SSI Claim Screen Package - Full Initial Claim

Omitting Food From In-Kind Support and Maintenance Calculations

SSI Claim Screen Package - Full Initial Claim

OMB: 0960-0838

SSI Claim Screen Package

Full Initial Claim

4/22/2021

Table of Contents

a. Identity Information editing 9

b. Citizenship Information editing 11

c. Contact Information editing 13

d. Accommodation Information editing 17

2. Supplemental Security Income Application 18

4. Children in Deeming Unit 23

7. Residency and Presence in U.S. 28

10. Financial Institutions Permission 32

11. Personal Information Authorization 33

1. Residence Address and Jurisdiction 53

5. Home Ownership and Rental Liability 60

6. Household Expenses and Contributions 61

8. In-Kind Support and Maintenance 63

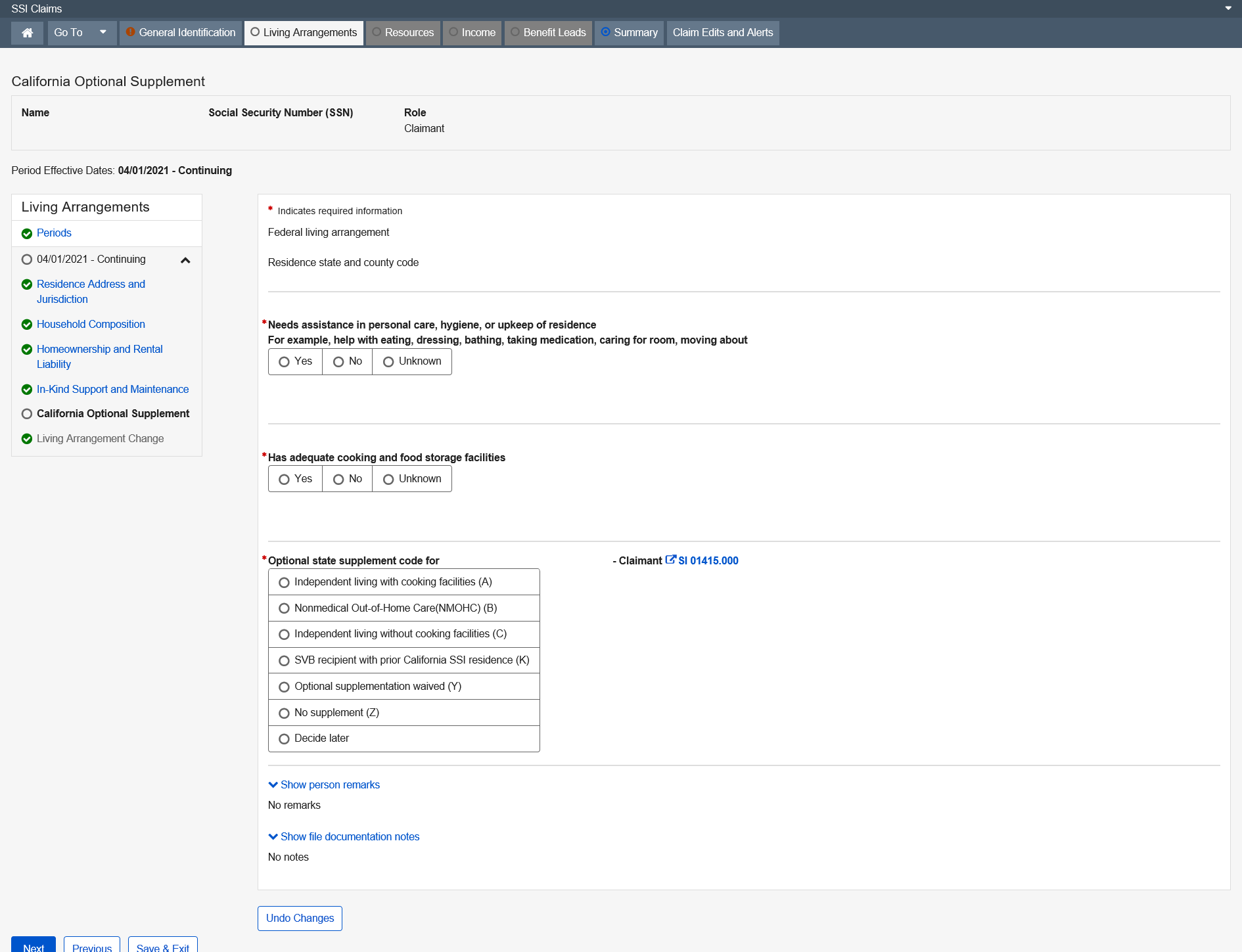

9. California Optional Supplement 65

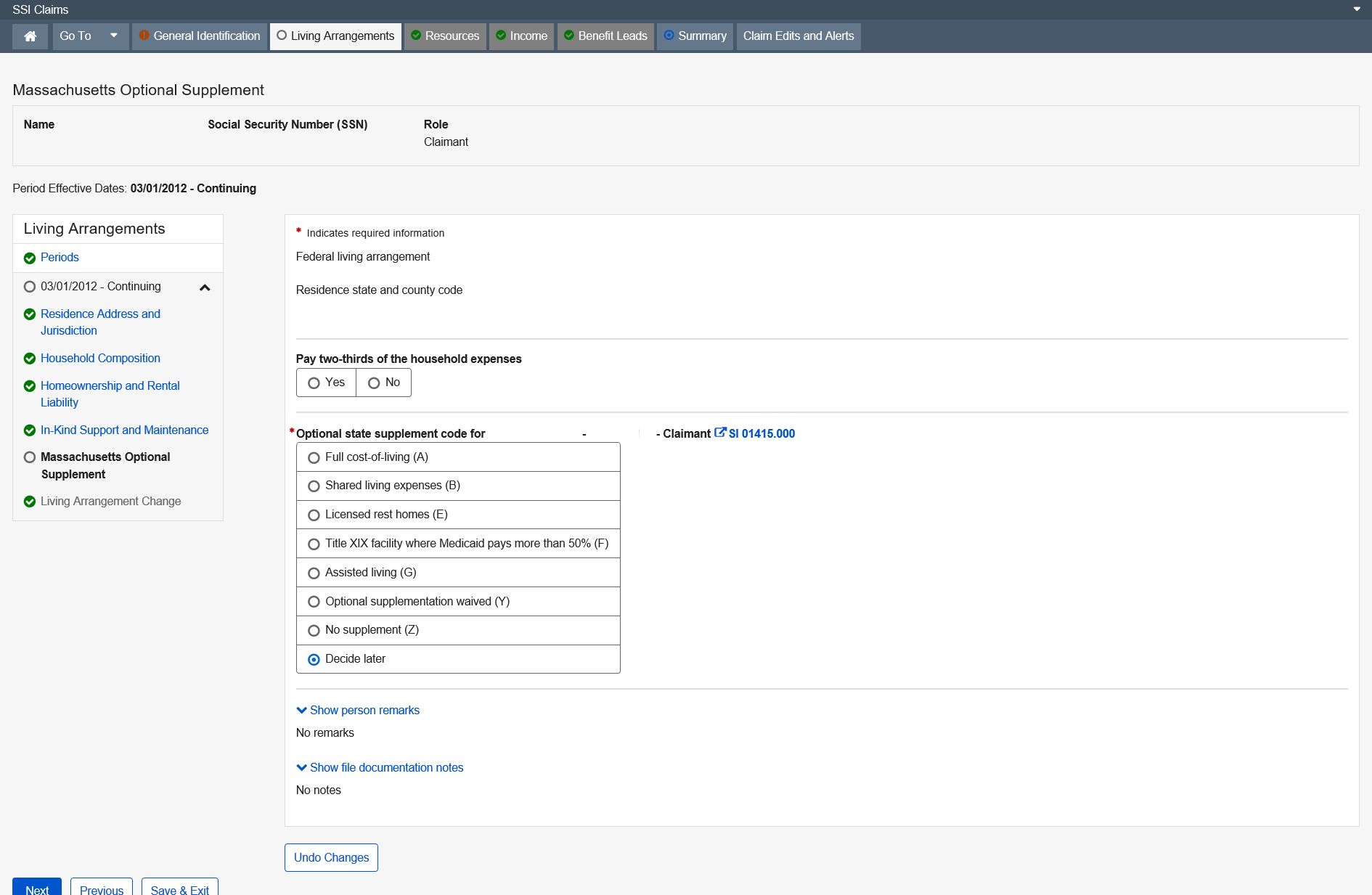

10. Massachusetts Optional Supplement 66

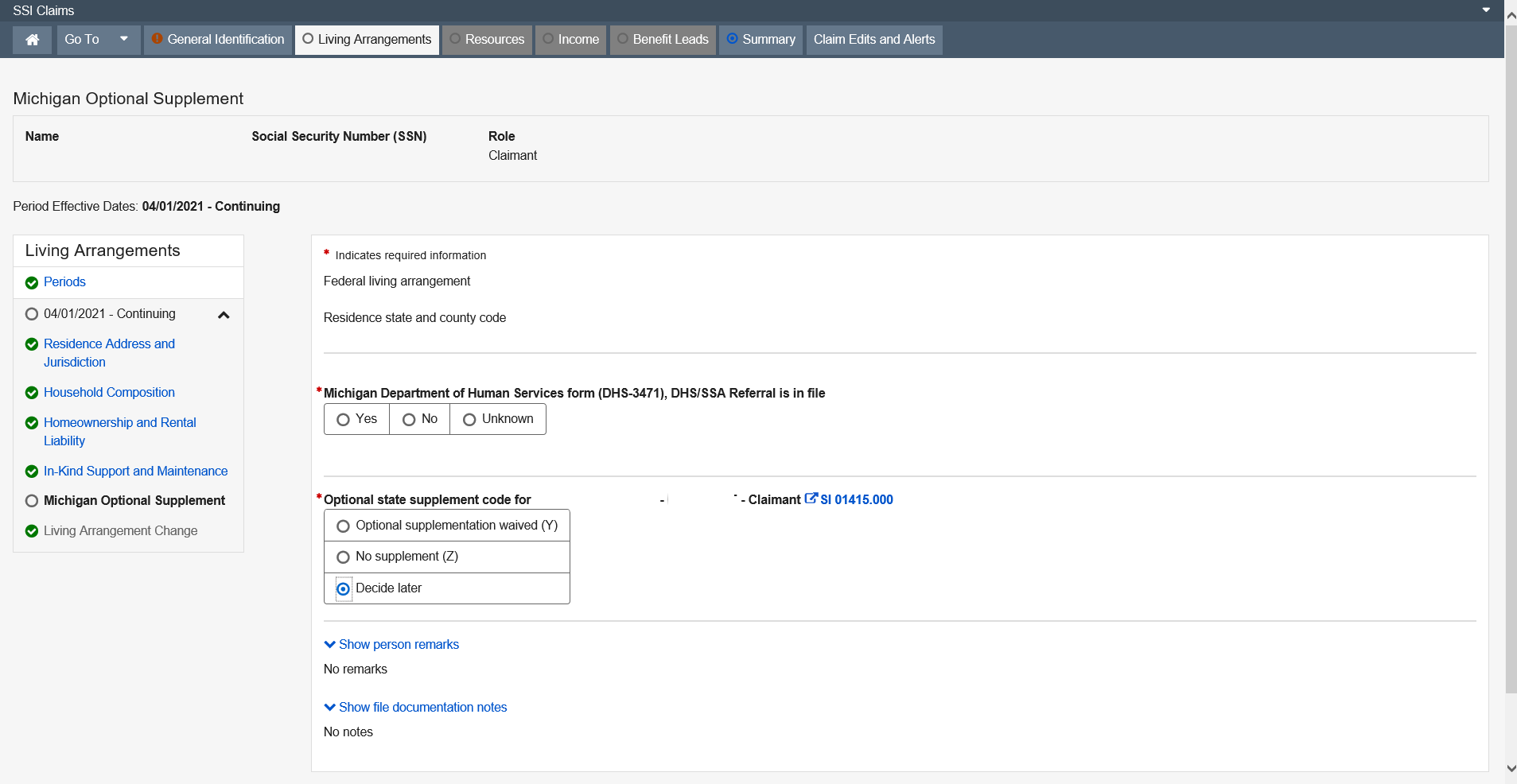

11. Michigan Optional Supplement 67

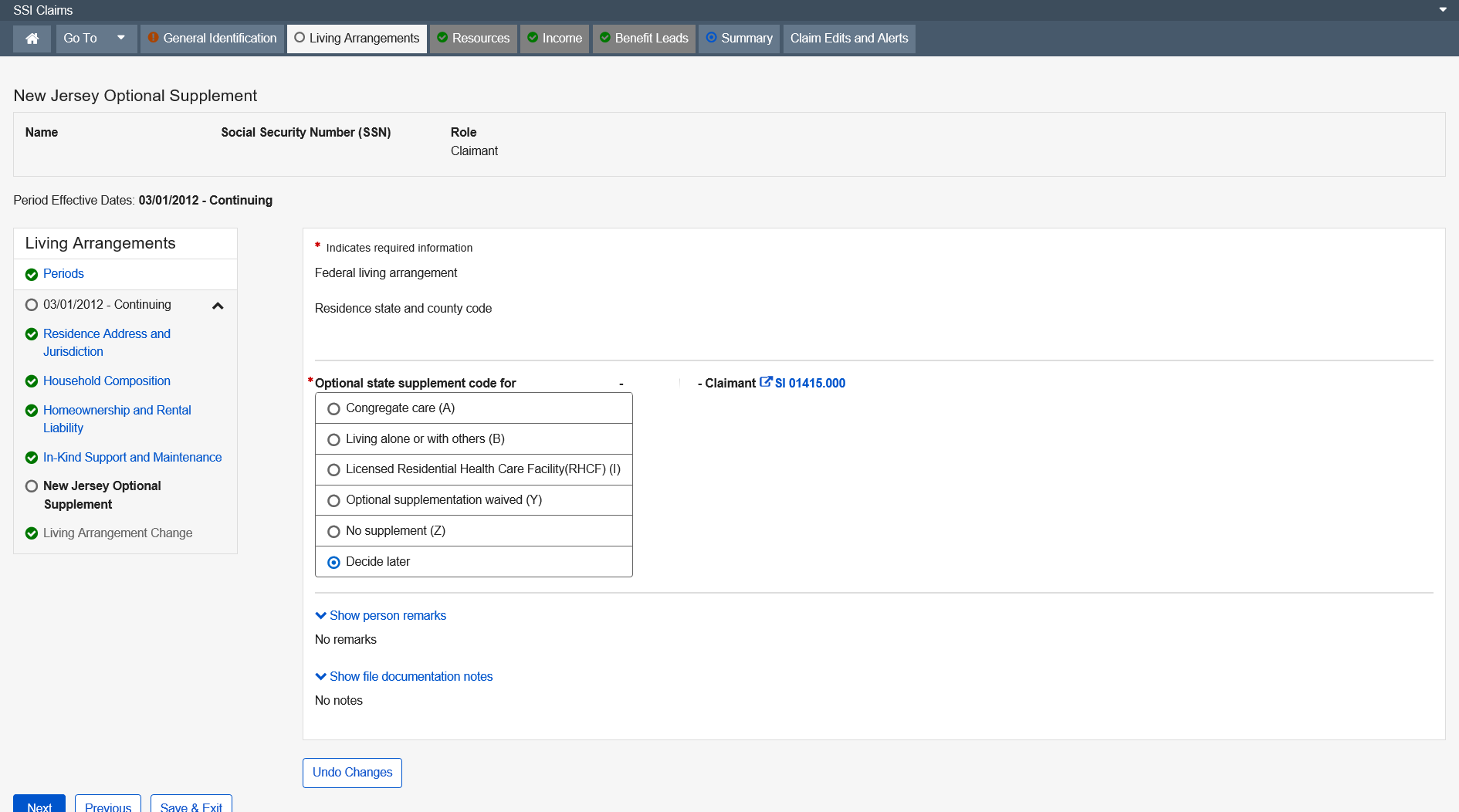

12. New Jersey Optional Supplement 68

13. New York Optional Supplement 69

14. Vermont Optional Supplement 70

15. Optional State Supplement 71

16. Living Arrangement Change 72

6. Achieving a Better Life Experience (ABLE) Account 83

7. Financial Institution Account 85

9. Stock, Bond, or Mutual Fund 90

10. Promissory Note, Loan, or Property Agreement 91

11. Item Held for Potential Value or Investment 93

14. Burial Space or Related Item 98

16. Property / Cash Given or Sold 101

2. Temporary Assistance for Needy Families 106

3. Refugee Cash Assistance 108

4. Bureau of Indian Affairs Assistance 110

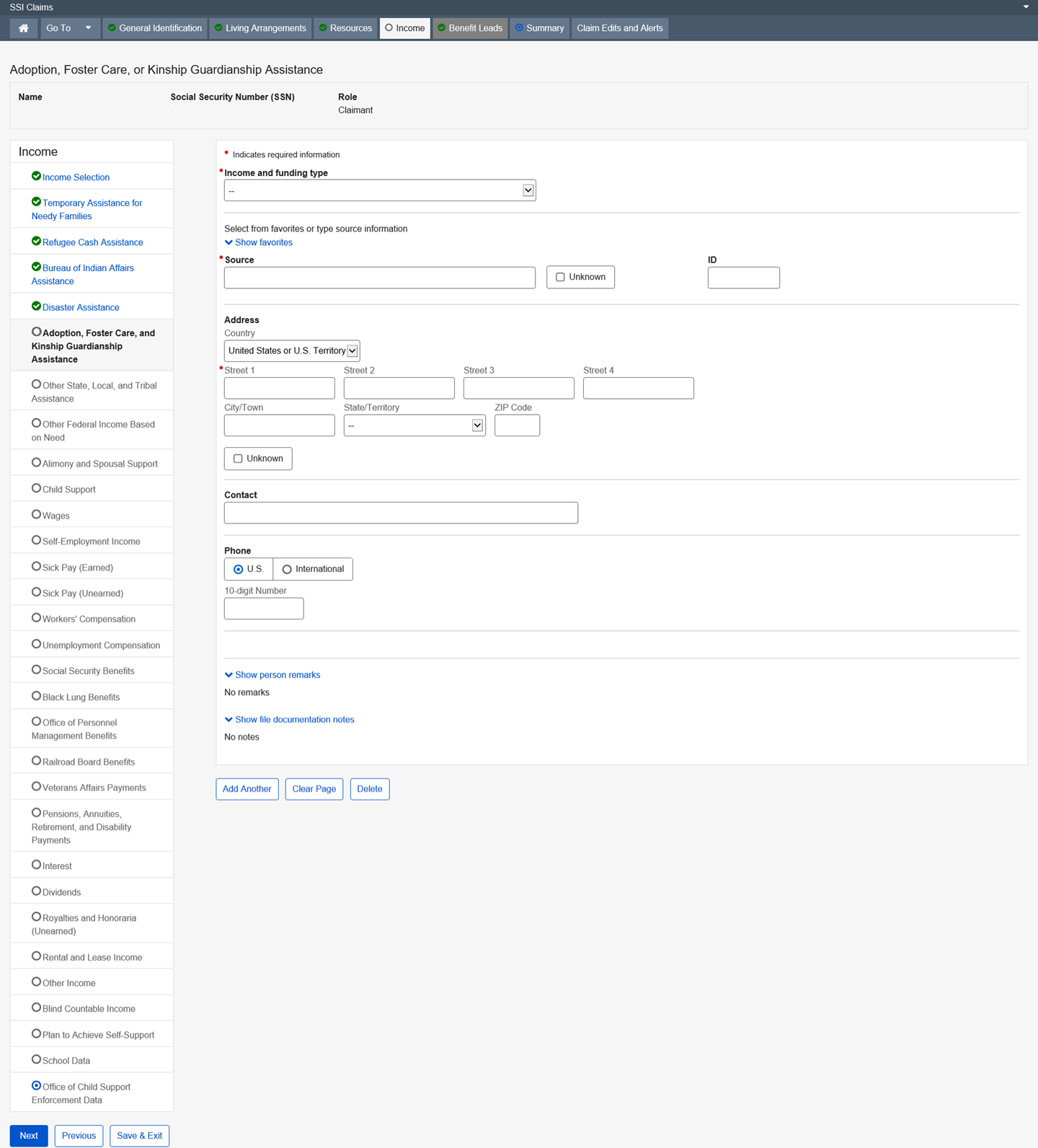

6. Adoption, Foster Care, or Kinship Guardianship Assistance 115

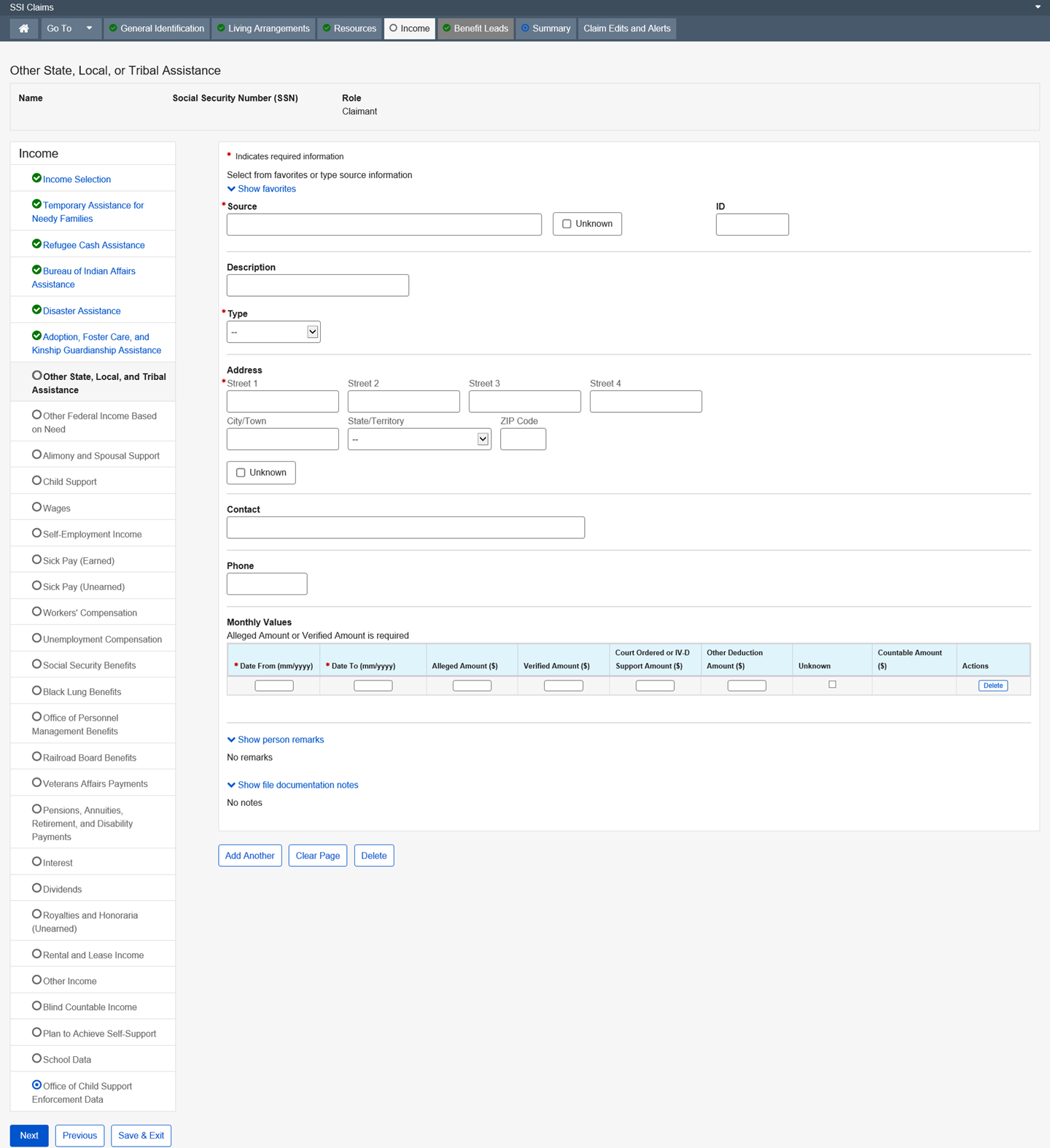

7. Other State, Local, or Tribal Assistance 118

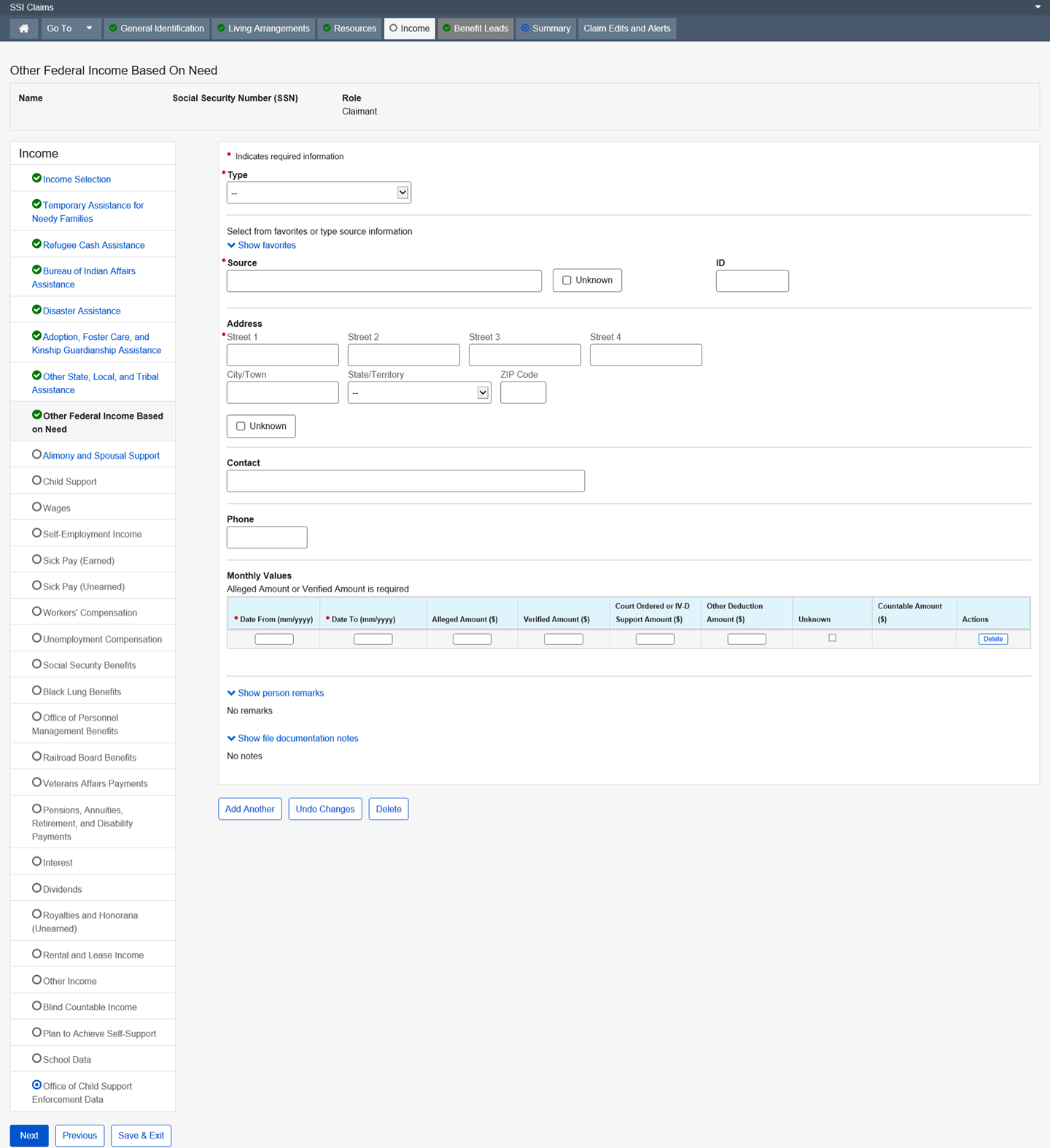

8. Other Federal Income Based on Need 120

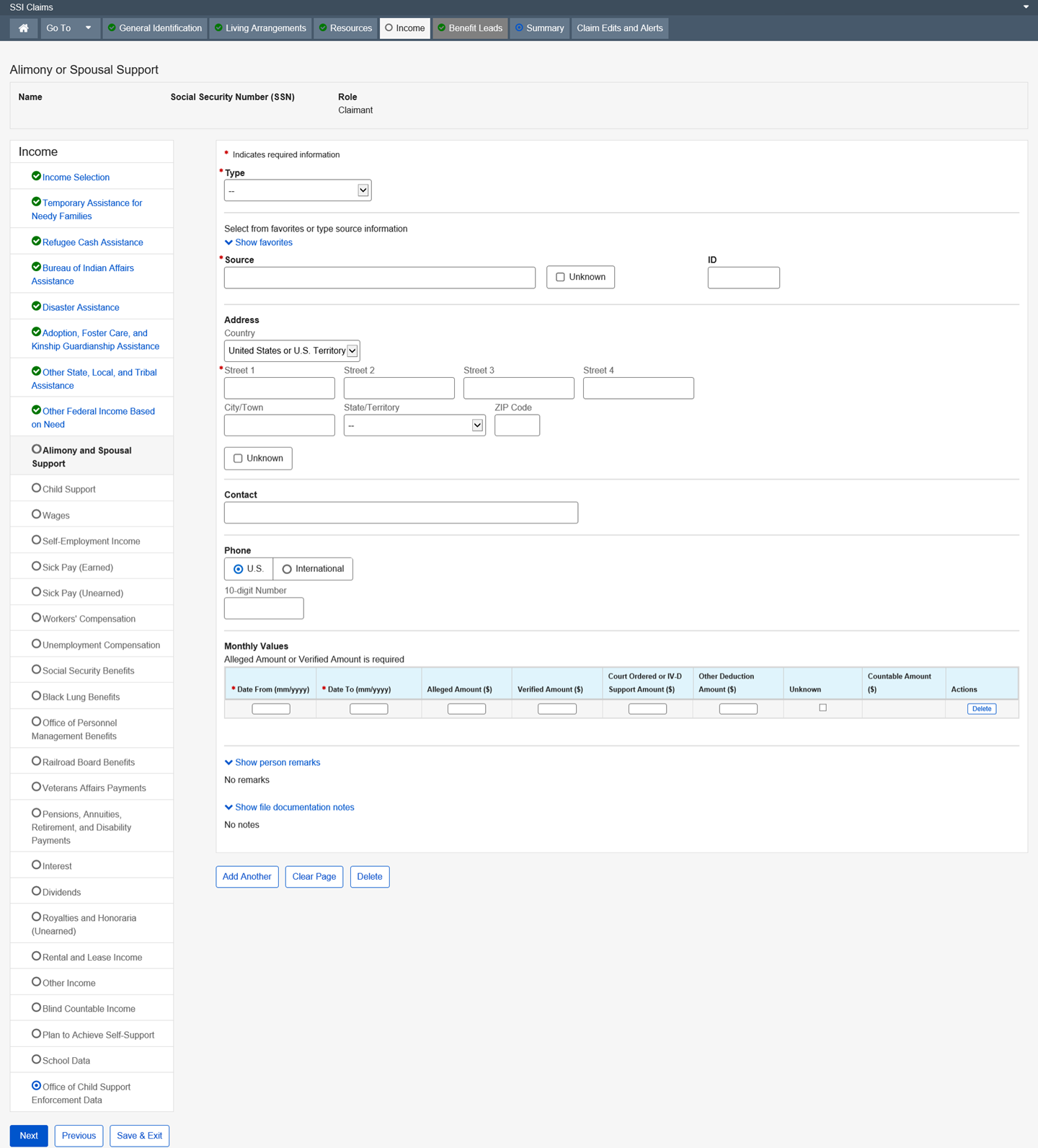

9. Alimony or Spousal Support 122

12. Quarterly Wages Summary 130

13. Self-Employment Income 131

14. Substantial Gainful Activity 134

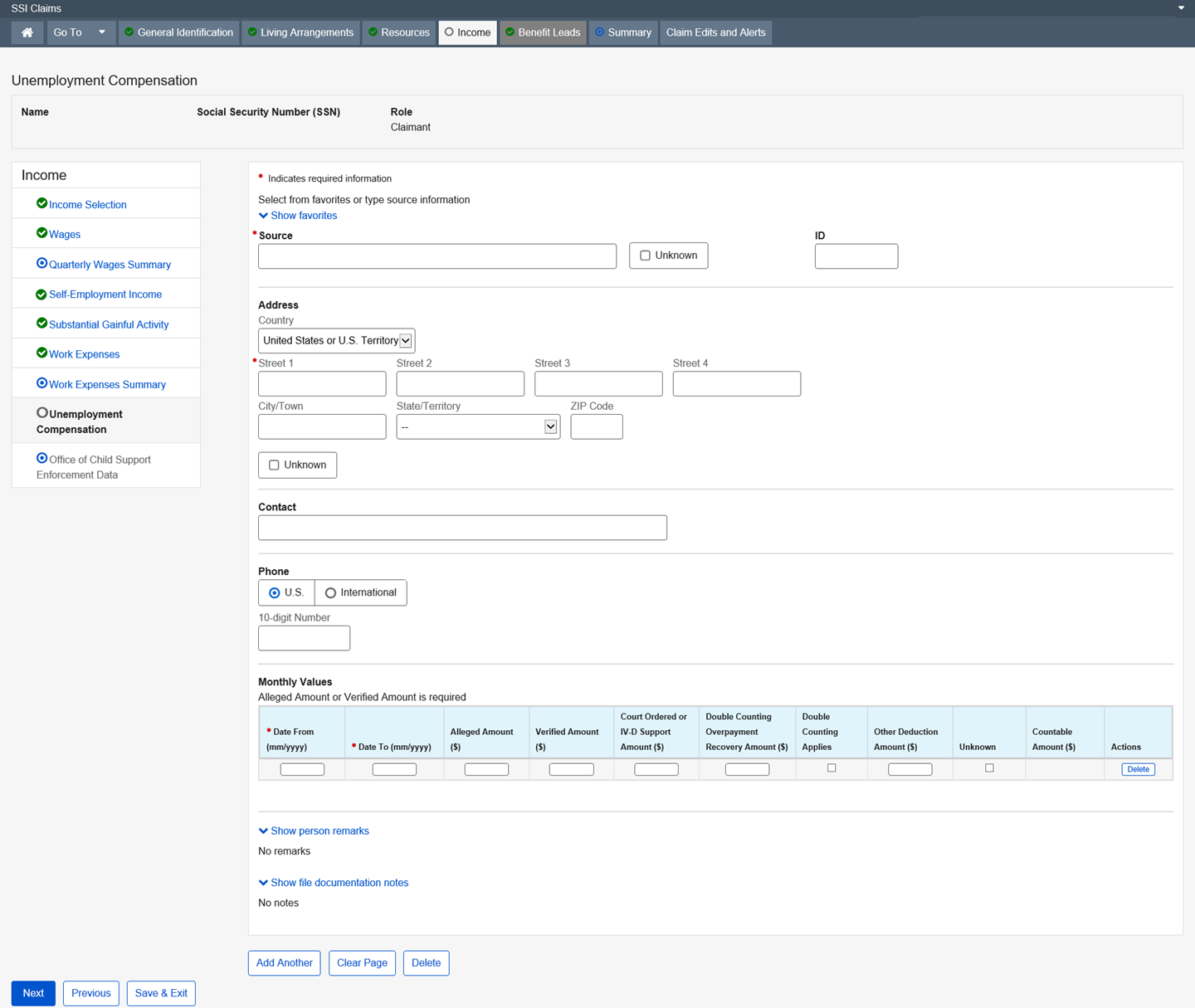

20. Unemployment Compensation 144

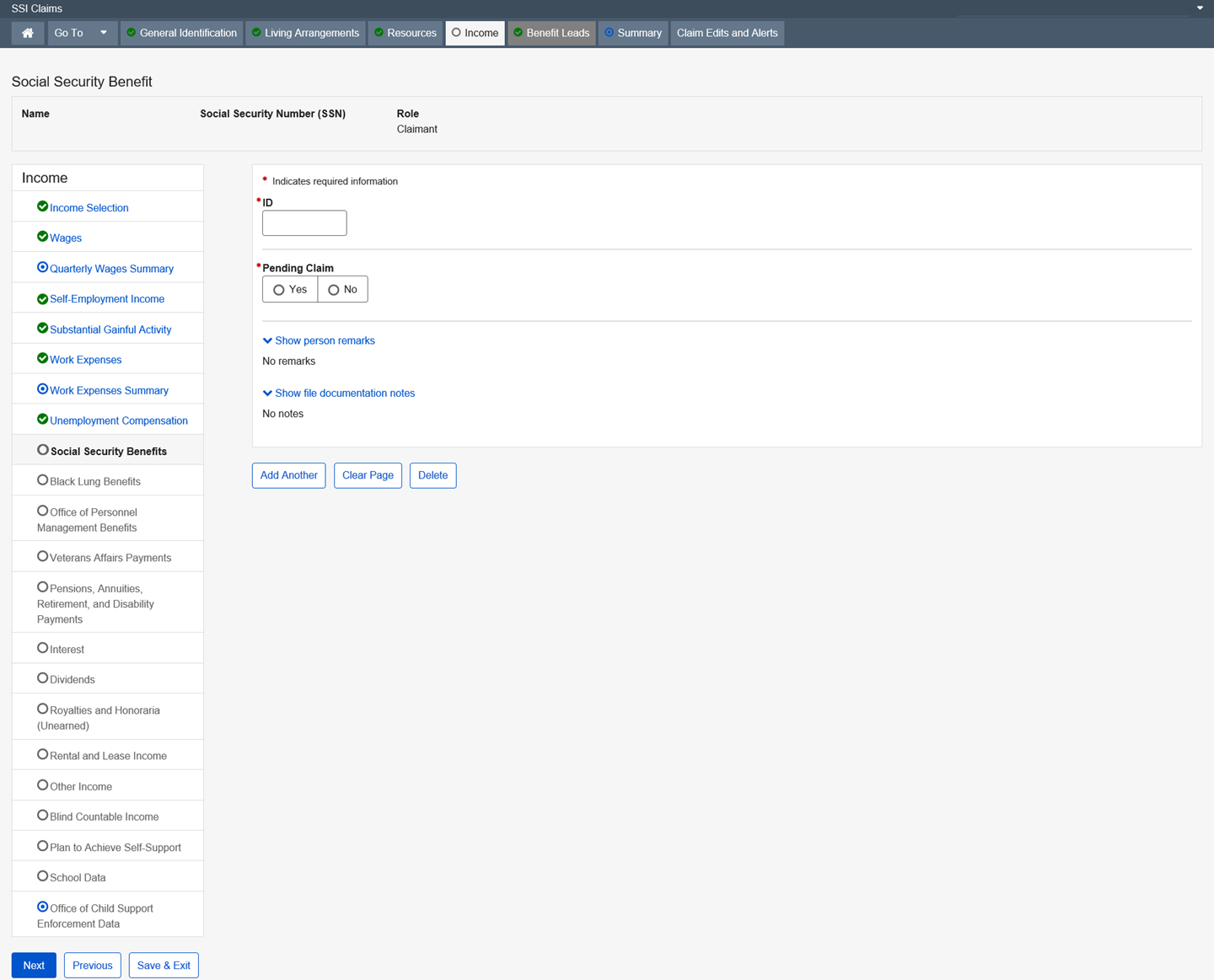

21. Social Security Benefit 146

23. Office of Personnel Management Benefit 148

24. Railroad Board Benefits 150

25. Veterans Affairs Payment 152

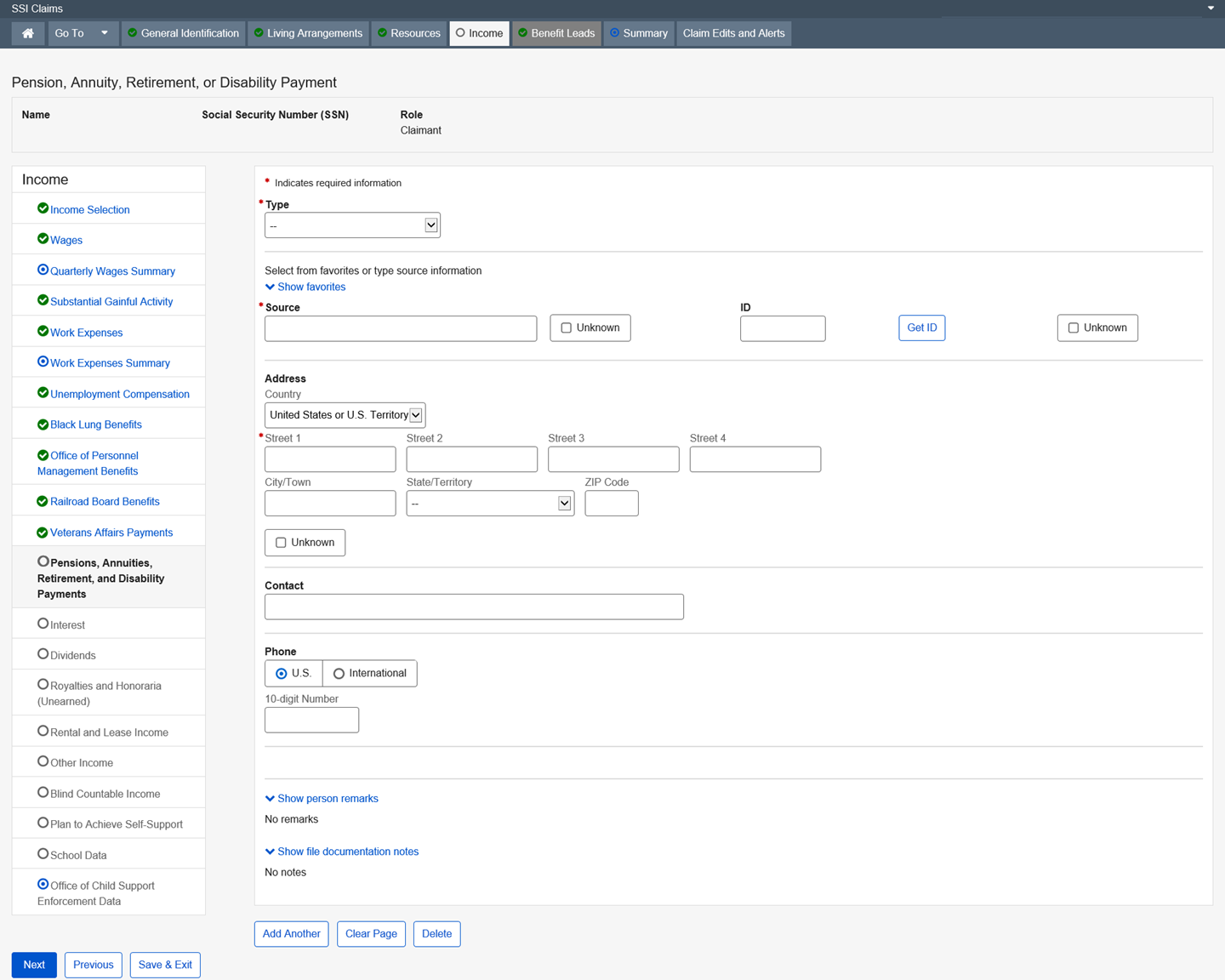

26. Pension, Annuity, Retirement, or Disability Payment 155

29. Royalties or Honorarium (Unearned) 165

30. Rental or Lease Income 167

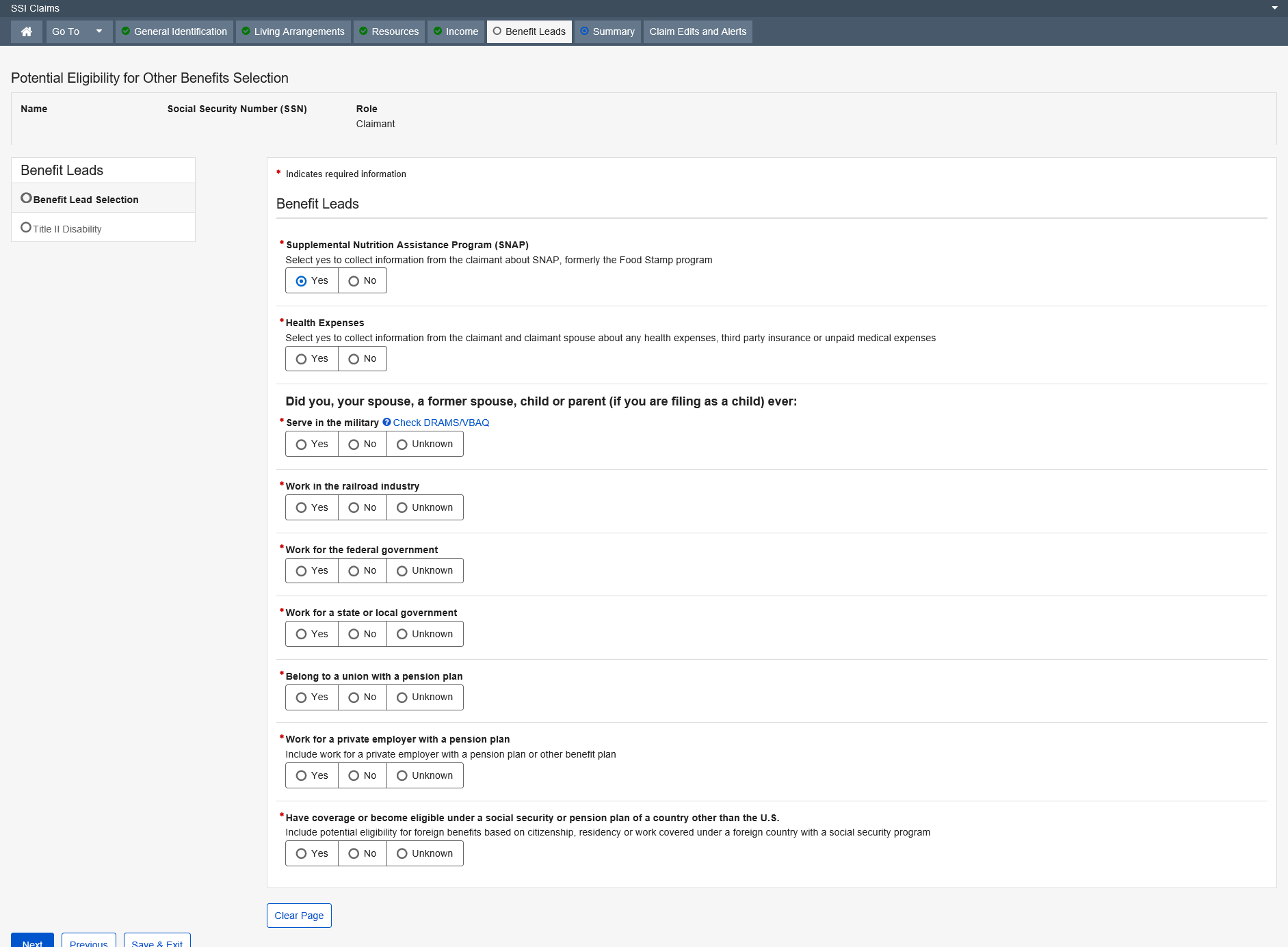

1. Potential Eligibility for Other Benefits Selection 178

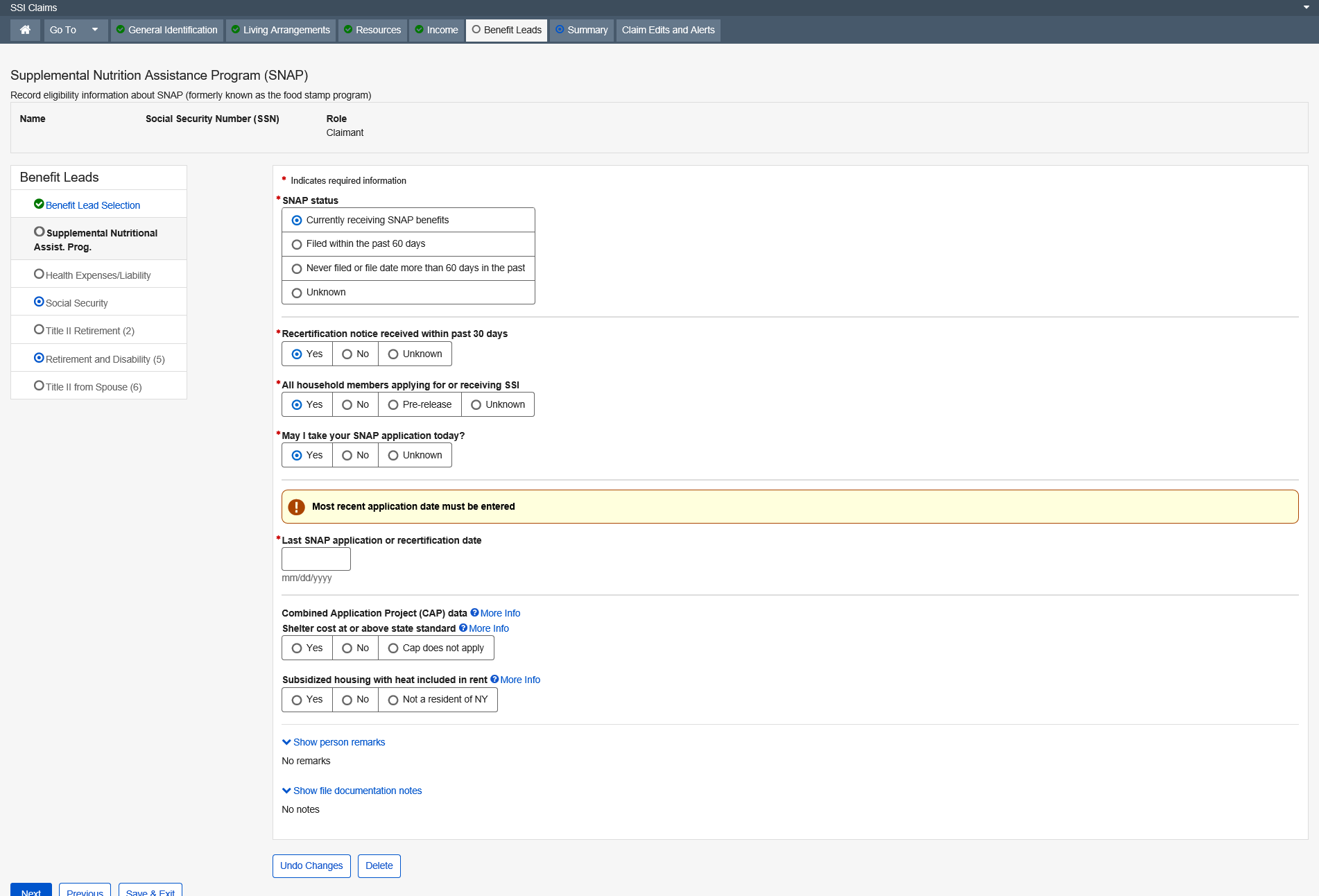

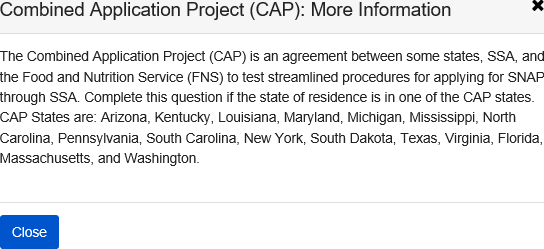

2. Supplemental Nutrition Assistance Program (SNAP) 179

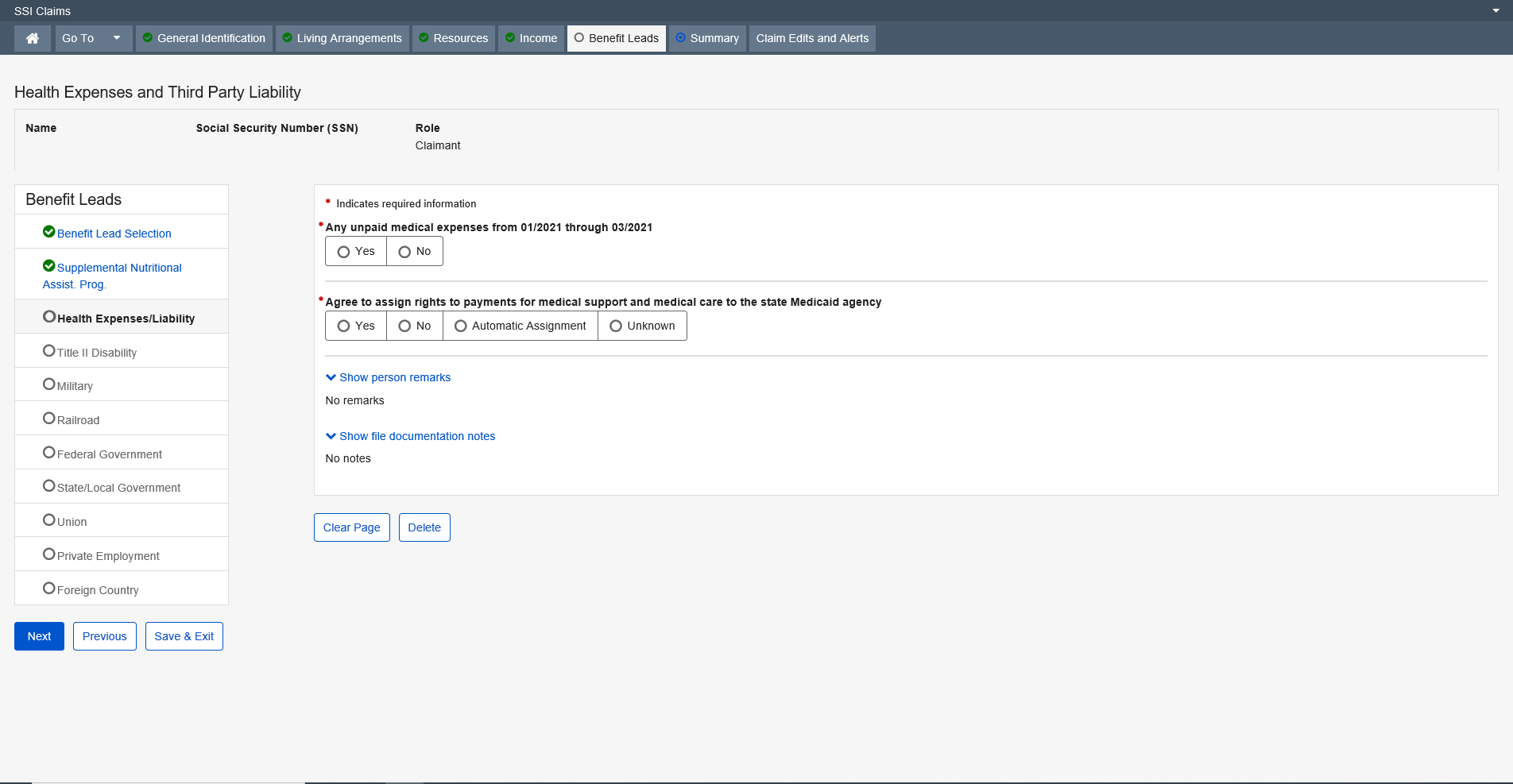

3. Health Expenses and Third Party Liability 181

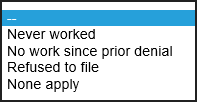

6. Child’s Entitlement from Parents 185

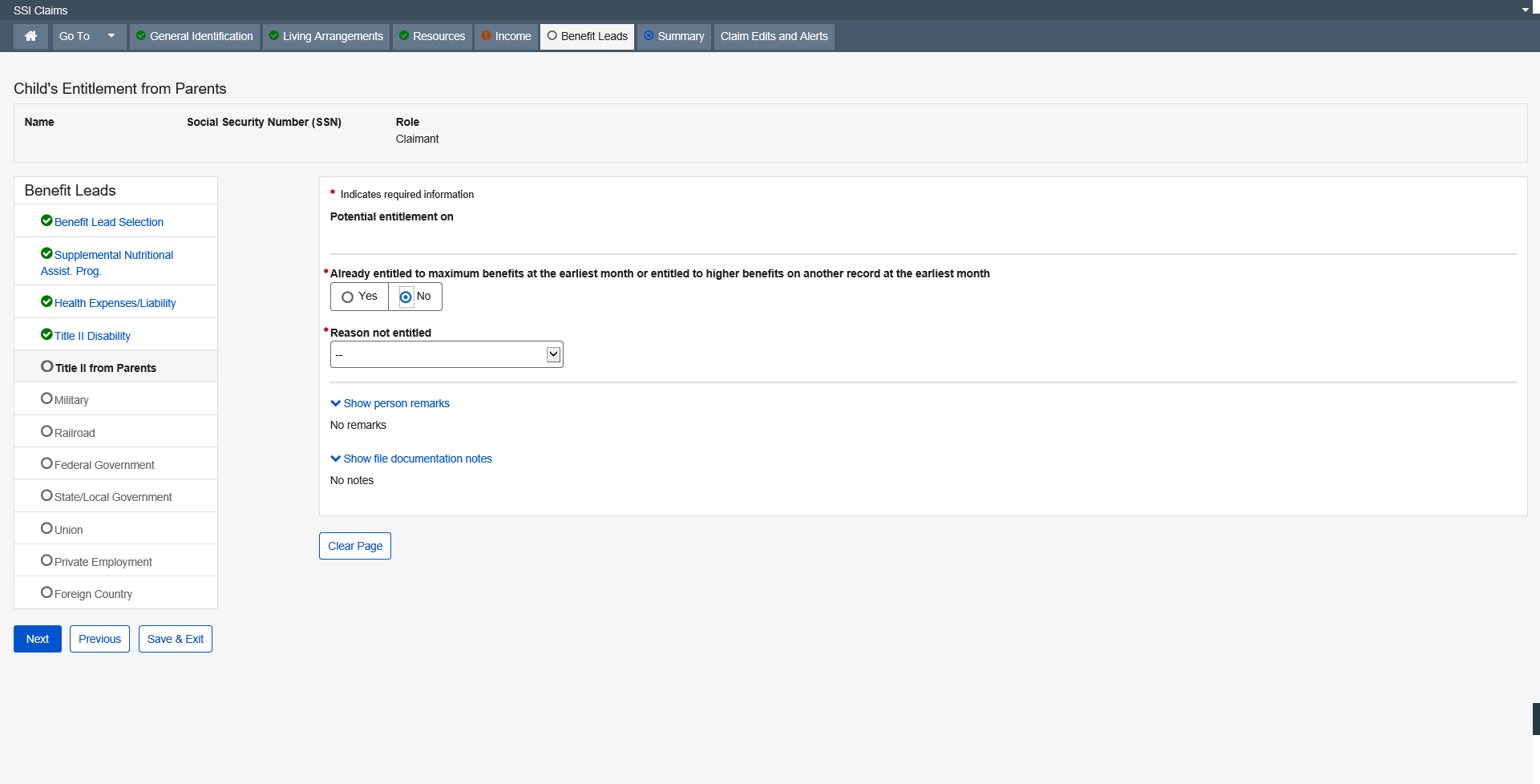

8. Retirement and Disability Entitlement 187

9. Spouse or Surviving Spouse Entitlement 188

13. State or Local Government 195

1. Living Arrangements Summary 203

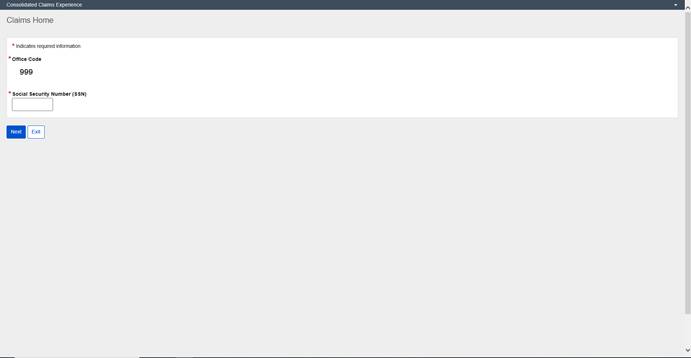

This page is used to input a Social Security Number (SSN) to establish or review claim(s).

