QEI Closeout Report _PRA 2022

New Markets Tax Credit (NMTC) Program Allocation and Qualified Equity Tracking (AQEI) System

QEI Closeout Report _PRA 2022

OMB: 1559-0024

Draft For Paperwork Reduction Act Purposes Only

-

U.S. Department of Treasury

Community Development Financial Institutions Fund

QEI Closeout Report Guidance

February 2023

OMB Approval No. 1559-0024 Paperwork Reduction Act Notice.

This compliance reporting document is provided to award recipients of New Markets Tax Credits (NMTC) allocation authority through the NMTC Program. Award recipients are not required to respond to this collection of information unless it displays a currently valid Office of Management and Budget (OMB) control number. The estimated average burden associated with this collection of information is 20 hours per year. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Program Manager, Compliance Monitoring and Evaluation, Department of the Treasury, Community Development Financial Institutions Fund, 1500 Pennsylvania Avenue, Washington, D.C. 20220.

Disclaimer: This document is intended to serve as public guidance for the subject matter contained herein. The CDFI Fund reserves the right, however, to modify this guidance at any time upon public notice. The examples contained in this guidance are not exhaustive in nature and the CDFI Fund has the discretion to consider additional factors when determining matters of compliance.

Table of Contents

General Information about the Closeout Report 4

Creating a New Closeout Report 5

Certification of QEI Closeout Report 12

General Information about the Closeout Report

The Closeout Report is the CDFI Fund’s approach to aggregate an Allocatee’s use of Qualified Equity Investment (QEI) proceeds and to gather additional information on the status of the Qualified Low-Income Community investment (QLICI) and Qualified Active Low-Income Community Business (QALICB) at the end of the tax credit compliance period.

Allocatees are now required to report on QEIs that have reached the end of the 7-year tax credit compliance period. The QEI Closeout Report must be filed after the Transaction Level Report (TLR) and Institution Level Report (ILR) have been submitted for QEIs that have reached the end of their compliance period. The information entered into the TLR and ILR reports will then be used to prepopulate the QEI Closeout Report. The link for the QEI Closeout Report can be found on the menu bar of the AMIS Homepage.

Who to contact for help

If Allocatees are having technical difficulty (e.g., discrepancies between the QEI Closeout Report and the TLR are identified or system errors), the most effective means of requesting support is submitting a Service Request. From the AMIS Service Request tab, select the “Create New Service Request” button. Ensure that “Compliance and Reporting” is selected for Program and “New Markets Compliance” is selected as Program Topic.

Alternatively, the Allocatee may send an email to AMIS@cdfi.treas.gov. Please type, “NMTC: QEI Closeout Report assistance needed” in the subject line of the email. A technical support staff person will generally reply within 24 hours on weekdays. Allocatees may also phone the CDFI Fund IT Help Desk at (202) 653-0422. If a technical support staff person is unavailable to immediately assist, please leave a message and a staff person will return the call within 36 hours on weekdays.

Creating a New Closeout Report

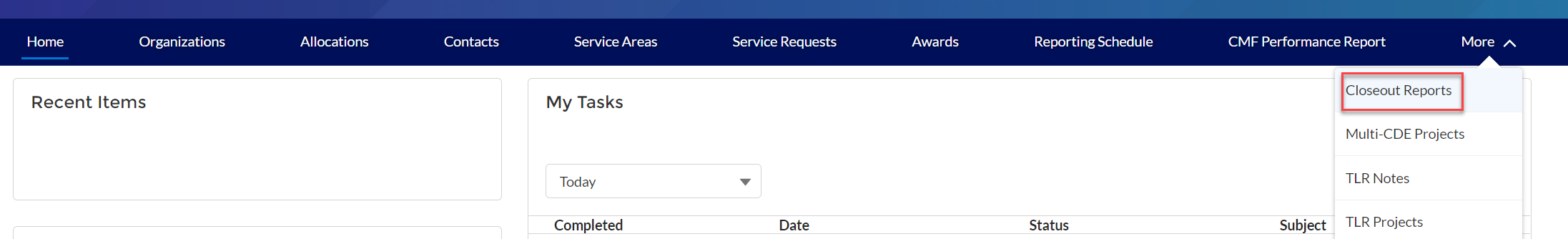

To create a new Closeout Report, log into the AMIS portal and select the Closeout Reports tab.

