EIA-914 instructions Sep 14 2020

Monthly Crude Oil and Lease Condensate, and Natural Gas Production Report

EIA-914 instructions Sep 14 2020

OMB: 1905-0205

U.S.

Department of Energy

U.S.

Department of Energy

U.S. Energy Information Administration 1000 Independence Ave., S.W. Washington, DC 20585

OMB No. 1905-0205

Expiration Date: 12/31/2023

Burden: 4.0 hours

MONTHLY CRUDE OIL AND LEASE CONDENSATE, AND NATURAL GAS PRODUCTION REPORT

TRANSMITTAL INSTRUCTIONS (EIA-914)

............................................................................................................................................................................................................................................

CONFIDENTIALITY OF INFORMATION

The information you provide on Form EIA-914 will be used for statistical purposes only and is confidential by law. In accordance with the Confidential Information Protection and Statistical Efficiency Act of 2002 and other applicable Federal laws, your responses will not be disclosed in identifiable form without your consent. Per the Federal Cybersecurity Enhancement Act of 2015, Federal information systems are protected from malicious activities through cybersecurity screening of transmitted data. Every EIA employee, as well as every agent, is subject to a jail term, a fine, or both if he or she makes public ANY identifiable information you reported.

REQUIRED RESPONDENTS

This report is mandatory under the Federal Energy Administration Act of 1974 (Public Law 93-275). Failure to comply may result in criminal fines, civil penalties, and other sanctions as provided by law. Title 18 USC 1001 makes it a criminal offense for any person knowingly and willingly to make to any Agency or Department of the United States any false, fictitious, or fraudulent statements as to any matter within its jurisdiction.

Form EIA-914 must be completed by selected operators of crude oil and natural gas wells in the United States that produce crude oil and natural gas, including federal and state offshore well operators. The operator is the person, company, or entity recognized by state or federal regulatory agencies as the operator. The operator should report 100% of the production for wells that they operate.

PURPOSE

The U.S. Energy Information Administration’s (EIA) Form EIA- 914, Monthly Crude Oil and Lease Condensate, and Natural Gas Production Report, collects information on crude oil and natural gas production by operators in the United States. The data collected are used to estimate production of crude oil and natural gas in the United States. A summary of the data will appear in the following EIA publications: Natural Gas Monthly, Natural Gas Annual, Petroleum Supply Annual, Petroleum Supply Monthly, Monthly Energy Review, Annual Energy Review, Annual Energy Outlook, and the EIA website.

RESPONSE DUE DATE

The monthly reporting period is the calendar month. The data must be submitted on a monthly basis within 40 days after the reporting period. For example, data reported for June 2018 must be submitted no later than August 9, 2018. If the 40th day falls on a weekend or national holiday, the data must be submitted by

the next business day.

EIA recognizes that some operators may not have the information readily available for each state. If your company does not maintain this information, estimates of the volumes may be provided. The estimating procedure and data supporting the estimates should result in a reasonably accurate estimate that may be subject to EIA review.

RESUBMISSIONS

Submit the entire revised EIA-914 form if either of the following conditions apply:

If the reported gross withdrawals (production) or lease production (sales) is revised by more than +/- 150 million cubic feet (MMcf), in either or both of the previous two months, for any state or area.

If the reported crude oil and lease condensate is revised by more than +/- 1,000 barrels (bbls), in either or both of the previous two months, for any state or area.

EIA reserves the right to request resubmissions as part of the data quality review process.

HOW TO FILE A RESPONSE

The form must be submitted to EIA via electronic filing using the Data XChange Portal. The Data XChange Portal is a secure web- based application that will enable you to upload a PDF transmittal sheet, enter data interactively using a web form, or conduct system- to-system transfers.

Secure File Upload: You may upload the required data securely to the Data xChange Portal using the pre- formatted PDF file layouts provided by EIA. Any other formats or file types will not be accepted. Follow the instructions found on the Data xChange Portal to securely upload your file.

Web Form: You may enter the required data manually via a web form into the Data XChange Portal. Follow the instructions found on the Data XChange Portal to complete the online form.

QUESTIONS

If you have any questions about this U.S. Energy Information Administration (EIA) survey after reading the instructions, please contact the EIA Survey Support Team Contact Center at 1-855- EIA-4USA (1-855-342-4872) or send an email to eia4usa@eia.gov.