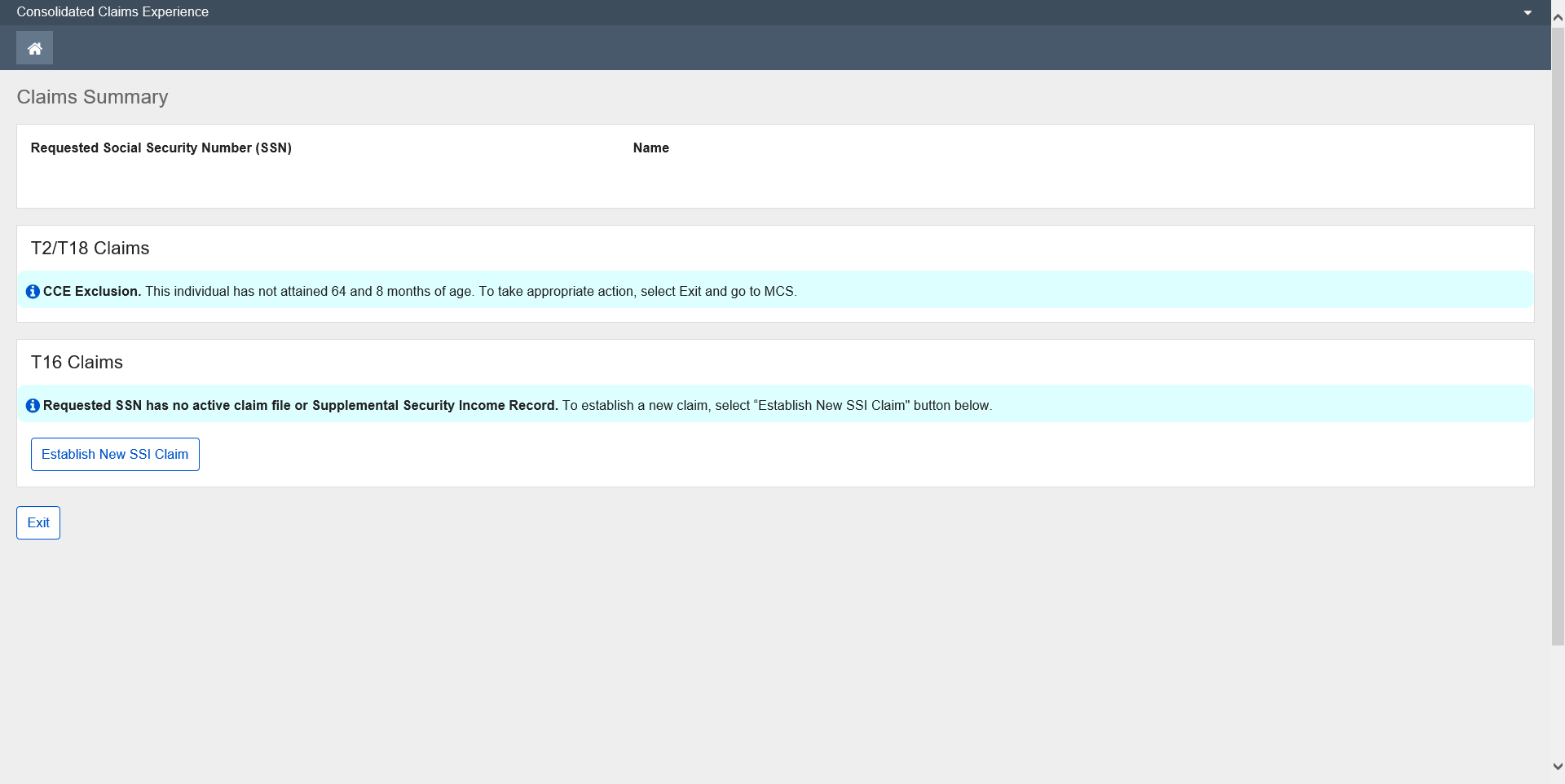

The Claim Summary page allows you to view, manage, and establish claims.

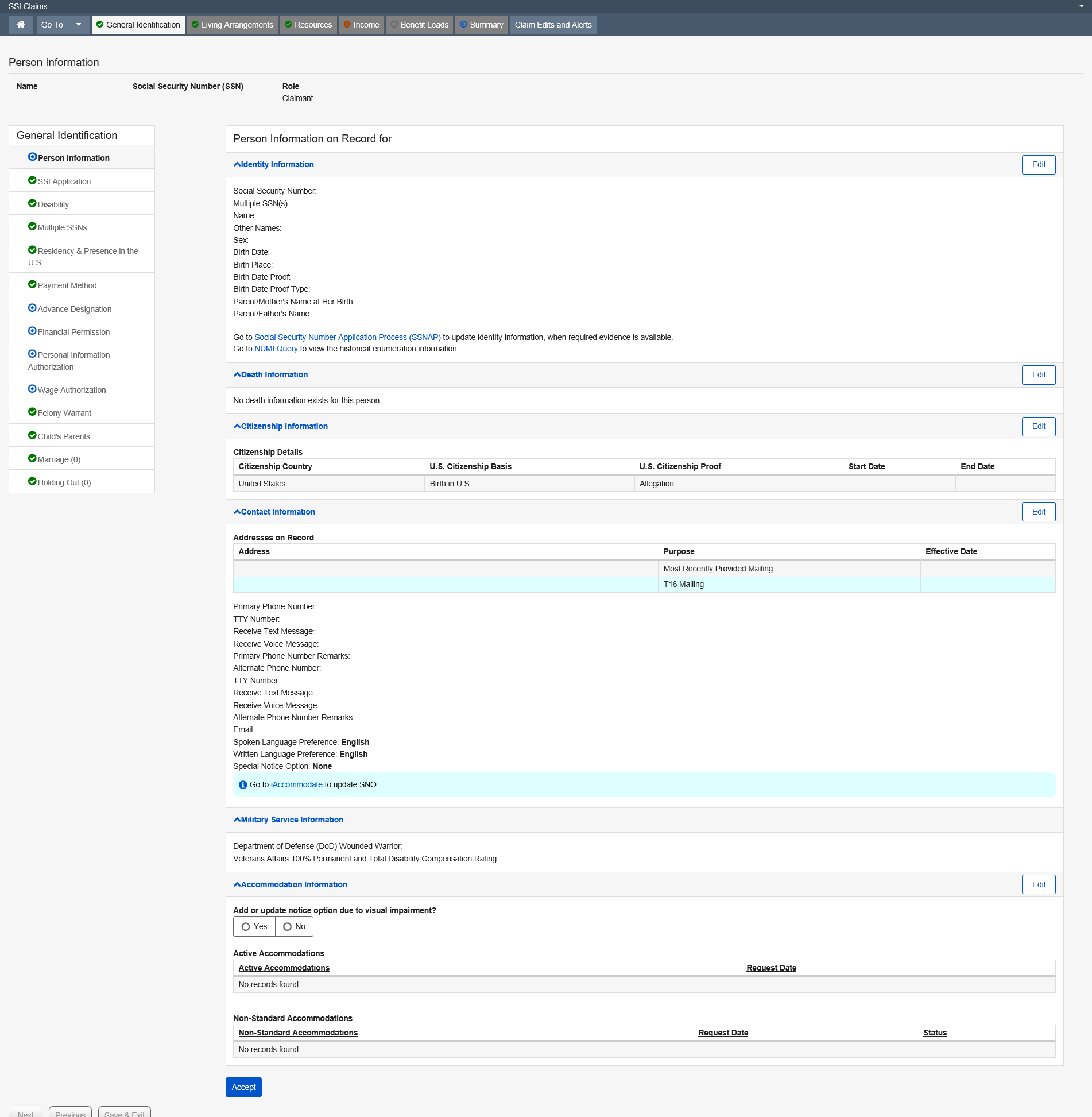

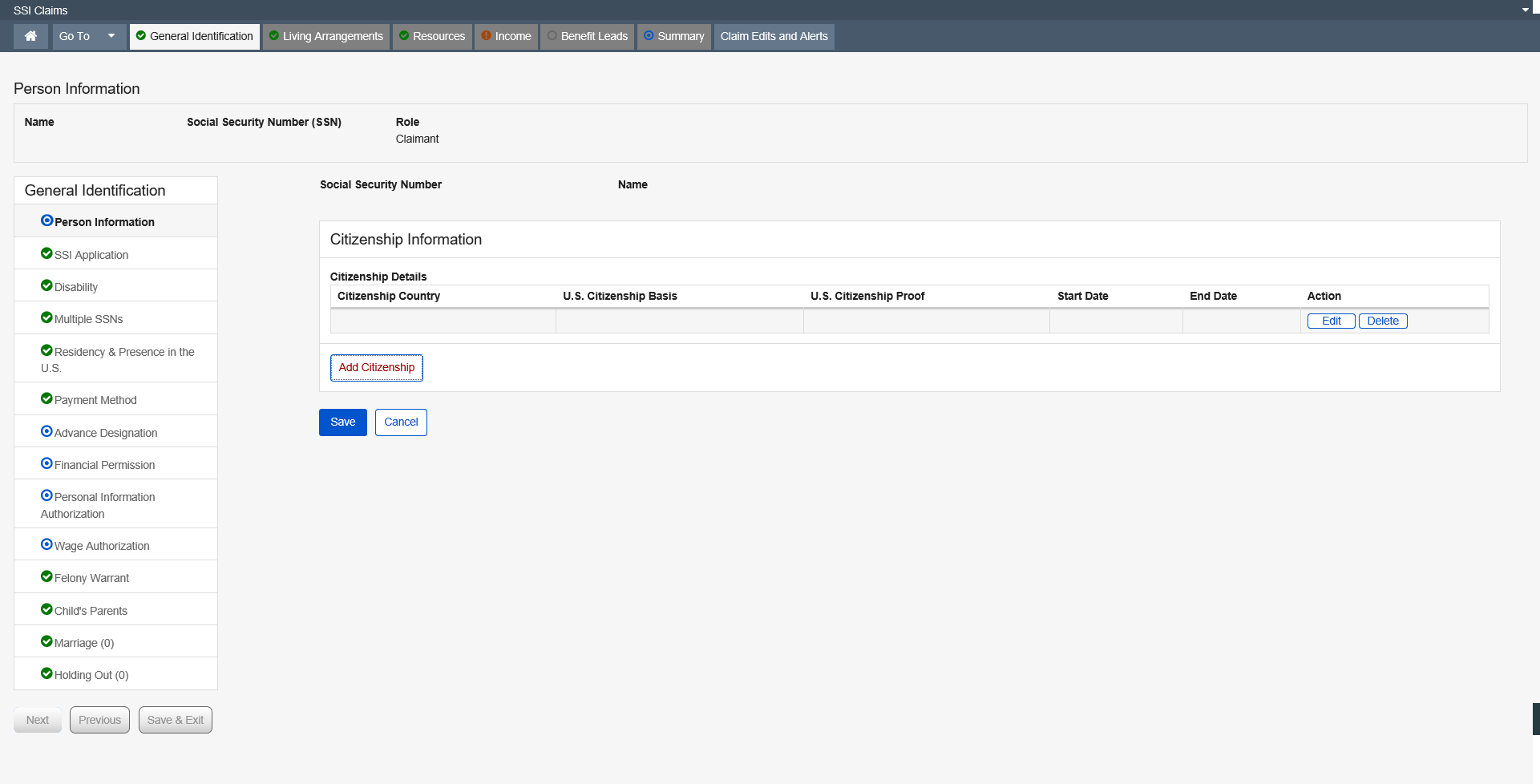

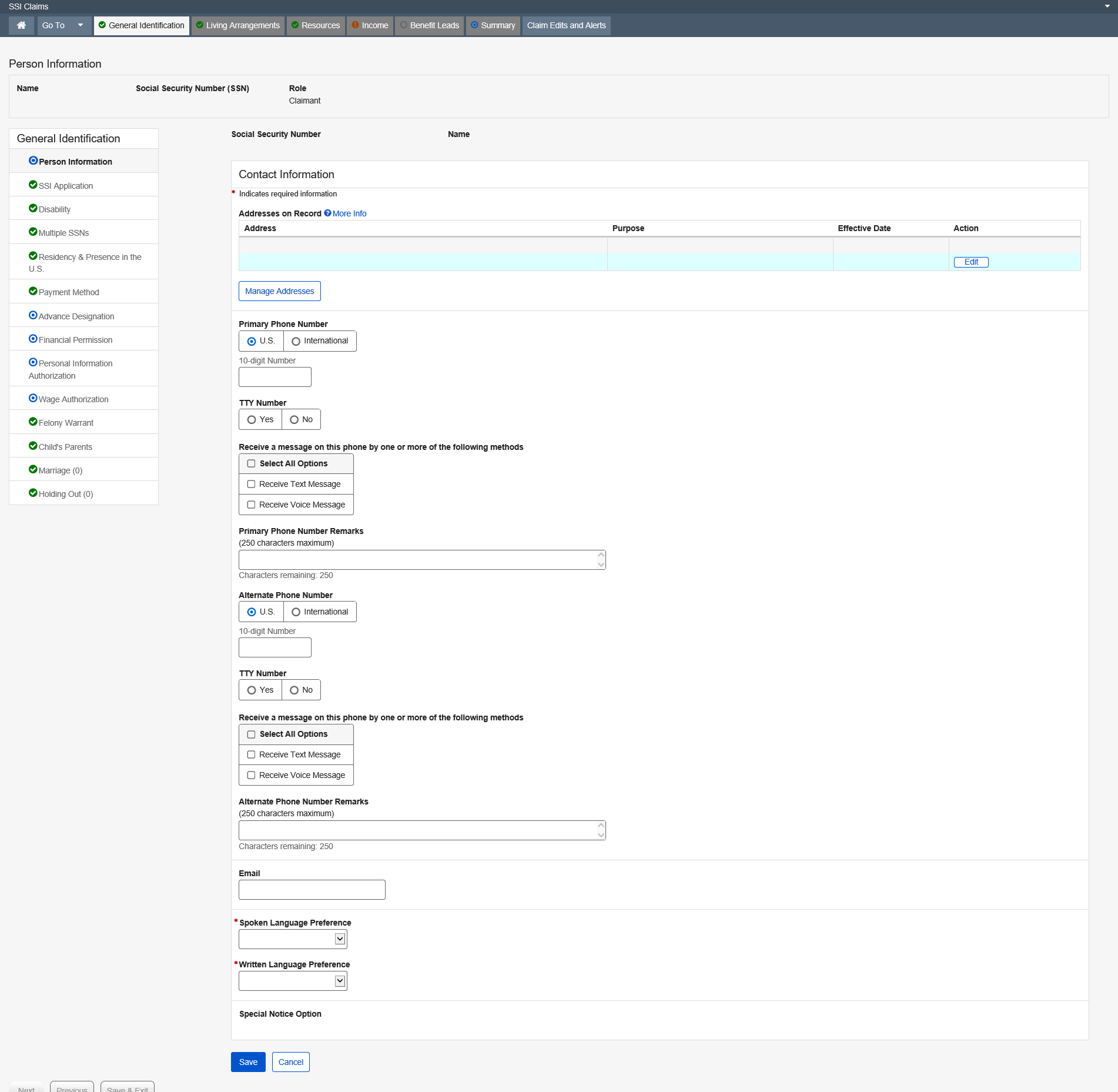

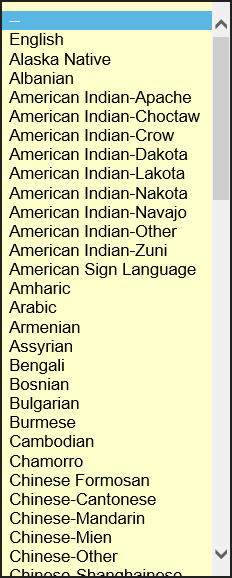

Person Information captures and displays data related to an individual’s identity, contact information, citizenship, military service, and special accommodation needs. The Person Information page enables the user to view, and when applicable, update an individual’s information. It also displays death information.

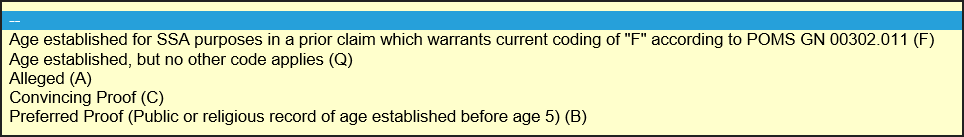

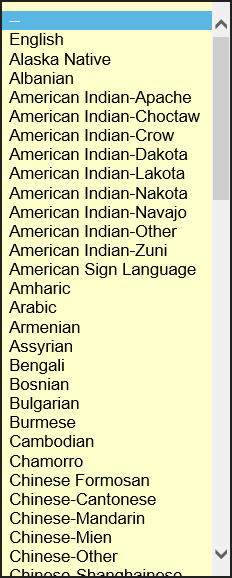

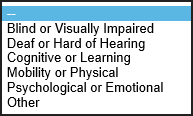

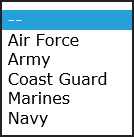

Dropdown list:

Birth

Date Proof

Birth Date Proof Type

Modal window:

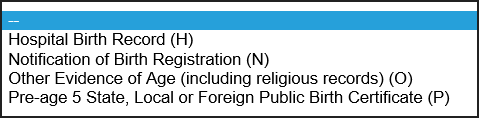

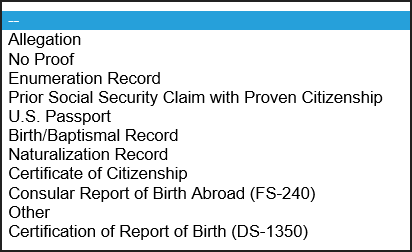

Dropdown list:

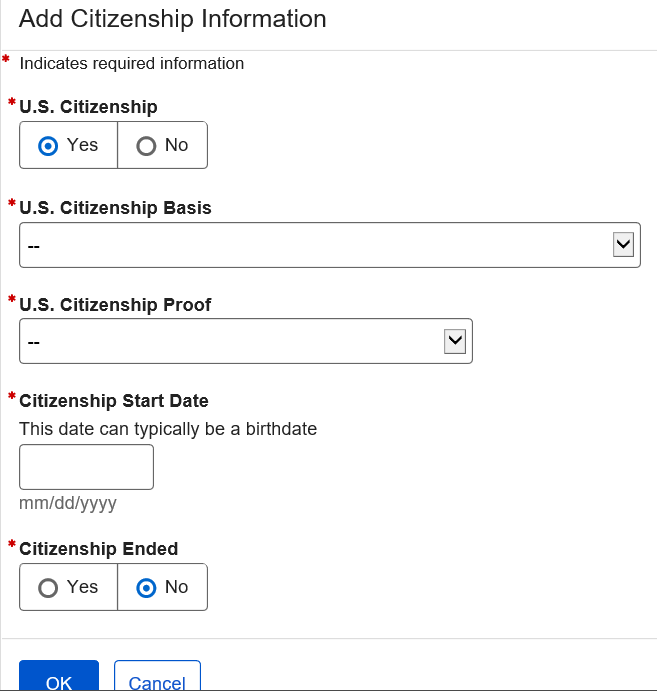

U.S.

Citizenship Basics

U.S. Citizenship Proof

Modal Window:

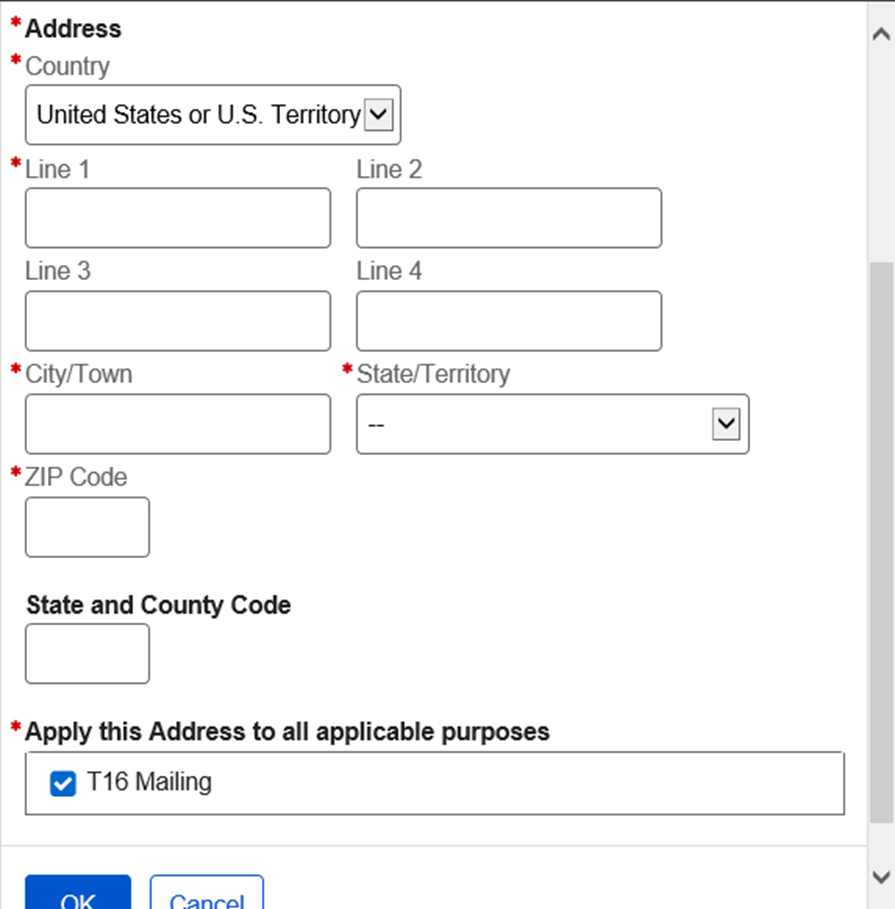

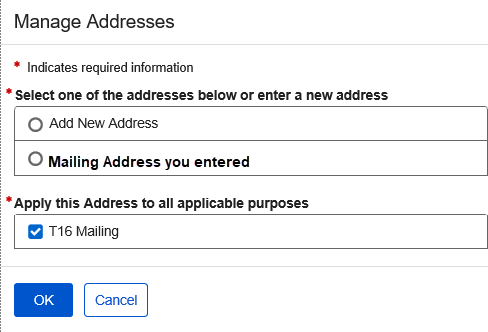

Add New Address

Edit T16 Mailing

Dropdown list:

Spoken Language Preference

Written Language Preference

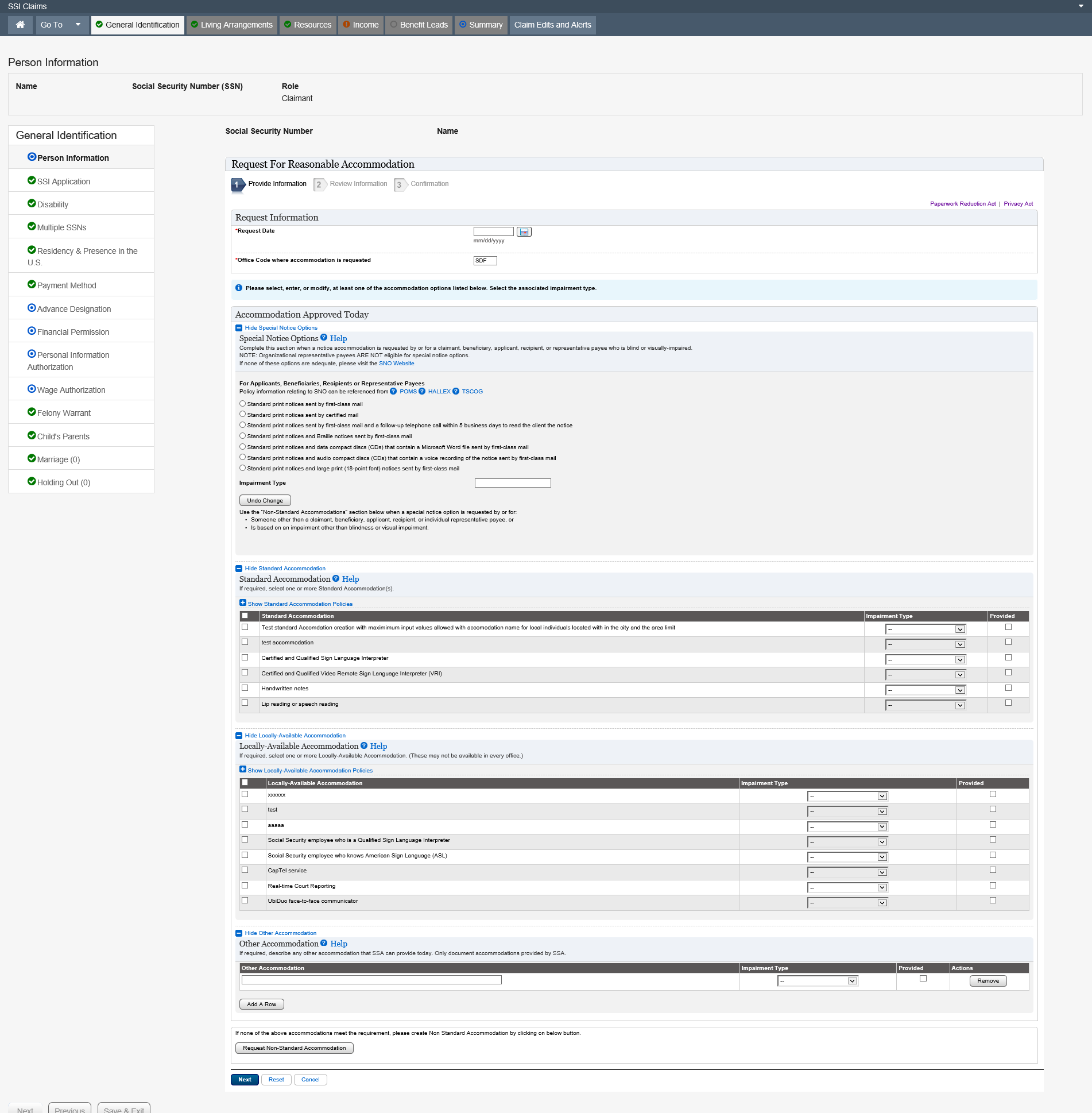

Dropdown list:

Impairment Type

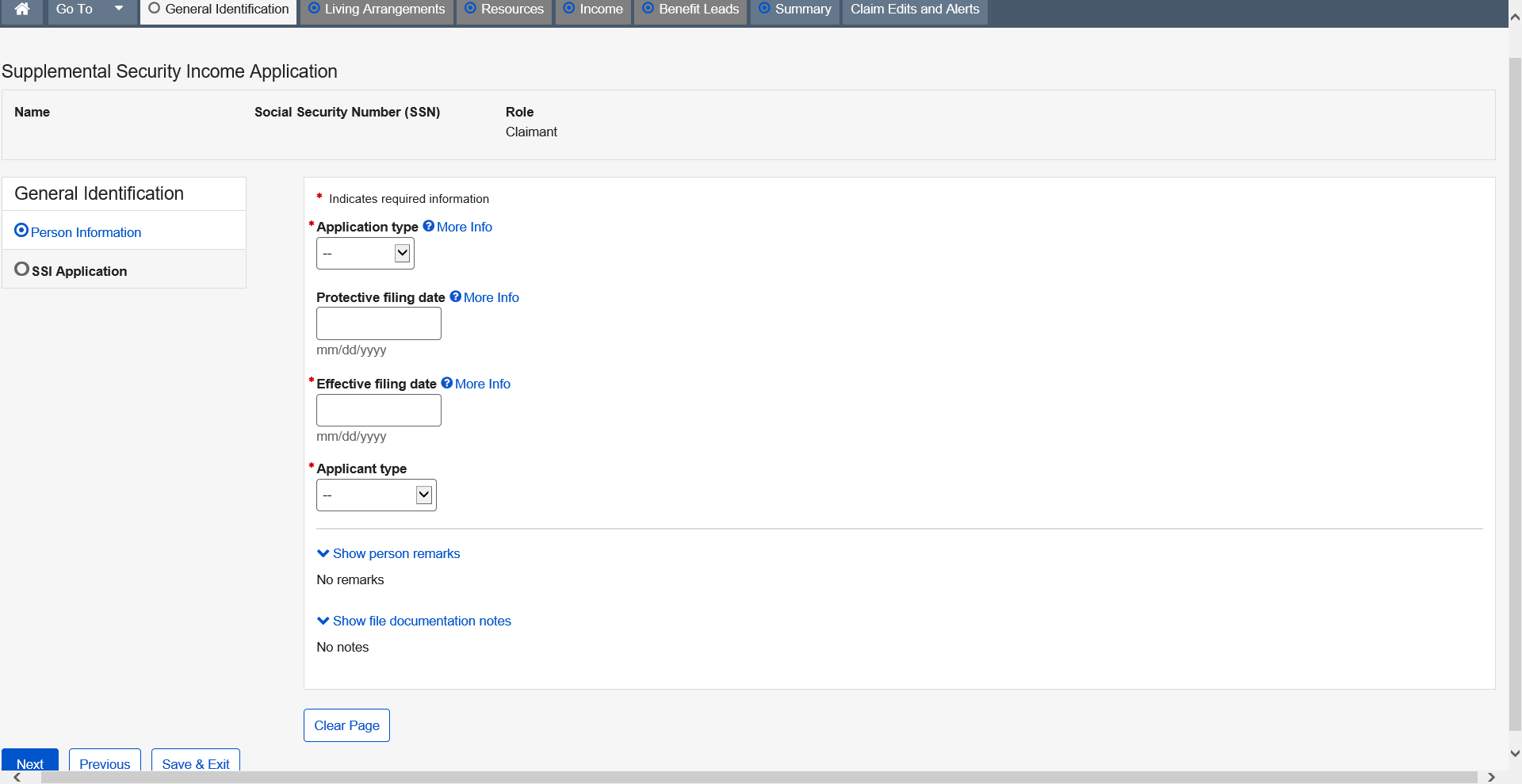

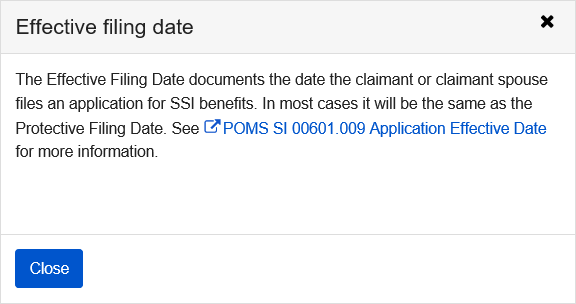

This page collects the type of application being processed, and the date the claim was established. Additionally, it collects information about the non-claimant applicant.

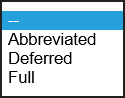

Dropdown list:

Application Type

Applicant Type

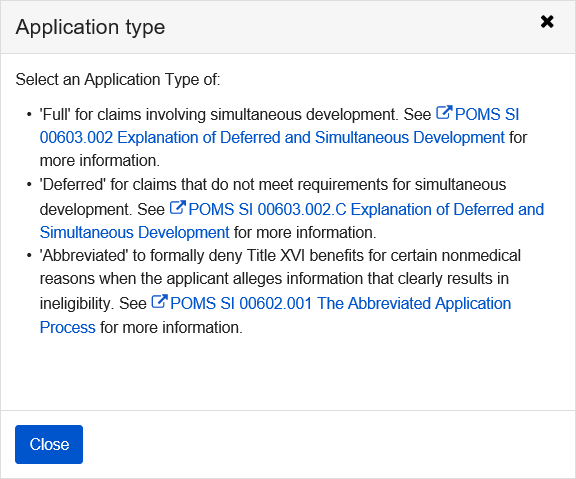

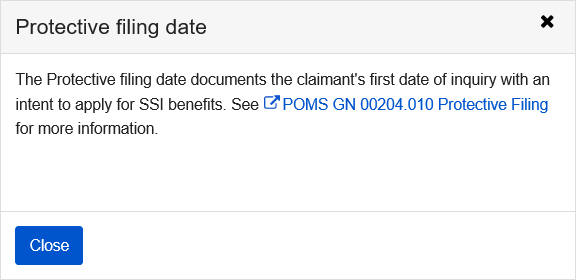

More Info link:

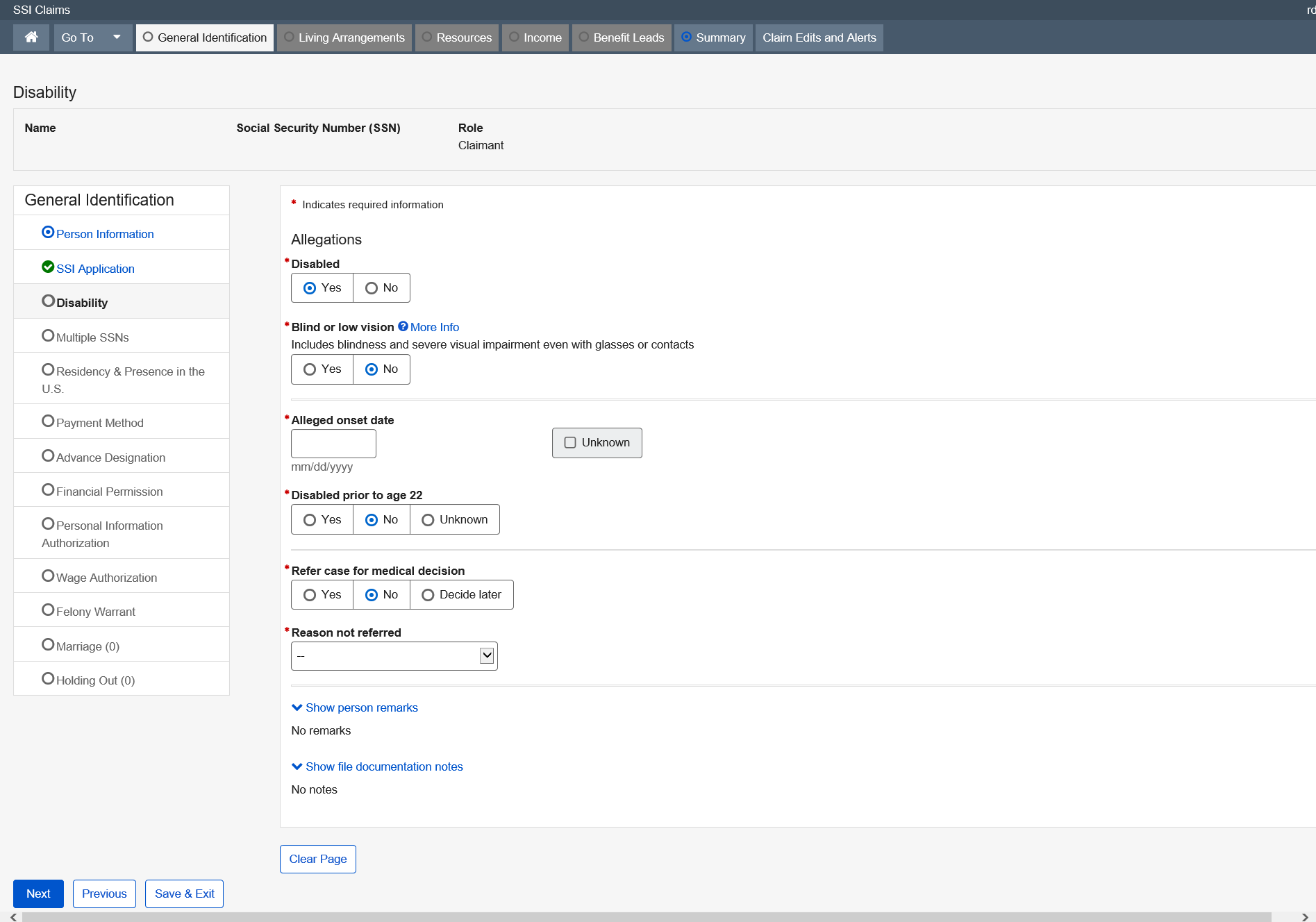

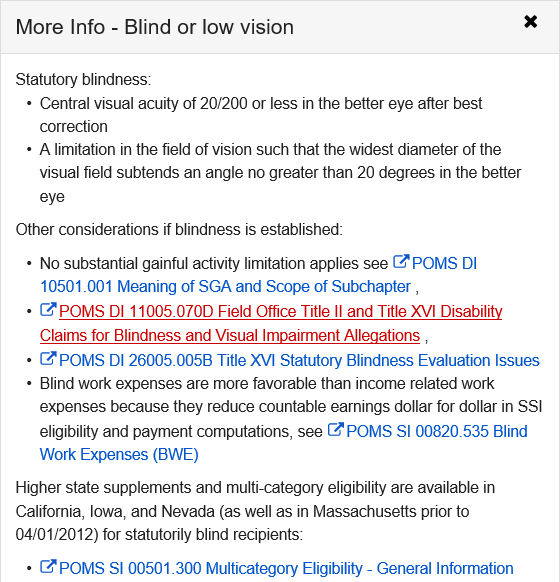

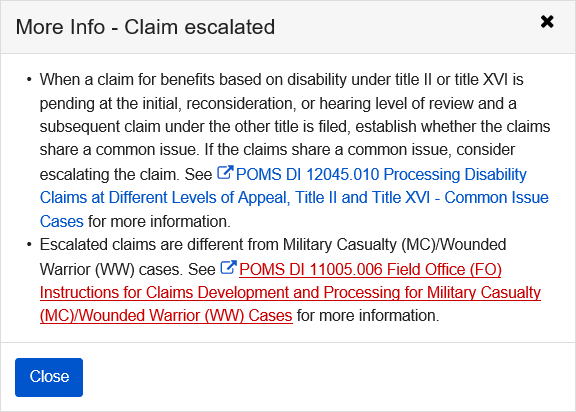

This page documents the allegation of disability or blindness, the onset date alleged by the individual, the SSA employee’s decision regarding the disposition of the medical portion of the file, and the date the field office sent the file for a medical decision.

Once in the path, this page remains in the path and the user cannot remove the page.

Refer

case for medical decision is No

Dropdown list:

Reason not referred

More Info link:

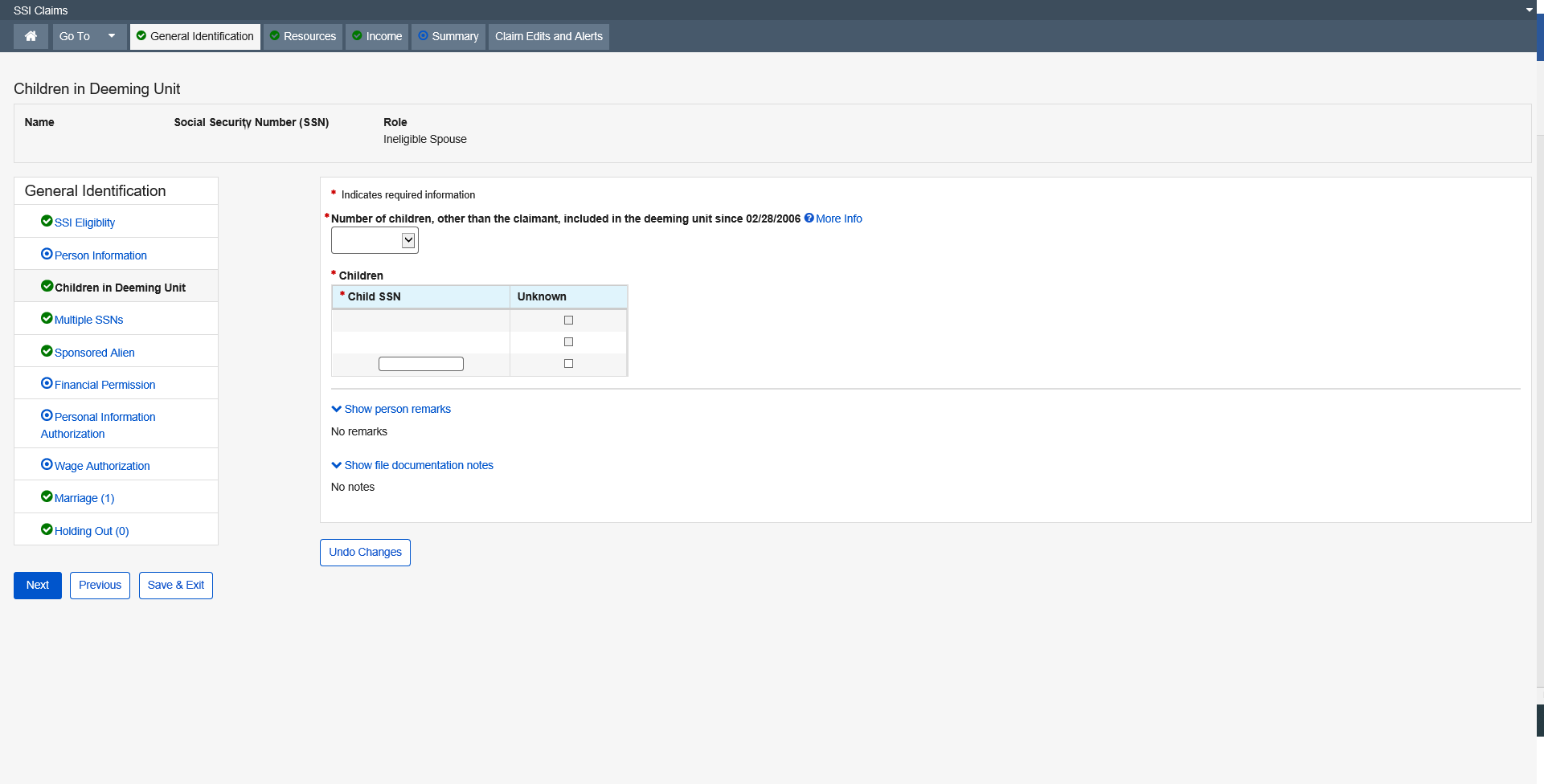

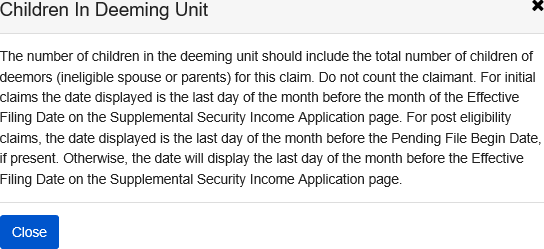

This page collects the number of ineligible children (including children eligible on their own records) who live with or have lived with the claimant since the date indicated.

More Info link:

Dropdown list:

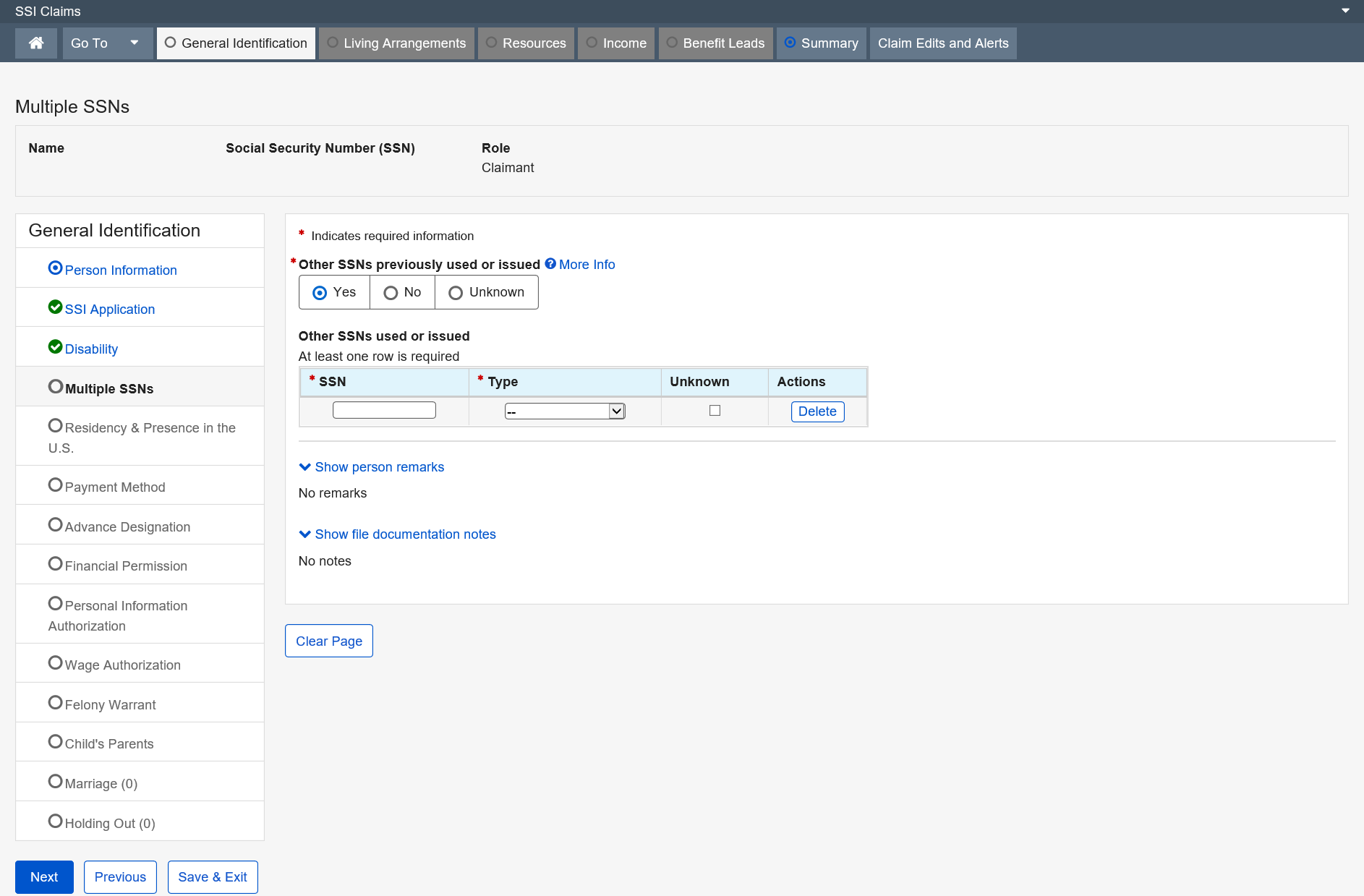

This page collects additional social security numbers that have either been used by or issued to the claimant, claimant spouse, living with parent, deemor children, sponsor, sponsor spouse and/or co-sponsor spouse.

Dropdown list:

Type

More Info link:

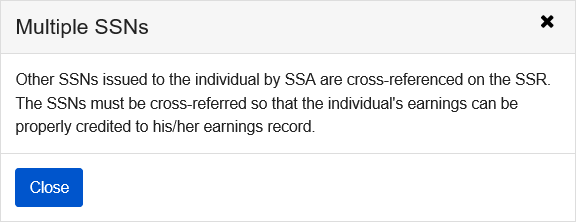

The purpose of this requirement is to determine each month if N13 (Not a citizen or lawfully admitted alien) applies. When N13 does not apply for the month, the person is considered qualified for SSI based on Alien Status. Note: All other factors of SSI eligibility must still be met.

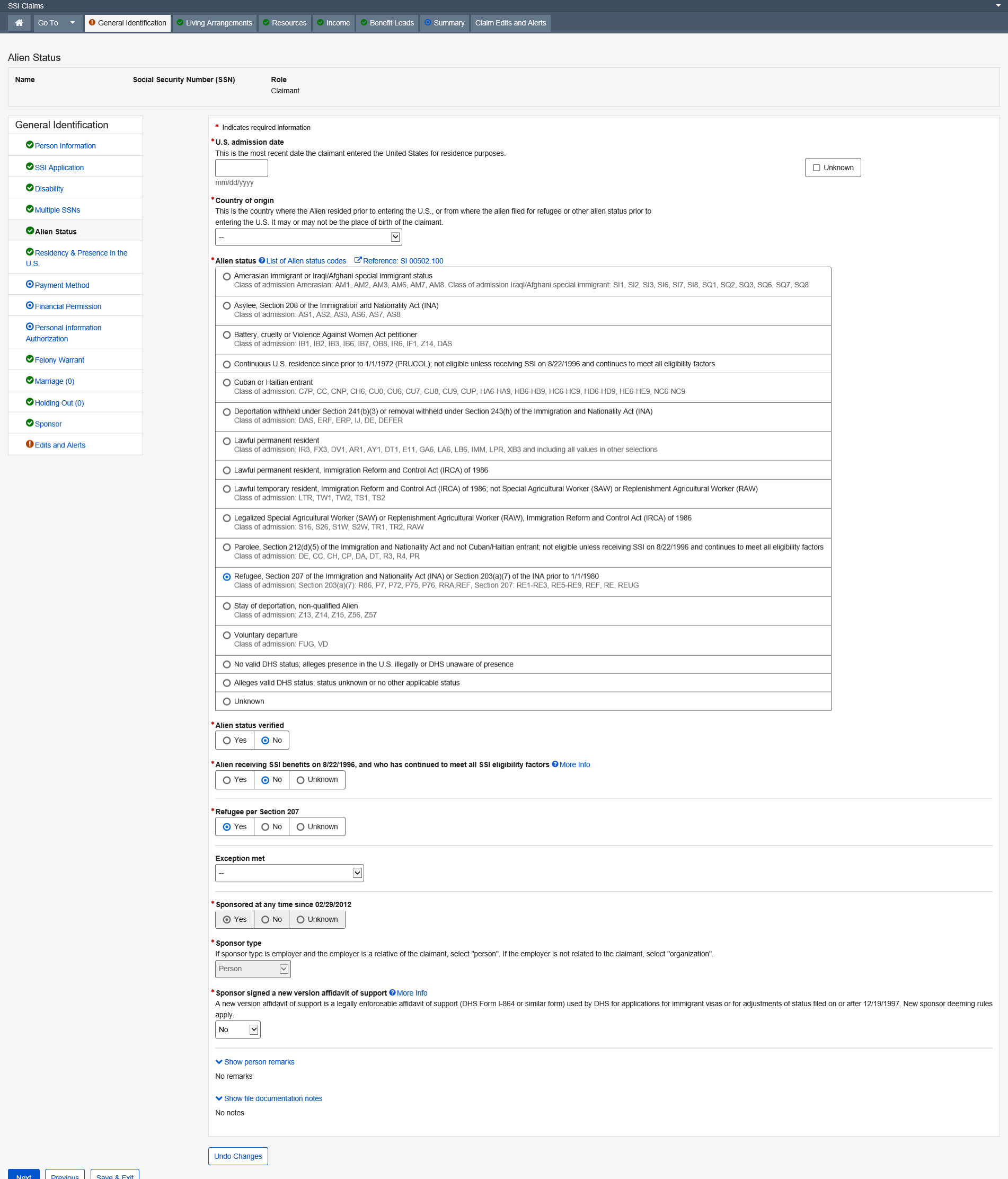

This page collects residency and continuous presence in the U.S. data for a claimant during initial claim situations. The data collected, along with other required data, determines eligibility.

