expressly exempted from reporting in the LMRDA. No report need be filed for a trust established as a Political Action Committee (PAC) if timely, complete, and publicly available reports on the PAC are filed with a Federal or state agency, or for a trust established as a political organization under 26 U.S.C. 527 if timely, complete, and publicly available reports are filed with the Internal Revenue Service. No Form T-1 need be filed for any trust that is an employee benefit plan that is required to file a Form 5500, i.e., whose plan administrator is required to file an annual report on behalf of the trust, under the Employee Retirement Income Security Act of 1974 (“ERISA”), 29 U.S.C. 1021 and/or 1024, for a plan year ending during the reporting period of the union. If the plan administrator of the trust, however, is eligible for an exemption from filing a Form 5500 or Form 5500-SF, then a Form T-1 must be filed for that section 3(l) trust regardless of whether a Form 5500 or Form 5500-SF is filed on its behalf. For a definition of plans "required to file a Form 5500" for purposes of filing the Form T-1, see 29 CFR 403.2(d)(3)(vi).1 No report need be filed for federal employee health benefit plans subject to the provisions of the Federal Employees Health Benefits Act (FEHBA), nor for any for-profit commercial bank established or operating pursuant to the Bank Holding Act of 1956, 12 U.S.C. 1843.

An abbreviated report may be filed for any covered trust or trust fund for which an independent audit has been conducted, in accordance with the standards (as adopted from 29 CFR. 2520.103-1) as discussed in the next paragraph.

A labor organization may complete only Items 1 through 15 and Items 26-27 (Signatures) of Form T-1 if annual audits are prepared according to the following standards and a copy of the audit is filed with the Form T-1. The audit must be performed by an independent qualified public accountant, who after examining the financial statements and other books and records of the trust, as the accountant deems necessary, certifies that the trust’s financial statements are presented fairly in conformity with Generally Accepted Accounting Principles (GAAP) or Other Comprehensive Basis of Accounting (OCBOA). The audit must include notes to the financial statements that disclose, for the preceding twelve-month period: losses, shortages, or other discrepancies in the trust’s finances; the acquisition or disposition of assets, other than by purchase or sale; liabilities and loans liquidated, reduced, or written off without the disbursement of cash; loans made to labor organization officers or employees that were granted at more favorable terms than were available to others; and loans made to officers and employees that were liquidated, reduced, or written off. The audit must be accompanied by schedules that disclose, for the preceding twelve- month period: a statement of the assets and liabilities of the trust, aggregated by categories and valued at current value, and the same data displayed in comparative form for the end of the previous fiscal year of the trust; a statement of trust receipts and disbursements aggregated by general sources and applications, which must include the names of the parties with which the trust engaged in $10,000 or more of commerce and the total of the transactions with each party.

Form T-1 must be filed with the Office of Labor-Management Standards (OLMS) of the U.S. Department of Labor’s (Department) Employment Standards Administration. The labor organization must file a separate Form T-1 for each trust that meets the above requirements. The LMRDA, CSRA, and FSA cover labor organizations that represent employees who work in private industry, employees of the U.S. Postal Service, and most Federal government employees. Questions about whether a labor organization is required to file should be referred to the nearest OLMS field office listed at the end of these instructions.

II. When to File

Form T-1 must be filed within 90 days of the end of the labor organization’s fiscal year. The Form T-1 shall cover the trust’s most recently completed fiscal year, i.e., the fiscal year ending on or before the closing date of the labor organization’s own fiscal year. The penalties for delinquency are described in Section V (Officer Responsibilities and Penalties) of these instructions. Examples of filing dates for the Form T-1 follow:2

Where the trust and labor organization have the same fiscal years

The trust and labor organization have fiscal years ending on December 31. The Form T-1 for the fiscal year ending December 31, 2009 must be filed not later than March 31, 2010.

The trust and the labor organization each has a fiscal year that ends on September 30. The labor organization’s first Form T-1 will be for the trust’s fiscal year ending September 30, 2010 and must be filed not later than December 29, 2010.

Where the trust and labor organization have different fiscal years

The trust’s fiscal year ends on June 30. The labor organization’s fiscal year ends on September 30. Its first Form T-1 for this trust will be for the trust’s fiscal year ending June 30, 2010 and must be filed not later than December 29, 2010.

The trust’s fiscal year ends on September 30. The labor organization’s fiscal year ends on December 31. Its first Form T-1 for this trust will be for the trust’s fiscal year ending September 30, 2010 and must be filed not later than March 31, 2011.

If a trust for which a labor organization was required to file a Form T-1 goes out of existence, a terminal financial report must be filed within 30 days after the date it ceased to exist. Similarly, if a trust for which a labor organization was required to file a Form T-1 continues to exist, but the labor organization’s interest in that trust ceases, a terminal financial report must be filed within 30 days after the date that the labor organization’s interest in the trust ceased. See Section IX (Trusts That Have Ceased to Exist) of these instructions for information on filing a terminal financial report.

III. How to File

Form T-1 must be prepared using software available on the OLMS Web site at http://www.olms.dol.gov and must be submitted electronically to the Department. A Form T-1 filer will be able to file a report in paper format only if it applies for and is granted a continuing hardship exemption of up to one year, but a paper format copy may be submitted initially if the filer asserts a temporary hardship and files electronically thereafter.

Information on downloading the electronic filing software and a detailed user guide can be found on the OLMS Web site at http://www.olms.dol.gov.

HARDSHIP EXEMPTIONS

A labor organization that must file Form T-1 may assert a temporary hardship exemption or apply for a continuing hardship exemption to prepare and submit the report in paper format. If a labor organization files both Form LM-2 and Form T-1, the exemption must be separately asserted for each report, although in appropriate circumstances the same reasons may be used to support both exemptions. If it is possible to file Form LM-2, or one or more Form T-1s, electronically, no exemption should be claimed for those reports, even though an exemption is warranted for a related report.

TEMPORARY HARDSHIP EXEMPTION:

If a labor organization experiences unanticipated technical difficulties that prevent the timely preparation and submission of an electronic filing of Form T-1, it may be filed in paper format by the required due date. An electronic format copy of the filed paper format document shall be submitted to the Department within ten business days after the required due date. Indicate in Item 3 (Amended, Hardship Exempted, or Terminal Report) that the labor organization is filing this form under the hardship exemption procedures. Unanticipated technical difficulties that may result in additional delays should be brought to the attention of the OLMS Division of Interpretations and Standards, which can be reached at the address below, by email at OLMS-Public@dol.gov, by phone at 202-693-0123, or by fax at 202-693-1340.

Note: If either the paper filing or the electronic filing is not received in the timeframe specified above, the report will be considered delinquent.

CONTINUING HARDSHIP EXEMPTION:

(a) The labor organization may apply in writing for a continuing hardship exemption if Form T-1 cannot be filed electronically without undue burden or expense. Such written application shall be received at least thirty days prior to the required due date of the report(s). The written application shall contain the information set forth in paragraph (b).

The application must be mailed to the following address:

U.S. Department of Labor

Employment Standards Administration

Office of Labor-Management Standards

200 Constitution Avenue, NW

Room N-5609

Washington, DC 20210-0001

Questions regarding the application should be directed to the OLMS Division of Interpretations and Standards, which can be reached at the above address, by e-mail at OLMS-Public@dol.gov, by phone at 202-693-0123, or by fax at 202-693-1340.

(b) The request for the continuing hardship exemption shall include, but not be limited to, the following: (1) the justification for the requested time period of the exemption; (2) the burden and expense that the labor organization would incur if it was required to make an electronic submission; and (3) the reasons for not submitting the report(s) electronically. The applicant must specify a time period not to exceed one year.

(c) The continuing hardship exemption shall not be deemed granted until the Department notifies the applicant in writing. If the Department denies the application for an exemption, the labor organization shall file the report(s) in electronic format by the required due date. If the Department determines that the grant of the exemption is appropriate and consistent with the public interest and the protection of labor organization members and so notifies the applicant, the labor organization shall follow the procedures set forth in paragraph (d).

(d) If the request is granted, the labor organization shall submit the report(s) in paper format by the required due date. The filer may be required to submit Form T-1 in electronic format upon the expiration of the period for which the exemption is granted. Indicate in Item 3 (Amended, Hardship Exempted, or Terminal Report) that the labor organization is filing under the hardship exemption procedures.

