Retirement Savings Module of the Household Financial Survey

MyRA Retirement Survey

02-09-15 Retirement Savings Module Collection of Information Instrument - Annotated edits 2-4-15_OMB comment 2-252_KC

Retirement Savings Module of the Household Financial Survey

OMB: 1505-0251

DRAFT COLLECTION OF INFORMATION

Retirement Savings Module of the Household Financial Survey

Current Retirement Saving Status

Do youYOU personally have a retirement savings account (money set aside that you intend to use when you retire)?

Yes

No [Skip to 13]

I don’t know [Skip to 13]

(If YES selected in 1) In what kind(s) of accounts do you save for retirement? Select all that apply.

Defined contribution plan, such as a 401(k) or 403(b) plan

Defined benefit pension

IRA, either traditional IRA or Roth IRA

Saving for retirement in your savings or checking account

Savings Bonds

Other (please specify): ____________________

I don't know

2a. (If NO selected in 1) You indicated that you do not currently have a retirement account. Have you EVER had a retirement account, but no longer have one because you withdrew the funds?

Yes

No

2b. (If YES selected in 2a) For what reason(s) did you withdraw funds from your retirement account? Select all that apply:

To cover emergency or short-term needs

To make a major purchase, such as car or home

To invest the money elsewhere

Other (please specify): ____________________

2c. (IF NO selected in 1) You indicated that you do not currently have a retirement account. Which of the following are your reasons for not saving in a retirement account? Select all that apply.

Too much risk involved

I am unfamiliar with how they work or where to enroll

My employer does not offer one

I don’t trust investors

The fees are too high

I don’t have enough money to set aside any for retirement

Bad experience with a retirement account I used to have

I expect to rely on Social Security

Other (please specify): _____________

(If A-C selected in 2) Is one or more of the retirement savings accounts you told us about offered to you through a former employer?

Yes

No

(If A-C selected in 2) Is one or more of the retirement savings accounts you told us about offered to you through your current employer?

Yes

No

(If B or C selected in 1, or NOT A or B in 2) In your current job, do you qualify for a retirement savings plan offered by your employer, such as 401(k) or 403(b)?

Yes

No

I don’t know

(If YES in 4 or 5) Does your employer offer any matching contributions to your retirement account(s)?

Yes

No

I don’t know

Depositing Behavior

(If YES in 1) Do you currently make deposits to your retirement account(s) through your paycheck (i.e., using automatic deductions)?

Yes

No

(If A or B in 7) Other than from your paycheck, how often would you say you make deposits to your retirement account(s)?

Once a month or more often

A few times per year

Once a year

Less than once a year

Never

(If A-F selected in 2) Have you ever used part of your tax refund to make a deposit into your retirement account?

Yes

No

(If YES selected in 9) Have you ever directly deposited a portion of your tax refund into your retirement account? In other words, did you enter your retirement account routing number in the tax form at the time of filing to have the refund sent directly there?

Yes

No

Withdrawing Behavior

(If A-F selected in 2) Have you ever withdrawn funds from your retirement account(s) for something other than retirement?to cover an emergency or short-term need?

Yes

No

11a. (If A selected in 11) When you withdrew funds from your retirement account(s), were you ever penalized (for example, taxes or fees)?

Yes

No

I don’t know

11b. (If A selected in 11) When you withdrew funds from your retirement account(s), what did you use the funds for? Select all that apply:

To make a major purchase, such as a car or home

To cover an emergency or short-term need

To invest the money elsewhere

Other (please specify): _______________________

(If A-F selected in 2) Have you ever withdrawn funds from your retirement account(s) to make a major purchase, such as a car or home?

Yes

No

Retirement Planning

Do you plan to retire some day?

Yes

No [Skip to 18]

I don’t know

(If YES in 13) I am confident in my ability to make wise decisions about saving and investing money so I will have enough for my retirement.

Strongly disagree

Disagree

Neutral

Agree

Strongly agree

(If YES in 13) How much to you agree with the following statement: “I am confident that I can meet my long-term goals for being financially secure in my retirement”?

Strongly disagree

Disagree

Neutral

Agree

Strongly agree

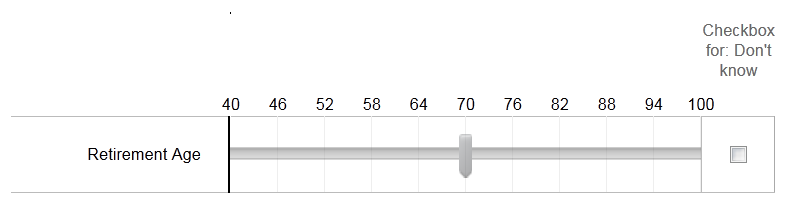

(If YES in 13) At what age do you think you expect to retire?

Under 62

62-64

65

66-69

70 or older

I do not expect to retire

I’m not sure

(If YES in 13) Thinking about your current financial planning, which of the following are you most likely to do to prepare financially for retirement? How do you plan to support yourself financially when you retire? Select all that apply.

Withdraw from account(s) I saved in (such as savings account, IRA, or 401(k))

Purchase Cash out stocks, mutual funds, or similar investments

Take out loan(s) Sell my home

Rely Financial support fromon family or friends for financial support in retirement

Rely on Social Security

Invest in a home or propertyReverse mortgage / home equity line of credit (HELOC)

Open a business / Become self-employed

Move to a more affordable town

Pay down debt

Other: _________________

None of the above

Risk Tolerance

Which of the following statements comes closest to the amount of financial risk that you are willing to take when you save or make investments?

