Setup/Monitoring Disclosure Requirements

Truth in Lending Act (Regulation Z) 12 CFR 1026

Forms from TILA

Setup/Monitoring Disclosure Requirements

OMB: 3170-0015

Appendix G to Part 1026—Open-End Model Forms and Clauses

G-1 Balance Computation Methods Model Clauses (Home-equity Plans) (§§ 1026.6 and 1026.7)

G-1(A) Balance Computation Methods Model Clauses (Plans other than Home-equity Plans) (§§ 1026.6 and 1026.7)

G-2 Liability for Unauthorized Use Model Clause (Home-equity Plans) (§ 1026.12)

G-2(A) Liability for Unauthorized Use Model Clause (Plans Other Than Home-equity Plans) (§ 1026.12)

G-3 Long-Form Billing-Error Rights Model Form (Home-equity Plans) (§§ 1026.6 and 1026.9)

G-3(A) Long-Form Billing-Error Rights Model Form (Plans Other Than Home-equity Plans) (§§ 1026.6 and 1026.9)

G-4 Alternative Billing-Error Rights Model Form (Home-equity Plans) (§ 1026.9)

G-4(A) Alternative Billing-Error Rights Model Form (Plans Other Than Home-equity Plans) (§ 1026.9)

G-5 Rescission Model Form (When Opening an Account) (§ 1026.15)

G-6 Rescission Model Form (For Each Transaction) (§ 1026.15)

G-7 Rescission Model Form (When Increasing the Credit Limit) (§ 1026.15)

G-8 Rescission Model Form (When Adding a Security Interest) (§ 1026.15)

G-9 Rescission Model Form (When Increasing the Security) (§ 1026.15)

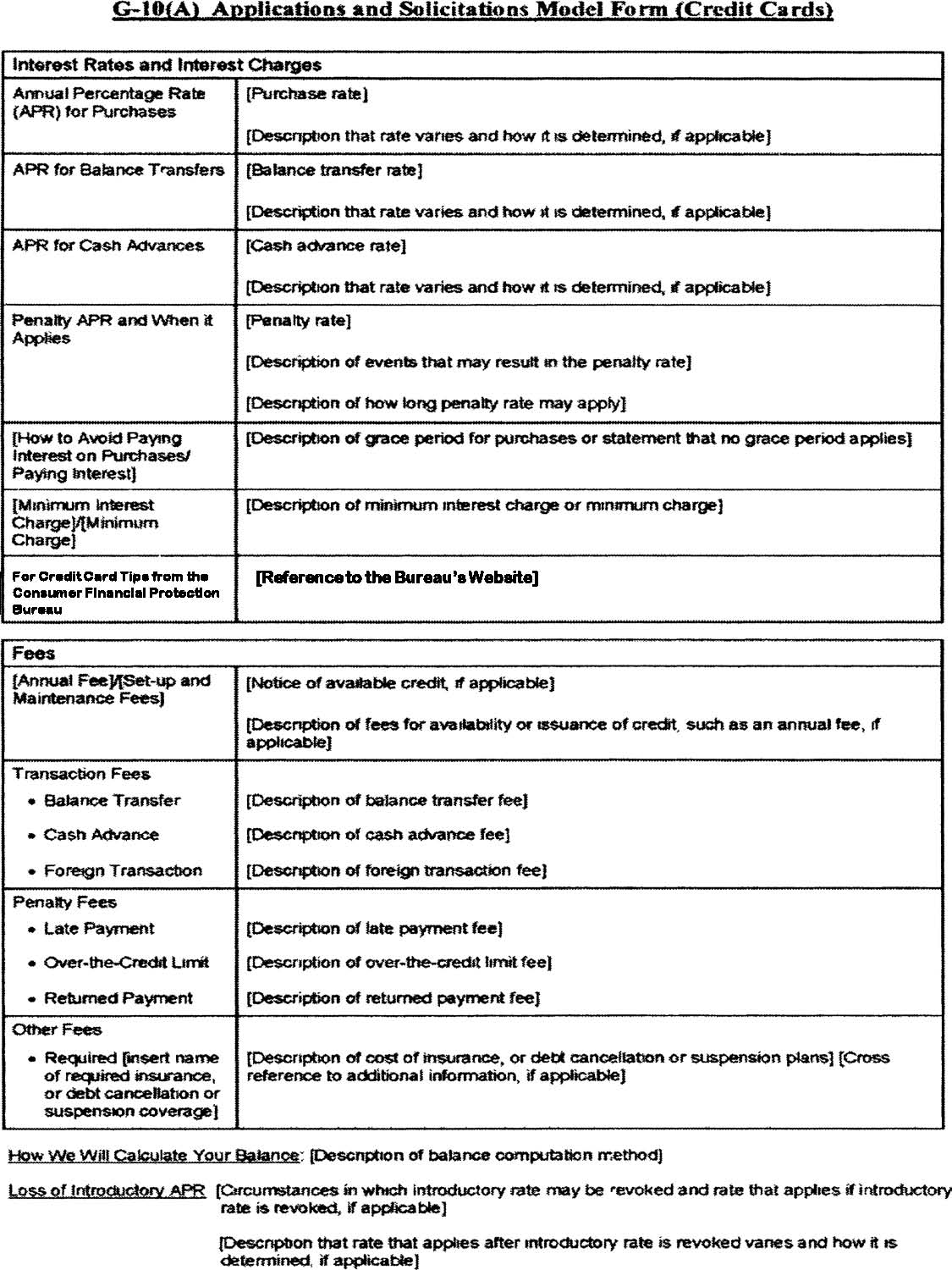

G-10(A) Applications and Solicitations Model Form (Credit Cards) (§ 1026.60(b))

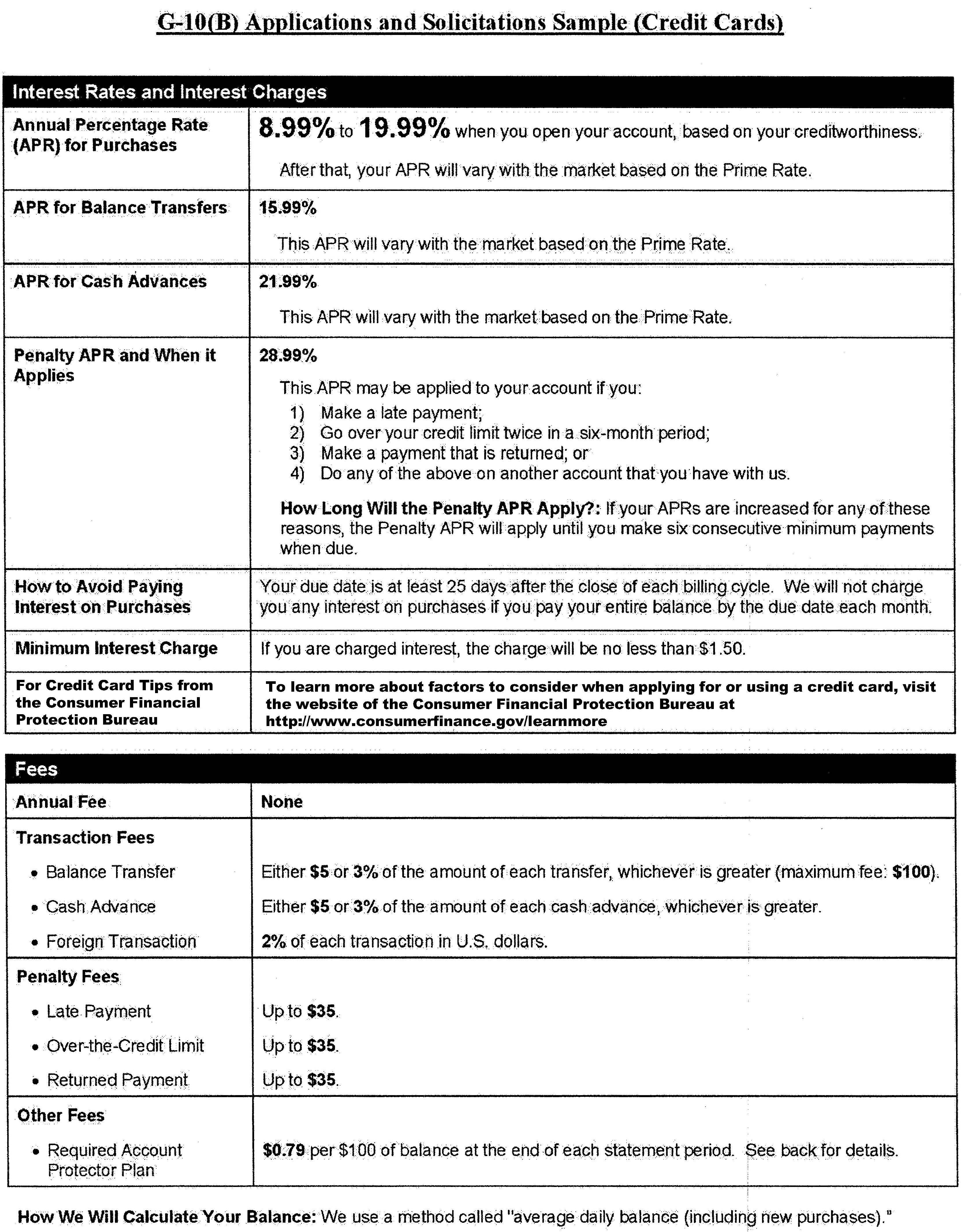

G-10(B) Applications and Solicitations Sample (Credit Cards) (§ 1026.60(b))

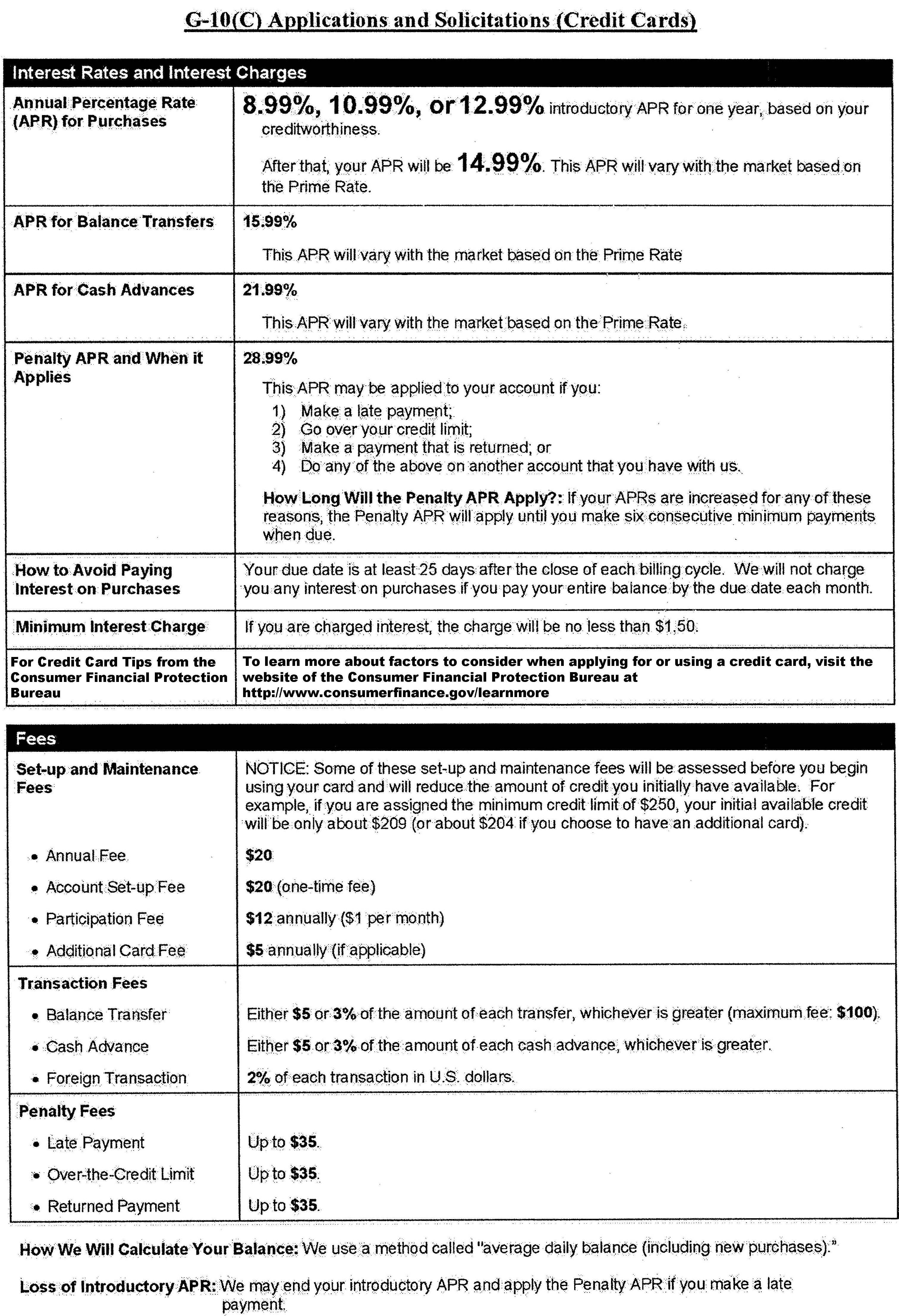

G-10(C) Applications and Solicitations Sample (Credit Cards) (§ 1026.60(b))

G-10(D) Applications and Solicitations Model Form (Charge Cards) (§ 1026.60(b))

G-10(E) Applications and Solicitations Sample (Charge Cards) (§ 1026.60(b))

G-11 Applications and Solicitations Made Available to General Public Model Clauses (§ 1026.60(e))

G-12 Reserved

G-13(A) Change in Insurance Provider Model Form (Combined Notice) (§ 1026.9(f))

G-13(B) Change in Insurance Provider Model Form (§ 1026.9(f)(2))

G-14A Home-equity Sample

G-14B Home-equity Sample

G-15 Home-equity Model Clauses

G-16(A) Debt Suspension Model Clause (§ 1026.4(d)(3))

G-16(B) Debt Suspension Sample (§ 1026.4(d)(3))

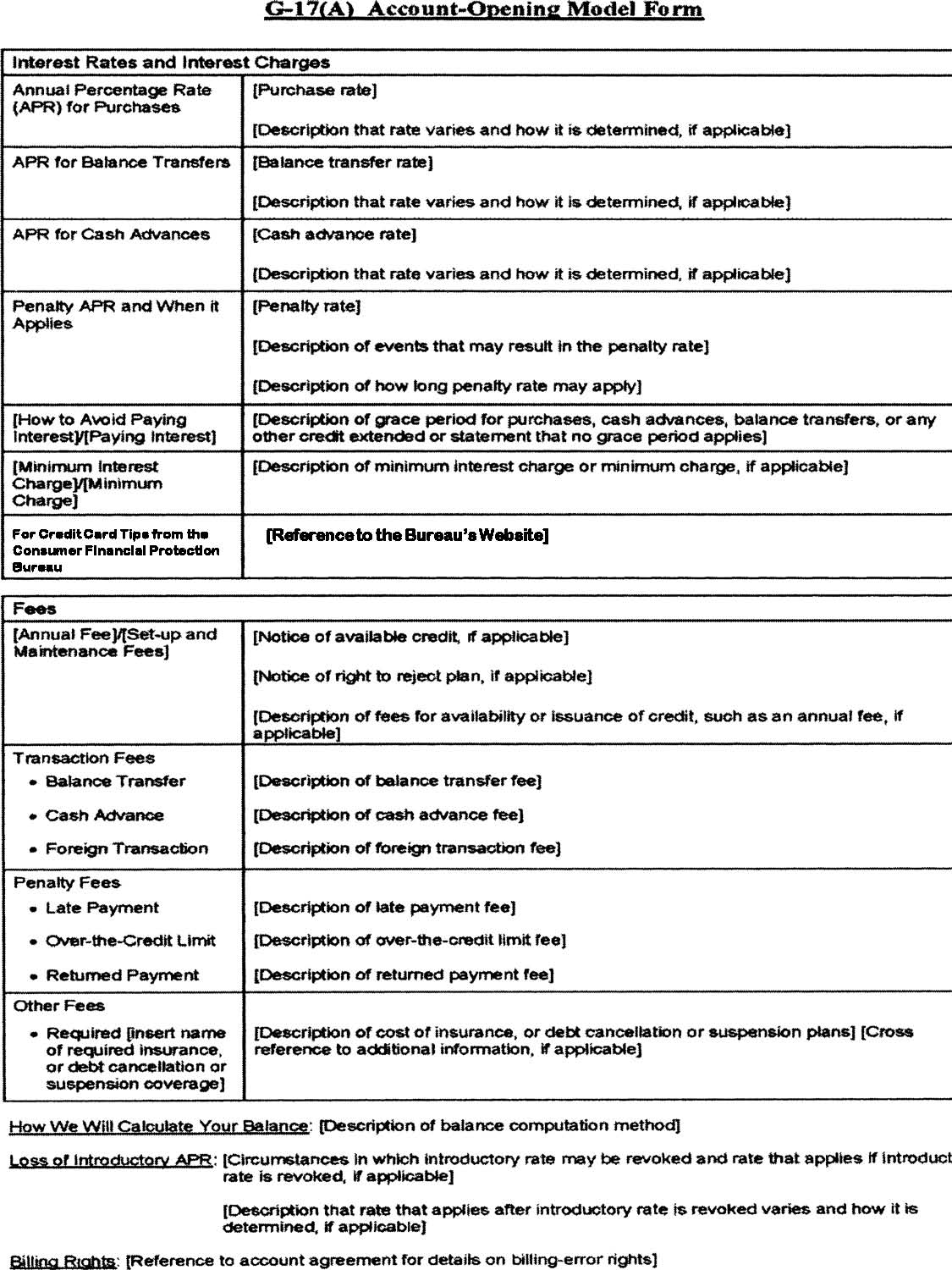

G-17(A) Account-opening Model Form (§ 1026.6(b)(2))

