Business or other for profit

Incarcerated People's Communications Services (IPCS) 2023 Mandatory Data Collection, WC Docket Nos. 23–62, 12–375, DA 23-638

2023 IPCS Mandatory Data Collection - Instructions

Business or other for profit

OMB: 3060-1314

|

|

|

Incarcerated People’s Communications Services

2023 Mandatory Data Collection

WC Docket Nos. 23-62, 12-375

Instructions

Table of Contents

C. Filing Deadline and Submission 7

C. Company-Wide Information 20

1. Overall Financial Information 21

2. Service-Specific Financial Information 22

3. Other Company-Wide Information 32

D. Facility-Specific Information 45

1. Facility-Specific Financial Information 45

2. Other Facility-Specific Information 52

APPENDIX A

APPENDIX B

APPENDIX C

I. Data Collection Overview

On January 5, 2023, the President signed into law the Martha Wright-Reed Just and Reasonable Communications Act of 2022, expanding the Commission’s statutory authority over communications between incarcerated people and the non-incarcerated to include “any audio or video communications service used by inmates . . . regardless of technology used.”1 The new Act also amends section 2(b) of the Communications Act, to make clear that the Commission’s authority extends to intrastate as well as interstate and international communications services used by incarcerated people.2

The Act requires the Commission to consider, as part of its implementation, the costs of “necessary” safety and security measures, as well “differences in costs” based on Facility size or “other characteristics.”3 It also allows the Commission to “use industry-wide average costs of telephone service and advanced communications services and the average costs of service of a communications service provider” in determining just and reasonable rates for incarcerated people’s communications services (IPCS).4

The Commission delegated authority to the Wireline Competition Bureau (WCB or Bureau) and the Office of Economics and Analytics (OEA) to “update and restructure” the Commission’s most recent data collection (the Third Mandatory Data Collection) “as appropriate in light of the requirements of the new statute.”5 This delegation requires that we collect “data on all incarcerated people’s communications services from all providers of those services now subject to” the Commission’s ratemaking authority, including, but not limited to, requesting “more recent data for additional years not covered by the [Third Mandatory Data Collection].”6

These instructions and the accompanying template are designed to implement the Commission’s directives.7

II. General Instructions

In these instructions, we first identify the entities that we require to respond to this data collection. We then review the information we require those entities to provide, and describe the procedure for submitting the requisite responses.

Throughout these instructions, the terms “you” and “your” refer to any entities directed to respond to these data requests that qualify as Providers, as we define that term below.

You may contact Commission staff at mandatorydatacollection@fcc.gov if you have questions regarding whether your Company must file a data collection response, or the requirements for such a response.

A. Who Must Submit Data

All Providers, as defined below, must submit complete, accurate, and truthful responses to this data collection.8 “Providers” includes all entities within the definition of “payphone provider” in section 276(d) of the Communications Act that provide communications between incarcerated people and the non-incarcerated,9 including Subcontractors as defined below. Providers that are affiliated shall respond as a single entity, regardless of the number of separately incorporated companies or other entities within that group that provide IPCS.10

An entity is classified as a Provider if it provides IPCS to people incarcerated in a Facility (i.e., a Prison or Jail), as defined in Part III of these instructions. In some instances, two entities work together to provide IPCS to a particular Facility. We refer to the Provider that has the contractual or other arrangement with the Contracting Authority as the Contractor, and the Provider without that arrangement as the Subcontractor. Thus, an entity is classified as a Provider if it partners with a Contractor, and also, for example, completes communications for incarcerated people, bills Consumers for those communications, and retains the revenue from those communications. An entity does not fall outside the definition of a Provider simply because it lacks a direct contractual relationship with a correctional authority. In contrast, an entity that provides billing and collection for IPCS provided by a separate entity and remits those revenues does not, without more, meet the definition of a Provider.

Providers (including all Contractors and Subcontractors) must complete all portions of this data collection unless otherwise indicated. Section II.C below provides instructions as to how certain data shall be submitted.

B. What Must Be Submitted

You must fully and completely respond to each request for information in this data collection by using the specified Word and Excel templates and certification form, as approved by the Office of Management and Budget (OMB) pursuant to the Paperwork Reduction Act of 1995 (PRA), Public Law No. 104-13.11 After obtaining approval from OMB, WCB and OEA will issue a Public Notice providing links to the approved Word and Excel templates and certification form. A reference copy of the templates and certification form is attached to these instructions.

Your full response shall consist of several parts:

A Word document (i.e., the Word template) containing responses that require a narrative explanation (see Appendix A to these instructions);

A set of Excel worksheets (i.e., the Excel template) containing responses that indicate specific numbers, percentages, and/or information (see Appendix B to these instructions);

An audited financial statement or report for 2022; and

A signed certification of truthfulness, accuracy, and completeness (see Appendix C to these instructions).

The Word and Excel templates and any additional worksheets must be submitted in machine-readable and manipulatable formats. As indicated, you also must submit an audited financial statement or report for 2022. In the absence of an audited financial statement or report, you must submit similar financial documentation for 2022 to the extent the Company produced it in the ordinary course of business. We note that this exception for the ordinary course of business is only applicable to the submission of this alternative documentation and does not extend to other requirements of the data collection.

Additionally, all responses must be accompanied by a certification by an officer of the Provider that, based on information and belief formed after reasonable inquiry, the statements and information contained in the submission are true, accurate, and complete. You must complete the certification form provided in Appendix C before submitting your response. Submissions made without a completed certification form will be rejected and returned for correction and resubmission.

We caution Providers to proceed in good faith and with absolute candor in responding to this data collection.12 Any failure to timely file an accurate, complete, and truthful response to this data collection may subject the Provider to sanctions, including, but not limited to, monetary forfeitures.13 Willful false statements in responses to this data collection also are punishable by fine or imprisonment under 18 U.S.C. § 1001.

As a general matter, these instructions direct you to enter your responses to requests for certain information or numbers at specific places in the Word and Excel templates. Where these instructions require you to provide the workpapers, formulas, calculations, or data underlying your responses, report and display the required information as clearly and succinctly as possible.

Narrative responses are to be provided in the Word template (Appendix A). Use that template to provide any additional information needed to ensure that your responses are full and complete, and to identify and explain any caveats associated with your responses. You should also use the Word template to provide any formulas, explanations, or appropriate references for calculations, where necessary, including any explanations needed to make your entries in the Excel template transparent and understandable.

Unless otherwise stated, use the Excel template (Appendix B) to provide your responses to the inquiries that follow. As a general matter, your entries on that template will be specific numbers or percentages (e.g., a Facility’s Average Daily Population) or discrete information (e.g., a Facility’s geographical coordinates). The Excel template has formulas in certain cells that operate in accordance with these instructions and that use data you enter in other cells to facilitate a complete reporting of the required data. To be complete, your submission must include both the data that you enter in the cells and the data that are automatically generated by the Excel formulas embedded in the template.

As described in further detail in the “Color Coding & Checks” tab in the Excel template, cells that contain formulas are generally highlighted in yellow or green. In certain tabs, to maintain visual clarity, only the first cell in a given row or column of cells with formulas is highlighted; the instructions set forth here apply to all cells with formulas, regardless of whether or not they are highlighted. Do not delete formulas from any cells or manually enter data or other information in cells that contain formulas. To ensure accurate and complete reporting, allow cells that have formulas to generate the appropriate data. The Excel template uses “N/A” to identify cells in which no data are to be reported. Do not report data in cells populated with “N/A.” Following the same format provided in the Excel template, you should add additional rows or columns to this template as necessary to complete your responses.

This data collection seeks data for the single calendar year 2022, covering the period from January 1, 2022, through December 31, 2022.