Figure 1: ‘Closeout Report’ Tab

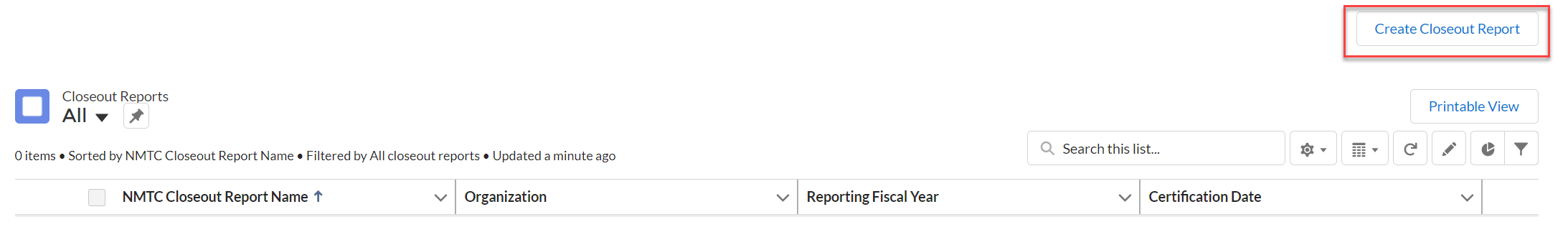

Once on the Closeout Reports page click on the “Create New Closeout Report” button.

Figure 2: ‘Create New Closeout Report’ Button

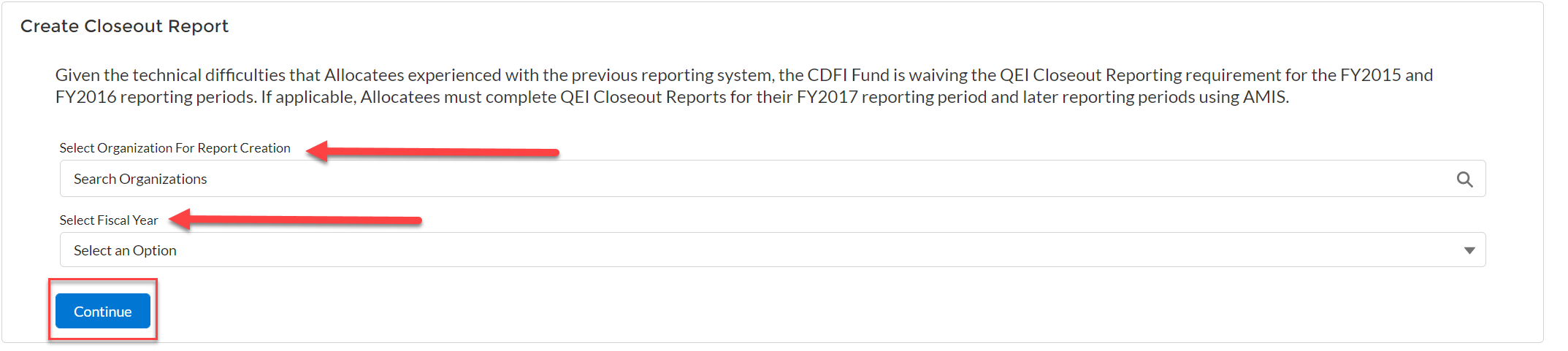

After clicking on the “Create New Closeout Report” button, the user will be directed to a page where they will need to use the search icon to select their organization that they wish to complete a closeout report for, as well as select the fiscal year (FY2017 or later) they would like to complete the QEI Closeout Report for.

.