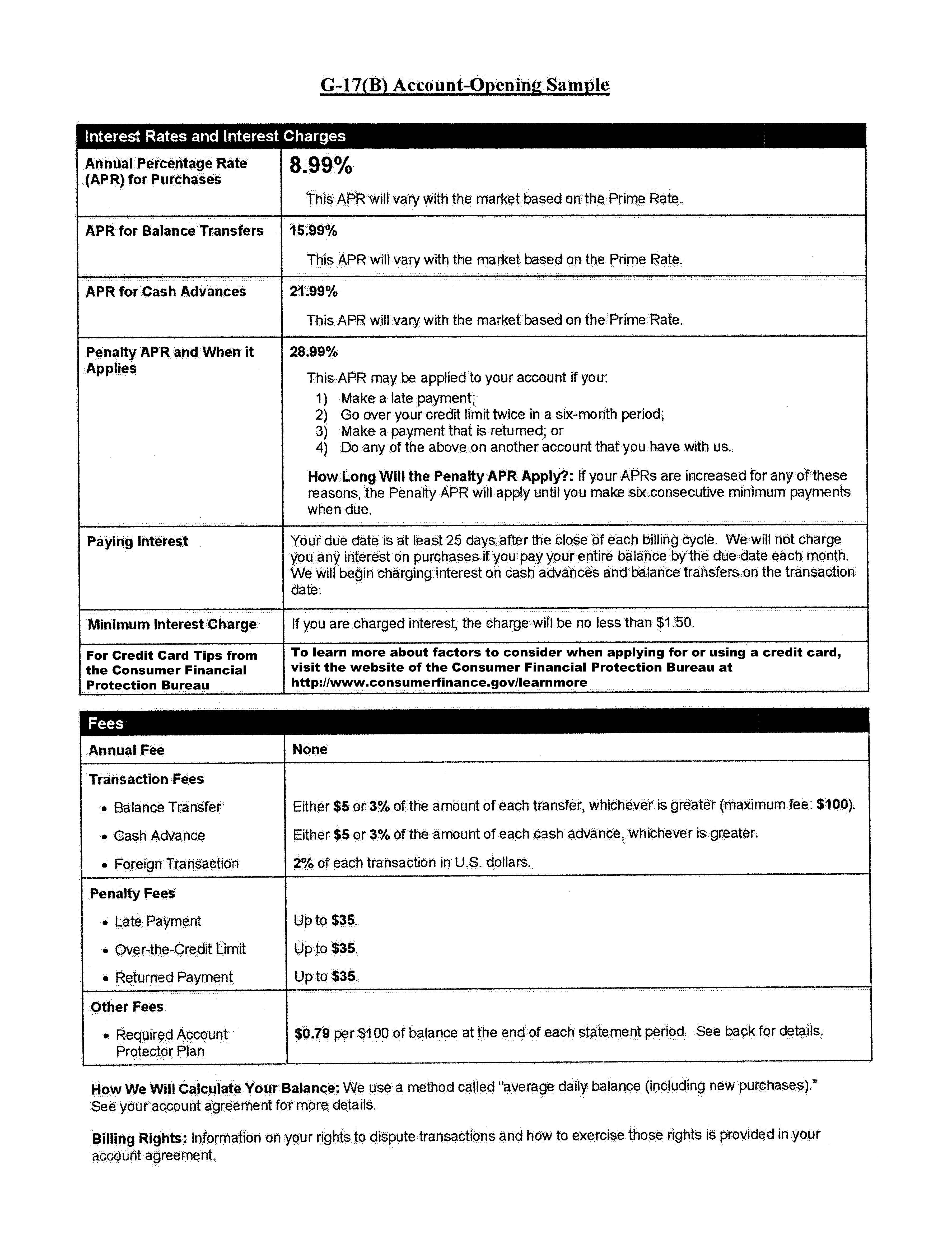

G-17(B) Account-opening Sample (§ 1026.6(b)(2))

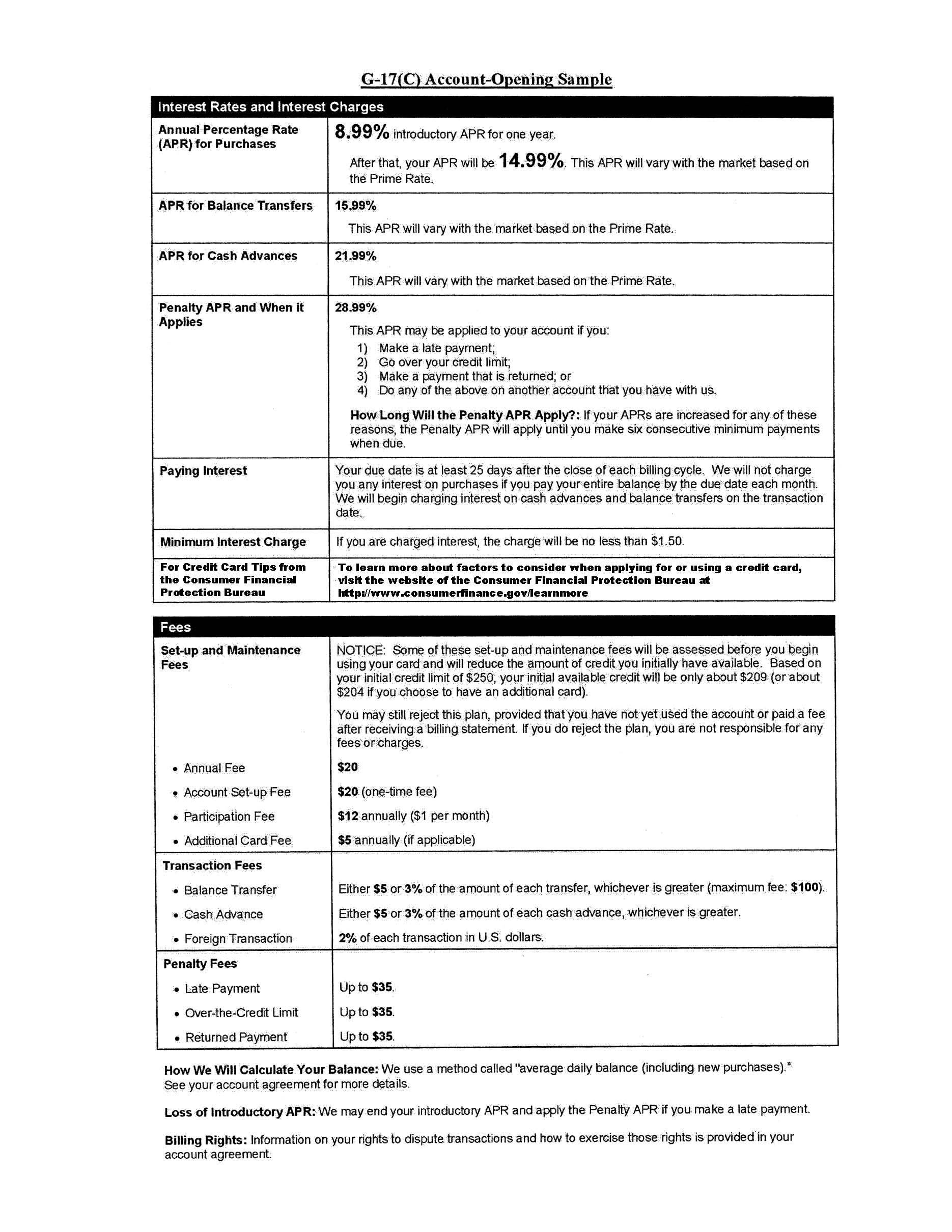

G-17(C) Account-opening Sample (§ 1026.6(b)(2))

G-17(D) Account-opening Sample (§ 1026.6(b)(2))

G-18(A) Transactions; Interest Charges; Fees Sample (§ 1026.7(b))

G-18(B) Late Payment Fee Sample (§ 1026.7(b))

G-18(C)(1) Minimum Payment Warning (When Amortization Occurs and the 36-Month Disclosures Are Required) (§ 1026.7(b))

G-18(C)(2) Minimum Payment Warning (When Amortization Occurs and the 36-Month Disclosures Are Not Required) (§ 1026.7(b))

G-18(C)(3) Minimum Payment Warning (When Negative or No Amortization Occurs) (§ 1026.7(b))

G-18(D) Periodic Statement New Balance, Due Date, Late Payment and Minimum Payment Sample (Credit cards) (§ 1026.7(b))

G-18(E) [Reserved]

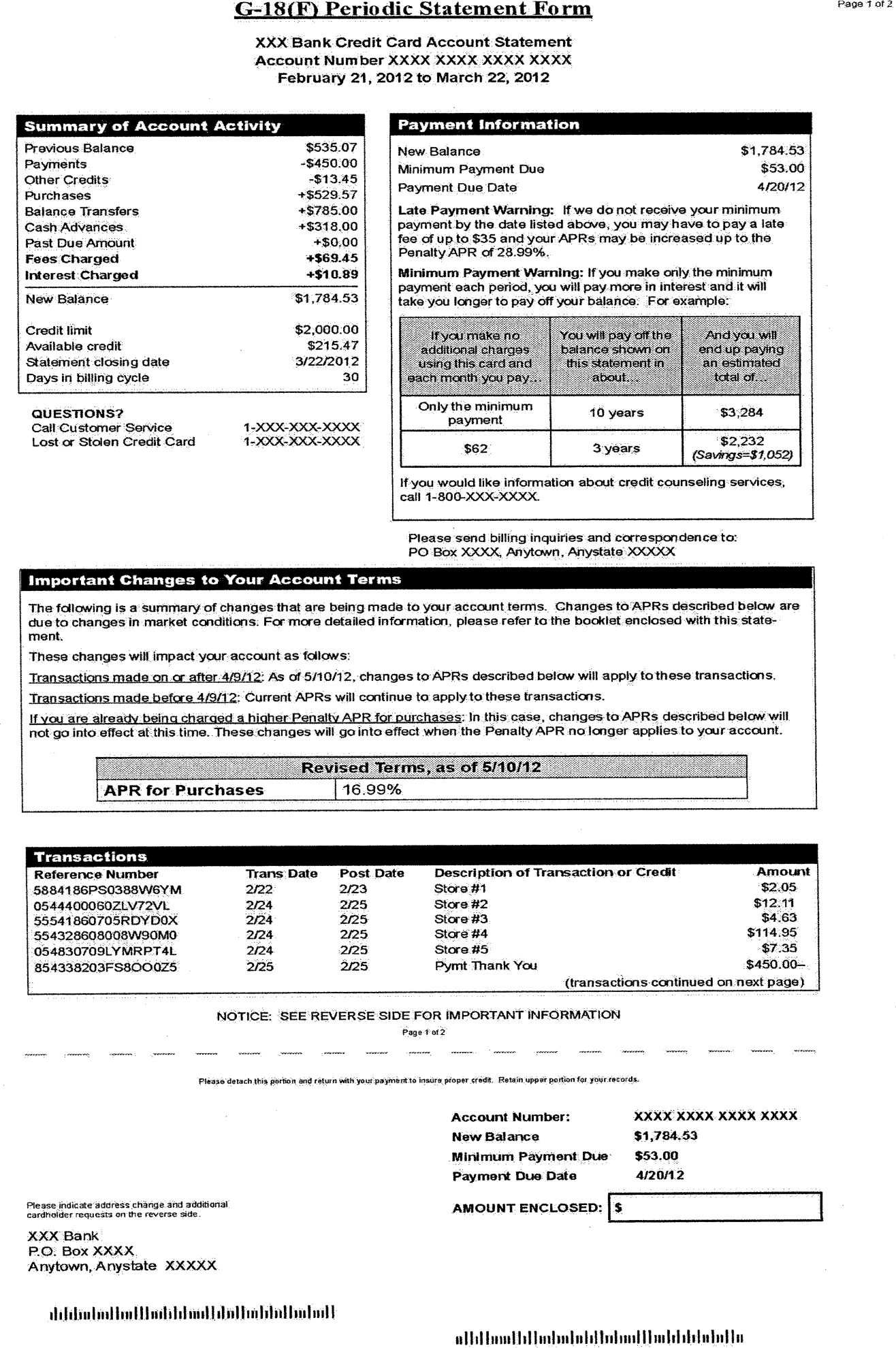

G-18(F) Periodic Statement Form

G-18(G) Periodic Statement Form

G-18(H) Deferred Interest Periodic Statement Clause

G-19 Checks Accessing a Credit Card Account Sample (§ 1026.9(b)(3))

G-20 Change-in-Terms Sample (Increase in Annual Percentage Rate) (§ 1026.9(c)(2))

G-21 Change-in-Terms Sample (Increase in Fees) (§ 1026.9(c)(2))

G-22 Penalty Rate Increase Sample (Payment 60 or Fewer Days Late) (§ 1026.9(g)(3))

G-23 Penalty Rate Increase Sample (Payment More Than 60 Days Late) (§ 1026.9(g)(3))

G-24 Deferred Interest Offer Clauses (§ 1026.16(h))

G-25(A) Consent Form for Over-the-Limit Transactions (§ 1026.56)

G-25(B) Revocation Notice for Periodic Statement Regarding Over-the-Limit Transactions (§ 1026.56)

G-1—Balance Computation Methods Model Clauses (Home-Equity Plans)

(a) Adjusted balance method

We figure [a portion of] the finance charge on your account by applying the periodic rate to the “adjusted balance” of your account. We get the “adjusted balance” by taking the balance you owed at the end of the previous billing cycle and subtracting [any unpaid finance charges and] any payments and credits received during the present billing cycle.

(b) Previous balance method

We figure [a portion of] the finance charge on your account by applying the periodic rate to the amount you owe at the beginning of each billing cycle [minus any unpaid finance charges]. We do not subtract any payments or credits received during the billing cycle. [The amount of payments and credits to your account this billing cycle was $ ___.]

(c) Average daily balance method (excluding current transactions)

We figure [a portion of] the finance charge on your account by applying the periodic rate to the “average daily balance” of your account (excluding current transactions). To get the “average daily balance” we take the beginning balance of your account each day and subtract any payments or credits [and any unpaid finance charges]. We do not add in any new [purchases/advances/loans]. This gives us the daily balance. Then, we add all the daily balances for the billing cycle together and divide the total by the number of days in the billing cycle. This gives us the “average daily balance.”

