QSR Instructions CU

Emergency Capital Investment Program Reporting

QSR Instructions CU

Quarterly Supplemental Report Schedules C & D***

OMB: 1505-0275

March XX, 2023 – Version 1

U.S. Department of the Treasury |

Emergency Capital Investment Program |

Instructions for the Quarterly Supplemental Report for Credit Unions |

Contents

I. General Instructions 3

A. Introduction 3

B. Organization of the Quarterly Supplemental Report 3

C. When Reports are Due 4

D. Definitions and Rules of Practice 4

E. Submission of the Report 4

F. Lending Activity 7

G. Qualified Lending 9

II. Schedule A–Summary Qualified Lending 12

A. General Instructions for Schedule A–Summary Qualified Lending 12

B. Line-item Instructions for Schedule A–Summary Qualified Lending 12

III. Schedule B–Disaggregated Qualified Lending 13

A. General Instructions for Schedule B–Disaggregated Qualified Lending 13

B. Line-item Instructions For Schedule B–Disaggregated Qualified Lending 14

IV. Schedule C–Additional demographic data on Qualified Lending 14

A. General Instructions for Schedule C–Additional Demographic Data on Qualified Lending 14

B. Line-item Instructions For Schedule C–Additional Demographic Data on Qualified Lending 15

V. Schedule D–Additional Place-based data on Qualified Lending 16

A. General Instructions for Schedule D–Additional Place-Based Data on Qualified Lending 16

B. Line-item Instructions For Schedule D–Additional Place-Based Data on Qualified Lending 17

VI. Glossary 19

Every institution (Participant) participating in the Emergency Capital Investment Program (ECIP) of the U.S. Department of the Treasury (Treasury) is required to submit a Quarterly Supplemental Report covering each quarter beginning with the closing date of its ECIP investment (the reporting period).

The primary purpose of the Quarterly Supplemental Report is to establish the growth in Qualified Lending, as defined in the Glossary, by a Participant over the baseline amount of Qualified Lending reported in the Initial Supplemental Report submitted by the Participant (Baseline Qualified Lending). In addition, the Quarterly Supplemental Report may also be used to measure the impact of ECIP on targeted communities.

Credit unions should use these instructions to complete the Quarterly Supplemental Report. Insured depository institutions, bank holding companies, and savings and loan holding companies should use the Instructions for the Quarterly Supplemental Report for Insured Depository Institutions, Bank Holding Companies, and Savings and Loan Holding Companies, not this document. Participants must prepare and file the Quarterly Supplemental Report in accordance with these instructions

The Quarterly Supplemental Report has four schedules:

Schedule A–Summary Qualified Lending is used to collect the Qualified Lending and Deep Impact Lending, as defined in the Glossary, of a Participant for a given quarter. Schedule A is therefore used to establish the growth in a Participant’s Qualified Lending over its Baseline Qualified Lending for the purposes of calculating the payment rate on the ECIP subordinated debt issued by the Participant.

Schedule B–Disaggregated Qualified Lending is used to present further detail on the composition of the Participant’s Qualified and Deep Impact Lending.

Schedule C–Additional Demographic Data on Qualified Lending collects additional demographic data on certain categories of Qualified Lending and Deep Impact Lending.

Schedule D–Additional Place-based Data on Qualified Lending collects additional geographic data on certain categories of Qualified Lending and Deep Impact Lending.

Schedules B, C and D will be used to better understand the composition of a Participant’s Qualified Lending and to assess the impact of ECIP on targeted communities.

All schedules are required to be completed in accordance with these instructions and any supplemental instructions issued by Treasury. All schedules must be completed using a spreadsheet template, available through the ECIP Portal or on the ECIP webpage, and uploaded to the ECIP Portal, as described below.

If you have questions regarding this form, please contact the Emergency Capital Investment Program at ECIP@treasury.gov.

Participants are required to submit each Quarterly Supplemental Report concurrently with the Call Report Form 5300 (Call Report) of the Participant for the quarter covered by the Quarterly Supplemental Report, as set out in the ECIP Securities Purchase Agreement.

The Quarterly Supplemental Report has four schedules. Two schedules are due quarterly, and two schedules are due annually, as set forth below:

Schedule A – Quarterly, concurrent with the Call Report for the quarter covered by the Quarterly Supplemental Report.

Schedule B – Quarterly, concurrent with the Call Report for the quarter covered by the Quarterly Supplemental Report.

Schedule C – Annually for the prior calendar year, concurrent with the Call Report for the quarter ending on March 31.

Schedule D – Annually for the prior calendar year, concurrent with the Call Report for the quarter ending on March 31.

For example, Schedules A and B for the quarter ending December 31, 2023 will be due concurrently with the Call Report for that quarter and Schedules C and D for calendar year 2023 will be due concurrently with the Call Report for the quarter ending March 31, 2024.

Submission Deadlines for 2022 and Q1 2023 Quarterly Supplemental Reports

Participants that had an ECIP closing date in 2022 are required to follow an alternate report filing schedule for each quarter of calendar year 2022 and for the first calendar quarter of 2023:

Participants must submit a Quarterly Supplemental Report with Schedules A and B for each quarter since their ECIP closing date by June 30, 2022. The report for each quarter must be submitted separately. For Participants that closed during a quarter, the Quarterly Supplemental Report for that quarter must include all loans from the closing date and must not include any loans prior to the closing date.

Participants must submit Schedules C & D for the period from the Participant’s ECIP closing date through December 31, 2022 by June 30, 2022.

Unless otherwise stated, the Quarterly Supplemental Report and the Instructions for the Quarterly Supplemental Report incorporate the definitions and general rules of practice embodied in the Call Report, as well as the instructions pertaining thereto.

The person submitting the report must have a sign-on account with ID.me to validate his or her identity prior to accessing the ECIP Portal. Instructions for registering for an ID.me account can be found here: ID.me registration instructions.

The schedules must be completed and uploaded together as follows:

Access the ECIP Portal via the Treasury ECIP webpage here: ECIP Webpage.

