Annual Financial and Actuarial Information Reporting (29 CFR Part 4010)

Annual Financial and Actuarial Information Reporting (29 CFR Part 4010)

4010 filing instructions draft for after 4044 reg published v.02

Annual Financial and Actuarial Information Reporting (29 CFR Part 4010)

OMB: 1212-0049

Add

a cover page that’s section of it’s own

Add

a cover page that’s section of it’s own

ERISA

4010

Appendix

3 updated February 28, 2024 to provide additional information about

the “Assign an Actuary” feature

Schedule

P instructions updated July X, 2024 to reflect changes to the ERISA

4044 regulation (i.e., assumptions used to determine benefit

liabilities to be reported on Schedule P for plan years ending July

1, 2024 or later).

Filing Instructions

Table of Contents

Instructions for Schedule G . 14

Instructions for Schedule I 16

Instructions for Schedule F 23

Instructions for Schedule P 28

Introduction

4010 information must be submitted electronically using PBGC’s secure e-filing portal. The portal:

Offers a secure website for submitting confidential information,

Provides the filer an opportunity to check a draft filing for omissions and inconsistencies prior to submission, and

Enables filers to create a new filing using data from a filing submitted for a prior year.

The 4010 application walks the filer through various screens, prompting the filer to answer questions and enter required information. It identifies whether a question needs to be answered based on the answers to previous questions and skips any unnecessary questions. Some of the useful features include the ability to:

Save a partially completed filing,

Review a list of errors, omitted information, inconsistencies, etc. to ensure a filing is complete and consistent before submission,

Modify information prior to submission,

Generate and show the information contained in the filing in a “form” format, either before or after submission,

View attachments to confirm that the appropriate documents were attached,

Amend a previously submitted filing to revise information or attach a file that wasn’t available at the time the filing was submitted.

Filing content

The information that must be included with a 4010 filing is divided into four categories, each assigned to a separate schedule:

Schedule G — General information, including information required under § 4010.4 and § 4010.6(a)(2),

Schedule I — Identifying information on members (other than exempt members) and plans required under § 4010.7,

Schedule F — Financial information required under § 4010.9, and

Schedule P — Plan actuarial information required under § 4010.8.

A comprehensive list of the information to be entered (or attached to) each of these schedules is available (for illustrative purposes only) in a traditional “form” format. See “Illustrative Form” section.

Definitions

The following terms are used throughout this document:

Filing coordinator (“FC”) — § 4010.2 defines “filer” as a person required to file 4010 information (i.e., a contributing sponsor of a defined benefit pension plan and each member of the contributing sponsor’s controlled group). However, in many cases, the “filer” will assign someone else the task of using the web-based application to prepare/submit the filing. The term “Filing Coordinator” is used to describe this person. For purposes of this document, the terms are used interchangeably.

Information year — the fiscal year of non‑exempt members of the controlled group; if not all non‑exempt members have the same fiscal year, the information year is the calendar year.

Current information year — the information year for which the filing is being made. The term “current” relates to the information year, not the calendar year in which the filer is preparing the filing. For simplicity, the phrase “this year” is occasionally used in the instructions to refer to the current information year.

Prior information year — the information year immediately preceding the current information year. For simplicity, the phrase “last year” is occasionally used in the instructions to refer to the prior information year.

Example — Consider a controlled group with a calendar year fiscal year. With respect to the information year ending December 31, 2023 (for which the 2023 filing is due on or before April 15, 2024), references to the current information year relate to 2023, and references to the prior information year relate to 2022, regardless of when the filing is being prepared.

Using the eFiling Portal

Detailed

information about how the e-Filing Portal works (e.g., how to create

a new filing, how to access previously submitted filings) is provided

in PBGC’s e-Filing

Portal User’s Guide.

Entering information

The application is very flexible to ensure that data can be entered in the order that best suits the needs of a particular filer. For example, one filer might enter identifying information on all non-exempt members and then move on to entering identifying information on plans. Another might enter identifying information for one member and then immediately enter financial information related to that member. Either order will work, although one way might require the filer to click a few more buttons to get to the desired part of the application. The most direct way to complete the filing is to complete Schedule I in its entirety before beginning Schedules F or P. Detailed information about how to navigate between the various schedules is provided in Appendix 1.

Saving an incomplete schedule

Items marked with a red asterisk must be completed before you will be able to save a Schedule. If you attempt to save your work before providing responses to all of the items with a red asterisk, or if any of the information you entered is in an incompatible format (e.g., a 6-digit phone number, a date in the wrong format), a note will appear at the top of the screen listing the items that need to be completed or modified.

Key features

Adding comments to a filing

In some instances, filers may wish to comment on information entered into the system. For example, an actuary may wish to document the methodology used to project prior census data.

Comments should identify the member or plan to which a comment relates. For example, if the filer wants to include a Schedule I comment reporting that the one controlled group member’s address will be changing in a few months, the name of that member should be noted in the comment.

Attaching files

Filers may (and in some instances must) attach electronic files to their submission. Examples of files that may be attached include, but are not limited to, actuarial valuation reports, financial statements, and organizational charts. Detailed information about attaching filings is provided in Appendix 2.

Reassigning filing

The filing coordinator may transfer filing responsibility/access to anyone else who has an e-Filing Portal account. The reassignment can apply to a previously submitted filing or a filing that is still in draft form. This feature is available from the dashboard.

Note re: reassigning filings Due

to the confidential nature of 4010 filings, the only person who can

reassign a 4010 filing is the filing coordinator who submitted the

filing or, if the filing has not yet been submitted, the filing

coordinator who created the draft. If you are planning on retiring

or changing jobs, we strongly recommend you reassign the filing as

needed prior to your departure.

Creating a new filing using data from a previously submitted filing

When a new filing is created, a question will appear asking whether you would like to start a new filing or pre-populate from a previous filing (for which you are also the filing coordinator of record).

In situations where the person responsible for preparing the 4010 filing has changed, the prior filing coordinator must reassign the previously submitted filing to the new filing coordinator before the new filing coordinating can pre-populate a new filing using the information contained in the prior filing.

Amending a filing

This feature enables you to amend a filing after it’s been submitted. To do so, select the “Amend” option from the drop-down menu next to that filing from the dashboard.

Assigning an actuary

This feature enables someone other than the filing coordinator to access the Schedule P for a particular plan. For details, see Appendix 3.

Filing assistance

Filers needing assistance may contact PBGC by sending an e-mail to ERISA.4010@pbgc.gov or calling (202) 229-4070. If you are deaf, hard of hearing, or have a speech disability, dial 7-1-1 to access telecommunications relay services.

PBGC staff is available to help filers, especially first-time filers, understand the filing requirements during a “pre-filing consultation”. During this consultation, we will provide an overview of the process, share helpful tips on avoiding common errors, and how the eFiling Portal works. To schedule a pre‑filing consultation, email or call PBGC at the phone number/email address shown above.

Schedule G – General information

Section I – General information |

||||||||||

1. Controlled group Information |

||||||||||

a. Full name of ultimate parent company _________________________________________________________ |

||||||||||

b. Is the ultimate parent a foreign entity? Yes No |

||||||||||

2. Filing coordinator |

||||||||||

a. Name |

_________________________________________________________ |

|||||||||

b. Company |

_________________________________________________________ |

|||||||||

c. Title |

_________________________________________________________ |

|||||||||

d. Address |

_________________________________________________________ |

|||||||||

e. City |

_______________________ |

f. State |

____ |

g. Zip |

____________ |

|||||

h. Province |

_______________________ |

|||||||||

i. Country |

_______________________ |

|||||||||

j. Phone |

(_ _ _) _ _ _ - _ _ _ _ |

k. extension |

_______ |

l. email |

_____________________ |

|||||

3. Date current information year ends |

_ _ / _ _ / ___ _ |

|||||||||

4. Name, phone number and email address of person to contact with questions about this filing (leave blank if that person is the filing coordinator) ________________________________________________________________ __________________________________________________________________________________________ |

||||||||||

5. Was a 4010 filing required for the prior information year? |

Yes No |

|||||||||

6. Is a 4010 filing required for the current information year? |

Yes No |

|||||||||

If Item 5 is “Yes” and item 6 is “No”, you must complete the § 4010.6(a)(2) demonstration (see next page) |

||||||||||

7. Does §4010.6(c) for previously submitted materials apply for this filing? |

Yes No |

|||||||||

|

||||||||||

Section II – Comments |

||||||||||

|

||||||||||

If Section I, Item 5 is “Yes” and item 6 is “No”, you must complete the § 4010.6(a)(2) demonstration shown below. Check the box next to each of the statements below if the statement is accurate with respect to the current information year.

