ERA2 Treasury Portal User Guide v3 040224_EOUpdate_May2025

Emergency Rental Assistance Program (ERA2)

ERA2 Treasury Portal User Guide v3 040224_EOUpdate_May2025

OMB: 1505-0270

Emergency Rental Assistance Program (ERA2)

Treasury Portal User Guide

May

XX, 2025

v 4.0

Revision History

Version |

Date |

Updates |

V1.0 |

10/06/2023 |

Original |

V2.0 |

01/03/2024 |

Clarifications on Financial Reporting |

|

01/03/2024 |

Clarifications and descriptions of data validations for participant demographic Tables 1, 2, 3 and 4. |

V3.0 |

04/02/2024 |

Clarifications and description of data required on the Emergency Rental Assistance Project Data tab, and the Emergency Rental Assistance Project Participant Demographics Data tab, and related information. |

V4.0 |

05/XX/2025 |

Updates to reporting fields mandated by the President’s January 20, 2025 Executive Order 14168 titled, “Defending Women From Gender Ideology Extremism and Restoring Biological Truth to the Federal Government."

Clarifications of when the reporting system requires UEIs and TINS |

Table of Contents

Section I. Quarterly Reporting Basics 5

Section II. Navigation and Logistics 7

Section III. Recipient Profile Tab 19

Section IV. Project Overview Tab 24

Section V. Subrecipients, Contractors, and Beneficiaries Tab 45

Section VI. Recipient Subawards, Contracts and Direct Payments Tab 49

Section VII. Expenditures Tab 53

Section VIII. Project Data and Participant Demographics Tab 61

Section IX. Performance and Financial Reporting Tab 79

Section X. Report Certification and Submission Tab 86

Appendix A – Bulk File Upload Overview 89

Appendix C – Recipient Obligations and Expenditures (Payments) to Individuals (Beneficiaries) 110

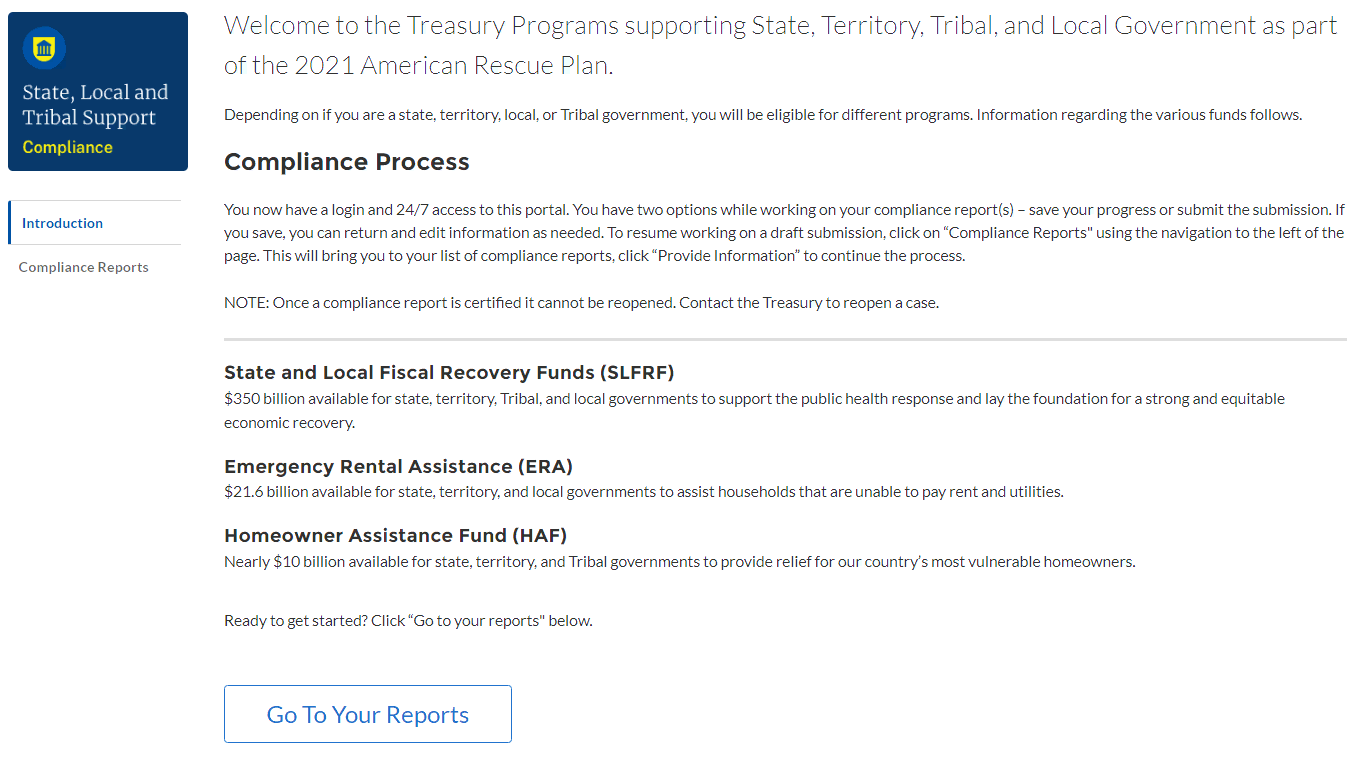

Each ERA2 Recipient (ERA2 grantee) must submit Quarterly Reports with quarter-specific and cumulative performance and financial information. The reports must be submitted via Treasury’s portal.

This guide provides instructions and on using Treasury’s portal to submit required Emergency Rental Assistance (ERA2) Quarterly Reports. Much of the information in this guide is the same as provided in the earlier version of the Portal User Guide (which applied to both ERA1 and ERA2 programs), except for guidance on several new reporting requirements and updated reporting formats specific to the ERA2 program.

The guide is a supplement to the ERA2

Reporting Guidance which contains official guidance

on

reporting requirements.

Please also see Treasury’s ERA webpage for additional information on programmatic and reporting topics.

ERA2 Recipients must designate staff or officials for

three roles for developing and submitting the required ERA2 quarterly

reports. Recipients must provide the names and contact information

for persons designated for each of the three roles prior to accessing

their quarterly reports. The designations must be made on-line in

Treasury’s portal, as described below.

The required roles are as follows:

ERA2 Account Administrator for Reporting (AA) for the ERA2 award. Individuals designated for this role is responsible for working within your organization to determine its designees for the roles of Point of Contact for Reporting and Authorized Representative for Reporting and for inputting their names and contact information via Treasury’s portal and for making any changes or updates as needed over the ERA2 award period. The Account Administrator should identify an individual to serve in his/her place in the event of staff changes.

ERA2 Point of Contact for Reporting (POC) will receive official Treasury notifications about ERA2 reporting. Such notifications include alerts about upcoming reporting timeframes, requirements, and deadlines. Typically, the POC is a key individual for managing the ERA2 Recipient’s reporting. The POC can enter data into a report but cannot submit reports.

ERA2 Authorized Representative for Reporting (ARR) is responsible for certifying and submitting official reports on behalf of the ERA2 Recipient. Treasury will only accept reports or other official communications submitted by the ERA2 Authorized Representative for Reporting. The ARR is responsible for communications with Treasury on such matters as extension requests and amendments of previously submitted reports.

ERA2 reports include monthly reports, Quarterly Reports, interim reports, and final reports.

An ERA2 Recipient may designate multiple people to a single role or a single individual for multiple roles. For example, the individual designated as the ERA2 POC may also be designated as the ERA2 Authorized Representative for Reporting. The ERA2 Recipient may designate the same individual for all three roles.

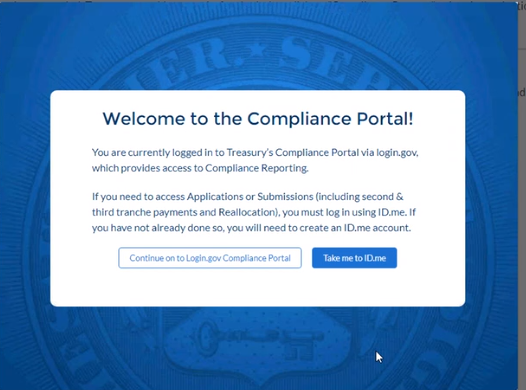

Everyone who is designated by the ERA2 Recipient for any reporting role must register with ID.me or Login.gov before gaining access to Treasury’s portal. See the following links for registration instructions:

ID.me Guidance (Used by Recipient staff to apply for recovery act awards/assistance as well as to complete compliance reporting)

Login.gov Guidance (Used by Recipient staff to complete compliance reporting)

The names and contact information for the ERA2-designated individuals will be pre-populated in the “Recipient Profile” portion of the ERA2 Quarterly Reports. Recipients can update the designations and related information at any time. Please see the Hints and Tips for Designating Points of Contact for ERA1 and ERA2 Reporting for further details.

Individuals designated as an ERA2 Recipient’s ARR or AA are the only individuals with authority to certify and submit ERA2 Compliance Reports via Treasury’s portal. Staff serving as the ERA2 POC are not authorized to certify and submit ERA2 Compliance Reports. The POC is authorized only to enter data and validate the data on Treasury’s portal and to check draft data for submission errors and so forth.

Key terms appear in bold and are explained in the Data Dictionary posted on the Treasury’s ERA2 webpage.

Log in to Treasury’s Portal via login.gov (see Figure 1).

Upon logging in, navigate to the Introduction tab (see Figure 2).

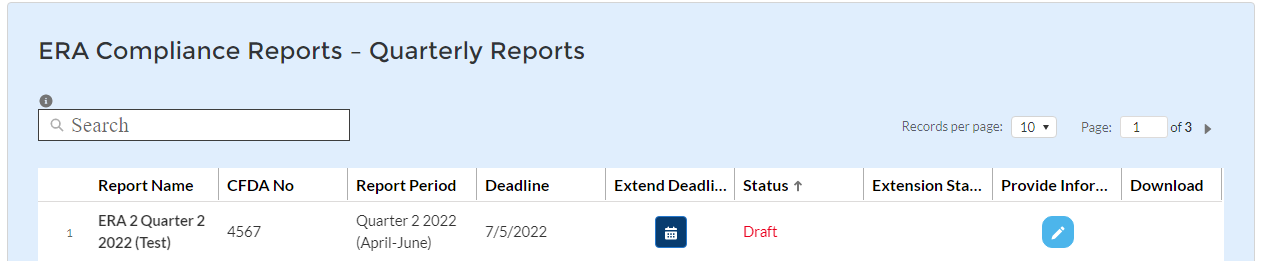

Click on the Compliance Reports tab (see Figure 3) to navigate to a window listing the of the ERA2 reports.

Figure 3 – Quarterly Report Selection

Each listed Quarterly Report links to the required online forms for the specific report. See Figure 3 above for an example Quarterly Report Selection screen.

To begin a report, click on the blue pencil icon under the “Provide Information” column to access the given report. The ERA Compliance Reports section lists all ERA reports. Reports in “Draft” status are available for data entry.

To navigate to a specific report, click the icon under Provide Information (see Figure 3) to enter data for the current report for the specific ERA2 Award. This action will advance you to the Reporting Guidance tab. The Reporting Guidance and Bulk Upload Templates and Instructions tabs are informational tabs. Recipient reporting begins with the Recipient Profile tab.

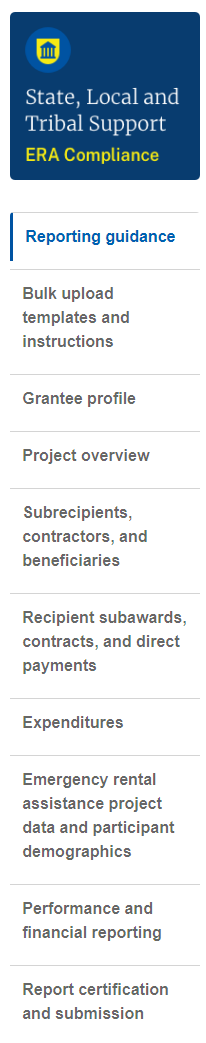

The Navigation Bar (see Figure 4) which appears on the left side of Treasury’s portal screens allows you to navigate between each tab.

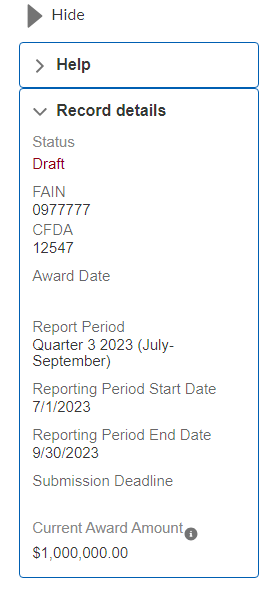

On the right side of the screen, users will see another navigation pane with information about their ERA2 award (see Figure 5). This information box displays the status of the current report; the ERA2 award FAIN number; the ERA2 program CFDA number; the ERA2 Award Date; the Reporting Period for the specific quarterly report; the Reporting Period Start and End Dates; the Quarterly Report Submission Deadline; and the ERA2 Funds Allocated and the Current Total ERA2 Award Amount.

If the report has been submitted and the original submission deadline has not passed, the navigation bar displays an “unsubmit” button at the bottom of the display window. ERA2 Recipients that submit their quarterly report prior to the official due date can modify the submitted reports by clicking the “unsubmit” button. Clicking on “unsubmit” places the report into draft status so revisions and edits can be made prior to the due date. Only an ERA2 ARR or ERA AA can “unsubmit” reports.

Figure 5 – Project Information Navigation Pane

Treasury’s portal leads the ERA2 Recipient POC, ARR and AA through a series of online forms that, when completed, will fulfill the ERA2 Quarterly Reporting obligations. Users can manually enter data directly into the portal or, for many data elements, providing required information via a bulk upload file that includes all relevant information in a Treasury approved process and format.

Treasury encourages Recipients, particularly those with a large

quantity of data for reporting, to use the bulk upload functionality.

The bulk upload approach reduces Recipient administrative burden and

minimizes data entry errors. However, the manual data entry option is

available to all users and may be preferred by smaller programs with

less data to submit.

Bulk Upload Function

ERA2 Recipients can use bulk upload templates for providing much of the required information. The tabs and associated templates are listed below.

Please see Appendix A – Bulk Upload Overview for complete guidance on using the Bulk Upload function.

Subrecipients, Contractors and Beneficiaries Tab

Template #1 - Subrecipient, Contractor, Beneficiary Profile Template

Use this template to establish

records for all entities that initially became ERA2 award

subrecipients, contractors and beneficiaries in the current reporting

period.

Recipient Subawards, Contracts and Direct Payments Tab

Template #2 - Subaward, Contract, Direct Payment Record Template

Use

this template to establish records for all subawards, contracts, and

direct payments under the ERA2 award that were established initially

in the reporting period. This template can also be used to report

revisions to subawards, contracts, and direct payment obligations

established in prior periods.

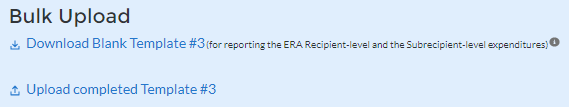

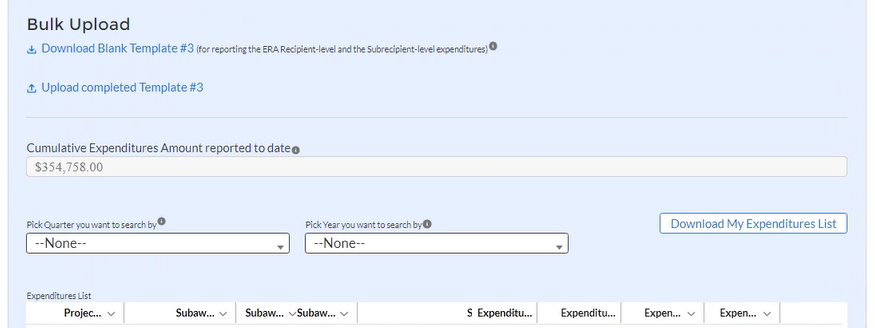

Expenditures Tab

Template #3 - Reporting Expenditures associated with the Recipient’s Obligations valued at $30,000 or more Template.

Use this template to report expenditures made in the current reporting period that are associated with subawards, contracts and direct payments for which the Recipient obligated $30,000 or more.

Template #4 - Reporting Expenditures associated with the Recipient’s Obligations valued at less than $30,000 Template.