SECTION 1: RESPONDENT IDENTIFICATION

(Campaign Header Information)

Campaign header information can be found on the landing page of the Data xChange Community Portal after you have logged into your account under the open campaigns section.

Campaign Name: The name of the survey form and report period for which data are being collected.

Account Name: Name of the company.

Alias: Doing Business As (DBA) or secondary name of the company.

Account City: City in which the company is located.

Account State: State in which the company is located.

SECTION 1A: SALES, ACQUISITIONS, AND AFFILIATED COMPANIES

For this report period, are you including any recently acquired properties (leases, wells, fields, other companies, etc.) for the first time?

Select YES and list all companies and states involved if:

Your company acquired properties that resulted in more than a 150 million cubic feet (MMcf) per month increase in reported gross withdrawals or lease production for any state or area, OR

Your company acquired properties that resulted in more than a 1,000 barrel (bbl) per month increase in reported oil production for any state or area.

Report only transactions affecting operated properties.

Note:

Use

the two character state abbreviation, to identify where the

properties are located. See list

below.

Use

the two character state abbreviation, to identify where the

properties are located. See list

below.

Otherwise, select NO.

Include any comments in the textbox.

For this reporting period, have you excluded any divested (or sold) properties (leases, wells, fields, etc.) for the first time?

Select YES and list all companies and states involved if:

Your company divested properties that resulted in more than a 150 million cubic feet (MMcf) per month decrease in reported gross withdrawals or lease production for any state or area, OR

Your company divested properties that resulted in more than a 1,000 barrel (bbl) per month decrease in reported oil production for any state or area.

Report only transactions affecting operated properties.

Note:

Use the two character state abbreviation, to identify where the properties are located. See list below.

Otherwise, select NO.

Include any comments in the textbox.

For this report period, are you completing this form for a combined group of subsidiary/affiliated companies?

Select YES and list the subsidiary/affiliated companies if:

Your company is completing this form for a combined group of subsidiary/affiliated companies.

Otherwise, select NO.

Include any comments in the textbox.

SECTION 2: MONTHLY NATURAL GAS PRODUCTION

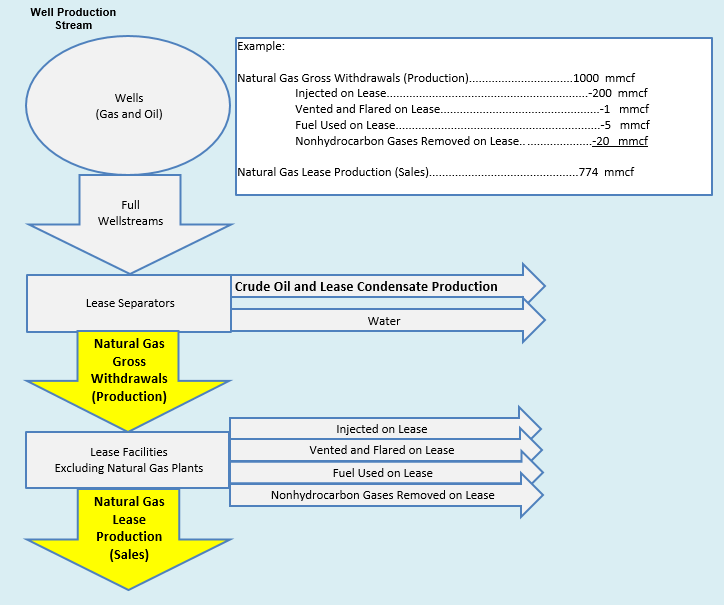

The graphic below is an example that represents the well production stream. Use it as a guide to answer the questions below.

For the Monthly Natural Gas Production section, report:

100% of the production for wells that you or your company operates. This includes natural gas production associated with both oil wells and gas wells operated by the company within a state. This is also called the "Gross Operated" or "8/8ths Basis" production.

All production of natural gas in million cubic feet (MMcf) rounded to the nearest million (no decimals).

Natural gas volumes at a pressure of 14.73 psia and 60 degrees Fahrenheit. If your pressure base is different from 14.73 psia, convert your volumes to 14.73 psia. To do this, calculate a pressure adjustment factor for each state or federal offshore area. This adjustment factor is the value of your pressure base at 60 degress Fahrenheit divided by 14.73. Multiply all your volumes by this factor and report the resulting values. For example, if your pressure base is 15.025 psia at 60 degrees Fahrenheit, your factor will be 15.025/14.73=1.02. Call the EIA-914 helpline if you need assistance at 1-855-342-4872.