(d) Average daily balance method (including current transactions)

We figure [a portion of] the finance charge on your account by applying the periodic rate to the “average daily balance” of your account (including current transactions). To get the “average daily balance” we take the beginning balance of your account each day, add any new [purchases/advances/loans], and subtract any payments or credits, [and unpaid finance charges]. This gives us the daily balance. Then, we add up all the daily balances for the billing cycle and divide the total by the number of days in the billing cycle. This gives us the “average daily balance.”

(e) Ending balance method

We figure [a portion of] the finance charge on your account by applying the periodic rate to the amount you owe at the end of each billing cycle (including new purchases and deducting payments and credits made during the billing cycle).

(f) Daily balance method (including current transactions)

We figure [a portion of] the finance charge on your account by applying the periodic rate to the “daily balance” of your account for each day in the billing cycle. To get the “daily balance” we take the beginning balance of your account each day, add any new [purchases/advances/fees], and subtract [any unpaid finance charges and] any payments or credits. This gives us the daily balance.

G-1(A)—Balance Computation Methods Model Clauses (Plans Other Than Home-Equity Plans)

(a) Adjusted balance method

We figure the interest charge on your account by applying the periodic rate to the “adjusted balance” of your account. We get the “adjusted balance” by taking the balance you owed at the end of the previous billing cycle and subtracting [any unpaid interest or other finance charges and] any payments and credits received during the present billing cycle.

(b) Previous balance method

We figure the interest charge on your account by applying the periodic rate to the amount you owe at the beginning of each billing cycle. We do not subtract any payments or credits received during the billing cycle.

(c) Average daily balance method (excluding current transactions)

We figure the interest charge on your account by applying the periodic rate to the “average daily balance” of your account. To get the “average daily balance” we take the beginning balance of your account each day and subtract [any unpaid interest or other finance charges and] any payments or credits. We do not add in any new [purchases/advances/fees]. This gives us the daily balance. Then, we add all the daily balances for the billing cycle together and divide the total by the number of days in the billing cycle. This gives us the “average daily balance.”

(d) Average daily balance method (including current transactions)

We figure the interest charge on your account by applying the periodic rate to the “average daily balance” of your account. To get the “average daily balance” we take the beginning balance of your account each day, add any new [purchases/advances/fees], and subtract [any unpaid interest or other finance charges and] any payments or credits. This gives us the daily balance. Then, we add up all the daily balances for the billing cycle and divide the total by the number of days in the billing cycle. This gives us the “average daily balance.”

(e) Ending balance method

We figure the interest charge on your account by applying the periodic rate to the amount you owe at the end of each billing cycle (including new [purchases/advances/fees] and deducting payments and credits made during the billing cycle).

(f) Daily balance method (including current transactions)

We figure the interest charge on your account by applying the periodic rate to the “daily balance” of your account for each day in the billing cycle. To get the “daily balance” we take the beginning balance of your account each day, add any new [purchases/advances/fees], and subtract [any unpaid interest or other finance charges and] any payments or credits. This gives us the daily balance.

G-2—Liability for Unauthorized Use Model Clause (Home-Equity Plans)

You may be liable for the unauthorized use of your credit card [or other term that describes the credit card]. You will not be liable for unauthorized use that occurs after you notify [name of card issuer or its designee] at [address], orally or in writing, of the loss, theft, or possible unauthorized use. [You may also contact us on the Web: [Creditor Web or email address]] In any case, your liability will not exceed [insert $50 or any lesser amount under agreement with the cardholder].

G-2(A)—Liability for Unauthorized Use Model Clause (Plans Other Than Home-Equity Plans)

If you notice the loss or theft of your credit card or a possible unauthorized use of your card, you should write to us immediately at: [address] [address listed on your bill],

or call us at [telephone number].

[You may also contact us on the Web: [Creditor Web or email address]]

You will not be liable for any unauthorized use that occurs after you notify us. You may, however, be liable for unauthorized use that occurs before your notice to us. In any case, your liability will not exceed [insert $50 or any lesser amount under agreement with the cardholder].

G-3—Long-Form Billing-Error Rights Model Form (Home-Equity Plans)

YOUR BILLING RIGHTS

KEEP THIS NOTICE FOR FUTURE USE

This notice contains important information about your rights and our responsibilities under the Fair Credit Billing Act.

Notify Us in Case of Errors or Questions About Your Bill

If you think your bill is wrong, or if you need more information about a transaction on your bill, write us [on a separate sheet] at [address] [the address listed on your bill]. Write to us as soon as possible. We must hear from you no later than 60 days after we sent you the first bill on which the error or problem appeared. [You may also contact us on the Web: [Creditor Web or email address]] You can telephone us, but doing so will not preserve your rights.

In your letter, give us the following information:

• Your name and account number.

• The dollar amount of the suspected error.

• Describe the error and explain, if you can, why you believe there is an error. If you need more information, describe the item you are not sure about.

If you have authorized us to pay your credit card bill automatically from your savings or checking account, you can stop the payment on any amount you think is wrong. To stop the payment your letter must reach us three business days before the automatic payment is scheduled to occur.

Your Rights and Our Responsibilities After We Receive Your Written Notice

We must acknowledge your letter within 30 days, unless we have corrected the error by then. Within 90 days, we must either correct the error or explain why we believe the bill was correct.

After we receive your letter, we cannot try to collect any amount you question, or report you as delinquent. We can continue to bill you for the amount you question, including finance charges, and we can apply any unpaid amount against your credit limit. You do not have to pay any questioned amount while we are investigating, but you are still obligated to pay the parts of your bill that are not in question.

If we find that we made a mistake on your bill, you will not have to pay any finance charges related to any questioned amount. If we didn't make a mistake, you may have to pay finance charges, and you will have to make up any missed payments on the questioned amount. In either case, we will send you a statement of the amount you owe and the date that it is due.

If you fail to pay the amount that we think you owe, we may report you as delinquent. However, if our explanation does not satisfy you and you write to us within ten days telling us that you still refuse to pay, we must tell anyone we report you to that you have a question about your bill. And, we must tell you the name of anyone we reported you to. We must tell anyone we report you to that the matter has been settled between us when it finally is.

If we don't follow these rules, we can't collect the first $50 of the questioned amount, even if your bill was correct.

Special Rule for Credit Card Purchases

If you have a problem with the quality of property or services that you purchased with a credit card, and you have tried in good faith to correct the problem with the merchant, you may have the right not to pay the remaining amount due on the property or services.

There are two limitations on this right:

(a) You must have made the purchase in your home state or, if not within your home state within 100 miles of your current mailing address; and

(b) The purchase price must have been more than $50.

These limitations do not apply if we own or operate the merchant, or if we mailed you the advertisement for the property or services.

G-3(A)—Long-Form Billing-Error Rights Model Form (Plans Other Than Home-Equity Plans)

Your Billing Rights: Keep This Document For Future Use

This notice tells you about your rights and our responsibilities under the Fair Credit Billing Act.

What To Do If You Find A Mistake On Your Statement

If you think there is an error on your statement, write to us at:

[Creditor Name]

[Creditor Address]

[You may also contact us on the Web: [Creditor Web or email address]]

In your letter, give us the following information:

• Account information: Your name and account number.

• Dollar amount: The dollar amount of the suspected error.

• Description of problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a mistake.

You must contact us:

• Within 60 days after the error appeared on your statement.

• At least 3 business days before an automated payment is scheduled, if you want to stop payment on the amount you think is wrong.

You must notify us of any potential errors in writing [or electronically]. You may call us, but if you do we are not required to investigate any potential errors and you may have to pay the amount in question.

What Will Happen After We Receive Your Letter

When we receive your letter, we must do two things:

1. Within 30 days of receiving your letter, we must tell you that we received your letter. We will also tell you if we have already corrected the error.

2. Within 90 days of receiving your letter, we must either correct the error or explain to you why we believe the bill is correct.

While we investigate whether or not there has been an error:

• We cannot try to collect the amount in question, or report you as delinquent on that amount.

• The charge in question may remain on your statement, and we may continue to charge you interest on that amount.

• While you do not have to pay the amount in question, you are responsible for the remainder of your balance.

• We can apply any unpaid amount against your credit limit.

After we finish our investigation, one of two things will happen:

• If we made a mistake: You will not have to pay the amount in question or any interest or other fees related to that amount.

• If we do not believe there was a mistake: You will have to pay the amount in question, along with applicable interest and fees. We will send you a statement of the amount you owe and the date payment is due. We may then report you as delinquent if you do not pay the amount we think you owe.

If you receive our explanation but still believe your bill is wrong, you must write to us within 10 days telling us that you still refuse to pay. If you do so, we cannot report you as delinquent without also reporting that you are questioning your bill. We must tell you the name of anyone to whom we reported you as delinquent, and we must let those organizations know when the matter has been settled between us.

If we do not follow all of the rules above, you do not have to pay the first $50 of the amount you question even if your bill is correct.

Your Rights If You Are Dissatisfied With Your Credit Card Purchases

If you are dissatisfied with the goods or services that you have purchased with your credit card, and you have tried in good faith to correct the problem with the merchant, you may have the right not to pay the remaining amount due on the purchase.

To use this right, all of the following must be true:

1. The purchase must have been made in your home state or within 100 miles of your current mailing address, and the purchase price must have been more than $50. (Note: Neither of these are necessary if your purchase was based on an advertisement we mailed to you, or if we own the company that sold you the goods or services.)

2. You must have used your credit card for the purchase. Purchases made with cash advances from an ATM or with a check that accesses your credit card account do not qualify.

3. You must not yet have fully paid for the purchase.

If all of the criteria above are met and you are still dissatisfied with the purchase, contact us in writing [or electronically] at:

[Creditor Name]

[Creditor Address]

[[Creditor Web or e-mail address]]

While we investigate, the same rules apply to the disputed amount as discussed above. After we finish our investigation, we will tell you our decision. At that point, if we think you owe an amount and you do not pay, we may report you as delinquent.

G-4—Alternative Billing-Error Rights Model Form (Home-Equity Plans)

BILLING RIGHTS SUMMARY

In Case of Errors or Questions About Your Bill

If you think your bill is wrong, or if you need more information about a transaction on your bill, write us [on a separate sheet] at [address] [the address shown on your bill] as soon as possible. [You may also contact us on the Web: [Creditor Web or e-mail address]] We must hear from you no later than 60 days after we sent you the first bill on which the error or problem appeared. You can telephone us, but doing so will not preserve your rights.

In your letter, give us the following information:

• Your name and account number.

• The dollar amount of the suspected error.

• Describe the error and explain, if you can, why you believe there is an error. If you need more information, describe the item you are unsure about.

You do not have to pay any amount in question while we are investigating, but you are still obligated to pay the parts of your bill that are not in question. While we investigate your question, we cannot report you as delinquent or take any action to collect the amount you question.

Special Rule for Credit Card Purchases

If you have a problem with the quality of goods or services that you purchased with a credit card, and you have tried in good faith to correct the problem with the merchant, you may not have to pay the remaining amount due on the goods or services. You have this protection only when the purchase price was more than $50 and the purchase was made in your home state or within 100 miles of your mailing address. (If we own or operate the merchant, or if we mailed you the advertisement for the property or services, all purchases are covered regardless of amount or location of purchase.)

G-4(A)—Alternative Billing-Error Rights Model Form (Plans Other Than Home-Equity Plans)

What To Do If You Think You Find A Mistake On Your Statement

If you think there is an error on your statement, write to us at:

[Creditor Name]

[Creditor Address]

[You may also contact us on the Web: [Creditor Web or e-mail address]]

In your letter, give us the following information:

• Account information: Your name and account number.

• Dollar amount: The dollar amount of the suspected error.

• Description of Problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a mistake.

You must contact us within 60 days after the error appeared on your statement.

You must notify us of any potential errors in writing [or electronically]. You may call us, but if you do we are not required to investigate any potential errors and you may have to pay the amount in question.

While we investigate whether or not there has been an error, the following are true:

• We cannot try to collect the amount in question, or report you as delinquent on that amount.

• The charge in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine that we made a mistake, you will not have to pay the amount in question or any interest or other fees related to that amount.

• While you do not have to pay the amount in question, you are responsible for the remainder of your balance.

• We can apply any unpaid amount against your credit limit.

Your Rights If You Are Dissatisfied With Your Credit Card Purchases

If you are dissatisfied with the goods or services that you have purchased with your credit card, and you have tried in good faith to correct the problem with the merchant, you may have the right not to pay the remaining amount due on the purchase.

To use this right, all of the following must be true:

1. The purchase must have been made in your home state or within 100 miles of your current mailing address, and the purchase price must have been more than $50. (Note:Neither of these are necessary if your purchase was based on an advertisement we mailed to you, or if we own the company that sold you the goods or services.)

2. You must have used your credit card for the purchase. Purchases made with cash advances from an ATM or with a check that accesses your credit card account do not qualify.

3. You must not yet have fully paid for the purchase.

If all of the criteria above are met and you are still dissatisfied with the purchase, contact us in writing [or electronically] at:

[Creditor Name]

[Creditor Address]

[[Creditor Web address]]

While we investigate, the same rules apply to the disputed amount as

discussed above. After we finish our investigation, we will tell you

our decision. At that point, if we think you owe an amount and you

do not pay we may report you as delinquent.

G-11—Applications and Solicitations Made Available to the General Public Model Clauses

(a) Disclosure of Required Credit Information

The information about the costs of the card described in this [application]/[solicitation] is accurate as of ( month/year ). This information may have changed after that date. To find out what may have changed, [call us at ( telephone number )][write to us at ( address )].

(b) No Disclosure of Credit Information

There are costs associated with the use of this card. To obtain information about these costs, call us at ( telephone number ) or write to us at ( address ).

G-12 [Reserved]

G-13(A)—Change in Insurance Provider Model Form (Combined Notice)

The credit card account you have with us is insured. This is to notify you that we plan to replace your current coverage with insurance coverage from a different insurer.

If we obtain insurance for your account from a different insurer, you may cancel the insurance.

[Your premium rate will increase to $ __ per __.]

[Your coverage will be affected by the following:

[ ] The elimination of a type of coverage previously provided to you. [(explanation)] [See __ of the attached policy for details.]

[ ] A lowering of the age at which your coverage will terminate or will become more restrictive. [(explanation)] [See __ of the attached policy or certificate for details.]

[ ] A decrease in your maximum insurable loan balance, maximum periodic benefit payment, maximum number of payments, or any other decrease in the dollar amount of your coverage or benefits. [(explanation)] [See __ of the attached policy or certificate for details.]

[ ] A restriction on the eligibility for benefits for you or others. [(explanation)] [See __ of the attached policy or certificate for details.]

[ ] A restriction in the definition of “disability” or other key term of coverage. [(explanation)] [See __ of the attached policy or certificate for details.]

[ ] The addition of exclusions or limitations that are broader or other than those under the current coverage. [(explanation)] [See __ of the attached policy or certificate for details.]

[ ] An increase in the elimination (waiting) period or a change to nonretroactive coverage. [(explanation)] [See __ of the attached policy or certificate for details).]

[The name and mailing address of the new insurer providing the coverage for your account is (name and address).]

G-13(B)—Change in Insurance Provider Model Form

We have changed the insurer providing the coverage for your account. The new insurer's name and address are (name and address). A copy of the new policy or certificate is attached.

You may cancel the insurance for your account.

G-16(A) Debt Suspension Model Clause

Please enroll me in the optional [insert name of program], and bill my account the fee of [how cost is determined]. I understand that enrollment is not required to obtain credit. I also understand that depending on the event, the protection may only temporarily suspend my duty to make minimum payments, not reduce the balance I owe. I understand that my balance will actually grow during the suspension period as interest continues to accumulate.

[To Enroll, Sign Here]/[To Enroll, Initial Here]. X____________________

G-16(B) Debt Suspension Sample

Please enroll me in the optional [name of program], and bill my account the fee of $.83 per $100 of my month-end account balance. I understand that enrollment is not required to obtain credit. I also understand that depending on the event, the protection may only temporarily suspend my duty to make minimum payments, not reduce the balance I owe. I understand that my balance will actually grow during the suspension period as interest continues to accumulate.

