Rule 17g-5 Supporting Statement

Rule 17g-5 Supporting Statement.docx

Rule 17g-5 Conflicts of Interest

OMB: 3235-0649

SUPPORTING STATEMENT

for the Paperwork Reduction Act

Information Collection Submission for

Rule 17g-5: Conflicts of Interest

A. JUSTIFICATION

1. Necessity of Information Collection

Section 15E of the Securities Exchange Act of 1934 (“Exchange Act”),1 added to the Exchange Act by the Credit Rating Agency Reform Act of 2006 (“Rating Agency Act”)2 and amended by the Dodd-Frank Wall Street Reform and Consumer Protection Act enacted in 2010,3 sets forth the regulatory framework applicable to credit rating agencies that register with the Securities and Exchange Commission (“Commission” or “SEC”) as nationally recognized statistical rating organizations or NRSROs. Section 15E(h) contains self-executing requirements and directs the Commission to adopt rules addressing certain conflicts of interest arising in the issuance of credit ratings.4

Rule 17g-5 implements Section 15E(h)(2) of the Exchange Act5 by requiring an NRSRO to disclose and manage certain conflicts of interest, as well as specifically prohibiting other conflicts of interest.6 Paragraph (a)(3) of the rule provides for a collection of information. Specifically, Rule 17g-5(a)(3) prohibits an NRSRO from issuing or maintaining a credit rating for a security or money market instrument issued by an asset pool or as part of any asset-backed securities transaction (collectively, “asset-backed security”) unless information about the asset-backed security is disclosed by the NRSRO.7 Per the rule, the NRSRO must maintain on a password-protected internet website a list of each asset-backed security for which it is currently in the process of determining an initial credit rating, along with other specified information.8 The NRSRO must also provide free and unlimited access to the website to any NRSRO that provides it with a copy of the certification required by Rule 17g-5(e).9

Rule 17g-5(a)(3) further requires the NRSRO to obtain from the issuer, sponsor, or underwriter that hired the NRSRO to rate the security, a written representation that can be reasonably relied upon setting forth certain undertakings, including that the issuer, sponsor, or underwriter will maintain on a password-protected internet website the information specified in Rule 17g-5(a)(3)(i)10 and will post any executed Form ABS Due Diligence-15E delivered by a person employed to conduct due diligence services with respect to the security.11 Rule 17g-5(a)(3)(iv) provides an exemption from Rule 17g-5(a)(3) if the issuer of the asset-backed security is not a U.S. person12 and the NRSRO has a reasonable basis to conclude that all offers and sales of securities or money market instruments by any issuer, sponsor, or underwriter linked to the asset backed-security will occur outside the U.S.13

Rule 17g-5 contains “collection of information” requirements within the meaning of the Paperwork Reduction Act of 1995.14 The collection of information is necessary to achieve the Commission’s objective of mitigating potential conflicts of interest that may arise in the rating of asset-backed securities.15 The collection of information has been approved and extended by the Office of Management and Budget (“OMB”) under control number 3235-0649 (expiring September 30, 2024).

2. Purpose and Use of the Information Collection

The collection of information under Rule 17g-5 relating to an asset-backed security that an NRSRO has been hired to rate (“hired NRSRO”), including the requirements to maintain initial rating information on a password-protected internet website and to provide access to the website to non-hired NRSROs, facilitates the potential issuance of unsolicited ratings by non-hired NRSROs. This may promote the integrity of the credit rating process by making it more difficult for an issuer, obligor, or underwriter of an asset-backed security to exert influence over a hired NRSRO to issue higher ratings than warranted, as that fact may be revealed through lower ratings issued by non-hired NRSROs.16 Also, the requirement that only non-hired NRSROs that provide the certification required by Rule 17g-5(e) be given access to the website helps ensure that only NRSROs that intend to determine or monitor credit ratings have access to the website.17

Rule 17g-5(a)(3)(iv) includes an exemption for asset-backed securities issued by non-U.S. persons and offered or sold outside the U.S. The collection of information permits NRSROs to determine whether they meet the conditions of the exemption.

