NMTC Allocation and QEI Tracking Guide_PRA 2022

New Markets Tax Credit (NMTC) Program Allocation and Qualified Equity Tracking (AQEI) System

NMTC Allocation and QEI Tracking Guide_PRA 2022

OMB: 1559-0024

February

2023

February

2023

N E W M A R K E T S TA X C R ED I T P R O G R A M

NMTC

PROG R A M

A LLOCATION AND QEI TRACKING

GUIDANCE MANUA L

The CDFI Fund is an equal opportunity provider.

OMB Approval No. 1559-0024 Paperwork Reduction Act Notice.

This compliance reporting document is provided for award recipients of New Markets Tax Credits (NMTC) allocation authority through the NMTC Program. Award recipients are not required to respond to this collection of information unless it displays a currently valid Office of Management and Budget (OMB) control number. The estimated average burden associated with this collection of information is 20 hours per year. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Program Manager, Compliance Monitoring and Evaluation, Department of the Treasury, Community Development Financial Institutions Fund, 1500 Pennsylvania Avenue, Washington, D.C. 20220.

Disclaimer: This document is intended to serve as public guidance for the subject matter contained herein. The CDFI Fund reserves the right, however, to modify this guidance at any time upon public notice. The examples contained in this guidance are not exhaustive in nature and the CDFI Fund has the discretion to consider additional factors when determining matters of compliance.

Table of Contents

1.1 Overview of Allocation/QEI Tracking in AMIS 4

1.2 Logging into and Navigating Allocation/QEI Tracking in AMIS 4

1.3 Technical and Program Support 6

1.4 Notes for Using Allocation/QEI Tracking 6

SECTION 2.0 ALLOCATION SUMMARY 8

SECTION 3.0 ALLOCATION TRANSFERS TO SUBSIDIARY CDES 8

3.1 Editing Allocation Transfer Data 10

4.1 Background Information on Investor Data 14

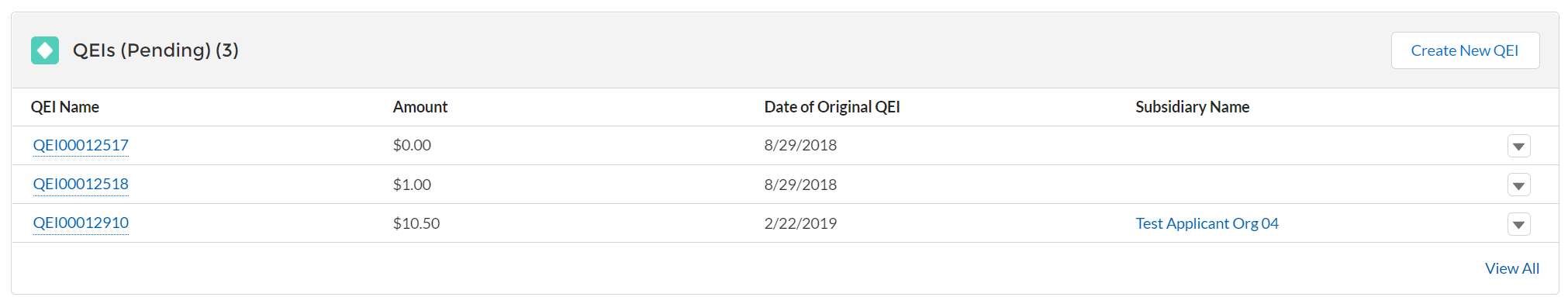

4.2 QEIs (Pending) Related List 16

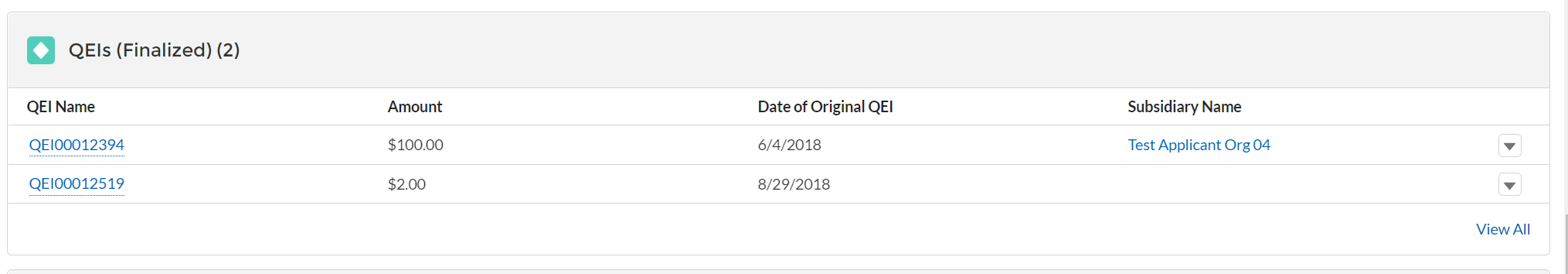

4.3 QEIs (Finalized) Related List 16

4.2 Overview of Required Investor Data 22

4.3 Updating or Deleting a Pending QEI 27

4.4 Finalizing a QEI and Sending Email Notification to the CDFI Fund 27

4.5 Viewing Text of QEI Email Notification from the CDFI Fund 28

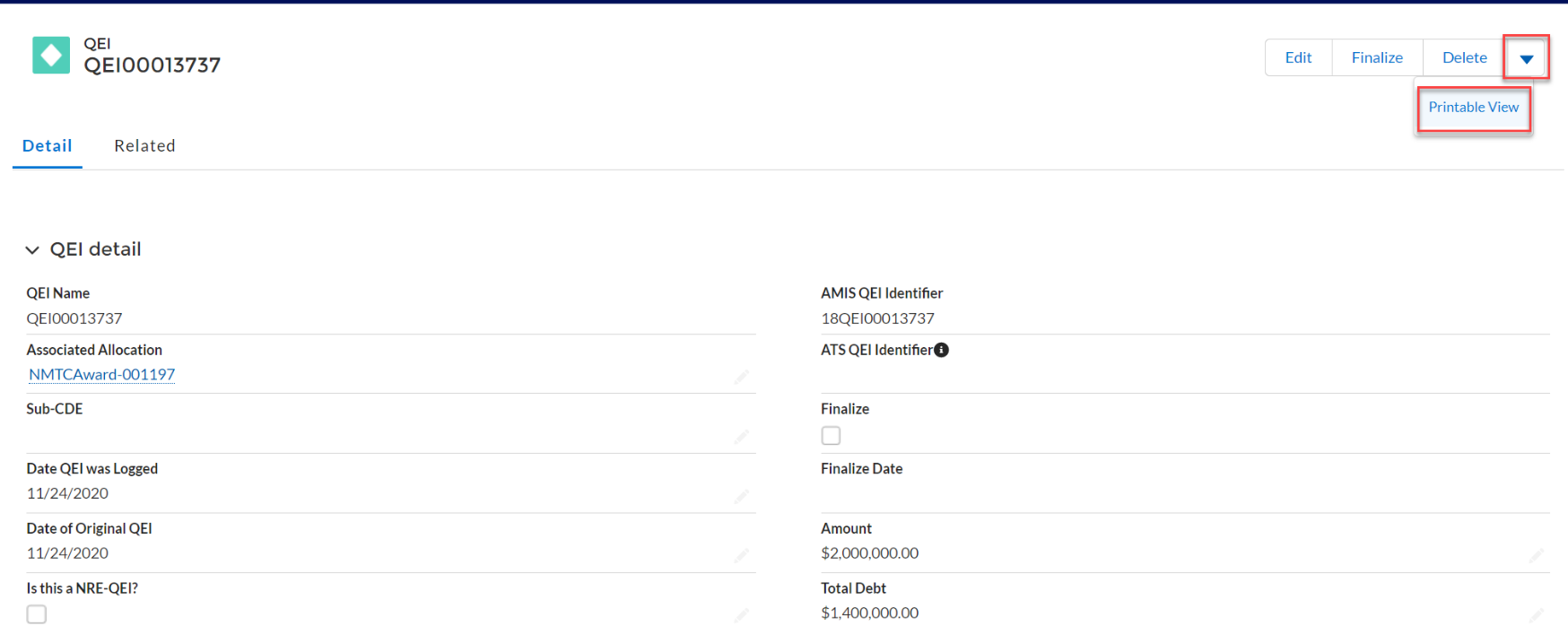

4.6 Viewing and Printing QEI Data for Finalized QEIs 29

4.7 Amending Finalized QEI Data 29

SECTION 5.0 REPAYMENT QUALIFIED EQUITY INVESTMENTS (RQIS) 31

SECTION 6.0 SUMMARY OF REPORTING SCHEDULE 33

SECTION 7.0 SUMMARY OF QEI ISSUANCE NOTIFICATIONS 34

SECTION 8.0 SUMMARY OF DATA REQUIREMENTS 35

SECTION 9.0 SUMMARY OF DISBURSEMENT REPORT 42

SECTION 1.0 INTRODUCTION

In May 2018, the Community Development Financial Institutions Fund (CDFI Fund) transitioned Qualified Equity Investment (QEI) reporting from the legacy system, the Allocation Tracking System (ATS), into the Awards Management Information System (AMIS) environment. The Allocation/QEI Tracking in AMIS is designed to:

Enhance the Allocatee’s ability to report to the CDFI Fund on information regarding the issuance of its QEIs, per Section 6.5 of its Allocation Agreement, in a timely manner;

Collect data to monitor the Allocatee’s compliance with certain components of Section

3.2 (Authorized Uses of NMTC Allocation) of its Allocation Agreement;

Enhance the Treasury Department’s ability to monitor the issuance of QEIs to ensure that no Allocatee exceeds its allocation authority, and to ensure that QEIs are finalized within the timeframes required by the Allocation Agreement and the Internal Revenue Code Section 45D; and

Provide the Treasury Department with investor and lender data, which may be aggregated and analyzed in connection with NMTC Program evaluation efforts.

To support these goals, the Allocation/QEI Tracking in AMIS focuses on the following three components: (1) Allocation Transfers; (2) QEIs Finalized; and (3) Reporting Schedule. Through the AMIS portal, users will enter data regarding transfers of allocations to approved subsidiary Community Development Entity (sub-CDE), reporting of the issuance of QEIs finalized, and on the investors who contributed to the QEIs. Each area will also provide the user with a summary of the data entered, as well as the ability to alter any data that has not yet been finalized and submitted to the CDFI Fund. While AMIS retains the basic functionality of prior systems, there will be clarification to certain reported data points. AMIS will also facilitate:

Capturing the “investment amount” for all listed investors.

Identifying and differentiating between a “tax credit investor” and a “leverage lender”.

Capturing the price paid for the tax credit for individual QEIs.

Identifying the “type” of leverage lender and “source” of the leverage.

Identifying the “type” of tax credit investor.

Capturing the “amount of public subsidy” used in the QEI.

Identifying up to five tiers of “tax credit investors” and the “leverage lenders”.

Registering QEIs eligible under Treasury Directive 9600.

Increasing transparency in due dates for required reports.

Allocatees will access Allocation/QEI Tracking through the AMIS. To access Allocation/QEI Tracking in AMIS:

Go to the CDFI Fund’s website at www.cdfifund.gov, the CDFI Fund’s homepage. On the top right corner, above the internal search bar, click the “Sign In” button. When an Allocatee clicks the “Sign In” button, the AMIS homepage will open in a new window. Once on the AMIS home page, on the top right menu bar, click “Log In”. Enter your login credentials and click “Sign In”.

To access the organization’s Allocation(s), click on the “Allocations” tab. This tab will provide the Allocatee with access to their associated allocation(s).

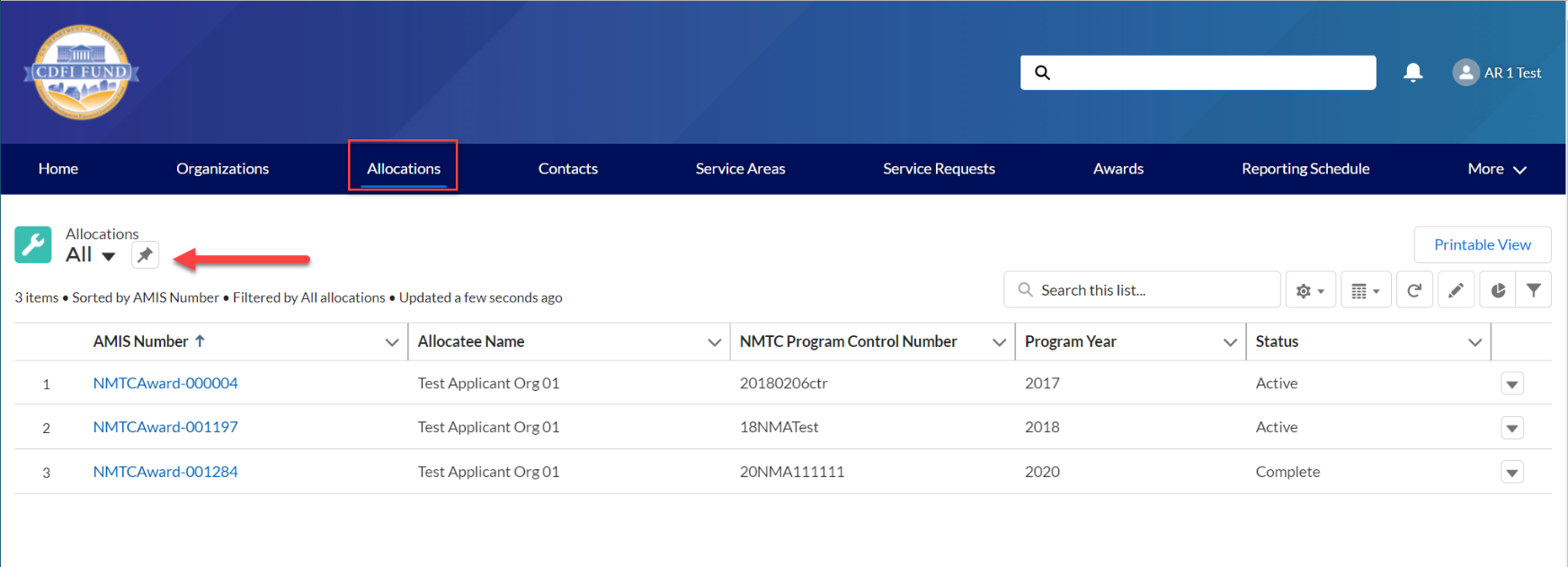

Once on the Allocations home page, select "All" from the drop-down field. (Figure 1)

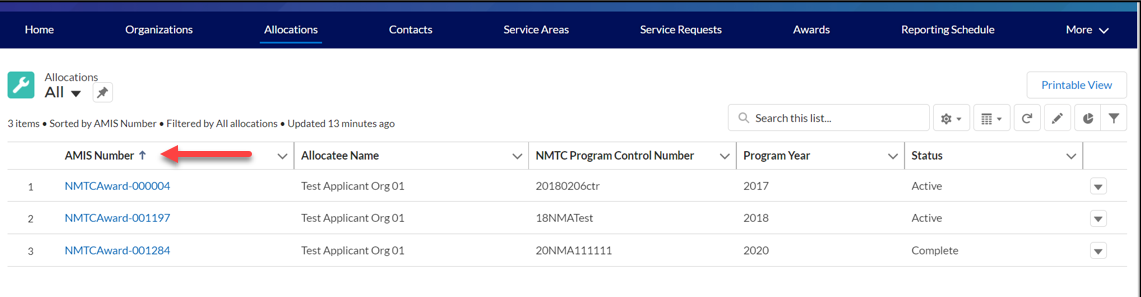

Select your associated Allocation(s) by clicking the AMIS Award Number. (Figure 1.1)

Figure 1: Viewing All Allocations

Figure 1.1: Selecting an Allocation

If you have forgotten your password, select the “Forgot your password?” link and enter your AMIS Username to receive a password reset email message. If you continue to experience difficulty logging into AMIS, please send an e-mail detailing the problem to AMIS@cdfi.treas.gov.

Through Allocation/QEI Tracking, Allocatees can report data for both the Allocatee and any Subsidiary-Allocatees (Sub-Allocatees or Sub-CDEs) to which the Allocatee transfers its Allocation award. The Allocatee is responsible for ensuring that all data regarding the issuance of QEIs by any Sub-CDEs is properly entered in Allocation/QEI Tracking and submitted to the CDFI Fund. Allocation/QEI Tracking also provides the Allocatee with easy to use navigation buttons and links for guidance through the data entry process. In addition, Allocatees may use related lists displayed on the Allocation to move between different views of Allocation/QEI Tracking.

The CDFI Fund’s Technical Support and Office of Compliance Monitoring and Evaluation (OCME) staff are available Monday-Friday, 9:00 am – 5:00 pm ET, to assist Allocatees with any technical or programmatic questions regarding Allocation/QEI Tracking.

Technical Support:

If Allocatees are having technical difficulty (e.g., you cannot save your data), the most effective means of requesting support is submitting a Service Request. From the AMIS Service Request tab, select the “Create New Service Request” button. Select “Continue” to accept the default record type of “General Inquiry”. Ensure that “NMTC-AMIS technical problem” is selected for the Type drop-down field. Alternatively, the Allocatee may send an email to AMIS@cdfi.treas.gov. Please type, “NMTC: Allocation/QEI Tracking IT assistance needed” in the subject line of the email. A technical support staff person will generally reply within 24 hours on weekdays. Allocatees may also phone the CDFI Fund IT Help Desk at (202) 653-0422. If a technical support staff person is unavailable to immediately assist, please leave a message and a staff person will return the call within 36 hours on weekdays.

OCME Support:

If an Allocatee is having difficulty understanding the data requirements in Allocation/QEI Tracking, the Allocatee should submit an AMIS Service Request. Alternatively, the Allocatee may send an email to CCME@cdfi.treas.gov. Please type, “NMTC: Allocation/QEI Tracking program assistance needed” in the subject line of the email. A CCME staff person will generally reply to question(s) within 48 hours on weekdays. Allocatees may also call the OCME phone line at (202) 653-0423. If a CCME staff person is unavailable to immediately assist, please leave a message and a staff person will generally return the call within 48 hours on weekdays.

For a more efficient use of Allocation/QEI Tracking, it is recommended that Allocatees keep the following tips in mind as they prepare to enter QEI and investor data:

General System Notes:

Read this step-by-step guide thoroughly and become familiar with both the system and the required data elements before beginning to use Allocation/QEI Tracking in AMIS to enter data. Please refer to section 8.0 for a summary of these requirements.

If Allocatees experience any difficulty using Allocation/QEI Tracking, they should notify the CDFI Fund immediately.

Allocation/QEI Tracking will generate pop-up error/warning messages or red text messages directly in the body of the screen to facilitate use of the system, to assist Allocatees in entering data accurately, and to prohibit loss of data. Please be sure to read these messages carefully.

To move through Allocation/QEI Tracking, be sure to use the navigation tools provided in Allocation/QEI Tracking. Using the “back” and “forward” arrows on an Internet browser may result in a loss of data.

Certain functions may take a few minutes to process (e.g., generating the email notification for the CDFI Fund). Please wait for the system to finish processing, and do not click a button more than once.

The system will automatically log the Allocatee out if the account remains inactive for two (2) or more hours and any unsaved data may be lost.

Programmatic Notes:

Enter QEI and investor data on the date (or within a few days of the date) on which the NMTC investor provides the investment to the Allocatee or its Sub-CDE. Both the CDFI Fund and IRS will use this data to conduct compliance analysis, thus it is in the best interest of the Allocatee to enter the data as soon as possible.

Try to finalize any QEIs (Pending) expeditiously. QEIs (Pending) will not be taken into account when the CDFI Fund administers a check for compliance with certain components of Section 3.2 of the Allocation Agreement, or in determining an applicant’s eligibility to apply for allocations in future NMTC rounds.

Once a QEI is finalized, by clicking the “Finalize” button, the Allocatee will not be able to alter any data for this QEI and related investors. Ensure the accuracy of all the data entered before finalizing a QEI.

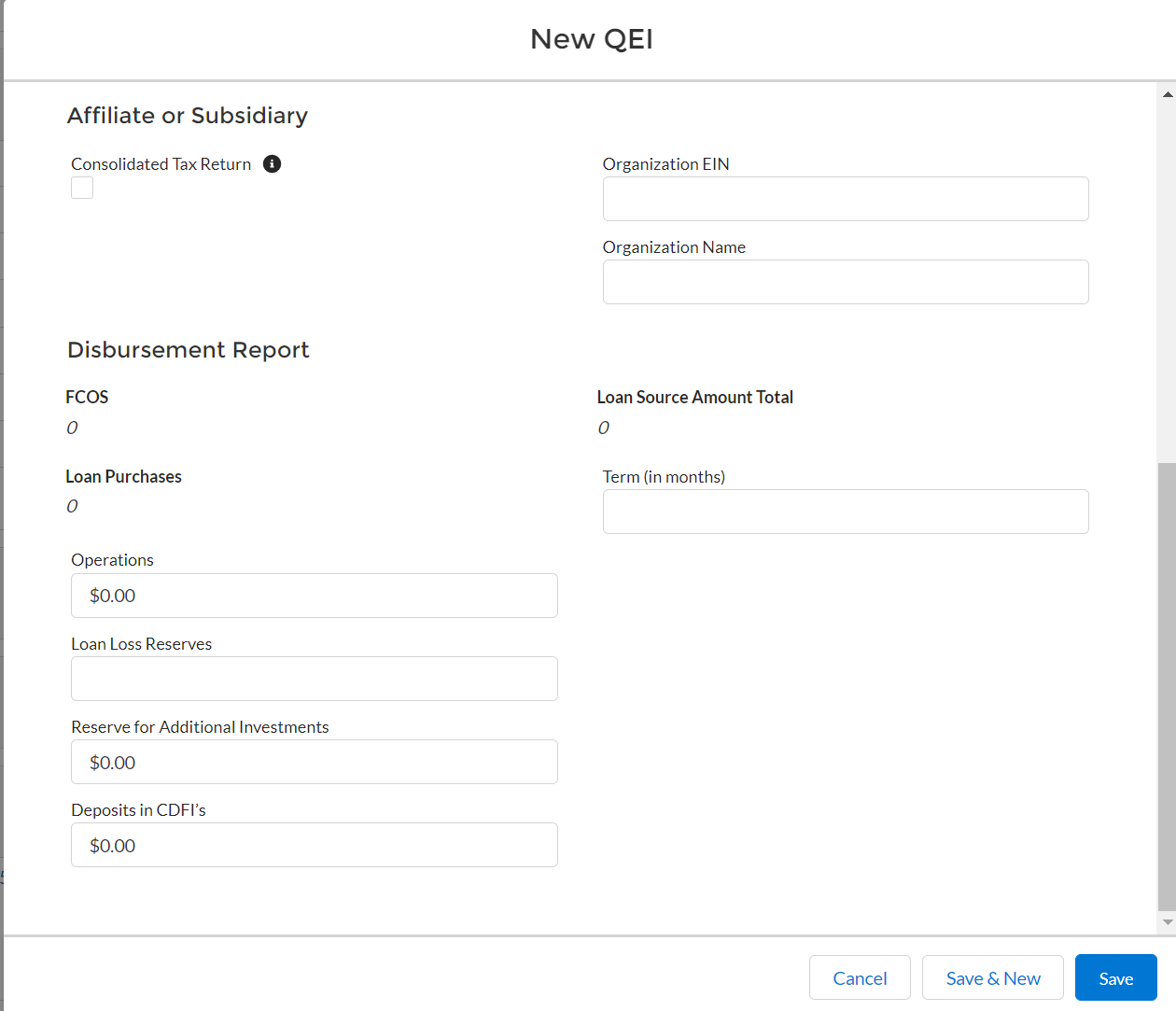

Allocatee should ensure that the following fields in Disbursement Report are completed for each QEIs:

Operations

Loan Loss Reserves

Reserves for Additional Investments

Deposits in CDFIs

Term in Months

Please see Section 9 (Summary of Disbursement Report) for more details.

In the event that there is an error in the finalized QEI/investor data, the Allocatee must submit a Service Request via AMIS to request a change to the data. (See Section 4.11).

SECTION 2.0 ALLOCATION SUMMARY

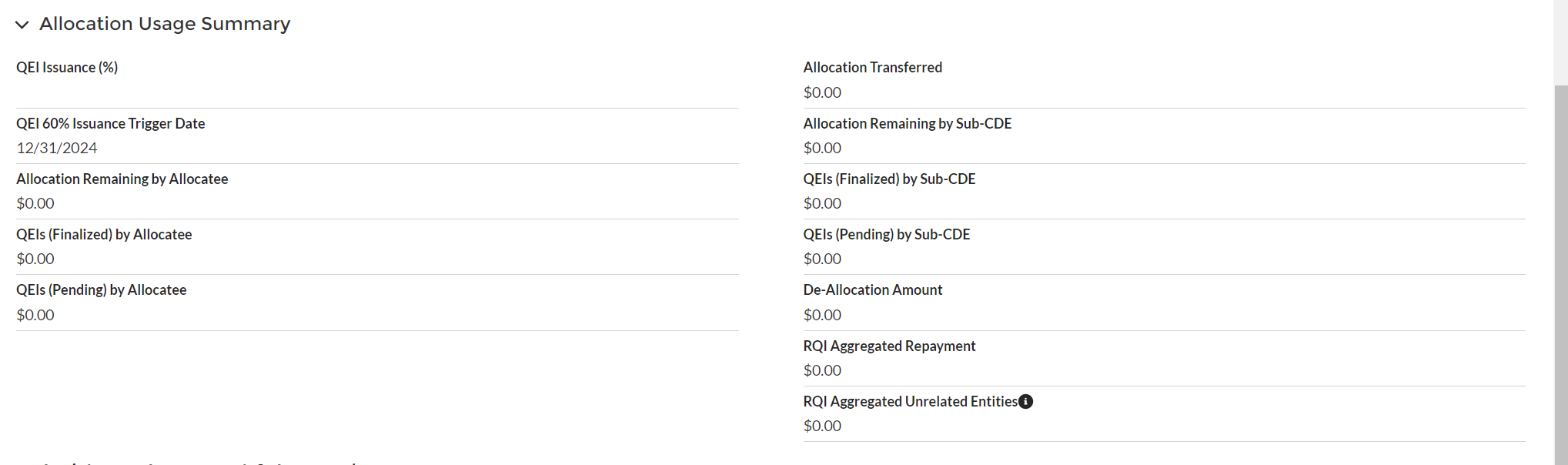

When the Allocatee clicks on the “Allocations” tab, located in the top menu bar, the Allocatee will be directed to a page where they will select a specific allocation (shown in section 1.1 above). Once on the allocation, the totals in the “Allocation Usage Summary” section will include any allocations the Allocatee used directly, as well as, any allocations used by Sub- CDE(s). All of the data on this page will automatically populate using the data entered throughout Allocation/QEI Tracking. Therefore, the Allocatee will not be able to alter any of the data on this screen. (Figure 2)

SECTION 3.0 ALLOCATION TRANSFERS TO SUBSIDIARY CDES

Click on the Related tab and scroll down to the “Sub-CDEs” related list, Allocatees can access this section to report on any allocation authority transferred to eligible Sub-CDEs listed in the Allocatee’s Allocation Agreement or subsequently approved via an amendment. (Figure 5)

Figure 5: Allocation Transfers to Subsidiary CDEs

An Allocatee is permitted to transfer all or a portion of its allocation authority to a Subsidiary CDE(s) that is: (1) certified as a CDE by the CDFI Fund; and (2) enjoined to the Allocation Agreement. When transferring allocations to a Sub-CDE(s), the Allocatee is not bound to a particular amount, and it may change the amount of allocations that it transfers to any particular Sub-CDE at any time. Allocation/QEI Tracking will track the amount of allocation authority the Allocatee has transferred to each Sub-CDE on a cumulative basis. For example, if the Allocatee transfers to one Sub-CDE multiple times, Allocation/QEI Tracking will only track the aggregate amount of allocations transferred to that Sub-CDE. Once a Sub-CDE uses its transferred allocation authority to issue QEIs that are pending or finalized in Allocation/QEI Tracking, the Allocatee will not be able to re-allocate that particular portion of the allocation authority to another Sub-CDE.

Example 1: The Allocatee received a $100,000 allocation award and has two Sub-CDEs listed in Section 3.2 of its Allocation Agreement. The Allocatee transfers $80,000 to Sub- CDE #1, which uses this transfer to issue $30,000 in QEIs, which are entered into, and saved in Allocation/QEI Tracking. The Allocatee transfers the remaining $20,000 of its allocation award to Sub-CDE #2. Sub-CDE #2 identifies an opportunity to issue a QEI of $40,000. To ensure that Sub-CDE #2 has enough allocations to issue the full $40,000 QEI, the Allocatee may go into Allocation/QEI Tracking, and reduce the amount transferred to Sub-CDE #1 to

$60,000 and increase the amount transferred to Sub-CDE #2 to $40,000. The system will not allow the Allocatee to reduce the amount transferred to Sub-CDE #1 below $30,000 since that amount of allocation authority was previously used by Sub-CDE #1 to issue QEIs finalized in the system.

To enter a transfer of allocations for the first time, or to update transfer data that is already entered, follow these steps:

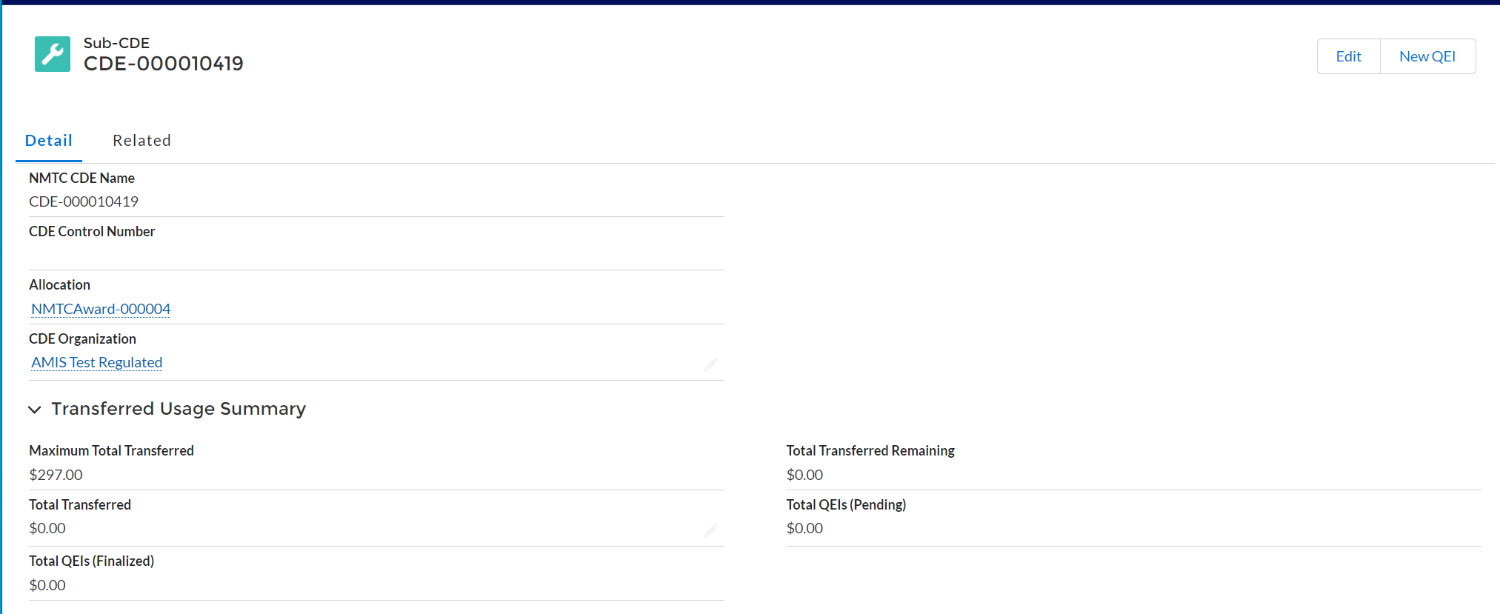

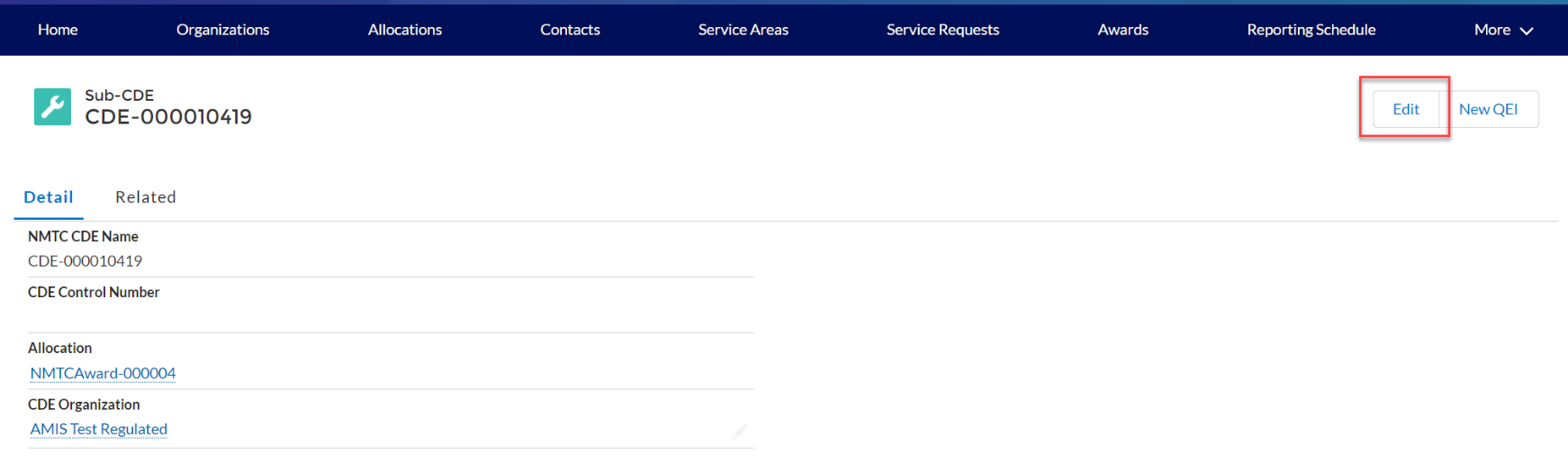

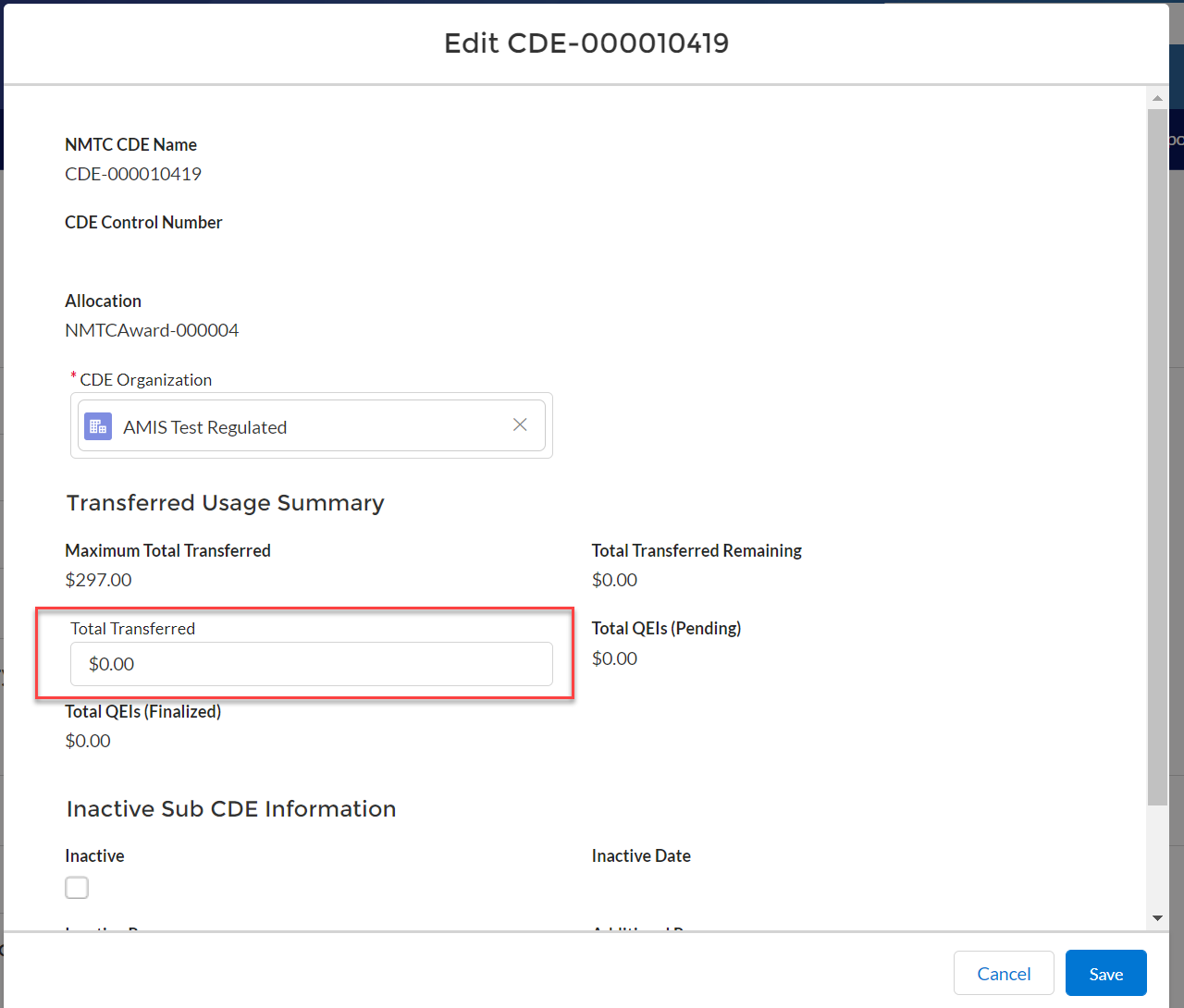

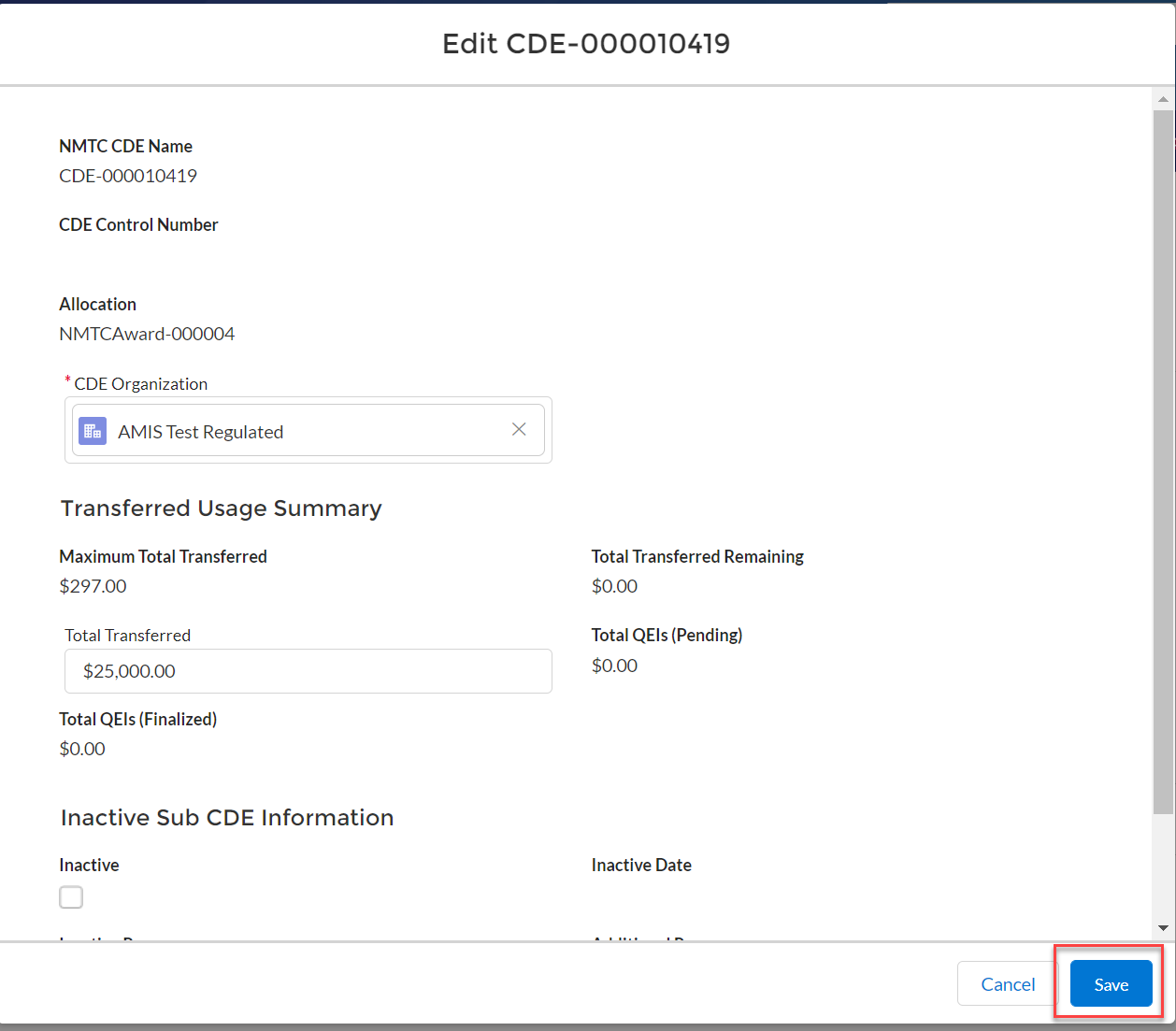

To update transfer data that was previously entered, select a Sub-CDE from the related list by clicking on the Subsidiary Name hyperlink and then clicking on the Edit button on the Details tab. Edit the transfer amount. (Figure 6.1 & Figure 6.2)

To add a transfer, select the appropriate Sub-CDE name from the related list. The sub-CDE must be certified and enjoined to the Allocatee’s allocation agreement. If the subsidiary is not visible on the related list it may not have been added to the Allocation Agreement. If this is the case, contact CCME by submitting Service Request. (Please refer to section 1.3 for instructions).

Figure 6.1: Making New Transfer

Figure 6.2: Editing Total Transferred Amount

Click “Save” to complete the transfer and return to the “Sub-CDE” page. Click “Cancel” to terminate the transfer and return to the “Sub-CDE” page.

When editing an existing Sub-CDE, after clicking the “Edit” button, a summary of the Sub-CDE will display.

Enter a new value in the “Total Transferred” field.

Click “Save” to complete the transfer and return to the “Sub-CDE” page. Click “Cancel” to terminate the transfer and return to the “Sub-CDE” page. (Figure 7)

Once a Sub-CDE uses its transferred allocations to issue QEIs that are either pending or finalized in the system, the Allocatee will not be able to delete this allocation transfer or re-allocate that particular portion of the allocation transfer to another Sub-CDE. If an Allocatee is attempting to delete an allocation transfer for a Sub-CDE that has only pending QEIs with that allocation, they must first delete the pending QEIs via the “QEIs (Pending)” screen. (See Section 4.7)

When adding or editing a transfer, the Allocatee will see or be required to supply the following data:

Figure 8: Allocation Transfer Data Fields

-

Data Field

Description

Subsidiary Name/CDE Organization

Select from the related list that includes all the subsidiary CDEs listed in Section 3.2 of the Allocatee’s Allocation Agreement.

NOTE: If a specific Sub-CDE is not listed in this related list, this may mean that the subsidiary CDE is not listed in Section 3.2 of the Allocatee’s Allocation Agreement or the Allocatee has already transferred allocations to the subsidiary. If this is the case, go to the Sub-CDE related list. Users should ensure a subsidiary CDEs is

selected to avoid transfer errors.

Total Transferred

Remaining

Allocation/QEI Tracking will automatically calculate this field based on information supplied in other portions of Allocation/QEI Tracking.

QEIs (Finalized)

Allocation/QEI Tracking will automatically calculate this field based on information supplied in other portions of Allocation/QEI Tracking.

QEIs (Pending)

Allocation/QEI Tracking will automatically calculate this field based on information supplied in other portions of Allocation/QEI Tracking.

Total Transferred

Enter the total amount of allocations the Allocatee wants to transfer to the selected subsidiary CDE.

NOTE: Allocation/QEI Tracking will never allow this amount to exceed the Allocation

Award amount or to be less than the sum of: (1) “QEIs (Finalized)” by this Subsidiary CDE and (2) “QEIs (Pending)” for this Subsidiary CDE.

SECTION 4.0 RECORDING QEIS

In the “All Related QEIs” related list of the Allocation page, Allocatees will report data to the CDFI Fund regarding: (a) QEIs that have been finalized/issued by the Allocatee or any Sub- CDE(s); and (b) the investors that provided these QEIs. Allocatees will also use this section of Allocation/QEI Tracking to notify the CDFI Fund of receipt of QEIs, as required by Section 6.5 of the Allocatee’s Allocation Agreement.

While Section 6.5 of the Allocation Agreement specifies that the Allocatee must provide notification to the CDFI Fund within 60 days of actually issuing the QEI, the CDFI Fund strongly encourages entering QEI and investor data on the date (or within a few days of the date) on which the NMTC investor originally provides the QEI to the Allocatee or its Sub-

CDE(s). Both the CDFI Fund and IRS will use this data to conduct compliance analysis, thus it is in the Allocatee’s best interest to enter the data as soon as possible.

Some Allocatees may have NMTC investors with a pass-through structure, such as a limited liability company (LLC) or limited partnership (LP). For compliance and evaluation purposes, the CDFI Fund will collect information about the various entities and individuals that comprise such pass-through investors and that ultimately claim NMTCs on tax returns. To facilitate this process, the CDFI Fund has defined various investor “tiers”:

Tier 1 Investors are those who directly provide the QEIs to the Allocatee or its Sub- CDE.

Tier 2+ Investors are the contributors, partners and/or members of a Tier 1 Investor with a pass-through structure.

NMTC Claimants are those entities and individuals that will actually claim NMTCs on their tax returns.

Not Applicable are those entities and individuals that are neither a pass-through entity nor NMTC claimant.

From a flow perspective, the system will prompt Allocatees to enter complete data for one investor at a time (e.g., the Tier 1 data; and if the Tier 1 Investor is a pass-through entity, Tier 2 etc.) Depending upon the structure of each investing entity, it is possible for a Tier 2+ Investor to also be a NMTC Claimant or be neither an NMTC claimant nor pass-through

entity. Additionally, it is possible for many other investor layers to exist between a Tier 2+ Investor with a pass-through structure, and the eventual NMTC Claimants. Regardless of tier, the Allocatee will be required to enter a standard set of data points for each entity identified, including and those that are neither a pass-through entity nor NMTC claimant:

Name of the Investor

Investor Type

Investment Amount

TIN

Investor Status

Leverage Amount

Amount of Public Subsidy

Leverage Lender Type

Source of Leverage

Equity Amount

Equity Investor Type

For QEIs that employ a “leverage structure”, the system will require information on all entities (the tax credit investors, the leverage lender and any resulting tax claimants) involved regardless of their status as disregarded for tax purposes.

In the following hypothetical example, (see Figure 9) a CDE secured a $25,000,000 QEI from Investor A. The QEI is composed of five (5) investment tiers with nine (9) separate entities of which four (4) will be NMTC tax claimants. The system will require that all nine (9) entities be reported in the QEI structure.

NOTE: By default, the system will require that at least one Tier 1 Investors be identified in order for a QEI to be finalized. For QEIs employing a leverage structure, where the Tier 1 investor is a “leverage fund” it would be expected that at least two Tier 2 investors would be reported – the tax credit investor and the leverage lender.

Figure 9: Multi-Tiered QEI & Leverage Structure

-

Tier

Name

Investment Amount

Debt (Leverage)

Equity

Investor Status

Parent Entity

1

Investor A

$25,000,000

$17,500,000

$7,500,000

Pass-Through Entity

2

Investor B

$2,500,000

$2,500,000

NMTC Claimant

Investor A

Investor C

$22,500,000

$17,500,000

$5,000,000

Pass-Through Entity

Investor A

3

Investor D

$17,750,000

$17,500,000

$250,000

Pass-Through Entity

Investor C

-

Investor E

$4,750,000

$4,750,000

NMTC Claimant

Investor C

4

Investor F

$250,000

$250,000

Pass-Through Entity

Investor D

Investor G

$17,500,000

$17,500,000

Not Applicable

Investor D

5

Investor H

$125,000.00

$125,000

NMTC Claimant

Investor F

Investor I

$125,500.00

$125,000

NMTC Claimant

Investor F

The “QEIs (Pending)” related list summarizes those QEIs for which: (1) The Allocatee has not completed data entry; and/or (2) The Allocatee has not finalized the QEI and submitted the requisite data to the CDFI Fund. Use the buttons in the “QEIs (Pending)” related list to add, edit or delete a QEI and/or investor data. (Figure 10)

Figure 10: QEIs (Pending) Related List

Upon clicking on the Allocation tab and selecting an allocation, the Allocatee will find a “QEIs (Finalized)” related list by clicking on the related tab. This related list summarizes all of the QEIs that have been finalized and for which the requisite email notification has been submitted to the CDFI Fund. To view the data elements of any finalized QEI, click on the specific QEI. Allocatees will not be able to change any of the data on this screen, as it is automatically generated by the information already entered throughout Allocation/QEI Tracking. (Figure 11)

Figure 11: QEIs (Finalized) Related List

To enter a QEI for the first time, scroll to the “QEIs (Pending)” related list on the related tab & follow these steps:

Click the “New” button in the “QEIs (Pending)” related list section.

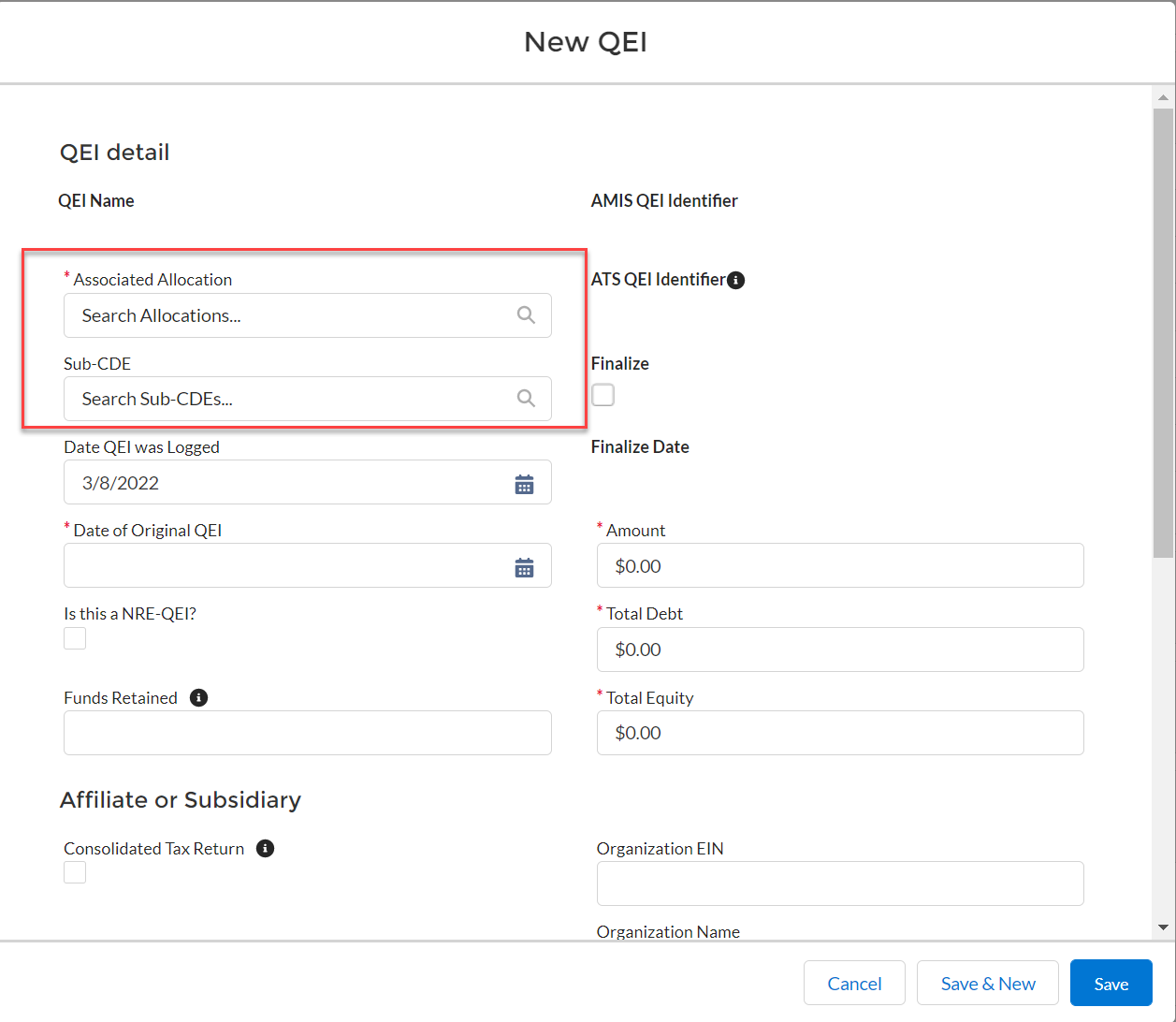

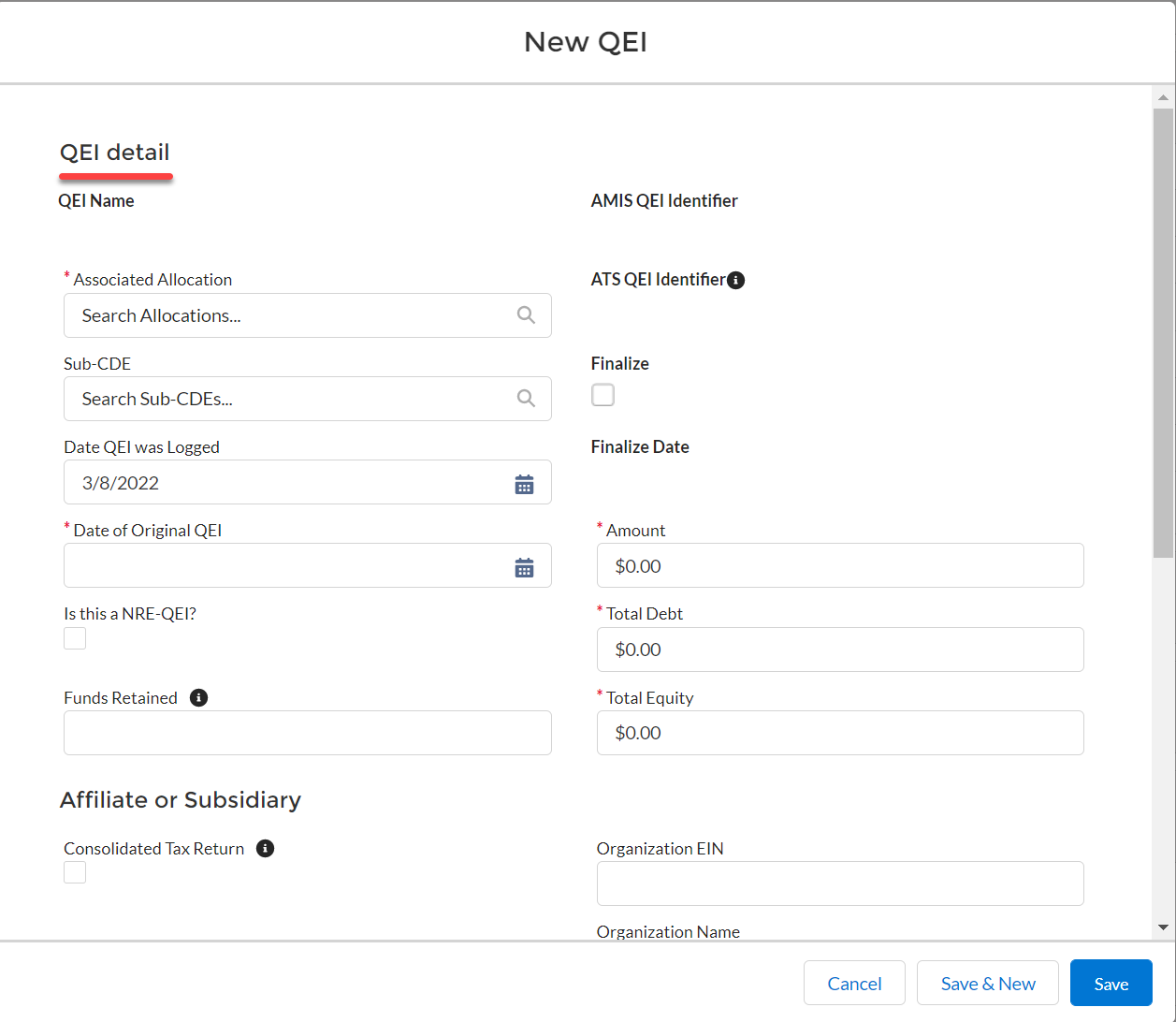

On the next screen, the “Associated Allocation” field will populate and with the current allocation. Next, click on the search icon next to the “Sub-CDE” field and select name of the CDE that is associated with the QEI. If a particular Sub-CDE is not listed, this means that no allocation authority has been transferred to that Sub-CDE. (Figure 12)

On the current screen, enter “QEI Detail” data into each field as prompted. Note that some fields are automatically populated by the system. (Figure 13).

Figure 13: QEI Details

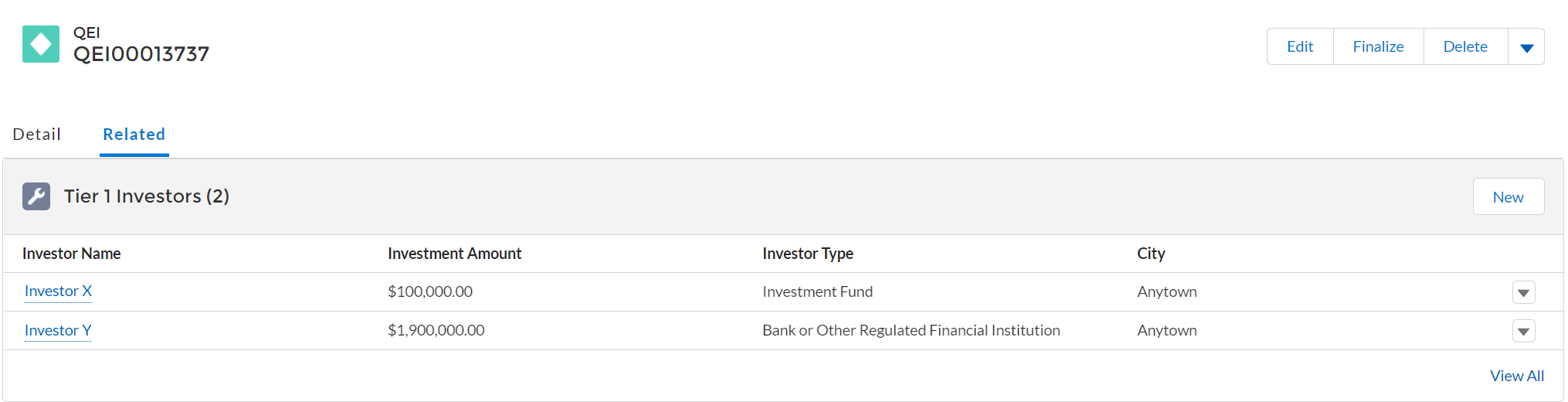

Click “Save” to save the “QEI Detail” data entered. Upon clicking “Save”, a related list will appear on the related tab of the QEI record titled, “Tier 1 Investors” (see Section 4.5 for more information about entering investor data). (Figure 14)

Figure 14: QEI Details and Tier I Investor

At any time, click “Cancel” to terminate the entry and return to the specific pending QEI’s screen.

Upon clicking “Save” in step #4 above, the Allocatee will create a QEI record in Allocation/QEI Tracking. If for some reason an Allocatee is unable to enter all the required investor data at one time for a particular QEI, the pending QEI can be re-accessed at a later date using the “Edit” button located to the left of the QEI name in the “QEIs (Pending)” related list. See Section 4.7 for more information on updating a QEI.

For each QEI, Allocatees will see and/or be required to supply the following data:

Figure 15: QEI Details Data Fields

-

Data Field

Description

Associated Allocation

The allocation to which the QEI is associated.

Sub-CDE

Enter/select the Sub-CDE that the QEI is associated with.

Date QEI Was Logged

Auto-populated based on the date the QEI data was logged in the system.

Allocations Remaining by Allocatee /

Allocations Remaining by Sub-CDE

Allocation/QEI Tracking in AMIS will automatically calculate this field based on information supplied in other portions of Allocation/QEI Tracking.

Amount

Enter the amount of the QEI at original issue (i.e., do not report on the current market value of the QEI).

Date of Original QEI

Enter the date on which the investor actually provided the Allocatee or Sub-CDE with the actual investment (e.g., do not provide the date the investor provided the commitment). For compliance purposes, this date will serve as the credit allowance date, which marks the start of: (1) the seven-year period during which the QEI must stay with the CDE; and (2)

the 12-month period that the CDE has to make QLICIs with its QEI proceeds.

Is this a NRE-QEI?

Checkbox to indicate if the CDE intends to take advantage of the provisions of TD 9600 by designating the QEI as a Non-Real Estate QEI.

Funds Retained

Funds in excess of the cash exchanged for the QEI at original issue that are retained as fees or expenses at the investment fund level.

NOTE: This amount should equal any additional inflows to the investment fund in excess of the QEI amount. This may include closing fees collected by the CDE, sub-Allocation fees collected by the CDE, fees or expenses paid

from the investment fund to third parties, etc.

QEI Identifier

Field will auto-populate

Finalize Checkbox

Field will automatically be checked once the QEI is finalized

Finalized Date

Will auto-populate the date once the QEI is finalized

Total Debt

Total debt (leverage) amount contributed by investors and included in Amount.

Total Equity

Total equity amount contributed by investors and included in the QEI Amount.

Consolidated Tax Return

Checkbox to indicate if the issuing CDE is an affiliate or subsidiary of an entity that files a consolidated tax return? If yes, the Allocatee will be

required to provide the TIN/EIN and name of the parent taxpayer with whom the issuing CDE files a consolidated tax return.

Organization EIN

EIN/TIN of parent organization with whom the issuing CDE files a consolidated tax return.

Organization Name

Name of parent organization with whom the issuing CDE files a consolidated tax return.

Entering Investor Data

Allocation/QEI Tracking will prompt Allocatees to enter complete data for one Tier 1 Investor at a time, reference figure 16, (e.g., the Tier 1 data, and if the Tier 1 Investor is a pass-through entity, Tier 2+ data and any relevant NMTC Claimant data).

Once the “QEI Detail” data for a particular QEI has been successfully entered and saved, a related list will appear on the related tab of QEI record titled, “Tier 1 Investors”.

Figure 16: Tier 1 Investor

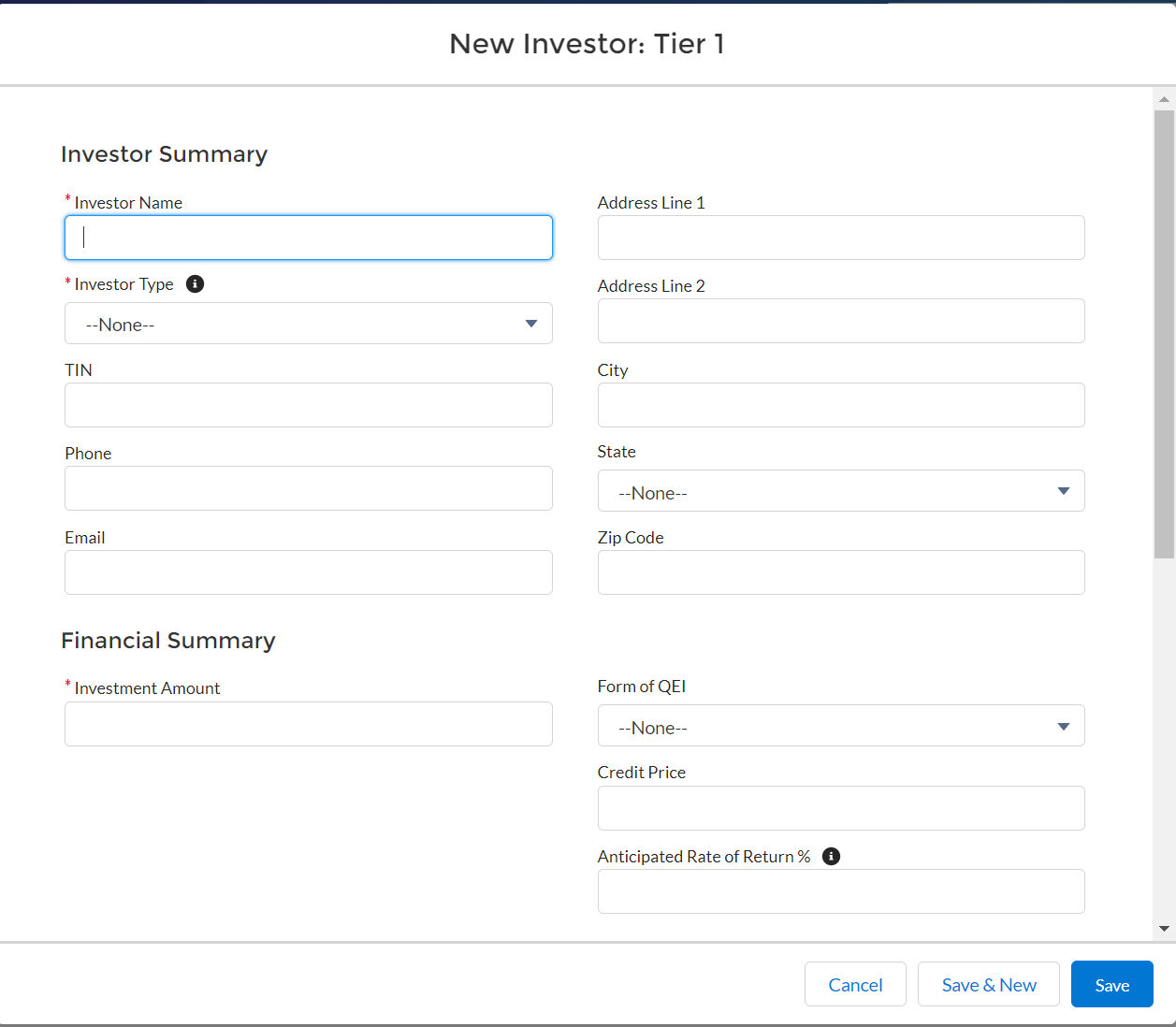

Follow the steps below to enter Tier 1 Investor data for each QEI:

To enter Tier 1 Investor data:

On the QEI related page, click the “New” button under the related list titled, “Tier 1 Investors”.

Select Tier 1 as the Record Type.

Enter Tier 1 Investor data as prompted. See Figure 16 for a detailed explanation of the required Tier 1 Investor data.

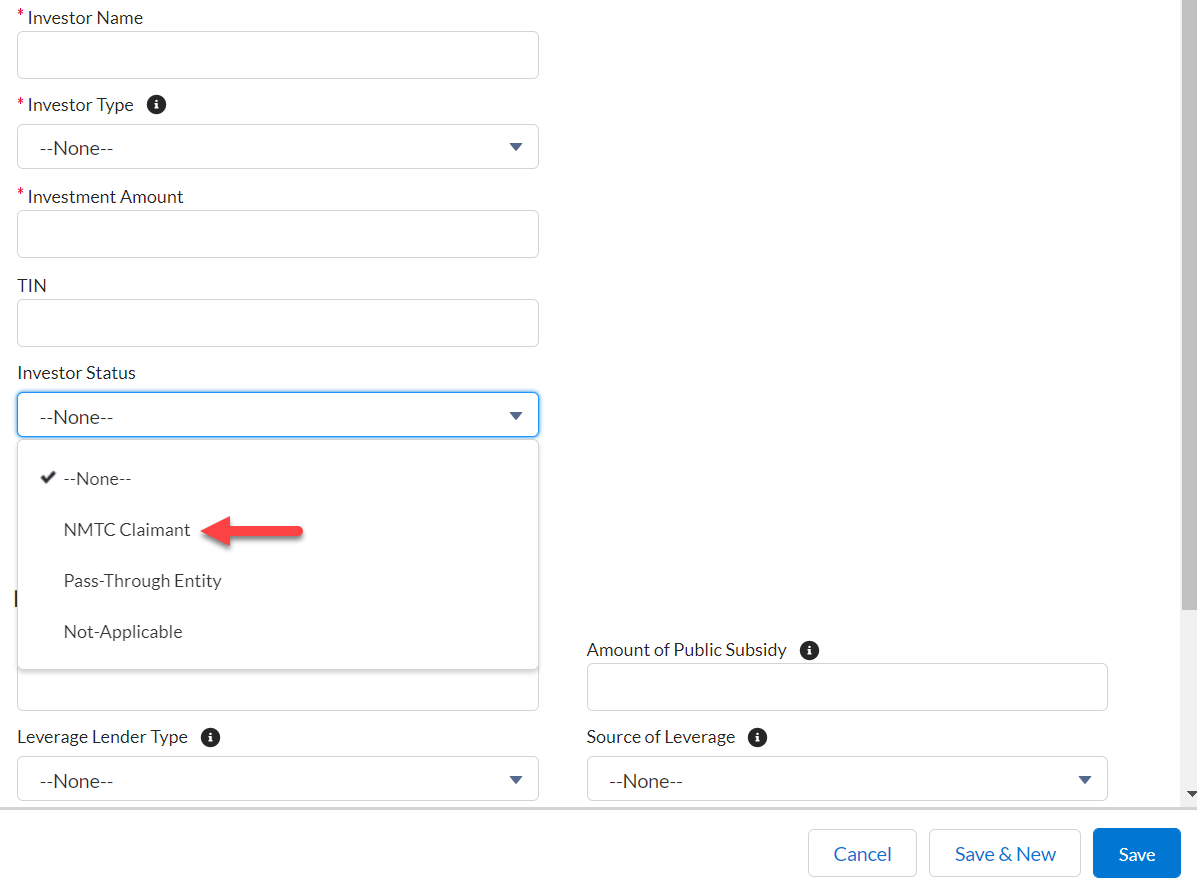

Click “Save”. If the Tier 1 Investor is not a pass-through entity, locate the Investor status field and select either NMTC Claimant or Not Applicable from the drop down field and then click “Save”. Upon clicking save, you will be redirected to the “Investor Detail” page. If the Tier 1 Investor is a pass-through entity, go to step #2 below.

To add additional Tier 1 Investors, repeat steps #1a-1c above.

If at any time during the investor data entry process, the “QEI Detail

s” data is altered on the “New QEI” or “Edit” screen, Allocatees will need to click “Save” to ensure this updated information is properly stored.Upon completion of entering Tier 1 Investors, locate the “Other Relevant Information” section and click on the QEI in the “Tier 1 parent QEI” field to return to the QEI Detail page to finalize that QEI (see Section 4.8 for more information about finalizing a QEI).

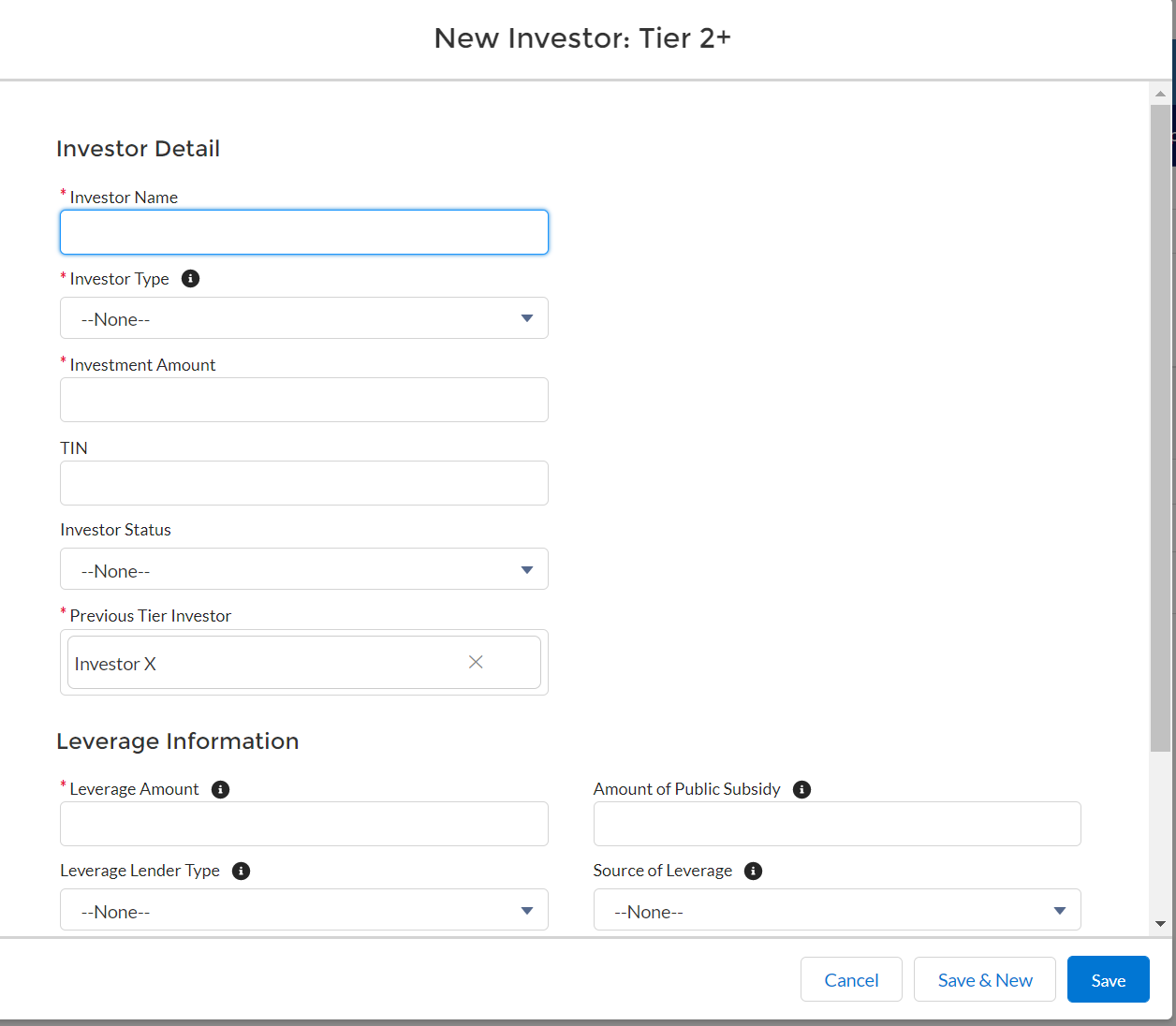

If a Tier 1 Investor is a pass-through entity:

Select the pass-through entity drop down option and then click “Save”. Upon clicking save, you will be directed to the “Investor Detail” page.

Once directed to the “Investor Detail” page, click on the related tab and navigate to the “Next Tier Investor” section.

Click the “New” button under this related list to add a Tier 2 Investor.

Enter Tier 2 Investor data as prompted.

Click “Save”. If the Tier 2 Investor is not a pass-through entity the Allocatee will be directed to the associated investor’s detail page. If the Tier 2 Investor is a pass-through entity, go to step #3 below.

To add additional Tier 2 Investors, repeat steps #2c-2e above.

If at any time during the investor data entry process Allocatees alter the Tier 1 Investor data on the “Add Investor” or “Edit” screen, they will need to click “Save” to ensure this updated information is properly stored.

If a Tier 2 Investor is a pass-through entity:

Upon clicking “Save” from adding the Tier 2 investor, a related list will appear on the QEI record related page titled, “Next Tier Investor”.

Click the “New” button in the “Next Tier Investor” related list to add another investor.

Enter data as prompted. If it is an NMTC Claimant, select the “NMTC Claimant” option from the drop down field. See Figure 17 for a detailed explanation of the required data.

Click “Save” to save data. Message should appear at top of page indicating the investor information was successfully saved.

To add additional NMTC Claimants, repeat steps #3b-3d above.

Once an Allocatee has entered all required QEI/investor data, navigate back to the “QEIs (Pending)” related list on the allocation and select the QEI. Click the “Finalize” button on the QEI page to finalize the QEI.

If at any time during this data entry process Allocatees are not prepared to enter all required investor data at one time, click “Save” to save the investor data that has already been entered and return to that Investor’s page. All QEI and investor data that has been entered will be saved and re-accessible via the “QEIs (Pending)” related list on the allocation. (See Section 4.7 for more information about updating a QEI).

For each Tier 1 Investor, Allocatees will see and be required to supply the following data. If an Allocatee is consolidating QEIs received by multiple Tier 1 Investors on the same day, the Allocatee will be required to provide this set of data for each Tier 1 investor separately. (Figure 18)

Figure 18: Tier 1 Investor Data Fields

-

Data Field

Description

Investor Name

Enter name of Tier 1 Investor

Investor Type

Select from a drop down box that includes (1) Individual investor; (2) Foundation or other philanthropic organization; (3) Pension fund; (4) Bank or other regulated financial institution; (5) Real estate developer or investment company; (6) Venture fund; (7) Investment bank; (8) Insurance company; (9) Utility company;

(10) Other type of corporate investor; (11) Other type of investor; and (12) Investment Fund.

NOTE: Select “Investment Fund” if using a leverage structure.

Is this a new investor?

Leave the checkbox unmarked if the Allocatee or any of its affiliates has received any funds (whether debt, equity, grant, etc.) from this investor in the last five years.

NOTE: In cases where the Tier 1 Investor is a pass-through entity, this applies to the next tier of investors. If there are multiple investors, the answer should be

based on the largest contributor.

Is this an affiliated entity?

Check or leave the checkbox unmarked. An “affiliate” is any legal entity that controls, is controlled by, or is under common control with, the Allocatee.

Investment Amount ($)

Enter amount of this Tier 1 Investor’s contribution. If there is only one Tier 1

Investor contributing to a QEI, then the “Investment Amount” should equal the “QEI Amount” at the top of the page. Do not use commas.

Credit Price

Enter price per credit the investor paid for NMTC.

Form of QEI

Select from a dropdown box that includes Stock or Capital Interest.

TIN

Enter the Tier 1 Investor’s nine-digit taxpayer identification number. Do not use

hyphens. This is a required field unless “Individual Investor” is selected for Investor Type.

Anticipated Rate of Return

Enter the rate of return that you expect this Tier 1 Investor to receive. The rate of return can include the benefit of the NMTC on a pre-tax basis.

NOTE: Calculate the rate of return on a pre-tax basis for the NMTC Equity Investor. Include cash flows for equity invested, tax credits received,

projected/actual put payment received, and fees/other distributions paid or collected by the NMTC Equity Investor as part of the NMTC financing.

Address Line 1 and 2 City, State,

and Zip

Enter the full address of the Tier 1 Investor. Zip code must be five digits.

Phone and Email

Enter the contact information for the Tier 1 Investor

Investor Status

Select from the following options: Pass-Through Entity, NMTC Claimant, or Not Applicable.

Equity Amount

Enter the amount of actual equity the investor (or its partners or members) put into the QEI. Do not use commas.

Equity Investor Type

System provides a drop-down menu for the selection of the equity investor type:

CDE or CDE-affiliate

Third-party not related to or affiliated with the CDE, Leverage Investor, or the QALICB

Other

Leverage Amount

If your investor’s QEI is using a “leveraged” structure (see IRS Revenue Ruling 2003-20 available on the CDFI Fund’s website at www.cdfifund.gov), enter the amount of funds the pass-through investor entity borrowed and designated as a such in order to provide this QEI. You should include debt even if it came from a non-partner or non-member entity. If your investor is not using a “leveraged” structure, enter zero in this field. Do not use commas.

NOTE: Leverage amount excludes fees collected or expenses paid to third parties/upper tier entities.

Amount of Public Subsidy

The amount of public subsidy used to fund the “leveraged” loan.

NOTE: Public subsidy includes funds used in the leverage loan capital stack that is

derived from loans/grants from the city, state, or federal agencies. This includes sources such as HUD 108 and SBA 504 loans.

Leverage Lender Type

System provides a drop-down of options to categorize the leverage lender:

CDE or CDE-affiliate

NMTC Equity Investor or an affiliate of this entity

QALICB or QALICB-affiliate

Third-party not related to or affiliated with the CDE, NMTC Investor, or the QALICB

Other Tax Credit Pass-Through entity (includes pass-through entity for other tax credit program, such as state NMTC)

Other

Other Tax Credit Amount

Report the tax credit amount received in conjunction with this pass‐through entity for another tax credit program. Include other Federal and state tax credit programs that were used to fund the QEI though the investment fund (i.e. leverage structure).

Conditionally required if Leverage lender Type equals OTHER TAX CREDIT PASS‐THROUGH.

Source of Leverage

System provides a drop-down of options to categorize the source of the leverage amount:

Non-NMTC source of public subsidy.

Short-term loan originated to the QALICB or QALICB-affiliate with a term less than one year.

CDE loan originated to the QALICB or QALICB-affiliate from the CDE with a term greater than one year.

Other loan that does not fit one of the definitions above.

Private donations or grants given to QALICB or QALICB-affiliate.

Other QALICB or QALICB-affiliate assets (not specifically sourced for the transaction, from other parties not related to the QALICB and not originating from public grants or other sources of subsidy).

Other

NOTE: If multiple Leverage Loan sources are used, choose the largest source when reporting. In the event two or more sources are equal, choose source most

vital to ensuring the project’s success.

Other Public Sources Used to Fund Leveraged Loan

Report the amount of other public sources (state, local and Federal), excluding other tax credits, used to fund the leveraged loan including public sources that are received by Affiliates of the QALICB and used to fund the leverage loan. Do not include the federal NMTC amount.

Conditionally required if Leverage lender Type equals QALICB or QALICB-affiliate and Sources of Leverage equals Non-NMTC source of public subsidy.

Tier 1 Parent QEI

Auto-Populates the QEI that the Tier 1 investor is associated with.

The sum of the amounts of debt and equity capital contributing to this QEI should equal the total “Investment Amount” provided by the selected Tier 1 Investor. A value must be provided for the debt and equity fields to avoid a system error.

If an Allocatee indicates that a Tier 1 Investor and/or a Tier 2 Investor is a pass-through entity, the Allocatee will be required to provide the following data for all Tier 2 Investors and NMTC Claimants (Figure 19 & 20):

Figure 19: Tier 2+ Investor Data Fields

-

Data Field

Description

Name of the Tier 2 Investor

Enter name of Tier 2 Investor

NOTE: If the individual shareholders in an S Corporation will claim the tax credit on their individual tax returns, these individual shareholders should be listed as a tax

claimant in AMIS and the required investor information should be completed.

Investor Type

Select from a drop down box that includes (1) Individual investor; (2) Foundation or other philanthropic organization; (3) Pension fund; (4) Bank or other regulated financial institution; (5) Real estate developer or investment company; (6) Venture

fund; (7) Investment bank; (8) Insurance company; (9) Utility company; (10) Other type of corporate investor; (11) Other type of investor; and (12) Investment Fund

Investment Amount ($)

Enter the amount of this Tier 2+ Investment Amount. Do not use commas.

TIN

Enter the Tier 2 Investor TIN, do not use hyphens.

Investor Status

Select from the following options: Pass-Through Entity, NMTC Claimant, or Not Applicable.

Previous Tier Investor

Auto-populates with the investor’s previous Tier Investor

Leverage Amount

If your investor’s QEI is using a “leveraged” structure (see IRS Revenue Ruling 2003- 20 available on the CDFI Fund’s website at www.cdfifund.gov), enter the amount of funds the pass-through investor entity borrowed in order to provide this QEI. You should include debt even if it came from a non-partner or non-member entity. If your investor is not using a “leveraged” structure, enter zero in this field. Do not use commas.

NOTE: Leverage amount excludes fees collected or expenses paid to third parties/upper tier entities.

Amount of Public Subsidy

The amount of public subsidy used to fund the leveraged loan.

Leverage Lender Type

A drop-down of options for Other tax credit pass-through entity (includes pass- through entity for other tax credit program, such as state NMTC.

Other Tax Credit

Report the tax credit amount received in conjunction with this pass‐through entity for another tax credit program. Include other Federal and state tax credit programs that were used to fund the QEI though the investment fund (i.e. leverage structure).

Conditionally required if Leverage lender Type equals OTHER TAX CREDIT PASS‐THROUGH.

Source of Leverage

System provides a drop-down of options to categorize the source of the leverage loan.

Other Public Sources Used to Fund Leveraged Loan

Report the amount of other public sources (state, local and Federal), excluding other tax credits, used to fund the leveraged loan including public sources that are received by Affiliates of the QALICB and used to fund the leverage loan. Do not include the federal NMTC amount.

Conditionally required if Leverage lender Type equals QALICB or QALICB-affiliate and Sources of Leverage equals Non-NMTC source of public subsidy.

Equity Amount

Enter the amount of equity the investor (or its partners or members) contributed to the Investment Amount. Do not use commas.

Equity Investor Type

A drop-down for the selection of the equity investor type.

Figure 20: NMTC Claimant Investor

While the CDFI Fund encourages Allocatees to enter QEIs as expeditiously as possible, the CDFI Fund understands that certain events may preclude an Allocatee from entering all the required QEI and investor data in one session. To this end, Allocation/QEI Tracking in AMIS permits an Allocatee to enter and save QEI and investor data before submitting final notification to the CDFI Fund. If at any time during the investor data entry process the Allocatee clicks the “Save” button, all QEI and investor data that has been entered will be saved and re-accessible via the “QEIs (Pending)” section on the allocation.

To update any QEIs listed in the “QEIs (Pending)” section follow these steps:

Click QEI Name hyperlink that you would like to update/change. This will take you to the specific QEI detail page. Click on the Edit button in the upper right.

This will give the Allocatee an opportunity to revise any QEI or investor data that has already been saved.

If the Allocatee updates any of the “QEI Detail” data, the Allocatee should remember to click “Save” before moving on.

To delete a Pending QEI, select the “DEL” action button under the action column by the Investor name

In the Tier 1 Investors section on the selected QEI, select the Tier 1 investor that needs to be updated, by clicking the Investor Name hyperlink. This will take you to the Tier 1 Investor detail page. Click on the Edit button in the upper right. See Section 4.6 for an overview of the required investor data points. If an Allocatee would simply like to view and review data entered for any “QEIs (Pending)”, the Allocatee can click on the specific QEI name to pull up the data.

Until the Allocatee clicks the “Finalize” button for a pending QEI, this QEI will remain in the “QEIs (Pending)” related list. Although these allocations will be marked as used in Allocation/QEI Tracking, the actual dollar amount of the pending QEIs will not be taken into account when the CDFI Fund administers a check for compliance with relevant components of Section 3.2 (Authorized Uses of NMTC Allocation) of the Allocation Agreement, or in determining an applicant’s eligibility to apply for allocations in future NMTC rounds.

For any QEIs listed in the “QEIs (Pending)” related list, a “Finalize” button will be displayed at the top of each QEI detail record. Clicking this button will send an email to the CDFI Fund and your Authorized Representative, acknowledging your issuance of a QEI (see Figure 21 for the content of this email). Additionally, the QEI will be removed from the “QEIs (Pending)” related list and added to the “QEIs (Finalized)” related list on the allocation.

Upon finalizing a QEI and notifying the CDFI Fund of such by clicking the “Finalize” button, the Allocatee will not be able to alter any data for this QEI and related investors, as this email notification is final, and will be added to the Allocatee’s official records at the CDFI Fund. After clicking this button, Allocation/QEI Tracking in AMIS will display a pop-up message that warns the Allocatee that once a QEI is finalized they will not be able to make any edits and confirm

they wish to finalize. It is important that the Allocatee ensures the accuracy of all the data that was entered BEFORE clicking the “Finalize” button.

The finalizing process may take a few minutes. Please wait for Allocation/QEI Tracking to complete its process, and do not click the “Finalize” button multiple times. When Allocation/QEI Tracking is done finalizing a QEI the page will refresh and a lock icon will appear on the QEI detail page next to the “Edit” button.

NOTE: By default, the listed Authorized Representative will automatically receive confirmation notice of when the QEI is finalized. However, the Allocatees can add a second contact in the “Assistance Agreement & Approval” section of the Allocation page.

Subsequent to finalizing a QEI and submitting the requisite email notice to the CDFI Fund, an Allocatee can view this notice by clicking on the value in the “Subject” field in the “Activity History” related list. The following is the text of the email notification. Fields highlighted in gray, brackets and italics are automatically populated by Allocation/QEI Tracking.

Figure 21: QEI Email Notification Sent to Allocatee’s Authorized Representative

[Current Date] [Current Time]

[Name of Allocatee’s Authorized Representative] [Name of Allocatee]

[Street Address] [City], [State] [Zip]

Email: [Email of Allocatee’s Authorized Representative]

Re: Acknowledgement of New Markets Tax Credit (NMTC) Qualified Equity Investment ([QEI Identifier]) Dear [Name of Allocatee’s Authorized Representative]:

This system-generated email serves as an acknowledgement of the following Qualified Equity Investment (QEI) made in a qualified Community Development Entity (CDE), as certified by the Community Development Financial Institutions Fund (the CDFI Fund):

Allocation Award Control Number: [Allocation Award Control Number] Name of Allocatee: [Name of Allocatee]

Name of CDE that issued QEI: [Name of issuing CDE] [CDE Control No. of Issuing CDE] QEI Identifier: [QEI Identifier]

Total Amount of QEI: [$Amount of QEI] Date of QEI: [Date of Original QEI]

Tier 1 Investor(s):

[Tier 1 Investor Name], [Street Address Line 1], [Street Address Line 2], [City], [State] [Zip] (Ph: [Phone]) [Tier 1 Investor Name], [Street Address Line 1], [Street Address Line 2], [City], [State] [Zip] (Ph: [Phone])

The CDE holding this notification is entitled to notify the above investors of their right to claim NMTCs in proportion to the amount invested by such investors (at the time of original investment) in the aforementioned CDE.

Any investments made under the NMTC Program are subject to the regulations stipulated by IRC §45D.

Upon clicking the “Finalize” button, the Allocatee can still view the QEI and investor data that has been entered. The CDFI Fund has also provided the Allocatee with various reports that can be generated based on the data that was submitted. (Figure 22)

Figure 22: QEIs (Finalized) Detail Section

For best printing results use the “Printable View” hyperlink located at the top right of the page. You will be redirected to the printable view page, which the user will need to click the “Print This Page” hyperlink, and then click “Print”.

As mentioned in Section 4.8, once the Allocatee finalizes a QEI and notifies the CDFI Fund of such, the Allocatee will not be able to alter any data for this QEI and related investors, as this email notification is final, and will be added to your official records at the CDFI Fund.

Therefore, the CDFI Fund strongly encourages Allocatees to ensure the accuracy of all the data that is entered before finalizing a QEI.

However, in the event that an error is identified in finalized QEI/investor data, the Allocatee must submit a Service Request via AMIS to request the CDFI Fund change the data using the following designations:

Program: NMTC Program

The Service Request should reference the following:

The Allocatee’s name

The Allocatee’s Award Control Number

QEI Identifier

The specific changes needed.

The CDFI Fund will typically process QEI amendment requests in five business days. However, situations that are more complex can extend the time necessary to implement corrections. The Service Request portal can be used to track the progress of the resolution.

SECTION 5.0 REPAYMENT QUALIFIED EQUITY INVESTMENTS (RQIS)

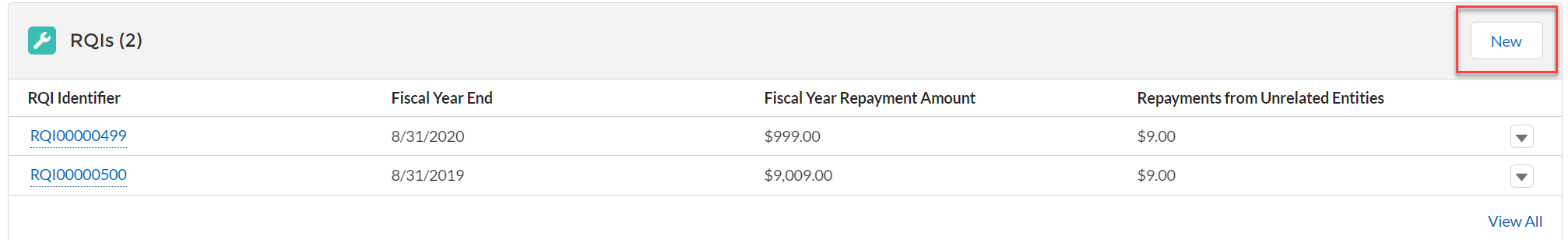

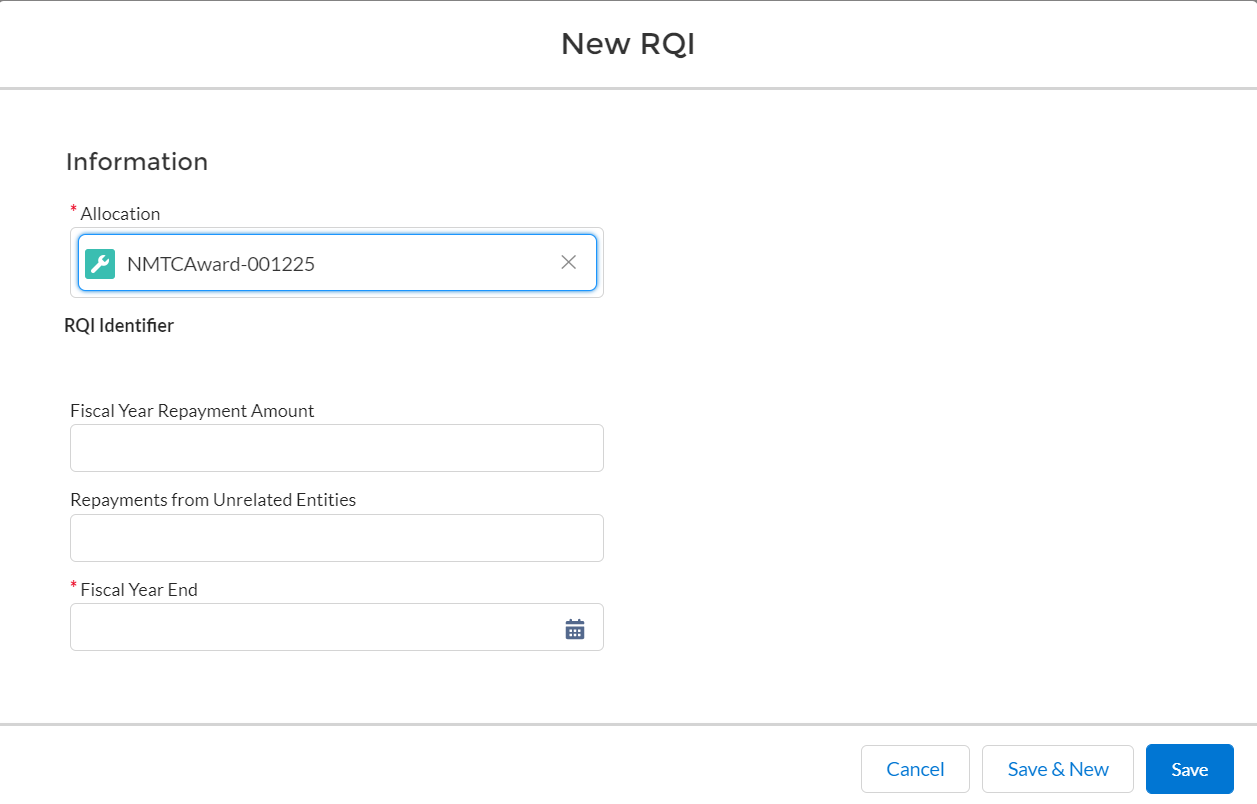

A section is available, on the allocation page, which allows Allocatees to report aggregate repayment proceeds received from prior QLICIs. To access this feature, navigate to the allocation page and scroll down to the “RQI” section. Click the “New RQI” button, and fill in all necessary fields. The fiscal year end field will auto populate. An RQI is NOT required if the CDE is using direct tracing and can therefore track how much repayment is associated with a specific QEI. (Figure 23 & 24)

Allocatees will be required to identify any repayments received from prior Qualified Low Income Community Investments if the proceeds must be reinvested under the IRS regulations. For loans, Allocatees should only include the principal amounts required to be reinvested and should not include interest repayments. The amount entered should reflect the

amount of repayments received during the applicable reporting period. Thus, if an Allocatee with a December 31, fiscal year end received $1 million in repayments from prior QLICIs in FY 2012 and an additional $2 million in FY 2013; it would report $1 million for the period ending 12/31/2012 and $2 million for the period ending 12/31/2013.

Allocatees must also identify debt or equity repayments received from prior Qualified Low Income Community Investments originated to unrelated entities. Using the same example above, of the $2.0 million principal repayments received in FY 2013, $1.5 million was derived from a QLICI to an unrelated entity. Allocatees would enter $2.0 million in the “Fiscal Year Repayment Amount” field and enter $1.5 million in the “Repayments from Unrelated Entities” field. Please enter zero in this field if none of the repayments were derived from prior QLICIs to an unrelated entity1.

Allocatees wishing to edit repayment data for a fiscal year may select the “Edit” button next to the applicable fiscal year end. Please note that the CDFI Fund will not allow Allocatees to edit prior year repayment data after it has submitted its AMIS reports for the applicable fiscal

year. For example, an Allocatee with a December 31, fiscal year end that submitted its FY 2013 AMIS reports on June 29, 2014 would not be allowed to edit FY 2013 repayment data after June 29, 2014. As with amendments to finalized QEIs, all amendment requests to a closed field must be submitted to the CDFI Fund via a Service Request.

Figure 24: New RQI Details

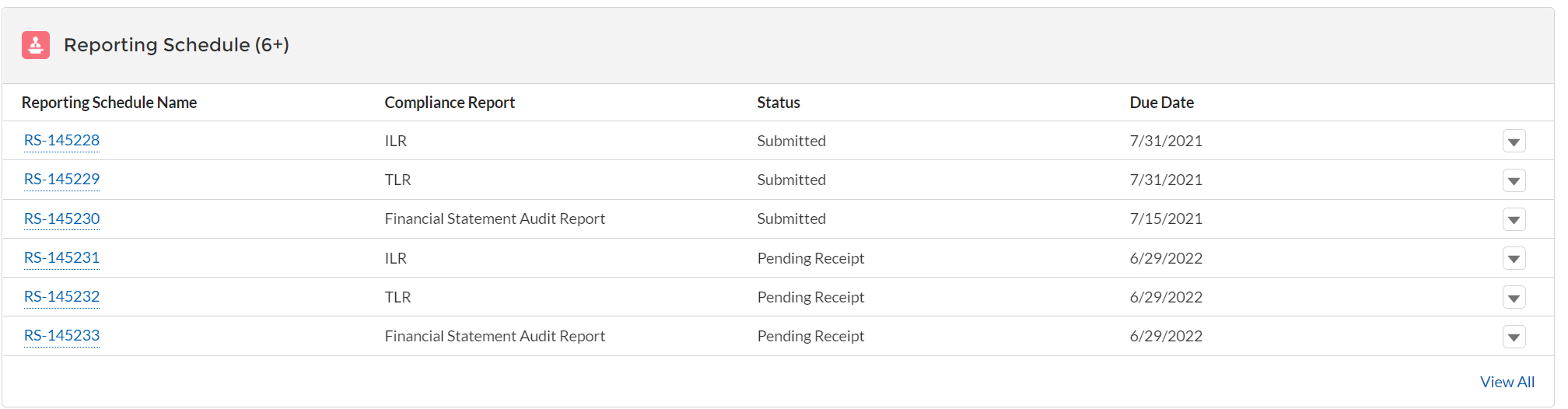

SECTION 6.0 SUMMARY OF REPORTING SCHEDULE

Upon the finalization of the Allocatee’s first QEI, a reporting schedule will be created for the submission of NMTC compliance reports. The compliance reports consist of the following:

Institution Level Report (ILR)

Transaction Level Report (TLR) and the associated QEI Distribution Report.

Audited Financial Statement

QEI Closeout Report

Each finalized QEI has a 7-year compliance period of reporting or “POP”. Given that a QEI can be created under the Allocation up to five (5) years after the allocation Effective Date, an Allocation can have twelve (12) compliance reporting periods.

Figure 25: QEI Reporting Schedule

SECTION 7.0 SUMMARY OF QEI ISSUANCE NOTIFICATIONS

Under Section 3.2 (e) of the Allocation Agreement, Allocatees are required to issue a specified percentage (typically 60 percent) of the NMTC Allocation by a specific date (QEI Issuance Trigger Date) found the Allocation Agreement. AMIS will automatically send notices to the Authorized Representative if the Allocatee’s QEI issuance is below the requirement specified in Section 3.2 (e) of the Allocation Agreement. (See Figure 26).

Figure 26: Sample QEI Issuance Reminder Email Notification

SECTION 8.0 SUMMARY OF DATA REQUIREMENTS

This section provides the Allocatee with a list of all the data points that are necessary to enter and submit to the CDFI Fund using Allocation/QEI Tracking in AMIS.

Figure 27: Summary of Allocation/QEI Tracking Data Points

-

Data Fields

Description

Allocation Transfer

Subsidiary Name

The name of the CDE that received the equity investment

(e.g., the Allocatee or an eligible subsidiary CDE that received a transfer of allocations).

Total Transferred

Amount allocation authority transferred to the subsidiary CDE

QEIs (Finalized)

Allocation/QEI Tracking will automatically calculate this

field based on information supplied in other portions of Allocation/QEI Tracking.

QEIs (Pending)

Allocation/QEI Tracking will automatically calculate this field based on information supplied in other portions of

Allocation/QEI Tracking.

QEI Details

Associated Allocation

The allocation that the QEI is associated with

Sub-CDE

The Sub-CDE that the QEI is associated with.

Date QEI Was Logged

Auto-populated based on the date the QEI data was logged in the system.

Allocations Remaining by Allocatee / Allocations Remaining by Sub-CDE

Allocation/QEI Tracking in AMIS will automatically calculate this field based on information supplied in other portions of Allocation/QEI Tracking.

For the Allocatee, the formula for this field is: Allocation award amount

MINUS allocations transferred to all Sub-CDEs MINUS finalized QEIs finalized by the Allocatee MINUS pending QEIs finalized by the Allocatee

For Sub CDE, the formula for this field is:

Amount of allocations transferred to the selected Sub CDE MINUS finalized QEIs finalized by the selected Sub CDE MINUS pending QEIs finalized by the selected Sub CDE

Is this a NRE-QEI?

Allocatee will check the box if the CDE intends to take advantage of the provisions of TD 9600. The Allocatee must designate the QEI as a Non-Real Estate QEI.

NOTE: TD 9600 encourages investments in non-real estate businesses for working capital and equipment and to invest certain returns of capital from those investments in unrelated certified Community Development Financial

Institutions (CDFIs).

Amount

Enter the amount of the QEI at original issue (i.e., do not report on the current market value of the QEI). The equity investment is acquired by the investor at its original issue

solely in exchange for cash to the CDE or on behalf of the CDE.

Date of Original QEI

Enter the date on which the investor actually provided the Allocatee or Sub-CDE with the actual investment (e.g., do not provide the date the investor provided the commitment). For compliance purposes, this date will serve as the credit allowance date, which marks the start of: (1) the seven-year period during which the QEI must stay with the CDE; and (2) the 12-month period that the CDE has to make QLICIs with its QEI proceeds.

NOTE: If the Allocatee or Sub-CDE is taking advantage of the look back period, Allocation/QEI Tracking will not allow you to enter a date before the assigned look back date for the each Allocation round, and per IRC 1.45D-1T(b)(2)(i),

the credit allowance date for such QEIs will be the date of the Allocation Agreement.

Funds Retained

Funds in excess of the cash exchanged for the QEI at original issue that are retained as fees or expenses at the investment fund level.

NOTE: This amount should equal any additional inflows to the investment fund in excess of the QEI amount. This may include closing fees collected by the CDE, sub-Allocation

fees collected by the CDE, fees or expenses paid from the investment fund to third parties, etc.

QEI Identifier

A unique identifier automatically generated by the system.

Finalize Checkbox

The data point will automatically be checked once the QEI is finalized by the user.

Finalized Date

The data point will automatically be populated once the QEI is finalized.

Total Debt

Total debt amount contributed by investors and included in the QEI Amount.

Total Equity

Total equity amount contributed by investors and included in the QEI Amount.

-

Consolidated Tax Return

Checkbox to indicate if the issuing CDE an affiliate or subsidiary of an entity that files a consolidated tax return. If yes, please provide the TIN/EIN and name of the parent

taxpayer with whom the issuing CDE files a consolidated tax return.

Organization EIN

EIN/TIN of parent organization

Organization Name

Name of parent organization

Tier 1 Investors Contributing to QEI

Investor Name

Enter name of Tier 1 Investor

Investor Type

Select from a drop down box that includes (1) Individual investor; (2) Foundation or other philanthropic organization; (3) Pension fund; (4) Bank or other regulated financial institution; (5) Real estate developer or investment company; (6) Venture fund; (7) Investment bank; (8) Insurance company; (9) Utility company; (10) Other type of corporate investor; (11) Other type of investor; and (12) Investment Fund

NOTE: “Investment Fund” should be used in cases where the investor is a leveraged fund created to aggregate funds.

Is this a new investor?

Leave the checkbox unmarked if the Allocatee or any of its affiliates has received any funds (whether debt, equity, grant, etc.) from this investor in the last five years.

In cases where the Tier 1 Investor is a pass-through entity, this applies to the next tier of investors. If there are multiple investors, the answer should be based on the

largest equity contributor.

Is this an affiliated entity?

Allocatee should check this box is the investor is an

“affiliate” - any legal entity that controls, is controlled by, or is under common control with, the Allocatee.

Investment Amount ($)

Enter amount of this Tier 1 Investor’s Contribution to the QEI. If there is only one Tier 1 Investor contributing to a

QEI, then the “Investment Amount” should equal the “QEI Amount” at the top of the page. Do not use commas.

Credit Price

Enter price per credit the investor paid for the expected NMTC.

Form of QEI

Select from a dropdown box that includes Stock or Capital Interest.

TIN

Enter the Tier 1 Investor’s nine-digit taxpayer identification

number. Do not use hyphens. Required unless “Individual Investor” is selected for investor type.

Anticipated Rate of Return

Enter the rate of return that you expect this Tier 1 Investor to receive. The rate of return can include the benefit of the NMTC on a pre-tax basis.

NOTE: Calculate the rate of return on a pre-tax basis for the NMTC Equity Investor. Include cash flows for equity

-

invested, tax credits received, projected/actual put payment received, and fees/other distributions paid or

collected by the NMTC Equity Investor as part of the NMTC financing.

Address Line 1 and 2 City, State, and Zip

Enter the address of the Tier 1 Investor. Zip code must be five digits.

Phone and Email

Enter the contact information for the Tier 1 Investor

Investor Status

Select from the following options Pass-Through Entity, NMTC Claimant, or Not Applicable.

Equity Amount

Enter the amount of equity the investor (or its partners or

members) contributed to the Investment Amount. Do not use commas.

Equity Investor Type

System provides a drop-down menu for the selection of the equity investor type:

CDE or CDE-affiliate

Third-party not related to or affiliated with the CDE, Leverage Lender, or the QALICB

Other

Leverage Amount

If your investor’s QEI is using a “leveraged” structure (see IRS Revenue Ruling 2003-20 available on the CDFI Fund’s website at www.cdfifund.gov), enter the amount of funds the pass-through investor entity borrowed in order to provide this QEI. You should include debt even if it came from a non-partner or non-member entity. If your investor is not using a “leveraged” structure, enter zero in this field. Do not use commas.

NOTE: Leverage amount excludes fees collected or expenses paid to third parties/upper tier entities.

Amount of Public Subsidy

The amount of public subsidy used to fund the “leveraged” loan.

NOTE: Public subsidy includes funds used in the leverage loan capital stack that is derived from loans/grants from the

city, state, or federal agencies. This includes sources such as HUD 108 and SBA 504 loans.

Leverage Lender Type

System provides a drop-down of options to categorize the leverage lender:

CDE or CDE-affiliate

NMTC Equity Investor or an affiliate of this entity

QALICB or QALICB-affiliate

Third-party not related to or affiliated with the CDE, NMTC Investor, or the QALICB

-

Other Tax Credit Pass-Through entity (includes pass- through entity for other tax credit program, such as state NMTC)

Other

Other Tax Credit Amount

Report the tax credit amount received in conjunction with this pass‐through entity for another tax credit program. Include other Federal and state tax credit programs that were used to fund the QEI though the investment fund (i.e. leverage structure).

Conditionally required if Leverage lender Type equals OTHER TAX CREDIT PASS‐THROUGH.

Source of Leverage

System provides a drop-down of options to categorize the source of the leverage loan.

Non-NMTC source of public subsidy.

Short-term loan originated to the QALICB or QALICB- affiliate with a term less than one year.

CDE loan originated to the QALICB or QALICB-affiliate from the CDE with a term greater than one year.

Other loan that does not fit one of the definitions above.

Private donations or grants given to QALICB or QALICB- affiliate.

Other QALICB or QALICB-affiliate assets (not specifically sourced for the transaction, from other parties not related to the QALICB and not originating from public grants or other sources of subsidy).

Other

NOTE: If multiple Leverage Loan sources are used, choose the largest source when reporting. In the event two or more sources are equal, choose source most vital to

ensuring the project’s success.

Other Public Sources Used to Fund Leveraged Loan

Report the amount of other public sources (state, local and Federal), excluding other tax credits, used to fund the leveraged loan including public sources that are received by Affiliates of the QALICB and used to fund the leverage loan. Do not include the federal NMTC amount.

Conditionally required if Leverage lender Type equals QALICB or QALICB-affiliate and Sources of Leverage equals Non-NMTC source of public subsidy.

Tier 1 Parent QEI

Auto-Populates the QEI that the Tier 1 investor is associated with.

Tier 2+ Investors

Name of the Tier 2 Investor

Enter name of Tier 2 Investor

NOTE: If the individual shareholders in an S Corporation will claim the tax credit on his or her individual tax returns, each individual shareholder should be listed as a tax claimant in AMIS and the required investor information

should be completed.

Investor Type

Select from a drop down box that includes (1) Individual investor; (2) Foundation or other philanthropic organization; (3) Pension fund; (4) Bank or other regulated financial institution; (5) Real estate developer or investment company; (6) Venture fund; (7) Investment bank; (8) Insurance company; (9) Utility company; (10) Other type of corporate investor; (11) Other type of

investor; and (12) Investment Fund

Investment Amount ($)

Enter amount of this Tier 2+ Investor’s investment amount. Do not use commas.

-

TIN

Enter the Tier 2 Investor TIN/EIN, do not use hyphens.

NOTE: If the Investor Type is “Individual Investor”, the system will require a TIN.

Investor Status

Select from the following options Pass-Through Entity, NMTC Claimant, or Not Applicable.

Previous Tier Investor

Auto-populates with the investor’s Previous Tier Investor

Leverage Amount

If your investor’s QEI is using a “leveraged” structure (see IRS Revenue Ruling 2003-20 available on the CDFI Fund’s website at www.cdfifund.gov), enter the amount of funds the pass-through investor entity borrowed in order to provide this QEI. You should include debt even if it came from a non-partner or non-member entity. If your investor is not using a “leveraged” structure, enter zero in this field.

Do not use commas.

Amount of Public Subsidy

The amount of public subsidy used to fund the leveraged amount.

Leverage Lender Type

System provides a drop-down of options to categorize the leverage lender

Other Tax Credit Amount

Report the tax credit amount received in conjunction with this pass‐through entity for another tax credit program. Include other Federal and state tax credit programs that were used to fund the QEI though the investment fund (i.e. leverage structure).

Conditionally required if Leverage lender Type equals OTHER TAX CREDIT PASS‐THROUGH.

Source of Leverage

System provides a drop-down of options to categorize the source of the leverage loan.

Other Public Sources Used to Fund Leveraged Loan

Report the amount of other public sources (state, local and Federal), excluding other tax credits, used to fund the leveraged loan including public sources that are received by Affiliates of the QALICB and used to fund the leverage loan. Do not include the federal NMTC amount.

Conditionally required if Leverage lender Type equals QALICB or QALICB-affiliate and Sources of Leverage equals Non-NMTC source of public subsidy.

Equity Amount

Enter the amount of equity the investor (or its partners or

members) contributed to the Investment Amount. Do not use commas.

Equity Investor Type

A drop-down for the selection of the equity investor type.

QEI

Repayments (RQI)

Allocation

Pre-populates with allocation the RQI is associated with

RQI Identifier

System automatically populates a unique identifier.

Fiscal year repayment amount

Fiscal Year End date in which the Allocatee indicates repayment of QEIs were received.

NOTE: An RQI is only required if the CDE is not using direct

tracing and cannot indicate how much repayment is associated with a specific QEI.

Repayments from unrelated entities

Aggregate amount of repayments received from “unrelated entities”

Fiscal Year End

Select the fiscal year end for reporting year.

QEI Reporting Schedule –

Reporting Schedule Name

System generated link details of individual reports.

-

Individual Allocation

Compliance Report

This section will be populated with one of the following values to distinguish the report that is due: Institution Level Report (ILR), Transaction Level Report (TLR), Audited

Financial Statement Audit Report, and QEI Closeout Report.

Status

Populated with the status of the Compliance Report with following possible values: Pending Receipt, Submitted, Submitted - Overdue, Overdue, N/A (Not Applicable).

Date Received

The date the report was received.

Days to Submit

Populated with the number of days left to submit the report.

Due Date

Populated with the due date of the report – typically 180 days after the Allocatee’s fiscal year end.

Submission Indicator

System generated symbols tied “Status”.

View Report Tab

System generated link to reports.

PoP Year

Period of Performance (reporting) year.

QEI Issuance Notifications

QEI Issuance Percentage

Located in the “Allocation Usage Summary” section, this data point pre-populates with the required percent of QEIs to be issued as specified in Section 3.2 (e) of the Allocation Agreement.

The required benchmark is typically set at 60% of allocation award amount.

QEI Issuance Trigger Date

Located in “Allocation Usage Summary” section, this data point populates with the deadline date to issue a specified percentage of the Allocation authority as QEIs in accordance with Section 3.2 (e) of the Allocation

Agreement.

SECTION 9.0 SUMMARY OF DISBURSEMENT REPORT

This section provides the Allocatee with the data points that are necessary to enter and update information on the usage of individual QEIs using the Allocation/QEI Tracking module in AMIS. Of note, only selected fields will be editable as AMIS will auto-populate QLICI amounts based on previously submitted Institution Level Reports (ILR) and Transaction Level Reports (TLR).

Figure 28: Screenshot of Disbursement Report Summary

Figure 29: Summary of Disbursement Report Data Points

-

Data Field

Description

FCOS

AMIS will auto-populate this field with previously reported QLICIs classified as Financial Counseling and Other Services (FCOS).

Loan Purchases

AMIS will auto-populate this field with previously reported QLICIs classified as Loan Purchases.

Loan Source Amount Totals

AMIS will auto-populate this field with previously reported QLICIs reported in the TLR.

Operations

Enter the total amount of the QEI proceeds spent on Operations

Loan Loss Reserves

Enter the amount of the QEI proceeds that the Organization set aside for loan losses in existing QLICIs funded by the QEI. This amount, summed with “Reserves for Additional Investment” should not exceed the amount of reserves that the

Organization is permitted to establish pursuant to the IRS regulations (i.e., 5% of the QEI proceeds).

Reserves for Additional Investments

Enter the amount of the QEI proceeds that the Organization has set aside for additional investment in existing QLICIs. This amount, summed with “Reserves for Loan Losses,” should not exceed the amount of reserves that the Organization is

permitted to establish pursuant to the IRS regulations (i.e., 5% of the QEI proceeds).

Deposits in CDFIs

Enter the amount of QEI proceeds that was invested in unrelated certified CDFIs as

permitted under the provisions of TD 9600. This only applies to QEIs that are designed as a Non-Real Estate QEI under TD9600.

Term in Months

Enter the term, in months, of the QEI at original issue. This amount should be equal to, or greater than, the 7-year tax credit period (i.e., 84 months) during

which the QEI must remain with the CDE.

NOTE: Users can edit the “Distribution Report” section of a QEI at any time. AMIS requires users to acknowledge when the sum of FCOS, Loan Purchases, Operations, Loan Loss Reserves, Reserve for Additional Investments, Deposits in CDFI's and Loan Source Amount Total are greater than the QEI Amount. This warning will not prevent the user from saving the data.

Draft For Paperwork Reduction Act Purposes Only

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | NMTC Allocation and QEI Tracking Guide_March_2022_C2L |

| Subject | Training |

| Author | Henry, Trefor |

| File Modified | 0000-00-00 |

| File Created | 2023-08-28 |

© 2026 OMB.report | Privacy Policy