Top

of Form

Search:

|

|

|

About

OMB

President's

Budget

Management

Information

&

Regulatory Affairs

Legislative

Information

Agency

Information

Bottom

of Form

|

CIRCULAR NO.

A-129

REVISED

November

2000

POLICIES

FOR FEDERAL CREDIT PROGRAMS

AND NON-TAX RECEIVABLES

GENERAL

INFORMATION

Purpose

Authority

Coverage

Rescissions

Effective

Date

Inquiries

Definitions

APPENDIX

A

I.

RESPONSIBILITIES OF DEPARTMENTS AND AGENCIES

Office

of Management and Budget

Department of the Treasury

Federal

Credit Policy Working Group

Departments and Agencies

II.

BUDGET AND LEGISLATIVE POLICY FOR CREDIT PROGRAMS

Program

Review

Form of Assistance

Financial

Standards

Implementation

III.

CREDIT MANAGEMENT AND EXTENSION POLICY

A.

CREDIT EXTENSION POLICIES

Applicant

Screening

Loan Documentation

Collateral Requirements

B.

MANAGEMENT OF GUARANTEED LOAN LENDERS

AND

SERVICERS

Lender

Eligibility

Lender Agreements

Lender and Servicer

Reviews

Corrective Actions

IV.

MANAGING THE FEDERAL GOVERNMENTS RECEIVABLES

Accounting

and Financial Reporting

Loan Servicing Requirements

Asset

Resolution

V.

DELINQUENT DEBT COLLECTION

Standards

for Defining Delinquent and Defaulted Debt

Administrative

Collection of Debts

Referrals to the Department of

Justice

Interest, Penalties, and Administrative

Cost

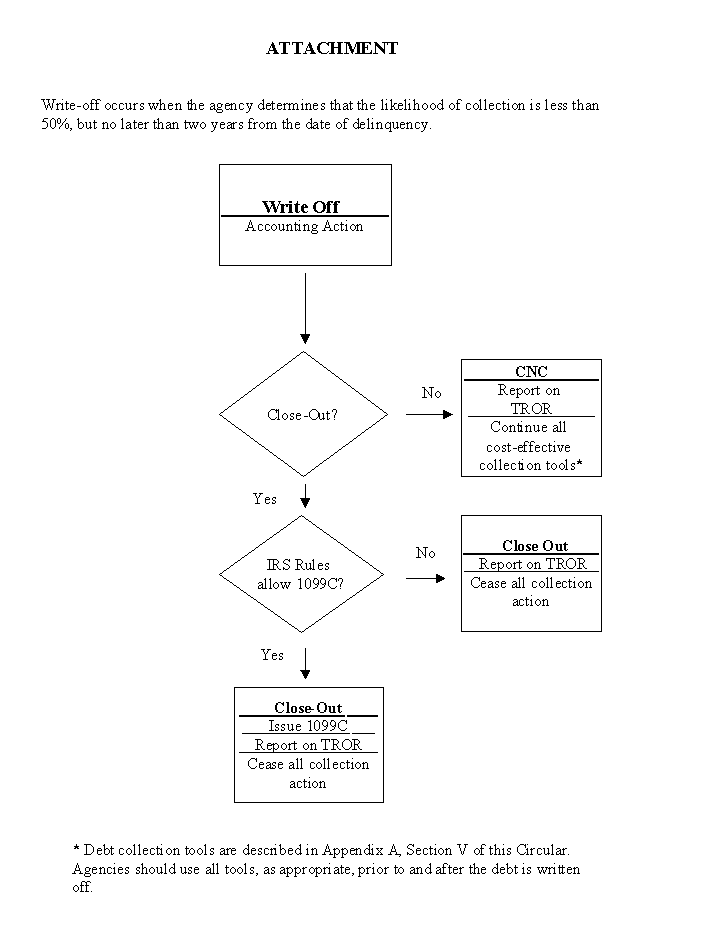

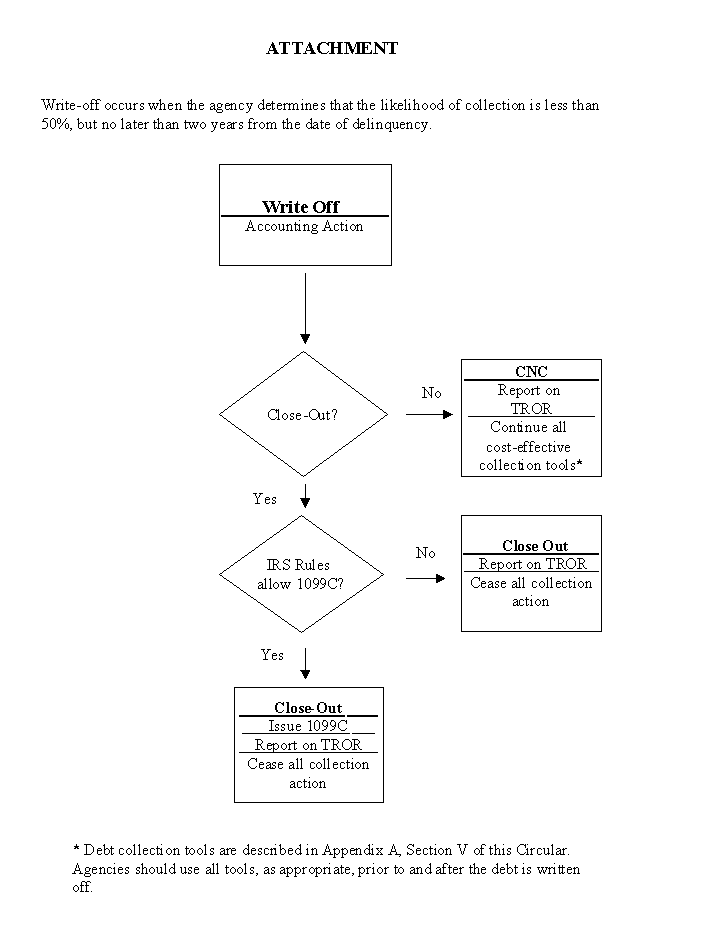

Termination of Collection, Write-Off, Use of Currently

Not Collectible

(CNC), and Close-Out

Attachment

A

- Write-Off Close-Out process flowchart

APPENDIX

B

Checklist

for Credit Program Legislation, Testimony, and

Budget

Submissions

APPENDIX

C

Model

Bill Language for Credit Programs

CIRCULAR

NO. A-129

Revised

TO

THE HEADS OF EXECUTIVE DEPARTMENTS AND ESTABLISHMENTS

SUBJECT:

Policies for Federal Credit Programs and Non-Tax Receivables

Federal

credit programs are created to accomplish a variety of social and

economic goals. Agencies must implement budget policies and

management practices that ensure the goals of credit programs are

met while properly identifying and controlling costs. In

addition, Federal receivables, whether from credit programs or

other non-tax sources, must be serviced and collected in an

efficient and effective manner to protect the value of the

Federal Government's assets.

GENERAL

INFORMATION

1.

Purpose.

This Circular prescribes policies and procedures for justifying,

designing, and managing Federal credit programs and for

collecting non-tax receivables. It sets principles for designing

credit programs, including: the preparation and review of

legislation and regulations; budgeting for the costs of credit

programs and minimizing unintended costs to the Government; and

improving the efficiency and effectiveness of Federal credit

programs. It also sets standards for extending credit, managing

lenders participating in Government guaranteed loan programs,

servicing credit and non-tax receivables, and collecting

delinquent debt.

2.

Authority.

This Circular is issued under the authority of the

Budget and Accounting Act of 1921, as amended;

the Budget

and Accounting Act of 1950, as amended;

the Debt

Collection Act of 1982; as amended by the Debt Collection

Improvement Act of 1996;

Section

2653 of Public Law 98-369

the

Federal Credit Reform Act of 1990, as amended;

the Federal

Debt Collection Procedures Act of 1990;

the Chief

Financial Officers Act of 1990, as amended;

Executive

Order 8248;

the

Cash Management Improvement Act Amendments of 1992;

and pre-existing common law authority to charge interest on debts

and to offset payments to collect debts administratively.