Download the reporting template labeled “QSR Template - CU” through either the ECIP Portal or ECIP webpage. Users should note the following:

There are separate templates for credit unions and banks or holding companies. Be sure to use the correct template for your institution type.

Do not change any formatting, add rows or columns, or make any other alteration to the template.

For quarters when only Schedules A and B are due, only complete Schedules A and B. Do not complete Schedules C and D. For quarters when Schedules C and D are due, complete all four schedules.

Be sure to follow technical directions to ensure that each report is correctly identified with its corresponding quarter.

Prepare your Qualified Lending data in accordance with these instructions and fill out the template. Do not enter commas, decimal points, dollar signs, letters, or symbols. Participants must enter zeros in any column or row for which the Participant does not have origination data to report. Blank cells will be treated as zeros. All fields must be completed. Please double-check all figures before submitting a report. Save the completed template as a local file on your computer or your network.

The template contains some basic validation to assist Participants with identifying errors. If an error is identified, the corresponding cell will be highlighted.

Log into the ECIP Portal and click through the following path: Supplemental Reporting → Quarterly Supplemental Reports (QSR) → Complete Report for the relevant reporting period.

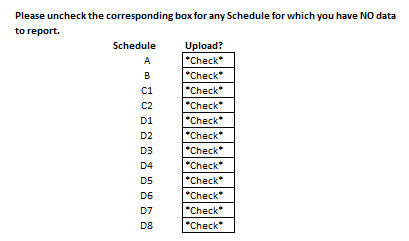

Uncheck the checkboxes next to any Schedules for which you have NO data to report (i.e., a checked box indicates that there is reported data).

Upload the completed template using the “Upload Files” field.

Attach a narrative explanation of the methodology the Participant used to generate the data in the Quarterly Supplemental Report, to enable Treasury to assess consistency with ECIP program requirements.1 Provide a level of detail in the narrative that would allow your organization to reproduce the report at a later point in time. If there are specific systems or datasets that were used to produce the report, it may be helpful to provide specific references to those sources (e.g., a report out of system X was used to calculate Y). Upload the narrative explanation as a PDF file, using the “Upload Add’l Doc” field.

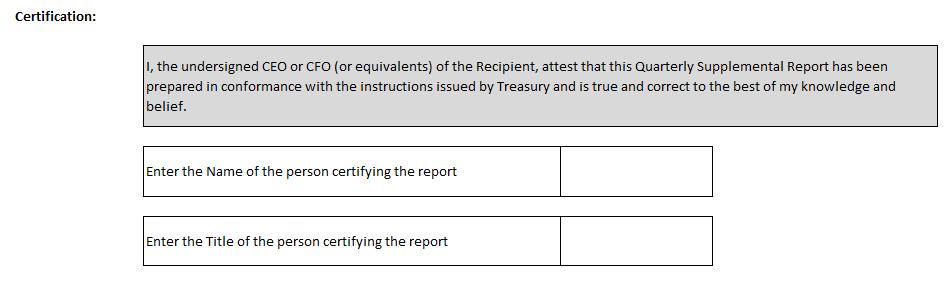

You will be presented with Recipient Certification fields, like the example below. Either the CEO or CFO of the Participant must print their name and title in the relevant fields to certify that the amounts listed in the report are complete and accurate.

Once uploaded, the Participant will be able to review the submitted data. Review the data and confirm that the data is presented accurately. If any data is incorrect, make changes to your template and repeat the steps above to upload the corrected data.

Once the required fields are completed and the narrative has been uploaded, click “Save.”

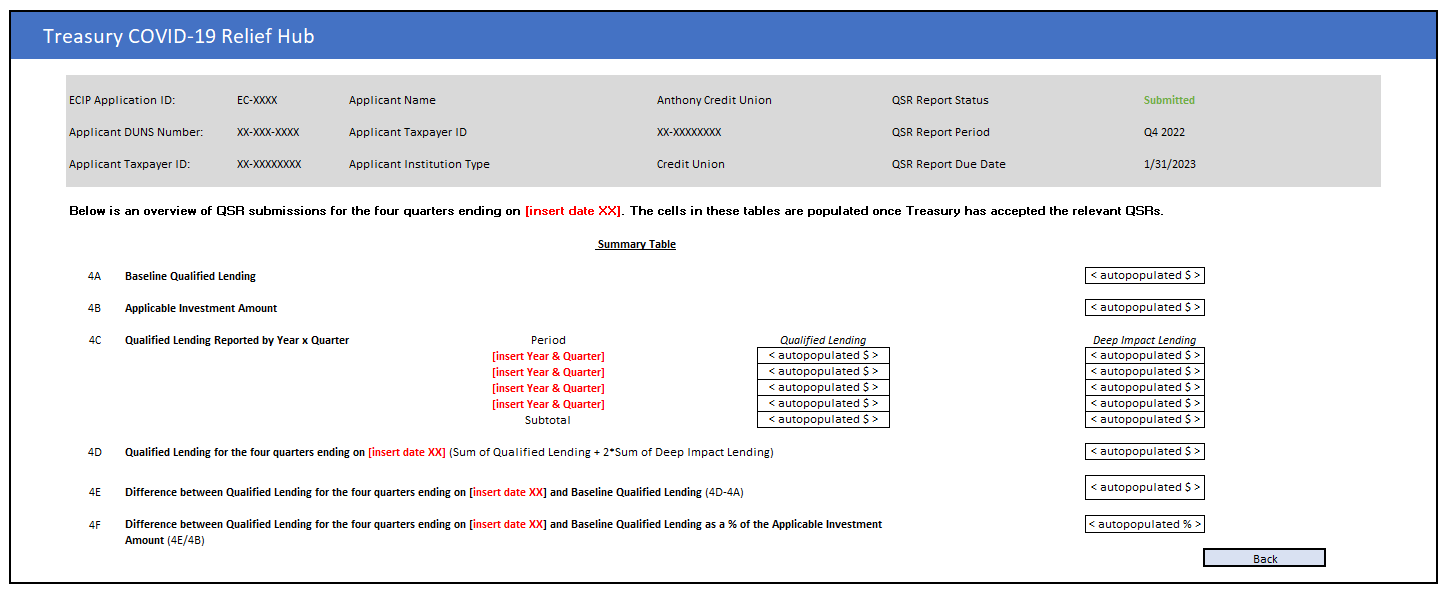

After the uploaded report has been accepted by the program, the system will generate a Summary Table for the relevant year, like the example below, that provides several data points which will be aggregated by the system to inform the calculation of the payment rate. Please see the Line-Item Instructions for Schedule A–Summary Qualified Lending (Section II.B) in these instructions for more information on how items 4A – 4F are calculated.