Note: If either the paper filing or the electronic filing is not received in the timeframe specified above, the report will be considered delinquent.

IV. Public Disclosure

The LMRDA requires that the Department make reports filed by labor organizations available for inspection by the public. Reports may be viewed and downloaded from the OLMS Web site at http://www.unionreports.gov. Reports may also be examined and copies purchased through the OLMS Public Disclosure Room (telephone: 202-693-0125) at the following address:

U.S. Department of Labor

Employment Standards Administration

Office of Labor-Management Standards

200 Constitution Avenue, NW

Room N-1519

Washington, DC 20210-0001

V. Officer Responsibilities and Penalties

The president and treasurer or the corresponding principal officers of the labor organization required to sign Form T-1 are personally responsible for its filing and accuracy. Under the LMRDA, officers are subject to criminal penalties for willful failure to file a required report and for false reporting. False reporting includes making any false statement or misrepresentation of a material fact while knowing it to be false, or for knowingly failing to disclose a material fact in a required report or in the information required to be contained in the report or in any information required to be submitted with it. Under the CSRA and FSA and implementing regulations, false reporting and failure to report may result in administrative enforcement action and litigation. The officers responsible for signing Form T-1 are also subject to criminal penalties for false reporting and perjury under Sections 1001 of Title 18 and 1746 of Title 28 of the United States Code.

The reporting labor organization and the officers required to sign Form T-1 are also subject to civil prosecution for violations of the filing requirements. Section 210 of the LMRDA (29 U.S.C. 440), provides that “whenever it shall appear that any person has violated or is about to violate any of the provisions of this title, the Secretary may bring a civil action for such relief (including injunctions) as may be appropriate.”

VI. Recordkeeping

The officers required to file Form T-1 are responsible for maintaining records that will provide in sufficient detail the information and data necessary to verify the accuracy and completeness of the report. The records must be kept for at least five years after the date the report is filed. Any record necessary to verify, explain, or clarify the report must be retained, including, but not limited to, vouchers, worksheets, receipts, applicable resolutions, and any electronic documents used to complete and file the report.

SPECIAL INSTRUCTIONS FOR CERTAIN ORGANIZATIONS

VII. Labor Organizations in Trusteeship

Any labor organization that has placed a subordinate labor organization in trusteeship is responsible for filing the subordinate’s annual financial reports. This obligation includes the requirement to file Form T-1 for any trusts in which the subordinate labor organization is interested. A trusteeship is defined in section 3(h) of the LMRDA (29 U.S.C. 402) as “any receivership, trusteeship, or other method of supervision or control whereby a labor organization suspends the autonomy otherwise available to a subordinate body under its constitution or bylaws.”

The report must be signed by the president and treasurer or corresponding principal officers of the labor organization that imposed the trusteeship and by the trustees of the subordinate labor organization. In order for the trustees to sign, click on the “Add Signature Block” button on page 1 to open a signature page near the end of the form.

VIII. Completing Form T-1

INTRODUCTION

Upon opening the Form T-1, a Document Status dialog box displays to briefly explain the special features of this document. Click on the “close” button to proceed.

Items 1, 2, and 4 - 7 are “pre-filled” items. These fields were filled in by the software based on information you entered when you accessed and downloaded the form from the OLMS Web site. You cannot edit these fields.

Be sure to click on the “Validate Form” button after you have completed the form but before you sign it. This action will generate an “Errors Page” listing any errors that must be corrected before you sign the form.

ITEMS 1 Through 20

Answer Items 1 through 20 as instructed. Select the appropriate box for those questions requiring a "Yes" or "No" answer; do not leave both boxes blank. Enter a single "0" in the boxes for items requiring a number or dollar amount if there is nothing to report.

1. FILE NUMBER — Enter in Item 1(a) the 6-digit (###-###) file number that OLMS assigned to the labor organization. If the labor organization does not have the number on file and cannot obtain the number from prior reports filed with the Department, the number can be obtained from the OLMS Web site at http://www.unionreports.gov or by contacting the nearest OLMS field office listed at the end of these instructions.

The software will enter the trust’s 7-digit (T### ###) file number in Item 1(b) and at the top of each page of Form T-1. This is the number you entered when you downloaded Form T-1. If the number is incorrect, you must download another copy of the form using the correct number.

For an initial filing of a Form T-1, this number may be obtained by calling the OLMS Division of Reports, Disclosure & Audits at (202) 693-0124 or by contacting OLMS at the following address:

U.S. Department of Labor

Employment Standards Administration

Office of Labor-Management Standards

200 Constitution Avenue, NW

Room N-5616

Washington, DC 20210-0001

For future filings, if the labor organization does not have the number on file and cannot obtain the number from the trust or from prior reports filed with the Department, information on obtaining the number can be found on the OLMS website at http://www.olms.dol.gov.

2. PERIOD COVERED — The software will enter the beginning and ending dates of the period covered by this report. These are the dates you entered when you downloaded Form T-1. If the dates are incorrect, you must download another form using the correct dates.

If the fiscal year changed, enter in Item 2 (Period Covered) the ending date for the period of less than 12 months, which is the new fiscal year ending date, and report in Item 25 (Additional Information) that the trust changed its fiscal year. For example, if the fiscal year ending date changes from June 30 to December 31, a report must be filed for the partial year from July 1 to December 31. Thereafter, the annual report should cover a full 12-month period from January 1 to December 31.

3. AMENDED, HARDSHIP EXEMPTED, OR TERMINAL REPORT — Do not complete this item unless this report is an amended, hardship exempted, or terminal report. Select Item 3(a) if the labor organization is filing an amended Form T-1 correcting a previously filed Form T-1. Select Item 3(b) if the labor organization is filing under the hardship exemption procedures defined in Section III. Select Item 3(c) if the trust has gone out of business by disbanding, merging into another organization, or being merged and consolidated with one or more trusts to form a new trust, or if the labor organization’s interest in the trust has ceased and this is the terminal report for the trust. Be sure the date the trust ceased to exist is entered in Item 2 (Period Covered) after the word “Through.” See Section IX (Trusts That Have Ceased to Exist) of these instructions for more information on filing a terminal report.

4. NAME OF UNION — Enter the name of the national or international labor organization or if the labor organization is a subordinate entity of such organization the name of the national or international labor organization that granted its charter. "Affiliates," within the meaning of these instructions, are labor organizations chartered by the same parent body, governed by the same constitution and bylaws, or having the relationship of parent and subordinate. For example, a parent body is an affiliate of all of its subordinate bodies, and all subordinate bodies of the same parent body are affiliates of each other.

If the labor organization has no such affiliation, enter the name of the labor organization as currently identified in the labor organization's constitution and bylaws or other organizational documents.

5. DESIGNATION — Enter the specific designation, if any, that is used to identify the labor organization, such as Local, Lodge, Branch, Joint Board, Joint Council, District Council, etc.

6. DESIGNATION NUMBER — Enter the number or other identifier, if any, by which the labor organization is known.

7. UNIT NAME — Enter any additional or alternate name by which the labor organization is known, such as "Chicago Area Local."

8. MAILING ADDRESS OF UNION — Enter the current address where mail is most likely to reach the labor organization as quickly as possible. The first and last name of the person, if any, to whom such mail should be sent and any building and room number should be included.

9. PLACE WHERE UNION RECORDS ARE KEPT — If the records required to be kept by the labor organization to verify this report are kept at the address reported in Item 8 (Mailing Address of Union), answer "Yes." If not, answer "No" and provide in Item 25 (Additional Information) the address where the labor organization's records are kept.

10. NAME OF TRUST — The software will enter the name of the trust. This is the trust name you entered when you downloaded Form T-1. If the name is incorrect, you must download another form using the correct name.

This item cannot be edited. If the labor organization needs to change this information, contact the OLMS Division of Reports, Disclosure, and Audits by telephone at 202-693-0124, by e-mail at OLMS-Public@dol.gov, or by fax at 202-693-1345. Indicate that the subject of the inquiry is the Form T-1 pre-filled identifying information.

11. TRUST EMPLOYER IDENTIFICATION NUMBER (EIN) — Enter the Employer Identification Number assigned to the trust by the Internal Revenue Service.

