Acf-196r

TANF Expenditure Report – ACF 196R

ACF_196R_Instructions_FINAL Feb 2024 _ Clean Version

ACF-196R

OMB: 0970-0446

OMB # 0970-0446 expires XX/XX/XXXX

INSTRUCTIONS FOR COMPLETION OF STATE TANF FINANCIAL REPORT FORM

ACF-196R

PAPERWORK REDUCTION ACT OF 1995 (Pub. L. 104-13) STATEMENT OF PUBLIC BURDEN

Through this information collection, ACF is gathering information to ensure that federal Temporary Assistance for Needy Family (TANF) and state maintenance-of-effort funds (MOE) are used for activities that are reasonably calculated to meet one of the purposes of TANF. Public reporting burden for this collection of information is estimated to average 14 hours per grantee, per response, including the time for reviewing instructions, gathering and maintaining the data needed, and reviewing the collection of information. This is a mandatory collection of information (42 U.S.C. § 611).

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information subject to the requirements of the Paperwork Reduction Act of 1995, unless it displays a currently valid OMB control number. The OMB # is 0970-0446 and the expiration date is XX/XX/XXXX.

|

Effective federal fiscal year (FFY) 2015, all states (including the District of Columbia) must complete reporting in accordance with these ACF 196R instructions on behalf of the agency administering the Temporary Assistance for Needy Families (TANF) program. Additionally, 45 CFR 265.6 requires states to submit program data and financial status reports electronically. States will continue to use ACF form 196 (Approved OMB No 0970-0247) to revise expenditures for FFYs prior to FFY 2015.

Electronic Submission: States are required to submit TANF financial reports using the ACF On-Line Data Collection (OLDC) system website at www.grantsolutions.gov. OLDC reduces paperwork, allows for quicker processing, automatically completes required calculations, and checks for certain data entry errors.

Due Dates: ACF-196R reports must be received by the Administration for Children and Families (ACF) within 45 days after the end of each quarter of the FFY.

For Quarter Ending (QE) Report Due

Q1 - December 31 February 14

Q2 - March 31 May 15

Q3 - June 30 August 14

Q4 - September 30 November 14

Terminology: To ensure clear communications for overlapping grant periods, please employ the following terminology in the use of this form:

Federal Fiscal Year (FFY) refers to the period from October 1 through September 30, during which states and territories may spend funds awarded in the current and prior years.

Grant Year (GY) refers to the year the funds were awarded and encompasses all reporting FFYs.

Quarterly Expenditure Reports

Part I: Financial Data

During any given FFY, a state receives TANF funding for the current year and may also have TANF funds remaining from prior years (i.e., carryover funds). For every reporting quarter where TANF funds remain, a 196R TANF report should be submitted. Effective FFY 2015, states report cumulative transfers, expenditures, and unliquidated obligations made with each open grant through the FFY only. In other words, each quarterly report reflects expenditures cumulative through the quarter for the FFY being reported, resulting in a fourth quarter report that reflects all actual expenditures made in the FFY for the GY being reported.

States only report maintenance-of-effort (MOE) expenditures, Contingency Fund expenditures, and transfers for the first FFY of a grant (e.g., GY 2023 expended in FFY 2023).

The ACF-196R encompasses a detailed list of expenditure categories (see “Line Item Instructions: ACF-196R” below). Line items for Awarded, Adjusted Award, Carryover, Total Expenditures, and Unobligated Balance will be pre-populated or calculated within each GY/FFY form. Carryover amounts update each FFY. States must submit a quarterly ACF-196R for each open GY award even if there are no new expenditures during the new quarter. To facilitate reporting in quarters within a FFY where there is no new expenditure activity, OLDC has a built-in feature that allows states to duplicate expenditure data from a previous quarter report to the subsequent quarterly 196R report using the “clone previous quarter” icon. This icon is located to the right of the “+” in OLDC.

When TANF funds for a GY are completely expended, i.e., federal unliquidated obligations and unobligated balances are zero, states must submit a report with the “final” box selected. Once a final report is submitted, no further reporting for that TANF GY award is necessary. States can submit a final ACF-196R for a GY award during any quarter of a fiscal year. While unspent prior GY funds remain available for use without FFY limitation (excluding Contingency Funds), ACF encourages states to spend their oldest funds first to close out the prior GY awards and minimize state reporting burden.

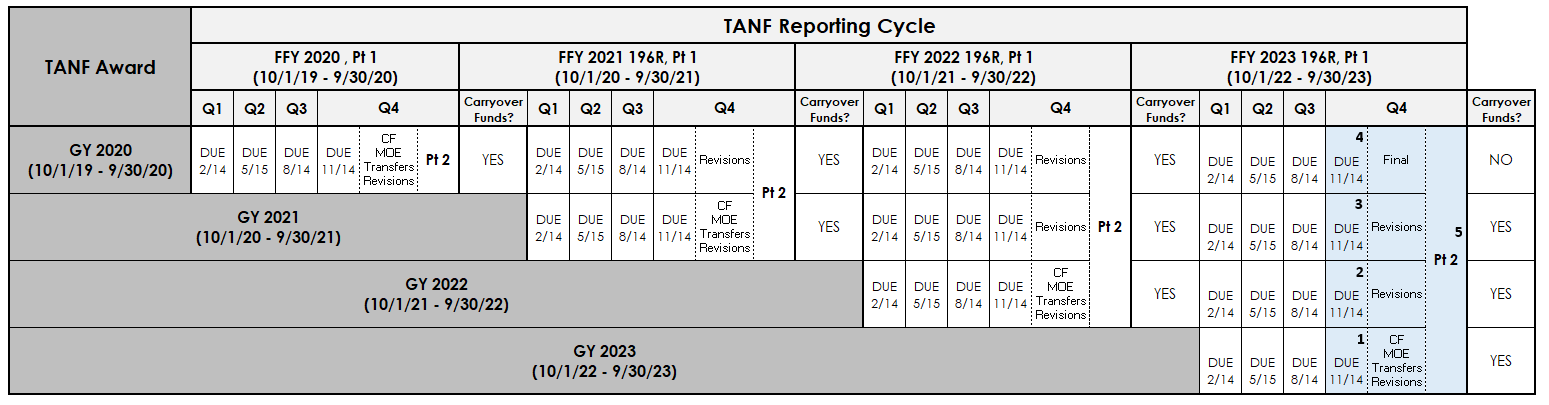

An example of TANF 196R reporting where multiple grant years are open can be represented as follows:

During FFY 2023, a state receives TANF funds for GY 2023. The state also has TANF funds remaining from prior years; GY 2020, GY 2021 and GY 2022. During the fourth quarter of FFY 2023, the state expended all the funds from the GY 2020 award, nothing from the GY 2021 award, and some funds from both the GY 2022 and GY 2023 TANF awards.

The reports that the state must submit on or before November 14, 2023 for the reporting period ending September 30, 2023 are demonstrated on table below:

ACF-196R-Part 1 for GY 2023 expended during FFY 2023. The state also reports expenditures claimed as MOE and Contingency Fund expenditures (if any).

ACF-196R-Part 1 for GY 2022 expended during FFY 2023.

ACF-196R-Part 1 for GY 2021 expended during FFY 2023, reporting no activity.

ACF-196R-Part 1 for GY 2020 expended during FFY 2023, marked “Final.”

ACF-196R-Part 2 for all open GYs, required annually

As cited in 45 CFR 265.8, a state that does not submit the required quarterly TANF Financial Report may be subject to a penalty.

Revisions to Data Reported in Prior Years

Adjustments or corrections for FFYs prior to FFY 2015 will be made on the ACF-196, as described in the instructions published in TANF-ACF-PI-2014-02. Beginning with FFY 2015, revisions to any expenditures for FFY 2015 and thereafter should be made to the quarter ended September 30 ACF-196R of the FFY in which the expenditure occurred. For a current FFY, revisions to a prior quarter should be made on the most current quarterly 196R submission up through the quarter ending September 30 submission for the current FFY. Since MOE must be reported in the first year of its respective GY, revisions to MOE expenditures, should be reported on the quarter ended September 30 report for the first year of its applicable GY. Explanations for the report revisions can be attached to the report submission.

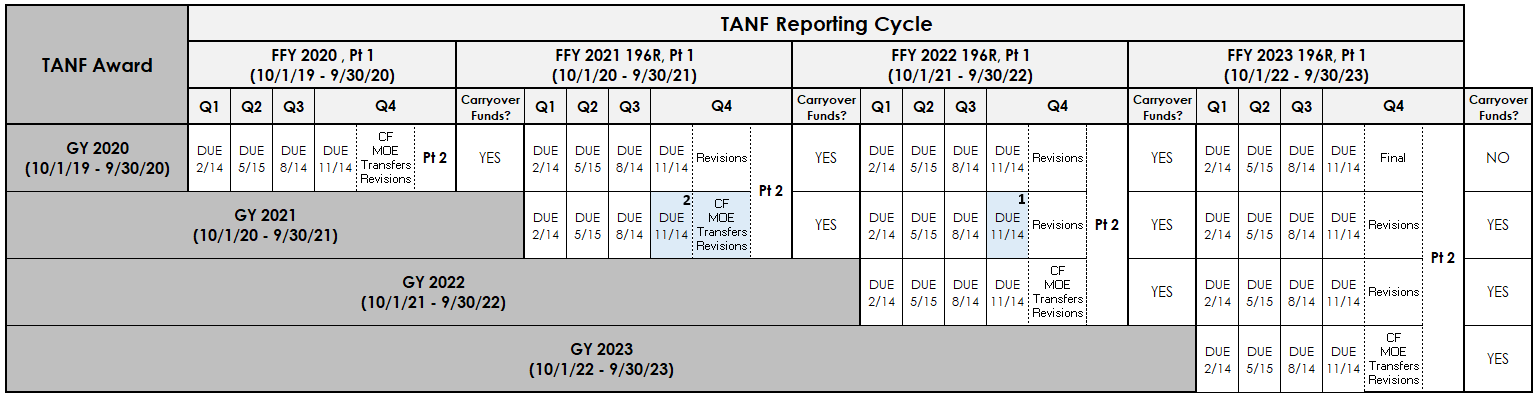

Examples of the below TANF report revisions are also demonstrated on the table that follows:

During FFY 2023, if a state needs to revise an FFY 2022 expenditure made with GY 2021 funds, it would do so on the GY 2021 ACF-196R for FFY 2022 (i.e., the GY 2021 ACF-196R for the quarter ending September 30, 2022). The table below highlights the correct report where a revision for this example should be made.

During FFY 2023, to revise the amount of MOE claimed during FFY 2021 for the same GY 2021 TANF grant, a state would revise the GY 2021 ACF-196R for the quarter ending September 30, 2021. The table below highlights the correct report where a revision for this example should be made.

Note: Available TANF balances resulting from revisions to prior year FFY reports will carry forward to the next subsequent FFY report. States are not able to make changes to the Awarded line item. Whenever a state submits a revised report for a prior FFY, OLDC automatically defaults to “Revision” and makes the selection that the report is a revision. If the state intends for a revision to be a final report, a selection for “Final” should be manually selected.

A state should not revise federal unliquidated obligations in prior years once it liquidates those funds and reports them as expenditures in future FFYs. For example, if a state reports $1 million of GY 2022 funds as unliquidated obligations at the end of FFY 2022, once it reflects the liquidation of these funds as an expenditure in a future quarter (i.e., FFY 2023 or later) the state should not revise the $1 million figure to $0 on the GY 2019 report for FFY 2022.

On the other hand, if a state revises an expenditure reported in a prior year, and this revision affects the amount reported as federal unliquidated obligations in that year, then it should revise the federal unliquidated obligations as well. For example, a state reported Total Expenditures of $10 million and federal unliquidated obligations of $3 million on its ACF-196R for GY 2022 funds expended in FFY 2022. If during FFY 2023, it recognizes that it actually had liquidated $11 million in total expenditures of GY 2022 during FFY 2022, it should revise the appropriate expenditure categories to reflect the additional $1 million in expenditures and reduce its federal unliquidated obligations to $2 million.

Note: A state should report and revise expenditures according to its own accounting method (cash basis vs. accrual); in other words, it need not change its own accounting method in order to comply with TANF financial reporting instructions.

General Instructions

Shaded blocks indicate that the entry of financial data is not required or is not applicable. In OLDC, some of these shaded areas are automatically generated or used as calculation checks.

Include costs of contracts and subcontracts in the appropriate reporting category, based on their nature or function.

Include costs of programs and services administered by counties, local agencies, and third parties in the appropriate category, based on their nature or function.

Report expenditures in the most specific and appropriate category. For example, if an expenditure that could be considered a Non-Recurrent Short-Term benefit can also be reported under a more specific category, that spending should be reported in the more specific category if feasible.

General Block Entries

Enter all expenditures, including cents. Do not round to the nearest dollar.

Enter state name.

Grant Year: OLDC automatically populates the federal GY (the FFY in which the grant was originally awarded) associated with the expenditures being reported.

Federal Fiscal Year: OLDC automatically populates the FFY, which corresponds to the FFY of the expenditure reporting period.

Report Quarter Ending Date: OLDC automatically populates the ending date for which the expenditures are being reported.

Next Quarter Ending: OLDC automatically populates the ending date of the next quarter.

OLDC indicates whether this is a new report or a revision of a report previously submitted for the same period. If applicable check the box indicating that the report is final, i.e., the report you are submitting will be the final report for the GY, thereby closing out the grant.

Add the signature of the person authorized to submit the report. Note that this signature conveys sign-off of data elements for which the state is responsible; the following line items will be pre-populated or calculated for the grantee: Awarded, Adjusted Award, Carryover, Total Expenditures, and Unobligated Balance.

Date Submitted: OLDC automatically stamps a date when the report is submitted.

Explanation of Columns

Column A is for reporting State Family Assistance Grant (SFAG) federal funds awarded and how those funds were utilized.

Column B is for reporting state MOE expenditures within the TANF program to meet its basic MOE requirement. Include state funds that are commingled with federal funds and segregated state funds expended under the state TANF program. Include all MOE funds contributed to a tribe or consortium of tribes operating an approved Tribal TANF Plan (see TANF-ACF-PA-2000-04 for more information). A state only reports expenditures claimed as MOE for a GY in the first FFY year-end report.

Contingency Funds: States receiving Contingency Funds under section 403(b) for the FFY must also use this same column to report state TANF expenditures made to meet the Contingency Fund MOE requirement and matching expenditures made above the 100 percent MOE level. Expenditures made to meet the Contingency Fund MOE requirement and expenditures made above the MOE level (for matching purposes) must be expenditures made under the state TANF program only; they cannot include expenditures made under “separate state programs” in Column C. In addition, child care expenditures (Line 11.a.) cannot be included as Contingency Fund MOE expenditures or MOE expenditures that are matched with Contingency Funds.

Relationship to Caseload Reduction Credit (reported on ACF-202): In accordance with 45 CFR 261.43, some states report MOE spending data in the calculation of the caseload reduction credit to determine the work participation rate target(s) a state must meet for a FFY. For the MOE reported on the quarter ended 9/30 196R to count in the calculation, each GY’s MOE must be reported on the first year quarter ended September 30 196R report by December 31. Subsequent revisions to the first year quarter ended 9/30 196R that increase MOE will not be reflected in the caseload reduction credit. Subsequent revisions to the first year quarter ended 9/30 196R that decrease MOE could invalidate the caseload reduction credit.

Column C is for reporting state MOE expenditures in separate state programs, outside the state TANF program. Include all MOE funds contributed to a tribe or consortium of tribes operating an approved Tribal TANF Plan (see TANF-ACF-PA-2000-04 for more information). A state will only report expenditures claimed as MOE for a GY in the first FFY year-end report.

NOTE: For the basic MOE requirement, the cumulative total expenditures (i.e., the sum of Columns B and C on Line 24 reported at the end of the FFY) should add up to at least 80 percent of FFY 1994 historic state expenditures if the state did not meet the TANF work participation requirements, or at least 75 percent of FFY 1994 historic state expenditures if the state met the TANF work participation requirements. See TANF-ACF-PI-1996-02 for more information.

Column D is for reporting the federal Contingency Fund grant awards and how those funds were utilized. Because Contingency Funds must be expended in the FFY in which they were awarded, a state will only report Contingency Fund expenditures in the GY report of the corresponding FFY (e.g., GY 2020 expended in FFY 2020). This report is also used for the annual reconciliation of the Contingency Fund. The Federal Medical Assistance Percentage Rate (FMAP) for the state for the FFY for which Contingency Funds were received is shown above this column.

Except as discussed below, the same financial and programmatic rules pertaining to the appropriate use of the state’s TANF block grant funds also apply when using Contingency Funds. However, there are two key differences between the state’s annual TANF block grant funds and Contingency Funds:

States may not transfer any Contingency Funds to the Child Care and Development Block Grant Program (also known as the Child Care Discretionary Fund within the Child Care and Development Fund) or the Social Services Block Grant Program under title XX of the Social Security Act (the Act).

Contingency Funds are available only for allowable expenditures made in the FFY for which they are awarded. States may not carry over any Contingency Funds for use in a succeeding FFY.

Line Item Instructions

Line 1. Awarded. Automatically generated in OLDC, Column A represents the cumulative total of federal TANF funds awarded (not including Contingency Funds) to the state (after any tribal adjustments) for a particular GY.

Automatically generated in OLDC, Column D represents the cumulative total of Contingency Funds awarded under section 403(b) to the state during the FFY as of the date the report is being submitted.

Lines 2 and 3. Transfers. Section 404(d)(1) of the Act governs the transfer of TANF funds to the CCDF Discretionary Fund and prohibits a state from transferring more than 30 percent of its total annual SFAG funds. Section 404(d)(2) of the Act governs the transfer of TANF funds to the SSBG program and prohibits a state from transferring more than 10 percent of its total annual SFAG funds to the SSBG. Also, the combined amount transferred to the SSBG and the CCDF Discretionary Fund may not exceed 30 percent of the annual SFAG funds. In other words, the sum of the total cumulative amount reported on Lines 2 and 3 of Column A cannot exceed 30 percent of the annual TANF block grant.

Furthermore, the total amount transferred to SSBG and CCDF affects the amount available for Jobs Access activities that may be used as the non-federal match under that program. The amount of TANF funds expended on Job Access programs that may be used as non-federal matching under the Job Access program is limited to the difference between 30 percent of TANF funds (amount reported on Line 1, Column A) and the total amount transferred to SSBG and the Discretionary Fund of CCDF (sum of amounts reported on Line 2, Column A, and Line 3, Column A).

Line 2. Transfers to Child Care and Development Fund (CCDF) Discretionary. Enter in Column A the total SFAG funds that the state transferred to the Discretionary Fund of the CCDF during the FFY. These funds are subject to the rules and regulations of that Fund in place for the FFY at the time when the transfer occurs. A state can only transfer current-year SFAG funds (i.e., this line item is only applicable in the first FFY that a GY award is made).

Line 3. Transfers to Social Services Block Grant (SSBG). Enter in Column A the total federal SFAG funds the state transferred to the SSBG during the FFY. All funds transferred to the SSBG program are subject to the statute and regulations of the SSBG program in place for the FFY at the time when the transfer occurs and pursuant to Section 404(a)(3) shall be used only for programs and services to children or their families whose income is less than 200 percent of the income official poverty line (as defined by the Office of Management and Budget). A state may only transfer current-year federal SFAG funds (i.e., this line item is only applicable in the first FFY that a GY award is made).

Transferring funds back to TANF. States wishing to transfer funds back to the TANF block grant must do so within the obligation periods established by the Terms and Conditions of the CCDF Discretionary and SSBG grants. A state documents the return of TANF funds by revising the quarter ended 9/30 196R report for the same GY and FFY that the funds were initially transferred from. This action will increase the available TANF funds for this GY and allow for further expenditures on allowable TANF activities. States should also document the return of these TANF funds on the respective CCDF and SSBG expenditure reports.

Line 4. Adjusted Award. OLDC automatically generate the net total of funds available for TANF after subtracting the amounts transferred to the CCDF program (Line 2) and/or the SSBG program (Line 3).

Line 5. Carryover. OLDC automatically calculates this amount, which represents the sum the Federal unliquidated obligations and unobligated Balances for a GY award, as of the end of the previous FFY. Revisions to reports submitted in prior FFYs will result in an automatic recalculation of available TANF balances in the most current subsequent FFY report.

Line 6. Basic Assistance. OLDC automatically calculates this amount, which represents the total expenditures from lines 6a.and 6b.

Line 6a. Basic Assistance (excluding Payments for Relative Foster Care, and Adoption and Guardianship Subsidies). Basic assistance is defined as cash, payments, vouchers, and other forms of benefits designed to meet a family’s ongoing basic needs (i.e., for food, clothing, shelter, utilities, household goods, personal care items, and general incidental expenses). Payments on behalf of children for whom the child welfare agency does not have legal care and responsibility who are living with caretaker relatives. Include in this line item child support pass-through payments, i.e., the amount of the state’s share of the assigned child support that it pays to the family (provided the state disregards this amount in determining the family’s eligibility for and the amount of TANF assistance, in accordance with sections 409(a)(7)(B)(i)(I)(aa) and 457(a)(1)(B) of the Act and the TANF MOE regulations at 45 CFR 263.2(a)(1)).

Line 6b. Relative Foster Care Maintenance Payments and Adoption and Guardianship Subsidies. Basic assistance provided on behalf of a child or children for whom the child welfare agency has legal placement and care responsibility and is living with a caretaker relative; or child or children living with legal guardians. This category also includes ongoing adoption subsidies. All expenditures are for cases that are not eligible for IV-E foster care assistance or subsidies (reference TANF Q & A: Use of Funds, published May 2, 2013, https://www.acf.hhs.gov/ofa/resource/q-a-use-of-funds?page=all). Include expenditures for payments made to foster parents standing in loco parentis, if state law provides.

Line 7. Assistance Authorized Solely Under Prior Law. OLDC automatically calculates this amount, which represents the total expenditures from lines 7a., 7b., and 7c.

Expenditures associated with the activities reported on this line item may not comply with the purposes of TANF and/or with the prohibitions in section 408, but are allowable expenditures of federal TANF funds as per section 404(a)(2), i.e., activities for which the state was authorized to use amounts received under part A or F, as such parts were in effect on September 30, 1995, or (at the option of the state) August 21, 1996.

Any expenditures that are consistent with the purposes of TANF, even if authorized under prior law, should not be reported in this category. For each subcategory below under which a state is reporting expenditures, the state must include a description of the nature of these benefits, including information regarding the target population and the specific assistance provided, in Part II of the ACF-196R. The Part II Narrative must also reference the state Aid to Families with Dependent Children (AFDC) plan provision under which these expenditures are authorized. (Note that states may not report MOE expenditures in this category; all state MOE expenditures must be consistent with the purposes of TANF).

Line7a. Foster Care Payments. Foster care assistance on behalf of children, authorized solely under section 404(a)(2) of the Act and referenced in a state’s former AFDC or Emergency Assistance plan.

Line 7b. Juvenile Justice Payments. Assistance payments on behalf of children in the state’s juvenile justice system, authorized solely under section 404(a)(2) of the Act and referenced in a state’s former AFDC or Emergency Assistance plan.

Line 7c. Emergency Assistance Authorized Solely Under Prior Law. Other benefits authorized solely under section 404(a)(2) of the Act and referenced in a state’s former AFDC or Emergency Assistance plan.

Line 8. Non-Assistance Authorized Solely Under Prior Law. OLDC automatically calculates this amount, which represents the total expenditures from lines 8a., 8b., and 8c.

Expenditures associated with activities reported on this line item are not otherwise consistent with the purposes of TANF and/or with the prohibitions in section 408, but are allowable expenditures of federal TANF funds as per section 404(a)(2), i.e., activities for which the state was authorized to use amounts received under part A or F, as such parts were in effect on September 30, 1995 (to continue approved juvenile justice services), or (at the option of the state) August 21, 1996.

Any expenditures that are consistent with the purposes of TANF, even if authorized under prior law, should not be reported in this category. For each subcategory below under which a state is reporting expenditures, the state must include a description of the nature of these benefits, including information regarding the target population and the specific assistance provided, in Part II of the ACF-196R. The Part II Narrative must also reference the state AFDC plan provision under which these expenditures are authorized. (Note that states may not report MOE expenditures in this category; all state MOE expenditures must be consistent with the purposes of TANF).

Line 8a. Child Welfare or Foster Care Services. Services provided to children and their families involved in the state’s child welfare system, authorized solely under section 404(a)(2) of the Act, and referenced in a state’s former AFDC or Emergency Assistance plan.

Line 8b. Juvenile Justice Services. Juvenile justice services provided to children, youth, and families, authorized solely under section 404(a)(2) of the Act, and referenced in a state’s former AFDC or Emergency Assistance plan.

Line 8c. Emergency Services Authorized Solely Under Prior Law. Other services, authorized solely under section 404(a)(2) of the Act, and referenced in a state’s former AFDC or Emergency Assistance plan.

Line 9. Work, Education, and Training Activities. OLDC automatically calculates this amount,

which represents the total expenditures from lines 9a., 9b., and 9c.

Line 9a. Subsidized Employment. Payments to employers or third parties to help cover the costs of employee wages, benefits, supervision, or training. Also, include costs for subsidizing a portion of the participant’s wage to compensate an employer for training costs. Include expenditures for subsidized employment targeted for youth.

Line 9b. Education and Training. Education and training activities, including secondary education (including alternative programs); adult education, high school diploma-equivalent (such as GED) and ESL classes; education directly related to employment; job skills training; education provided as vocational educational training or career and technical education; and post-secondary education. Do not include costs of early care and education or after-school or summer enrichment programs for children and youth in elementary, middle school, or high school.

Line 9c. Additional Work Activities. Work activities that have not been reported in employment subsidies or education and training. Include costs related to providing work experience and community service activities, job search assistance and job readiness, related services (such as employment counseling, coaching, job development, information and referral, and outreach to business and non-profit community groups).

Line 10. Work Supports. Assistance and non-assistance transportation benefits, such as the value of allowances, bus tokens, car payments, auto repair, auto insurance reimbursement, and van services provided in order to help families obtain, retain, or advance in employment, participate in other work activities, or as a non-recurrent, short-term benefit. It also includes goods provided to individuals in order to help them obtain or maintain employment, e.g., tools, uniforms, fees to obtain special licenses, as well as bonuses, incentives, and work support allowances (that do not meet the definition of “assistance”). Do not include child care; such expenditures should be reported under Early Care and Education, under Line 11.a. Do not include supportive services, such as substance abuse, mental health, and domestic violence services; such expenditures should be reported under Supportive Services on Line 16. Include expenditures for Job Access, which should also be reported on Line 26.

Line 11. Early Care and Education. OLDC automatically calculates this amount, which represents the total expenditures from lines 11a. and 11b.

Line 11a. Child Care (Assistance and Non-Assistance). Child care expenditures for families that need child care to work, participate in work activities (such as job search, community service, education, or training), or for respite purposes. This includes child care provided to families who receive child care during a temporary period of unemployment. The amounts reported in this category do not include funds transferred to the CCDF (Discretionary Fund - reported on the ACF-696) or the SSBG programs.

Line 11b. Pre-Kindergarten/Head Start. Pre-kindergarten or kindergarten education programs (allowable if they do not meet the definition of a “general state expense”), expansion of Head Start programs, or other school readiness programs.

Line 12. Financial Education and Asset Developments. Programs and initiatives designed to support the development and protection of assets including contributions to Individual Development Accounts (IDAs) and related operational costs (that fall outside the definition of administrative costs), financial education services, tax credit outreach campaigns and tax filing assistance programs, initiatives to support access to mainstream banking, and credit and debt management counseling.

Line 13. Refundable Earned Income Tax Credits. Refundable portion of state or local earned income tax credits (EITC) paid to families and otherwise consistent with the requirements of 45 CFR Parts 260 and 263 of the TANF regulations. If the state is using an intercept to recoup a debt owed to the state, only the portion of the refundable EITC that is actually received by the family may be considered a federal TANF or MOE expenditure.

Line 14. Non-EITC Refundable State Tax Credits. Refundable portion of other tax credits provided under state or local law that are consistent with the purposes of TANF and the requirements of 45 CFR Parts 260 and 263 of the TANF regulations (e.g., state refundable child care tax credit). If the state is using an intercept to recoup a debt owed to the state, only the portion of the refundable tax credit that is actually received by the family may be considered a federal TANF or MOE expenditure.

