SPST-0195 Minimum Requirements for Appraisal Management Companies 2018 Renewal

SPST-0195 Minimum Requirements for Appraisal Management Companies 2018 Renewal.docx

Minimum Requirements for Appraisal Management Companies

OMB: 3064-0195

Supporting Statement

Minimum Requirements for Appraisal Management Companies

OMB Control No. 3064-0195

INTRODUCTION

The FDIC is requesting approval from the OMB to extend, without change, a currently approved information collection (OMB Control No. 3064-0195) comprised of recordkeeping and reporting requirements under regulations issued by the Federal Deposit Insurance Corporation (“FDIC”), jointly with the Office of the Comptroller of the Currency (“OCC”), the Board of Governors of the Federal Reserve System (“Board”), the National Credit Union Administration (“NCUA”), the Bureau of Consumer Financial Protection (“Bureau”) and the Federal Home Finance Agency (“FHFA”) (collectively, “the agencies”) that implement the minimum requirements in section 1473 of the Dodd-Frank Wall Street Reform and Consumer Protection Act to be applied by States in the registration and supervision of appraisal management companies (AMCs). The regulations also implements the requirement in section 1473 of the Dodd-Frank Act for States to report to the Appraisal Subcommittee of the Federal Financial Institutions Examination Council (FFIEC) the information required by the Appraisal Subcommittee (ASC) to administer the new national registry of appraisal management companies (AMC National Registry or Registry). The information collection expires on August 31, 2018.

A. Justification.

1. Circumstances that make the collection necessary:

The FDIC, OCC, Board, NCUA, Bureau, and FHFA (Agencies) have issued final rules to implement the minimum requirements in section 1473 of the Dodd-Frank Wall Street Reform and Consumer Protection Act to be applied by States in the registration and supervision of appraisal management companies (AMCs). The final rule also implements the requirement in section 1473 of the Dodd-Frank Act for States to report to the Appraisal Subcommittee of the Federal Financial Institutions Examination Council (FFIEC) the information required by the Appraisal Subcommittee (ASC) to administer the new national registry of appraisal management companies (AMC National Registry or Registry).

2. Use of the information:

The information collection requirements are found at 12 CFR Part 323

State Recordkeeping Requirements

States seeking to register AMCs must have an AMC registration and supervision program. Section 323.11(a) requires each participating State to establish and maintain within its appraiser certifying and licensing agency a registration and supervision program with the legal authority and mechanisms to: (i) review and approve or deny an application for initial registration; (ii) periodically review and renew, or deny renewal of, an AMC’s registration; (iii) examine an AMC’s books and records and require the submission of reports, information, and documents; (iv) verify an AMC’s panel members’ certifications or licenses; (v) investigate and assess potential violations of laws, regulations, or orders; (vi) discipline, suspend, terminate, or deny registration renewals of, AMCs that violate laws, regulations, or orders; and (vii) report violations of appraisal-related laws, regulations, or orders, and disciplinary and enforcement actions to the ASC.

Section 323.11(b) requires each participating State to impose requirements on AMCs not regulated by a Federal financial institutions regulatory agency nor owned and controlled by an insured depository institution to: (i) register with and be subject to supervision by a State appraiser certifying and licensing agency in each State in which the AMC operates; (ii) use only State-certified or State-licensed appraisers for Federally-regulated transactions in conformity with any Federally-regulated transaction regulations; (iii) establish and comply with processes and controls reasonably designed to ensure that the AMC, in engaging an appraiser, selects an appraiser who is independent of the transaction and who has the requisite education, expertise, and experience necessary to competently complete the appraisal assignment for the particular market and property type; (iv) direct the appraiser to perform the assignment in accordance with USPAP; and (v) establish and comply with processes and controls reasonably designed to ensure that the AMC conducts its appraisal management services in accordance with section 129E(a)-(i) of TILA.

State Reporting Burden

Section 323.14 requires that each State electing to register AMCs for purposes of permitting AMCs to provide appraisal management services relating to covered transactions in the State must submit to the ASC the information required to be submitted under this Subpart and any additional information required by the ASC concerning AMCs.