Figure 3: Select Organization and Fiscal Year

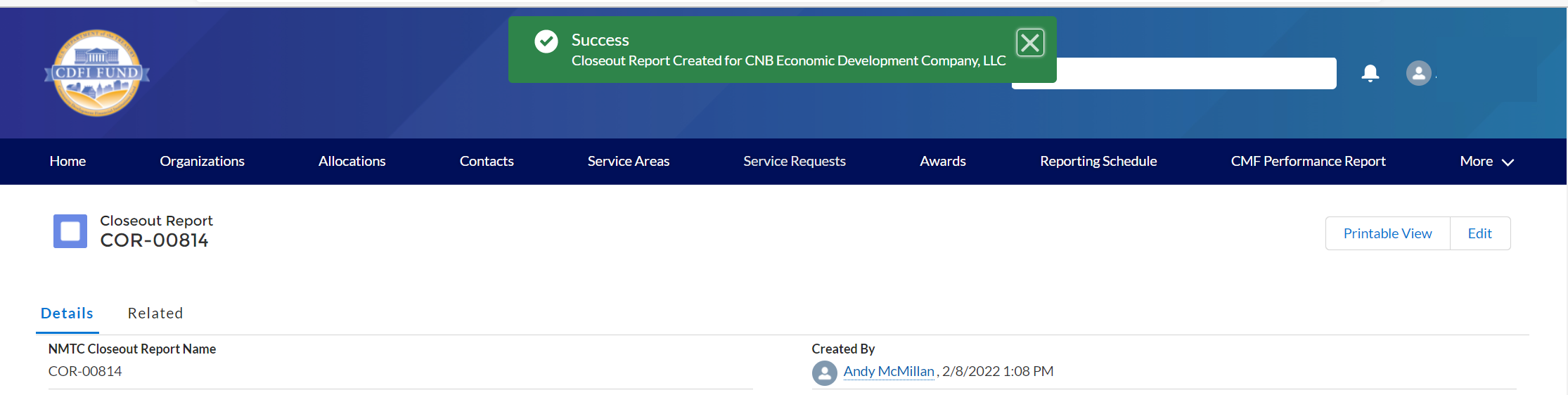

After clicking on the “Continue” button, the system will display a success message.