3. Consideration Given to Information Technology

Rule 17g-5(a)(3) requires the use of internet websites to disclose information about an asset-backed security with respect to which a hired NRSRO is in the process of determining a credit rating. Commission staff believes that programmatic solutions, including automatization, may be used to facilitate the posting of the required information on a website, thereby reducing the potential burden of compliance with the rule. With respect to the exemption under Rule 17g-5(a)(3)(iv) for asset-backed securities that are issued by non-U.S. persons and offered or sold outside the U.S. and the certification required by Rule 17g-5(e), Commission staff does not believe that the associated collections of information implicate the use of information technology.

4. Duplication

Commission staff has not identified any duplication with respect to the information required by Rule 17g-5.

5. Effect on Small Entities

None of the currently registered NRSROs that are subject to the collection of information under Rule 17g-5 meets the definition of small entity.18 However, issuers, obligors, or underwriters of asset-backed securities that hire NRSROs to rate such securities and are therefore required to provide certain representations to the hired NRSROs under Rule 17g-5 may be small entities.

6. Consequences of Not Conducting Collection

Without the collection of information under Rule 17g-5(a)(3), it may be difficult or impossible for a non-hired NRSRO to rate an asset-backed security and issue an unsolicited rating on the security. This could lead to lower quality ratings, reduced transparency in the rating process, and reduced competition among NRSROs.

7. Inconsistencies with Guidelines in 5 CFR 1320.5(d)(2)

There are no special circumstances. This collection is consistent with the guidelines in 5 CFR 1320.5(d)(2).

8. Consultations Outside the Agency

The SEC’s Office of Credit Ratings (“OCR”) conducts annual examinations of NRSROs pursuant to Section 15E(p)(3)(A) of the Exchange Act and engages representatives of the NRSRO industry through meetings and information exchanges. This provides the Commission and OCR staff with the opportunity to determine, and act upon, paperwork burdens imposed upon NRSROs and others that may affected by burdens that are associated with the information collection.

The required notice with a 60-day comment period soliciting comments on this collection of information was published in the Federal Register on May 7, 2024.19 The Commission did not receive comments on its estimates of the paperwork burden associated with Rule 17g-5.

9. Payment or Gift

No payments or gifts were provided to respondents.

10. Confidentiality

The initial credit rating information that is posted on the internet website of an NRSRO that has been hired to rate an asset-backed security by an issuer, obligor, or underwriter, pursuant to Rule 17g-5(a)(3)(i) and (ii), is only required to be made available to a non-hired NRSRO that provides the hired NRSRO with a copy of the certification furnished to the Commission pursuant to subparagraph (e) of Rule 17g-5 (“Rule 17g-5(e) certification”).20 Also, information maintained by an issuer, obligor, or underwriter on a website pursuant to Rule 17g-5(a)(3)(iii)(A) is required to be made available only to non-hired NRSROs that provide the issuer, obligor, or underwriter with a copy of the Rule 17g-5(e) certification. The Commission does not make certifications furnished by non-hired NRSROs public. Also, Commission staff does not expect that issuers, obligors, or underwriters would make certifications provided by non-hired NRSROs public.21 Representations provided by an issuer, obligor, or underwriter to a hired NRSRO in connection with the rating of an asset-backed security are not expected to be made public, unless the NRSRO or the issuer, obligor, or underwriter chooses to make the representations public.22

The information collection does not collect any Personally Identifiable Information (PII). The Systems of Record Notice may be reviewed at https://www.sec.gov/oit/system-records-notices. The Privacy Impact Assessment document for Electronic Data Gathering Analysis and Retrieval may be reviewed at https://www.sec.gov/about/privacy/pia/pia-edgar.pdf.

11. Sensitive Questions

Not applicable.

