Locating and Paying Participants

Locating and Paying Participants

Modernized MyPBA Screen Mockups 2012-09-28

Locating and Paying Participants

OMB: 1212-0055

September 2012

Draft of Modernized My PBA Screens

The screen mockups are intended to show the expected placement of the data elements for the modernized MyPBA. Please disregard

any data reflected on the screens, e.g., 2012

inconsistent data

review tags shown in brackets (e.g., [*F*], [*R*], etc.).

Contents

Form 700 Apply for Pension Benefits 2

Form 701 Payee Information Form 9

Form 705 Beneficiary Application for Pension Benefits 10

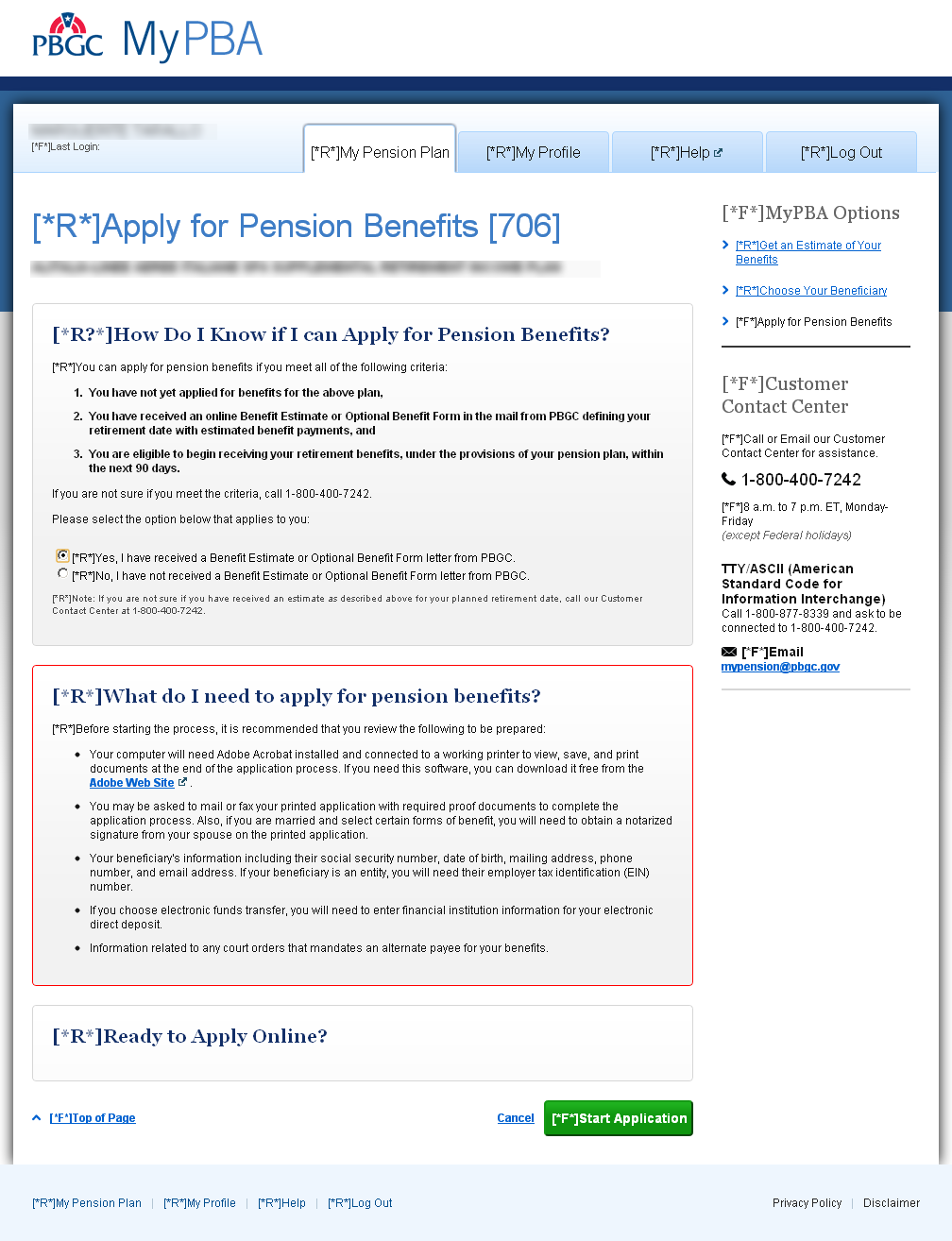

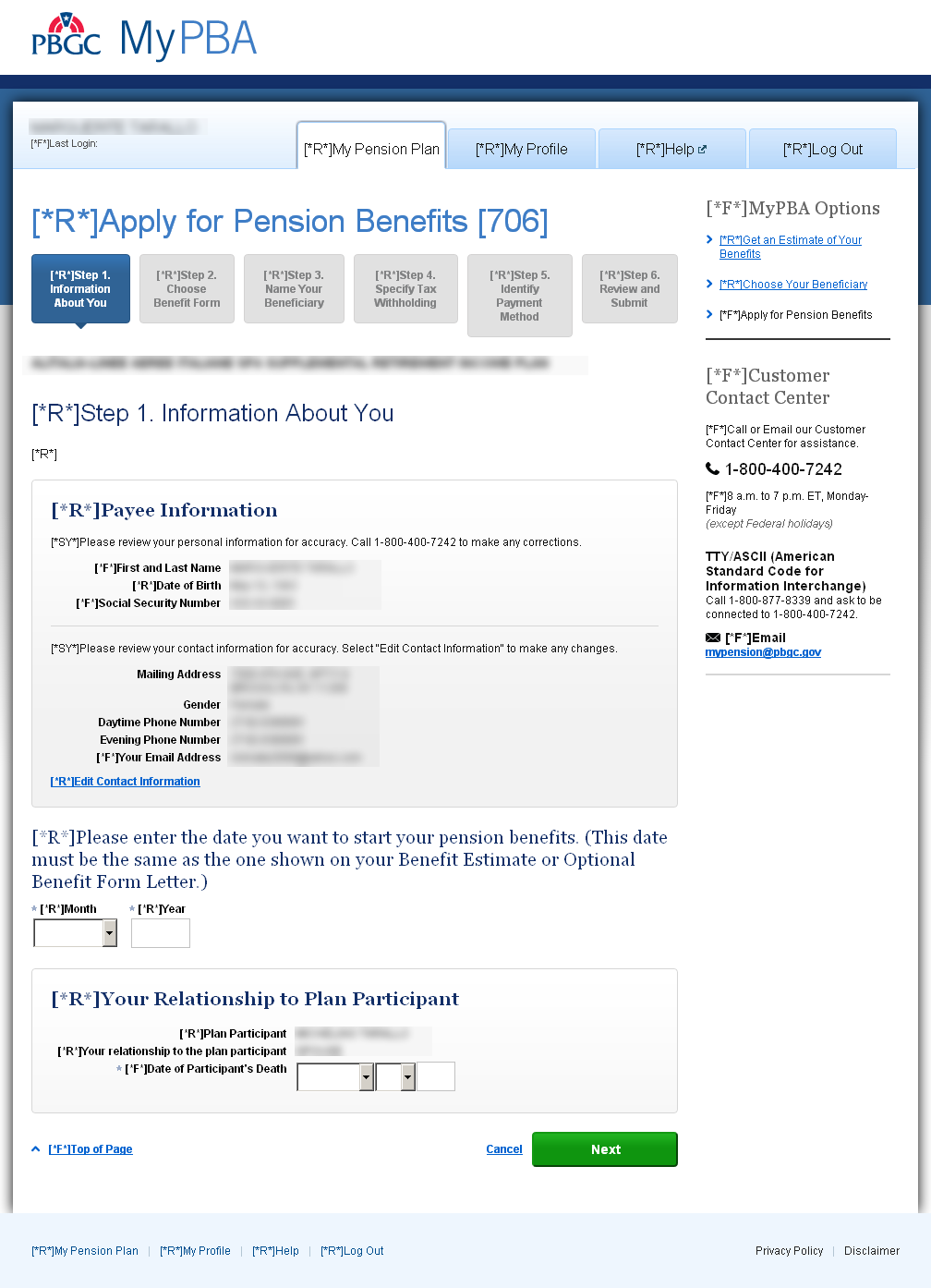

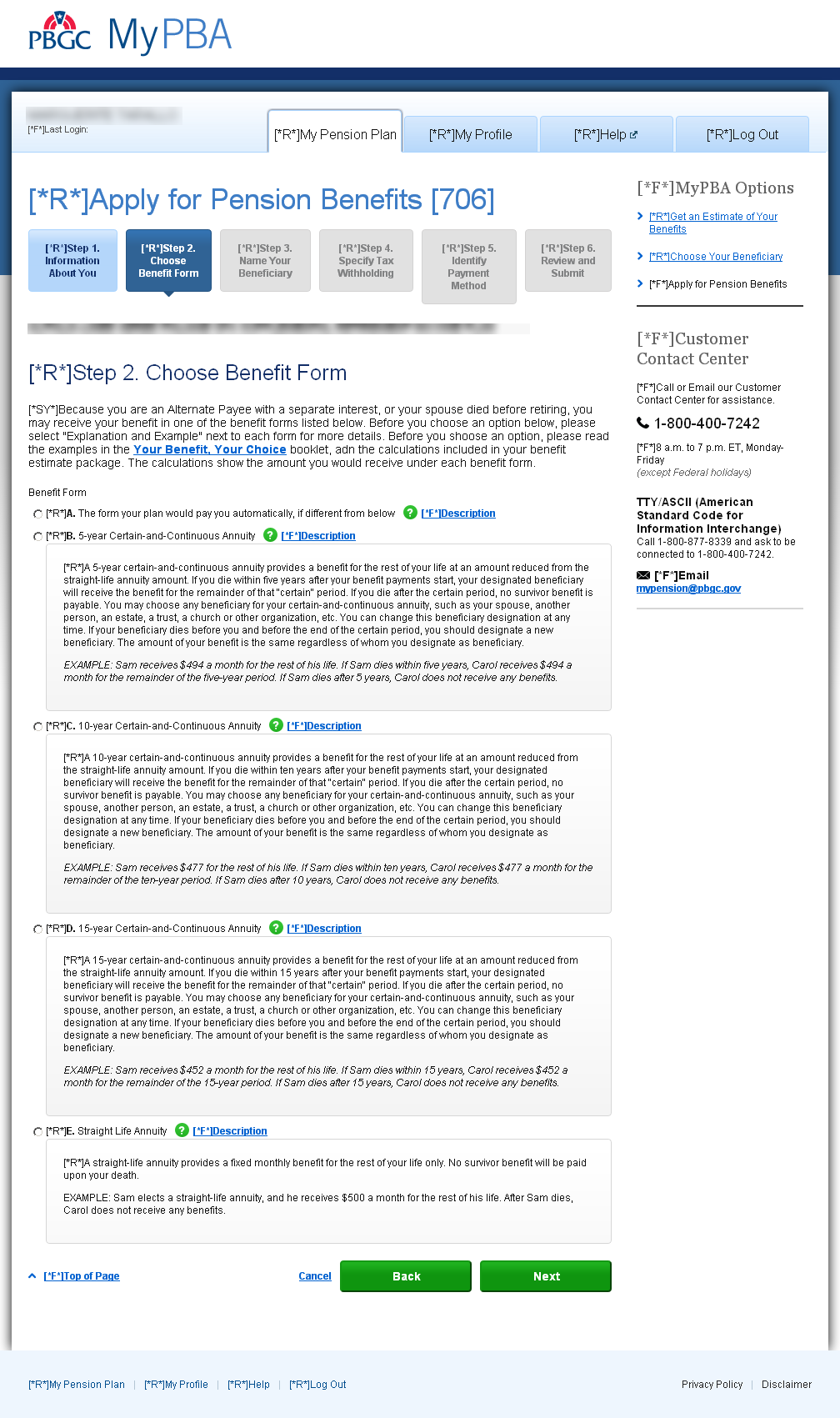

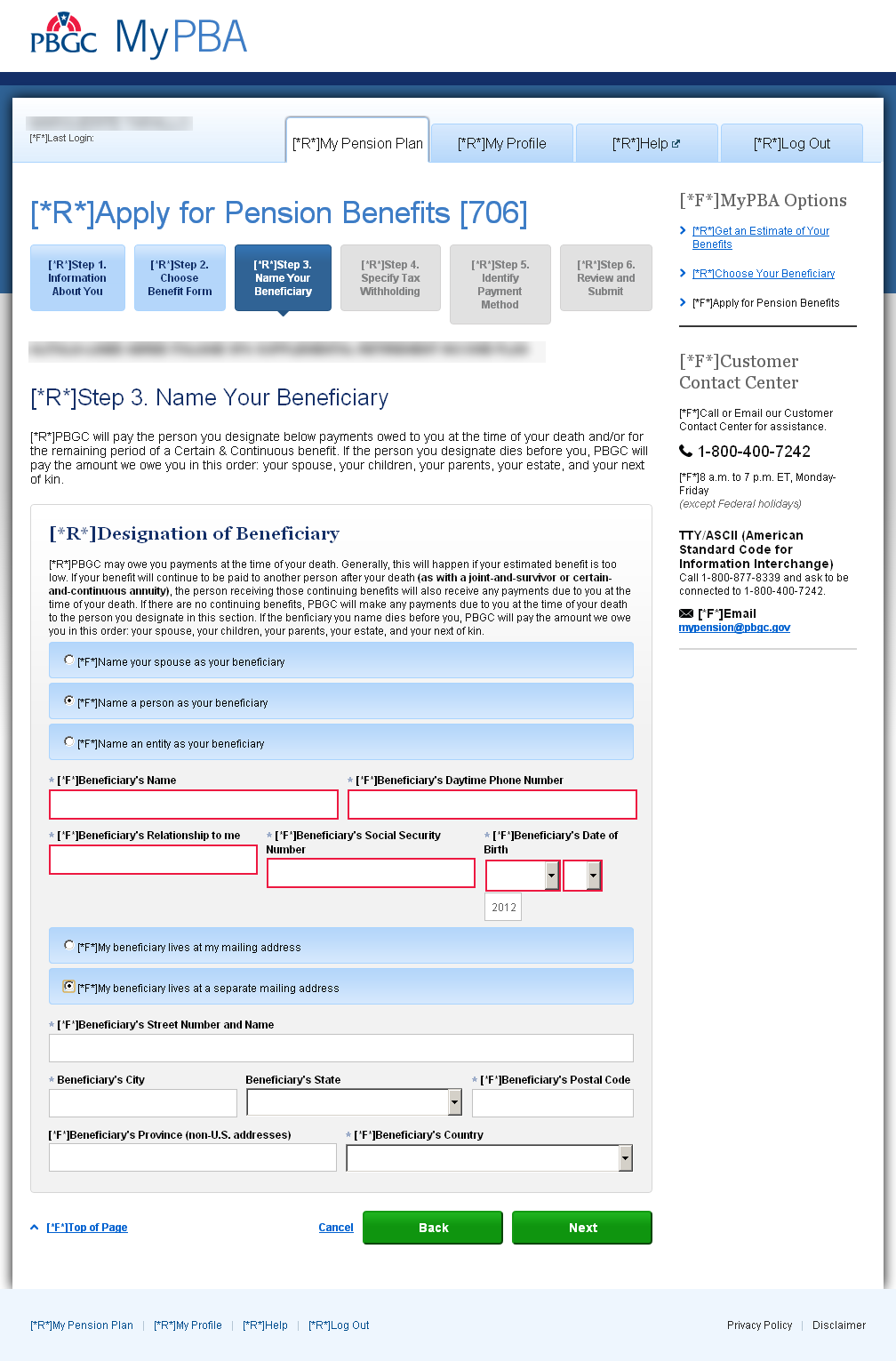

Form 706 Beneficiary Application For Pension Benefits – OF 18

Form 707 Designation of Beneficiary for Benefits Owed at Death 26

Form 708 Designation of Beneficiary 27

Form 711 Change of Beneficiary for Certain & Continuous (C&C) Benefits Only 28

Form 716 Continuous Eligibility Certification 29

Form 716A Continuous Eligibility Certification 30

Form 720 Application for Lump-Sum Payment 31

Update Electronic Direct Deposit Screen 33