Figure 4: Display Closeout Report Creation Success Message

Closeout Report Data Points

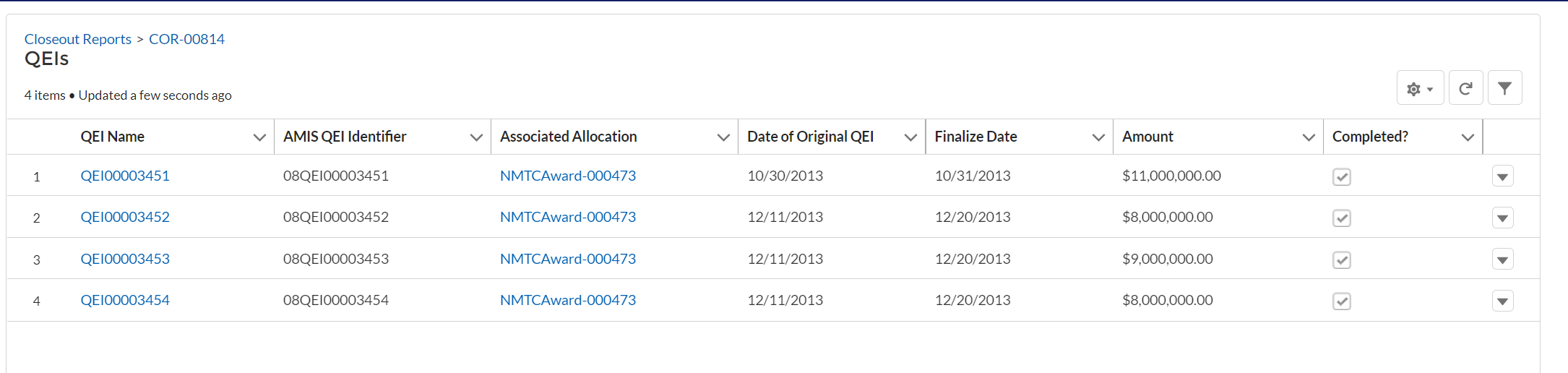

QEI Detail

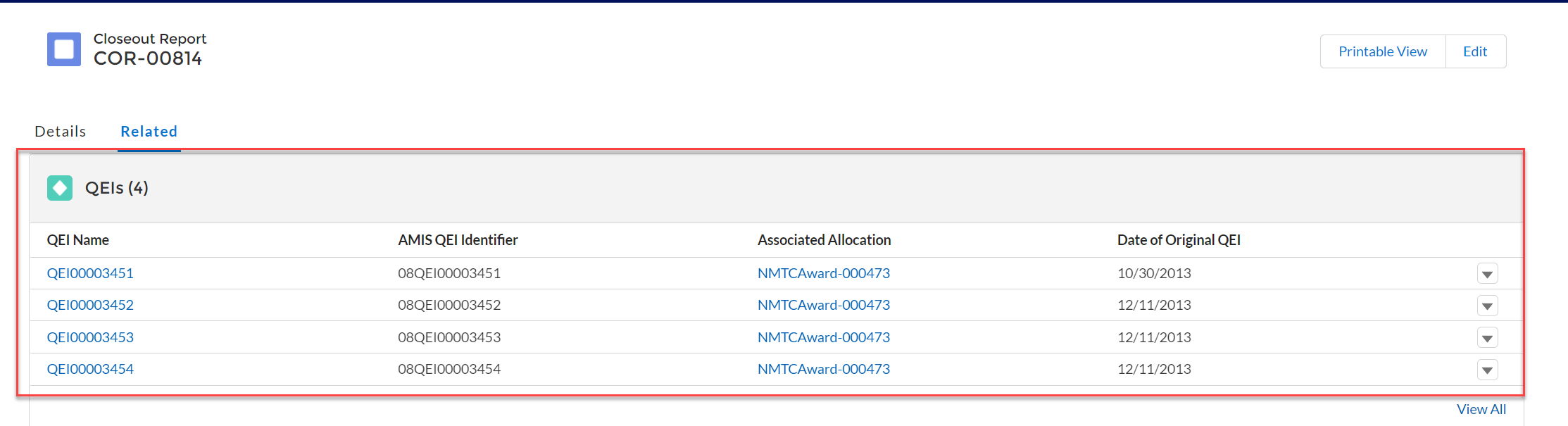

To begin entering QEI information click on one of the QEI names, located in the QEI related list, to view the associated QEI information. (Figure 4)

Note: To complete the Closeout Report, the user must enter data for every QEI listed. The QEI Closeout Report is based on the 7-year tax credit period of the QEI rather that the loan status of the QLICI. As such, estimates can be used if the QLICI’s exit occurs after the QEI Closeout report is due.

Figure 5: QEI Related list on Closeout Report Detail Page

On the QEI Detail Page, the fields below require a user entered response. (Figure 5)

Figure 6: QEI Detail Page Required and Conditionally Required Fields.

Loan Loss Reserves

Report the dollar amount of the QEI that was used for Loan Loss Reserves.

If this amount exceeds 5% of the Original QEI Amount, a warning message will be displayed. The warning message will not prevent the amount from being submitted, but it serves as an advisory to review the amount entered for accuracy.

NOTE: This field is auto-populated with the amount reported in the QEI Disbursement Report summary for the individual QEI. As such, any changes to this amount must be made to the QEI Disbursement Report.

Loan Loss Reserves Usage at Closeout

Select a response from the provided dropdown menu. (This field will be disabled if a response of zero is entered for Loan Loss Reserves)

Retained as Loan Loss Reserves (for an active loan or additional loans)

Retained by the CDE or an affiliate Distributed to Investor

Provided to Borrower

Other (A response in the text box is mandatory if this option is selected)

Click the “Save Changes to the QEI Detail Section” button.