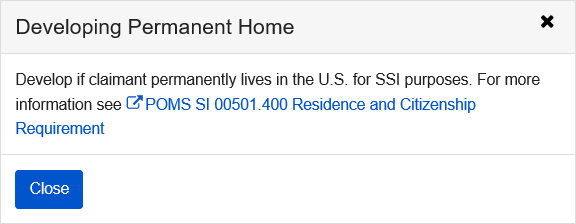

More info link:

Residency

and Presence in U.S. (Initial Claim)

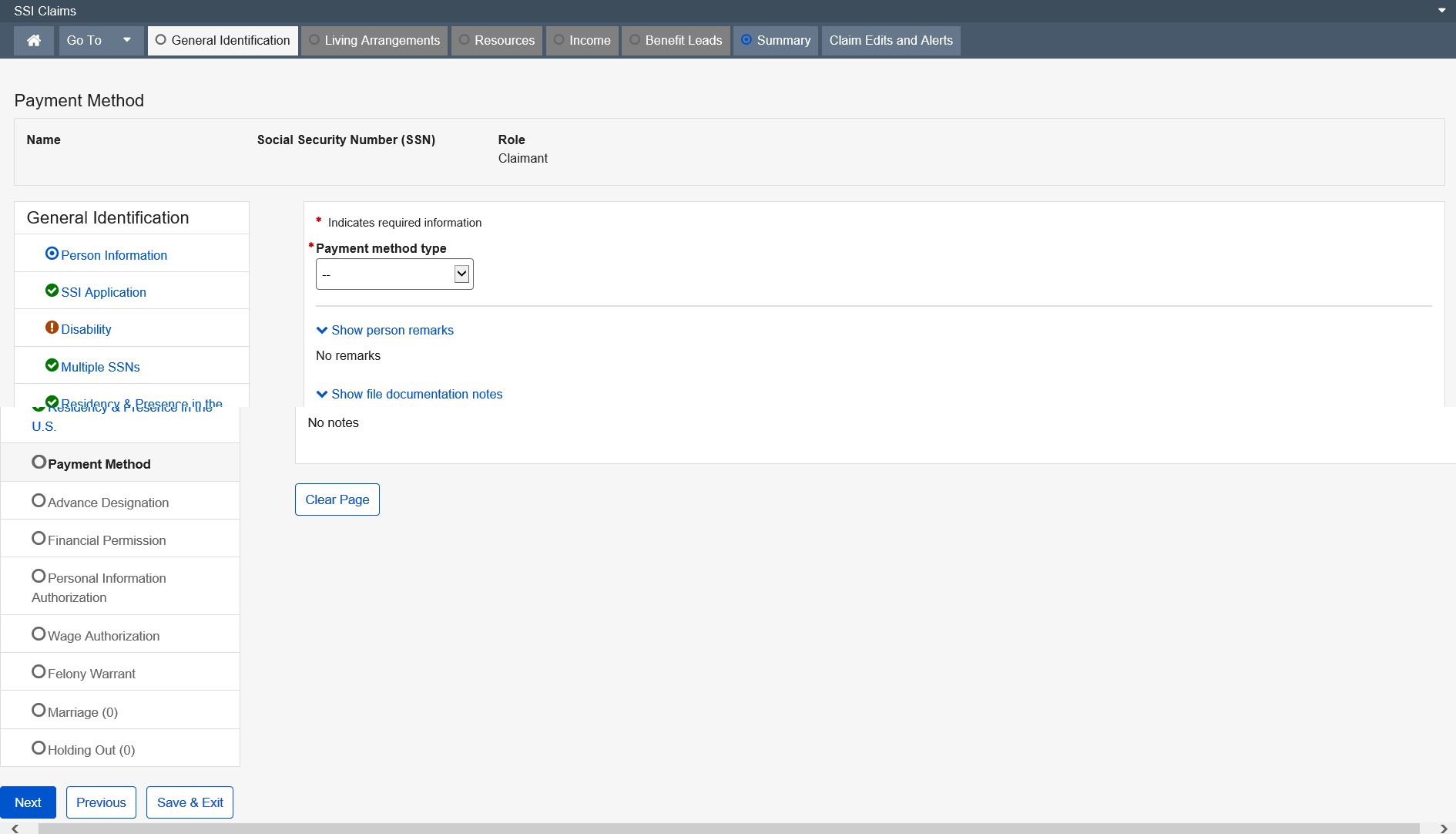

The Payment Method page collects the claimant and eligible spouse’s payment choice.

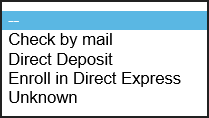

Dropdown list:

Payment method type

“Payment method type” is Direct Deposit

Dropdown list:

Account type

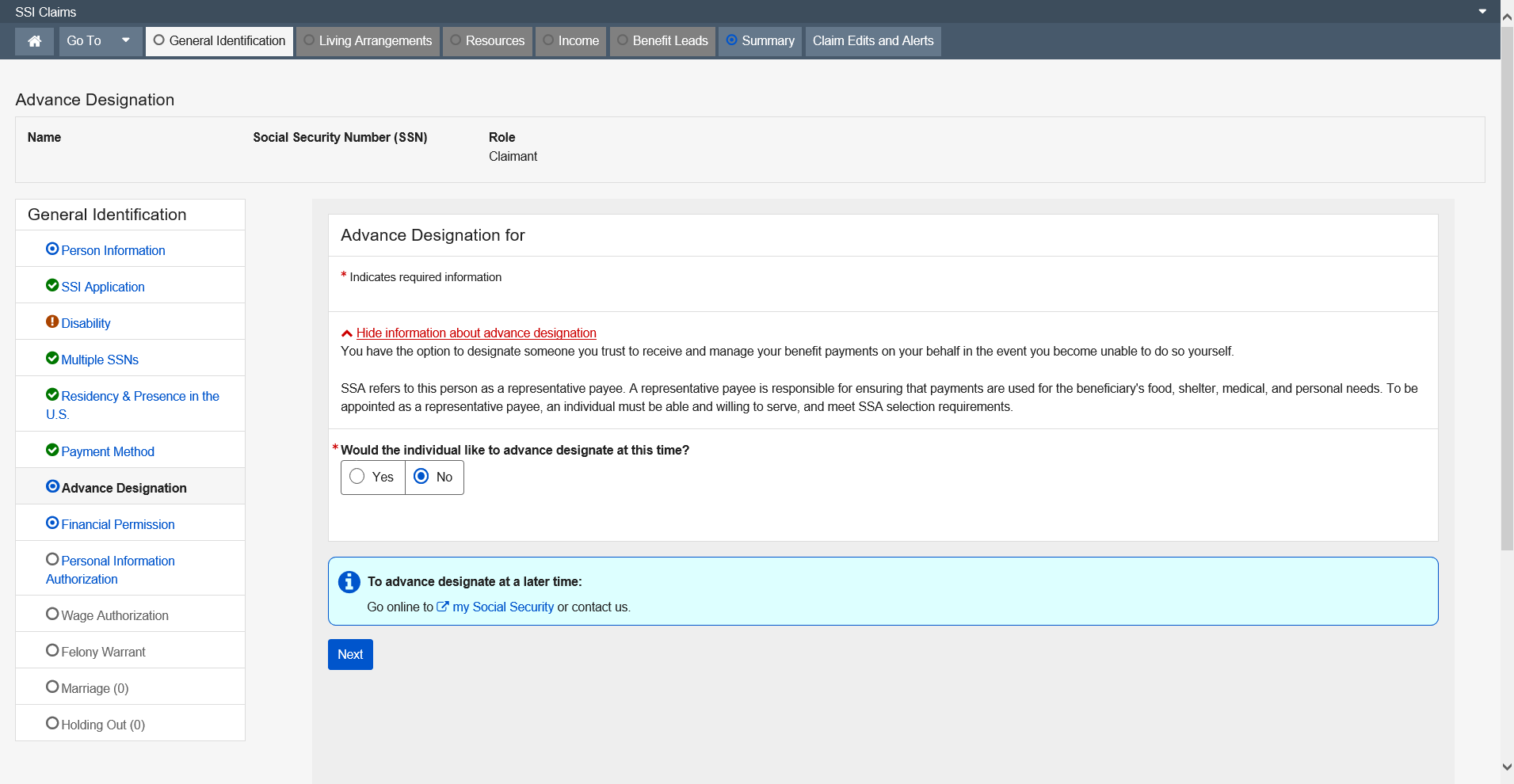

SSI Advance Designation is a mini-path function in the SSI Claims system. Advance Designation is automatically placed in the SSI Claims path for the person on the claim when a new claim is established for the person on the claim. When accessing Advance Designation, the user is presented with the Advance Designation of Representative Payee application in establish, update or query mode.

The Advance Designation of Representative Payee application collects advance designation data for the applicants and beneficiaries who do not have a representative payee. If the time comes that they need a representative payee, individuals can be advance designated in priority order. The Advance Designation of Representative Payee application also allows applicants and beneficiaries who have a representative payee to update the phone number of any existing advance designations that are currently present in the application.

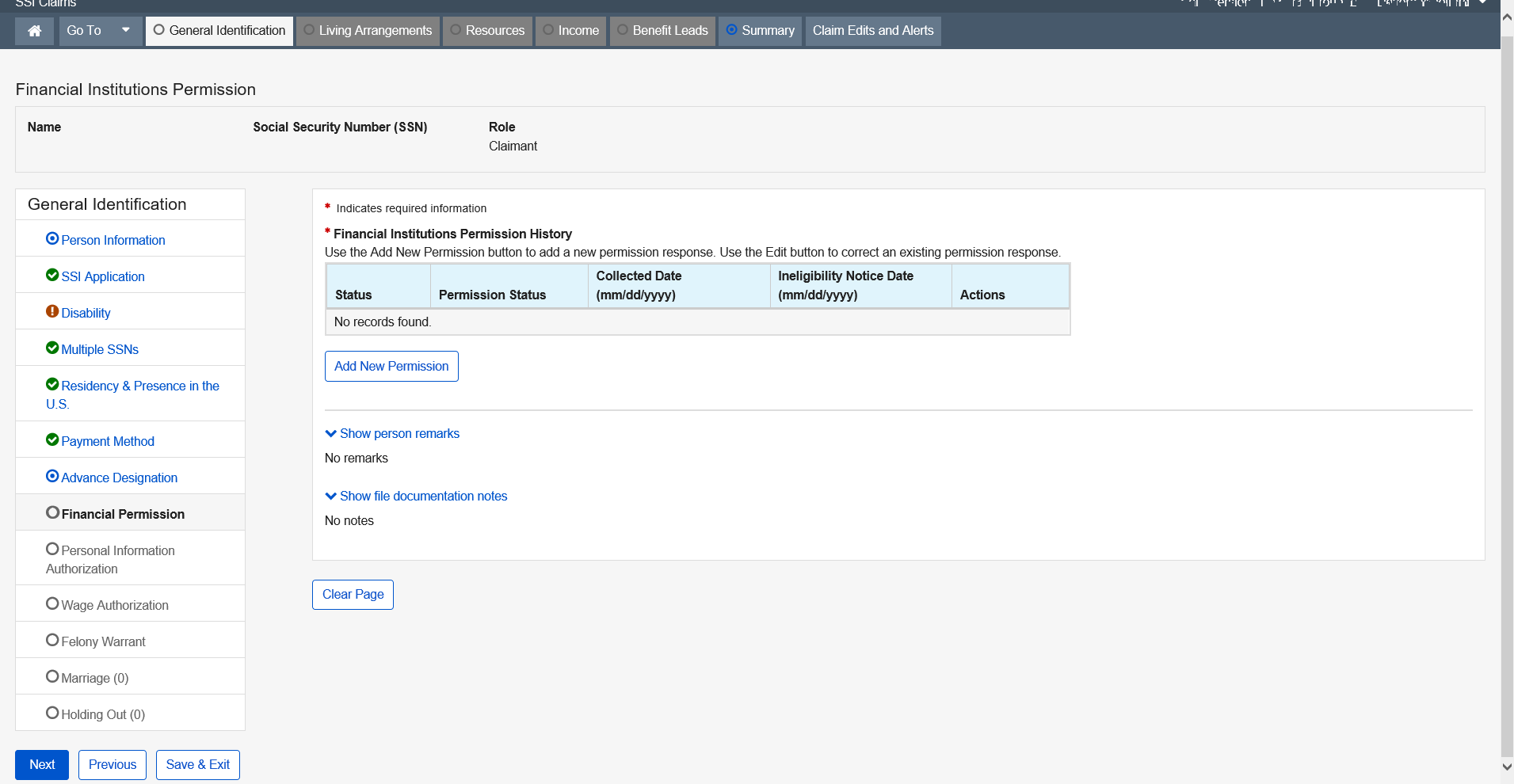

The Financial Institutions Permission page documents whether the claimant, eligible spouse, and deemors give permission to contact Financial Institutions.

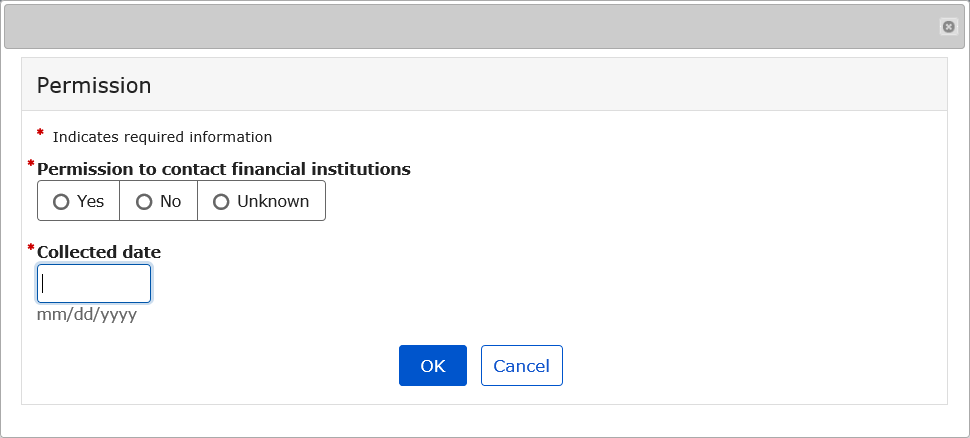

Modal Window:

Add New Permission

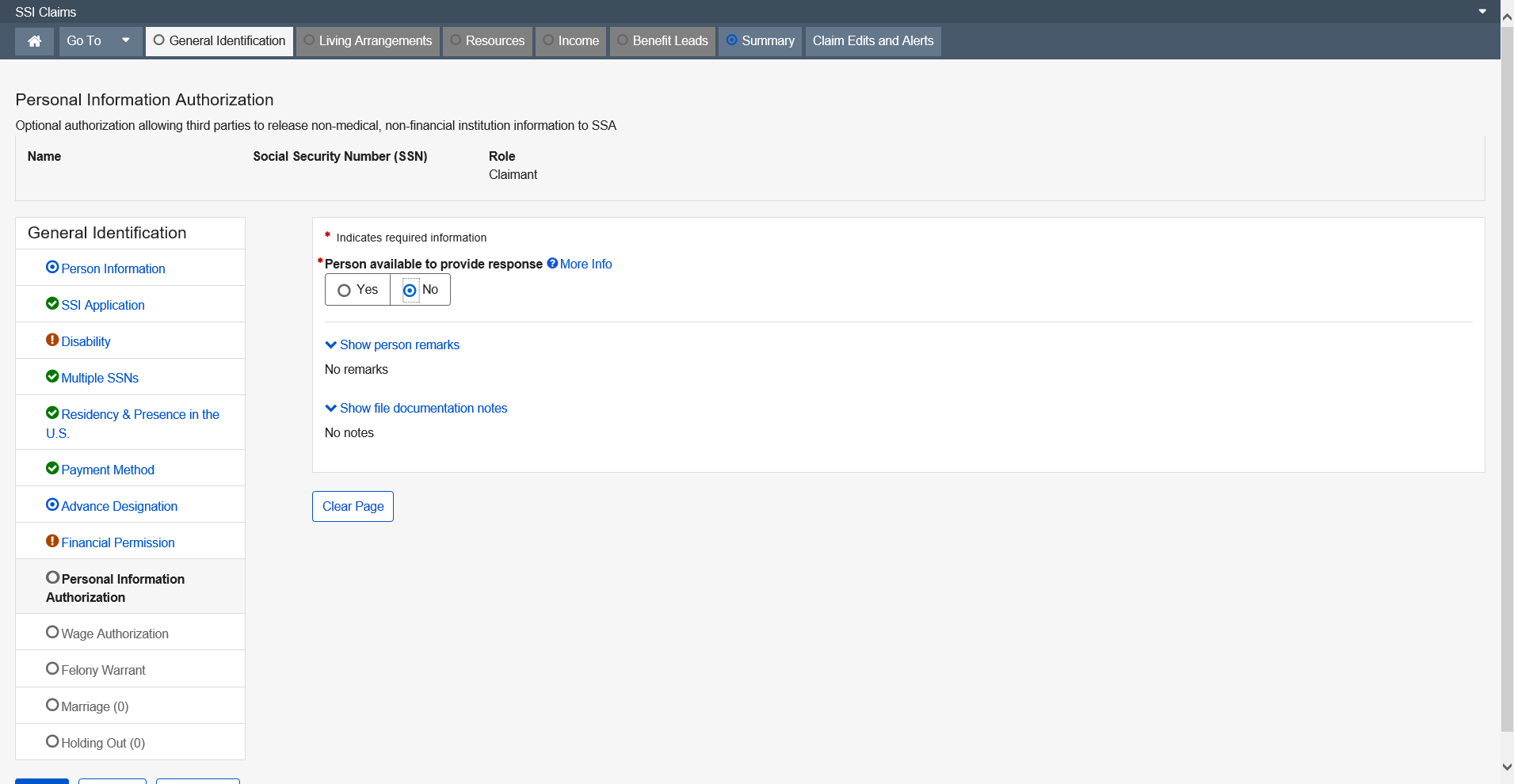

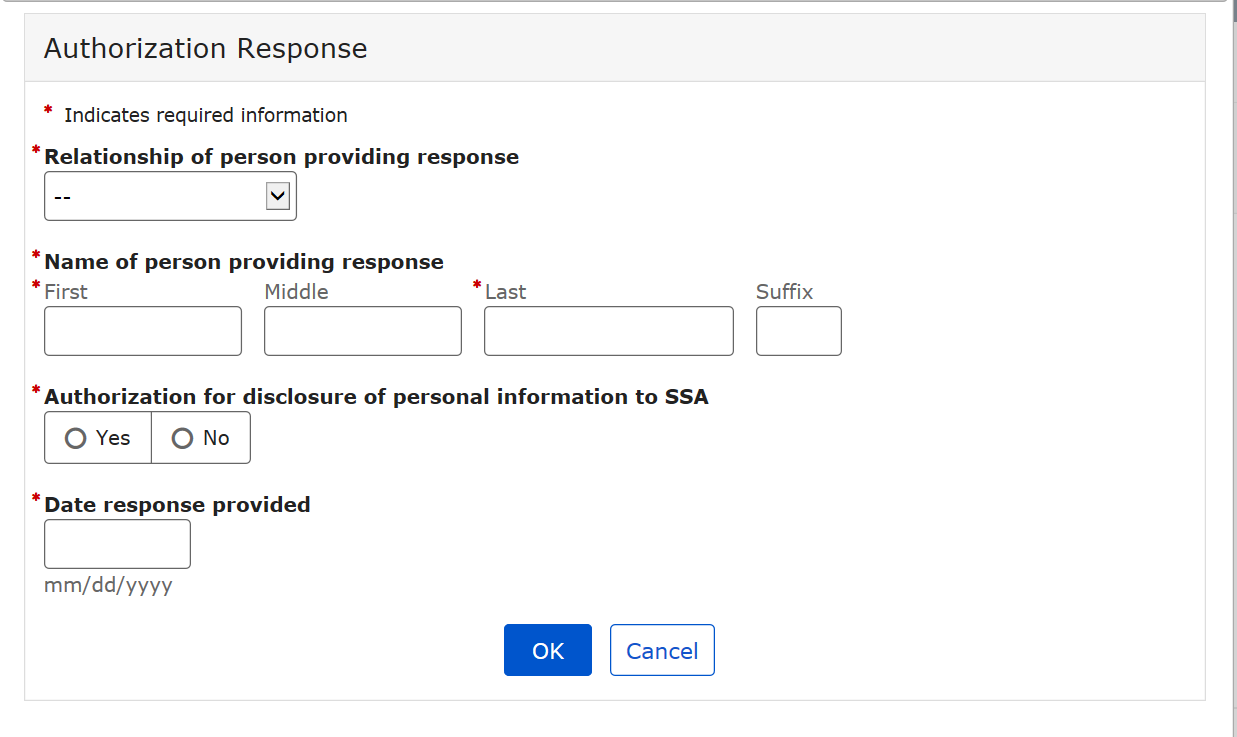

This page documents whether the claimant, eligible spouse, and members of the deeming unit give authorization for third parties to disclose their personal information to SSA.

More Info link:

Modal Window:

“Person available to provide response” is Yes

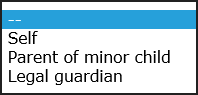

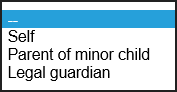

Dropdown list:

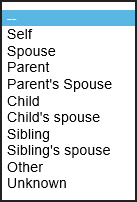

Relationship of person providing response

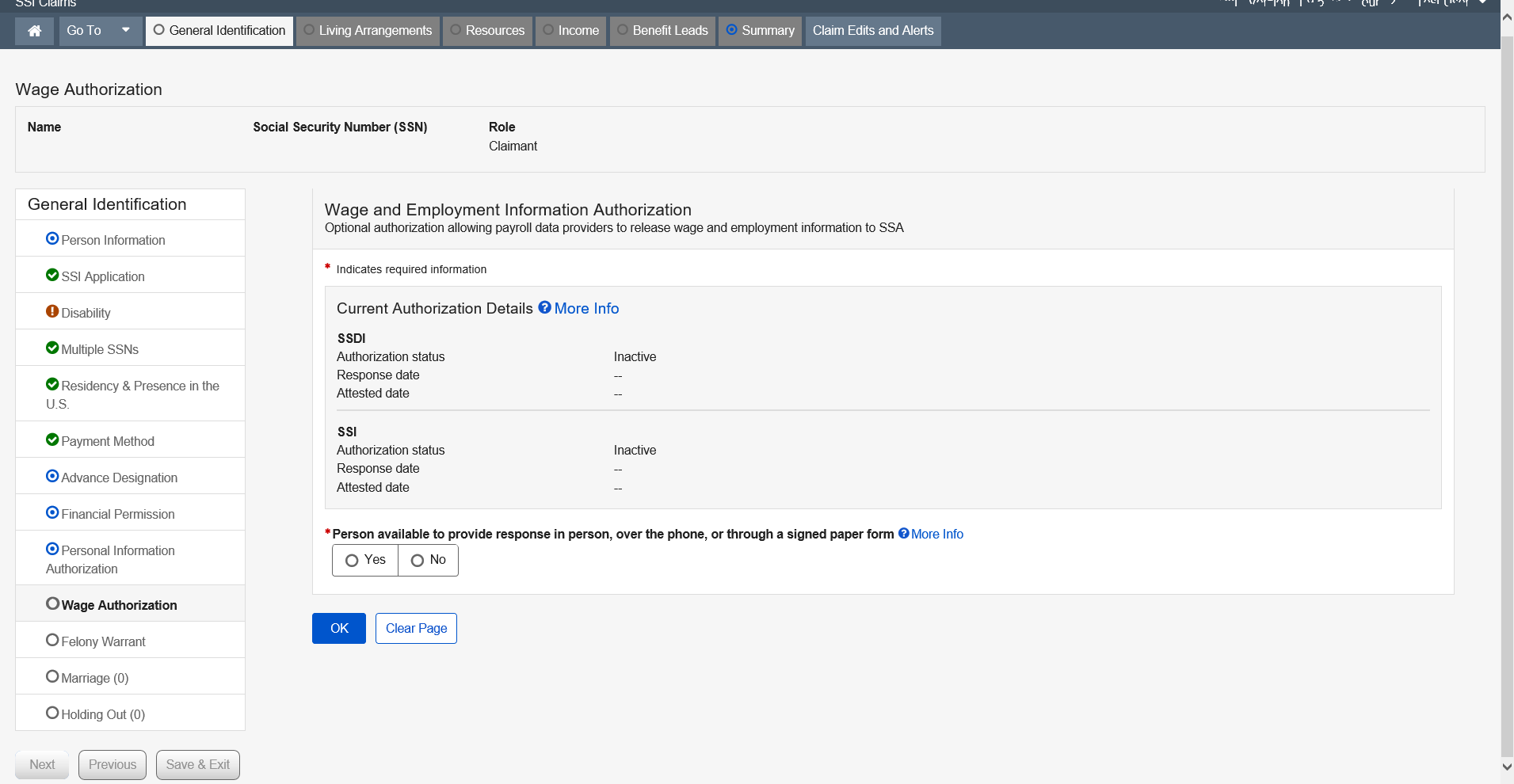

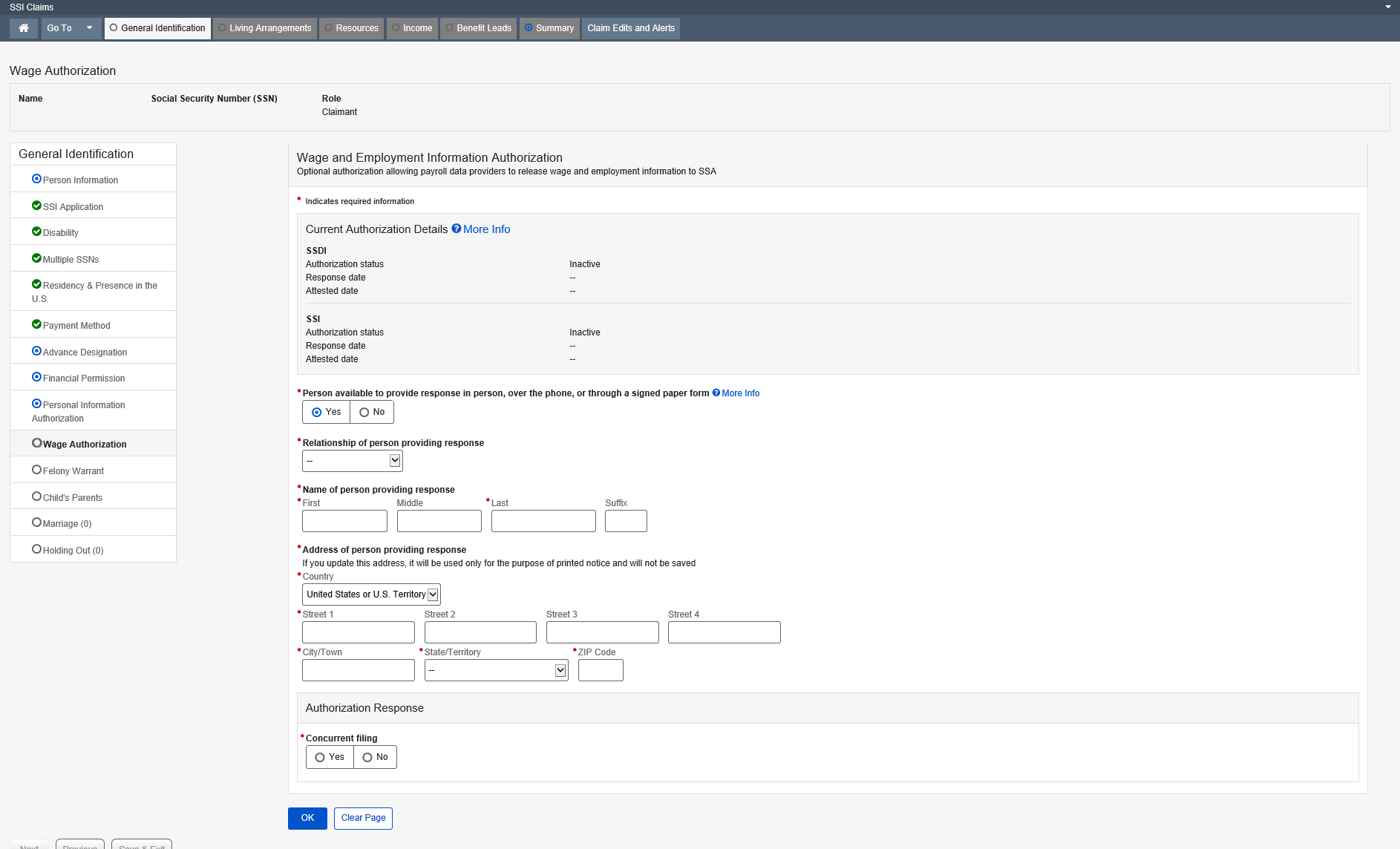

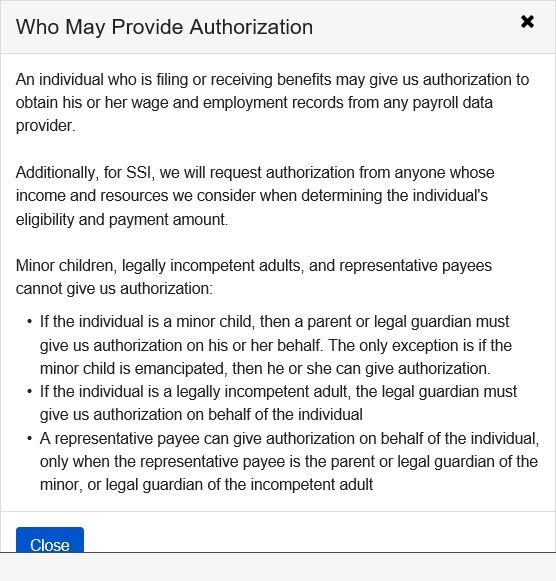

SSI Wage Authorization is a mini-path function in SSI Claims system. Upon accessing the page, the user is presented with a data collection screen. The SSI Wage Authorization page interfaces with the Programmatic Wage Authorization application, which houses authorization responses and presents the appropriate response collection elements and information depending on the authorization response status and claim status of both Title 16 and Title 2. This function collects and/or displays information regarding authorization for SSA to obtain wage and employment information from third party providers for the claimant, eligible spouse, ineligible spouse, eligible child, ineligible child, parent, sponsor, sponsor spouse, and sponsor cosponsor.

The SSI Wage Authorization function is automatically placed in the SSI Claims system path when required by current Policy in Initial Claims, Preeffectuation Review Contact page, and Redetermination events. It is also available to the user in other SSI Claims system events upon request. SSI Wage Authorization allows the user to review and update Programmatic Wage Authorization status without having to exit the SSI Claims system application.

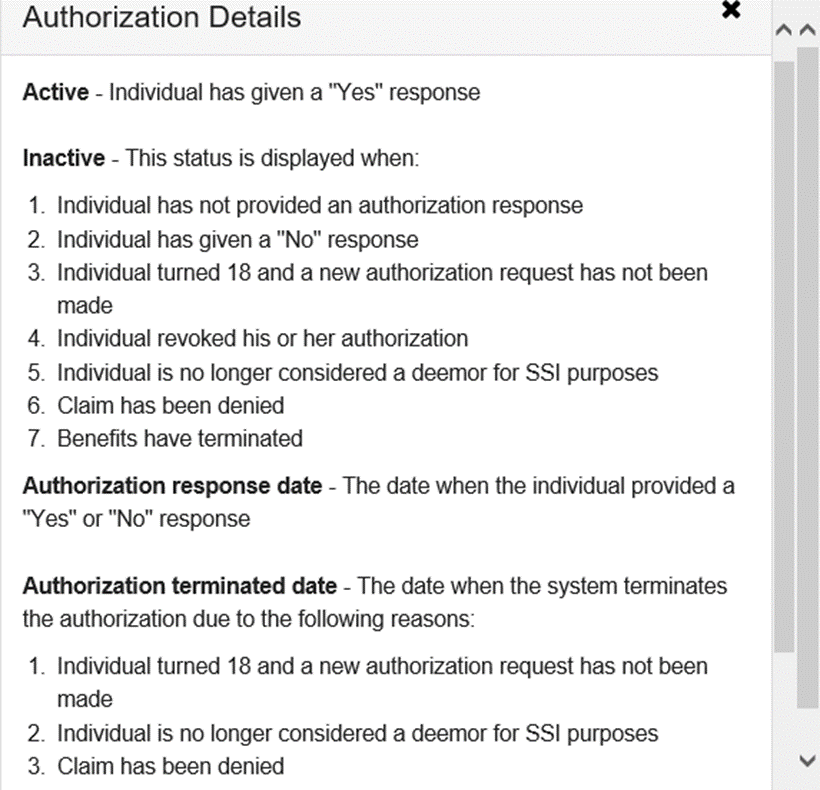

More Info link:

Current Authorization Details

“Person

available to provide response in person, over the phone, or through a

signed paper form” is Yes

More Info link:

Dropdown list:

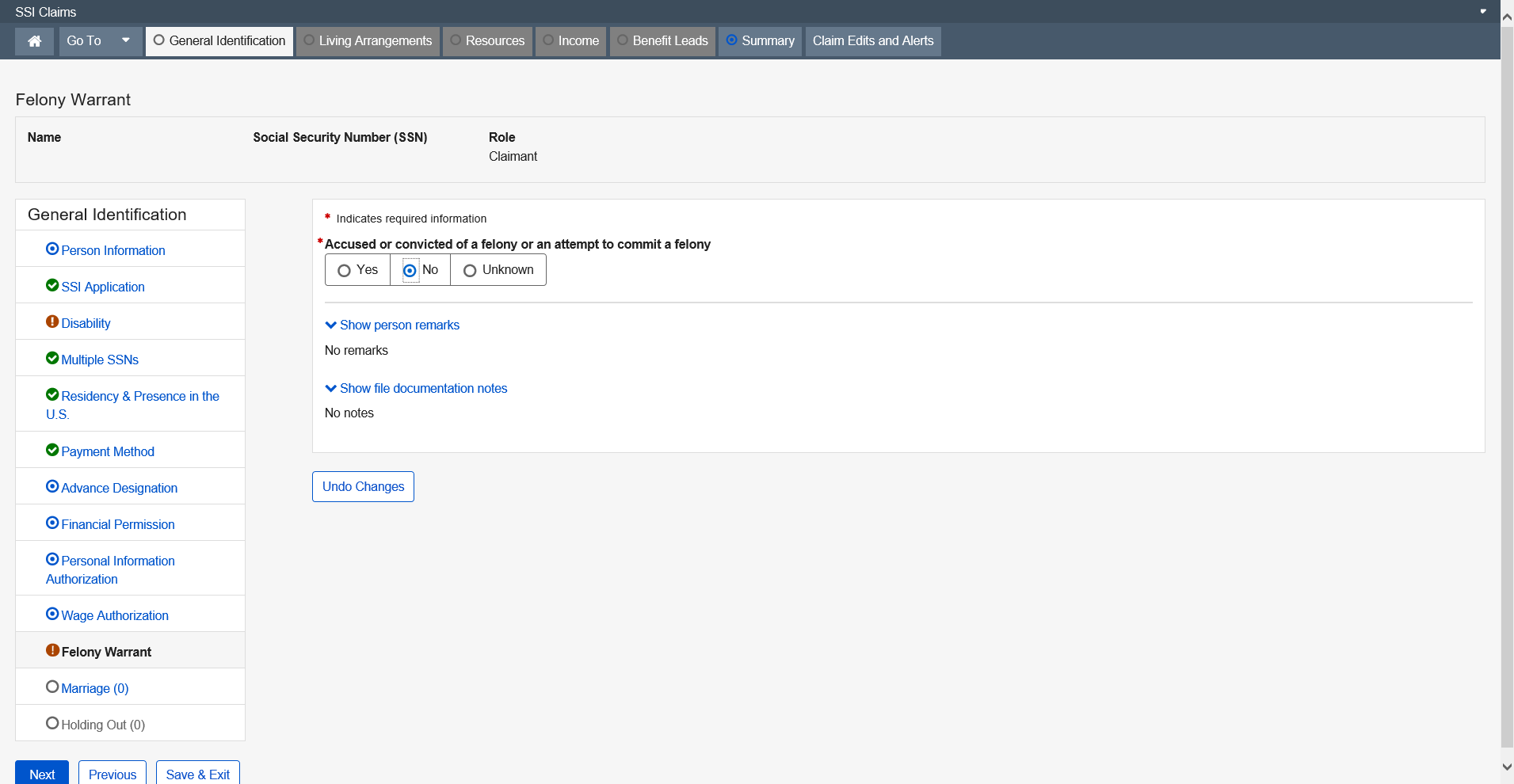

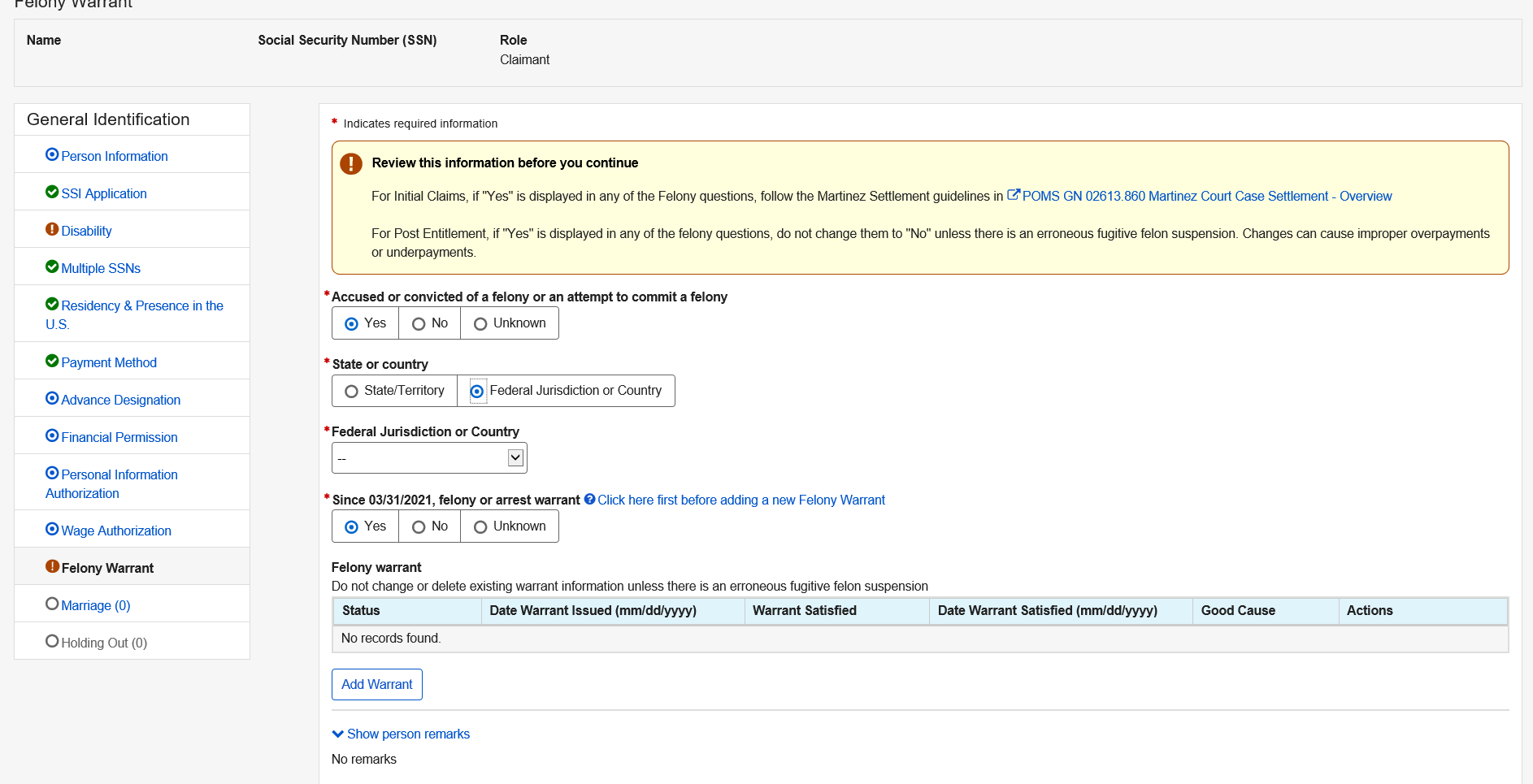

These pages document the claimant’s or eligible spouse’s status as a Fugitive Felon or Parole Probation Violator.

This DFR documents two (2) separate pages:

Felony Warrants

Parole or Probation Violation Warrants

As a result of the Martinez Court Settlement, SSA will only suspend on the following felony arrest warrants:

Escape from custody – Offense Code 4901

Flight to avoid prosecution or confinement – Offense Code 4902

Flight – escape – Offense Code 4999

As a result of the Clark Court order, SSA can no longer make initial determination to suspend or deny payments based on a Parole or Probation violations. Historical information will be displayed, but new claims will not include PPV questions.

“Accused or convicted of a felony or an attempt to commit a felony” is Yes

Dropdown list:

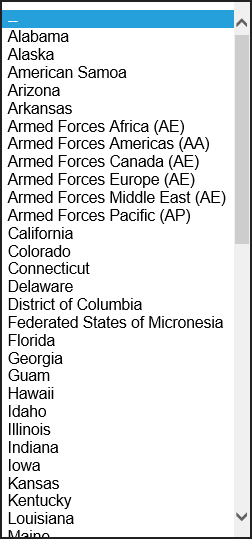

State or Country

State

Federal Jurisdiction or Country

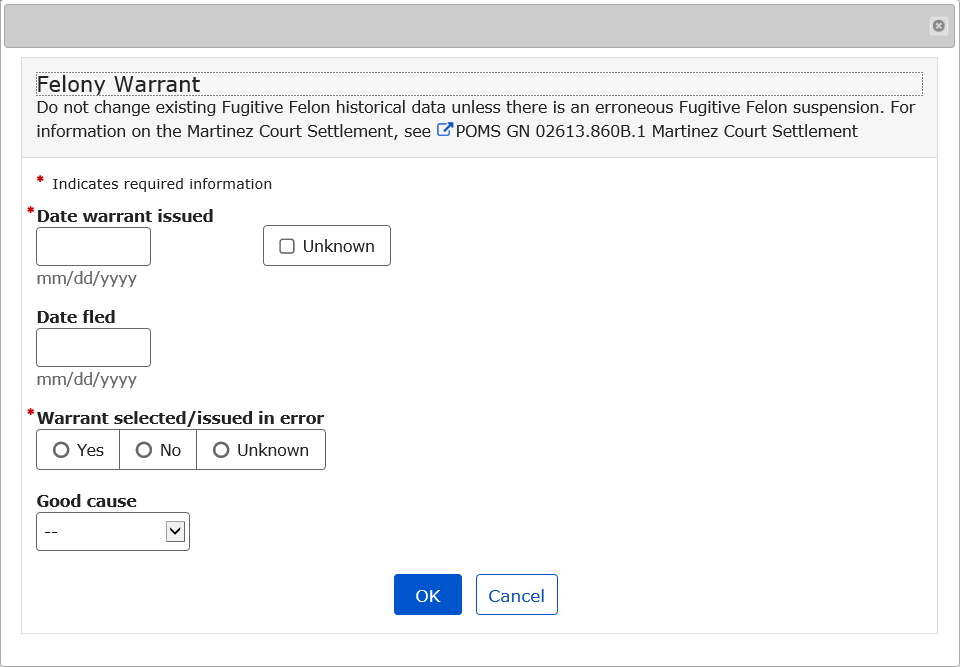

Modal Window:

Add Warrant

Dropdown list:

Good Cause

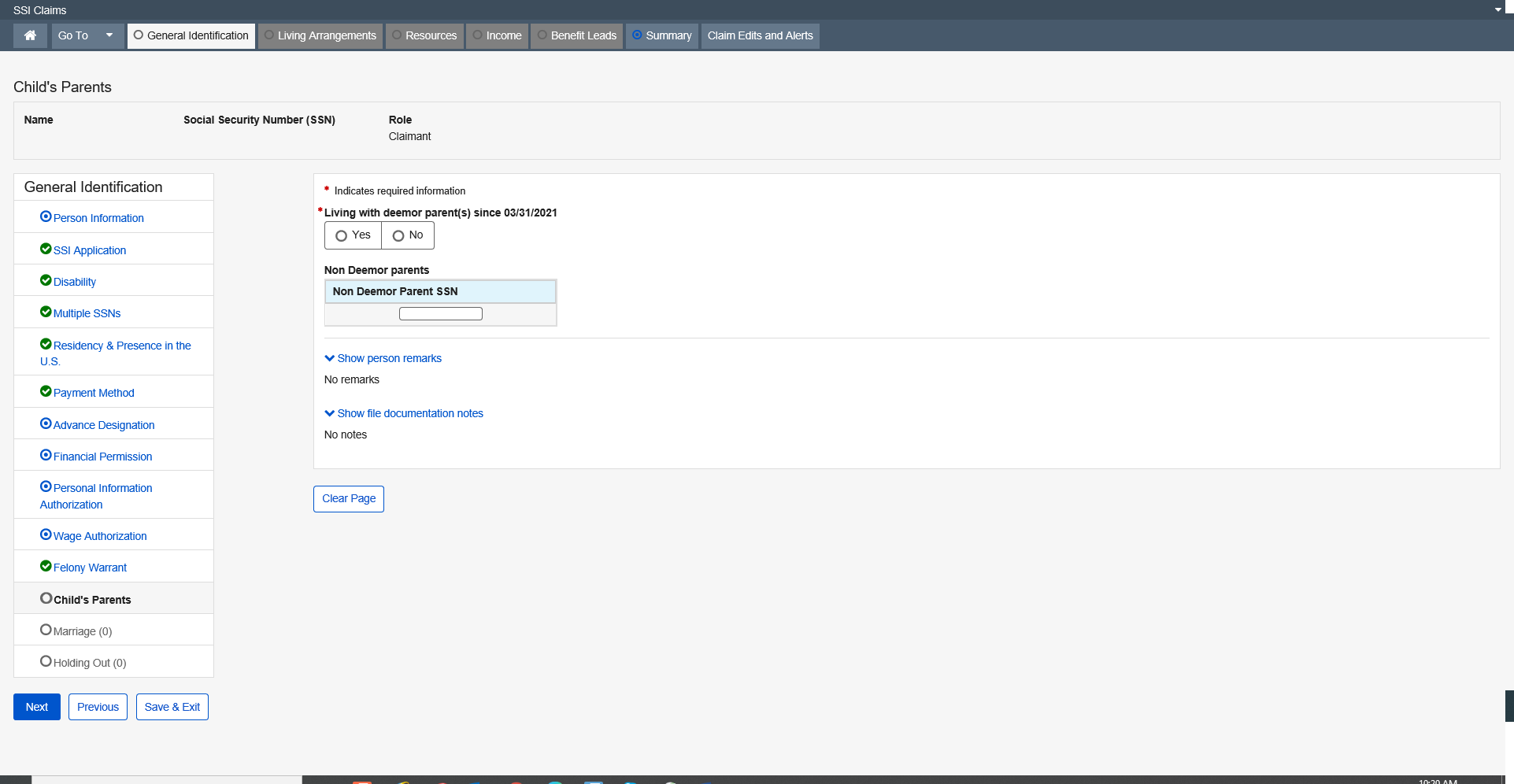

This page documents the SSNs of parents living with a child claimant who is under age 18 prior to the effective filing date. It also documents SSNs of non-deemor parents for a claimant who alleges becoming disabled prior to age 22. It also adds a lead on the Child’s Entitlement from Parents page for deemor and non deemor parents.

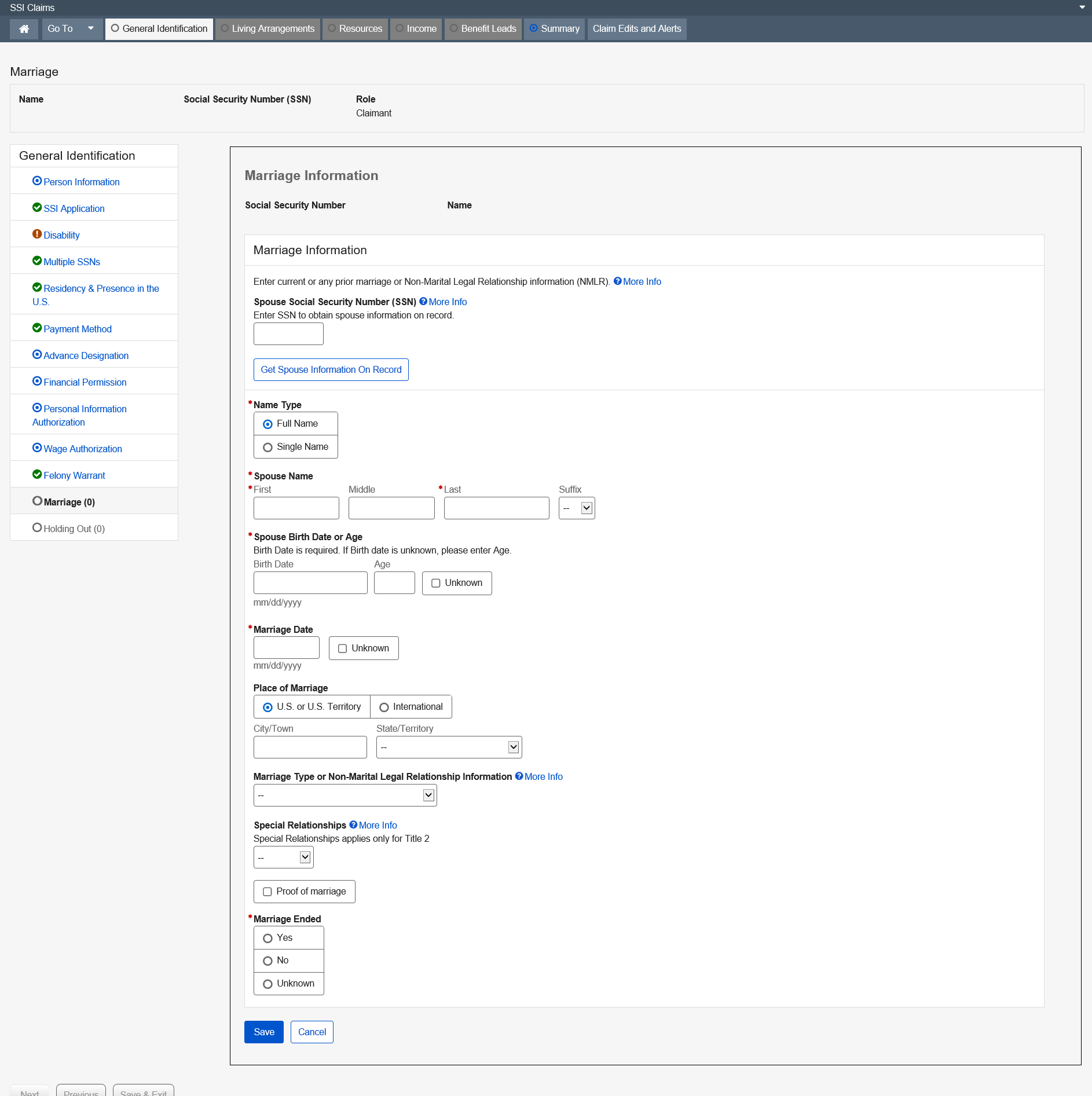

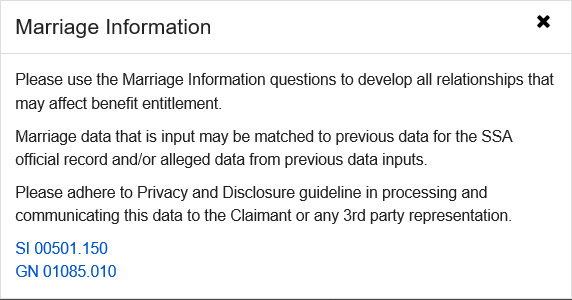

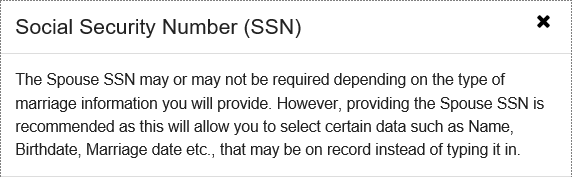

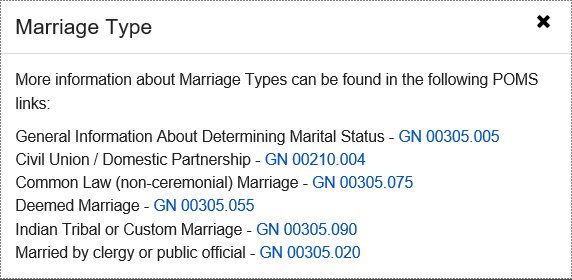

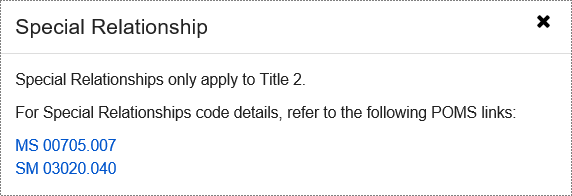

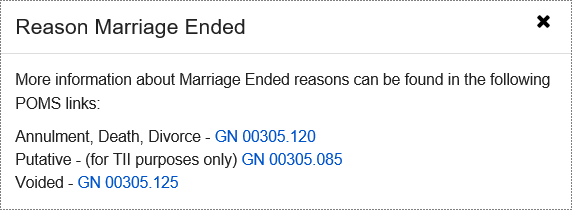

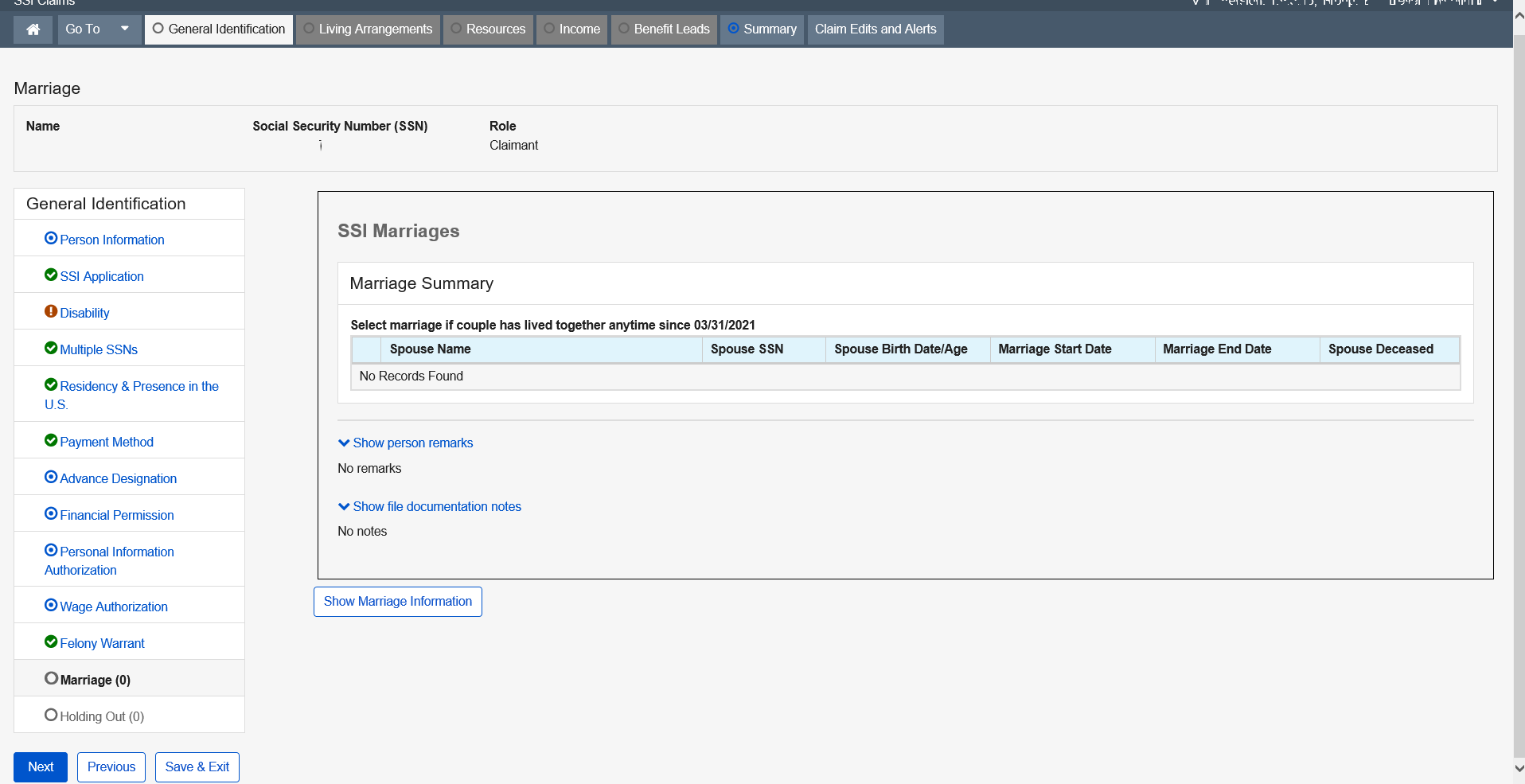

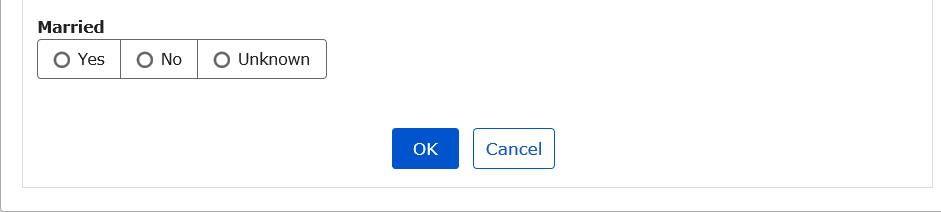

The Marriage page captures and displays data related to marriages, which are active or terminated for all the people on the Person Claim Summary page. It establishes marital relationships and also collects the information about a separated/former spouse of the claimant. The information collected on the Marriage page is shared data among all claims where that person’s SSN is active. The Marriage Information section of the Marriage page enables the user to view, and when applicable, update an individual’s information. This information is collected in Person Information (PI).