Election to Withhold Federal Income Tax from Periodic Payments Screen 34

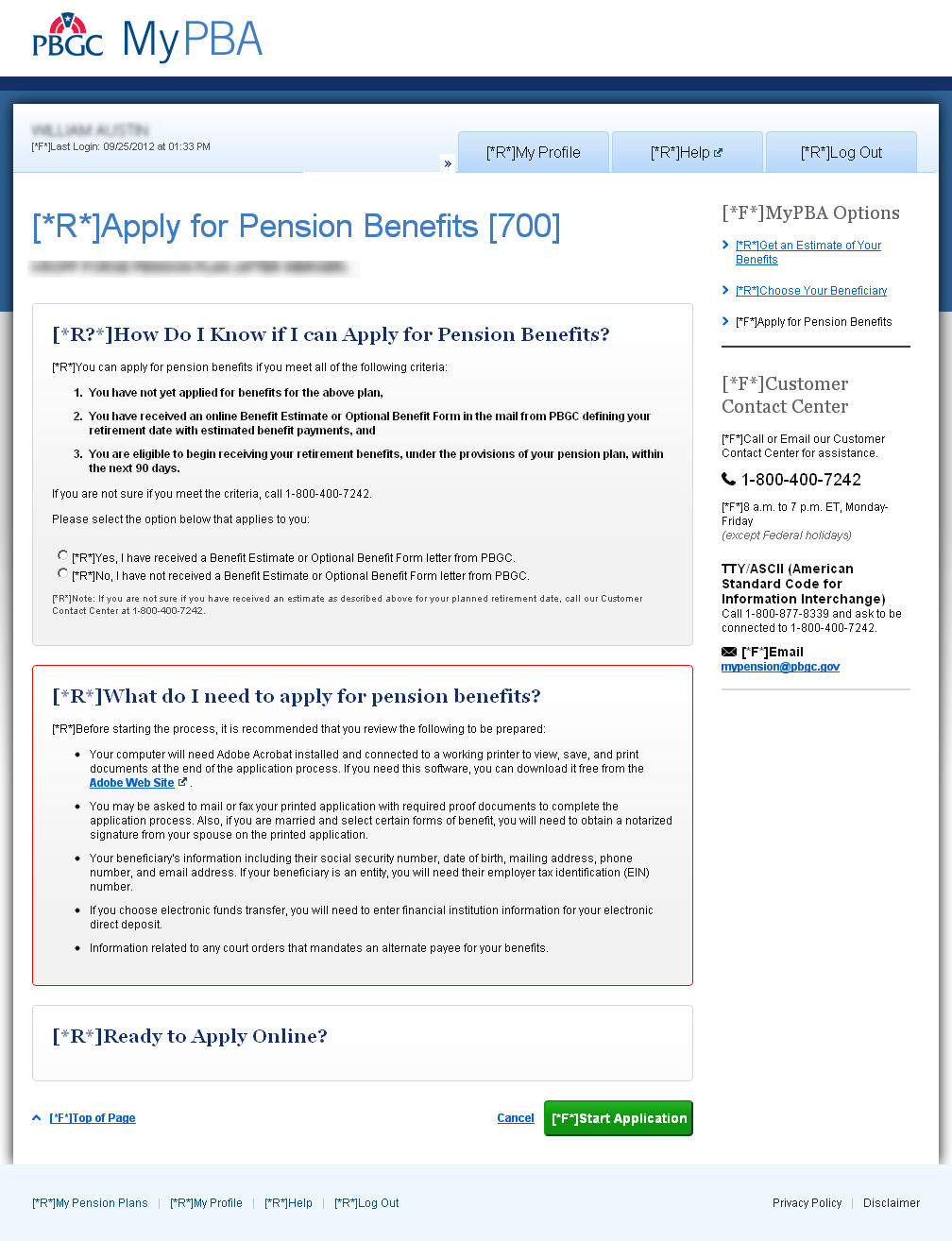

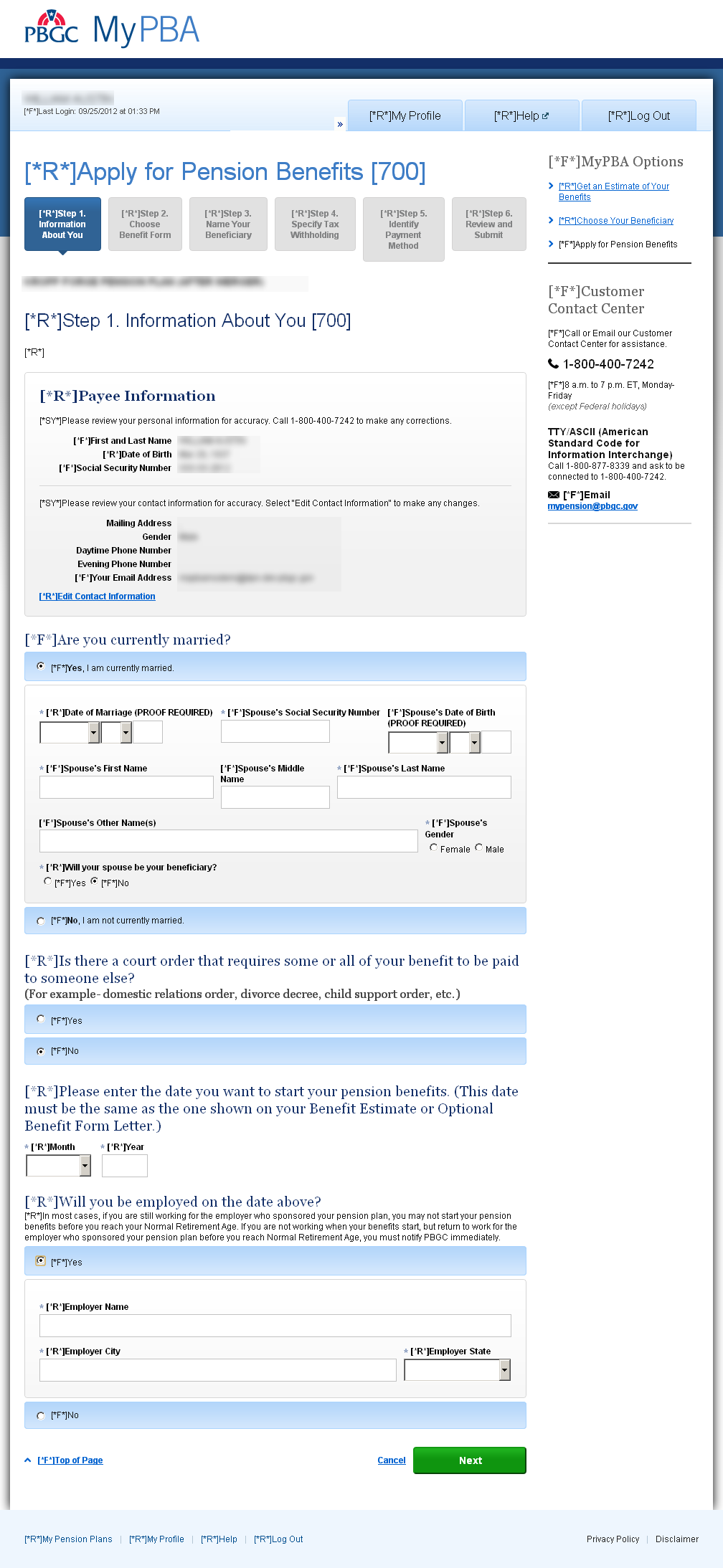

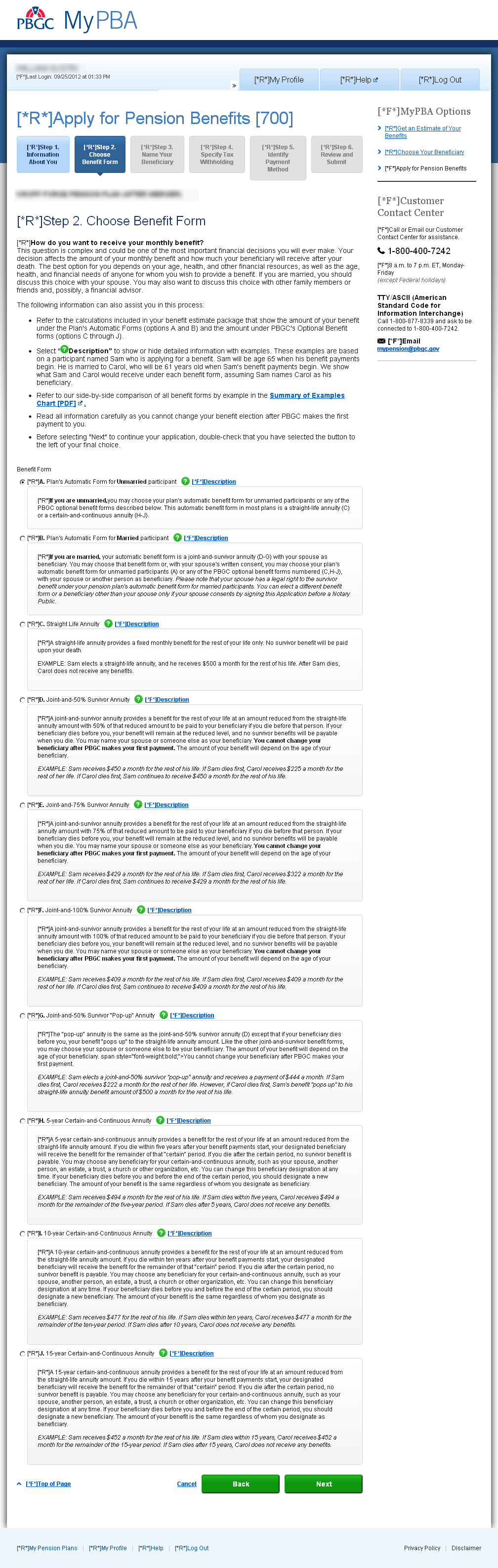

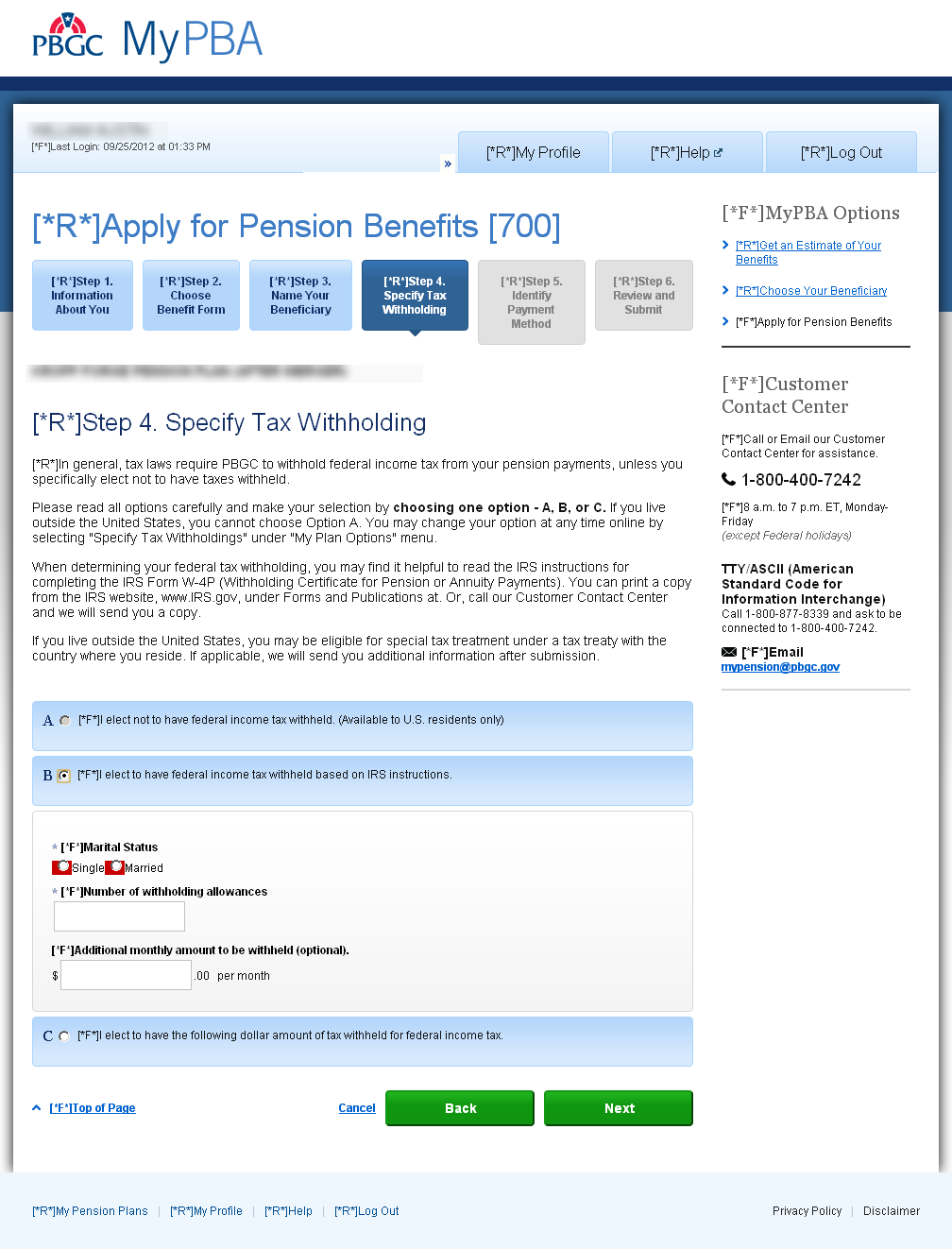

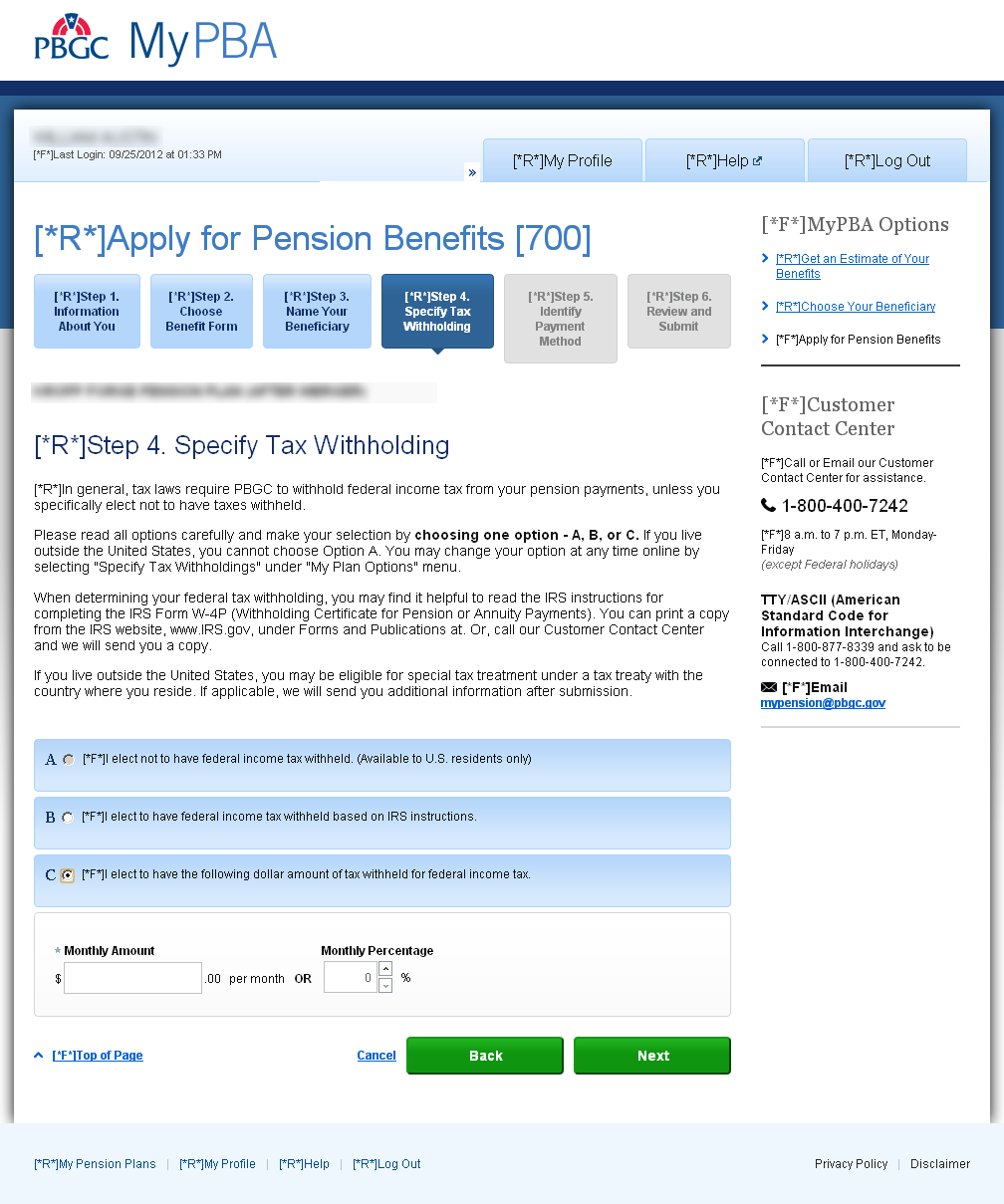

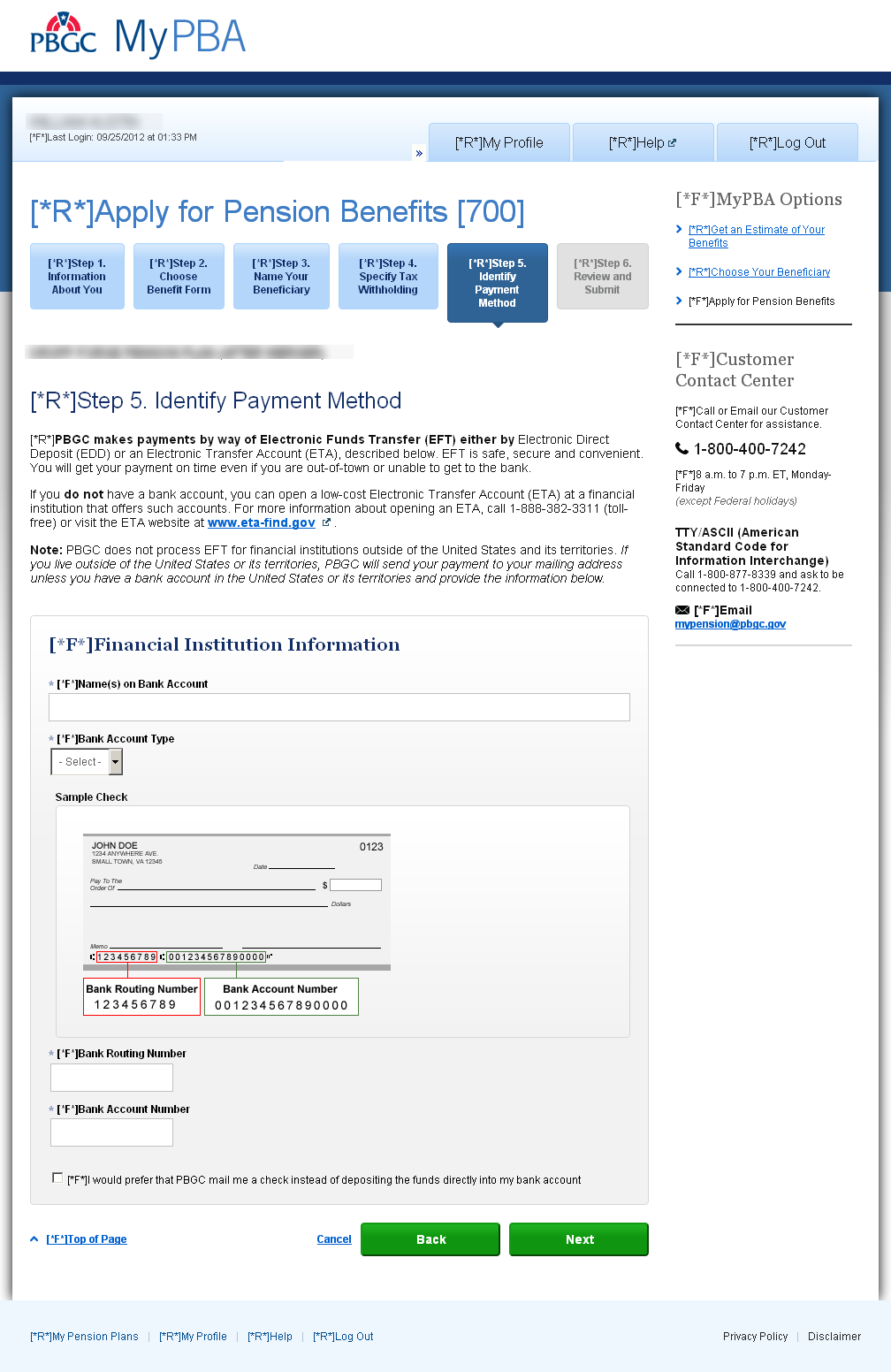

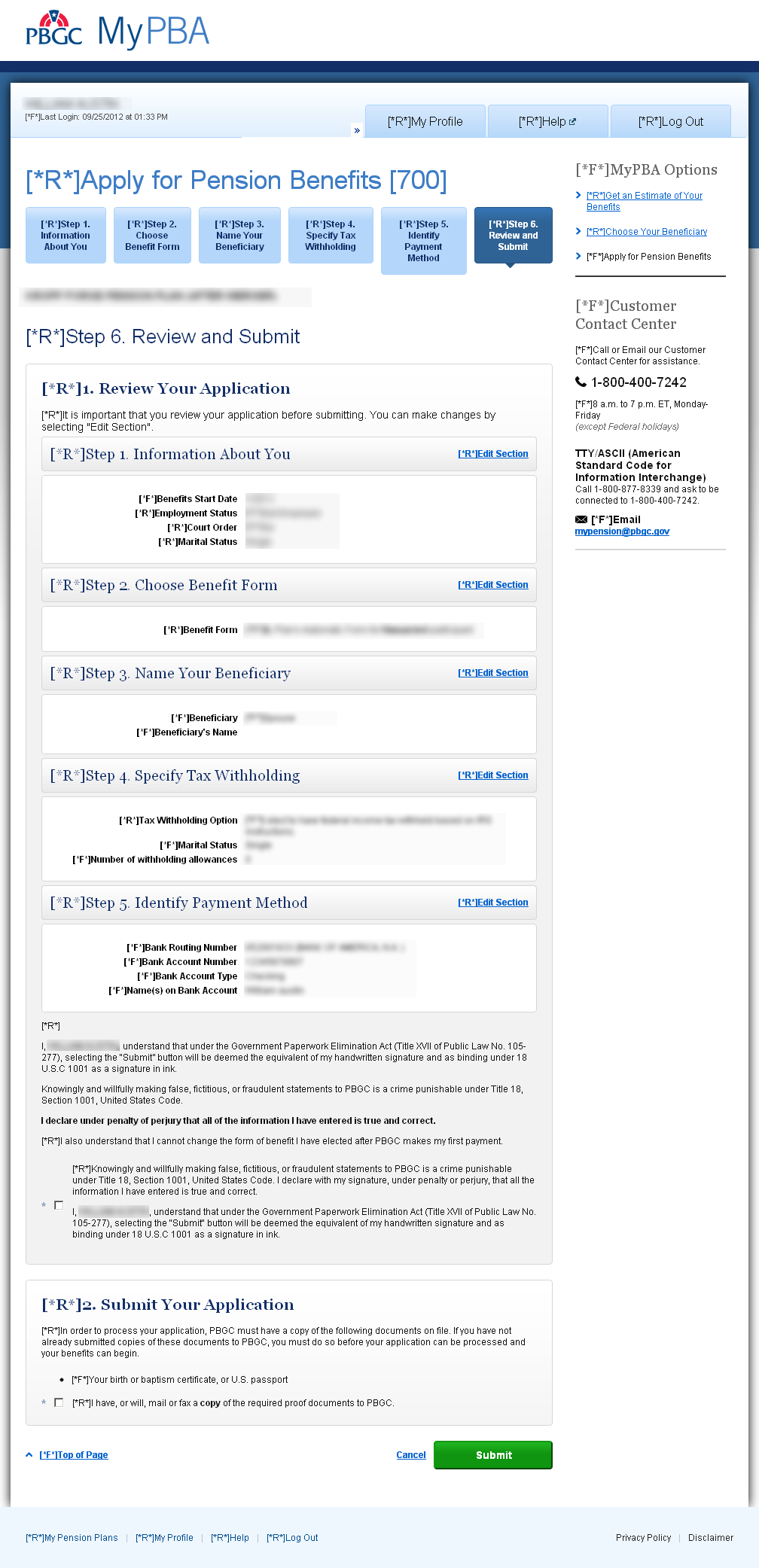

Form 700 Apply for Pension Benefits

Step 4 Tax Withholding: if option B is selected, fields for that option are displayed.

Step 4 Tax Withholding: if option C is selected, fields for that option are displayed.