You must submit a valid entry on the Excel template in response to each request in this data collection. If a request on the Excel template is for a specific number or percentage and a response is required, enter a specific number or percentage, including zero or zero percent, or allow the Excel template to generate the number or percentage, as appropriate; do not enter “N/A” or any other response. If a request on the Excel template is for a specific number or percentage and a response is optional, enter a specific number or percentage, including zero or zero percent, as appropriate, if a response is provided; otherwise enter “N/A.” A response is optional only if specifically identified as such in these instructions.

Enter only positive numbers or zero on the Excel template in response to a request for numbers or percentages, with the following exception: if the Company’s account balance for an asset, contra asset, liability, contra liability, revenue, contra revenue, expense, or contra expense account is the opposite of its expected debit or credit balance, report that balance as a negative number on the Excel template. For example, the expected account balance for accumulated deferred income taxes is a credit balance, representing a tax debt that will need to be paid in the future. If this is the case, report a positive number for accumulated deferred income taxes. If, instead, the account balance for the accumulated deferred income taxes is a debit balance, representing an over-payment or advance payment of income taxes, report that balance as a negative number.

Blank cells in the Excel worksheets will be understood to be zeros. Do not hide cells or split cells. Do not add rows above the Provider’s reported data in the worksheets. If a Provider wishes to state that the data in a particular worksheet are confidential, do so on rows below the Provider’s data response.

If your responses are deemed incomplete or are not submitted in the required format, your filing may be rejected and returned to you for correction and resubmission. An incomplete or noncompliant submission may subject you to enforcement actions, including monetary forfeitures.14

C. Filing Deadline and Submission

The Commission will submit this data collection, including all required forms, to OMB for its approval, pursuant to the PRA. After obtaining approval from OMB, WCB and OEA will publish a notice in the Federal Register announcing OMB’s approval and establishing an effective date for the data collection.15 WCB and OEA will also issue a Public Notice announcing the effective date.

Your response to this data collection will be due October 31, 2023, unless an effective date for the data collection is not established before that date. The Public Notice announcing the data collection’s effective date will reiterate this deadline (or specify an alternative date in the event the data collection does not become effective prior to October 31, 2023).

You must submit public versions of your response by filing the completed templates and certification form electronically, using the Commission’s Electronic Comment Filing System (ECFS), accessible at https://www.fcc.gov/ecfs/.

You may file any information that you believe should be afforded confidential treatment in accordance with the terms of the Protective Order adopted for use in these dockets and by adhering to the standard set forth in section 0.459(b) of the Commission’s rules.16 You may access the Protective Order through this link: https://www.fcc.gov/document/wireline-competition-bureau-adopts-ipcs-protective-order. A confidential version of your filing must be submitted to the Secretary’s office using the original Word and Excel templates, as approved by OMB, and in a machine-readable and manipulatable format. You must also provide courtesy copies of the confidential filing to WCB and OEA via email at mandatorydatacollection@fcc.gov.

For further information and any questions on completing your response, please contact Simon Solemani, WCB, Pricing Policy Division, at 202-418-2270 or at Simon.Solemani@fcc.gov, or Richard Kwiatkowski, OEA, Economic Analysis Division, at 202-418-1383 or at Richard.Kwiatkowski@fcc.gov.

III.

Relevant Definitions

All capitalized terms used in these instructions are defined terms with the meaning assigned to them in this section.

2022 means calendar year 2022, the one-year period from January 1, 2022 to December 31, 2022.

Accounting Entity means the smallest group of separate Business Segments that collectively account for 100% of the Provider’s IPCS-Related Operations and IPCS-related investments, expenses, and revenues.

Admissions means the number of Incarcerated People booked into and housed in a Facility by formal legal documents and the authority of the courts or other official agency, including repeat offenders booked on new charges as well as people sentenced to weekend programs who enter the Facility for the first time. It excludes Incarcerated People reentering the Facility after an escape, work release, medical appointment, treatment facility appointment, or bail and court appearance.

Affiliates means any two or more companies, partnerships, or other legal entities where (a) one entity directly or indirectly owns or controls the other or others, (b) a Third Party controls or has the power to control both or all, (c) the entities share common ownership or have interlocking directorates, or (d) the entities share employees, equipment, and/or facilities. For purposes of this definition, the term “own” means to hold or control an equity interest (or the equivalent thereof) of more than 10%.

Ancillary Services Charges means any fees or charges Consumers may be assessed for or in connection with IPCS that are not included in the per-minute charges assessed for individual audio communications or the per-minute, per-session, or per-month charges assessed for video communications. Permissible Ancillary Services Charges for or in connection with interstate and international Audio IPCS are limited to those listed in 47 CFR § 64.6000(a)(1)-(5) and consist of Automated Payment Fees, Live Agent Fees, Paper Bill/Statement Fees, Fees for Single-Call and Related Services, and Third-Party Financial Transaction Fees. All other Ancillary Services Charges are prohibited in connection with interstate and international Audio IPCS. For purposes of this definition, “interstate” includes any jurisdictionally mixed charge, as defined in 47 CFR § 64.6000(u).

Ancillary Services means services provided for or in connection with Audio or Video IPCS. Ancillary Services includes both Permissible Ancillary Services and Other Ancillary Services, as defined in these instructions.

Annual Total Expenses means the sum of annual Operating Expenses and annual Capital Expenses.

Audio IPCS means, for the purpose of this data collection, all services classified as inmate calling services within the meaning of 47 CFR § 64.6000(j), including: (a) Interconnected VoIP; (b) Non-interconnected VoIP; (c) all Telecommunications Relay Services (TRS), including the use of a device or transmission service to access TRS; and (d) all point-to-point video services made available to incarcerated people for communication in American Sign Language (ASL) with other ASL users.

Automated Payment Fees means credit card payment fees, debit card payment fees, and bill processing fees, including fees for payments made by interactive voice response, through the Internet, or by use of an Incarcerated People’s Kiosk or Incarcerated People’s Tablet.

Automated Payment Service means any service providing Customers of IPCS with credit card payment, debit card payment, and bill processing services, including enabling payments by interactive voice response, web, or Incarcerated People’s Kiosk or Incarcerated People’s Tablet.

Average Daily Population or ADP means the sum of all Incarcerated People in a Facility for each day of a Year, divided by the number of days in the Year.

Billed Communications means the number of IPCS communications supplied during a Year for which payment is demanded.

Billed Minutes means the number of Audio and/or Video IPCS minutes supplied during a Year for which payment is demanded.

Billed Revenues means gross sales, without adjustment for uncollectable accounts or expenses related to producing these sales, derived from the number of units of a service supplied during a Year for which payment is demanded.

Billed Transactions means the number of discrete instances where a seller supplies Single-Call and Related Service or Third-Party Financial Transaction Service and a buyer agrees to pay a price for that service.

Billed Uses means the number of times a Provider attempted to charge a Consumer for Automated Payment Service, Live Agent Service, or Paper Bill/Statement Service during 2022 and for which payment is demanded.

Business Segment means a component of a Company that generates its own revenues and creates its own products, product lines, or services and for which a financial report is routinely prepared for management, shareholder, or creditor review.

C Corporation means a Company that is taxed as a distinct entity under the rules of the Internal Revenue Service.

Capital Expenses means the sum of (a) the Return that debt, preferred stock, and equity investors require; (b) interest paid on customer prepayments or deposits; (c) depreciation expense; (d) amortization expense; and (e) federal and state income tax expense attributable to the fraction of the Return attributable to equity holders.

Cash Working Capital means the average investor-supplied capital a firm needs to fund its day-to-day operations.

Company means the Accounting Entity unless otherwise indicated.

Consumer means the party paying a Provider of IPCS.

Contracting Authority means an entity with authority to enter into contracts on behalf of a Facility. It includes any Facility that does its own contracting.

Contractor means the Provider that has a contractual or other arrangement with a Contracting Authority to provide IPCS at a Facility.

