Allocation Agreement for Participating Municipalities

State Small Business Credit Initiative Allocation Agreement

SSBCI Allocation Agreement for Joint Municipal Applications vCLEARED

Allocation Agreement for Participating Municipalities

OMB: 1505-0227

( STATE

SMALL BUSINESS CREDIT INITIATIVE ACT OF 2010)

STATE

SMALL BUSINESS CREDIT INITIATIVE ACT OF 2010)

OMB Control # 1505-0227

____________LEAD APPLICANT NAME CONSORTIUM_________

STATE SMALL BUSINESS CREDIT INITIATIVE

ALLOCATION AGREEMENT

FOR

PARTICIPATING MUNICIPALITIES

_______________ December XX, 2011______________

TABLE OF CONTENTS

Page

PARTIES . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

RECITALS. . . . . . . . . . . . . . . . . . . . . . . . . . . 1

ARTICLE I. DEFINITIONS AND RULES OF INTERPRETATION . . . . . 2

Section 1.1 Definitions . . . . . . . . . . . . . . . . 2

Allocated Funds . . . . . . . . . . . . . . . . . . 2

Allocation . . . . . . . . . . . . . . . . . . . . 2

Allocation Time Period . . . . . . . . . . . . . . 2

Application . . . . . . . . . . . . . . . . . . . . 2

Approved Municipal Program . . . . . . . . . . . 2

Authorized Municipal Official . . . . . . . . . . . 2

Cooperative Agreement . . . . . . . . . . . . . . . 2

Disbursement. . . . . . . . . . . . . . . . . . . . 2

Principal . . . . . . . . . . . . . . . . . . . . . 2

Program Income . . . . . . . . . . . . . . . . . . 3

Schedule . . . . . . . . . . . . . . . . . . . . . 3

Subawardee. . . . . . . . . . . . . . . . . . . . . 3

Subgrant. . . . . . . . . . . . . . . . . . . . . . 3

This Agreement. . . . . . . . . . . . . . . . . . . 3

Section 1.2 Rules of Interpretation . . . . . . . . . . 3

ARTICLE II. THIS ALLOCATION . . . . . . . . . . . . . . . . 4

Section 2.1 The Allocation Commitment . . . . . . . . . 4

Section 2.2 Purpose of this Allocation . . . . . . . . .4

Section 2.3 Allocation Time Period . . . . . . . . . . .4

ARTICLE III. DISBURSEMENTS AND CONDITIONS PRECEDENT TO

DISBURSEMENT. . . . . . . . . . . . . . . . . . 4

Section 3.1 Disbursements of Allocated Funds. . . . . . 4

Section 3.2 Opinion of Participating Municipality Counsel. . . . . . . . . . .. . . . . . . .. . . . . . . . . . . 5

Section 3.3 Cooperative Agreement. . . . . . . . . . . 5

Section 3.4 Conditions Precedent for Disbursements. . . 5

ARTICLE IV. COVENANTS AND AGREEMENTS OF THE PARTICIPATING MUNICIPALITY . . . . . . . . . . . . . . . . . . . . . .. . 5

Section 4.1 Compliance with Government Requirements . . 5

Section 4.2 Authorized Uses of Allocated Funds/

Allowable Costs . . . . . . . . . . . . . . 6

Section 4.3 Authorized Uses of Program Income . . . . . 6

Section 4.4 Restrictions on the Use of Allocated Funds

and Program Income. . . . . . . . . . . . . 6

Section 4.5 Commencement of Performance . . . . . . . . 7

Section 4.6 SSBCI Policy Guidelines, National Standards and Internal Control and Financial Management Systems Requirements . . . . . .7

Section 4.7 Quarterly Reports . . . . . . . . . . . . . 7

Section 4.8 Annual Report . . . . . . . . . . . . . . . 8

Section 4.9 Access to Records of and Certifications

from Financial Institutions . . . . . . . . 11

Section 4.10 Notices of Certain Material Events. . . . . 12

Section 4.11 High Risk . . . . . . . . . . . . . . . . . 13

Section 4.12 Subgrants . . . . . . . . . . . . . . . . . 13

Section 4.13 Retention of Records. . . . . . . . . . . . 13

Section 4.14 Right to Inspect, Audit, and Investigate . 13

ARTICLE V. REPRESENTATIONS AND WARRANTIES. . . . . . . . . . 14

Section 5.1 Designation of Eligible Organization. . . . 14

Section 5.2 Authority . . . . . . . . . . . . . . . . . 14

Section 5.3 Due Authorization . . . . . . . . . . . . . 14

Section 5.4 Due Execution and Delivery; Binding

Agreement . . . . . . . . . . . . . . . . . 14

Section 5.5 No Conflicts. . . . . . . . . . . . . . . . 14

Section 5.6 Litigation. . . . . . . . . . . . . . . . . 15

Section 5.7 Disclosure. . . . . . . . . . . . . . . . . 15

ARTICLE VI. TERMINATION FOR CAUSE AND OTHER REMEDIES . . . . 15

Section 6.1 General Events of Default . . . . . . . . . 15

Section 6.2 Discretionary Remedies. . . . . . . . . . . 16

Section 6.3 Specific Events of Default . . . . . . . . 16

Section 6.4 Mandatory Remedies . . . . . . . . . . . . 17

Section 6.5 No Waiver . . . . . . . . . . . . . . . . . 17

Section 6.6 Prior Notice to Participating Municipalities of Exercise of Remedies . . . . . . . .. . . . . . . . 18

ARTICLE VII. TERMINATION OF AVAILABILITY . . . . . . . . . . 18

Section 7.1 Termination of Availability . . . . . . . . 18

ARTICLE VIII. MISCELLANEOUS. . . . . . . . . . . . . . . . . 18

Section 8.1 Notices . . . . . . . . . . . . . . . . . . 18

Section 8.2 Entire Agreement. . . . . . . . . . . . . . 19

Section 8.3 Amendments. . . . . . . . . . . . . . . . . 19

Section 8.4 Assignment. . . . . . . . . . . . . . . . . 19

Section 8.5 Successors. . . . . . . . . . . . . . . . . 20

Section 8.6 Cumulative Rights . . . . . . . . . . . . . 20

Section 8.7 No Election . . . . . . . . . . . . . . . . 20

Section 8.8 Rights Confined to Parties. . . . . . . . . 20

Section 8.9 No Partnership. . . . . . . . . . . . . . . 20

Section 8.10 Survival of Representations and Warranties. 20

Section 8.11 Applicable Law. . . . . . . . . . . . . . . 21

Section 8.12 Severability. . . . . . . . . . . . . . . . 21

Section 8.13 Headings. . . . . . . . . . . . . . . . . . 21

Section 8.14 Counterparts. . . . . . . . . . . . . . . . 21

SIGNATURES. . . . . . . . . . . . . . . . . . . . . . . . . . 22

ANNEX 1 PURPOSE OF THE ALLOCATION

ANNEX 2 DISBURSEMENTS/CERTIFICATION OF PERFORMANCE AND REPRESENTATIONS AND WARRANTIES

ANNEX 3 SCHEDULE

ANNEX 4 QUARTERLY USE-OF-FUNDS REPORT/CERTIFICATION ON USE-OF-ALLOCATED FUNDS

ANNEX 5 REPORTING SCHEDULE

ANNEX 6 OPINION OF MUNICIPALITY COUNSEL

ANNEX 7 SUBSEQUENT REPORTING

ANNEX 8 PARTICIPATING MUNICIPALITIES

ALLOCATION AGREEMENT dated as of

December ##, 2011, between the United States Department of the Treasury, an executive department of the United States Government (“Treasury”), and the municipalities listed on Annex 8 attached hereto (the “Participating Municipalities”).