Project Detail

For each QEI, the system will pre-populate all of the associated projects from the most recently submitted TLR. Under the Projects related list, click on the Project Name associated. (Figure 6)

Figure 7: TLR Project Hyperlink on QEI Detail Page

On the Project Detail’s Page, the Business Description Expanded field is required. (Figure 7)

Figure 8: Required Field on Project Detail Page

Business Description Expanded

Allocatees are required to provide additional details on the business description

Provide additional information to elaborate on the description of the business/project and services in 300 characters or less.

Click the “Save Changes to the Project Detail Section” button.

Transaction Detail

Each Originator Transaction ID that has been reported and certified for the QEI will display under the Transactions related list on the associated project detail page. Click on each Transaction Name to enter further data. (Figure 7)

Figure 9: TLR Transaction Hyperlink on Project Detail Page

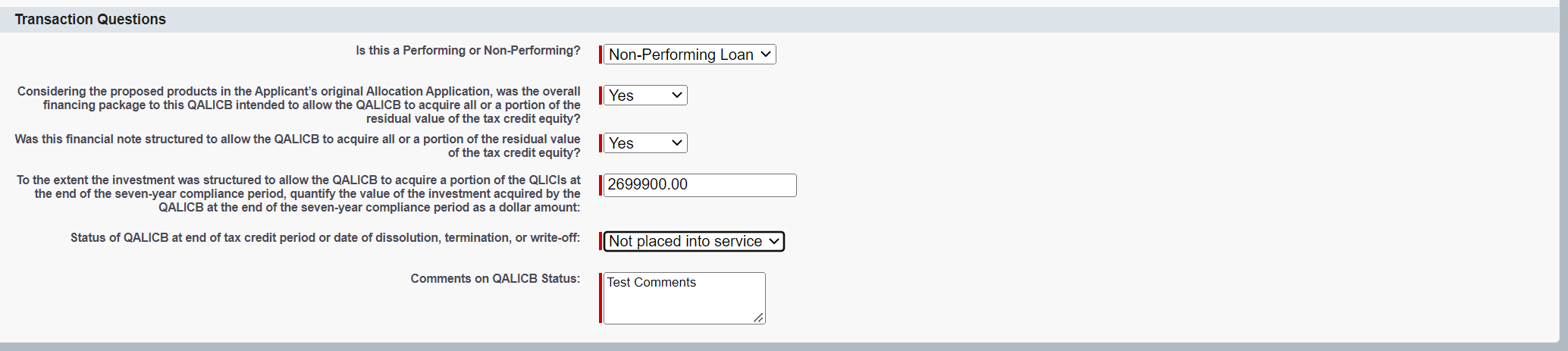

The fields below require a user entered response. (Figure 8)

Figure 10: Example of Required and Conditionally Required Fields on Transaction detail Page

The Loan Status and Purpose fields of the transaction that were reported in the most recent TLR will determine the types of Transaction Questions the user will be required to answer for each transaction in the QEI Closeout Report.

Field(s) required for Loan Status of ‘ACTIVE’ or ‘ACTIVEEND’

Is this a Performing or Non-Performing Loan?

Select a response from the provided dropdown menu:

Performing (payments for the loan have been made in full and on time)

Non-Performing (payments for the loan have not been made for at least 90 days)

Field(s) required for Loan Status of ‘Refinanced’ or ‘Sold’

Refinanced or Sold

Choose a response from the following options from the provided dropdown.

Sold to Affiliated (with the CDE) Entity

Sold to Non-Affiliated (with the CDE) Entity

Refinanced by Affiliated (with the CDE) Entity (if this option is selected a response to the question below is required)

Refinanced by Non-Affiliated (with the CDE) Entity (if this option is selected a response to the question below is required)

Refinanced by Affiliated (with the CDE) Entity or Refinanced by Non-Affiliated (with the CDE) Entity.