12. PURPOSE — Enter the purpose of the trust. For example, if the trust is a credit union that provides loans to labor organization members, the purpose may be “credit union.”

13. MAILING ADDRESS OF TRUST —

The software will enter the current address where mail is most likely to reach the trust as quickly as possible. The first and last name of the person, if any, to whom such mail should be sent, and any building and room number should be included. These fields are pre-filled from the OLMS database, but can be edited by the filer.

14. PLACE WHERE TRUST RECORDS ARE KEPT — If the records required to be kept to verify this report are kept at the address reported in Item 13 (Mailing Address of Trust), answer “Yes.” If not, answer “No” and provide in Item 25 (Additional Information) the address where the trust’s records are kept. The labor organization need not keep separate copies of these records at its own location, as long as members have the same access to such records from the trust as they would be entitled to have from the labor organization.

Note: The president and treasurer of the labor organization are responsible for maintaining the records used to prepare the report.

15. AUDIT EXEMPTION —

Answer “Yes” to Item 15 if the labor organization will be submitting an independent, certified audit in place of the remainder of Form T-1. If an audit report meeting the standards described in Section I (Who Must File) is submitted with a Form T-1 that has been completed for Items 1 through 15 then it is not necessary to complete Items 16 through 25, and Schedules 1 through 3. However, Items 26-27 (Signatures) must be completed.

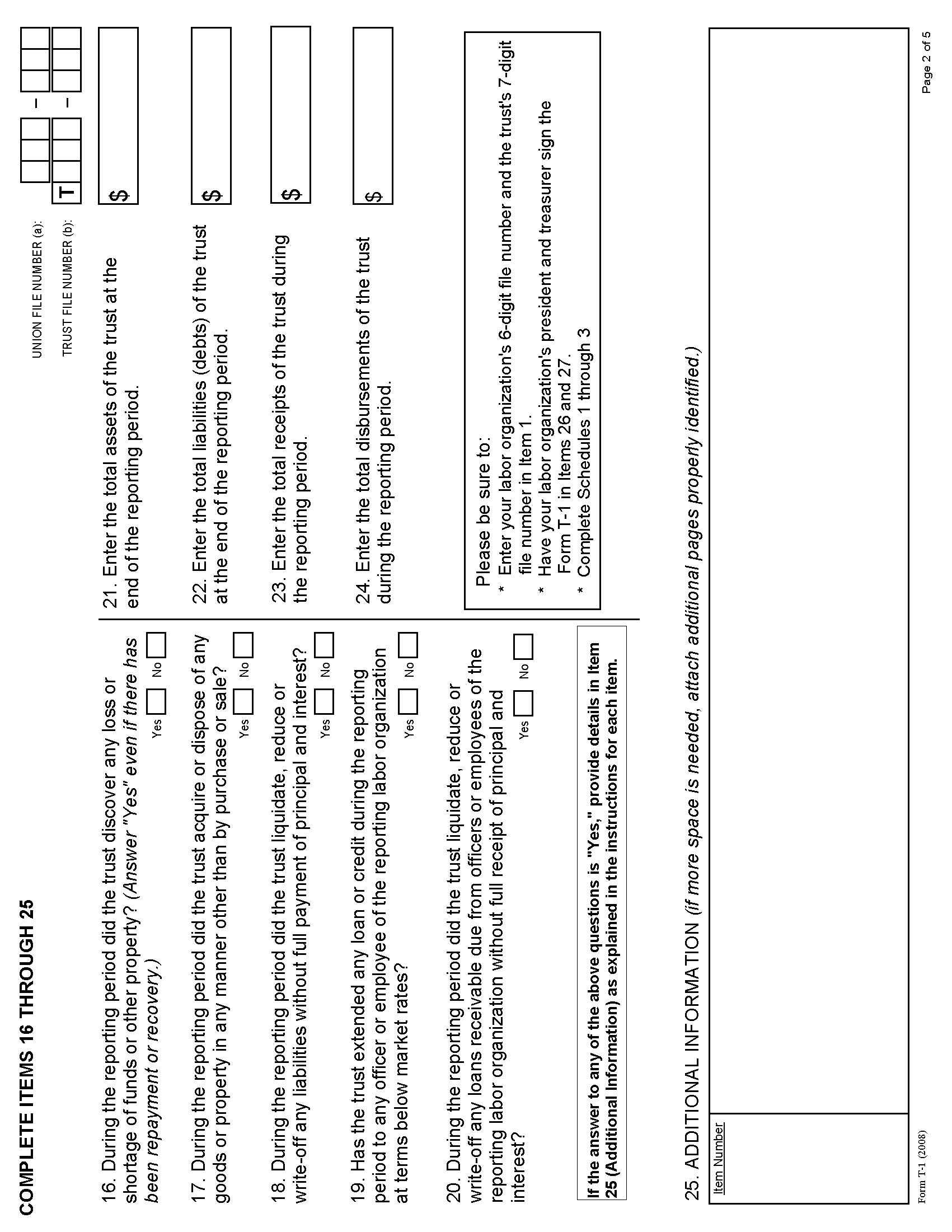

16. LOSSES OR SHORTAGES — Answer “Yes” to Item 16 if the trust experienced a loss, shortage, or other discrepancy in its finances during the period covered. A “loss or shortage of funds or other property” within the meaning of Item 16 does not include delinquent contributions from employers, delinquent accounts receivable, losses from investment decisions, or overpayments of benefits. Describe the loss or shortage in detail in Item 25 (Additional Information), including such information as the amount of the loss or shortage of funds or a description of the property that was lost, how it was lost, and to what extent, if any, there has been an agreement to make restitution or any recovery by means of repayment, fidelity bond, insurance, or other means.

17. ACQUISITION OR DISPOSITION OF ASSETS — If Item 17 is answered “Yes,” describe in Item 25 (Additional Information) the manner in which the trust acquired or disposed of the asset(s), such as donating office furniture or equipment to charitable organizations, trading in assets, writing off a receivable, or giving away other tangible or intangible property of the trust. Include the type of asset, its value, and the identity of the recipient or donor, if any. Also report in Item 25 the cost or other basis at which any acquired assets were entered on the trust’s books or the cost or other basis at which any assets disposed of were carried on the trust’s books.

A filer may group similar acquired or disposed assets together, in a larger category, as well as grouping multiple assets acquired from or disposed of to the same source. For example, if a trust acquired various types of office equipment as a donation, these assets may be grouped together for purposes of the description in Item 25.

For assets that were traded in, enter in Item 25 the cost, book value, and trade-in allowance.

18. LIQUIDATION OF LIABILITIES — If Item 18 is answered “Yes,” provide in Item 25 (Additional Information) all details in connection with the liquidation, reduction, or writing off of the trust’s liabilities without the disbursement of cash.

19. LOANS AT FAVORABLE TERMS — If Item 19 is answered “Yes,” provide in Item 25 (Additional Information) all details in connection with each such loan, including the name of the labor organization officer or employee, the amount of the loan, the amount that was still owed at the end of the reporting period, the purpose of the loan, terms for repayment, any security for the loan, and a description of how the terms of the loan were more favorable than those available to others.

20. WRITING OFF OF LOANS — If Item 20 is answered “Yes,” describe in Item 25 (Additional Information) all details in connection with each such loan, including the amount of the loan and the reasons for the writing off, liquidation, or reduction.

FINANCIAL DETAILS

REPORT ONLY DOLLAR AMOUNTS

Report all amounts in dollars only. Round cents to the nearest dollar. Amounts ending in $.01 through $.49 should be rounded down. Amounts ending in $.50 through $.99 should be rounded up.

Enter a single “0” if there is nothing to report.

REPORTING CLASSIFICATIONS

Complete all items and lines on the form as given. Do not use different accounting classifications or change the wording of any item or line.

ASSETS AND LIABILITIES

21. ASSETS — Enter the total value of all the trust’s assets at the end of the reporting period including, for example, cash on hand and in banks, property, loans owed to the trust, investments, office furniture, automobiles, and anything else owned by the trust. Enter “0” if the trust had no assets at the end of the reporting period.