3.

Coverage.

a.

Applicability.

The provisions of this Circular apply to all credit programs of

the Federal Government, including:

(1)

Direct loan programs;

(2) Loan guarantee programs and

loan insurance programs in which the Federal Government bears a

legal liability to pay for all or part of the principal or

interest in the event of borrower default; and

(3)

Loans or other financial assets acquired by a Federal agency (or

a receiver or conservator acting for a Federal agency) as a

result of a claim payment on a defaulted guaranteed or insured

loan or in fulfillment of a Federal deposit insurance

commitment.

Sections IV and V of Appendix A ("Managing

the Federal Government's Receivables" and "Delinquent

Debt Collection") also apply to receivables due to the

Government from the sale of goods and services; fines, fees,

duties, leases, rents, royalties, and penalties; overpayments to

beneficiaries, grantees, contractors, and Federal employees; and

similar debts.

b.

Exclusions

Under the Debt Collection Acts.

Certain debt collection techniques authorized or mandated by the

provisions of the Debt Collection Act of 1982 (DCA), as amended

by the Debt Collection Improvement Act of 1996 (DCIA), do not

apply to debts arising under the Internal Revenue Code, certain

sections of the Social Security Act, or the tariff laws of the

United States. <31 U.S.C.§3701>

c.

Other

Statutory Exclusions.

The policies and standards of this Circular do not apply when

they are statutorily prohibited or are inconsistent with

statutory requirements. However, agencies are required to

periodically review legislation affecting the form of assistance

and/or financial standards for credit programs to justify

continuance of any non-conformance.

4.

Rescission.

This Circular rescinds and replaces OMB Circular No. A-129

(revised), dated January 1993, and OMB Bulletin No. 91-05, dated

November 26, 1990.

This

Circular supplements, and does not supersede, the requirements

applicable to budget submissions under OMB Circular No. A-11 and

to proposed legislation and testimony under OMB Circular No.

A-19.

5.

Effective Date. This

Circular is effective immediately.

6.

Inquiries.

Further information on the implementation of credit management

and debt collection policies may be found in the Department of

the Treasury's Financial Management Service <Managing Federal

Receivables> and in <OMB's Governmentwide 5-Year Plan>

for financial management submitted annually to Congress.

For

inquiries concerning budget and legislative policy for credit

programs contact the Office of Management and Budget, Budget

Review Division, Budget Analysis Branch, Room 6025, New Executive

Office Building, 725 17th Street, NW, Washington, DC 20503; (202)

395-3945. Questions on all other sections of the Circular should

be directed to the Office of Federal Financial Management (202)

395-4534.

7.

Definitions.

Unless otherwise defined in this circular, key

terms used in this circular are defined in OMB Circular Nos. A-11

and A-34.

Jacob

J. Lew

Director

Appendices

(3)

APPENDIX

A

I.

RESPONSIBILITIES OF DEPARTMENTS AND AGENCIES

Statutory

|

Federal Credit Reform Act of 1990, 2 U.S.C. § 661

Debt

Collection Act of 1982/Debt Collection Improvement Act of

1996,

31 U.S.C. §§ 3701, 3711-3720E

Federal

Debt Collection Procedures Act of 1990

Budget

and Accounting Act of 1921

Budget

and Accounting Act of 1950

Chief

Financial Officers Act of 1990

Cash Management

Improvement Act Amendments of 1992

|

1.

Office of Management and Budget.

The Office of Management and Budget (OMB) is responsible for

reviewing legislation to establish new credit programs or to

expand or modify existing credit programs; monitoring agency

conformance with the Federal Credit Reform Act; formulating and

reviewing agency credit reporting standards and requirements;

reviewing and clearing testimony pertaining to credit programs

and debt collection; reviewing agency budget submissions for

credit programs and debt collection activities; developing and

maintaining the Federal credit subsidy calculator used to

calculate the cost of credit programs; formulating and reviewing

credit management and debt collection policy; approving agency

credit management and debt collection plans; and providing

training to credit agencies.

2.

Department of the Treasury.

The Department of the Treasury (Treasury), acting through the

Office of Domestic Finance, works with OMB to develop Federal

credit policies and/or reviewing legislation to create new credit

programs or to expand or modify existing credit programs. The

Department of the Treasury, through its Financial Management

Service (FMS), promulgates government-wide debt collection

regulations implementing the debt collection provisions of the

Debt

Collection Improvement Act of 1996 (DCIA).

FMS works with the Federal program agencies to identify debt that

is eligible for referral to Treasury for cross-servicing and

offset, and to establish target dates for referral. Performance

measures are established which set annual referral and collection

goals. In accordance with the DCIA and other Federal laws, FMS

conducts offset of Federal payments, including tax refunds, under

the Treasury Offset Program. FMS also provides collection

services for delinquent non-tax Federal debts (referred to as

cross-servicing), and maintains a private collection agency

contract for referral and collection of delinquent debts.

Additionally, FMS issues operational and procedural guidelines

regarding government-wide credit management and debt collection

such as "Managing

Federal Receivables"

and the "Guide

to the Federal Credit Bureau Program."

FMS, under its program responsibility for credit and debt

management and as an active member of the Federal Credit Policy

Working Group, assists in improving credit and debt management

activities government-wide.

3.

Federal Credit Policy Working Group. The

Federal Credit Policy Working Group (FCPWG) is an interagency

forum that provides advice and assistance to the Office of

Management and Budget (OMB) and Treasury in the formulation and

implementation of credit policy. Membership consists of

representatives from the Executive Office of the President, the

Council of Economic Advisers, the OMB, and the Department of the

Treasury. The major credit and debt collection agencies

represented include the Departments of Agriculture, Commerce,

Education, Health and Human Services, Housing and Urban

Development, Interior, Justice, Labor, State, Transportation,

Veterans Affairs and the Agency for International Development,

the Export-Import Bank, the Federal Deposit Insurance Corporation

and the Small Business Administration. Other departments and

agencies may be invited to participate in the FCPWG at the

request of the Chairperson. The Director of OMB designates the

Chairperson of the FCPWG.

4.

Department and Agencies. Departments

and agencies shall manage credit programs and all non-tax

receivables in accordance with their statutory authorities and

the provisions of this Circular to protect the Government's

assets and to minimize losses in relation to social benefits

provided.

Agencies

shall ensure that:

(1)

Federal credit program legislation, regulations, and policies are

designed and administered in compliance with the principles of

this Circular;

(2) The costs of credit programs

covered by the <Federal Credit Reform Act of 1990> are

budgeted for and controlled in accordance with the principles of

that Act. (Some agencies and programs are expressly exempted from

the statute.);

(3) Every effort is made to prevent

future delinquencies by following appropriate screening standards

and procedures for determination of creditworthiness;

(4)

Lenders participating in guaranteed loan programs meet all

applicable financial and programmatic requirements;

(5)

Informed and cost effective decisions are made concerning

portfolio management, including full consideration of contracting

out for servicing or selling the portfolio;

(6) The

full range of available techniques are used, such as those found

in the <Federal Claims Collection Standards> and <Treasury

regulations>, as appropriate, to collect delinquent debts,

including demand letters, administrative offset, salary offset,

tax refund offset, private collection agencies, cross-servicing

by Treasury, administrative wage garnishment, and

litigation;

(7) Delinquent debts are written-off as

soon as they are determined to be uncollectible; and

(8)

Timely and accurate financial management and performance data are

submitted to OMB and the Department of the Treasury so that the

Government's credit management and debt collection programs and

policies can be evaluated.

In

order to achieve these objectives, agencies shall:

(1)

Establish, as appropriate, boards to coordinate credit management

and debt collection activities and to ensure full consideration

of credit management and debt collection issues by all interested

and affected organizations. Representation should include, but

not be limited to, the agency Chief Financial Officer (CFO) and

the senior official(s) for program offices with credit activities

or non-tax receivables. The Board may seek from the agency's

Inspector General, input based on findings and conclusions from

past audits and investigations.