Take substantial financial risks expecting to earn substantial returns

Take above average financial risks expecting to earn above average returns

Take average financial risks expecting to earn average returns

Not willing to take any financial risks

Response to Hypothetical New Retirement Account

For the next series of questions, please imagine that a new kind of retirement savings account is made available for you and with these features:

is guaranteed by the government to earn a steady 2.24% interest rate and protected from losses. You would be allowed to contribute as little as $5 per month (up to $5,500 per year).

2% to 3% interest rate

Guaranteed by the government to have no risk of losses

Low minimum monthly contribution ($5)

Contribute up to $5,500 per year

Can withdraw all deposited funds without penalty at any time

Can deposit up to $15,000 total, keep the account open for up to 30 years, and can convert the account into another form of retirement account at any time

How likely would you be to open and make deposits to this type of retirement savings account, if your employer offered it?

Using a rating scale of 1 – 5; 5 = Very likely, 1 = Not at all likely

How likely would you be to make deposits into this type of retirement savings account, if your employer offered it?

Using a rating scale of 1 – 5; 5 = Very likely, 1 = Not at all likely

How likely would you be to open and make deposits to this type of retirement savings account, if you could do so without your employer? (using a rating scale of 1 – 5)

Using a rating scale of 1 – 5; 5 = Very likely, 1 = Not at all likely

How likely would you be to make deposits into this type of retirement savings account, if you could do so without your employer?

Using a rating scale of 1 – 5; 5 = Very likely, 1 = Not at all likely

How much do you agree with the following statement: I would be more likely to open a retirement account with after tax earnings if the account allowed me to easily withdraw a portion of my retirement contributions with no penalty once per year.

Strongly agree

Agree

Neither agree nor disagree

Disagree

Strongly disagree

How much do you agree with the following statement: I would be likely to increase the amount of my contributions to a retirement account with after tax earnings if the account allowed me to easily withdraw a portion of my retirement contributions with no penalty once per year.

Strongly agree

Agree

Neither agree nor disagree

Disagree

Strongly disagree

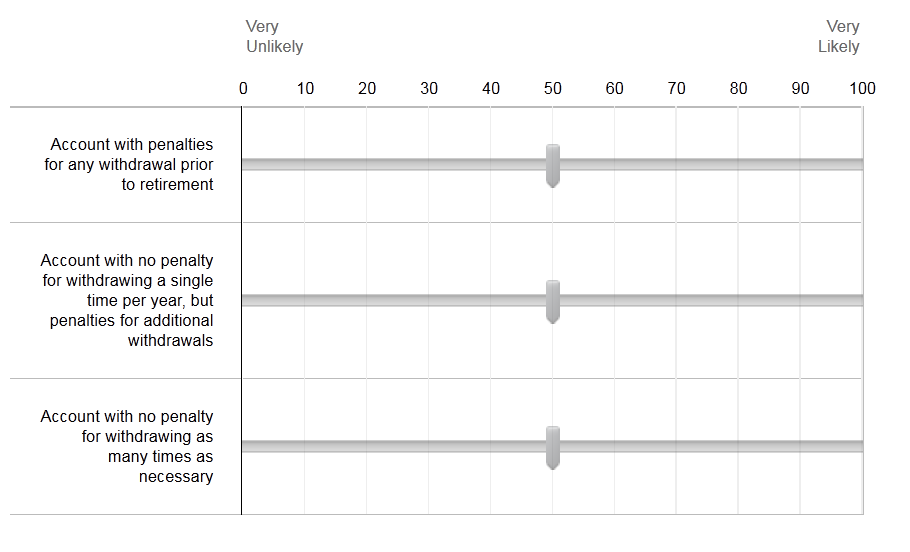

Some people prefer accounts with flexibility to withdraw at any time, while other people prefer accounts with rules that make the money harder to spend, which helps ensure that the money will be there later.

Imagine there are three types of retirement accounts that are the same in every way except the following as shown on the illustrartion below:rules about withdrawing funds prior to retirement.

Using the slide bars, how likely would you be to open and contribute to such a retirement account?

(at top of screen for 21 – 23) Imagine you are offered a retirement account with these features:

2% to 3% interest rate

Guaranteed by the government to have no risk of losses

Low minimum monthly contribution ($5)

Contribute up to $5,500 per year

Can withdraw funds without penalty at any time

Can deposit up to $15,000 total, keep the account open for up to 30 years, and can convert the account into another form of retirement account at any time

If you were able to open this type of account, about how much money do you think you would deposit into it every month, counting money deposited directly from your paycheck and other deposits you would make? (Open response)

If you opened this new kind of account, how likely would you want to use it to save for short term needs, rather than only to save for retirement?

Using a rating scale of 1 – 5; 5 = Very likely, 1 = Not at all likely

If you opened this new kind of account, how likely would you want to use it to save for emergency expenses, such as for medical bills or a car repair?

Using a rating scale of 1 – 5; 5 = Very likely, 1 = Not at all likely

What percentage of monthly deposits would be directed to the following saving goals (Responses must equal 100%. If you do not envision using deposits for one or more of the possible saving goals, mark 0 in the associated answer box):

Retirement

Shorter-term needs, such as a home down payment or new appliance

Emergency expenses, such as medical bills or car repairs

Reallocating Debt Payments to Saving

If you have student loans, once you’ve repaid your student loans in full, would you be interested in saving more for retirement by regularly contributing what once was a student loan payment to a retirement account instead?

Yes

No

Not applicable

If you have a mortgage, once you’ve repaid your mortgage in full, would you be interested in saving more for retirement by regularly contributing what once was a mortgage payment to a retirement account instead?

Yes

No

Not applicable

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Blair Russell |

| File Modified | 0000-00-00 |

| File Created | 2021-01-24 |

© 2026 OMB.report | Privacy Policy