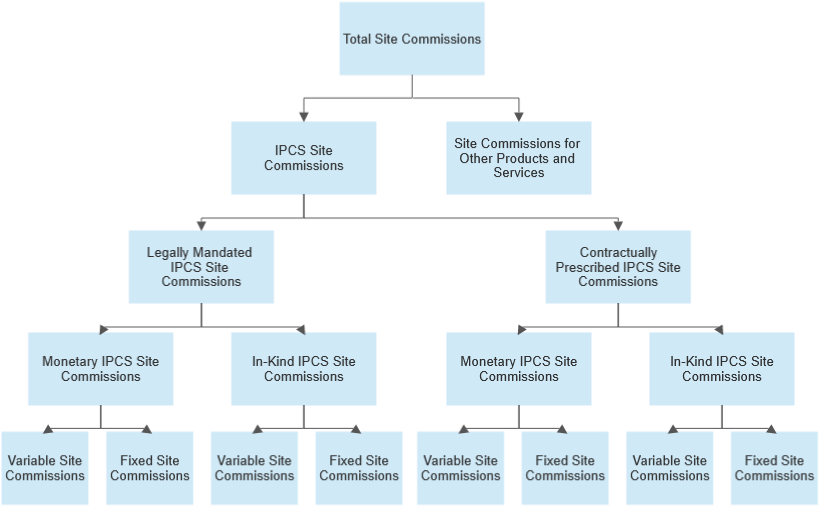

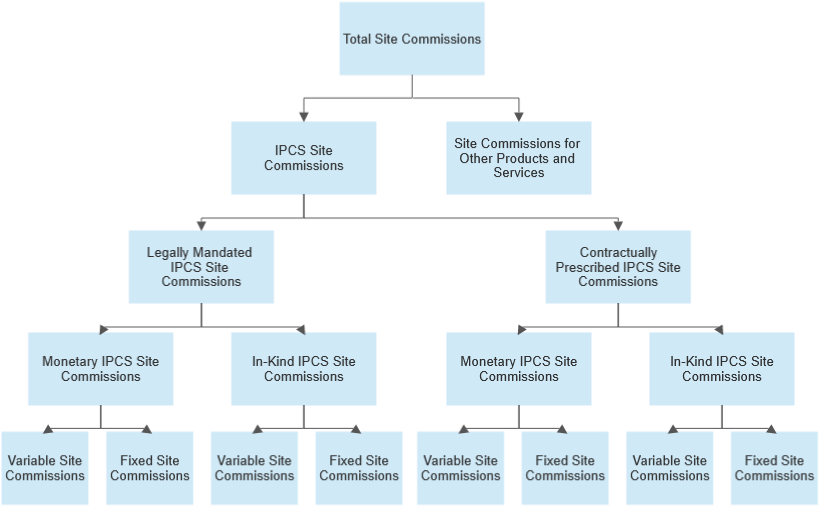

Contractually Prescribed Site Commission means a Site Commission payment, other than a Legally Mandated Site Commission payment, required pursuant to a contract negotiated between a Contracting Authority and a Provider.

Customer means the party paying a Provider of IPCS.

Extra Payments to Telecommunications Carriers or Other Entities for International Communications means the incremental charges a Provider pays to complete communications solely to international destinations.

Facility means a Jail or Prison and, for the purposes of this data collection, includes synonymous terms, such as “correctional Facility,” “correctional institution,” and “detention Facility.”

Fees for Single-Call and Related Services means billing arrangements whereby an Incarcerated Person’s collect communications are billed through a Third Party on a per-communication basis, where the called party or Incarcerated Person does not have an account with the Provider and does not want to establish an account.

Fixed Site Commission means a Site Commission that is assessed or paid without regard to IPCS usage or revenues. Fixed Site Commissions include, but are not limited to, minimum annual guaranteed payments, other lump-sum payments, and payments in-kind that Providers make pursuant to IPCS contracts.

Gross Investment means the book value of an asset prior to subtracting accumulated depreciation or amortization.

Incarcerated People’s Communications Services or IPCS means the provision of telephone service; interconnected VoIP service; non-interconnected VoIP service; interoperable video conferencing service; and any audio or video communications service used by incarcerated people for the purpose of communicating with individuals outside the Facility where the incarcerated person is held, regardless of the technology used.

IPCS-Related Operations means the actions or tasks performed by the Provider or authorized personnel to deliver IPCS and associated Ancillary Services to Incarcerated People and those they communicate with, including but not limited to billing, customer service, and other requirements as determined by contract or by law. It excludes all Site Commission payments, including In-Kind Site Commission payments.

IPCS-Related Products and Services means any hardware, software, applications, devices, products, or services used by a Provider or under a Provider’s direction as part of its IPCS-Related Operations. IPCS-Related Products and Services also may support a Company’s non-IPCS Products and Services.

Incarcerated Person means a person detained in a Facility, regardless of the duration of the detention. These instructions use Incarcerated People as the plural of Incarcerated Person.

Incarcerated People’s Kiosk means a self-service transaction machine that a Provider owns or leases and makes available to Incarcerated People at a Facility to obtain IPCS-Related Services, such as obtaining a calling card or depositing money in a prepaid account, or a stationary device that a Provider owns or leases and makes available at a Facility for Incarcerated People to access IPCS or to obtain IPCS-Related Products and Services. An Incarcerated People’s Kiosk may also be used to access Other Products and Services.

Incarcerated People’s Tablet means a portable device that a Provider owns or leases and makes available to an Incarcerated Person or to Incarcerated People at a Facility to access IPCS or to obtain IPCS-Related Products and Services, such as depositing money in a prepaid account. An Incarcerated People’s Tablet may also be used to access Other Products and Services.

In-Kind Site Commission means a Site Commission that does not take the form of a Monetary Site Commission.

Interconnected Voice over Internet Protocol or Interconnected VoIP means a service that: (i) enables real-time, two-way voice communications; (ii) requires a broadband connection from the user’s location; (iii) requires Internet protocol-compatible customer premises equipment (CPE); and (iv) permits users generally to receive calls that originate on the public switched telephone network and to terminate calls to the public switched telephone network.

International Communication means a communication or transmission from any state, territory, or possession of the United States, or the District of Columbia to points outside the United States.

Interstate Communication means, pursuant to 47 U.S.C. § 153(28), communication or transmission (a) from any state, territory, or possession of the United States (other than the Canal Zone), or the District of Columbia, to any other state, territory, or possession of the United States (other than the Canal Zone), or the District of Columbia, (b) from or to the United States to or from the Canal Zone, insofar as such communication or transmission takes place within the United States, or (c) between points within the United States but through a foreign country. Interstate Communication shall not, for purposes of these instructions, include wire or radio communication between points in the same state, territory, or possession of the United States, or the District of Columbia, through any place outside thereof, if such communication is regulated by a state commission.

Interoperable Video Conferencing Service means a service that provides real-time video communications, including audio, to enable users to share information of the user’s choosing.

Intrastate Communication means any communication that originates and terminates in the same state, territory, or possession of the United States (other than the Canal Zone), or the District of Columbia.

Jail means a Facility of a local, state, or federal law enforcement agency that is used primarily to hold individuals who are: (a) awaiting adjudication of criminal charges; (b) post-conviction and committed to confinement for sentences of one year or less; or (c) post-conviction and awaiting transfer to another Facility. The term also includes city, county or regional Facilities that have contracted with a private company to manage day-to-day operations; privately owned and operated Facilities primarily engaged in housing city, county or regional Incarcerated People; Facilities used to detain individuals operated directly by the Federal Bureau of Prisons or U.S. Immigration and Customs Enforcement, or pursuant to a contract with those agencies; juvenile detention centers; and secure mental health Facilities.