Add Marriage

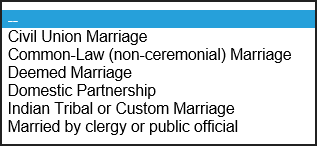

Dropdown list:

Suffix

State/Territory

More Info link:

Dropdown list:

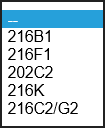

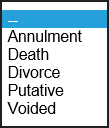

Marriage Type or Non-Marital Legal Relationship Information

Special Relationships

Reason Marriage Ended

SSI Marriages - Marriage Summary

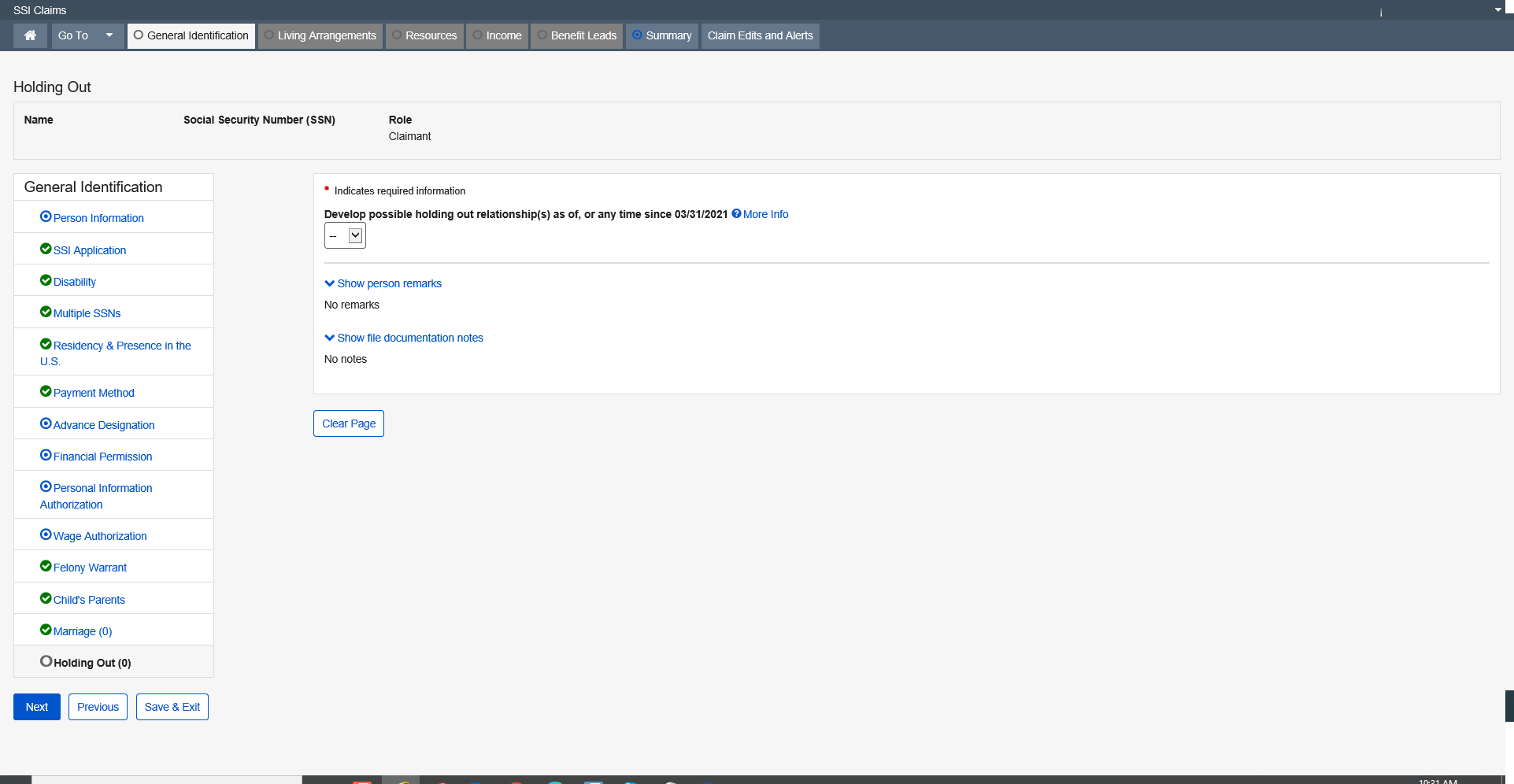

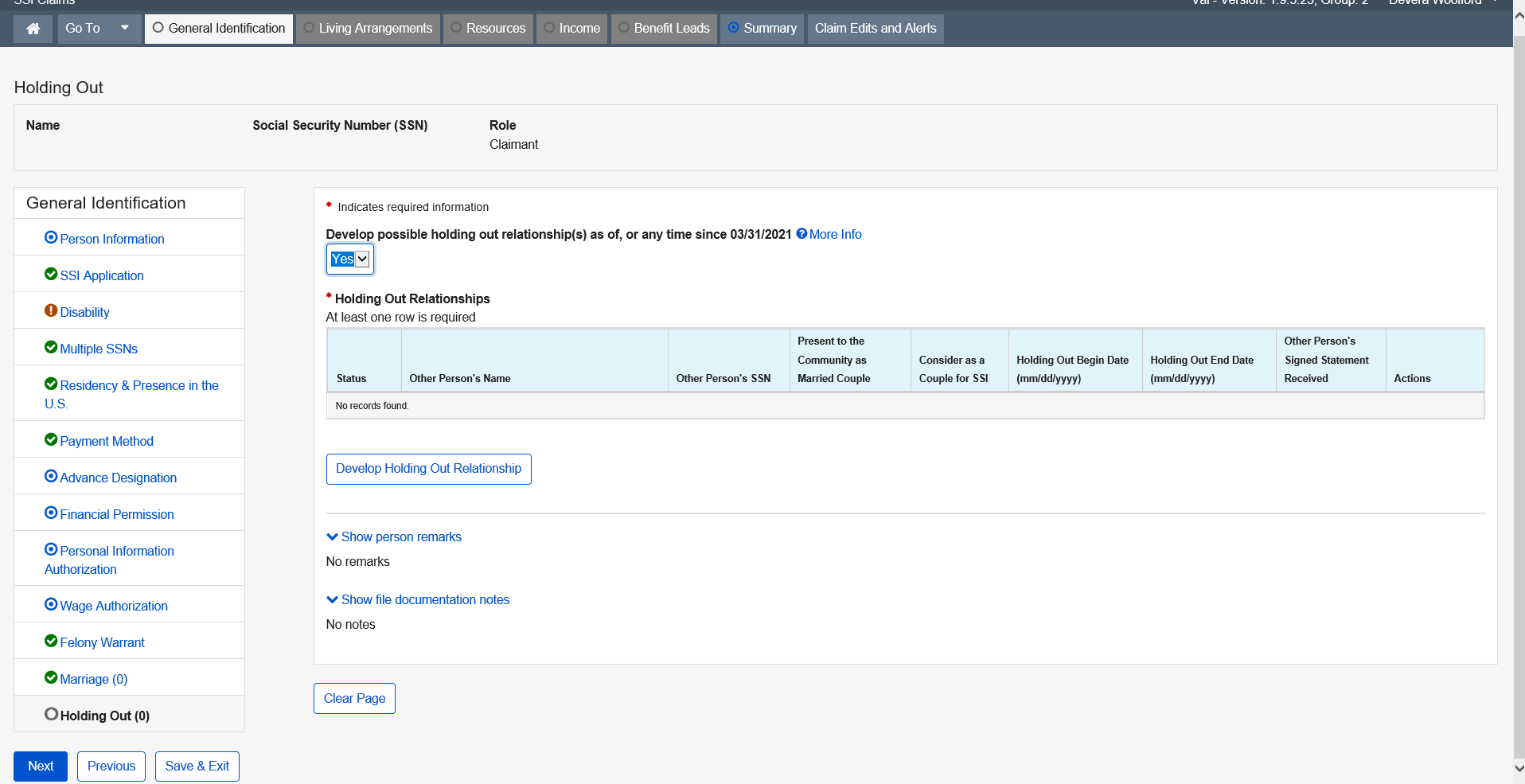

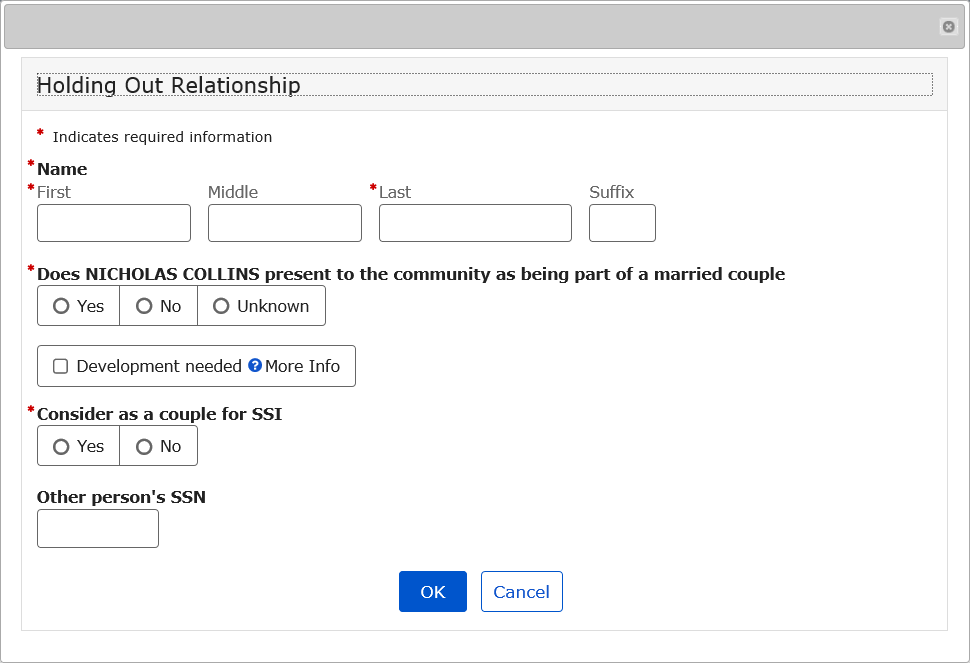

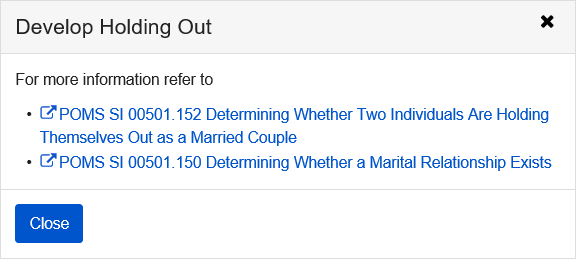

This page collects the information about the possible holding out relationship(s) of the person. It also collects the decision about a holding out relationship. The information collected on the Holding Out page is shared data among all claims where that person’s SSN is active.

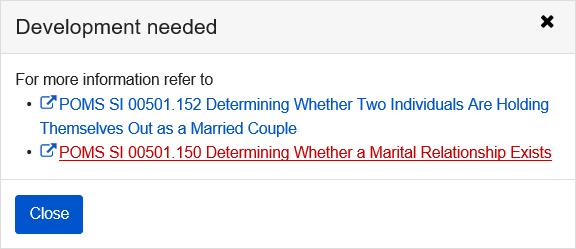

Develop

possible holding out relationship(s) as of, or any time since

xx/xx/xxxx is Yes

Modal Window:

Develop Holding Out Relationship

More Info link:

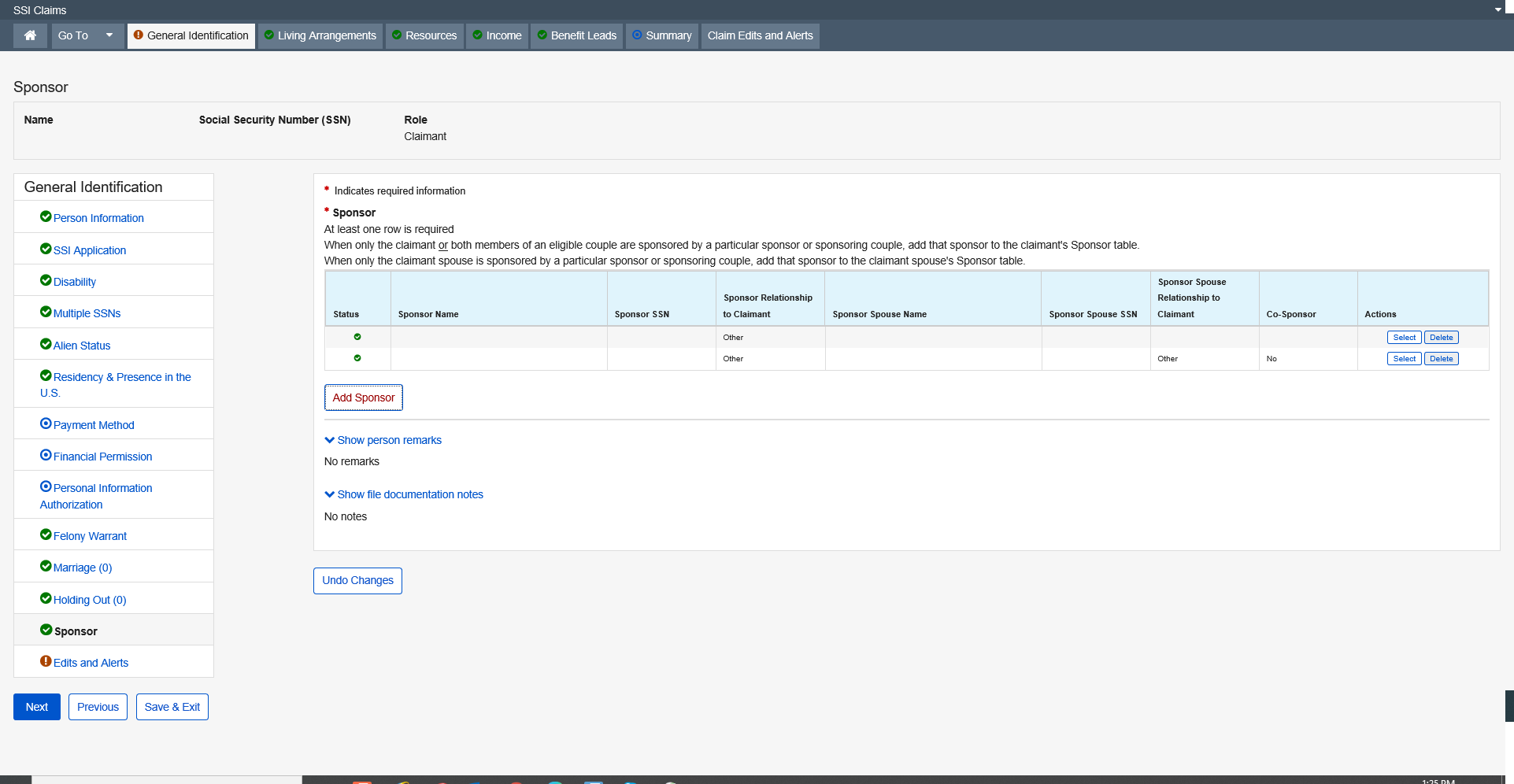

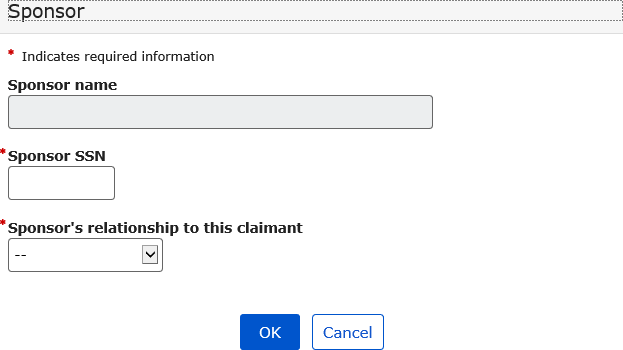

This page collects preliminary information about the claimant's individual sponsors and their spouses. This information is used to determine the sponsors, co-sponsor spouses, and sponsor's spouses that exist on the claimant’s record.

Modal Window:

Add Sponsor

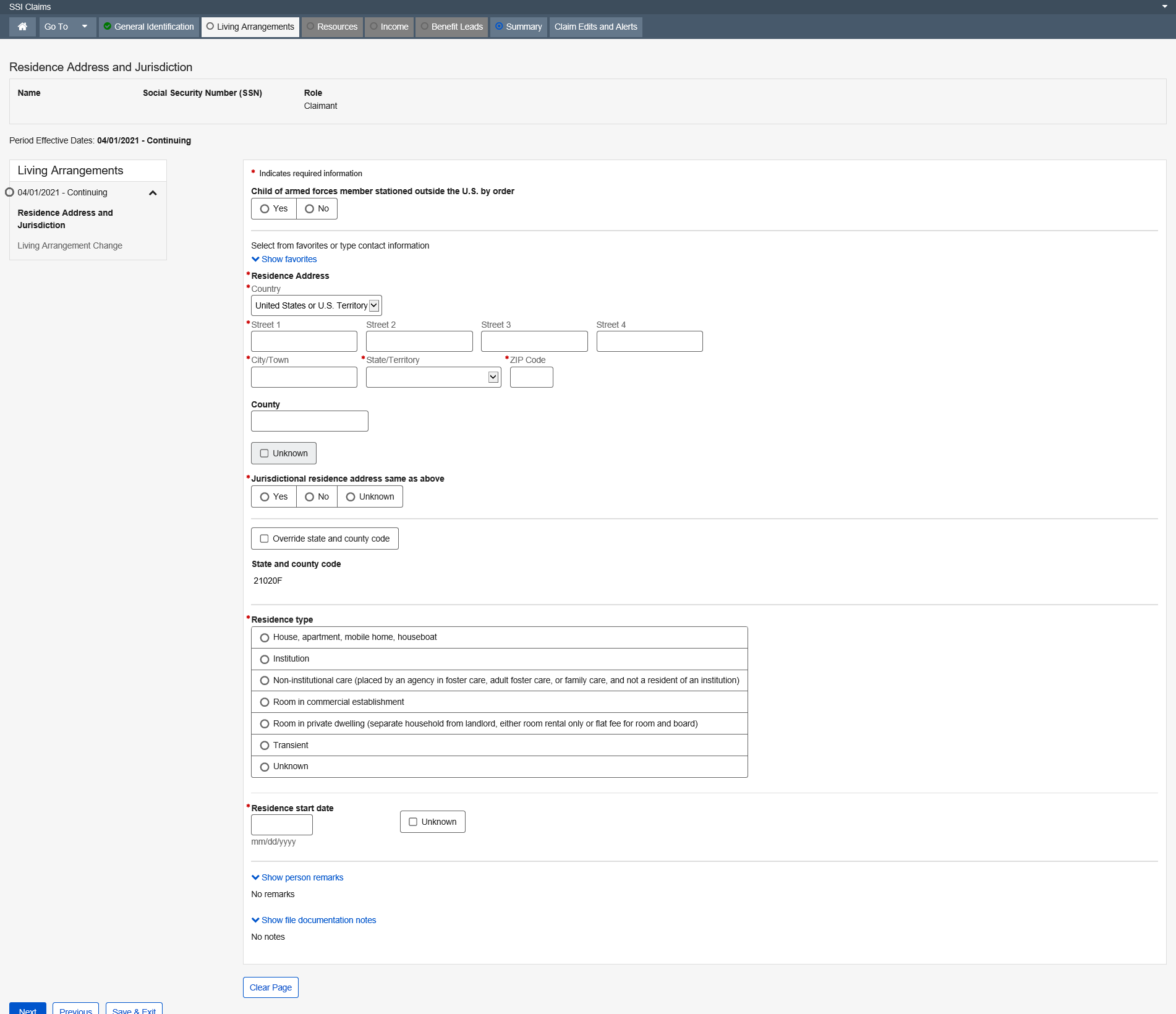

The Residence Address and Jurisdiction page collects the claimant’s physical residence address and jurisdictional address when it is different from the physical residence address. In addition, it is used to record additional residence related data to determine the claimant’s federal living arrangement. It is the first living arrangement data collection page in the SSI application for deferred, full, and abbreviated claims.

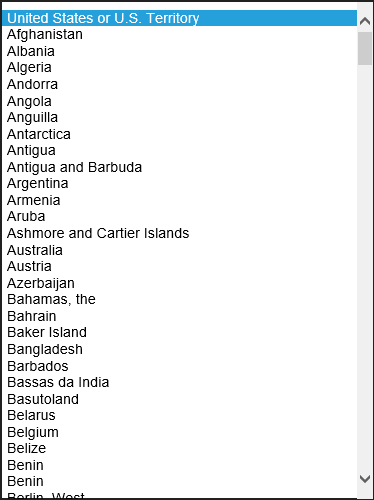

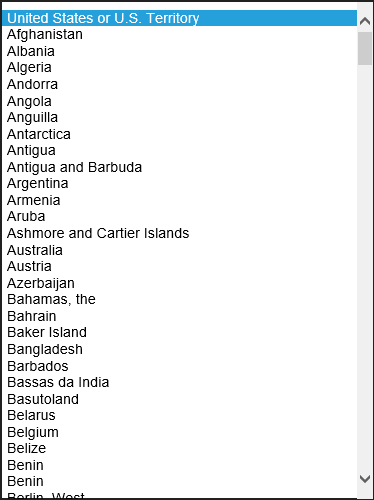

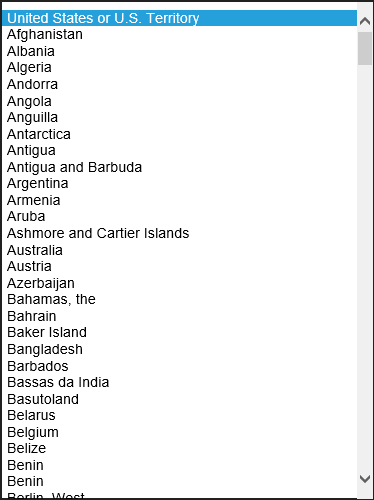

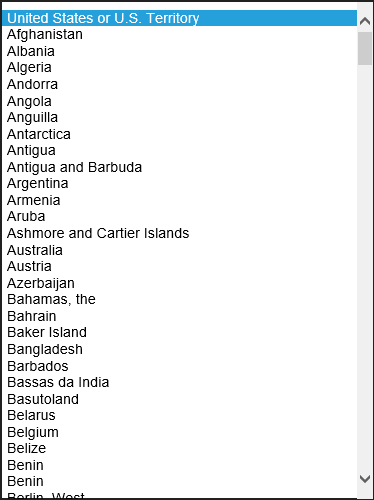

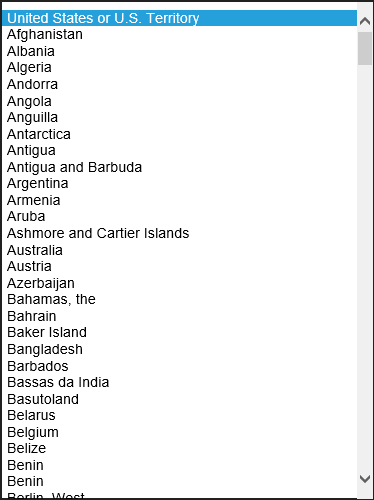

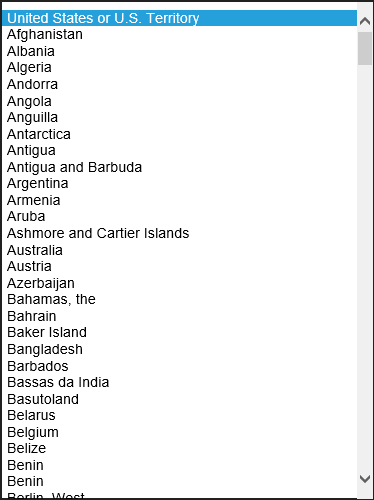

Dropdown list:

Country

State/Territory

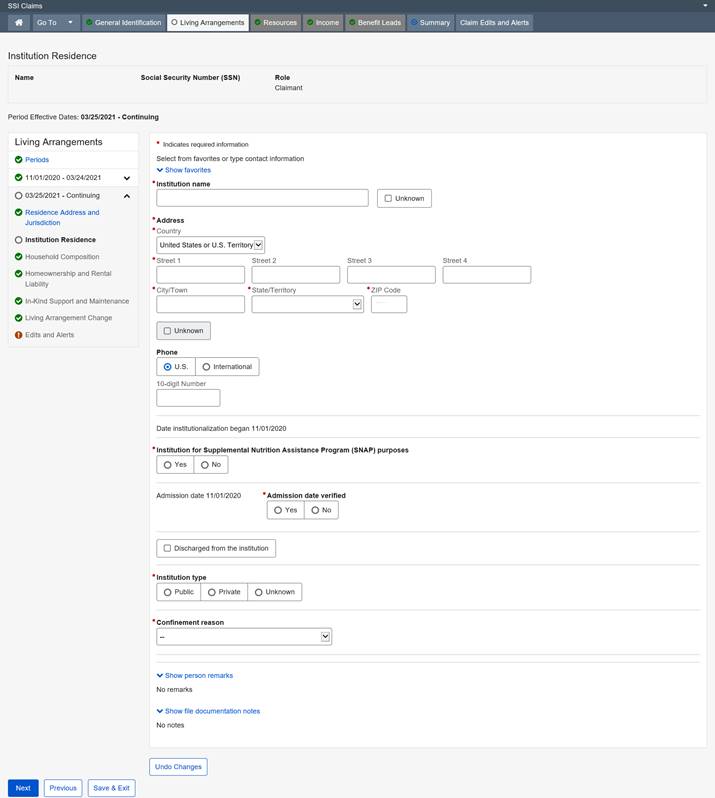

The purpose is to record residence data collected when the claimant is residing in an institution.

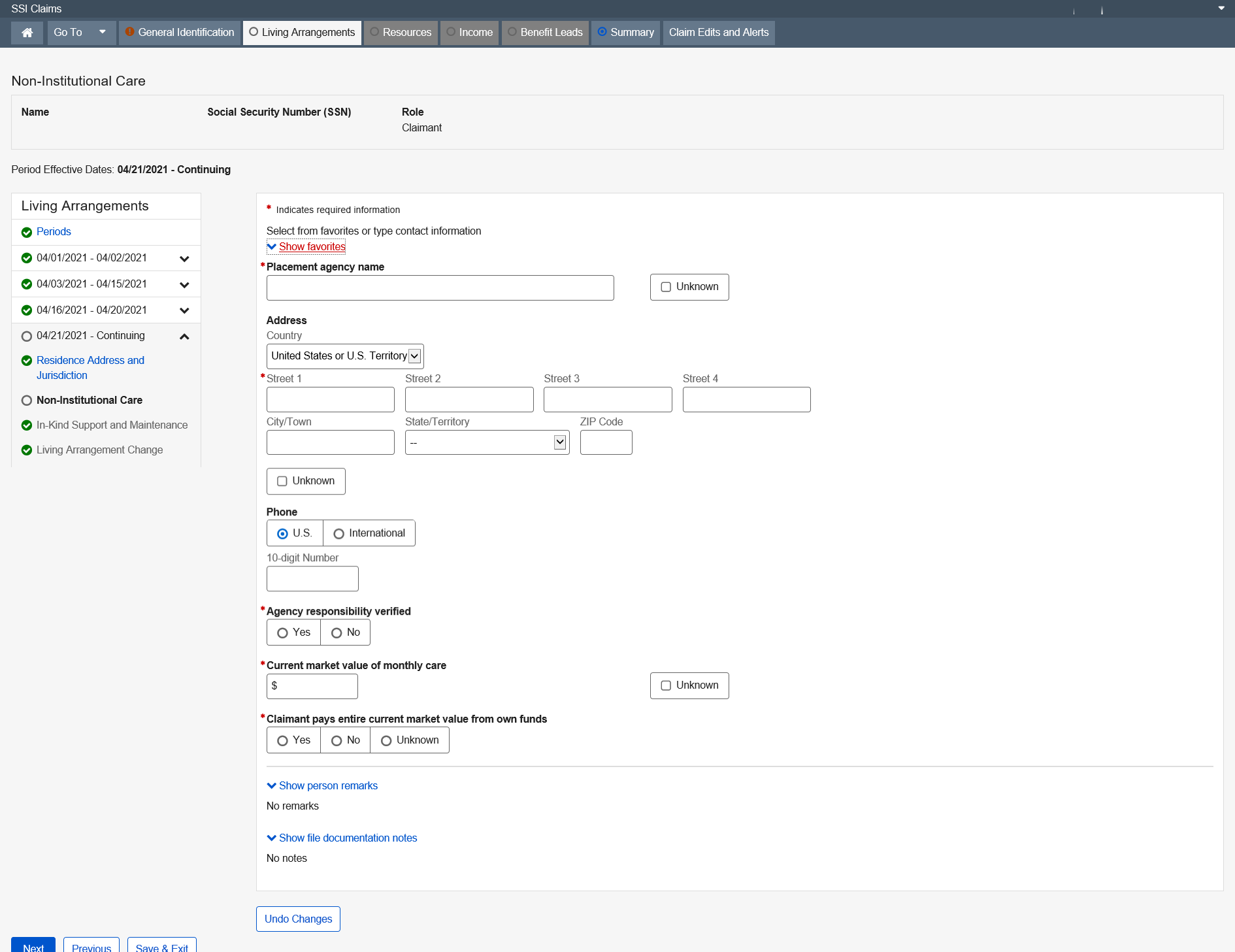

This page collects living arrangement information when the claimant lives in a non-institutional care situation. Non-Institutional Care is when the claimant is placed by a public or private agency under a specific program of protective placement such as foster or family care. This information is necessary to document the living arrangement determination.

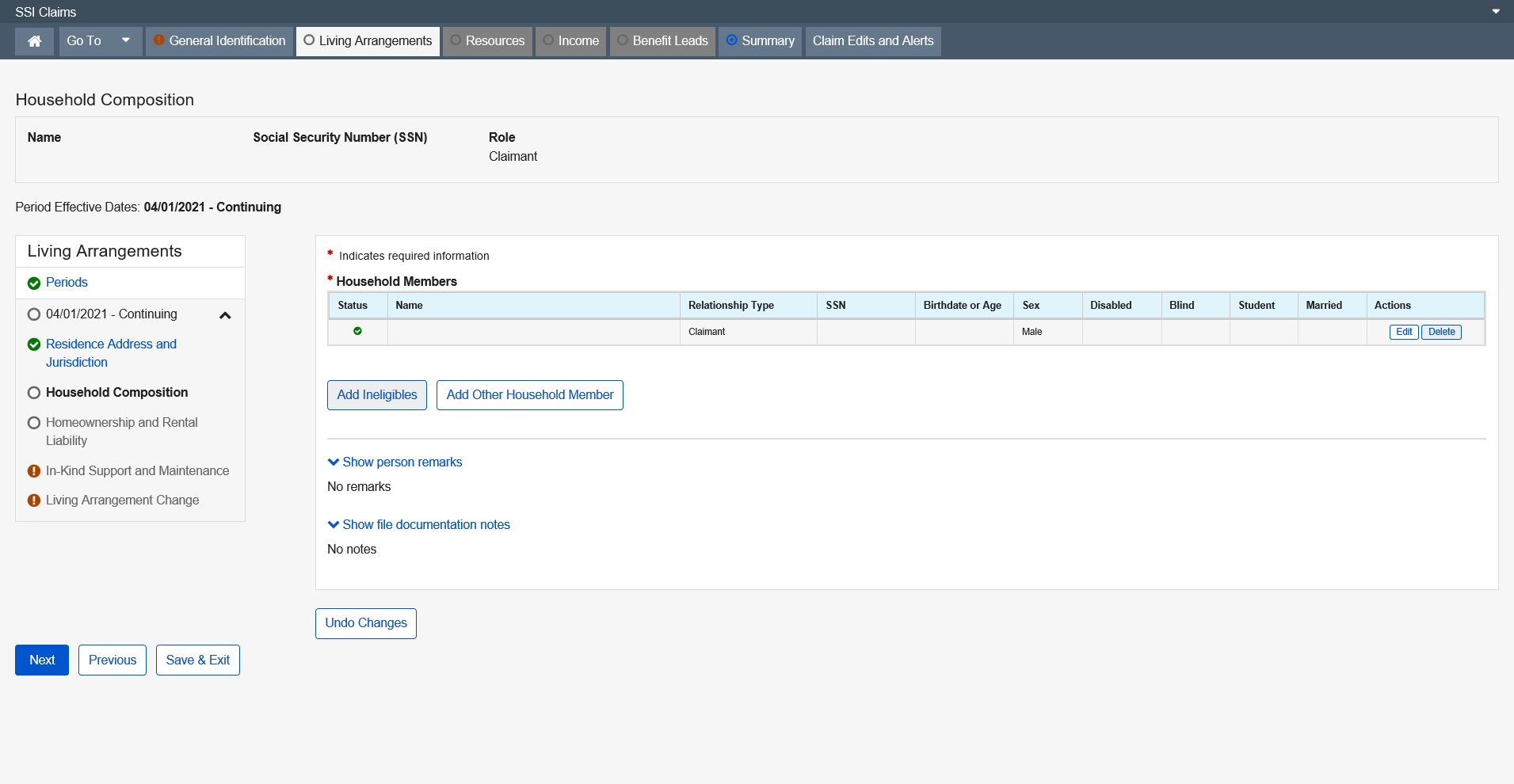

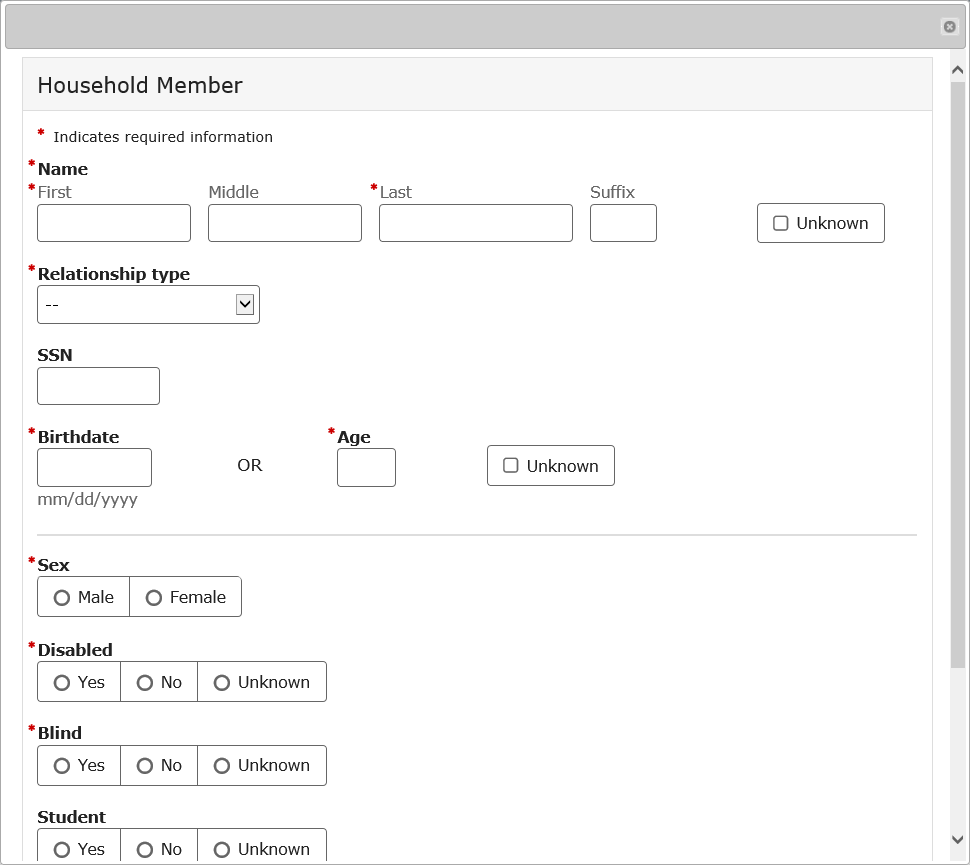

The Household Composition page exists to collect household composition information necessary for decisions relating to the federal living arrangement determination, in-kind support and maintenance from within the household and deeming.

Modal Window:

Add Other Household Members

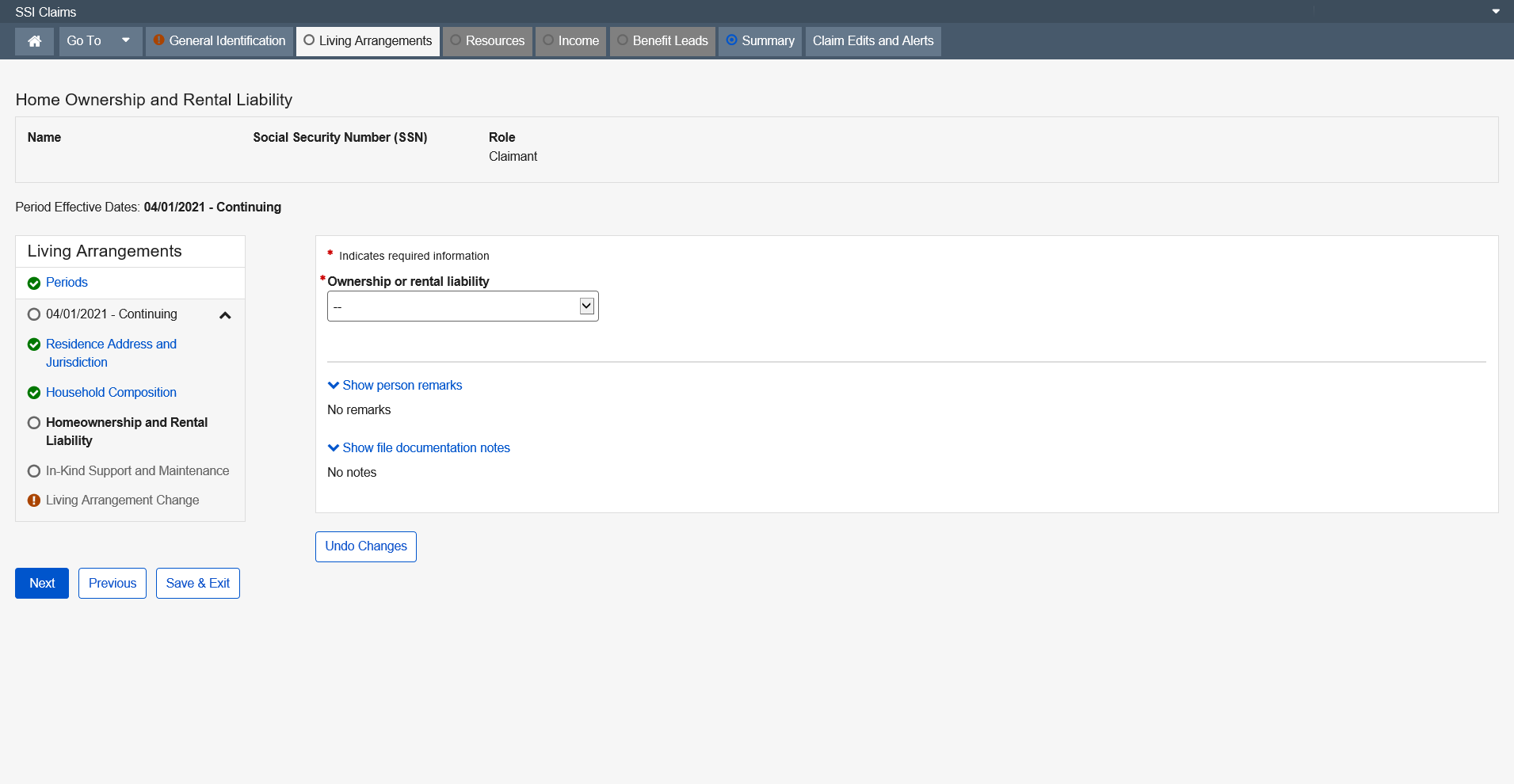

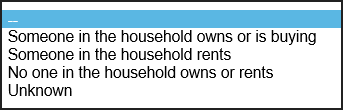

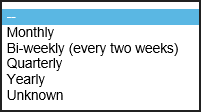

The Home Ownership and Rental Liability page collects data regarding home ownership or rental liability in household situations. It collects the mortgage or rental payment amount and frequency of mortgage or rental payment, whether anyone in the household is a child or parent of the landlord, current market value of the home and landlord information. This information is used in conjunction with other living arrangement screens to determine eligibility and/or payment amount.

Dropdown list:

Ownership or Rental liability

Payment Frequency

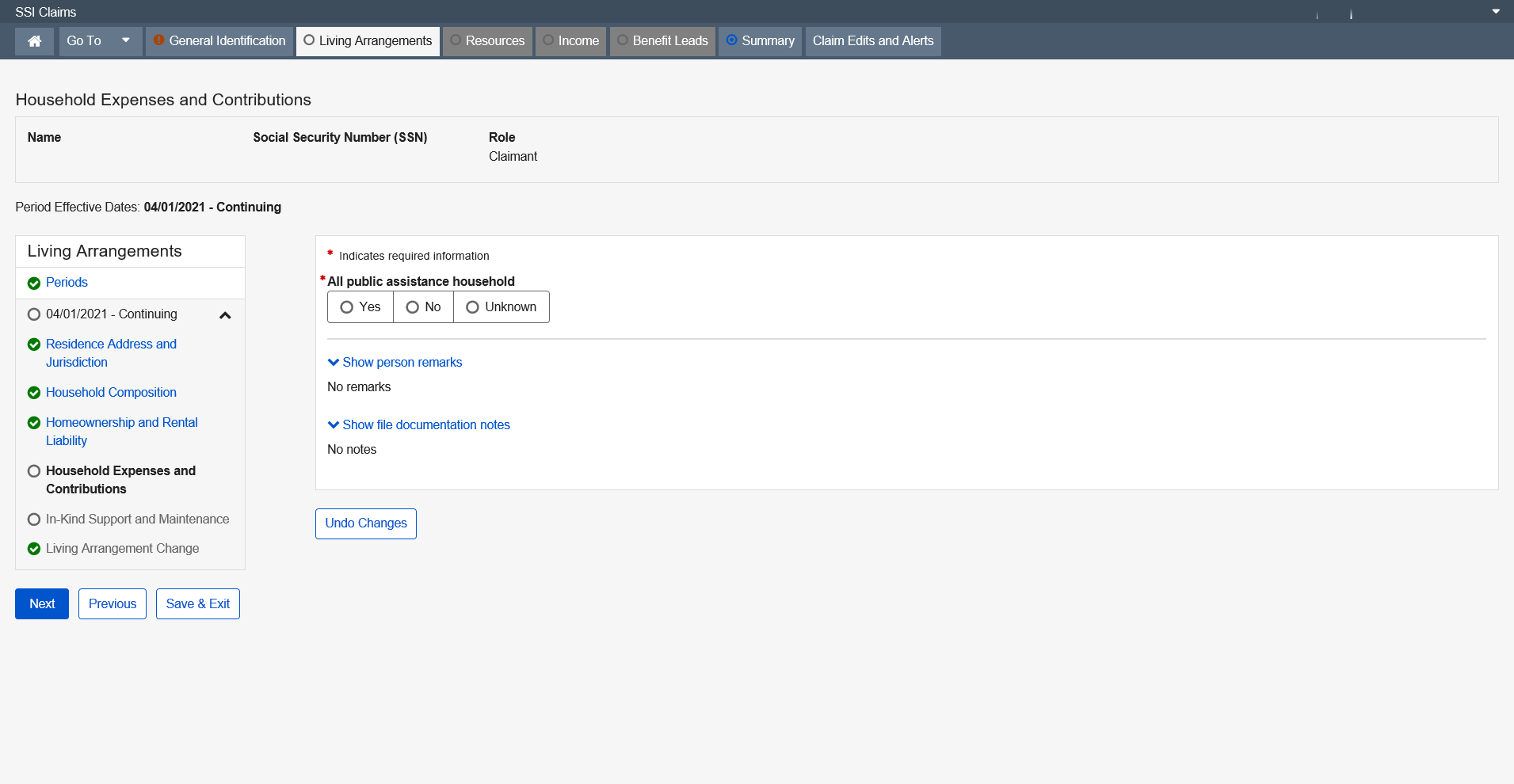

This page documents:

Whether the claimant lives in an all public assistance household, or a public assistance household subject to the payment cap.

Whether the claimant lives in the household of another, and whether a bona fide loan agreement exists between the claimant and another household member to cover the claimant's share of the household expenses.

The claim representative’s decision as to whether unstated income or the probability of inside in-kind support and maintenance (ISM) is an issue in special situations.

When the claimant owns or rents, this page also collects information about household expenses and contributions needed to derive the amount of in-kind support and maintenance and cash received by the claimant or eligible couple from within the household, as well as the monthly loan amount when there is a loan agreement that does not meet the "assume to cover pro rata share" requirement.

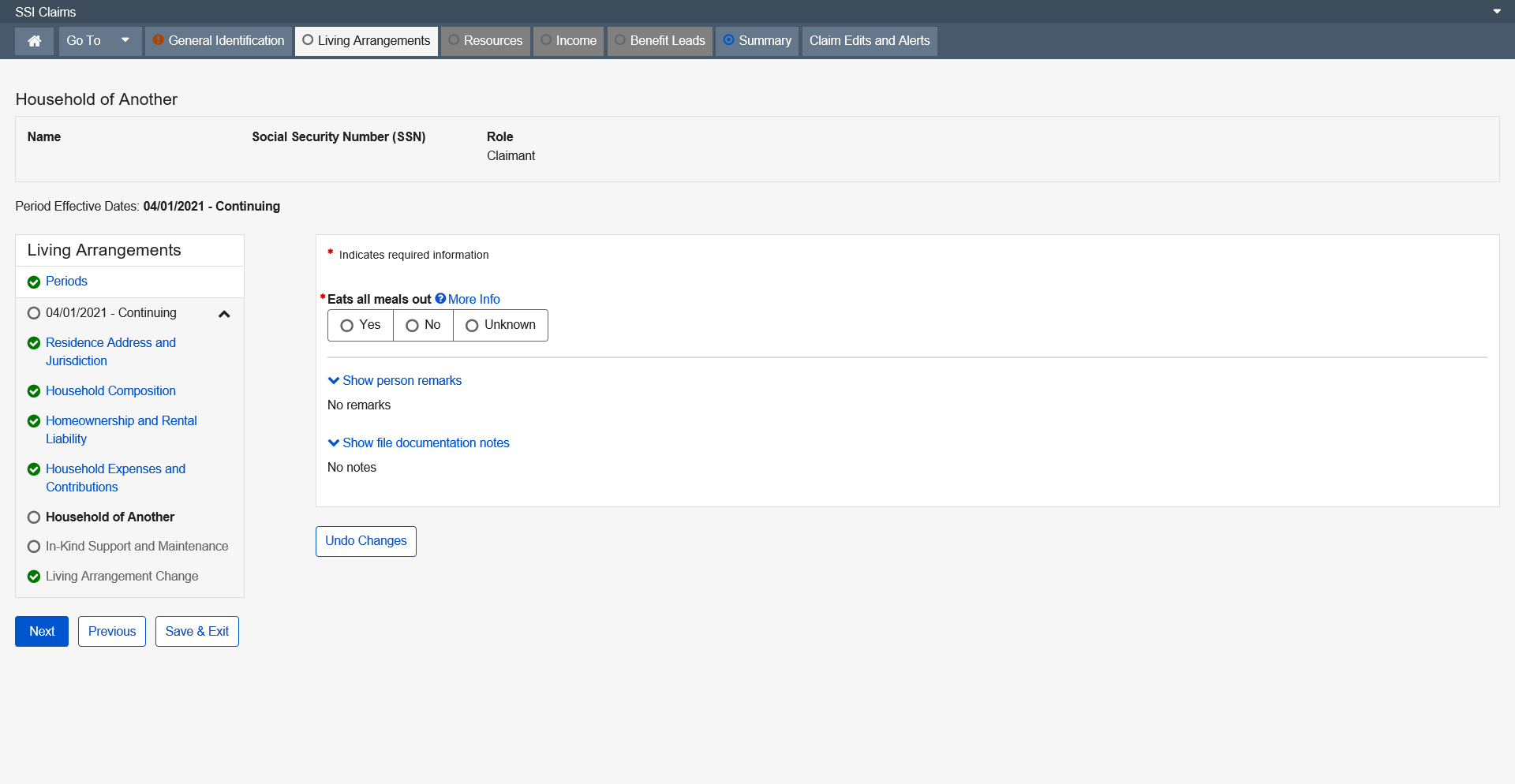

This page collects the data to determine if the claimant pays his or her pro rata share of the household expenses when the claimant is not the householder (owner/renter). It also collects the information needed to determine if the claimant receives in-kind support and maintenance from the household.

More Info link:

Eat all meals out

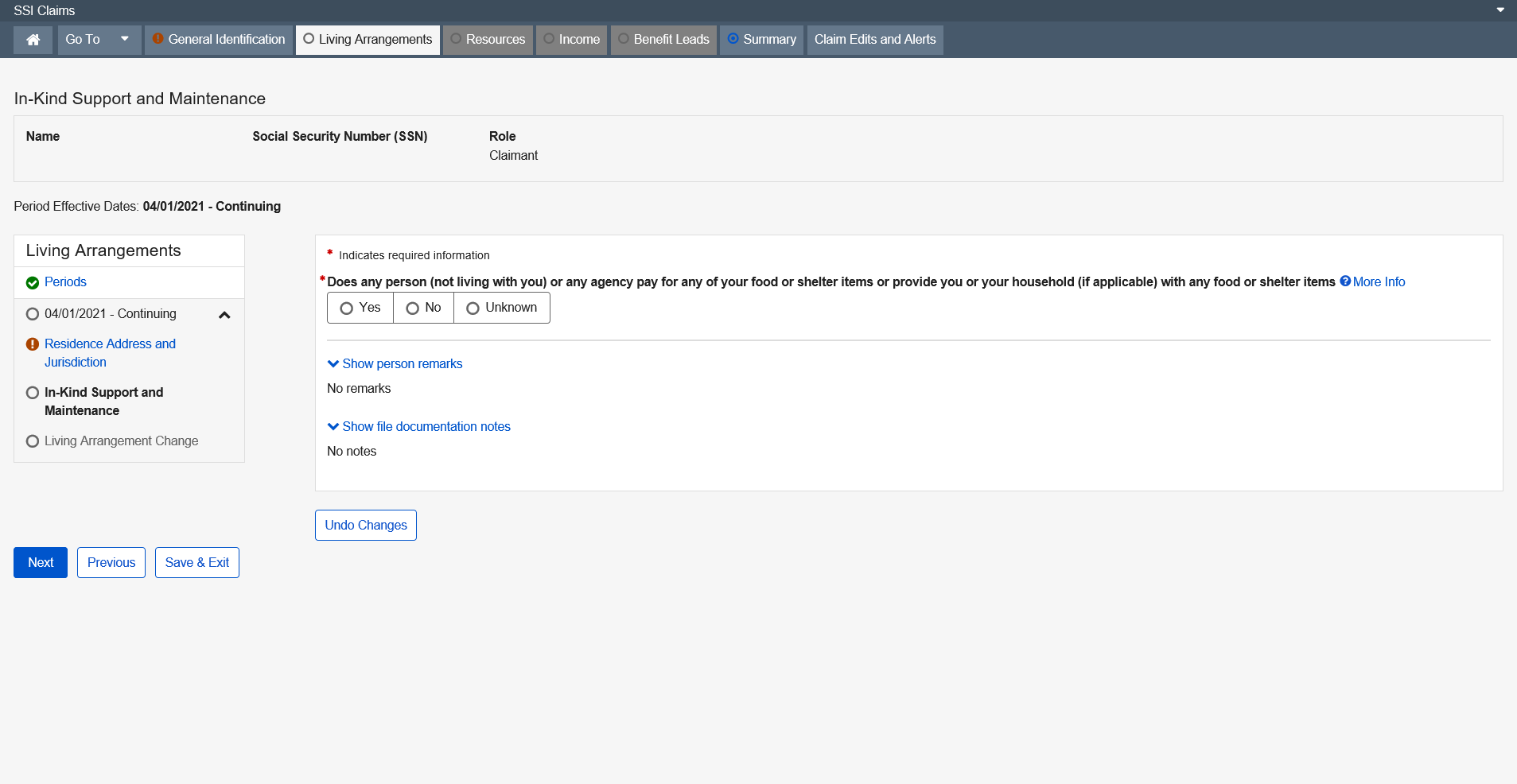

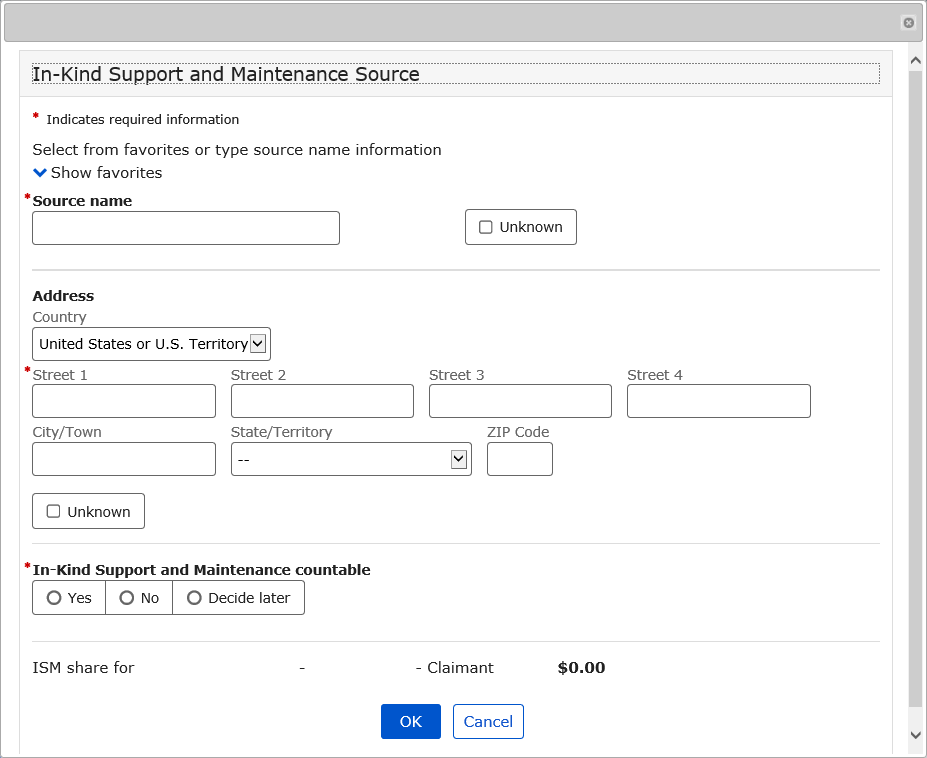

This page collects the data to determine if outside In-Kind Support and Maintenance applies for full applications. It collects information about all types of ISM other than inside ISM; i.e., collects information on ISM to one, institutional ISM, and outside ISM.

More Info link:

Modal Window:

Add ISM

The California Optional Supplement page collects the claimant’s responses to questions required of all SSI applicants in the state of California. It also records the Claim Representative’s determination of the appropriate State Supplementation code.

The Massachusetts Optional Supplement page documents the claimant’s household expenses in claims with living arrangement periods prior to 04/2012. The documentation of the claimant’s household expenses on this page was necessary to determine if the claimant meets the 2/3 of household expense requirement. It also records the Claim Representative’s determination of the appropriate State Supplementation code.

The Michigan Optional Supplement page documents the claimant’s eligibility for Michigan Optional Supplement payments. It records the Claim Representative’s determination of the appropriate State Supplementation code.

The New Jersey Optional Supplement page documents the claimant’s eligibility for New Jersey Optional Supplement payments. It records the Claim Representative’s determination of the appropriate State Supplementation code.

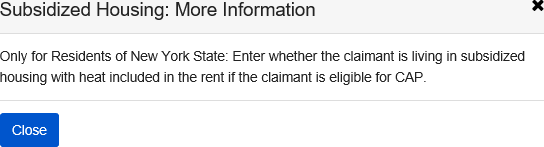

The New York Optional Supplement page documents the claimant’s eligibility for New York Optional Supplement payments.