In each Quarterly Supplemental Report, the Participant must report the number and dollar value of all Qualified Lending, as defined in the Glossary, for each quarter covered by the Quarterly Supplemental Report. Qualified Lending is a subset of Lending Activity, as defined in the Glossary and in this section of these instructions, and thus, a Participant should first identify its Lending Activity.

Components of Lending Activity. For purposes of the Quarterly Supplemental Report, Lending Activity includes:

all new extensions of credit that would be reportable during the reporting period in the Call Report or equivalent regulatory report;

loans originated and sold during the reporting period, even if not reportable in the Call Report or equivalent regulatory report due to such sale;

purchases of loans or participations in loans that are: (a) acquired by the Participant during the reporting period; (b) made by non-depository CDFI loan funds; and (c) originated within one year of purchase by the institution;

the pro-rata share of the Participant’s purchase of a participation in a loan that is: (a) originated by another ECIP Participant during the reporting period; and (b) purchased by the Participant during the reporting period; and

open-ended extensions of credit if the credit was originated during the reporting period.

Exclusions. Notwithstanding anything to the contrary in these instructions, Lending Activity excludes:

any loans made under the Paycheck Protection Program;

the portion of any loan for which, on the date of origination, a third party other than the U.S. government, or any U.S. state, territory, or locality assumed the credit risk of the loan2;

purchases of loans or participations in loans other than those listed in bullets (iii) and (iv) above; and

any loan that is an extension or renewal of any existing loan unless it involves an increase of 20% or more in the principal amount of the loan, in which case the entire loan amount, including the increase, is eligible for inclusion.

Originations. Report new loans and extensions of credit completed during the reporting period. Report loans originated and sold during the reporting period as long as the loan was not sold on the day of origination.

Lines of Credit. Report the full amount authorized (the maximum credit limit) for an open-ended extension of credit if the credit was established during the reporting period. For example, if the Participant established a $2 million line of credit during the reporting period, include $2 million in Lending Activity. A line of credit that is an extension or renewal of an existing line of credit is excluded from Lending Activity unless it involves an increase of 20% or more in the principal amount of the line of credit, in which case the entire authorized amount, including the increase, is eligible for inclusion. Funds drawn on a line of credit that was established before the reporting period must not be included in Lending Activity.

Loan Purchases and Participations. Report the purchase price for purchases of loans or participations in loans during the reporting period that are: (a) acquired by the Participant during the reporting period; (b) made by non-depository CDFI loan funds; and (c) originated within one year of purchase by the institution. Report the Participant’s pro-rata share of the total loan amount of a purchase of a participation in a loan that is: (a) originated by another ECIP Participant during the reporting period; and (b) purchased by the Participant during the reporting period. For the purposes of the Quarterly Supplemental Report, a “participation” means a loan origination or financing structure in which the ECIP Participant has assumed at least some credit risk of the loan on the day of origination. Purchases of loans other than from non-depository CDFI loan funds, including purchases of loans from other ECIP Participants, must not be included in Lending Activity.

Lending Activity Categories. The Lending Activity categories are defined based on the instructions to the Call Report. For example, Lending Activity reportable on Line 1 in Schedule A–Summary Qualified Lending is originations of loans that would be classified as “Non-commercial loans / lines of credit” on the Call Report or equivalent regulatory report. The Quarterly Supplemental Report measures loan originations, not loan balances. Do not report balances from the Call Report.

Mergers, Acquisitions or Business Combinations. If the Participant has completed a merger, acquisition, or other business combination with another institution after the date of closing of the ECIP investment, the Participant must begin including the lending of the acquired institution in the Participant’s Quarterly Supplemental Report by the first full quarter after the Participant and the acquired institution have completed integrating data management systems, and no later than the first quarter that begins after the date that is nine months after the merger, acquisition or other business combination is completed. For example, if the Participant’s acquisition of another institution closed on April 15, 2025, the lending of the acquired institution in the Participant’s Quarterly Supplemental Report will need to be included beginning no later than the Quarterly Supplemental Report covering April 1, 2026 to June 30, 2026. In addition, the Participant must adjust its baseline as follows:

If the acquired institution is also an ECIP participant, the Initial Supplemental Report that was submitted by the acquired ECIP participant will be used to calculate the Baseline Qualified Lending for the acquired institution.

If the acquired institution is not an ECIP participant, the Participant must submit an Initial Supplemental Report for the acquired institution covering the annual period ending on the last day of the last completed quarter before the merger, acquisition or other business combination was completed. For example, if the Participant’s acquisition of another institution closed on April 15, 2025, submit an Initial Supplemental Report for the acquired institution covering the annual period ending on March 31, 2025. The Initial Supplemental Report for the acquired institution is due concurrently with the Participant’s first Quarterly Supplemental Report that includes the lending of the acquired institution. The Initial Supplemental Report for the acquired institution will be used to calculate the Baseline Qualified Lending for the acquired institution.