Legally Mandated Site Commission means a Site Commission payment required by state statutes or regulations that are adopted pursuant to state administrative procedure statutes where there is notice and an opportunity for public comment, such as by a state public utility commission or similar regulatory body with jurisdiction to establish IPCS rates, terms, and conditions, and that operate independently of the contracting process between Facilities and Providers.

Live Agent Fees means fees associated with the optional use of a live operator to complete IPCS Transactions.

Live Agent Service means providing Customers of IPCS the optional use of a live operator to complete IPCS-related transactions.

Maximum Communication Duration means the maximum limit, if any, that a Provider or Facility imposes on the length of an Audio IPCS call or a Video IPCS communication from a Facility.

Monetary Site Commission means a Site Commission that takes the form of a monetary payment.

Net Capital Stock means Gross Investment in assets, net of accumulated depreciation and amortization, accumulated deferred federal and state income taxes, and customer prepayments or deposits, plus an allowance for Cash Working Capital.

Net Investment means the book value of an asset after subtracting accumulated depreciation or amortization.

Non-interconnected VoIP Service means a service that enables real-time voice communications that originate from, or terminate to, the end-user’s location using Internet Protocol or any successor protocol and that requires Internet Protocol compatible customer premises equipment. It does not include any service that is an Interconnected VoIP service.

Operating Expenses means recurring expenses incurred to supply a service on a continuous basis, including but not limited to maintenance and repair of plant, equipment, and facilities; billing, collection, and customer care; general and administrative expense; other overhead expense; tax expense other than income tax expense; bad debt expense; and the IPCS-specific expenses specified in this data request.

Other Ancillary Services means Ancillary Services other than Automated Payment Service, Live Agent Service, Paper Bill/Statement Service, Single-Call and Related Services, and Third-Party Financial Transaction Services. Other Ancillary Services can be associated with interstate, international, or intrastate, Audio or Video IPCS.

Other Products and Services means products and services other than Audio IPCS, Video IPCS, Safety and Security Measures, Automated Payment Service, Live Agent Service, Paper Bill/Statement Service, Single-Call and Related Services, Third-Party Financial Transaction Services, and Other Ancillary Services.

Paper Bill/Statement Fees means fees associated with providing Customers of IPCS an optional paper billing statement.

Paper Bill/Statement Service means providing Customers of IPCS a paper billing statement.

Pass-Through Entity means a Company that passes its income through to its owners.

Permissible Ancillary Services means Automated Payment Service, Live Agent Service, Paper Bill/Statement Service, Single-Call and Related Services, and Third-Party Financial Transaction Services, as defined in these instructions.

Prison means a Facility operated by a territorial, state, or federal agency that is used primarily to confine individuals convicted of felonies and sentenced to terms in excess of one year. The term also includes public and private Facilities that provide outsource housing to other agencies such as the State Departments of Correction and the Federal Bureau of Prisons; and Facilities that would otherwise fall under the definition of Jail but in which the majority of Incarcerated People are post-conviction or are committed to confinement for sentences of longer than one year.

Provider means any communications service provider that provides IPCS, as defined in 47 U.S.C. §§ 153, 276(d), regardless of the technology used. This definition includes all Contractors, as defined above, as well as all Subcontractors, as defined below, to the extent that their activities include the provision of IPCS. A Provider may offer Audio IPCS, Video IPCS, or both.

Releases means the number of Incarcerated People released after a period of confinement (e.g., sentence completion, bail or bond releases, other pretrial releases, transfers to other jurisdictions, and deaths). It includes Incarcerated People who have completed weekend programs and are leaving the Facility for the last time. It excludes temporary discharges, such as discharges for work, medical or other appointments, court appearances, furloughs, and day reporting.

Return means the Company’s Net Capital Stock multiplied by its Weighted Average Cost of Capital.

Revenue-Sharing Agreement means any agreement, whether express, implied, written, or oral between a Provider or any Affiliate and a Third Party, such as a financial institution, or between a Provider and any of its Affiliates that, over the course of the agreement, directly or indirectly results in the payment of all or part of the revenue received from the provision of IPCS or any Ancillary Services to the other party to the agreement.

Safety and Security Measures means any safety or security surveillance system, product, or service, including any such system, product, or service that helps the Facility ensure that Incarcerated People do not communicate with persons they are not allowed to communicate with; helps monitor and record on-going communications; or inspects and analyzes recorded communications. Safety and Security Measures also include other related systems, products, and services, such as a voice biometrics system, a personal identification number system, or a system concerning the administration of subpoenas concerning communications. The classification of a system, product, or service as a Safety and Security Measure does not mean that it is part of a Provider’s IPCS-Related Operations.

Single-Call and Related Services means billing arrangements whereby an Incarcerated Person’s collect communications are billed through a Third Party on a per-communication basis, where the called party does not have an account with the Provider or does not want to establish an account.

Site Commissions means any form of monetary payment, in-kind payment, gift, exchange of services or goods, fee, technology allowance, or product that a Provider or Affiliate of a Provider may pay, give, donate, or otherwise provide to an entity that operates a Facility, an entity with which the Provider enters into an agreement to provide IPCS, a governmental agency that oversees a Facility, the city, the county, or state where a Facility is located, or an agent of any such Facility.

Subcontractor means an entity that provides IPCS at or for a Facility on behalf of a Provider that has a contractual or other arrangement with a Contracting Authority to provide IPCS at or for the Facility. A Subcontractor need not have a direct contractual relationship with a Contracting Authority.

Third Party means an entity that is not a Provider, including a Subcontractor, an Affiliate of a Provider, or a Facility.

Third-Party Financial Transaction Fees means the exact fees, with no markup, that Providers are charged by Third Parties to transfer money or process financial transactions to facilitate a Customer’s ability to make account payments via a Third Party.

Third-Party Financial Transaction Services means the transfer of money or the processing of financial transactions to facilitate a Customer’s ability to make account payments via a Third Party.

Unbilled Communications means the number of IPCS communications supplied during a Year for which payment is not demanded.

Unbilled Minutes, Unbilled Minutes of Use, and Unbilled MOU mean the number of Audio and/or Video IPCS minutes supplied during a Year for which payment is not demanded.

Variable Site Commissions means Site Commissions that are assessed on a per-unit basis, such as a per-minute basis, percentage of IPCS revenue, or number of IPCS devices at a Facility.

Video IPCS means any video communications service used by Incarcerated People for the purpose of communicating with individuals outside the correctional institution where the people are incarcerated, regardless of the technology used. It typically includes an integrated audio component, and excludes all services classified as Audio IPCS, as well as Other Products and Services, such as one-way entertainment, educational, religious, vocational, and instructional programming.

Weekly Turnover Rate means the percentage calculated by subtracting the average number of weekly Releases during a Year from the average number of weekly Admissions during that Year and then dividing the resulting number by the Average Daily Population for that Year.

Weighted Average Cost of Capital or WACC means the sum of the cost of equity, the cost of preferred stock, and the cost of debt, each expressed as an annual percentage rate and weighted by its proportion in the capital structure.

Year means a calendar year, beginning January 1 and ending December 31 of any given year.

IV.

Required Information

This Part sets forth the information you must provide in your response to this data collection. In some cases, data are to be reported on the attached Excel template, while other questions require a narrative response on the attached Word template. Unless otherwise indicated, all responses should be entered into the Excel template. In general, this Part proceeds from Company-level inquiries to specific Facility-level inquiries.

This Part begins by asking you to provide general information about your Company, including information pertaining to your IPCS operations. Next, we direct you to provide financial data and related information at the Company level. We then direct you to disaggregate that financial information into service-specific categories and provide you detailed cost allocation instructions in connection with this step. We also instruct you how to report data where a Provider has an agreement with another entity for the provision of IPCS. We then require you to report Company-level Ancillary Services and Site Commission data, followed by data regarding transactions with Affiliates. Finally, following the instructions for reporting Company-level data, we direct you to report certain information at the Facility level.