RECITALS

WHEREAS, many companies, particularly small businesses, have found it increasingly difficult to get new loans to keep their businesses operating and banks are tightening requirements or cutting off existing lines of credit even when the businesses are up-to-date on their loan repayments;

WHEREAS, in the State Small Business Credit Initiative Act of 2010 (title III of the Small Business Jobs Act of 2010, Public Law 111-240, 124 Stat. 2568, 2582) (the “Act”), Congress appropriated funds to Treasury to be allocated and disbursed to States and eligible municipalities that have created programs to increase the amount of capital made available by private lenders to small businesses, and to cover Treasury’s reasonable administrative expenses;

WHEREAS, in order to be considered for an allocation (as hereinafter defined), the eligible municipalities must submit an Application (as hereinafter defined) to Treasury for review and evaluation in a noncompetitive selection process; and

WHEREAS, based on a review and evaluation of the Participating Municipalities’ Application, the Participating Municipalities have been approved to receive an allocation, subject to the satisfaction of the terms and conditions contained in this Agreement (as hereinafter defined);

THEREFORE, in consideration of the premises and mutual covenants, conditions and agreements hereinafter set forth, the parties hereto hereby agree as follows:

ARTICLE I

DEFINITIONS AND RULES OF INTERPRETATION

Section 1.1 Definitions. Terms used in this Agreement that are not defined shall have the same meaning as in the Act. When used in this Agreement, the following terms shall have the respective meanings specified in this Section 1.1, unless the text clearly requires otherwise.

Allocated Funds. “Allocated Funds” shall mean the funds awarded to the Participating Municipalities on account of this Allocation.

Allocation. “Allocation” shall mean the award of Federal funds by the Treasury to the Participating Municipalities in accordance with the allocation formula contained in the Act.

Allocation Time Period. “Allocation Time Period” shall have the meaning ascribed to such term in Section 2.3 of this Agreement.

Application. “Application” shall mean the State Small Business Credit Initiative Application dated XXXX XX, 2011, including any written information in connection therewith and any attachments, appendices and/or written supplements thereto, submitted by the Participating Municipalities to Treasury.

Approved Municipal Programs. “Approved Municipal Programs” means the [insert program names], approved by Treasury as eligible for Federal contributions to, or for the account of, the Municipalities’ programs.

Authorized Municipal Official. “Authorized Municipal Official” means each of the Participating Municipalities’ officials having oversight responsibility for the Approved Municipal Program(s).

Cooperative Agreement. “Cooperative Agreement” shall mean the required agreement between the Participating Municipalities that delineates obligations among the Participating Municipalities.

Disbursement. “Disbursement” shall mean a transfer of Allocated Funds by Treasury to the Participating Municipalities under this Agreement.

Principal. “Principal” shall mean, for purposes of Section 4.9, if a sole proprietorship, the proprietor; if a partnership, each managing partner and each partner who is a natural person and holds a 20% or more ownership interest in the partnership; and if a corporation, limited liability company, association or a development company, each director, each of the five most highly compensated executives or officers of the entity, and each natural person who is a direct or indirect holder of 20% or more of the ownership stock or stock equivalent of the entity.

Program Income. “Program Income” shall mean gross income received by the Participating Municipalities that is directly generated by an Allocation-supported activity or earned as a result of this Allocation during the Allocation Time Period. Program Income includes, but is not limited to, income from: fees for services performed that were funded or supported with Allocated Funds; and interest earned on loans made using Allocated Funds. Program Income does not include interest on Allocated Funds, the receipt of principal on loans made using Allocated Funds, rebates, credits, discounts, or refunds, or interest earned on any of them.

Schedule. “Schedule” shall have the meaning ascribed to such term in Section 4.2 and Annex 3 of this Agreement.

Subawardee. “Subawardee” shall mean the legal entity to which a Subgrant is awarded and which is accountable to the Participating Municipalities for the use of Allocated Funds provided.

Subgrant. “Subgrant” shall mean an award of Allocated Funds by the Participating Municipalities to an eligible Subawardee. The term does not include procurement purchases.

This Agreement. “This Agreement” or “this Agreement” shall mean this Allocation Agreement dated as of August 24, 2011, together with the Annexes attached hereto, and the Assurances (Non-Construction) submitted by the Participating Municipalities as part of its Application, as the foregoing may be amended or modified from time to time in accordance with their respective terms.

Section 1.2 Rules of Interpretation. Unless the context shall otherwise indicate, the terms defined in Section 1.1 of this Agreement shall include the plural as well as the singular and the singular as well as the plural. The words “herein,” “hereof,” and “hereto,” and words of similar import, refer to this Agreement as a whole.

ARTICLE II

THIS ALLOCATION

Section 2.1 The Allocation Commitment. Subject to all of the terms and conditions hereof and in reliance upon all representations, warranties, assurances, certifications, covenants and agreements contained herein, Treasury will provide to the Participating Municipalities, an Allocation in the aggregate amount not to exceed [insert amount] ($xxxxxxxx).

Section 2.2 Purpose of this Allocation. The purpose of this Allocation is to carry out the Approved Municipal Program(s) as described in Annex 1 attached hereto, which is/are incorporated herein by reference.

Section 2.3 Allocation Time Period. The effective date of this Allocation shall be the date of this Agreement. The expiration date of this Allocation is March 31, 2017. The period of time between the effective date and the expiration date is the Allocation Time Period. The Participating Municipalities may charge to this Allocation allowable costs incurred, in accordance with Section 4.2 hereof, during the Allocation Time Period. Costs incurred prior to the Allocation Time Period are not allowable unless authorized in writing by Treasury. After the Allocation Time Period, the Participating Municipalities may charge to unobligated Allocated Funds in their possession allowable costs incurred in accordance with Section 4.2 hereof.

ARTICLE III

DISBURSEMENTS AND CONDITIONS PRECEDENT TO DISBURSEMENTS

Section 3.1 Disbursements of Allocated Funds. Subject to the terms and conditions hereof, Treasury will make Disbursements of Allocated Funds via electronic funds transfer to the account of the Participating Municipalities designated in advance by the Participating Municipalities. Treasury will make Disbursements to the Participating Municipalities in accordance with Annex 2, attached hereto, which is incorporated herein by reference.

Section 3.2 Cooperative Agreement. Before Treasury’s initial Disbursement of the Allocated Funds, the Participating Municipalities shall have executed and delivered to Treasury a Cooperative Agreement in form and substance satisfactory to Treasury.

Section 3.3 Opinion of Participating Municpal Counsel. Before Treasury's initial Disbursement of all or a portion of the Allocated Funds, Treasury shall have received, from counsel for each Participating Municipality, a favorable opinion satisfactory in scope, form, and substance to Treasury, with respect to the matters stated in Sections 5.1, 5.2, 5.3, 5.4, 5.5, and 5.6 hereof. Such opinions shall also cover such other matters incident hereto as Treasury may require. Opinions conforming substantially to the form opinion of counsel attached hereto as Annex 6 will be satisfactory to Treasury.

Section 3.4 Conditions Precedent for Disbursements. In addition to the prerequisite set forth in Sections 3.2 and 3.3 hereof, each Participating Municipality shall provide before each successive Disbursement following the initial one-third Disbursement certifications signed by each Authorized Municipal Official that such Participating Municipality has performed and complied with all applicable agreements and conditions contained herein, and that with respect to each Participating Municipality, the representations and warranties set forth in this Agreement and in the Assurances (Non-Construction) contained as part of the Application shall be true and correct in all material respects. The form of the certification is in Exhibit 2-1 of Annex 2 attached hereto. If any condition or prerequisite specified herein or in any document connected herewith shall not have been fulfilled to the satisfaction of Treasury, Treasury may, in its sole discretion, elect not to make a Disbursement until such time as such condition or prerequisite shall be fulfilled to the satisfaction of Treasury.