More Info link

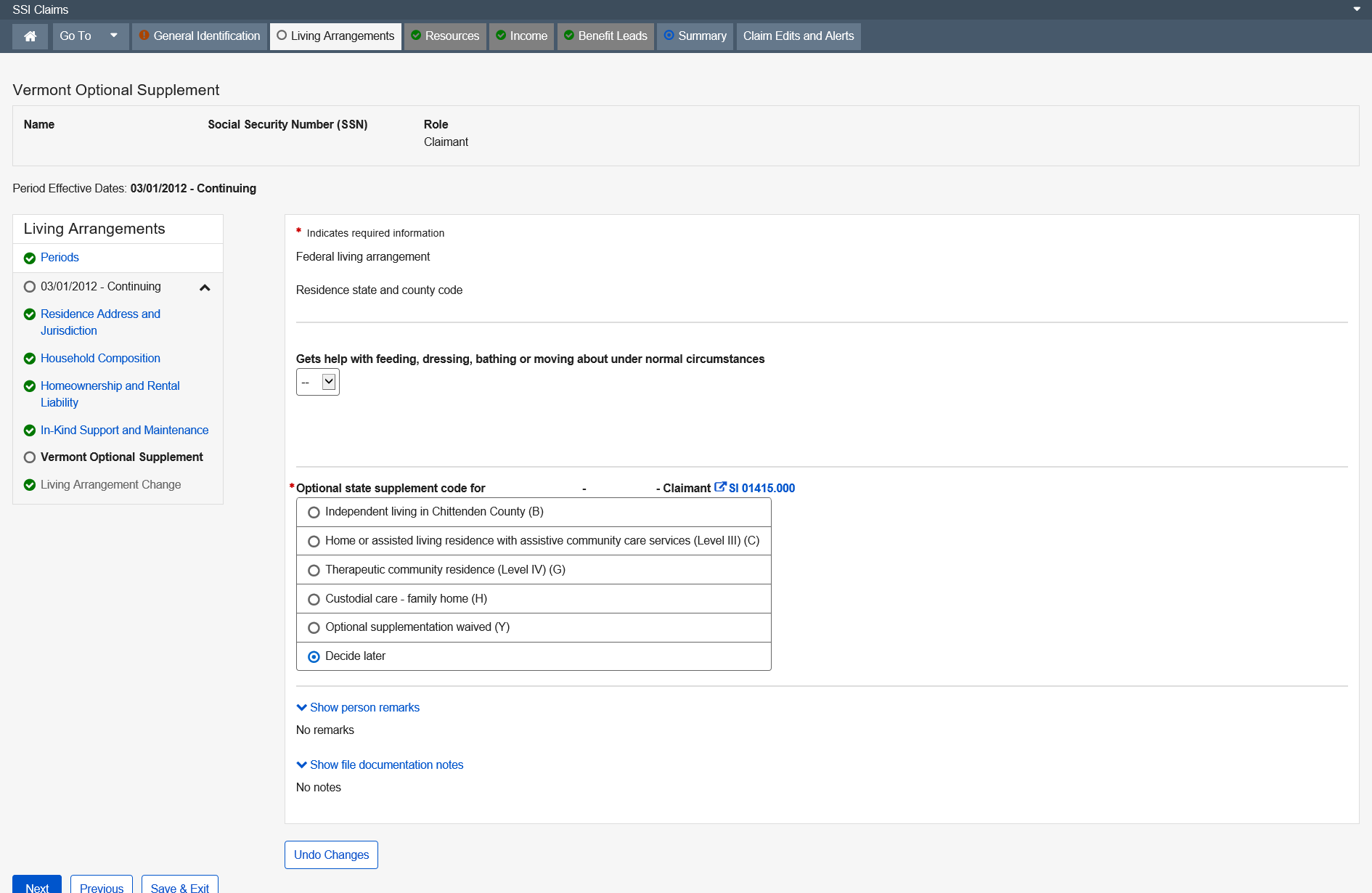

The Vermont Optional Supplement page documents the claimant’s eligibility for Vermont Optional Supplement payments. It records the determination of the appropriate State Supplementation code.

More Info link

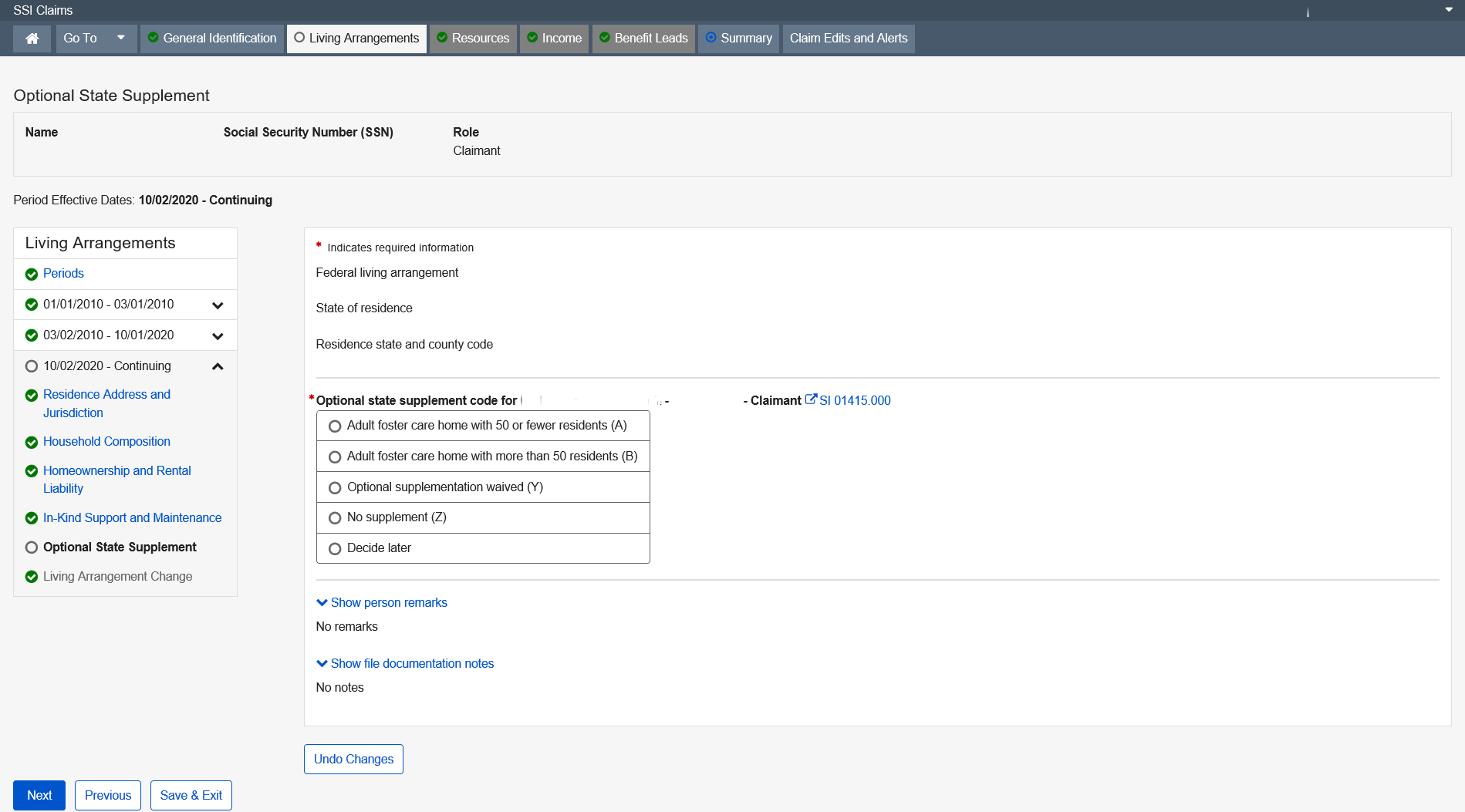

The Optional State Supplement page is used to collect the identifying information that documents the claimant's eligibility for optional state supplementary payments.

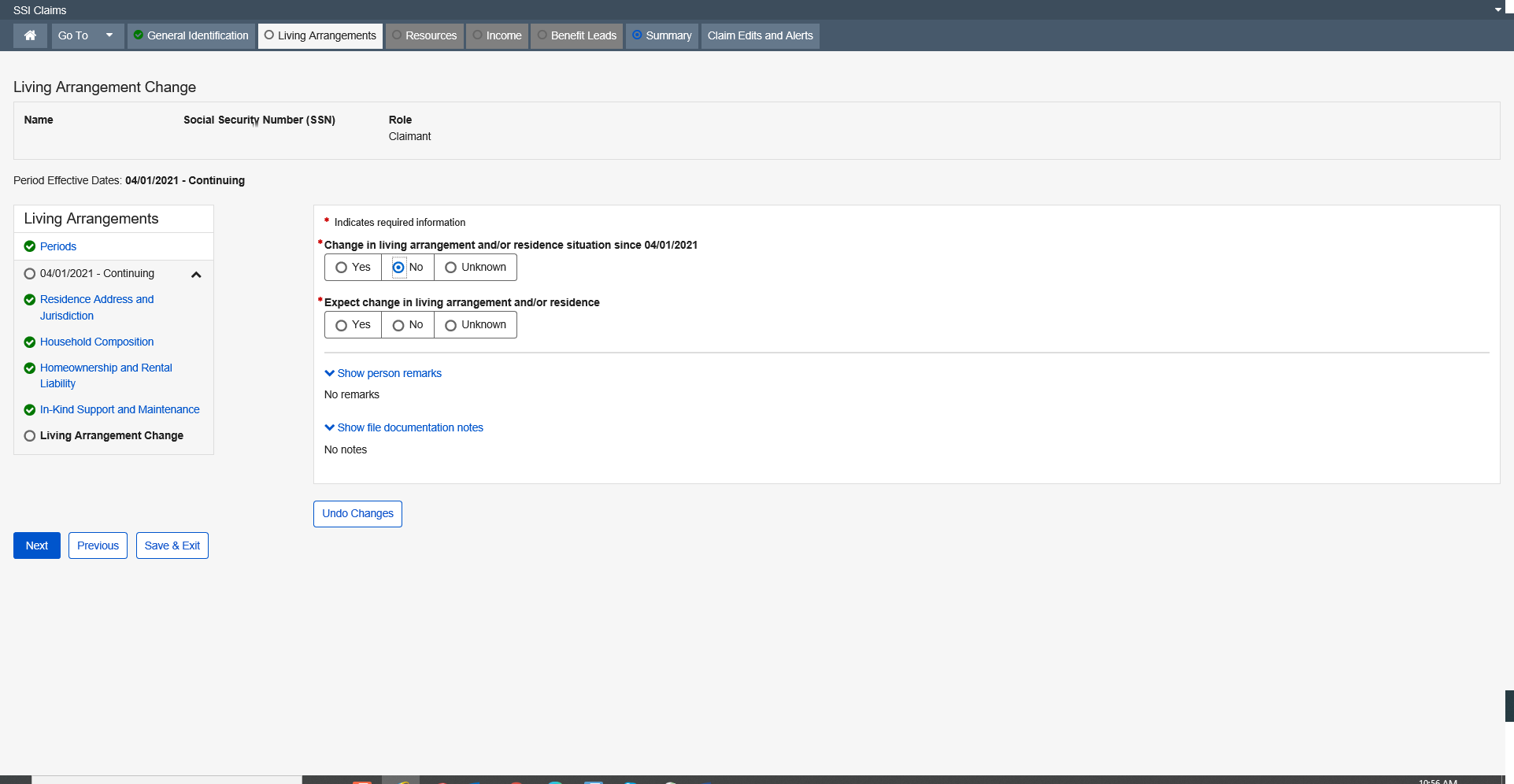

The Living Arrangement Change page exists to record the claimant’s allegation about whether or not the living arrangement information already collected has changed. It also indicates whether a living arrangement change is expected.

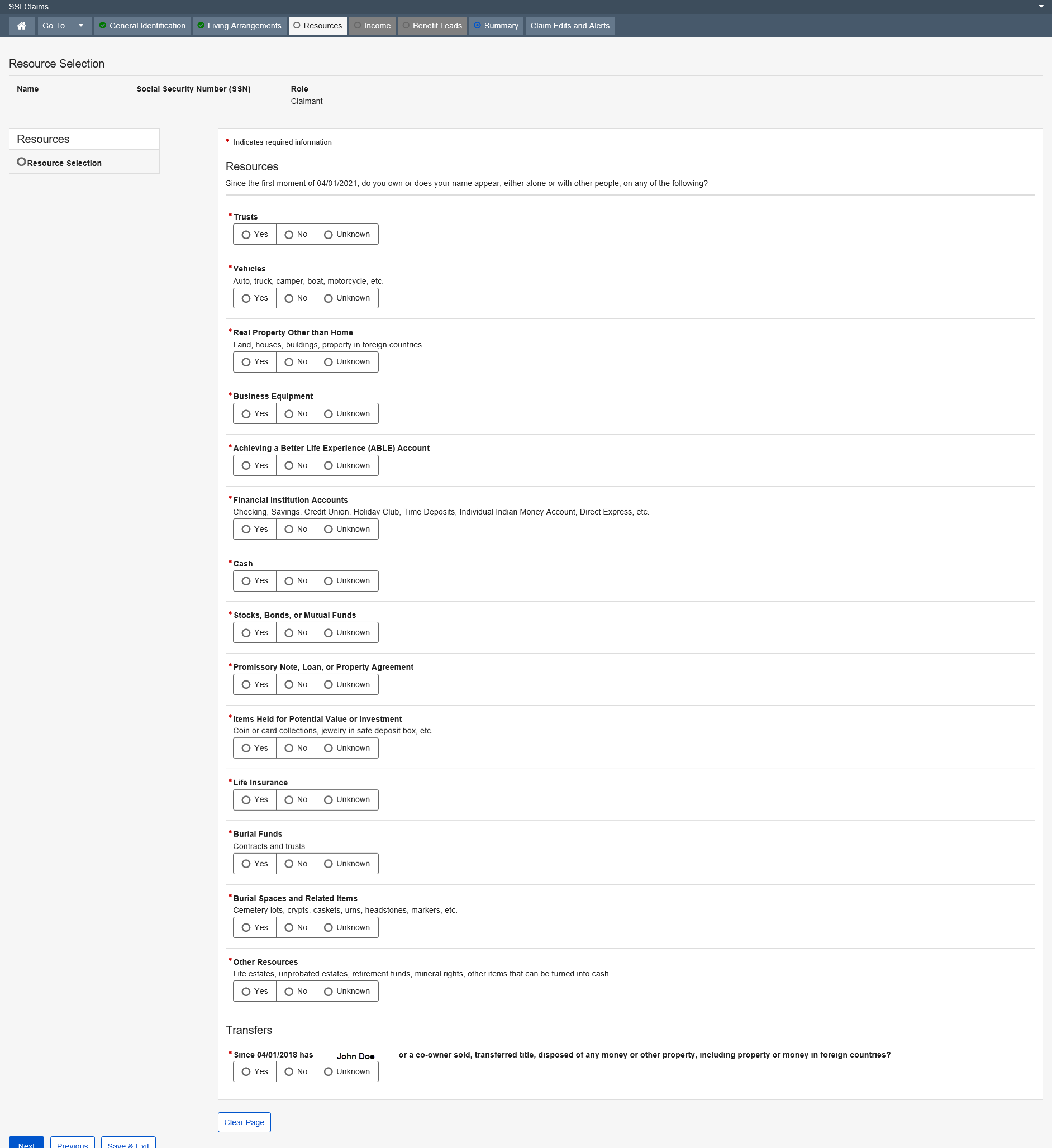

The Resource Selection page collects and displays information about the resources owned by the claimant or deemor (claimant, claimant spouse, ineligible spouse, parent, sponsor, sponsor spouse, and co-sponsor spouse associated with the claim). This page collects the claimant’s or deemor’s allegation of ownership for each resource type and is used to trigger the first source of a resource type into the SSI Claim path. When a source of a particular resource type already exists in the SSI Claim path, this page displays information about the existing sources. This page provides an option for the user to add another source of an existing resource type. During preeffectuation reviews or redeterminations, the page provides a way for the user to indicate which of the existing resources will be presented as he walks the path.

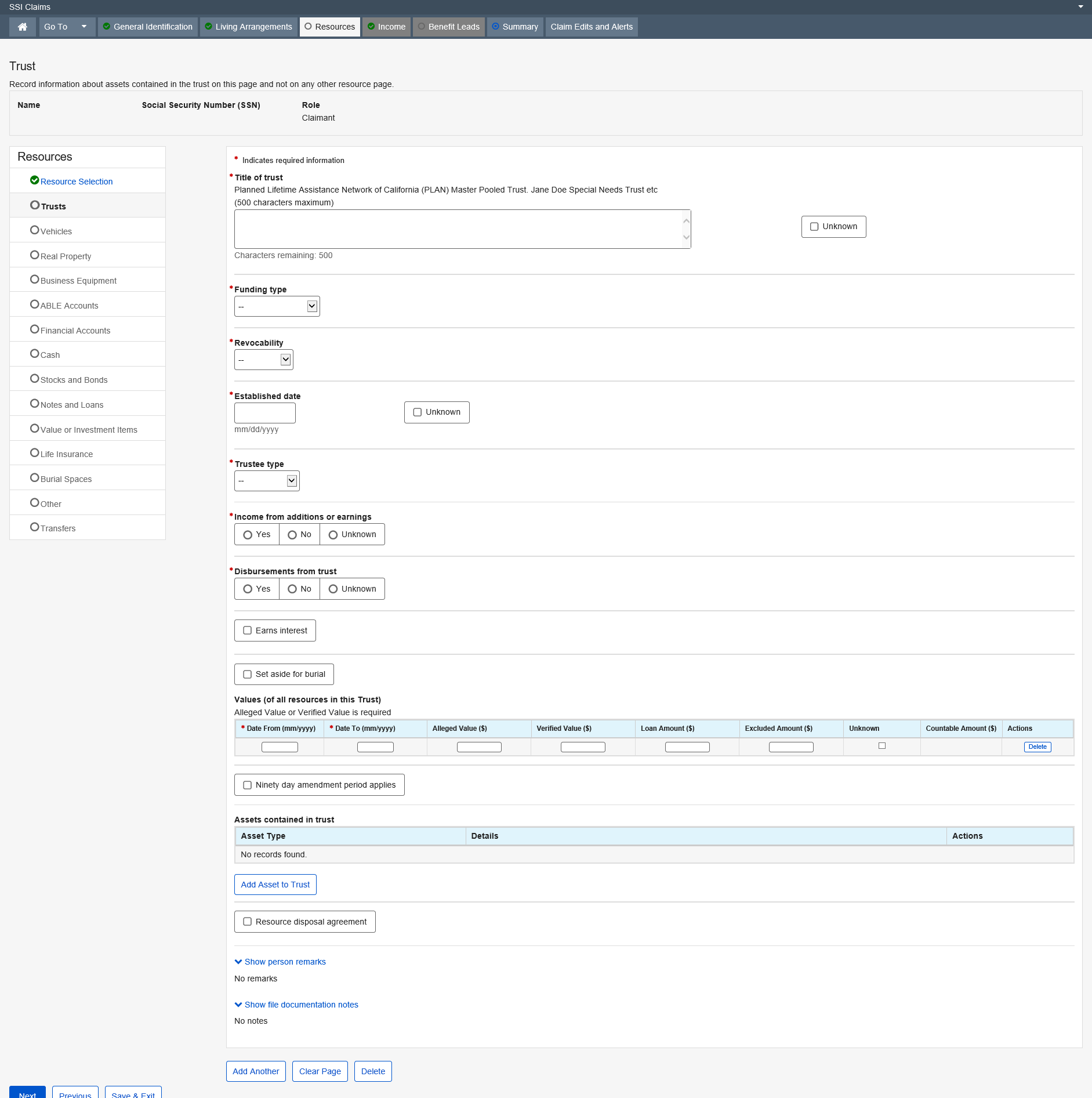

The Trust page collects information about trusts for Supplemental Security Income (SSI) claimants and deemors. The page collects information about any trusts (excluding burial trusts) which the claimant or deemors own or whose name appears on the title. It also records assets contained within the trust and a description of those assets. The value section of the page records the combined value of the assets contained within the trust including the total loan amounts against those assets. This information is used, in conjunction with other resource pages, to determine the claimant's countable resources.

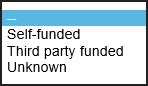

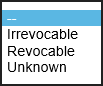

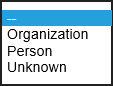

Dropdown list:

Funding type

Revocability

Trustee type

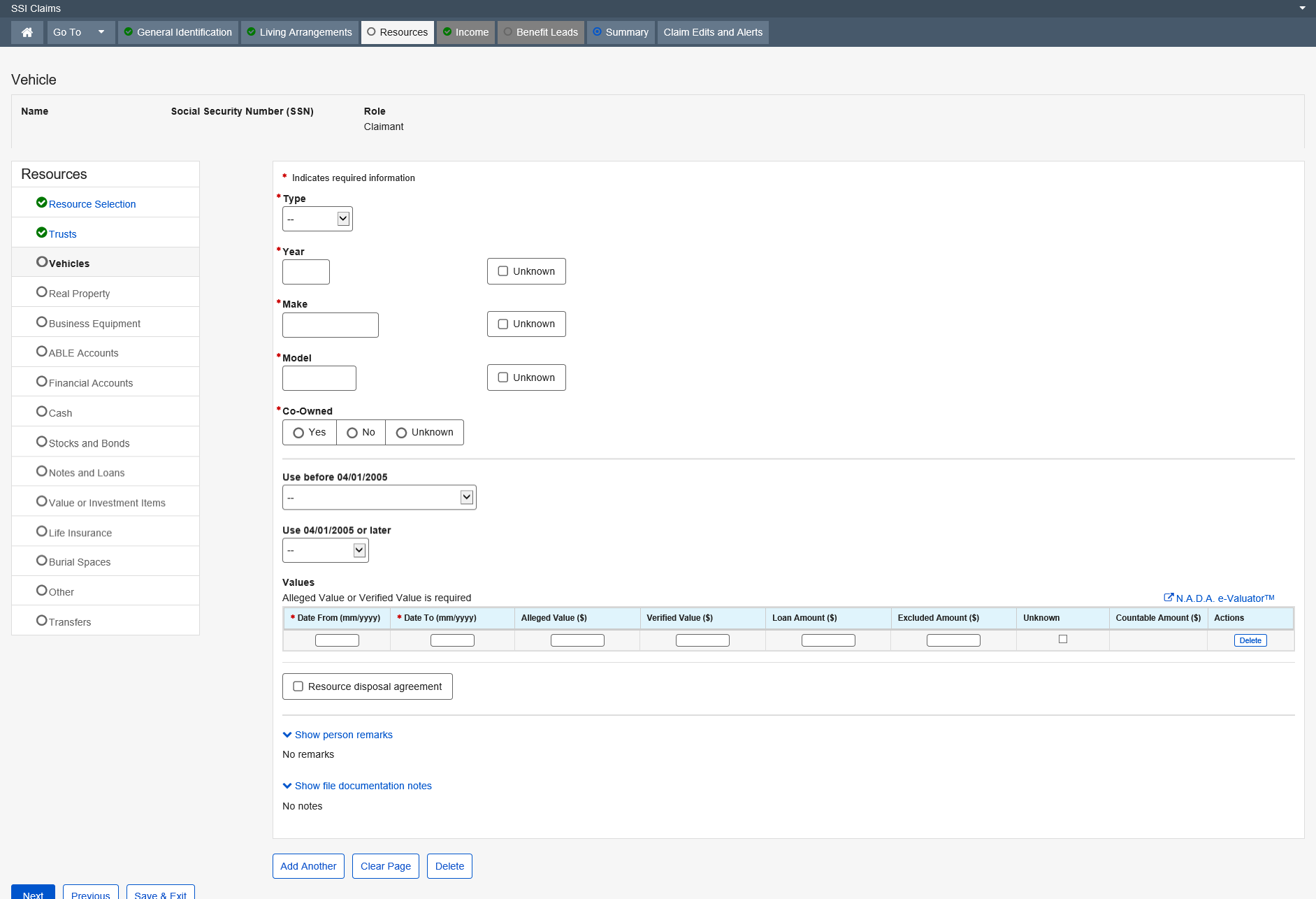

The Vehicle page collects information about any vehicles (e.g., cars, trucks, boats, motorcycles, etc.) which the claimant or deemor’s own or whose name appears on the title. It also records a description of the vehicle, the market value, the amount owed on a loan for which this vehicle is security and the use of the vehicle. This information is used, in conjunction with other resource pages, to determine the claimant's countable resources.

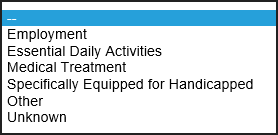

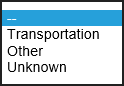

NOTE: Due to a regulations change effective March 9, 2005, two USE fields (04/01/2005 OR LATER and BEFORE 04/01/2005) were added to accommodate the proper documentation of the use of the vehicle during each of those time-periods.

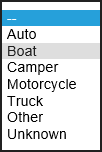

Dropdown list:

Type

Use before 04/01/2005

Use 04/01/2005 or later

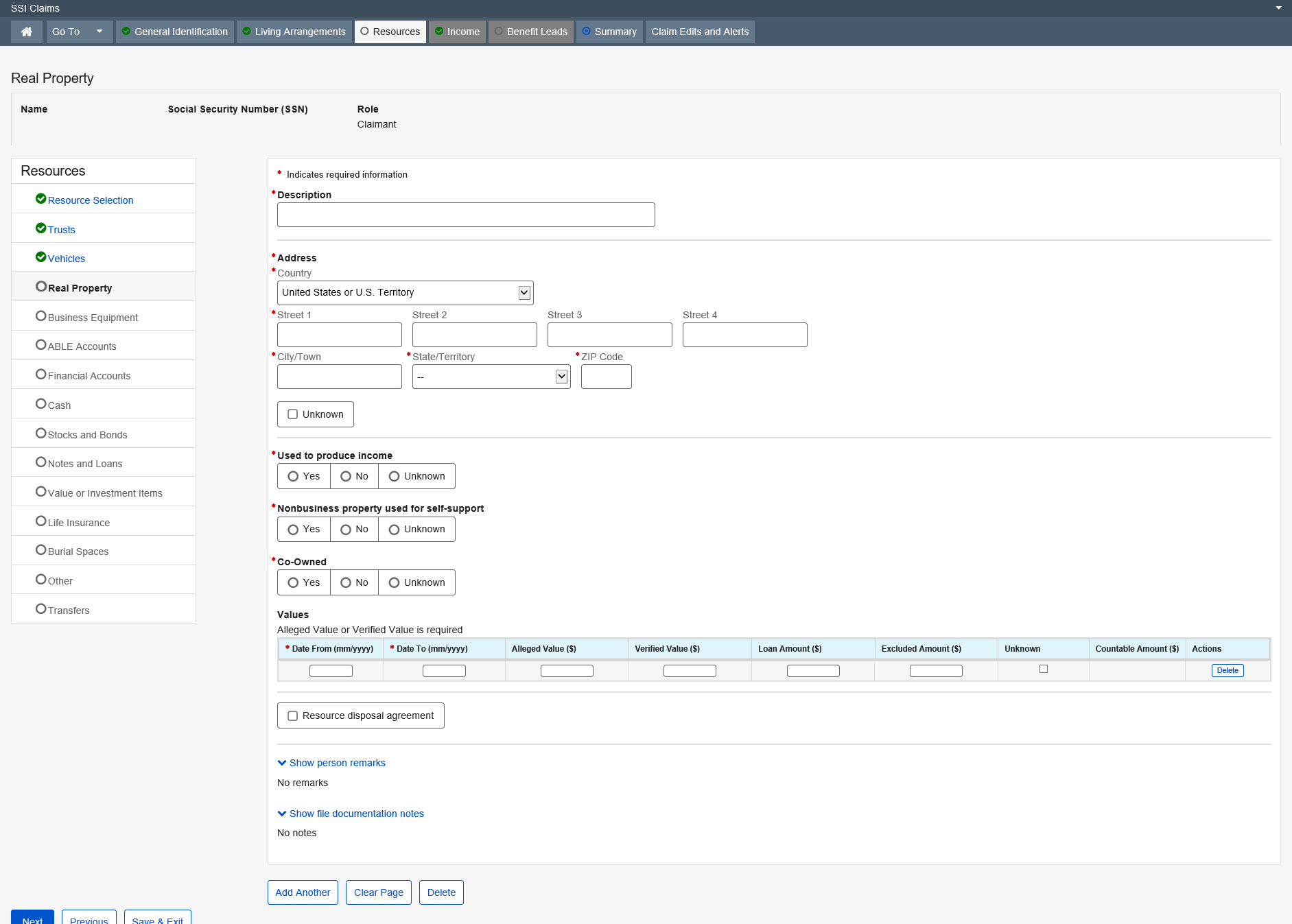

The Real Property page is used to collect the identifying information for any real property that is owned by the claimant, eligible spouse and/or deemors. In addition to the identifying information, this data group collects the value of the resource. For example: land, houses, buildings, and property in foreign countries.

Dropdown list:

Country – United States or U.S. Territory (Default)

State/Territory

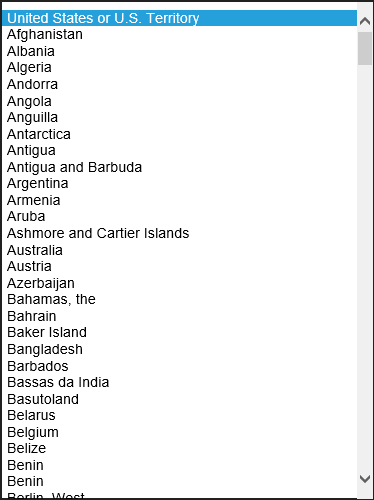

The Business Equipment page is used to collect business equipment information, values and whether or not the equipment is co-owned for resources. This information is used in conjunction with other resource pages to determine the claimant’s countable resources.

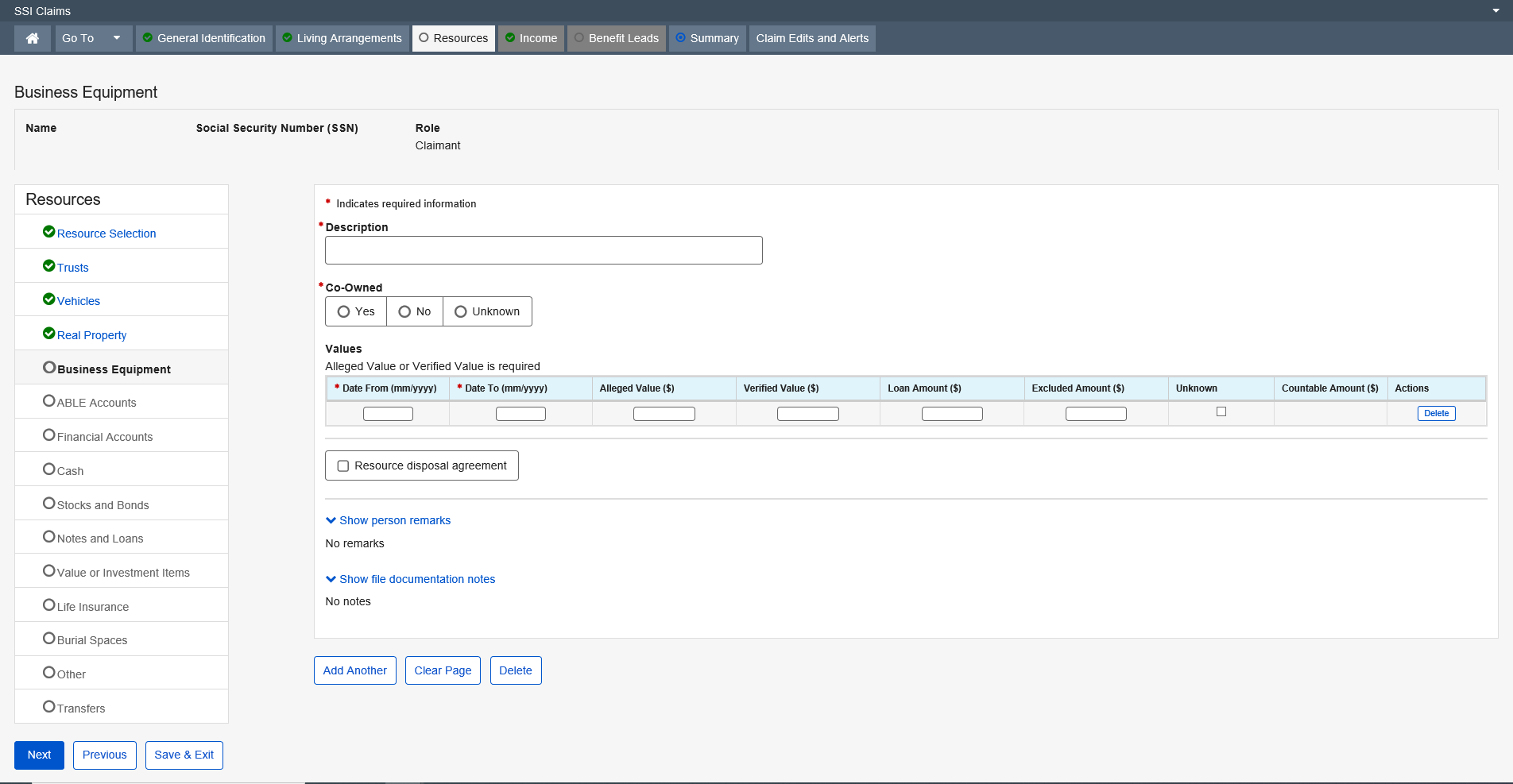

The Achieving a Better Life Experience (ABLE) Account page (hereafter referred to as the ABLE page) exists in the SSI Claims System for all claimants and deemors when an Achieving a Better Life Experience (ABLE) account has been reported to the Field Office.

Upon receipt of a state agency report, SSA’s systems employ a series of rules to match and update each account received to an existing ABLE account.

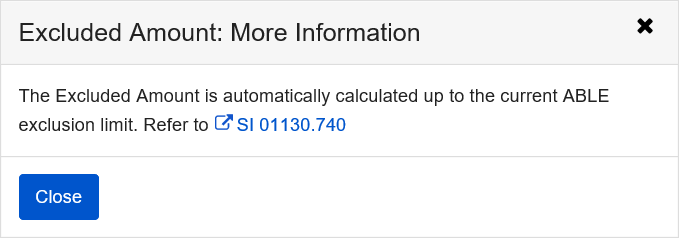

More Info:

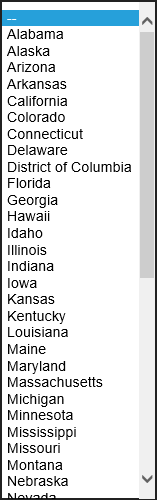

Dropdown list:

Program state

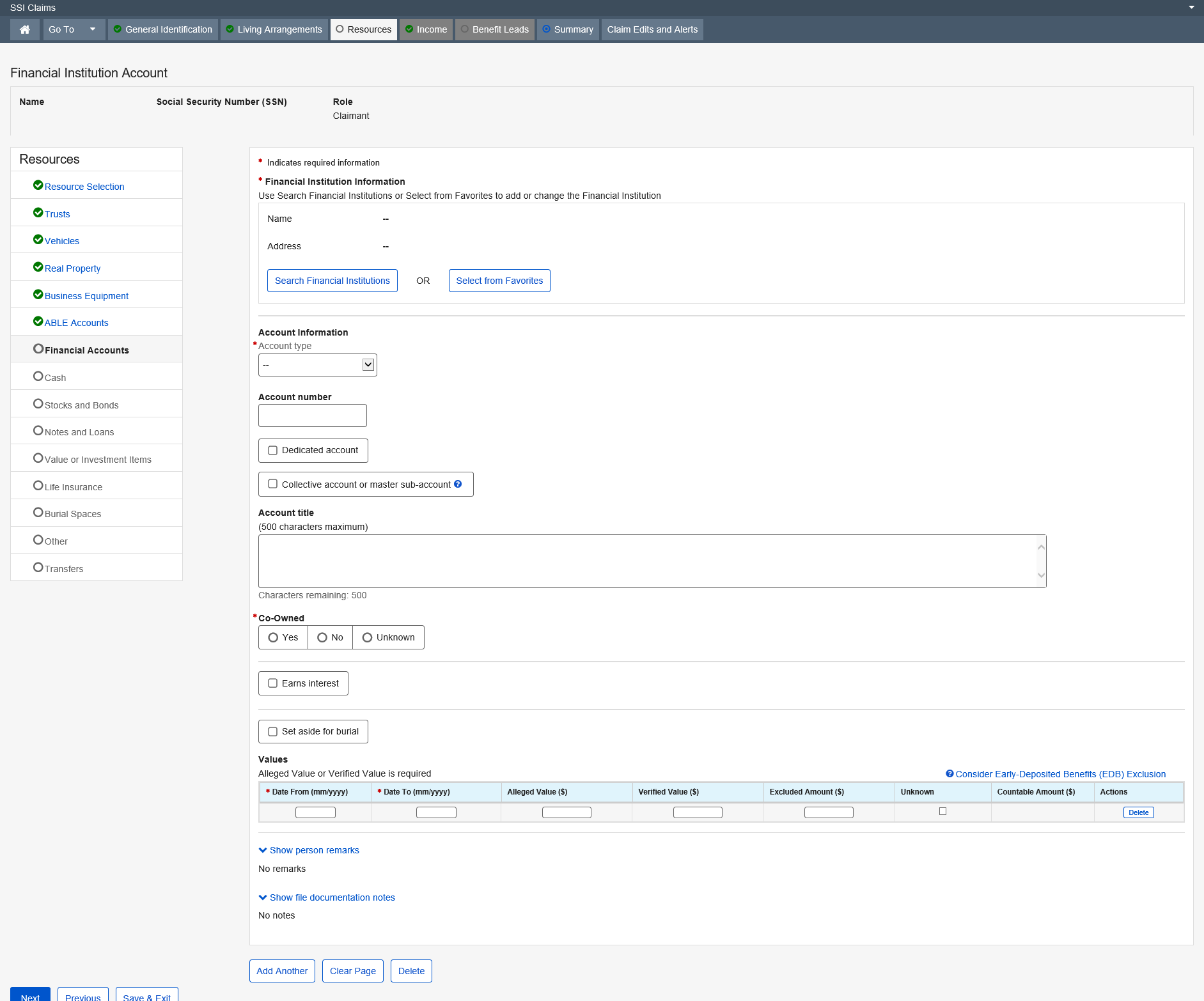

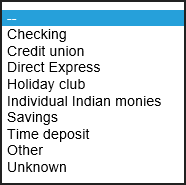

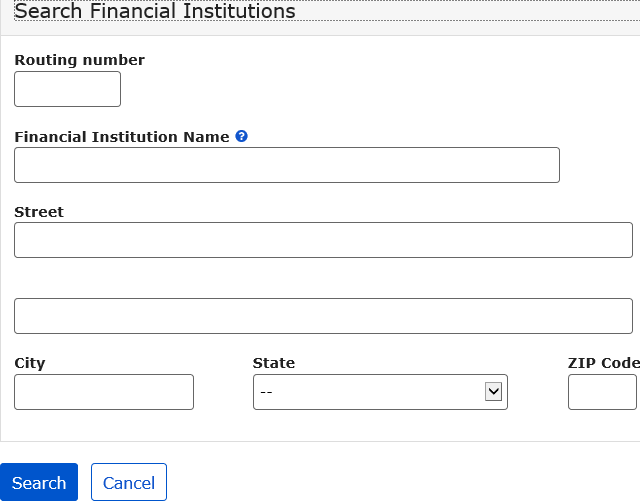

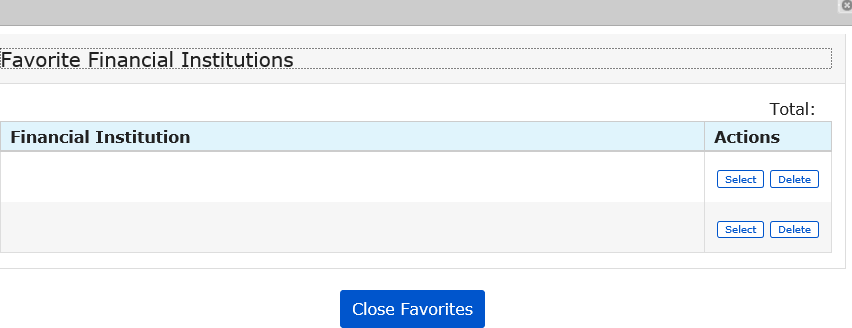

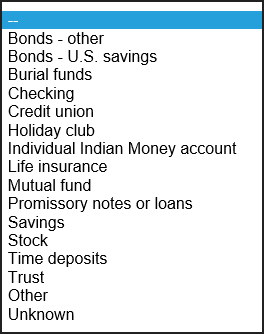

The Financial Institution Accounts pages exists in SSI Claims Systems, which records information about the financial institution accounts of Supplemental Security Income (SSI) claimants and deemors. The information collected includes: the type of financial institution account, the account number, the name and address of the financial institution, the value of the account for particular periods, and whether the account is co-owned, earns interest and/or is set aside for burial.

Dropdown list:

Account type

Modal Window:

Search Financial Institutions

Select from Favorites

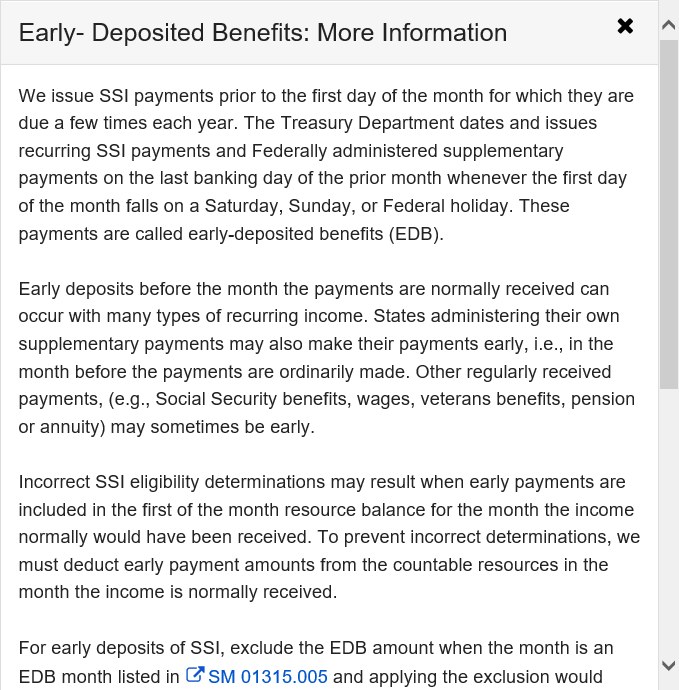

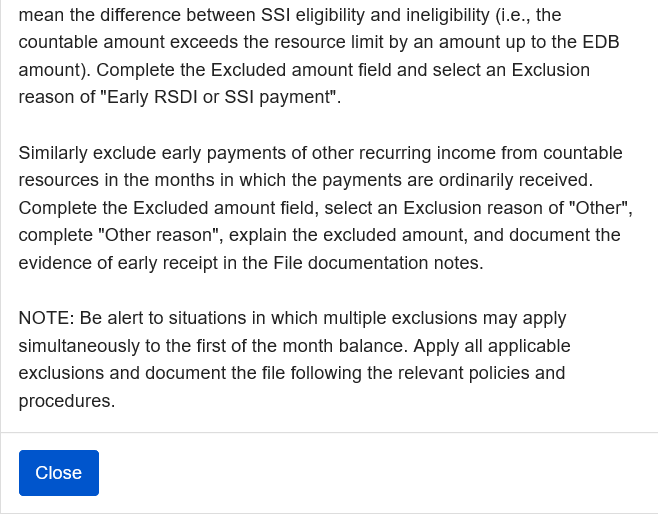

More Info link:

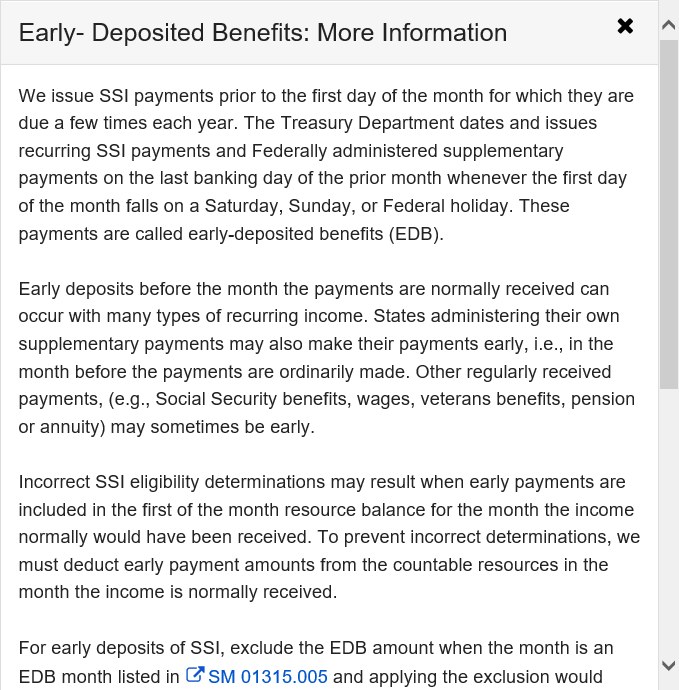

Consider Early-Deposited Benefits (EDB) Exclusion

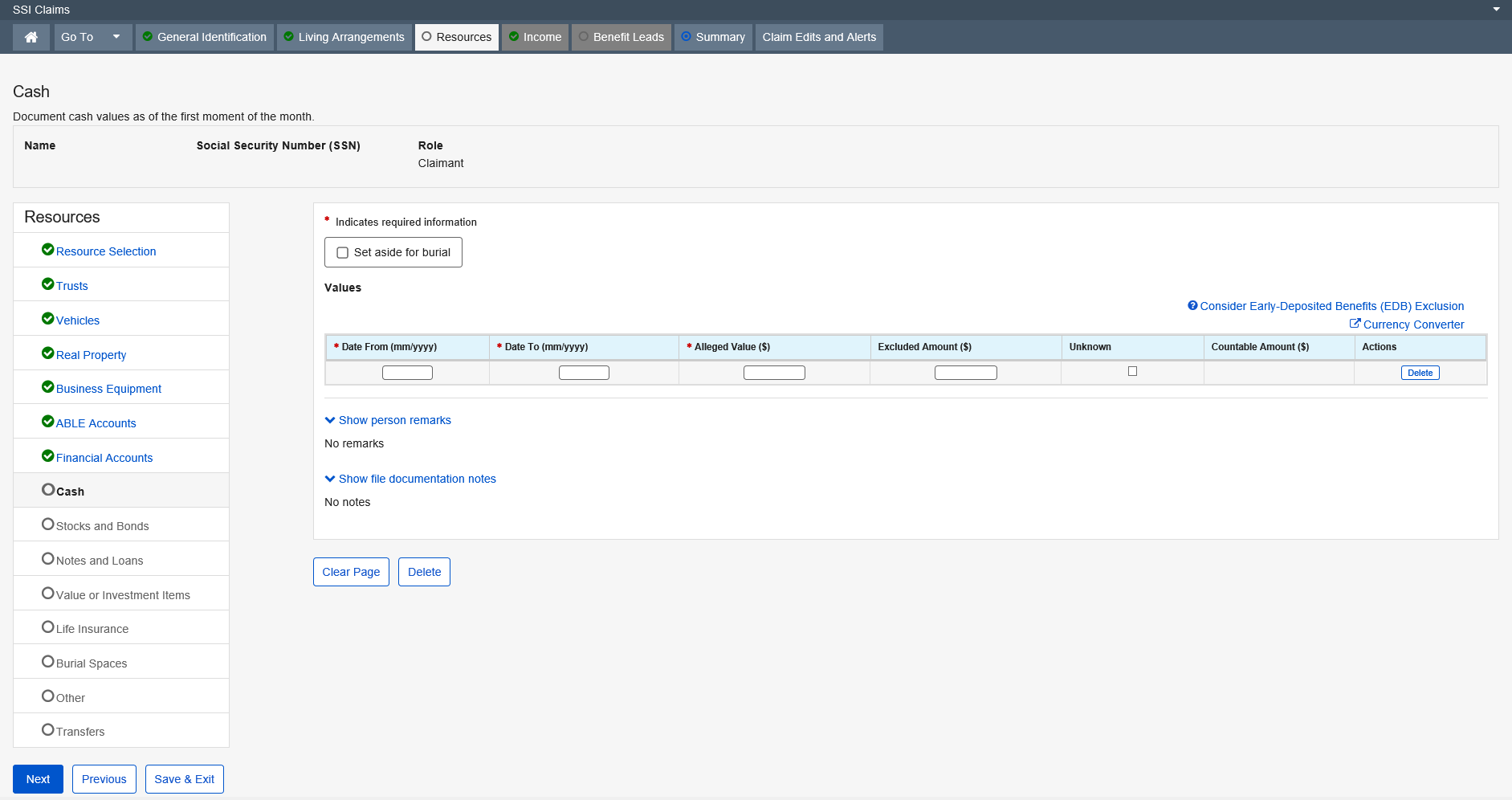

The Cash page exists in the SSI Claims system application to record information about cash in the possession of Supplemental Security Income (SSI) claimant or deemor. The information collected includes: periods of possession, amounts, exclusion reason(s), and if it is set aside for burial. This information is used, in conjunction with other resource pages, to determine the claimant’s countable resources.

More Info link:

Consider Early-Deposited Benefits (EDB) Exclusion

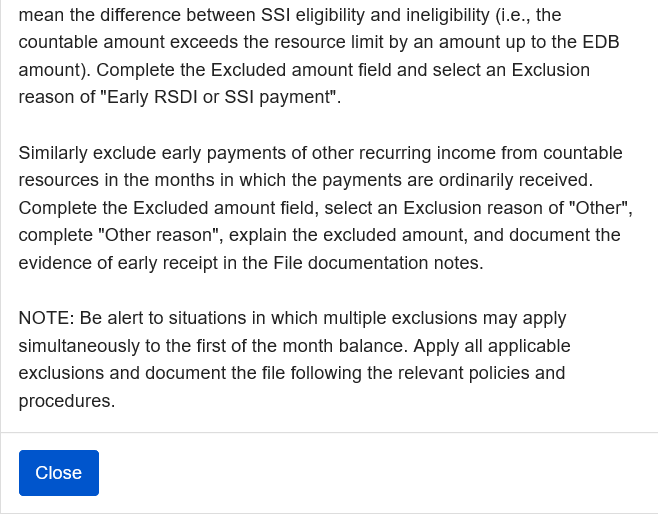

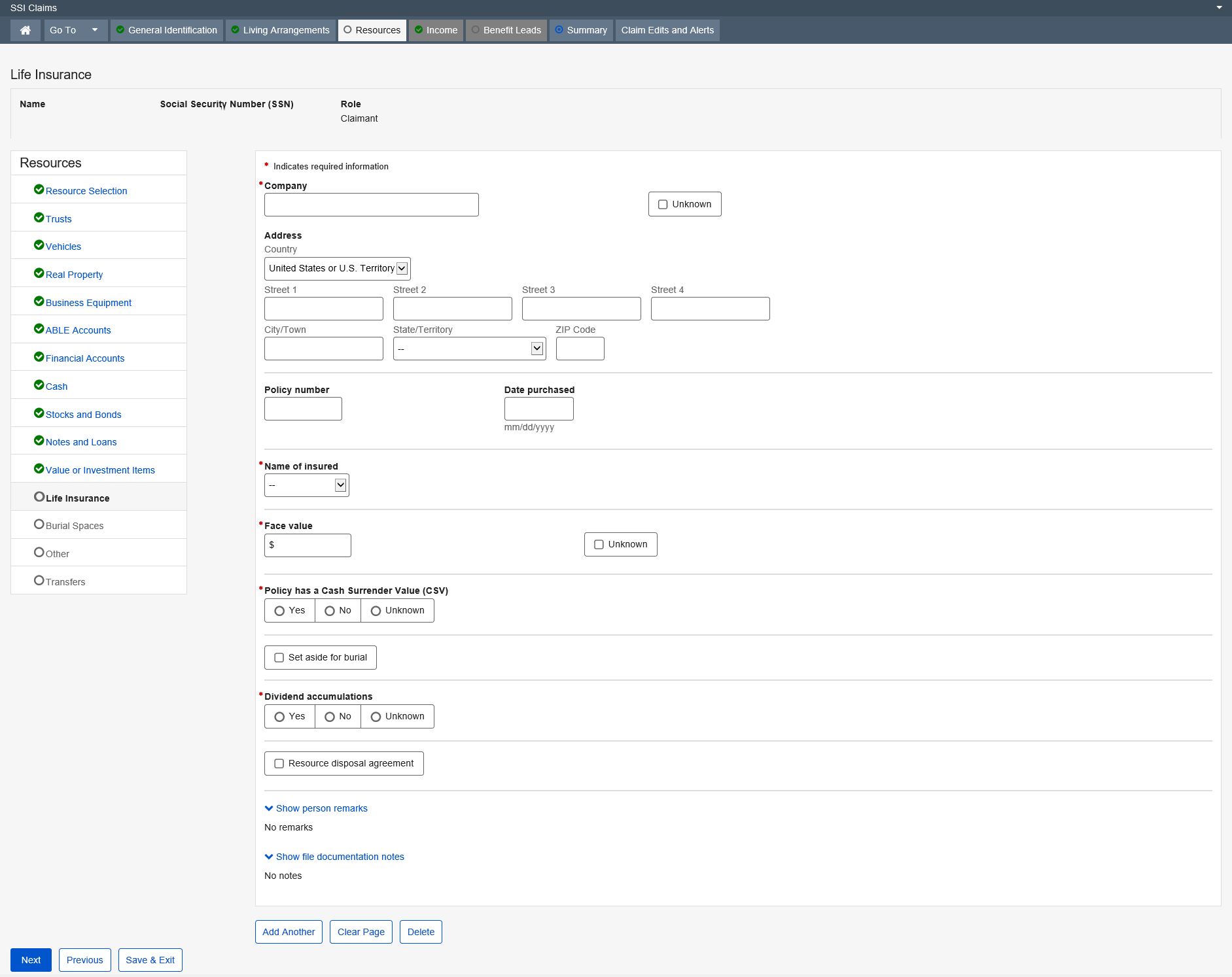

The Stock, Bond, or Mutual Bond page collects information about a stock, bond, or mutual fund of a Supplemental Security Income (SSI) claimant or deemor. The information collected includes the type of stock, bond or mutual fund, description, the issuance date for a bond, whether it earns interest or dividends, the value for particular periods, whether it is co-owned, and/or whether the stock, bond, or mutual fund is set aside for burial. This information is used, in conjunction with other resource pages, to determine the claimant’s countable resources.