The Participant’s Baseline Qualified Lending will be adjusted by adding in the Baseline Qualified Lending for the acquired institution, which will be calculated based on the Initial Supplemental Report submitted by the acquired institution. For any merger, acquisition, or other business combination, for purposes of calculating the Participant’s dividend or interest rate based on the amount of Qualified Lending during the year in which the transaction occurred, Treasury will prorate the Baseline Qualified Lending reported by the acquired institution in its Initial Supplemental Report based on the portion of the relevant year after the transaction occurred. Subsequent rate adjustments will include the full Baseline Qualified Lending reported by the acquired institution in its Initial Supplemental Report.

Total Originations. In Schedule A and Schedule B, Participants should report their total Lending Activity for the reporting period in the columns that ask for “Total Originations,” including Lending Activity that is not Qualified Lending or Deep Impact Lending. In Schedule A–Summary Qualified Lending, “Total Originations” are reported in columns A and B. Activity that is excluded from Lending Activity, such as loan extensions or renewals unless there is an increase of 20% or more in the principal amount of the loan, must not be included in “Total Originations.”

Target Communities. Qualified Lending is a subset of Lending Activity. Lending Activity is considered Qualified Lending or Deep Impact Lending if it is made to one of the Target Communities in the table below. Refer to the Glossary to these instructions for further information on the categories of Target Communities. Only Lending Activity that can be verified as meeting the definition of Qualified Lending should be included in the Quarterly Supplemental Report.

Demographic Data Collection. Participants are required to collect sufficient data to enable them to complete all the fields and all the schedules in the Quarterly Supplemental Report accurately. As required under the ECIP Securities Purchase Agreement, the Participant’s principal executive officer or principal financial officer will need to certify that the information provided on each Quarterly Supplemental Report is accurate. Treasury expects that it will not be possible for Participants to accurately complete the Quarterly Supplemental Report without processes in place to attempt to collect the data necessary to complete all the fields and all the schedules in the Quarterly Supplemental Report accurately. Participants are not expected to require their customers (also referred to in these instructions as borrowers) to provide demographic data; a Participant’s customers may leave any fields requesting demographic data blank. If the Participant cannot determine the demographic characteristics of the customer, the loan cannot be included as Qualified Lending under the People or Business categories below for which the demographic characteristics of the borrower are relevant, such as loans to Other Targeted Populations.

Participants may use the following methods for collecting demographic data from customers: (i) self-reporting by customers; (ii) methods that the Participant uses for the purposes of complying with the Home Mortgage Disclosure Act; and (iii) methods that the Participant uses for the purposes of complying with CDFI Fund certification or reporting requirements. However, Participants may not use geographical proxies, even if such proxies are accepted for the purposes of compliance with the Home Mortgage Disclosure Act or CDFI Fund certification or reporting requirements. Other than the methods outlined above, Participants may not use any other methods or proxies to determine the demographic characteristics of the customer.

Because Participants may require time to develop sufficient data-collection systems, for each Quarterly Supplemental Report through the report for the quarter ending on June 30, 2024, Treasury will not consider the Quarterly Supplemental Report to be inaccurate or incomplete solely on the basis of a lack of demographic data. For each such Quarterly Supplemental Report, the Participant must provide a narrative explanation, uploaded through the “Upload Add’l Doc” field, of their plans to implement sufficient data-collection systems and their progress in implementing those plans. Beginning with the Quarterly Supplemental Report covering the quarter ending September 30, 2024, Treasury will consider a Quarterly Supplemental Report to be inaccurate and incomplete if the Participant is not collecting sufficient demographic data to enable them to complete all the fields and schedules in the Quarterly Supplemental Report.

Place-based Categories of Target Communities. To determine whether a loan is made to a place-based Target Community in the table below (for example, whether a loan is made to a Rural Community), use the address of the real property for loans collateralized by real property, and the address of the borrower for all other lending. In situations where a loan is made to finance one real property but is collateralized by another, use the address of the real property that is being financed. For example, if a Recipient originates a loan to finance the construction, development or purchase of property X, located in County A, but the loan is secured by a lien on property Y, located in County B, use the address of property X to determine whether the loan is made to a place-based Target Community.

Loans to Multiple Borrowers. Loans to two or more joint applicants, such as mortgage loans, should be reported in each Qualified Lending category that applies to any of the joint applicants. For example, a mortgage loan to a couple where one individual is Black American and the other individual is Hispanic American should be reported in both categories. However, loans must not be double-counted within a single aggregated category. For example, the example loan above must only be counted once towards Deep Impact Lending on Schedule A, and only reported once as a Mortgage Loan to Other Targeted Populations on Schedule B. This approach only applies to joint loans; the characteristics of any co-signers on a loan are not considered when determining if a loan is Qualified Lending, other than for the purposes of identifying LMI Borrowers and Low-income Borrowers.3 In addition, this approach only applies to loans to natural persons, not loans to businesses or other entities. Please see the instructions for Loans to Underserved Small Businesses in Section IV below for more information on how to report loans to businesses owned by multiple individuals.

Purchases of Loans Made by Non-depository CDFI Loan Funds and Purchases of Participations in Loans Made by Other ECIP Participants. As noted above, Lending Activity includes certain purchases of loans or participations in loans. These purchases of loans or participations are only eligible to qualify as Qualified Lending or Deep Impact Lending if the underlying loan is made to a Target Community listed in the table below.

In each Schedule, purchases of loans or participations in loans may only be included as Deep Impact Lending if:

the loan is originated by a non-profit non-depository CDFI loan funds AND made to a Target Community listed under Deep Impact Lending in the table below (e.g., Persistent Poverty Counties); or

the loan is originated by another ECIP Participant and made to a Target Community listed under Deep Impact Lending in the table below.

Purchases of loans or participations in loans that are originated by for-profit non-depository CDFI loan funds may only be included as Qualified Lending and not Deep Impact Lending even if they were made to a Target Community listed under Deep Impact Lending in the table above.

TABLE 1–TARGET COMMUNITIES

Qualified Lending and Deep Impact Lending. In Schedule A–Summary Qualified Lending, report Deep Impact Lending in columns E and F. Only report Qualified Lending that is not Deep Impact Lending in columns C and D.