To Enroll, Initial Here. X____________________

G-17(A)

G-

G-18(B)—Late Payment Fee Sample

Late Payment Warning: If we do not receive your minimum

payment by the date listed above, you may have to pay a $35 late fee

and your APRs may be increased up to the Penalty APR of 28.99%.

G-18(E)

[Reserved]

G-18(H)—Deferred Interest Periodic Statement Clause

[You must pay your promotional balance in full by [date] to avoid paying accrued interest charges.]

G-24—Deferred Interest Offer Clauses

(a) For Credit Card Accounts Under an Open-End (Not Home-Secured) Consumer Credit Plan

[Interest will be charged to your account from the purchase date if the purchase balance is not paid in full within the/by [deferred interest period/date] or if you make a late payment.]

(b) For Other Open-End Plans

[Interest will be charged to your account from the purchase date if the purchase balance is not paid in full within the/by [deferred interest period/date] or if your account is otherwise in default.]

G-25(A)—Consent Form for Over-the-Credit Limit Transactions

Your choice regarding over-the-credit limit coverage

Unless you tell us otherwise, we will decline any transaction that causes you to go over your credit limit. If you want us to authorize these transactions, you can request over-the-credit limit coverage.

If you have over-the-credit limit coverage and you go over your credit limit, we will charge you a fee of up to $35. We may also increase your APRs to the Penalty APR of XX.XX%. You will only pay one fee per billing cycle, even if you go over your limit multiple times in the same cycle.

Even if you request over-the-credit limit coverage, in some cases we may still decline a transaction that would cause you to go over your limit, such as if you are past due or significantly over your credit limit.

If you want over-the-limit coverage and to allow us to authorize transactions that go over your credit limit, please:

—Call us at [telephone number];

—Visit [website]; or

—Check or initial the box below, and return the form to us at [address].

____________________

_ I want over-the-limit coverage. I understand that if I go over my credit limit, my APRs may be increased and I will be charged a fee of up to $35. [I have the right to cancel this coverage at any time.]

[_ I do not want over-the-limit coverage. I understand that transactions that exceed my credit limit will not be authorized.]

Printed Name:____________________

Date:____________________

[Account Number]:____________________

G-25(B)—Revocation Notice for Periodic Statement Regarding Over-the-Credit Limit Transactions

You currently have over-the-credit limit coverage on your account, which means that we pay transactions that cause you go to over your credit limit. If you do go over your credit limit, we will charge you a fee of up to $35. We may also increase your APRs. To remove over-the-credit-limit coverage from your account, call us at 1-800-xxxxxxx or visit [insert web site]. [You may also write us at: [insert address].]

[You may also check or initial the box below and return this form to us at: [insert address].

_ I want to cancel over-the-limit coverage for my account.

Printed Name:____________________

Date:____________________

[Account Number]:____________________

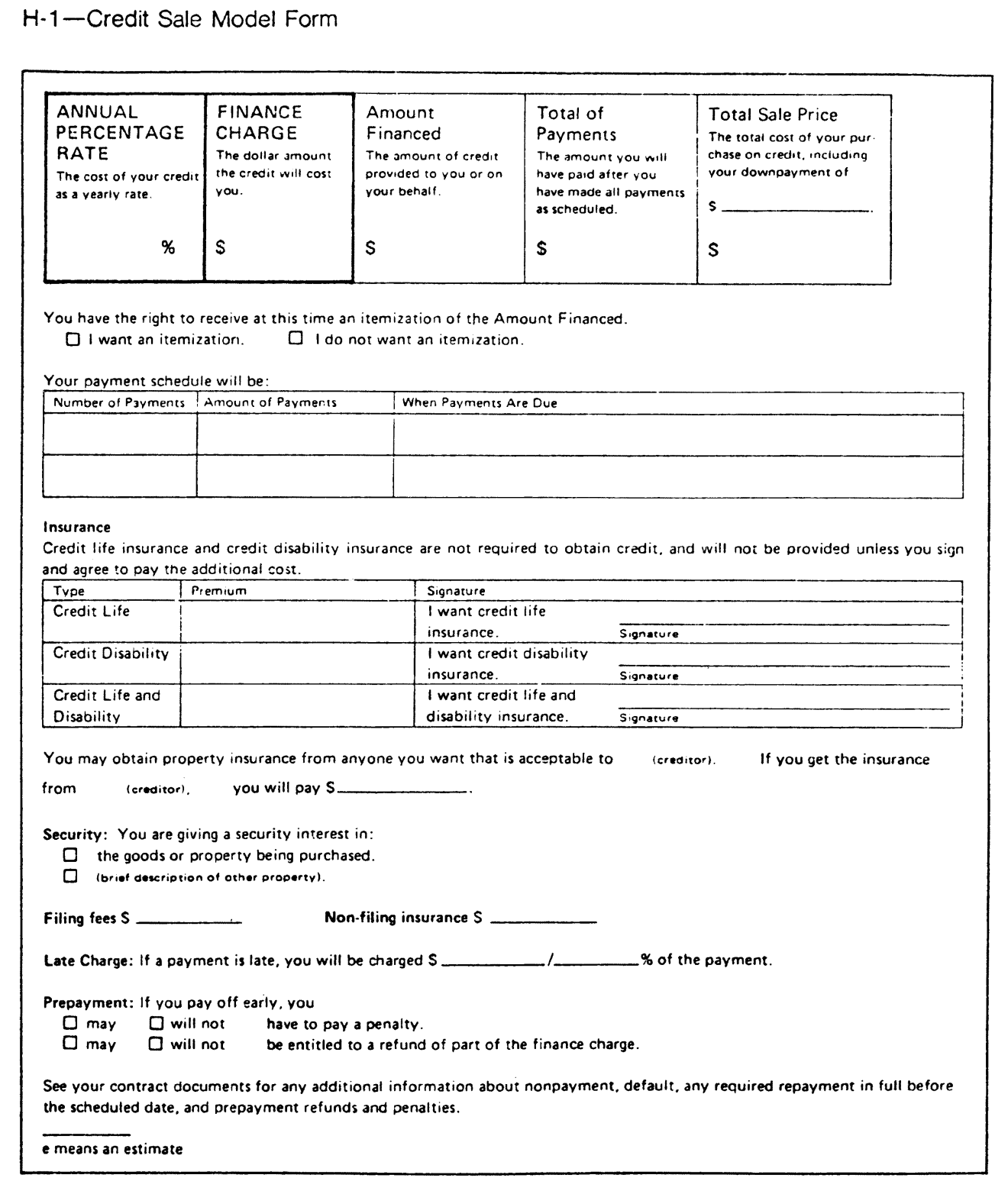

Appendix H to Part 1026— Closed-End Model Forms and Clauses

H-1 Credit Sale Model Form (§ 1026.18)

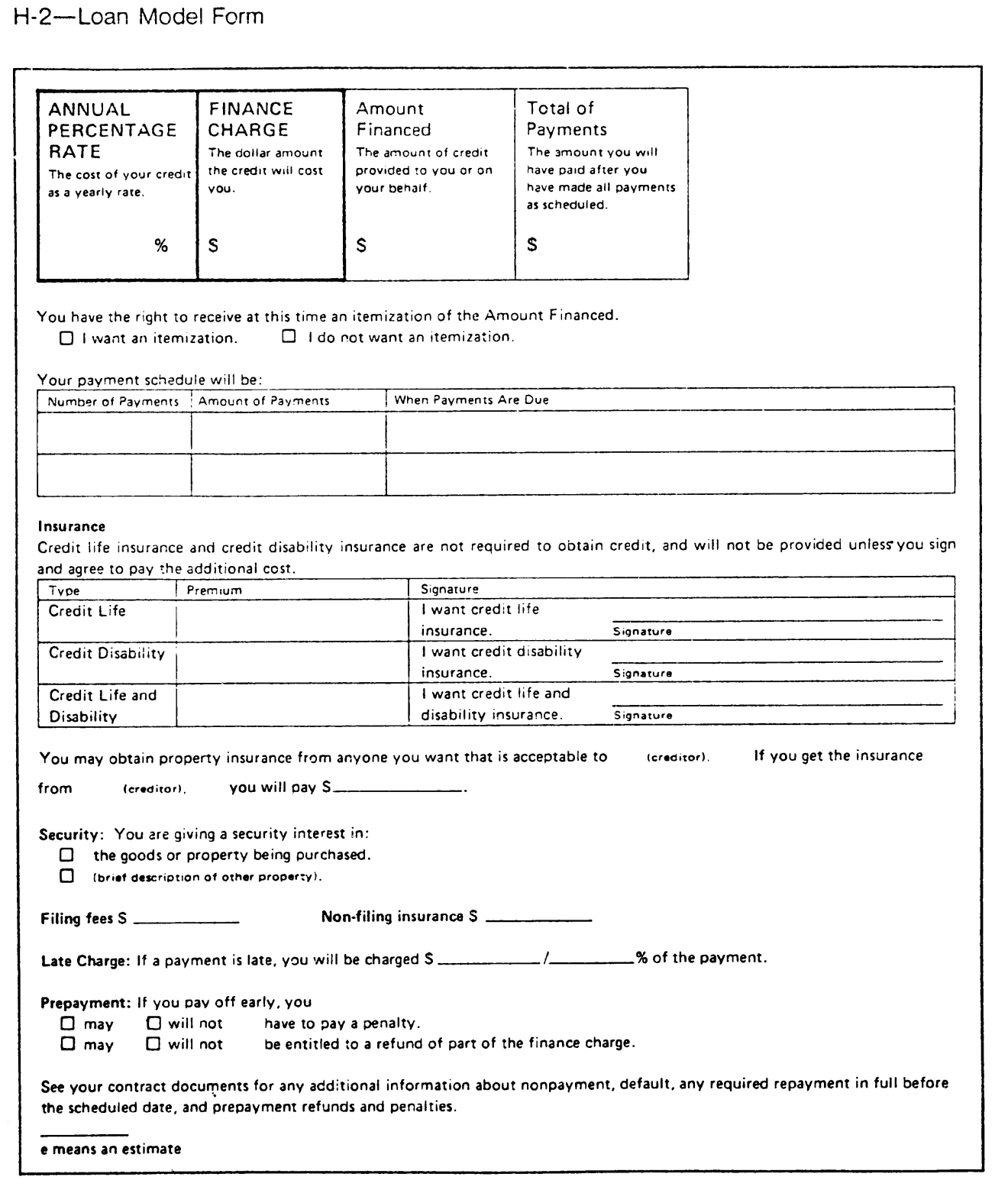

H-2 Loan Model Form (§ 1026.18)

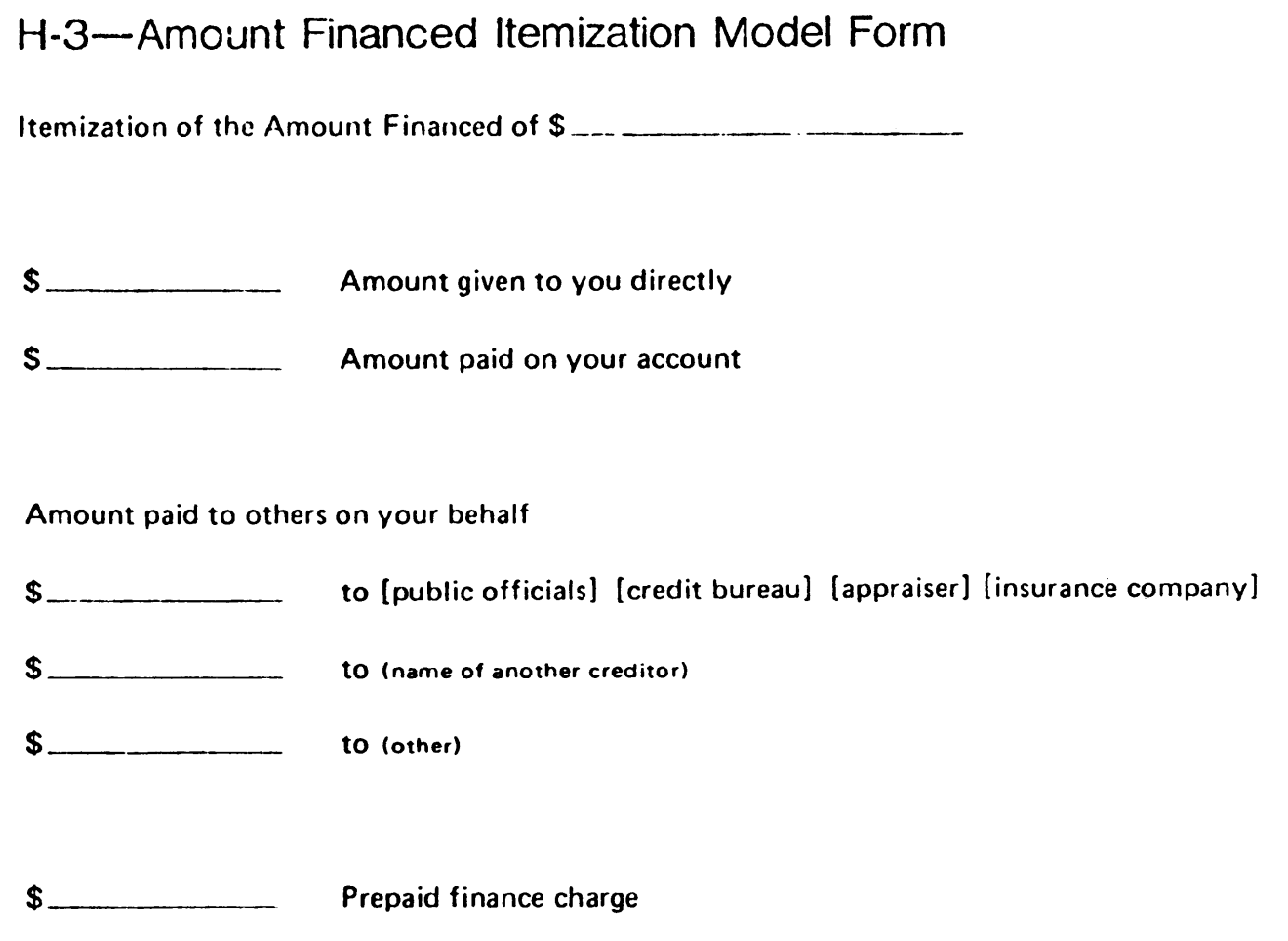

H-3 Amount Financed Itemization Model Form (§ 1026.18(c))