Use this template to report the aggregate amounts of obligations and expenditures made in the reporting period that are associated with subawards, contracts and direct payments for which the Recipient had obligated less than $30,000 to entities other than individuals. Expenditures must be classified by expenditure category.

Template #5 - Reporting Recipient Obligation and Expenditures to

Individuals Template

Use this

template to report the aggregate amounts the Recipient paid to

individuals in the reporting period. The aggregate amounts of

expenditures are classified by expenditure category.

Reporting on Templates 3, 4, and 5 should include new payments the Recipient made in the reporting period and prior period adjustments (increases or decreases) in the Recipient’s obligations and expenditures. Expenditures reported in prior periods cannot be directly edited or updated; however, Recipients can revise obligations and expenditures reported in prior periods by entering adjusting entries (increases or decreases) in the current reporting period either manually or using bulk upload Templates 3, 4, and 5.

NOTE: Beginning with the Q3 2023 quarterly report, the portal has not allowed bulk uploads of required information listed on the ERA2 Emergency Rental Assistance Project Data and Participant Demographics tab. ERA2 Recipients must manually enter Project Data and Participant Demographics for all quarterly reports starting with the Q3 2023 report.

Performance and Financial Reporting Tab

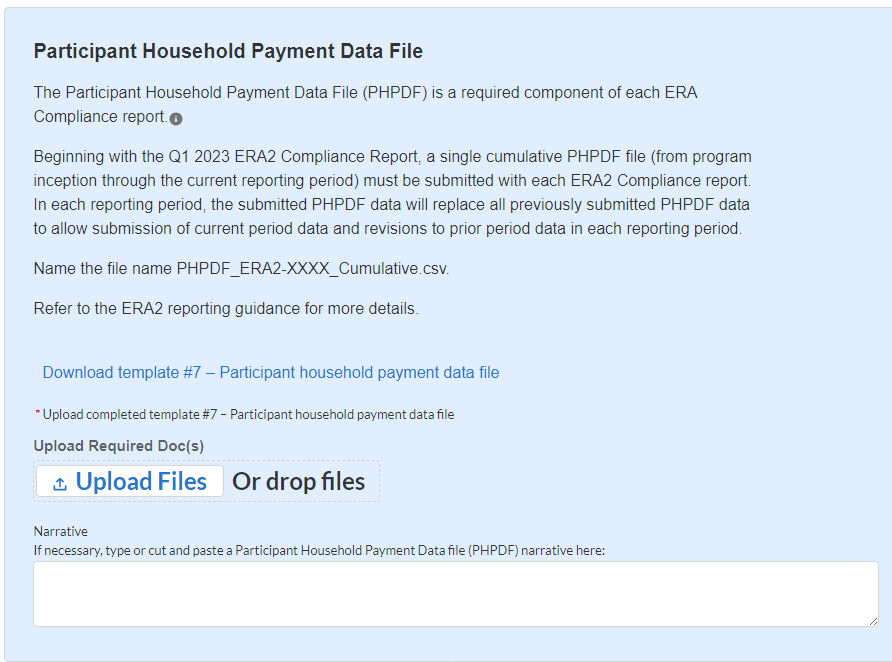

Template #7 - Participant Household Payment Data File Template

Use

this template to report information about each ERA2 Financial

Assistance payment made to or on behalf of each participant household

from the date of ERA2 award

through the end of the current reporting period.

All ERA2 Recipients are required to provide a Participant Household Payment Data File as part of each Quarterly Report. The Participant Household Payment Data File must be submitted as a “.csv” file upload; manual entry is not allowed for the Participant Household Payment Data file.

Please see Tip – Participant Household Payment Data File (Template 7) Guide and Checklist for more details on requirements and formatting of Template 7.

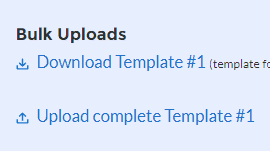

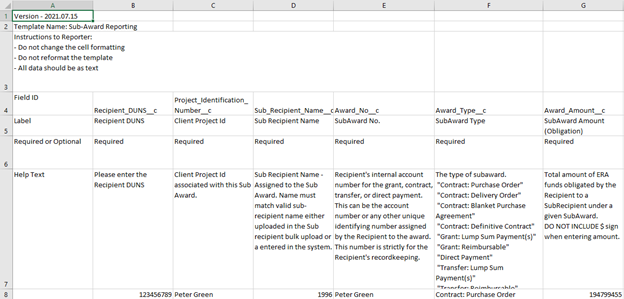

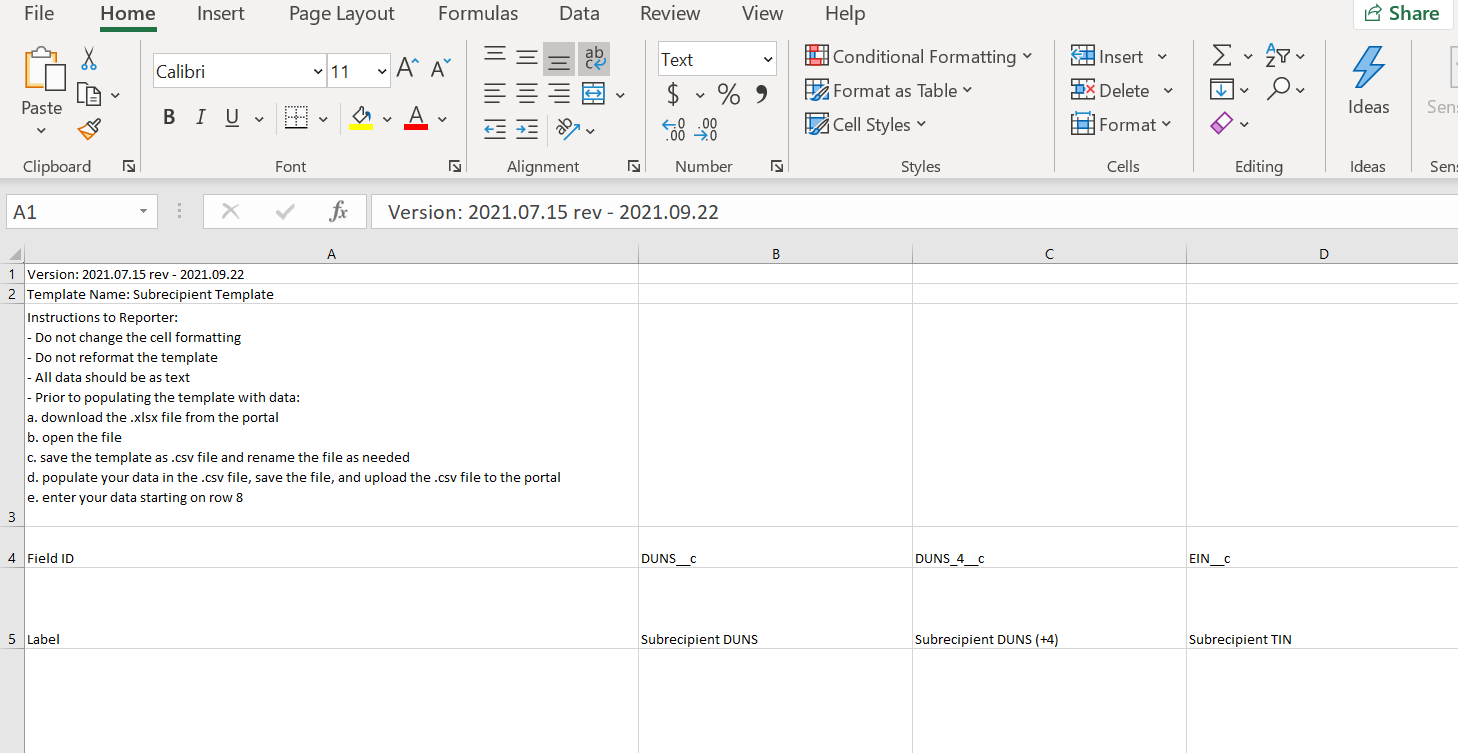

When using the bulk upload function, ERA2 Recipients must provide the required information in specified formats and use Treasury-approved templates for each respective bulk file upload. Templates must be downloaded individually on the Bulk Upload Templates and Instructions tab.

Recipients that use the bulk upload functionality must

download the current version of each bulk file upload template as an

early step in planning for the required Quarterly Report.

The template for each upload file is also available in the relevant tab for download (see Figure 6).

Tabs and components of the report accepting bulk upload files are clearly marked in Treasury’s portal and identified through this User Guide.

Figure 6 – Sample Bulk Upload Icon with Template Download Link

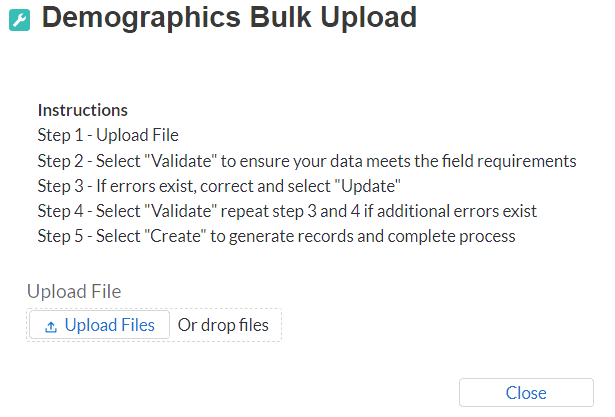

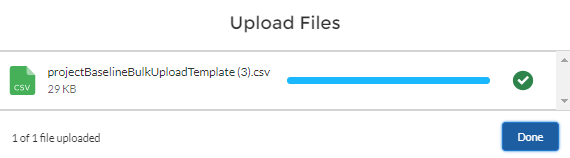

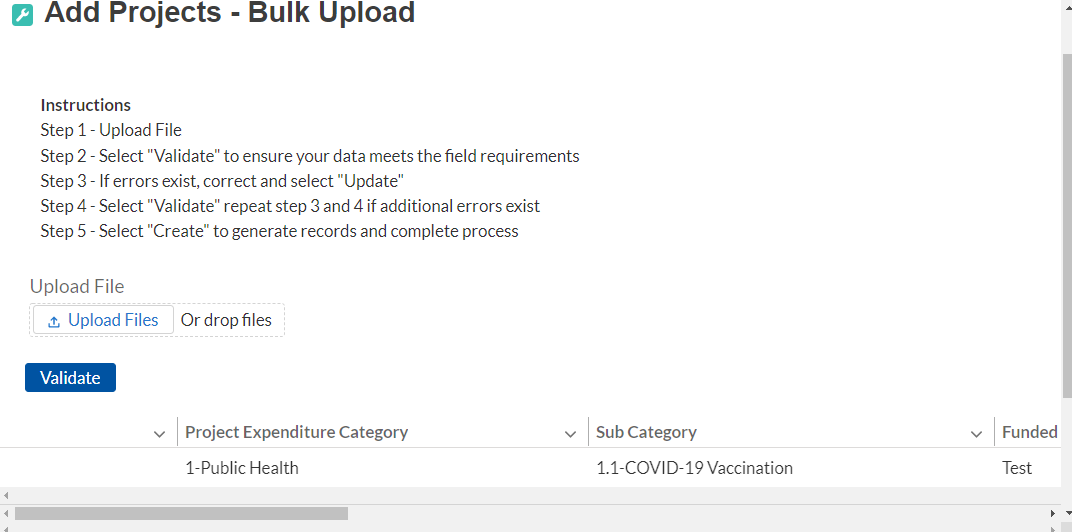

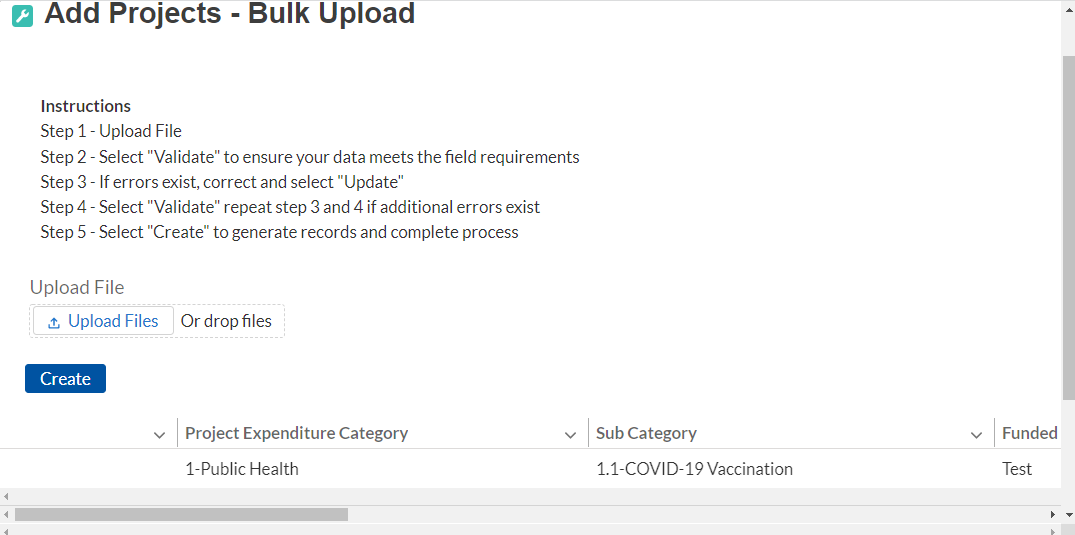

All bulk file templates download in the .xls format, but the templates must be saved in .csv format prior to upload. When you click the upload button users will be directed to a pop-up screen (see Figure 7) including basic instructions on uploading the file.

ERA2 Recipients can either choose to add files or drag and drop files

to initiate the bulk upload.

Figure 7 – Demographics Bulk Upload

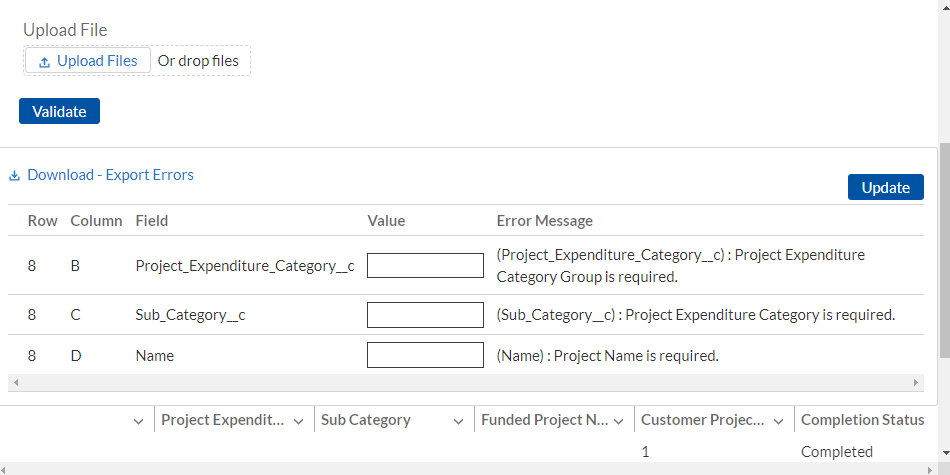

Treasury’s ERA portal will reject a Bulk Upload File if it contains incorrect data (e.g., data not matching a picklist requirement) or if the file is not in “.csv” format. The portal will display an error message on screen if the bulk file upload data contains errors. When a user receives an error message(s), they must reconcile the errors in the bulk upload file and re-submit the corrected version to the portal. The user must “Validate” (step 4) each time they make new corrections until no errors remain in the Bulk Upload File. Then you will click “Import” to finalize.

Please see Appendix A – Bulk File Upload Overview for detailed instructions for using the bulk upload function.

There are three common Bulk File Upload errors as described below (see Figure 8):

Blank Data: Blank Data: When a required field is left blank within your bulk upload file, the specific bulk upload file row and cell number will be displayed on the screen. In the example below, the user made an error pertaining to the “Completion Status” and the error is in Column FF, Row 89.

Invalid Data: Invalid data includes any type of data (numeric or text) that does not meet the requirements set forth in the Help Text within each bulk upload file template. In the example below, the user made an error pertaining to the “Adopted Budget” and the error is in Column G, Row 9.

Duplicate Data: Duplicate data includes any type of data (numeric or text) that is repeated in the same column when the Help Text within a bulk upload file template requires a unique entry. For example, unique numbers should be provided for the project identification number. In the example below, the user made an error pertaining to the “Completion Status” and the error is in Column E, Row 8.

