Form 2017 Economic Cens 2017 Economic Cens 2017 Economic Census New Questions

Generic Clearance for Internet Nonprobability Panel Pretesting

Economic Census Additional Proposed Content Protocol

2017 Economic Census New Question Testing: Part 2

OMB: 0607-0978

Economic Census Proposed Content: Part 2

Cognitive Testing Protocol

Note – This protocol is a guide. The questions presented here will not necessarily be asked exactly as worded in the protocol or in this order. It also is important to note that not all questions will be asked in every interview.

Before beginning

Introductions (if necessary)

Audio taping – would only be done if interviews take place in a conference room.

Permission to audio- record discussion?

Before we get started: I'd like to audio record this interview, so I don't have to rely on my memory later. This session is confidential. Only people connected with this project will have direct access to your recording. Is this all right with you?

Setting up WebEx:

May I send you an email with a link to a WebEx meeting? You may be asked to download a WebEx client for your browser. (If the respondent cannot or will not use WebEx, email the spreadsheets directly to them).

Participant Background

How long have you been with the company?

What is your title/role?

What are your major responsibilities?

What are your government reporting responsibilities?

What other government surveys or filings, if any, do you also handle?

Survey Background

Can you tell me about how you/your company usually handles filling out the economic census?

What is your role? How many people are involved?

How do you typically gather the data?

General Probes

In your own words, what was that question asking?

What are you thinking about?

Can you tell me more about that?

You answered, “…” because…?

I want to make sure I understand, can you explain that again?

Can you tell me how you arrived at that answer? What did you include? What did you exclude? What records did you use?

Reflect back on R’s answer and ask R to correct (“I want to make sure I have it right. I think you said, “…?”)

Draft Questions

Today, you are going to be helping us gather feedback on different ways to present new questions that you may answer in the next economic census. I would like you to review each item and then I will ask you some questions about it.

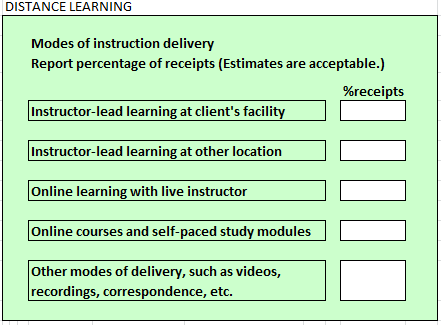

DISTANCE LEARNING

To be asked only to select companies operating under 2017 NAICS: 6114, 6115, 6116

Take a moment to read through this question.

In your own words, what do you think this question is asking?

How did you come up with your answer?

What kinds of things were you including?

What does the term ‘distance learning’ mean to you?

How is this information kept in your records?

HEALTH CARE LOCATION AT A RETAIL ESTABLISHMENT

To be asked only to select companies operating under 2017 NAICS: 6211, 6213, 6214

Are you operating a health care location in a pharmacy or a retail establishment?

Yes

Yes

No

Take a moment to read through this question.

In your own words, what do you think this question is asking?

How did you come up with your answer?

What kinds of things were you thinking of when you were answering this questions?

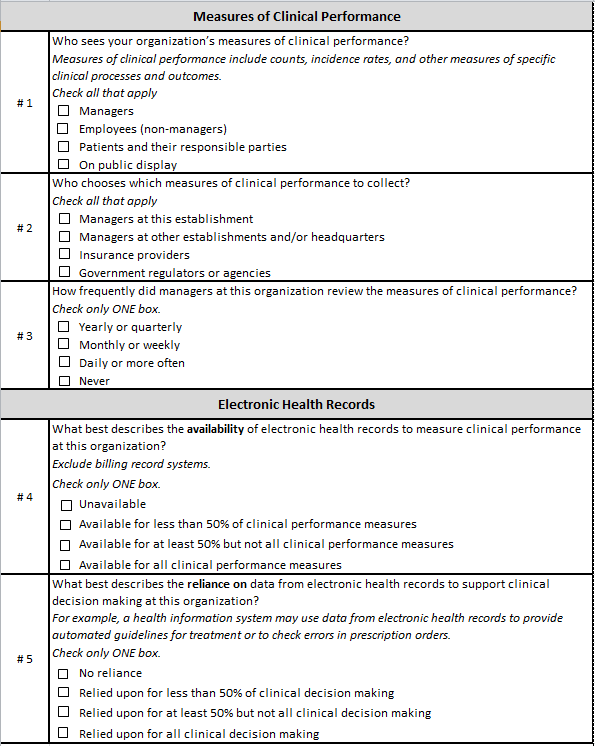

MEASURES OF CLINICAL PERFORMANCE & ELECTRONIC HEALTH RECORDS

To be asked only to select companies operating under 2017 NAICS: 621, 622, 623

Measures of Clinical Performance

Question 1:

In your own words, what do you think this question was asking?