22. LIABILITIES — Enter the total amount of all the trust’s liabilities at the end of the reporting period including, for example, unpaid bills, loans owed, the total amount of mortgages owed, payroll withholdings not transmitted by the end of the reporting period, and other debts of the trust. Enter “0” if the trust had no liabilities at the end of the reporting period.

RECEIPTS AND DISBURSEMENTS

Receipts are money actually received by the trust and disbursements are money actually paid by the trust. The purpose of Items 23 and 24 is to report the flow of cash in and out of the trust during the reporting period. Transfers between separate bank accounts or between special funds of the trust do not represent the flow of cash in and out of the trust and should not be reported as receipts and disbursements.

Since Items 23 and 24 report cash flowing in and out of the trust, “netting” is not permitted. “Netting” is the offsetting of receipts against disbursements and reporting only the balance (net) as either a receipt or a disbursement.

Do not include in Item 23 or 24 the total amount from the sale or redemption of U.S. Treasury securities, marketable securities, or other investments that was promptly reinvested (i.e., “rolled over”) in U.S. Treasury securities, marketable securities, or other investments during the reporting period. “Promptly reinvested” means reinvesting (or “rolling over”) the funds in a week or less without using the funds for any other purpose during the period between the sale of the investment and the reinvestment.

Receipts and disbursements by an agent on behalf of the trust are considered receipts and disbursements of the trust and must be reported in the same detail as other receipts and disbursements.

23. RECEIPTS — Enter the total amount of all receipts of the trust during the reporting period including cash, interest, dividends, realized short and long term capital gains, rent, royalties, and other receipts of any kind. Enter “0” if the trust had no receipts during the reporting period.

24. DISBURSEMENTS — Enter the total amount of all disbursements made by the trust during the reporting period including, for example, net payments to officers and employees of the trust, payments for administrative expenses, loans made by the trust, taxes paid, and disbursements for the transmittal of withheld taxes and other payroll deductions. Enter “0” if the trust made no disbursements during the reporting period.