Figure 8 – Example Bulk Upload Errors

ERA2 Recipients that use manual data entry will key in information as instructed on the screen. Manual inputs are described in detail below for each section of this guide.

Note: * indicates a required field. You must enter information into the field before you can save or proceed to the next screen.

The portal will review manually inputted data to ascertain that the data provided is consistent with expected format or description (e.g., entering “one hundred” instead of 100). If a given data entry fails a validation rule, the portal will display an error message for you to address (see Figure 9).

Figure 9 – Manual Entry Error Example

After Treasury’s portal validates the data that has been manually entered for a given tab, the user may continue to the next tab. The portal will display an error notification for those elements that fail the validation rules (For example: leaving a required field as blank). The portal will alert users who manually enter a data value that does not satisfy the validation rules (For example, trying to enter a currency value beyond a specific range).

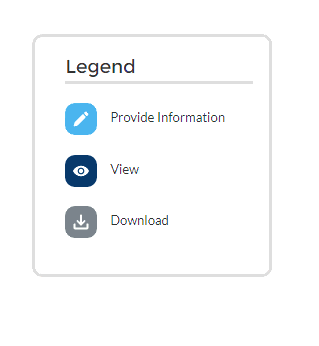

Clickable Icons

Some data entry areas will have an icon (see Figure 10) that will allow users to Provide Information (enter data), View information (previous data entries), or Download information (previous data entries).

Figure 10 – Clickable Icons Legend

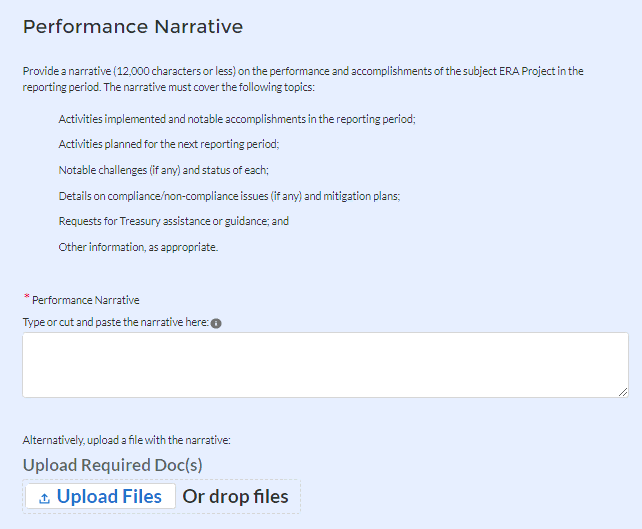

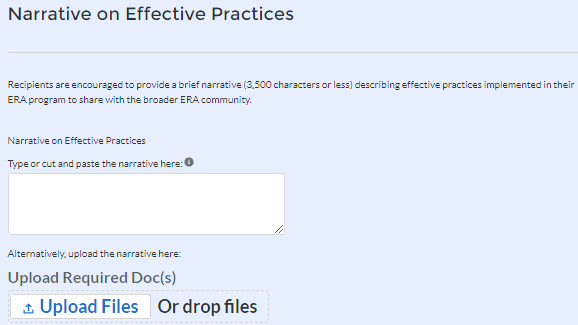

When providing narratives, type the responses using a word processing system (such as Microsoft Word) to minimize grammatical errors, track word count, and concisely answer all required narrative details. Users can copy and paste the final narratives directly into the text boxes in Treasury’s portal.

Users can expand a text box (see Figure 11) by clicking and dragging the icon in the bottom-right corner.

![]()

Figure 11 – Manual Entry Text Box

Saving Data

Within each tab of Treasury’s portal, users will see a next button and a save button at the bottom of each section or at the bottom of the screen.

Clicking the “Save” button will allow users to save current progress without advancing to the next module. Users can click the “Save” button when they plan to exit the portal and come back to the report later.

Clicking the “Next” button will automatically save

all information entered on that screen and advance the user to the

next tab. When a user clicks “Next” the screen will

display a green notification across the top of the screen to indicate

the report is successfully saved (see Figure 12).

Uploading and Deleting Word, Excel, and PDF Documents

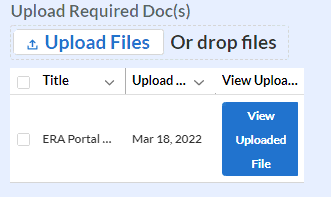

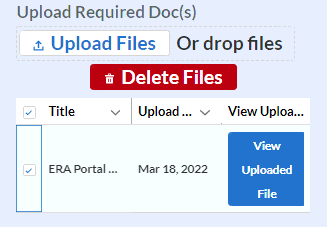

After a user has uploaded a file in either Word or PDF format, the user will see the file Title and Upload Date populate within the relevant section. To view the uploaded file, click the “View Uploaded File” button (see Figure 13). Users may upload multiple files in each section.

Figure 13 – File Upload Functionality

Users can delete a previously uploaded file on the “Performance and Financial Reporting” tabs by clicking the check box next to the Title of the file to be deleted. A red “Delete Files” button will appear above the file (see Figure 14). Click the Delete File button to delete the selected file.

Figure

14 – Deleting Uploaded Files

Report Processing Information

This

section of the User Guide provides information on submitting a

report, editing a report prior to submission, and editing a report

after submission.

Maintaining a copy of the submitted report.

Treasury’s portal currently enables ERA2 Recipients to download a Zipped file that includes a suite of documents including a document in PDF format that contains key components of the submitted reports and several files in Excel format that contain details on amounts obligated and expended as well as the Participant Household Payment Data File. To access the Zipped document, after submitting the report, users should click on the icon under the “download” heading. The download for ERA2 Recipients whose quarterly report contains a large amount of data will be in the form of a downloadable file in Zip format.

Note: As currently configured, the downloadable PDF format document displays only key components of the overall quarterly report. ERA2 Recipients who may need copies of the complete report they submitted are encouraged to take screenshots of the portal screens and maintain copies of all uploaded templates for their records.

Figure

15 – Image of submitted report

Editing a report prior to the submission due date

Users can provide a portion of the required information in a report, save it, log out of the portal, and return to complete the report later.

Users can submit a Quarterly Report and later re-open and revise the report any time prior to the submission due date for the current quarter. To do so, users click on the “unsubmit” button on the right-side navigation screen. Clicking on the “unsubmit” button places the report into draft status so revisions and edits can be made prior to the due date. Only an ERA2 ARR or ERA AA can “unsubmit” reports. Recipients who unsubmit their reports for revisions must recertify and resubmit the report by the report due date.

Quarterly Reports cannot be revised after Treasury closes the reporting period. Once Treasury closes the Quarterly Report reporting period, the “Status” for a report that was not officially certified and submitted will show as “Administratively Closed.” ERA2 Recipients with reports listed as “Administratively Closed” will not be able to submit the report for the given quarter.

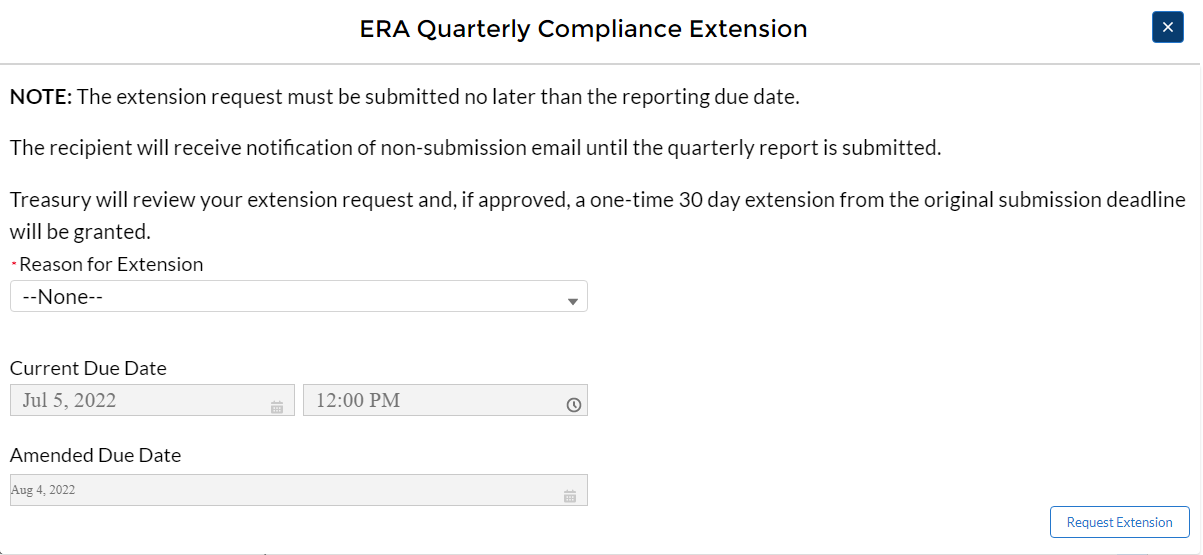

Requesting an extension to a report prior to the submission due date

Recipients may request a one-time 30-day extension for Quarterly Report submission using the button under “Extend Deadline” (See Figure 16). Requests for extensions must be submitted before the report submission deadline and must include a brief narrative “Reason for Extension” (See Figure 17). After inputting the required information, the user must click the “Request Extension” button at the lower right portion of the screen. When the user requests an extension the “Extension Status” (See Figure 16) will indicate that a request has been submitted. Upon Treasury’s approved, the extended due date will be displayed in “Deadline” column (See Figure 16).

Only ERA2 Account Administrators or Authorized Representatives can submit requests for a due date extension.

Figure 17 – Reason for Extension

The portal has two information tabs. These are the Reporting Guidance and the Bulk Upload Templates and Instructions tab. These tabs provide hyperlinks to the ERA2 Reporting Guidance, User Guide, bulk upload templates, and other information on completing the ERA2 Quarterly Reports.

The Bulk Upload Templates and Instructions Tab provides hyperlinks to the bulk upload templates. The bulk upload templates are revised frequently. The latest revision date is listed next to the template name as shown below. Please verify that the revision date shown on the upper left corner (Cell A1) on each downloaded template matches the date listed for the file in the Bulk Upload tab. Please ensure that you are always using the latest version of each template prior to starting your quarterly report submissions.

ERA2 Recipients must review and confirm pre-populated information about the entity’s SAM.gov registration status and executive compensation. Refer to the ERA2 Reporting Guidance for additional details about the required information.

The Recipient Profile tab has two segments: a) Recipient

Profile and b) SAM.gov Registration and Executive Compensation.

Recipient Profile will be pre-populated with information from the Recipient’s ERA2 application and other sources (see Figure 18).

The screen will also display the names and contact information for individuals the ERA2 Recipient has designated for key roles for ERA2 program reporting.

Figure 18 – ERA Recipient Information

Please use the textbox “Please Report any Errors or Needed Updates (if any)” (see Figure 19) to flag errors, notifying Treasury of information that needs to be corrected.

Figure

19 – Report Errors and Updates

Please use the dropdown (see Figure 20) to confirm your entity’s SAM.gov status and Executive Compensation reporting eligibility questions.

Note: This information is required for Treasury to complete the FSRS.gov reporting on your behalf.

![]()

If the ERA2 Recipient is registered in SAM.gov, select “Yes” from the picklist (see Figure 21) and move on to Step 7 below.

![]()

Figure 21 – SAM.gov Registration

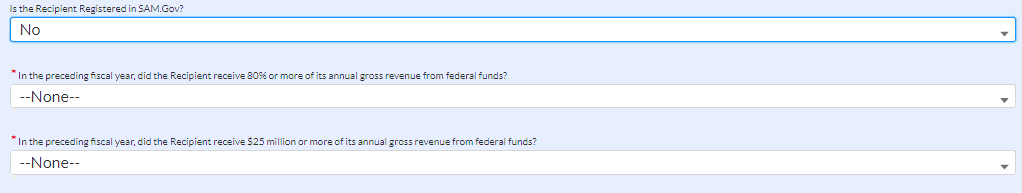

If the ERA2 Recipient is not registered in SAM.gov, select “No” from the picklist. Two additional questions will populate the space below (see Figure 22).

Figure 22 – Additional Questions

Note: For SAM.gov registration assistance, please contact the Federal Service Desk at www.fsd.gov or 1-866-606-8220.

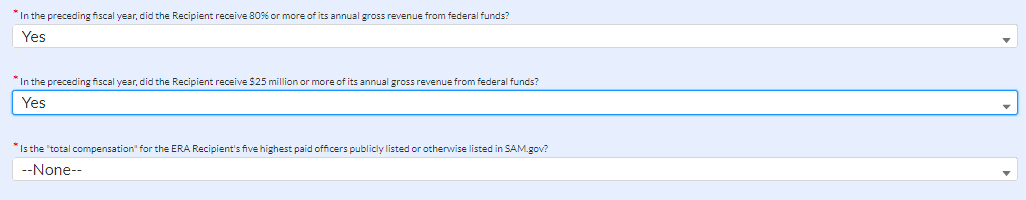

If the ERA2 Recipient received 80% or more of its annual gross revenue from federal funds in the preceding fiscal year AND the ERA2 Recipient received $25 million or more of its annual gross revenue from federal funds, an additional question will appear (see Figure 23).

Figure 23 – Annual Gross Revenue

Select “Yes” if the total compensation for the ERA2 Recipient organization’s five highest paid officers is publicly displayed or otherwise listed in SAM.gov (see Figure 24) and move on to Step 7 below.

![]()

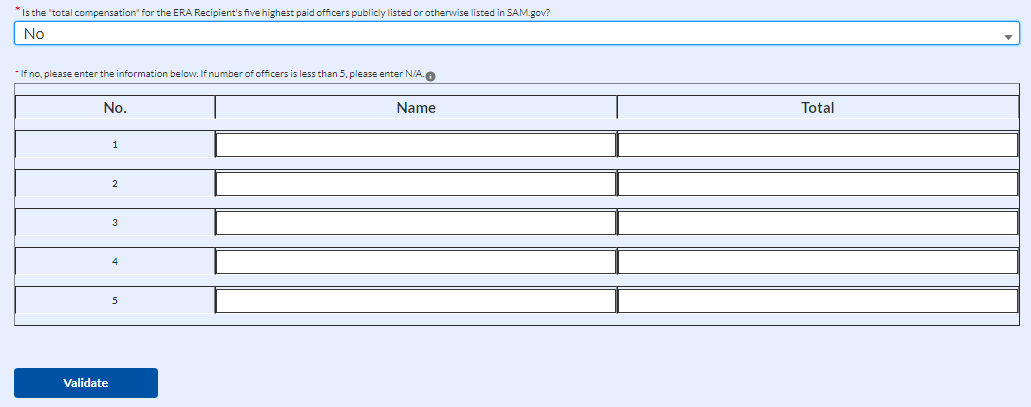

Select “No” if the total compensation for the ERA2 Recipient organization’s five highest paid officers is not publicly displayed or otherwise listed in SAM.gov. Enter the name(s) of the officer(s) in the data entry table that will be displayed on-screen (see Figure 25), and the total compensation received by each. If fewer than five (5) officers exist, enter “N/A” and $0 in the empty field(s).

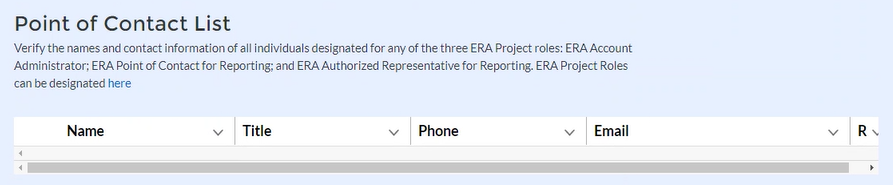

Figure 26 illustrates the table that will list the members of your organization that are currently designated for roles in managing the ERA2 Reports. Please review the list for accuracy. You can update this information by clicking the blue “here” icon above the table. Clicking the icon will open a tab where you can modify/update your organization’s staff and role designations. Please see the Hints and Tips for Designating Points of Contact for ERA1 and ERA2 Reporting for further details.

Figure 26 – ERA2 Reporting Contacts

Click the Save button to record progress.

![]()

Click the Next button to advance to the Project Overview tab.

![]()

Unique Entity Identifier (UEI)

ERA2 Recipients must provide the Unique Entity Identifier (UEI) for itself and for each of its Subrecipients and each of its Contractors that receive ERA2 obligations of $30,000 or more, and well as UEI or TINs for incorporated beneficiaries such as corporate landlords and utility providers that receive ERA2 obligations of $30,000 or more.