ARTICLE IV

COVENANTS AND AGREEMENTS OF THE PARTICIPATING MUNICIPALITIES

Each Participating Municipality shall duly perform and observe each and all of the following covenants and agreements unless the text clearly requires a different duration:

Section 4.1 Compliance with Government Requirements. In carrying out its responsibilities pursuant to this Agreement, such Participating Municipality shall comply with the Act, Treasury regulations or other requirements prescribed by Treasury pursuant to the Act, and applicable provisions of the grants management common rule referenced in the attachment to OMB Circular A-102 (“Grants and Cooperative Agreements with State and Local Governments”), which are incorporated herein by reference. The Participating Municipality also shall comply with all applicable Federal, State, and local laws, regulations, ordinances, and OMB Circulars, including, but not limited to, the regulations at 31 C.F.R. Part 21, related to lobbying.

Section 4.2 Authorized Uses of Allocated Funds/Allowable Costs. The Participating Municipality shall only use the Allocated Funds for the purposes and activities specified in this Agreement including, but not limited to, the Schedule contained in Annex 3 attached hereto, which is incorporated herein by reference, and for paying allowable costs of those purposes and activities in accordance with the cost principles set forth in OMB Circular A-87 (Cost Principles for State, Local, and Indian Tribal Governments) and codified in 2 C.F.R. Part 225.

Section 4.3 Authorized Uses of Program Income. The Participating Municipality shall add Program Income to the Allocated Funds, and shall use such Program Income for the same purposes and under the same conditions as the Allocated Funds.

Section 4.4 Restrictions on the Use of Allocated Funds

Funds and Program Income.

(a) No Participating Municipality shall use any Allocated Funds in a manner other than as authorized hereunder, without the prior written approval of Treasury.

(b) No Participating Municipality shall use any Allocated Funds to pay any person to influence or attempt to influence any agency, elected official, officer or employee of a State or Local Government in connection with the making, award, extension, continuation, renewal, amendment, or modification of any State or Local Government contract, grant, loan or cooperative agreement as such terms are defined in 31 U.S.C. § 1352.

(c) No member of or delegate to the United States Congress or resident U.S. Commissioner shall be admitted to any share or part of this Agreement or to any benefit that may arise herefrom.

(d) No Participating Municipality shall use any Allocated Funds to pay any costs incurred in connection with (i) any defense against any claim or appeal of the United States Government, any agency or instrumentality thereof (including Treasury), against the Participating Municipality, or (ii) any prosecution of any claim or appeal against the United States Government, any agency or instrumentality thereof (including Treasury), which the Participating Municipality instituted or in which the Participating Municipality has joined as a claimant.

(e) No Participating Municipality shall use any Allocated Funds for loans used to finance, in whole or in part, business activities prohibited by Treasury regulations, including Treasury regulations promulgated after the date of this Allocation Agreement and the SSBCI Policy Guidelines as published by Treasury on its website at www.treasury.gov/ssbci.

(f) No Participating Municipality may use Allocated Funds outside the geographic borders of the Participating Municipality unless the Authorized Municipal Official or chief executive of the Participating Municipality warrants, in writing, that the loan or investment will result in significant economic benefit to the Participating Municipality.

Section 4.5 Commencement of Performance. Each Participating Municipality shall be fully positioned within 90 days of the date of this Agreement to act on providing the type of credit support that the Approved Municipal Program was established to provide using the Allocated Funds.

Section 4.6 SSBCI Policy Guidelines, National Standards and Internal Control and Financial Management System Requirements.

Each Participating Municipality shall comply with the SSBCI Policy Guidelines published by Treasury on its website at www.treasury.gov/ssbci, including any SSBCI Policy Guidelines and national standards that are established by Treasury after the date of this Allocation Agreement.

Each Participating Municipality shall comply with the standards for financial management systems, including internal control requirements, specified in the grants management common rule at § __.20. Notwithstanding the foregoing, the cash management requirements in § __.20(b)(7) of the grants management common rule shall not apply to the Participating Municipalities.

Section 4.7 Quarterly Reporting. Within 30 days after the end of each quarterly reporting period (excluding the quarterly reporting period ending on the expiration date of this Allocation), the Participating Municipalities shall deliver to Treasury a quarterly report, which shall be signed by each of the Participating Municipalities’ Authorized Municipal Official. The reporting period covered by, and the due date for, each quarterly report are listed in Annex 5 attached hereto. Each report shall be in such form as Treasury may, from time to time prescribe, and shall consist of the following information:

A report on the use of Allocated Funds for each Approved Municipal Program on both a quarterly and a cumulative basis, including the total amount of Allocated Funds used for direct and indirect administrative costs, the total amount of Allocated Funds used, the amount of Program Income generated, and the amount of charge-offs against the Federal contributions to the reserve funds set aside for any Approved Capital Access Programs; and

A certification in the form prescribed in Annex 4.

Section

4.8 Annual Reports.

For CAPs and OCSPs other than venture capital programs, by March 31 of each year, beginning March 31, 2012, the Participating Municipalities shall submit to Treasury an annual report, for the prior calendar year ending December 31st, which shall be signed by each Authorized Municipal Official, in such form as Treasury may from time to time prescribe, that contains the following information for each loan, indicating the SSBCI-approved loan program in which the loan is enrolled (e.g. capital access program, loan guarantee, loan participation, direct loan, collateral support):

A unique loan identifier number, the census tract and zip code of the borrower’s principal location in the municipality;

The lending institution’s name and Employer Identification Number (EIN);

The total amount of principal loaned/authorized as a line of credit, and of that amount, the portion that is from non-private sources;

Date of initial disbursement;

For CAP loans, the insurance premiums paid by the borrower, the lender, and the Participating Municipalities; or for loans in which the Participating Municipalities are participating, the amount of the participation; or for loans guaranteed by the Participating Municipalities, the amount of loan guarantee provided by the SBBCI recipient and the amount of funds set aside by the Participating Municipalities to cover the loan guarantee; or for loans for which the Participating Municipalities provide collateral support, the amount of collateral support provided and the amount of funds set aside by the Participating Municipalities to cover the collateral support obligation;

The borrower’s annual revenues in the last fiscal year;

The borrower’s Full Time Equivalent (FTE) employees;

The 6-digit North American Industry Classification System (NAICS) code for the borrower’s industry;

The year the borrower’s business was incorporated; and

The estimated number of jobs created or retained as a result of the loan.

The amount of additional private financing occurring after the loan closing, if required under the provisions of Annex 7.

All data elements (1) through (10)shall be reported only in the annual report covering the period in which the loan was made. If required under the provisions of Annex 7, the Participating Municipalities will provide the data required in (11) for the periods specified in Annex 7.

For OCSP venture capital programs, by March 31 of each year, beginning March 31, 2012, each Participating Municipality shall submit to Treasury an annual report, for the year ending December 31st, which shall be signed by each Authorized Municipal Official, in such form as Treasury may from time to time prescribe, that contains the following information for each investment in an eligible small business, indicating the SSBCI -approved venture capital program:

A unique investment identifier number, the census tract and zip code of the investee’s principal location in that state;

The State Small Business Credit Initiative-approved program in which the venture capital investment is enrolled;

The total amount of venture capital and other financing invested or loaned, and of that amount, the portion that is from non-private support;

The amount of venture capital provided by the Approved Municipal venture capital fund program;

Date of initial disbursement;

The business’s annual revenues in the last fiscal year;

The business’s Full Time Equivalent (FTE) employees;

The 6-digit North American Industry Classification System (NAICS) code for each business’s industry;

The year the business was incorporated; and

The estimated number of jobs created and the estimated number of jobs retained as a result of the investment;

The amount of additional private financing occurring after the investment closing, if required under the provisions of Annex 7.

All data elements (1) through (10) shall be reported only in the annual report covering the period in which the investment was made. If required under the provisions of Annex 7, each Participating Municipality will provide the data required in (11) for the periods specified in Annex 7.

The Participating Municipalities shall also provide detailed information on any qualifying loan or swap funding facility and information on aggregate loan losses.

For the final annual report due on March 31, 2017, a summary of the performance results of this Allocation, including a narrative of how or the extent to which the purpose of this Allocation, as described in Annex 1 attached hereto, was accomplished using Allocated Funds.

In addition, each Authorized Municipal Official shall attach to the Participating Municipalities’ annual report a completed and executed Federal Financial Report, SF-425. The due dates for the submission of the annual reports are listed in Annex 5 attached hereto.

Treasury may require the Participating Municipalities to submit this report using an electronic reporting system.

Section 4.9 Access to Records of and Certifications from Financial Institutions. Before providing any loan, loan guarantee, or other financial assistance using Allocated Funds to a financial institution or any other private entity, the Participating Municipalities shall obtain the following:

the binding written agreement of the financial institution or other private entity to make available to the Treasury Inspector General all books and records related to the use of the Allocated Funds, subject to the Right to Financial Privacy Act (12 U.S.C. § 3401 et seq.), including detailed loan records, as applicable;

a certification from the financial institution that the financial institution is in compliance with the requirements of 31 C.F.R. § 103.121; and

a certification from the private entity, including any financial institution, that the Principals of such entity have not been convicted of a sex offense against a minor (as such terms are defined in section 111 of the Sex Offender Registration and Notification Act (42 U.S.C. 16911)).

Section 4.10 Notices of Certain Material Events. The Participating Municipalities shall promptly notify Treasury in writing in reasonable detail of any of the following events:

(a) any proceeding instituted against any Participating Municipality in, by or before any court, governmental or administrative body or agency, which proceeding or its outcome could have a material adverse effect upon the operations, assets or properties of the Participating Municipality;

(b) any material adverse change in the condition, financial or otherwise, or operations of any of the Participating Municipalities;

(c) the occurrence of any event described in Sections 6.1 and 6.2 herein (General Events of Default and Specific Events of Default);

(d) problems, delays, or adverse conditions, real or anticipated, that will materially impair any Participating Municipality’s ability to accomplish the purpose of this Allocation set forth in Annex 1 attached hereto, with a description of actions taken or contemplated to be taken, and any assistance needed to resolve the situation;

(e) deviations from the annual schedule submitted by the Participating Municipalities under Section 4.8 apportioning Allocated Funds among the Approved Municipal Programs if the deviations will result in the need for additional funding from any third party to accomplish the purpose of this Allocation set forth in Annex 1 attached hereto; and

(f) favorable developments which enable meeting time schedules and objectives sooner or at less cost than anticipated or producing more beneficial results than originally planned.

(g) any material change to the Cooperative Agreement referenced in Section 3.2 which includes, but is not limited to the addition or withdrawal of any municipality from the Cooperative Agreement, changes in any governance structure of the Cooperative Agreement, or change in the relationship to the administering entity in the Cooperative Agreement.

Section 4.11 High Risk. Notwithstanding the foregoing, Treasury may unilaterally increase the frequency and the scope of Participating Municipalities’ reporting requirements if Treasury finds the Participating Municipalities to be high risk in accordance with the grants management common rule at § __.12.

Section 4.12 Subgrants. The Participating Municipalities shall not make any Subgrants using Allocated Funds without the prior written approval of Treasury.

Section 4.13 Retention of Records. The Participating Municipalities shall retain all financial records, supporting documents, statistical records, and all other records pertinent to the Allocation for a period of three years from the date of submission of the final quarterly report under Section 4.7 herein, except as otherwise provided in the grants management common rule at § __.42.

Section 4.14 Right to Inspect, Audit and Investigate. Treasury, the Treasury Inspector General, the Comptroller General of the United States, or any of their duly authorized representatives, have the right of timely and unrestricted access to any books, documents, papers, or other records of the Participating Municipalities that are pertinent to the Allocation, in order to make audits, investigations, examinations, excerpts, transcripts and copies of such documents. This right also includes timely and reasonable access to the Participating Municipalities’ personnel for the purpose of interview and discussion related to such documents. This right of access shall last as long as records are retained, except that Treasury’s right of access expires on September 27, 2017.

ARTICLE V

REPRESENTATIONS AND WARRANTIES

The Participating Municipalities hereby jointly and severally make each and all of the following representations and warranties:

Section 5.1 Designation of Eligible Organization. Each Participating Municipality has designated the party identified in Annex 8 to implement each Participating Municipality’s Approved Municipal Program. Each party identified is a department, agency, or political subdivision of the Participating Municipality.

Section 5.2 Authority. Each Participating Municipality has all requisite power and authority under the constitution and the laws of the State of [INSERT STATE] to execute and deliver this Agreement, to consummate the transactions contemplated hereby, and to perform its obligations hereunder.

Section 5.3 Due Authorization. The execution and delivery by each Participating Municipality of this Agreement, the consummation by each Participating Municipality of the transactions contemplated hereby, and the performance by each Participating Municipality of its obligations hereunder have been duly authorized by all necessary action on the part of the Participating Municipality.

Section 5.4 Due Execution and Delivery; Binding Agreement. This Agreement has been duly executed and delivered by each Participating Municipality, and constitutes the legal, valid and binding obligation of each Participating Municipality enforceable in accordance with its terms.

Section 5.5 No Conflicts. The execution and delivery by each Participating Municipality of this Agreement, the consummation by each Participating Municipality of the transactions contemplated hereby, and the performance by each Participating Municipality of its obligations hereunder do not and will not:

(a) conflict with or violate any existing law or administrative regulation, or any existing administrative or judicial decree or order; and

(b) conflict with, result in a breach of, or constitute a default under any existing agreement or other instrument to which such Participating Municipality is subject or by which it is bound.

Section 5.6 Litigation. There is no lawsuit or judicial or administrative action, proceeding, or investigation pending or threatened against any Participating Municipality which is likely to have a material adverse effect on the ability of such Participating Municipality to perform its obligations under this Agreement.

Section 5.7 Disclosure. Neither this Agreement nor any Annex attached hereto, nor any certification or assurance referenced herein, nor any other document or instrument delivered to Treasury by any Participating Municipality pursuant to this Agreement contains any untrue statement of a material fact or omits to state a material fact necessary in order to make the statements contained herein or therein, in light of the circumstances under which they were made, not misleading. Each Participating Municipality has disclosed, in writing, to Treasury all facts that might reasonably be expected to result in a material adverse effect upon such Participating Municipality’s ability either to conduct its business or to carry out the purpose of this Allocation. No Participating Municipality has knowingly and willfully made or used a document or writing containing any false, fictitious or fraudulent statement or entry as part of its correspondence or communication with Treasury.

ARTICLE VI

TERMINATION FOR CAUSE AND OTHER REMEDIES

Section 6.1 General Events of Default. In the event that either:

any representation, warranty, certification, assurance or any other statement of fact contained in this Agreement or the Application of any Participating Municipality including, but not limited to, the Assurances (Non-Construction) contained as part of the Application, or any representation or warranty set forth in any document, report, certificate, financial statement or instrument now or hereafter delivered to Treasury in connection with this Agreement, is found to be inaccurate, false, incomplete or misleading when made, in any material respect; or

any Participating Municipality materially fails to observe, comply with, meet or perform any term, covenant, agreement or other provision contained in this Agreement including, but not limited to, any Participating Municipality’s failure to submit complete and timely quarterly reports or annual reports, or any Participating Municipality ceases to use the Allocated Funds to undertake the activities authorized in Annex 1 attached hereto;

Treasury, in its sole discretion, may find any or all of the Participating Municipalities to be in default.

Section 6.2 Discretionary Remedies. If Treasury finds any Participating Municipality to be in default under Section 6.1 of this Agreement, Treasury may, in its sole discretion, take any one or more of the following actions, subject to Section 6.6 of this Agreement:

withhold Disbursements pending the Participating Municipalities’ correction of the default; or

wholly or partly reduce, suspend, or terminate the commitment of Treasury to make Disbursements to the Participating Municipalities under this Agreement, whereupon the commitment of Treasury to make Disbursements to any or all Participating Municipalities under this Agreement will be reduced, suspended, or terminated, as the case may be.

Section 6.3 Specific Events of Default. In the event of a Treasury Inspector General audit finding of either:

intentional or reckless misuse of Allocated Funds by any Participating Municipality; or

any Participating Municipality having intentionally made misstatements in any report issued to Treasury under the Act;

Treasury shall find any or all the Participating Municipalities to be in default.

Section 6.4 Mandatory Remedies. If Treasury finds the Participating Municipalities to be in default under Section 6.3 of this Agreement, Treasury shall take the following actions:

in the case of an event of default under

Section 6.3(a), recoup any misused Allocated Funds that have been disbursed to the Participating Municipalities; or

in the case of an event of default under

Section 6.3(b), terminate the commitment of Treasury to make Disbursements to the Participating Municipalities under this Agreement, and find the Municipalities ineligible to receive any additional funds under the Act, whereupon the commitment of Treasury to make Disbursements to the Participating Municipalities under this Agreement will be terminated and the Municipalities will be ineligible to receive any additional funds under the Act.

Section 6.5 No Waiver. No delay or failure by Treasury in the exercise of any right, power, or remedy accruing upon the occurrence of any event described in Section 6.1 or Section 6.3 herein shall impair any such right, power, or remedy, or be construed to be a waiver of or acquiescence in such event, nor shall any abandonment or discontinuance of steps taken to exercise any right, power or remedy preclude any further exercise thereof.

Section 6.6 Prior Notice to Participating Municipalities of Exercise of Remedies. Prior to exercising or imposing any remedy contained in Section 6.2 other than a withholding of a Disbursement(s) under Section 6.2(a), Treasury will, to the maximum extent practicable, provide the Participating Municipalities with written notice of the event(s) described in Section 6.1 hereof and the proposed remedy. Treasury’s written notice will give the Participating Municipalities 10 calendar days from the date of the notice to respond. Treasury may, in its sole discretion, also afford the Participating Municipalities 20 calendar days from the date of the notice to correct the event. If the Participating Municipalities fail to correct the event within either the 10 calendar day response time or, if applicable, the 20 calendar day correction or cure period, Treasury may, in its sole discretion, impose or exercise the remedy or remedies set forth in its written notice. Moreover, if the Participating Municipalities fail to respond timely to Treasury’s written notice, Treasury may impose or exercise the remedy or remedies set forth in its written notice, effective as of the date specified in such notice. Nothing in this Agreement, however, will provide the Participating Municipalities with any right to any formal or informal hearing or comparable proceeding not otherwise required by law.

ARTICLE VII

TERMINATION OF AVAILABILITY

Section 7.1 Termination of Availability. Treasury may, upon submitting to the Participating Municipalities written notification, terminate any or all of the Participating Municipalities’ Allocation of any portion of the Allocated Funds that Treasury has not disbursed to the Participating Municipalities by 2-years from the date of this Allocation Agreement.

ARTICLE VIII

MISCELLANEOUS

Section 8.1 Notices. All notices, requests, demands, consents, waivers and other communications given under any provision of this Agreement shall be in writing and shall be delivered by hand, mailed by postage-prepaid first-class mail, delivered by overnight courier service, or transmitted electronically via facsimile (fax) or email transmission to the addresses indicated below:

if to Treasury:

Department of the Treasury

ATTN: State Small Business Credit Initiative

Main Treasury Building

Room 1310

1500 Pennsylvania Avenue, N.W.

Washington, DC 20220

Telephone No. (202) 622-0713

Facsimile No. (202) 622-9947

Email address: SSBCIapplications@treasury.gov

if to the Participating Municipalities, please see Annex 8 for detailed contact information.

The address, telephone number, email address or facsimile number for either party hereto may be changed at any time and from time to time upon written notice given to the other party.

Section 8.2 Entire Agreement. This Allocation Agreement (including all annexes and amendments thereto), the Application and the attachments, exhibits, appendices and supplements to the Application, and the Allocation notice letter, between the Participating Municipalities and Treasury with respect to the obligation of funds necessary to provide transfers to the Participating Municipalities contain the entire agreement of the parties with respect to the subject matter hereof and supersede all prior agreements or understandings, written or oral, in respect thereof. The Application, including any attachments, exhibits, appendices and supplements thereto, any attachments, schedules, annexes, appendices and supplements to the Allocation Agreement, and said Allocation notice letter are incorporated in and made a part of this Agreement.

Section 8.3 Amendments. Unless otherwise expressly provided in this Agreement, no provision of this Agreement may be amended, modified, waived, supplemented, discharged or terminated orally but only by an instrument in writing duly executed by Treasury and each Participating Municipality. If the Participating Municipalities propose to make an amendment to the Allocation Agreement, they must submit a request, in writing, to Treasury.

Section 8.4 Assignment. The Participating Municipalities may not assign or transfer their rights under this Agreement without the prior written consent of Treasury.

Section 8.5 Successors. This Agreement shall be binding upon and inure to the benefit of Treasury and the Participating Municipalities and their respective successors and permitted assigns.

Section 8.6 Cumulative Rights. Each and every right, power, and remedy conferred in this Agreement shall be cumulative and shall be in addition to every other right, power and remedy herein conferred or now or hereafter existing at law or in equity, by statute or otherwise.

Section 8.7 No Election. Each and every right, power, and remedy, whether conferred in this Agreement or otherwise existing, may be exercised from time to time and as often and in such order as may be determined by Treasury, and the exercise or the beginning of the exercise of any right, power or remedy shall not be construed to be an election or a waiver of the right to exercise at the same time or thereafter any other right, power or remedy.

Section 8.8 Rights Confined to Parties. Nothing expressed or implied herein is intended or shall be construed to confer upon, or to give, any person other than the Participating Municipalities or Treasury, and their respective successors and permitted assigns, any right, remedy or claim under or by reason of this Agreement or of any term, condition, representation, warranty, covenant, or agreement contained herein, and all of the terms, conditions, representations, warranties, covenants, and agreements contained herein shall be for the sole and exclusive benefit of the Participating Municipalities, and Treasury, and their respective successors and permitted assigns.

Section 8.9 No Partnership. Neither this Agreement nor any part or provision hereof, nor the exercise by Treasury of any of its respective rights or remedies hereunder, shall evidence or establish, be construed as evidencing or establishing, any partnership, joint venture, or similar relationship of Treasury with the Participating Municipalities.

Section 8.10 Survival of Representations and Warranties. All representations, warranties, covenants, and agreements made by each Participating Municipality in this Agreement (including, without limitation, the Application and the Assurances (Non-Construction) submitted by the Participating Municipalities as part of the Application and the Cooperative Agreement referenced in section 3.2) or in any document, report, certificate, financial statement, note, or instrument now or hereafter furnished in connection with this Agreement shall survive the execution and delivery of this Agreement and the Disbursement of Allocated Funds pursuant hereto.

Section 8.11 Applicable Law. This Agreement, and the rights and obligations of the parties hereunder, shall be governed by, and construed and interpreted in accordance with United States Federal law and not the law of any State or locality of the United States. To the extent that a court looks to the laws of any State to determine or define the Federal law, it is the intention of the parties hereto that such court shall look only to the laws of the State of [insert state].

Section 8.12 Severability. Any provision of this Agreement that is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not of itself invalidate or render unenforceable such provision in any other jurisdiction.

Section 8.13 Headings. The descriptive headings of the various articles and sections contained in this Agreement were formulated and are for convenience only and shall not be deemed to affect the meaning or construction of the provisions hereof.

