November 2014 MARTS News Articles

Attachment D Compilation of News Articles on MARTS Dec 2014.docx

Advance Monthly Retail Trade Survey (MARTS)

November 2014 MARTS News Articles

OMB: 0607-0104

November

2014

MARTS

News’

Articles

Retail Indicators Branch December

11, 2014

US Retail Sales: November 2014 Preview 3

Advance Monthly Retail Sales 5

Ahead of the Bell: US Retail Sales 6

US retail sales likely increased in November, but falling gas prices limiting growth 6

U.S. stocks: Futures point to careful bounce-back as retail sales loom 7

Retail sales expected to rise in November 7

Retail sales seen hitting fastest growth in three months 8

November sales grew despite Black Friday's decline 9

Mixed messages expected in today’s US retail sales report – ING 10

Holiday Retail Sales Could Be A Disaster 11

Retail Sales dominate calendar 11

Futures Gain as Oil Edges Up; Jobless Claims, Monthly Retail Sales on Tap 12

Wall street eyes retail sales, awaits oil fall out 12

Preview: US retail sales could roil markets 13

US Nov retail sales up 0.7% vs. 0.4% expected 15

U.S. Retail Sales Rose 0.7% in November 16

Sharpest Increase Since June Signals Strong Start to Crucial Holiday Shopping Season 16

Retail Sales in U.S. Climbed in November by Most in Eight Months 17

U.S. consumer spending gains steam, boosted by lower gas prices 19

US Retail Sales Climb on Holiday Shopping 20

Retail sales raise hopes for 2014 21

US retail sales climb on holiday shopping 22

Dollar Gains as Retail Sales Rise Most in 8 Months in November 23

U.S. retail sales in November hit fastest growth in eight months 23

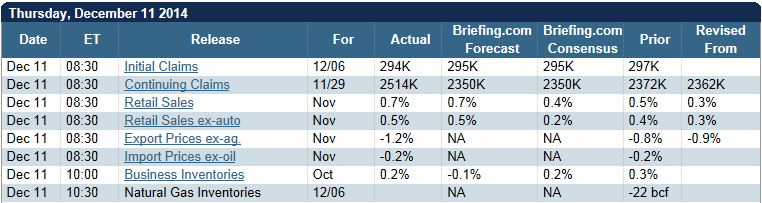

Consensus

Briefing.com

Marketwatch.com

Capitalspector.com

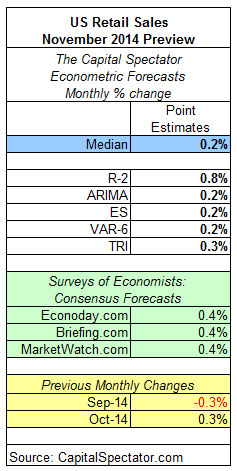

US Retail Sales: November 2014 Preview

US retail sales are expected to rise 0.2% in tomorrow's November report vs. the previous month, according to The Capital Spectator's median point forecast for several econometric estimates. The median prediction reflects a slight deceleration in growth vs. the previous month's 0.3% advance.3

Compared with a trio of estimates based on recent surveys of economists, The Capital Spectator's median projection for November is below the consensus forecasts.

Here's a closer look at the numbers, followed by brief summaries of the methodologies behind the forecasts that are used to calculate The Capital Spectator's median prediction:

Press Release

Advance Monthly Retail Sales

November 2014

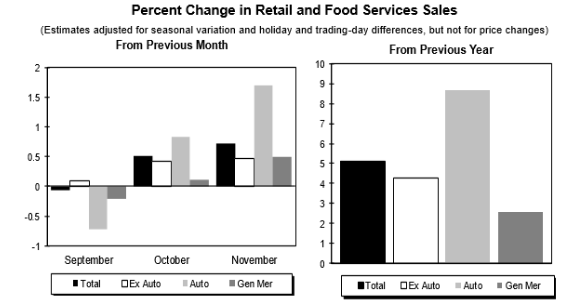

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $449.3 billion, an increase of 0.7 percent (±0.5%) from the previous month, and 5.1 percent (±0.9%) above November 2013. Total sales for the September through November 2014 period were up 4.7 percent (±0.7%) from the same period a year ago. The September to October 2014 percent change was revised from +0.3 percent (±0.5%)* to +0.5 percent (±0.2%).

Retail trade sales were up 0.7 percent (± 0.5%) from October 2014, and 4.9 percent (±0.7%) above last year. Auto and other motor vehicle dealers were up 9.5 percent (±3.2%) from November 2013 and nonstore retailers were up 8.7 percent (±2.1%) from last year.

The scheduled release dates for 2015 are as follows: January 14, February 12, March 12, April 14, May 13, June 11, July 14, August 13, September 15, October 14, November 13, December 11.

The advance estimates are based on a subsample of the Census Bureau’s full retail and food services sample. A stratified random sampling method is used to select approximately 4,900 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms. Responding firms account for approximately 60% of the MARTS dollar volume estimate. For an explanation of the measures of sampling variability included in this report, please see the Reliability of Estimates section on the last page of this publication.

The Advance Monthly Sales for Retail and Food Services for December is scheduled to be released January 14, 2015 at 8:30 a.m. EST.

News Articles

Before Release

Associated Press

Ahead of the Bell: US Retail Sales

US retail sales likely increased in November, but falling gas prices limiting growth

The Commerce Department releases retail sales data for November on Thursday at 8:30 a.m. Eastern. INCREASE LIKELY: Economists forecast that retail sales rose a seasonally-adjusted 0.4 percent last month, according to a survey by the data firm FactSet.4,5

That would follow a slight 0.3 percent gain in October. Retail sales have slowly improved this year, despite solid job growth that usually leads to more consumer spending. Employers have added an average of 241,000 jobs a month so far in 2014, causing the unemployment rate to fall to 5.8 percent from 6.7 percent at the start of the year. Wage gains have been meager, however, which could explain why retail sales have been less than robust.

HOLIDAY SHOPPING AND GAS PRICES: Retail sales usually rise ahead of the year-end holidays, but the tumbling price of gasoline, which is a component in the report, might cause growth to be extremely muted in November.

Average national gas prices have slid to $2.64 a gallon, down nearly 30 cent, or 9.8 percent, over the past month, according to the AAA's Daily Fuel Gauge. Plummeting fuel costs mean that sales at gas stations might have plunged 8 percent in November, which would suppress overall growth in retail sales. Yet when people save money at the pump, they have more to spend on tech gadgets, clothing, and at restaurants.