(2) Ensure that the

statutory and regulatory requirements and standards set forth in

this Circular, <Treasury regulations>, and supplementary

guidance set forth in the Treasury/FMS <Managing Federal

Receivables> are incorporated into agency regulations and

procedures for credit programs and debt collection

activities;

(3)Propose new or revised legislation,

regulations, and forms as necessary to ensure consistency with

the provisions of this Circular;

(4) Submit

legislation and testimony affecting credit programs for review

under the OMB Circular No. A-19 legislative clearance process,

and budget proposals for review under the Circular No. A-11

budget justification process;

(5) Periodically

evaluate Federal credit programs to assure their effectiveness in

achieving program goals;

(6) Assign to the agency CFO,

in accordance with the <Chief Financial Officers Act of 1990>,

responsibility for directing, managing, and providing policy

guidance and oversight of agency financial management personnel,

activities, and operations, including the implementation of asset

management systems for credit management and debt

collection;

(7) Prepare, as part of the agency CFO

Financial Management 5-Year Plan, a Credit Management and Debt

Collection Plan for effectively managing credit extension,

account servicing, portfolio management and delinquent debt

collection. The plan must ensure agency compliance with the

standards in this Circular; and

(8) Ensure that data

in loan applications and documents for individuals are managed in

accordance with the <Privacy Act of 1974>, as amended by

the <Computer Matching and Privacy Protection Act of 1988>,

and the <Right to Financial Privacy Act of 1978, as amended>.

The Privacy Act of 1974 does not apply to loans and debts of

commercial organizations.

II.

BUDGET AND LEGISLATIVE POLICY FOR CREDIT PROGRAMS

Federal

credit assistance should be provided only when it is necessary

and the best method to achieve clearly specified Federal

objectives. Use of private credit markets should be encouraged,

and any impairment of such markets or misallocation of the

nation's resources through the operation of Federal credit

programs should be minimized.

1.

Program Review.

REFERENCES:

Statutory

|

Federal Credit Reform Act of 1990, 2 U.S.C. § 661

|

Guidance

|

OMB Circular No. A-11

|

Proposals

submitted to OMB for new programs and for reauthorizing,

expanding, or significantly increasing funding for existing

credit programs should be accompanied by a written review which

examines, at a minimum, the following factors:

The

Federal objectives to be achieved, including:

(1)

Whether the credit program is intended to:

(a)

Correct a capital market imperfection, which should be defined;

and/or (b) Subsidize borrowers or other beneficiaries, who should

be identified, or encourage certain activities, which should be

specified.

(2)

Why they cannot be achieved without Federal credit assistance,

including:

(a)

A description of existing and potential private sources of credit

by type of institution and the availability and cost of credit to

borrowers; and

(b) An explanation as to whether and

why these private sources of financing and their terms and

conditions must be supplemented and subsidized.

The

justification for use of a credit subsidy. The review should

provide an explanation of why a credit subsidy is the most

efficient way of providing assistance, including how it provides

assistance in overcoming capital market imperfections, how it

would assist the identified borrowers or beneficiaries or would

encourage the identified activities, and why it would be

preferable to other forms of assistance such as grants or

technical assistance.

The

estimated benefits of the program or program change. The review

should estimate or, when the program exists, measure the

benefits expected from the program or program change, including

the amount by which the distribution of credit is expected to be

altered and the favored activity is expected to increase.

Information on conducting a cost-benefit analysis can be found

in <OMB Circular No. A-94>.

The

effects on private capital markets. The review should estimate

the extent to which the program substitutes directly or

indirectly for private lending, and analyze any elements of

program design that encourage and supplement private lending

activity, with the objective that private lending is displaced

to the smallest degree possible by agency programs.

The

estimated subsidy level. The review should provide an explicit

estimate of the subsidy, as required by the <Federal Credit

Reform Act of 1990>, and an estimate of the expected annual

administrative costs (including extension, servicing, and

collection) of the credit program. If loan assets are to be sold

or are to be included in a prepayment program for programmatic

or other reasons, then the subsidy estimate should include the

effects of the loan asset sales. For guidance on loan asset

sales, see the <Debt Collection Improvement Act of 1996>,

<OMB Circular No. A-11>, and the Treasury/FMS' <Managing

Federal Receivables>. Loan asset sales/prepayment programs

must be conducted in accordance with policies in this Circular

and procedures in "Managing Federal Receivables,"

including the prohibitions against the financing of prepayments

by tax-exempt borrowing and sales with recourse except where

specifically authorized by statute. The cost of any guarantee

placed on the asset sold requires budget authority.

The

administrative resource requirements. The review should include

an examination of the agency's current capacity to administer

the new or expanded program and an estimation of any additional

resources that would be needed.

2.

Form of Assistance.

REFERENCES:

Statutory

|

Federal Credit Reform Act of 1990, 2 U.S.C. § 661

Internal Revenue Code (Section 149(b)

|

When

Federal credit assistance is necessary to meet a Federal

objective, loan guarantees should be favored over direct loans,

unless attaining the Federal objective requires a subsidy, as

defined by the <Federal Credit Reform Act of 1990>, deeper

than can be provided by a loan guarantee.

Loan

guarantees may provide several advantages over direct loans.

These advantages include: private sector credit servicing (which

tends to be more efficient), private sector analysis of the

borrowers creditworthiness, (which tends to allocate resources

more efficiently), involvement of borrowers with private sector

lenders (which promotes their movement to private credit), and

lower portfolio management costs for agencies.

Loan

guarantees, by removing part or all of the credit risk of a

transaction, change the allocation of economic resources. Loan

guarantees may make credit available when private financial

sources would not otherwise do so, or they may allocate credit

to borrowers under more favorable terms than would otherwise be

granted. This reallocation of credit may impose a cost on the

Government and/or the economy.

Direct

loans usually offer borrowers lower interest rates and longer

maturities than loans available from private financial sources,

even those with a Federal guarantee. The use of direct loans,

however, may displace private financial sources and increase the

possibility that the terms and conditions on which Federal

credit assistance is offered will not reflect changes in

financial market conditions. The costs to the Government and the

economy are therefore likely to be greater.

Direct

or indirect guarantees of tax-exempt obligations are prohibited

under <Section 149(b) of the Internal Revenue Code>.

Guarantees of tax-exempt obligations are an inefficient way of

allocating Federal credit. Assistance to the borrower, through

the tax exemption and the guarantee, provides interest savings

to the borrower that are smaller than the tax revenue loss to

the Government. It is generally thought that the cost to the

taxpayer is greater than the benefit to the borrower. The

Internal Revenue Code provides some exceptions to this

requirement; see Section 149(b) of the Internal Revenue Code for

further details.

To

preclude the possibility that Federal agencies will guarantee

tax-exempt obligations, either directly or indirectly, agencies

will:

(1)

not guarantee federally tax-exempt obligations;

(2)

provide that effective subordination of a direct or guaranteed

loan to tax-exempt obligations will render the guarantee void. To

avoid effective subordination, the direct or guaranteed loan and

the tax-exempt obligation should be repaid using separate

dedicated revenue streams or otherwise separate sources of

funding, and should be separately collateralized. In addition,

the direct or guaranteed loan terms, such as grace periods,

repayment schedules, and availability of deferrals, should be

consistent with private sector standards to ensure that they do

not create effective subordination;

(3) prohibit use

of a Federal guarantee as collateral to secure a tax-exempt

obligation;

(4) prohibit Federal guarantees of loans

funded by tax-exempt obligations; and

(5) prohibit

the linkage of Federal guarantees with tax-exempt obligations.

For example, such prohibited linkage occurs if the project is

unlikely to be financed without the Federal guarantee covering a

portion of the cost. In such cases, the Federal guarantee is, in

effect, enabling the tax-exempt obligation to be issued, since

without the guarantee the project would not be viable to receive

any financing. Therefore, the tax-exempt obligation is dependent

on and linked to the Federal guarantee.

Where

a large degree of subsidy is justified, comparable to that which

would be provided by guaranteed tax-exempt obligations, agencies

should consider the use of direct loans.Financial

Standards.

REFERENCES:

Statutory

|

Federal Credit Reform Act of 1990, 2 U.S.C. § 661

Chief Financial Officers Act of

1990

|

Guidance

|

OMB Circular No. A-11; SFFAS 2, OMB Circular

No.

A-34

|

In

accordance with the <Federal Credit Reform Act of 1990>,

agencies must analyze and control the risk and cost of their

programs. Agencies must develop statistical models predictive of

defaults and other deviations from loan contracts. Agencies are

required to estimate subsidy costs and to obtain budget authority

to cover such costs before obligating direct loans and committing

loan guarantees. Specific instructions for budget justification

and subsidy cost estimation under the Federal Credit Reform Act

of 1990 are provided in <OMB Circular No. A-11>, and

instructions for budget execution are provided in <OMB

Circular No. A-34>.

Agencies

shall follow sound financial practices in the design and

administration of their credit programs. Where program objectives

cannot be achieved while following sound financial practices, the

cost of these deviations shall be justified in agency budget

submissions in comparison with expected benefits. Unless a waiver

is approved, agencies should follow the financial practices

discussed below.

Lenders

and borrowers who participate in Federal credit programs should

have a substantial stake in full repayment in accordance with

the loan contract.

(1)

Private lenders who extend credit that is guaranteed by the

Government should bear at least 20 percent of the loss from a

default. Loan guarantees that cover 100 percent of any losses on

a loan encourage private lenders to exercise less caution than

they otherwise would in evaluating loan requests. The level of

guarantee should be no more than necessary to achieve program

purposes. Loans for borrowers who are deemed to pose less of a

risk should receive a lower guarantee.

(2) Borrowers

should have an equity interest in any asset being financed with

the credit assistance, and business borrowers should have

substantial capital or equity at risk in their business (see

Section III.A.3.b for additional discussion).

(3)

Programs in which the Government bears more than 80 percent of

any loss should be periodically reviewed to determine whether the

private sector has become able to bear a greater share of the

risk.

Agencies

should establish interest and fee structures for direct loans

and loan guarantees and should review these structures at least

annually. Documentation of the performance of these annual

reviews for credit programs is considered sufficient to meet the

review requirement described in <Section 902 (a) 8 of the

Chief Financial Officers Act of 1990>.

(1)Interest

and fees should be set at levels that minimize default and other

subsidy costs, of the direct loan or loan guarantee, while

supporting achievement of the program's policy objectives.

(2)

Agencies must request an appropriation in accordance with the

Federal Credit Reform Act of 1990 for default and other subsidy

costs not covered by interest and fees.

(3) Unless

inconsistent with program purposes, and where authorized by law,

riskier borrowers should be charged more than those who pose less

risk. In order to avoid an unintended additional subsidy to

riskier borrowers within the eligible class and to support the

extension of credit to those riskier borrowers, programs that,

for public policy purposes, do not adhere to this guideline,

should justify the extra subsidy conveyed to the higher-risk

borrowers in their annual budget submissions to OMB.

Contractual

agreements should include all covenants and restrictions (e.g.,

liability insurance) necessary to protect the Federal

Government's interest.

(1)

Maturities on loans should be shorter than the estimated useful

economic life of any assets financed.

(2) The

Government's claims should not be subordinated to the claims of

other creditors, as in the case of a borrower's default on either

a direct loan or a guaranteed loan. Subordination increases the

risk of loss to the Government, since other creditors would have

first claim on the borrower's assets.

In

order to minimize inadvertent changes in the amount of subsidy,

interest rates to be charged on direct loans and any interest

supplements for guaranteed loans should be specified by

reference to the market rate on a benchmark Treasury security

rather than as an absolute level. A specific fixed interest rate

should not be cited in legislation or in regulation, because

such a rate could soon become outdated, unintentionally changing

the extent of the subsidy.

(1)

The benchmark financial market instrument should be a marketable

Treasury security with a similar maturity to the direct loans

being made or the non-Federal loans being guaranteed. When the

rate on the Government loan is intended to be different than the

benchmark rate, it should be stated as a percentage of that rate.

The benchmark Treasury security must be cited specifically in

agency budget justifications.

(2) Interest rates

applicable to new loans should be reviewed at least quarterly and

adjusted to reflect changes in the benchmark interest rate. Loan

contracts may provide for either fixed or floating interest

rates.

Maximum

amounts of direct loan obligations and loan guarantee

commitments should be specifically authorized in advance in

annual appropriations acts, except for mandatory programs exempt

from the appropriations requirements under <Section 504(c) of

the Federal Credit Reform Act of 1990>.

Financing

for Federal credit programs should be provided by Treasury in

accordance with the Federal Credit Reform Act of 1990.

Guarantees of the timely payment of 100 percent of the loan

principal and interest against all risk create a debt obligation

that is the credit risk equivalent of a Treasury security.

Accordingly, a Federal agency other than the Department of the

Treasury may not issue, sell, or guarantee an obligation of a

type that is ordinarily financed in investment securities

markets, as determined by the Secretary of the Treasury, unless

the terms of the obligation provide that it may not be held by a

person or entity other than the Federal Financing Bank (FFB) or

another Federal agency. In exceptional circumstances, the

Secretary of the Treasury may waive this requirement with

respect to obligations that the Secretary determines: (1) are

not suitable for investment for the FFB because of the risks

entailed in such obligations; or (2) are, or will be, financed

in a manner that is least disruptive of private finance markets

and institutions; or (3) are, or will be, based on the

Secretary's consultation with OMB and the guaranteeing agency,

financed in a manner that will best meet the goals of the

program. The benefits of using the FFB must not expand the

degree of subsidy.

Federal

loan contracts should be standardized where practicable. Private

sector documents should be used whenever possible, especially

for loan guarantees.

4.

Implementation.

Statutory

|

Federal Credit Reform Act of 1990, 2 U.S.C. §

661

Government Performance and

Results Act of 1993

|

Guidance

|

OMB Circular No. A-11; OMB Circular No. A-19

|

The

provisions of this Section II will be implemented through the

<OMB Circular No. A-19> legislative review process and the

<OMB Circular No. A-11> budget justification and submission

process. For accounting standards for Federal credit programs,

see <Accounting for Direct Loans and Loan Guarantees,

Statement of Federal Financial Accounting Standards Number 2>,

developed by the Federal Accounting Standards Advisory Board.

Proposed

legislation on credit programs, reviews of credit proposals made

by others, and testimony on credit activities submitted by

agencies under the OMB Circular No. A-19 legislative review

process should conform to the provisions of this

Circular.

Whenever agencies propose provisions or

language not in conformity with the policies of this Circular,

they will be required to request in writing that OMB waive the

requirement. The request will be submitted on a standard waiver

request form, available from OMB. Such requests will identify

the waiver(s) requested, and will state the reasons for the

request and the time period for which the exception is required.

Exceptions, when allowed, will ordinarily be granted only for a

limited time in order to allow for an evaluation by OMB. The

waiver request form should be submitted to the OMB examiner with

primary responsibility for the account.

A

checklist for reviews of legislative and budgetary proposals is

included as Appendix B to this Circular. Agencies should use the

model bill language provided in Appendix C in developing and

reviewing legislation unless OMB has approved the use of

alternative language that includes the same substantive

elements.

Every

four years, or more often at the request of the OMB examiner

with primary responsibility for the account, the agency's annual

budget submission (required by <OMB Circular No. A-11,

Section 15.2>) should include:

(1)

A plan for periodic, results-oriented evaluations of the

effectiveness of the program, and the use of relevant program

evaluations and/or other analyses of program effectiveness or

causes of escalating program costs. A program evaluation is a

formal assessment, through objective measurement and systematic

analysis, addressing the manner and extent to which credit

programs achieve intended objectives. This information should be

contained in agencies' annual performance plans submitted to OMB.

(For further detail on program evaluation, refer to the

Government Performance and Results Act of 1993 (GPRA) and related

guidance);

(2) A review of the changes in financial

markets and the status of borrowers and beneficiaries to verify

that continuation of the credit program is required to meet

Federal objectives, to update its justification, and to recommend

changes in its design and operation to improve efficiency and

effectiveness; and

(3) Proposed changes to correct

those cases where existing legislation, regulations, or program

policies are not in conformity with the policies of this Section

II. When an agency does not deem a change in existing

legislation, regulations, or program policies to be desirable, it

will provide a justification for retaining the non-conformance.

III.

CREDIT MANAGEMENT AND EXTENSION POLICY

A.

CREDIT EXTENSION POLICIES

REFERENCES:

Statutory

|

31 U.S.C. § 3720B, 18 U.S.C. § 1001, 31

U.S.C. § 7701(d)

|

Regulatory

|

31 C.F.R. Part 285.13, Executive Order 13,109, 61

Federal Register 51,763

|

Guidance

|

Treasury/FMS "Managing Federal Receivables,"

"Treasury Report on Receivables (TROR)," and "Guide

to the Federal Credit Bureau Program"

|

1.

Applicant

Screening.

Program

Eligibility.

Federal credit granting agencies and private lenders in

guaranteed loan programs, shall determine whether applicants

comply with statutory, regulatory, and administrative

eligibility requirements for loan assistance. If it is

consistent with program objectives, borrowers should be required

to certify and document that they have been unable to obtain

credit from private sources. In addition, application forms must

require the borrower to certify the accuracy of information

being provided. (False information is subject to penalties under

<18 U.S.C.§ 1001>.)

Delinquency

on Federal Debt.

Agencies should determine if the applicant is delinquent on any

Federal debt, including tax debt. Agencies should include a

question on loan application forms asking applicants if they

have such delinquencies. In addition, agencies and guaranteed

loan lenders, shall use credit bureaus as a screening tool.

Agencies are also encouraged to use other appropriate databases,

such as the Department of Housing and Urban Development's Credit

Alert Interactive Voice Response System <CAIVRS> to

identify delinquencies on Federal debt.

Processing of

applications shall be suspended when applicants are delinquent

on Federal tax or <non-tax debts, including judgment liens

against property for a debt to the Federal Government, and are

therefore not eligible to receive Federal loans, loan guarantees

or insurance. (See <31 U.S.C. § 3720B> regarding

non-tax debts.) This provision does not apply to disaster loans.

Agencies should review and comply with <31 U.S.C. §

3720B> and <31 C.F.R. 285.13> before extending credit.

Processing should continue only when the debtor satisfactorily

resolves the debts (e.g., pays in full or negotiates a new

repayment plan).

Creditworthiness.

Where creditworthiness is a criterion for loan approval,

agencies and private lenders shall determine if applicants have

the ability to repay the loan and a satisfactory history of

repaying debt. Credit reports and supplementary data sources,

such as financial statements and tax returns, should be used to

verify or determine employment, income, assets held, and credit

history.

Delinquent

Child Support.

Agencies shall deny Federal financial assistance to individuals

who are subject to administrative offset to collect delinquent

child support payments. See <Executive Order 13,109, 61

Federal Register 51,763 (1996)>. The Attorney General has

issued <Minimum Due Process Guidelines: Denial of Federal

Financial Assistance Pursuant to Executive Order 13,109>,

which agencies shall include in their procedures or regulations

promulgated for the purpose of denying Federal financial

assistance in accordance with Executive Order 13,109.

Taxpayer

Identification Number.

Pursuant to <31 U.S.C. § 7701(d)>, agencies must

obtain the taxpayer identification number (TIN) of all persons

doing business with the agency. All agencies and lenders

extending credit shall require the applicant or borrower to

supply a TIN as a prerequisite to obtaining credit or

assistance.

2.

Loan Documentation.

Loan origination files should contain loan applications, credit

bureau reports, credit analyses, loan contracts, and other

documents necessary to conform to private sector standards for

that type of loan. Accurate and complete documentation is

critical to providing proper servicing of the debt, pursuing

collection of delinquent debt, and in the case of guaranteed

loans, processing claim payments. Additional information on

documentation requirements is available in the supplement to the

Treasury

Financial Manual

<Managing Federal Receivables>.

3.

Collateral Requirements.

For many types of loans, the Government can reduce its risk of

default and potential losses through well managed collateral

requirements.

Appraisals

of Real Property.

Appraisals of real property serving as collateral for a direct

or guaranteed loan must be conducted in accordance with the

following guidelines:

(1)

Agencies should require that all appraisals be consistent with

the <Uniform Standards of Professional Appraisal Practice>,

promulgated by the Appraisal Standards Board of the Appraisal

Foundation. Agencies shall prescribe additional appraisal

standards as appropriate.

(2) Agencies should ensure

that a State licensed or certified appraiser prepares an

appraisal for all credit transactions over $100,000 ($250,000 for

business loans). (This does not include loans with no cash out

and those transactions where the collateral is not a major factor

in the decision to extend credit). Agencies shall determine which

of these transactions, because of the size and/or complexity,

must be performed by a State licensed or certified appraiser.

Agencies may also designate direct or guaranteed loan

transactions under $100,000 ($250,000 for business loans) that

require the services of a State licensed or certified appraiser.

Loan

to Value Ratios.

In some credit programs, the primary purpose of the loan is to

finance the acquisition of an asset, such as a single family

home, which then serves as collateral for the loan. Agencies

should ensure that borrowers assume an equity interest in such

assets in order to reduce defaults and Government losses.

Federal agencies should explicitly define the components of the

loan to value ratio (LTV) for both direct and guaranteed loan

programs. Financing should be limited by not offering terms

(including the financing of closing costs) that result in an LTV

equal to or greater than 100 percent. Further, the loan maturity

should be shorter than the estimated useful economic life of the

collateral.

Liquidation

of Real Property Collateral for Guaranteed Loans.

In general, it is not in the Federal Government's financial

interest to assume the responsibility for managing and disposing

of real property serving as collateral on defaulted guaranteed

loans. Private lenders should be required to liquidate, through

litigation if necessary, any real property collateral for a

defaulted guaranteed loan before filing a default claim with the

credit granting agency.

Asset

Management Standards and Systems.

Agencies should establish policies and procedures for the

acquisition, management, and disposal of real property acquired

as a result of direct or guaranteed loan defaults. Agencies

should establish inventory management systems to track all

costs, including contractual costs, of maintaining and selling

property. Inventory management systems should also generate

management reports, provide controls and monitoring

capabilities, and summarize information for the Office of

Management and Budget and the Department of the Treasury. (See

<Treasury Report on Receivables>).

B.

MANAGEMENT OF GUARANTEED LOAN LENDERS AND SERVICERS

REFERENCES:

Guidance

|

Treasury/FMS "Managing Federal Receivables"

|

1.

Lender Eligibility.

Participation

Criteria.

Federal credit granting agencies shall establish and publish in

the Federal Register specific eligibility criteria for lender

participation in Federally guaranteed loan programs. These

criteria should include:

(1)

Requirements that the lender is not currently debarred/suspended

from participation in a Government contract or delinquent on a

Government debt;

(2) Qualification requirements for

principal officers and staff of the lender;

(3)

Fidelity/surety bonding and/or errors and omissions insurance

with the Federal Government as a loss payee, where appropriate,

for new or non-regulated lenders or lenders with questionable

performance under Federal guarantee programs;

(4)

Financial and capital requirements for lenders not regulated by a

Federal financial institution regulatory agency, including

minimum net worth requirements based on business volume.

Review

of Eligibility.

Agencies shall review and document a lender's eligibility for

continued participation in a guaranteed loan program at least

every two years. Ideally, these reviews should be conducted in

conjunction with on-site reviews of lender operations (see B.3)

or other required reviews, such as renewal of a lender agreement

(see B.2). Lenders not meeting standards for continued

participation should be decertified. In addition to the

participation criteria above, guarantor agencies should consider

lender performance as a critical factor in determining continued

eligibility for participation.

Fees.

When authorized and appropriated for such purposes, agencies

should assess non-refundable fees to defray the costs of

determining and reviewing lender eligibility.

Decertification.

Guarantor agencies should establish specific procedures to

decertify lenders or take other appropriate action any time

there is:

(1)

Significant and/or continuing non-conformance with agency

standards; and/or

(2) Failure to meet financial and

capital requirements or other eligibility criteria.

Agency

procedures should define the process and establish timetables by

which decertified lenders can apply for reinstatement of

eligibility for Federal guaranteed loan programs.