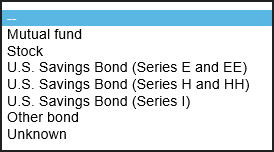

Dropdown list:

Type

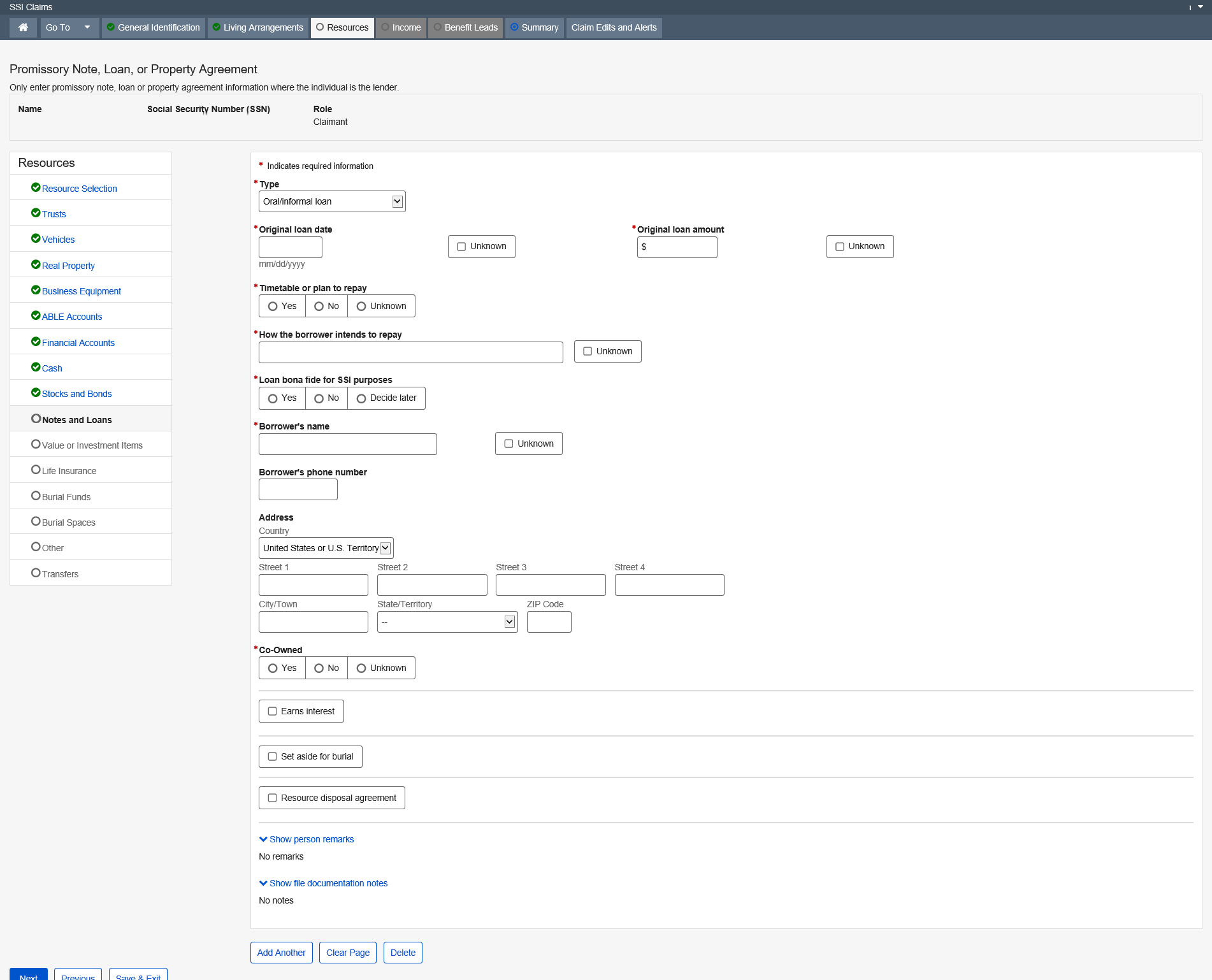

The Promissory Note, Loan or Property Agreement page exists in the SSI Claims System application, which allows the user to collect information about any promissory note, loan or property agreement which a claimant or deemor owns, or whose name appears on the title. It also records information about the borrower, the date and amount of the original loan, current market value, the outstanding principal balance, and the plan for repayment. This information is used in conjunction with other resource pages, to determine the claimant’s countable resources.

Dropdown list:

Type

Address – Country

The Item Held for Potential Value or Investment page is used to collect items of value such as collectibles, race or breeding horses, jewelry not worn or held for family significance, etc. These items can be owned by the claimant, eligible spouse and/or deemors. This information is used in conjunction with other resource pages to determine the claimant’s countable resources.

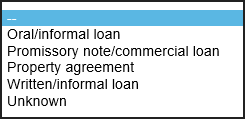

The Life Insurance page exists in the SSI Claims system , which records information about the life insurance policies of Supplemental Security Income (SSI) claimants and deemors. The information collected includes: the type of policy, name of insured, face value, cash surrender value, loan amount, excluded amounts, insurance company name and address, if the policy pays dividends, whether the policy is co-owned, and/or is set aside for burial. This information is used in conjunction with other resource pages, to determine the claimant’s countable resources.

Dropdown list:

Name of insured

Address - Country

State/Territory

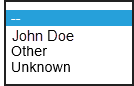

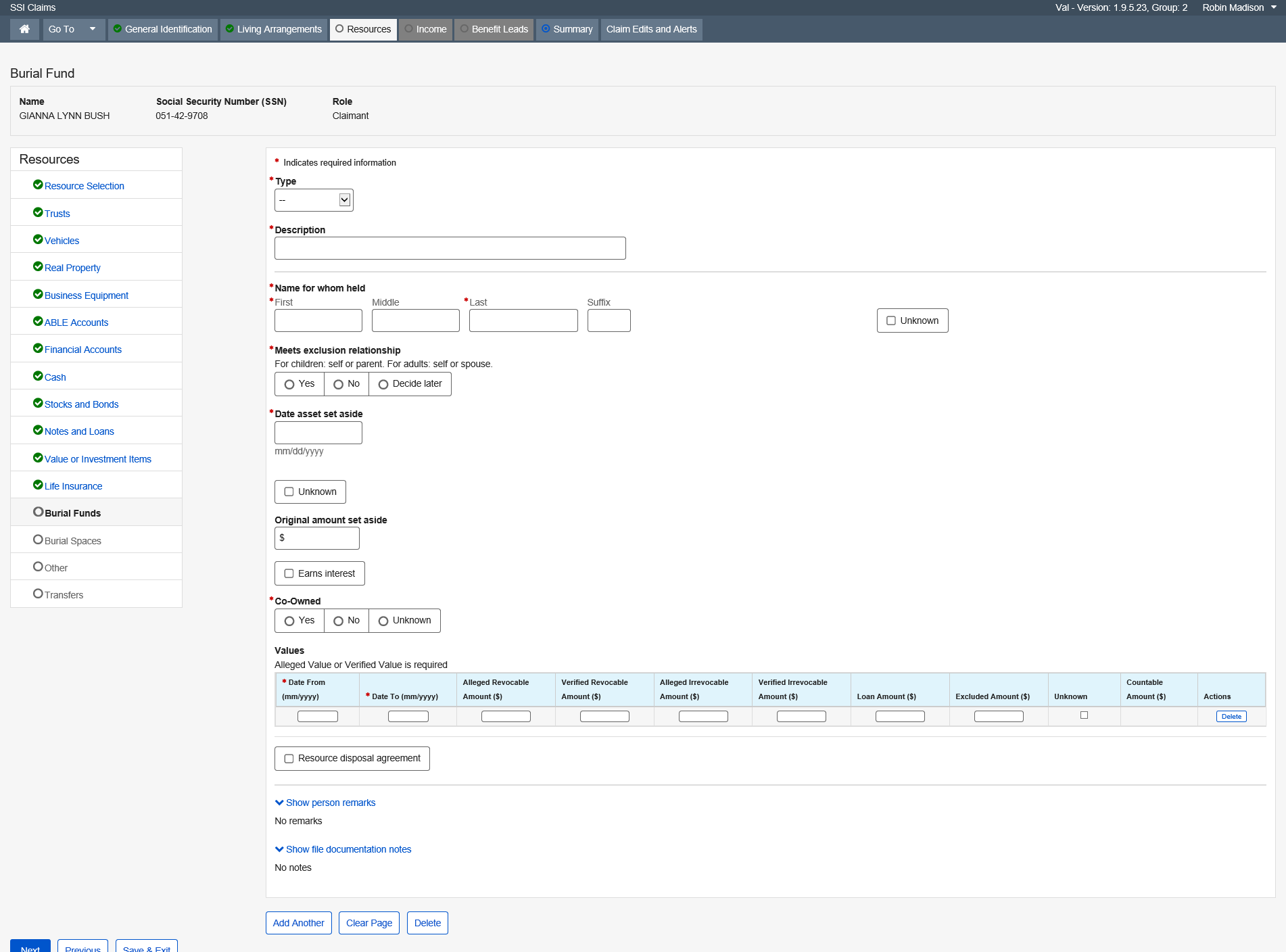

The Burial Fund page exists in the SSI Claims System, and allows the user to collect information about burial contracts and trusts that the claimant owns. It also records who the contract or trust is for, the date it was set aside, the original amount set aside, whether it is co-owned, revocable, irrevocable or partially irrevocable, earns interest, as well as the purchase price or market value. This information is used in conjunction with other resource pages to determine the claimant’s countable resources.

Dropdown list:

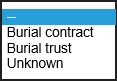

The Burial Space or Related Item page is used to collect information about the location and value of burial spaces and related items (cemetery lots, crypts, caskets, vaults, urns, and mausoleums, other repositories for burial, headstones or markers) which the claimant owns or whose name appears on the title. This information is used, in conjunction with other resource pages, to determine the claimant’s countable resources.

Dropdown list:

Type

Relationship of person for whom held

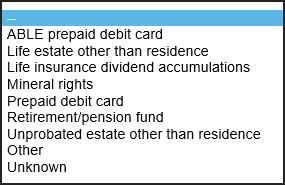

The Other Resource page collects information about other resources, which are not listed separately on the Resources Selection menu for a Supplemental Security Income (SSI) claimant or deemor. The information collected includes the type of resource, a description, its value for particular periods, and whether or not the resource is co-owned and/or is set aside for burial. This information is used, in conjunction with other resource screens, to determine the claimant’s countable resources.

Dropdown list:

Type

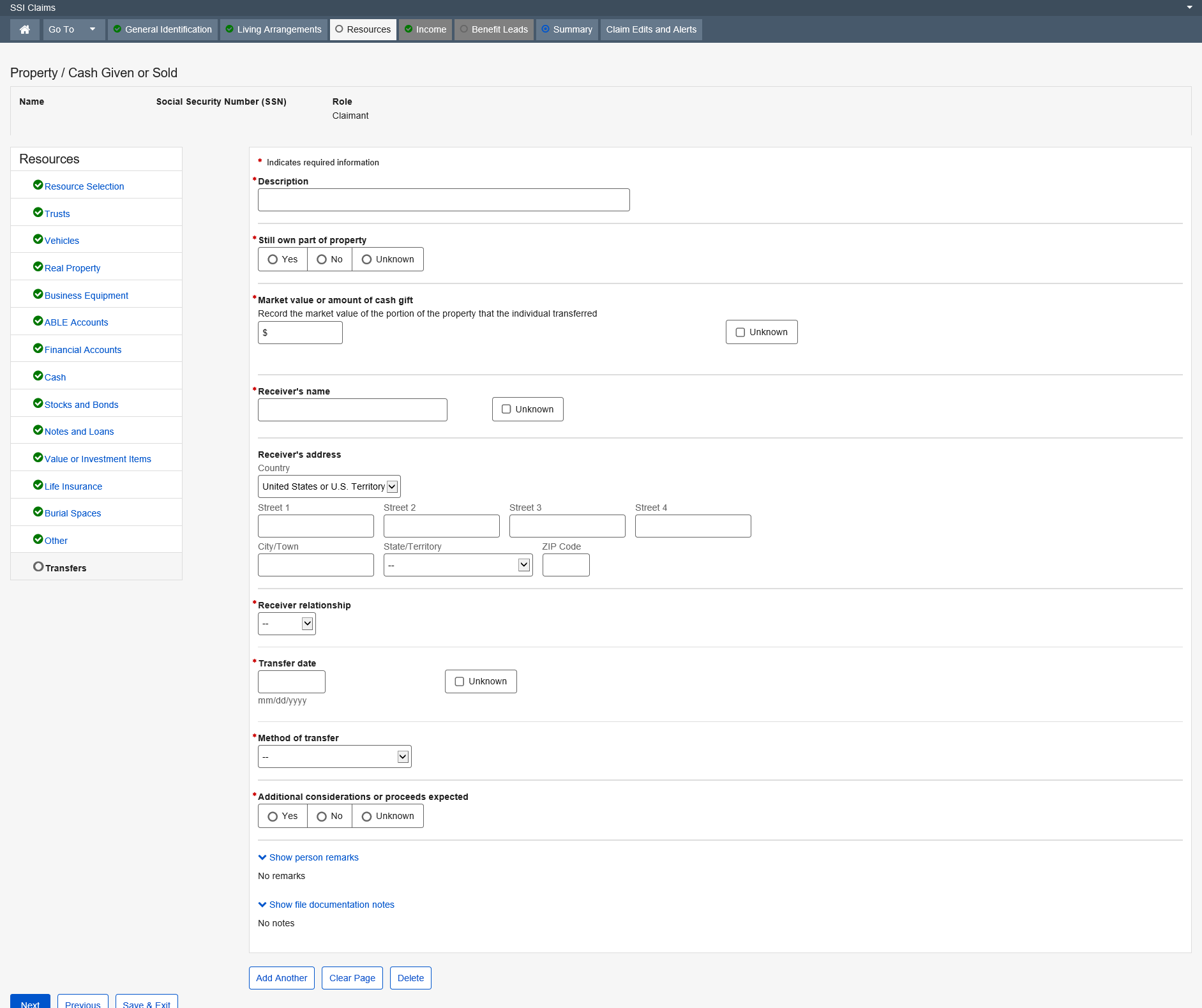

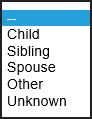

The Property / Cash Given or Sold page is used to collect whether the claimant or claimant's eligible spouse disposed of any resources in the 36 months prior to the effective filing month or in the post-entitlement period of review. This data group serves two purposes. The first purpose is to collect information regarding the validity of an alleged transfer of resource ownership for SSI resource determinations. The second purpose of this data group is to collect information about resources that have been given away or sold at less than fair market value for State Medicaid agency notification.

Dropdown list:

Receiver’s address – Country

Receiver relationship

-

Method of transfer

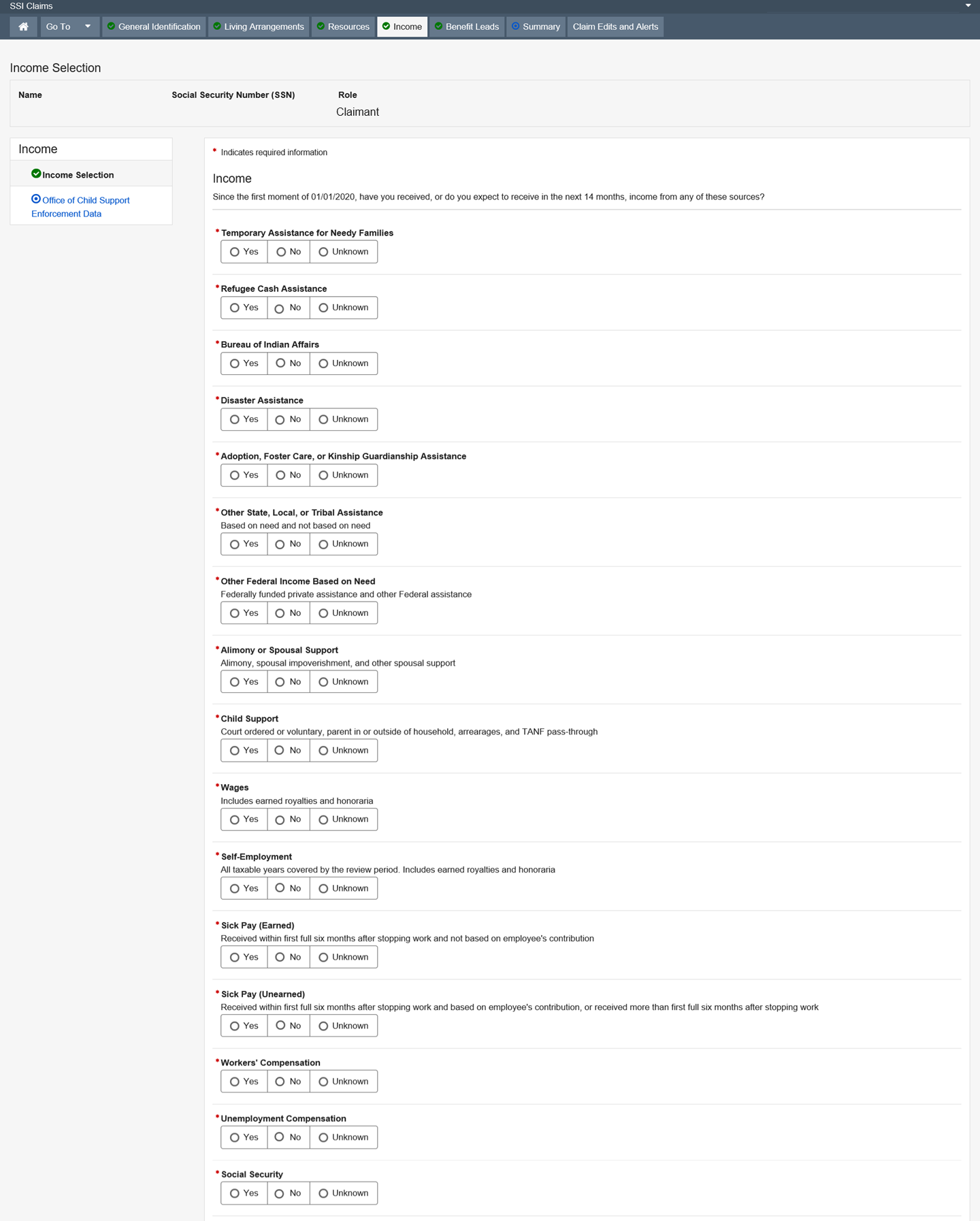

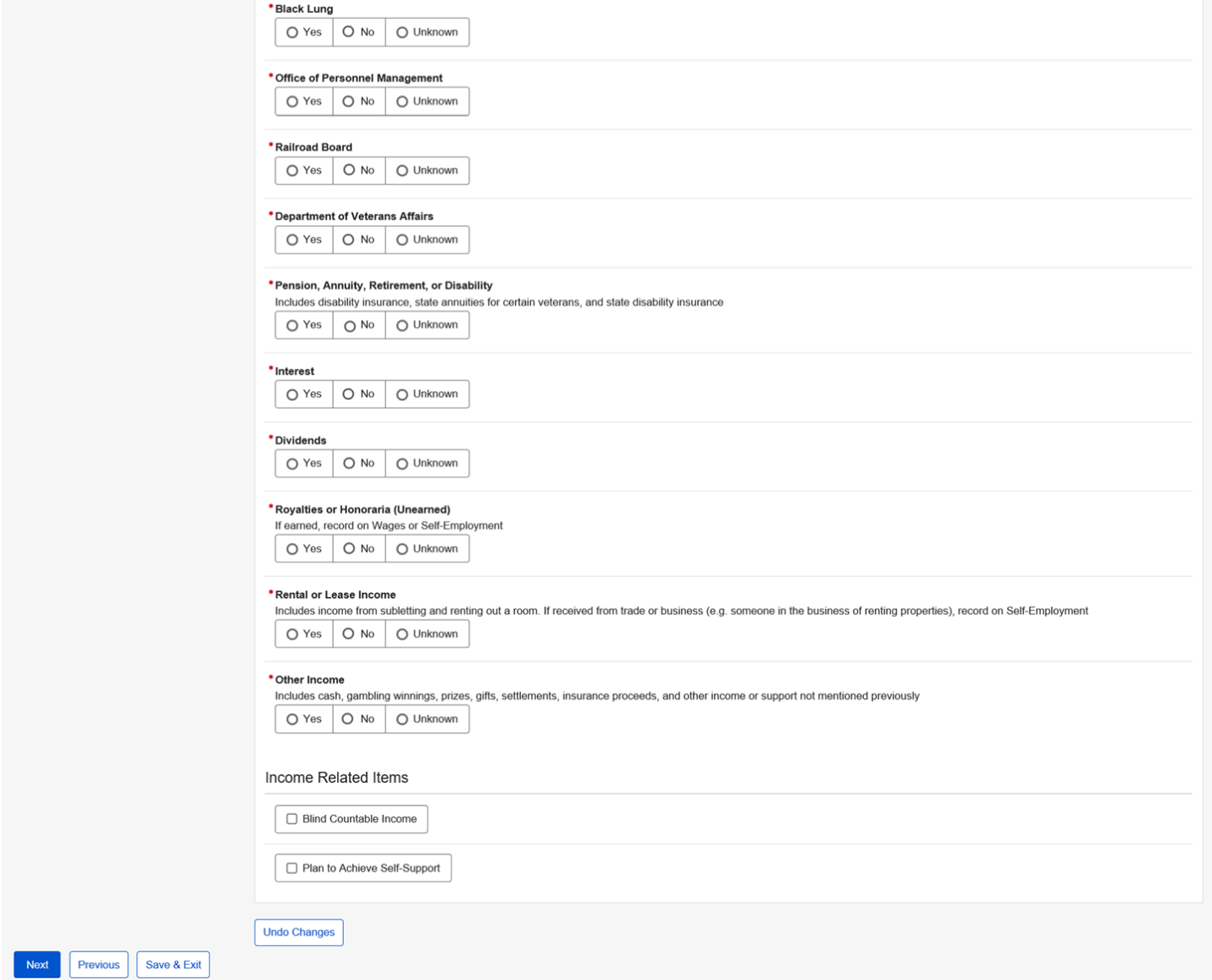

The Income Selection page collects and displays information about the type of income being received by the claimant or deemor. The Income types that are selected trigger the source of income type into the SSI Claim path. When a source of a particular income type already exists in the SSI Claim path, this page displays information about the existing sources.

This page also provides an option for the user to add another source of an existing income type.

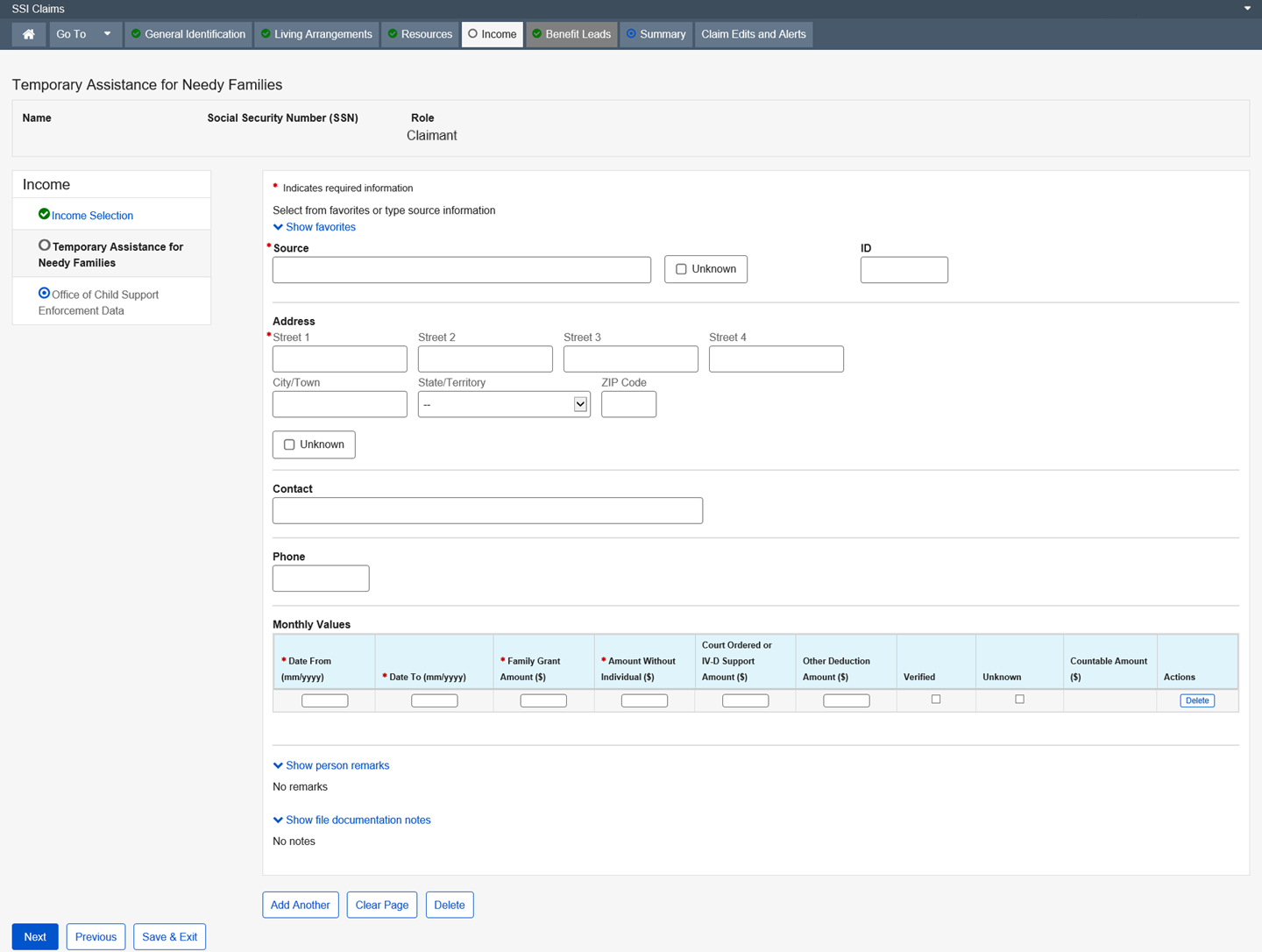

This page collects and/or displays information regarding Temporary Assistance for Needy Families being alleged or received and the amount.

Dropdown list:

State/Territory

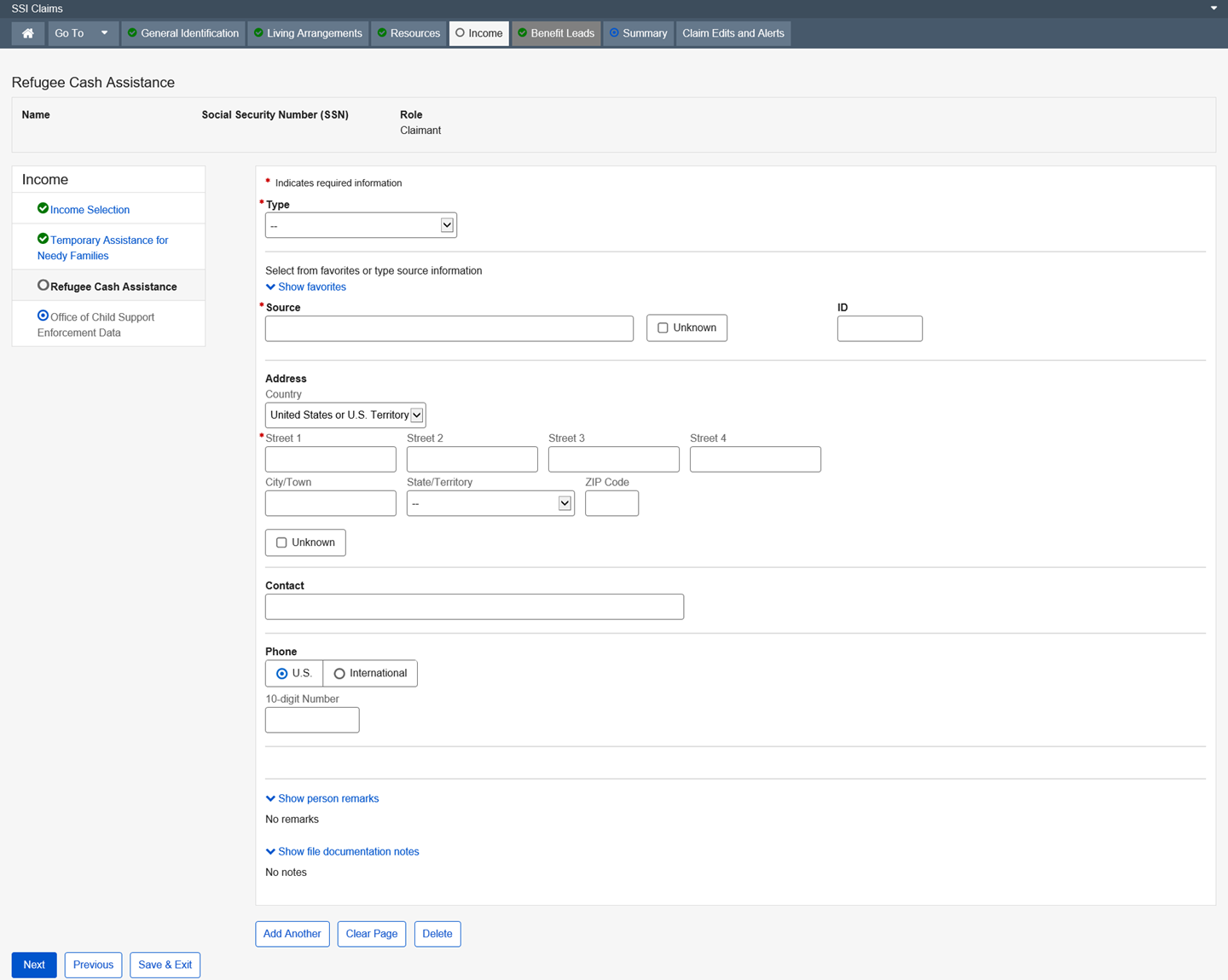

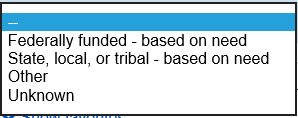

This page collects and/or displays information regarding the type of refugee cash assistance being alleged or received and the amount.

Dropdown list:

Type

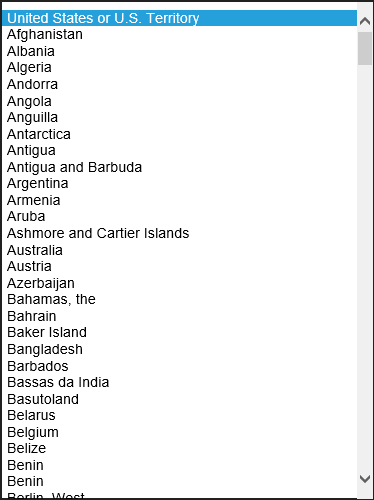

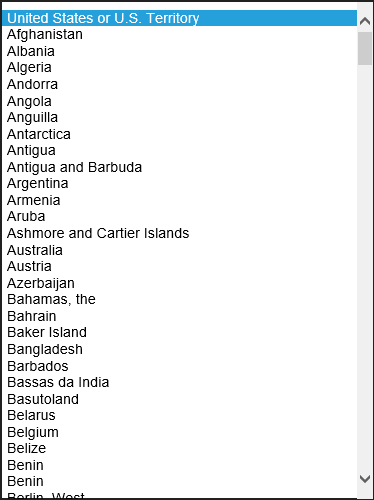

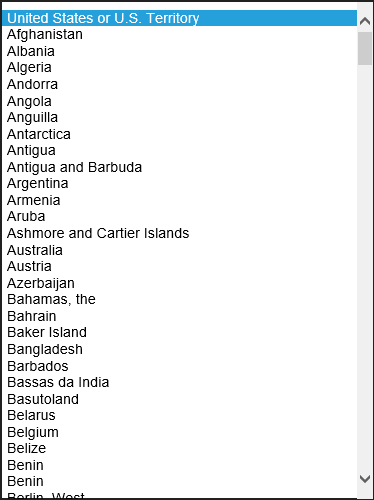

Country – United States or U.S. Territory (Default)

State/Territory

This page collects and/or displays information regarding the Bureau of Indian Affairs Assistance being alleged or received and the amount.

Dropdown list:

Type

State/Territory

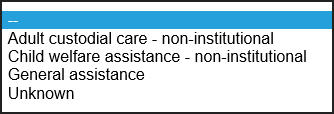

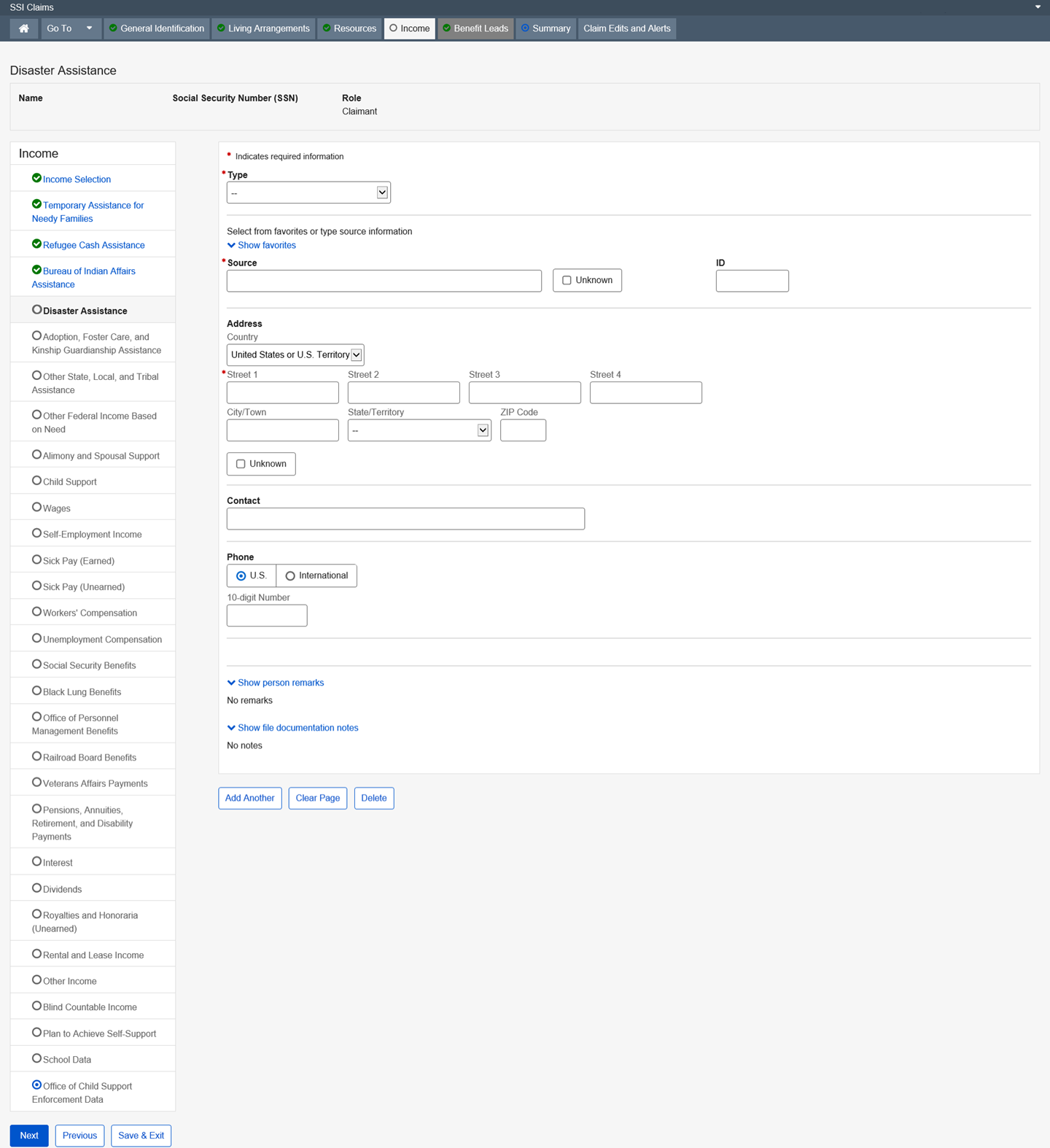

This page collects and/or displays information regarding the type of Disaster Assistance being alleged or received and the amount.

Dropdown list:

Type

State/Territory

Country – United States or U.S. Territory (Default)

This page collects and/or displays information regarding adoption, foster care, or kinship guardianship assistance being alleged or received, and the amount.

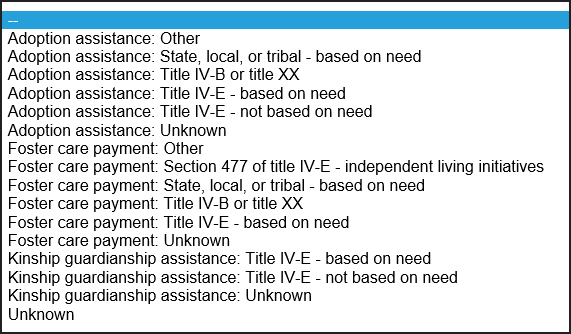

Dropdown list:

Income and Funding Type

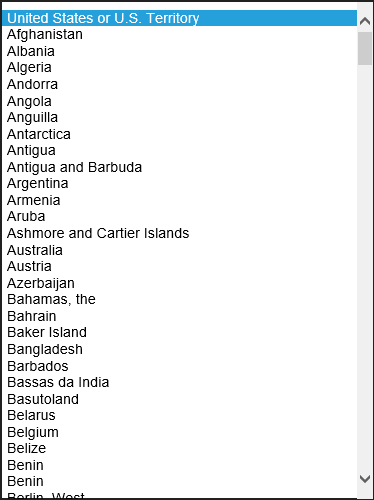

Country – United States or U.S. Territory (Default)

State/Territory

This page collects and/or displays information regarding the type of other state, local, or tribal assistance being alleged or received and the amount.

Dropdown list:

Type

State/Territory

This page collects and/or displays information regarding the type of Federal Income based on need being alleged or received, and the amount.

Dropdown list:

Type

State/Territory

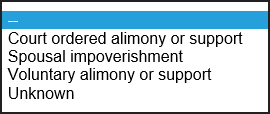

This page collects and or displays information regarding Alimony or Spousal Support being alleged or received and the amount.

Dropdown list:

Type

Country – United States or U.S. Territory (Default)

State/Territory

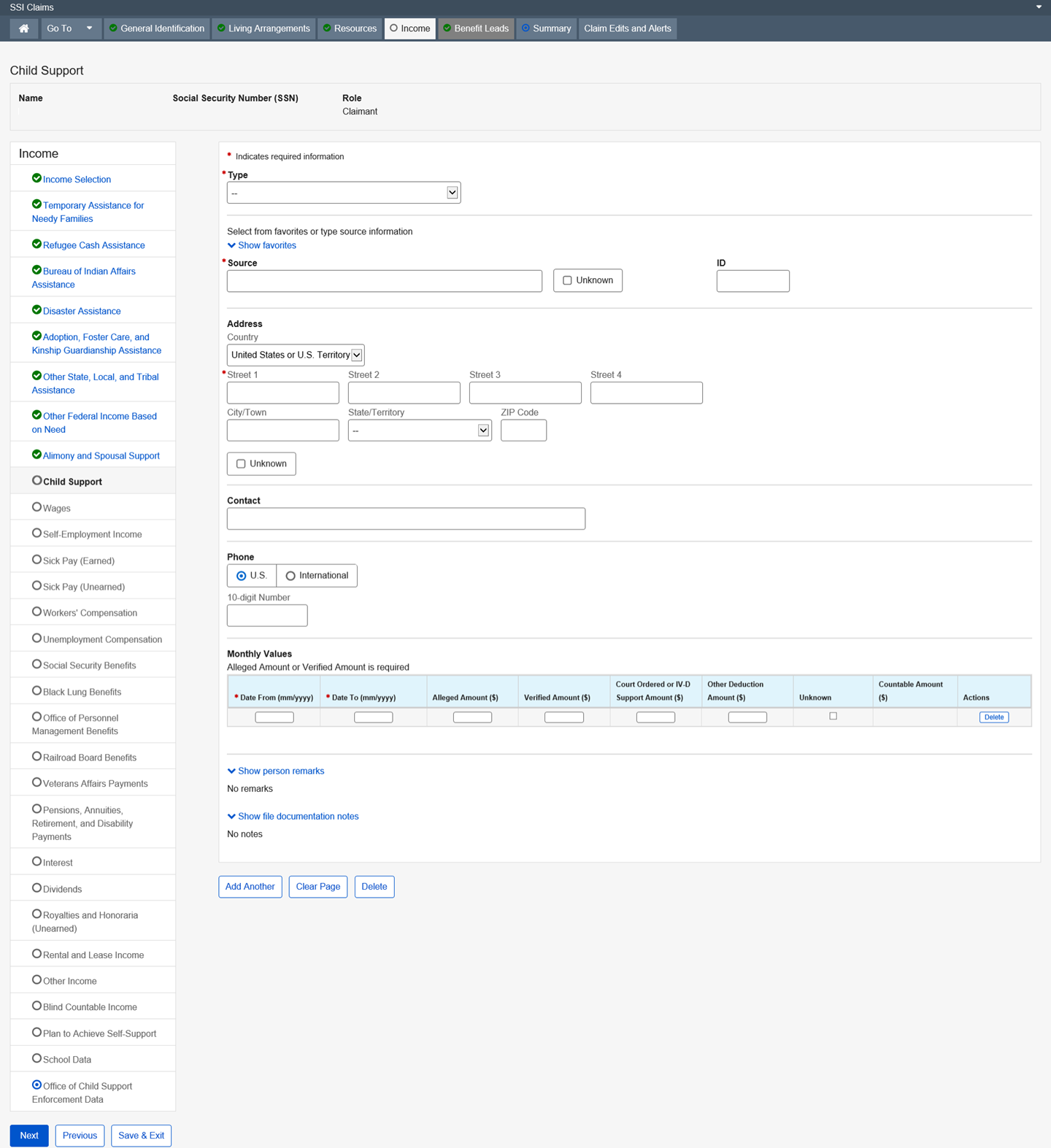

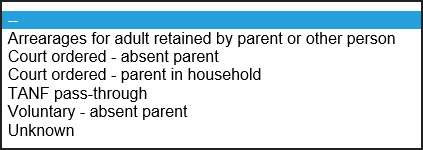

This page collects and/or displays information regarding Child Support being alleged or received and the amount of income being garnished for Child Support for the period.

Dropdown list:

Type

Country – United States or U.S. Territory (Default)

State/Territory

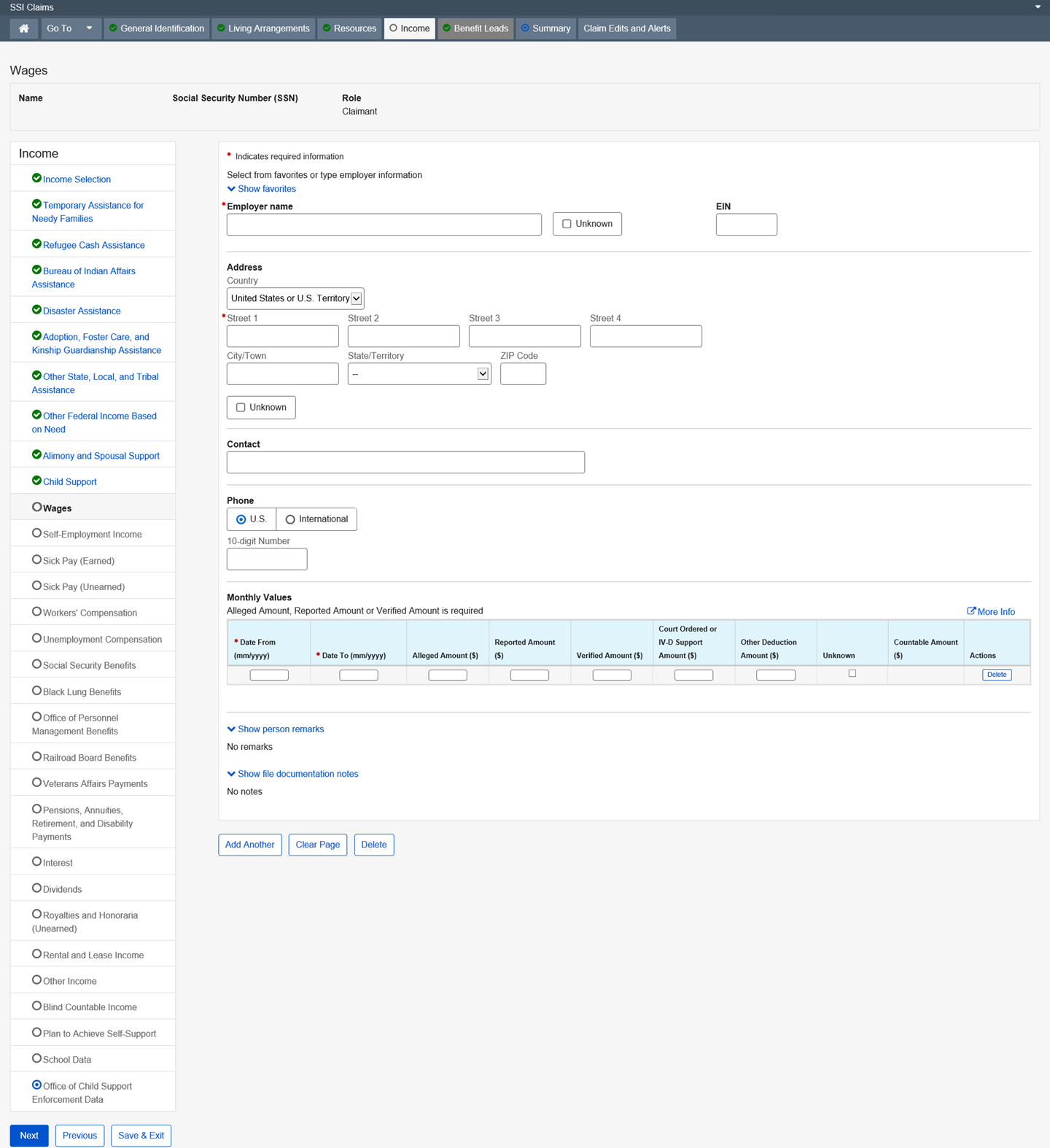

This page collects and/or displays information regarding the verification of wages the person receives, the date the person receives the wages, and the amount of the wages along with any deductions. This page is updated by the user and other external applications (e.g. SSI Telephone Wage Reporting and SSI Monthly Wage Verification).

Dropdown list:

Country – United States or U.S. Territory (Default)

State/Territory

This page displays information about wages in a quarterly format.

The employee compares this wage information with information on the alert produced by the State Wage Record Match. The alert is disposed of or developed based on the result of the employee comparison.

This page collects and/or displays information regarding self-employment income.

Dropdown list:

Country – United States or U.S. Territory (Default)

State/Territory

IRS Tax Year Type

Profit or Loss

![]()

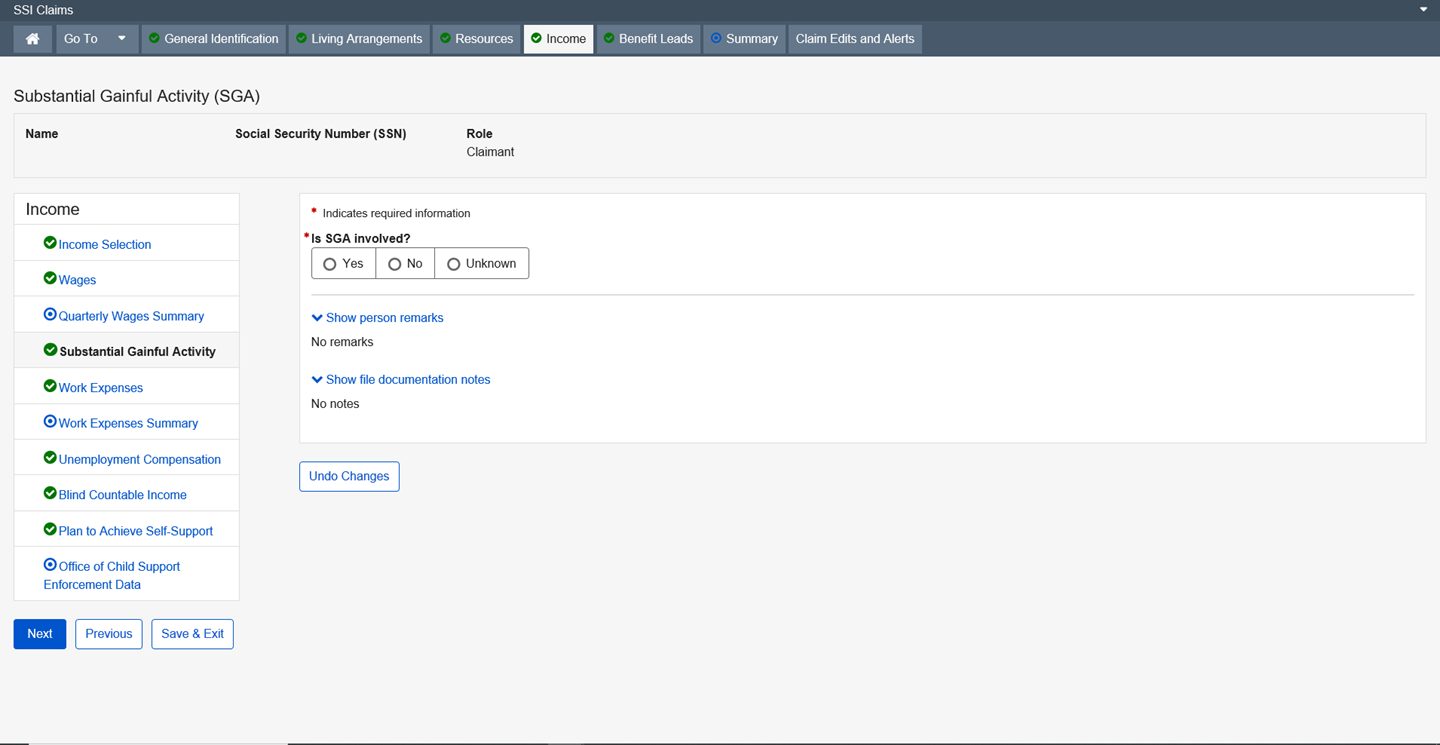

The Substantial Gainful Activity (SGA) page collects information regarding the Claim Specialist’s determination of the claimant's involvement in SGA.

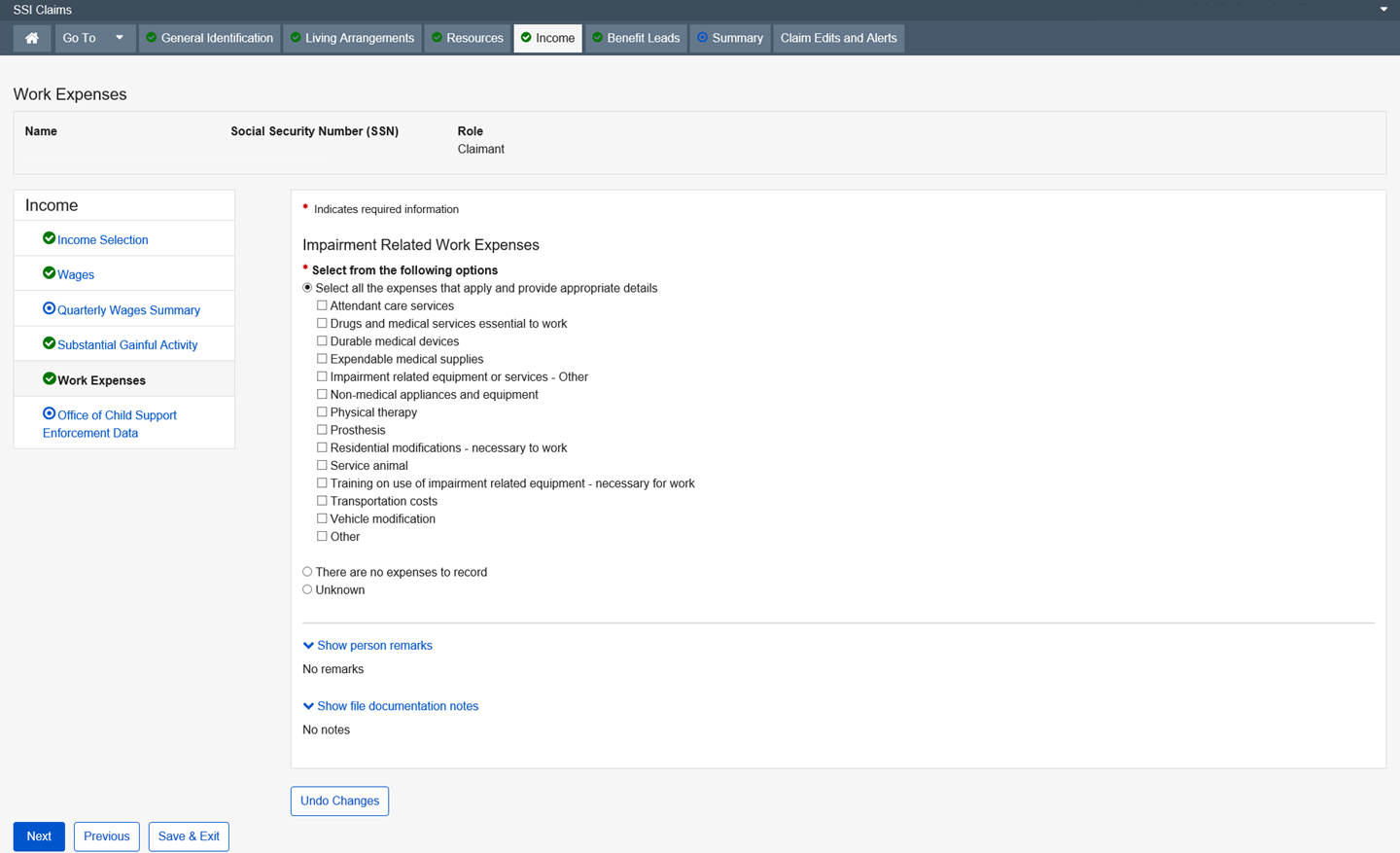

This page collects and/or displays information regarding work expenses incurred by claimants that have alleged disability or blindness on the Disability page. The system places this page in the path when an individual has alleged disability or blindness or low vision, and has reported Wages or Self-Employment income.

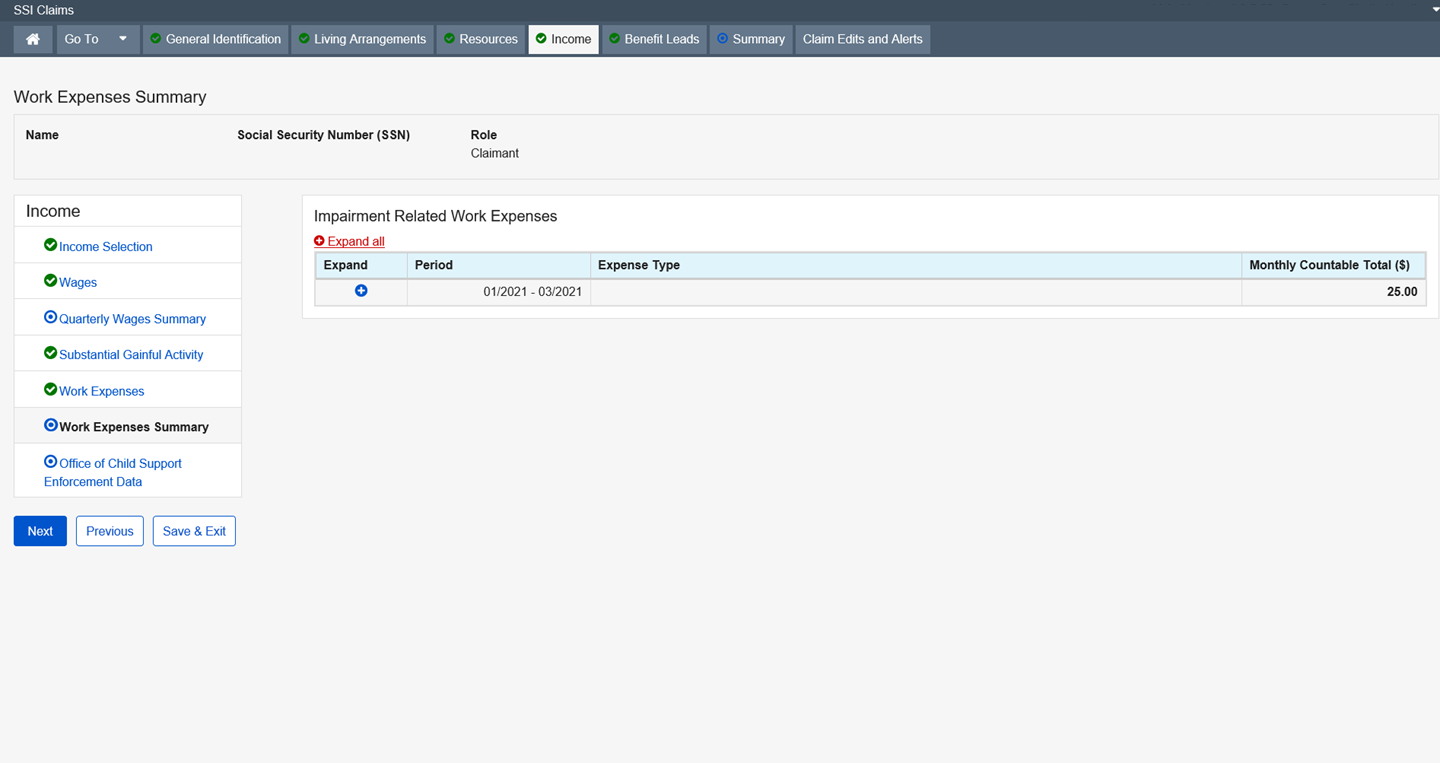

The Work Expenses Summary page displays information regarding blind or impairment related work expenses reported on the claim. Reported expenses are grouped by period. A period is a month or series of months with the same expenses in the same amounts. Periods are first displayed in collapsed format, and can be expanded to present each expense and the associated monthly expense amount.