Many analysts believe that holiday spending could rise by at least 4 percent this year because of recent job growth. The hiring spree since February has bolstered the number of people with steady paychecks by nearly 2.65 million and consumer confidence has also improved.

But initial indicators suggest that the Thanksgiving and Black Friday weekend was bleak for traditional retailers. The number of people shopping in stores and online slid 5.2 percent from last year to estimated 133.7 million people shopped in stores and online, according to a survey of 4,631 people conducted by Prosper Insights & Analytics for the National Retail Federation. Total spending for the weekend was projected to fall 11 percent to $50.9 billion from a year ago.

That hints at the absence of meaningful wage gains for many workers. Average hourly wages have risen just 2.1 percent over the past 12 months, slightly ahead of inflation.

But consumer tastes might also be shifting as people forgo smaller expenditures to replace bigger ticket items such as automobiles. Motor vehicles sold in November at an annualized clip of 17.2 million, a 4.6 percent increase from the prior year, according to Autodata Corp. Subaru and Chrysler led the major automakers with sales increases around 20 percent on strong demand for their small SUVs. Car-buying site Kelley Blue Book estimated that as much as 30 percent of last month's sales occurred during the Thanksgiving holiday weekend.

MarketWatch

U.S. stocks: Futures point to careful bounce-back as retail sales loom

Retail sales could see the biggest jump in three months. Wall Street was shaping up for a tentative rebound on Thursday, with stock futures higher and oil prices making slight gains, as investors waited for retail-sales data.6,7

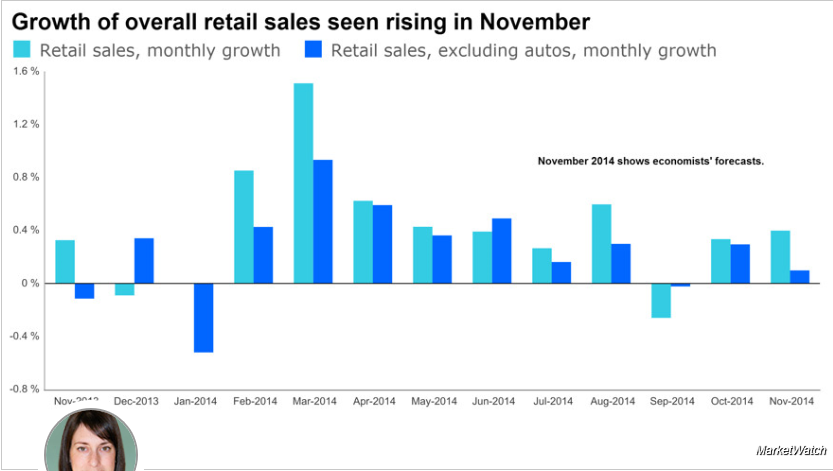

Retail sales ahead: A busy day for economic news could provide some distraction for traders. Retail sales are expected to show the fastest growth in three months when the November data is released at 8:30 a.m. Eastern Time. Economists polled by MarketWatch are expecting a rise of 0.4%, against a 0.3% rise in the prior month.

With gas prices at multiyear lows and consumer sentiment at multiyear highs, retail sales data will likely be the main catalyst for stocks this week.

At the same time, weekly jobless claims are due, and economists expect a reading just about unchanged from the prior week, coming in just below 300,000. Business inventories will be released for October at 10 a.m. Eastern.

Retail sales expected to rise in November

Expect November retail sales to be better than last year, but don’t be deceived by the numbers, say analysts. “People that have jobs are still feeling pressure,” said Steve Blitz, chief economist at ITG. “Debt usually rises faster than wages in this part of the cycle, as consumers feel more confident but debt is not rising as fast as wages.”8

The lower energy prices will not transformed into higher spending, said Blitz.

Retail sales for November will be released on Thursday at 8.30 a.m. Eastern and are expected to be up 0.4% including auto sales, slightly higher than the month before, according to economists polled by MarketWatch. Economists expect the headline number to be strong, from strong autos sales, but minus autos the figures will be lower.

The Internet has changed how people shop and retailers are offering holiday sales earlier, said Edward Jones’ senior retail analyst, Brian Yarbrough.

“There was a tremendous amount of promotional activity that started around Halloween,” said Keith Jelinek, senior managing director at FTI Consulting.

This year, Wal-Mart Stores Inc. started offering sales the day after Halloween and Target Corp. started offering sales a week or so later. Virtually every retail store visited and the mall itself has been integrating digital into physical locations, according to Goldman Sachs retail analysts in a research note. Target was a key example as customers using the Cartwheel app spend 30% more in-store than those not using the app, said the analysts. Target reported strong sales in apparel and baby items for Black Friday with spending was up 30% through their app, according to Goldman Sachs analysts. Wal-Mart reported its second-biggest online sales over Thanksgiving. J.C. Penney Co. Inc. reported strong overall Black Friday sales, specifically in cold weather gear, such as coats, scarfs, hats and boots, said the Goldman analyst report.

Thanksgiving retail sales were lackluster, down 11% from the year before, according to the National Retail Federation.

To try to lure people back into the stores, brands like J.C. Penney Co. Inc., Kohl’s and Macy’s Inc. are doing more targeted marketing, retraining store employees to help give the customer the best experience and make sure shopping is seamless whether it’s online or in the store, say retail experts.

Retail sales seen hitting fastest growth in three months

Growth for retail sales likely picked up in November to hit the fastest pace in three months, according to analysts' forecasts for data to be released Thursday. Economists polled by MarketWatch expect the government to report that retail-sales growth rose to 0.4% last month, boosted by autos, compared with 0.3% in October. Excluding autos, economists forecast that retail sales rose 0.1% last month, hit by falling gasoline prices, compared with 0.3% in October.9

While cheaper gas is expected to ding retailers’ results for November, fatter American pocketbooks could lead to greater discretionary consumer spending. The per-gallon price for regular gas in the U.S. has tumbled about $1, or 28%, since a recent peak in June, according to government data.

“Our standard rule of thumb is every one-cent change in gasoline prices translates into a $1 billion change in household energy consumption. Thus, if the roughly 90-cent decline in gas prices…is sustained over the next several quarters, household cash flow could improve by $90 billion over the next year,” wrote Joseph LaVorgna, chief U.S. economist with Deutsche Bank.

However, there’s already been some disappointing data for November. Sales this Black Friday—the day after Thanksgiving that retailers hope kicks off a strong gift-buying season—came in on the soft side, according to a number of reports.

The U.S. Commerce Department will release the retail-sales data at 8:30 a.m. Eastern.