As a reminder, this data collection seeks data for calendar year 2022. Please provide data for your responses for 2022, the one-year reporting period from January 1, 2022, to December 31, 2022.

A. General Information

This section directs you to provide general information and data about your Company and its Affiliates, among other matters, in total for 2022, unless otherwise specified.

Company Name: Enter the Company’s name.

Accounting Entity: Enter the name of each corporation, partnership, or other legal entity within the Accounting Entity.

Contact Person: Enter the name, title, email address, and phone number of the person whom the Commission may contact to inquire about the Company’s response to the collection.

Holding Company Name: Enter the name of Company’s ultimate parent, if any.

Filing Date: Enter the filing date using the following format: “MM/DD/YYYY” to indicate the month, day, and year.

Headquarters Address: Enter the physical address where the Company’s headquarters are located.

Publicly Listed: Identify whether the Company is a corporation or part of a corporation whose ownership is dispersed among the general public in many shares of stock which are traded on a stock exchange or in over-the-counter markets.

IPCS or Ancillary Services:

List all IPCS or Ancillary Services that the Company provided at or for Facilities, or to Incarcerated People or those they communicated with, during 2022. List all such services even if the Company only provided them at some Facilities. List one service per column, starting in Column B.

In the Word template, describe in detail each type of Audio IPCS that the Company provided at or for Facilities during 2022.

In the Word template, describe in detail each type of Video IPCS that the Company provided during 2022. Identify the transmission technology, the service parameters and the key performance indicators used to provide and evaluate each type of Video IPCS. Describe the steps the Company took to monitor these services to ensure they functioned as intended.

In the Word Template, describe the infrastructure, including any Wi-Fi routers, wiring, or other infrastructure located within Facilities, the Company provided to deliver each of its Video IPCS offerings during 2022. Explain how, if at all, the infrastructure the Company provided to deliver Video IPCS differed from the infrastructure it provided to deliver Audio IPCS. To what extent was the Company, as opposed to the Facility, generally responsible for providing and maintaining any infrastructure that is located within a Facility. Submit any information the Company has on the capabilities (e.g., speed and latency) of the Video IPCS infrastructure located within the Facilities the Company serves.

In the Word template, identify each type of device that the Company used to provide IPCS during 2022, including any devices that the Company provided to Incarcerated People or to those with whom they communicate. Provide the average per-unit price that the Company paid for each identified type of device used during 2022.

In the Word template, identify and describe the infrastructure, devices, and other equipment and technologies the Company used to provide:

Both Audio IPCS and Video IPCS;

Only Audio IPCS; and

Only Video IPCS.

In the Word Template, describe generally whether the Company or the Facilities the Company serves provided any broadband connection used to provide IPCS. Where the Company provided the broadband connection, explain the extent to which the Company used those connections to provide Audio IPCS as well as Video IPCS, and the extent to which Facilities used those connections for their own communications. Identify the broadband service level required for the Company’s Audio IPCS and Video IPCS offerings to function as intended, and generally discuss the availability of this service level at the Facilities the Company serves.

In the Word Template, describe the type of data storage, if any, the Company used to retain the contents of, or information regarding, incarcerated people’s communications during 2022. Generally describe the amount of storage space required, expressed in terms of the amount of data used, to store the contents of, and data regarding, incarcerated people’s communications. Additionally, describe in detail any contractual provisions, including any provisions addressing the storage system, data retention period, or retrieval and analysis of stored information, that required or addressed such data storage. Also identify and describe, if applicable, the software the Company used to store the contents of, or information regarding, incarcerated people’s communications.

In the Word Template, explain how the Company markets its Video IPCS to consumers, including identifying any packages, bundles, and other services or features included with Video IPCS. Additionally, include the units of sale the Company uses to sell Video IPCS to consumers (e.g., calls, minutes, or data allotments).

In the Word Template, explain any conditions or limitations in place that restrict how Incarcerated People may use the Company’s Video IPCS, including accessing the service, the availability of the service, and any other limitations that affect usage. Separately, identify whether these conditions are imposed by the Company or by the Facility.

In the Word Template, we seek information regarding the Safety and Security Measures the Company provided during 2022. To the extent the set of Safety and Security Measures provided by the Company varied among the Facilities it served, or among the types of IPCS it provided, describe the reasons for that variation. In particular, explain whether, and if so why, the Safety and Security Measures provided differ based on: (i) contractual provisions; (ii) Facility restrictions; (iii) differences between Audio IPCS and Video IPCS; or (iv) variables in the infrastructure, devices, and other equipment and technologies used to provide IPCS (e.g., implementation on kiosks versus tablets, or implementation on third-party applications versus internally-developed applications).

In the Word template, to the extent the Safety and Security Measures provided by the Company varied based on contractual provisions or Facility restrictions, describe the reason(s) for such variation and identify which Safety and Security Measures are involved. Also address:

Whether the Company offers different Safety and Security Measures based on whether it seeks to provide Audio IPCS, Video IPCS, or both forms of IPCS;

Whether the Company offers a standard package of Safety and Security Measures and, if so, whether Contracting Authorities may add to, or subtract from, the package other services, options, or features;

Whether the Company requires Contracting Authorities to purchase any Safety and Security Measures as part of a package of services, either with its IPCS offerings or with other Safety and Security Measures; and

Whether Contracting Authorities require the Company to provide as a base package, not subject to negotiation, different sets of Safety and Security Measures.

In the Word template, describe how, if at all, the variations you describe in your responses to the previous two inquires impact the costs that the Company incurs to provide Safety and Security Measures.

In the Word template, the Company may elect to report any other factors that may impact the costs the Company incurs to provide Safety and Security Measures (e.g., fixed costs that may be shared by multiple Safety and Security Measures, the provision of certain Safety and Security Measures at different scales, Facility sizes, or Facility locations), and how those factors impact costs.

In the Word template, if the Company provided any services for which it charged Automated Payment Fees during 2022, describe the functions the Company performed, and the processes the Company used, to complete the underlying Consumer transactions.

In the Word template, if the Company provided any services for which it charged Live Agent Fees during 2022, describe the functions the Company performed, and the processes the Company used, in providing Live Agent Services.

In the Word template, if the Company provided any services for which it charged Fees for Single-Call and Related Services during 2022, describe the functions the Company performed, and the processes the Company used, to facilitate the underlying IPCS calls.

In the Word template, if the Company provided any services for which it charged Third-Party Financial Transaction Fees during 2022, describe the functions the Company performed, and the processes the Company used, to facilitate the underlying financial transactions.

In the Word template, if the Company provided any services for which it charged Other Ancillary Services Charges during 2022, identify each type of Other Ancillary Services Charge and its purpose, and describe the functions the Company performed, and the processes the Company used, to provide each Other Ancillary Service.

In the Word template, if the Company mailed paper bills or statements for any IPCS account and charged Paper Bill/Statement Fees during 2022, describe the Company’s policy for issuing and mailing such bills or statements, including any elections that must be made by the account holder or recipient of any mailed bills or statements.

Business Segments Other Than IPCS or Ancillary Services:

List all Business Segments, other than IPCS or Ancillary Services, that the Company engaged in during 2022. List one Business Segment per column, starting in Column B.

Provide the Billed Revenues for each listed Business Segment during 2022. Enter Billed Revenues in the same column as the corresponding Business Segment.

List all Business Segments, other than IPCS or Ancillary Services, the Company or an Affiliate provided at or for Facilities, or to Incarcerated People or those they communicate with, during 2022. List all such Business Segments even if the Company or Affiliate provided them only at some Facilities. List one Business Segment per column, starting in Column B.