SCHEDULES 1 THROUGH 3

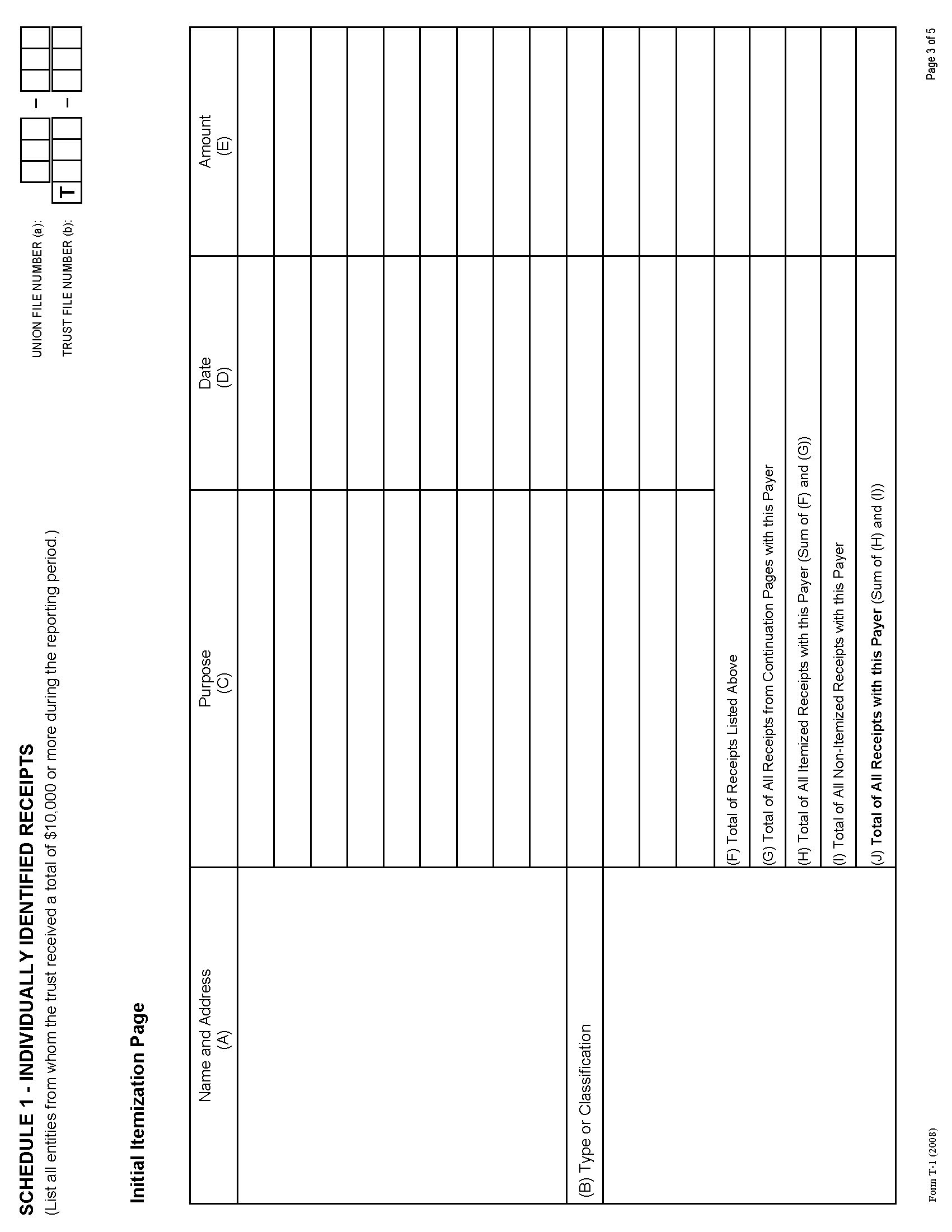

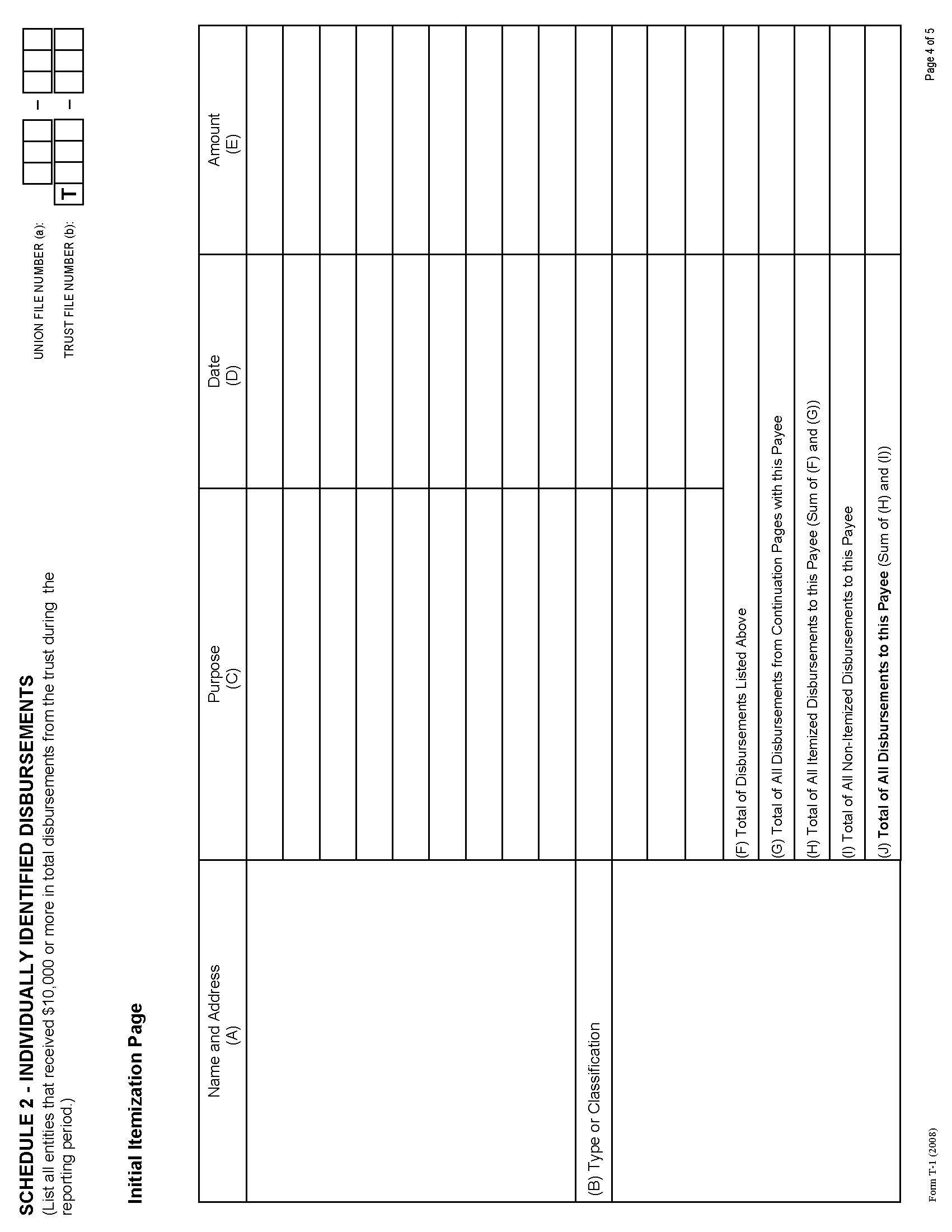

SCHEDULES 1 AND 2 — RECEIPTS AND DISBURSEMENTS

Schedules 1 and 2 provide detailed information on the financial operations of the trust.

All “major” receipts during the reporting period must be separately identified in Schedule 1. A “major” receipt includes: 1) any individual receipt of $10,000 or more; or 2) total receipts from any single entity or individual that aggregate to $10,000 or more during the reporting period. This process is discussed further below.

All “major” disbursements during the reporting period must be separately identified in Schedule 2. A “major” disbursement includes: 1) any individual disbursement of $10,000 or more; or 2) total disbursements to any single entity or individual that aggregate to $10,000 or more during the reporting period. This process is discussed further below.

Exemptions

Labor organizations are not required to separately identify any individual or entity on Schedule 1 from which the trust receives receipts of $10,000 or more, individually or in the aggregate, during the reporting period, if the receipts are derived from pension, health, or other benefit contributions that are provided pursuant to a collective bargaining agreement covering such contributions. Additionally, the labor organization is not required to itemize benefit payments on Schedule 2 from the trust to a plan participant or beneficiary, if the detailed basis on which such payments are to be made is specified in a written agreement.

Filers should not include on Schedules 1 and 2 the total amount from the sale or redemption of U.S. Treasury securities, marketable securities, or other investments that was promptly reinvested (i.e., “rolled over”) in U.S. Treasury securities, marketable securities, or other investments during the reporting period “Promptly reinvested” means reinvesting (or “rolling over”) the funds in a week or less without using the funds for any other purpose during the period between the sale of the investment and the reinvestment.

Note: Disbursements to officers and employees of the trust who received more than $10,000 from the trust during the reporting period should be reported in Schedule 3, and need not also be reported in Schedule 2.

Example 1: The trust has an ongoing contract with a law firm that provides a wide range of legal services to which a single payment of $10,000 is made each month. Each payment would be listed in Schedule 2.

Example 2: The trust received a settlement of $14,000 in a small claims lawsuit. The receipt would be individually identified in Schedule 1.

Example 3: The trust made three payments of $4,000 each to an office supplies vendor for office supplies during the reporting period. The $12,000 in disbursements to the vendor would be reported in Schedule 2 in line I of an Initial Itemization Page for that vendor.

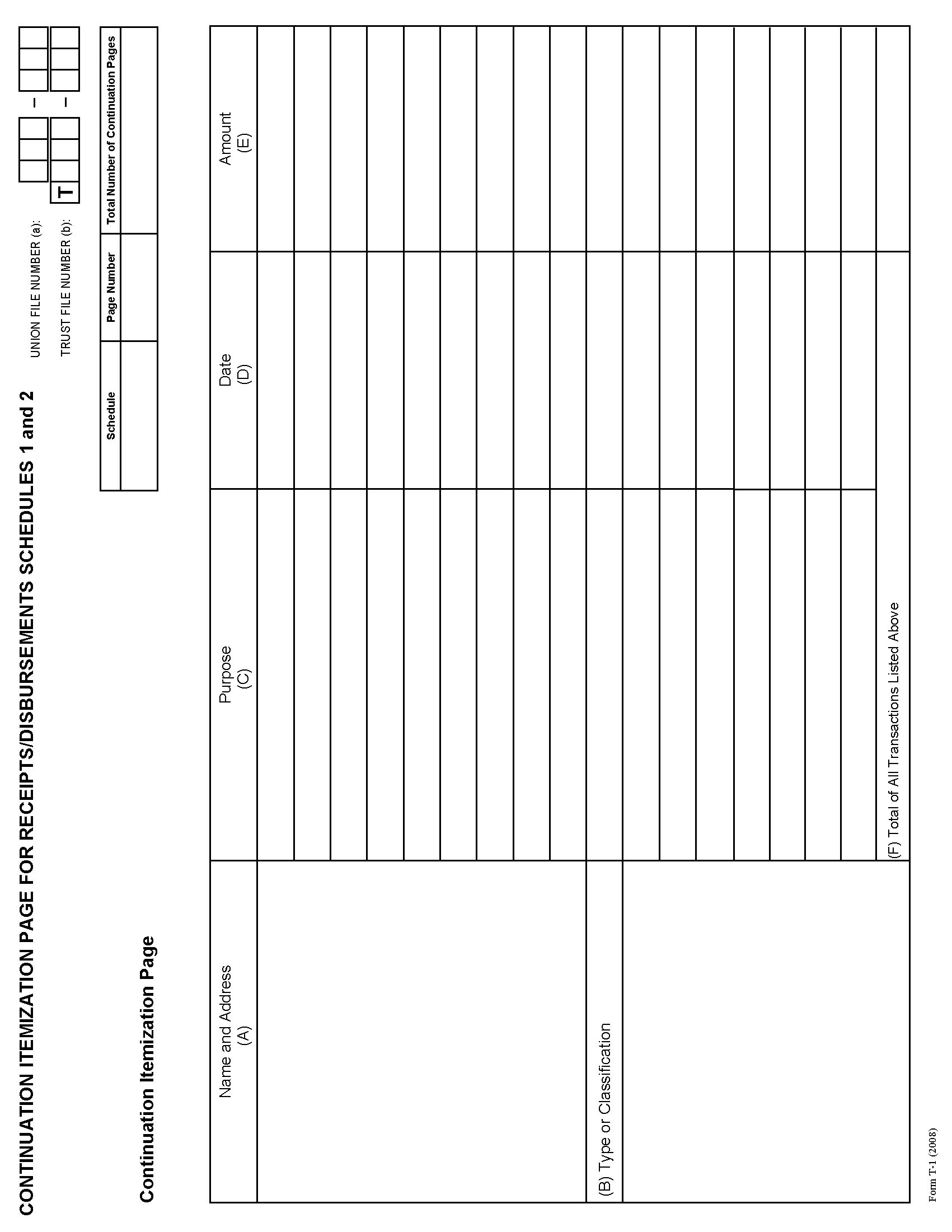

Procedures for Completing Schedules 1 and 2

Complete an Initial Itemization Page and a Continuation Itemization Page(s), as necessary, for each payer/payee for whom there is (1) an individual receipt/disbursement of $10,000 or more or (2) total receipts/disbursements that aggregate to $10,000 or more during the reporting period. For each major receipt/disbursement, provide the full name and business address of the entity or individual, type of business or job classification of the entity or individual, purpose of the receipt/disbursement, date, and amount of the receipt/disbursement. Receipts/disbursements must be listed in chronological order.

An Initial Itemization Page must be completed for each payer/payee described above. Additional Itemization Page(s) for additional payers/payees can be generated and added to the end of Form T-1 by pressing the “Add More Receipts” or “Add More Disbursements” button located at the top of the first Initial Itemization Page. If the number of receipts/disbursements exceeds the number of space provided on the Initial Itemization Page a Continuation Itemization Page(s) can be generated and added to the end of the Form T-1 by pressing the “More Receipts for this Payee” or “More Disbursements for this Payer” button located below Column (A). The software will automatically enter the name, address, and type or classification of the payee/payer on the Continuation Itemization Page(s).