How to find the ERA2 Recipient’s UEI in the Portal

If the ERA2 Recipient entity is registered in SAM.gov, Treasury will retrieve its UEI from the Recipient’s existing SAM.gov profile. The Recipient profile will be updated automatically with the UEI (See Figure 27).

Figure 27 – UEI Information on Recipient Profile tab

The portal will also identify and pre-populate UEI numbers for the ERA2 Recipient’s subrecipient or contractor entities that maintain an active SAM.gov registration (See Figure 28).

Figure 28 – UEI Information on Subawards, Contracts and Direct Payments tab

How to find UEI on SAM.gov

If a ERA2 Recipient is registered in SAM.gov, its Unique Entity ID (SAM) has been assigned and is viewable in SAM.gov. This includes inactive registrations. The Unique Entity ID is currently displayed below the DUNS Number on your entity registration record. Remember, you must be signed in to your SAM.gov account to view the entity records. To learn how to view your Unique Entity ID (SAM) go to this help article.

On the ERA2 Project Overview tab, ERA2 Recipients report on up to three categories of ERA2 projects associated with their ERA2 award.

Note: Beginning on October 1, 2022, ERA2 Recipients that have obligated at least 75 percent of their total ERA2 allocation for emergency rental assistance and related activities may use the unobligated amounts of their ERA2 allocation to support one or more of three categories of ERA2 projects. See FAQ 46 for more information. The three types of allowed ERA2 projects are: ERA2 Emergency Rental Assistance Project; ERA2 Affordable Rental Housing Project; and ERA2 Eviction Prevention Project.

All ERA2 Recipients will use this tab to report on their ERA2 Emergency Rental Assistance projects.

ERA2 Recipients that are using ERA2 funds for one or more ERA2 Affordable Rental Housing and/or ERA2 Eviction Prevention project(s) will also use this tab to report on those categories of projects.

All data required on the Project Overview tab must be inputted manually. Bulk Upload templates are not available for these sections of the quarterly reports.

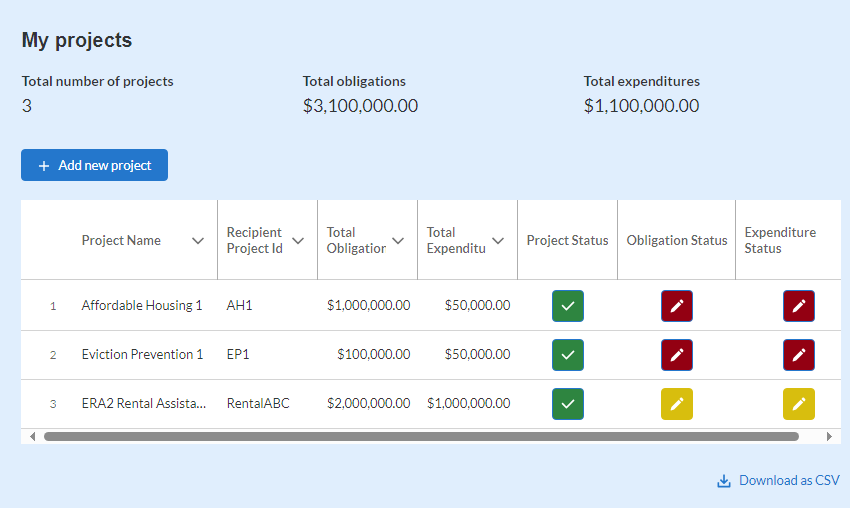

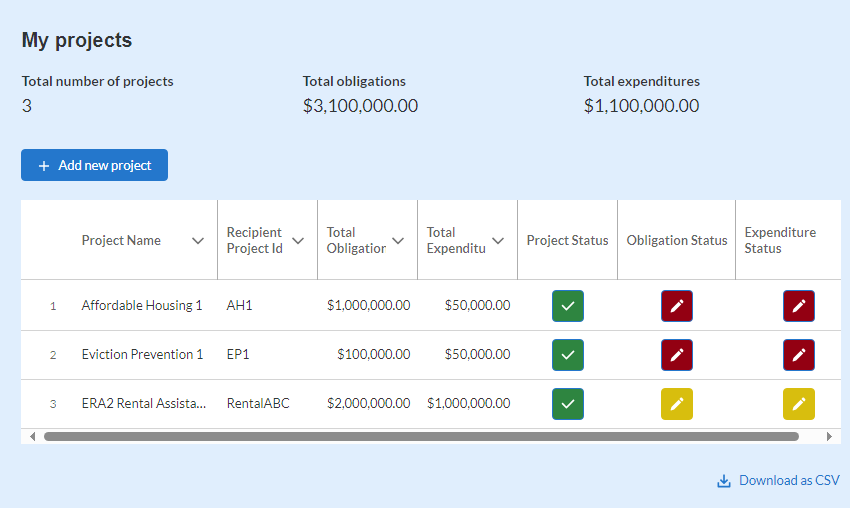

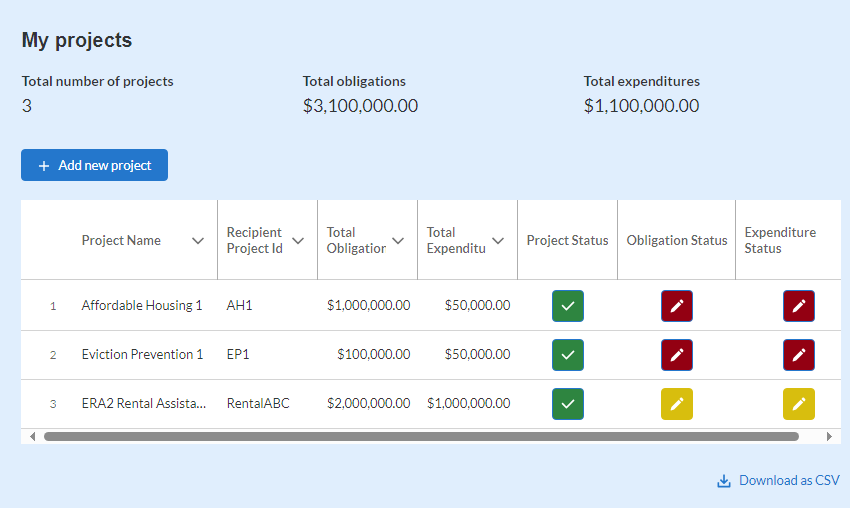

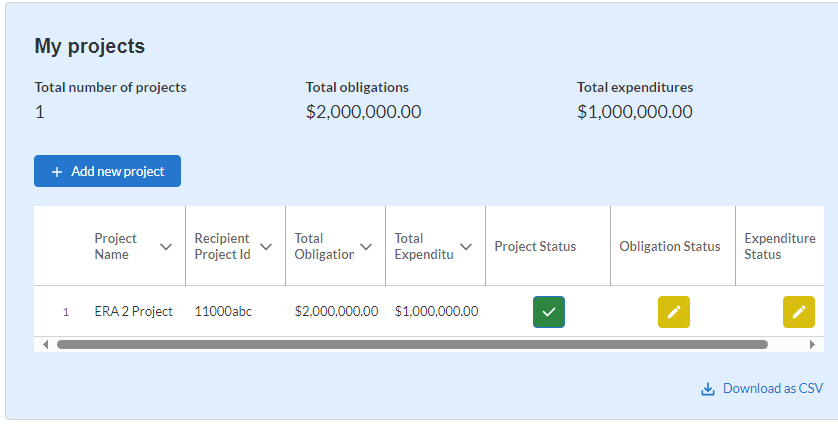

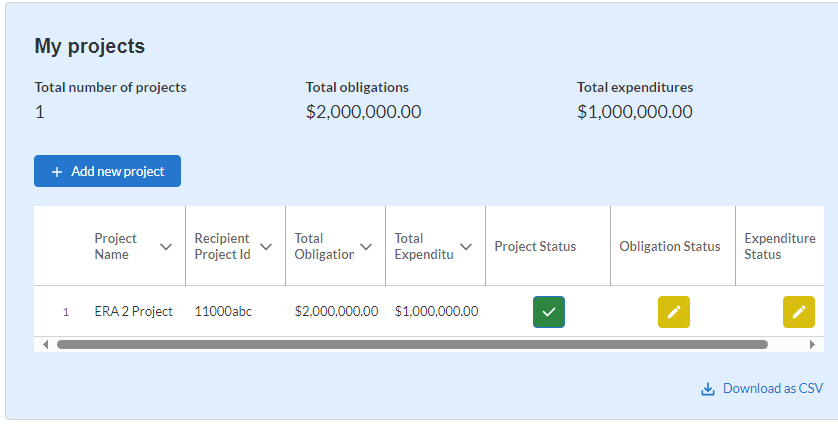

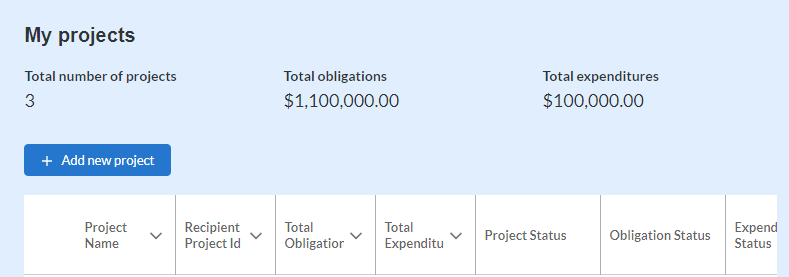

The core section displayed on the Project Overview tab is the My Projects Dashboard screen as shown (see Figure29). As shown, each of the recipient’s ERA2 project(s) has three buttons/check boxes for “Project Status”, “Obligation Status”, and “Expenditure Status.” Prior to report submission, all check boxes must display a Green Checkmark. Click on the buttons to make updates or to see items requiring corrections.

Figure 29 – My Project Dashboard

The My Project dashboard displays information about the ERA2 Recipient’s ERA2 Emergency Rental Assistance Project. The dashboard is programmed to be prepopulated with information about the rental assistance project on each ERA2 Recipient’s dashboard.

If the ERA2 Recipient also administers an ERA2 Affordable Rental Housing Project(s) and/or an ERA2 Eviction Prevention Project(s), the Recipient must input information about those projects into the dashboard as part of their quarterly reports. See below for detailed instructions on entering the required information about each of the Recipient’s ERA2 projects. Figure 34 shows a sample dashboard for an ERA2 Recipient with three projects – that is, the Emergency Rental Assistance Project, one Affordable Rental Housing Project, and one Eviction Prevention Project.

As shown in Figure 29, the dashboard displays the following items.

Number of Projects. This number is calculated by the portal based on the information the ERA2 Recipient enters on the My Project data entry screen. The number of projects is displayed on-screen. In Figure 29, the number “3” is displayed because the sample ERA2 Recipient is administering the three projects listed above.

Total Obligations. This is the sum of amounts inputted on this tab by the ERA2 Recipient as being the cumulative amounts obligated as of the end of the reporting period for each of its three projects. As shown on Figure 29, the sample ERA2 Recipient has reported cumulative obligations of the following amounts: $1,000,000 for its Affordable Rental Housing Project; $100,000 for its Eviction Prevention Project; and $2,000,000 for its Emergency Rental Assistance Project. The dashboard displays the sum of the obligated amounts under the heading “Total Obligations”, that is $3,100,000.

Total Expenditures. This is the sum of expenditure amounts inputted on this tab by the ERA2 Recipient for the ERA2 Emergency Rental Assistance project plus amounts expended under the Affordable Rental Housing project and the Eviction Prevention Project. As shown on Figure 30, the sample ERA2 Recipient has reported cumulative expenditures in the following amounts: $50,000 for its Affordable Rental Housing Project; $50,000 for its Eviction Prevention Project; and $1,000,000 for its Emergency Rental Assistance Project. The dashboard displays the sum of the obligated amounts under the heading “Total Expenditures,” that is $1,100,000.

The dashboard screen also displays the following information about each ERA2 Recipient’s projects. All the displayed information is manually entered by the ERA2 Recipient on the dashboard pop-up pages (see below for input details):

Project Name. This is the name for the specific project as inputted by the ERA2 Recipient. The sample ERA2 Recipient has three separate projects so the Recipient inputted three different names. That is, a different name for each project.

Recipient Project ID. This a string of figures inputted by the ERA2 Recipient that will serve as the ID for the given ERA2 Project. The ERA2 Recipient is administering three separate projects, so it inputted different Project IDs for each of the three projects.

Total Obligations. This is the cumulative amount obligated for the project as entered by the ERA2 Recipient. The ERA2 Recipient manually inputs this amount on the pop-up screens for each project.

Total Expenditures. This is the cumulative amount expended for the project as entered by the ERA2 Recipient. The ERA2 Recipient manually inputted this amount on the pop-up screen. Note that the dashboard displays red and yellow check marks, which indicate that the information the ERA2 Recipient entered on the pop-up screen does not align with what was entered on the portal’s Expenditures and/or Subaward tabs.

Project Status. The dashboard displays on Project Status check mark for each of the sample ERA2 Recipient’s three projects. A green checkmark indicates the inputted data about the specific project appears valid. A yellow checkmark indicates that something about the inputted information about the specific is not correct or is invalid.

Obligation Status. The dashboard also verifies the obligation information inputted by the ERA2 Recipient about each of its projects. A green checkmark in this location for a specific project indicates that cumulative obligation amount entered in the My Project screen for total obligations for the specific project aligns with the amounts of obligations recorded for the project on the Subaward, Contractor and Beneficiaries Tab and the Expenditures Tab. A yellow or red checkmark indicates that the cumulative obligation amount entered by the ERA2 Recipient on the pop-up window is inconsistent with data the ERA2 Recipient entered on the portal’s Subaward and Expenditures tabs.

Expenditures Status. Like the Obligation Status, this is also a green, yellow, or red checkmark. Green indicates the cumulative expenditure as entered on the My Project screen for the specific project aligns with the sum of expenditures recorded for the project on the Expenditures tab. A yellow or red checkmark indicates that the cumulative expenditure amount entered by the ERA2 Recipient on the pop-up window is inconsistent with data the ERA2 Recipient entered on the portal’s expenditures tabs.

Required Data -- Recipient’s ERA2 Emergency Rental Assistance Project

All ERA2 Recipients are administering one ERA2 Emergency Rental

Assistance Project which will be highlighted on the Project Overview

Dashboard as shown by the red-outlined information shown. (See Figure

30.)

Figure 30 – Additional Features of the My Projects Dashboard

Each ERA2 Recipient must provide the following information about their ERA2 Emergency Rental Assistance Project via a pop-up window the Project Overview Tab. To access the pop-up window, press the Green Check box in the “Project Status” column on the dashboard, as shown. (See Figure 31.)

Figure 31 – Project Status Button

When the user clicks on the Project Status check box on the

ERA2 Rental Assistance Project area of the dashboard, the “Edit

Project” pop-up window will be displayed on-screen.

The Edit Project contains 15 required data fields about the status of the ERA2 Emergency Rental Assistance Project as shown below.

ERA2 Recipients must manually enter the following data on its ERA2 Emergency Rental Assistance project on the pop-up screen.

ERA Project Category. “Rental Assistance” will be pre-populated for the Rental Assistance project in the drop-down for this data field as shown. (See Figure 32.)

Figure 32 – ERA Project Category

Project Name. Input or Edit the name of the ERA2 Emergency Rental Assistance Project in the data field as shown. Please make certain the name provided is different from project names entered for other ERA projects. (See Figure 33.)

![]()

Figure 33 – Enter Project

Name

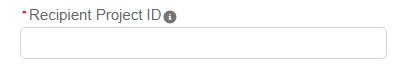

Recipient Project ID. Input the Project ID developed by the ERA2 Recipient in the data field as shown in Figure 34. Please make certain the Project ID provided for the Recipient’s ERA2 emergency Rental Assistance Project is different from Project IDs created for any other of the Recipient’s projects and is also different from the Recipient’s ERA1 Project ID.

Figure 34 – Enter Project ID

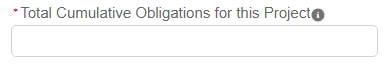

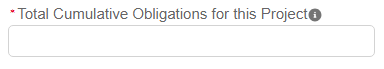

Total Cumulative Obligations for this Project. Enter the total cumulative dollar value of obligations made by the Recipient under this ERA2 Emergency Rental Assistance project from the initiation of the project through the end of the current reporting period. Enter the cumulative amount in the field as shown in Figure 35.