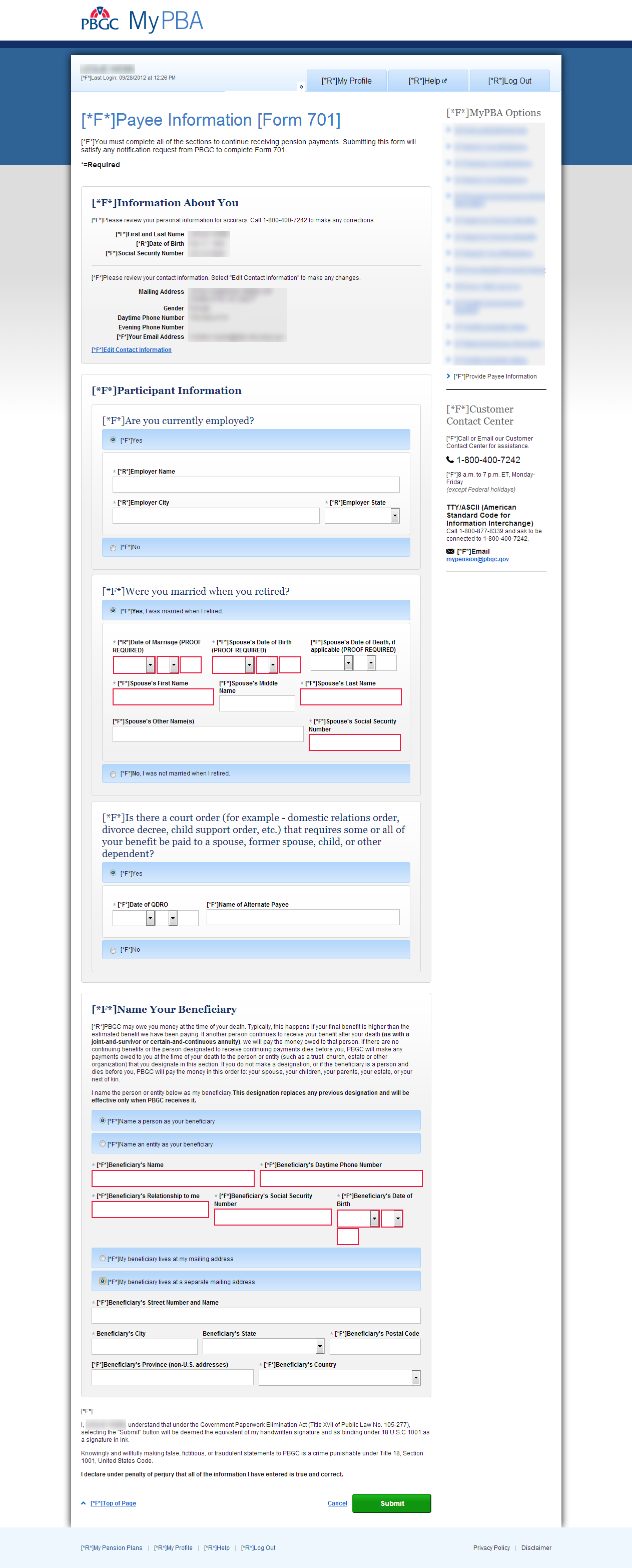

Form 701 Payee Information Form

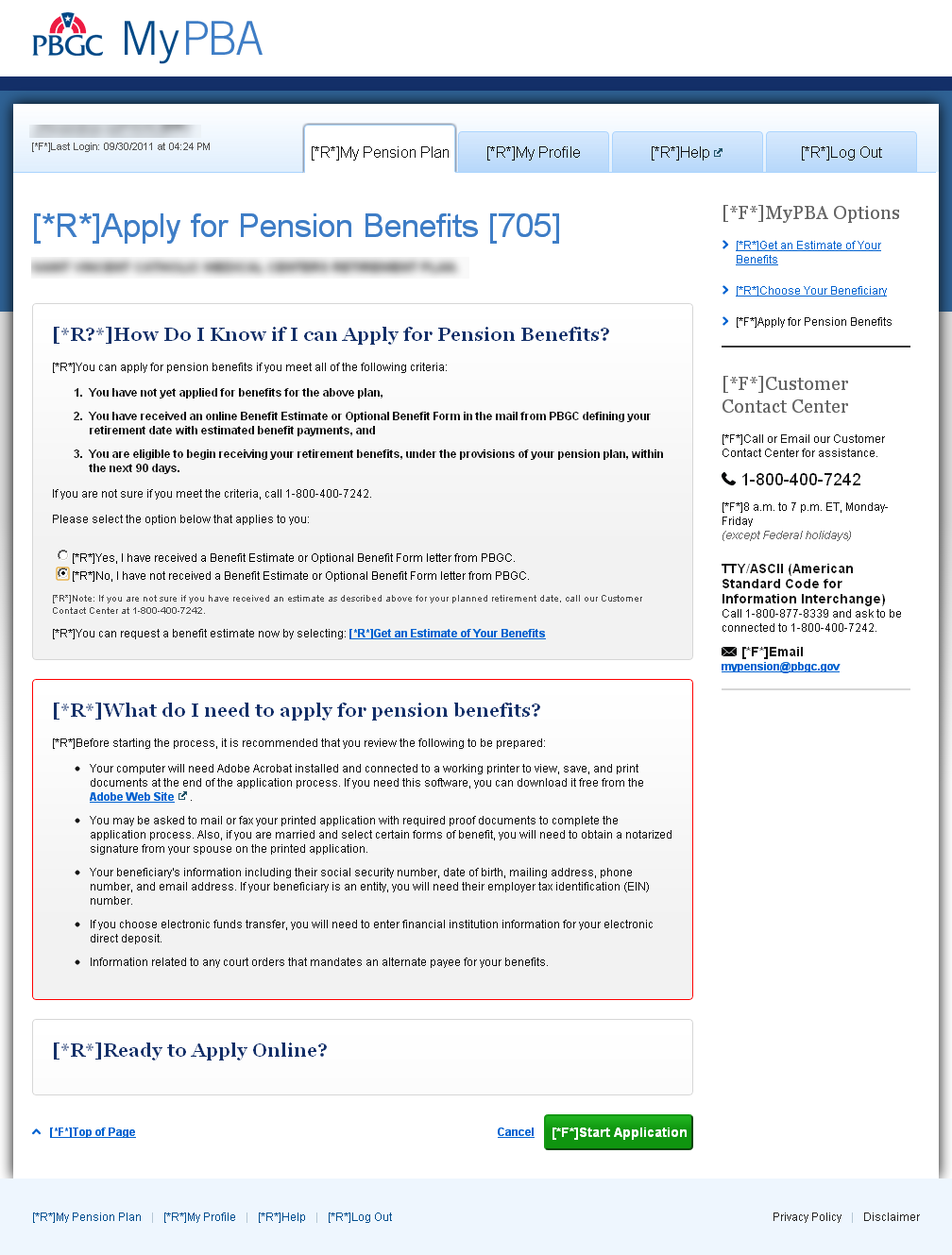

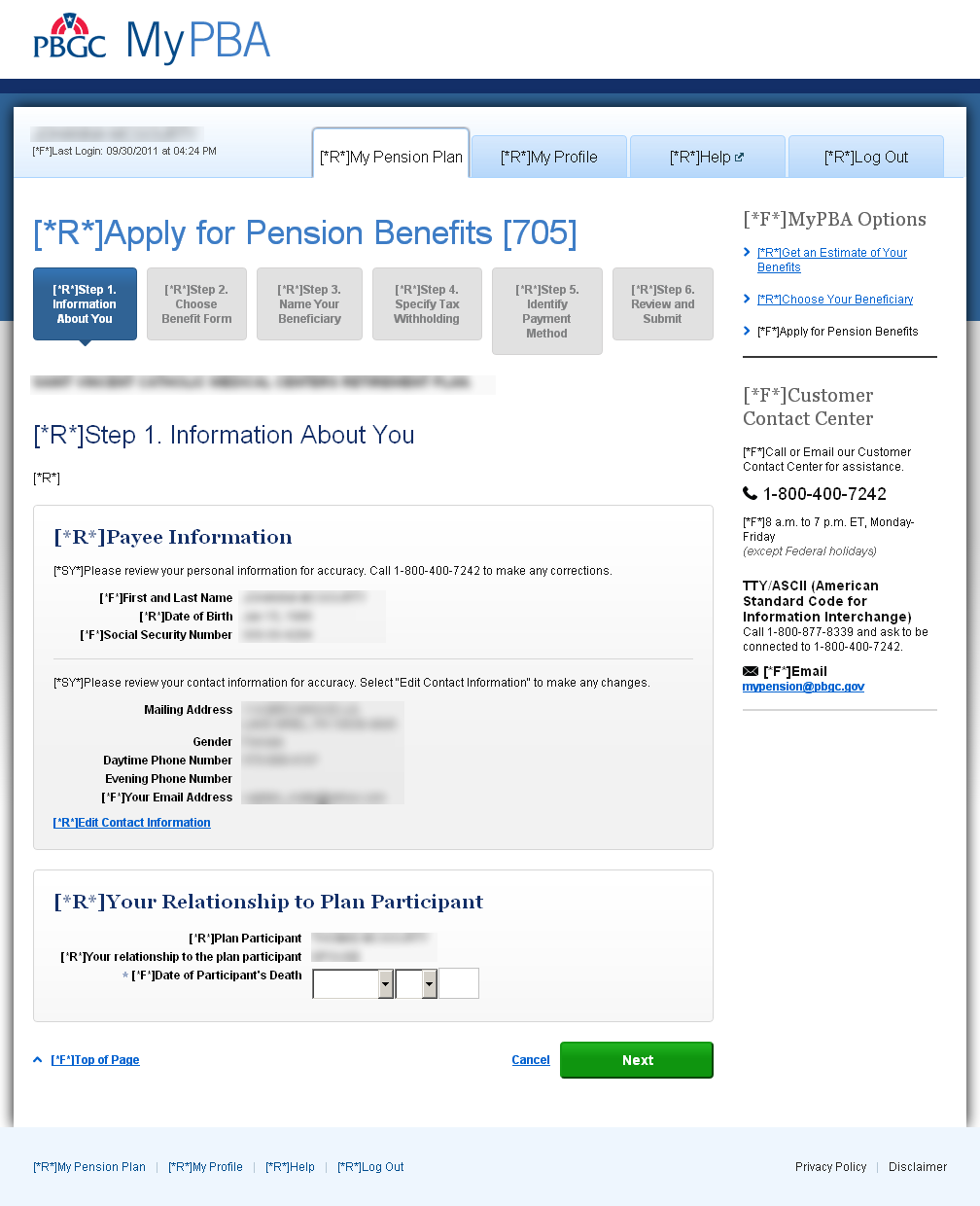

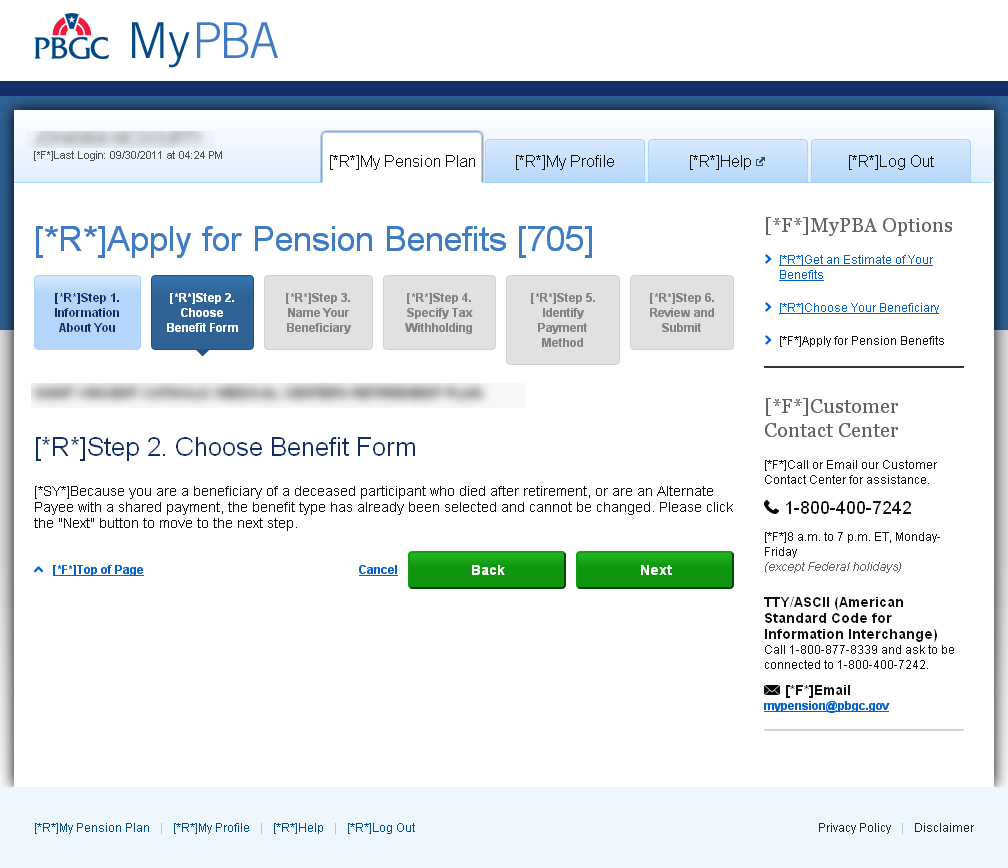

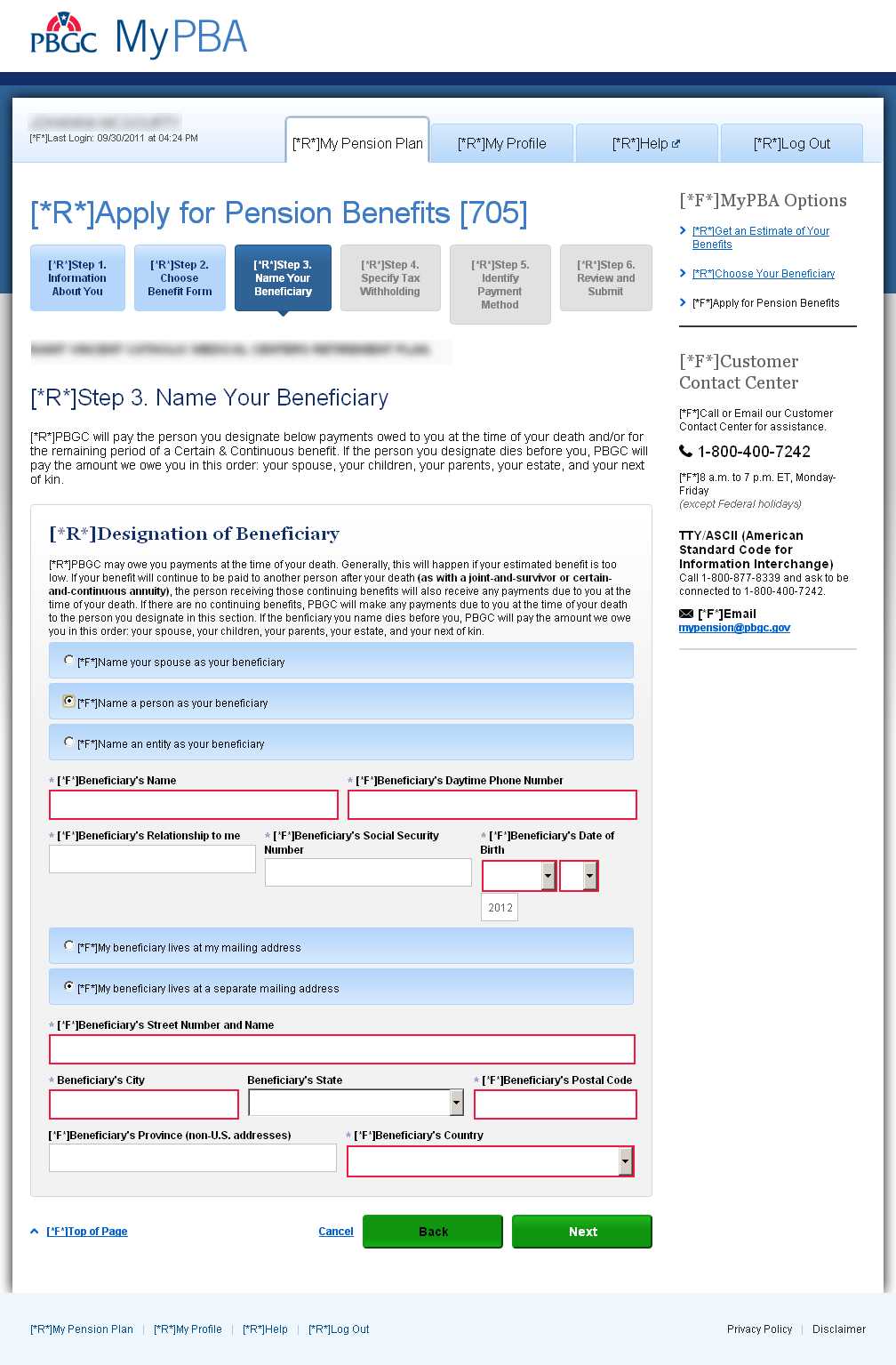

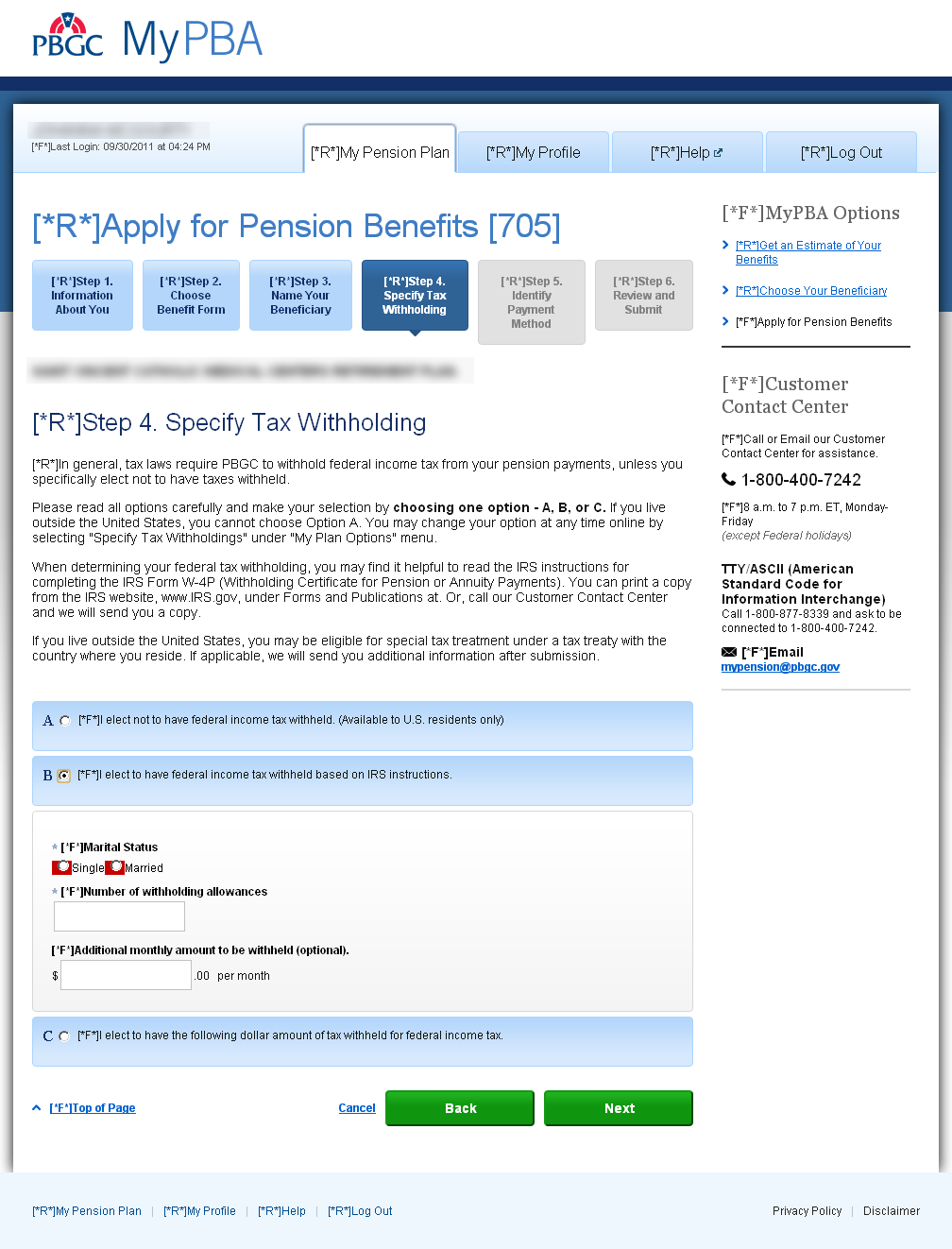

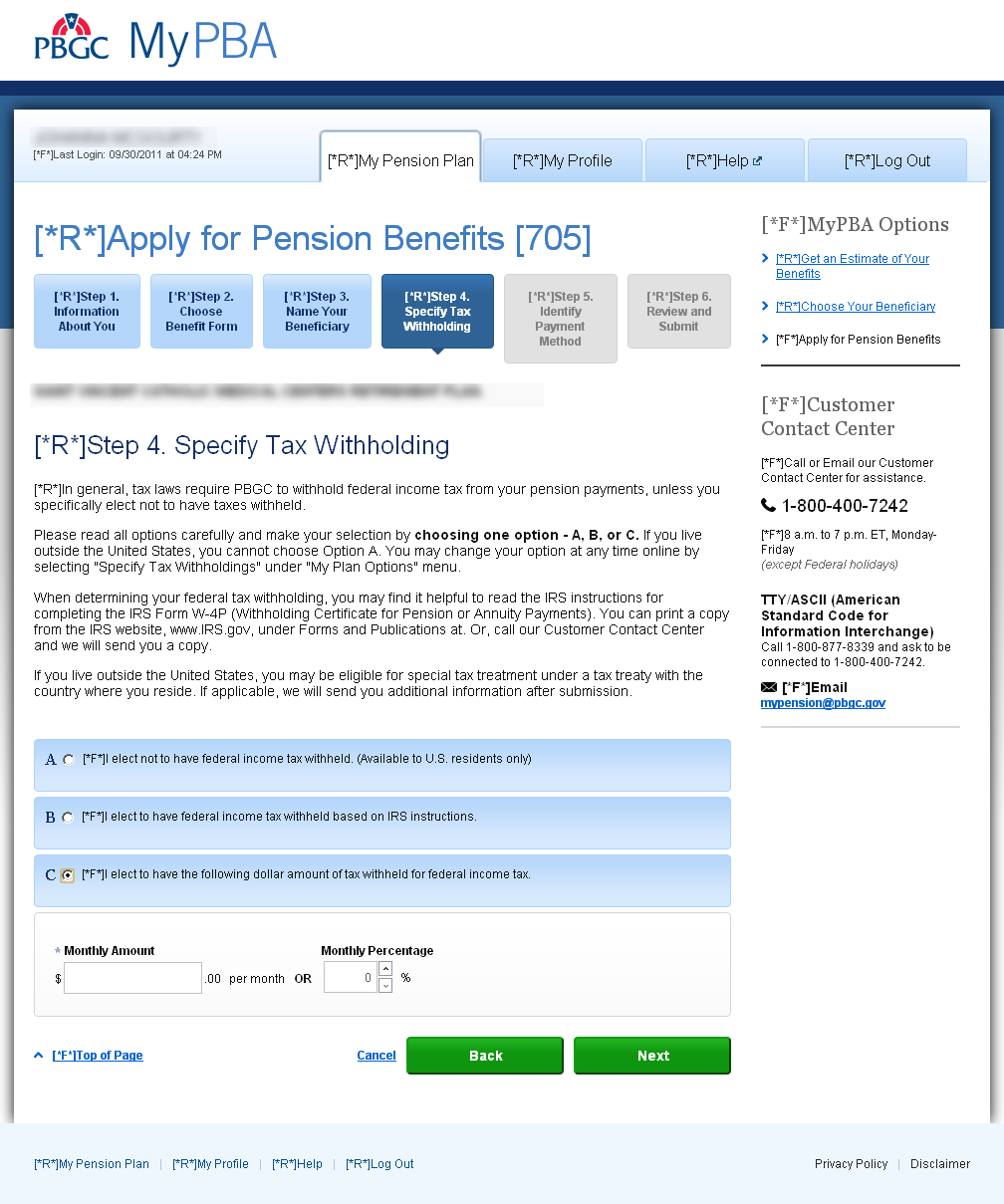