Loans to Multiple Target Communities. A loan or investment may be to more than one Target Community. For example, a loan may be made to a Low-income Borrower in a Persistent Poverty County. In Schedule A–Summary Qualified Lending, each loan must only be counted towards Qualified Lending or Deep Impact Lending once. If a loan is counted towards Deep Impact Lending, it may not also be counted towards Qualified Lending.

Narrative Explanation. Participants may determine which of their Lending Activity meets the definitions of Qualified Lending by: (i) geocoding their loans against the Place-based categories of Target Communities; (ii) using Home Mortgage Disclosure Act data; (iii) using any additional data fields that the Participant collects on its lending; and (iii) any other methodology or data which identifies Qualified Lending and is consistent with the instructions above regarding demographic data collection. Participants may not use proxies to determine their Qualified Lending; only lending that the Participant can verify as meeting the definition of Qualified Lending should be included. The narrative should describe which methodology, or combination of methodologies, Participants used to identify their Qualified Lending.

Calculation of Rate Reduction. Under the ECIP Securities Purchase Agreement and Form of Subordinated Security for credit unions, Participants are eligible for a reduction in the dividend or interest rate on the ECIP instruments beginning in the third year after the investment is made. The rate is adjusted annually based on the Participant’s increase in Qualified Lending and Deep Impact Lending in the preceding year compared to the Baseline Qualified Lending as a percentage of the ECIP investment in the Participant. The Annual Qualified Lending that is used to calculate the payment rate for each year is lending during the 12 months ending on the last day of the calendar quarter immediately preceding the anniversary of the Participant’s ECIP closing date. For example, if a Participant closed its ECIP investment on June 20, 2022, the Annual Qualified Lending that is used to calculate the payment rate for each year is lending for the 12 months ending on March 31.

1 - 2. For each of lines 1 and 2, report the number and dollar value of originations of the loans or investments described in the line number. For example, in line 1, report the number and dollar value of originations of loans that would be classified as “Non-commercial loans / lines of credit” on the Call Report or equivalent regulatory report. In column A, report the total number of loan originations or investments. In column B, report the dollar value of total loan originations or investments. In column C, report the number of loan originations or investments that meet the definition of Qualified Lending. In column D, report the dollar value of originations or investments that meet the definition of Qualified Lending. In column E, report the number of loan originations or investments that meet the definition of Deep Impact Lending. In column F, report the dollar value of originations or investments that meet the definition of Deep Impact Lending.

3A/B. Total Originations. These items are the sum of all Lending Activity by the Participant for the reporting period. These amounts should equal the sum of columns A (items 1A + 2A) and B (items 1B + 2B), respectively.

3C/D. Qualified Lending Originations. These items are the sum of all Qualified Lending (excluding Deep Impact Lending) reported by the Participant for the reporting period. These amounts should equal the sum of columns C (items 1C + 2C) and D (items 1D + 2D), respectively.

3E/F. Deep Impact Lending Originations. These items are the sum of all Deep Impact Lending reported by the Participant for the reporting period. These amounts should equal the sum of columns E (items 1E + 2E) and F (items 1F + 2F), respectively.

4A. Baseline Qualified Lending. This item is the Baseline Qualified Lending reported by the Participant in its Initial Supplemental Report, adjusted as required in these instructions or otherwise.

4B. Applicable Investment Amount. This item is the initial investment amount made by Treasury in the Participant under ECIP, adjusted as required in these instructions or otherwise.

4C. Qualified Lending Reported by Year X Quarter. These items are the Qualified and Deep Impact Lending reported by the Participant in its Quarterly Supplemental Reports for a given year.

4D. Annual Qualified Lending. This item is the total Qualified Lending for the Participant for a given year, calculated by adding the sum of Qualified Lending and two (2) times the sum of Deep Impact Lending reported by the Participant in its Quarterly Supplemental Reports for a given year.

4E. Increase in Qualified Lending. This item is the difference between the Annual Qualified Lending reported by the Participant in its Quarterly Supplemental Reports for a given year and the Baseline Qualified Lending reported by the Participant in its Initial Supplemental Report, adjusted as necessary, calculated by subtracting item 4A from item 4D (i.e., item 4D – item 4A).

4F. Percentage Change in Qualified Lending. This item is the Increase in Qualified Lending divided by the Applicable Investment Amount, calculated by dividing item 4E by item 4B (i.e., item 4E ÷ item 4B).

Schedule B–Disaggregated Qualified Lending collects Lending Activity by Qualified Lending or Deep Impact Lending category.

Loans to Multiple Target Communities. A loan or investment may be to more than one target community. For example, a loan may be made to a Low-income Borrower in a Persistent Poverty County. In Schedule B–Disaggregated Qualified Lending, report each loan in each applicable target community category. For example, a loan made to a Low-income Borrower in a Persistent Poverty County must be included in both columns E/F and Q/R. The same loan or investment may be included in both Qualified Lending and Deep Impact Lending. Since a single loan may be reported in more than one column, Treasury expects that aggregating lending activity across columns (such as adding together the number or dollar value of items in columns A through AJ) will not equal values reported in Schedule A–Summary Qualified Lending and the aggregated value will not be a useful data point.

1. In line 1, report total originations of non-commercial loans / lines of credit (the sum of lines 2 through 12).

2–12 and 14–15. |

For each of lines 2 through 12 and lines 14 and 15, report originations of the loans or investments described in the line number. For example, in line 2, report originations of loans that would be classified as “Unsecured credit card loans” on the Call Report or equivalent regulatory report. In columns A through AJ, report the number and dollar value of originations or investments that can be identified as having been made to the Target Community in the column heading, as defined in the Glossary. For example, in columns A and B, report the number and dollar value of originations or investments that were made to LMI Borrowers, as defined in the Glossary. In columns AC and AD, report the number and dollar value of originations or investments that are Qualified PWI, as defined in the Glossary. In columns AI and AJ, report the number and dollar value of originations or investments that are Deep Impact PWI, as defined in the Glossary. |

13. In line 13, report total originations of commercial loans / lines of credit (the sum of lines 14 and 15).

16. Total. Report the total for each column (line 1 + line 13).

Schedule C–Additional Demographic Data on Qualified Lending collects additional demographic data on certain categories of Qualified Lending or Deep Impact Lending.

