Supporting Statement URI Part A 20170706

Supporting Statement URI Part A 20170706.docx

Risk Preferences and Demand for Crop Insurance and Cover Crop Programs (RPDCICCP)

OMB: 0536-0076

Supporting Statement for

Risk Preferences and Demand for Crop Insurance and Cover Crop Programs

Section A

Justification

Circumstances making the collection of information necessary

ERS currently models the demand for federal crop insurance and cover crop promotion programs as part of multiple research objectives. Federal crop insurance programs and soil conservation programs, including those that promote use of cover crops, can significantly alter the farm revenue risk profile for the farmers who adopt them. Whether farmers will choose to adopt insurance and/or soil conservation programs depends on the individual risks faced by each farmer, which can vary across different regions, crops, and time periods, as well as how farmers assess the costs of the risks that they face. In practice, large premium subsides are necessary to induce widespread enrollment by farmers in federal crop insurance, and few US farmers adopt the maximum possible levels of crop insurance. Similarly, enrollment in soil conservation programs represents a small fraction of eligible farmers. Under reasonable assumptions about the risk profiles that farmers face, the high premium subsidy rates necessary to induce insurance enrollment, the low adoption levels for the highest insurance coverage rates, and the low adoption rates for soil conservation programs are all inconsistent with traditional theories of farmer decision-making under risk (Pannell et al, 2000; Babcock, 2015; Du et al., 2016).

ERS’ economic models, however, rely on traditional economic theories of farmer decision-making under risk, and over-predict participation rates for all of these programs. Two reasons have been put forth to explain the divergence between model predictions and actual program adoption rates (see Sydnor, 2010, Barseghyan et al, 2013, Babcock, 2015, Du et al, 2016, and Attachment C).

First, existing economic models do not account for interaction effects between different risk management programs. Econometric studies about the joint effects of both types of programs on farm revenues and environmental outcomes are few and inconclusive. This research is difficult to conduct with observational or administrative data due to the heterogeneity of US farms and production practices, the variety and complexity of real-world programs, and the limited variation in premium subsidies across the US farming population.

Second, the behavioral mechanisms used by ERS to model farmer decision-making under risk may be outdated. The classical economic model of risk preferences is called expected utility or “EU” (von Neumann and Morgenstern, 1944). Under the EU model, risk impacts how individuals assess the value of a decision. The EU model classifies individuals as risk-seeking, risk-neutral, or risk-averse depending on their idiosyncratic taste for risk. A farmer who behaves with EU risk aversion would be expected to fully insure against risk and to avoid any cover crop investments that increase the variance of production risk.

In practice, few farmers adopt the maximum possible levels of crop insurance and, more generally, high premium subsidies are necessary to induce widespread enrollment. In addition, enrollment in soil conservation programs represents a small fraction of eligible farmers. Several competing theories of decision-making under risk – collectively referred to as non-EU preferences – all predict that farmers will purchase less insurance than the levels predicted with EU preferences. Cumulative Prospect Theory (CPT) incorporates a number of features of observed decision making under risk that are not accurately captured by the EU model, including loss aversion, over-weighting of rare probabilities, and evaluating risks relative to a reference point instead of relative to current wealth holdings (Tversky and Kahneman, 1992; Camerer, 2004). Myopic loss aversion (MLA) predicts that individuals will be more loss averse over short-term risky decisions than over longer-term repeated decisions (Benartzi and Thaler, 1995; Thaler et al, 1997).

CPT and MLA risk preferences have been proposed to explain the patterns of program adoption observed for commodity support programs, federal crop insurance, and cover crop promotion programs. They have been hypothesized as possible reasons for discrepancies between economic model predictions and actual enrollment decisions. Testing the predictions of these theories, however, cannot be performed with existing survey or administrative sources because of the complexity of real-world risk environments and a lack of instruments to identify preferences over a suitable range of risky gains and losses. This study will collect the data necessary to accurately measure CPT and MLA preferences, and test for correlations between these preferences and demand for stylized versions of crop insurance and cover crop programs in a simplified laboratory environment.

The standard approach for studying the effect of behavioral economic theories is to use experiments to measure an individual’s preferences, and correlate his/her preferences with decisions made in simple experimental tasks involving risk and/or real-world decisions. We propose to use an experiment with student subjects to measure (1) subjects’ risk preferences, and (2) subjects’ joint crop insurance and cover crop demand elasticities. The experiment will use simplified versions of real-world programs to allow us to identify the relationship between different behavioral theories and program adoption decisions. The experiment will also introduce controlled variation in premium subsidy rates to allow us to observe how subjects’ trade-off across different risk management strategies over a wide range of subsidy levels.

We propose to conduct this experiment using a convenience sample of student subjects. It is common practice in academic research to test experiments with student subjects before replicating the experiment with more difficult to reach populations (Gneezy and Potters, 1997; Harrison and List, 2004; Levitt and List, 2007). Additionally, our proposed experiment will test the theoretical predictions of behavioral economic risk models—noting that results of tests of theoretical predictions are more likely to generalize across diverse subject pools than measurements of idiosyncratic preferences alone.1

The information to be collected under this proposed study is needed to provide evidence as to which theories best predict joint adoption of cover crop and crop insurance programs. This research will be exploratory in nature, and will be used to gain insights into specific economic behaviors regarding decision-making under risk. This research will not be used to generate population estimates, and the results from the proposed study design are not intended to be generalizable outside of the study participants. Results from this experiment will be used to inform future experimental research studies for risk management decision-making with more representative samples.

Data collection for this project is authorized by the 7 U.S.C. 2204(a) (see Attachment A: 7 USC 2204a).

Purpose and use of the information collection

This experiment will examine the link between risk preferences and demand for risk management programs. We propose to use a laboratory experiment to (1) characterize the relationship between cover crop usage and crop insurance purchases, and (2) explore how this relationship depends on individuals’ risk preferences and demographic characteristics. Outputs from the proposed experiment will be used to inform future risk management experiments with farmer subjects.

The experiment will be conducted with student subjects from the University of Rhode Island. Subjects will be recruited using email communications and classroom solicitations. Sessions will be conducted at the Department of Environmental and Natural Resource Economics’ Policy Simulation Laboratory (SimLab) at the University of Rhode Island.

We will measure the effect of varying subsidy rates on subjects’ demand for stylized goods that mimic crop insurance and cover crop investments. We will also vary the riskiness of experimental earnings between subjects. These between subject treatments to vary experimental earnings will mimic the differences in farm revenue risks across key subpopulations of US farmers including producers with marginal lands and producers of high value crops. With these between subject treatments, we will test whether subjects’ demand for the experimental crop insurance and cover crop investments changes on average with differences in earnings risk. In the course of measuring differences in subjects’ demand for the stylized crop insurance and cover crop investments, we will also observe which types of risk preferences best explain subjects’ purchases of the stylized crop insurance and cover crop investments. By studying these issues, we will be able to gain insight into behavioral theories that are important for modeling uptake of crop insurance, commodity support, and cover crop promotion programs.