12. Burden of Information Collection

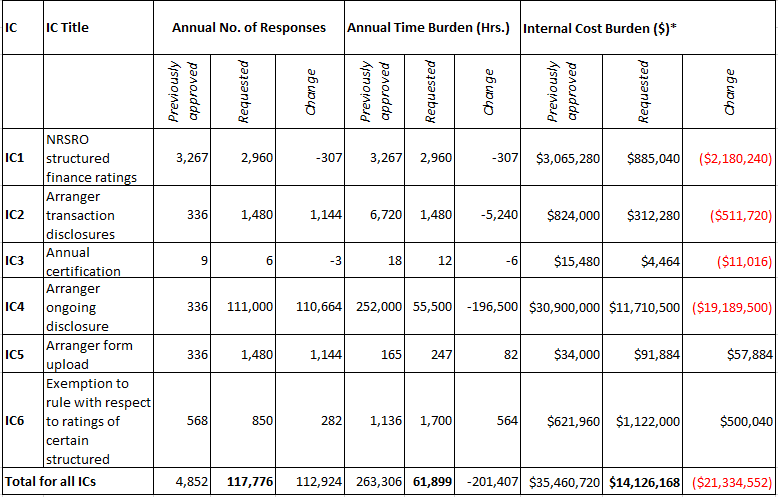

For purposes of the Paperwork Reduction Act, Commission staff derives the hour burden estimates based on the average number of hours NRSROs and issuers, sponsors or underwriters that hire NRSROs to rate asset-backed securities would spend preparing and disclosing the information required by Rule 17g-5(a)(3). Commission staff also estimates the number of new asset-backed securities transactions that may be rated in a given year as the rating of a new transaction triggers the requirement to update the list of initial ratings that NRSROs must disclose on the website required to be maintained under Rule 17g-5(a)(3), as well as other requirements under the rule. Currently, there are 6 NRSROs that are registered in the issuers of asset-backed securities ratings class and are therefore subject to Rule 17g-5(a)(3).

Commission staff estimates that there are approximately 1,480 new asset-backed securities transactions a year that would be subject to the requirements of Rule 17g-5(a)(3),23 and, based on staff experience, it is estimated that each transaction will be rated by approximately two NRSROs. Commission staff estimates that it will take each NRSRO one hour per transaction to make the required information under Rule 17g-5(a)(3) available on a website, for a total industry-wide hour burden per year of approximately 2,960 hours24 and an industry-wide annual cost of $885,040.25

Rule 17g-5(a)(3) further requires an NRSRO to obtain from an issuer, sponsor or underwriter hiring the NRSRO to rate an asset-backed security (“respondent”), a written representation on which the NRSRO can reasonably rely that the respondent will disclose the information it provides to the NRSRO to rate the security on a password-protected internet website. It is estimated that it will take a respondent one hour per transaction to make the information publicly available on a website. Based on the estimated 1,480 new asset-backed securities transactions a year, Commission staff estimates that the total annual burden for respondents will be approximately 1,480 hours,26 for a total annual cost of $312,280.27

9250

Rule 17g-5(a)(3) also requires disclosure of information by a respondent that is used by a hired NRSRO to undertake credit rating surveillance on a rated asset-backed security. Commission staff estimates that approximately 9,250 outstanding asset-backed security deals will be under surveillance28 and that it will take a respondent approximately 30 minutes per month to disclose information for each transaction on its website. As such, it is estimated that the total annual industry-wide hour burden will be 55,500 hours,29 resulting in a total annual cost of $11,710,500.30

Rule 17g-5(a)(3) also provides a conditional exemption to the rule for asset-backed securities issued by non-U.S. persons and offered and sold outside the U.S. Commission staff believes that NRSROs will seek information from arrangers (acting on behalf of issuers, sponsors, or underwriters of asset-backed securities transactions) to form a reasonable basis to conclude that all offers and sales of an asset-backed security will occur outside the United States, thereby resulting in associated hour and cost burdens. Based on staff experience, it is estimated that two NRSROs will rate each transaction and that each NRSRO will spend approximately 2 hours per transaction gathering and reviewing information received from arrangers to determine if the exemption applies. Based on the estimated 425 rated transactions that will be eligible for the exemption in a given year,31 the total annual hour burden to NRSROs is estimated at 1,700 hours,32 and the total cost is estimated at $748,000, which reflects the cost of obtaining representations from arrangers to have a reasonable basis to rely on the conditional exemption.33

Commission staff also estimates that it will cost an arranger approximately $880 per transaction to provide the representations,34 for a total aggregate annual cost to arrangers of approximately $374,000.35 As a result, Commission staff estimates that the aggregate cost for the representations will be $1,122,000.36

Regarding paragraph (e) of Rule 17g-5, Commission staff estimates that it will take each NRSRO approximately 2 hours to complete the required certification, resulting in a total industry-wide annual burden for 6 NRSROs of 12 hours.37 The total annual cost of preparation of the certification is estimated at $4,464.38