For loans to LMI Borrowers (columns A and B in Schedule B), Other Targeted Populations (columns C and D in Schedule B), mortgage lending to Other Targeted Populations (columns G and H in Schedule B), and loans to Underserved Small Businesses (columns Y and Z in Schedule B), report the number and dollar value of loans disaggregated by the demographic categories in the column headings. There are two tabs for Schedule C – one for loans to LMI Borrowers, Other Targeted Populations, and mortgage lending to Other Targeted Populations (Schedule C1), and one for loans to Underserved Small Businesses (Schedule C2).

Loans to Borrowers in Multiple Demographic Categories. Loans to borrowers who identify across multiple demographic categories should be reported in each category to which they identify. For example, a loan to a borrower who identifies as both Black American and Hispanic American should be reported in both categories. A loan to a small business with gross annual revenues that do not exceed $100,000 and that is majority owned by a Minority should likewise be reported in both demographic categories.

Loans to Underserved Small Businesses. “Underserved Small Business” includes a business that is majority owned by individual(s) who are Other Targeted Populations. In Schedule C2, report in columns E through P and S through T loans to businesses that are majority owned by Minorities of a single race or ethnicity and otherwise owned by individuals who are not Minorities.4 For example, a loan to a business that is 60% owned by Black Americans and 40% owned by individuals who are not Minorities should be reported in columns E and F. A loan to a business that is majority owned by individuals who identify across multiple demographics should be reported in each category to which they identify. For example, a loan to a business that is 75% owned by an individual that identifies as both Black American and Hispanic American should be reported in columns E and F and S and T. Report loans to businesses that are majority owned by more than one Minority individual of different races or ethnicities in columns Q and R. For example, a loan to a business that is 30% owned by a Black American and 30% owned by a Hispanic American should be reported in columns Q and R. A loan to a business that is 60% owned by a Black American and 30% owned by a Hispanic American should similarly be reported in columns Q and R.

1. In line 1, report total originations of non-commercial loans / lines of credit (the sum of lines 2 through 12).

2–12 and 14–15. |

For each of lines 2 through 12 and lines 14 and 15, report originations of the loans or investments described in the line number. For example, in line 2, report originations of loans that would be classified as “Unsecured credit card loans” on the Call Report or equivalent regulatory report. In Schedule C—Additional Demographic Data for Qualified Lending, in each column, report the number or dollar value of total loan originations or investments, as applicable, to borrowers identified in the column heading. For example, in Schedule C1—Additional Demographic Data for Qualified Lending (People), report the number and dollar value of loans to borrowers with income at 50% or below of Area Median Income in columns A and B. In Schedule C2—Additional Demographic Data for Qualified Lending (Businesses), report the number and dollar value of loans to businesses with gross annual revenues that do not exceed $100,000 in columns A and B. |

13. In line 13, report total originations of commercial loans / lines of credit (the sum of lines 14 and 15).

16. Total. Report the total for each column (lines 1 + line 13).

Schedule D–Additional Place-based Data on Qualified Lending collects additional place-based data on certain categories of Qualified Lending or Deep Impact Lending.

For the place-based categories of Qualified Lending and Deep Impact Lending, report the counties, census tracts, or other geographic area the lending or investment was made to and the total number and dollar value of originations to each geographic area.

The following categories of lending or investment should be reported at the county level:

Rural Communities (columns I and J in Schedule B) – Schedule D1

Persistent Poverty Counties (columns Q and R in Schedule B) – Schedule D5

Reporting at the county level is subject to a de minimis exemption. Only for lending to Rural Communities (Schedule D1) and Persistent Poverty Counties (Schedule D5), counties that contain less than 5% of the Participant’s lending for that category by dollar value are excluded from reporting on Schedule D. For example, for lending to Rural Communities, the Participant should start with the total dollar value of originations in Rural Communities reported in Schedule B, item 16J. That lending should then be disaggregated by county, and the Participant should report in Schedule D1 lending to any counties that have 5% or more of the lending reported in Schedule B, item 16J.

The following categories of lending or investment should be reported at the census tract level:

Urban Low-Income Communities (columns K and L in Schedule B) – Schedule D2

Underserved Communities (columns M and N in Schedule B) – Schedule D3

Minority Communities (columns O and P in Schedule B) – Schedule D4

Report additional place-based data on lending to Indian Reservations and Native Hawaiian Homelands (columns S and T in Schedule B) on Schedule D6, disaggregated by the American Indian Area, as defined by the United States Census Bureau, to which the lending was made.

Report additional place-based data on lending to U.S. Territories (columns U and V in Schedule B) on Schedule D7. Report the territory to which the lending or investment was made and for Puerto Rico, report the municipality name. That is, report lending or investment disaggregated by whether it was made to Guam, American Samoa, the U.S. Virgin Islands, the Northern Mariana Islands, and each municipality in Puerto Rico.