AMC Reporting Requirements

Section 323.13(c) requires that a Federally-regulated AMC must report to the State or States in which it operates the information required to be submitted by the State pursuant to the ASC’s policies, including: (i) information regarding the determination of the AMC National Registry fee; and (ii) the information listed in section 323.12.

Section 323.12 provides that an AMC may not be registered by a State or included on the AMC National Registry if such company is owned, directly or indirectly, by any person who has had an appraiser license or certificate refused, denied, cancelled, surrendered in lieu of revocation, or revoked in any State. Each person that owns more than 10 percent of an AMC shall submit to a background investigation carried out by the State appraiser certifying and licensing agency. While section 323.12 does not authorize States to conduct background investigations of Federally-regulated AMCs, it would allow a State to do so if the Federally-regulated AMC chooses to register voluntarily with the State.

AMC Recordkeeping Requirements

Section 323.10 provides that an appraiser in an AMC’s network or panel is deemed to remain on the network or panel until: (i) the AMC sends a written notice to the appraiser removing the appraiser with an explanation; or (ii) receives a written notice from the appraiser asking to be removed or a notice of the death or incapacity of the appraiser. The AMC would retain these notices in its files.

3. Consideration of the use of improved information technology:

Respondents may use any technology they wish.

4. Efforts to identify duplication:

There is no duplication. The information is not available elsewhere.

5. Methods used to minimize burden if the collection has a significant impact on a substantial number of small entities:

There are no alternatives that would result in lowering the burden on small institutions, while still accomplishing the purpose of the rule.

6. Consequences to the Federal program if the collection were conducted less frequently:

Less frequent collection would result in safety and soundness concerns.

7. Special circumstances necessitating collection inconsistent with 5 CFR 1320.5(d)(2):

There are no special circumstances. This information collection is conducted in accordance with the guidelines in 5 CFR 1320.5(d)(2).

8. Efforts to consult with persons outside the agency:

A 60-day notice seeking public comment on the agencies renewal of the information collection was published on May 2, 2018 (83 FR 19285). The FDIC received one comment letter from an appraisal management company trade association.

In response to the request for comment on whether this collection of information is necessary for the proper performance of the functions of the FDIC, including whether the information has practical utility, the commenter agreed that this collection of information is necessary and has practical utility but “only to the extent that the information collected serves the proper purpose to promote appraiser independence while ensuring a healthy real estate valuation market.” This suggests that the commenter believes that the “proper purpose” of the collection is limited to the promotion to appraiser independence. In response to this comment, the FDIC notes that the purpose of the AMC rule and the collection is to implement all required elements of the statute, not only provisions that relate to appraiser independence.1 The Agencies were required to adopt regulations to implement all the statutory requirements and this collection of information is a necessary and useful component of such implementation.

In response to the request for comment on the accuracy of FDIC’s estimate of the information collection burden, the commenter opines that the FDIC’s estimate of the number of entities that meet the definition of an AMC under IC #3: (Reporting Requirements for State and Federal AMCs) is too low. The commenter did not offer an estimate of what the number should be and appears to agree that, as stated in footnote 12, the actual number of affected AMCs will be known once the AMC National Registry is fully operational.

The commenter indicates that its members believe that the estimate of the annual burden to comply is also too low. The commenter recommends that the estimate be increased to twice the current estimate. The commenter notes that each state differs in complexity of their demands for the collection of information and not all are on the same renewal schedule. Some renew annually and some biennially, which have varying burdens for preparation and validation. The burden estimates for this collection have historically been prepared on an industry-wide basis and then allotted to each agency. The FDIC prepared the industry-wide estimates for this renewal. We invite commenters to review the analysis, which is included in our supporting statement, and comment during the 30-day comment period.

In response to the request for comment on ways to enhance the quality, utility, and clarity of the information to be collected, the commenter suggested that the ASC should issue additional guidance to states and AMCs concerning the AMC minimum requirements. The goal of such guidance would be to “provide consistency in the implementation of the regulations and information required.” The commenter also expressed concern that wide variation of AMC requirements from state to state may have material unintended consequences on lending activity in a particular jurisdiction. The commenter’s suggestions do not relate to the information collection. In addition, while Title XI and the AMC rule set minimum standards for the registration and supervision of AMCs by states, Title XI and the AMC rule expressly provide that a state may adopt requirements in addition to those contained in the AMC regulation. 12 U.S.C. 3353(b); 12 CFR 34.210(d). The FDIC will, however, refer these suggestions to the ASC for consideration.

In response to the request for comments on ways to minimize the burden of the collection on respondents, including through the use of automated collection techniques or other forms of information technology, the commenter recommends that the ASC find opportunities to develop reporting efficiencies in the licensing system, which could include partnering with the Nationwide Multistate Licensing System (NMLS) or investing in a new process. Furthermore, the commenter believes the ASC should be more aggressive in supporting modernization of the outdated National Appraiser Registry (which AMCs must use to comply with the minimum requirements). FDIC notes that the commenter’s suggestions do not relate to the information collection. The FDIC will, however, refer these suggestions to the ASC for consideration.

9. Payment or Gift to Respondents:

No payments or gifts will be provided to respondents.

10. Any assurance of confidentiality:

No assurances of confidentiality have been made in the Rule. The information will be kept private to the extent permitted by law.

11. Justification for questions of a sensitive nature:

None of the information required to be disclosed or maintained is of a sensitive nature.

12. Estimate of Hour Burden Including Annualized Hourly Costs:

IC #1: Written Notice of Appraiser Removal from Network or Panel

This information collection (IC) relates to the written notice of appraiser removal from the network or panel pursuant to § 323.10. The burden for written notices of appraiser removal from a network or panel is estimated to be equal to the number of appraisers who leave the profession per year multiplied by the estimated percentage of appraisers who work for AMCs, then multiplied by burden hours per notice. The number of appraisers who leave is calculated by adding the number of appraisers who are laid off or resign to the number of appraisers that have had their licenses revoked or surrendered. In 2015 ICR, the total burden hours are then split between the OCC, the Federal Reserve Board (FRB), the Federal Deposit Insurance Corporation (FDIC), and the Federal Housing Finance Agency (FHFA) in a ratio of 3:3:3:1. This assumption is based on conversations between the subject matter experts at the aforementioned agencies.

The number of appraisers who are laid off or resign each year is estimated by multiplying the annual rate of “Total separations” by the number of appraisers for each year. Using data from the Bureau of Labor Statistics (BLS) on the finance and insurance industry for 2017, the average monthly rate of “Total separations” can be estimated at 2.0 percent, or 24.0 percent per year.2 The monthly average has stayed relatively constant over the past 3 years and should be a reasonable estimate for future periods.3 The following table shows data on monthly “Total separations”:

The number of appraisers is estimated by using the number of appraisers in 2017 as a proxy for the level of appraiser employment over the next three years. In 2017 the total number of appraisers was 97,000.4 The following table contains data on annual levels of employment of appraisers in the U.S. between 2010 and 2017:

Using the annual rate of total separations and the level of employment for appraisers, the number of appraisers who are laid off or resign is calculated by multiplying the annual separation rate by the number of appraisers: 97,000 x 24% = 23,280.

The second portion of the IC is the number of appraisers who have their license revoked or surrendered per year. According to the Appraisal Subcommittee, between January 1, 2007 and December 31, 2016 the number of appraisers who have had their license revoked or surrendered is 1,585 and 860, respectively.5 Therefore, the annual average over the 10 year span was 245 licenses revoked or surrendered per year.