§ 4010.6(a)(2) demonstration

Either:

|

Either:

|

Either:

|

Schedule I – Identifying information

Section I — Identifying Information for controlled group members The following information must be reported with respect to each non-exempt member of the controlled group, including foreign members. |

|||||||||||||||||||||

1. Basic information |

|||||||||||||||||||||

a. Name |

____________________________________________________________ |

||||||||||||||||||||

b. Address |

____________________________________________________________ |

||||||||||||||||||||

c. City |

_________________________ |

d. State |

________________ |

e. Province |

______________ |

||||||||||||||||

f. Country |

____________________________ |

g. Zip Code |

_________________ |

||||||||||||||||||

h. Phone |

(_ _ _) _ _ _ - _ _ _ _ |

i. Extension ______ |

j. EIN, only if U.S. entity |

_________________ |

|||||||||||||||||

k. Does controlled group contain more than 10 non-exempt members? If “Yes”, see instructions re: required attachment. If “No”, enter the relationship of this member to the ultimate parent __________________________________________________ |

Yes No |

||||||||||||||||||||

2. Is this an exempt member of the controlled group that sponsors an exempt plan |

Yes No |

||||||||||||||||||||

3. Was this member a member of the controlled group immediately before the current information year began? |

|||||||||||||||||||||

|

Yes |

||||||||||||||||||||

|

No, member joined controlled group during information year on _ _/_ _/_ _ _ _ |

||||||||||||||||||||

|

No, other |

||||||||||||||||||||

|

|||||||||||||||||||||

Section II — Plan information The following information must be reported with respect to each plan (including exempt plans) sponsored by any controlled group member as of the last day of the information year |

|||||||||||||||||||||

1. Information for current year |

|||||||||||||||||||||

a. Plan Name |

____________________________________________________________ |

||||||||||||||||||||

b. Plan Sponsor |

____________________________________________________________ |

||||||||||||||||||||

c. EIN |

_ _ - _ _ _ _ _ _ _ |

d . Plan number |

_ _ _ |

||||||||||||||||||

2. Is this plan a multiple employer plan |

Yes No |

||||||||||||||||||||

3. Is the requirement to submit actuarial information waived either because the plan is an exempt plan (as defined in § 4010.8(c)) or because the actuarial information is being reported by another filer (in accordance with § 4010.8(f))? |

Yes No |

||||||||||||||||||||

4. Information related to plan freezes |

|

||||||||||||||||||||

a. Is this plan frozen for eligibility or benefit accrual purposes? |

|||||||||||||||||||||

Items 4b and 4c are required only if 4a is answered “yes”. |

|

||||||||||||||||||||

b. Date of Freeze |

_ _ / _ _ / _ _ _ _ |

||||||||||||||||||||

c. Nature of Freeze |

Plan closed to new entrants |

||||||||||||||||||||

|

Both pay and service are frozen |

||||||||||||||||||||

|

Service is frozen, pay is not |

||||||||||||||||||||

|

Other/combination (enter explanation) ___________________________________ ____________________________________________________________________ |

||||||||||||||||||||

Schedule I – Identifying information (continued) |

|||||||||||||||||||||

Section II (continued) |

|||||||||||||||||||||

5. Information on changes in EIN/PN |

|||||||||||||||||||||

a. Has the EIN or PN reported in item 1 changed since the beginning of the current information year? |

Yes No N/A (new plan)

|

||||||||||||||||||||

Item 5b and 5c are required only if item 5a is answered “yes” |

|||||||||||||||||||||

b. Prior EIN |

_ _ - _ _ _ _ _ _ _ |

c. Prior PN |

_ _ _ |

||||||||||||||||||

Item 6 is required only if item 5a is answered “N/A (new plan)”. |

|||||||||||||||||||||

6. New plan information |

|||||||||||||||||||||

a. Date plan was first maintained by controlled group |

_ _ _ / _ _ / _ _ _ _ |

||||||||||||||||||||

b. Explanation |

Newly-established plan |

||||||||||||||||||||

|

Spun-off

or transferred from plan sponsored by member outside |

||||||||||||||||||||

|

Spun-off from plan sponsored by member within controlled group |

||||||||||||||||||||

|

Other (enter explanation) ___________________________________________ ________________________________________________________________ |

||||||||||||||||||||

|

|||||||||||||||||||||

Section III — Former members/plans |

|||||||||||||||||||||

1. Former controlled group members If any entity, other than an exempt entity, ceased to be a member of the controlled group during the information year, enter required information with respect to that entity (see instructions). |

________________________________________________________________________________________________________________________ |

||||||||||||||||||||

2. Former plans If any plan, other than an exempt plan, ceased to be maintained by a member of the controlled group during the information year, enter required information with respect to that plan (see instructions). |

________________________________________________________________________________________________________________________ |

||||||||||||||||||||

|

|||||||||||||||||||||

Section IV — Comments |

|||||||||||||||||||||

|

|||||||||||||||||||||

|

|||||||||||||||||||||

Section V — Attachments |

|||||||||||||||||||||

A list of attached files and the text entered to describe each file will appear here. |

|||||||||||||||||||||

Schedule F – Financial information

Schedule F – Financial information (continued)

Schedule P – Plan actuarial information

Section I — Basic information |

|||||||||||

1. Plan identifying information |

|||||||||||

a. Plan name |

__________________________________________________________ |

||||||||||

b. Plan sponsor |

__________________________________________________________ |

||||||||||

c. EIN |

_ _ - _ _ _ _ _ _ _ |

d. Plan number |

_ _ _ |

||||||||

2. Enrolled actuary information |

|||||||||||

a. Name |

__________________________________________________________ |

||||||||||

b. Telephone |

(_ _ _) _ _ _ - _ _ _ _ |

c. Extension |

_ _ - _ _ _ _ |

||||||||

d. EA Number |

_____________________ |

e. email |

____________ |

||||||||

3. Enter the following information with respect to the plan year ending within the information year |

|||||||||||

a. Date plan year begins |

_ _ / _ _ / _ _ _ _ |

b. Date plan year ends |

_ _ / _ _ / _ _ _ _ |

||||||||

c. Is the plan year a short plan year? |

Yes No |

||||||||||

|

|||||||||||

Section II — Funded status information (§4044 basis) |

|||||||||||

1. Participant count and benefit liabilities |

Number

of |

Benefit liabilities before reflecting expense load |

|||||||||

a. Active |

_______ |

________________ |

|||||||||

b. Terminated vested |

_______ |

________________ |

|||||||||

c. Receiving benefits |

_______ |

________________ |

|||||||||

d. Total |

_______ |

________________ |

|||||||||

2. Benefit liabilities after reflecting expense load |

|||||||||||

a. Expense load per § 4044.52(d) |

________________ |

||||||||||

b. Total benefit liabilities* |

________________ |

||||||||||

*

Determined using retirement age, interest, mortality, expense

load provided in § 4044.51-57 and other assumptions as

provided in |

|||||||||||

3. Census data used to determine benefit liabilities |

a. Projection from a date within the plan year ending within the information year |

|

|||||||||

b. As of the end of the plan year ending within the information year or the beginning of the subsequent year |

|

||||||||||

4. Interest rate used to determine benefit liabilities |

|||||||||||

a. Period 1 |

____ % for first ___ years |

b. Period 2 |

____% |

||||||||

5. Fair market value of assets (excluding receivables) at plan year-end |

_______________ |

||||||||||

|

|||||||||||

Section III — Other information |

|||||||||||

1. Information related to the [dates entered in section I, items 3a and 3b of this section] plan year Item 1a may be left blank. Items 1b–1d and 1f are required. Item 1e is required only if item 1d is “yes”. |

|||||||||||

a. Funding target (as of the valuation date) determined as if the plan has been in at-risk status for a consecutive period of at least 5 plan years |

___________ |

||||||||||

b. 4010 funding target attainment percentage (as of valuation date) |

_______% |

||||||||||

c. Adjusted funding target attainment percentage (as of valuation date) |

_______% |

||||||||||

d. Did any benefit limitations apply under ERISA 206(g) at any time during the plan year? |

Yes No |

||||||||||

e.