This page collects and/or displays information regarding earned sick pay being alleged or received and the amount.

Dropdown list:

Country – United States or U.S. Territory (Default)

State/Territory

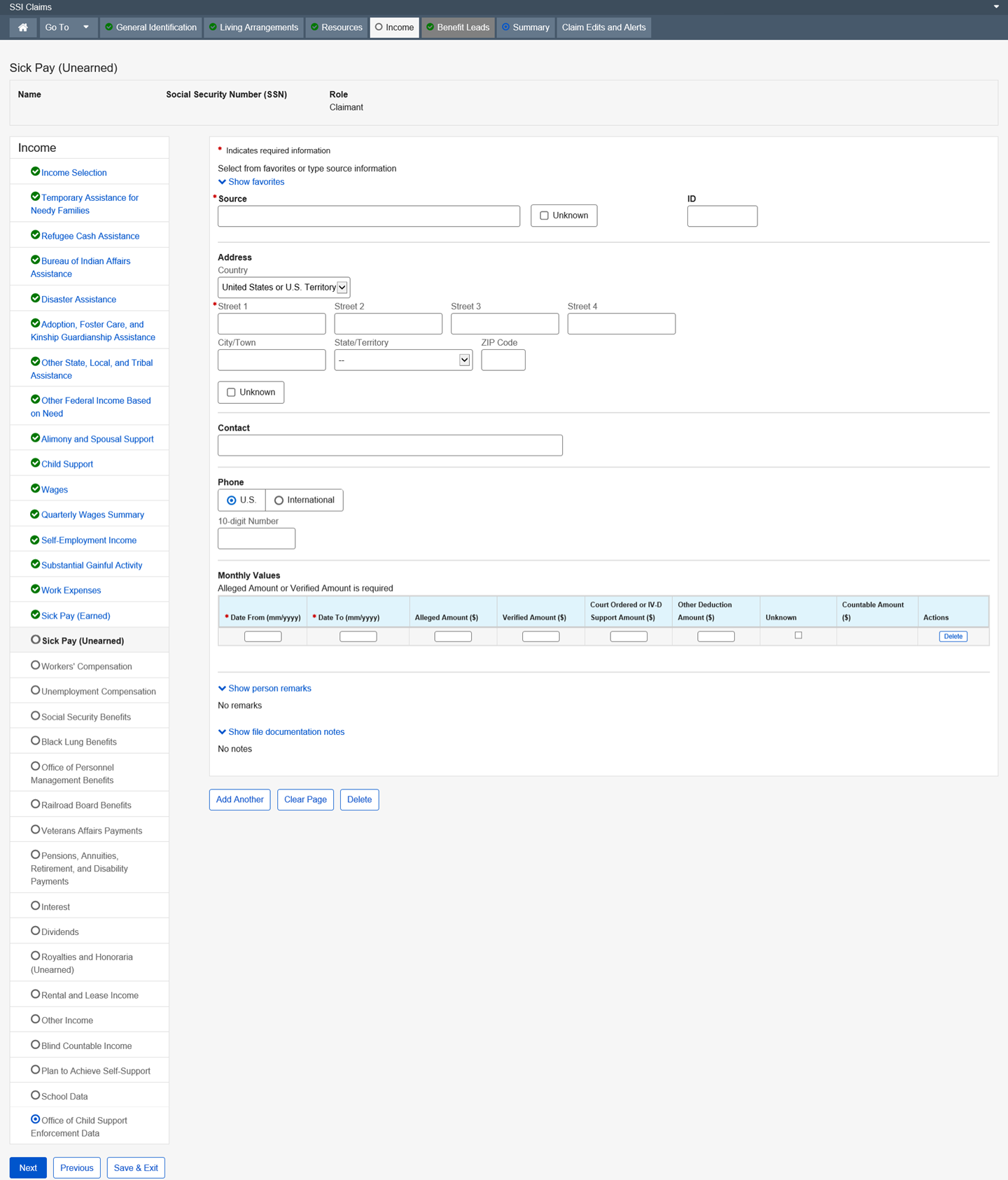

This page collects and/or displays information regarding unearned sick pay being alleged or received and the amount.

Dropdown list:

Country – United States or U.S. Territory (Default)

State/Territory

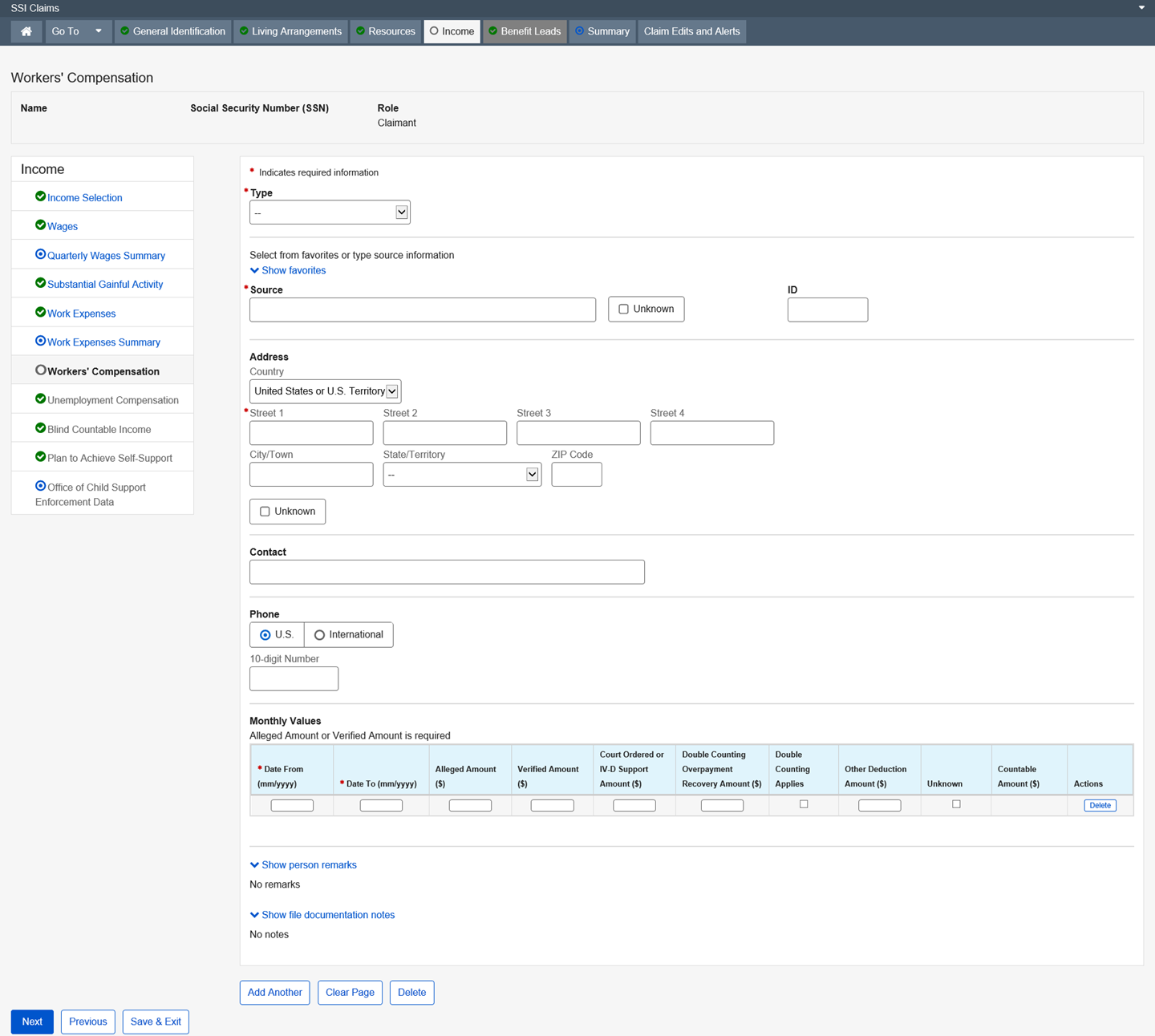

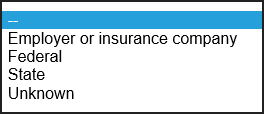

This page collects and displays information about Workers’ Compensation benefits being alleged or received.

Dropdown list:

Type

Country – United States or U.S. Territory (Default)

State/Territory

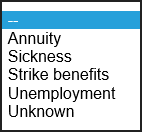

This page collects and/or displays information regarding the type of unemployment being alleged or received and the amount.

Dropdown list:

Country – United States or U.S. Territory (Default)

State/Territory

This page collects and/or displays information regarding the type of Social Security being alleged or received and the amount. It is updated by the user, iClaim and the Master Beneficiary Record (MBR) interface with SSI systems.

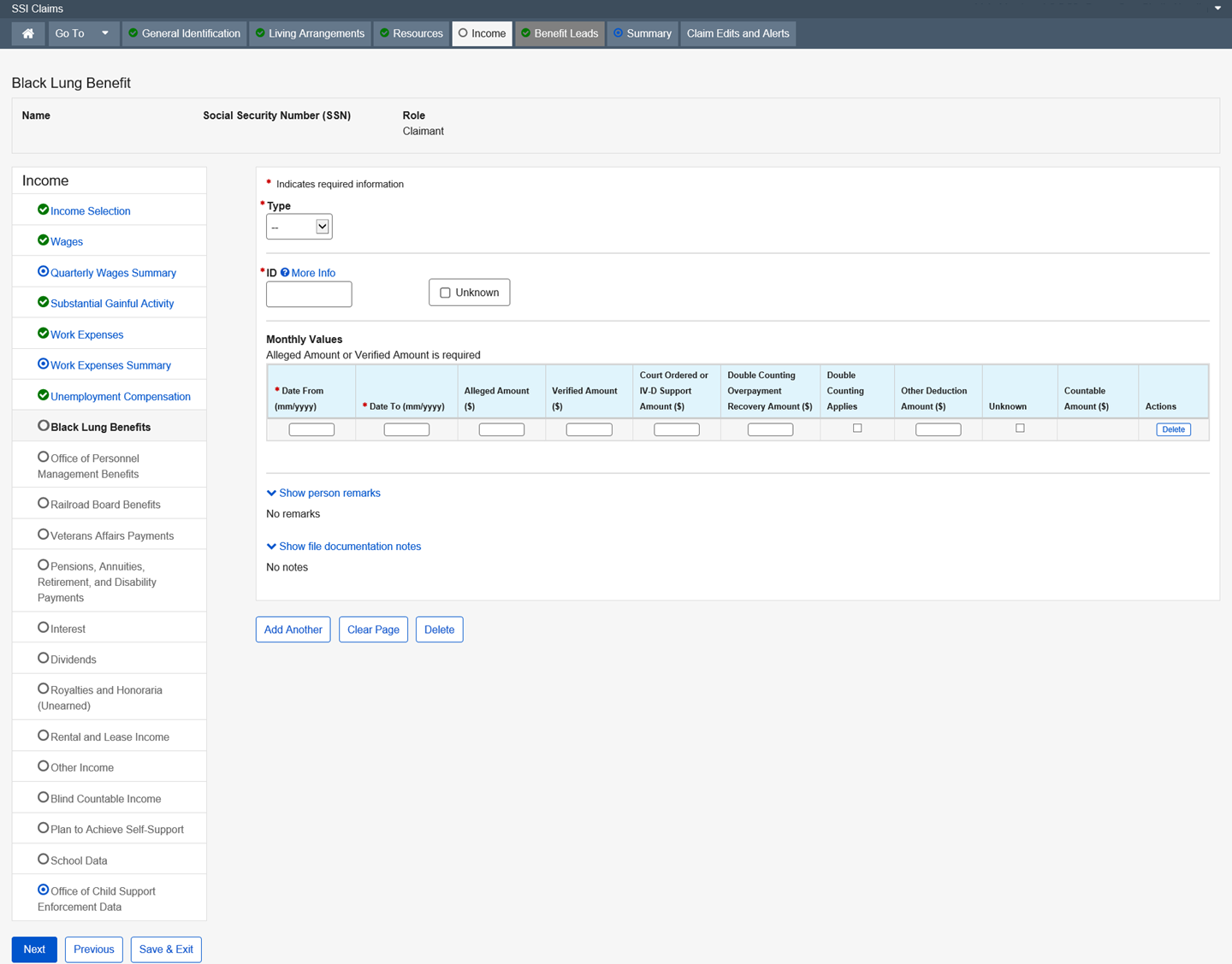

This page collects and/or displays information regarding the type of Black Lung Benefit being alleged or received and the amount.

Dropdown list:

Type

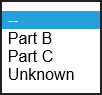

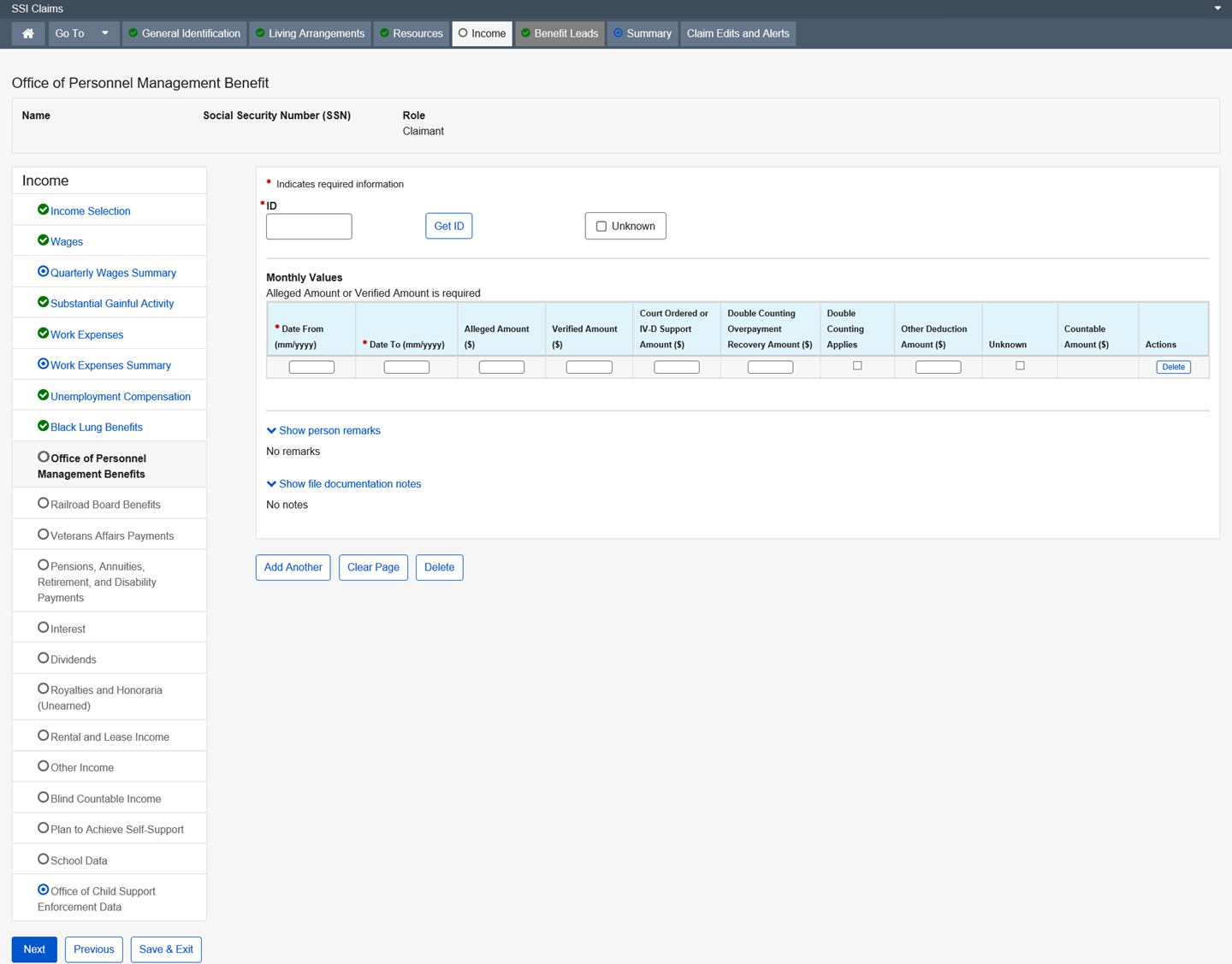

This page collects and/or displays information regarding Office of Personnel Management Benefit being alleged or received and the amount. OPM makes U.S. Civil Service and Federal Employee Retirement System (FERS) payments for disability, retirement, or death. When this information is updated to the SSR via the OPM interface, the system will also update the data on the Centrally Stored Information (CSI). Open a standalone post entitlement event via MSSICS to send the updated data to the SSR. Cost of living allocations (COLAs) are only updated for those individuals on the SSR.

Modal Window:

Get ID

This page collects and/or displays information regarding the type of Railroad Board Benefit being alleged or received, and the amount.

Dropdown list:

Type

Modal Window:

Get ID

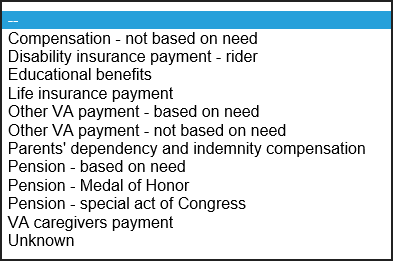

This page collects and/or displays information regarding the type of Veterans Affairs Payments income being alleged or received, and the amount.

Dropdown list:

Type

Modal Window:

Get ID

Get ID – Dropdown list:

VA Payee

VA beneficiary receiving portion of augmented benefits

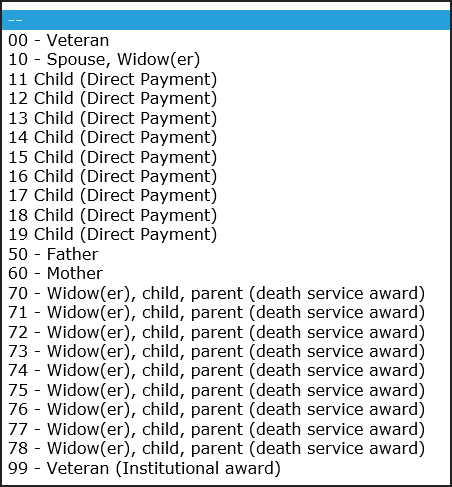

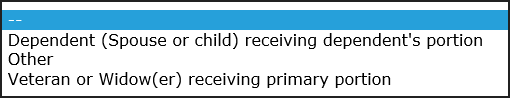

This page collects and/or displays information regarding the type of pension, annuity, retirement, disability payment, or similar income being alleged or received and the amount.

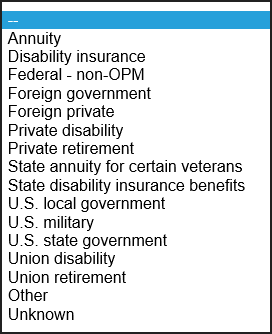

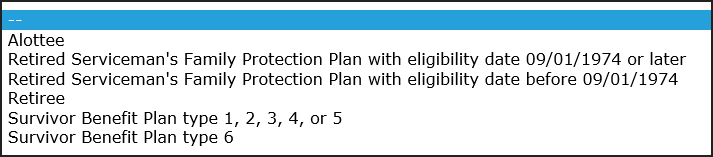

Dropdown list:

Type

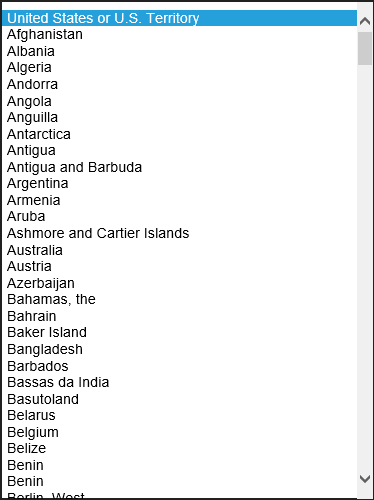

Country – United States or U.S. Territory (Default)

State/Territory

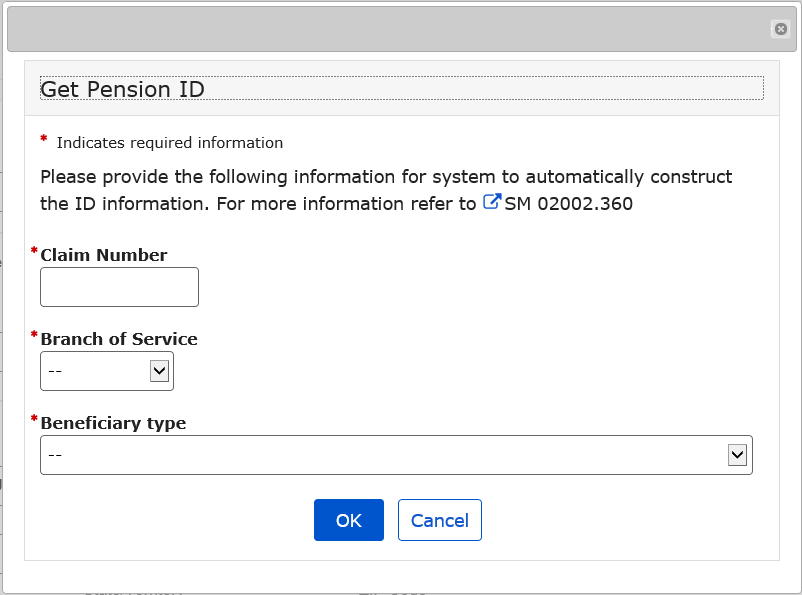

Modal Window:

Get ID

Get ID – Dropdown list:

Branch of Service

Beneficiary Type

This page collects and/or displays information regarding the type of interest being alleged or received and the amount.

Dropdown list:

Type

Country – United States or U.S. Territory (Default)

State/Territory

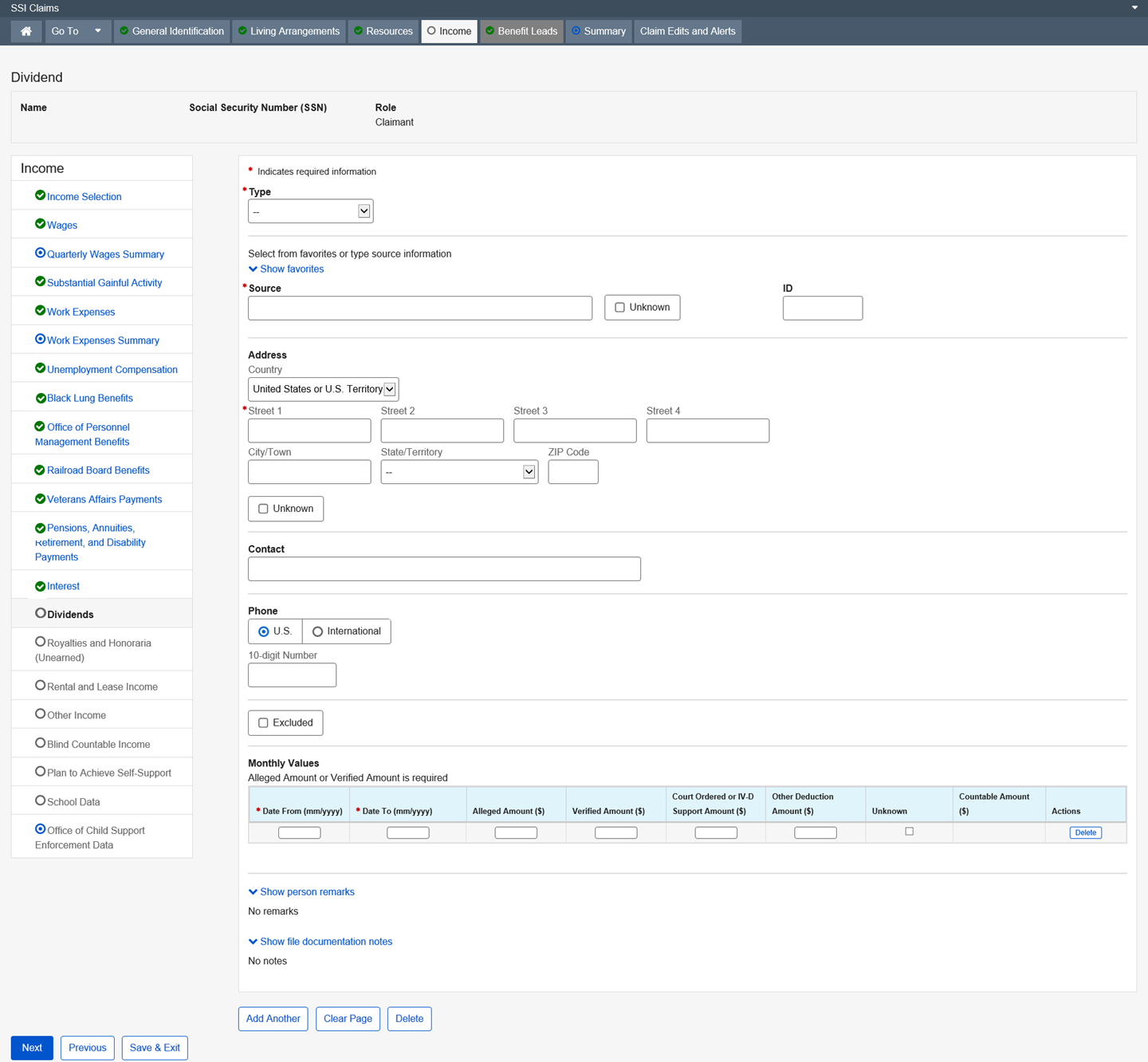

This page collects and/or displays information regarding the type of Dividend being alleged or received and the amount.

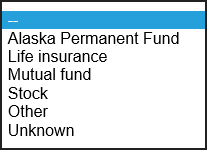

Dropdown list:

Type

Country – United States or U.S. Territory (Default)

State/Territory

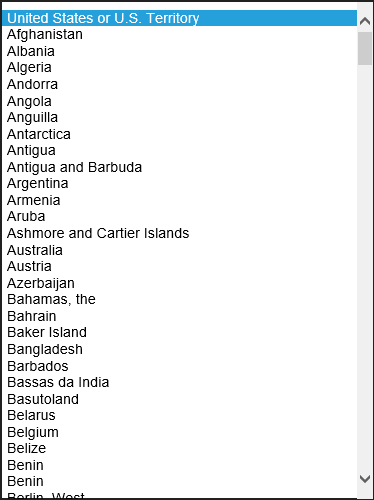

This page collects and/or displays information about the type of royalties and/or honorarium (unearned) being alleged or received and the amount. It is counted as unearned income. If the royalties or honoraria (unearned) are determined to be earned, then enter as wages on the Wages page.

Dropdown list:

Country – United States or U.S. Territory (Default)

State/Territory

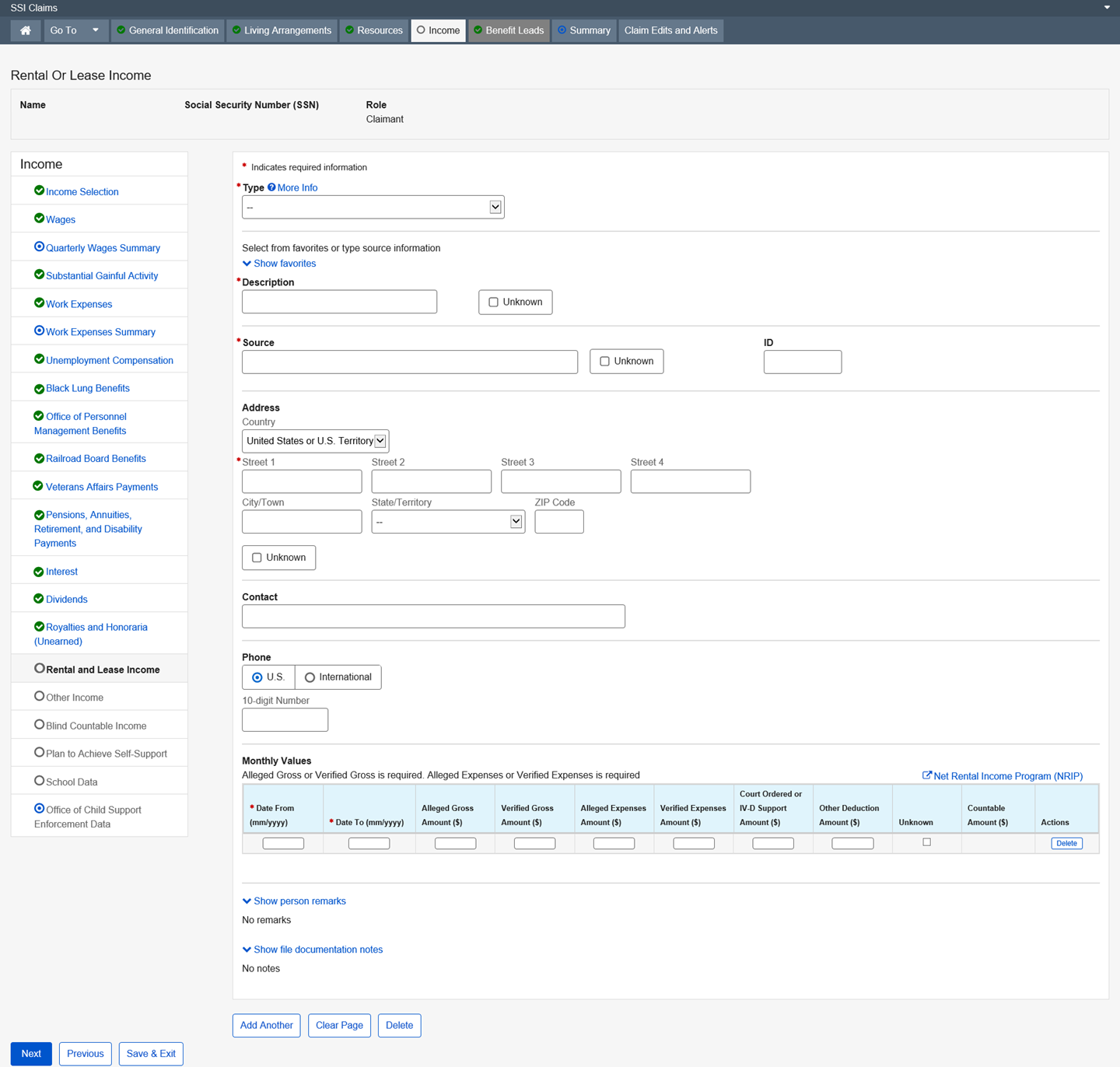

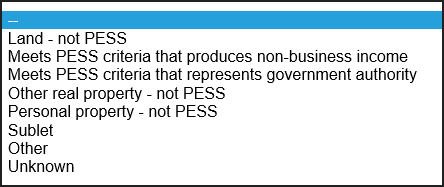

This page collects and/or displays information regarding the type of Rental or Lease Income being alleged or received and the amount.

Dropdown list:

Type

Country – United States or U.S. Territory (Default)

State/Territory

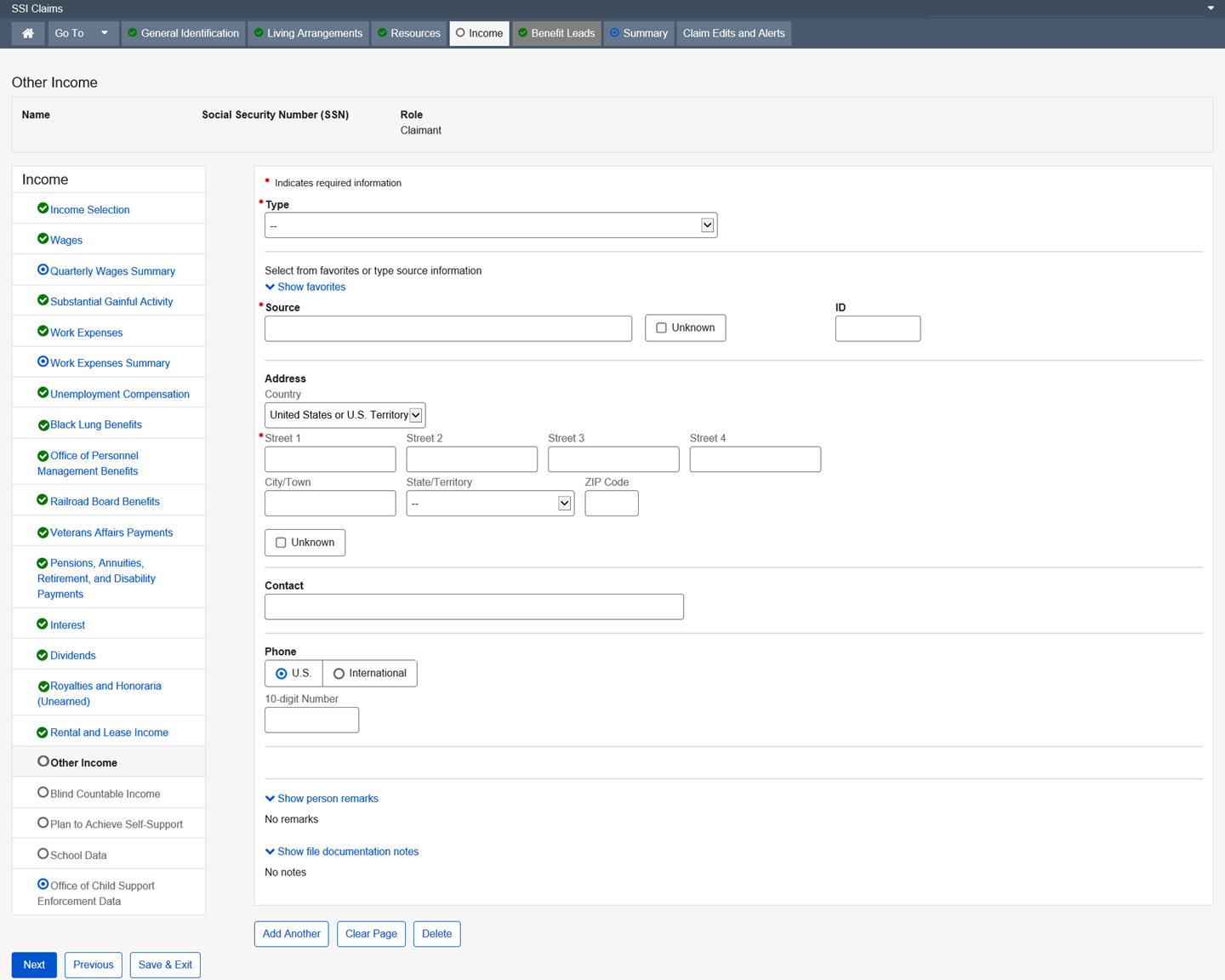

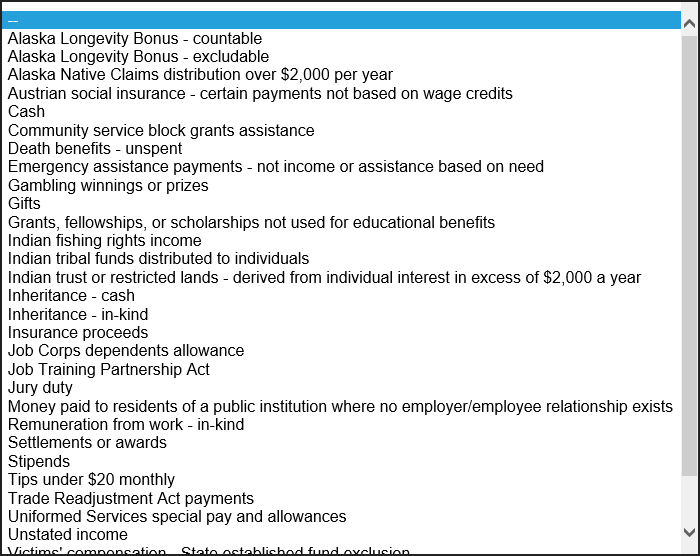

This page collects and/or displays information regarding the type of “other income” being alleged or received and the amount. “Other Income” is any type of income that cannot be collected on any of the other income pages.

Dropdown list:

Type

Country – United States or U.S. Territory (Default)

State/Territory

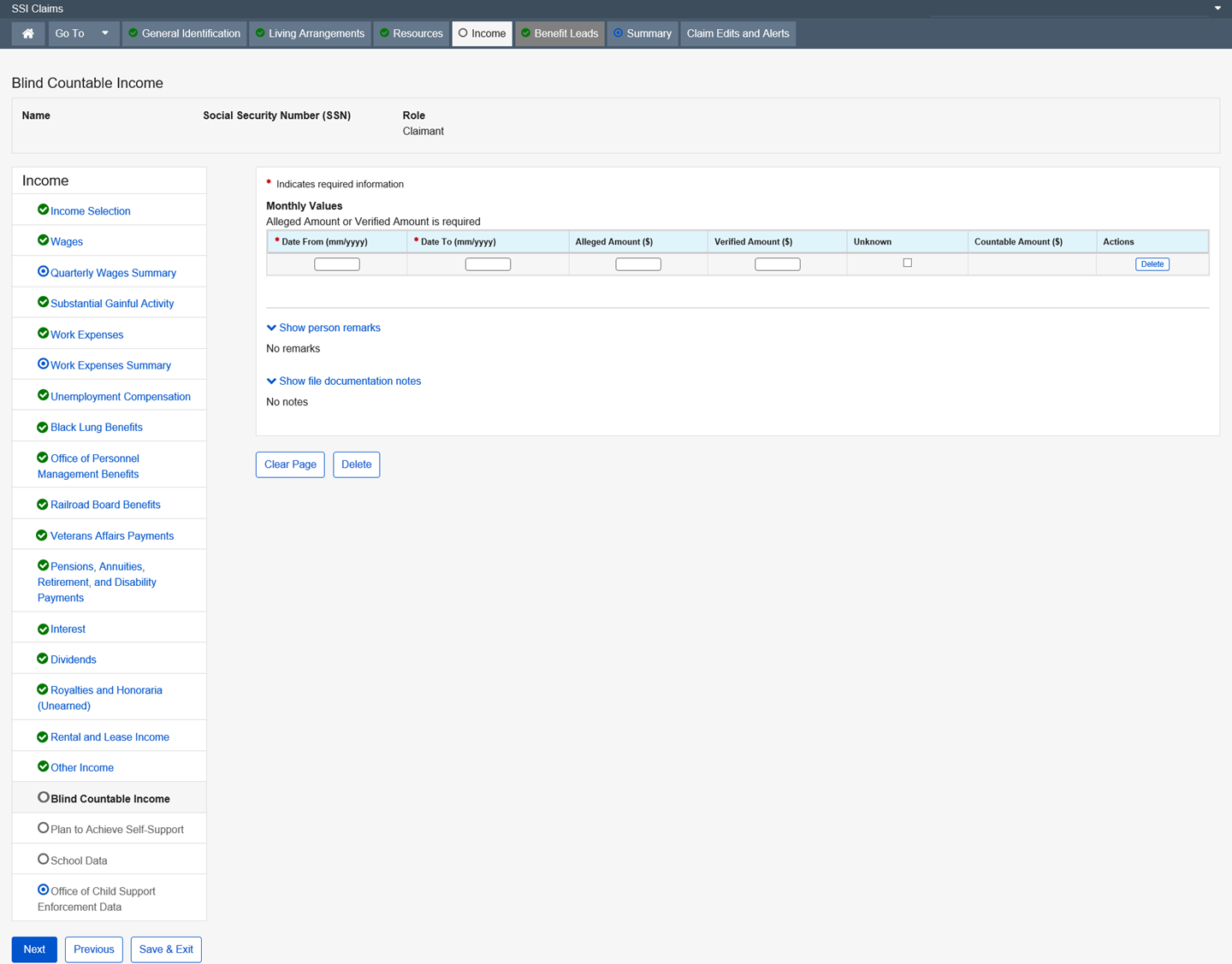

This page collects and/or displays information regarding the type of Blind Countable Income being alleged or received, and the amount.

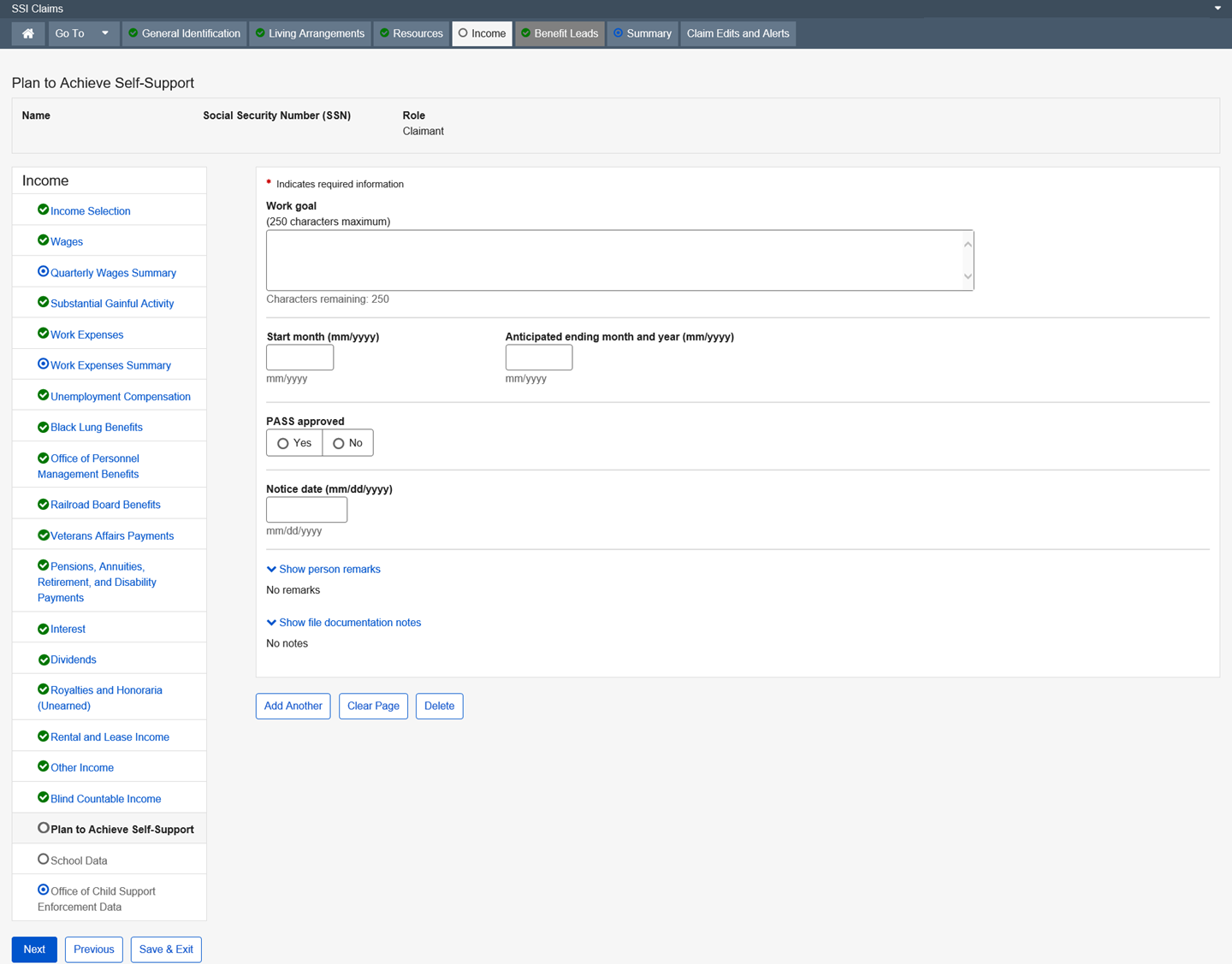

This page collects and/or displays information regarding a Plan for Achieving Self-Support (PASS). The PASS is a disabled or blind person’s work goal to achieve self-support. Approved expense items used for a PASS program are deducted from earned income.

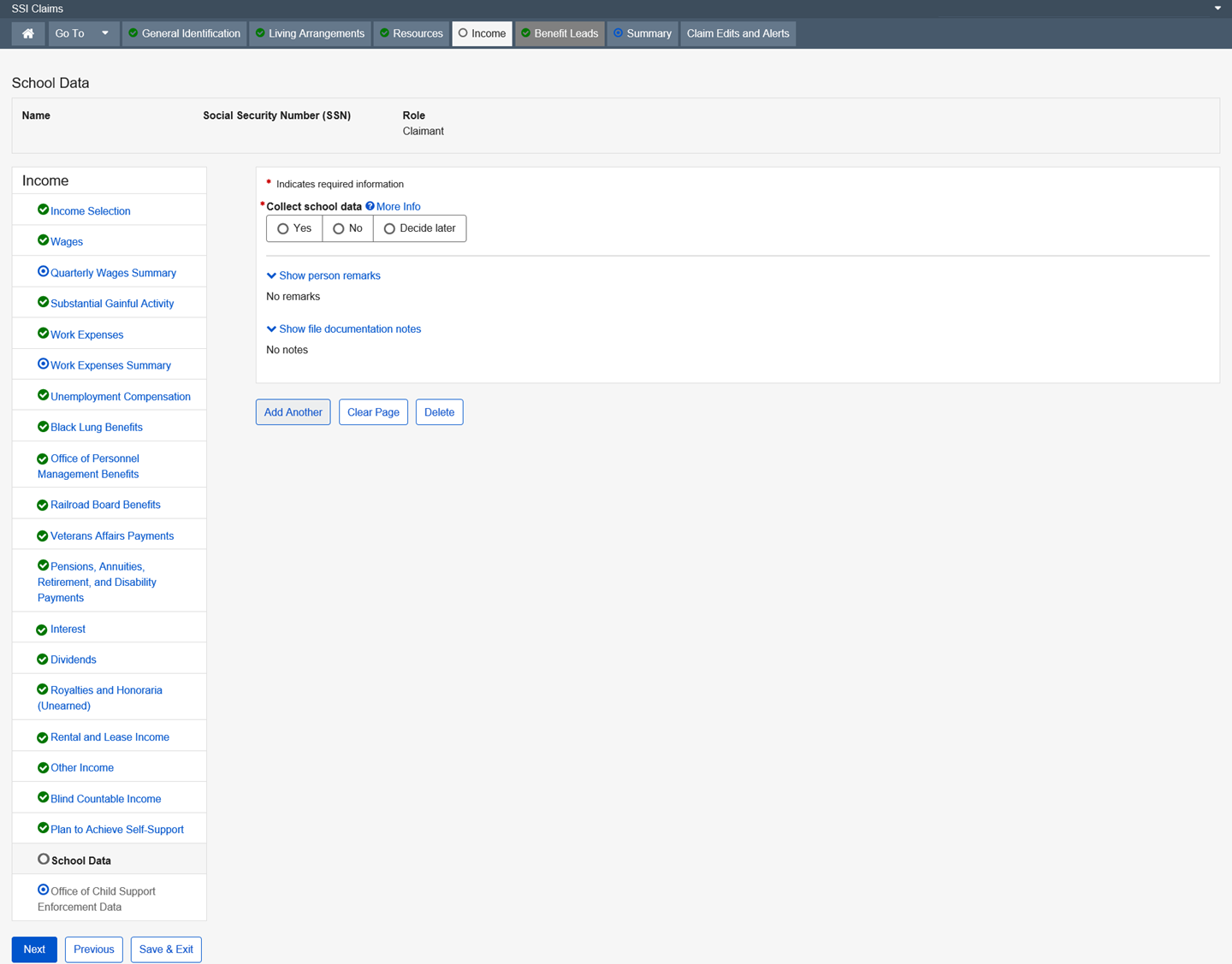

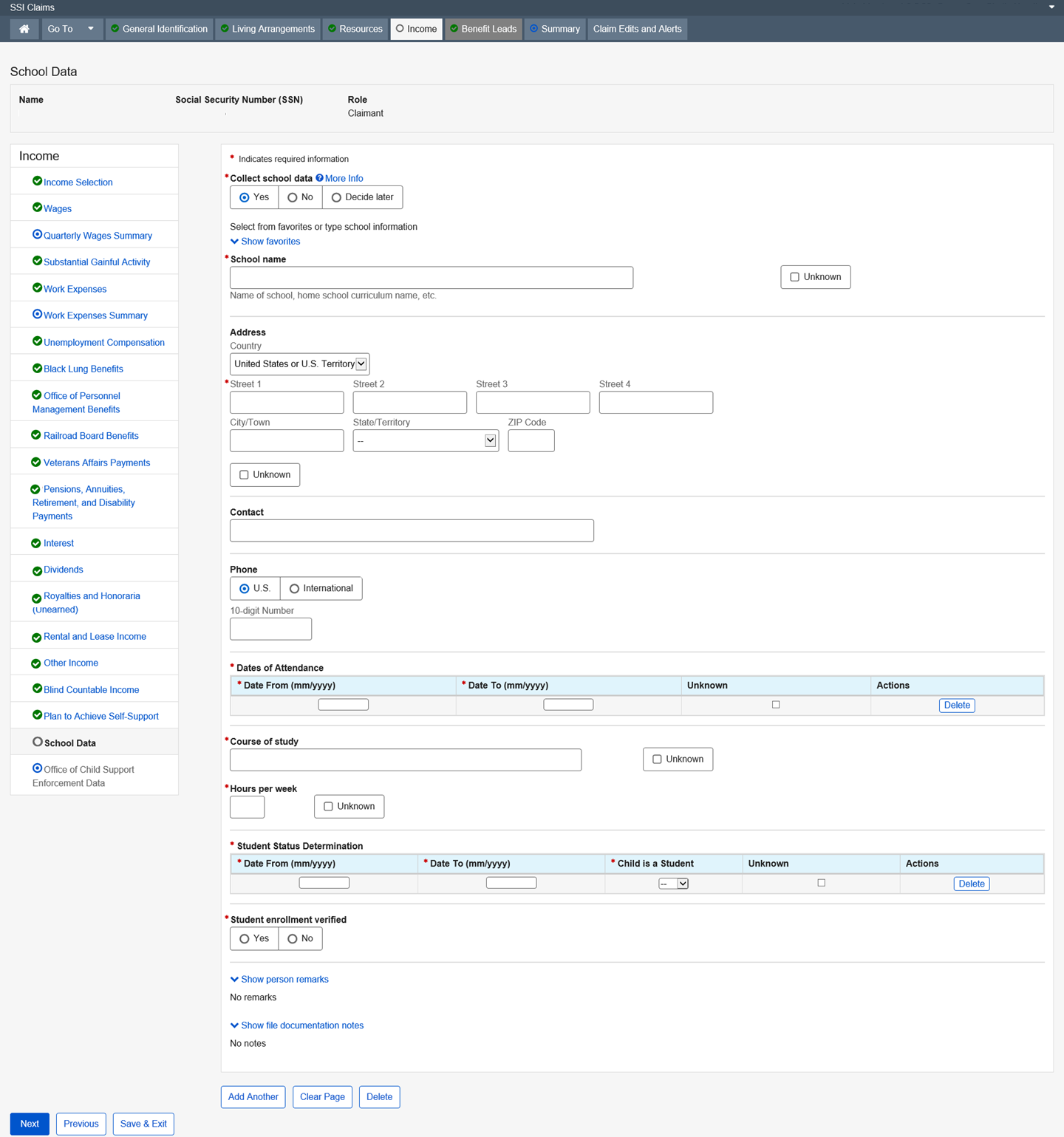

This page collects information regarding school attendance and student status for individuals (both eligible and ineligible) who are under age 22 and attending school regularly. This information is used to determine whether a student qualifies for the Student Earned Income Exclusion. This information is also used to determine if a child who is a student, between 18 and 22, not married, not eligible for SSI and living in the household of the claimant, is an ineligible child for inclusion in the deeming process.

Screenshot – Collect School Data - Yes

Dropdown list:

Country – United States or U.S. Territory (Default)

State/Territory

Child Support Enforcement is a mini-path function in SSI Claims system. Upon accessing the Child Support Enforcement function, the user is directed to query page containing data from the Office of Child Support Enforcement (OCSE). The ICSE function links to the OCSE Query pages, which house data from the National Directory of New Hires (NDNH). OCSE controls and maintains the data in NDNH.

The Child Support Enforcement function is automatically placed in the SSI Claims system path when required by current Policy in Initial Claims events and is available to the user in other SSI Claims system events upon request. The Child Support Enforcement page allows the user to retrieve and view New Hire, Wage, and Unemployment data directly from NDNH without having to exit the SSI Claims system.

Dropdown list:

Jump to report section

![]()

This page collects the claimant and claimant spouse’s allegation regarding their prior involvement with military service, work for railroad, federal, state, or local government, work under a union or private pension plan, and potential eligibility under a foreign government's social security system or pension plan. It also collects the claimant and claimant spouse’s allegations as to their spouse, former spouse, or parent's prior involvement with military service, work for railroad, federal, state, or local government, work under a union or private pension plan and potential eligibility under a foreign government's social security system or pension plan. It also inquires about their eligibility for Supplemental Nutrition Assistance Program (SNAP), Medicaid, health expenses and third party liability coverage.

The Supplemental Nutrition Assistance Program (SNAP) page exists in the Supplemental Security Income (SSI) application, and allows the user to collect data used to determine whether or not:

A claimant wants to file for SNAP

SSA can take the claimant’s SNAP application

A claimant wants to file their SNAP application at the SSA Field Office

SNAP data is collected for the eligible individual. SNAP eligibility is determined based on the household as the entity and not an individual, so this page only appears once, even if a couple is filing.

When a claimant does not wish to file for assistance at the SSA office, an explanation is recorded for policy documentation, and does not appear on their application.

More Info link:

The Health Expenses and Third Party Liability page allows the user to collect data pertaining to:

A client’s eligibility for Medicaid coverage

A client’s third party insurance coverage and who is the owner of the policy.

Information pertaining to an insurance claim or legal action that the claimant may have filed or has pending

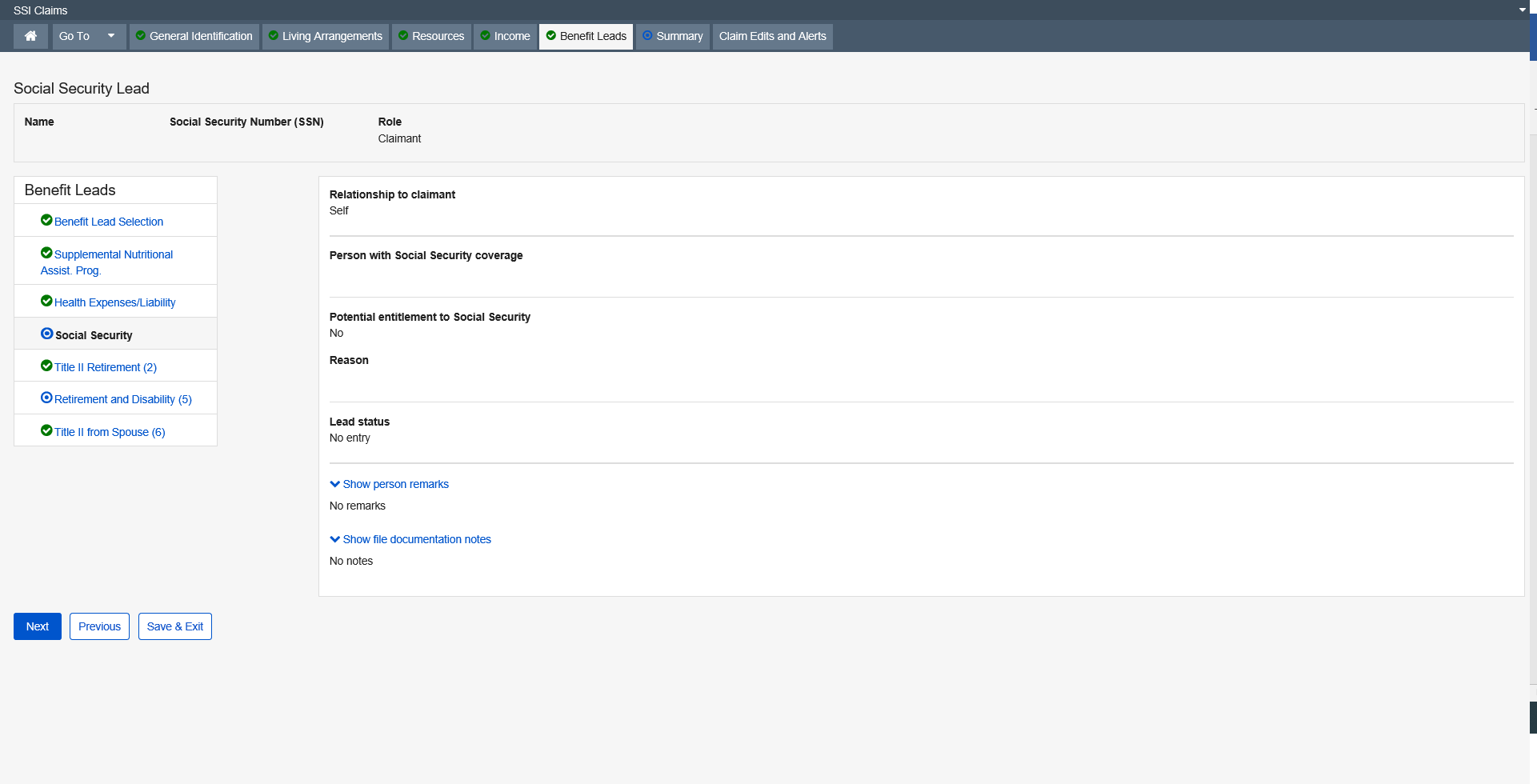

The Social Security Lead page collects information about the claimant or his/her spouse’s, former spouse’s or parent’s social security coverage. The information collected on this page is used to decide if the user should refer the claimant to file and pursue Title II benefits.