For transactions that have been “Refinanced by Affiliated Entity” or “Refinanced by Non-Affiliated Entity,” choose the source of capital used for refinancing from the following options. (Example: If the NMTC financial note was refinanced with bank debt from a market rate lender, select “Financing provided by private sector sources.” If it was refinanced with a loan from a CDFI with access to below market capital, select “Financing provided by philanthropic or other non-governmental sources.”)

Financing provided by private sector sources ∙ Financing provided by philanthropic or other non-governmental sources

Financing provided by state or local government program

Financing provided by federal program ∙ Financing provided by multiple types of sources

Other – If “Other” is selected, provide a response of up to 50 characters in the provided text box.

Field(s) required for transactions with a Loan Status of ‘Closed’

Converted to Equity

Select YES or NO from the provided dropdown menu for Converted to Equity (selecting the NO option would indicate that the transaction was paid in full).

NOTE: In cases where the QLICI is assigned to the investment fund:

Select “NO” if the QLICI was assigned to the investment fund after the 7 year tax credit compliance period.

Select “YES” if the QLICI was assigned to the investment fund after the 7 year tax credit compliance period and the investment fund is owned or controlled by the QALICB or Affiliate of the QALICB.

Field(s) required for transactions with a Loan Status of “Charged-Off’ or Restructured with

Charge-Off’

Reason for the QLICI Charge-Off or Restructuring

Enter in the text box provided the “Reason for the QLICI charge off or restructured”.

Field(s) required for all transactions

Considering the proposed products in the Allocatee’s original Allocation Application, was the overall financing package to this QALICB intended to allow the QALICB to acquire all or a portion of the residual value of the tax credit equity?

Select YES or NO from the provided drop-down menu.

Was this financial note structured to allow the QALICB to acquire all or a portion of the residual value of the tax credit equity?

Select YES or NO from the provided drop-down menu.

To the extent the investment was structured to allow the QALICB to acquire a portion of the QLICIs at the end of the 7-year compliance period, quantify the value of the investment acquired by the QALICB at the end of the 7-year compliance period as a dollar amount

Enter the value of the investment acquired by the QALICB in dollars:

The amount should not exceed the original QEI amount.

The “value received” should be minus the “put price” and “exit fees” paid by the QALICB

Status of QALICB at end of tax credit period or date of dissolution, termination, or write-off

Selection for transactions with ‘Purpose’ of any Real Estate option (i.e. RECOCOM, RECOMULTI etc.)

Select from the following options:

Placed into service

Not placed into service (if this option is selected please elaborate below in ‘Comments on QALICB status’)

Selection for transactions with a Purpose of ‘BUSINESS’ or ‘MICRO’

Select from the following options:

Continues as a going concern

No longer in existence service (if this option is selected please elaborate below in ‘Comments) on QALICB status’.

Comments on QLICB Status

This field is required if “Not placed into service” or “No longer in existence” is selected for ‘Status of QALICB at end of tax credit compliance period or date of dissolution, termination, or write-off’.

Provide the legal name of the business(s) and the state in which they are located.

Click the “Save Changes in Transaction Questions Section” button.

Click the “Back to Project” button, then the “Back to Report” button, then click the “Save Changes in QEI Detail Section” button to update all changes that have been made. Once you click save changes on the QEI Detail page, the completed checkbox will be marked.

Click on the “Back to Report” button and repeat each of the steps above until all of the information is provided for each QEI listed. Figure 11: Completed Checkbox on QEI Detail Page

Certification of QEI Closeout Report

Once all QEI records have been completed, as seen in Figure 11, then the final step is certification.