For each of the following categories of borrowers or projects that create direct benefits for LMI communities or to Other Targeted Populations, report each county the lending or investment was made to and the total number and dollar value of originations to each county on Schedule D8:

Affordable Housing (columns AA and AB in Schedule B)

Public Welfare and Community Development Investments that primarily benefit LMI Borrowers or communities (Qualified PWI) (columns AC and AD in Schedule B)

Community Service Facility (columns AE and AF in Schedule B)

Deeply Affordable Housing (columns AG and AH in Schedule B)

Public Welfare and Community Development Investments that primarily benefit Low-Income Borrowers, Minority borrowers, or Minority Businesses (Deep Impact PWI) (columns AI and AJ in Schedule B)

Schedule D1 (Rural Communities) and Schedule D5 (Persistent Poverty Counties)

Column A Report the state

Column B Report the name of the County or County Equivalent

Column C Report the 5-digit FIPS code for the state and county

Column D Report the total number of originations in each county or census tract, as applicable

Column E Report the total dollar value of originations in each county or census tract, as applicable

Schedule D2 (Urban Low-Income Communities), Schedule D3 (Underserved Communities), and Schedule D4 (Minority Communities)

Column A Report the state

Column B Report the name of the County or County Equivalent

Column C Report the 11-digit FIPS code for the relevant census tract

Column D Report the total number of originations in each county or census tract, as applicable

Column E Report the total dollar value of originations in each county or census tract, as applicable

Schedule D6 (Indian Reservations & Native Hawaiian Homelands)

Column A Report the American Indian Area name

Column B Report the American Indian Area code

Column C Report the 11-digit FIPS code for the area

Column D Report the total number of originations in each area

Column E Report the total dollar value of originations in each area

Schedule D7 (U.S. Territories or Puerto Rico)

Column A Report the U.S. Territory (Guam, American Samoa, the U.S. Virgin Islands, and the Northern Mariana Islands) or for Puerto Rico, report the name of the municipality.

Column B Report the 11-digit FIPS code for the area

Column C Report the total number of originations in each area

Column D Report the total dollar value of originations in each area

Schedule D8 (Projects Benefiting LMI Communities or OTP)

Column A Report the project or investment type (Affordable Housing; Qualified PWI; Community Service Facility; Deeply Affordable Housing; Deep Impact PWI).

Column B Report the state

Column C Report the name of the county

Column D Report the 5-digit FIPS code for the county

Column E Report the total number of originations in each county

Column F Report the total dollar value of originations in each county

The following definitions apply to the Quarterly Supplemental Report and these instructions. Datasets referenced below that should be used to identify Qualified Lending and Deep Impact Lending will be updated periodically.

“Affordable Housing” means financing for any (1) affordable housing development project that has received a funding allocation under a state’s Low-Income Housing Tax Credit (LIHTC) program (9% or 4% credits), from a U.S. Department of Housing and Urban Development grantee utilizing HOME or Housing Trust Fund grant funds, or a project that has received funding from the Farm Labor Housing Direct Loans & Grants program or Housing Preservation Grants program at the U.S. Department of Agriculture; or (2) financing for any affordable housing units restricted to households earning below 60% of area median income for a period not less than 10 years, prorated based on the percentage that such units make up of the total number of housing units.

“Area Median Income” means the estimated median family income as defined in the latest “Census and Federal Financial Institutions Examining Council Estimated MSA/MD Median Family Income for CRA/HMDA Reports” (see https://www.ffiec.gov/Medianincome.htm for the latest version for 2020 CRA/HMDA Reports).

“Community Service Facility” means financing of a facility that is a “community service facility” as defined in 26 USC § 42(d)(4)(C)(iii) and that is underwritten on the basis of primarily serving Low-Income Borrowers or Other Targeted Populations or are sponsored by a unit of government to serve Low-Income Borrowers or Other Targeted Populations.

“Deep Impact Lending” is a subset of Qualified Lending. Lending Activity is considered Deep Impact Lending if it is made to one of the Target Communities listed in the “Deep Impact Lending” column in Table 1–Target Communities in these instructions.

“Deep Impact PWI” means Public Welfare and Community Development Investments that primarily benefit Low-income Borrowers, Minority borrowers, or Minority Businesses. For the purposes of determining whether an investment primarily benefits Low-income Borrowers, Minority borrowers, or Minority Businesses, “primarily benefit” means the same as how it is used in the definition of Community Economic Development Entities in 12 C.F.R. § 24.2(c).

“Deeply Affordable Housing” means financing for any (1) affordable housing units restricted to households earning below 30% of area median income5 for a period not less than 10 years, prorated based on the percentage that such units make up of the total number of housing units; or (2) Affordable Housing in a “high opportunity area” as defined by the Federal Housing Finance Agency in 12 C.F.R. § 1282.1(b).

“Indian Reservations and Native Hawaiian Homelands” means (1) an “Indian Reservation” as defined in the CDFI Fund regulations at 12 C.F.R § 1805.104 (i.e., any geographic area that meets the requirements of section 4(10) of the Indian Child Welfare Act of 1978 (25 U.S.C. 1903(10)), and shall include: land held by incorporated Native groups, regional corporations, and village corporations, as defined in or established pursuant to the Alaska Native Claims Settlement Act (43 U.S.C. 1602); public domain Indian allotments; and former Indian reservations in the State of Oklahoma); or (2) Hawaiian Home Lands.

“Lending Activity” means loan originations, investments or other activity that is eligible to be included in the Quarterly Supplemental Report, as explained further in the section of the General Instructions titled “Lending Activity.”

“LMI Borrower” means having an income of not more than: (1) for borrowers in Metropolitan Areas, 120 percent of the area median income; and (2) for borrowers in Non-Metropolitan Areas, the greater of 120 percent of the area median income; or 120 percent of the statewide Non-Metropolitan area median income. For the purposes of identifying LMI Borrowers, Participants should aggregate the income of the applicant, any joint applicant, and any co-signers on the loan and compare that aggregated income to the relevant threshold of area median income.

“Low-income Borrower” means having an income of not more than: (1) for borrowers in Metropolitan Areas, 80 percent of the area median income; and (2) for borrowers in Non-Metropolitan Areas, the greater of 80 percent of the area median income; or 80 percent of the statewide Non-Metropolitan area median income. For the purposes of identifying Low-income Borrowers, Participants should aggregate the income of the applicant, any joint applicant, and any co-signers on the loan and compare that aggregated income to the relevant threshold of area median income.

“Metropolitan Area” means an area designated as such by the Office of Management and Budget pursuant to 44 U.S.C. 3504(e) and 31 U.S.C. 1104(d) and Executive Order 10253 (3 C.F.R., 1949–1953 Comp., p. 758), as amended. For the Quarterly Supplemental Report, Participants must use the list of Metropolitan Areas posted to the ECIP website.