In the Word template, describe in detail all Business Segments, other than IPCS and associated Ancillary Services, the Company or an Affiliate provided at or for Facilities, or to Incarcerated People or those they communicate with, during 2022.

In the Word template, describe in detail how, if at all, the Company’s IPCS and associated Ancillary Services interact with Business Segments other than IPCS or Ancillary Services.

In the Word template, state whether the Company provides any type of IPCS as part of a bundle with, or otherwise provides any type of IPCS in conjunction with, any other type of IPCS and/or Other Products and Services. If the answer is yes, for each such bundle:

Identify the components of the bundle, and state whether each of those components qualifies as IPCS or as Other Products and Services;

Describe in detail the steps the Company employed to ensure its responses to this data collection do not allocate the costs of its Other Products and Services to IPCS or associated Ancillary Services;

State whether the Company also provides the bundled IPCS component(s) individually as standalone services;

State the price consumers pay for each bundle as a whole, as well as the standalone price of each component within each bundle. For any component offered only as part of a bundle, state what its price would be if it were offered on a standalone basis;

State whether bundling IPCS with Other Products and Services increases or decreases the Company’s overall costs, and identify the specific categories of costs that are affected and how those costs are affected; or, if bundling does not increase or decrease the Company’s overall costs, indicate that in the Word template; and

State whether the Company’s bundling practices vary among Facilities or contracts, and, if so, describe the variations in detail.

Assets:

List each type of tangible (e.g., phones, tablets, audio communications equipment, video communications equipment, and kiosks) and intangible asset (e.g., capitalized research and development, purchased software, internally developed software, patents, trademarks, capitalized site commissions, acquired technology rights, acquired contract rights, costs to obtain customer contracts, and capitalized Site Commissions) attributable to providing IPCS or associated Ancillary Services during 2022. Exclude any type of asset whose Net Investment is less than 5% of the Company’s total Net Investment. List one asset per column, starting in Column B.

Provide the Net Investment in each listed type of asset as of December 31, 2022. Enter Net Investment in the same column as the corresponding asset.

List each Audio IPCS, Video IPCS, or Ancillary Service, if any, that each listed type of asset supported. List each service in the same column as the corresponding asset.

List each Non-IPCS-Related Service or Product, if any, that each listed type of asset supported. List each Product or Service in the same column as the corresponding asset.

Affiliates Other Than Affiliates that Provided IPCS or Ancillary Service: List the names of all of the Company’s Affiliates, other than Affiliates that provided IPCS or Ancillary Services, during 2022. List one Affiliate per column, starting in Column B.

Billed Revenues of Affiliates Other Than Affiliates that Provided IPCS or Ancillary Services: Enter total Billed Revenues for these Affiliates for 2022. Enter Billed Revenues in the same column as the corresponding Affiliate.

Business Segments of Affiliates Other Than Affiliates that Provided IPCS or Ancillary Services:

List all Business Segments in which Affiliates, other than Affiliates that provided IPCS or Ancillary Services, engaged during 2022. List one Business Segment per column, starting in Column B.

Identify each Affiliate, other than Affiliates that provided IPCS or Ancillary Services, that participated in the supply of each Business Segment on your list. List Affiliates in the same column as the corresponding Business Segment.

Billed Revenues of Affiliates Other Than Affiliates that Provided IPCS or Ancillary Services by Business Segments: Enter Billed Revenues for 2022 by each Affiliate, other than Affiliates that provided IPCS or Ancillary Services, for each Business Segment on your list. Enter Billed Revenues in the same column as the corresponding Affiliate.

Affiliate Transactions: List all types of assets and services that the Company obtained from an Affiliate, other than an Affiliate that provided IPCS or Ancillary Services, that were used in the provision of IPCS or Ancillary Services during 2022. List one asset or service per column, starting in Column B. List each of the below items in the same column as the corresponding asset or service for 2022:

Each Affiliate, other than an Affiliate that provided IPCS or Ancillary Services, that provided those assets or services;

The amounts the Company paid its Affiliates, other than Affiliates that provided IPCS or Ancillary Services, for those assets and services; and

The Net Investment of Affiliates, other than Affiliates that provided IPCS or Ancillary Services, in those assets as of the date of the transaction.

The Annual Total Expenses that Affiliates, other than Affiliates that provided IPCS or Ancillary Services, incurred to provide those services during the Year immediately prior to the transaction.

Accounting and Record Keeping Systems: In the Word template, describe in detail the Accounting Entity’s accounting and record-keeping systems.

Mandatory Data Collection Response: In the Word template, provide an overview of how the Company used its accounting and record-keeping system to respond to this Mandatory Data Collection. As part of this overview, explain the process by which the Company used data from income statements, balance sheets, general ledgers, subledgers, journals, department, division, or other organization group accounts or subaccounts, and other records or sources of financial data to develop, compile, assign, attribute, allocate or report Company-wide, service-specific, and Facility-specific revenues, investments, and expenses, as required by this Mandatory Data Collection. Identify the sources for all depreciation and amortization schedules or asset life projections used to determine the amount of depreciation and amortization expenses reported and how these expenses are derived using these schedules and projections or other methods in lieu of or in combination with these schedules and projections. Explain how Company-wide, service-specific, Facility-specific, department, division, or other organization group data are used to determine how costs are incurred in order to assign, attribute, or allocate investments and expenses, as required by this Mandatory Data Collection, including, for example, data as to the number of communications or call minutes, ADP, headcounts, labor hours, or salaries; computer processing, electronic equipment or other inside or outside plant equipment, circuit, and electric power use or capacity; internal or external maintenance or computer-center help desk requests, tickets, orders or dispatch numbers; and purchase orders, transactions, or other measures of resource use and cost-causation.

Representative Information: In the Word template, address in detail whether the information collected though the data collection will be representative of the Company’s future provision of IPCS and associated Ancillary Services. Identify for the two-year period from January 1, 2024, to December 31, 2025, any specific known and measurable changes to the Company’s IPCS or Ancillary Services investments, expenses, revenues, and demand that are not reflected in the data collected through this data collection.

Sources: In the Word template, identify the source for any data or any document included in or relied upon in your response.

B. Overview Information

This section provides an overview of the Company’s provision of Audio and Video IPCS and associated Ancillary Services by incorporating information from other sections of your Excel template. You should first enter the information required in those other sections of the Excel template. Note, once you do that, the information required for this section will automatically be entered into the fields for subsections (3) through (5) of this portion of the Excel template, which are highlighted in green. Manually enter the information requested only for subsections (1) and (2) of this portion of the template. All of the information will be at the Accounting Entity level.

Company Name

Facilities

Number of Facilities

Number of Prisons

Number of Jails with ADP of 1,000 and above

Number of Jails with ADP below 1,000

Number of contracts

Number of Prison contracts

Number of Jail contracts

Annual Total Expenses during 2022 for:

Audio IPCS

Video IPCS

Safety and Security Measures

Automated Payment Services

Live Agent Services

Paper Bill/Statement Services

Single-Call and Related Services

Third-Party Financial Transactions Services

Billed Revenues during 2022 for:

Audio IPCS

Video IPCS

Safety and Security Measures

Automated Payment Services

Live Agent Services

Paper Bill/Statement Services

Single-Call and Related Services

Third-Party Financial Transactions Services

Site Commissions paid during 2022:

Total Site Commissions

Total Monetary Site Commissions

Total In-Kind Site Commissions

Total Legally Mandated Site Commissions

Total Contractually Prescribed Site Commissions

C. Company-Wide Information

This section seeks financial data and other information about the Company and directs you to determine the Annual Total Expenses the Company incurs to provide Audio IPCS, Video IPCS, Safety and Security Measures, various types of Ancillary Services, and Other Products and Services during 2022.