Also Thursday morning, the government will publish its latest report on new claims for jobless benefits, and economists expect the weekly reading to be just about unchanged from the prior week at a hair below 300,000. Initial claims for regular state unemployment-insurance benefits have been hovering around 300,000 for several months. That historically slow pace signals that employers are letting go of very few workers.

The U.S. Labor Department will release the jobless-claims data at 8:30 a.m. Eastern.

The holidays tend to introduce volatility into the weekly data, and economists warn over reading too much into a single report. However, broader readings of unemployment are also signaling that the labor market is moving in the right direction. Competition among the jobless for open spots has hit the lowest level since early in the recession, with about 1.9 unemployed people per job opening in October, the narrowest ratio since early in the Great Recession.

A strengthening labor market should support a healthy economic cycle, with more confident and better paid workers spending more, which, in turn, could lead to more growth of jobs and the economy.

Chicago Tribune

November sales grew despite Black Friday's decline

Despite a wimpy Black Friday, early estimates show retail sales posted solid growth in November as a whole, suggesting that earlier and more frequent discounts are stealing the thunder of the traditional shopping weekend, but giving the industry optimistic signs for the season.10

November retail sales were up an estimated 5.4 percent over last year, according to ShopperTrak, a Chicago-based company that monitors shopping patterns in stores. The company based its estimate on sales and transaction data from a subset of its retail clients.

Research firm Retail Metrics reported similarly upbeat comparable store sales growth averaging 4.4 percent in November, fueled by 8 percent growth at L Brands (parent company of Victoria's Secret and Bath & Body Works, among others) and 9 percent at Costco. Gap Inc. on Monday reported 6 percent same-store sales growth for November thanks to an 18 percent jump at Old Navy while Gap stores were down 4 percent.

Visits to bricks-and-mortar stores — which still account for more than 90 percent of retail sales — continued to decline, but it was "the smallest decline in recent years," ShopperTrak said in a statement. While the number of individuals shopping in stores hasn't dropped notably, shoppers visit fewer stores per trip, likely researching online and heading out with a mission in mind, the company said.

"The early push in the season has helped to offset a slightly underperforming Thanksgiving weekend," ShopperTrak said in a statement. "We saw seven days in the month of November with higher shopper visits than the previous year, which shows that the trend toward fewer visits per shopping trip is stabilizing."

The Commerce Department is scheduled to release its November retail sales estimates Thursday.

Retail industry watchers were surprised last week when the National Retail Federation announced that sales during the Black Friday weekend slid an estimated 11 percent from 2013, based on a survey of more than 4,600 shoppers. Still, the trade group stuck by its prediction that overall retail sales during the holiday season will grow 4.1 percent to $616.9 billion, important to an industry that makes one-fifth of its annual revenue in November and December. Retail sales are watched as a measure of consumer spending, which accounts for two-thirds of the country's gross domestic product.

Some data-crunchers, questioning the accuracy of surveying shoppers about their spending, say the Black Friday gloom was overblown. Applied Predictive Technologies, a software company that bases its estimates on sales register transactions, said sales were down 5.8 percent during the Thanksgiving weekend, about half the NRF's estimate.

ShopperTrak, which projects a 3.8 percent sales increase for the season, reported a more modest sales drop of 2.1 percent during the Thanksgiving weekend amid shifting customer habits. Sales on Black Friday itself, traditionally the busiest shopping day of the season with the steepest deals, fell 6.8 percent, while shopping on Thanksgiving Day, grew 24 percent as stores open earlier on that day. Martin said Sunday was the "real culprit" for the sluggish weekend spending, with the day's sales down 6 percent, reasoning that four days of aggressive deals was "just too much for consumers to endure." ShopperTrak, which says the majority of holiday shopping is still to come, expects the Saturday before Christmas to surpass Black Friday as the busiest shopping day of the season.

Meanwhile, online sales during the five-day shopping period between Thanksgiving Day and Cyber Monday climbed 12.6 percent over the same period last year, according to IBM Digital Analytics. Sales growth on Cyber Monday, billed as the day with the most and biggest online discounts, slowed to 8.6 percent, as online deals also were spread out over several days. Online sales accounted for 6.6 percent of all retail sales in the third quarter of 2014, according to Census Bureau data released last month.

FXStreet

Mixed messages expected in today’s US retail sales report – ING

James

Knightley, Senior Economist at ING, notes that today’s US

retail sales report is likely to provide several mixed messages as

positive auto sales looks to add a positive support but gasoline and

black Friday sales suggests that the final figure would be

weak.11

Key

Quotes

“Today’s retail sales report is

likely to provide several mixed messages. On the one hand, gasoline

station sales are likely to be weak given the plunge in oil prices

that has fed through into significant declines in gasoline prices –

a gallon of regular was averaging around US$3.10 in October versus

US$2.85 in November (it currently stands at US$2.64). On the other

hand, auto sales have been very strong, with unit sales totalling

17.08m versus 16.35m the previous month.”

“However,

the key story is what has happened to pre- and post-Thanksgiving

holiday sales. Given strong employment and good consumer confidence

readings, hopes were high for a decent set of numbers, but the fact

that Black Friday spending fell 11% YoY according to the National

Retail Federation suggests that it has been a disappointing sales

season so far. That said, the sales season is spread over a long

period and with last Friday’s labour report pointing to further

signs of wage rises we are hopeful of a decent December

outcome.”

“We are in line with consensus

expecting a 0.3% MoM increase in November retail sales.”

Seeking Alpha

Holiday Retail Sales Could Be A Disaster

As has been widely reported, retail sales for the 4-day Thanksgiving weekend period were down 11% from 2013, according to the National Retail Federation. This number includes online sales, which were said to be down 10.2% for the four day period year over year. While this large and unexpected decline in retail spending can perhaps be partially explained by the fact the many retailers began "Black Friday" discounting and promotional activity at the beginning of November, which might have "pulled forward some of the potential Thanksgiving weekend sales, I think there's no question that holiday sales are down so far year over year and I will show several correlated economic indicators which I believe are suggestive of a potential holiday retail sales disaster developing.12

In my view, on average and in general, households have less disposable income to spend on holiday gifts this year. According to data from Sentier Research, average real median household income declined .6% in October. If average real household income is declining, or even just flat-lining, consumers are likely to be more cautious with discretionary spending. Even the monthly employment report from the Government, which has debatable legitimacy, showed a significant shift from full-time employment into lower wage part-time jobs, as explained in this analysis from CNBC. If, on average, the U.S. workforce is comprised of lower wage jobs, it will translate into lower disposable income, decreased discretionary spending and, therefore, disappointing retail sales.

Option Monster

Retail Sales dominate calendar

Retail sales are the main item on today's economic calendar. Economists expect the Commerce Department will report an overall gain of 0.4 percent last month and 0.2 percent excluding automobile sales. Both rose 0.3 percent in October.13

Initial jobless claims, scheduled for release at the same time, are

forecast at 295,000, compared with 297,000 in the previous week.

Export and import prices are also due at 8:30 a.m. ET but are

unlikely to affect sentiment because inflation isn't a major worry

now. Other items on the agenda include German inflation numbers

early in the session and natural-gas inventories at 10:30 a.m. ET.

Ciena and Lululemon Athletica report earnings before the opening

bell, while Adobe Systems and Quicksilver follow in the

afternoon.

Friday brings Chinese industrial production and

retail sales earlier, along with producer prices and the University

of Michigan's consumer-sentiment index. Attention may also focus on

Japan and the yen with elections scheduled for Sunday.

NASDAQ

Futures Gain as Oil Edges Up; Jobless Claims, Monthly Retail Sales on Tap

U.S. stock futures were slightly higher Thursday, having taken a beating this week, as oil regained some ground and ahead of weekly jobless claims and monthly retail sales data, both of which are expected to show a modestly positive trend.

At 08:30 a.m. E.T., initial jobless claims in the week to Dec. 6 are expected to be at 295,000, slightly down from 297,000 the preceding week. The consensus range is between 280,000 and 315,000, according to data compiled by Econoday.

Also at 08:30 a.m., retail sales are expected to have gained 0.4% in November, up from a 0.3% gain in October. The consensus range is between 0.1% and 0.7%. Meanwhile, export prices in November are seen edging down 0.2% compared to a 1% decline in October while import prices are expected to have dropped 1.7% compared to a 1.3% drop in October.14

CNBC (Market Insider)

Wall street eyes retail sales, awaits oil fall out

A faster pace of vehicle sales is likely to be registered in November's retail report, which should also show the impact of falling energy prices and sluggish Black Friday spending.15

On the supply side, the U.S. Treasury is scheduled to conduct a 30-Year government bond auction. European stock markets were higher in morning trade on Thursday as a bounce in oil prices helped boosted sentiment after a key data release from the European Central Bank (ECB).

Investors in the region welcomed the results of the second cheap loans operation - known as a targeted long-term refinancing operation (TLTRO) - by the ECB, which managed to meet market expectations on Thursday amid calls for the central bank to do more to help kick start the region's economy.

U.S. stocks closed sharply lower on Wednesday as the price of crude fell to a new five-year low and the Organization of Petroleum Exporting Countries (OPEC) cut its demand outlook for next year. However, the price of oil received a slight bounce on Thursday morning, with Brent futures rising to $64.46 per barrel.

Weekly jobless claims and import prices are also expected at 8:30 a.m. Business inventories are due at 10 a.m.

Forexlive

Preview: US retail sales could roil markets

The US November retail sales report will be released Thursday at 8:30 am ET, here’s a preview of what to expect. The true gauge of the US consumer comes during the holiday season and that’s why retail numbers for November and December are so closely watched.16

The narrative in markets is that a better economy and lower gas prices will boost consumer spending in the months ahead. Lower energy prices will me mess spending at the pump but the underlying pace of retail sales — that excludes autos, gasoline and building supplies — is expected to rise a healthy 0.5%, seasonally adjusted.

US retail sales control group – past Novembers highlighted

There are two problems with that narrative.

1. Early reports on Black Friday sales have been mixed. The National Retail Federation said spending was down 11%. The economy might be a bit stronger but it’s after a long slump; wages remain stagnant and consumer credit card bills are mountainous.

2. There is a secular change in the retail market towards online shopping. That is tough to capture in sales data that compares and adjusts to the prior year and makes all statistics a bit dubious.

None of that is reflected by the 24 economists who were surveyed by Bloomberg to provide the consensus. Their estimates are all in a narrow range from 0.3%-0.6% for the control group.

News Articles

After Release

Moody’s Dismal Scientist

First Take

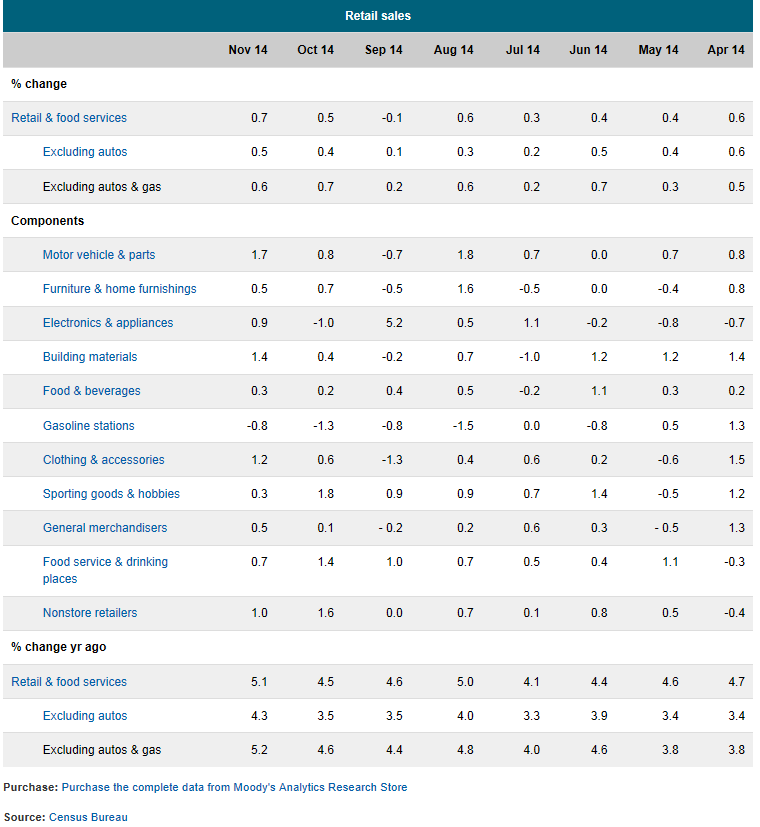

Retail sales rose 0.7% in November, blowing past expectations. Auto sales led growth. Excluding auto sales were up 0.5%. These compare with upwardly revised October gains of 0.5% and 0.4%, respectively. Sales were again held down by declining gasoline prices, but core sales growth of 0.6% suggests a healthy start to the holiday shopping season. Outside of autos, gains were led by building supply stores, apparel stores, nonstore retailers, and department stores. Miscellaneous retail stores were the only other segment to post a decline. Sales were 5.1% above their year-ago level, the strongest growth since July 2013.17

The Numbers

The November retail sales report was strong. Sales grew 0.7%, well above expectations, and growth in the prior two months was revised up by 0.2 percentage point.

As expected, growth was led by auto dealers. However, strength was widespread. Segments posting growth of 1% or better for the month included building supply stores, apparel stores, nonstore retailers, and department stores.

There were few areas of weakness. Declining gasoline prices drove down sales at gas stations. Sales also fell at miscellaneous retailers. Other segments posting comparatively weak growth were grocery stores, sporting good and hobby stores, and general merchandise stores other than department stores. The latter were likely hurt by falling gasoline prices, and sporting goods stores had an extremely good October so the deceleration was not a sign of weakness.

Year-over-year growth accelerated to 5.1%, the fastest in nearly a year and a half. Growth was led by auto dealers and nonstore retailers. Sales were below their year-ago level in October at gasoline stations and department stores.

Revisions to growth in October were widespread across segments.

Behind the Numbers

Retail

sales were surprisingly strong in November. Not only did growth

exceed expectations, but upward revisions to the prior two months put

sales at a notably higher level than anticipated. Growth was

broad-based, with the few areas of weakness either related to lower

gasoline prices or not concerning for other reasons. Modest sales

growth at grocery stores may have been influenced by lower gasoline

prices and also suggested more discretionary spending, as it was

accompanied by stronger growth at restaurants.

The outlook

remains positive, supported by mostly strong fundamentals. Gasoline

prices are continuing to move lower. While a negative for sales at

segments that sell gasoline, this is a positive for other retailers,

freeing up money for spending and supporting confidence. Steady job

gains and gradually improving growth in wage income are also

important positives for the retail outlook. Weak wage growth has been

a major drag, but there are some signs wage gains are beginning to

improve. Housing markets will keep improving as well, as rising house

prices lift wealth and construction. This will particularly support

sales at retailers that cater to housing. Gradually improving access

to credit is also a positive for the outlook.

Strong

November sales brighten the holiday outlook. Income growth is inching

higher. Combined with falling gasoline prices, low debt burdens, high

saving, and slowly improving access to credit, consumers have the

ability to spend. Confidence remains low but appears to be trending

higher. Pent-up demand will also support spending. This risk of an

external shock remains but is small. Survey evidence pointing to low

holiday shopping completion rates are also a plus for the near-term

outlook. These factors will carry into 2015 and support accelerating

sales growth through the year.

CNBC

US Nov retail sales up 0.7% vs. 0.4% expected

U.S. consumer spending advanced at a brisk clip in November as lower gasoline prices gave the holiday shopping season a boost, offering the latest sign of underlying momentum in the economy. The Commerce Department said on Thursday retail sales excluding automobiles, gasoline, building materials and food services, increased 0.6 percent last month after an unrevised 0.5 percent rise in October. The so-called core retail sales correspond most closely with the consumer spending component of gross domestic product. Economists polled by Reuters had expected core retail sales to rise 0.4 percent last month. 18

Last month's increase suggested consumer spending, which accounts for more than two-thirds of U.S. economic activity, was accelerating in the fourth quarter after slowing a bit in the July-September period.

It added to November's bullish employment report in painting a fairly upbeat picture of the economy, despite a recession in Japan and faltering growth in the euro zone, China and major emerging markets. Core sales last month were lifted by a 1.2 percent jump in receipts at clothing stores, an indication that the holiday shopping season got off to a solid start, with retailers offering discounts to attract shoppers.

Receipts at online stores increased 1.0 percent. Sales at electronic and appliance stores advanced 0.9 percent, while receipts at furniture stores rose 0.5 percent. Sales at sporting goods stores rose as did receipts at health and personal care stores. While declining gasoline prices are stimulating consumer spending, they weighed on service station sales, with receipts falling 0.8 percent.

That decline was, however, offset by a 1.7 percent surge in automobile sales, which helped to lift overall retail sales by 0.7 percent in November. That was the largest gain since March and followed an upwardly revised 0.5 percent increase in October. Economists had expected retail sales to rise 0.4 percent in November. Retail sales excluding gasoline stations increased 0.9 percent. Sales building materials and garden equipment increased 1.4 percent. Sales at restaurants and bars rose 0.7 percent.

The Wall Street Journal

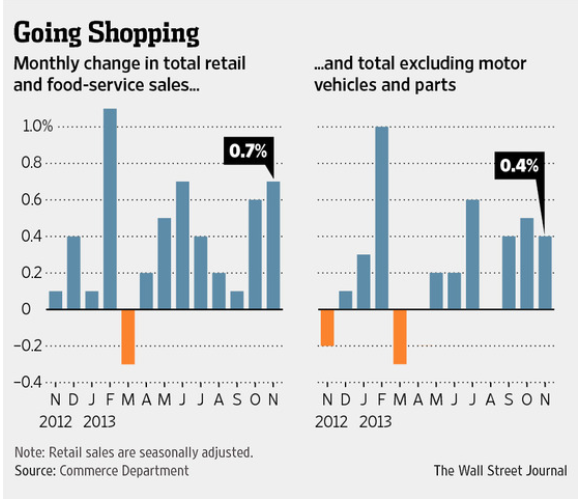

U.S. Retail Sales Rose 0.7% in November

Sharpest Increase Since June Signals Strong Start to Crucial Holiday Shopping Season

Americans spent more freely as the holiday shopping season opened, reflecting renewed consumer strength that could boost economic growth next year. Retail sales rose a seasonally adjusted 0.7% in November from October, marking the biggest gain since June, the Commerce Department said Thursday. The prior month's gain was revised up to 0.6% from 0.4%.19

Rising consumer spending, accelerating job growth and a strengthening manufacturing sector have fueled hopes that the U.S. economic recovery could be poised to move into a higher gear in 2014.

"It is difficult to get any sort of meaningful pickup without the consumer being a part of it," said David Berson, chief economist at Nationwide Insurance. "The numbers certainly suggest a stronger trajectory of consumer spending than we had thought."

Los Angeles-based Sport Chalet reported a 17% year-over-year jump in sales during Thanksgiving weekend, the traditional kickoff of the holiday shopping season. "It is early to predict how the rest of the season will play out, but it is certainly off to a fantastic start," Chief Executive Craig Levra said.