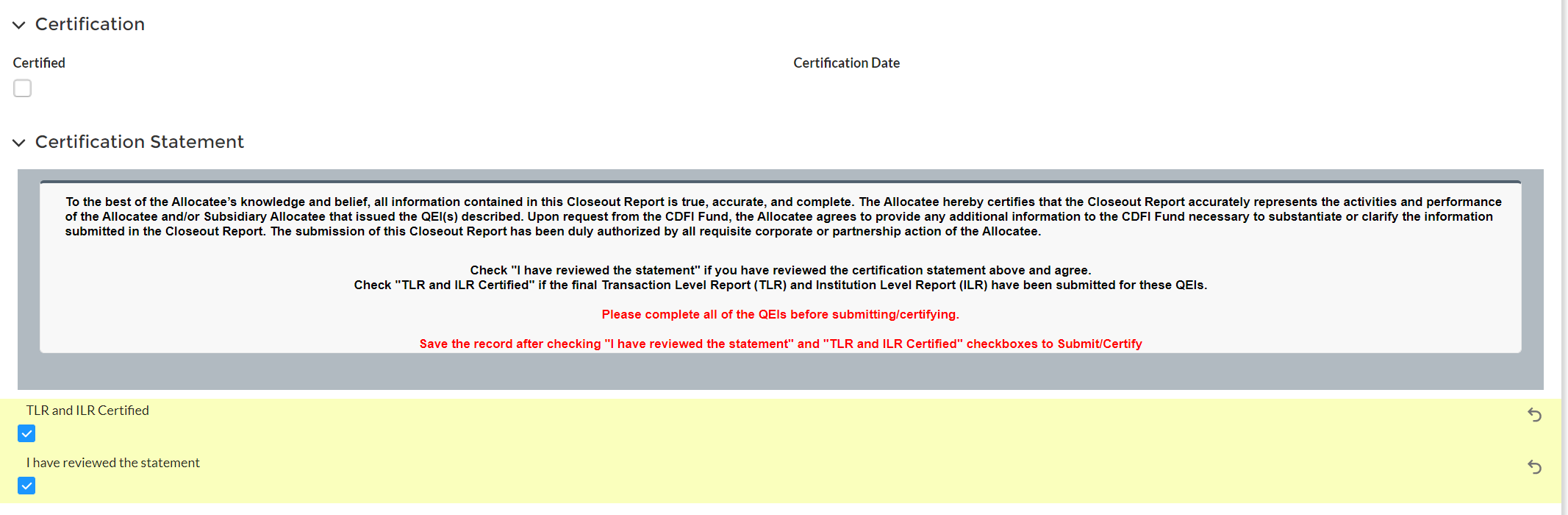

Figure 12: Certification Statement and Completed QEIs

Read the certification and mark both certification statement checkboxes. (Figure 11)