Zero (0) if operated properties in any area produce no natural gas. If there are no operated properties in an area, leave the cell blank for that area.

For the reporting period only.

Reasonable estimates if necessary to meet the EIA-914 due date.

Note:

Include gas production form both oil wells and gas wells.

Prior period adjustments (correcting past errors by adjusting current month’s volumes) are not accepted. Corrections must be submitted as a revision to the actual month the oil or natural gas was produced if it results in a change to previously reported data by more than the resubmission policy thresholds referenced on page one.

For each state or federal offshore area that your company produced natural gas in, what are the natural gas gross withdrawals (production) and the natural gas lease production (sales)? Definitions for Natural Gas Gross Withdrawals and Natural Gas Lease Production can be found on page 5. Include any comments in the textbox.

SECTION 3: MONTHLY CRUDE OIL AND LEASE CONDENSATE PRODUCTION

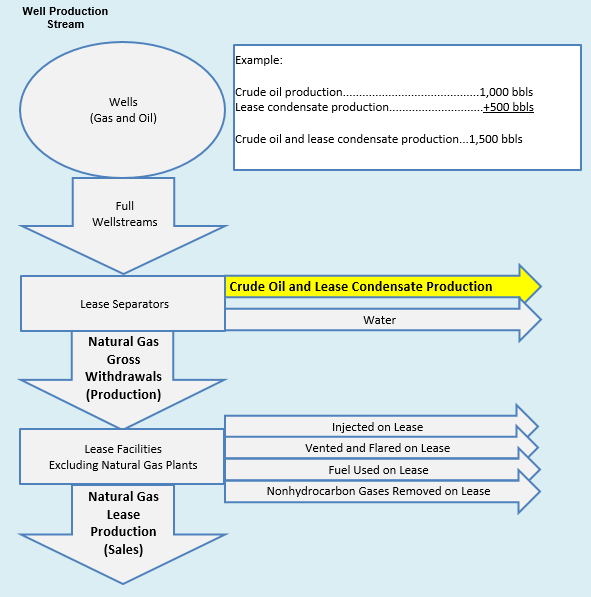

The graphic below is an example that represents the well production stream. Use it as a guide to answer the questions below.

For the Monthly Crude Oil and Lease Condensate Production section, report:

100% of the production for wells that you or your company operates. This includes all crude oil and lease condensate production associated with both oil wells and gas wells operated by the company within a State. This is also called the "Gross Operated" or "8/8ths Basis" production.

All production of crude oil and lease condensate (combined) rounded to the nearest barrel (no decimals).

Zero (0) if operated properties in any area produce no crude oil and lease condensate. If there are no operated properties in an area, leave the cell blank for that area.

For the reporting period only.

Reasonable estimates if necessary to meet the EIA-914 due date.

Note:

Include crude oil and lease condensate production form both oil wells and gas wells.

Prior period adjustments (correcting past errors by adjusting current month’s volumes) are not accepted. Corrections must be submitted as a revision to the actual month the oil or natural gas was produced if it results in a change to previously reported data by more than the resubmission policy thresholds referenced on page one.

For each state or federal offshore area that your company produced crude oil and lease condensate in, what is the total volume of crude oil and lease condensate produced? Crude oil and lease condensate is defined as liquid hydrocarbons recovered from lease separators or field facilities. Include any comments in the textbox.

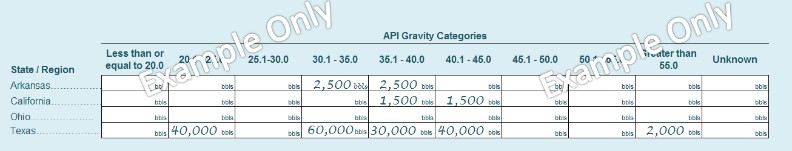

SECTION 4: CRUDE OIL & LEASE CONDENSATE RUN TICKET VOLUMES (SALES) BY API GRAVITY

For the Crude Oil & Lease Condensate Run Ticket Volumes (Sales) by API Gravity section, report:

The crude oil and lease condensate run ticket volumes by each API gravity category for each state where this operator has producing wells (see example below).

The volume of crude oil and lease condensate by API gravity category rounded to the nearest barrel (no decimals).

Crude oil and lease condensate volumes by API gravity categories at 60 degrees Fahrenheit.