Section 8.14 Counterparts. This Agreement may be executed in separate counterparts, each of which shall constitute an original but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties hereto have duly executed this Agreement as of the date first above written.

TREASURY: United States Department of the Treasury

By: ______________________________

Name: Don Graves Jr.

Title: Deputy Assistant Secretary

PARTICIPATING MUNICIPALITY:

By: _______________________________

Name:

Title:

______________

Date:

ANNEX 1

PURPOSE OF THE ALLOCATION

This Annex 1 constitutes an integral part of the Allocation Agreement dated as of xxxx xx, 2011, between the Treasury and the Participating Municipalities.

The purpose of the Allocation is to assist the Participating Municipalities to increase the amount of capital made available by private lenders to small businesses through its Approved Municipal Programs.

To accomplish this, the Participating Municipalities will use $##### of their Allocated Funds to support the new [insert name of program].

All programs will be administered by the []

ANNEX 2

DISBURSEMENT

POLICIES AND PROCEDURES

This Annex 2 constitutes an integral part of the Allocation Agreement dated as of xxxx xx, 2011, between the Treasury”) and the Participating Municipalities.

1. Treasury Disbursement of Initial One-Third of Allocated Funds to the Participating Municipalities.

Treasury will promptly disburse the first one-third of the Allocation to the Participating Municipalities after each Participating Municipality executes the Allocation Agreement and Treasury receives the opinions required by Annex 6.

2. Subsequent Disbursements of Allocated Funds

Except as provided in paragraphs 2 and 3 herein, Treasury will disburse to the Participating Municipalities each successive one-third of the Allocation Funds after each Participating Municipality certifies to Treasury that it has expended, transferred, or obligated 80 percent of the last transferred one-third for federal contributions to, or for the account of, the Approved Municipal Program. Each Participating Municipality’s certification shall be in the form attached hereto as Exhibit 2-1.

3. Authority to Withhold Disbursements Pending Audit

Treasury may withhold the Disbursement of any successive one-third of the Allocated Funds pending the results of a financial audit. Treasury will notify the Participating Municipalities of its decision to withhold such Disbursement.

4. Withholding or Suspending Payments

Notwithstanding any other provision contained in the Allocation Agreement, Treasury may, in its discretion, withhold or suspend making Disbursements to the Participating Municipalities for failure to comply with any term, agreement, covenant or condition of the Allocation Agreement. Treasury will generally resume making Disbursements to the Participating Municipalities upon the Participating Municipalities’ subsequent compliance.

5. Cash Depositories

Disbursements shall be deposited and maintained in a United States Government-insured interesting-bearing account whenever possible.

Consistent with the United States Government national goal of expanding opportunities for women-owned and minority-owned business enterprises, Treasury encourages the Participating Municipalities to use women-owned or minority-owned depository financial institutions (a depository financial institution which is owned at least 50 percent by women or minority group members).

The Participating Municipalities are not required to maintain a separate depository account for receiving Disbursements of Allocated Funds. If the Participating Municipalities maintain a single depository account where Allocated Funds are commingled with funds from other sources, the Participating Municipalities shall maintain on its books a separate subaccount for the Allocated Funds.

EXHIBIT 2-1

CERTIFICATION OF PERFORMANCE AND

REPRESENTATIONS AND WARRANTIES

United States Department of the Treasury

Main Treasury Building, Room 1310

1500 Pennsylvania Avenue

Washington, D.C. 20220

Reference is made to the Allocation Agreement dated as of August 24, 2011 (the “Allocation Agreement”), between the United States Department of the Treasury (“Treasury”) and the Participating Municipalities. Capitalized terms used herein and not defined herein shall have the respective meanings ascribed to them in the Allocation Agreement.

This certification is delivered to Treasury pursuant to paragraph 2 (“Subsequent Disbursement Requests of Allocated Funds”) of Annex 2 (“Disbursement Policies and Procedures”) attached to the Allocation Agreement.

The undersigned, on behalf of each Participating Municipality, hereby makes the following certifications as of the date of this certification:

1. the Participating Municipality has performed and complied with all applicable terms, covenants, agreements and conditions required by the Allocation Agreement to be performed or complied with by it as of this date;

2. the representations and warranties set forth in the Allocation Agreement and in the Assurances (Non-Construction) contained as part of the Application are true and correct in all material respects;

3. the Participating Municipality has expended, transferred, or obligated 80 percent or more of the last disbursed one-third of Allocated Funds for federal contributions to, or for the account of, the Participating Municipality’s Approved Municipal Programs; and

4. the authority of the undersigned to execute and deliver this certification on behalf of the Participating Municipality is valid and in full force and effect.

By: ___________________________________

Name:

Title:

Date: __________________________

ANNEX 3

SCHEDULE

This Annex 3 constitutes an integral part of the Allocation Agreement dated as of August 24, 2011 between the Treasury and the Participating Municipalities.

Limitation on Use of Allocated Funds for Administrative Expenses

Each Participating Municipality may use its Allocation to pay both direct and indirect administrative costs incurred in carrying out the Approved Municipal Program subject to the aggregated limitations described in the table below.

Allocation |

Maximum Amount Available to Pay for Direct and Indirect Administrative Costs |

First One-Third (33%) or $10,329,494 |

Five Percent (5%) or $516,474 |

Second One-Third (33%) or $10,329,494 |

Three Percent (3%) or $309,884 |

Third One-Third (34%) or $10,642,510 |

Three Percent (3%) or $319,275

|

ANNEX 4

QUARTERLY USE-OF-FUNDS-REPORT

This Annex 4 constitutes an integral part of the Allocation Agreement dated as of August 24, 2011, between the “Treasury”) and the Participating Municipalities. Capitalized terms used herein and not defined herein shall have the respective meanings ascribed to them in the Allocation Agreement.

As part of its quarterly reporting requirement, each Participating Municipality shall submit a certification in the form attached hereto as Exhibit 4-1.

EXHIBIT 4-1

CERTIFICATION ON USE-OF-ALLOCATED FUNDS

United States Department of the Treasury

Main Treasury Building, Room 1310

1500 Pennsylvania Avenue

Washington, D.C. 20220

Reference is made to:

the Allocation Agreement dated as of August 24, 2011 (the “Allocation Agreement”), between the United States Department of the Treasury (“Treasury”) and the City of _____ (the “Participating Municipality”). Capitalized terms used herein and not defined herein shall have the respective meanings ascribed to them in the Allocation Agreement.

This certification is delivered to Treasury pursuant to Section 4.7 (“Quarterly Reports”) of the Allocation Agreement.

The undersigned, on behalf of the Participating Municipality, hereby makes the following certifications as of the date of this certification:

1. the information provided by the Participating Municipality under Section 4.7 (“Quarterly Reports”) of the Allocation Agreement on the use of Allocated Funds is accurate;

2. funds continue to be available and legally committed to contributions by the Participating Municipality to, or for the account of, Approved Municipal Programs, less any amount that has been contributed by the Participating State to, or for the account of, Approved Municipal Programs subsequent to the Participating Municipality being approved for participation in the State Small Business Credit Initiative;

3. the Participating Municipality is implementing its Approved Municipal Program or Programs in accordance with the Act and the regulations or other guidance issued by Treasury under the Act; and

4. the authority of the undersigned to execute and deliver this certification on behalf of the Participating Municipality is valid and in full force and effect.