The specific research questions addressed by the proposed study are:

Do measurements of individuals’ CPT risk preferences correlate with individual’s estimated demand elasticities for crop insurance and/or cover crop programs?

Do measurements of individuals’ MLA risk preferences correlate with individual’s estimated demand elasticities for crop insurance and/or cover crop programs?

What is the effect of changing premium subsidies on subjects’ demand for crop insurance and cover crop programs?

What are the causal effects of changes in the mean and variance of revenue on subjects’ demand for crop insurance and cover crop programs?

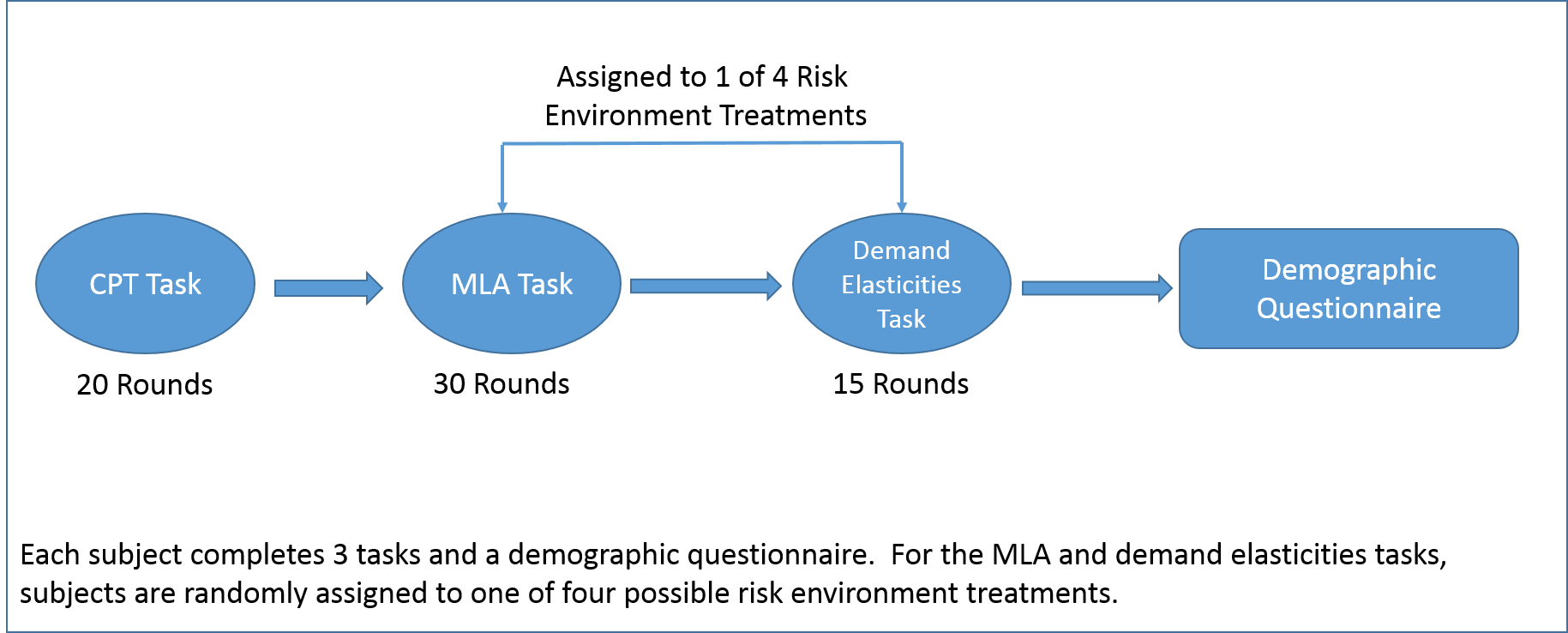

Figure 1: Schematic of Experimental Design

Figure

1 provides a schematic of the experimental design. Each subject will

be randomly assigned to one of four possible risk environments.

Within their assigned risk environment treatment, each subject will

complete three different tasks: a task to measure Cumulative Prospect

Theory (CPT) risk preferences, a task to measure Myopic Loss Aversion

(MLA) risk preferences, a task to measure insurance and cover crop

demand elasticities. The CPT and MLA tasks will measure different

types of risk preferences using methods which are standard for the

academic literature on experimental risk elicitations. The third

task will measure demand elasticities jointly for stylized crop

insurance purchases and cover crop decisions.

The CPT, MLA, and demand elasticities tasks will consist of a number of rounds2 where subjects’ make a series of decisions involving risk. The CPT task will consist of 20 rounds, the MLA task will consist of 30 rounds, and the demand elasticities task will consist of 15 rounds. Each round of each task will require a subject to evaluate one or more risky decisions. Detailed descriptions of all tasks are included in Attachment B: Experimental Design Protocol. Each subject will complete all 65 rounds and a brief demographic questionnaire within a 90 minute period.

Risk environment treatments will vary the amount of risk attached to subjects’ earnings in the MLA and demand elasticities tasks. The four possible risk environment treatments are (1) low expected revenue and low revenue risk, (2) high expected revenue and low revenue risk, (3) low expected revenue and high revenue risk, and (4) high expected revenue and high revenue risk. Detailed descriptions of all risk environment treatments are included in Attachment B: Experimental Design Protocol. Subjects will be equally allocated to all treatments as shown in the Table 1. We will also provide to OMB additional documentation in a separate whitepaper for the theoretical predictions of expected utility, cumulative prospect theory, and myopic loss aversion on crop insurance demand, and document the suitability of our experimental design for detecting the different effects of these theories on our experimental outcomes at the conclusion of this study.

Table 1: Allocation of Subjects to Risk Environment Treatments

|

Low Expected Revenue |

High Expected Revenue |

Total |

Low Revenue Risk |

125 |

125 |

250 |

High Revenue Risk |

125 |

125 |

250 |

Total |

250 |

250 |

500 |

Ex-post data analysis will include coefficient estimates of risk parameters and demand elasticities; estimates of correlation coefficients between risk parameter estimates, elasticity estimates, and demographic characteristics; and univariate comparisons of demand elasticities and correlation coefficients under the different environmental treatments (F-tests, t-tests and non-parametric tests). An additional ex-post analysis will be conducted to examine the relationship between payment amounts and performance for the risk elicitation task. This analysis will entail within-subject univariate comparisons of risk parameter coefficient estimates under different payment scales used in the risk elicitation task (F-tests, t-tests and non-parametric tests). The results of this analysis will be provided to OMB in a separate whitepaper upon completion of this study.