Figure 35 – Enter Cumulative Obligations

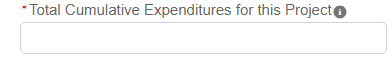

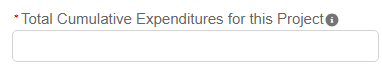

Total Cumulative Expenditures for this Project. Enter the total cumulative dollar value of expenditures for this ERA2 Emergency Rental Assistance project from the initiation of the project through the end of the current reporting period. Enter the cumulative amount in the field as shown in Figure 36.

Figure 36 – Enter Cumulative Expenditures

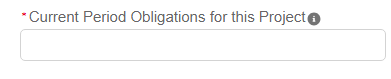

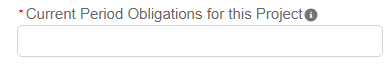

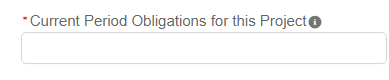

Current Period Obligations for this Project. Enter the

obligations by the ERA2 Recipient made in the current reporting

period for this ERA2 emergency rental assistance project in Figure

37.

Figure 37 – Enter Current Period Obligations

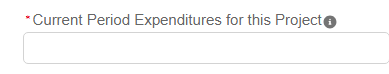

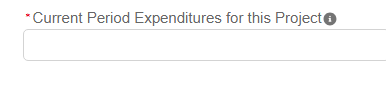

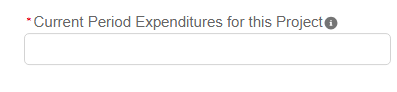

Current Period Expenditures for this Project. Enter the expenditures the ERA2 Recipient and its subrecipients made in the current reporting period for this ERA2 emergency rental assistance project in Figure 38.

Figure 38 – Enter Current Project Expenditures

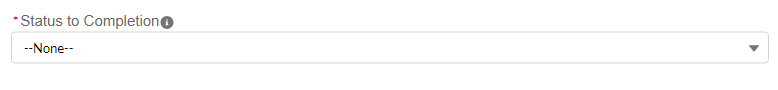

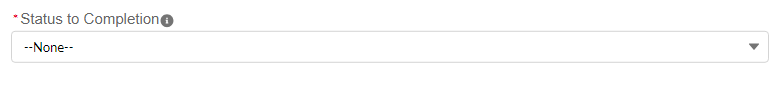

Status to Completion. Select from the drop-down list to identify the ERA2 Recipient’s estimate of the status of this ERA2 Emergency Rental Assistance Project. The selection options are: Not Started; Completed Less than 50%: Completed 50% or More; Completed; Cancelled, as shown in Figure 39.

Figure

39 – Status to Completion

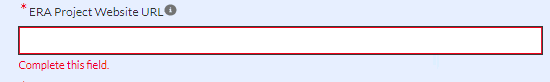

ERA Project Website URL. Provide the URL for this ERA2 Emergency Rental Assistance website that is used to educate the public about the project. Enter the URL in the field as shown in Figure 40.

![]()

Figure 40 – Project Website

Geographic Service Area. Select from the dropdown list to

identify the geographic service area covered by this ERA2 Emergency

Rental Assistance project. The selection options are:

State-wide;

County-wide; City-Wide; Targeted Communities, as shown in Figure 41.

![]()

Figure 41 – Service Area

ERA2 Emergency Rental Assistance Project Description. Provide a narrative (12,000 characters (2,000 word) or less) with the following information about this ERA2 Emergency Rental Assistance Project as of the end of the reporting period, as applicable:

Performance goals planned and met.

Major timelines.

Key partner organizations.

Planned outreach strategies.

Other housing services provided.

Housing stability services provided; and

Other affordable rental housing and eviction prevention services provided, if applicable. Do not include information on any affordable rental housing or eviction prevention services provided as authorized in FAQ46.

Provide the narrative (or update the narrative reported in past quarters) in the text box provided. The text box can be resized as needed. See Figure 42.

![]()

Figure 42 – Text Box for Narrative

Narrative on Approach for Prioritizing ERA2 Assistance to Certain Households. Review and update, as needed, the previously submitted description (as submitted on prior quarterly reports) of the ERA2 Recipient’s approach for prioritizing ERA2 assistance to certain households (e.g., households with incomes less than 50% of area median income and those with at least one member who were unemployed 90 days or more prior to the date the household applied for ERA2 assistance), and provide a URL where the information on the system for prioritizing the assistance is publicly available. See Figure 43.

![]()

Figure 43 – Text Box for Narrative

Use of a Fact-Based Proxy for Determining Eligibility. Select from a dropdown list to indicate whether the ERA2 Recipient used a fact-based proxy for determining applicants’ income eligibility for financial assistance under this ERA2 Emergency Rental Assistance Project. The selection options are: Yes and No, as Shown in Figure 44.

![]()

Figure 44 – Select Yes or No

If the ERA2 Recipient selects “yes” on the dropdown list the portal will display a follow-up text box where the ERA2 Recipient must provide a narrative (12,000 characters (2,000 words, or less)) describing the proxy and all relevant thresholds, figures, policies, and procedures used for verifying eligibility. The ERA2 Recipient should type or cut and paste the narrative in the text box provided. The text box will display the narrative submitted in the most recent quarterly report and the Recipient can provide edits and updates as needed. The ERA2 Recipient may choose to submit an entirely new narrative as well. Provide the information in the text box as shown in Figure 45.

![]()

Figure 45 – Text Box for Narrative

When the user has provided all required information on the screen, click the “Save Project” button at the bottom left of the screen.

![]()

Required Data -- ERA2 Affordable Rental Housing Project(s)

All ERA2 Recipients that have initiated an ERA2 Affordable Rental Housing Project must create a record for that project on the Project Overview tab.

The Recipient must set-up separate reporting records for each ERA2 Affordable Rental Housing Project it initiates. Each ERA2 Affordable Rental Housing development funded in whole or in part with ERA2 funds is a separate project, and as such, grantees that use ERA2 funds to support multiple such housing developments will report each of them as a separate ERA2 Affordable Housing Development Project.

To set up a new ERA2 Affordable Housing Development Project reporting record, the user must click the “Add Project” button on the top left section of the My Projects Dashboard as shown in Figure 46.

Figure 46 – Add Project Button

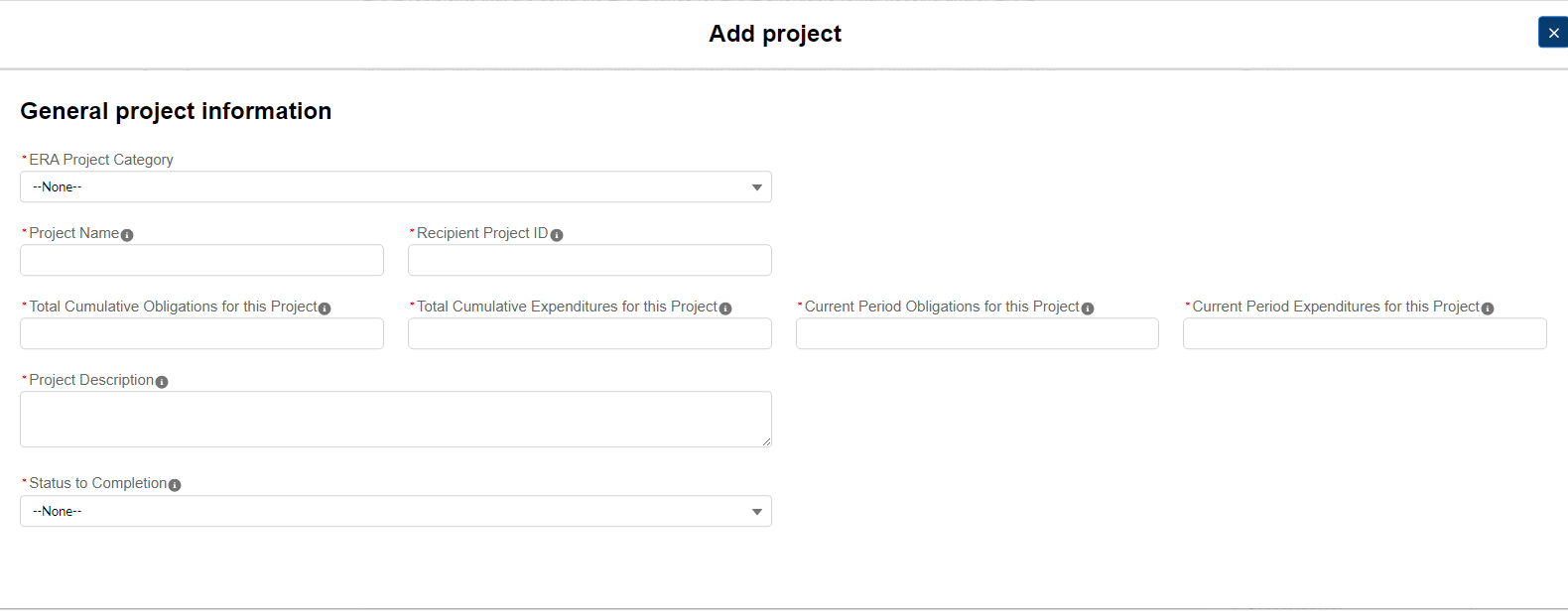

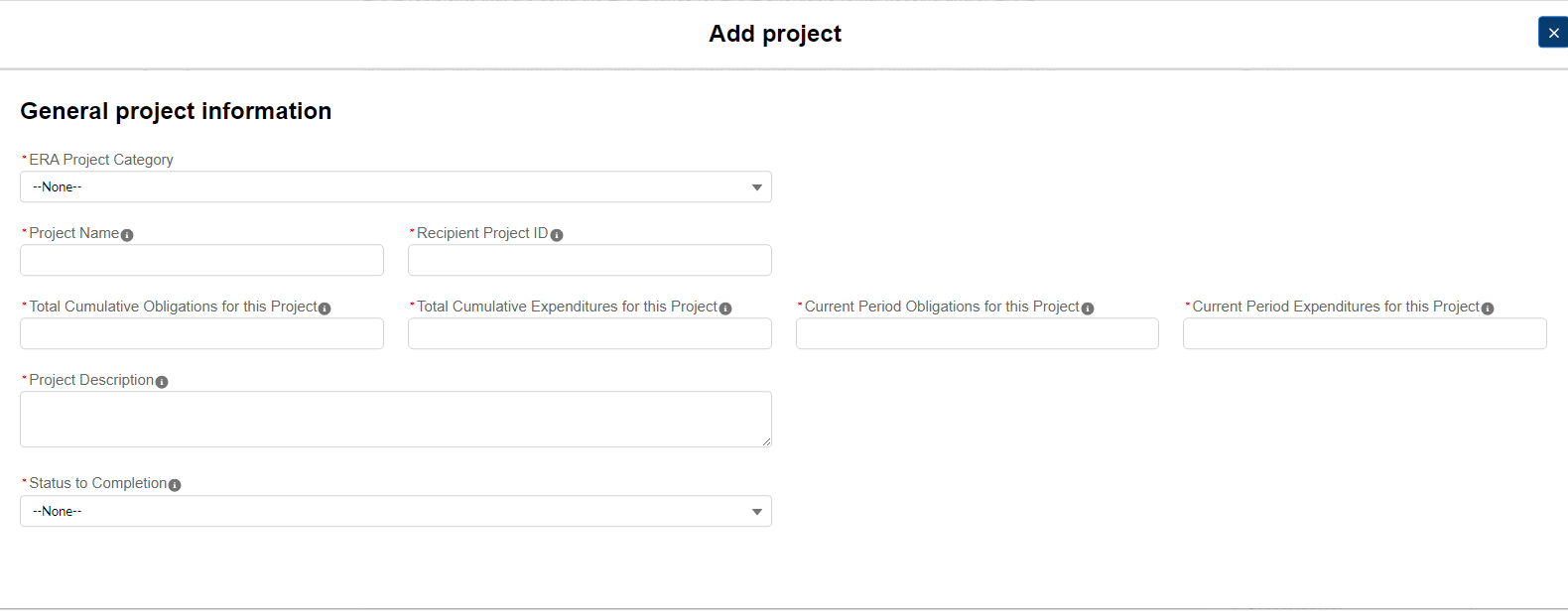

Clicking on the “Add Project” button will display the “Add Project” pop-up screen as shown in Figure 47.

Figure 47 – Add Project Pop-Up Screen

The field at the top of the “Add Project” pop-up screen is the “ERA Project Category” field, which is a dropdown list. Users should select “Affordable Housing” from the dropdown list as shown on Figure 48.

![]()

Figure 48 – Project Category

When Affordable Housing is selected under “ERA Project Category”, the Project Pop-Up will display 32 required data fields describing the ERA2 Affordable Rental Housing Project as shown below.

ERA2 Recipients must provide the following information about their ERA2 Affordable Rental Housing Project(s)

Project Name. Input the name of the ERA2 Emergency Rental Assistance Project in the data field as shown on Figure 49

Figure

49 – Project Name

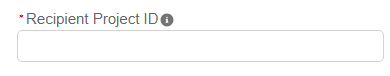

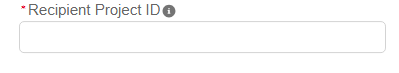

Recipient Project ID. Input the Project ID developed by the ERA2 Recipient in the data field as shown in Figure 50. Please make certain the Project ID for the Recipient’s ERA2 Emergency Rental Assistance Project is different from the ID used for other ERA2 and ERA1 projects.

Figure 50 – Project ID

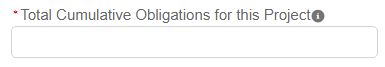

Total Cumulative Obligations for this Project. Enter the total dollar value of obligations made by the Recipient under this ERA2 Affordable Rental Housing project from the initiation of the project through the end of the current reporting period as shown in Figure 51.

Figure 51 – Cumulative Obligations

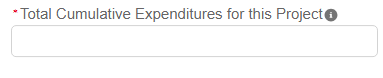

Total Cumulative Expenditures for this Project. Enter the total dollar value of expenditures for this ERA2 Affordable Rental Housing project from the initiation of the project through the end of the current reporting period as shown in Figure 52.

Figure 52 – Cumulative Expenditures

Current Period Obligations for this Project. Enter the obligations the ERA2 Recipient made in the current reporting period for this ERA2 Affordable Rental Housing project as shown in Figure 53.

Figure 53 – Current Period Obligations

Current Period Expenditures for this Project. Enter the expenditures the ERA2 Recipient and its subrecipients made in the current reporting period for this ERA2 Affordable Rental Housing project as shown in Figure 54.

Figure 54 – Current Period Expenditures

Project Description. Users must provide a brief narrative description of the project (minimum of 300 and maximum of 500 words). Please describe how this funding fulfills a specific need within the community supports “affordable rental housing purposes” as specified in FAQ46 and integrates with other program resources and/or funds to provide services, and so forth. See Figure 55.

Figure 55 – Project Description

Status

to Completion. Select from the drop-down list to identify the

ERA2 Recipient’s estimate of the status of this ERA2 Affordable

Rental Housing Project. The selection options are: Not Started;

Completed Less than 50%: Completed 50% or More; Completed; Cancelled,

as shown in Figure 56.

Figure 56 – Status to Completion

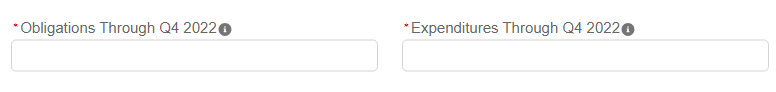

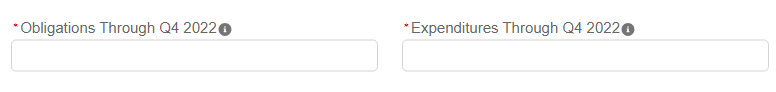

Obligations and Expenditures Through Q4 2022. Users are asked to report the cumulative amount of ERA2 funds the ERA2 Recipient had obligated and expended for this ERA2 Affordable Rental Housing project as of the end of Quarter 4 2022. Please enter “0” is no funds had been obligated / expended by that time. Once this data is entered on a quarterly report it will carry forward and appear on future quarterly reports. See Figure 57.