By: ___________________________________

Name:

Title:

Date: __________________________________

ANNEX 5

REPORTING SCHEDULE FOR THE CONSORTIUM OF [INSERT]

Quarterly Report Due Dates |

|

Report for period covering: |

Due Date: |

October 1, 2011 through December 31, 2011 |

January 30, 2012 |

January 1, 2012 through March 31, 2012 |

April 30, 2012 |

April 1, 2012 through June 30, 2012 |

July 30, 2012 |

July 1, 2012 through September 30, 2012 |

October 30, 2012 |

October 1, 2012 through December 31, 2012 |

January 30, 2013 |

January 1, 2013 through March 31, 2013 |

April 30, 2013 |

April 1, 2013 through June 30, 2013 |

July 30, 2013 |

July 1, 2013 through September 30, 2013 |

October 30, 2013 |

October 1, 2013 through December 31, 2013 |

January 30, 2014 |

January 1, 2014 through March 31, 2014 |

April 30, 2014 |

April 1, 2014 through June 30, 2014 |

July 30, 2014 |

July 1, 2014 through September 30, 2014 |

October 30, 2014 |

October 1, 2014 through December 31, 2014 |

January 30, 2015 |

January 1, 2015 through March 31, 2015 |

April 30, 2015 |

April 1, 2015 through June 30, 2015 |

July 30, 2015 |

July 1, 2015 through September 30, 2015 |

October 30, 2015 |

October 1, 2015 through December 31, 2015 |

January 30, 2016 |

January 1, 2016 through March 31, 2016 |

April 30, 2016 |

April 1, 2016 through June 30, 2016 |

July 30, 2016 |

July 1, 2016 through September 30, 2016 |

October 30, 2016 |

October 1, 2016 through December 31, 2016 |

January 30, 2017 |

Annual Report Due Date |

|

Report for period ending on: |

Due Date: |

December 31, 2011 |

March 31, 2012 |

December 31, 2012 |

March 31, 2013 |

December 31, 2013 |

March 31, 2014 |

December 31, 2014 |

March 31, 2015 |

December 31, 2015 |

March 31, 2016 |

December 31, 2016 |

March 31, 2017 |

ANNEX 6

DRAFT OPINION OF COUNSEL

[Treasury Will Generally Deem A Legal Opinion in this Form To Be Satisfactory Under Section 3.2 of the Allocation Agreement]

[Letterhead of Participating Municipality Counsel]

[Dated on or after the Date of the Allocation Agreement]

United States Department of the Treasury

ATTN: State Small Business Credit Initiative

Main Treasury Building

Room 1310

1500 Pennsylvania Avenue, N.W.

Washington, DC 20220

Re: State Small Business Credit Initiative Allocation Agreement

Ladies and Gentlemen:

We have acted as counsel for [Insert Name of Participating Municipality] (the “Participating Municipality”) in connection with the transactions contemplated by the State Small Business Credit Initiative Allocation Agreement for Participating Municipalities dated as of [Insert Date of Allocation Agreement], by and between the United States Department of the Treasury and the Participating Municipality (the “Agreement”). This opinion is furnished to you pursuant to Section 3.2 of the Agreement.

We have examined the Agreement and considered such questions of law as we have deemed appropriate. Based on the foregoing, it is our opinion that:

1. The Participating Municipality has designated [Insert name of department, agency, or political subdivision] to implement the Participating Municipality’s Approved Municipal Program (as defined in Section 1.1 of the Agreement). [Insert name of designated department, agency, or political subdivision] is a [Insert department, agency, or political subdivision] of the Participating Municipality.

2. The Participating Municipality has all requisite power and authority under the constitution and the laws of [Insert name of Participating Municipality] to execute and deliver this Agreement, to consummate the transactions contemplated by the Agreement, and to perform its obligations under the Agreement.

3. The execution and delivery by the Participating Municipality of the Agreement, the consummation by the Participating Municipality of the transactions contemplated under the Agreement, and the performance by the Participating Municipality of its obligations under the Agreement have been duly authorized by all necessary action on the part of the Participating Municipality.

4. The Agreement has been duly executed and delivered by the Participating Municipality, and constitutes the legal, valid, and binding obligation of the Participating Municipality enforceable in accordance with the terms of the Agreement.

5. The execution and delivery by the Participating Municipality of the Agreement, the consummation by the Participating Municipality of the transactions contemplated by the Agreement, and the performance by the Participating Municipality of its obligations under the Agreement do not and will not:

(a) Conflict with or violate any existing law or administrative regulation, or any existing administrative or judicial decree or order; and

(b) To the best of our knowledge, conflict with, result in a breach of, or constitute a default under any existing agreement or other instrument to which the Participating Municipality is subject or by which it is bound.

6. To the best of our knowledge, there is no lawsuit or judicial or administrative action, proceeding, or investigation pending or threatened against the Participating Municipality which is likely to have a material adverse effect on the ability of the Participating Municipality to perform its obligations under the Agreement.

This opinion letter is based on the laws of the [Insert Name of Participating Municipality] and the Federal laws of the United States. This opinion is solely for your benefit and may not be relied upon by any other person without our prior written consent.

ANNEX

7

SUBSEQUENT ANNUAL REPORTING

Section 4.8 of this Allocation Agreement references Annex 7 to determine the conditions under which Participating Municipalities are required to provide, in the annual report to be submitted to Treasury, data on private financing occurring after the loan/investment closing. Reporting this data for subsequent years allows the SSBCI to determine program effectiveness in achieving the Participating Municipalities’ projected 10 to 1 private leveraging expectation across all Approved Municipal Programs and the projected 1 to 1 private leveraging requirement for each Approved Municipal Program that is an OCSP.

Section 3006(c) of the Act includes the following eligibility criteria referencing the 10 to 1 private leverage expectation for OCSPs: “For a Municipality other credit support program to be approved under this section, that program shall be required to be a program of the Municipality that… can demonstrate a reasonable expectation that, when considered with all other Municipal programs of the Municipality, such Municipality programs together have the ability to use the amount of new Federal contributions to, or for the account of, all such new programs in the Municipality to cause and result in amounts of new small business lending at least 10 times the new Federal contribution amount.”

Definitions for use in this Annex. Terms used in this Annex that are not defined shall have the same meaning as in the Act and this Agreement.

Cumulative Private Leverage Ratio for all Approved Municipal Programs. “Cumulative Private Leverage for all Approved Municipal Programs” shall mean the result of dividing the Total Cumulative Private Financing Generated by all Approved Municipal Programs by the Total SSBCI Funds Used by all Approved Municipal Programs. This resulting weighted average is known as the Cumulative Private Leverage ratio formula which is outlined below and reflects the Participating Municipality’s ability to meet its reasonable expectation of 10 to 1 leveraging to date.

Cumulative Private Leverage Ratio for Individual Approved OCSP Program. “Cumulative Private Leverage Ratio for Individual Approved OCSP Program” shall mean the result of dividing the Total Cumulative Private Financing Generated by the individual Approved OCSP Municipal Program by the Total SSBCI Funds Used by the individual Approved OCSP Municipal Program. This resulting figure is known as the Cumulative Private Leverage ratio formula which is outlined below and reflects the Participating Municipality’s ability to meet its leveraging requirement of 1 to 1.

Total Cumulative Private Financing Generated by all Approved Municipal Programs. “Total Cumulative Private Financing Generated by all Approved Municipal Programs” shall mean cumulative sum, to date of the reporting, of all private financing across all Approved Municipal Programs across the multiple years of the programs. This includes all loans or investments from a private source to an eligible borrower or eligible portfolio company, whether occurring at or subsequent to loan/investment closing, and whether funded or unfunded. It encompasses equity investments, written commitments of future equity investments, term loans, lines of credit, and any new infusions of cash by the borrower.

Total Cumulative Private Financing Generated by the Individual Approved Municipal OCSP Program. “Total Cumulative Private Financing Generated by the Individual Approved Municipal OCSP Program” shall mean the cumulative sum, to date of the reporting, of all private financing associated with one particular Approved Municipal Program across the multiple years of this program. This includes all loans or investments from a private source to an eligible borrower or eligible portfolio company, whether occurring at or subsequent to loan/investment closing, and whether funded or unfunded. It encompasses equity investments, written commitments of future equity investments, term loans, lines of credit, and any new infusions of cash by the borrower.

Total

Cumulative SSBCI Funds Used by all Approved Municipal Programs.