Results will be exploratory in nature and used to inform future experiments to study risk management decision-making with more representative subjects/samples. Results may be shared with other agencies within USDA, but will not be used to evaluate existing policies or directly inform new policy making. Results may be disseminated as presentations and publications for academic and professional audiences, but will not be used to prepare official agency statistics. We will provide separate documentation to OMB for how this exploratory research will inform further ERS research on risk preferences to clarify the practical utility of this study upon completion of this study.

All questions in the demographic questionnaire were designed to require low cognitive effort for subjects to answer. 6 out of 28 questions require a numerical response. The remaining 22 questions are either binary responses or Likert scale answers. Questions 16-21 and 23 were specifically adapted from questions used in the Agricultural Resource Management Survey (ARMS)3 in order to facilitation comparisons between results from this proposed experiment and future experiments with farmer subjects.

1. Question 1: Gender has a strong correlation with risk preferences and decision-making under risk. This has been demonstrated robustly for student subjects (Holt and Laury, 2002; Eckel and Grossman, 2008a; Borghans et al, 2009; Croson and Gneezy, 2009; Sapienza et al, 2009) and non-student subjects (Jianakoplos and Bernasek, 1998; Halek and Eisenhauer, 2001; Dohmen et al, 2011; Charness and Gneezy, 2012), as well as for US farmers (Rosch, 2017).

2. Questions 2 and 3: Age has a strong correlation with risk preferences and decision-making under risk. This has been demonstrated robustly for non-student subjects (Riley and Chow, 1992; Halek and Eisenhauer, 2001; Harrison et al, 2007; Dohmen et al, 2010; Dohmen et al, 2011), and farmers (Bocqueho et al, 2014; Rosch, 2017). Experiments with student subjects, however, do not always find correlations between age and risk preferences (Holt and Laury, 2002; Eckel and Grossman, 2008a). By including a question about class standing, we include an extra control for age-related experience which may be relevant for student populations (Zocco, 2009).

3. Questions 4, 5, and 6: These three questions deal with cognitive aptitude, and are used to control for unobservable differences in subjects’ ability to follow the rules of the experiment. GPA and ACT/SAT scores are measures of cognitive ability; choice of major is self-explantory. Risk attitudes have been shown to correlate with choice of major in student populations (Zocco, 2009) and with cognitive ability in non-student populations (Dohmen et al, 2010). Additionally, cognitive ability has been shown to predict of choice of major and post-schooling labor market outcomes (Heckman et al, 2006).

4. Question 7: Zip code of high school address provides information about the student’s parents neighborhood, which is commonly used to infer parental household income levels from census data (Eckel and Grossman, 2008b; Karlan et al, 2011; Chetty et al, 2016). Some studies find that income is correlated with risk attitudes for student subjects (Holt and Laury, 2002) while others do not (Bruhin et al, 2010). However, income and farm capital investments are correlated with risk attitudes for US farmers (Rosch, 2017). We choose to focus on parental household income instead of student household income as students may not be financially independent from their parents. Also, we request household zipcode information in lieu of direct reporting of income or wealth as students may not be able to accurately report information on behalf of their parents.

5. Question 8: Experience with participating in laboratory experiments has been shown to impact experimental results for market experiments (Hussam et al, 2008) and public goods experiments (Zelmer, 2003) but not repeated experimental elicitations for willingness to pay (Despositario et al, 2009) or risk aversion (Baucells and Villasis, 2010). Our experiment uses an experimental task for estimating insurance demand elasticities. Because aspects of this task are similar to bidding in market experiments, we include a control for this characteristic.

6. Questions 9-12: These questions assess subjects’ exposure to economics and statistics coursework, two disciplines which rely heavily on mathematics. Mathematical skills have been shown to correlate with accuracy and precision of measurements of risk aversion for two commonly-used risk elicitation methods (Dave et al., 2010). There is also evidence to suggest that the extent of economics training influences subject decision-making for public goods games (Marwell and Ames, 1981; Zelmer, 2003).

7. Questions 13-15: These questions control for saliency of the experimental procedures. Question 13 measures students’ self-perception about their own comprehension of the rules of the experiment. This question has been used for this purpose in many different economics experiments (Eckel and Grossman, 2000; Ferraro et al, 2003; Davis and Millner, 2005; Crumpler and Grossman, 2008). Question 14 measures students’ non-financial motivations for participating in the experiment, which have been shown to override financial incentives in some experimental contexts (Camerer et al, 1999; James, 2005). Question 15 measures how easily students could afford to go out to dinner. Going out to dinner is an expenditure likely to be familiar for students with a local value equivalent to $10-25. Our experimental design has a subject participation fee of $10 and expected earnings between $20-25. The literature shows that low show up fees introduce selection bias for non-student subjects (Harrison et al, 2009). Risk averse individuals tend to be more likely to be motivated to participate in experiments for low show-up fees than more risk tolerant types. However, the literature has not explored whether risk averse types are also more likely to be motivated by performance payments in addition to show-up fees. A student who can easily afford an expenditure of $10-25 may be less motivated by performance payments than a student who is less able to afford this level of expenditure. Because this is a potential confounding factor for our ex-post data analyses, we include this question to characterize subjects’ cash constraints over small dollar amounts.

8. Questions 16-21: These questions measure access to credit, and use of real financial options and insurance products. Risk attitudes have been shown to be correlated with use of savings, investments, and insurance products for US farmers (Rosch, 2017). These questions are adapted from standard ARMS survey questions to measure use of savings, financial investments, and insurance for farm and household vehicles, equipment, and machinery. The wording was adapted to use the financial, insurance, and credit products relevant for student populations.

9. Question 22: Purchase of lottery tickets is correlated with myopic behavior in non-student subjects (Haisley et al, 2008). Including this question allow us to compare the consistency of experimental measures of myopia with a survey based measure of myopia.

10. Questions 23-28: These questions measure risk attitudes in a number of different contexts. Including these questions allows us to compare the consistency of our experimental measure of risk aversion with these survey based measures of risk aversion. Question 23 exactly replicates a question used in the 1996, 2001, and 2014 ARMS surveys. Questions 24-28 replicate Question 23 in five different contexts that are likely to be familiar to students, and have been shown to be well-correlated with risk preferences and actual risky behaviors for non-student subjects (Dohmen et al, 2011). It is important to measure risk attitudes in multiple contexts because an individual’s risk preferences may appear different when examining their real-world decisions in different risky contexts (Einav et al, 2012).

Use of improved information technology and burden reduction

ERS will employ information technology to reduce the burden of respondents who agree to participate in this research. The proposed experiment will be conducted at the Department of Environmental and Natural Resource Economics’ Policy Simulation Laboratory (SimLab) at the University of Rhode Island. Subjects will participate in the experiment through custom-designed software on laboratory computers. The software was pre-tested and refined to improve the user experience and reduce the cognitive burden on subjects (see Attachment H: Pretest Report).