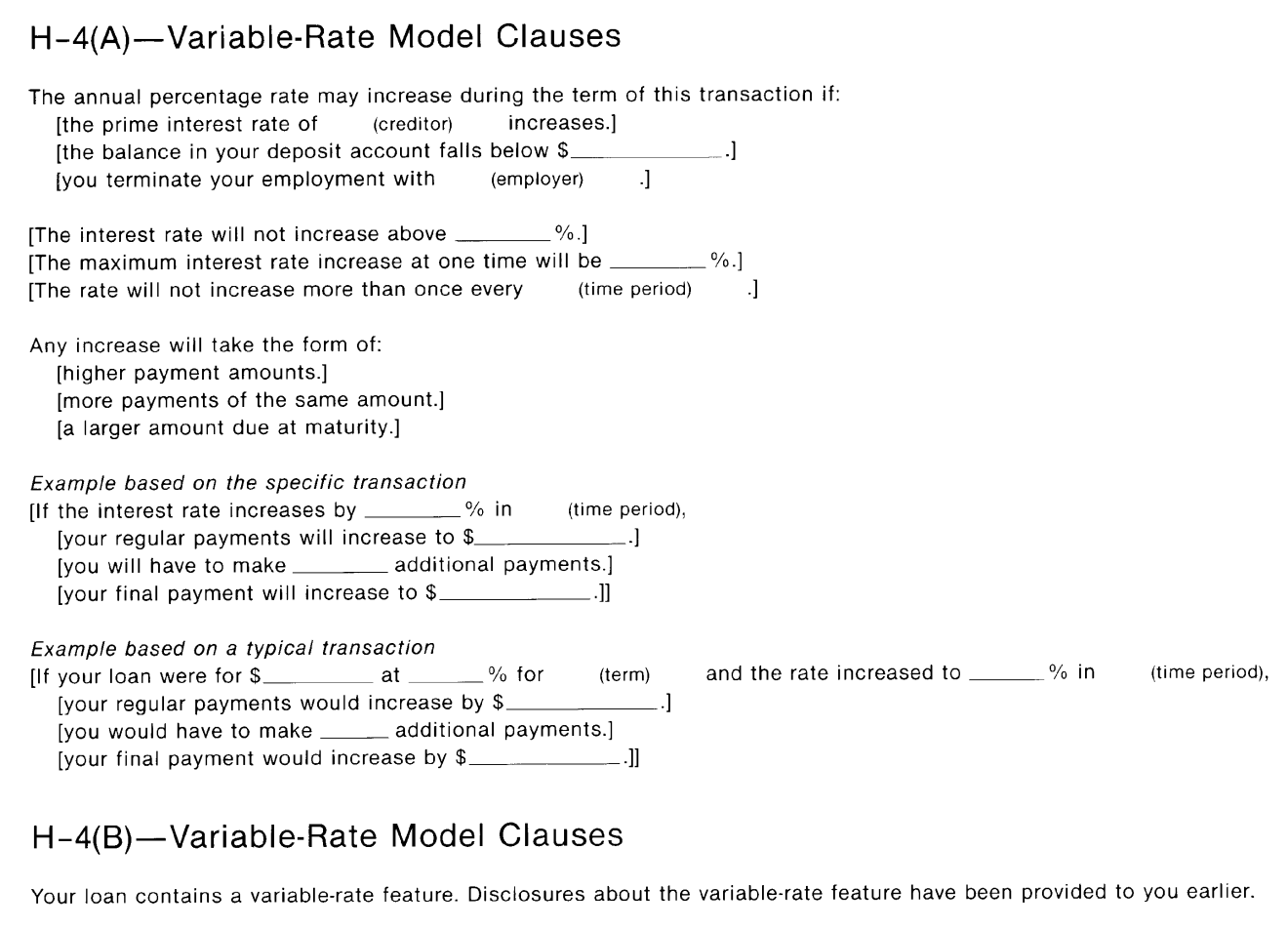

H-4(A) Variable-Rate Model Clauses (§ 1026.18(f)(1))

H-4(B) Variable-Rate Model Clauses (§ 1026.18(f)(2))

H-4(C) Variable-Rate Model Clauses (§ 1026.19(b))

H-4(D) Variable-Rate Model Clauses (§ 1026.20(c))

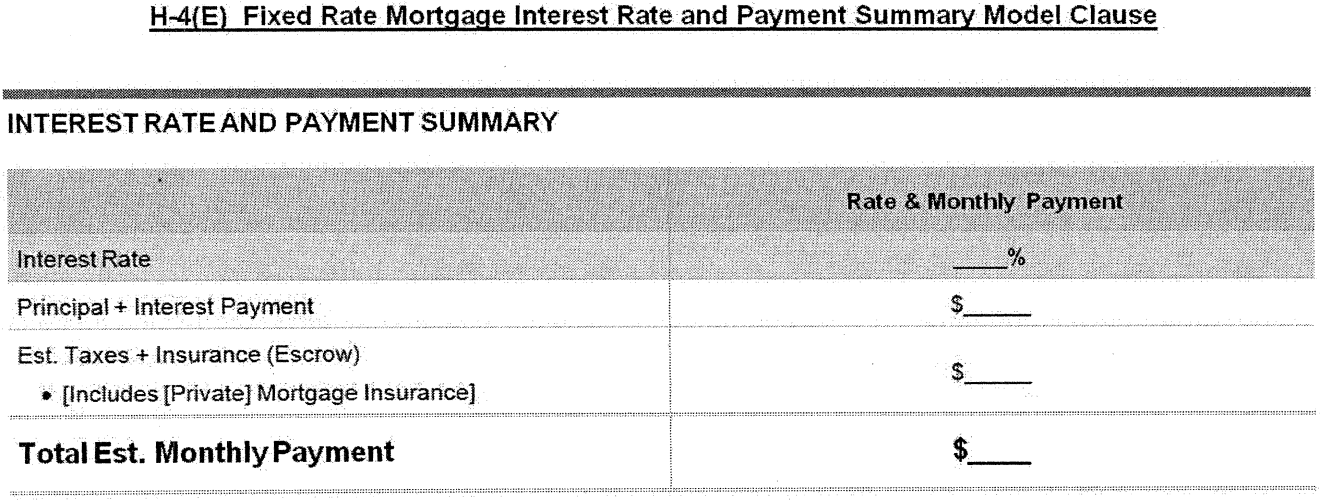

H-4(E) Fixed-Rate Mortgage Interest Rate and Payment Summary Model Clause (§ 1026.18(s))

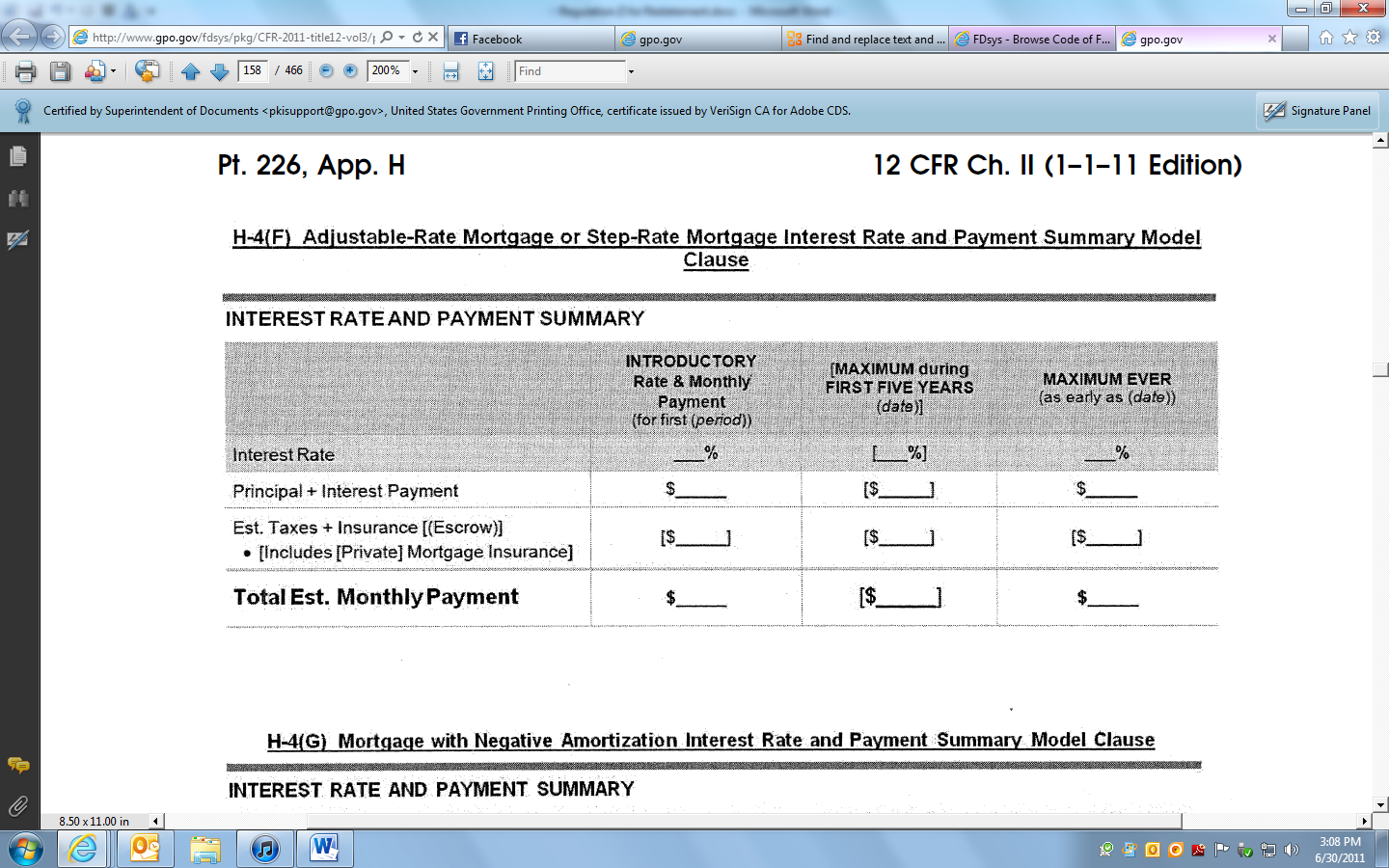

H-4(F) Adjustable-Rate Mortgage or Step-Rate Mortgage Interest Rate and Payment Summary Model Clause (§ 1026.18(s))

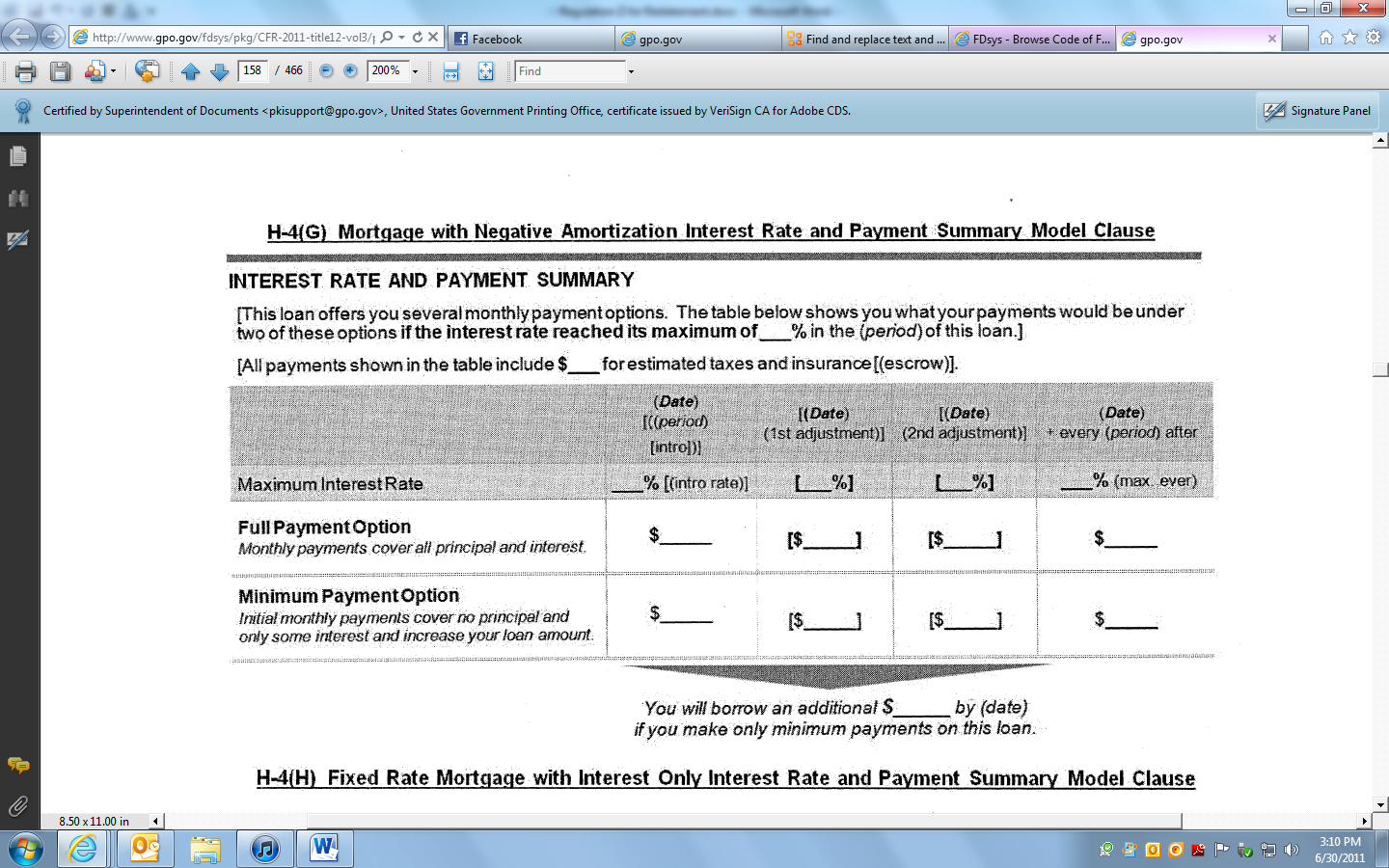

H-4(G) Mortgage with Negative Amortization Interest Rate and Payment Summary Model Clause (§ 1026.18(s))

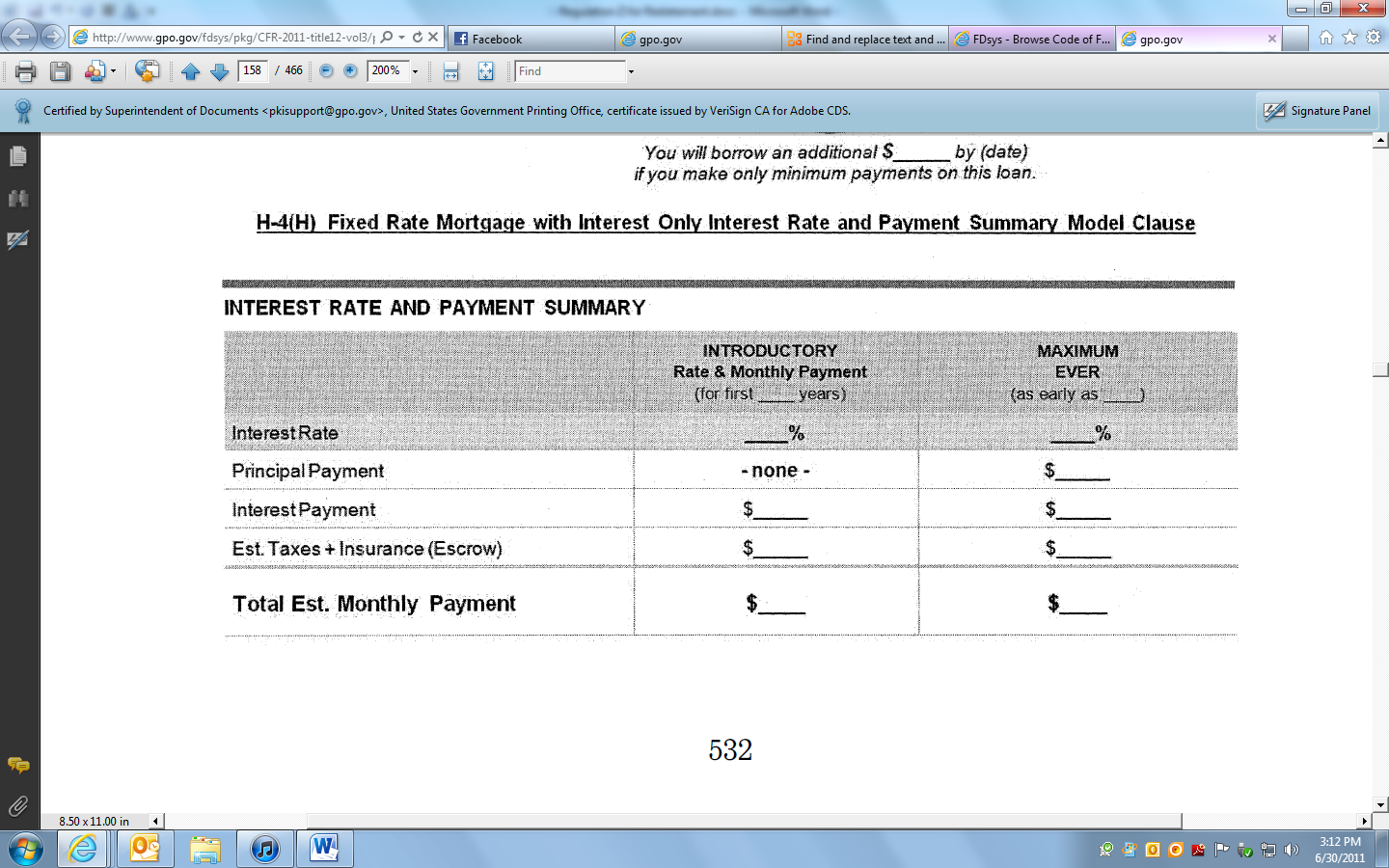

H-4(H) Fixed-Rate Mortgage with Interest-Only Interest Rate and Payment Summary Model Clause (§ 1026.18(s))