Enter in Column (A) the full name and business address of the entity or individual from which the receipt was received or to which the disbursement was made. Do not abbreviate the name of the entity or individual. If you do not have access to the full address, the city and state are sufficient.

Enter in Column (B) the type of business or job classification of the entity or individual, such as printing company, office supplies vendor, lobbyist, think tank, marketing firm, bookkeeper, receptionist, shop steward, legal counsel, union member, etc.

Enter in Column (C) the purpose of the receipt/disbursement, which means a brief statement or description of the reason the receipt/disbursement was made.

Enter in Column (D) the date that the receipt/disbursement was made. The format for the date must be mm/dd/yyyy. The date of receipt/disbursement for reporting purposes is the date the trust actually received or disbursed the money, rather than the date that the right to receive, or the obligation to disburse, was incurred.

Enter in Column (E) the amount of the receipt/disbursement.

The software will enter in Line (F) the total of all transactions listed in Column (E).

The software will enter in Line (G) the totals from any Continuation Itemization Pages for this payee/payer.

The software will enter in Line (H) the total of all itemized transactions with this payee/payer (the sum of Lines (F) and (G)).

Enter in Line (I) the total of all other transactions with this payer/payee (that is, all individual transactions of less than $10,000 each).

The software will enter in Line (J) the total of all transactions with the payee/payer for this schedule (the sum of Lines (H) and (I))

Special Instructions for Reporting Credit Card Disbursements

Disbursements to credit card companies may not be reported as a single disbursement to the credit card company as the vendor. Instead, charges appearing on credit card bills paid during the reporting period must be allocated to the recipient of the payment by the credit card company according to the same process as described above.

The Department recognizes that filers will not always have the same access to information regarding credit card payments as with other transactions. Filers should report all of the information required in the itemization schedule that is available to the labor organization.

For instance, in the case of a credit card transaction for which the receipt(s) and monthly statement(s) do not provide the full legal name of a payee and the trust does not have access to any other documents that would contain the information, the labor organization should report the name as it appears on the receipt(s) and statement(s). Similarly, if the receipt(s) and statement(s) do not include a full street address, the labor organization should report as much information as is available and no less than the city and state.

Once these transactions have been incorporated into the recordkeeping system they can be treated like any other transaction for purposes of assigning a description and purpose.

In instances when a credit card transaction is canceled and the charge is refunded in whole or part by entry of a credit on the credit card statement, the charge should be treated as a disbursement, and the credit should be treated as a receipt. In reporting the credit as a receipt, Column (C) of Schedule 1 must indicate that the receipt was in refund of a disbursement, and must identify the disbursement by date and amount.

Special Procedures for Reporting Confidential Information

Filers may use the procedure described below to report the following types of information:

Information that would identify individuals paid by the trust to work in a non-union bargaining unit in order to assist the labor organization in organizing employees, provided that such individuals are not employees of the trust who receive more than $10,000 in the aggregate in the reporting year from the trust. Employees receiving more than $10,000 must be reported on Schedule 3;

Information that would expose the reporting labor organization’s prospective organizing strategy. The labor organization must be prepared to demonstrate that disclosure of the information would harm an organizing drive. Absent unusual circumstances information about past organizing drives should not be treated as confidential;

Information that would provide a tactical advantage to parties with whom the reporting labor organization or an affiliated labor organization is engaged or will be engaged in contract negotiations. The labor organization must be prepared to demonstrate that disclosure of the information would harm a contract negotiation. Absent unusual circumstances information about past contract negotiations should not be treated as confidential;

Information pursuant to a settlement that is subject to a confidentiality agreement, or that the labor organization or trust is otherwise prohibited by law from disclosing; and,

Information in those situations where disclosure would endanger the health or safety of an individual.

In Item 25 (Additional Information) the labor organization must identify each schedule from which any itemized receipts or disbursements were excluded because of an asserted legitimate interest in confidentiality. The notation must describe the general types of information that were omitted from the schedule, but the name of the payer/payee, date, and amount of the transaction(s) is not required.

A labor organization member, however, has the statutory right “to examine any books, records, and accounts necessary to verify” the financial report if the member can establish “just cause” for access to the information. 29 U.S.C. 431(c); 29 U.S.C. CFR 403.8 (2002). Any exclusion of itemized receipts or disbursements from Schedules 1 or 2 would constitute a per se demonstration of “just cause” for purposes of this Act. Consequently, any labor organization member (and the Department), upon request, has the right to review the undisclosed information in the labor organization's possession at the time of the request that otherwise would have appeared in the applicable schedule if the information is withheld in order to protect confidentiality interests. The labor organization also must make a good faith effort to obtain additional information from the trust.

Information that is withheld from full disclosure is not subject to the per se disclosure rule if its disclosure would violate the Health Insurance Portability and Accountability Act of 1996 or applicable regulations or other state or federal law, a non-disclosure provision of a settlement agreement, or would endanger the health or safety of an individual.

NOTE: Under no circumstances should a filer disclose the identity of the recipient of HPPA-related payments. Likewise, a filer should not disclose the identity of the recipient of any payment where doing so would violate federal or state law, a non-disclosure provision of a settlement agreement, or would endanger the health or safety of an individual.. Filers should not include social security or bank account numbers in completing the form.