That is good news for the high-end retailer, whose business got off to a disappointing start to the year, prompting it to close several stores. "Many of our stores are near large military installations and defense contractors" that suffered from government-spending cuts, Mr. Levra said.

U.S. consumers, who are responsible for more than two-thirds of economic activity, have absorbed a series of financial blows this year. The federal government boosted payroll taxes and cut spending, and then as the fiscal drag began to wane, politicians in Washington spooked households with several months of budget fights.

But the unemployment rate is dropping, while the stock market has soared to record highs and home values have risen. Americans have recouped nearly all the wealth they lost during the recession, and lawmakers appear poised to pass a budget that would prevent another government shutdown early next year.

Pent-up demand has some consumers returning to prerecession habits, said Gail Worth, owner of a Harley-Davidson dealership in Grandview, Mo. "That impulse to buy that was gone for so long is back again," she said. A tough winter meant this year's sales got off to a late start. "It was snowing till mid-May. In the motorcycle business, that is death," she said. Business picked up in the summer, Ms. Worth said, and is on track to surpass 2012's results.

An earlier report from retailers' national trade group said Thanksgiving weekend sales were down from last year, but the holiday fell at the end of November this year, and Thursday's data suggested consumers started their shopping earlier.

In addition to strong auto sales, the report also showed that consumers spent freely last month on furniture, electronics and building materials. Retail sales were up 4.7% from the same period last year, the largest annual gain since July.

The improvement prompted several forecasters to upgrade their predictions for economic growth in the final three months of the year. Economists at Barclays raised their estimate to a 2.2% annual rate from 2%, while J.P. Morgan Chase economists boosted their forecast to 2% from 1.5%.

Thursday's report is one of the last important pieces of economic data Federal Reserve officials will see before they meet next week to discuss whether to start reining in the central bank's $85 billion-a-month bond-buying program, which is designed to bridle interest rates and spur economic growth. Expectations for an economic upturn have been dashed several times since the U.S. emerged from recession more than four years ago.

"When you look at the totality of the data of late…it certainly increases the probability that the Fed takes action to begin tapering sooner," said Jim Baird, chief investment officer at Plante Moran Financial Advisors. "Whether or not that is now or whether they wait until the spring is an open question."

Bloomberg

Retail Sales in U.S. Climbed in November by Most in Eight Months

Retail sales in the U.S. rose in November by the most in eight months as shoppers benefited from an improving job market and cheaper fuel. The 0.7 percent gain in purchases matched the highest estimate of economists surveyed by Bloomberg and followed a 0.5 percent advance in October that was larger than previously reported, Commerce Department figures showed today in Washington. Demand improved in 11 of 13 major store categories.20

A surge in hiring and the lowest gasoline prices in four years are giving households the wherewithal to sustain spending, which accounts for almost 70 percent of the economy. Rising confidence also has put Americans in the mood to shop during the holiday season, helping retailers such as Costco Wholesale Corp. (COST) and Gap Inc. beat analyst sales estimates.

“Consumers are in good shape,” Guy Berger, a U.S. economist at RBS Securities Inc. in Stamford, Connecticut, said before the report. He is among the top retail-sales forecasters in the past two years, according to data compiled by Bloomberg. “Employment is growing at a pretty brisk pace. Fuel prices plummeting means people have more to spend.”

Last month’s sales gain was the biggest since a 1.5 percent advance in March. The increases at building materials, clothing and department stores were the biggest since April.

The median forecast of 87 economists surveyed by Bloomberg called for a 0.4 percent advance. Estimates ranged from little changed to an increase of 0.7 percent. Retail sales for October were previously reported as a gain of 0.3 percent.

Other reports today showed fewer Americans filed claims for jobless benefits last week and the cost of imported goods dropped in November by the most in more than two years. The number of applications for unemployment insurance benefits declined by 3,000 in the week ended Dec. 6 to 294,000, according to a report from the Labor Department.

The import-price index (COMFCOMF) dropped 1.5 percent last month, the most since June 2012, led by a 6.7 percent plunge in fuel costs, the Labor Department also announced.

The Commerce Department’s figures showed sales climbed 1.7 percent at automobile dealers after a 0.8 percent increase the prior month. Industry figures, the ones used to calculate economic growth, showed sales of cars and light trucks rose to a 17.1 million annualized rate in November from 16.4 million the prior month, according to data from Ward’s Automotive Group. In August, the rate was 17.5 million, the most since January 2006.

“Households are reaping significant disposable income gains each week at current gas prices,” Emily Kolinski Morris, chief economist of Dearborn, Michigan-based Ford Motor Co., said on a Dec. 2 sales call.

Retail sales excluding autos also increased 0.5 percent, today’s report showed. They were projected to rise 0.1 percent, according to the Bloomberg survey median.

The only two retail categories showing declines last month were service stations and miscellaneous retailers. Gasoline station sales dropped 0.8 percent as lower gasoline costs depressed receipts. The Commerce Department’s data aren’t adjusted for prices. Lower fuel prices are freeing up money for consumers to spend elsewhere. Regular gasoline at the pump sold at an average $2.62 a gallon as of Dec. 10, down more than $1 from this year’s high in April, according to AAA, the biggest U.S. auto group.

Excluding autos, gasoline and building materials, which render the figures used to calculate gross domestic product, sales climbed 0.6 percent, the most since June, after a 0.5 percent increase the previous month.

A strengthening job market is one reason gains are broad-based. Payrolls jumped by 321,000 last month, the most in almost three years, after a 243,000 gain in October. The jobless rate held at a six-year low and average hourly earnings rose by the most since June 2013.

Early discounts prompted consumers to spend on holiday gifts. That helped November same-store sales to exceed analysts’ estimates at chains including L Brands Inc., the owner of the Victoria’s Secret and Bath & Body Works brands, clothing chain Gap, and warehouse club Costco.

Better jobs prospects and cheaper fuel are also buoying sentiment, with the Bloomberg Consumer Comfort Index hovering close to a seven-year high.

Holiday season sales gains will allow the economy to build on the strength seen earlier in the year. GDP grew at a 3.9 percent annualized rate in the three months ended in September, after a 4.6 percent second-quarter pace that was the fastest since the end of 2011. Household consumption expanded at a 2.2 percent pace.