For the reporting period only.

Reasonable estimates if necessary to meet the EIA-914 due date.

Do NOT Report:

The average API gravity for each state.

Note:

If the sales volumes are unavailable, please report the production volumes by API Gravity Category.

Leave cells blank for any state or region that the operator is not operating producing wells or has no sales.

Prior period adjustments (correcting past errors by adjusting current month’s volumes) are not accepted. Corrections must be submitted as a revision to the actual month the oil or natural gas was produced if it

results in a change to previously reported data by more than the resubmission policy thresholds referenced on page one.

Example:

For the reporting period, Operator X has 5,000 bbls sold in Arkansas as reported on their run tickets. Of those 5,000 bbls sold, 2,500 bbls have an API gravity of 34 and 2,500 bbls have an API gravity of 36.

For the reporting period, Operator X has another 3,000 bbls sold in California as reported on their run tickets. These 3,000 bbls are from one well in California. However, 1,500 of these bbls are reported on the run tickets as having an API gravity of 39. The remaining 1,500 bbls, from the same well, are reported as having an API gravity of 41.

Operator X has no sells in Ohio during the reporting period.

Operator X operates many wells in Texas. Operator X groups all of their Texas run tickets by these API gravity categories and then sums them for each API gravity category. For the reporting period, Operator X reports 40,000 bbls in the 20.1-25.0 API gravity category, 60,000 bbls in the 30.1-35.0 API gravity category, 30,000 bbls in the 35.1-40.0 API gravity category, 40,000 bbls in the 40.1-45.0 API gravity category, and 2,000 bbls in the greater than 55.0 API gravity category, for a total of 172,000 bbls in Texas.

This is how Operator X would complete the table.

Report the amount of crude oil and lease condensate by API Gravity Category for each state for your operated wells. For each state, group your run tickets, corrected to 60 degrees Fahrenheit, by API Gravity Category, and then sum them.

Do you have any comments for API Gravity data reported in 4.1? Include any comments in the textbox.

DEFINITIONS

Flared/Vented: Natural gas that is disposed of by releasing it into the atmosphere (venting) or burning (flaring).

Natural Gas Gross Withdrawals: Natural gas after lease separation, including all natural gas plant liquids, nonhydrocarbon gases, gas injected, gas flared and vented, and gas production used as fuel on the lease. Also includes production delivered as royalty payments.

Crude Oil and Lease Condensate: Liquid hydrocarbons recovered from lease separators or field facilities.

Lease Separator: A facility installed at a well or field for the purpose of separating the full well stream volume into its components. For oil wells, these components include produced crude oil, natural gas, and water. For gas wells, these components include produced natural gas, lease condensate, and water.

Natural Gas Lease Production: Gross withdrawals of natural gas minus gas production injected on the lease, vented on the lease, flared on the lease, used as fuel on the lease, and nonhydrocarbon gases removed in treating or processing operations on the lease.

Nonhydrocarbon Gases: Typical nonhydrocarbon gases that may be present in produced natural gas, such as carbon dioxide, helium, hydrogen sulfide, nitrogen, and water vapor.

Run Ticket or Sales Receipt: Receipt containing the volume and API gravity of oil that has been sold. The payment amount is based on the run ticket information.

SANCTIONS

The timely submission of Form EIA-914 by those required to report is mandatory under Title 15 U.S.C. §772(b), as amended. Failure to respond may result in a civil penalty of not more than $10,633 each day for each violation. The government may bring a civil action to prohibit reporting violations that may result in a temporary restraining order or a preliminary or permanent injunction without bond. In such civil action, the court may also issue mandatory injunctions commanding any person to comply with these reporting requirements.

REPORTING BURDEN

Public reporting burden for this collection of information is estimated to average 4.0 hours per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information including suggestions for reducing this burden to: Energy Information Administration, Statistical Methods and Research, EI-21, 1000 Independence Avenue, S.W., Washington, D.C. 20585; and to the Office of Information and Regulatory Affairs, Office of Management and Budget, Washington, D.C. 20503.

EIA-914 Monthly Crude Oil and Lease Condensate, and Natural Gas

Production Report– Question Instructions

Page

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | EIA-914 Instructions |

| Author | U.S. Energy Information Administration |

| File Modified | 0000-00-00 |

| File Created | 2021-08-03 |

© 2026 OMB.report | Privacy Policy