H-4(I) Adjustable-Rate Mortgage Introductory Rate Disclosure Model Clause (§ 1026.18(s)(2)(iii))

H-4(J) Balloon Payment Disclosure Model Clause (§ 1026.18(s)(5))

H-4(K) No Guarantee to Refinance Statement Model Clause (§ 1026.18(t))

H-5 Demand Feature Model Clauses (§ 1026.18(i))

H-6 Assumption Policy Model Clause (§ 1026.18(q))

H-7 Required Deposit Model Clause (§ 1026.18(r))

H-8 Rescission Model Form (General) (§ 1026.23)

H-9 Rescission Model Form (Refinancing (with Original Creditor)) (§ 1026.23)

H-10 Credit Sale Sample

H-11 Installment Loan Sample

H-12 Refinancing Sample

H-13 Mortgage with Demand Feature Sample

H-14 Variable-Rate Mortgage Sample (§ 1026.19(b))

H-15 Graduated-Payment Mortgage Sample

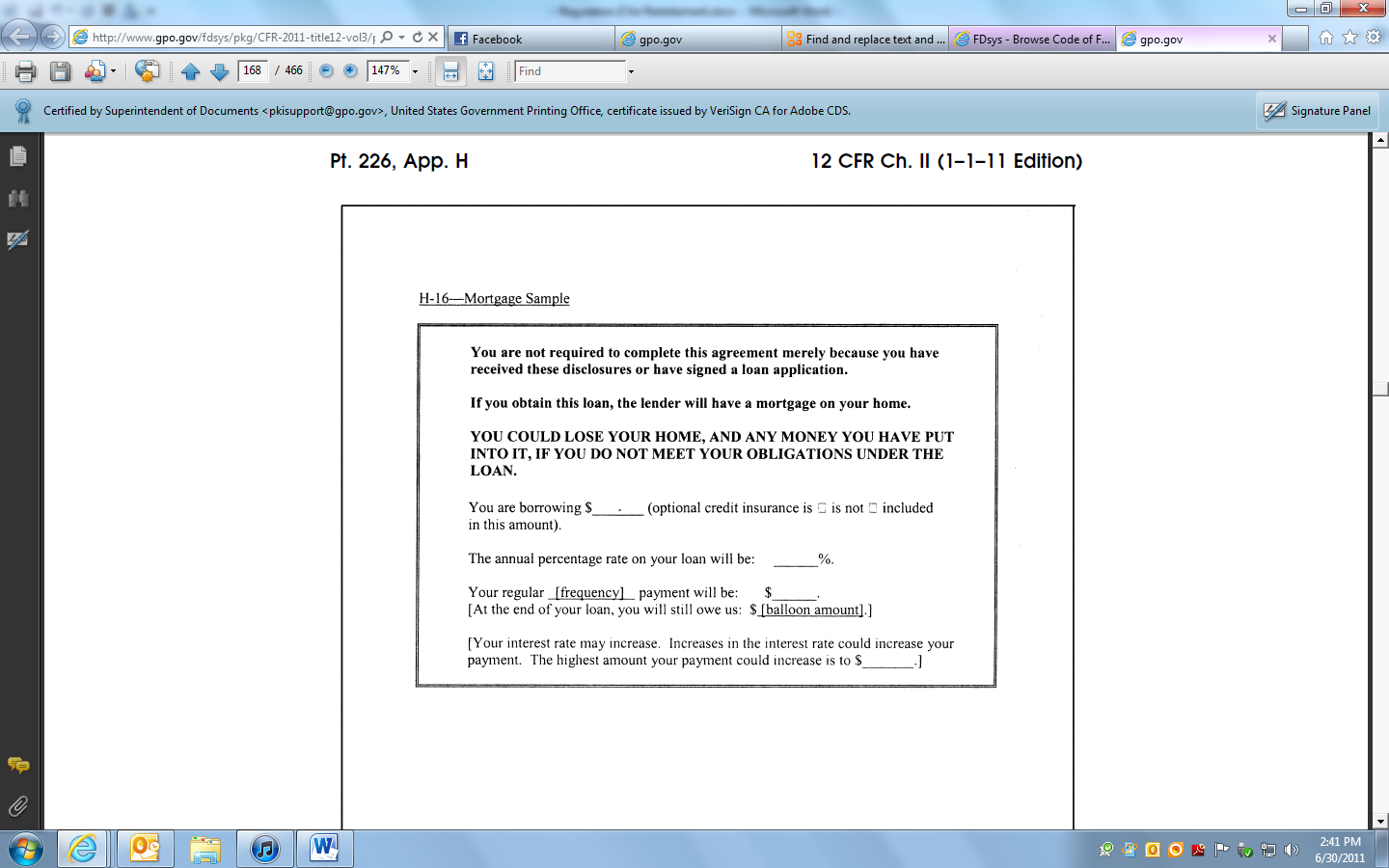

H-16 Mortgage Sample

H-17(A) Debt Suspension Model Clause

H-17(B) Debt Suspension Sample

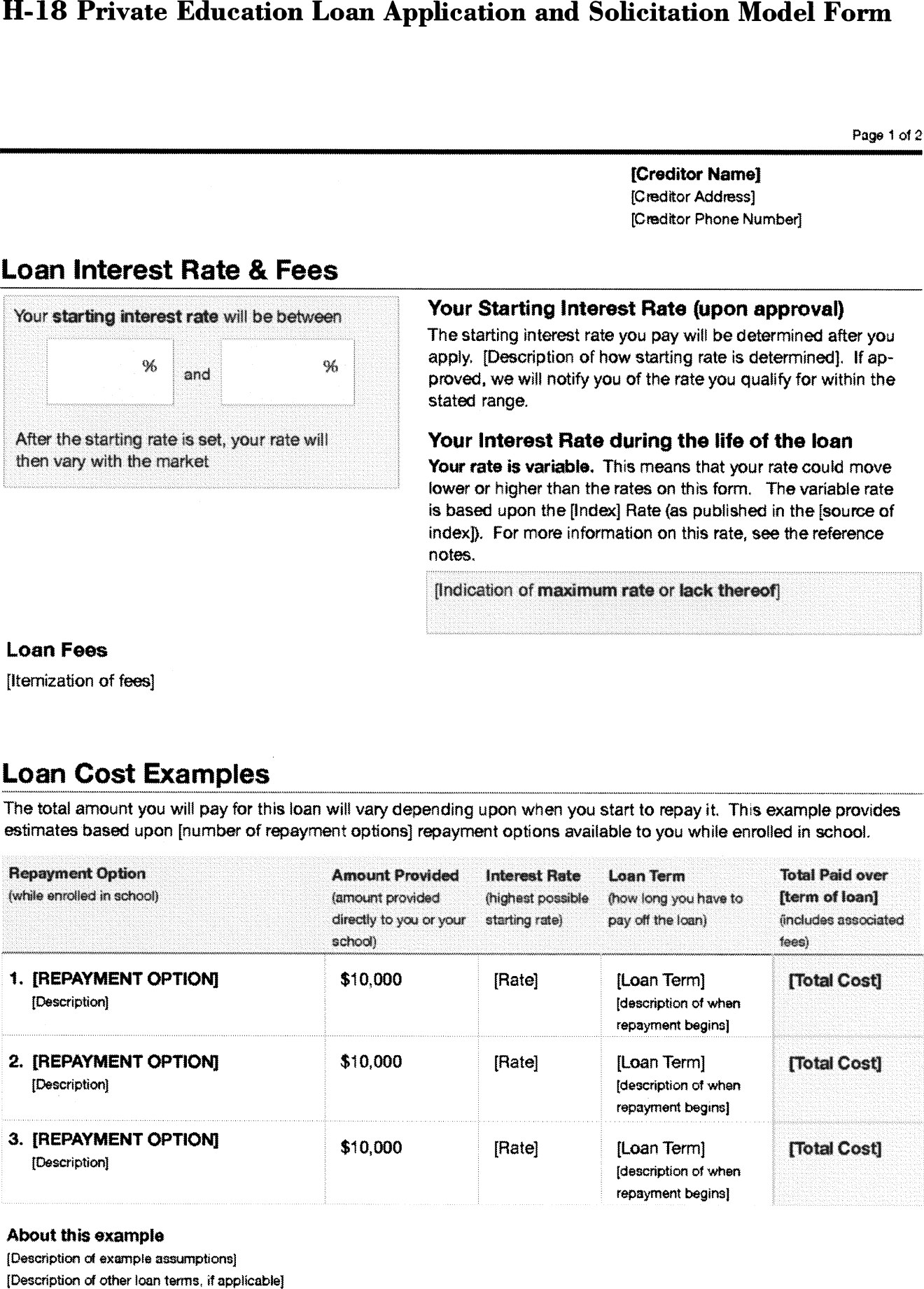

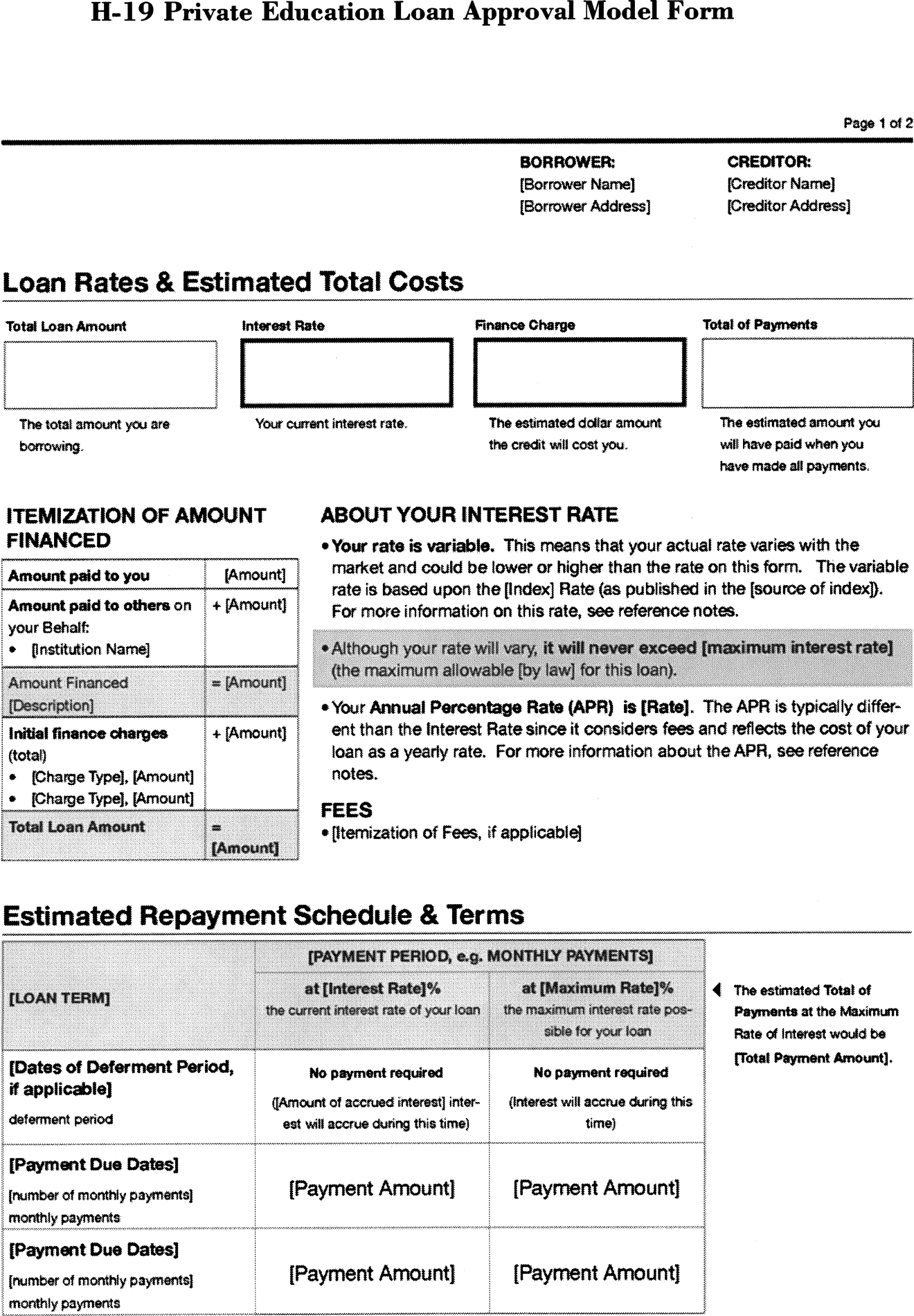

H-18 Private Education Loan Application and Solicitation Model Form

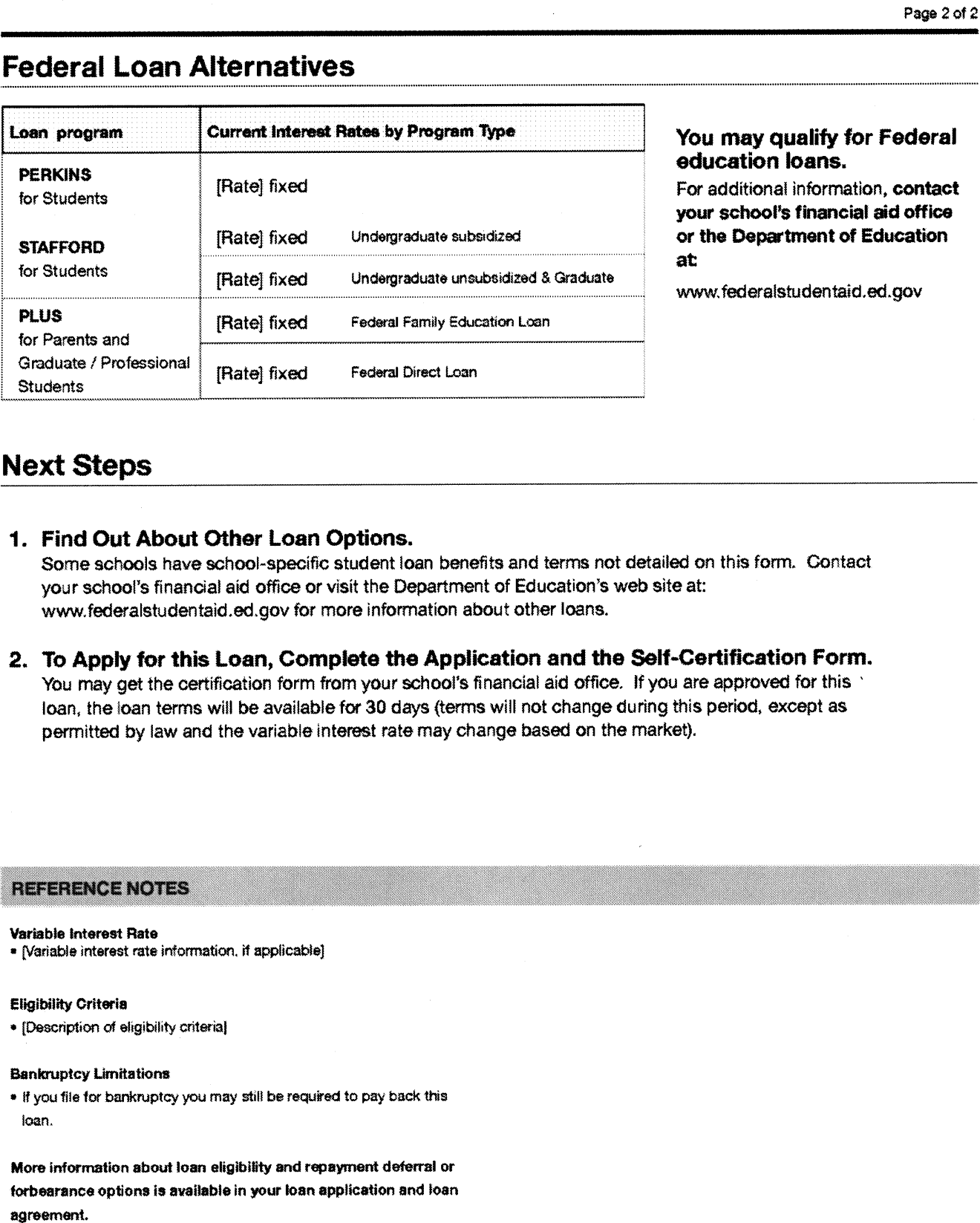

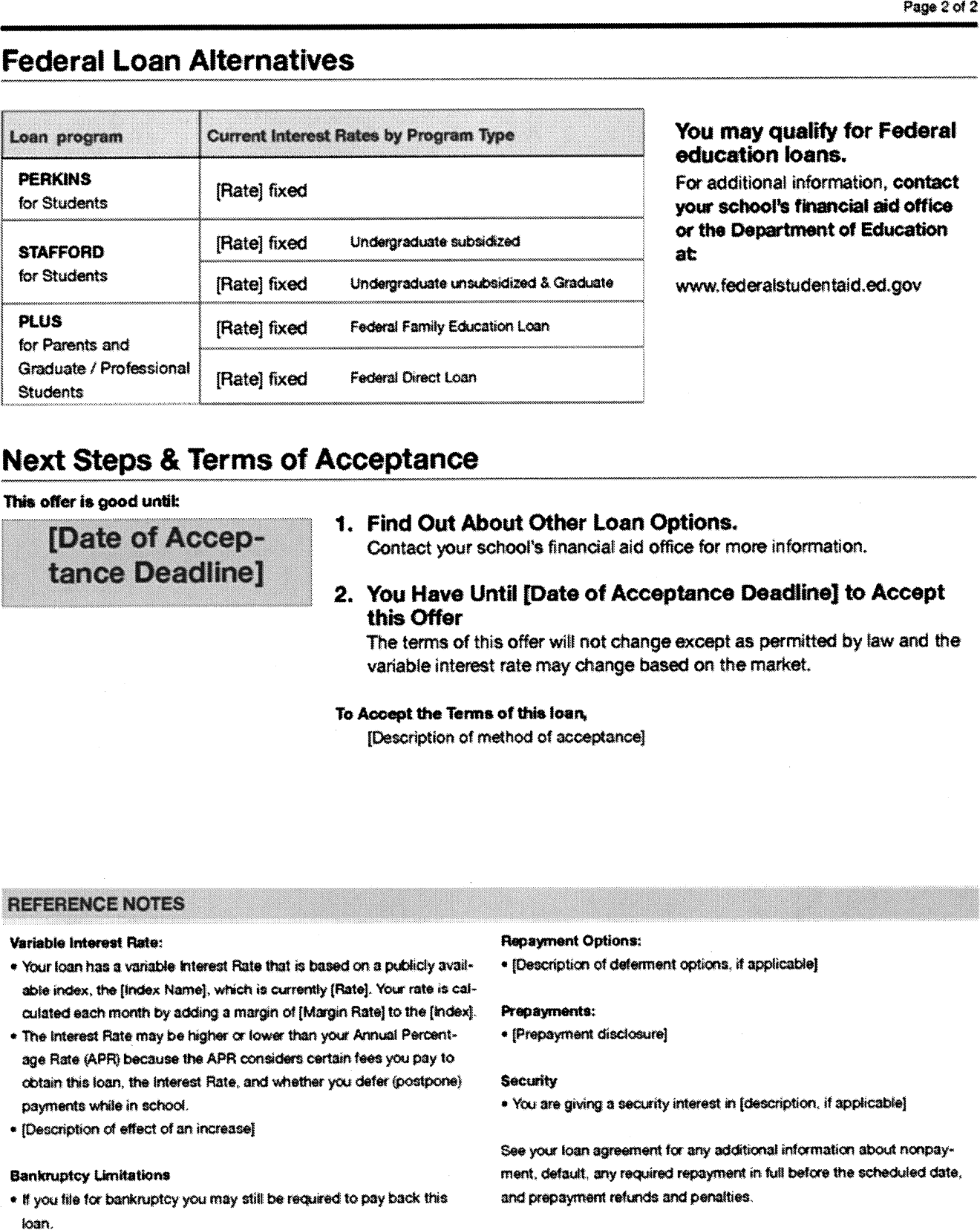

H-19 Private Education Loan Approval Model Form

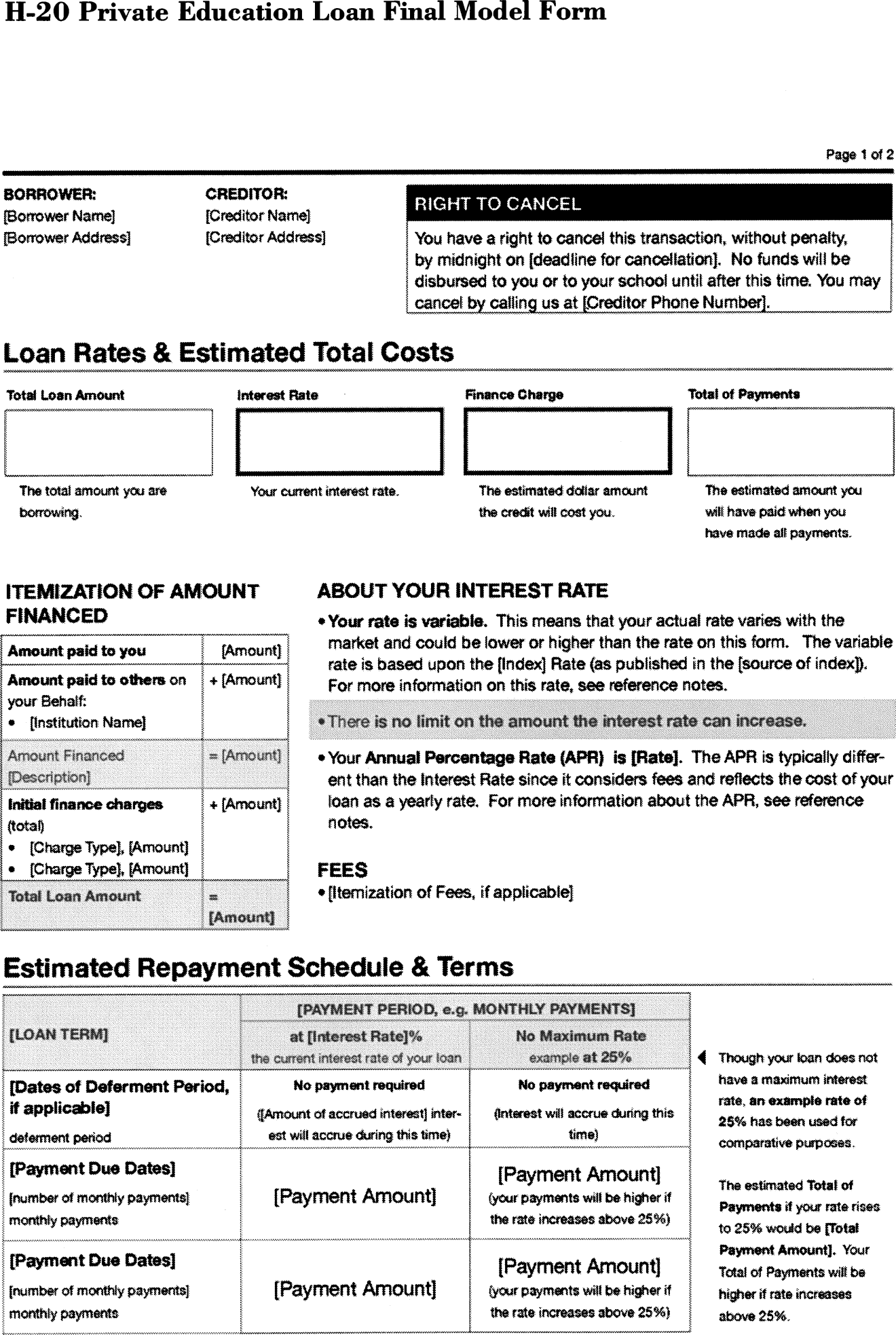

H-20 Private Education Loan Final Model Form

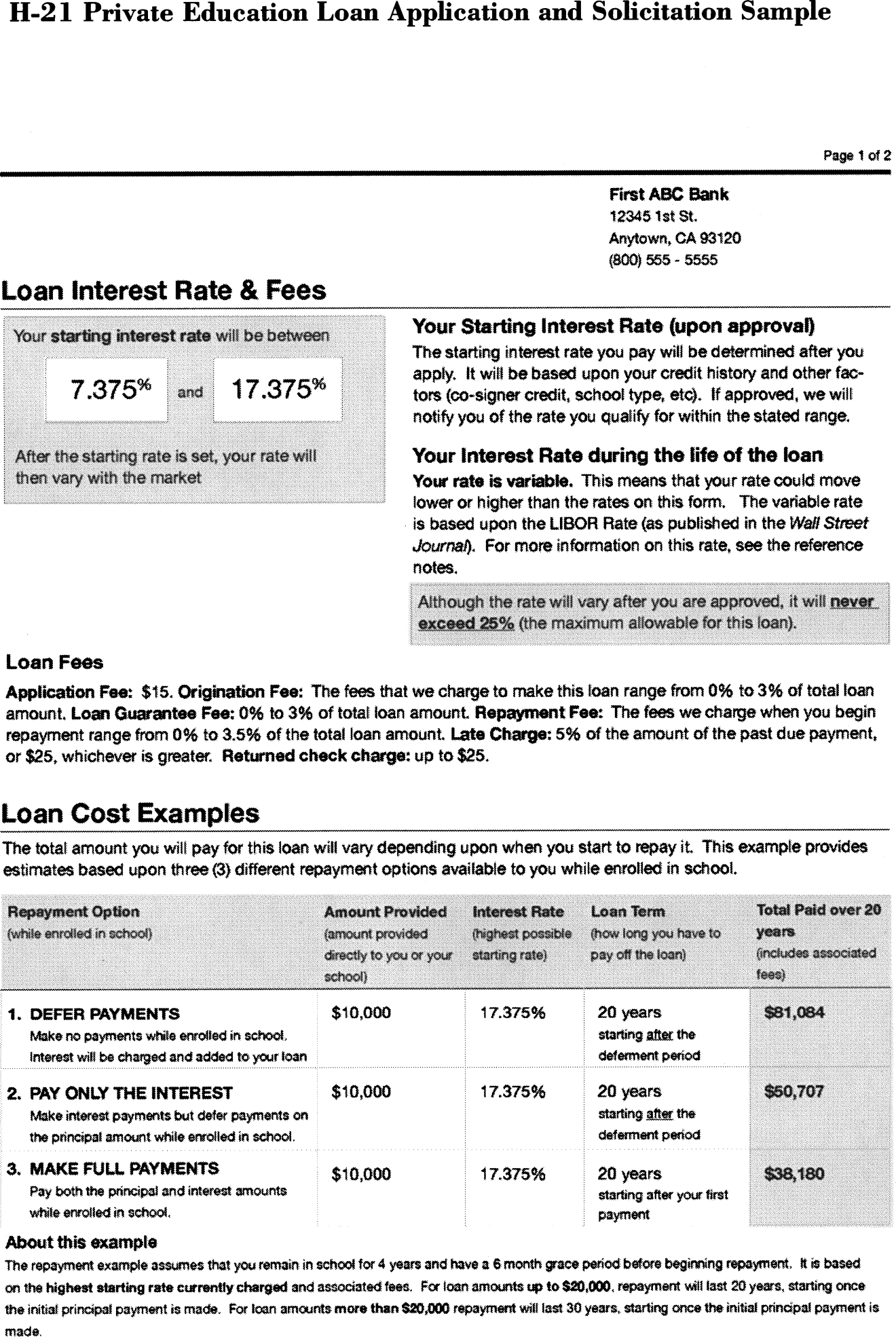

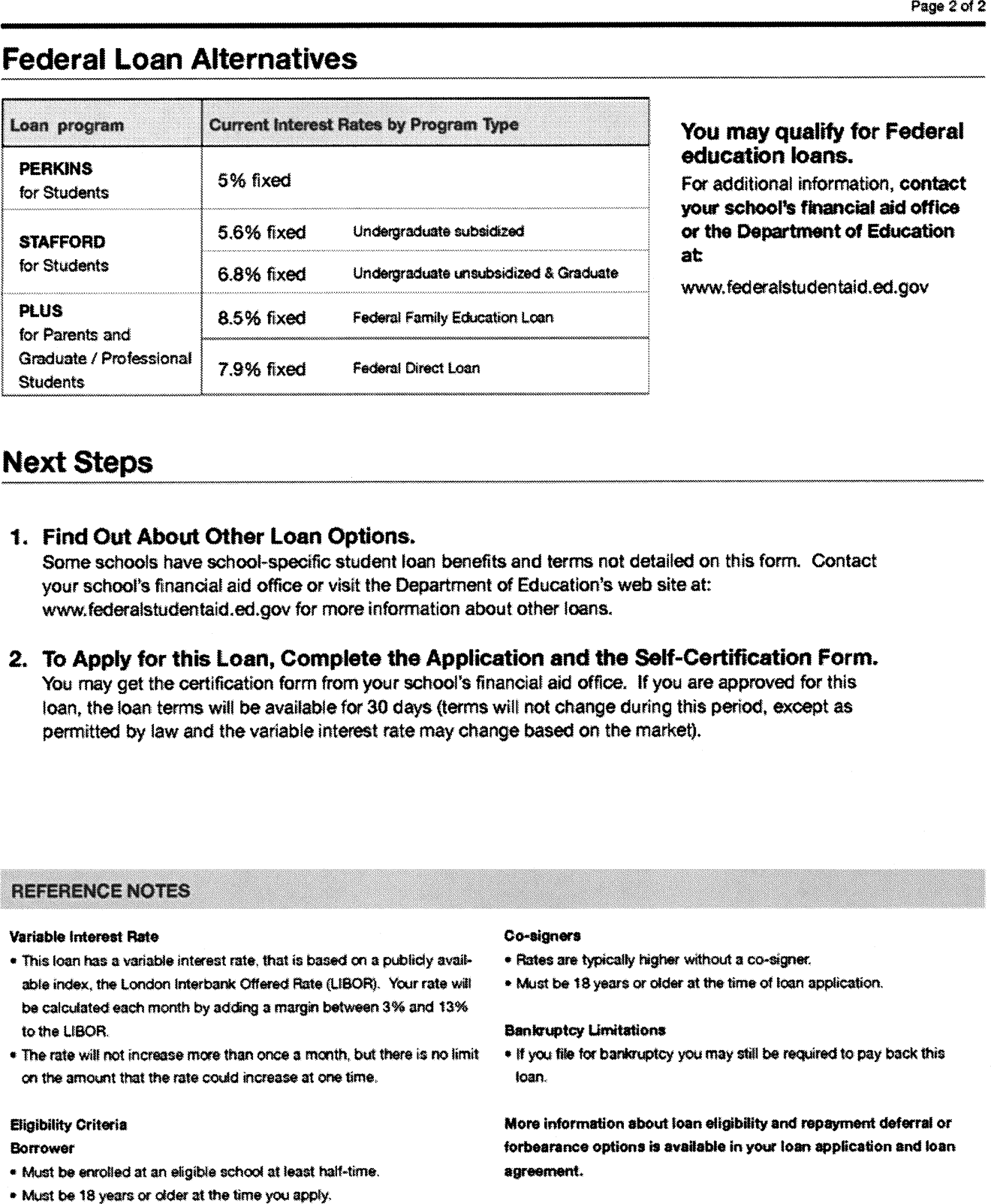

H-21 Private Education Loan Application and Solicitation Sample

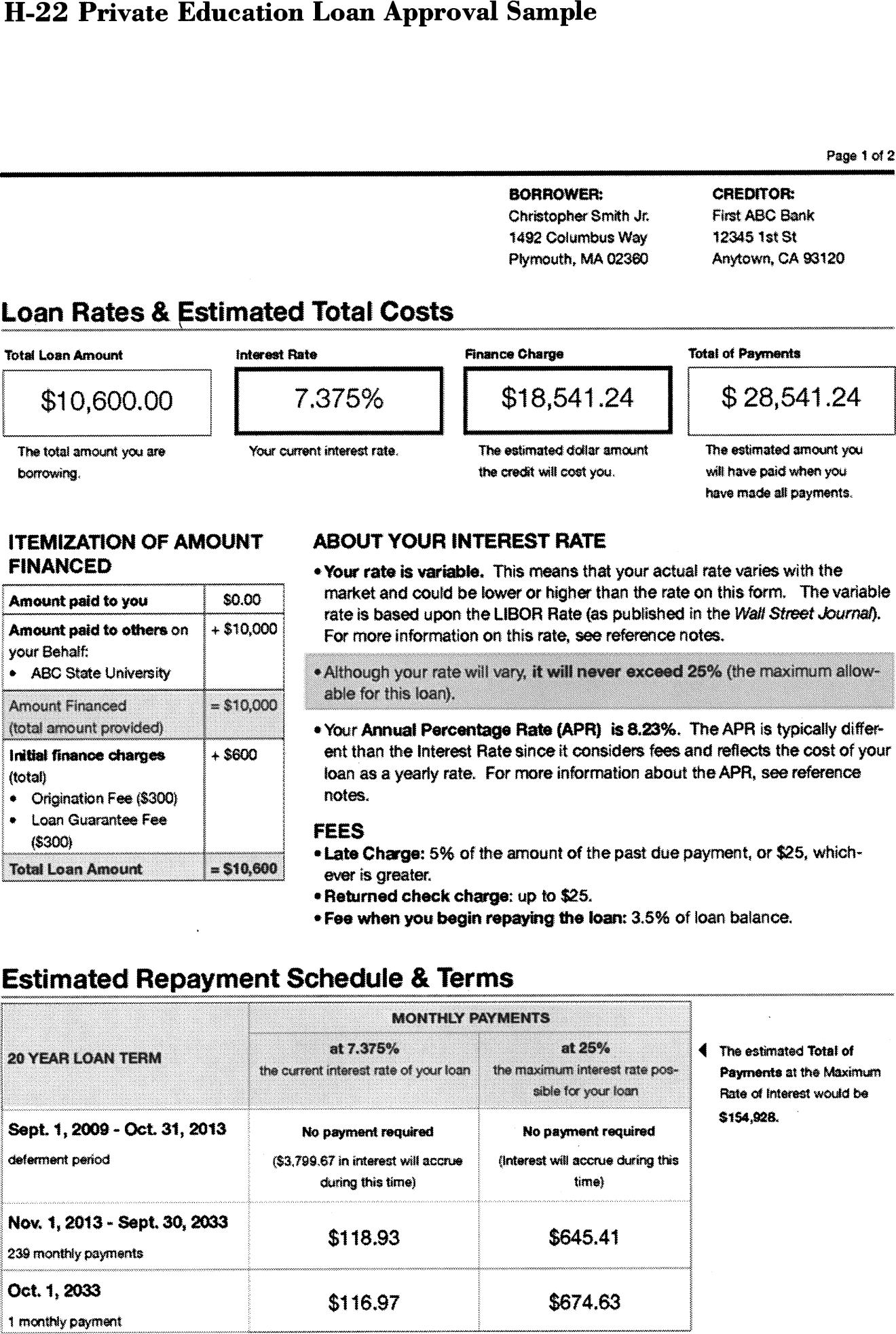

H-22 Private Education Loan Approval Sample

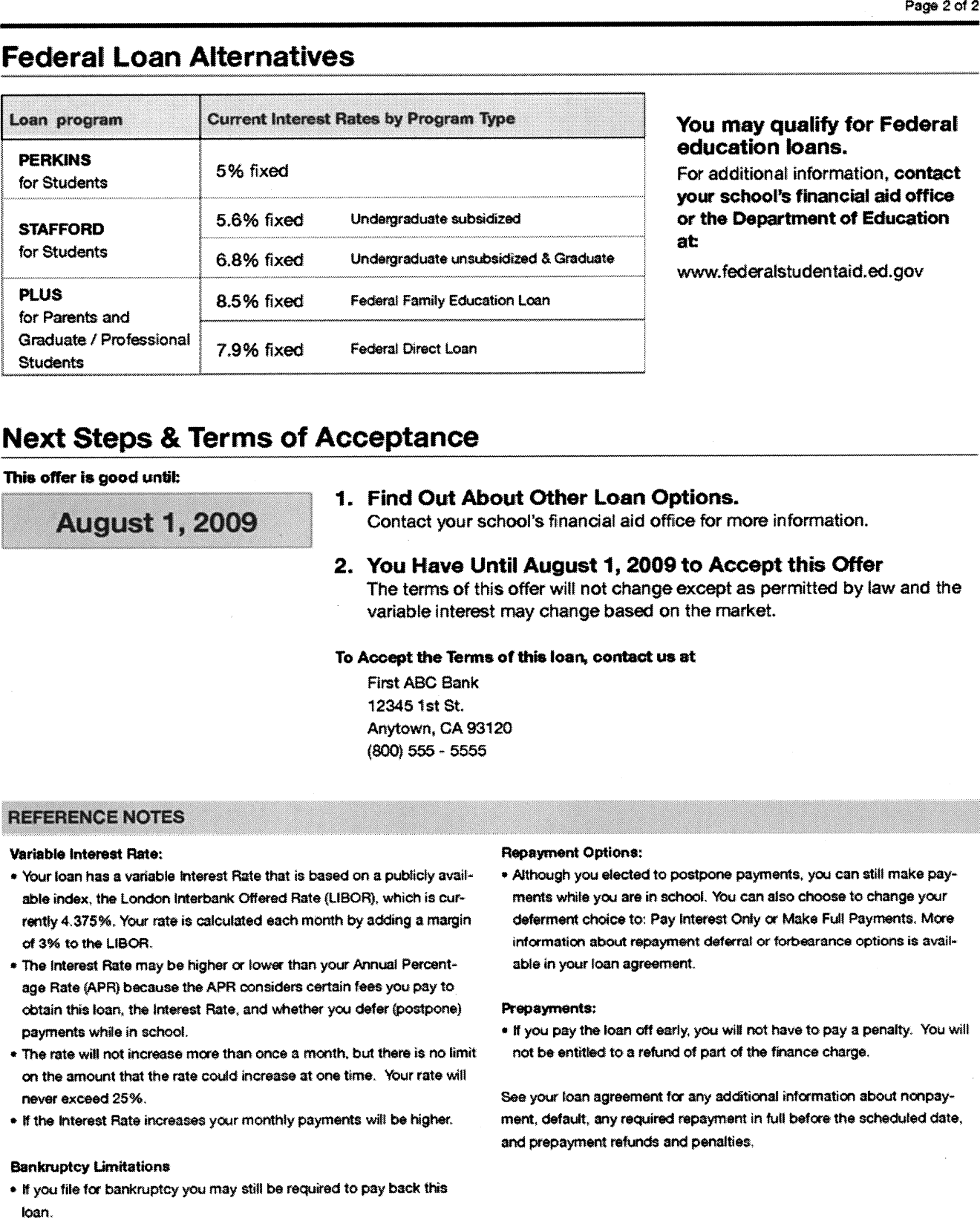

H-23 Private Education Loan Final Sample

H-4(C)—Variable-Rate Model Clauses

This disclosure describes the features of the adjustable-rate mortgage (ARM) program you are considering. Information on other ARM programs is available upon request.

How Your Interest Rate and Payment Are Determined

• Your interest rate will be based on [an index plus a margin] [a formula].

• Your payment will be based on the interest rate, loan balance, and loan term.

—[The interest rate will be based on (identification of index) plus our margin. Ask for our current interest rate and margin.]

—[The interest rate will be based on (identification of formula). Ask us for our current interest rate.]

—Information about the index [formula for rate adjustments] is published [can be found] ________.

—[The initial interest rate is not based on the (index) (formula) used to make later adjustments. Ask us for the amount of current interest rate discounts.]

How Your Interest Rate Can Change

• Your interest rate can change (frequency).

• [Your interest rate cannot increase or decrease more than ___ percentage points at each adjustment.]

• Your interest rate cannot increase [or decrease] more than ___ percentage points over the term of the loan.

How Your Payment Can Change

• Your payment can change (frequency) based on changes in the interest rate.

• [Your payment cannot increase more than (amount or percentage) at each adjustment.]

• You will be notified in writing ____ days before the due date of a payment at a new level. This notice will contain information about your interest rates, payment amount, and loan balance.

• [You will be notified once each year during which interest rate adjustments, but no payment adjustments, have been made to your loan. This notice will contain information about your interest rates, payment amount, and loan balance.]

• [For example, on a $10,000 [term] loan with an initial interest rate of ____ [(the rate shown in the interest rate column below for the year 19 ____)] [(in effect (month) (year)], the maximum amount that the interest rate can rise under this program is ____ percentage points, to ____%, and the monthly payment can rise from a first-year payment of $____ to a maximum of $____ in the _____ year. To see what your payments would be, divide your mortgage amount by $10,000; then multiply the monthly payment by that amount. (For example, the monthly payment for a mortgage amount of $60,000 would be: $60,000 ÷ $10,000 = 6; 6 × ____ = $____ per month.)]