Line 15. Non-Recurrent Short-Term Benefits. Short-term benefits to families in the form of cash, vouchers, subsidies, or similar form of payment to deal with a specific crisis situation or episode of need and excluded from the definition of assistance on that basis. This category includes expenditures such as emergency assistance and diversion payments, emergency housing and short-term homelessness assistance, emergency food aid, short-term utilities payments, burial assistance, clothing allowances, and back-to-school payments. It does not include tax credits, child care, transportation, or short-term education and training; such expenditures should be reported under other categories, as appropriate. Note, if there is another category specific to an activity, the related expenditures should be reported under that category, rather than Line 15, regardless of whether the activity meets the definition of Non-Recurrent Short Term Benefit at 45 CFR 260.31(b)(1).

Line 16. Supportive Services. Services such as domestic violence services, and health, mental health, substance abuse and disability services, housing counseling services, and other family supports. (Note that a state may not use federal TANF funds on expenditures for medical services).

Line 17. Services for Children and Youth. Programs designed to support and enrich the development and improve the life-skills and educational attainment of children and youth. This may include after-school programs, and mentoring or tutoring programs. Note that if there is another category specific to an activity, the related expenditures should be reported under that category, rather than Line 17; for example, subsidized youth employment programs should be reported under Line 9.a.

Line 18. Prevention of Out-of-Wedlock Pregnancies. Programs that provide sex education or abstinence education and family planning services to individuals, couples, and families in an effort to reduce out-of-wedlock pregnancies. Includes expenditures related to comprehensive sex education or abstinence programs for teens and pre-teens. Other benefits or services that a state provides under TANF purpose three (to prevent and reduce the instances of out-of-wedlock pregnancies), should be reported under a more appropriate subcategory, e.g., Services for Children and Youth.

Line 19. Fatherhood and Two-Parent Family Formation and Maintenance Programs. Programs that aim to promote responsible fatherhood and/or encourage the formation and maintenance of two-parent families. For example, activities within these programs may include marriage education, marriage and relationship skills, fatherhood skills programs; parent skills workshops; public advertising campaigns on the value of marriage and responsible fatherhood; education regarding how to control aggressive behavior; financial planning seminars; and divorce education and reduction programs.

Line 20. Child Welfare Services. OLDC automatically calculates this amount, which represents the total expenditures from lines 20a., 20b., and 20c.

Line 20a. Family Support/Family Preservation/Reunification Services. Community-based services, provided to families involved in the child welfare system that are designed to increase the strength and stability of families so children may remain in or return to their homes. These services may include respite care for parents and relative caregivers; individual, group, and family counseling; parenting skills classes; case management; etc.

Line 20b. Adoption Services. Services and activities designed to promote and support successful adoptions. Services may include pre- and post-adoptive services to support adoptive families, as well as adoptive parent training and recruitment.

Line 20c. Additional Child Welfare Services. Other services provided to children and families at risk of being in the child welfare system, or who are involved in the child welfare system. This may include independent living services, service coordination costs, legal action, developing case plans, assessment/evaluation of family circumstances, and transportation to or from any of the services or activities described above.

Line 21. Home Visiting Programs. Expenditures on programs where nurses, social workers, or other professionals/para-professionals provide services to families in their homes, including evaluating the families’ circumstances; providing information and guidance around maternal health and child health and development; and connecting families to necessary resources and services.

Line 22. Program Management. OLDC automatically calculates this amount, which represents the total expenditures from lines 22a., 22b., and 22c.

Line 22a. Administrative Costs. Defined in 45 CFR Part 263.0. Based on the nature or function of the contract, states must include appropriate administrative costs associated with contracts and subcontracts that count towards the 15 percent administrative cost caps.

Cap on Administrative Costs

States have two administrative expenditure caps that must not be exceeded on the ACF-196R:

For the administrative expenditure cap applicable to federal funds (Columns A and D), cumulative administrative costs (reported on Line 22.a. of the ACF-196R) may not exceed 15 percent of the sum of the total adjusted SFAG reported over the full life cycle of each TANF grant. TANF Contingency funds are limited to one FFY for expenditure while TANF expenditures could extend over multiple FFYs as they are available until expended.

For the administrative cost cap applicable to state MOE funds, administrative costs reported on Line 22.a. of columns B and C may not exceed 15 percent of the total expenditures reported on Line 24 of columns B and C as of the end of the first FFY of the GY.

NOTE: Based on the nature or function of the contract, states must include appropriate administrative costs associated with contracts and subcontracts that count towards the 15 percent administrative cost caps.

Line 22b. Assessment/Service Provision. Costs associated with screening and assessment (including substance abuse screening), SSI/SSDI application services, case planning and management, and direct service provision that are neither “administrative costs,” as defined at 45 CFR Part 263.0, nor are otherwise able to be allocated to another expenditure category. For example, case management for a TANF recipient related to the provision of an array of services.