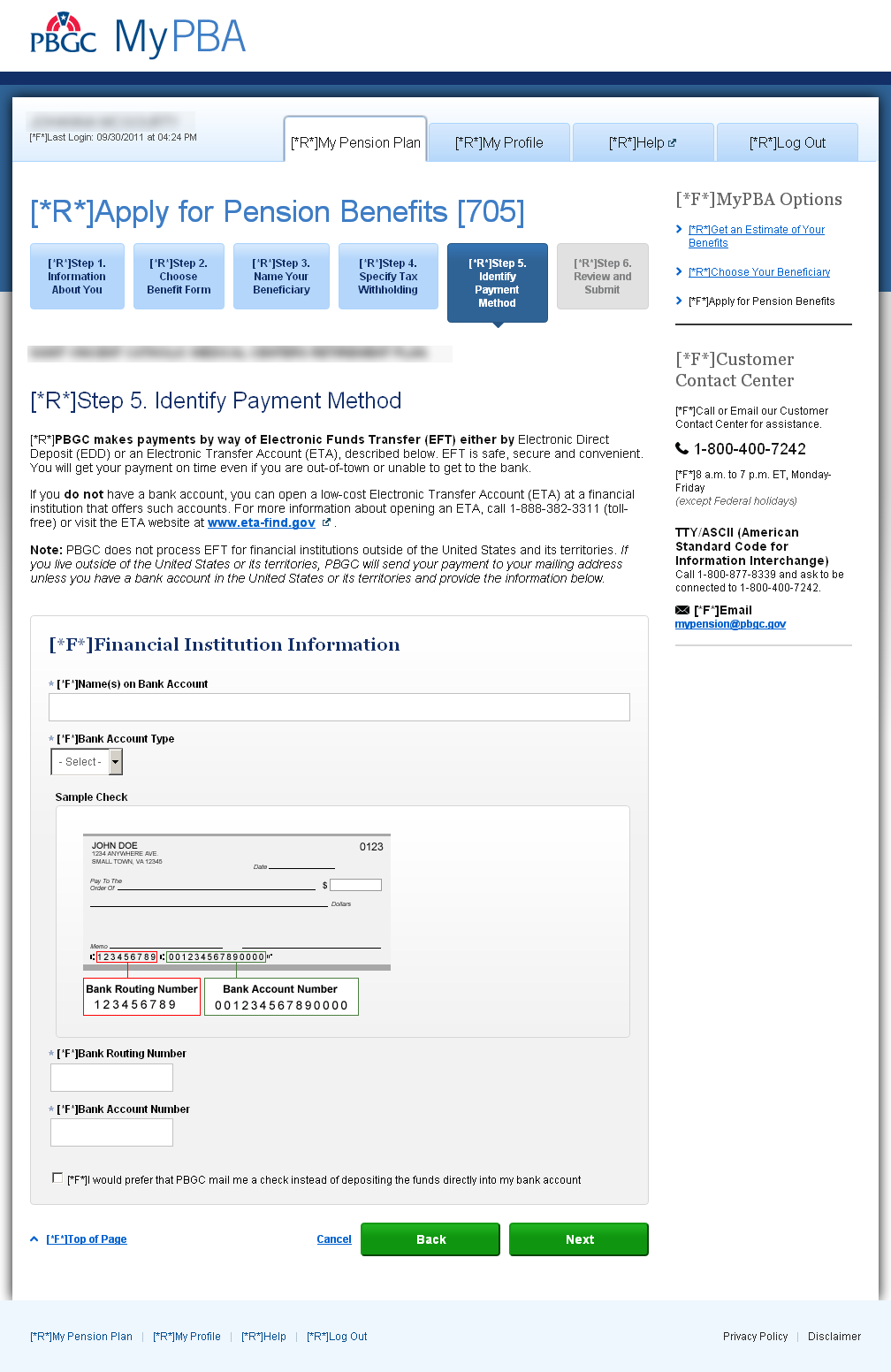

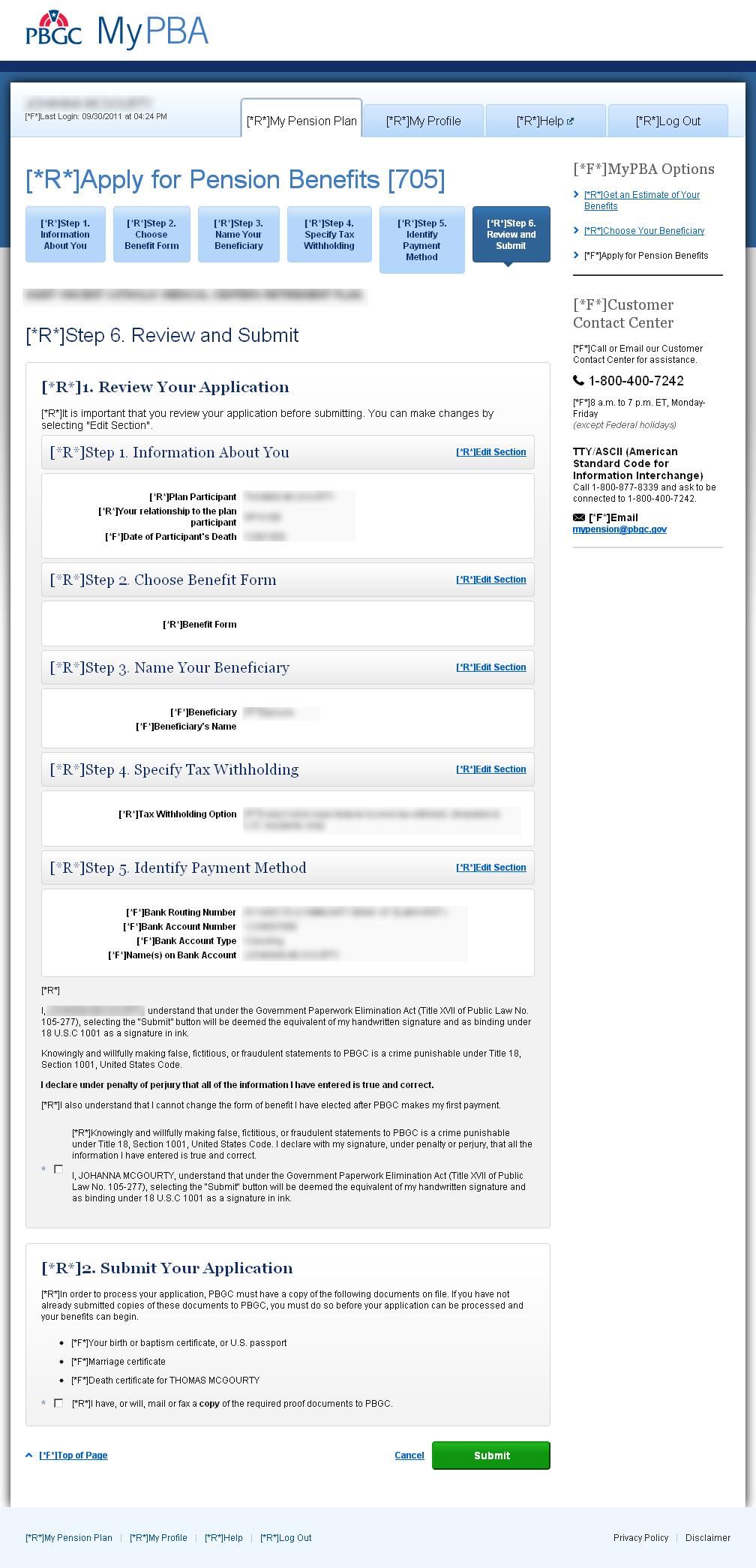

Form 705 Beneficiary Application for Pension Benefits

Step 4 Tax Withholding: if option B is selected, fields for that option are displayed.

Step 4 Tax Withholding: if option C is selected, fields for that option are displayed.