[Example

The example below shows how your payments would have changed under this ARM program based on actual changes in the index from 1982 to 1996. This does not necessarily indicate how your index will change in the future.

The example is based on the following assumptions:

Amount |

$10,000 |

Term |

_____ |

Change date |

_____ |

Payment adjustment |

(frequency) |

Interest adjustment |

(frequency) |

[Margin]* |

____ |

Caps ____ [periodic interest rate cap] |

|

____ [lifetime interest rate cap |

|

____ [payment cap] |

|

[Interest rate carryover] |

|

[Negative amortization] |

|

[Interest rate discount]** |

|

Index.......(identification of index or formula) |

|

*This is a margin we have used recently, your margin may be different.

**This is the amount of a discount we have provided recently; your loan may be discounted by a different amount.]

Year |

Index |

Margin |

Interest |

Monthly |

Remaining |

1982 |

|

|

|

|

|

1983 |

|

|

|

|

|

1984 |

|

|

|

|

|

1985 |

|

|

|

|

|

1986 |

|

|

|

|

|

1987 |

|

|

|

|

|

1988 |

|

|

|

|

|

1989 |

|

|

|

|

|

1990 |

|

|

|

|

|

1991 |

|

|

|

|

|

1992 |

|

|

|

|

|

1993 |

|

|

|

|

|

1994 |

|

|

|

|

|

1995 |

|

|

|

|

|

1996 |

|

|

|

|

|

Note: To see what your payments would have been during that period, divide your mortgage amount by $10,000; then multiply the monthly payment by that amount. (For example, in 1996 the monthly payment for a mortgage amount of $60,000 taken out in 1982 would be: $60,000÷$10,000=6; 6×____=$____ per month.)

H-4(I)—Introductory Rate Model Clause

[Introductory Rate Notice

You have a discounted introductory rate of ____ % that ends after (period).

In the (period in sequence), even if market rates do not change, this rate will increase to __ %.]

H-4(J)—Balloon Payment Model Clause

[Final Balloon Payment due (date): $____]

H-4(K)—“No-Guarantee-to-Refinance” Statement Model Clause

There is no guarantee that you will be able to refinance to lower your rate and payments.

H-9—Rescission Model Form (Refinancing with Original Creditor)

NOTICE OF RIGHT TO CANCEL

Your Right To Cancel

You are entering into a new transaction to increase the amount of credit previously provided to you. Your home is the security for this new transaction. You have a legal right under federal law to cancel this new transaction, without cost, within three business days from whichever of the following events occurs last:

(1) the date of this new transaction, which is ________; or

(2) the date you received your new Truth in Lending disclosures; or

(3) the date you received this notice of your right to cancel.

If you cancel this new transaction, it will not affect any amount that you presently owe. Your home is the security for that amount. Within 20 calendar days after we receive your notice of cancellation of this new transaction, we must take the steps necessary to reflect the fact that your home does not secure the increase of credit. We must also return any money you have given to us or anyone else in connection with this new transaction.

You may keep any money we have given you in this new transaction until we have done the things mentioned above, but you must then offer to return the money at the address below.

If we do not take possession of the money within 20 calendar days of your offer, you may keep it without further obligation.

How To Cancel

If you decide to cancel this new transaction, you may do so by notifying us in writing, at

____________________

(Creditor's name and business address).