Loan

Servicers.

Lenders transferring and/or assigning the right to service

guaranteed loans to a loan servicer should use only servicers

meeting applicable standards set by the Federal guarantor

agency. Where appropriate, agencies may adopt standards for loan

servicers established by a Government Sponsored Enterprise (GSE)

or a similar organization (e.g., Government National Mortgage

Association for single family mortgages) and/or may authorize

lenders to use servicers that have been approved by a GSE or

similar organization.

2.

Lender Agreements.

Agencies should enter into written agreements with lenders that

have been determined to be eligible for participation in a

guaranteed loan program. These agreements should incorporate

general participation requirements, performance standards and

other applicable requirements of this Circular. Agencies are

encouraged, where not prohibited by authorizing legislation, to

set a fixed duration for the agreement to ensure a formal review

of the lender eligibility for continued participation in the

program.

General

Participation Requirements.

(1)

Requirements for lender eligibility, including participation

criteria, eligibility reviews, fees, and decertification (see

Section

1,

above);

(2) Agency and lender responsibilities for

sharing the risk of loan defaults (see Section

II.3. a.(1));

and, where feasible

(3) Maximum delinquency, default

and claims rates for lenders, taking into account individual

program characteristics.

Performance

Standards.

Agencies should include due diligence requirements for

originating, servicing, and collecting loans in their lender

agreements. This may be accomplished by referencing agency

regulations or guidelines. Examples of due diligence standards

include collection procedures for past due accounts, delinquent

debtor counseling procedures and litigation to enforce loan

contracts.

Agencies should ensure, through the claims

review process, that lenders have met these standards prior to

making a claim payment. Agencies should reduce claim amounts or

reject claims for lender non-performance.

Reporting

Requirements.

Federal credit granting agencies should require certain data to

monitor the health of their guaranteed loan portfolios, track

and evaluate lender performance and satisfy OMB, Treasury, and

other reporting requirements which include the <Treasury

Report on Receivables (TROR)>. Examples of these data which

agencies must maintain include:

(1)

Activity

Indicators

-- number and amount of outstanding guaranteed loans at the

beginning and end of the reporting period and the agency share of

risk; number and amount of guaranteed loans made during the

reporting period; and number and amount of guaranteed loans

terminated during the period.

(2) Status

Indicators

-- a schedule showing the number and amount of past due loans by

"age" of the delinquency, and the number and amount of

loans in foreclosure or liquidation (when the lender is

responsible for such activities).

Agencies may have

several sources for such data, but some or all of the information

may best be obtained from lenders and servicers. Lender

agreements should require lenders to report necessary information

on a quarterly basis (or other reporting period based on the

level of lending and payment activity).

Loan

Servicers.

Lender agreements must specify that loan servicers must meet

applicable participation requirements and performance standards.

The agreement should also specify that servicers acquiring loans

must provide any information necessary for the lender to comply

with reporting requirements to the agency. Servicers may not

resell the loans except to qualified servicers.

3.

Lender and Servicer Reviews.

To evaluate and enforce lender and servicer performance, agencies

should conduct on-site reviews. Agencies should summarize reviews

findings in written reports with recommended corrective actions

and submit them to agency review boards. (See Section I.4.b.(1).)

Reviews

should be conducted biennially where possible; however, agencies

should conduct annual on-site reviews all lenders and servicers

with substantial loan volume or whose:

Financial

performance measures indicate a deterioration in their

guaranteed loan portfolio;

Portfolio

has a high level of defaults for guaranteed loans less than one

year old;

Overall

default rates rise above acceptable levels; and/or

Poor

performance results in collecting monetary penalties or an

abnormally high number of reduced or rejected claims.

Agencies

are encouraged to develop a lender/servicer classification

system which assigns a risk rating based on the above factors.

This risk rating can be used to establish priorities for on-site

reviews and monitor the effectiveness of required corrective

actions.

Reviews should be conducted by guarantor

agency program compliance staff, Inspector General staff, and/or

independent auditors. Where possible, agencies with similar

programs should coordinate their reviews to minimize the burden

on lenders/servicers and maximize use of scarce resources.

Agencies should also utilize the monitoring efforts of GSEs and

similar organizations for guaranteed loans that have been

<"pooled">.

4.

Corrective Actions. If

a review indicates that the lender/servicer is not in conformance

with all program requirements, agencies should determine the

seriousness of the problem. For minor non-compliance, agencies

and the lender or servicer should agree on corrective actions.

However, agencies should establish penalties for more serious and

frequent offenses. Penalties may include loss of guarantees,

reprimands, probation, suspension, and decertification.

IV.

MANAGING THE FEDERAL GOVERNMENT'S RECEIVABLES

Agencies

must service and collect debts, including defaulted guaranteed

loans they have acquired, in a manner that best protects the

value of the assets. Mechanisms must be in place to collect and

record payments and provide accounting and management information

for effective stewardship. Agencies should collect data on the

status of their portfolios on a monthly basis although they are

only required to report quarterly. These servicing activities can

be carried out by the agency, or by third parties (such as

private lenders or guaranty agencies), or a contract with a

private sector firm. Unless Otherwise exempt, the <Debt

Collection Improvement Act of 1996 (DCIA)>, codified at <31

U.S.C.§ 3711>, requires Federal agencies to transfer any

non-tax debt which is over 180 days delinquent to the Department

of the Treasury/FMS for debt collection action (31 C.F.R. Part

285). Under certain conditions, it may be advantageous to sell

loans or other debts to avoid the necessity of debt servicing.

1.

Accounting and Financial Reporting.

REFERENCES:

Statutory

|

DCA, Chief Financial Officers Act (CFO) of 1990,

Government Performance and Results Act, Federal Credit Reform

Act of 1990, 31 U.S.C. § 3719, 31 U.S.C. § 3711, 2

U.S.C. § 661

|

Regulatory

|

31 C.F.R. Part 285, OMB Circular No. A-127

|

Guidance

|

JFMIP Standards on Direct and Guaranteed Loans,

Instructions for the Treasury Report on Receivables Due from

the Public (TROR), Treasury/FMS "Managing Federal

Receivables," Federal Accounting Standards Advisory Board

- "Accounting for Direct Loans and Loan Guarantees,"

Statement of Federal Financial Accounting Standards No. 2, as

amended," "Amendments to Accounting Standards for

Direct Loans and Loan Guarantees," Statement of Federal

Financial Accounting Standards No. 18.

|

Accounting

and Financial Reporting Systems.

Agencies shall establish accounting and financial reporting

systems to meet the standards provided in this Circular, <OMB

Circular No. A-127, "Financial Management Systems">,

<"JFMIP Standards on Direct and Guaranteed Loans">,

and other government-wide requirements. These systems shall be

capable of accounting for obligations and outlays and of meeting

the <reporting requirements of OMB> and <Treasury>,

including those associated with the <Federal Credit Reform

Act of 1990> and the <Chief Financial Officers (CFO) Act

of 1990>.

Agency

Reports.

Agencies should use comprehensive reports on the status of loan

portfolios and receivables to evaluate management effectiveness.

Agencies shall prepare, in accordance with the CFO Act and OMB

guidance, annual financial statements that include loan programs

and other receivables. Agencies should also collect data for

program performance measures (such as default rates, purchase

rates, recovery rates, subsidy rates [actual vs. projected], and

administrative costs) consistent with the <Government

Performance and Results Act of 1993> (GPRA) and <Federal

Credit Reform Act of 1990>.

Agencies are also

required to report periodically to Treasury on the status and

condition of their non-tax delinquent portfolio on the <TROR>.

Due to a timing difference between the submissions of fiscal

year-end data for the TROR, and data used for agency financial

statements (the fiscal year-end receivables report is due in

November and agency financial statements are not due until

February/March of the following year), the data in these two

reports may not be identical. Agencies should be able to explain

differences and show the relationship of information contained

in the two reports, but the reports are not required to

reconcile.

2.

Loan Servicing Requirements. Agency

servicing requirements, whether performed in-house or by another

agency or private sector firm, must meet the standards described

below and in the Treasury/FMS publication <Managing Federal

Receivables>.