Overall Financial Information

This subsection directs you to provide financial data and other information in the aggregate for the entire Company as defined above in Part III. Relevant Definitions (i.e., Accounting Entity). All financial data must comply with generally accepted accounting principles (GAAP).17 The carrying value of all assets, both tangible and intangible, shall reflect the results of the most recent impairment testing, and any adjustments required to account for any impairment loss shall be separately identified. In the Word template, explain in detail the process the Company used to ensure GAAP-consistent impairment testing and provide any additional information needed to make that process fully transparent and understandable. Alternatively, explain in detail in the Word template why an impairment test is not necessary, when impairment testing normally occurs under Company policy, and identify with specificity any accounting adjustments that were made at the time of the most recent impairment testing.

Investment and Expense Data: Provide the following investment and expense data in the aggregate for the Accounting Entity for 2022. If the Company has no investment or expense data to report for any of the following categories, report zero in the corresponding cell in the Excel template.

Capital Assets: Report year-end amounts for 2022 for each of the items specified below. Report amounts for items (i), (ii) or (iii), and (iv) separately for each of the following categories of assets: (aa) tangible assets; (bb) capitalized research and development; (cc) purchased software; (dd) internally developed software; (ee) trademarks; (ff) capitalized site commissions; (gg) other identifiable intangible assets; and (hh) goodwill. Report a single amount for each of items (v), (vi), and (vii).

Gross Investment;

Accumulated depreciation;

Accumulated amortization;

Net Investment;

Accumulated deferred federal income taxes;

Accumulated deferred state income taxes; and

Customer prepayments or deposits.

Capital Expenses: Report the amount for 2022 for each of the items specified below. Report amounts for items (i) or (ii) separately for each of the following categories of assets: (aa) tangible assets; (bb) capitalized research and development; (cc) purchased software; (dd) internally developed software; (ee) trademarks; (ff) capitalized site commissions; (gg) other identifiable intangible assets; and (hh) goodwill. Report as amortization in item (ii) any amortization of capitalized site commissions that the Company’s books recognized as an amortization expense or as an offset against gross revenues (e.g., as contra revenues). Report a single amount for each of items (iii), (iv), and (v). In the Word template, identify the discrete types of expenses reported in each Capital Expense category.

Depreciation;

Amortization;

Interest other than interest paid on customer prepayments or deposits;

Interest paid on customer prepayments or deposits; and

Other income tax-related adjustments.

Operating Expenses: Report the amount for 2022 for each of the items specified below. Each expense must be reported for only one category. For example, do not report expenses incurred for Extra Payments to Telecommunications Carriers or Other Entities for International Communications as an expense incurred for Payments to telecommunications carriers or other entities for Interstate, International, or Intrastate Communications other than Extra Payments for International Communications; report such expenses in the designated category separately. Exclude any charges for asset impairment loss. In the Word template, identify the discrete types of expenses reported in each Operating Expense category.

Maintenance, repair, and engineering of site plant, equipment, and facilities;

Payments to telecommunications carriers or other entities for Interstate, International, or Intrastate Communications other than Extra Payments to Telecommunications Carriers or Other Entities for International Communications;

Extra Payments to Telecommunications Carriers or Other Entities for International Communications;

Field services;

Network operations;

Call center;

Data center and storage;

Payment of Site Commissions recognized as an expense or an offset against gross revenues when paid or when the Site Commissions-related transaction occurred;

Billing, collection, client management, and customer care;

Sales and marketing;

General and administrative;

Other overhead;

Taxes other than income taxes;

Transactions related to mergers and acquisitions; and

Bad debt.

2. Service-Specific Financial Information

The preceding subsection instructs you to provide financial information at the Company level. We now require you to provide Company-wide revenue and Annual Total Expense data for 2022, separately and discretely, for Audio IPCS, Video IPCS, Safety and Security Measures, various types of Ancillary Services, and Other Products and Services.

Determining the Company’s Annual Total Expenses for 2022 involves several steps. First, we instruct you to assign, attribute, or allocate the reported Company-wide investments and expenses (in total, without separation into interstate, international, and intrastate components), other than those for Site Commissions, among Audio IPCS, Video IPCS, Safety and Security Measures, Automated Payment Services, Live Agent Services, Paper Bill/Statement Services, Single-Call and Related Services, Third-Party Financial Transaction Services, Other Ancillary Services, and Other Products and Services in accordance with the cost allocation instructions set forth below.

We then instruct you to calculate federal and state income taxes, Cash Working Capital, Net Capital Stock, and Return for Audio IPCS, Video IPCS, Safety and Security Measures, Automated Payment Services, Live Agent Services, Paper Bill/Statement Services, Single-Call and Related Services, and Third-Party Financial Transaction Services. We do not require a calculation of federal and state income taxes, Cash Working Capital, Net Capital Stock, or Return for Other Ancillary Services or Other Products and Services. Cells are populated with N/A in the Excel template to indicate that federal and state income taxes, Cash Working Capital, Net Capital Stock, and Return should not be reported for these services. Cells also are populated with N/A in the Excel template to indicate that capitalized Site Commissions, amortization related to capitalized Site Commissions, and Site Commissions accounted for as an expense or offset to gross revenues are not to be allocated to or reported for any service.

We next instruct you to provide the results of your cost assignments, attributions, and allocations separately and discretely (i.e., totaling, in sum, the respective amounts reported for Company-wide investments and expenses) for Audio IPCS, Video IPCS, Safety and Security Measures, Automated Payment Services, Live Agent Services, Paper Bill/Statement Services, Single-Call and Related Services, Third-Party Financial Transaction Services, Other Ancillary Services, and Other Products and Services, which shall include amounts for investments, Capital Expenses, and Operating Expenses. We also instruct you to report your federal and state income tax calculations separately and discretely for Audio IPCS, Video IPCS, Safety and Security Measures, Automated Payment Services, Live Agent Services, Paper Bill/Statement Services, Single-Call and Related Services, and Third-Party Financial Transaction Services.

We then require you to make two elections. We first instruct you to elect whether to use the default Weighted Average Cost of Capital or an alternative Weighted Average Cost of Capital. We then instruct you to elect whether to include an allowance for Cash Working Capital. If you elect an alternative Weighted Average Cost of Capital greater than 9.75% or include an allowance for Cash Working Capital, we require you to report the components of those elections.

We instruct you to provide the Company’s Annual Total Expenses (in total, without separation into interstate, international, and intrastate components) of providing, separately and discretely, Audio IPCS, Video IPCS, Safety and Security Measures, Automated Payment Services, Live Agent Services, Paper Bill/Statement Services, Single-Call and Related Services, and Third-Party Financial Transaction Services.

We then instruct you to make three elections relating to potential adjustments to the Company’s investments, expenses, Net Capital Stock, and Annual Total Expenses. These potential adjustments would involve: (a) separating your investments, expenses, Net Capital Stock, and Annual Total Expenses for certain types of Ancillary Services into audio and video components; (b) separating the Company’s investments, expenses, Net Capital Stock, and Annual Total Expenses for Audio IPCS, Video IPCS, Safety and Security Measures, Automated Payment Services, Live Agent Services, Paper Bill/Statement Services, Single-Call and Related Services, and Third-Party Financial Transaction Services into interstate, international, and intrastate components; and (c) adjusting those investments, expenses, Net Capital Stock, and Annual Total Expenses for any other reason. We will interpret elections to not make these adjustments as establishing that the adjustments would show no meaningful differences in investments, expenses, Net Capital Stock, and Annual Total Expenses costs.

Revenue Data

Enter, for 2022, the total Billed Revenues for the Accounting Entity for each of the following categories. The revenue reported for items (a), (b), and (d) though (j) shall exclude all revenue associated with Safety and Security Measures for which there is a separate price:

Audio IPCS;

Video IPCS;

Safety and Security Measures;

Automated Payment Services;

Live Agent Services;

Paper Bill/Statement Services;

Single-Call and Related Services;

Third-Party Financial Transaction Services;

Other Ancillary Services; and

Other Products and Services.