If (d) is “yes”, enter additional required

information

_______________________________________________ |

|||||||||||

f. Has one or more minimum funding waivers been granted for the plan totaling in excess of $1 million for which there is an outstanding balance at the end of the plan year? |

Yes No |

||||||||||

2. Information related to the information year ending [date entered in Schedule G, item 3 ] |

|||||||||||

a. Has a statutory lien arisen during the information year as the result of missed contributions in excess of $1 million (that were not made within 10 days of the due date)? |

Yes No |

||||||||||

Section IV — Additional actuarial information |

|

Which of the following five statements best describes the method under which the additional information required under §4010.8(a)(11) will be provided? |

|

1. All of the information is included in one actuarial valuation report. It is my understanding that the report will be submitted: |

|

a. As an attachment to this filing |

|

b. Electronically within 15 days of the Form 5500 filing deadline for the plan year ending within the information year |

|

2. The actuarial valuation report does not contain all of the additional required information. Therefore, supplemental information will also be provided. It is my understanding that the report and the supplemental information will be submitted: |

|

a. As an attachment to this filing |

|

b. Electronically within 15 days of the Form 5500 filing deadline for the plan year ending within the information year |

|

c. A combination of (a) and (b) |

|

Section V – Comments |

|

|

|

Schedule

P – Plan actuarial information (continued) |

Section VI – Attachments |

A list of attached files and the text entered to describe each file will appear here. |

|

|||

Section VII – Certification |

|||

I am the actuary reported in Section I, item 2. To the best of my knowledge and belief, the actuarial information submitted above is true, correct, and complete and conforms to all applicable laws and regulations. Benefit liabilities were determined using the interest rate and expense load shown above, the mortality assumption provided in §4044.53, and the expected retirement age assumption provided in §4044.55 through §4044.57. If this certification is qualified, as permitted under 26 CFR §301.6059-1(d), I have included an explanation below: |

|||

Qualification |

________________________________________________________________________ ________________________________________________________________________ |

||

Signature |

____________________________________________ |

Date |

_ _ / _ _ / _ _ _ _ |

|

|

|

|

Item numbers below relate to Schedule G of the illustrative form. A red asterisk (*) indicates the item must be completed (if applicable) before the schedule can be saved.

Schedule G must be completed if a 4010 filing is required for the current information year or if a 4010 filing was required for the previous information year.

Section I – Basic information

1. Controlled group information

For purposes of 4010 filings, a “controlled group” is a controlled group of corporations under Code section 414(b) or a group of trades or businesses under common control under section 414(c) (see § 4001.2). It includes all contributing sponsors of the plan and all members of each contributing sponsor’s controlled group.

a. Full Name of ultimate parent company* – Enter the full name of the ultimate parent company of the controlled group.

b. Is the ultimate parent a foreign entity?* – If the ultimate parent company of the controlled group is a foreign entity, check the “Yes” box. Otherwise, check the “No” box. Note that additional financial information may be required if the answer is “Yes”.

2. Filing coordinator information

This information does not need to be entered. It will be automatically populated on the system-generated form using the filing coordinator’s account information.

3. Date current information year ends*

In general, the information year is the fiscal year of all non‑exempt members of the controlled group. If not all non‑exempt members have the same fiscal year, the information year is the calendar year.

You may enter the date manually or click on the calendar icon and select the applicable date.

4. Filing contact person (if not the Filing coordinator)

The purpose of this item is to report who the PBGC should contact if they have a question about the information reported in the filing. In many cases, this person will be the Filing Coordinator. If that is the case, leave this item blank. If someone else should be the first point of contact, enter that person’s contact information.

5. Was a 4010 filing required for the prior information year?*

If a 4010 filing was required for the prior information year, check the “Yes” box. Otherwise, check the “No” box.

This question is the basis for determining whether several subsequent questions apply.

6. Is a 4010 filing required for the current information year?*

Note re: “abbreviated filing” required in certain situations

§ 4010.6(a)(2) provides that when a 4010 filing is required one year but not the next, the filer must “demonstrate” that, in fact, a filing is not required for the current information year. This demonstration is commonly referred to as an “abbreviated filing” because only Schedule G needs to be submitted.

Because of this requirement, if you answer “Yes” to item 5 and “No” to item 6, additional items will appear. To satisfy the § 4010.6(a)(2) requirement, you will need to report whether three statements (that will appear on the screen) are accurate.

Check the box in front of each statement if the statement is accurate. If the statement is not correct, do not check the box. Next, click the “Save” button and information will pop up explaining what you need to do next (e.g., how to submit the “demonstration” to PBGC).

If the language that pops up says that a filing is required this year and you do not believe that is correct, please re-read the three statements and review your responses (i.e., whether or not you checked the box).

If a 4010 filing is required for the current information year, check the “Yes” box. Otherwise, check the “No” box.

7. Does § 4010.6(c) exception for previously submitted materials apply?

Check the “Yes” box if some of the information required to be reported under 4010 is not being included with this filing because it was already submitted to the PBGC for another purpose (e.g., as an attachment to a reportable event filing). Otherwise, check the “No” box.

If “Yes” is checked, in the comments section of Schedule G, explain what materials were previously submitted, the type of filing it was submitted with, and the date submitted.

Section II – Comments

Enter any additional information that you believe will assist PBGC in its review of Schedule G.

Item numbers below relate to Schedule I of the illustrative form. A red asterisk (*) indicates the item must be completed (if applicable) before the schedule can be saved.

Section I — Identifying information for controlled group members

Identifying information must be reported with respect to each member of the filer’s controlled group (including foreign members) as of the last day of the information year unless that member is “exempt” as defined with §4010.4(c).

To enter identifying information for a member, click the “Enter Controlled Group Member Information” button. This will take you to Schedule I – Section I where you will be prompted to answer a series of questions about the member you wish to report.

Note re: contributing sponsors of

multiple employer plans Because

only members of the filer’s controlled group need to be

reported, a filer who is a contributing sponsor of a multiple

employer plan need not provide identifying information for another

contributing sponsor of the multiple employer plan if that other

contributing sponsor is not a member of the filer’s controlled

group.

Note re: exempt members that sponsor

exempt plans

Although identifying information does

not need to be reported with respect to exempt members, identifying

information about exempt plans sponsored by exempt members does need

to be reported in Schedule I

– Section II (Plan

Information). To facilitate this reporting, the EIN and plan number

of the exempt member sponsor must be reported in Schedule I

– Section I (Member

Information).

1. Basic information about controlled group members

Enter the following information with respect to each reportable member:

a. Name* – Enter the legal name of the member

Items b-i relate to the location of the headquarters of the member

b. Address* – Enter the street address

d. State * – If the headquarters is located in the U.S., select the applicable state from the drop down menu

e. Province - If the headquarters is located in another country, enter the name of the province

f. Country* – Select the country in which the headquarters of the member is located from the drop down menu.

g. Zip code* – Enter the zip code

h. Telephone* – Enter the telephone number. If the headquarters is located outside of the U.S., include the country code

i. Extension – Enter the telephone extension, if applicable

j. Employer identification number (EIN)* – If the member is a U.S. entity, enter the EIN with no dashes. If the member is not a U.S. entity, for the first foreign entity enter 777777777. For any additional foreign entities change the last digit or digits of the reported EIN so that it is unique (777777771, 777777772, 777777773, etc.)

k. Does controlled group contain more than 10 non-exempt members? Check the “Yes” box if the controlled group consists of more than 10 non-exempt members. Otherwise check the “No” box. If the answer is:

“Yes”, attach an organizational chart or other diagram showing the members of the filer’s controlled group as of the end of the information year and the legal relationships of the members to each other. The attachment may (but need not) exclude information about exempt controlled group members

“No”, enter a description of the legal relationship between this member and ultimate parent in the space provided. Examples could be parent, subsidiary, or brother-sister member.

2. Is this an exempt member of the controlled group that sponsors an exempt plan?* Check the applicable box.

3. Was this member a member of the controlled group immediately before the current information year began?*

Choose the applicable response from the drop down button to indicate whether the member was in the controlled group immediately before the information year began.

If you choose the response indicating that the member joined the controlled group during the information year, report the date the member company became part of the controlled group. You may enter the date manually or click on the calendar icon and select the applicable date.

Once you complete item 2 (in this section), you are finished answering questions about this member. Click the “Save and Close” button to return to Schedule I. From there, you can:

Enter information about another member by clicking the “Enter Controlled Group Member information” button,

Enter information about a plan sponsored by a member that’s already been reported by clicking the “Enter Plan Information”,

Complete the rest of Schedule I (i.e., Sections III – V, see below), or

Proceed to another schedule by clicking the applicable button at the top of the screen. See Appendix 1 for detailed information about how to navigate between the various schedules.