REFERENCES:

Statutory

|

Privacy Act of 1974, Debt Collection Act of 1982

(DCA), Debt Collection Improvement Act of 1996 (DCIA), 31

U.S.C. § 3711

|

Guidance

|

Treasury/FMS' "Managing Federal Receivables,"

and the "Guide to the Federal Credit Bureau Program"

|

Documentation.

Approved loan files (or other systems of records) shall contain

adequate and up-to-date information reflecting terms and

conditions of the loan, payment history, including occurrences

of delinquencies and defaults, and any subsequent loan actions

which result in payment deferrals, refinancing, or rescheduling.

Billing

and Collections.

Agencies shall ensure that there is routine invoicing of

payments, and that efficient mechanisms are in place to collect

and record payments. When making payments and where appropriate,

borrowers should be encouraged to use agency systems established

by Treasury which collect payments electronically, such as

pre-authorized debits and credit cards.

Escrow

Accounts.

Agency servicing systems must process tax and insurance deposits

for housing and other long-term real estate loans through escrow

accounts. Agencies should establish escrow accounts at the time

of loan origination and payments for housing and other long-term

real estate loans through an escrow account.

Referring

Account Information to Credit Reporting Agencies.

Agency servicing systems must be able to identify and refer

debts to credit bureaus in accordance with the requirements of

<31 U.S.C. § 3711>. Agencies shall refer all

non-tax, non-tariff commercial accounts (current and delinquent)

and all

delinquent non-tariff and non-tax consumer accounts. Agencies

may report current

consumer debts as well and are encouraged to do so. The

reporting of current data (in addition to any delinquencies)

provides a truer picture of indebtedness while simultaneously

reflecting accounts that the borrower has maintained in good

standing. There is no minimum dollar threshold, i.e., accounts

(debts) owed for as low as $5 may be referred to credit

reporting agencies. Agencies shall require lenders participating

in Federal loan programs to provide information relating to the

extension of credit to consumer or commercial credit reporting

agencies, as appropriate. For additional information, agencies

should refer to Treasury/FMS' <Guide to the Federal Credit

Bureau Program>.

3.

Asset Resolution

REFERENCES:

Statutory

|

DCIA, 31 U.S.C. § 3711(i)

Federal

Credit Reform Act of 1990, 2 U.S.C. § 661

|

Guidance

|

OMB Circular No. A-11, Section 85.7, OMB Circular No.

A-34

|

The

DCIA, as codified at <31 U.S.C. § 3711(i)> authorizes

agencies to sell any non-tax debt owed to the United States that

is more than 90 days delinquent, subject to the provisions of

the <Federal Credit Reform Act of 1990>. The

Administration's budget policy is that agencies are required to

sell any non-tax debts that are delinquent for more than one

year for which collection action has been terminated, if the

Secretary of the Treasury determines that the sale is in the

best interest of the United States Government. Agencies are

required to sell the debts for cash or a combination of cash and

profit participation, if such an arrangement is more

advantageous to the government, and make the sales without

recourse. Loan sales should result in shifting agency staff

resources from servicing to mission critical

functions.

Beginning in FY 2000, for programs with

$100 million in assets (unpaid principal balance) that are

delinquent for more than two years, the agency is expected to

dispose of assets expeditiously. (See <OMB Circular No.

A-11>.) Agencies may request from OMB, an exception for the

following:

(1)

Loans to foreign countries and entities;

(2) Loans in

structured forbearance, when conversion to repayment status is

expected within 24 months or after statutory requirements are

met;

(3) Loans that are written off as unenforceable

e.g., due to death, disability, or bankruptcy;

(4)

Loans that have been submitted to Treasury for offset and are

expected to be extinguished within three (3) years;

(5)

Loans in adjudication or foreclosure; and

(6) Student

loans.

Agencies shall provide to OMB an annual list of

loans that are exempted.

Evaluate

Asset Portfolio.

On an annual basis, agencies shall take steps to evaluate and

analyze existing asset portfolios and programs associated

therewith, to determine if there are avenues to:

(1)

Improve

Credit Management and Recoveries.

Improvement in current management, performance, and recoveries of

asset portfolios shall be reviewed against current marketplace

practices;

(2) Realize

Administrative Savings.

Analyses of current asset portfolio practices shall include the

benefit of transferring all or some portion of the portfolio to

the private sector. Agencies shall develop a staffing utilization

plan to ensure that when asset sales result in a decreased

workload, staff are shifted to priority workload mission critical

functions.

(3) Initiate

Prepayment.

Agencies shall initiate prepayment programs when statutorily

mandated or, if upon analysis of an existing asset portfolio

practice, it is deemed appropriate. Prepayment programs may be

initiated without the approval of OMB. Delinquent borrowers may

participate in a prepayment program only if past due principal,

interest, and charges are paid in full prior to their request to

prepay the balance owed.

Financial

Asset Services.

Agencies shall engage the services of outside contractors as

deemed necessary to assist in its asset resolution program.

Contractors providing various types of asset services are

available through the <General Services Administration's

Multiple Award Schedule for Financial Asset Services> as

follows:

(1)

Program Financial Advisors;

(2) Transaction

Specialists

(3) Due Diligence Contractors;

(4)

Loan Service/Asset Managers; and

(5) Equity

Monitors/Transaction Assistants.

Loan

Asset Sales Guidelines.

OMB and Treasury jointly will update existing guidelines and

procedures to implement loan prepayment and loan asset sales. In

accordance with the agreed upon procedures, agencies conducting

such prepayment and loan asset sales programs will consult with

both OMB and Treasury throughout the prepayment and loan asset

sales processes to ensure consistency with the agreed upon

policies and guidelines. Unless an agency can document from

their past experience that the sale of certain types of loan

assets is not economically viable, a financial advisor shall be

engaged by each agency to conduct a portfolio valuation and to

compare pricing options for a proposed prepayment plan or loan

asset sale. Based on the financial advisor's report, the

agencies will develop a prepayment or loan asset sales schedule

and plan, including an analysis of the pricing option selected.

As part of the ongoing consultation between OMB, Treasury, and

the agencies, prior to proceeding with their prepayment or loan

asset sales, the agencies will submit their final prepayment or

loan asset sales plans and proposed pricing options to OMB and

Treasury for review in order to ensure that any undue cost to

the Government or additional subsidy to the borrower is avoided.

The agency Chief Financial Officer will certify that an agency

loan prepayment and loan asset sales program is in compliance

with the agreed upon guidelines. See <Asset Sales

Guidelines>.

V.

DELINQUENT DEBT COLLECTION

Agencies

shall have a fair but aggressive program to recover delinquent

debt, including defaulted guaranteed loans acquired by the

Federal Government. Each agency will establish a collection

strategy consistent with its statutory authority that seeks to

return the debtor to a current payment status or, failing that,

maximize collection on the debt.

1.

Standards for Defining Delinquent and Defaulted Debt

REFERENCES:

Statutory

|

DCA/DCIA/31 U.S.C. §§ 3701, 3711-3720D

|

Regulatory

|

Federal Claims Collection Standards, 31 C.F.R. Section

900.2(b)

|

Guidance

|

Treasury/FMS' "Managing Federal Receivables"

|

The

Federal Claims Collections Standards define delinquent debt in

general terms. Agency regulations may further define delinquency

to meet specific types of debt or program requirements.

Direct

Loans.

Agencies shall consider a direct loan account to be delinquent

if a payment has not been made by the date specified in the

agreement or instrument (including a post-delinquency payment

agreement), unless other satisfactory payment arrangements have

been made.

Guaranteed

Loans.

Loans guaranteed or insured by the Federal Government are in

default when the borrower breaches the loan agreement with the

private sector lender. A default to the Federal Government

occurs when the Federal credit granting agency repurchases the

loan, pays a loss claim or pays reinsurance on the loan. Prior

to establishing a receivable on the agency financial records,

each agency must consider statutory and regulatory authority

applicable to the debt in order to determine if the agency has a

legal right to subject the debt to the collection provisions of

this Circular.

Other

Debt.