Cost Allocation Instructions

Using the hierarchy of methods specified below, you must assign, attribute, or allocate Company-wide investments and expenses (in total, without separation into interstate, international, and intrastate components) among:

Audio IPCS;

Video IPCS;

Safety and Security Measures;

Automated Payment Services (ancillary to Audio or Video IPCS);

Live Agent Services (ancillary to Audio or Video IPCS);

Paper Bill/Statement Services (ancillary to Audio or Video IPCS);

Single-Call and Related Services (ancillary to Audio or Video IPCS);

Third-Party Financial Transaction Services (ancillary to Audio or Video IPCS);

Other Ancillary Services (ancillary to Audio or Video IPCS); and

Other Products and Services.

For purposes of these cost allocation instructions, each of these services is treated as a separate (or particular) “service.” The data for items (a), (b), and (d) though (j) shall exclude all investments and expenses associated with Safety and Security Measures. The data for items (d) through (i) should reflect all of the Company’s Ancillary Services, regardless of whether they are provided in connection with Audio IPCS, Video IPCS, or both. Allocate any fees paid to third parties to provide Single-Call and Related Services, as well as any costs the Provider incurred to self-provide those services, to Single-Call and Related Services.

The sums of the investment and expense amounts assigned, attributed, or allocated to each particular service (excluding amounts for federal and state income taxes, Cash Working Capital, Net Capital Stock, and Return allocated to these services) shall, for each type of investment or expense, equal the total investment and expense amounts (excluding Site Commissions) respectively reported for the Company in the Excel template.

First, to the extent possible, directly assign investments used exclusively to provide a particular service to that service; likewise, to the extent possible, directly assign expenses incurred exclusively to provide a particular service to that service. Calculate federal and state income taxes separately for each of Audio IPCS, Video IPCS, Safety and Security Measures, Automated Payment Services, Live Agent Services, Paper Bill/Statement Services, Single-Call and Related Services, and Third-Party Financial Transaction Services but not for Other Ancillary Services or Other Products and Services, as specified in items 6 and 7 below. For any investments or expenses that are not directly assignable, turn to the next step.

Second, determine which remaining investments and expenses are shared investments or expenses and which are common investments or expenses. Any investments and expenses that are not directly assignable to a specific service are either shared or common investments and expenses. Then, group shared investments and expenses into shared investment and expense categories based on business function, activity, or task. Similarly, group common investments and expenses into common investment and expense categories based on business function, activity, or task.

Shared investments are for assets used exclusively to supply a specific subset of services that are not assignable or attributable to a particular service. Shared expenses are expenses incurred solely to supply a specific subset of services that are not assignable or attributable to a specific service.

Common investments are for assets not assignable or attributable to a specific service or subset of services. Common expenses are expenses that are not assignable or attributable to a specific service or subset of services.

Third, determine the subset of services for which each category of shared investments and expenses, and each category of common investments and expenses, was incurred. Then, to the extent possible, directly attribute each category of shared and common investments and expenses to their associated services based on direct analysis of factors that cause a particular business function, activity, or task, and thus investments or expenses, attributable to a particular service to increase or decrease. For any category of shared or common investments or expenses that cannot be directly attributed in this manner, turn to the next step.

Fourth, for each remaining category of shared and common investments and expenses for which neither direct assignment nor direct attribution is possible, determine whether there is an indirect, cost-causative link to an investment or expense category (or group of categories) that has already been directly assigned or directly attributed. Where there is such a link, indirectly attribute each remaining category of shared and common investments and expenses to the same services, in the same proportion, to which its linked categories were directly assigned or directly attributed. For any category of shared or common investments or expenses that cannot be indirectly correlated in this manner, turn to the next step.

Fifth, where none of the methods described above is possible, allocate categories of shared investments and expenses among the particular services that share those investments and expenses in proportion to each service’s share of the sum of all of those investments or expenses that have already been directly assigned or attributed to these particular services. Allocate categories of common investments and expenses among the particular services in proportion to each service's share of the total of all investments or expenses already directly assigned or attributed to all services.

Federal income taxes (calculated for Audio IPCS, Video IPCS, Safety and Security Measures, Automated Payment Services, Live Agent Services, Paper Bill/Statement Services, Single-Call and Related Services, and Third-Party Financial Transaction Services): First, subtract reported interest expense other than interest paid on customer prepayments or deposits (and any amount reported for other income tax-related adjustments) from Return to determine the federal taxable income. Second, divide the corresponding reported federal income tax rate by 1 minus this reported federal income tax rate to determine a federal income tax gross-up factor. (See the following instructions below for determining the federal income tax rate to report.) Third, multiply the federal income tax gross-up factor by federal taxable income to determine the amount of federal income tax to report.

Federal income tax rate for Accounting Entities that are C Corporations or taxed as C Corporations under the rules of the IRS. Report the 2022 federal corporate income tax rate, 21%, if the Accounting Entity is or is part of a company that is a C corporation or taxed as a C Corporation under the rules of the IRS. Use this tax rate to calculate federal income taxes as instructed above.

Federal income tax rate for Pass-Through Entities under the rules of the IRS. An Accounting Entity that passes income through or is part of a company that passes income through to its owners (i.e., a Pass-Through Entity, as defined in Part III) for federal income tax purposes may claim an allowance for federal income taxes. If the Accounting Entity passes income through or is part of a company that passes income through to its owners and wishes to claim an allowance for federal income taxes, report a weighted average of the 2022 federal income tax rate applicable to each owner, where the weights reflect each owner’s share of the 2022 total income passed through. Use this weighted average federal income tax rate to calculate federal income taxes as instructed above. Otherwise, report a federal tax rate equal to zero.

State income taxes (calculated for Audio IPCS, Video IPCS, Safety and Security Measures, Automated Payment Services, Live Agent Services, Paper Bill/Statement Services, Single-Call and Related Services, and Third-Party Financial Transaction Services): First, add the portion of federal income tax not deductible for state income tax purposes to federal taxable income to determine state taxable income. Second, divide the weighted average of the reported applicable individual state income tax rates by 1 minus the weighted average of the reported applicable state income tax rates to determine a state income tax gross-up factor. (See the following instructions below for calculating the weighted average of the reported applicable state income tax rates.) Third, multiply the state income tax gross-up factor by state taxable income to determine the amount of state income tax to report.

Weighted average state income tax rate: Enter “C” in the specified cells in the Excel template if the Company is subject to the state corporate income tax rate under the rules of a given state’s taxing authority. Enter “PTE” (for Pass-Through Entity) if the Company passes income through to its owners under the rules of a given state’s taxing authority. Report separately for 2022 each state income tax rate applicable to the Company. (See the following instructions below for determining the state income tax rates to report.) Report the total of your 2022 Billed Revenues from Audio IPCS, Video IPCS, and Ancillary Services separately for each state. The Excel template uses these reported data to calculate an Audio and Video IPCS and Ancillary Services revenue-weighted average of the individual state income tax rates (i.e., the sum of the products of each state tax rate multiplied by the percentage of the Company’s total of Audio and Video IPCS and Ancillary Services Billed Revenues derived from the supply of these services in each corresponding state). Use the weighted average state income tax rate to calculate state income taxes as instructed above.

State income tax rates for Accounting Entities that are subject to state corporate income taxes under the rules of the applicable state taxing authority. Report the 2022 state corporate income tax rate for each state in which the Accounting Entity is subject to or is part of a company that is subject to state corporate income taxes. Use these state corporate income tax rates to calculate the revenue-weighted average of the state income tax rates as instructed above. If the Accounting Entity is subject to state corporate income taxes in some states but passes income through to its owners for state tax purposes in other states, follow the instruction below for reporting income tax rates for those other states.