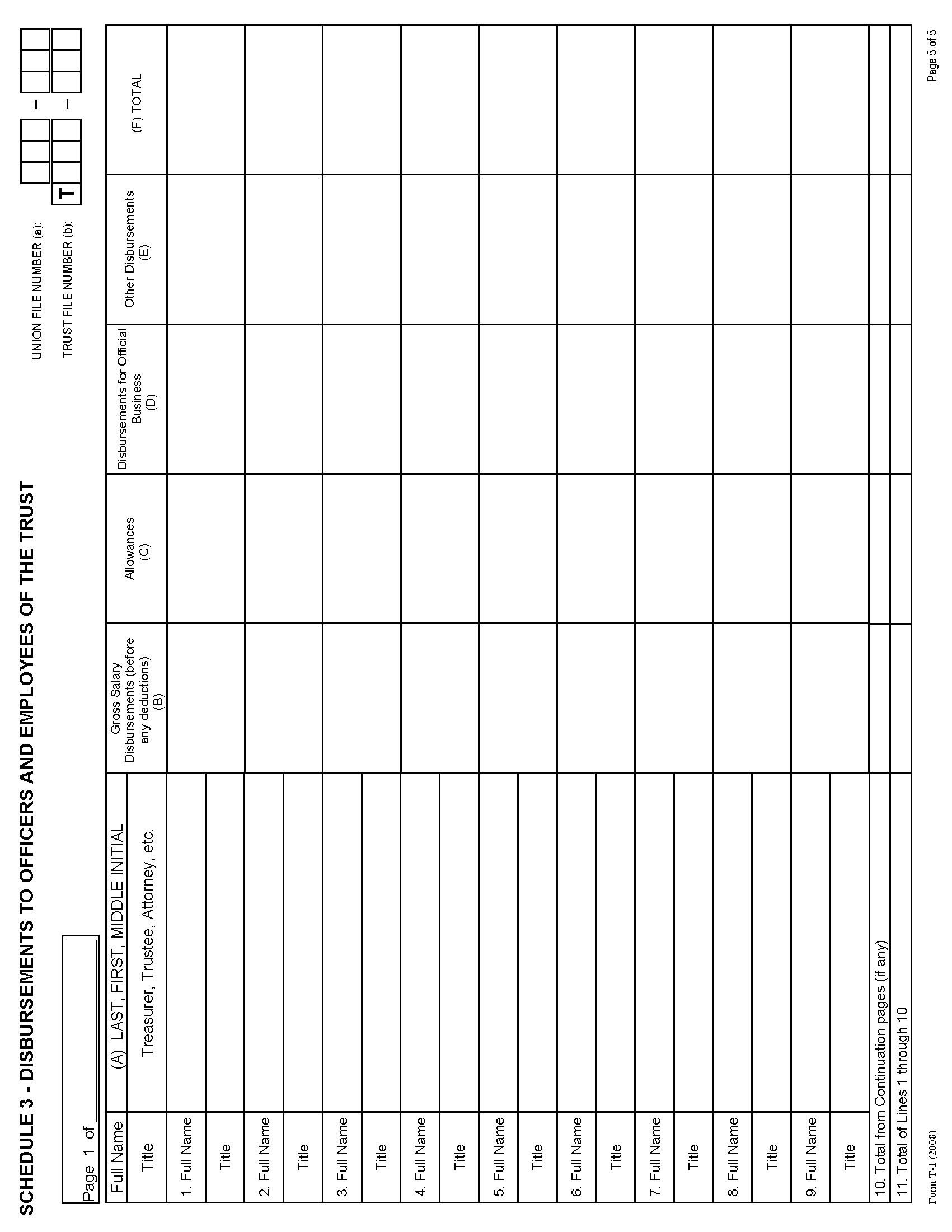

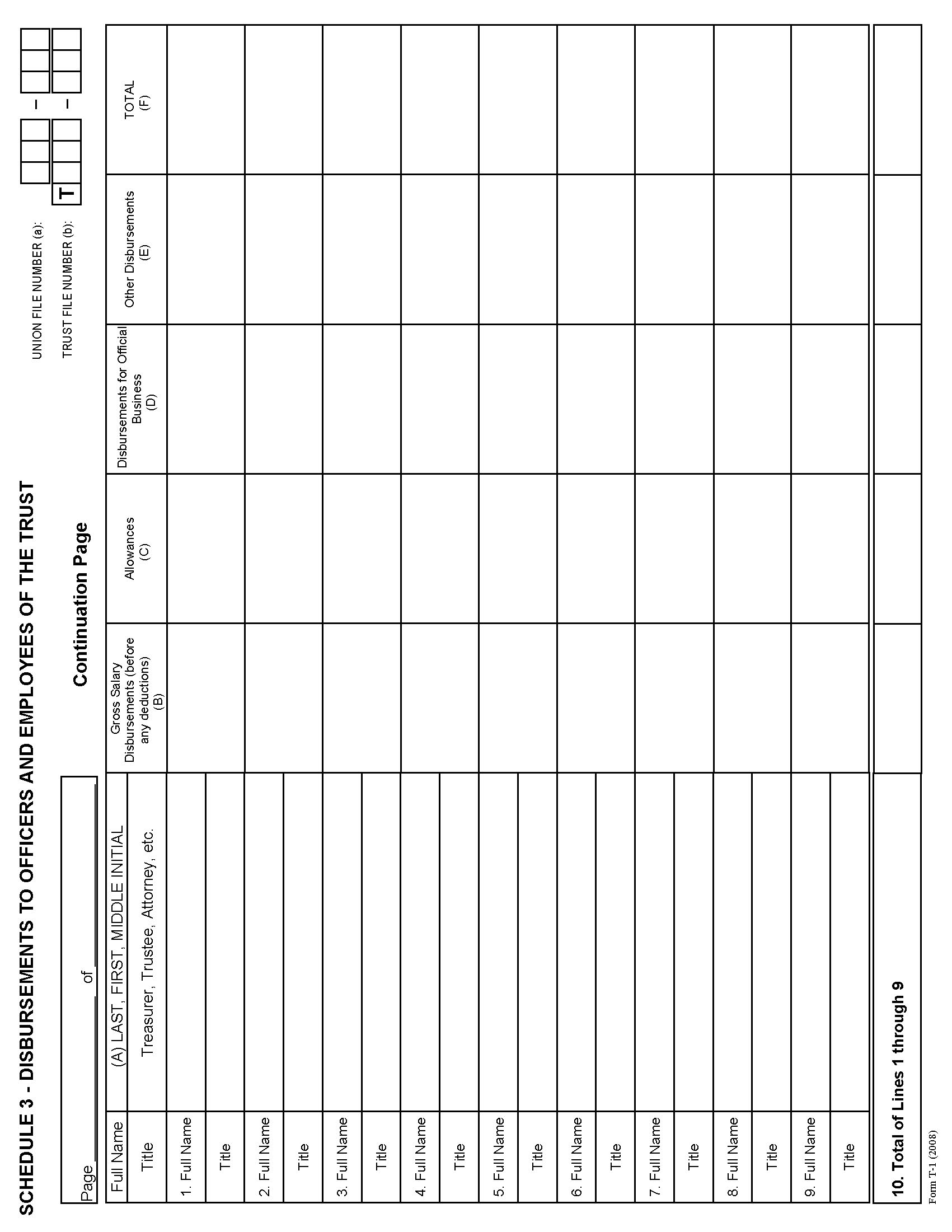

SCHEDULE 3 — DISBURSEMENTS TO OFFICERS AND EMPLOYEES OF THE TRUST

List the names and titles of all officers of the trust, whether or not any salary or disbursements were made to them or on their behalf by the trust. Report all direct and indirect disbursements to all officers of the trust and to all employees of the trust who received more than $10,000 in gross salaries, allowances, and other direct and indirect disbursements from the trust during the reporting period. Benefit payments made to an officer or employee of the trust as a plan participant or beneficiary should not be reported as a payment to a particular individual if the detailed basis on which such payments are to be made is specified in a written agreement. Any such payments, instead, should be included in the total disbursements in Item 24. If no direct or indirect disbursements were made to any officer of the trust enter 0 in Columns (B) through (F) opposite the officer’s name.

For purposes of completing the Form T-1,

An “officer of the trust” means any person designated as an officer in the trust’s governing documents, any person authorized to perform the executive functions of the trust, and any member of its executive board or similar governing body.

An “employee of the trust” means any individual employed by the trust.

These definitions will require a fact-specific inquiry by filers to determine whether trustees, the trust administrator, and other individuals performing service to the trust under its control or the trust administrator’s control are officers or employees of the trust.

Continuation pages can be generated if needed by clicking on the “Add More Disbursements To Officers Of Trust” button located at the top of Schedule 3.

NOTE: A “direct disbursement” to an officer or employee is a payment made by the trust to the officer or employee in the form of cash, property, goods, services, or other things of value.

An “indirect disbursement” to an officer or employee is a payment made by the trust to another party for cash, property, goods, services, or other things of value received by or on behalf of the officer or employee. “On behalf of the officer or employee” means received by a party other than the officer or employee of the trust for the personal interest or benefit of the officer or employee. Such payments include payments made by the trust for charges on an account of the trust for credit extended to or purchases by, or on behalf of, the officer or employee.

Column (A): Enter in Column (A) the last name, first name, and middle initial of each person who was either (1) an officer of the trust at any time during the reporting period or (2) an employee of the trust who received $10,000 or more in total disbursements from the trust during the reporting period. Also enter the title or the position held by each officer or employee listed. If an officer or employee held more than one position during the reporting period, in Item 25 (Additional Information) list each position and the dates during which the person held the position.

Column (B): Enter the gross salary of the officer or employee (before tax withholdings and other payroll deductions). Include disbursements by the trust for "lost time" or time devoted to trust activities.

Column (C): Enter the total allowances made by direct and indirect disbursements to the officer or employee on a daily, weekly, monthly, or other periodic basis. Do not include allowances paid on the basis of mileage or meals which must be reported in Column (D) or (E), as applicable.

Column (D): Enter all direct and indirect disbursements to the officer or employee that were necessary for conducting official business of the trust, except salaries or allowances which must be reported in Columns (B) and (C), respectively.

Examples of disbursements to be reported in Column (D) include: all expenses that were reimbursed directly to an officer or employee, meal allowances and mileage allowances, expenses for officers' or employees’ meals and entertainment, and various goods and services furnished to officers or employees but charged to the trust. Such disbursements should be included in Column (D) only if they were necessary for conducting official business; otherwise, report them in Column (E). Include in Column (D) travel advances that meet the following conditions:

The amount of an advance for a specific trip does not exceed the amount of expenses reasonably expected to be incurred for official travel in the near future, and the amount of the advance is fully repaid or fully accounted for by vouchers or paid receipts within 30 days after the completion or cancellation of the travel.

The amount of a standing advance to an officer or employee who must frequently travel on official business does not unreasonably exceed the average monthly travel expenses for which the individual is separately reimbursed after submission of vouchers or paid receipts, and the individual does not exceed 60 days without engaging in official travel.