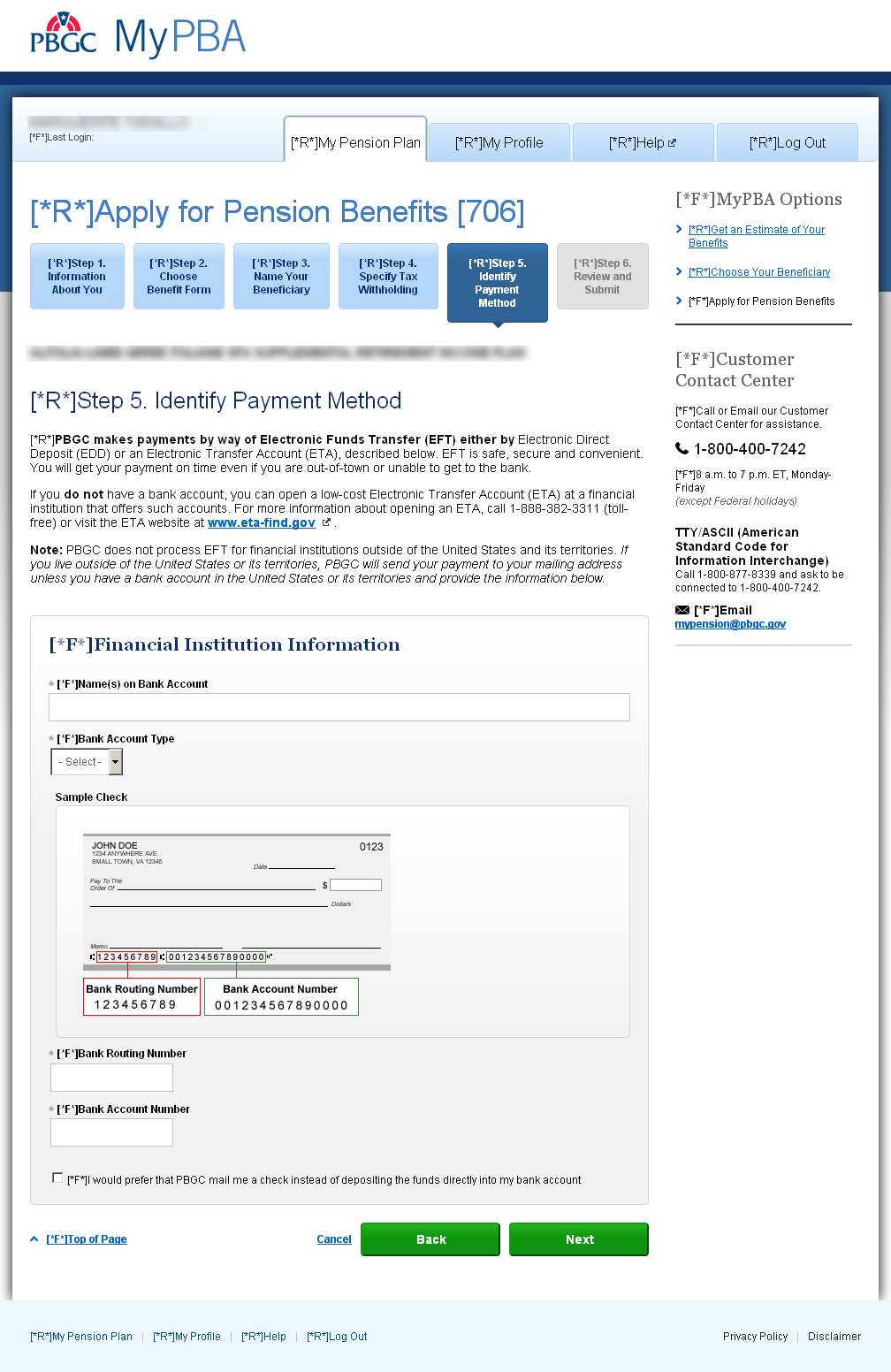

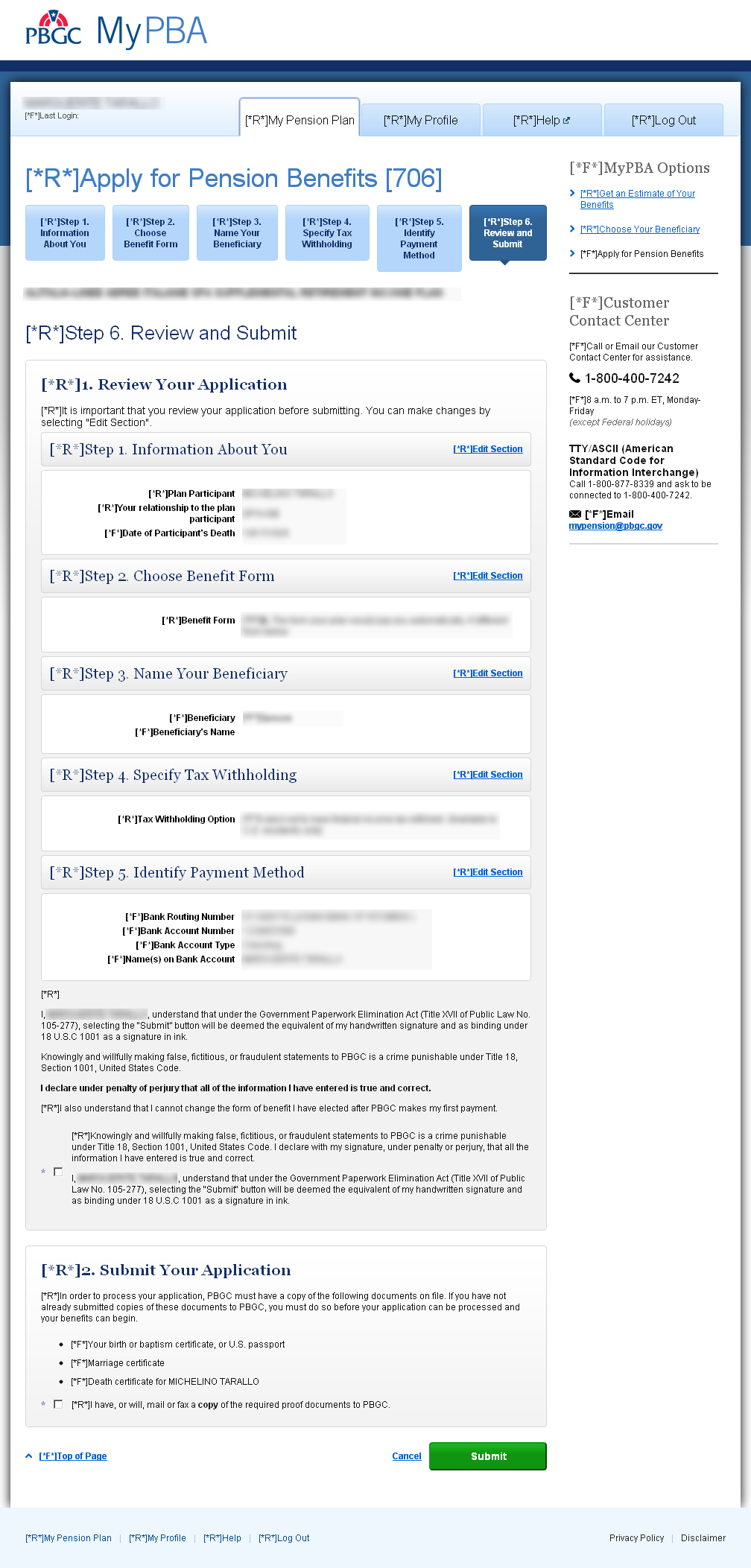

Form 706 Beneficiary Application For Pension Benefits – OF

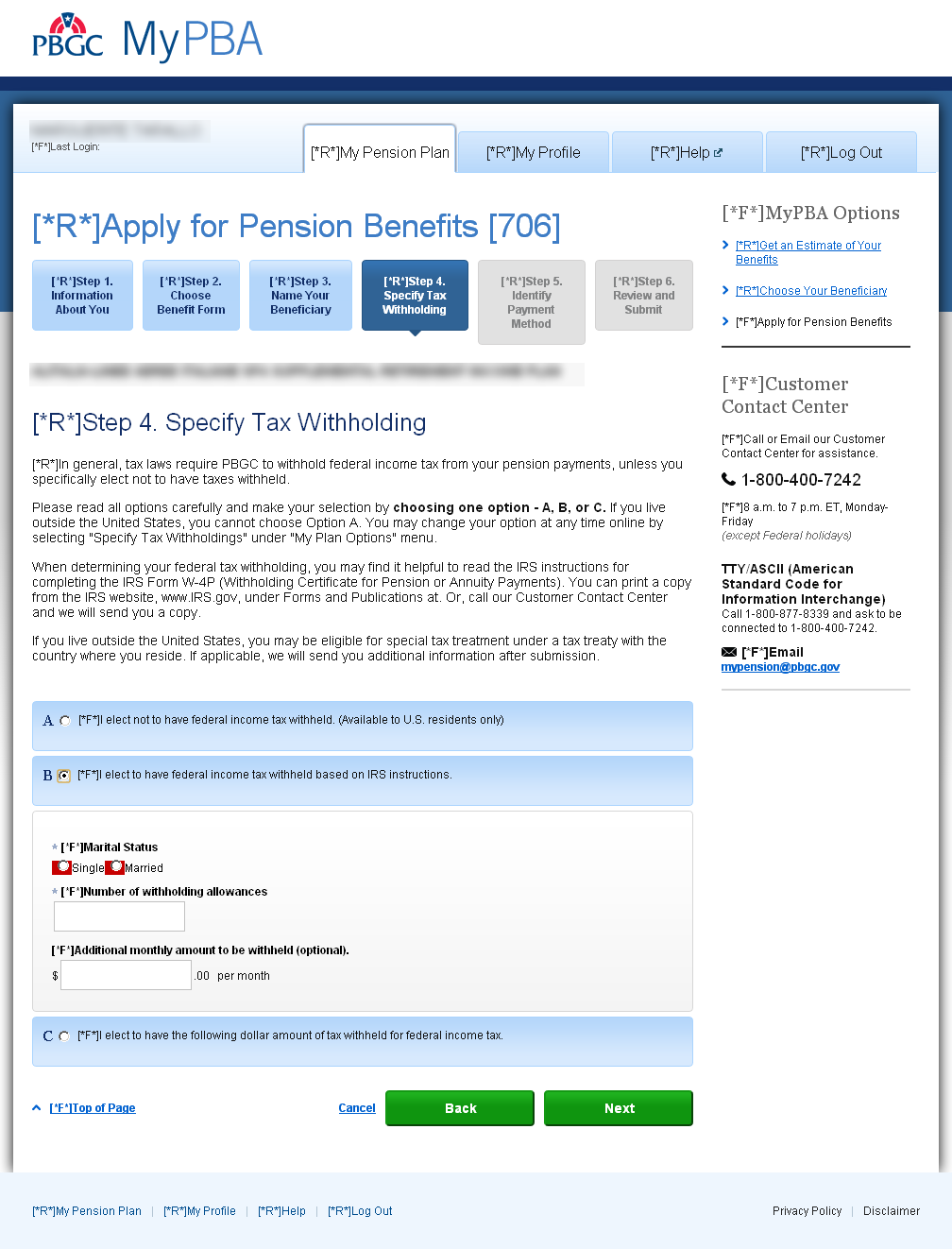

Step 4 Tax Withholding: if option B is selected, fields for that option are displayed.

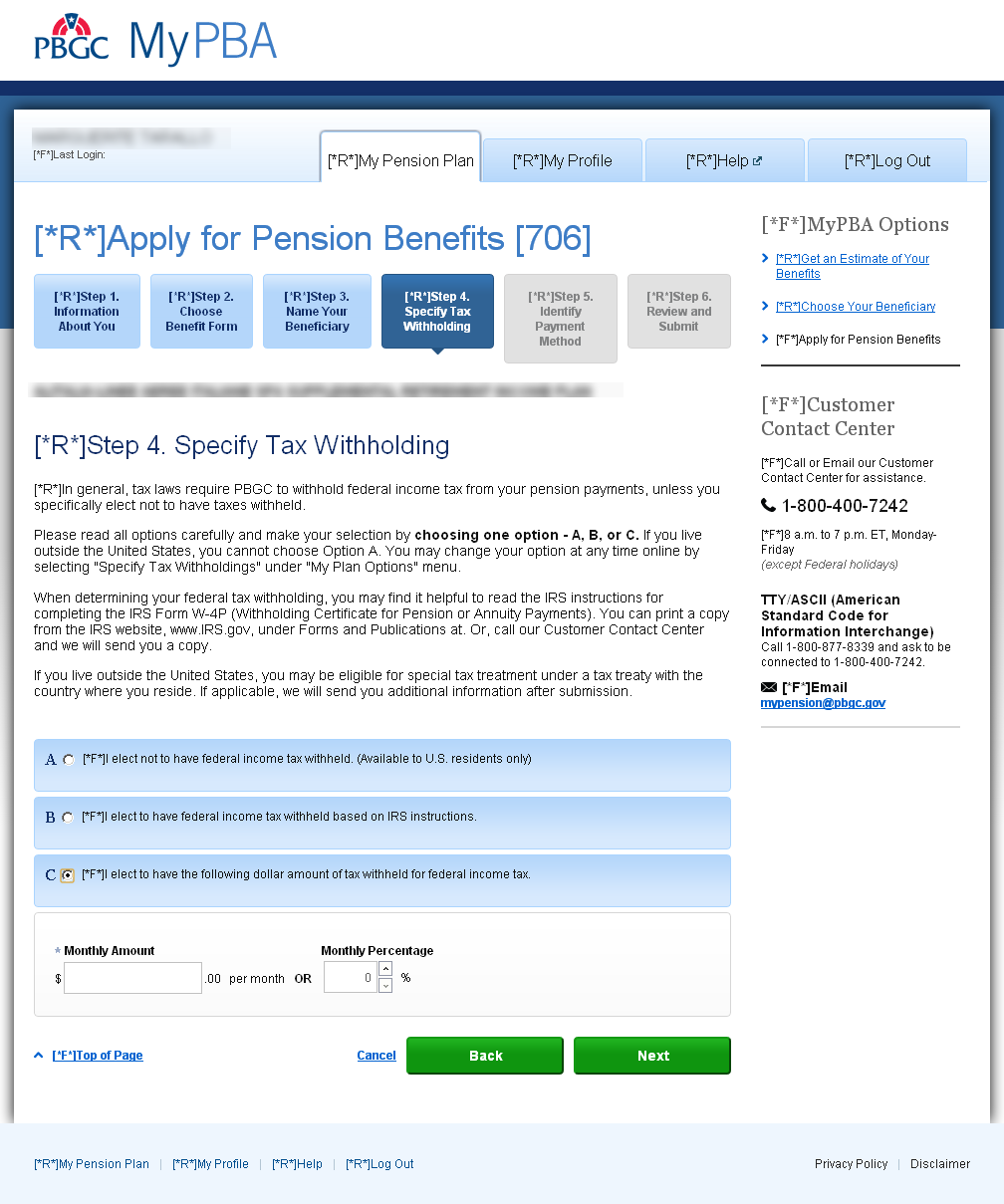

Step 4 Tax Withholding: if option C is selected, fields for that option are displayed.

