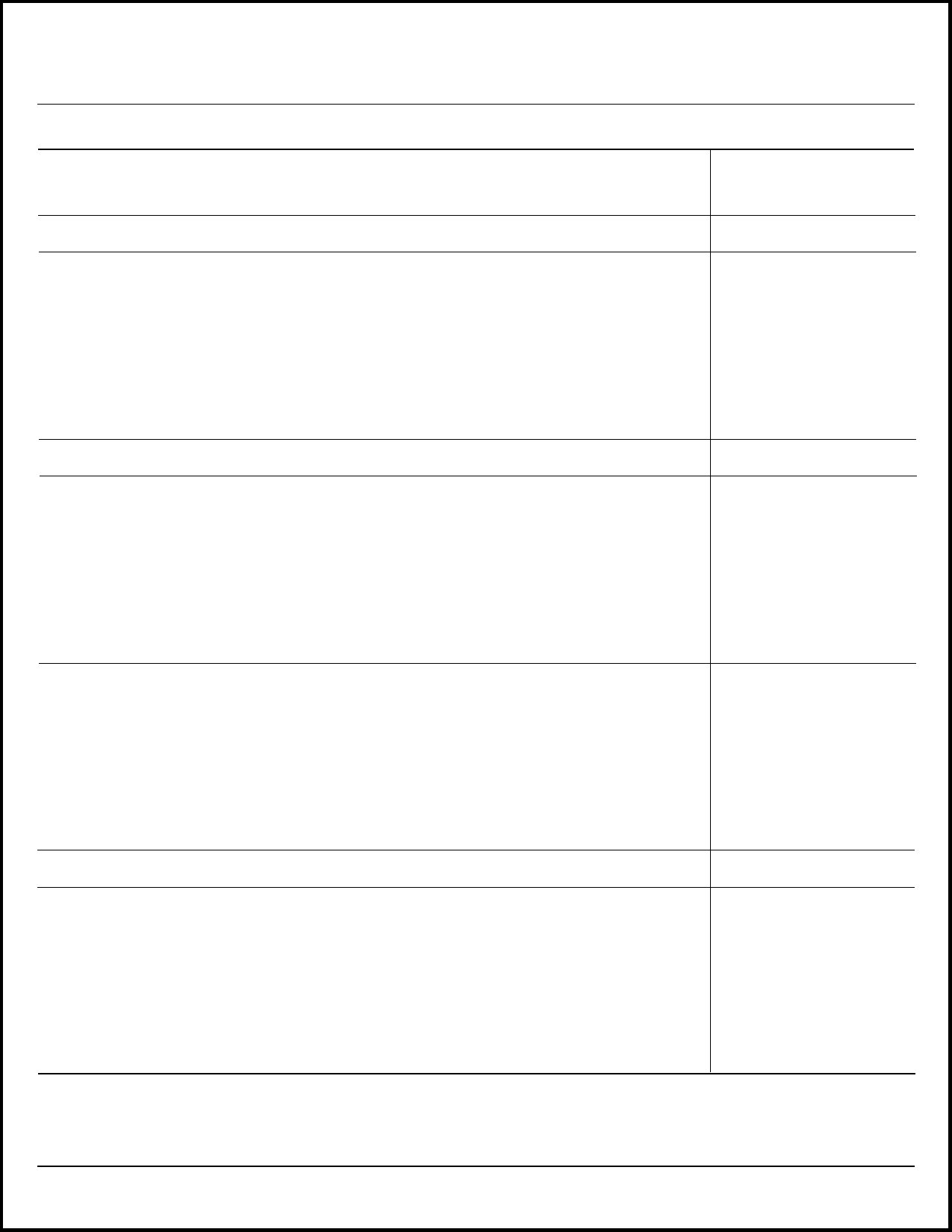

HUD-52652 Family Self-Sufficiency Program FSS Escrow Account Credi

Family Self-Sufficiency Program (FSS)

HUD 52652

Family Self-Sufficiency Program (FSS)

OMB: 2577-0178

form

HUD-52652

(1/14)

ref.

Handbook 7420.8

Previous

Editions are Obsolete

U.S.

Department of Housing and Urban Development

FSS

Escrow Account Credit Worksheet Office

of Public and Indian Housing

Family

Self-Sufficiency Program

Escrow

credit must be determined at each reexamination and interim

determination occurring after the effective date of the FSS

Contract

of Participation while the family is participating in the FSS

program.

Head

of the FSS family

Date

1. Current

Annual Income (Enter amount from line 7i of form HUD-50058.)

1.

2. Applicable

Lower-Income Limit (Enter the current lower-income limit for the

jurisdiction in which the FSS

family is living.)

3.

Current Adjusted Income (Enter amount on line 8y of form

HUD-50058.)

If

line 3 is greater than line 2, this family does not qualify for

an FSS credit.

3.

4. Earned

income included in line 1 (Add up the income items coded B, M, F,

HA, and W in column 7f of

form HUD-50058.)

4.

5. Earned

income included in Annual Income on effective date of the FSS

Contract of Participation. (Enter

amount from contract of participation.)