Efforts to identify duplication; use of similar information

Multiple literature reviews were completed in support of this proposed study. These reviews included (1) the interaction between cover crops and crop insurance programs on agricultural production decisions, (2) the connection between risk preferences and adoption of risk management strategies, including use of insurance, and (3) experimental methods for studying risk preferences and insurance in laboratory sessions. We will provide to OMB an additional comprehensive review of the experimental economics literature on risk preferences to complement the literature reviews included below. This comprehensive review will be prepared concurrently with the rest of the activities proposed in this research study.

The first review concentrated on the interaction between cover crops and crop insurance programs on agricultural production decisions. In the agricultural economics literature, risk has long been recognized as an important driver of agricultural production decisions (see Antle, 1983; Hardaker, 2004; Chavas et al, 2010; Just and Pope, 2013). Risk has been shown to affect a wide-range of decisions including use of pesticides (Pannell, 1991), adoption of cover crops (Snapp et al, 2005; Schipanski et al, 2014), and adoption of crop insurance (Goodwin and Kastens; 1993; Smith and Baquet, 1996; Coble et al, 1996; Velandia et al, 2009).

Cover crops and crop insurance impact farmers’ incentives to apply chemical fertilizers and pesticides because of their effect on farmers’ risk exposure. Cover crops improve soil quality (Dabney et al, 2001; Hartwin and Ammon, 2002), which should reduce the demand for fertilizer applications. On the other hand, crop insurance reduces farmers’ financial losses in the event of a bad crop. This gives farmers incentives to augment their fertilizer applications because the increased costs can be partially offset by crop insurance indemnity payments. However, the individual and joint effects of cover crops and crop insurance on farmers’ actual use of chemical inputs are unclear.

Many empirical studies have attempted to identify an effect of crop insurance on agricultural chemical use in the US with mixed outcomes (Horowitz and Lichtenberg, 1993; Smith and Goodwin, 1996; Coble et 1997; Roberts et al, 2006). Field experiments with farmers in northern Ghana, however, found that providing crop insurance increases on-farm investments in fertilizer applications (Karlan et al, 2014). An ERS analysis of the joint impact of crop insurance and commodity support programs on agricultural production decisions noted that the empirical studies to date on the effect of cover crops and crop insurance on fertilizer applications and environmental outcomes have been few, limited in scope, and overall inconclusive (see Attachment C: ERS literature review). Our literature review revealed no previous experimental studies looking at the joint impact of cover crops and crop insurance.

The second literature review focused on the connection between risk preferences and adoption of risk management strategies, including use of insurance. The econometric literature (Sydnor, 2010; Barseghyan et al., 2013) and the experimental literature (Shapira and Venezia, 2008; Richter et al., 2014; Jaspersen, 2015; Harrison and Ng, 2016) both support the idea that insurance purchases are motivated by non-EU preferences but are inconclusive about which type of preferences best explain their findings. Econometric and simulation studies to assess whether farmers’ crop insurance adoption rates are consistent with non-traditional models of risk preferences support the idea that farmers’ crop insurance purchases are driven by non-EU risk preferences (Du et al, 2016; Babcock, 2015). However, these studies involve non-representative samples of farmers, consider crop insurance investments in isolation from all other risk management strategies, and are unable to determine which type of non-EU preferences best explain adoption decisions.

The third literature review covered experimental methods for studying risk preferences and insurance in laboratory sessions. Jaspersen (2016) synthesized 95 experiments published in top tier journals since 1980 and discussed the methodological issues around decision context, risk elicitation procedure, and remuneration procedures. Few of these studies considered crop insurance, and only one those experiments involved real monetary payments to subjects. In that study, Slovic et al. (1977) found that subjects are more willing to purchase insurance in a farming context than in a generically framed context. In this experiment, however, subjects had three possible mechanisms for mitigating risk: insurance, crop allocation, and use of inputs. Thus, the results about the connection between risk preferences and crop insurance are confounded by the presence of the other risk management strategies in the experiment. Additionally, the researchers did not attempt to explicitly measure subjects’ risk preferences.

Of the experiments that we reviewed, the one most similar to our proposed design is Kunreuther and Michel-Kerjan (2015). Kunreuther and Michel-Kerjan looked at demand for multi-year insurance contracts against hurricane damage in Florida, and found higher demand for multi-year contracts than for single-year contracts. Our design differs from theirs in four crucial ways. First, we look at crop insurance instead of home owners’ insurance, which is important because farmers tend to treat crop insurance differently than conventional insurance products (Babcock, 2015). Second, we vary insurance prices within subjects in order to estimate demand elasticities; Kunreuther and Michel-Kerjan’s study had fixed prices which limited the types of ex-post data analysis they could conduct. Third, we vary risk exposure between subjects in order to understand the impact of risk exposure on insurance demand; in Kunreuther and Michel-Kerjan, all subjects faced the same risk exposure. Finally, Kunreuther and Michel-Kerjan look at insurance demand in isolation. Our design looks at how the presence of an alternate risk management device (cover crops) impacts crop insurance demand.

Impact on small businesses or other small entities

No respondents will be small businesses. All respondents for this study will be students recruited to participate in experiments on the campus of the University of Rhode Island.

Consequences of not conducting data collection, or of collecting information less frequently

The proposed study will support an initiative to develop more robust and efficient models of demand for risk management programs that will benefit subsequent ERS and USDA information collections. Current ERS research using economic models based on traditional risk preference theories over-predict adoption rates, farmer benefits, and program costs for a variety of risk management programs. The quality of research that ERS can provide to its stakeholders will be increased if ERS is able to utilize state-of-the-art experimental research approaches to validate alternative models of risk preferences. Experimental studies are often the only empirical tool capable of identifying and assessing the impacts of the behavioral mechanisms that drive real-world decision-making.

Special circumstances that would cause an information collection to be conducted so as to require respondents to report information to the agency more often than quarterly

There are no special circumstances associated with this information collection. All responses will be one time responses.

Comments in response to the Federal Register Notice and efforts to consult outside the agency

This clearance package was posted in the Federal Register on 16 September 2016 as Department of Agriculture Economic Research Service Notice of Intent to Request New Information Collection, Vol. 81, No. 180 Federal Register (September 16, 2016) (see Attachment I Federal Register Notice). No comments have been received from the public.

Our research team includes external members Dr. Thomas Sproul and Dr. Charles Holt. Dr. Sproul is an assistant professor in the Department of Environmental & Natural Resource Economics at the University of Rhode Island. He has expertise in agricultural economics and policy, risk modeling, and behavioral and experimental economics. Dr. Holt is the A. Willis Robertson Professor of Political Economy at the University of Virginia. He is acknowledged as one of the top experimental economists, with 30 years of experience and extensive expertise in studying risk preferences with laboratory experiments.