How did you come up with your answer?

This question asks about measure of clinical performance. What were you including in your answers? What sort of measures do you track?

How is this information kept in your records?

Question 2:

In your own words, what do you think this question was asking?

How did you come up with your answer?

Is there anyone else involved in these decisions? If so, who are they?

Question 3:

In your own words, what do you think this question was asking?

How did you come up with your answer? (Note if the respondent indicates that they monitor at another frequency and probe accordingly.)

Electron Health Records

Question 1:

In your own words, what do you think this question was asking?

How did you come up with your answer?

What were you including in your answer? (Note whether respondent notices the exclude instruction)

What does the term “electronic health record” mean to you? Can you give me some examples?

Question 2:

In your own words, what do you think this question was asking?

How did you come up with your answer?

Can you give some examples of the types of decisions you have made?

NET PATIENT CARE REVENUE 1

To be asked only to select companies operating under 2017 NAICS: 621, 622

New breakouts are highlighted

Revenue |

Report in thousand of dollars |

1. Net Patient Care Revenue: Using net patient revenues, report your sources of revenue in each of the below categories. Include the value of total patient care operating receipts collected for the reporting period. This figure should be reported net of any negotiated discounts and write-downs for bad debt. Exclude non-patient care revenue such as grants, subsidies, contributions, philanthropy, and sales from gift shops, cafeteria and parking lot receipts. |

$ _______,000.00 |

A. Government payers: Report revenues from the following sources: |

|

Medicare: Fee for service only from parts A, B and D (exclude part C) |

$ _______,000.00 |

Medicaid: fee for service only |

$ _______,000.00 |

Workers Compensation |

$ _______,000.00 |

All other government programs such as but

not limited to: |

$ _______,000.00 |

B. Revenue from health care providers. including hospitals, health practitioners, outpatient care facilities, etc. |

$ _______,000.00 |

C. Private Insurance |

|

Private health insurance, including Medicare and Medicaid managed care plans - Include revenue from medical plans administerd by private insurers, including employer sponsored, other group plans, Medicare part C (managed care plans), Medicaid managed care plans, and Federal, State, and Local government health insurance |

$ _______,000.00 |

Property and casualty insurance - Include revenue from auto and homeowners Insurance and other accident/liability insurance. (Exclude Workers Compensation Insurance.) |

$ _______,000.00 |

D. Patient Out of Pocket from Patients and

their families |

$ _______,000.00 |

E. All Other Sources of revenue for Patient

Care |

$ _______,000.00 |

2. Non-Patient Care Revenue |

|

A. Contributions, gifts, and grants received |

$ _______,000.00 |

B. Investment and property income – include interest and dividends. Exclude gains (losses) from assets sold |

$ _______,000.00 |

C. Revenue from health care providers (health practitioners, hospitals, outpatient care facilities, and all other health care practitioners) for non-patient care services provided. Include revenue for medical administration and other administrative services, incentive payments, management fees, medical director fees, etc. |

$ _______,000.00 |

D. All other non-patient care revenue – Include other operating and non-operating revenue (e.g., gift shop sales, cafeteria sales, parking lot receipts, florist receipts) – Specify the primary source of revenue below |

$ _______,000.00 |

3. Total Revenue - Sum of lines 1A through 2D |

$ _______,000.00 |

Take a moment to read through this question.

In your own words, what do you think this question is asking?

How did you come up with your answer?

How is this information kept in your records?

Are there any of these sources of revenue that are unclear to you? If so, can you tell me more about that?

1A – How are Medicare fees listed in your records? Do you have an overall number, or do you have the cost broken out into parts? Would you be able to provide this information excluding part C?

1A – What government programs did you include in this figure?

1C – What did you include in your figures for property and casualty insurance?

1E- What other sources of patient revenue did you include in this figure?

2D – What other sources of non-patient revenue did you include in this figure?