Overpayments to contractors, grantees, employees, and

beneficiaries; fines; fees; penalties; and other debts are

delinquent when the debtor does not pay or resolve the debt by

the date specified in the agency's initial written demand for

payment (which generally should be within 30 days from the date

the agency mailed notification of the debt to the debtor).

2.

Administrative Collection of Debts.

REFERENCES:

Statutory

|

15 U.S.C. § 1673(a)(2), 31 U.S.C. § 3701, §§

3711-3720E, 26 U.S.C. § 6402, 5 U.S.C. § 5514, Fair

Debt Collection Practices Act

|

Regulatory

|

31 C.F.R. Part 285, Federal Claims Collection

Standards, 31 C.F.R. Part 901, Federal Claims Collections

Standards, 5 C.F.R. 550 Part K, 26 C.F.R. 301.6402-1 through

7, Federal Acquisitions Regulations, Subpart 32.6

|

Guidance

|

Treasury/FMS "Managing Federal Receivables"

and FMS Cross-servicing/Offset Guidance Documents,

Treasury's/FMS' "Guide to the Federal Credit Bureau

Program"

|

Agencies

shall promptly act on the collection of delinquent debts, using

all available collection tools to maximize collections. Agencies

shall transfer debts delinquent 180 days or more to the

Treasury/FMS or Treasury-designated debt collection centers for

further collection actions and resolution. Exceptions to this

requirement (e.g., the debt has been referred for litigation) can

be found in <31 U.S.C.§ 3711> and <31 C.F.R. Part

285.12(d)>.

Collection

Strategy.

Agencies shall maintain an accurate and timely reporting system

to identify and monitor delinquent receivables. Each agency

shall develop a systematic process for the collection of

delinquent accounts. Collection strategies shall take full

advantage of available collection tools while recognizing

program needs and statutory authority.

Collection

Tools for Debts Less than 180 Days Delinquent.

Agencies may use the following collection tools when the debt is

fewer than 180 days delinquent:

(i)

Demand

Letters.

As soon as an account becomes delinquent, agencies should send

demand letters to the debtor. The demand letter must give the

debtor notice of each form of collection action and type of

financial penalty the agency plans to use. Additional demand

letters may be sent if necessary. See <31 U.S.C.§ 3711>

<31 C.F.R. Parts 285 and 901.2>.

For consumer

accounts, the first demand letter or initial billing notice

should include the 60 day notification requirement of the

agency's intent to refer to a credit bureau. Once the 60 day

period has passed, the agency should initiate reporting if the

account has not been resolved. This will also enable

uninterrupted reporting to credit bureaus by cross-servicing

agencies. The 60 day notification of intent to refer to a credit

bureau is not required for commercial accounts. (See

Treasury/FMS' <Guide to the Federal Credit Bureau

Program>.)

(ii) Internal

Offset.

If the agency that is owed the debt also makes payments to the

debtor, the agency may use internal offset to the extent

permitted by that agency's statutes and regulations and the

common law. Delinquent debts owed by an agency's employees may be

offset in accordance with statutes and regulations administered

by the Office of Personnel Management. See <OPM regulations

and statutes>.

(iii) Treasury

Offset Program.

Agencies may collect delinquent debt, which is less than 180 days

delinquent, by referring those debts to Treasury/FMS in order to

offset Federal payments due to the debtor. Payments, which

Treasury will offset, include certain benefit payments, federal

retirement payments, salaries, vendor payments and tax refunds.

<31 U.S.C. Section 3716>, <31 U.S.C. § 3720A>,

<31 C.F.R. Part 285>,< 26 C.F.R. 301.6402>, <31

C.F.R. Chapter II, Part 901.3>, and, <Federal Acquisition

Regulations Subpart 32.6>. If a Federal payment has not yet

been initiated in the Treasury Offset Program, agencies may

request that the paying agency perform the offset.

(iv)

Administrative

Wage Garnishment.

Agencies have the authority to administratively garnish the wages

of delinquent debtors in order to recover delinquent debt. The

maximum garnishment for any one debt is 15% of disposable pay.

Multiple garnishments from all sources against one debtor's wages

may not exceed 25% of disposable pay of an individual. <31

U.S.C. § 3720D>, <31 C.F.R. Part 285.11> and 15

U.S.C. § 1673(a)(2).

(v) Contracting

with Private Collection Agencies.

Treasury has contracted with private collection agencies that may

be used by Federal agencies to provide assistance in the recovery

of delinquent debt owed to the Government. <31 U.S.C. §

3711>, <31 U.S.C. § 3718>, <31 C.F.R. Parts 285,

and 901>, <Fair Debt Collection Practices Act >.

Agencies may also transfer debts to Treasury prior to 180 days

for the purpose of referral to private collection agencies.

(vi)

Treasury

Cross-Servicing.

Agencies may transfer debts to Treasury for full servicing at any

time after the due process requirements. (See <31 C.F.R. Part

285>.)

Collection

of Debts Which are Over 180 Days Delinquent.

This paragraph sets forth Treasury's collection procedures for

debts which are over 180 days delinquent.

(i)

Treasury

Offset Program.

The DCIA requires that all agencies recover debt delinquent more

than 180 days by referring those debts to the Treasury for offset

of tax refunds and other Federal payments. Agencies must refer

all accounts for offset in accordance with guidance provided by

the Department of the Treasury/FMS. <Federal Claims Collection

Standards>, <31 U.S.C. § 3716>, <31 U.S.C. §

3720A> and <31 C.F.R. Part 285>. The following types of

offset are undertaken in the Treasury Offset Program (TOP):

(1)

Tax Refund Offset;

(2) Vendor Offset;

(3)

Federal Retirement Offset;

(4) Salary Offset;

(5)

Benefit Offset (At the time of publication, benefit payments have

not been incorporated into the program. Benefit payments, such as

Social Security Administration (SSA), Black Lung and Railroad

Retirement Benefits (RRB) will be added in the future.); and

(6)

Other Federal payments as allowed by law (as such payments are

allowed into the program).

(ii)

Cross-Servicing.

The DCIA requires that all debts owed to agencies which are more

than 180 days delinquent shall be transferred to Treasury/FMS or

a Treasury-designated debt collection center for servicing. The

DCIA contains provisions and requirements for exempting certain

classes of debts from being transferred for servicing

<www.treas.fms.gov/debt>.(See <31 U.S.C. § 3711>,

and <31 C.F.R. Part 285>.) Once debts are transferred to

Treasury, agencies must cease all collection activities other

than maintaining accounts for the Treasury Offset Program.

Once

Treasury has received a debt for servicing, the appropriate debt

collection actions will be taken. These actions may include

sending demand letters; phone calls to delinquent debtors; credit

bureau reporting; referring debtors to the Treasury Offset

Program; referring debtors to private collection agencies;

administrative wage garnishment; and any other available debt

collection tool.

3.

Referrals to the Department of Justice.

A.

Referral for Litigation

REFERENCES:

Statutory

|

31 U.S.C. § 3711, 28 U.S.C. §§ 3001,

3002(1)

|

Regulatory

|

31 C.F.R. Part 904, Federal Claims Collection

Standards

|

Guidance

|

Department of the Treasury/FMS "Litigation

Referral Process Handbook," and "Managing Federal

Receivables," Appendix 8

|

Agencies,

including Treasury/FMS or Treasury-designated debt collection

centers, shall refer delinquent accounts to the Department of

Justice, or use other litigation authority that may be available,

as soon as there is sufficient reason to conclude that full or

partial recovery of the debt can best be achieved through

litigation. Referrals to Justice should be made in accordance

with the <Federal Claims Collection Standards>. If the

debtor does not come forward with a voluntary payment after the

claim has been referred for litigation, a lawsuit shall be

initiated promptly.

In

consultation with the Department of Justice, agencies shall

establish a system to account for: (a) claims referred to

Justice, and (b) claims closed by Justice and returned to the

respective agencies.

Agencies

shall accelerate claim referrals to the Department of Justice in

those districts where the Department of Justice contracts with

private law firms for debt collection.

Agencies

shall stop the use of any collection activities including TOP

and refrain from further contact with the debtor once a claim