We have also consulted with Dr. Elisabet Rutstrom as an additional external expert. Dr. Rutstrom is the director of the Dean’s Behavioral Economics Laboratory at the J. Mack Robison College of Business at Georgia State University. She has 20 years’ experience conducting economics experiments, as well as special expertise in using experimental approaches to assess individuals’ attitudes towards risk and uncertainty in student and non-student populations.

We include contact information for all external experts consulted for this proposed study:

Name: Dr. Thomas Sproul

Title: Assistant Professor

Affiliation: University of Rhode Island, Department of Environmental & Natural Resource Economics

Address: Kingston Coastal Institute, 1 Greenhouse Road, Kingston, RI 02881

Phone: (401) 874-9197

Email: sproul@uri.edu

Name: Dr. Charles Holt

Title: A. Willis Robertson Professor of Political Economy

Affiliation: University of Virginia, Department of Economics

Address: PO Box 400182, University of Virginia, Charlottesville, VA 22904-4182 USA

Phone: (434) 924-7894

Email: holt@virginia.edu

Name: Dr. Elisabet Rutstrom

Title: Professor and Director of the Dean's Behavioral Economics Laboratory

Affliation: Georgia State University, J. Mack Robison College of Business and Dept of Economics, Andrew Young School of Policy Studies

Address: PO Box 3965, Atlanta, GA 30302-3965

Phone: (404) 413-7111

Email: erutstrom@gsu.edu

Explanation of any payment or gift to respondents

The experiment will be conducted using money payments to participants in the experiment. Incentivized money payments help insure that participants treat the decisions made in the experiment as reflective of decisions they would make when faced with equivalent real-world decisions (Camerer and Hogarth, 1999; List, 2001; Holt and Laury, 2002; Harrison and Rutstrom, 2008).

Payment procedures. Subjects will receive a show-up fee as is consistent with standard practice at SimLab. They will receive this payment even if they decline to participate in the experiment. In addition to the show-up fee, subjects will receive compensation based on the decisions they make during the course of the experiment.

Each subject will complete three elicitation tasks (see Attachment B: Experimental Design Protocol for detailed descriptions of each task). Each elicitation task will consist of multiple rounds: 20 rounds for the Cumulative Prospect Theory (CPT) risk preference task, 30 rounds for the Myopic Loss Aversion (MLA) risk preference task, and 15 rounds for the insurance and cover crop demand elicitation task. Each round of each task will require a subject to evaluate one or more risky decisions. Each subject will complete all 65 rounds within a 90 minute time period.

When all rounds of all tasks are completed, one round will be randomly selected for payment from the entire experiment. Subjects will receive a cash payment based on the decision in that specific round. For rounds that involve multiple risky decisions, a single decision from the round will be selected for payment.

Show-up fee. The show-up fee for this experiment will be $10.

Expected payment. The expected payment for this experiment, including show-up fee, is between $20-25. Pre-testing with 9 subjects yielded payoffs of $10.00 - $29.80, with session lengths ranging from 47 – 74 minutes. Median payout was $23.33, and median run-time was 62 minutes.

Maximum possible payment. The maximum possible payment is $100 plus the show up fee. The probability of drawing a payment of $100 is 0.385%. The probability of receiving a payment of $75 or more is 0.692%. The probability of receiving a payment of more than $50 is 2.29%. We explain in detail how these probabilities were calculated in Attachment B: Experimental Design Protocol. In designing our experimental procedures and payment levels, we took into consideration academic standards for normal payoff ranges for student and non-student populations, statistical power considerations, budgetary limitations, and the history of discussions between OMB and ERS regarding other research approved under a previous generic clearance for experimental research (OMB control # 0536-0070).

Payment reporting. We will report to OMB the distribution of payments, including the minimum, maximum, and average payments of all sessions on a monthly basis. In addition, if any payment to a single participant in excess of $50 occurs, we will notify OMB immediately. OMB will reserve the right to pause the collection if large payment outliers become a significant concern during the experiment. In such a case, we will consult with OMB for identifying appropriate methods to address this issue. The experiment may be resumed only after obtaining further OMB approval.

Expected cost of experiment. We anticipate average per subject earnings of between $20-25 (including a $10 show-up fee). We anticipate recruiting up to 500 student participants, bringing the expected total cost of subject payments to $12,500 – $15,000.

Payment norms for SimLab. Table 2 summarizes the total payments, show-up fees, and session lengths for experiments conducted a University of Rhode Island’s SimLab since 2014. The show-up fee, expected payment, and session length planned for our experiment are all consistent with the norms used for this laboratory.

Table 2: Payments and Session Lengths for Recent Experiments Conducted at SimLab

Paper |

Authors |

Dates of Lab Sessions |

Average Payment USD |

Show Up Fee |

Approximate Duration (mins) |

USD Payment / hour |

Extrapolated Payment for 1.5 hours + $10 show up fee |

Personality and Cooperation - Treatment 5-7 |

Guilfoos |

Nov 2015 |

27.14 |

10 |

100 |

10.28 |

25.42 |

Statistical Dependence of Risk Preferences – Treatment 2 |

Sproul |

Sep-Oct 2015 |

$25.59 |

10 |

40 |

23.39 |

45.09 |

Statistical Dependence of Risk Preferences – Treatment 1 |

Sproul |

May 2015 |

$23.85 |

10 |

60 |

13.85 |

30.78 |

Endogenous Moral Hazard Policies-Pilot - Treatment 1-2 |

Guilfoos & Uchida |

May 2015 |

$25.75 |

10 |

60 |

15.75 |

33.63 |

Uncertainty, Communication, and Social Learning in a Coordination Game Experiment |

Uchida,Guildfoos, Miao, Trandafir |

Sep-Oct 2014 |

$25.70 |

5 |

90 |

13.8 |

30.70 |

Myopic Loss Aversion and Learning |

Sproul |

May 2014 |

$19.09 |

5 |

90 |

10.06 |

25.09 |

The impact of information on behavior under an ambient-based policy for regulating nonpoint source pollution |

Emi, Fooks, Guilfoos, Messer, Pradhanang, Suter, Trandafir, Uchida |

Apr–May 2014 |

$35.50 |

10 |

105 |

14.5 |

31.86 |

Assurance of confidentiality provided to respondent

Respondent data will be protected by the Privacy Act of 1974 (5 USC 552a).

Subjects will complete a consent form at the start of the experiment (Attachment F). They will be allowed to withdraw from the study at any time. Subjects will receive an ID number to keep track of all decisions made within the experiment, including answers to demographic questions. Students will also sign payment receipts for experimental earnings, but this information will be kept separate from all other experimental records.