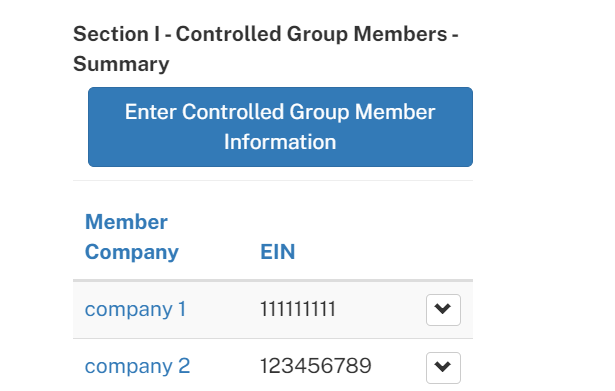

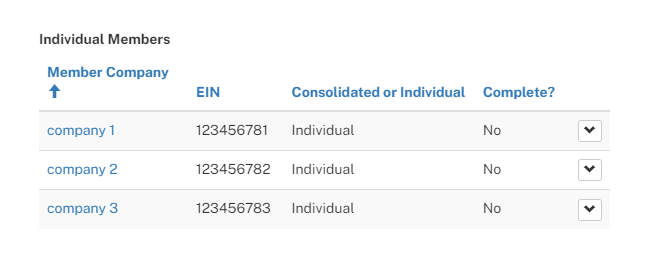

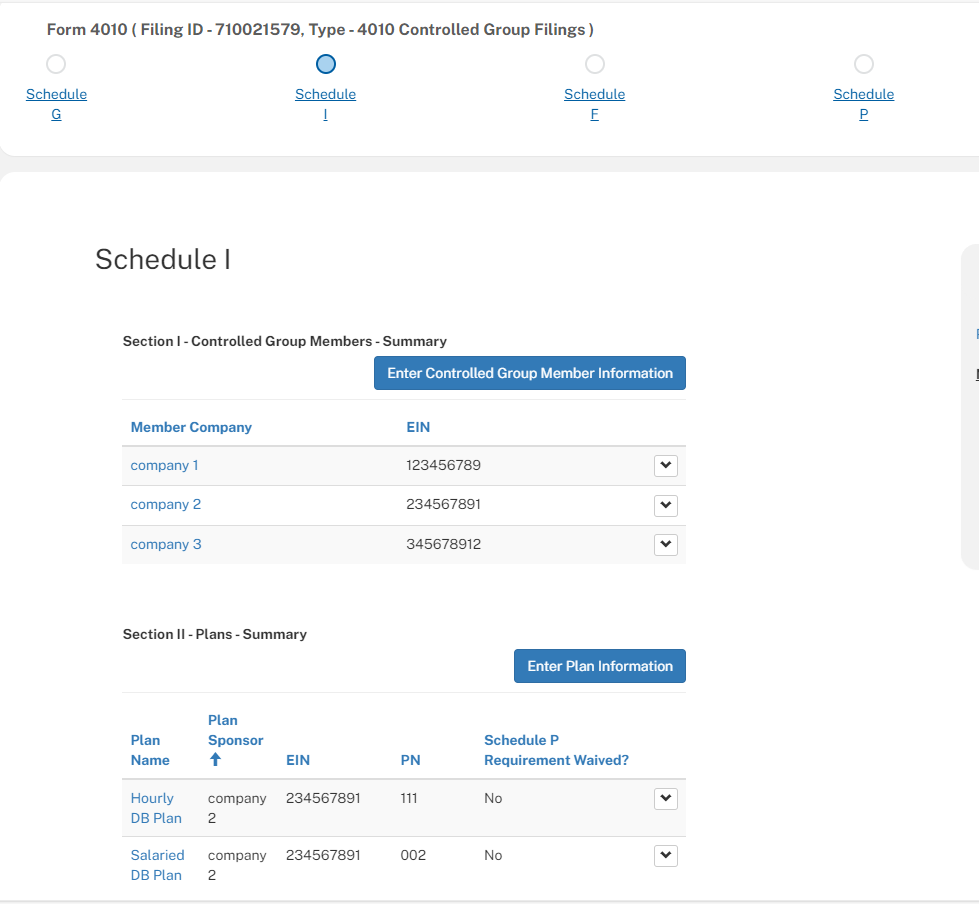

Once

you save information about a member (or if that member’s

information was pre-populated), that member will be listed in the

Controlled Group Members - Summary (see picture to the right).

Once

you save information about a member (or if that member’s

information was pre-populated), that member will be listed in the

Controlled Group Members - Summary (see picture to the right).

To edit information about a member or to delete a member from a draft filing, click the drop-down button (i.e., the “v” button) next to that member’s entry on the list and select the desired function (i.e., edit or delete) from the drop-down menu.

Section II — Plan information

Identifying information must be reported with respect to each plan (including exempt plans) sponsored by any member of the filer’s controlled group as of the last day of the information year.

To enter identifying information for a plan, click the “Enter Plan Information” button. This will take you to where you will be prompted to answer a series of questions related to a particular plan.

1. Information for current year

a. Plan Name* – Enter the legal plan name

b -c. Plan Sponsor/Employer identification number (EIN) – Select the plan sponsor from the drop down menu (which in this instance, looks like a magnifying glass). If the plan sponsor is not on the list of member companies, it most likely means that you have not yet entered member information with respect to that plan sponsor in Section I.

d. Plan Number (PN)* – Enter the three-digit plan number

2. Multiple employer plan question*

If the plan is a multiple employer plan, check the “Yes” box and attach a document listing all contributing sponsors of the plan. This list must include the information required under § 4010.7(b)(1)(vi).

If the plan is not a multiple employer plan, check the “No” box.

3. Actuarial information waiver question*

If the requirement to submit actuarial information under § 4010.8 is waived either because the plan is an exempt plan (as defined in § 4010.8(c) or because the actuarial information is being reported by another filer (in accordance with § 4010.8(f), check the “Yes” box. Otherwise, check the “No” box.

4. Information related to plan freezes*

a. Is this plan frozen for eligibility or benefit accrual purposes? *

Check the “Yes” box if the plan is frozen in any capacity. For example, check “Yes” if the plan was amended at any time during or before the current information year to:

Cease benefit accruals for some or all active participants (i.e., pay and service are frozen) after a specified date,

Change the benefit formula so that service after a specified date is not recognized for benefit accrual purposes (i.e., service is frozen, pay is not),

Change the plan eligibility requirements so that employees hired after a specified date are not covered by the plan, or

Modify the plan in some similar fashion.

Answer “Yes” even if the freeze applies only to one location, type of employee, part of the benefit formula, etc.

If you answer “Yes”, you must provide additional information (see items 4b and 4c below).

The next two questions will pop up only if “yes” is checked for question 4a.

b. Date of freeze* – You may enter the date manually or click on the calendar icon and select the applicable date. If there have been multiple freezes, report the date of the most recent freeze. The comment feature may be used to report additional information.

c. Nature of freeze* – Click the drop down menu and select the option that best describes the nature of the freeze from the options on the drop down menu. Options include:

Plan closed to new entrants

Both pay and service are frozen

Service is frozen, but pay is not

Other/combination, enter explanation

If service is frozen (i.e., the second or third option listed above), it is clear the plan is closed to new entrants. In such cases, check the “Service is frozen” or “Both pay and service are frozen” option, whichever is applicable, not the “other/combination” option.

If you select the “other/combination” option, provide information about the nature of the freeze in the space labelled “Freeze Explanation”.

5. Information on changes in EIN or PN*

a. Has the EIN or plan number changed since the beginning of the current information year?*

If, as of the last day of the prior information year, the plan did not exist, was not covered by Title IV of ERISA, or was sponsored by an entity outside of the controlled group, check the “N/A (new plan)” box. Otherwise select “Yes” or “No” as applicable. If you answer:

“No”, you are finished answering questions about this plan. Click “Save and Close”.

“Yes”, you must provide additional information (see items 5b and 5c below).

The next two questions will pop up only if “yes” is checked for question 5a.

b. Prior EIN* - Enter the prior EIN even if it hasn’t changed.

c. Prior PN* - Enter the prior plan number even if it hasn’t changed.

The next question will pop up only if you selected “N/A, new plan” for question 5a.