With respect to the executed Form ABS Due Diligence-15E that issuers, sponsors, underwriters are required to post on their websites under Rule 17g-5(a)(3)(E), Commission staff estimates that an issuer, sponsor, or underwriter will take approximately 10 minutes to upload and post each form to its website, for a total industry-wide annual disclosure burden of approximately 247 hours, based on the estimated 1,480 newly rated asset-backed securities transactions per year.39 Commission staff also estimates that the total industry-wide annual cost for issuers, sponsors, and underwriters to upload and post each form to their websites will be $91,884.40

To summarize, it is estimated that the total annual hour burden associated with Rule 17g-5 will be 61,899 hours41 and that the total cost will be $14,126,168.42

* The figures in the Previously approved column represent costs that were approved with the adoption of amendments to Rule 17g-5 in 2009, 2014, and 2019. These costs have not been updated since the adoption of the amendments. Staff is updating these costs to account for inflation.

13. Costs to Respondents

Commission staff does not anticipate that NRSROs or respondents will incur any additional operational or maintenance costs to comply with the collection of information or the conditional exemption.

14. Cost to Federal Government

Rule 17g-5 does not result in any costs to the federal government beyond normal full-time employee labor costs.

15. Changes in Burden

There are significant changes to the annual aggregate cost and hour burden for Rule 17g-5 due to a decrease in the estimated number of new asset-backed securities transactions based on updated estimates using current data. Also, the method for estimating the number of new asset-backed securities transactions has been updated to reflect the calculation method set forth in the 2019 Rule Amendment Release.43 The cost and hour burden relating to the certification requirement under Rule 17g-5(e) has decreased due to the reduction in the number of NRSROs subject to the certification requirement from 9 to 6, as only 6 NRSROs are registered in the issuer of asset-backed securities rating class. Finally, the overall cost estimate has been updated to account for inflation.

16. Information Collection Planned for Statistical Purposes

Not applicable. The information collection is not used for statistical purposes.

17. Approval to Omit OMB Expiration Date

Commission staff is not seeking approval to omit the expiration date.

18. Exceptions to Certifications for Paperwork Reduction Act Submissions

This collection complies with the requirements in 5 CFR 1320.9.

B. Collections of Information Employing Statistical Methods

The collection of information does not employ statistical methods or analyze the information for the Commission.

1 15 U.S.C. 78o-7.

2 Pub. L. No. 109-291 (2006).

3 Pub. L. No. 111-203, 124 Stat. 1376, H.R. 4173 (2010).

4 See 15 U.S.C. 78o-7(h).

5 See 15 U.S.C. 78o-7(h)(2) (directing the Commission to adopt rules prohibiting or requiring the management and disclosure of any conflicts of interest relating to the issuance of credit ratings by NRSROs).

6 See 17 CFR 240.17g-5.

7 See 17 CFR 240.17g-5(a)(3) and (b)(9).

8 See 17 CFR 240.17g-5(a)(3)(i).

9 See 17 CFR 240.17g-5(a)(3)(ii). Rule 17g-5(e) requires an NRSRO seeking access to the website to furnish the Commission a certification, as specified in the rule, each year it requests a password for access to the website. See 17 CFR 240.17g-5(e).

10 See 17 CFR 240.17g-5(a)(3)(iii).

11 See 17 CFR 240.17g-5(a)(3)(iii)(E).

12 See 17 CFR 230.902(k) (defining the term “U.S. person”).

13 See 17 CFR 240.17g-5(a)(3)(iv).

44 U.S.C. 3501, et seq.

15 See generally Amendments to Rules for Nationally Recognized Statistical Rating Organizations, 74 FR 63832, 63851 (Dec. 4, 2009).

16 See id.

17 See 17 CFR 240.17g-5(e) (the certification must include a representation that, in part, provides that the website will be accessed “solely for the purpose of determining or monitoring credit ratings”).

18 See 17 CFR 240.0-10 [Small entities under the Securities Exchange Act for purposes of the Regulatory Flexibility Act] (defining “small business or small organization” as a person that, on the last day of its most recent fiscal year, had total assets of $5 million or less).