ERS researchers will not have any access to participant names, and participant names will not be stored on government computers.

ERS has decided not to invoke the Confidential Information Protection and Statistical Efficiency Act of 2002 (CIPSEA).

Justification for sensitive questions

No sensitive questions will be asked.

Estimates of hour-burden including hourly costs

Each subject will participate in at most one session. We anticipate that laboratory sessions will require less than 90 minutes to complete. Pre-testing with 9 subjects yielded payoffs of $10.00 - $29.80, with session lengths ranging from 47 – 74 minutes. Median payout was $23.33, and median run-time was 62 minutes.

All experiments will be conducted at the University of Rhode Island. Subjects will be recruited to participate in economic experiments via email and in-class solicitations. Email invitations (Attachment J) reach a population of 1300 students. In-class invitations reach approximately 350 additional students per semester. Response rates are approximately 40% for in-class invitations and 13.8% for email invitations. Given current response rates, we anticipate recruiting 180 students via email and 140 students from in-class invitations per semester. The maximum number of subjects to be recruited for all experiments is 500 students.4

The total anticipated maximum burden hours for this study is 861 hours. Table 3 summarizes how this value was estimated.

Table 3: Calculation of Burden Hours for Proposed Study

Experiment |

Sample Size |

Freq |

Responses |

Non-Response |

Total Burden Hours |

||||||

Resp. Count |

Freq x Count |

Min./ Resp. |

Burden Hours |

Nonresp Count |

Freq. x Count |

Min./ Nonr. |

Burden Hours |

||||

Recruitment |

|||||||||||

In-class (2 semesters) |

700 |

1 |

320 |

320 |

5 |

26.7 |

380 |

380 |

5 |

31.7 |

58.4 |

1300 |

1 |

180 |

180 |

5 |

15.0 |

1120 |

1120 |

2 |

37.3 |

52.3 |

|

Laboratory Time |

|||||||||||

Experiment |

500 |

1 |

500 |

500 |

85 |

708.3 |

0 |

0 |

85 |

0 |

708.3 |

Questionnaire |

500 |

1 |

500 |

500 |

5 |

41.7 |

0 |

0 |

5 |

0 |

41.7 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

500 |

|

|

791.7 |

1,500 |

|

|

69.0 |

860.7 |

For a 1.5-hour experiment, we anticipate average earnings per subject to be $20-25 (including a $10 show-up fee). We anticipate recruiting up to 500 student participants, bringing the expected total cost of subject payments to $10,000 – $12,500.

Estimate of other total annual cost burden to respondent or recordkeepers

There will be no capital, operating, or maintenance costs to the respondent as the result of participation in this experiment.

Estimate of costs to the Federal Government

The Federal Government has funded this research through a 2-year cooperative agreement with the University of Rhode Island. This cooperative agreement is intended to fund multiple projects including the proposed experiment. The total reimbursable cost of the cooperative agreement is $228,000. Total ERS in-house resources are anticipated to be equivalent to 30% of the salary for full-time GS-12 level employee over the 2-year span of the project.

Changes in burden hour

This is new data collection.

Plans for tabulation, publication, and project time schedule

If approved, this research will be completed within 16 months of approval. Data will be analyzed and a report will be written in 2018.

Data analysis will include using multivariate regressions to produce coefficient estimates of risk parameters and demand elasticities; estimates of correlation coefficients between risk parameter estimates, elasticity estimates, and demographic characteristics; and univariate comparisons of demand elasticities and correlation coefficients under the different environmental treatments (t-tests and non-parametric tests).

Results will inform future experiments to study farmers’ risk management decision-making processes. Results may be shared with other agencies within USDA, but will not be used to evaluate existing policies or directly inform new policy making. Additionally, results may be disseminated as presentations and publications for academic and professional audiences, but will not be used to prepare official agency statistics.

Reasons display of OMB expiration date is inappropriate

No exemption is requested.

Exceptions to certification for paperwork reduction act submissions

No exceptions to certification are requested.

List of Attachments

Attachment A – 7 USC 2204a

Attachment B – Experimental Design

Attachment C – ERS Literature Review on Consequences of Commodity Support Programs and Crop Insurance on Agricultural Production and the Environment

Attachment D – Instructions

Attachment E – Questionnaire

Attachment F – Consent Form

Attachment G – Disclaimer

Attachment H – Pretest Report

Attachment I – Federal Register Notice

Attachment J – Recruitment Message

References

Antle, J. M. (1983). Incorporating risk in production analysis. American Journal of Agricultural Economics, 65(5), 1099-1106.

Babcock, B. A. (2015). Using Cumulative Prospect Theory to Explain Anomalous Crop Insurance Coverage Choice. American Journal of Agricultural Economics, aav032.

Bardsley, N. (2010). Experimental economics: Rethinking the rules. Princeton University Press.

Barseghyan, L., Molinari, F., O’Donoghue, T., & Teitelbaum, J. C. (2013). The nature of risk preferences: Evidence from insurance choices. American Economic Review, 103(6), 2499–2529.

Baucells, M., & Villasís, A. (2010). Stability of risk preferences and the reflection effect of prospect theory. Theory and Decision, 68(1-2), 193-211.

Benartzi, S., and R. H. Thaler. "Myopic loss aversion and the equity premium puzzle." The Quarterly Journal of Economics 110, no. 1 (1995): 73-92.

Bocquého, G., Jacquet, F., & Reynaud, A. (2014). Expected utility or prospect theory maximisers? Assessing farmers' risk behaviour from field-experiment data. European Review of Agricultural Economics, 41(1), 135-172.

Borghans, L., Heckman, J. J., Golsteyn, B. H., & Meijers, H. (2009). Gender differences in risk aversion and ambiguity aversion. Journal of the European Economic Association, 7(2‐3), 649-658.

Bruhin, A., Fehr‐Duda, H., & Epper, T. (2010). Risk and rationality: Uncovering heterogeneity in probability distortion. Econometrica, 78(4), 1375-1412.

Camerer, C. F. "Prospect theory in the wild: Evidence from the field." Advances in Behavioral Economics (2004): 148-161.

Camerer, C. (2011). The promise and success of lab-field generalizability in experimental economics: A critical reply to Levitt and List. Available at SSRN 1977749.

Camerer, C. F., & Hogarth, R. M. (1999). The effects of financial incentives in experiments: A review and capital-labor-production framework. Journal of risk and uncertainty, 19(1-3), 7-42.

Camerer, C. F., Hogarth, R. M., Budescu, D. V., & Eckel, C. (1999). The effects of financial incentives in experiments: A review and capital-labor-production framework. In Elicitation of Preferences (pp. 7-48). Springer Netherlands.