Figure 57 – Obligations and Expenditures through Q4 2022

Project Zip code. Please input the zip code for the physical location of the housing development project that comprises this ERA2 Affordable Rental Housing Project, as shown in Figure 58.

Figure 58 – Project Zip Code

Project Address. Please input the physical address of the housing development that comprises this ERA2 Affordable Rental Housing Project, as shown on Figure 59.

Figure 59 – Project Address

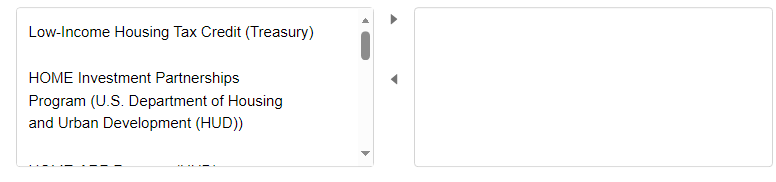

Select

a Primary Use of Funds. The uses of ERA2 funds for this ERA2

Affordable Rental Housing Project must align with allowed uses of

Federal funds under at least one of the Federal programs listed on

the dropdown list for this question. Users must identity the primary

Federal program from the dropdown list. See Figure 60. The options

are:

Low-Income Housing Tax Credit (Treasury);

HOME

Investment Partnerships Program (U.S. Department of Housing and Urban

Development (HUD))

HOME-ARP Program (HUD)

Housing Trust

Fund Program (HUD)

Public Housing Capital Fund (HUD)

Indian

Housing Block Grant Program (HUD)

Section 202 Supportive

Housing for the Elderly (HUD)

Section 811 Supportive Housing

for Persons with Disabilities (HUD)

Farm Labor Housing Direct

Loans and Grants (U.S. Department of Agriculture (USDA)) Multifamily

Preservation and Revitalization Program (USDA

Figure

60 – Use of Funds Aligned with Federal Program

Figure

60 – Use of Funds Aligned with Federal Program

Is the grantee complying with the program regulations and other requirements of the federal program(s) noted above? Users must indicate whether the ERA2 grantee is in full compliance with the regulations and other requirements of the Federal program with which the ERA2 funds are aligned (as noted in the question above). Users must select from the dropdown list. The selection options are: Yes and No. See Figure 61.

Figure 61 – Compliance with Program Regulations

Besides ERA2, other Federal Program Funds Used for this Project. Users must select one or more additional Federal program(s), if any, used together with the ERA2 funds for this ERA2 Affordable Rental Housing Project. Users should select one or more of the federal programs listed in the “Available” box and move them into the “Chosen” box on-screen as shown in Figure 62.

Figure 62 – Other Federal Fund

Estimate Total Development Cost. Users must provide the total estimated cost of the affordable rental housing project (dollar amount). ERA2 Recipients should update this estimate each reporting period to account for changes in cost projections. See Figure 63.

![]()

Figure 63 – Estimated Total Development Cost

Estimated portion of total development cost of the ERA2 Affordable Rental Housing project attributable to affordable rental housing. Users must provide the overall estimated cost of this project to be used for affordable rental housing. ERA2 Recipients should update this estimate each reporting period to account for changes in cost projections. See Figure 64.

![]()

Figure 64 – Portion Attributable to Affordable Rental Housing

Units serving very low-income families. Users must provide the number of units in this affordable rental housing project designated for very low-income families. The term “Low-income families” is defined as families whose incomes do not exceed 50 percent of the median area family income. See Figure 65.

![]()

Figure 65 – Units Designated for Very Low-Income Families

Estimated start of service of the project. Users must use the calendar feature displayed on the screen to identify the estimated start of service date for this ERA2 Affordable Rental Housing project. See the regulations for the Federal program with which the uses of ERA2 funds are aligned to determine what constitutes the “start of service.” For projects that predated the ERA2 Recipient’s contribution of ERA2 funds, please note the start of service for the specific ERA2-funded units. See Figure 66.

![]()

Figure 66 – Estimated Project Start Date

Date of first ERA2 expenditure on project. Users must use the calendar feature displayed on the screen to identify the date the ERA2 Recipient’s first expenditure of ERA2 funds for this ERA2 Affordable Rental Housing Project. Please use the definition of expenditure for the Federal program with which the uses of ERA2 funds are aligned to determine this date. If the program does not specify, the ERA2 Recipient should use its internal accounting mechanisms to determine its first expenditure. See Figure 67

![]()

Figure 67 – Date of First ERA2 Expenditure

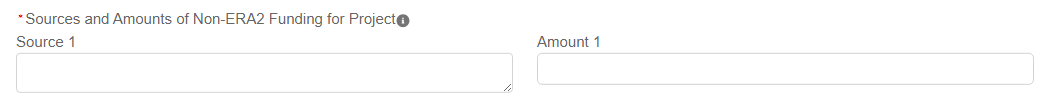

Sources and Amounts of Non-ERA2 Funding for Project. Users must provide the name(s) of all sources of non-ERA2 funds used for this affordable rental housing project and the amount(s) provided by each source. Sources of funds may include, for example, the ERA2 Recipient’s own budget; funds provided through other federal, state, or local housing programs; funds provided through nongovernmental entities; and private investments. ERA2 Recipients should update this estimate each reporting period to account for changes. The portal displays 10 pairs of “Source” and “Amount” fields. The “Source” text box can be enlarged to accommodate several sentences if needed. Figures xxx below shows an example of one pair. See Figure 68.

Figure 68 – Non-ERA2 Funding

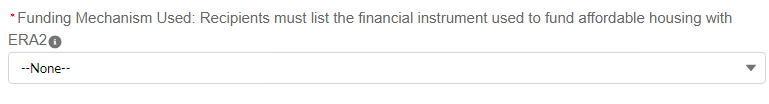

Funding Mechanism Used. Recipients must list the financial instrument used to fund the affordable rental housing with ERA2 funds. Users must identify one or more financial instrument(s) that has been or will be used for this ERA2 Affordable Rental Housing project. Select from the dropdown list. The selection options are Loans [including no-interest loans and deferred-payment loans]; Interest Subsidies; Grants; Other financial arrangements. See Figure 69.

Figure 69 – Funding Mechanism

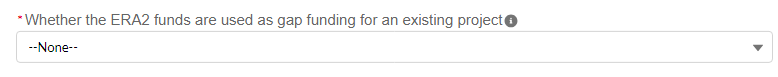

Whether the ERA2 funds are used as gap funding for an existing project. Users must indicate whether the ERA2 funds are being / will be used as gap funding for an affordable rental housing project that was in existence prior to October 2022. Select from the dropdown list. The selection options are: Yes; No. See Figure 70.

Figure 70 – Gap Funding

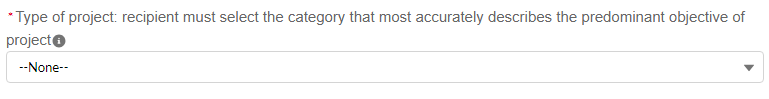

Type of project. The ERA2 Recipient must select the category that most accurately describes the predominant objective of the affordable rental housing project. Users must select the category that most accurately describes the predominant objective of this affordable rental housing project from the dropdown list. If the user selects, “other” please provide a brief explanation. The selection options are Rehabilitation; Construction; Preservation; Operation; Other. See Figure 71.

Figure 71 – Project Type

Total number of rental units in project. The user most provide the total number of rental units planned for this ERA2 Affordable Rental Housing project. ERA2 Recipients should update this estimate each reporting period to account for changes. See Figure 72.

Figure 72 – Number of Rental Units to Total

Number of rental units funded by ERA2. Users must provide the total number of rental units planned to be supported with ERA2 funds as part of this affordable rental housing project. ERA2 Recipients should update this estimate each reporting period to account for changes. See Figure 73.

Figure 73 – Number of Rental Units funded with ERA2 Funds

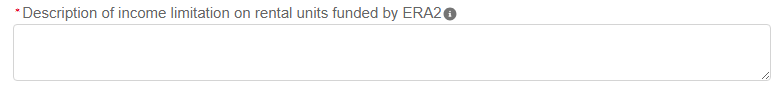

Description of income limitation on rental units funded by ERA2. Users must provide a brief narrative description of current income requirements for tenants of the ERA2-funded rental units in this ERA2 Affordable Rental Housing project as of the end of the reporting period. ERA2 Recipients should update the response in subsequent reporting periods as needed. The text box can be enlarged to accommodate several sentences if needed. See Figure 74.

Figure 74 – Description of Income Limitation

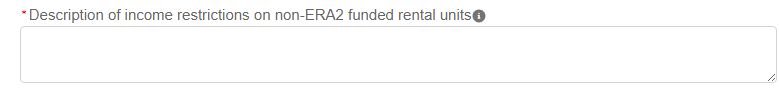

Description of income restrictions on non-ERA2 funded rental units. Users must provide a brief narrative description of current income requirements for tenants of the non-ERA2-funded rental units (if any) in this affordable rental housing project as of the end of the reporting period. ERA2 Recipients should update the response in subsequent reporting periods as needed. The text box can be enlarged to accommodate several sentences if needed. See Figure 75.

Figure 75 -- Narrative

Development Partners (if any). Users must provide the names of all entities that are/ will be collaborating with the ERA2 Recipient on this affordable rental housing project as of the end of the reporting period. The text box can be enlarged to accommodate several sentences if needed. See Figure 76.

Figure 76 – Development Partners

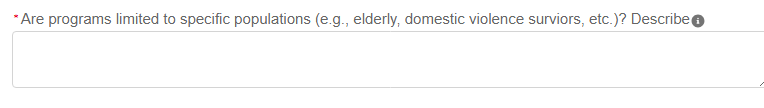

Are programs limited to specific populations (e.g., elderly, domestic violence survivors, etc.)? If this affordable rental housing project is limited to specific tenant populations, please list the specific populations as of the end of the reporting period. See Figure 77.

Figure 77 – Specific Populations

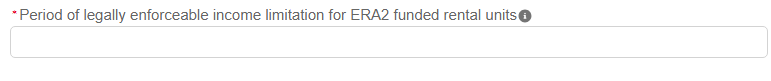

Period of legally enforceable income limitations for ERA2-funded rental units. Users must provide the duration (in years and months, such as “10 years and 6 months” or “5 years”) of the income requirements/limitations for tenants of ERA2-funded rental units in this affordable rental housing project. See Figure 78.

Figure 78 – Period of Legally Enforceable Income Limitations

Period of legally enforceable income limitations for any non-ERA2 funded rental units. Users must provide the duration (in years and months, such as “10 years and 6 months” or “5 years”) of the income requirements/limitations for tenants of ERA2-funded rental units in this affordable rental housing project. See Figure 79.

![]()

Figure 79 – Period of Legally Enforceable Income Limitation, Non-ERA2 Funded Units

When the user has provided all required information on the screen, they should click the “Add Project” button.

![]()

Required Data -- Recipient’s ERA2 Eviction Prevention Project(s)

All ERA2 Recipients that initiate an ERA2 Eviction Prevention Project must create a record for that project on the Project Overview tab. The Recipient must create separate records for each ERA2 Eviction Prevention Project it initiates.

To set up a new ERA2 Eviction Prevention Project, the user must click the “Add Project” button on the top left section of the My Projects Dashboard as shown in Figure 80.

Figure 80 – Add New Project Button

Clicking on the “Add Project” button will display the “Add Project” pop-up screen as shown in Figure 81.

Figure 81 – Add Project

The field at the top of the “Add Project” pop-up screen is the “ERA Project Category” field, which is a dropdown list. Users should select “Eviction Prevention” from the dropdown list as shown on Figure 82

Figure 82 – ERA Project Category

When the “Eviction Prevention” is selected, the Edit Project Pop-Up will display a series of 17 required data fields about the status of the ERA2 Eviction Prevention Project as shown below.

ERA2 Recipients must provide the following information about their ERA2 Eviction Prevention Project(s).

Project Name. Input the name of the ERA2 Eviction Prevention Project in the data field as shown on Figure 83.

Figure 83 – Project

Name

Recipient Project ID. Input the Project ID developed by the ERA2 Recipient in the data field as shown in Figure 84. Please make certain the Project ID for the Recipient’s ERA2 Eviction Prevention Project is unique to the specific project (different from other ERA1 & ERA2 project IDs).

Figure 84 – Recipient Project ID

Total Cumulative Obligations for this Project. Enter the total dollar value of obligations made by the Recipient under this ERA2 Eviction Prevention Project from the initiation of the project through the end of the current reporting period as shown in Figure 85.

Figure 85 – Total Cumulative Obligations

Total Cumulative Expenditures for this Project. Enter the total dollar value of expenditures for this ERA2 Eviction Prevention Project from the initiation of the project through the end of the current reporting period as shown in Figure 86.

Figure 86 – Total Cumulative Expenditures

Current Period Obligations for this Project. Enter the obligations the ERA2 Recipient made in the current reporting period for this ERA2 Eviction Prevention Project as shown in Figure 87.

Figure 87 – Current Period Obligations

Current Period Expenditures for this Project. Enter the expenditures ERA2 Recipient and its subrecipients made in the current reporting period for this ERA2 Eviction Prevention Project as shown in Figure 88.

Figure 88 – Current Period Expenditures

Project Description. Provide a brief narrative description of this ERA2 Eviction Prevention project (minimum of 300 words and maximum of 500 words). Please describe how this funding fulfills a specific need within the community, supports broader eviction prevention and housing stability initiatives as specified in FAQ46, integrates with other program resources and/or funds to provide services, and so forth. The text box can be enlarged to accommodate several sentences if needed. See Figure 89.

Figure 89 – Project Description

Status

to Completion. Select the most accurate status descriptor for

this ERA2 eviction prevention project. The options are: Not Started,

Completed Less than 50%; Completed 50% or More; Completed; Cancelled.

See Figure 90.

Figure 90 – Status to Completion

Obligations and Expenditures Through Q4 2022. Users are asked to report the cumulative amount of ERA2 funds the ERA2 Recipient had obligated and expended for this ERA2 Eviction Prevention Project. Please enter “0” is no funds had been obligated / expended by that time. Once this data is entered on a quarterly report it will carry forward and appear on future quarterly reports. See Figure 91.

Figure 91 – Obligations and Expenditures Through Q4 2022

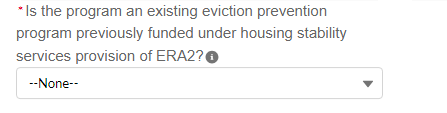

Is this ERA2 Evection Project an existing prevention program previously funded under the housing stability services provision of ERA2? Select from the dropdown list. The selection options are: Yes and No. See Figure 92.

Figure 92 – Existing Eviction Prevention Program

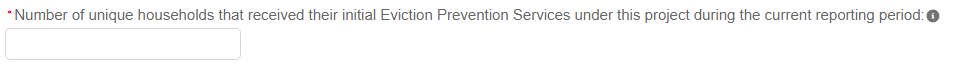

Number of unique households that received their initial Eviction Prevention Services under this project during the current reporting period. Please enter the total number of unique households that received their first eviction prevention services under this ERA2 Eviction Prevention Project in the current reporting period. In determining the total number of unique households receiving this assistance, count any household only one time, even if the household received the services more than once in the reporting period. See Figure 93.

Figure 93 – Households Receiving Initial Eviction Prevention Services

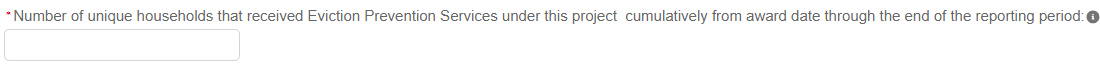

Number of unique households that received Eviction Prevention Services under this project cumulatively from award date through the end of the reporting period. Enter the cumulative number of households received any amount of eviction prevention services under this ERA2 project from the initiation of this project through the end oof the current reporting period. In determining the cumulative total, count any household only one time, even if the household received services more than once. See Figure 94.

Figure 94 – Households Received Eviction Prevention Services

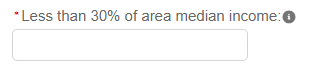

Less than 30% of area median income. Enter the cumulative number of households that received any amount of eviction prevention services under this ERA2 project from the initiation of this project through the end of the current reporting period, with household incomes less than 30% of area median income. In determining the cumulative total, count any household only one time, even if the household received services more than once. See Figure 95.