Do not report the following disbursements in Schedule 3, but they should be reported in Schedule 2 if they meet the definition of a major disbursement:

Payments to individuals, other than officers and employees of the trust, who perform work or service for the trust;

Reimbursements to an officer or employee for the purchase of investments or fixed assets, such as reimbursing an officer or employee for a file cabinet purchased for office use;

Indirect disbursements for temporary lodging (room rent charges only) or transportation by public carrier necessary for conducting official business while the officer or employee is in travel status away from his or her home and principal place of employment with the trust if payment is made by the trust directly to the provider or through a credit arrangement;

Disbursements made by the trust to someone other than an officer or employee as a result of transactions arranged by an officer or employee in which property, goods, services, or other things of value were received by or on behalf of the trust rather than the officer or employee, such as rental of offices and meeting rooms, purchase of office supplies, refreshments and other expenses of meetings, and food and refreshments for the entertainment of groups other than the officers or employees on official business;

Office supplies, equipment, and facilities furnished to officers or employees by the trust for use in conducting official business; and

Maintenance and operating costs of the trust’s assets, including buildings, office furniture, and office equipment; however, see “Special Rules for Automobiles” below.

Column (E): Enter all other direct and indirect disbursements to the officer or employee. Include all disbursements for which cash, property, goods, services, or other things of value were received by or on behalf of each officer or employee and were essentially for the personal benefit of the officer or employee and not necessary for conducting official business of the trust. Benefits payments to the trust officers and employees are not of the type required to be reported in Schedule 3 if the detailed basis on which such payments are to be made is specified in a written specific trust agreement.

Include in Column (E) all disbursements for transportation by public carrier between the officer or employee’s home and place of employment or for other transportation not involving the conduct of official business. Also, include the operating and maintenance costs of all the trust’s assets (automobiles, etc.) furnished to the officer or employee essentially for the officer or employee’s personal use rather than for use in conducting official business.

Column (F): The software will add Columns (B) through (E) of each line and enter the totals in Column (F).

The software will enter on Line 10 the totals from any continuation pages for Schedule 3.

The software will enter on Line 11 the totals of Lines 1 through 10 for Columns (B) through (F).

SPECIAL RULES FOR AUTOMOBILES

Include in Column (E) of Schedule 3 that portion of the operating and maintenance costs of any automobile owned or leased by the trust to the extent that the use was for the personal benefit of the officer or employee to whom it was assigned. This portion may be computed on the basis of the mileage driven on official business compared with the mileage for personal use. The portion not included in Column (E) must be reported in Column (D).

Alternatively, rather than allocating these operating and maintenance costs between Columns (D) and (E), if 50% or more of the officer or employee’s use of the vehicle was for official business, the trust may enter in Column (D) all disbursements relative to that vehicle with an explanation in Item 25 (Additional Information) indicating that the vehicle was also used part of the time for personal business. Likewise, if less than 50% of the officer or employee’s use of the vehicle was for official business, the trust may report all disbursements relative to the vehicle in Column (E) with an explanation in Item 25 indicating that the vehicle was also used part of the time on official business.

The amount of decrease in the market value of an automobile used over 50% of the time for the personal benefit of an officer or employee must also be reported in Item 25.

ADDITIONAL INFORMATION

AND SIGNATURES

25. ADDITIONAL INFORMATION — Use Item 25 to provide additional information as indicated on Form T-1 and in these instructions. Enter the number of the item to which the information relates in the Item Number column if the software has not entered the number.

26-27. SIGNATURES — Before entering the date and signing the form, enter the telephone number at which the signatories conduct official business.

The completed Form T-1 that is filed with OLMS must be signed by both the president and treasurer, or corresponding principal officers, of the labor organization. If an officer other than the president or treasurer performs the duties of the principal executive or principal financial officer, the other officer may sign the report. If an officer other than the president or treasurer signs the report, enter the correct title in the title field next to the signature and explain in Item 25 (Additional Information) why the president or treasurer did not sign the report. Forms must be signed with digital signatures. Information about digital signatures can be obtained on the OLMS Web site at http://www.olms.dol.gov.

IX. Trusts That Have Ceased to Exist

If a trust has gone out of existence as a trust in which a labor organization is interested, the president and treasurer of the labor organization must file a terminal financial report for the period from the beginning of the trust’s fiscal year to the date of termination. A terminal financial report must be filed if the trust has gone out of business by disbanding, merging into another organization, or being merged and consolidated with one or more trusts to form a new trust. Similarly, if a trust in which a labor organization previously was interested continues to exist, but the labor organization’s interest terminates, the labor organization must file a terminal financial report for that trust.

The terminal financial report must be filed within 30 days after the date of termination to the following address:

U.S. Department of Labor

Employment Standards Administration

Office of Labor-Management Standards

200 Constitution Avenue, NW

Room N-1519

Washington, DC 20210-0001

To complete a terminal report on Form T-1, follow the instructions in Section VIII and, in addition:

Enter the date the trust, or the labor organization’s interest in the trust, ceased to exist in Item 2 after the word “Through.”

Select Item 3(c) indicating that the trust, or the labor organization’s interest in the trust, ceased to exist during the reporting period and that this is the terminal Form T-1 for the trust from the labor organization.

Enter “3(c)” in the Item Number column in Item 25 (Additional Information) and provide a detailed statement of the reason the trust, or the labor organization’s interest in the trust, ceased to exist. If the trust ceased to exist, also report in Item 25 plans for the disposition of the trust’s cash and other assets, if any. Provide the name and address of the person or organization that will retain the records of the terminated organization. If the trust merged with another trust, report that organization’s name and address.

Contact the nearest OLMS field office listed below if you have questions about filing a terminal report.

If You Need Assistance

The Office of Labor-Management Standards has field offices located in the following cities to assist you if you have any questions concerning LMRDA and CSRA reporting requirements.

Atlanta, GA

Birmingham, AL

Boston, MA

Buffalo, NY

Chicago, IL

Cincinnati, OH

Cleveland, OH

Dallas, TX

Denver, CO

Detroit, MI

Grand Rapids, MI

Guaynabo, PR

Honolulu, HI

Houston, TX

Kansas City, MO

Los Angeles, CA

Miami (Ft. Lauderdale), FL

Milwaukee, WI

Minneapolis, MN

Nashville, TN

New Haven, CT

New Orleans, LA

New York, NY

Newark (Iselin), NJ

Philadelphia, PA

Pittsburgh, PA

St. Louis, MO

San Francisco, CA

Seattle, WA

Tampa, FL

Washington, DC

Consult the OLMS Web site listed below or local telephone directory listings under United States Government, Labor Department, Office of Labor-Management Standards, for the address and telephone number of the nearest field office.

Copies of labor organization annual financial reports, labor organization officer and employee reports, employer reports, and labor relations consultant reports filed for the year 2000 and after can be viewed and printed at http://www.unionreports.gov. Copies of reports for the year 1999 and earlier can be ordered through the Web site.

Information about OLMS, including key personnel and telephone numbers, compliance assistance materials, the text of the LMRDA, and related Federal Register and Code of Federal Regulations documents, is also available at:

http://www.olms.dol.gov

1 The following sections of title 29 of the Code of Federal Regulations identify for purposes of these instructions, the types of ERISA plans that are not required to file a Form 5500: section 2520.104-20 (small unfunded, insured, or combination welfare plans), section 2520.104-22 (apprenticeship and training plans), section 2520.104-23 (unfunded or insured management and highly compensated employee pension plans), section 2520.104-24 (unfunded or insured management and highly compensated employee welfare plans), section 2520.104-25 (day care center plans), section 2520.104-26 (unfunded dues financed welfare plans maintained by employee organizations), section 2520.104-27 (unfunded dues financed pension plans maintained by employee organizations), section 2520.104-43 (certain small welfare plans participating in group insurance arrangements), and section 2520.104-44 (large unfunded, insured, or combination welfare plans; certain fully insured pension plans). Labor organizations must file a Form T-1 for these types of plans.

2 To ensure “currency,” these examples will be revised, as appropriate, in future publications of the instructions.

-

| File Type | application/msword |

| File Title | INSTRUCTIONS FOR FORM LM-2 |

| Author | pboswort |

| Last Modified By | U.S. Department of Labor |

| File Modified | 2008-08-21 |

| File Created | 2008-08-08 |

© 2026 OMB.report | Privacy Policy