Figure 13: Certification Agreement Statements

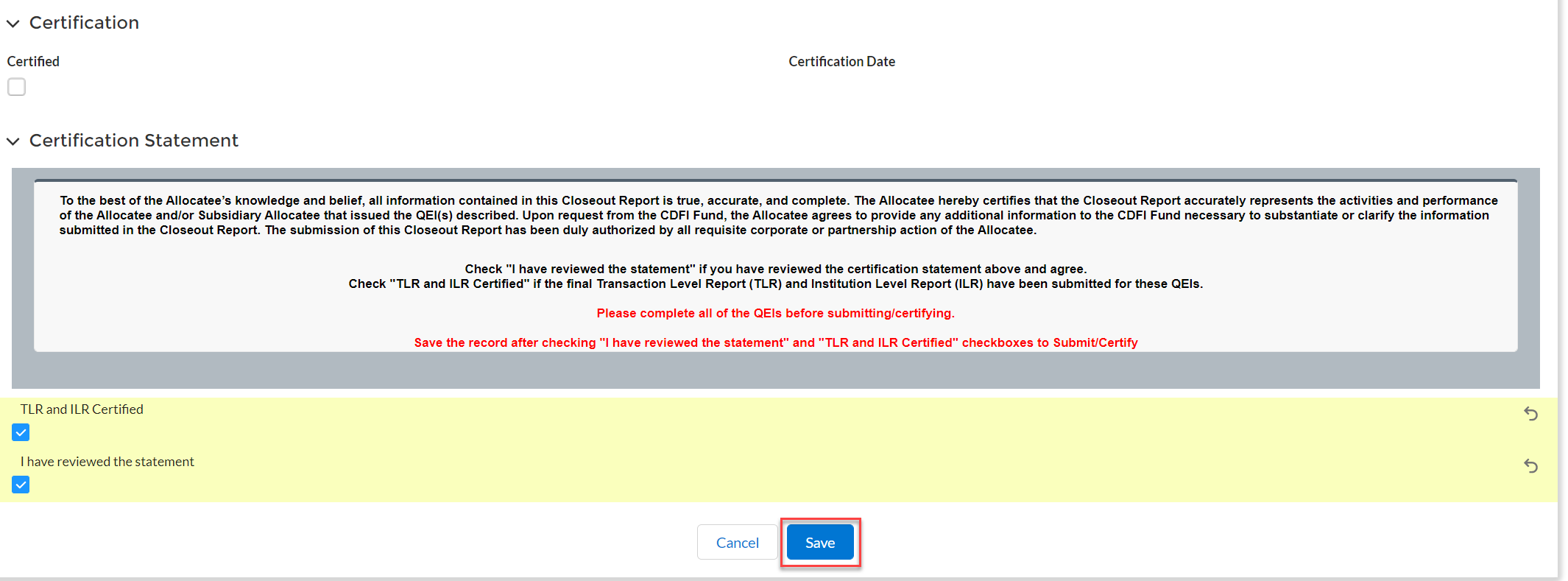

Next, click the “Save” button.

Note: Once you have submitted and certified the Closeout Report, you will not be able to make any additional changes.

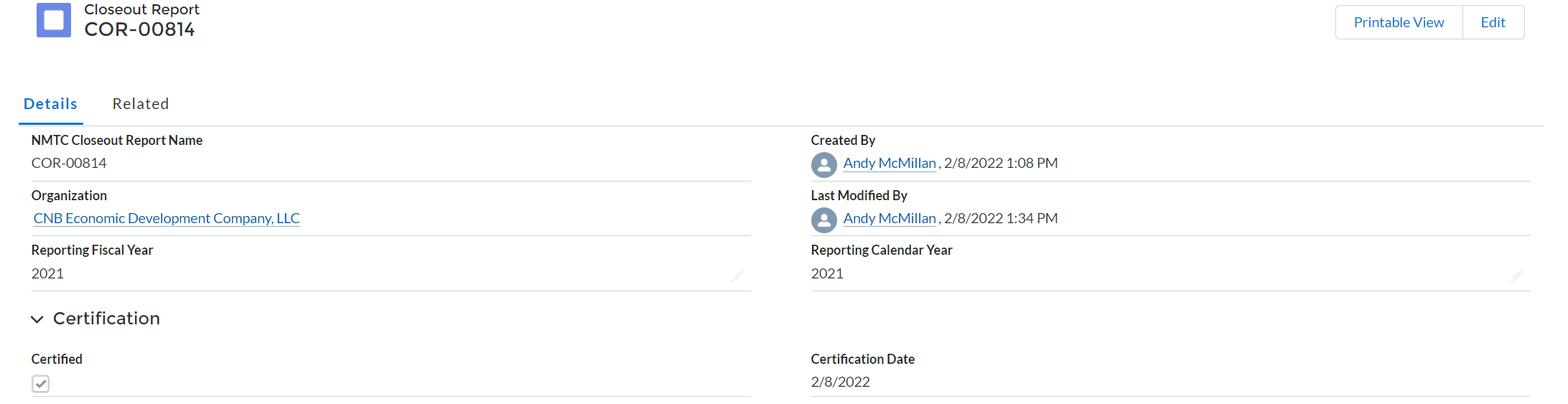

Upon Saving, the certified checkbox will be marked, and the date will be stamped onto the Closeout Report Detail page. (Figure 12)

Figure 14: Certified Checkbox and Date

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | QEI-Closeout-Report-CDFIFUND-Guidance_February_2022_C2L |

| Subject | Training |

| Author | Creative Systems and Consulting |

| File Modified | 0000-00-00 |

| File Created | 2023-08-28 |

© 2026 OMB.report | Privacy Policy