Line 22c. Systems. Costs related to monitoring and tracking under the program. Note that section 404(b)(2) states that the 15 percent administrative cost cap shall not apply to the use of the grant for information technology and computerization needed for tracking or monitoring required by or under part IV-A of the Act. The systems exclusion applies to items that might normally be administrative costs, but are systems-related and needed for monitoring or tracking purposes under TANF. Under our final rules the same information technology exclusion applies to MOE expenditures. The TANF regulations at 45 CFR 263.2 and 263.11 provide guidance about what is excluded under this definition.

Line 23. Other. Non-assistance activities that were not included under Line 6 through Line 22. States including expenditures on this line must provide a description of the specific benefits provided and the target population in Part II of the ACF-196R.

Line 24. Total Expenditures. The total expenditures (i.e., the sum of Line 6 through Line 23) of federal TANF and MOE funds expended in a federal FFY will be automatically calculated in OLDC for Columns A, B, C, and D.

The state must describe any estimates used in deriving any expenditures reported in any category in Part II of the ACF-196R. A state may not report estimated expenditures if actual expenditures related to benefits provided to TANF-eligible recipients are reasonably available. If requiring actual data would be infeasible or would materially interfere with delivering the benefit or service and if the state seeks to use a reasonable estimation methodology, it must both describe the methodology and explain why it is reasonable, both in estimating the share of families that can be claimed and the estimates for their expenses.

Line 25. Transitional Services for Employed. Enter in Columns A, B, C, and D the total expenditures to provide transitional services to families that cease to receive assistance under the TANF program because of employment. Expenditures reported on Line 25 must also be included in the expenditure categories reported on Line 6 through Line 23 above. Section 411(a)(5) of the Act requires separate quarterly reporting of expenditures on transitional services for families who have ceased to receive assistance because of employment.

Line 26. Job Access. Expenditures for the Department of Transportation Access to JOBS program. Column A must include only federal TANF expenditures that are used to meet matching requirements for the Department of Transportation Job Access program. Expenditures reported on Line 26 must also be included in the expenditure categories reported on Line 10 above.

Line 27. Federal Unliquidated Obligations. Enter in Columns A and D the federal unliquidated obligations for the FFY. Obligations reported on this line must meet the definition of obligations contained in 45 CFR 92.3

Line 28. Unobligated Balance. OLDC automatically calculates total federal unobligated balances of the GY’s funds in Columns A and D as of the end of each FFY. After the end of the first FFY, any amount of unspent Contingency funds reported in Column D will be recouped by ACF. Any year-end report revisions submitted will result in an automatic recalculation of the Unobligated Balance of a GY as described in “Revisions to Data Reported in Prior Years” above.

Line 29. State Replacement Funds. Enter in Column B, the cumulative total state replacement funds expended as a result of the imposition of a TANF penalty from October 1 of the FFY for which the report is being submitted through the current quarter being reported. If a state’s SFAG is reduced because of the imposition of a penalty under section 409, section 409(a)(12) provides that the state must replace funds lost due to the penalty with state funds in an amount that is no less than the amount withheld. These funds must be in addition to the funds reported under Line 24, Column B.

Annual Narrative Reports

Part II: Narrative Descriptions of Expenditures and Estimate

Narratives are required for expenditures for categories of Assistance Authorized Solely Under Prior Law, Non-Assistance Authorized Solely Under Prior Law, and Other. Descriptions for these expenditure categories should include information regarding the target population (including estimated size, if available), and the types and amounts of benefits provided. Attachments can be added to the report, as needed.

Additionally, a state must describe any estimates used in deriving any expenditures reported in any category in Part II of the ACF-196R. Estimates are not allowed if actual data are available. If actual data are not available, please provide an explanation as to why estimates were used, as well as a description of the methods for estimation. Note that states may not estimate assistance.

These narratives are required once per year by November 14. These narratives should encompass all applicable expenditures made during the FFY for all open GYs. A state must submit a Part II report for each FFY, or validate that it does not have any information required by Part II to report.

For Final Reports

The following should be ensured when a state checks the box indicating that the quarterly report for a specific grant year is “Final:”

Ensure that the state did not exceed the caps on administrative costs and the limits on transfers as described in these instructions.

Ensure that the available balances of both unliquidated obligations and unobligated balance sum to zero.

Ensure that reported expenditures in OLDC agree with data in the Payment Management System (i.e., the ACF 196R Line 24 total expenditures plus transfers to the CCDF - Line 2 and SSBG - Line 3 should equal the total draws in PMS).

Administration

for Children and Families

330 C

Street, SW., Washington, DC 20201

February 2024 pg

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Skip Navigation |

| Author | USER |

| File Modified | 0000-00-00 |

| File Created | 2023-12-19 |

© 2026 OMB.report | Privacy Policy