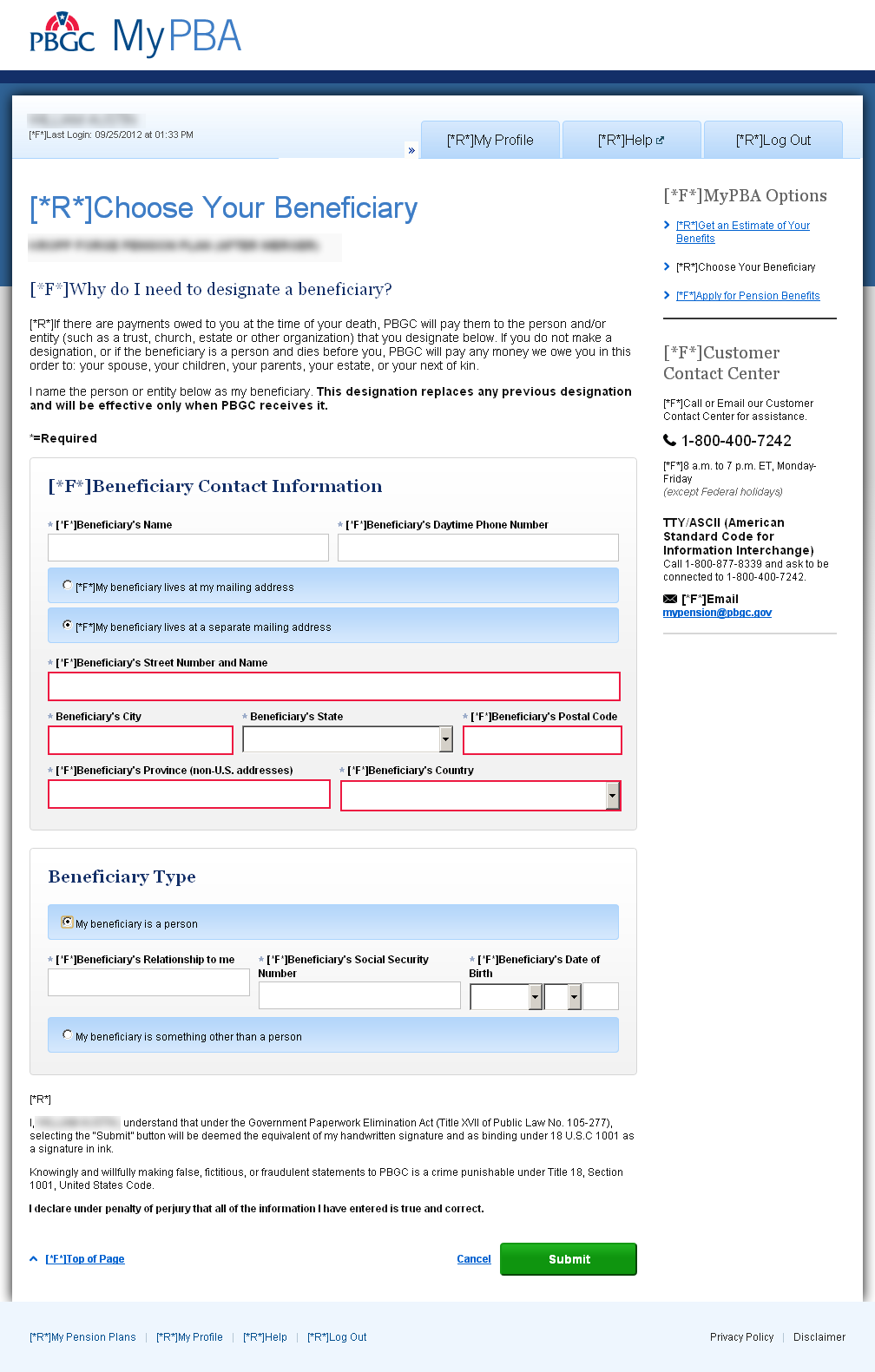

Form 707 Designation of Beneficiary for Benefits Owed at Death

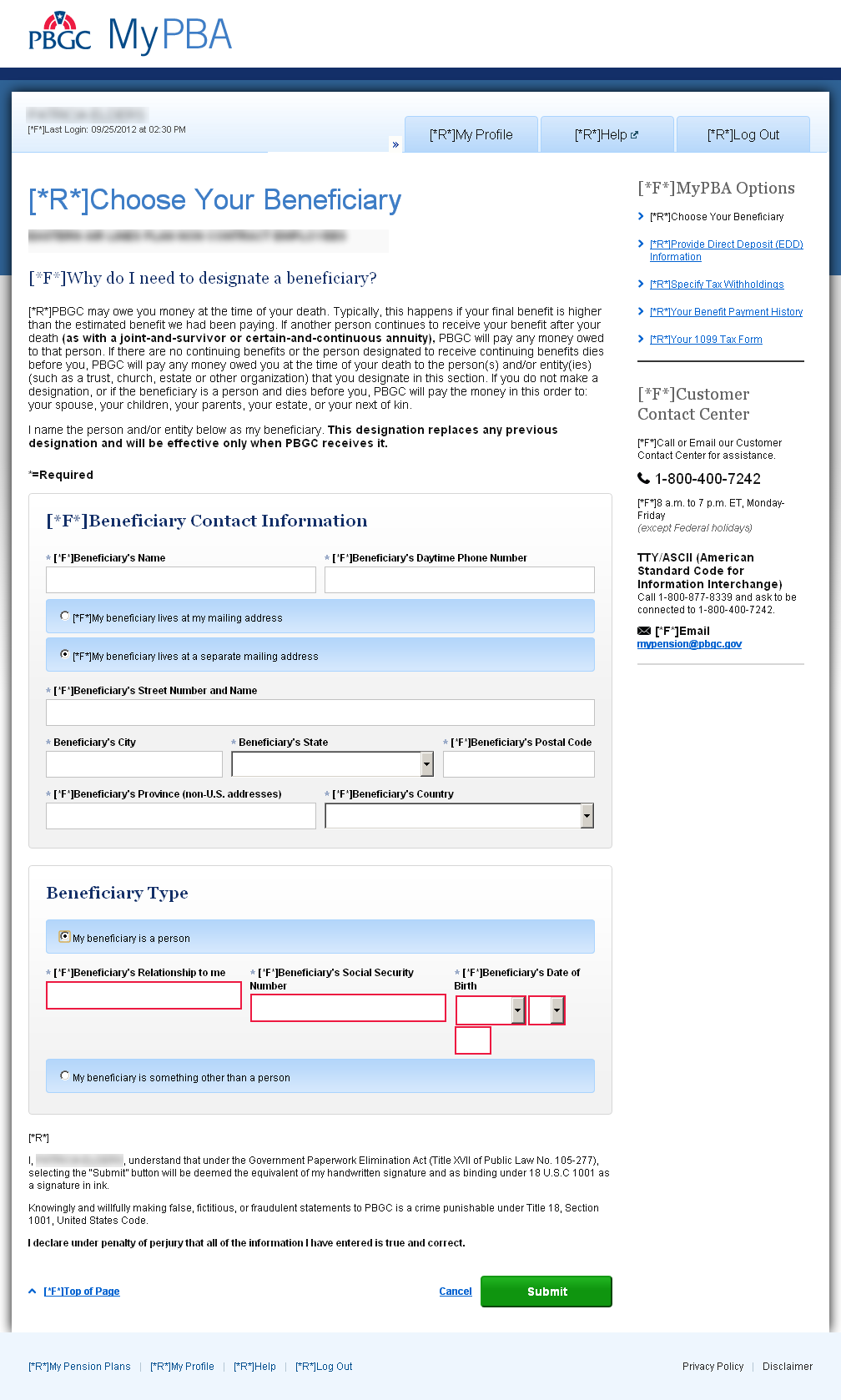

Form 708 Designation of Beneficiary

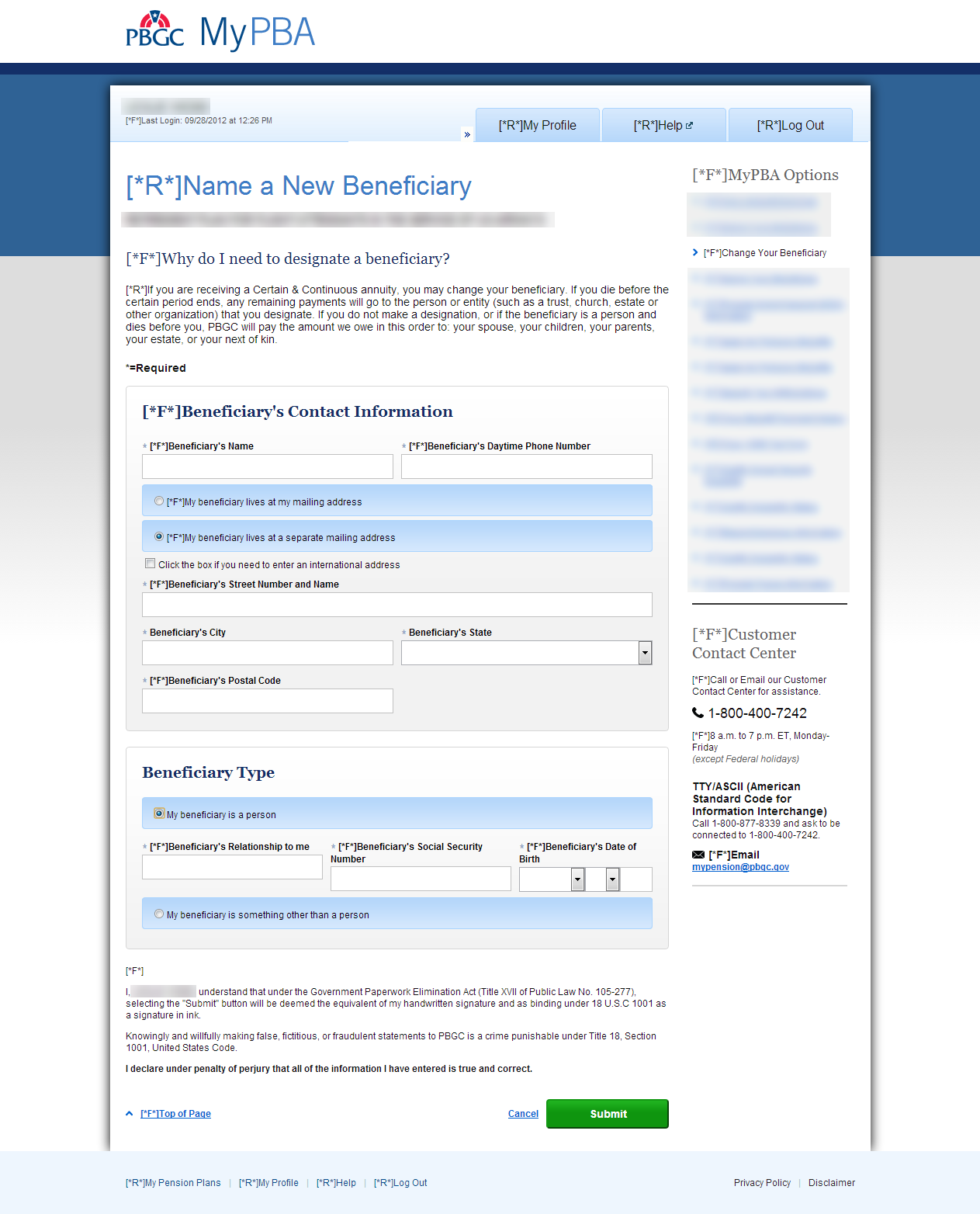

Form 711 Change of Beneficiary for Certain & Continuous (C&C) Benefits Only

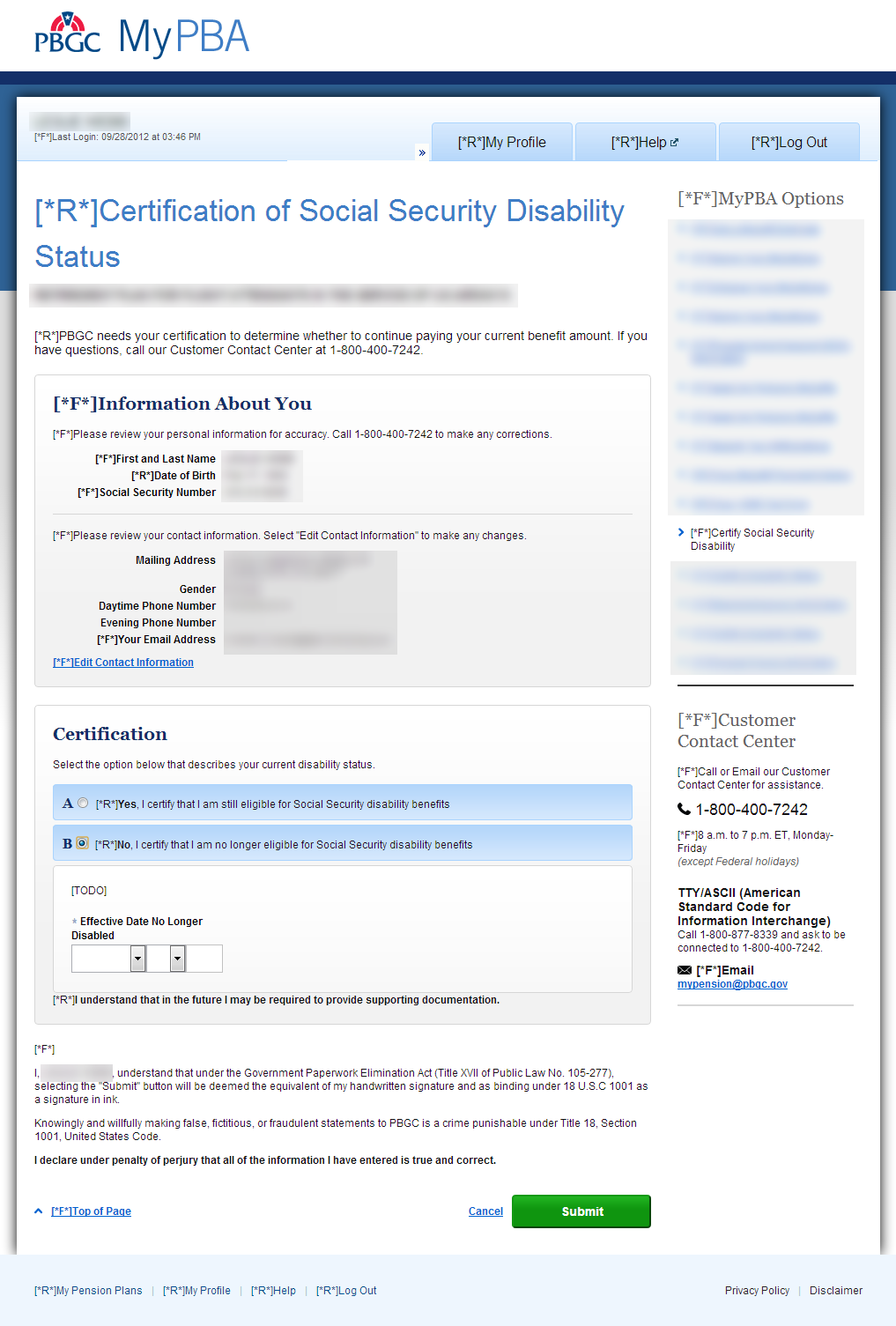

Form 716 Continuous Eligibility Certification

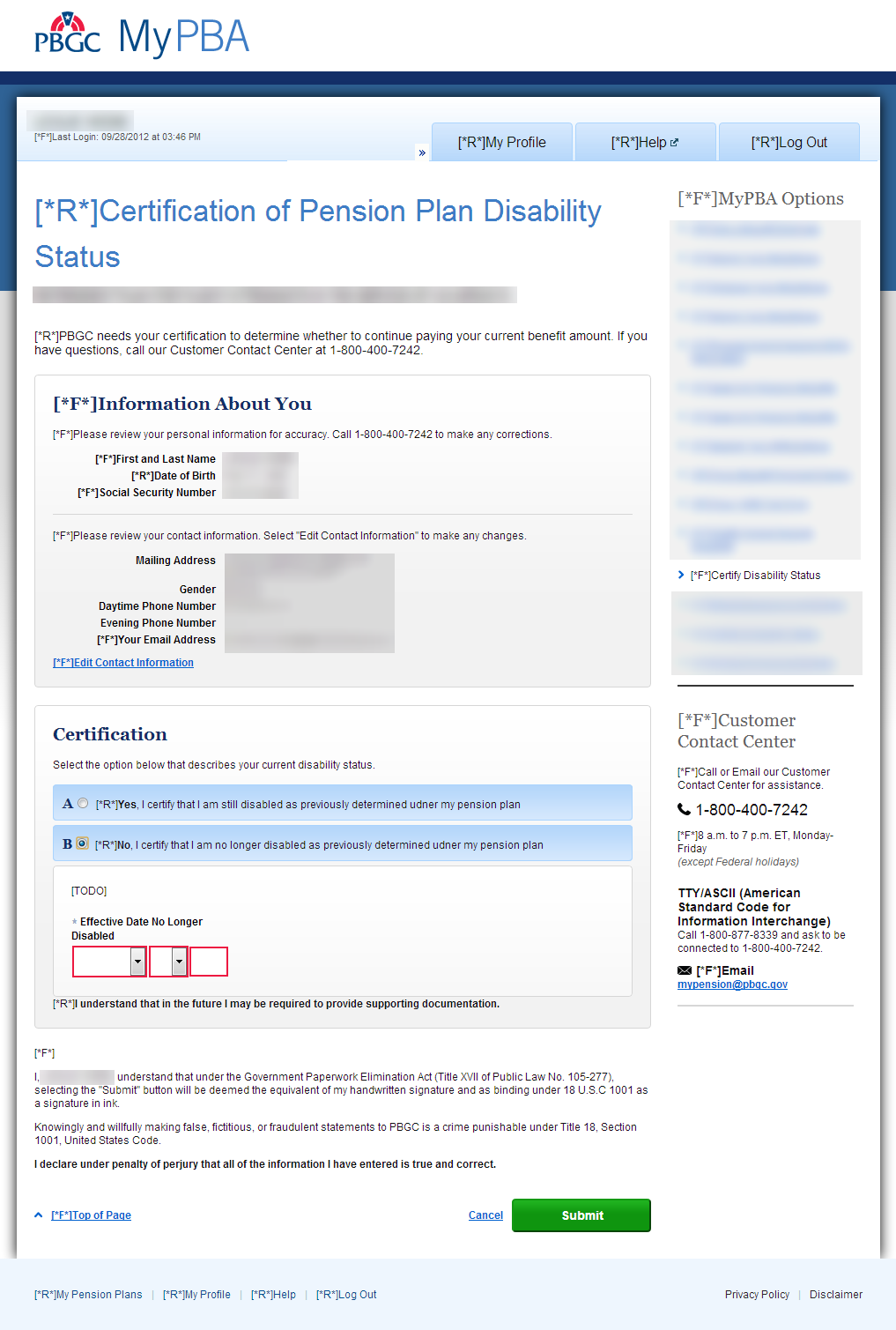

Form 716A Continuous Eligibility Certification

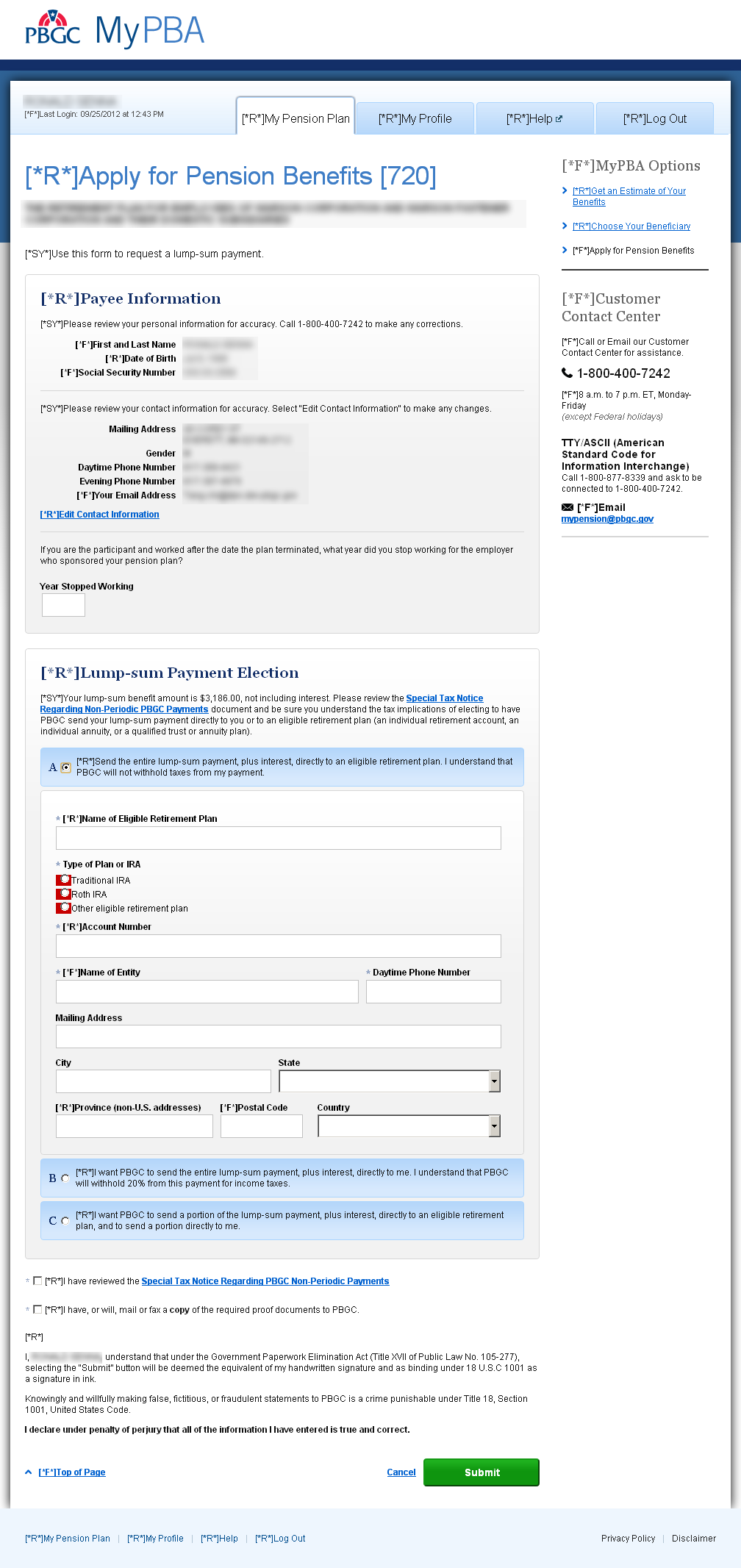

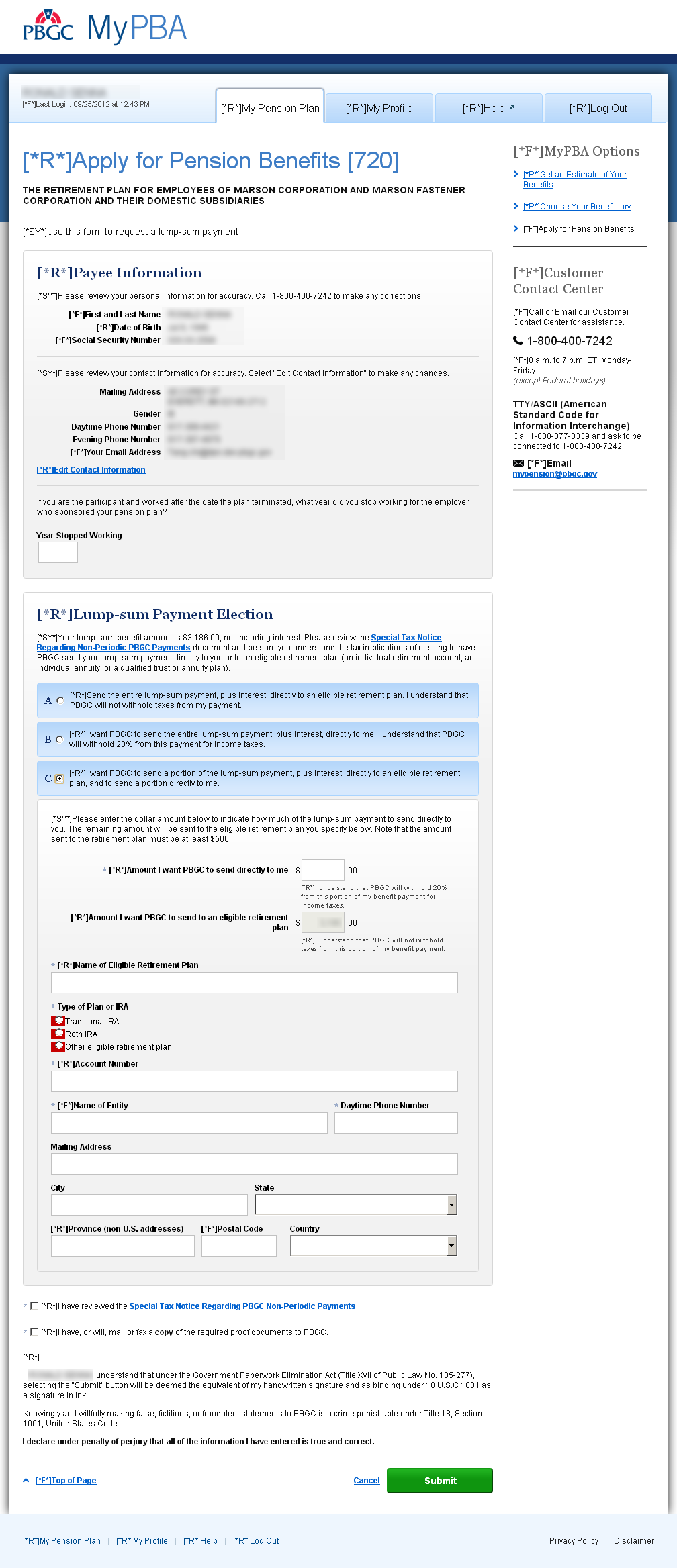

Form 720 Application for Lump-Sum Payment

Lump sum Payment Election: if option A is selected, fields for that option are displayed.