6. New plan Information

a. Date plan was first maintained by controlled group* – Report the date that the plan was first maintained by the controlled group. You may enter the date manually or click on the calendar icon and select the applicable date.

b. Explanation* – Select the reason why the plan was not reported last year from the drop‑down menu:

Newly-established plan,

Spun-off or transferred from a plan sponsored by a member outside controlled group,

Spun-off from plan sponsored by member within the controlled group, or

Other

If you select the “Other” option, provide a description as to how the plan came to be maintained by the controlled an explanation in the space labelled “Enter explanation*”.

Once you complete item 6 (of this section), you are finished answering questions about this plan. Click the “Save and Close” button to return to Schedule I. From there, you can:

Enter information about another plan sponsored by a member that’s already been reported by clicking the “Enter Plan Information”,

Enter information about another member by clicking the “Enter Controlled Group Member information” button,

Complete the rest of Schedule I (i.e., Sections III – V, see below), or

Proceed to another schedule by clicking the applicable button at the top of the screen. See Appendix 1 for detailed information about how to navigate between the various schedules.

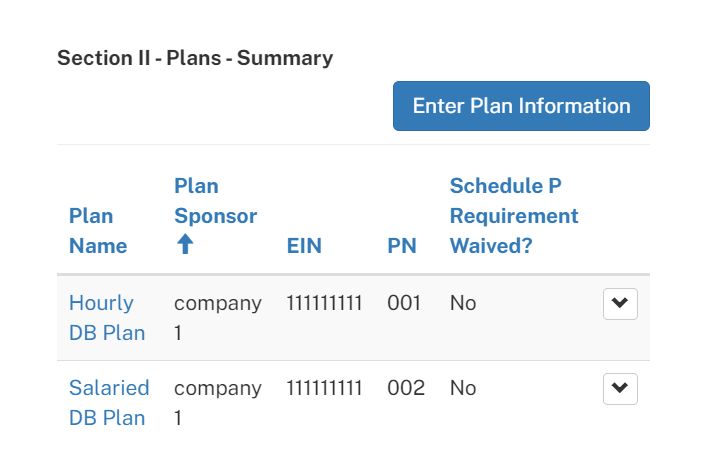

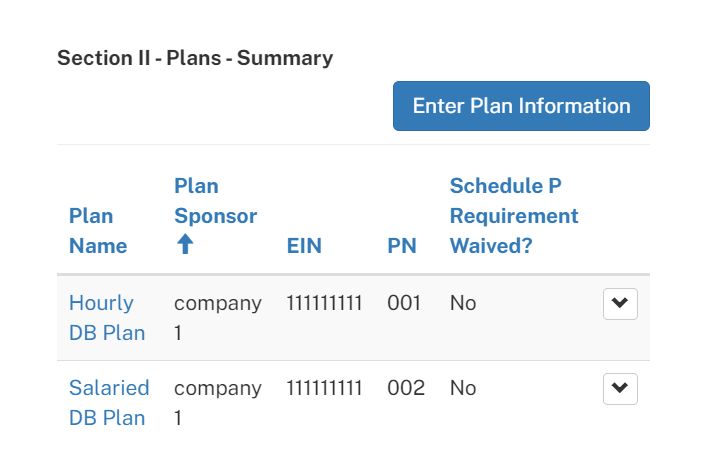

A fter

you enter and save identifying information about a plan (or if that

plan’s identifying information was pre-populated), that plan

will be listed in Section II – Plans - Summary (see picture to

the right). If you click the click the drop-down button (i.e., the

“v” button) next to that member’s entry on the

list, a drop-down menu will appear. Select:

fter

you enter and save identifying information about a plan (or if that

plan’s identifying information was pre-populated), that plan

will be listed in Section II – Plans - Summary (see picture to

the right). If you click the click the drop-down button (i.e., the

“v” button) next to that member’s entry on the

list, a drop-down menu will appear. Select:

“Edit”, to modify previously reported information or enter information that has not yet been entered.

“Delete” to delete a plan.

“Assign to Actuary” to complete a Schedule P for a particular plan. For additional information on the “Assign to Actuary” feature, see Appendix 3.

Section III — Former members/plans

1. Former controlled group members

For any entity, other than an exempt entity, that ceased to be a member of the controlled group during the information year and is thus, not reported in Schedule I, Section I of this filing, enter the following information in the space provided:

Member name,

Employer Identification Number,

Date the entity ceased to be a member, and

An explanation (e.g., no longer a member of the controlled group, now meets the definition of an exempt entity).

2. Former plans

For any plan, other than an exempt plan, that ceased to be maintained by a member of the controlled group during the information year, and is thus not reported in Schedule I, Section II of this filing, enter the following information in the space provided:

Plan name,

Plan sponsor’s Employer Identification Number,

Plan number,

An explanation (e.g., terminated, transferred to a member outside of the controlled group),

Date the plan ceased to be maintained by a member of the controlled group, and

Identifying information about the sponsor currently maintaining the plan (if transferred to a new plan sponsor).

Section IV — Comments

Enter any additional information that you believe will assist PBGC in its review of Schedule I.

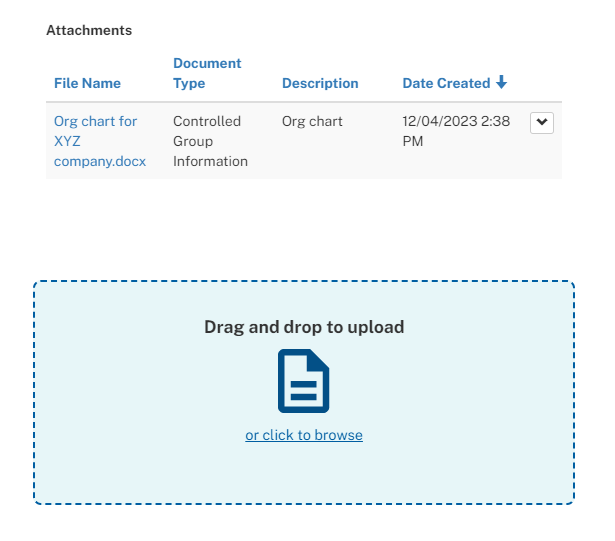

Section V — Attachments

Attach any required documents for Schedule I (e.g., an organization chart if the controlled group has more than 10 non‑exempt members or a list of contributing sponsors if a reported plan is a multiple employer plan). Feel free to attach additional documents that you believe will assist PBGC in its review of Schedule I. See Appendix 2 for additional information about attachments.

This section references the item numbers on the illustrative form. A red asterisk (*) indicates the item must be completed (if applicable) before the schedule can be saved.

In general, audited financial statements for the fiscal year ending within the information year with respect to all non-exempt controlled group must be made available as part of the filing. If audited statements are unavailable, unaudited financial statements are acceptable as long as the audited financial statement is submitted to PBGC within 15 days after it is prepared.

If no financial statements are available, a federal tax return for the tax year ending within the information year is acceptable provided audited financial statements are submitted to PBGC within 15 days after they are prepared.

To submit financial statements after a 4010 filing has already been submitted, use the “Amend Filing” feature to amend Schedule F accordingly, and either attach the financial information or provide information as to where it can be obtained (e.g. the exact URL of the SEC webpage).

Section I — Type of submission

1. Which of the permissible filing alternatives is being used?*

Financial information must be reported for each non‑exempt controlled group member (including foreign members).

If the member is included in the

consolidated financial statements of the controlled group, the

consolidated financial statements may be submitted instead of

individual member financial information. Financial information about

entities that are not members of the controlled group (e.g.,

joint ventures) or that are exempt entities may, but need not, be

included in the consolidated financial statements.

Note re: situations where ultimate

parent is foreign and

If the ultimate parent is foreign and

the consolidated financial information includes information about

U.S. entities, filers are required to submit consolidated financial

information solely about the non-exempt U.S. entities as well as for

the foreign parent.

consolidated financial information is

being reported.

Check the box indicating the method you are using to provide the required financial information for members of the controlled group:

a. §4010.9(a) – separate financial information (financial statements or tax returns) for each non‑exempt controlled group member will be provided

b. §4010.9(b) – consolidated financial information that includes combined information for all non‑exempt controlled group members will be provided

c. Consolidated financial information that includes combined information for some, but not all controlled group members will be provided, along with separate financial information for those non-exempt members whose information is not included in the consolidated information.

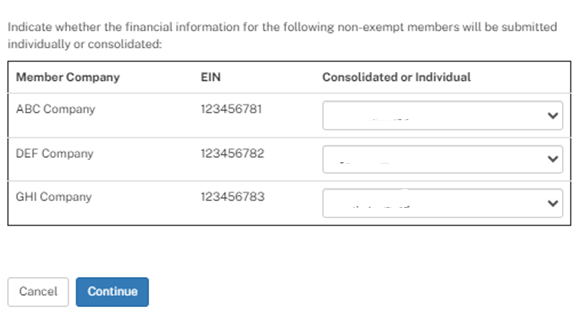

I f

you select option c, a screen will pop up showing a list of

non-exempt members reported in Schedule I

– Section I. See image to the right. Click

the drop down menu next to each non-exempt member, one-at-a-time and

select either:

f

you select option c, a screen will pop up showing a list of

non-exempt members reported in Schedule I

– Section I. See image to the right. Click

the drop down menu next to each non-exempt member, one-at-a-time and

select either:

“Consolidated” if that member’s financial information is included in the consolidated financial statements, or

“Individual” if that member’s financial information will be provided separately.

Once you have assigned each member to the appropriate category, click the “Continue” button.

The following question will appear only if the ultimate parent is foreign (see item 1b of Schedule G) and some, but not all, of the financial information is consolidated (i.e., the filer selects (c) for Schedule F, item 1, see above).

2. Is financial information for any U.S. non-exempt members consolidated with the financial information of the ultimate foreign parent?*

Check “Yes” or “No”, whichever is applicable. If you answer “Yes”, you will be required to submit consolidated financial information solely related to U.S. entities (i.e., U.S. financial statements) in addition to the ultimate foreign parent’s consolidated financial information.

In general, audited financial statements for the fiscal year ending within the information year with respect to the U.S. non-exempt members of the controlled group must be made available as part of the filing. If audited statements are unavailable, unaudited financial statements are acceptable as long as the audited financial statements are submitted to PBGC within 15 days after it is prepared.

If no financial statements are available, a federal tax return for the tax year ending within the information year is acceptable provided audited or unaudited financial statements are submitted to PBGC within 15 days after they are prepared.

To submit financial statements after a 4010 filing has already been submitted, use the “Amend Filing” feature to amend Schedule F accordingly, and either attach the financial information or provide information as to where it can be obtained (e.g. the exact URL of the SEC webpage).

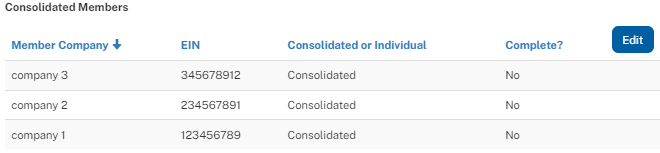

Section II — Consolidated financial information

This section is required only if you checked the box for (b) or (c) when completing item 1 of Section I (i.e., if the financial information to be reported is consolidated for some or all non-exempt members).

A

list of all non-exempt members whose financial information is

consolidated with other members will be listed on the Schedule F

homepage. Click the “edit” button (see image to the

right) to enter the required information as described below:

A

list of all non-exempt members whose financial information is

consolidated with other members will be listed on the Schedule F

homepage. Click the “edit” button (see image to the

right) to enter the required information as described below:

1. With respect to consolidated financial information solely for U.S. entities:

a. What type of financial information is being reported?

In general, audited financial statements for the fiscal year ending within the information year with respect to the U.S. non-exempt members of the controlled group must be made available as part of the filing. However:

If audited statements are unavailable, unaudited financial statements are acceptable as long as audited financial statements are submitted to PBGC within 15 days after they are prepared.

If no financial statements are available, a federal tax return for the tax year ending within the information year is acceptable provided audited or unaudited financial statements are submitted to PBGC within 15 days after they are prepared.

To submit financial statements after a 4010 filing has already been submitted, use the “Amend Filing” feature to amend Schedule F accordingly, and either attach the financial information or provide information as to where it can be obtained (e.g. the exact URL of the SEC webpage).

Check the applicable box to report the type of financial information that is being reported for the U.S. entities whose financial information is consolidated with other members.

b. Will consolidated financial information be attached to this filing?

You may attach a copy of the financial information to the filing, or, if the financial information is publicly available, provide information about where it can be found (see items 1c and 1d). Check “Yes” if you are attaching it to this filing. Otherwise check “No, because it is publicly available”

The next two items are required only if you check “No, because it is publicly available” for item 1b.

c. URL where publicly available information can be found

Report the exact URL of the webpage.

d. When was information made available to the public?

Enter the date the financial information was posted on the URL referenced in item 1c.

Item 2 is required only if you reported (in Schedule G) that the ultimate parent is a foreign entity and either:

The consolidated financial information combines information for all non-exempt members (i.e., you selected option b in item 1 of Schedule F, Section I), or

The consolidated financial information combines information for some, but not all, non-exempt members (i.e., you selected option c in item 1 of Schedule F, Section I), but it does include financial the foreign ultimate parent.

2. With respect to consolidated financial information solely for the foreign ultimate parent:

a. What type of financial information is being reported?

The instructions are the same as for item 1a of this section except that for this item, they relate solely to the foreign ultimate parent and “Federal tax return” is not one of the options.

b. Will the consolidated financial information be attached to this filing?

The instructions are the same as for item 1b of this section except that for this item, they relate solely to the foreign ultimate parent.

c. URL where publicly available information can be found (including title of web page, if applicable).

The instructions are the same as for item 1c of this section except that for this item, they relate solely to the foreign ultimate parent.

d. When was information made available to the public?

The instructions are the same as for item 1d of this section, except that for this item, they relate solely to the foreign ultimate parent.

Section III — Individual member financial information

This section is required only if you checked the box for (a) or (c) when completing item 1 of Section I (i.e., individual financial information will be reported separately for each non-exempt member or financial information is consolidated for some, but not all, non-exempt members).

A list of all non-exempt members for which individual financial

information is being reported will be displayed on the Schedule F

home screen. You must answer a series of questions about how the

financial information for each of those members is being reported.

To do so, click the drop-down menu for each member, one-at-a-time

(see image on right), select “Edit” and enter the

requested information as described below:

list of all non-exempt members for which individual financial

information is being reported will be displayed on the Schedule F

home screen. You must answer a series of questions about how the

financial information for each of those members is being reported.

To do so, click the drop-down menu for each member, one-at-a-time

(see image on right), select “Edit” and enter the

requested information as described below:

1. Basic information

Once you select the applicable member, the following information will automatically be populated.

a. Name of the controlled group member

b. EIN

2. Information about the individual financial information for member shown in item 1

The instructions are the same as for item 1 of Schedule F, Section II, except that in this case, they relate solely to the individual financial information for the member shown in item 1 of this section.

Enter any additional information that you believe will assist the PBGC in its review of the Schedule F.

Section V — Attachments

Attach any required documents for Schedule F. Feel free to attach additional documents that you believe will assist PBGC in its review of Schedule F. See Appendix 2 for additional information about attachments.

A separate Schedule P is required for each non-exempt plan maintained by any member of the controlled group. The purpose of Schedule P is to report Plan Actuarial Information for each non‑exempt plan sponsored by a member of the controlled group as of the last day of the information year.

If the filing coordinator has assigned an actuary to a particular plan, both the Filing Coordinator and that actuary will have access to that Schedule P. Access is limited to one actuary at a time.

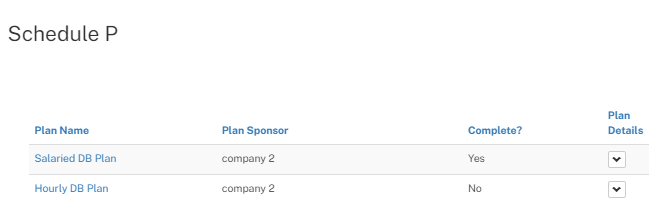

T he

Schedule P home page is automatically populated with the names of all

plans reported in Schedule I

– Section II unless the requirement to report actuarial

information for such plan is waived (e.g., exempt plans and certain

multiple employer plans). See image to the right.

he

Schedule P home page is automatically populated with the names of all

plans reported in Schedule I

– Section II unless the requirement to report actuarial

information for such plan is waived (e.g., exempt plans and certain

multiple employer plans). See image to the right.

To enter or edit Plan Actuarial Information for a particular plan, click on the click the drop down button next to that plan’s entry on the list and select “Edit” or click on the name of the plan. If a plan does not appear, it most likely means you omitted the plan when you completed Schedule I – Section II or inadvertently reported (on that schedule) that actuarial information did not need to be submitted for that plan. You can return Schedule I and modify plan information as needed.

When you finish entering information for one plan, you will be given the option of entering actuarial information for another plan or saving the information you’ve entered so far and exiting this section.