5.

6. Increase

in earned income since the effective date of the FSS Contract of

Participation. (Subtract

line 5 from line 4. If negative, enter 0.)

6.

7.

Current Annual Income less increase in earned income since the

effective date of the FSS Contract of

Participation. (Subtract line 6 from line 1.)

7.

8. Thirty

percent of current monthly Adjusted Income (Line 3 divided by 40. The

calculated amount should equal the amount on line 9f of form

HUD-50058.)

8.

9. Current

Adjusted Income less increase in earned income since the

effective date of the FSS Con- tract

of Participation. (Subtract line 6 from line 3.)

9.

10.

30% of current monthly Adjusted Income less increase in earned

income since the effective date of

the

FSS Contract of Participation. (Line 9 divided by 40)

10.

11.

10% of current monthly Annual Income less increase in earned

income since the effective date of the

FSS

Contract of Participation. (Line 7 divided by 120)

11.

12.

If applicable, welfare rent (enter amount on line 9g of form

HUD-50058) or public housing ceiling rent

(enter

amount on line 10c of form HUD-50058)

12.

13.

TTP based on current Annual Income less increase in earned income

since effective date of the

FSS

Contract of Participation. (If housing choice vouchers, enter the

amount on line 10,

otherwise,

enter the greater of line 10, 11, or 12.)

13.

14.

Difference between 30% of current monthly Adjusted Income and TTP

adjusted for increases in earned

income. (Subtract line 13 from line 8. Enter 0 if negative.)

14.

15.

Current TTP (Enter the amount on line 9j of form HUD-50058 or,

in the case of housing choice

vouchers,

enter the amount on line 8 of this form.)

15.

16.

TTP on effective date of the FSS Contract of Participation or, in

the case of housing choice

vouchers,

30% of monthly Adjusted Income on effective date of the FSS

Contract of Participation.

(Enter amount from contract of participation.)

16.

17.

Difference between current TTP and TTP on effective date of the

FSS Contract of Participation.

(Subtract

line 16 from line 15. Enter 0 if negative.)

17.

18.

Enter the lesser of line 14 or line 17.

18.

19.

Applicable Very Low-Income Limit (Enter the current very

low-income limit for the jurisdiction in which the FSS family is

living.)

19.

20.

Amount by which Adjusted Income exceeds the Very Low-Income Limit

(Subtract line 19 from line 3.)

20.

21.

30% of the amount by which Adjusted Income exceeds the Very

Low-Income Limit (Line

20 divided by 40)

21.

22.

Escrow credit (Subtract line 21 from line 18.)

22.

This

HUD form is optional and is used here to illustrate the process.

PHAs may develop their own FSS Worksheet.

OMB

Approval No. 2577-0178

(exp.01/31/2017)

Public reporting burden for this collection of information is estimated to average 1.0 hours per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the Reports Management Officer, Paperwork Reduction Project (2577-0178), Office of Information Technology, U.S. Department of Housing and Urban Development, Washington, D.C. 20410-3600.

Do not send this form to the above address.

Response to this collection of information is mandatory by law (Section 23 (c) & (g)) of the U.S. Housing Act of 1937, as added by Section 554 of the Cranston-Gonzalez National Affordable Housing Act (PL 101-625) for participation in the FSS program.

The information collected on this form is considered sensitive and is protected by the Privacy Act. The Privacy Act requires that these records be maintained with appropriate administrative, technical, and physical safeguards to ensure their security and confidentiality. In addition, these records should be protected against any anticipated threats to, their security or integrity which could result in substantial harm, embarrassment,

inconvenience, or unfairness to any individual on whom the information is maintained.

HUD may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB control number.

Instructions for Completing the FSS Escrow Account Credit Worksheet

An escrow credit must be determined at each reexamination and interim determination occurring after the effective date of the FSS contract of participation while the family is participating in the FSS program.

The amount of the escrow credit can be calculated using Form HUD-52652, or another document which incorporates the procedures in Form HUD-52652.

The

amount of the escrow credit will vary depending on the income level

of each FSS family and is based on increases of earned

income

since the effective date of the contract of participation. If the

family’s adjusted income exceeds the lower-income limit in the

jurisdiction in which the FSS family is living (the amount on line 3

is greater than the amount on line 2), the family does not qualify

for an escrow credit. In such cases, line 4 - line 22 of Form

HUD-52652 will not be completed.

The

amount of the escrow credit will vary depending on the income level

of each FSS family and is based on increases of earned

income

since the effective date of the contract of participation. If the

family’s adjusted income exceeds the lower-income limit in the

jurisdiction in which the FSS family is living (the amount on line 3

is greater than the amount on line 2), the family does not qualify

for an escrow credit. In such cases, line 4 - line 22 of Form

HUD-52652 will not be completed.

Previous Editions are Obsolete |

form HUD-52652 (1/14) ref. Handbook 7420.8 |

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Dorsett, Darrin C |

| File Modified | 0000-00-00 |

| File Created | 2022-04-05 |

© 2026 OMB.report | Privacy Policy