Reuters

U.S. consumer spending gains steam, boosted by lower gas prices

U.S. consumer spending advanced at a brisk clip in November as lower gasoline prices gave the holiday shopping season a boost, offering the latest sign of underlying momentum in the economy. The Commerce Department said on Thursday retail sales excluding automobiles, gasoline, building materials and food services, increased 0.6 percent last month after rising 0.5 percent in October. The so-called core retail sales correspond most closely with the consumer spending component of gross domestic product. 21

"It provides a bit of a boost to fourth-quarter growth estimates," said Dan Greenhaus, chief strategist at BTIG in New York. "We expect the lower gasoline price boost to continue into next year's first half and with an improving jobs market, GDP should be well-supported in coming quarters."

November's increase in core retail sales exceeded Wall Street's expectations for a 0.4 percent gain. It also suggested that consumer spending, which accounts for more than two-thirds of U.S. economic activity, was accelerating in the fourth quarter after slowing in the July-September period.

Forecasting firm Macroeconomic Advisers raised its fourth-quarter growth estimate by three-tenths of a percentage point to a 2.4 percent annual rate.

U.S. stocks rose on the data, bouncing sharply from a three-day drop. Lululemon Athletica shares surged after the yoga apparel maker posted quarterly results. U.S. Treasury debt yields edged up, while the dollar rose against a basket of currencies.

The solid retail sales data added to November's bullish employment report in painting a fairly upbeat picture of the economy, despite a recession in Japan and faltering growth in the euro zone, China and major emerging markets. In a separate report, the Labor Department said new claims for state unemployment benefits fell last week, pushing them firmly beneath the key 300,000 level, in a sign of continued improvement in the jobs market. Tightening labor market conditions are starting to spur faster wage growth, which together with lower gasoline prices is helping to stimulate consumer spending.

U.S. gasoline prices have dropped by about 64 cents to $2.767 per gallon since the beginning of the year. Economists at Moody's Analytics estimate that consumers save about $1 billion over a year with each one-cent drop in the price of gasoline. "Consumers are putting the money they save at the pump to work," said Gennadiy Goldberg, a strategist at TD Securities in New York. Lower energy prices are also keeping imported inflation pressures subdued. A second report from the Labor Department showed import prices recorded their biggest drop in nearly 2-1/2 years in November.

Last month, core retail sales were lifted by a 1.2 percent jump in receipts at clothing stores, an indication that the holiday shopping season got off to a solid start, with retailers offering discounts to attract shoppers.

Aside from clothing, there were increases in most of the retail sales categories. While declining gasoline prices are supporting consumer spending, they weighed on service station sales, with receipts falling 0.8 percent.

That decline was, however, offset by a 1.7 percent surge in automobile sales, which helped lift overall retail sales by 0.7 percent in November. It was the largest gain since March and followed a 0.5 percent increase in October.

ABC News (AP)

US Retail Sales Climb on Holiday Shopping

U.S. retail sales perked up in November with the start of the holiday shopping season, led by online buying and purchases of autos, clothing and electronics. Retail sales rose a seasonally-adjusted 0.7 percent last month, the Commerce Department said Thursday. Falling gasoline prices caused purchases at gas stations to decline 0.8 percent, but that potentially freed up income to be spent elsewhere. Excluding gas stations, sales climbed a healthy 0.9 percent. Spending on motor vehicles accelerated 1.7 percent, while purchases at clothiers, online retailers, electronics stores and department stores all improved. Non-store retailers, which include online and mail-order outlets, rose 1 percent.22

The sales figures indicate that consumers have pumped up their holiday shopping, despite initial signs within the retail industry that Black Friday shopping plunged compared to the previous year.

Sales are up 5.1 percent over the past 12 months.

"In the months ahead, we expect consumers keep spending the extra income gained from the strong job market and the collapse in energy prices," said Laura Rosner, an analyst at the bank BNP Paribas.

Average national gas prices have slid to $2.64 a gallon, down nearly 30 cent, or 9.8 percent, over the past month, according to the AAA's Daily Fuel Gauge.

Many analysts believe that holiday spending could rise by at least 4 percent this year because of recent job growth. The hiring spree since February has bolstered the number of people with steady paychecks by nearly 2.65 million, and consumer confidence has also improved.

Employers added 321,000 jobs in November, and the unemployment rate held steady at 5.8 percent, the Labor Department reported last week.

Still, initial indicators suggested that the Thanksgiving and Black Friday weekend was bleak for traditional retailers. An estimated 133.7 million people shopped in stores and online, down 5.2 percent from a year ago, according to a survey of 4,631 people conducted by Prosper Insights & Analytics for the National Retail Federation. Total spending for the weekend was projected to fall 11 percent to $50.9 billion from a year ago.

That hints at the absence of meaningful wage gains for many workers, despite recent job growth. Average hourly wages have risen just 2.1 percent over the past 12 months, slightly ahead of inflation.

But consumer tastes might also be shifting. There are signs that holiday shopping began earlier in the month than last year, as consumers have become fatigued by Black Friday mania. Also, there are signs of people forgoing smaller expenditures to replace bigger ticket items such as automobiles.

Motor vehicles sold in November at an annualized clip of 17.2 million, a 4.6 percent increase from the prior year, according to Autodata Corp. Subaru and Chrysler led the major automakers with sales increases around 20 percent on strong demand for their small SUVs.

USA Today

Retail sales raise hopes for 2014

Retail sales jumped more than economists expected in November, raising spirits about the state of consumers and their spending pattern heading into the new year. The Census Bureau said November sales rose 0.7%, the best gain in five months, beating forecasts for a 0.6% gain, The results include Black Friday, one of the biggest days of the holiday shopping season, but exclude Cyber Monday, which fell on Dec. 2 this year.23

"Retail sales look great,'' said Chris Rupkey, chief U.S. economist for Bank of Tokyo Mitsubishi UFJ. "The latest Bloomberg poll says Americans think Washington uncertainty is hurting economic growth, but you'd never know it because they are still going out and buying goods at the shops and malls.''

The results appear to show consumers gaining confidence in the economy, which added more than 200,000 jobs in November as the unemployment rate fell to a five-year low of 7.0%. Retail sales' gain was the biggest in five months, and the Census Bureau also revised its estimate of October's sales gains to 0.6% from 0.4%. In the last year, retail sales have climbed 4.7%, the bureau said. The figures are not adjusted for inflation.

Big-ticket items seemed to do especially well, with a 1.8% gain in auto sales and gains of more than 1% in furniture, electronics and appliance stores, and restaurants. Sales of gasoline dropped 1.1%, and sales of food and clothing posted smaller declines. Excluding both gasoline and cars, sales rose 0.6%.