“Total Cumulative SSBCI Funds Used by all Approved Municipal

Programs” shall mean the sum of those SSBCI funds which are, to

date of the reporting,(a) deposited with a lender to cover the

federal SSBCI contributions to a CAP reserve fund, (b) disbursed or

committed to a specific borrower as part of a loan participation,

collateral support, or direct lending program, (c) set aside to cover

obligations arising from individual loan guarantees, loan

participations, or collateral support agreements to specific

borrowers, or (d) invested or committed to be invested in specific

businesses, pursuant to a venture capital investment. In the event

that the sum of (a) plus (b) plus (c) plus (d) exceeds the

Participating Municipality’s original total allocation (because

some of the funds invested have generated program income that has

been added to allocated funds), the “Total SSBCI Funds Used by

all Approved Municipal Programs” shall be the Participating

Municipality’s requested total allocation.

Total SSBCI Funds Used by the Individual Approved Municipal OCSP Program. “SSBCI Funds Used by the Individual Approved Municipal OCSP Program” shall mean the sum of those SSBCI funds which are, to date of the reporting (a) disbursed or committed to a specific borrower as part of a loan participation, collateral support, or direct lending program, and (b) set aside to cover obligations arising from individual loan guarantees, loan participations, or collateral support agreements to specific borrowers, and (c) invested or committed to be invested in specific businesses, pursuant to a venture capital investment. In the event that the sum of (a) plus (b) plus (c) exceeds the amount that the Participating Municipality’s sub-allocation for that particular Approved Municipal OCSP Program(because some of the funds invested have generated program income that has been added to allocated funds), the “Total SSBCI Funds Used by all Approved Municipal Programs” shall be the Participating Municipality sub-allocation for that particular Approved Municipal OCSP Program.

Formulas for calculating leverage.

A.

Calculating 10:1

Expectation.

Participating Municipalities calculate their leveraging for purposes of demonstrating a 10 to 1 ratio across all of their Approved Municipal Programs according to the following formula:

Cumulative Private Leverage Ratio for all Approved Municipal Programs = [Total Cumulative Private Financing Generated by all Approved Municipal Programs]/[Total Cumulative SSBCI Funds Used by all Approved Municipal Programs]

B.

Calculating 1:1 Requirement

for OCSPs.

Section 3006(c) also requires that each OCSP of a Participating Municipality demonstrate that, at a minimum, $1 of public investment by the Municipality program will cause and result in $1 of new private credit. Participating Municipalities calculate their leveraging for purposes of demonstrating the statutorily required 1 to 1 ratio within an individual OCSP according to the following formula:

Cumulative Private Leverage Ratio for Individual Approved Municipality OCSP Program = [Total Cumulative Private Financing Generated by the Individual Approved Municipality OCSP Program]/[SSBCI Funds Used by the Individual Approved Municipal OCSP Program]

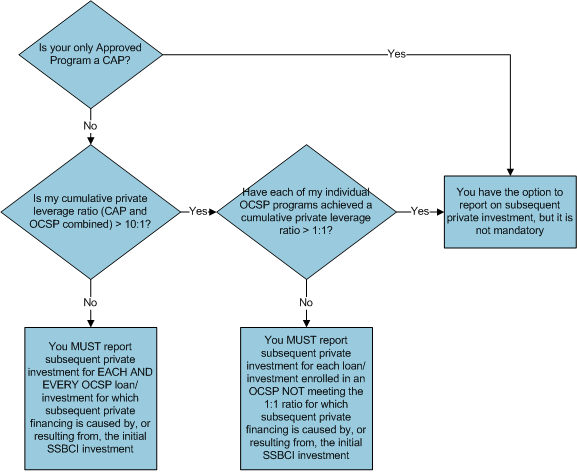

When Must a Participating Municipality Report Subsequent External Financing?

Generally, Participating Municipalities shall include in each year’s annual report transaction-level data only on loans and investments closed in the reporting period year. CAP loans will be reported only once because the design of CAPs is such that they exceed the 10 to 1 private leverage ratio in the same reporting period as their closing.

However, Participating Municipalities must also include in their annual report the amount of subsequent private financing (that is caused by or resulting from the initial OCSP loan or investment) for every previously closed OCSP loan or investment if Total Cumulative Private Financing Generated by all Approved Municipal Programs, as reflected in its annual report, is less than 10 to 1. (Please see Section IV of this Annex to determine if the subsequent private financing obtained by a company receiving an earlier loan or investment from an Approved Municipal Program can be considered “caused by or resulting from the initial OCSP loan or investment.”)

Even if the Participating Municipality has achieved the 10 to 1 private leverage ratio in a given reporting year, if the Participating Municipality operates an Approved Municipal OCSP Program that has not met the 1 to 1 private leverage ratio required of individual OCSPs, the Participating Municipality must also include in its annual the amount of subsequent private financing (that is caused by or resulting for the initial OCSP loan or investment) for every previously closed loan or investment enrolled in the non-compliant Approved OCSP Municipal Program. This reporting on subsequent private investment associated with prior loans or investments must continue until that OCSP program has achieved the 1 to 1 private leverage ratio. (Please see Section IV of this Annex to determine if the subsequent private financing obtained by a company receiving an earlier loan or investment from an Approved Municipal Program can be considered “caused by or resulting from the initial OCSP loan or investment.”)

The Participating Municipality has the option to report subsequent financing for previously closed OCSP loans or investments if their Total Cumulative Private Financing Generated by all Approved Municipal Programs has already exceeded 10 to 1. Under these circumstances, reporting is not mandatory.

Please see Exhibit 7-1 for a flowchart summarizing how to determine whether a Participating Municipality must report subsequent private financing for OCSP loans and investments.

When Is Subsequent Financing Caused by, or Resulting from, the Initial SSBCI-supported OCSP Financing?

Subsequent financing may be considered to be caused by, or resulting from, the initial SSBCI-supported OCSP financing when the initial SSBCI-supported OCSP financing increases the current and future creditworthiness of a company. If the Participating Municipality is required to report subsequent private financing, either for all OCSP programs or for a particular OCSP program, the Participating Municipality should record an amount greater than $0 only when the subsequent private financing is caused by, or resulting from, the initial SSBCI-supported OCSP financing, based on the guidance provided below.

For example, some loans or investments made under venture capital programs, or direct loan or loan participation programs, satisfy this condition. By investing equity or subordinated debt, their financing can directly strengthen a company’s balance sheet and allow it to (a) acquire assets that can collateralize a bank loan or (b) increase the cash available to service bank debt. The direct nexus between the initial SSBCI–supported loan/investment and subsequent private financing occurs only when the initial loan/investment is a form of subordinate, mezzanine or equity financing — in other words a form of financing that actually strengthens the company’s balance sheet or that can be used to secure or repay debt. Therefore, Participating Municipalities should record subsequent private financing for venture capital investments, direct loans, or loans enrolled in loan participation programs only when the initial loan/investment involves subordinate, mezzanine, or equity financing.

Loan guarantee and collateral support programs, in contrast, are designed to reduce the current risk associated with funding a company with weaker collateral or cash flow projections. Generally, these types of programs do not directly add assets to a company’s balance sheet that improve its creditworthiness for further loans or investments. For this reason, the Participating Municipality should record subsequent private financing for these types of investments as $0, unless the Participating Municipality has received explicit permission from Treasury, based on Treasury’s review of the structure of the Participating Municipality’s program(s).

Exhibit

7-1 — Is my Municipality required to report on subsequent

private financing?

ANNEX 8

Participating

Municipalities

City:

Designated Municipality Office:

Authorized Representative:

Authorized Representative Contact Information:

TD F 103.1.O (1/2011)

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Kara Ward |

| File Modified | 0000-00-00 |

| File Created | 2021-01-23 |

© 2026 OMB.report | Privacy Policy