Figure 95 – 30% AMI

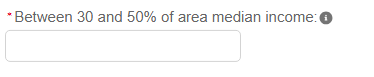

Between 30 and 50% of area median income. Enter the cumulative number of households that received any amount of eviction prevention services under this ERA2 project from the initiation of this project through the end of the current reporting period, with household incomes between 30% and 50% of area median income. In determining the cumulative total, count any household only one time, even if the household received services more than once. See Figure 96.

Figure 96 – 30-50% AMI

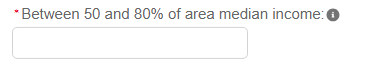

Between 50 and 80% of area median income. Enter the cumulative number of households that received any amount of eviction prevention services under this ERA2 project from the initiation of this project through the end of the current reporting period, with household incomes between 50% and 80% of area median income. In determining the cumulative total, count any household only one time, even if the household received services more than once. See Figure 97.

Figure 97 – 50-80% AMI

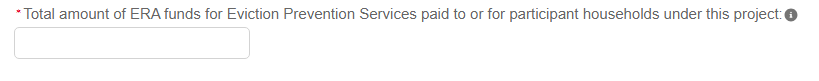

Total amount of ERA funds for Eviction Prevention Services paid to or for participant households under this project. Enter the cumulative total amount of ERA2 funds the grantee and/or its subrecipients and contractors, as applicable, expended (paid) to participant households under this ERA2 eviction prevention project from the initiation of this project through the end of the current reporting period. See Figure 98.

Figure 98 – ERA2 Funds Paid for Eviction Prevention

When the user has provided all required information on the screen, click the “Save Project” button at the bottom left of the screen.

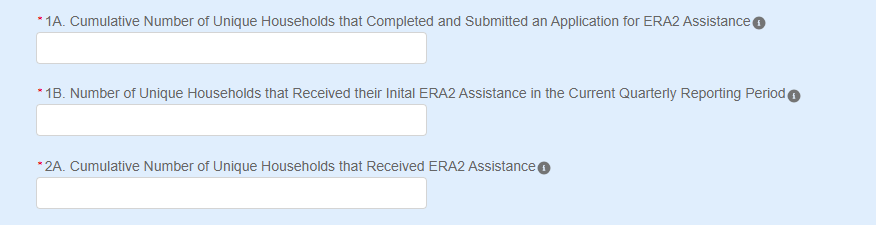

In this Tab, users report details about all entities (Subrecipients, Contractors and Beneficiaries (other than beneficiaries who are individual tenants or individual/small business landlords)) to which the ERA2 Recipient obligated $30,000 or more as of the end of the reporting period. Please refer to “Subrecipients, Contractors, and Beneficiaries Tab” in the ERA Reporting Guidance for additional information.

The tab consists of two segments: a) Subrecipient Information and b) My Subrecipients (Subaward, Contract and Direct Payment).

ERA2 recipients use the Subrecipients, Contractors and Beneficiaries tab to either manually input or bulk upload data on entities that were established for the first time in the current quarter as the Recipient’s subrecipients, contractors or beneficiaries. For bulk upload instructions specific to this submodule, see Appendix A – Bulk Upload Overview. Note, Recipients should not provide information on Subrecipients, Contractor or Beneficiaries for whom the information was provided in previous quarters.

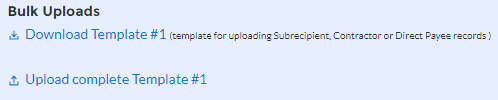

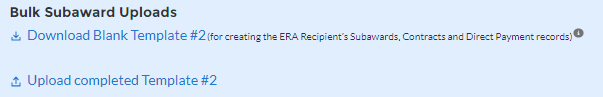

Users can download bulk file Template #1 for use in submitting the required data via bulk file upload. When ready to submit the data in your bulk upload file, use the Upload complete Template #1 button (see Figure 99).

Figure 99 – Bulk Upload of Subrecipient, Contractor and Direct Payee Records

Note: When using the bulk file upload capability or manual entry, subrecipient, contractor or beneficiary profiles must be completed prior to beginning the data entry for the subawards, contracts or direct payments.

Users that manually input the records for the entities that initially became the ERA2 Recipient’s Subrecipient, Contractors or Beneficiary in the current quarter should follow the instructions below.

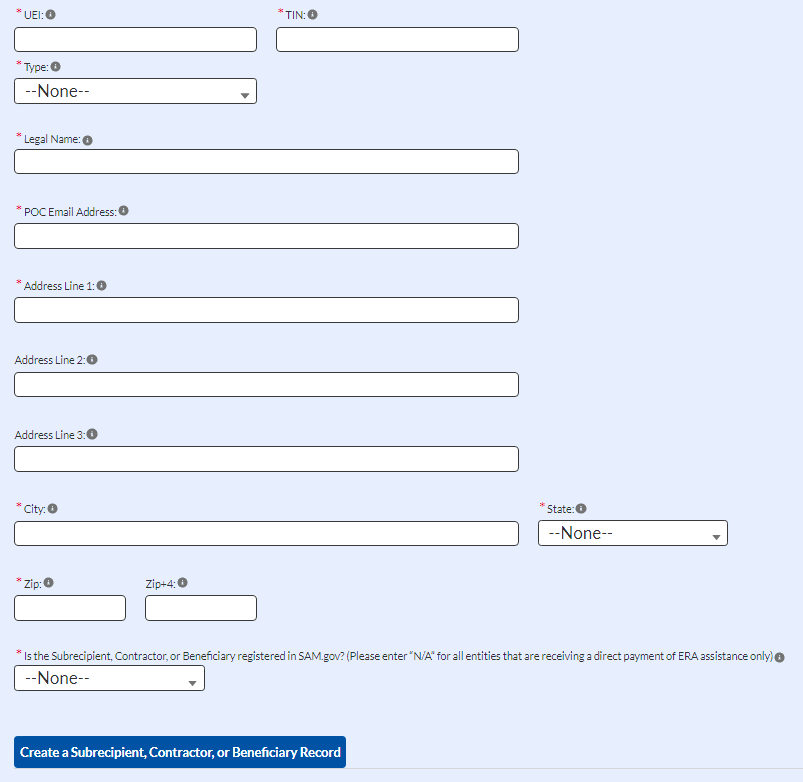

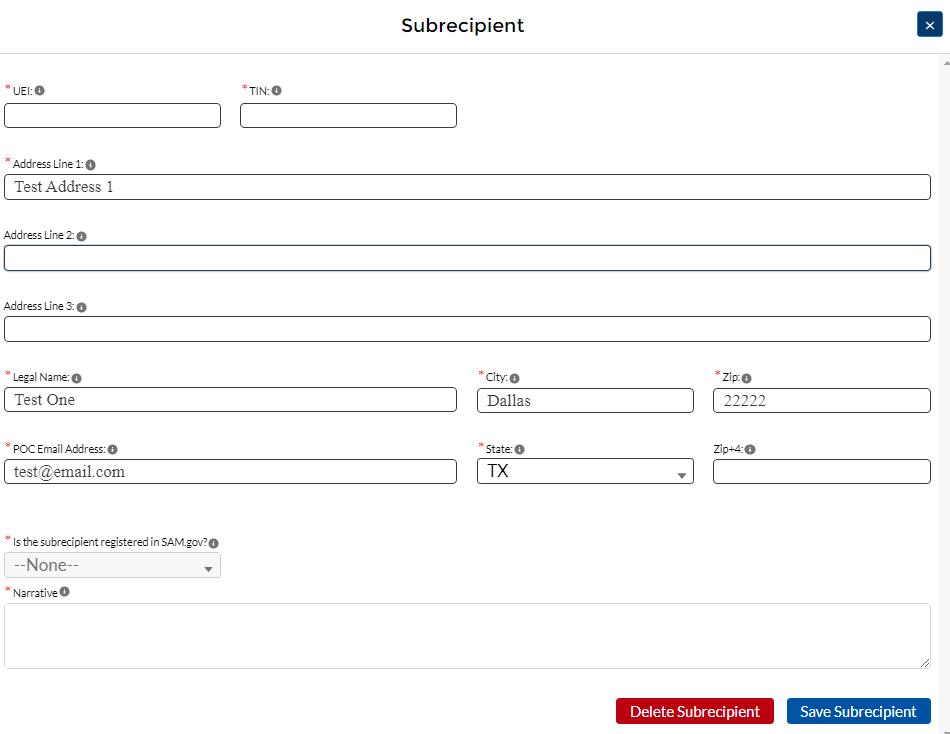

If the user is making a profile record for a new Subrecipient, Contractor or Beneficiary, enter the relevant information in each of the required fields (see Figure 100). All starred information is required. All Subrecipients and Contractors must include the entity’s UEI number. Beneficiary records must include either the UEI or TIN.

All new records entered must also provide the “Entity Type.” This is the role of the entity, such as Subrecipient, Contractor, or Beneficiary.

As the user enters information about each Subrecipient, Contractor and Beneficiary, the list at the bottom of the page will populate with key information for each record. Subrecipient, Contractor and Beneficiary information entered in past quarterly reports will carry over from quarter to quarter. Please do not create duplicate records.

When all Subrecipient, Contractor and Beneficiary profile record information is entered, the user should click the Next button to advance to the next module.

Figure 100 – Subrecipient, Contractor, Beneficiary Record

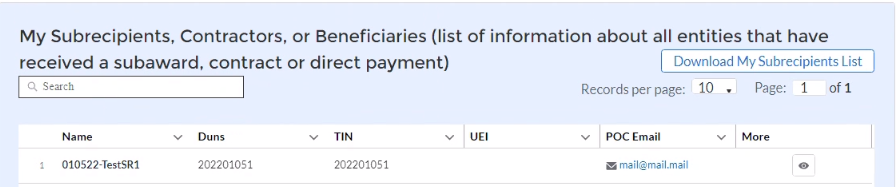

Figure 101 – Download My Subrecipients List

Update/Delete/Search/Download Subrecipients, Contractors, and Beneficiaries records.

Users can update a Subrecipient, Contractor or Beneficiary record when the portal is accessible in any reporting period. However, users can delete a record of this kind only in the reporting period when the record was initially created and must perform the deletion before certifying and submitting the quarterly report.

To revise a record at any time, including in the quarterly report

where it was initially created, users can identify the record from

the on-screen list of subrecipient records. Click the corresponding

“eye” button to open the pop-up window that displays the

record details, then edit any of the fields shown on screen. Once the

revisions have been made use the “Save Subrecipient”

button (see Figure 102) to update and save the revised data.

To

delete the entire record before submitting the quarterly report where

the record was initially created by using the “Delete

Subrecipient” button (see Figure 102).

Note the “Delete Subrecipient” button shown in Figure 102 is not available after the ERA2 Recipient submits the quarterly report in which the record was initially created.

Figure 102 – Subrecipient Record

Use the Subaward, Contracts, and Direct Payments tab to enter

required information about all ERA2 obligations valued at $30,000 or

more (in the form of subawards, contracts and direct payments)

created by the ERA2 Recipient in the quarterly reporting period.

By

entering the required details about any obligations made in the

quarterly reporting period, the information will be maintained in the

portal’s database and users will be able to review the details

and report associated expenditures in the current and future

quarterly reports.

Please refer to the ERA

Reporting Guidance for additional information on required

information about reporting details of obligations made in the form

of subawards, contracts and direct payments.

Subaward, Contract, and Direct Payment Information

ERA2 Recipients can use either manual entry or bulk upload to provide required information on this tab. For bulk upload instructions specific to this tab, see Appendix A – Bulk Upload Overview. Users can download the bulk template using the provided link in Treasury’s portal and use the upload button (see Figure 103).

Figure 103 – Bulk Upload of Subawards, Contracts, and Direct Payment Records

Users that choose to manually enter records, follow the instructions below.

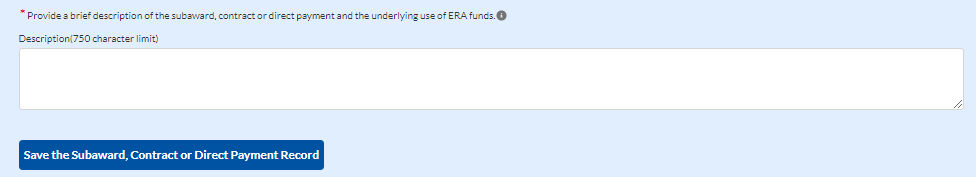

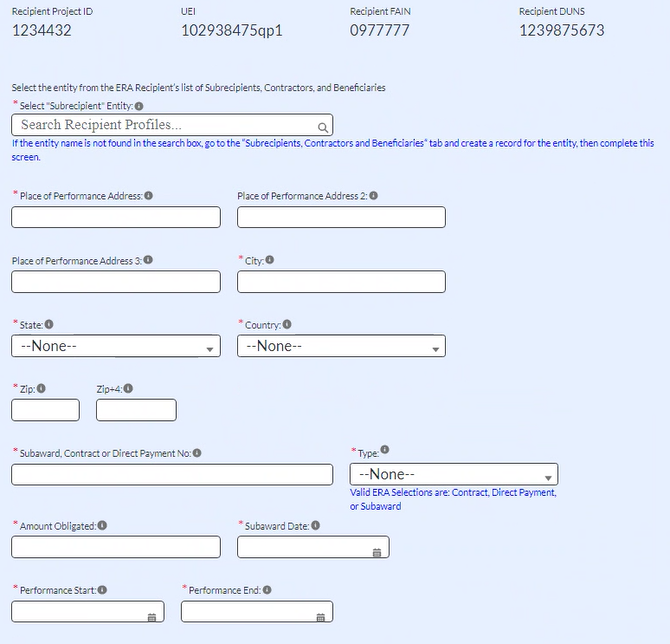

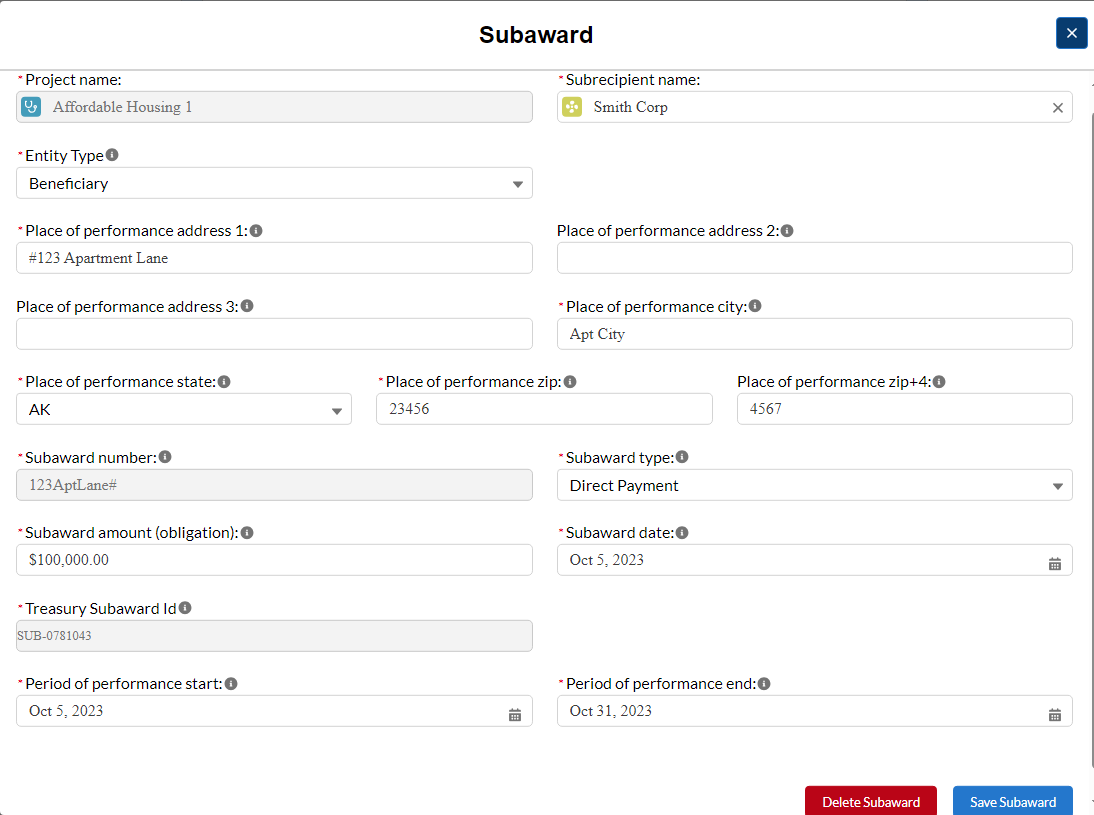

Enter the following fields: Subaward, Contract or Direct Payment Number, Amount Obligated, Date, Type, Performance Start, Performance End, Place of Performance Address, City, State, Zip, Zip+4, and Country. Valid selections are listed in blue font below two data elements in Figure 104 below.