19 See Proposed Collection; Comment Request; Extension: Rule 17g-5, 89 FR 38202 (May 7, 2024).

20 See Amendments to Rules for Nationally Recognized Statistical Rating Organizations, 74 FR at 63855.

21 See id.

22 See id.

23 This estimate was calculated using information from the databases maintained by Asset-Backed Alert and Commercial Mortgage Alert and represents the average annual number of new U.S. asset-backed securities transactions for the years ended December 21, 2021, 2022, and 2023.

24 1,480 new asset-backed securities transactions x 2 NRSROs x 1 hour = 2,960 hours.

25 2,960 hours x $299 per hour for a webmaster = $885,040. Commission staff assumes that a webmaster will be responsible for posting the required information on a website at an estimated salary of $299 per hour. This salary estimate and other salary estimates discussed in the supporting statement are derived from SIFMA’s Management & Professional Earnings in the Securities Industry 2013, modified by Commission staff to account for a 1,800-hour work-year and multiplied by 5.35 to account for bonuses, firm size, employee benefits, and overhead, as adjusted for inflation using the Bureau of Labor Statistics’ CPI Inflation Calculator.

26 1,480 new asset-backed securities transactions x 1 hour = 1,480 hours.

27 1,480 new asset backed-securities transaction x $211 per hour for a junior business analyst = $312,280. Commission staff believes that respondents would have a junior business analyst post the required information on a website.

28 See Amendments to Rules for Nationally Recognized Statistical Rating Organizations, 84 FR 40247 (Aug. 14, 2019) (“2019 Rule Amendment Release”). In the release, the Commission stated that it had previously estimated that, on average, a respondent would issue 20 new deals a year and would have 125 outstanding deals and concluded that there would be 6.25 outstanding deals for every new deal. Consistent with the Commission’s approach for estimating the number of asset-backed security deals under surveillance, Commission staff has combined the estimated 6.25 outstanding deals for every new deal with the estimated 1,480 new asset-backed securities transactions per year, resulting in an estimate of 6.25 x 1,480 = 9,250 outstanding deals.

29 (9,250 transactions x 0.5 hours x 12 months) = 55,500 hours.

30 55,500 hours x $211 per hour for a junior business analyst = $11,710,500.

31 This estimate was calculated using information from the databases maintained by Asset-Backed Alert and Commercial Mortgage Alert. Isolating the transactions coded in the database as “Non-U.S.” offerings provided an estimate of the number of transactions that would be eligible for the exemption. The estimate is based on the average annual number of transactions for the years ended December 31, 2021, 2022, and 2023.

32 2 hours x 425 transactions x 2 NRSROs per transaction = 1,700 hours.

33 (2 hours per transaction x legal fee for a compliance attorney at $440 per hour = $880 per transaction) x 425 annual transactions x 2 NRSROs per transaction = $748,000. Commission staff assumes that NRSROs will have a compliance attorney procure the representations at an estimated salary of $440 per hour.

34 2 hours per transaction x legal fee for a compliance attorney at $440 per hour = $880. Commission staff assumes that an arranger will have a compliance attorney prepare the representations at an estimated salary of $440 per hour.

35 $880 per transaction x 425 annual transactions = $374,000.

36 $880 per transaction x 425 annual transactions (for arrangers) + $880 per transaction x 425 annual transactions x 2 NRSROs per transaction (for NRSROs) = $1,122,000.

37 6 NRSROs x 2 hours = 12 hours.

38 6 NRSROs x 2 hours x $372 for a compliance manager = $4,464. Commission staff assumes that NRSROs will have a compliance manager prepare the required certification at an estimated salary of $372 per hour.

39 1,480 Forms ABS Due Diligence-15E per year x 10 minutes / 60 minutes = 246.66 hours, rounded to 247 hours.

40 247 hours x $372 per hour for a compliance manager = $91,884. Commission staff assumes that issuers, sponsors, or underwriters will have a compliance manager upload and post the Form ABS Due Diligence-15E to their websites at an estimated salary of $372 per hour.

41 2,960 + 1,480 + 12 + 55,500 + 247 +1,700 = 61,899 hours.

42 $885,040 + $312,280 + $4,464 + $11,710,500 + $91,884 +$1,122,000 = $14,126,168.

43 See 84 FR 40247.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | bhaml |

| File Modified | 0000-00-00 |

| File Created | 2024-09-05 |

© 2026 OMB.report | Privacy Policy