This screen is a read-only screen.

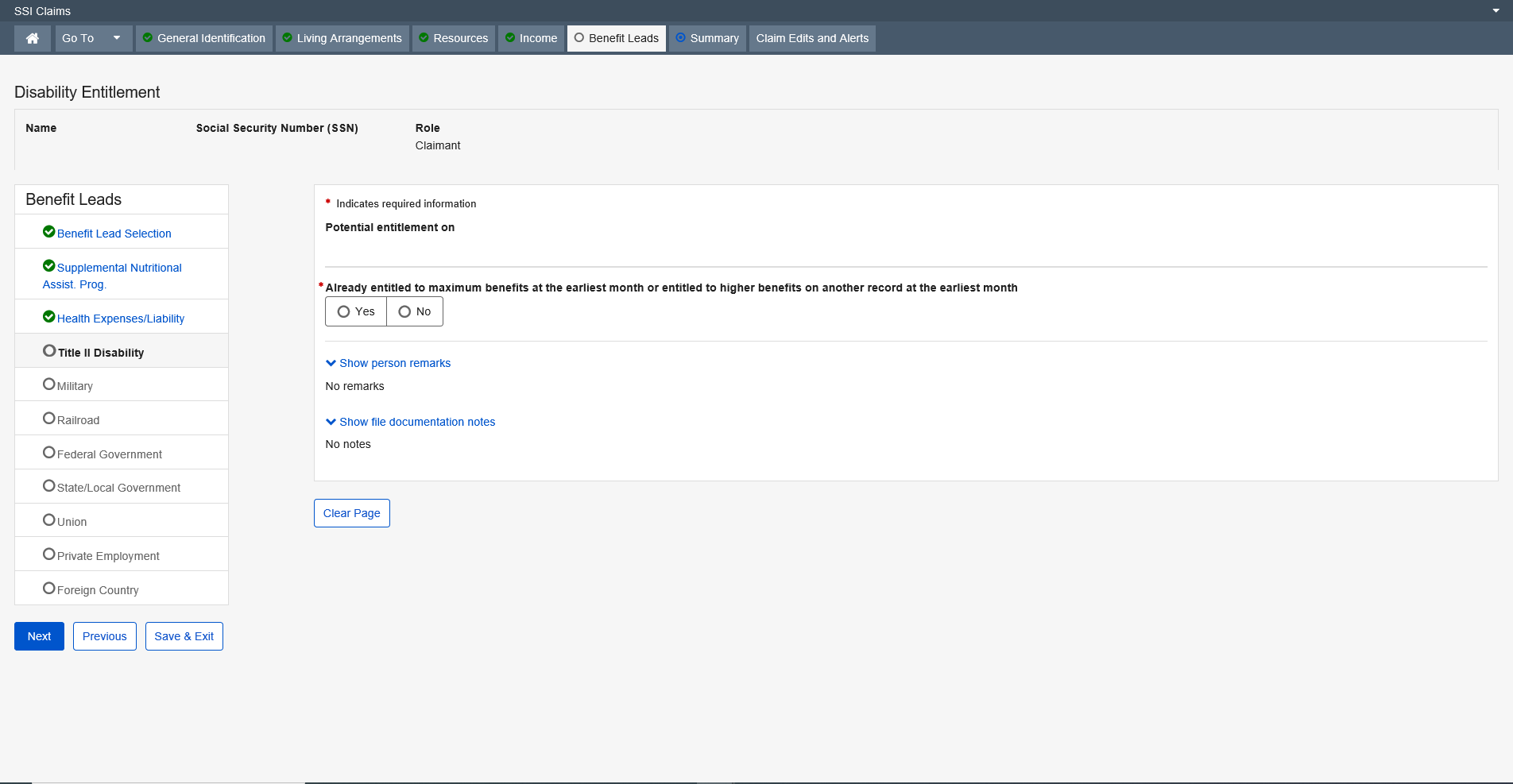

The Disability Entitlement page exists in the SSI Claims System to explore potential entitlement to Disability benefits for the claimant and claimant spouse. The information collected on this page is used to determine what, if any, action needs to be taken in order to ensure that the claimant has pursued potential entitlement to these benefits.

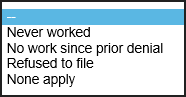

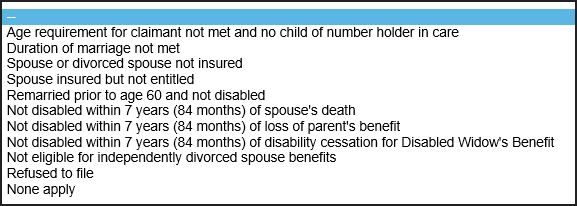

Dropdown list:

Reason not entitled

The Child’s Entitlement from Parents page exists in SSI Claims system to explore the claimant’s potential entitlement to auxiliary or survivor benefits from the claimant’s parents. All previous MSSICS screens of Child’s Entitlement from Father and Child’s Entitlement from Mother will be converted to Child’s Entitlement from Parents.

Dropdown list:

The Retirement Entitlement page exists in the Supplemental Security Income (SSI) application to explore potential entitlement to Retirement benefits for the claimant and claimant spouse. The information collected on this page is used to determine what, if any, action needs to be taken in order to ensure that the claimant has pursued potential entitlement to these benefits.

Dropdown list:

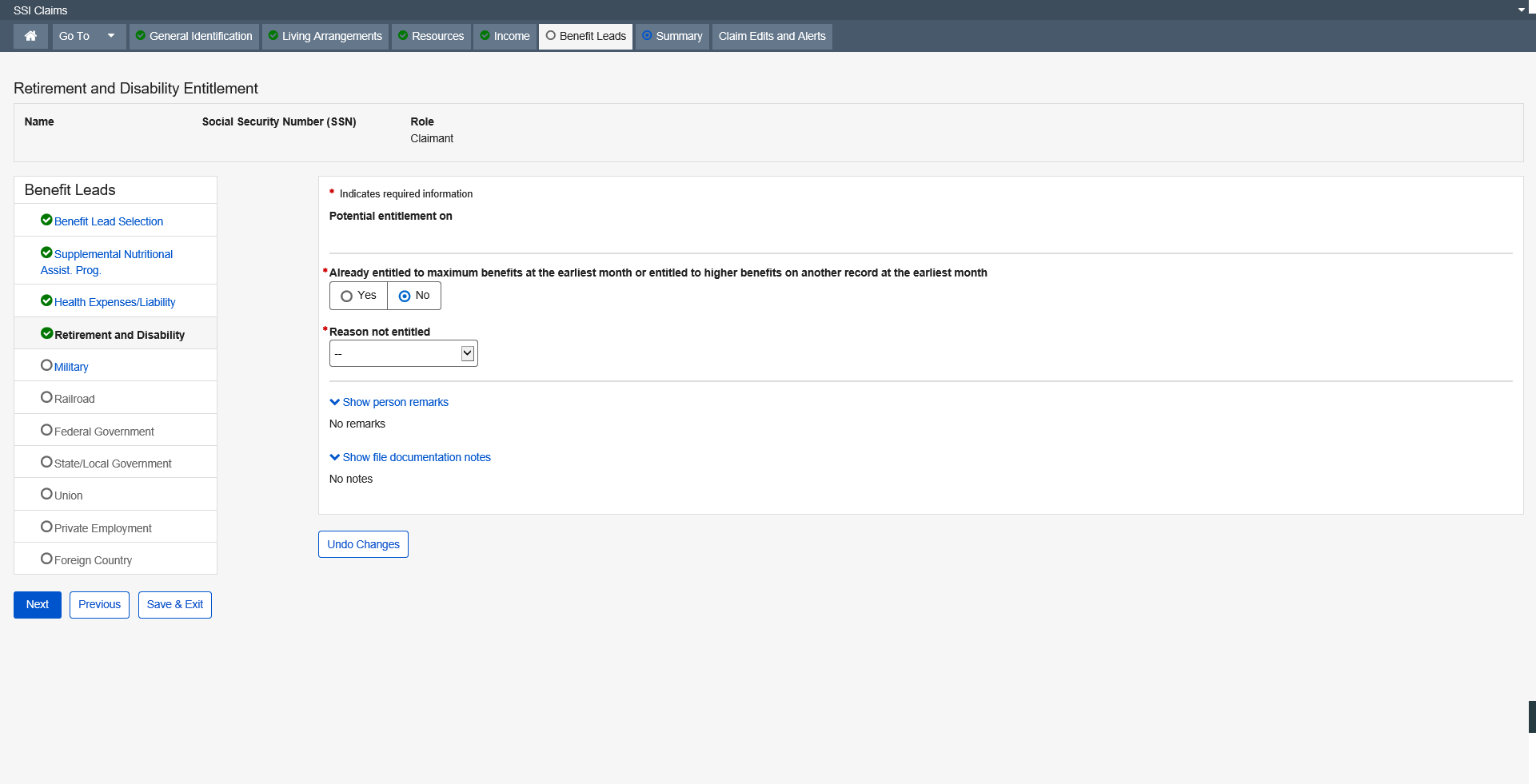

The Retirement and Disability Entitlement page exists in the SSI Claims System to explore potential entitlement to Retirement and Disability benefits for the claimant and claimant spouse. The information collected on this page is used to determine what, if any, action needs to be taken in order to ensure that the claimant and claimant spouse has pursued potential entitlement to these benefits. When a new event occurs (initial claim or redetermination) the user will be presented with Retirement entitlement and/or Disability entitlement pages in the path.

Dropdown list:

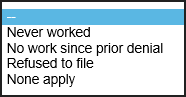

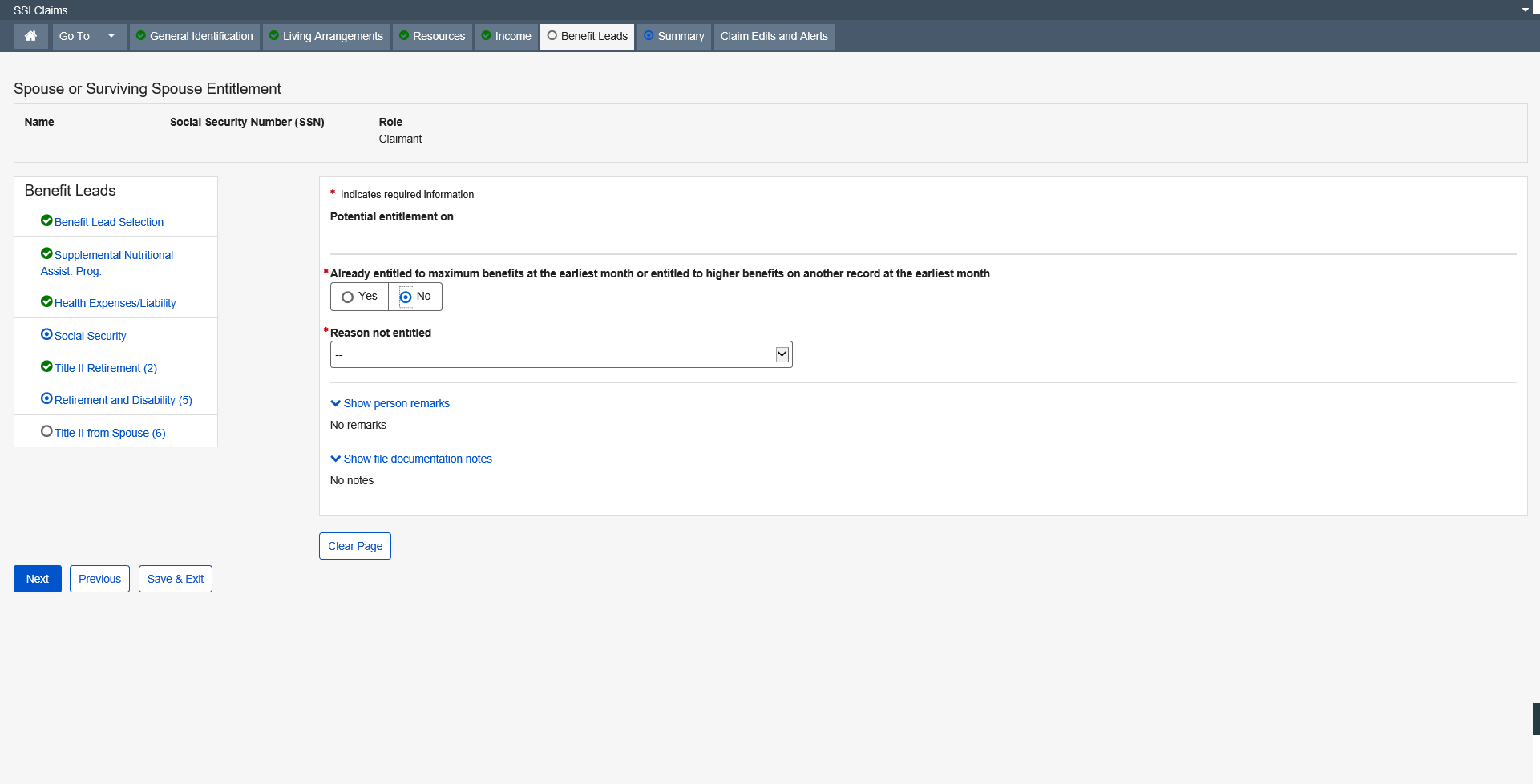

The Spouse or Surviving Spouse Entitlement page exists in the SSI Claims System to explore potential entitlement to spouse, widow, or widower’s benefits. The information collected on this page is used to determine what, if any, action needs to be taken in order to ensure that the claimant has pursued potential entitlement to these benefits. The information displayed on this page is derived from the data added to the claims file through the Marriage Information section of the Marriage page when certain criteria is met.

Dropdown list:

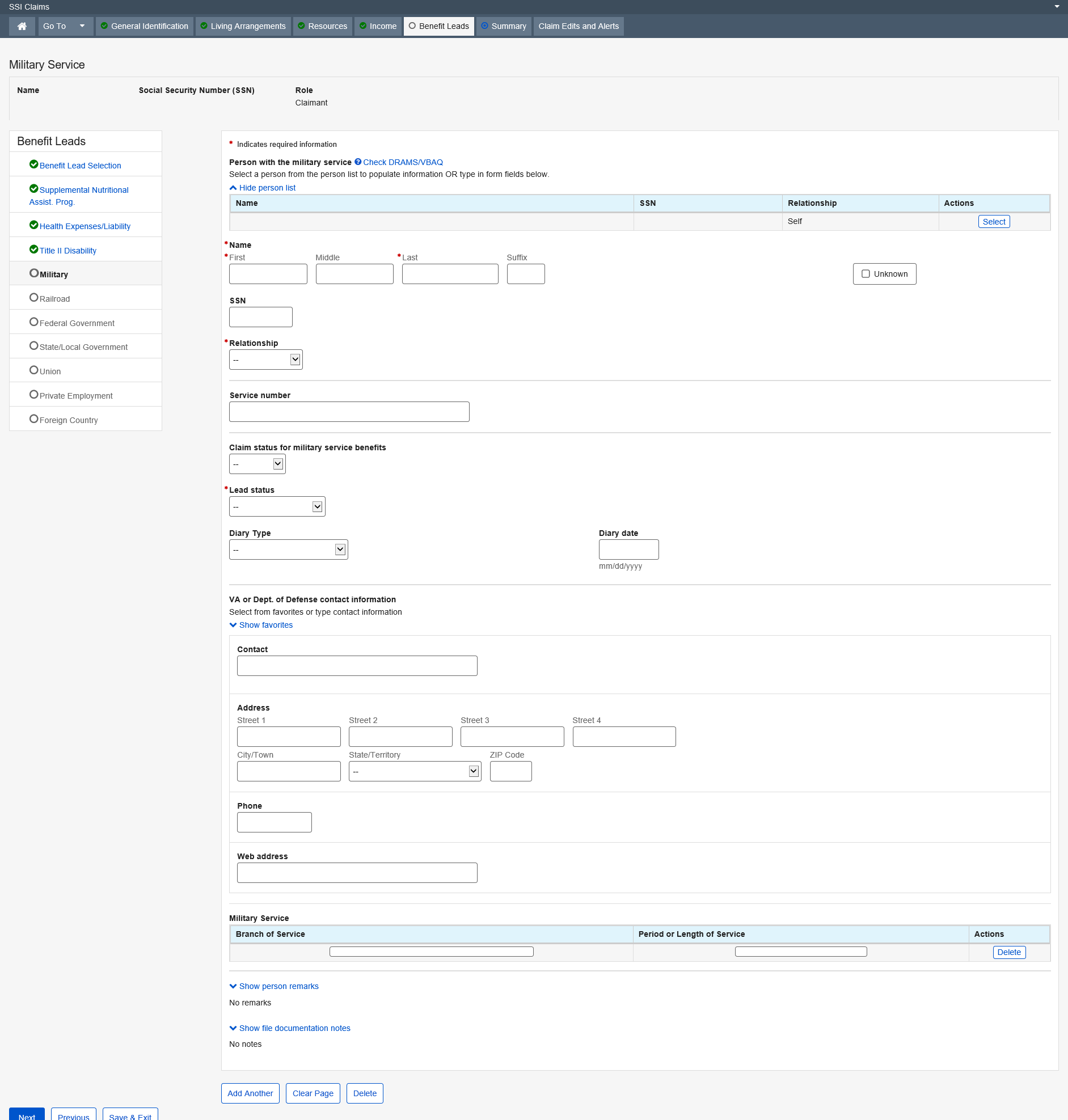

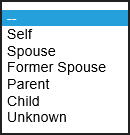

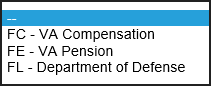

The Military Service page exists in the SSI Claims System to collect data on the military service of the claimant, spouse, former spouse or parent. The information is used to determine the claimant’s potential eligibility for a military pension or Veterans Affairs (VA) benefits by generating a referral letter directing the claimant to pursue such potential entitlements.

Dropdown list:

Relationship

Claim status for military service benefits

Lead status

Diary Type

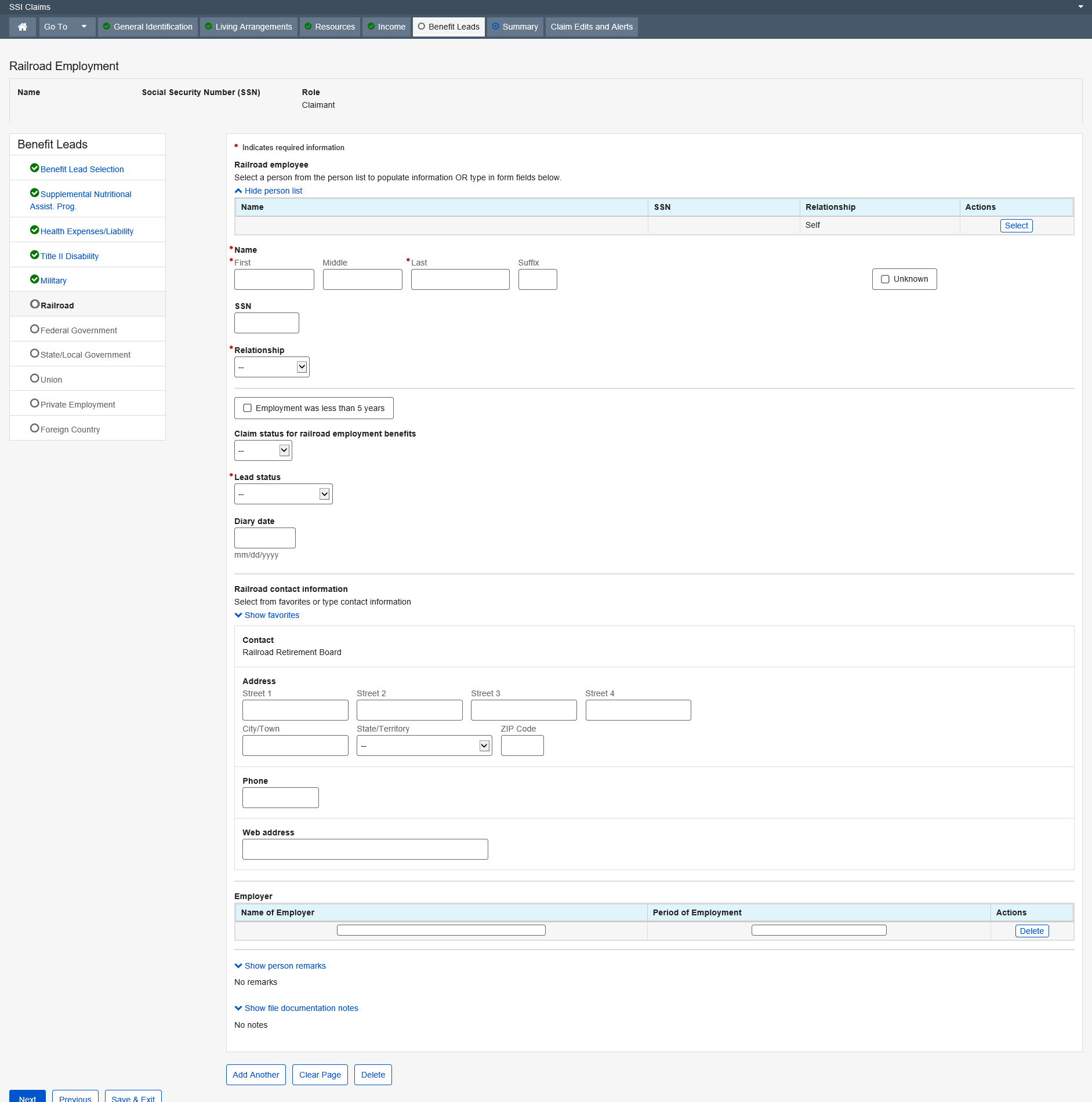

The Railroad Employment page exists in the SSI Claims system to explore potential entitlement to Railroad benefits for the claimant and claimant spouse. The information collected on this page is used to determine what, if any, action needs to be taken in order to ensure that the claimant has pursued potential entitlement to these benefits.

Dropdown list

Relationship

Claim status for military service benefits

Lead status

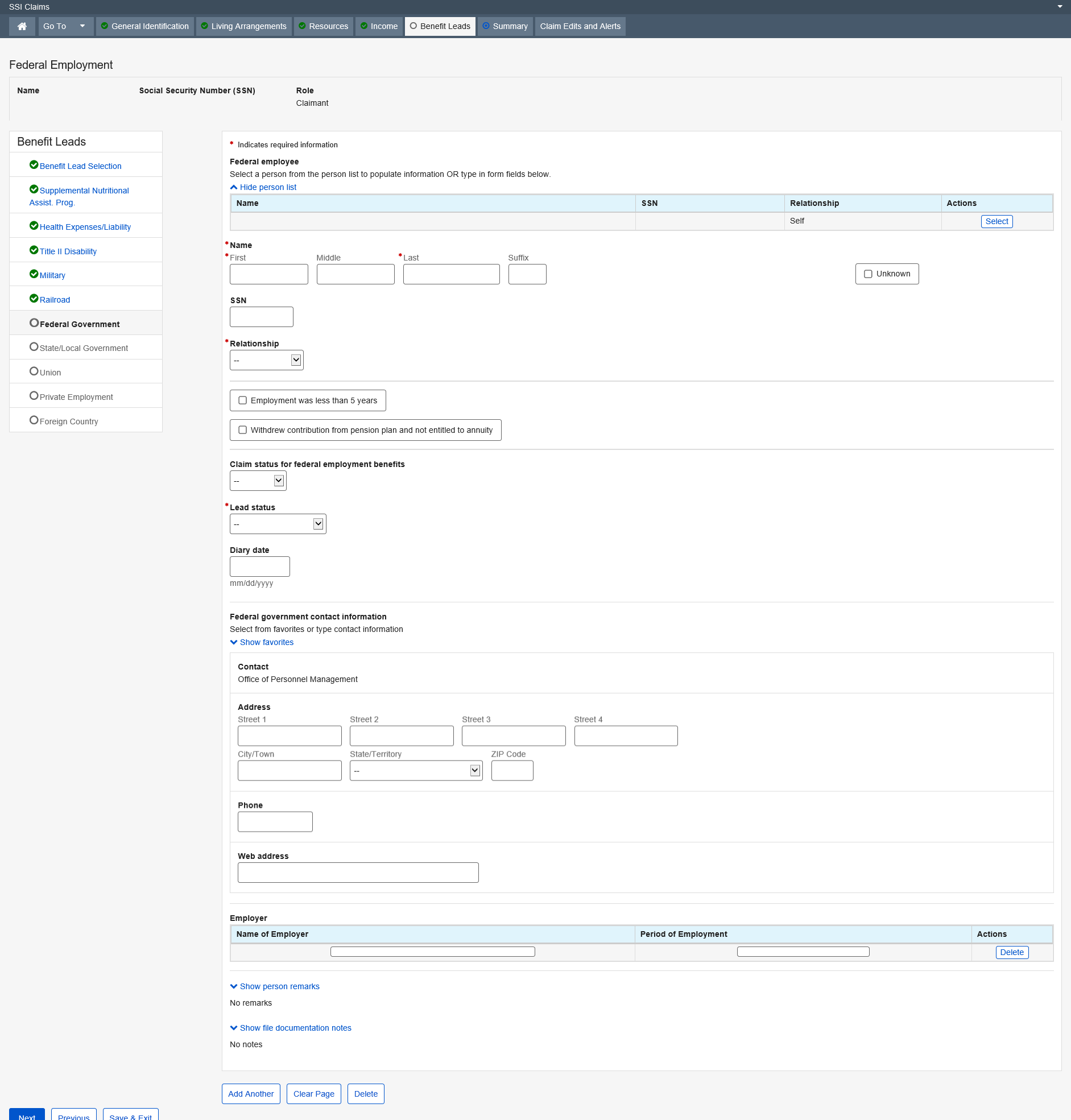

The Federal Employment page exists in the SSI Claims System to collect data about the claimant's or someone else's (i.e., spouse, former spouse or parent's) work for the federal government. The information is used to assess the claimant's potential eligibility for other benefits by generating a referral letter directing the claimant to pursue potential entitlement to federal employment benefits.

Dropdown list

Relationship

Claim status for military service benefits

Lead status

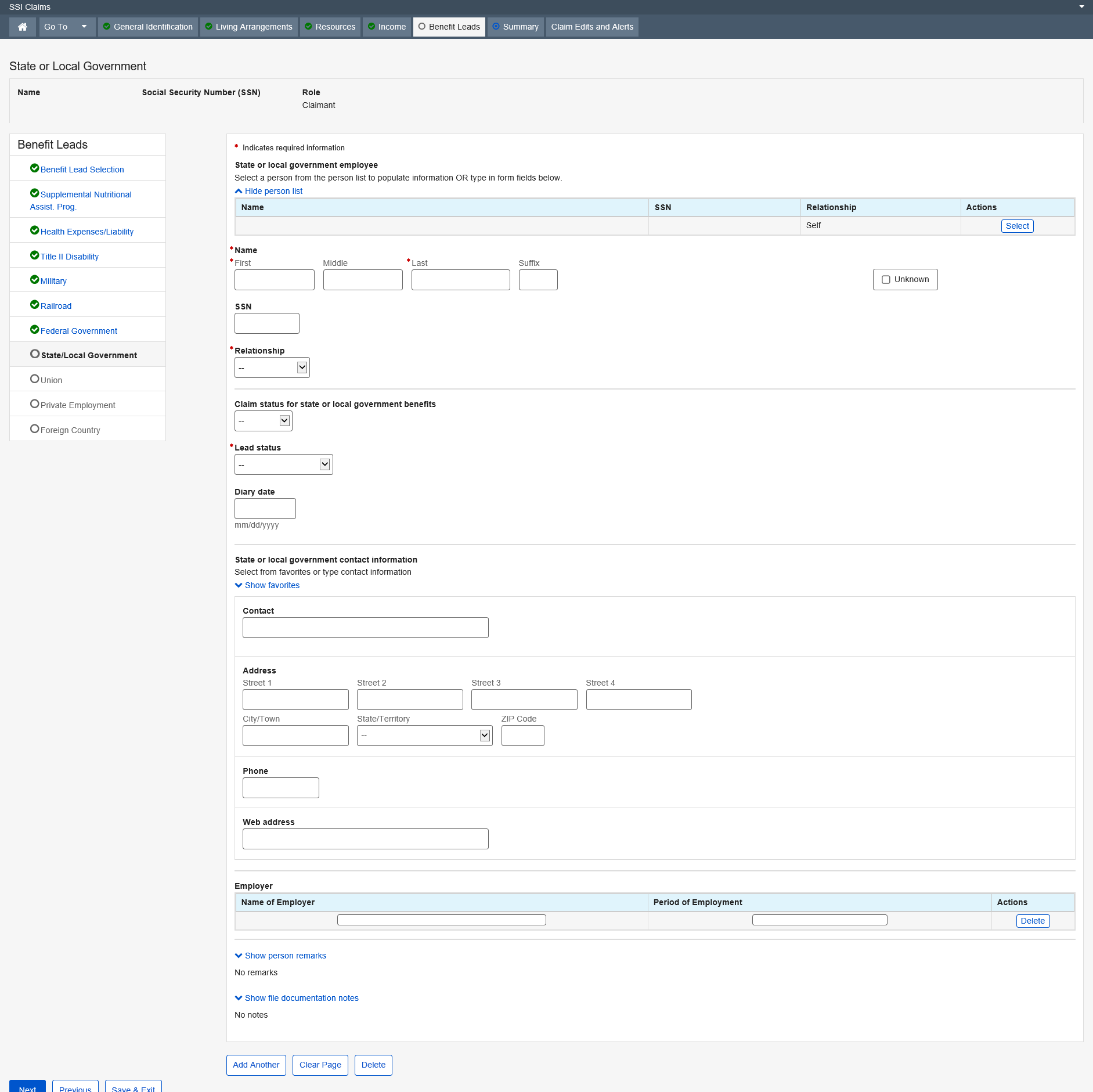

The State or Local Employment page exists in the SSI Claims System to explore potential entitlement to State or Local benefits for the claimant and claimant spouse. The information collected on this page is used to determine what, if any, action needs to be taken in order to ensure that the claimant has pursued potential entitlement to these benefits.

Dropdown list

Relationship

Claim status for state or local government benefits

Lead status

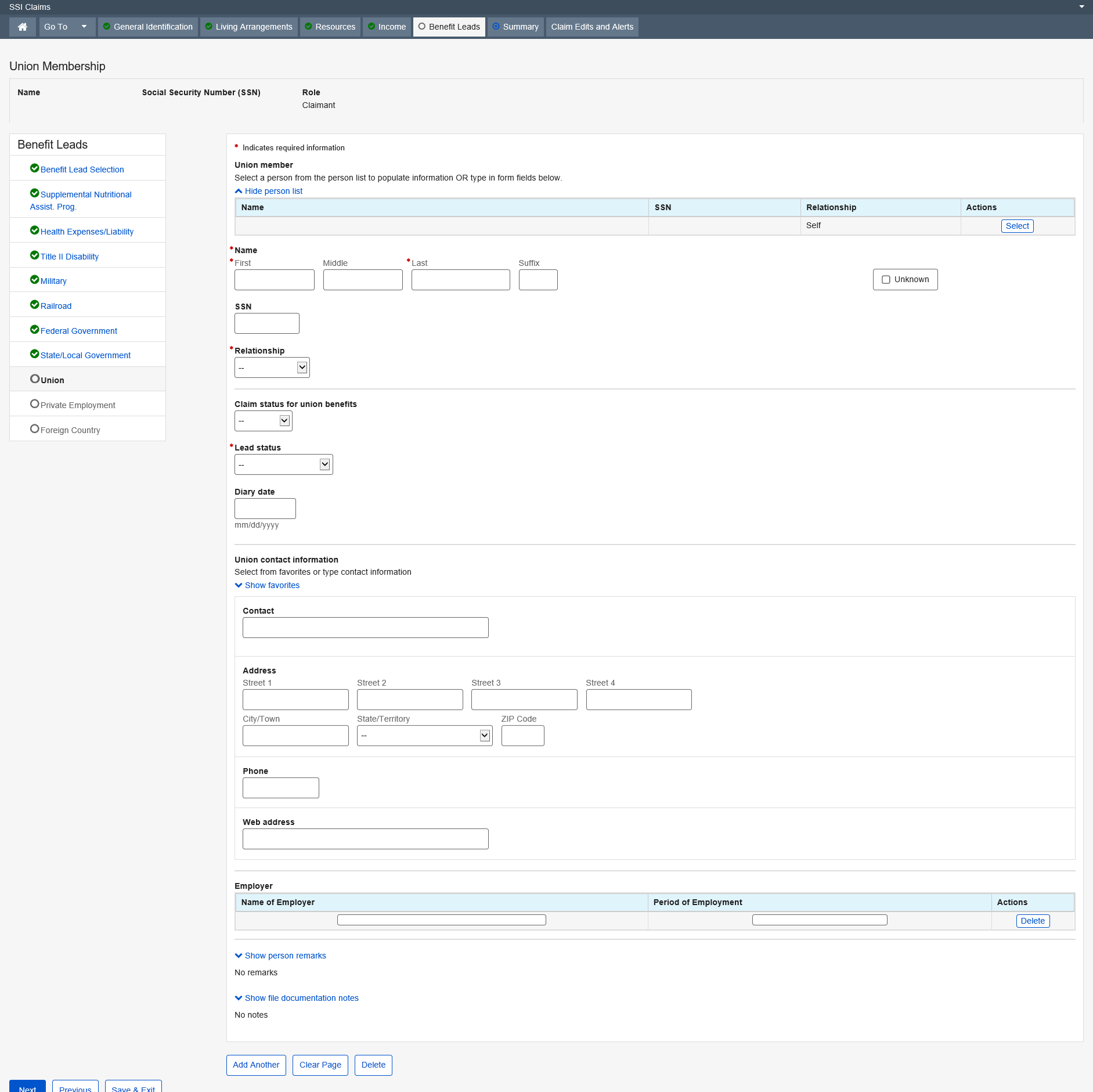

The Union Membership page exists in the SSI Claims System to explore potential entitlement to Union Membership benefits for the claimant and claimant spouse. The information collected on this page is used to determine what, if any, action needs to be taken in order to ensure that the claimant has pursued potential entitlement to these benefits.

Dropdown list

Relationship

Claim status for union benefits

Lead status

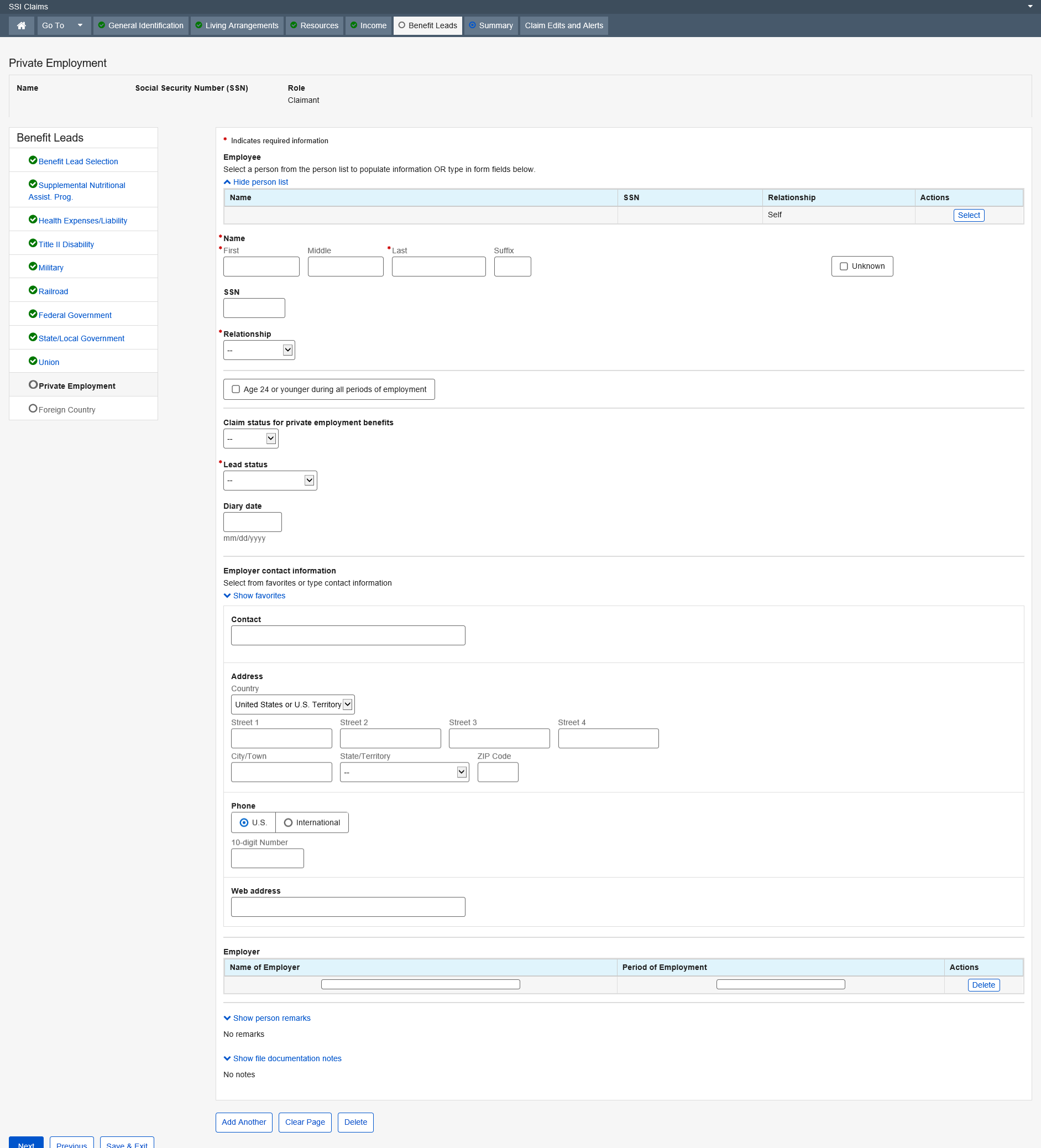

The Private Employment page exists in the SSI Claims System to collect data about the work history of the claimant, spouse, former spouse or parent. The information is used to determine eligibility for a pension plan from private employment by generating a referral letter directing the claimant to pursue potential entitlements.

Dropdown list

Relationship

Claim status for private employment benefits

Lead status

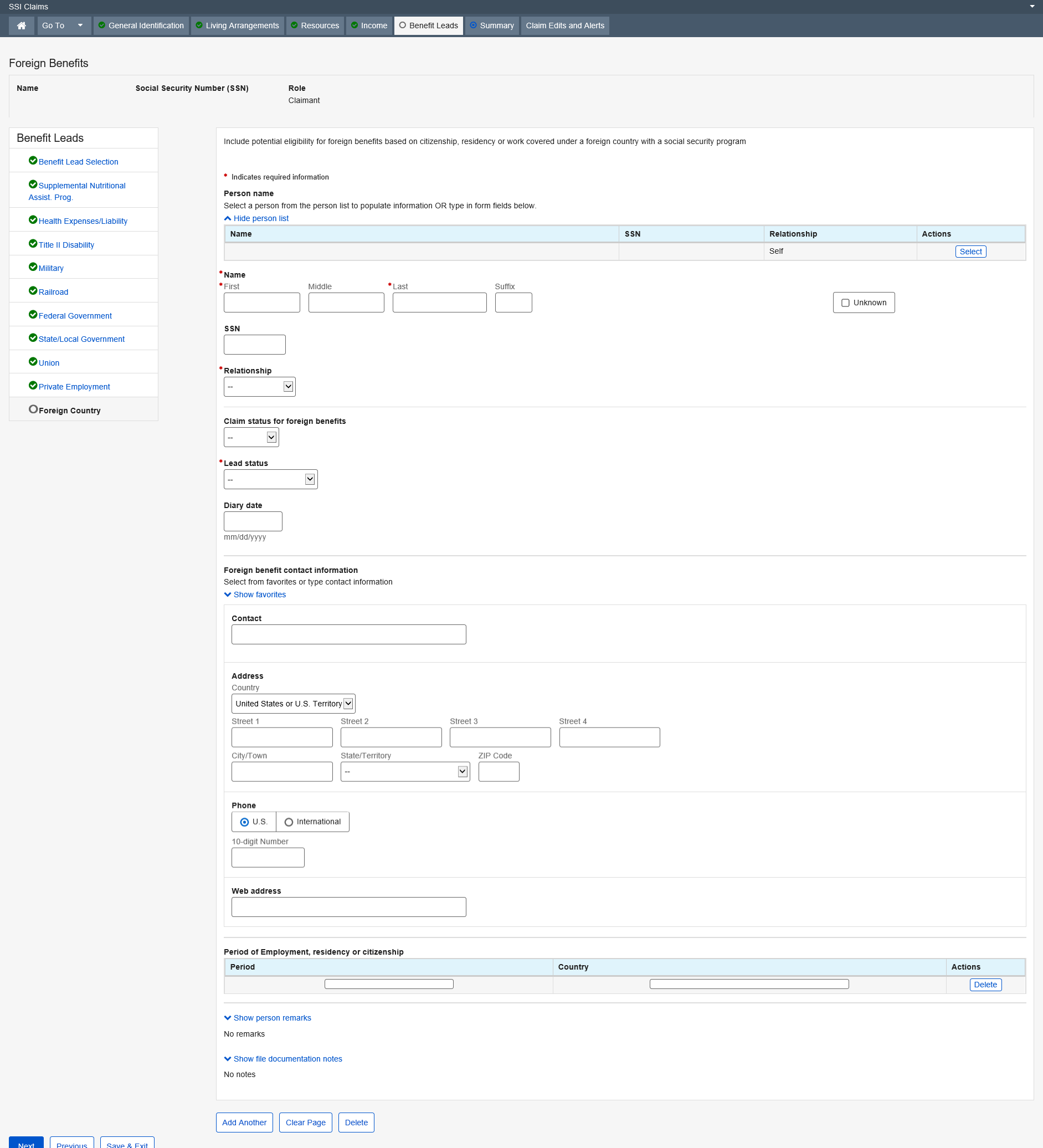

The Foreign Employment page exists in the SSI Claims system. This page collects data about the claimant’s or someone else’s (i.e., spouse, former spouse or parent’s) work under a foreign government social security or pension plan. This information is used to assess the claimant’s potential eligibility for other benefits by generating a referral letter directing the claimant to pursue potential entitlement to foreign employment benefits.

Dropdown list

Relationship

Claim status for foreign benefits

Lead status

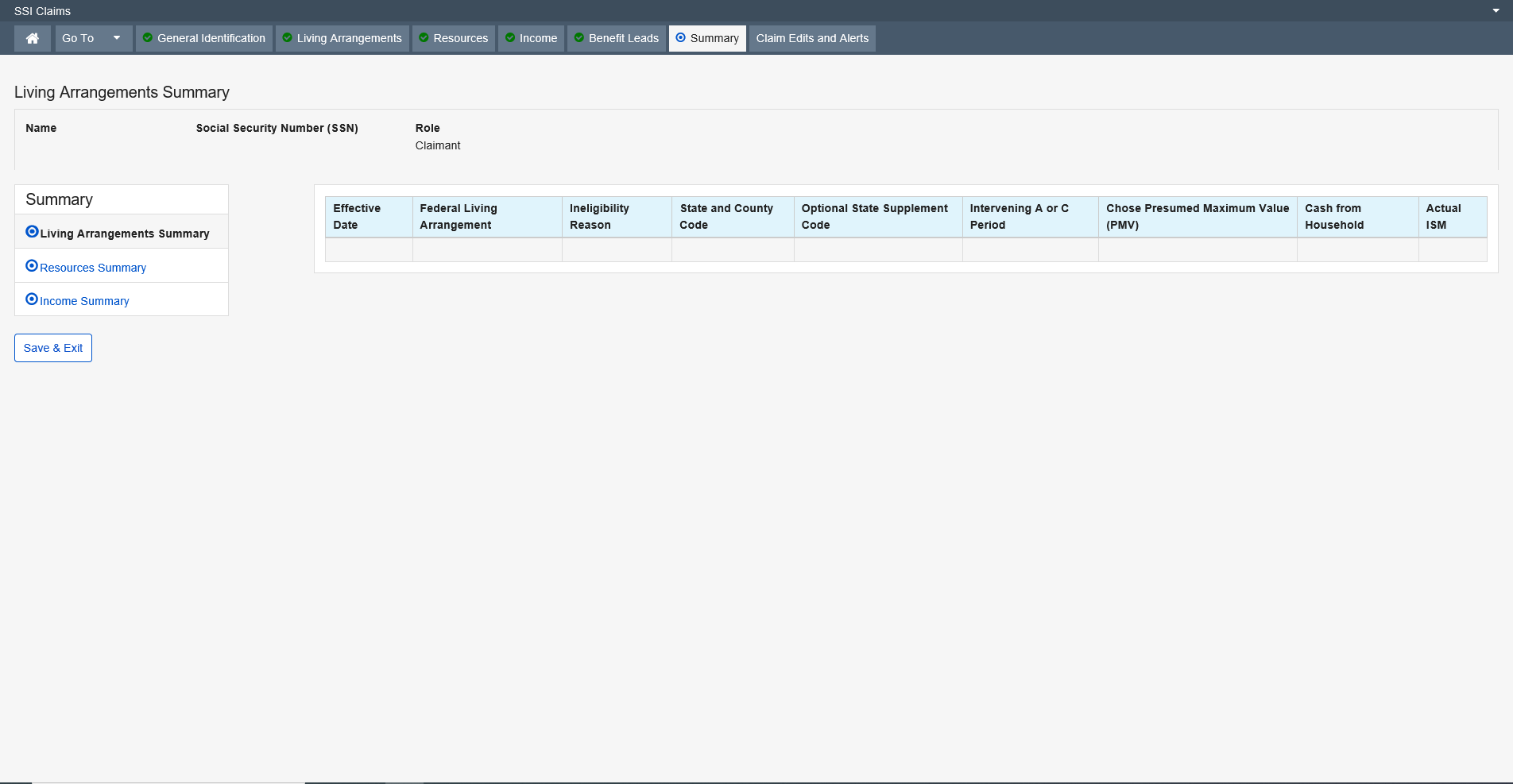

Living Arrangements Summary is an optional page that provides a summary of the Living Arrangements data that have been collected in the detailed Living Arrangements pages for a Supplemental Security Income claimant and claimant spouse, if applicable.

All fields on the Living Arrangements Summary page are display only.

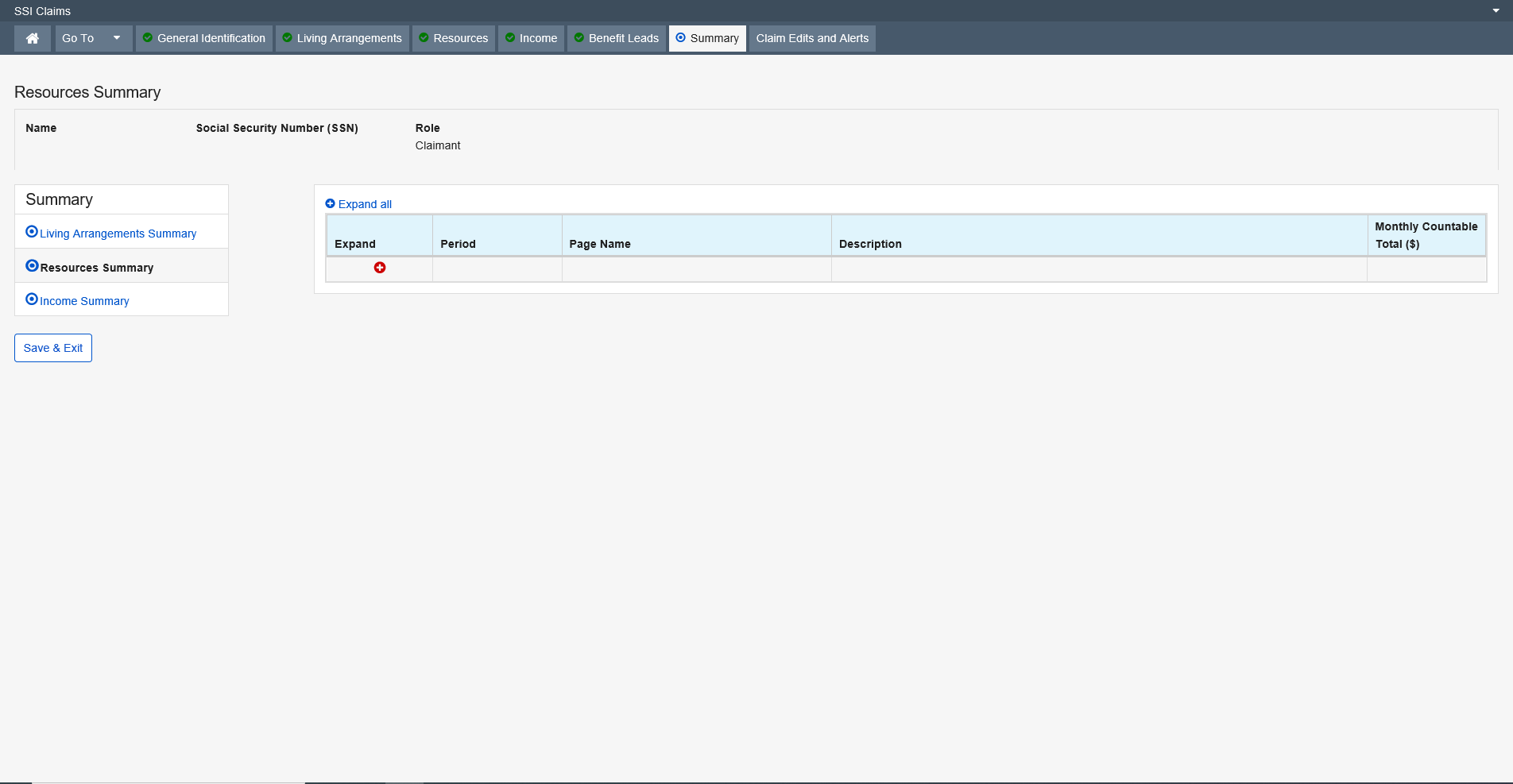

Resources Summary is an optional page that provides a condensed display of the resource data that has been collected in the detailed resource data groups for a Supplemental Security Income (SSI) claimant or deemor. In addition, the person’s countable resources are totaled in Resources Summary to aid Claims Representative's in their review of the claim or in performing manual resource deeming computations. Resources Summary is entirely propagated or derived and no data can be changed on this data group.

All fields on the Resources Summary page are display only.

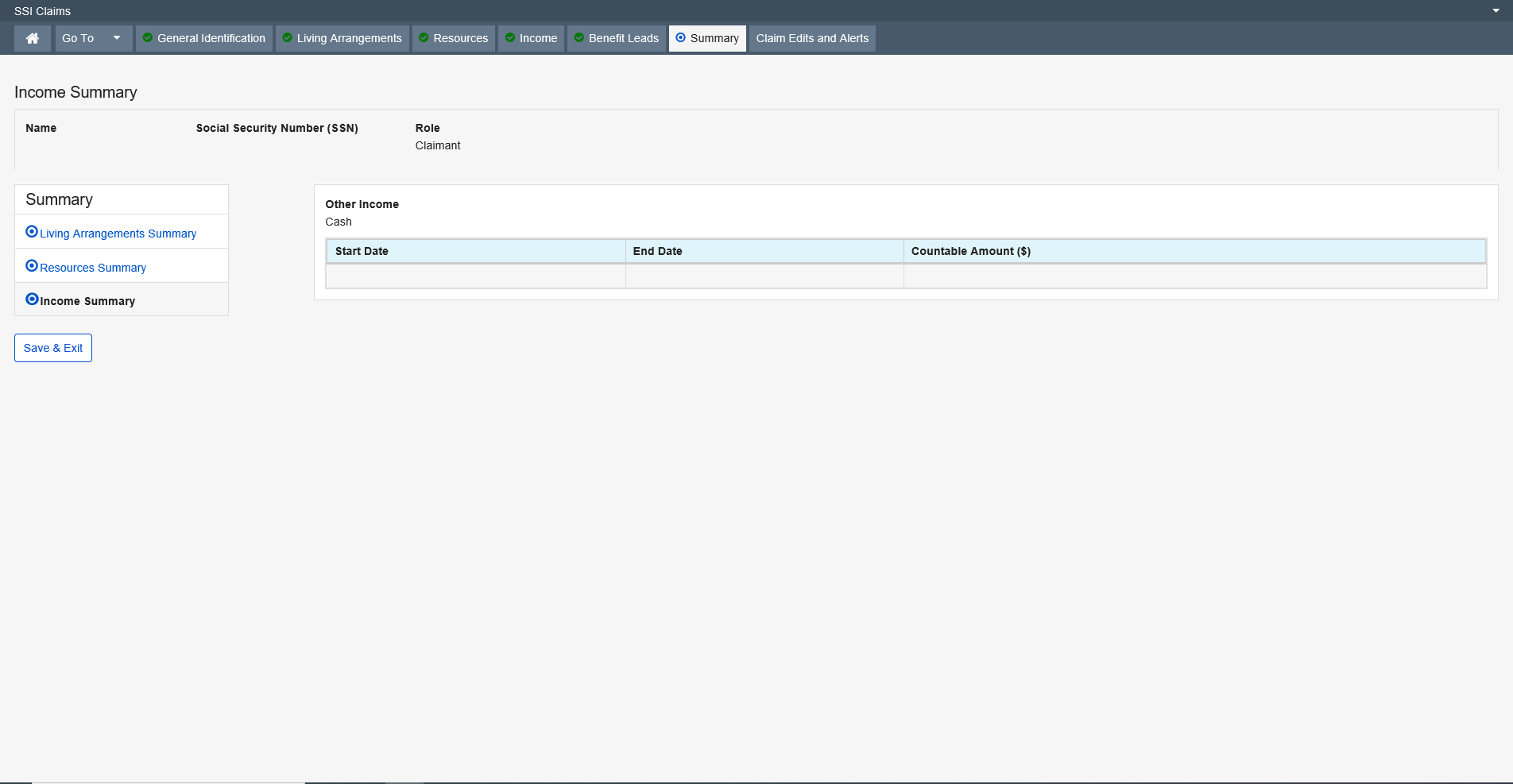

Income Summary (ISUM) is an optional, display-only page. It displays limited information about a person’s countable income for the past 26 months, the current month, and the future 14 months. The information displayed is from the person’s detailed income records.

All fields on the Income Summary page are display only.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy