Supporting Statement

Short Manufacturing Survey Supporting Statement.docx

NIST Generic Clearance for Community Resilience Data Collections

Supporting Statement

OMB: 0693-0078

Manufacturing Resilience Survey: Hurricane Maria (Short Survey Version)

U.S. Department of Commerce

National Institute of Standards and Technology

Generic Clearance for Community Resilience Data Collections

OMB CONTROL NO. 0693-0078

Expiration Date 07/31/2022

1. Explain who will be surveyed and why the group is appropriate to survey.

Survey Group: The goal of this collection is to consider the effects of Hurricane Maria in the context of businesses and supply chains in Puerto Rico. The research goals are to characterize the impacts to and recovery of small- and medium-sized manufacturers (SMMs).

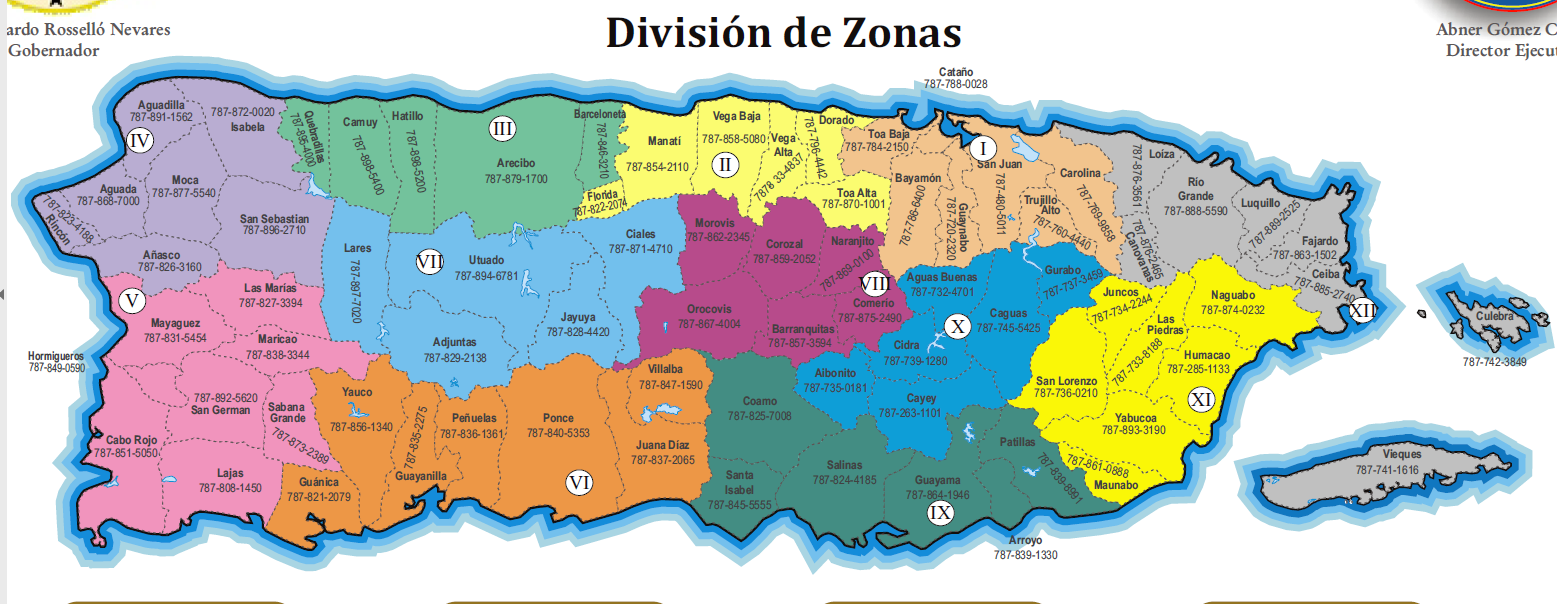

Study Area: To facilitate coordination across multiple study components within the Hurricane Maria Program, the NIST team has selected four regions of Puerto Rico for particular focus. These regions were selected in light of the geographic and socio-economic diversity of these regions, the path of the storm, and the variety of Hurricane Maria’s hazards and impacts in these regions (i.e., rainfall and flooding, landslides, wind damage, and impacts to hospitals and schools). The four selected regions are the 2017 emergency management regions of San Juan (Emergency Region I), Caguas (Emergency Region X), Humacao (Emergency Region IX), and Utuado (Emergency Region VII), which comprise 26 municipalities (municipios). Additionally, this project will assess the municipios of Mayagüez and Ponce given the high levels of manufacturing in those regions. The initial basis for the selection of these regions was the 2017 map of emergency management zones (see Appendix A), which was in effect at the time of Hurricane Maria. Although the emergency management zones have been revised since 2017, the NIST team is maintaining its selection of these four regions of focus for the Hurricane Maria Program. In all, this includes those businesses in the following municipios of Puerto Rico:

Adjuntas

Aguas Buenas

Aibonito

Bayamon

Caguas

Carolina

Catano

Cayey

Ciales

Cidra

Guaynabo

Gurabo

Humacao

Jayuya

Juncos

Lares

Las Piedras

Maunabo

Mayaguez

Naguabo

Ponce

San Juan

San Lorenzo

Toa Baja

Trujillo Alto

Utuado

Yabucoa

Within those geographies, we asked InfoUSA (2017)1 to give us a list of businesses in the following Standard Industrial Classification (SIC) codes for those with 250 or fewer employees at a given location, and that were in their listings prior to Hurricane Maria in 2017. These SIC codes were translated to NAICS (North American Industry Classification System) codes and matched to those of interest for this project. The included SIC codes include:

20-39 (manufacturing)

Additionally, Puerto Rico Manufacturing Extension Inc. (PRiMEX) provided us with a list of 668 manufacturers, not including the 131 that were listed in our sample from InfoUSA.

Thus, in total our sample includes 1,986 SMMs (1,318 listed within the InfoUSA sample [including an overlap of 131 on both InfoUSA and PRIMEX] and another 668 only in the PRIMEX sample).

Why appropriate to survey this group: The research objective is to examine the recovery trajectories of sampled small- and medium-sized manufacturing businesses in Puerto Rico since Hurricane Maria in Puerto Rico. This information is being studied to provide greater understanding of business continuity resilience planning and how these may differ between industries and affected regions. Specifically, we specifically developed a frame from these businesses above to cover all eligible businesses within the study regions.

More broadly, this study falls within a broader program of activity at NIST - the Hurricane Maria Program. Under this program, there is both a technical investigation of Hurricane Maria and its impacts on Puerto Rico and a scientific study of the impacts of and recovery from Hurricane Maria. As complementary components of the NIST Hurricane Maria Program, the NCST technical investigation and the NWIRP research study are closely coordinated. This protocol covers only the scientific study of Hurricane Maria.

Under the National Windstorm Impact Reduction Act Reauthorization of 2015 (Public Law 114-52), NIST is conducting a scientific study of the impacts of and recovery from Hurricane Maria. The National Windstorm Impact Reduction Act Reauthorization (Public Law 114-52) designates NIST as the lead agency for the National Windstorm Impact Reduction Program (NWIRP) and gives NIST responsibility to:

Ensure that the Program includes the necessary components to promote the implementation of windstorm risk reduction measures;

Support the development of performance-based engineering tools, and working with appropriate groups to promote the commercial application of such tools;

Request the assistance of Federal agencies other than the Program agencies, as necessary;

Coordinate all Federal post-windstorm investigations to the extent practicable; and

When warranted by research or investigative findings, issue recommendations to assist in informing the development of model codes, and provide information to Congress on the use of such recommendations.

The National Windstorm Impact Reduction Program (NWIRP)2 was established by Congress “…to achieve major measurable reductions in the losses of life and property from windstorms through a coordinated Federal effort, in cooperation with other levels of government, academia, and the private sector, aimed at improving the understanding of windstorms and their impacts and developing and encouraging the implementation of cost-effective mitigation measures to reduce those impacts.”

The goals of the NWIRP scientific study are to characterize the impacts to and recovery of: (1) businesses (this study) and supply chains, (2) education and healthcare services, and (3) infrastructure systems that support the functioning of critical buildings and emergency communications. By carrying out these three distinct but complementary projects as part of a single coordinated effort, the NWIRP scientific study will present a more complete picture of the impacts of and recovery from Hurricane Maria in Puerto Rico. We expect that a scientific study on the recovery of impacted communities in Puerto Rico will result in important insights and may lead to recommendations to improve recovery and resilience practices for communities facing risks from hurricanes and other windstorms.

2. Explain how the survey was developed including consultation with interested parties, pretesting, and responses to suggestions for improvement.

This survey instrument was developed by NIST and their contracting team. Many components of this instrument follow a series of business surveys that have been conducted by NIST and NIST collaborators in Port Arthur, Texas, Beaumont, TX, Charleston, SC, and surrounding areas for over two years as well as in Lumberton, North Carolina. The majority of these questions have been thoroughly vetted in the field in some form previous to this study. Additionally, we vetted these questions with eight SMMs as part of a pilot test.

As a first step, we programmed the survey into Qualtrics, and our internal team performed some test surveys within the team in both English and Spanish to assess comprehension and timing. After some modifications, using our sample frame of manufacturers, we pretested/piloted the survey with eight SMMs via a phone survey. The pilot included eight respondents out of 99 SMMs in the sample. From this, we made adjustments to the survey to simplify or remove questions where there was confusion from the respondents. In particular, we simplified some questions related to risk perception.

3. Explain how the survey will be conducted, how customers will be sampled if fewer than all customers will be surveyed, expected response rate, and actions your agency plans to take to improve the response rate.

The survey will be administered as an electronic survey using a letter to drive businesses to a simple URL with an option to complete as a phone-based survey. In most cases, the owner (or manager) of the business will complete the survey. The survey is expected to take a maximum of 20 minutes to complete. The respondent will have access to the electronic survey for at least a six-week period. This way, the respondent has time to organize completing the survey at a time that is most convenient to her/his work schedule. As mentioned, an optional phone-based survey will be offered to businesses preferring to respond in this manner. They will be able to call a hotline to fill out the survey, or they will receive a call from the contractor if they have not previously completed the survey only.

Sampling: After filtering out NAICS codes for education, government, non-profit group, and other establishments, we will initiate a primary replicate sample followed by weekly secondary replicate samples as needed.

Based on the pilot results and other factors, we have determined that the best-case completion rate will be approximately 30 percent although we expect the response rate to be closer to 5 to 10 percent based on pretesting. Therefore, we will create an Initial (Decision) Replicate of 833 records. This represents the number of records required to obtain 250 surveys, based on the best-case scenario. We will monitor our response rate, and if it falls below 13 percent, we may need to perform in-person visits as a supplemental measure for response rate improvement to meet the desired 250 completes. The results of the initial replicate allow for the review of response data to calculate the amount of additional sample (in replicated sub-samples) to be released to complete the targeted number of surveys. In this way, the resulting completed surveys will be obtained from a representative sample of establishments regardless of the ultimate sample size.

All replicated samples will be selected from the sample frame using an Nth name systematic selection, with the frame stratified by Industry (4-digit NAICS) and geography (municipio, and zip code within). The table below summarizes the number of businesses in the primary and replicate samples.

|

Number of SMMs |

Adjusted Sample Frame Size |

1,986 |

Initial Replicate Size* |

833 (280 of which in PRIMEX only) |

Remaining sample for secondary replicates |

1,153 |

# of Secondary Replicates |

20 |

SMMs per Secondary Replicate |

57-58 (19 of which in PRIMEX only) |

* Size based on best-case scenario to complete target of a 30% completion rate

Responses: There will be 250 responses that complete all sections of the survey except for the last section. These respondents are expected to take 20 minutes to complete the instrument questions. This represents a burden of 250*20 min = 5000 min = 83.33 burden hours. Information is not saved in a Privacy Act System of Records in which data is retrieved by a personal identified. Privacy Act Statement and SORN are not applicable for this collection.

Response Rate Improvement: We will send advance mailings that precede a phone call. These mailings will include an invitation to a web survey and provide an expectation for the follow-up call. We will make an initial mailing as a letter to businesses to assess the response rate to a web interview. This communication will also contain a toll-free phone number so that individuals can call in with questions or to do the survey. Here are some details of the initial evaluation phase:

Send initial mailing to businesses with a simple URL and ID code to the survey to a sample portion of respondents.

Assess response rate and cost per completed interview of the drive to web effort, separated by responses from the initial mailing and the follow-up calls.

Call non responders about a week after initial mailings are received and assess production rate.3

Test the efficacy of web searches for number telephone numbers for business calls resulting in a non-working call results

Review sample dispositions4 to find any potential issues with the list, or data collection efforts. For example, we are working with InfoUSA to remove any businesses from our sample that are no longer active in their database.

Below, we have detailed our initial steps (mentioned above) to improve response rate for this data collection effort:

Use call-center staff who will speak with familiar dialects.

Send pre-notification mailings.

Perform calls at different times of the day and week (e.g., Monday morning, Saturday afternoon).

Schedule calls outside of work hours (and potentially using different telephone numbers) for respondents who request it.

If initial calls are during a busy period, set up appointment times to perform the survey over the phone at a more convenient time.

Purchase a simple URL that we can easily provide to the business to give them the option to a) do the survey online at their pace or b) complete the survey over the phone during the initial call.

If possible, try to encourage them to take the survey then and there over the phone as that may maximize the likelihood of completion.

Develop introductory text that focuses on how this effort could provide insights to help businesses in the future (i.e., hone in on the outcomes of the project that provide benefits to them and others in their position).

Provide interviewers with training for refusal conversions.

Install monitoring capabilities and train “lead” interviewers on listening and feedback skills. Record both surveys to give feedback to students on best practices during interviewing (e.g., gaining cooperation, refusal aversion, reading verbatim, probing for open ended responses, pat responses to objections, scheduling callbacks, etc.). We will update our “best practices” guide weekly and post for all interviewers and schedule check-ins with interviewers to discuss these practices weekly as well as we discuss any needed changes for the week.

4. Describe how the results of the survey will be analyzed and used to generalize the results to the entire customer population.

It is expected that the findings of this survey will inform the understanding of the team in terms of business interruption and best practices and circumstances for recovery over medium- and long-term timeframes and when recovery is complicated due to another disaster, namely the COVID-19 pandemic.

The data will be analyzed as a representative case for SMMs impacted by Hurricane Maria in Puerto Rico and to address the NWIRP goals to learn about economic dimensions of disaster recovery. There are five main survey sections in the tool that relate to Hurricane Maria and subsequent recovery:

Respondent information in relation to business;

Damage and business interruption due to Hurricane Maria;

Response, Mitigation, and Preparedness;

Social and Institutional Networks;

Business information (e.g., year established, own or rent building, etc.); and

Perceptions and preferences of respondents towards future planning and learning.

Analyzing these types of data singularly and in conjunction is expected to extend understanding of business interruption in general and across sectors. Of particular interest to the NIST AEO researchers is enhanced understanding of the effect of utilities (if and when they are restored) in business re-opening and overall recovery as well as the financial recovery and mitigation actions taken by businesses. Puerto Rico is a key case study for these areas of inquiry due to the ongoing NIST NCST investigation and NWIRP study.

There is not a great deal of research conducted to date with primary research concerning business interruption following large-scale natural disasters, the ensuing recovery, and impacts from pandemic protocols (e.g., mandatory closure, following safety precautions, etc.).

The data will also be used to inform conceptual and quantitative modeling of the community as a system, including interdependencies between housing, business, and school recovery, the timing of aspects of community recovery, and the resources available versus those needed.

Furthermore, it is expected that administering the survey tool will provide useful information on best practices for general field research on business interruption from natural disasters (and adjusting those best practices in the face of a global pandemic).

Appendix A: 2017 Emergency Management Zones

1 InfoUSA was formerly part of InfoGroup but is now part of Data Axle (https://www.dataaxleusa.com/lp/infousa). Business data were originally pulled for March of 2017 and they are being updated to remove businesses who have since been put out of business.

2 https://www.nist.gov/el/materials-and-structural-systems-division-73100/national-windstorm-impact-reduction-program-nwirp

3 Production rate refers to the number of completed interviews obtained within one hour of an interviewer's time, both for an individual interviewer, and in aggregate. This metric can be applied to assess the impact of varying strategies (advance letters, cold calling, recalling non-respondents, etc., in order to adjust the approach to increase the response rate while being as efficient as possible.

4 Sample disposition - refers to the outcome of contact attempts with respondents, and includes completed interviews, refusals to do the interview, non-working telephone numbers, undeliverable mail, etc. This metric is used to measure the quality of the sample list, the ability of interviewers to reach the correct respondent, the openness of the respondents to the project, and many other factors.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Helgeson, Jennifer (Fed) |

| File Modified | 0000-00-00 |

| File Created | 2022-06-24 |

© 2026 OMB.report | Privacy Policy