Justification for no material or non-substantive change

Justification Nonmaterial Change 4010 instructions.v1.docx

Annual Financial and Actuarial Information Reporting (29 CFR Part 4010)

Justification for no material or non-substantive change

OMB: 1212-0049

Justification for No Material or Nonsubstantive Change to Currently-Approved Collection

AGENCY: Pension Benefit Guaranty Corporation (PBGC)

TITLE: Annual Financial and Actuarial Information Reporting (29 CFR part 4010)

STATUS: OMB control number 1212‑0049; expires 02/28/2026

CONTACT: Stephanie Cibinic (202-229-6352)

The Pension Benefit Guaranty Corporation (PBGC) is making changes that are not material to the currently-approved instructions for plans to submit financial and actuarial information to PBGC. Section 4010 of the Employee Retirement Income Security Act of 1974 (ERISA) and PBGC’s regulation on Annual Financial and Actuarial Information Reporting (29 CFR Part 4010) require a contributing sponsor of certain underfunded single-employer plans and members of the contributing sponsor’s controlled group to report identifying, financial and actuarial information to PBGC. In general, this reporting is required if one or more plans sponsored by a member of the controlled group has a funding target attainment percentage (4010 FTAP) below 80%.

The 4010 regulation specifies the items of identifying, financial, and actuarial information that filers must submit under section 4010 of ERISA, through PBGC’s e-filing portal (“4010 filing”). Computer-assisted analysis of this information helps PBGC to anticipate possible major demands on the pension insurance system and to focus PBGC resources on situations that may pose increased risks to that system. Because other sources of information are usually not as current as the section 4010 information and do not reflect a plan’s termination liability, the section 4010 filing plays a major role in PBGC’s ability to protect participant and premium-payer interests.

The changes to the e-filing portal instructions are being made alongside a redesign of that filing portal (including modifications to the login process to meet cybersecurity requirements under Executive Order 14028), which will be available on February 1. The changes are to the format and form of three questions, which are intended to improve user experience and accuracy of data entered. The three changes are described below, and the applicable screenshots also have been uploaded with this statement.

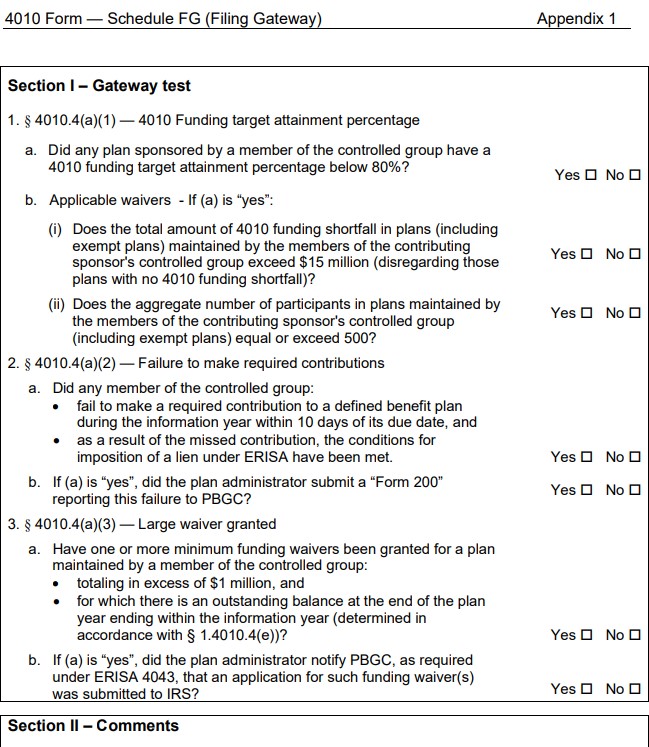

Change #1: Section 4010.6(a)(2) provides that when a 4010 filing is required for one information year but not the next, the filer must demonstrate that a filing is not required (an abbreviated filing). The demonstration is a series of questions that appear one-at-a-time on Schedule FG (Filing Gateway). With the new e-filing portal, Schedule FG is being eliminated and the demonstration is being moved to Schedule G (General Information). In addition, the demonstration is being reformatted into three checkboxes instead of a series of questions. The current and new formats are shown below.

Current demonstration questions

New demonstration check boxes

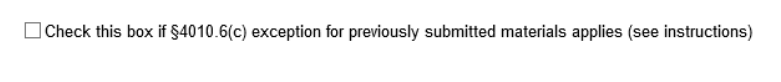

Change #2: The current e-filing portal was designed such that the user was instructed to check a box if a certain condition applied, in three different places within the system. With the new portal, those three “check box” statements are reformatted into a question that must be answered “Yes” or “No,” as shown below.

On Schedule G, a question about an exemption for previously submitted materials:

Current question

Revised question

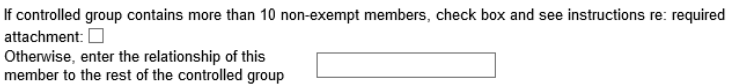

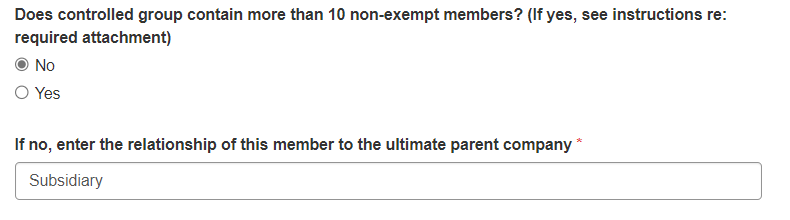

On Schedule I (Identifying Information), a question about how many members (other than exempt members) are in the filer’s controlled group:

Current question

Revised question

On Schedule I, a question about whether an entity identified is an exempt sponsor of an exempt plan:

Current question

![]()

Revised question

Change #3: In the current e-filing portal, when a filer uploads an attachment, the filer is required to enter a description of the attachment. With the new portal, the filer will also select the type of attachment from a list that appears in a drop down menu. The choices are:

Actuarial Valuation Report

Company Financial Statements

Company Tax Returns

Controlled Group Information

Other Company-Related Documents

Other Pension Plan-Related Documents

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Murphy Deborah |

| File Modified | 0000-00-00 |

| File Created | 2024-07-20 |

© 2026 OMB.report | Privacy Policy