“Minority” means any Black American, Native American, Hispanic American, Asian American, Native Alaskan, Native Hawaiian, or Pacific Islander.

“Minority Business” means a business that is 51% or more owned by a Minority. For the purposes of identifying the demographics of the owners of a business, Participants should identify the natural person Beneficial Owner(s) of a business, consistent with regulations issued by the U.S. Treasury’s Financial Crimes Enforcement Network at 31 C.F.R. § 1010.230 or any successive regulation.

“Minority Communities” means a census tract where the majority of the population consists of Minorities. For the Quarterly Supplemental Report, Participants must use the list of Minority Communities posted to the ECIP website.

“Other Targeted Populations” means Minorities and, solely for CDFIs, populations designated as Other Targeted Populations for that CDFI pursuant to any regulation issued by the CDFI Fund.

“Persistent Poverty Counties” means any county, including county equivalent areas in Puerto Rico, that has had 20% or more of its population living in poverty over the past 30 years, as measured by the 1990 and 2000 decennial censuses and the 2011–2015 5- year data series available from the American Community Survey of the Bureau of the Census or any other territory or possession of the United States that has had 20% or more of its population living in poverty over the past 30 years, as measured by the 1990, 2000 and 2010 Island Areas Decennial Censuses, or equivalent data, of the Bureau of the Census. For the Quarterly Supplemental Report, Participants must use the list of Persistent Poverty Counties posted to the ECIP website.

“Public Welfare and Community Development Investments” means Public Welfare Investments made in Community Economic Development Entities, as defined in 12 C.F.R. § 24.2(c), pursuant to 12 U.S.C. 24(eleventh) or 12 U.S.C. 338a, as reported to the Participant’s primary federal financial regulator.

“Qualified Lending” is a subset of Lending Activity. Lending Activity is considered Qualified Lending if it is made to one of the Target Communities listed in Table 1–Target Communities in these instructions.

"Qualified PWI” means Public Welfare and Community Development Investments that primarily benefit LMI Borrowers or communities. For the purposes of determining whether an investment primarily benefits LMI Borrowers or communities, “primarily benefit” means the same as how it is used in the definition of Community Economic Development Entities in 12 C.F.R. § 24.2(c).

“Rural Communities” means areas within a county not contained within a Metropolitan Statistical Area, as defined in OMB Bulletin No. 15-01 and applied using 2010 census tracts. For the Quarterly Supplemental Report, Participants must use the list of Rural Communities posted to the ECIP website.

“Small Businesses or Farms” means a business or farm with gross annual revenues of $1 million or less at the time of underwriting. Gross annual revenue for this purpose shall be determined in accordance with regulations issued by the Small Business Administration at 13 C.F.R. §121.104 defining “receipts,” or any successive regulation.

“Underserved Communities” means a local community, neighborhood, or rural district that is an “investment area” as defined in the CDFI Fund regulations at 12 C.F.R. § 1805.201(b)(3)(ii). For the Quarterly Supplemental Report, Participants must use the list of Underserved Communities posted to the ECIP website.

“Underserved Small Business” means a business with gross annual revenues that do not exceed $100,000 or that is majority owned by individual(s) who are Low-Income Borrowers or Other Targeted Populations. Gross annual revenue for this purpose shall be determined in accordance with regulations issued by the Small Business Administration at 13 C.F.R. §121.104 defining “receipts,” or any successive regulation. For the purposes of identifying the demographics of the owners of a business, Participants should identify the natural person Beneficial Owner(s) of a business, consistent with regulations issued by the U.S. Treasury’s Financial Crimes Enforcement Network at 31 C.F.R. § 1010.230 or any successive regulation.

“Urban Low-Income Communities” means a local community, neighborhood, or rural district in which the median family income (MFI) does not exceed (1) with respect to a census tract or block numbering area located within a Metropolitan Area, 80% of the Metropolitan Area MFI or the national Metropolitan Area MFI, whichever is greater, or (2) with respect to a census tract or block numbering area located outside of a Metropolitan Area, 80% of the statewide Non-Metropolitan Area MFI or the national Non- Metropolitan Area MFI, whichever is greater. For the Quarterly Supplemental Report, Participants must use the list of Urban Low-Income Communities posted to the ECIP website.

“U.S. Territories” means Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, and the Northern Mariana Islands.

Paperwork Reduction Act Notice

OMB Approval No. [•]

Expiration Date: [•]

The information collected will be used by the U.S. Government to set the dividend and interest rates for ECIP investments and to understand the impact of ECIP on target communities. The estimated burden associated with this collection of information is [•] per response. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Office of Privacy, Transparency and Records, Department of the Treasury, 1500 Pennsylvania Ave., N.W., Washington, D.C. 20220. DO NOT send the form to this address. An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a valid control number assigned by OMB.

1 The Participant must provide a methodology narrative for each schedule. The Participant may combine these explanations into a single document and upload this document only once. Participants also have the option to provide and upload narratives for each schedule separately.

2 Credit enhancement in the form of insurance, such as credit protection insurance, is not considered an assumption of credit risk when the enhancement is issued at the time of origination.

3 Please see the definitions of LMI Borrower and Low-income Borrower in the Glossary for more information on how to consider the income of joint applicants and co-signers.

4 For the purposes of reporting loans to Underserved Small Businesses, individuals whose race or ethnicity is unknown are considered individuals who are not Minorities.

5 For the purposes of defining “Deeply Affordable Housing” only, “area median income” refers to the definition used in the restricting covenant or contract or by the developer of the housing unit. That is, if an affordable housing developer restricts units to households earning below 30% of area median income for a period not less than 10 years, those units would be considered “Deeply Affordable Housing.”

ECIP Instructions for Quarterly Supplemental Report for Credit Unions |

||

OMB Number: ####-#### |

|

|

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Alexander, David (Detailee) |

| File Modified | 0000-00-00 |

| File Created | 2024-10-28 |

© 2026 OMB.report | Privacy Policy