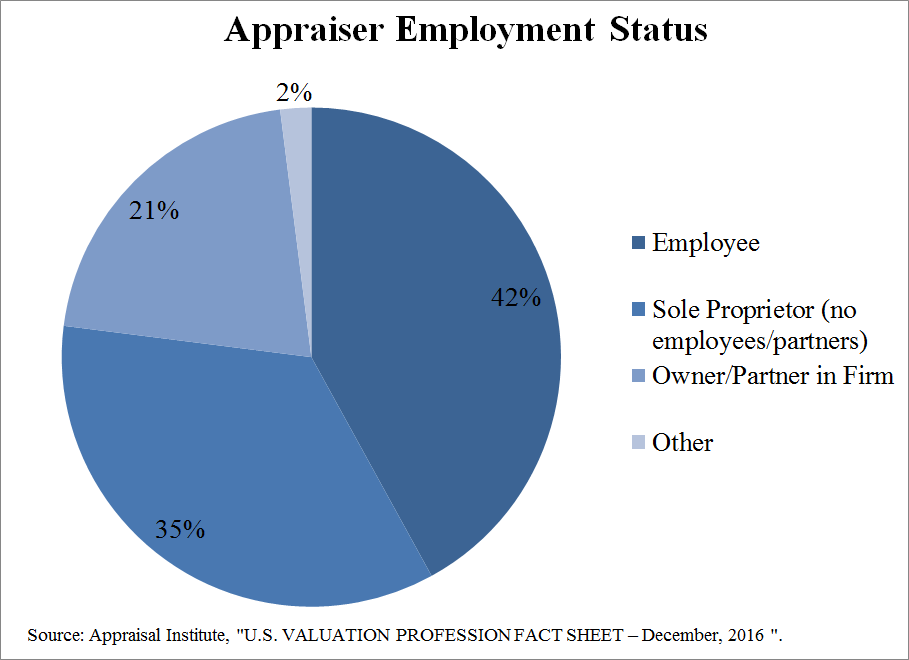

The number of appraisal removal notices for AMCs is then calculated adding the number of separations to the number of licenses revoked or surrendered, then multiplying by the estimated percent of total appraisers who work for AMCs. According the Appraisal Institute, approximately 58 percent of appraisers are sole proprietors, owner/partners in a firm, or are listed as having other forms of employment status.6 The remaining 42 percent of appraisers are employed by either AMCs, appraisal services companies, or other companies. This methodology likely overestimates the number of appraisal removal notices for AMC, however it is more reasonable than using all appraisers as a basis for the calculation, and it is the best available information as far as I am aware. Therefore, the total number of appraisal removal notices for AMC is 9,881 notices: (245 + 23,280) * 42 percent = 9,881 notices.

Lastly, the burden hours are calculated by multiplying the number of written notices of appraiser removal by the burden per notice. Therefore, the estimate for the total burden hours is 790 hours: 9,881 notices x 0.08 hours.7 As previously mentioned, the total burden hours are then split between the OCC, FRB, FDIC, and the FHFA such that the FHFA is responsible for 79 hours and the other three agencies are responsible for 237 hours each.

Total Hour Burden:

The total hour burden is calculated by combining all 4 of the ICs. The total hour burden is 1,445 hours: 790 + 200 + 400 + 55 = 1,445 hours. The OCC, FRB, and FDIC, will each have equally-sized shares of the total burden with each agency responsible for 421 hours. The FHFA is responsible for the remaining 183 hours.8 The burden hour estimates are recorded below:

|

Burden Hours |

Current Number of Appraisers in U.S. |

97,000 |

25% Laid off or Resign Each Year |

23,280 |

Licenses Revoked or Voluntarily Surrendered 2001-2010 |

2,283 |

Average Revoked or Voluntarily Surrendered per year |

245 |

Total Laid off/Resigned/Revoked/Surrendered |

2,528 |

Total Appraiser Removal Notices Issued |

9,881 |

0.08 Burden Hours Taken per Notice |

790 |

FHFA Burden |

79 |

OCC/FRB/FDIC Burden Each |

237 |

IC #2: Develop and Maintain a State Licensing Program.

The second IC relates to developing and maintaining a state licensing program for AMCs pursuant to section 323.14. This burden falls on the states, not AMCs. The burden is calculated by multiplying the number of states without a registration and licensing program by the hour burden to develop the system. The total burden hours are then equally divided among the OCC, FRB, FDIC, and FHFA. According to the Appraisal Institute as of July 26, 2017, there are 5 states that have not developed a system to register and oversee AMCs.9 The 2015 ICR estimate of the hour burden per state without a registration system was 40 hours. Subject matter experts do not believe this estimate needs to be updated for the 2018 ICR. Therefore, the total hour burden is 200 hours: 5 states x 40 hours/state = 200 hours. Lastly, the total hour burden is divided among the four agencies such that each agency is responsible for 50 burden hours.10

|

Burden Hours |

Number of States without Registration Systems |

5 |

Burden Hours per State |

40 |

Total Burden Hours |

200 |

OCC/FRB/FDIC/FHFA Burden Each |

50 |

IC #3: AMC Reporting Requirements (State and Federal AMCs).