Lump sum Payment Election: if option C is selected, fields for that option are displayed.

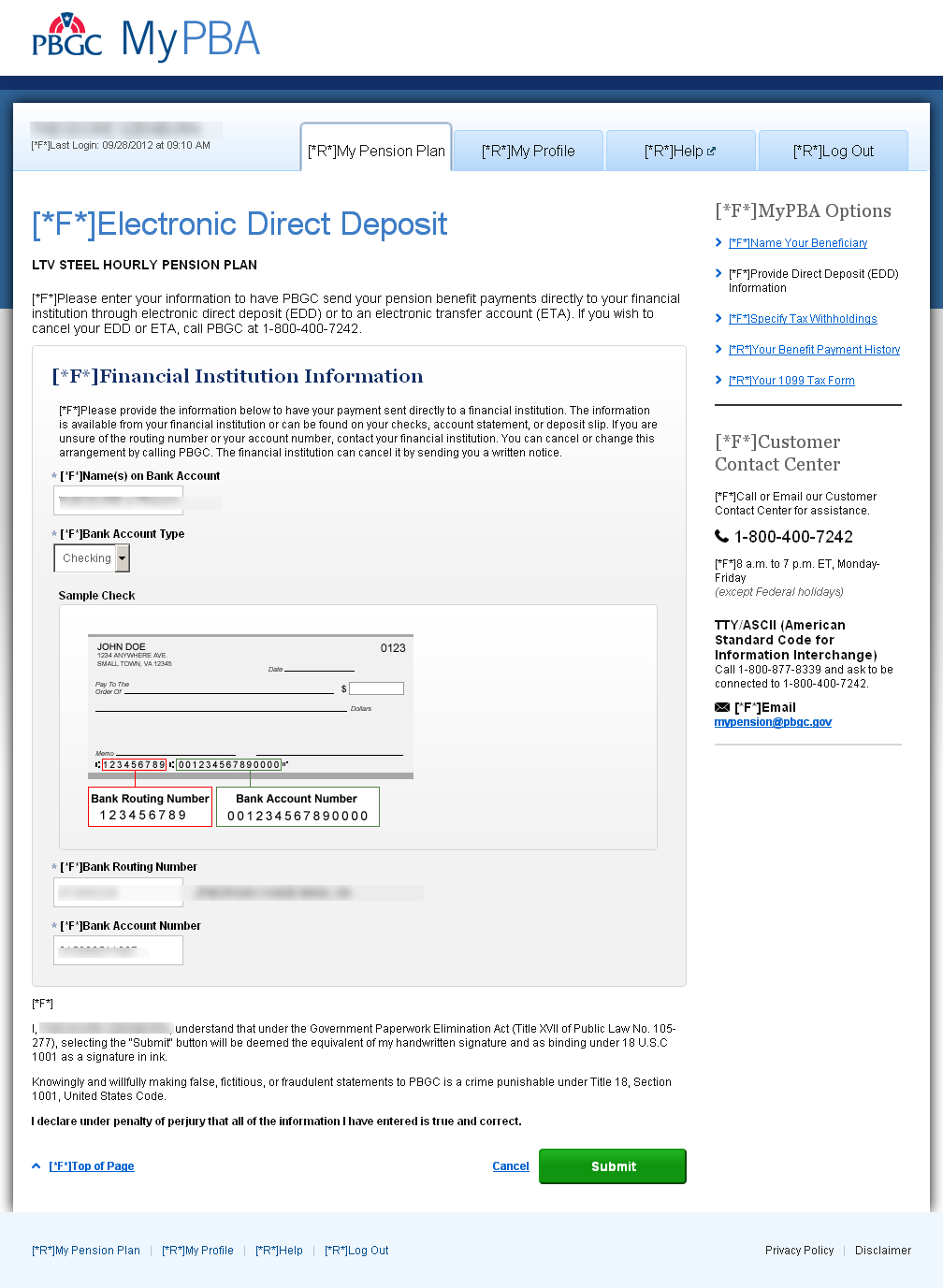

Update Electronic Direct Deposit Screen

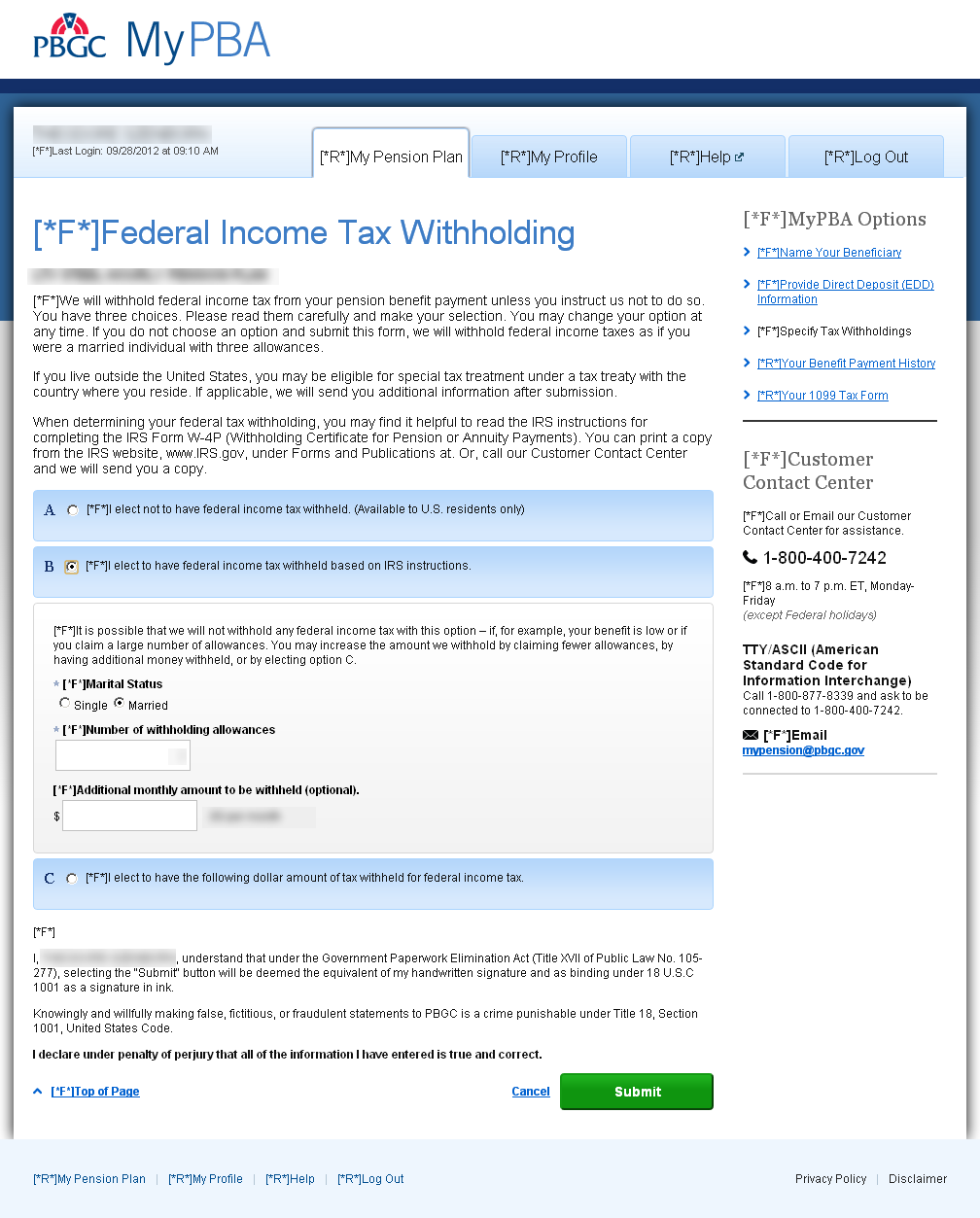

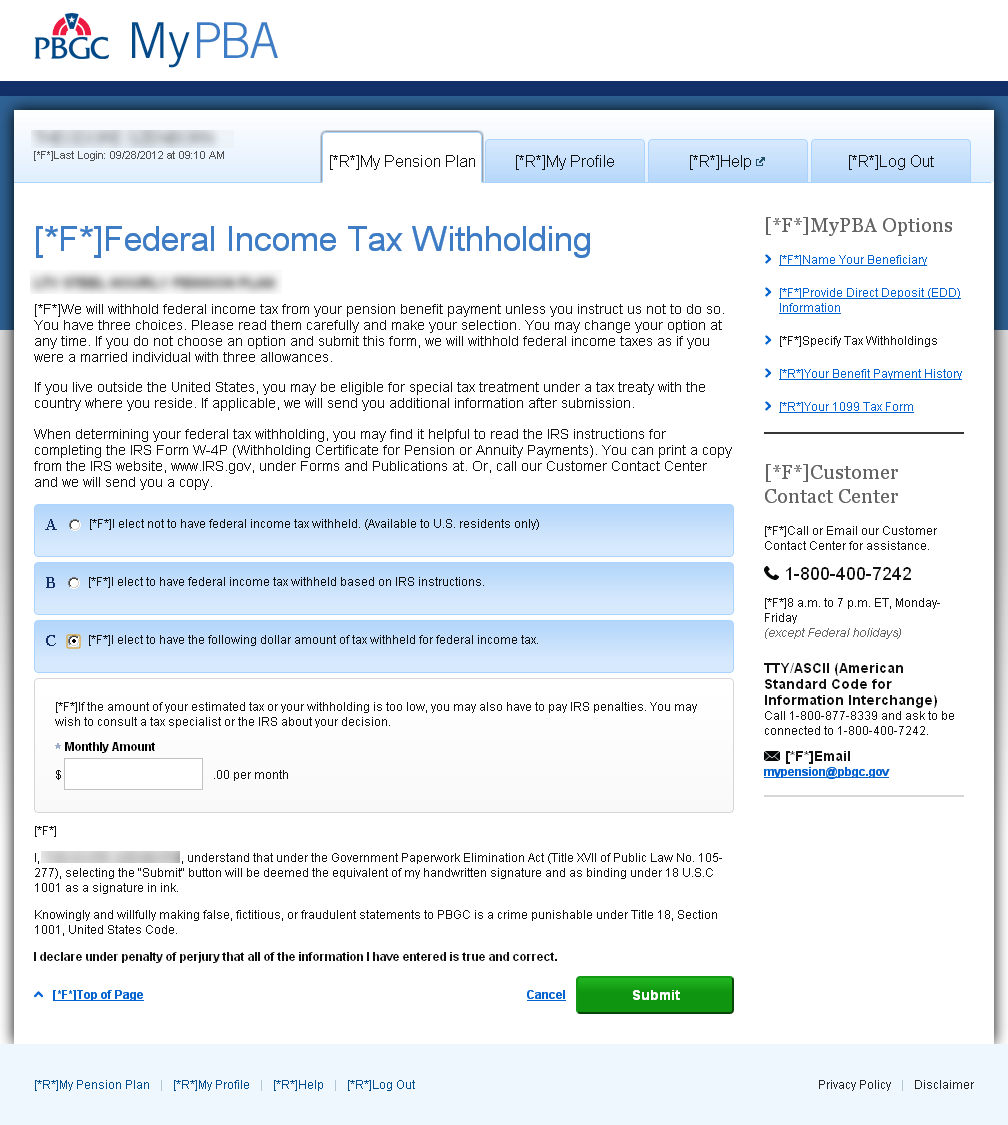

Election to Withhold Federal Income Tax from Periodic Payments Screen

Tax Withholding: if option B is selected, fields for that option are displayed.

Tax Withholding: if option C is selected, fields for that option are displayed.

Rev. 9/28/2012 - Page

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | dpcixa31 |

| File Modified | 0000-00-00 |

| File Created | 2021-01-30 |

© 2026 OMB.report | Privacy Policy