NET PATIENT CARE REVENUE 2

To be asked only to select companies operating under 2017 NAICS: 623

New breakouts are highlighted

Revenue |

Report in thousand of dollars |

1. Net Patient Care Revenue: Using net patient revenues, report your sources of revenue in each of the below categories. Include the value of total patient care operating receipts collected for the reporting period. This figure should be reported net of any negotiated discounts and write-downs for bad debt. Exclude non-patient care revenue such as grants, subsidies, contributions, philanthropy, and sales from gift shops, cafeteria and parking lot receipts. |

$ _______,000.00 |

A. Government payers: Report revenues from the following sources: |

|

Medicare: Fee for service only from parts A, B and D (exclude part C) |

$ _______,000.00 |

Medicaid: fee for service only |

$ _______,000.00 |

Workers Compensation |

$ _______,000.00 |

All other government programs such as but

not limited to: |

$ _______,000.00 |

B. Private Insurance |

|

Private health insurance, including Medicare and Medicaid managed care plans - Include revenue from medical plans administerd by private insurers, including employer sponsored, other group plans, Medicare part C (managed care plans), Medicaid managed care plans, and Federal, State, and Local government health insurance |

$ _______,000.00 |

Property and casualty insurance - Include revenue from auto and homeowners Insurance and other accident/liability insurance. (Exclude Workers Compensation Insurance.) |

$ _______,000.00 |

C. Social Security Benefits: Report direct payment of social security benefits on behalf of patients |

$ _______,000.00 |

D. Patient Out of Pocket from Patients and

their families |

$ _______,000.00 |

E. All Other Sources of revenue for Patient

Care |

$ _______,000.00 |

2. Non-Patient Care Revenue |

|

A. Contributions, gifts, and grants received |

$ _______,000.00 |

B. Investment and property income – include interest and dividends. Exclude gains (losses) from assets sold |

$ _______,000.00 |

C. All other non-patient care revenue – Include other operating and non-operating revenue (e.g., gift shop sales, cafeteria sales, parking lot receipts, florist receipts) – Specify the primary source of revenue below |

$ _______,000.00 |

3. Total Revenue - Sum of lines 1A through 2C |

$ _______,000.00 |

Take a moment to read through this question.

In your own words, what do you think this question is asking?

How did you come up with your answer?

How is this information kept in your records?

Are there any of these sources of revenue that are unclear to you? If so, can you tell me more about that?

1A – How are Medicare fees listed in your records? Do you have an overall number, or do you have the cost broken out into parts? Would you be able to provide this information excluding part C?

1A – What government programs did you include in this figure?

1C – What did you include in your figures for property and casualty insurance?

1E- What other sources of patient revenue did you include in this figure?

2D – What other sources of non-patient revenue did you include in this figure?

BUSINESS COOPERATIVE

To be asked of all companies

A cooperative is a business or organization owned by, controlled by, and operated for the benefit of people using its services. Members (also known as user-owners) benefit from use of service and product operations and/or earnings generated by the co-op. This includes purchasing co-ops, member/patron organizations, member-controlled non-profits, consumer co-ops, marketing co-ops, etc.

Is this Establishment a cooperative? (Check one)

_____ Yes

______ No

Take a moment to read through this question.

In your own words, what do you think this question is asking?

How did you come up with your answer?

Is the description of a business cooperative clear or unclear to you? If unclear, what could we do to make it more clear?

SELECTED EXPENSES BREAKOUT

To be asked only to select companies operating under 2017 NAICS: 31, 32, 33

Selected Expenses – Testing to see if A. and B. can be broken out from C., and are reportable on their own (concern is whether detail is kept at an establishment level as well as if the breakouts are kept as such on the books)

NAICS: 31, 32, 33 (all manufacturing)

16 C. Other operating expenses paid by this establishment

9. Purchased professional and technical services (exclude salaries paid to your own employees for these services):

A. Legal Services

B. Architectural, engineering, and various design services (such as interior and graphic)

C. Other purchased professional and technical services (Include management consulting, accounting, auditing, bookkeeping, actuarial, payroll processing, and other professional services).

Take a moment to read through this question.

In your own words, what do you think this question is asking?

How did you come up with your answer?

What were you including in your answers?

What professional or technical services does this establishment purchase?

How are expenses from professional and technical services kept in your records?

MOTOR VEHICLE PARTS MANUFACTURING

To be asked only to select companies operating under 2017 NAICS: 336310, 336320, 336340, 336350, 336390

Did this establishment manufacture aftermarket motor vehicle components in 2017?

_YES

_NO

If Yes –Report the approximate value of aftermarket motor vehicle components generated in 2017.

$ Billions Millions Thousands

Question 1:

In your own words, what do you think this question is asking?

How did you come up with your answer?

What kinds of things were you including?

What does the term ‘aftermarket motor vehicle components’ mean to you?

Question 2:

In your own words, what do you think this question is asking?

How did you come up with your answer?

What kinds of things were you including?

Thank the respondents for their time after they have answered the relevant questions.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Michael Brennan |

| File Modified | 0000-00-00 |

| File Created | 2021-01-23 |

© 2026 OMB.report | Privacy Policy