Economists at Barclays said the results were strong enough to raise their running estimate of fourth-quarter growth in the overall economy to an annual rate of 2.2%, from 2%. Consumer spending could rise 3% in the fourth quarter, compared with a year earlier, its best performance since late 2010, said Barclays economist Peter Newland said.

The economy grew 3.6% in the third quarter, bolstered by a buildup of inventories. Final demand, a measure that excludes the volatile inventory fluctuations, rose 1.9%, and consumer spending rose 1.4%. More skeptical economists suggested the numbers show the effects of slow income growth.

Retail sales actually rose more quickly earlier in the recovery, especially in 2011, Sterne Agee chief economist Lindsey Piegza said.

A "temporary reprieve from pump prices, and a lingering wealth effect from rising home prices and record-high equity markets have helped support consumer confidence and consumer spending,'' Piegza wrote in a note to clients. "Going forward, however, temporary factors can only do so much.''

The growth was highly unbalanced, said Diane Swonk, chief economist at Mesirow Financial. Cuts in food-stamp benefits held down food sales, and apparel sales are so weak that clothing prices are falling amid a highly promotional holiday season. "People are buying big things — but they aren't buying clothes,'' Swonk said. "Grocers are complaining.''

Another weak spot in consumer spending has been households' reticence about buying more services, so the total picture for consumer spending may not be quite as strong as the goods-focused retail sales report implies, Rupkey said. Consumer sentiment surveys by Thomson Reuters and Bloomberg have also shown more optimism in recent weeks.

Business Week

US retail sales climb on holiday shopping

U.S. retail sales perked up in November with the start of the holiday shopping season, led by online buying and purchases of autos, clothing and electronics. The Commerce Department says retail sales rose a seasonally-adjusted 0.7 percent last month. Falling gasoline prices caused purchases at gas stations to decline 0.8 percent, but that potentially freed up income to be spent elsewhere.24

Excluding gas stations, sales climbed a healthy 0.9 percent. Spending on motor vehicles accelerated 1.7 percent, while purchases at clothiers, online retailers, electronics stores and department stores all improved. The sales figures indicate that consumers have pumped up their holiday shopping, despite initial signs within the retail industry that Black Friday shopping plunged compared to the previous year. Sales are up 5.1 percent over the past 12 months.

Dollar Gains as Retail Sales Rise Most in 8 Months in November

The dollar rose versus a basket of major peers as a report showed retail sales climbed the most in eight months in November, indicating a strengthening U.S. economic recovery amid sluggish global growth.

The yen fell for the first time in four days on speculation Prime Minister Shinzo Abe’s Liberal Democratic Party will win re-election this weekend and extend measures that have weighed on the currency. Norway’s krone weakened through 9 per euro for the first time since 2009 as the Norges Bank unexpectedly cut interest rates. Russia’s ruble weakened to a record.

The Bloomberg Dollar Spot Index, which tracks the U.S. currency against those of 10 trading partners, rose 0.2 percent to 1,113.66 at 8:35 a.m. New York time, after falling to 1,108.21, the lowest since Dec. 2.

The 0.7 percent gain in purchases matched the highest estimate of economists surveyed by Bloomberg and followed a 0.5 percent advance in October that was larger than previously reported, Commerce Department figures showed today in Washington. Demand improved in 11 of 13 major store categories.25

Another Labor Department reports showed Jobless claims decreased by 3,000 to 294,000 in the week ended Dec. 6. The median forecast in a Bloomberg survey of economists called for first-time applications to hold at the prior week’s 297,000. Claims have been below 300,000 for 12 of the past 13 weeks.

MarketWatch

U.S. retail sales in November hit fastest growth in eight months

U.S. retail sales rose 0.7% in November, the fastest growth in eight months, supported by autos, clothing and purchases at other kinds of stores, as holiday shopping got underway, according to government data released Thursday. Economists polled by MarketWatch had expected November growth of 0.4%, compared with October's originally reported increase of 0.3%. On Thursday, the U.S. Commerce Department revised October's growth to 0.5%. Auto sales rose 1.7% in November, the strongest result since August. Excluding autos, retail-sales growth hit 0.5% last month, the strongest result since June. Economists had expected sales excluding autos to rise 0.1% in November, compared with an originally estimated increase of 0.3% in October. On Thursday, the government revised October's growth for non-auto retail sales to 0.4%. Retail sales are an important part of consumer spending, which is the backbone of the U.S. economy. Retail sales have increased 5.1% over the past 12 months.26

3 http://m.seekingalpha.com/article/2746535-u-s-retail-sales-november-2014-preview and http://www.capitalspectator.com/us-retail-sales-november-2014-preview/

4 http://www.foxbusiness.com/markets/2014/12/11/us-retail-sales-likely-increased-in-november-but-falling-gas-prices-limiting/

6 http://www.marketwatch.com/story/us-stocks-futures-point-to-careful-bounce-back-as-retail-sales-loom-2014-12-11

9 http://www.marketwatch.com/story/retail-sales-seen-hitting-fastest-growth-in-three-months-2014-12-10

10 http://www.chicagotribune.com/business/breaking/ct-november-retail-sales-1210-biz-20141210-story.html

11 http://www.fxstreet.com/news/forex-news/article.aspx?storyid=31dbf475-e2b1-479e-9af0-fa7b5a1c459b

14 http://www.nasdaq.com/article/futures-gain-as-oil-edges-up-jobless-claims-monthly-retail-sales-on-tap-cm422149

17 https://www.economy.com/dismal/pro/release.asp?sid=568EF0B2-0F8E-4D49-BA6C-94FEAB2041BD&tkr=1409120954&Lchk=1&r=usa_retail

19 http://www.wsj.com/articles/SB10001424052702303293604579253841832539898

20 http://mobile.bloomberg.com/news/2014-12-11/retail-sales-in-u-s-climbed-in-november-by-most-in-eight-months.html

21 http://www.reuters.com/article/2014/12/11/us-usa-economy-idUSKBN0JP1HP20141211

22 http://abcnews.go.com/Business/wireStory/us-retail-sales-climb-holiday-shopping-27524988

25 http://mobile.businessweek.com/news/2014-12-10/yen-rises-for-fourth-day-as-slump-in-oil-shares-spurs-haven-bid

26 http://www.marketwatch.com/story/us-retail-sales-in-november-hit-fastest-growth-in-eight-months-2014-12-11

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | May 2012 Sales Review & Retail Trends Summary |

| Subject | Retail Indicators Branch |

| Author | cybro001 |

| File Modified | 0000-00-00 |

| File Created | 2021-01-24 |

© 2026 OMB.report | Privacy Policy