Charness, G., & Gneezy, U. (2012). Strong evidence for gender differences in risk taking. Journal of Economic Behavior & Organization, 83(1), 50-58.

Chavas, J. P., Chambers, R. G., & Pope, R. D. (2010). Production economics and farm management: a century of contributions. American Journal of Agricultural Economics, 92(2), 356-375.

Chetty, R., Hendren, N., & Katz, L. F. (2016). The effects of exposure to better neighborhoods on children: New evidence from the Moving to Opportunity experiment. The American Economic Review, 106(4), 855-902.

Coble, K. H., Knight, T. O., Pope, R. D., & Williams, J. R. (1996). Modeling farm-level crop insurance demand with panel data. American Journal of Agricultural Economics, 78(2), 439-447.

Coble, K. H., Knight, T. O., Pope, R. D., & Williams, J. R. (1997). An expected-indemnity approach to the measurement of moral hazard in crop insurance. American Journal of Agricultural Economics, 79(1), 216-226.

Croson, R., & Gächter, S. (2010). The science of experimental economics. Journal of Economic Behavior & Organization, 73(1), 122-131.

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic literature, 47(2), 448-474.

Crumpler, H., & Grossman, P. J. (2008). An experimental test of warm glow giving. Journal of public Economics, 92(5), 1011-1021.

Dabney, S. M., Delgado, J. A., & Reeves, D. W. (2001). Using winter cover crops to improve soil and water quality. Communications in Soil Science and Plant Analysis, 32(7-8), 1221-1250.

Dave, C., Eckel, C. C., Johnson, C. A., & Rojas, C. (2010). Eliciting risk preferences: When is simple better?. Journal of Risk and Uncertainty, 41(3), 219-243.

Davis, D. D., & Millner, E. L. (2005). Rebates, matches, and consumer behavior. Southern Economic Journal, 410-421.

Depositario, D. P. T., Nayga, R. M., Wu, X., & Laude, T. P. (2009). Should students be used as subjects in experimental auctions?. Economics Letters, 102(2), 122-124.

Dohmen, T., Falk, A., Huffman, D., & Sunde, U. (2010). Are risk aversion and impatience related to cognitive ability? The American Economic Review, 100(3), 1238-1260.

Dohmen, T., Falk, A., Huffman, D., Sunde, U., Schupp, J., & Wagner, G. G. (2011). Individual risk attitudes: Measurement, determinants, and behavioral consequences. Journal of the European Economic Association, 9(3), 522-550.

Druckman, J. N., & Kam, C. D. (2009). Students as experimental participants: A defense of the'narrow data base'. Available at SSRN 1498843

Du, X., Feng, H., & Hennessy, D. A. (2016). Rationality of Choices in Subsidized Crop Insurance Markets. American Journal of Agricultural Economics, 99(3), 732-756.

Eckel, C. C., & Grossman, P. J. (2000). Volunteers and pseudo-volunteers: The effect of recruitment method in dictator experiments. Experimental Economics, 3(2), 107-120.

Eckel, C. C., & Grossman, P. J. (2008a). Men, women and risk aversion: Experimental evidence. Handbook of experimental economics results, 1, 1061-1073.

Eckel, C. C., & Grossman, P. J. (2008b). Subsidizing charitable contributions: a natural field experiment comparing matching and rebate subsidies. Experimental Economics, 11(3), 234-252.

Einav, L., Finkelstein, A., Pascu, I., & Cullen, M. R. (2012). How general are risk preferences? Choices under uncertainty in different domains. The American economic review, 102(6), 2606-2638.

Ferraro, P. J., Rondeau, D., & Poe, G. L. (2003). Detecting other-regarding behavior with virtual players. Journal of Economic Behavior & Organization, 51(1), 99-109.

Gneezy, U., & Potters, J. (1997). An experiment on risk taking and evaluation periods. The Quarterly Journal of Economics, 631-645.

Goodwin, B. K., & Kastens, T. L. (1993). Adverse selection, disaster relief, and the demand for multiple peril crop insurance. Contract report for the Federal Crop Insurance Corporation.

Guala, F. (2005). The methodology of experimental economics. Cambridge University Press.

Haisley, E., Mostafa, R., & Loewenstein, G. (2008). Myopic risk-seeking: The impact of narrow decision bracketing on lottery play. Journal of Risk and Uncertainty, 37(1), 57-75.

Halek, M., & Eisenhauer, J. G. (2001). Demography of risk aversion. Journal of Risk and Insurance, 1-24.

Hardaker, J. B. (Ed.). (2004). Coping with risk in agriculture. Cabi.

Harrison*, G. W., Johnson, E., McInnes, M. M., & Rutström, E. E. (2005). Temporal stability of estimates of risk aversion. Applied Financial Economics Letters, 1(1), 31-35.

Harrison, G. W., Lau, M. I., & Rutström, E. E. (2007). Estimating risk attitudes in Denmark: A field experiment. The Scandinavian Journal of Economics, 109(2), 341-368.

Harrison, G. W., Lau, M. I., & Rutström, E. E. (2009). Risk attitudes, randomization to treatment, and self-selection into experiments. Journal of Economic Behavior & Organization, 70(3), 498-507.

Harrison, G. W., & List, J. A. (2004). Field experiments. Journal of Economic literature, 42(4), 1009-1055.

Harrison, G. W., & Ng, J. M. (2016). Evaluating the Expected Welfare Gain from Insurance. Journal of Risk and Insurance, 83(1), 91–120. http://doi.org/10.1111/jori.12142

Harrison, G. W., & Rutström, E. E. (2008). Experimental evidence on the existence of hypothetical bias in value elicitation methods. Handbook of experimental economics results, 1, 752-767.

Hartwig, N. L., & Ammon, H. U. (2002). Cover crops and living mulches. Weed science, 50(6), 688-699.

Heckman, J. J., Stixrud, J., & Urzua, S. (2006). The effects of cognitive and noncognitive abilities on labor market outcomes and social behavior. Journal of Labor economics, 24(3), 411-482.

Holt, Charles A., and Susan K. Laury. "Risk aversion and incentive effects." American economic review 92, no. 5 (2002): 1644-1655.

Horowitz, J. K., & Lichtenberg, E. (1993). Insurance, moral hazard, and chemical use in agriculture. American Journal of Agricultural Economics, 75(4), 926-935.

Hussam, R. N., Porter, D., & Smith, V. L. (2008). Thar she blows: Can bubbles be rekindled with experienced subjects? The American Economic Review, 98(3), 924-937.

James, H. S. (2005). Why did you do that? An economic examination of the effect of extrinsic compensation on intrinsic motivation and performance. Journal of economic psychology, 26(4), 549-566.