Section I — Basic information

1. Basic information

This information does not need to be entered. It will be automatically populated on the system‑generated form using the plan information reported in Schedule I, Section II once you select the applicable plan.

a. Plan name

b. Plan sponsor

c. EIN

d. Plan number

2. Enrolled actuary information*

a. – e. Enter the name, EA number with no dashes, telephone number and email address of the enrolled actuary responsible for certifying the actuarial information reported for this plan.

The enrolled actuary does not need to be the enrolled actuary who certifies Schedule SB of Form 5500 or the actuary who certifies a premium filing.

3. Plan year information*

Enter the following information with respect to the plan year ending within the information year

a. Date plan year begins

b. Date plan year ends

c. Short plan year – Check the “Yes” box if the plan year ending within the current information year is less than 12 months. Otherwise, check “No”.

Section II — Funded status information (§4044 basis)

1. Participant count and benefit liabilities*

Enter participant count and benefit liabilities broken down into the following three categories (before reflecting the expense load):

a. Active participants

b. Terminated vested participants

c. Retirees and beneficiaries receiving benefits

With respect to benefit liabilities, determine the amounts using the assumptions and methods for valuing benefits to be paid as annuities in trusteed plans terminating at the end of the plan year with one exception: enter the value before reflecting the expense load required under § 4044.52(d).

See § 4010.8(d) for information on how to calculate benefit liabilities in an on-going plan and note that benefit liabilities for cash balance plans are determined as if the plan terminated (i.e., account balances converted to annuities in accordance with section 411(b)(5)(B)(vi) of the Code and 26 CFR 1.411(b)(5)-1(e)(2)). For 4010 purposes, expected improvements in mortality experience may be disregarded for valuing benefit liabilities.

The values may be rounded to the nearest thousand. For example, if the benefit liabilities for active participants is $123,456,789, you may enter $123,457,000 or $123,456,789. If the liability is $123,456,389, you may enter $123,456,000 or $123,456,389.

If projected census data are used to determine benefit liabilities, any reasonable methodology may be used to allocate liabilities into the various categories (e.g., based on the participant’s status as of the date the underlying data was collected, in a manner that results in a breakdown proportional to the prior year, etc.). The comment feature may be used to document the allocation methodology, but doing so is optional.

If census data are projected from a date before the end of the plan year ending within the information year, enter the counts as of that date. Otherwise, enter the breakdown of the actual census used to determine benefit liabilities. The methodology used to allocate participants to a particular category (active, terminated vested, retired), should be consistent with the methodology used for reporting participant counts and liabilities on Schedule SB of Form 5500 and, if applicable, on the comprehensive premium filing.

2. Benefit liabilities after reflecting expense load

a. Expense load* – Enter the applicable expense load calculated in accordance with § 4044.52(d). The amount may be rounded to the nearest thousand. For example, if the amount is $444,555.66, you may enter $445,000.

b. Total benefit liabilities after reflecting load – After you enter the counts and liabilities, click the “calculate total” button.

Note – if you change a previously entered number, the totals will not change until you click “Calculate Total”.

If you do not click this button, totals will automatically be calculated when you hit the “Save” button. In this case, if you return to this screen at a later time, or print the filing, the totals will appear.

3. Census data used to determine benefit liabilities*

§ 4010.8(d)(1) provides that census data may be determined as of the end of the plan year ending within the information year or as of the beginning of the subsequent plan year. If actual plan census data is not available as of either of those dates, a projection of plan census data from a date within the plan year ending within the information year is permitted. Such a projection must use reasonable actuarial methods including adjusting for significant events, if applicable. See § 4010.8(d)(2).

Check the box that best describes the census data used:

a. Projected from a date within the plan year ending within the information year

b. As of the end of the plan year ending within the information year or the beginning of the subsequent year

4. Interest rate used to determine benefit liabilities

Enter the select and ultimate interest rates to determine benefit liabilities reported above and number of years in the “select” period for which that interest rate is used.

Enter rates as percentages. For example, if the applicable rate for the first 20 years is 4.21%, enter 4.21, not .0421 for rate and 20 for number of years.

Note – the required interest assumption is provided § 4044.52(a) and published quarterly on www.pbgc.gov.

Note re: change to 4044 interest assumption structure

On June 6, 2024, PBGC issued a final rule changing the structure of the ERISA 4044 interest assumption for valuation dates on or after July 31, 2024 from a “select and ultimate” approach to a yield curve approach. If you are completing a Schedule P for a plan where benefit liabilities are measured on a date for which the new approach applies (i.e., a plan year ending on or after July 31, 2024):

Leave the interest rate questions blank, and

Enter the date of the applicable yield curve in the Schedule P comments section (e.g., “July 31, 2024 ERISA 4044 yield curve”, “September 30, 2024 yield curve”).

The ERISA 4044 yield curves are available on PBGC’s website and updated monthly.

Note that the final rule also modifies the ERISA 4044 mortality assumption and expense load for valuation dates on or after July 31, 2024. For details, see the final rule.

5. Fair market value of assets (excluding receivables) at plan year-end*

Enter the value at the end of the plan year that ends within the information year. Do not include contributions made after the end of the plan year, even if those contributions are designated as contributions for the prior plan year.

The value may be rounded (but not truncated) to the nearest thousand. For example, if the fair value of assets is $123,456,789.33, you may enter $123,457,000.

Section III — Additional actuarial information

1. Information related to the plan year reported in Schedule P, Section I

Item 1a may be left blank. See § 4010.8(b)(1). Enter percentages in this section by truncating at .01% (e.g., report 72.649% as 72.64%).”

a. Funding target as if plan were in at-risk status – Enter the funding target for the plan year ending within the information year (calculated in accordance with ERISA section 303(d)(i)), but determined (1) as if the plan has been in at-risk status for a consecutive period of at least 5 plan years (i.e., as if at-risk provisions are fully phased-in and at-risk load applies) and (2) without regard to the interest rate stabilization rules.

b. 4010 funding target attainment percentage* – Enter the funding target attainment percentage for the plan year ending within the information year determined without regard to the interest rate stabilization rules.

IRS notice 2012-61 provides rules with respect to how the funding target and asset value underlying this calculation are determined. However, § 4010.4(b)(2) provides that for purposes of 4010 reporting, the value of assets determined under ERISA section 303(g)(3) may (but need not) be substituted for the asset value described in Q&A NA-3 of that notice.

c. Adjusted funding target attainment percentage* – Enter the adjusted funding target attainment percentage for the plan year ending within the information year. The percentage should be the same as what will be reported on Schedule SB for the plan year ending within the information year.

d. Benefit limitations* – Check “Yes” if, at any time during plan year ending within the information year, the plan was subject to any of the benefit limitations provided in ERISA section 206(g). This includes plans for which the actuarial certification of the adjusted funding target attainment percentage (AFTAP) was not made by the first day of the tenth month of the plan year and was thus, conclusively presumed to be less than 60%. Otherwise, check “No”.

If you check “Yes”, another question (1e) will appear.

Item 1e is required only if item 1d of this section is answered “Yes”.

e. Benefit limitations explanation – Provide additional information related to the applicable benefit limitation (e.g., which limitation applied, whether the AFTAP was certified or presumed to be below the threshold that triggered the limitation)

f. Large waiver information* – Check “Yes” if, as of the end of the plan year ending within the information year:

The plan has one more outstanding minimum funding waivers under ERISA section 302(c) or Code section 412(c), and

The total amount waived with respect to such waivers exceeded $1 million.

Otherwise, check “No”.

2. Information related to the information year reported in Schedule G, Section I

a. Lien information* – Check “Yes” if:

During the information year, there was a failure to make a required installment or other required payment to the plan that resulted in conditions for imposition of a lien under ERISA section 303(k) or Code section 430(k), and

Such required payment was not made within 10 days after its due date.

Otherwise, check “No”.

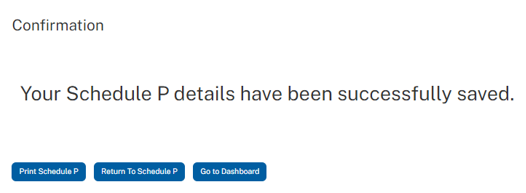

Once you complete Section IV, you may save the information you’ve entered in the Schedule P for this plan. If that’s what you want to do, click the “Save and Next” button at the bottom of the screen to return to the Schedule P homepage. Or, if you are ready to complete Sections V, VI, and/or VIII (see below), complete those sections before you click the “Save and Next” button.