Figure 104 – Subaward, Contract and Direct Payment Record

Figure 105 – Description of Subaward, Contract or Direct Payment

Enter the UEI for the Subrecipient or Contractor or UEI or TIN for the Beneficiary in the Select Subrecipient, Contractor or Beneficiary Entity text box (see Figure 104) and click the search icon on the right. If a Subrecipient, Contractor or Beneficiary record already exists, this will connect it to your Subaward, Contract, or Direct Payment.

Use the open textbox to provide a brief description of the Subaward, Contract or Direct Payment’s underlying eligible use (see Figure 105).

Click Create Subaward, Contract or Direct Payment Record to establish the Subaward record. Repeat Steps 1 through 3 to create additional Subaward, Contract or Direct Payment records.

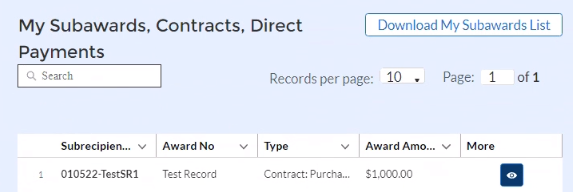

The list of Subawards, Contracts and Direct Payments will be displayed below the “My Subawards, Contracts and Direct Payments” title at the bottom of the page (see Figure 106).

When finished adding to your list, click the Next button to advance to the Expenditures tab.

Update/Search/Download Subaward, Contract, and Direct Payment records

Please use the search box shown in Figure 106 to search for specific subrecipient, contractor or beneficiary records.

Users can use the “Download My Subawards List” button shown in Figure 106 to download as Excel file that lists your subrecipient, contractor and beneficiary records.

Users can then use the downloaded information to perform offline review and verification on the previously submitted information. Use this process to identify any records that require updates. Users can also use this process to download past and current quarter data for recordkeeping.

Alternatively, use the “eye” symbol in Figure 106 to view subaward, contract and direct payment records online. Figure 107 displays a view of the information that will be shown on-screen when clicking the “eye” symbol.

Figure 107 – Subaward, Contract, and Direct Payment Record

Update and Revise subaward, contract and direct payments records by editing any of the fields shown on the “Subaward” pop-up screen and using the “Save Subaward” button (see Figure 107). However, the “Grey” fields cannot be updated/changed. These include the ERA2 Project name, the Subaward Number; and the Treasury Subaward ID.

Note the “Delete Subrecipient” button shown in the figure above is not available after the ERA2 Recipient submits the quarterly report in which the record was initially created.

Subawards cannot be deleted completely after the quarterly report in which they were initially created has been certified and submitted, as noted above. Nevertheless, much information about a Subaward can be revised (including zeroing out ($0.00) the Subaward amount).

The “Narrative” box will appear only when a user edits a subaward record that was created in a previous quarter. Users should add notes under “Narrative” describing the changes made to the record before saving.

Section V. Expenditures Tab

ERA2 grantees must report all expenditures made in the reporting period as part of each quarterly report. Please refer to the ERA Reporting Guidance for additional clarification on the Expenditures tab.

Expenditures reporting is categorized into three groups:

(1) Expenditures Associated with the ERA2 Recipient’s Subawards, Contracts and Direct Payments for which it had obligated $30,000 or More.

(2) Total of all Obligations and Total of all Expenditures Associated with the ERA2 Recipient’s Subawards, Contracts and Direct Payments for which it has obligated Less than $30,000; and

(3) The ERA2 Recipient’s Obligations and Expenditures (Payments) to Individuals (Beneficiaries).

Like other tabs, the Expenditures reporting tab allows users to enter data manually or leverage the bulk file upload capability. For bulk upload instructions specific to this tab, see Appendix A – Bulk Upload Overview. Users can download the unique bulk templates for each of the three groups listed above using the provided link. (See Figure 108 for where to download and then upload Template #3.)

Figure 108 – Download and Upload Templates

Users that manually enter data should follow the steps below.

Expenditures Associated with the ERA Recipient’s Subawards, Contracts and Direct Payments Valued at $30,000 or More (see Figure 109).

Select the Treasury Subaward ID for the Subrecipient, Contractor, Direct Payee from the dropdown list. The number is in the “SUB-XXXX” format. Remember, the portal assigned the Treasury Subaward ID when you set-up records for the entity on the “Subrecipients, Contractors, and Beneficiaries” tab. Selecting the Treasury Subaward ID number will trigger the portal to populate several required fields on-screen.

Select the ERA2 Project Name from the dropdown list. Note, the default project is the ERA2 recipient’s Emergency Rental Assistance Project. If the recipient has established one or more ERA2 Affordable Rental Housing Project(s) or ERA2 Eviction Prevention Project(s) (the establishment of a project is accomplished on the Project Overview Tab), those projects will appear on the project drop-down list as well. Users should take care to associate each expenditure with the correct ERA2 Project.

To report new expenditures under a specific subaward, contract or direct payment, please enter the Recipient’s Subaward, Contract or Direct Payment Number in the search function under “Subaward ID” to associate the expenditure record to the appropriate subaward, contract or direct payment.

Enter the Expenditure Start Date, Expenditure End Date, and Expenditure Amount.

Select the associated ERA Expenditure Category from the drop-down picklist. There is a text box to provide a narrative with details on any Administrative Costs.

Cumulative Expenditures Amount Reported to Date is also shown on the screen (see Figure 110).

Click the Save Expenditure Records button at the lower left corner of the display to submit the expenditure record. Repeat Steps 1 through 5 to report additional expenditures. The submitted information will appear in an on-screen list immediately below the section. Proceed to the next segment once all expenditures are reported.

Figure 109 – Manual Input of Expenditures Associated with Obligations of $30,000 or More

Figure 110 – Display of Cumulative Expenditure Amount Associated with Obligations of $30,000 or More

Note on Reporting Administrative Costs

ERA2 Recipients may create a “Subrecipient” or

“Contractor” record for itself to record and track

administrative expenses. To do so, the user should also create

“subaward” or “contract” records to obligate

ERA2 funds for administrative expenses, and report administrative

cost expenditures on the Expenditures Tab.

Alternatively, a user may use the default portal function that allows ERA2 Recipients to report any Administrative Costs incurred by the ERA2 Recipient (recipient-level) which are not associated with a subaward or contract for which the grantee had obligated less than $30,000.

To use this portal function to report an ERA Recipient’s administrative costs in amounts of $30,000 or more:

1. Leave the Subaward, Contract, Direct Payment ID/ number fields blank.

2. Enter the Expenditure Start Date, End Date, Expenditure Amount.

3. The Expenditures Category field is pre-selected to “Administrative Costs”.

5. Enter “N/A’ for the “Please provide a brief description” field.

6. Use the “Administrative Cost Narrative” field to provide a supporting narrative.

To report an ERA Recipient’s expenditure under a subaward or contract that is an administrative cost in an amount less than $30,000:

1. Select “Administrative Costs” for the Expenditures Category.

2. Use the “Administrative Cost Narrative” field to provide a supporting narrative.

Total Amount of Obligations and Expenditures Made in the Quarter Associated with the ERA2 Recipient’s Subawards, Contracts and Direct Payments for which the ERA2 Recipient had Obligated Less than $30,000 (see Figure 111).

Enter the Total Amount of Obligations and Expenditures in the Quarter . Users may enter “0” (zero) where appropriate.

Select the associated Expenditure Category and Subaward. Contract or Direct Payment Type from the drop-down picklist.

Click the Save Data Entry button to submit the record. Depending on the obligations and expenditures in the current reporting period, Steps 1 & 2 will need to be repeated up to 21 times (for 7 Expenditure Category types and 3 Aggregate Payment types).

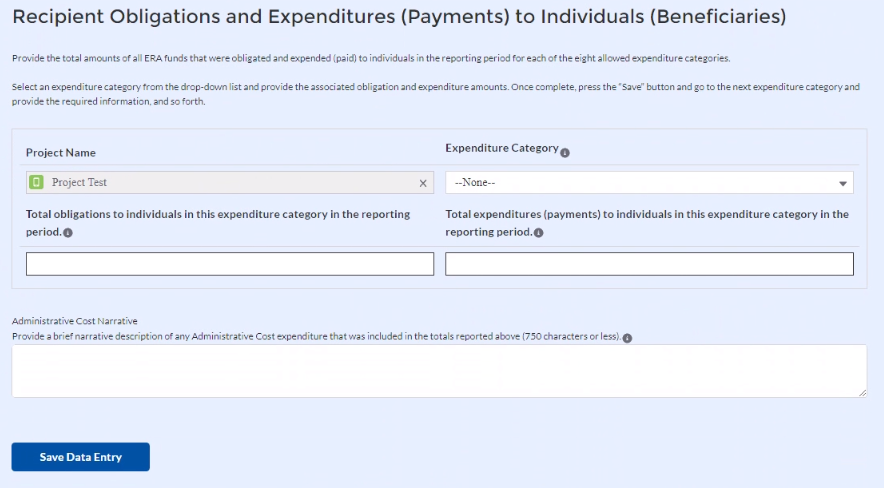

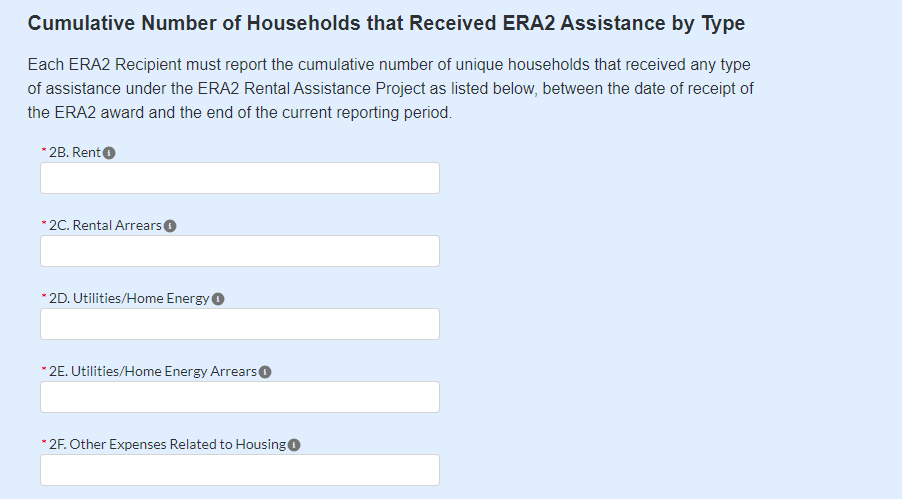

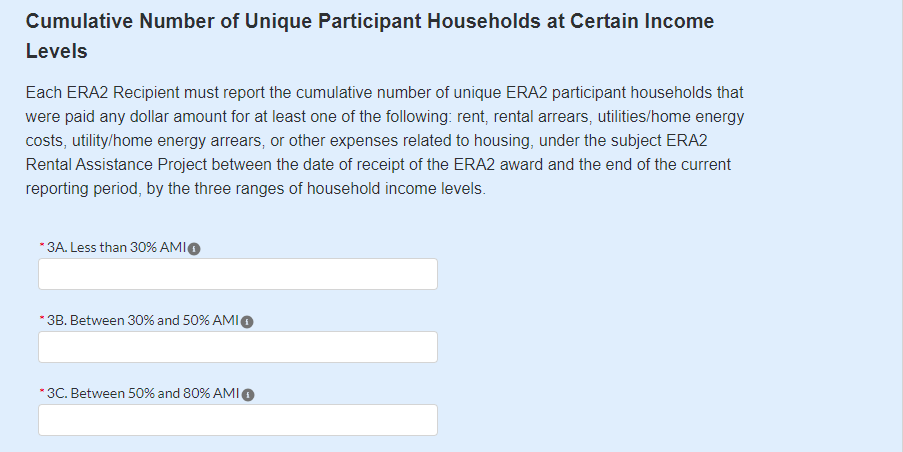

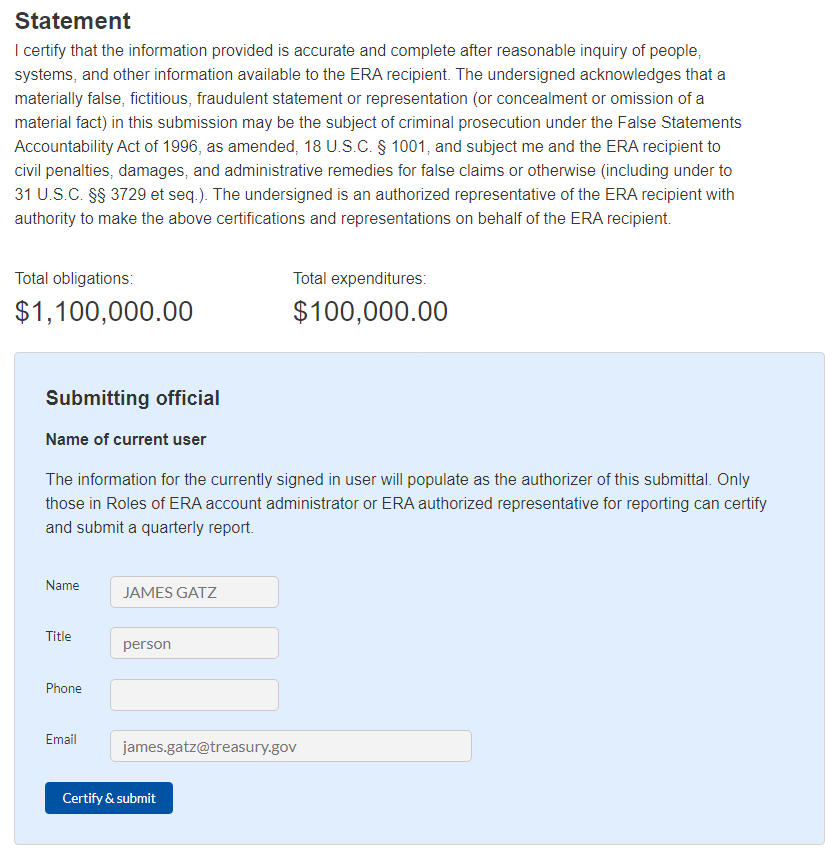

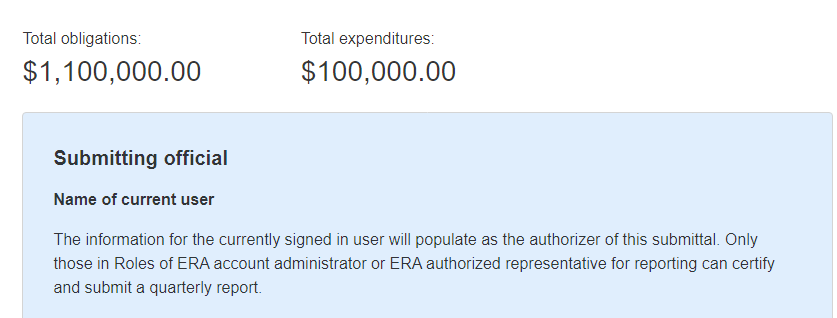

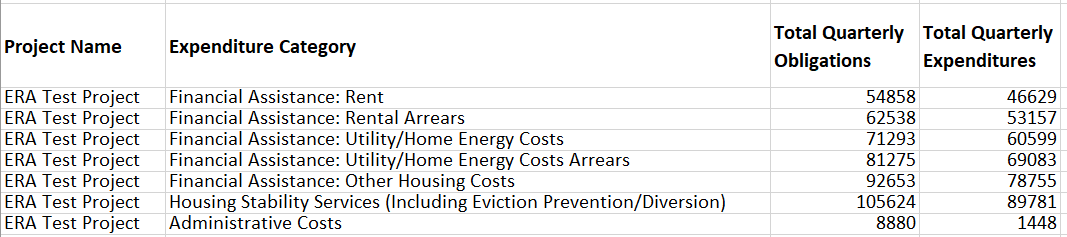

Treasury’s portal will display an on-screen summary of the reported obligations and expenditures in tabular format. Please see Appendix B for a sample of the table. The sample may be particularly helpful for Recipients who manually key-in these data points.