Jaspersen, J. G. (2015). Hypothetical Surveys and Experimental Studies of Insurance Demand: A Review. Journal of Risk and Insurance. Retrieved from http://onlinelibrary.wiley.com/doi/10.1111/jori.12100/full

Jianakoplos, N. A., & Bernasek, A. (1998). Are women more risk averse? Economic inquiry, 36(4), 620-630.

Just, R. E., & Pope, R. D. (Eds.). (2013). A comprehensive assessment of the role of risk in US agriculture (Vol. 23). Springer Science & Business Media.

Karlan, D., List, J. A., & Shafir, E. (2011). Small matches and charitable giving: Evidence from a natural field experiment. Journal of Public Economics, 95(5), 344-350.

Karlan, D., Osei, R., Osei-Akoto, I., & Udry, C. (2014). Agricultural decisions after relaxing credit and risk constraints. The Quarterly Journal of Economics, 129(2), 597-652.

Kunreuther, H., & Michel-Kerjan, E. (2015). Demand for fixed-price multi-year contracts: Experimental evidence from insurance decisions. Journal of Risk and Uncertainty, 51(2), 171-194.

Levitt, S. D., & List, J. A. (2007). What do laboratory experiments measuring social preferences reveal about the real world? The Journal of Economic Perspectives, 21(2), 153-174.

List, J. (2001). “Do Explicit Warnings Eliminate the Hypothetical Bias in Elicitation Procedures? Evidence from Field Auctions for Sportscards,” American Economic Review, 91(5): 1498-1507.

Marwell, G., & Ames, R. E. (1981). Economists free ride, does anyone else?: Experiments on the provision of public goods, IV. Journal of public economics, 15(3), 295-310.

Neumann, J. V., & Morgenstern, O. (1944). Theory of games and economic behavior (Vol. 60). Princeton: Princeton university press.

Pannell, D. J. (1991). Pests and pesticides, risk and risk aversion. Agricultural Economics, 5(4), 361-383.

Pannell, D. J., Malcolm, B., & Kingwell, R. S. (2000). Are we risking too much? Perspectives on risk in farm modelling. Agricultural Economics, 23(1), 69-78.

Plott, C. R. (1991). Will economics become an experimental science? Southern Economic Journal, 901-919.

Richter, A., Schiller, J., & Schlesinger, H. (2014). Behavioral insurance: Theory and experiments. Journal of Risk and Uncertainty, 48(2), 85–96.

Riley Jr, W. B., & Chow, K. V. (1992). Asset allocation and individual risk aversion. Financial Analysts Journal, 32-37.

Roberts, M. J., Key, N., & O'Donoghue, E. (2006). Estimating the extent of moral hazard in crop insurance using administrative data. Applied Economic Perspectives and Policy, 28(3), 381-390.

Rosch, S. (2017). Risk Attitudes of US Agricultural Producers. Selected Paper Prepared for the 2017 AAEA Annual Meeting in Chicago, IL, 30 July – 1 August 2017.

Sapienza, P., Zingales, L., & Maestripieri, D. (2009). Gender differences in financial risk aversion and career choices are affected by testosterone. Proceedings of the National Academy of Sciences, 106(36), 15268-15273.

Schipanski, M. E., Barbercheck, M., Douglas, M. R., Finney, D. M., Haider, K., Kaye, J. P., & White, C. (2014). A framework for evaluating ecosystem services provided by cover crops in agroecosystems. Agricultural Systems, 125, 12-22.

Shapira, Z., & Venezia, I. (2008). On the preference for full-coverage policies: Why do people buy too much insurance? Journal of Economic Psychology, 29(5), 747–761.

Slovic, P., Fischhoff, B., Lichtenstein, S., Corrigan, B., & Combs, B. (1977). Preference for insuring against probable small losses: Insurance implications. Journal of Risk and insurance, 237-258.

Smith, V. H., & Baquet, A. E. (1996). The demand for multiple peril crop insurance: evidence from Montana wheat farms. American journal of agricultural economics, 78(1), 189-201.

Smith, V. H., & Goodwin, B. K. (1996). Crop insurance, moral hazard, and agricultural chemical use. American Journal of Agricultural Economics, 78(2), 428-438.

Snapp, S. S., Swinton, S. M., Labarta, R., Mutch, D., Black, J. R., Leep, R., ... & O'Neil, K. (2005). Evaluating cover crops for benefits, costs and performance within cropping system niches. Agronomy Journal, 97(1), 322-332.

Sydnor, J. (2010). (Over) insuring modest risks. American Economic Journal: Applied Economics, 2(4), 177–199.

Thaler, R. H., A. Tversky, D. Kahneman, and A. Schwartz. "The effect of myopia and loss aversion on risk taking: An experimental test." The Quarterly Journal of Economics 112, no. 2 (1997): 647-661.

Tversky, A., and D. Kahneman. "Advances in prospect theory: Cumulative representation of uncertainty." Journal of Risk and Uncertainty 5, no. 4 (1992): 297-323.

Velandia, M., Rejesus, R. M., Knight, T. O., & Sherrick, B. J. (2009). Factors affecting farmers' utilization of agricultural risk management tools: the case of crop insurance, forward contracting, and spreading sales. Journal of agricultural and applied economics, 41(01), 107-123.

Weber, E. U., Blais, A. R., & Betz, N. E. (2002). A domain‐specific risk‐attitude scale: Measuring risk perceptions and risk behaviors. Journal of behavioral decision making, 15(4), 263-290.

Zelmer, J. (2003). Linear public goods experiments: A meta-analysis. Experimental Economics, 6(3), 299-310.

Zocco, D. (2009). Risk theory and student course selection. Research in Higher Education Journal, 3, 1.

1 Druckman and Kam (2011) provide extensive discussion of the external validity of experiments with student subjects that are specifically to test economic theories. See also Plott (1991), Guala (2005), Bardsley (2010), Croson and Gachter (2010), and Camerer (2011).

2 Rounds are also referred to as stages during the experiment. This is a convention to help subjects keep track of their own progress during the experiment. See Attachment B: Experimental Design Protocol for explanations of key terminology used.

3 The ARMS survey is the primary source of information to the U.S. Department of Agriculture and the public on a broad range of issues about U.S. agricultural resource use, costs, and farm sector financial conditions. This survey is conducted jointly by the National Agricultural Statistics Service (NASS) and the Economic Research Service (ERS). See https://www.ers.usda.gov/data-products/arms-farm-financial-and-crop-production-practices/documentation/ for additional descriptions of the data collected through this survey.

4 Choice of sample size is based on power calculations to measure risk parameters for a convenience sample of students as described in Attachment B: Experimental Design Protocol.

Supporting

Statement: Part A Page

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Rosch, Stephanie - ERS |

| File Modified | 0000-00-00 |

| File Created | 2021-01-20 |

© 2026 OMB.report | Privacy Policy