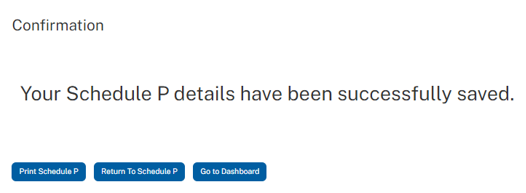

Once

you’ve saved the information entered on this Schedule P, a

screen will appear that looks like the image to the right. If you

want to:

Once

you’ve saved the information entered on this Schedule P, a

screen will appear that looks like the image to the right. If you

want to:

Enter actuarial information about another plan, click the “Return to Schedule P” button,

View the system-generated form version of this Schedule P, click the “Print Schedule P” button. See comments about the printable form in the instructions for the Enrolled Actuary’s certification below.

Proceed to another schedule, click the “Return to Schedule P” button and then click the applicable button at the top of the screen. See Appendix 1 for detailed information about how to navigate between the various schedules.

Section IV — Additional actuarial information

A copy of the plan’s actuarial valuation report for the plan year ending within the information year is required as part of the 4010 filing. The report must be submitted electronically. With the exception of certain plans subject to special funding rules (see below), the report must contain or be supplemented by the actuarial information specified in § 4010.8(a)(11).

If this additional actuarial information is not available by the filing due date, it may be submitted no later than 15 days after the Form 5500 filing.

Select the statement that describes when this information on this plan is expected to be submitted and whether the required information is completely contained:

Within one actuarial valuation report, or

In part, in an actuarial valuation report and in part, in another file or file(s).

Note re: Actuarial Valuation Reports

for Frozen Airline and CSEC plans If

the plan is a frozen airline plan that elected the alternate funding

schedule under section 402(b) of PPA or is subject to special

funding rules under the Cooperative and Small Employer Charity

Pension Flexibility Act, contact PBGC at 202-229-4070 to discuss the

requirements related to additional actuarial information to be

attached to the filing (in connection with the actuarial valuation

report).

Section V — Comments

Enter any additional information that will assist the PBGC in its review of the Schedule P. If the filing contains multiple Schedules P, note that each Schedule P has its own comments field, so it is not necessary to identify the plan to which the comment relates. The system-generated form version of a Schedule P for a particular plan will show only comments applicable to that plan.

Section VI — Attachments

Attach any required documents for Schedule P (unless you indicated that you would be attaching them at a later date). See Appendix 2 for additional information about attachments.

Section VII — Enrolled actuary’s certification

§ 4010.8(a)(12) requires that an enrolled actuary certify that the to the best of his/her knowledge and belief, the actuarial information submitted above is true, correct, complete, and conforms to all applicable laws and regulations. To the extent the certification is qualified, as permitted under 26 CFR § 301.6059-1(d), an explanation must also be submitted.

This certification is not done electronically. Rather, the enrolled actuary must manually sign a “form version” of the Schedule P information.

As

noted above, the “form version” can be generated by

selecting the “Print Schedule P” button on the screen

that appears after you save the Schedule P (see picture to the

right).

As

noted above, the “form version” can be generated by

selecting the “Print Schedule P” button on the screen

that appears after you save the Schedule P (see picture to the

right).

Once the printable version of form appears on your screen, print a hard copy using your browser's print feature and manually sign it.

Alternatively, you can generate a printable form version of the Schedule P information for a particular plan from the Schedule P home page by selecting “Preview” from the drop-down menu on that plan’s row (see picture below).

Lastly, if your role with respect to the filing is solely that of “assigned actuary”, you can also generate a printable form directly from the dashboard. To do so, click on the “4010-Schedule P” tab and select “View” from the drop‑down menu that appears when you click on the “Actions” button.

A navigation bar is displayed at the top of each screen as shown in the image below. To move from one schedule to another, save the information you’ve entered (by clicking “Save” at the bottom of the screen) and then click on the schedule you want to work on next. Click the name of the schedule, not the circle above it.

For example, assume John is working on a 4010 filing, that he has already entered identifying information about three non-exempt members and two plans and saved that information. At that point in the filing process, the top part of the Schedule I screen would look like the image above. The blue dot above the words “Schedule I” serves as a reminder that John is currently in Schedule I (i.e., the dot is colored in to help him keep track of where he is within the application). At this point in the filing, if John wants to report:

Identifying information for another member or another plan, he would stay in Schedule I,

Financial information about one, or all, of the members, he would click on the link to “Schedule F” at the top of the screen, or

Actuarial information for one of the plans reported in Section II, he would click on the link to Schedule P” at the top.

Note that you cannot move onto another schedule until you have saved your work on the schedule you’re currently in. Also note that you cannot save your work until you’ve provided answers to all of items with a red asterisk.

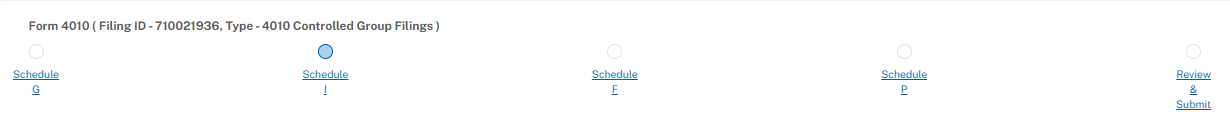

The

navigation bar also includes a “Review & Submit”

option (see far right of image below). When you’re ready to

submit the filing, click on that link and the review process will

begin. First, the system will generate a list of errors and

omissions, so you can modify the filing as needed before you submit.

Once you’ve rectified any errors and omissions, you will be

prompted to hit a “submit” button to submit your filing.

Attachments for Schedules F and I are typically uploaded at the end of those schedules, but they can also be uploaded directly from the “Review and Submit” screen. Because attachments for Schedule P (Plan Actuarial Information) relate solely to a particular plan, they can be uploaded only from the Schedule P for the plan to which the attachment relates.

To upload an electronic file, click the “Drag and drop to upload” or “click to browse” button (see bottom of image to the right) and drag or select the file you want to attach.

After uploading a file, a screen will pop up on which you will be prompted to provide the following information about the attachment:

The

type of document – Select the applicable document type from

the drop-down menu. Choices are:

The

type of document – Select the applicable document type from

the drop-down menu. Choices are:

Actuarial Valuation Report

Company Financial Statements

Company Tax Returns

Controlled Group Information

Other Company-Related Documents

Other Pension Plan-Related Documents

The schedule to which the attachment relates – If you are uploading the attachment:

While in a schedule, the system will automatically populate this item.

From the “Review & Submit” screen, click the drop-down menu and select the applicable schedule (i.e., I or F)

Description – Provide a description of the information contained in the attachment. If the attachment relates to a particular member or plan, include information so that PBGC can easily identify the member or plan to which the attachment relates.

Once you attach a file, it will appear in the Attachments section of the related Schedule (see top part of image shown above). To delete or view an attachment, click the drop-down menu button next to the row where information about that attachment appears.

To attach an electronic file to a previously submitted filing, go to the 4010 home page and click the “amend filing” button next to the applicable filing.

Note re: very large files

The portal cannot accept files that are

larger than 25MB. If you need to attach a file larger than that,

contact PBGC’s e-Filing Portal team by email at

efilingportal@pbgc.gov.

The “assign an actuary” feature enables the filling coordinator to provide another person access to the Schedule P for a particular plan. Such access includes the ability to enter or modify data, upload attachments, print Schedule P, and perform validation checks.

If you are the filing coordinator, please note:

The assignment is made on Schedule I by selecting “Assign an Actuary” from the drop down menu next to the plan in question from the list of plans shown in Section II of Schedule I (see image below) and then reporting information about the actuary (e.g., name, email address).

Only one actuary may be assigned to any particular Schedule P and that actuary must have an e‑Filing Portal account before access can be granted.

The assigned actuary does not need to be the same actuary who will be certifying the Schedule P information manually.

You retain your ability to enter or modify information on a Schedule P that has been assigned to an actuary.

If you are the assigned actuary, please note:

You will receive an email notifying you that you have been assigned to a particular plan for a particular 4010 filing.

To access the Schedule P for the plan you’ve been assigned, click on the “Form 4010-Schedule P” tab at the top your dashboard and then select the “SCH P Details” option from the drop‑down menu that appears when you click on the “Actions” button for that plan. See picture below:

There is an optional feature you can use to notify the filing coordinator when you are done entering Schedule P information. To use this feature, click on the “Notify FC” button, and the system will send a notification by email to the filing coordinator.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | PC0014220 |

| File Modified | 0000-00-00 |

| File Created | 2024-07-22 |

© 2026 OMB.report | Privacy Policy