The third IC relates to AMC reporting requirements pursuant to §§ 323.12 and 323.13(c). The reporting requirements for these line items include registration limitations/requirements as well as information regarding the determination of the AMC National Registry fee. The burden estimate is calculated by multiplying the number of AMCs by the frequency of response then by the burden per response. The burden hours are then divided between the OCC, FRB, FDIC, and FHFA at a ratio of 3:3:3:1.11

Based on information provided by FDIC’s Division of Risk Management Supervision, we estimate that there are approximately 400 entities that provide appraisal management services as defined by § 323.9(d). Of these 400 entities, we estimate that approximately 200 entities meet the definition of an AMC as defined by § 34.9(c).12

The frequency of response is estimated as the number of states that do not have an AMC registration program in which the average AMC operates.13 According the Appraisal Institute, 5 states do not have AMC registration or oversight programs.14 According to the Consumer Financial Protection Bureau (CFPB), the average AMC operates in 19.56 states.15 Therefore, the average AMC operates in approximately 2 states that do not have AMC registration systems: (5 states/55 states) x 19.56 states = 1.778 states ~ 2 states.

Therefore the total hour burden for the third IC is 400 hours: 200 AMCs x 2 states (frequency) x 1 hour = 400 hours. The burden hours are then divided such that the OCC, FRB, and FDIC are each responsible for 120 burden hours and the FHFA is responsible for 40 burden hours.16

|

Burden Hours |

Number of AMCs |

200 |

Burden Hours per AMC |

1 |

Frequency |

2 |

Total Burden Hours |

400 |

FHFA Burden |

40 |

OCC/FRB/FDIC Burden Each |

120 |

IC #4 - State reporting requirements to the Appraisal Subcommittee.

The fourth IC relates to state reporting requirements to the Appraisal Subcommittee pursuant to § 323.14. The burden hours are estimated by multiplying the number of states by the hour burden per state.17 Then the burden hours are divided equally among the OCC, FRB, FDIC, and the FHFA. The total burden hour for state reporting is 50 hours: 55 states x 1 hour/state = 55 hours. This is then equally divided across the 4 agencies for 14 burden hours each, with rounding.18

|

Burden Hours |

Number of States and Territories |

55 |

Burden Hours to be Carried Per State (placeholder) |

1 |

Total |

55 |

OCC/FRB/FDIC/FHFA Burden Each |

14 |

FDIC Burden:

|

Type of Burden |

Estimated Number of Respondents |

Estimated Number of Responses |

Estimated Time per Response |

Frequency of Response |

Total Annual Estimated Burden Hours |

FDIC, FRB and OCC Share |

FHFA Share |

IC #1 – AMC Written Notice of Appraiser Removal from Network or Panel (323.10) |

Record Keeping |

9,881 |

1 |

0,08 hours |

On Occasion |

790 |

237 |

79 |

IC #2 – State Recordkeeping Requirements (323.11(a) & (b) |

Record Keeping |

5 |

1 |

40 hours |

On Occasion |

200 hours |

50 |

50 |

IC #3 – AMC Reporting Requirements (State and Federal AMCs)(323.12 & 13(c)) |

Reporting |

200 |

2 |

1 hour |

On Occasion |

400 hours |

120 |

40 |

IC #4 – State Reporting Requirements to the Appraisal Sub Committee (323.14) |

Reporting |

55 |

1 |

1 hour |

On Occasion |

55 hours |

14 |

14 |

Total Estimated Annual Burden |

|

|

|

|

|

1,445 hours |

421 hours |

183 hours |

Cost of Hourly Burden: 421 hours x $ 110.00 per hour = $46,310.00

To estimate compensation costs associated with the collection, we used $110 per hour, which is based on May 2018 Bureau of Labor Statistics wage data for the average of the 90th percentile for seven occupations (i.e., accountants and auditors, compliance officers, financial analysts, lawyers, management occupations, software developers, and statisticians) plus an additional 35 percent to cover adjustments and private sector benefits. According to Bureau of Labor Statistics employer costs of employee benefits data, thirty five percent represents the average private sector costs of employee benefits.

13. Estimate of Start-up Costs to Respondents:

None.

14. Estimate of annualized costs to the government:

None.

15. Analysis of change in burden:

There has been no change in the method or substance of this information collection. There has been a decrease in the estimated number of appraisers and appraisal management companies resulting in a decrease in estimated annual burden of 1,124 hours (from 1,545 to 421).

16. Information regarding collections whose results are planned to be published for statistical use:

The results of this collection will not be published for statistical use.

17. Display of expiration date:

Not applicable.

18. Exceptions to certification statement:

None.

B. Statistical Methods.

Not applicable.

1 See 12 U.S.C. 3353(a)(setting minimum requirements for registration regulation in participating states); id.;section 3353(d) (setting registration limitations for AMCs); and id. section 3353(e) (requiring reporting of information by AMCs to the ASC).

2 Bureau of Labor Statistics, “Job Openings and Labor Turnover Survey: Finance and Insurance” (Series ID: JTS52000000TSR). Date accessed: February 27, 2018.

3 The average monthly rates of “Total separations” were 2.1% and 1.9% in 2015 and 2016, respectively.

4 Bureau of Labor Statistics, “Employed - Appraisers and assessors of real estate” (Series ID: LNU02038218). Date accessed: February 27, 2018.

5 Federal Financial Institution Examination Council: Appraisal Subcommittee, “Annual Report 2016: Appendix E Appraiser Disciplinary Actions Reported by State”. https://www.asc.gov/About-the-ASC/AnnualReports.aspx

6 Appraisal Institute, “U.S. VALUATION PROFESSION FACT SHEET – December, 2016”. Accessed March 14, 2018. https://www.appraisalinstitute.org/assets/1/7/U.S._Appraiser_Demos_3_1_16.pdf.

7 The “per notice” burden estimate of 0.08 hours is from 2015 ICR. Subject matter experts do not believe this estimate needs to be updated for the 2018 ICR.

8 The estimates for the burden hours for each agency have been rounded. This means the sum of all the agency burdens is greater than the actual total hour burden by 1 hour.

9 Appraisal Institute, “Enacted State AMC Laws”. https://www.appraisalinstitute.org/advocacy/enacted-state-amc-laws1/

10 The assumption to divide the burden hours between the agencies is based on conversations between the subject matter experts at the OCC, FRB, FDIC, and FHFA. The burden hours are shared in the same ratio as the 2015 ICR.

11 See previous footnote.

12 The agencies anticipate that more definitive information will become available when AMC registration requirements become effective on August 10, 2018.

13 The number of states includes all U.S. states, territories, and districts to include: the Commonwealth of the Northern Mariana Islands, the District of Columbia, Guam, Puerto Rico, and the U.S. Virgin Islands.

14 Appraisal Institute, “Enacted State AMC Laws”. https://www.appraisalinstitute.org/advocacy/enacted-state-amc-laws1/. Date accessed: February 27, 2018.

15 The CFPB conducted a survey of 9 AMCs in 2013 regarding the provisions in the rule and the related PRA burden.

16 The assumption to divide the burden hours between the agencies is based on conversations between the subject matter experts at the OCC, FRB, FDIC, and FHFA. The burden hours are shared in the same ratio as the 2015 ICR.

17 The number of states includes all U.S. states, territories, and districts to include: the Commonwealth of the Northern Mariana Islands, the District of Columbia, Guam, Puerto Rico, and the U.S. Virgin Islands.

18 The assumption to divide the burden hours between the agencies is based on conversations between the subject matter experts at the OCC, FRB, FDIC, and FHFA. The burden hours are shared in the same ratio as the 2015 ICR.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Administrator |

| File Modified | 0000-00-00 |

| File Created | 2021-01-20 |

© 2026 OMB.report | Privacy Policy