You may use any written statement that is signed and dated by you and states your intention to cancel, or you may use this notice by dating and signing below. Keep one copy of this notice because it contains important information about your rights.

If you cancel by mail or telegram, you must send the notice no later than midnight of

____________________

(Date)____________________

(or midnight of the third business day following the latest of the three events listed above).

If you send or deliver your written notice to cancel some other way, it must be delivered to the above address no later than that time.

I WISH TO CANCEL

____________________

Consumer's Signature

____________________

Date

H-14—Variable-Rate Mortgage Sample

This disclosure describes the features of the adjustable-rate mortgage (ARM) program you are considering. Information on other ARM programs is available upon request.

How Your Interest Rate and Payment Are Determined

• Your interest rate will be based on an index rate plus a margin.

• Your payment will be based on the interest rate, loan balance, and loan term.

—The interest rate will be based on the weekly average yield on United States Treasury securities adjusted to a constant maturity of 1 year (your index), plus our margin. Ask us for our current interest rate and margin.

—Information about the index rate is published weekly in the Wall Street Journal.

• Your interest rate will equal the index rate plus our margin unless your interest rate “caps” limit the amount of change in the interest rate.

How Your Interest Rate Can Change

• Your interest rate can change yearly.

• Your interest rate cannot increase or decrease more than 2 percentage points per year.

• Your interest rate cannot increase or decrease more than 5 percentage points over the term of the loan.

How Your Monthly Payment Can Change

• Your monthly payment can increase or decrease substantially based on annual changes in the interest rate.

• [For example, on a $10,000, 30-year loan with an initial interest rate of 12.41 percent in effect in July 1996, the maximum amount that the interest rate can rise under this program is 5 percentage points, to 17.41 percent, and the monthly payment can rise from a first-year payment of $106.03 to a maximum of $145.34 in the fourth year. To see what your payment is, divide your mortgage amount by $10,000; then multiply the monthly payment by that amount. (For example, the monthly payment for a mortgage amount of $60,000 would be: $60,000÷$10,000=6; 6×106.03=$636.18 per month.)

• You will be notified in writing 25 days before the annual payment adjustment may be made. This notice will contain information about your interest rates, payment amount and loan balance.]

[Example

The example below shows how your payments would have changed under this ARM program based on actual changes in the index from 1982 to 1996. This does not necessarily indicate how your index will change in the future. The example is based on the following assumptions:

Amount |

$10,000 |

|||||

Term |

30 years |

|||||

Payment adjustment |

1 year |

|||||

Interest adjustment |

1 year |

|||||

Margin |

3 percentage points |

|||||

Caps____ 2 percentage points annual interest rate |

||||||

____ 5 percentage points lifetime interest rate |

||||||

Index____ Weekly average yield on U.S. Treasury securities adjusted to a constant maturity of one year. |

||||||

Year |

Index |

Margin* |

Interest |

Monthly |

Remaining |

|

1982 |

14.41 |

3 |

17.41 |

145.90 |

9,989.37 |

|

1983 |

9.78 |

3 |

**15.41 |

129.81 |

9,969.66 |

|

1984 |

12.17 |

3 |

15.17 |

127.91 |

9,945.51 |

|

1985 |

7.66 |

3 |

**13.17 |

112.43 |

9,903.70 |

|

1986 |

6.36 |

3 |

***12.41 |

106.73 |

9,848.94 |

|

1987 |

6.71 |

3 |

***12.41 |

106.73 |

9,786.98 |

|

1988 |

7.52 |

3 |

***12.41 |

106.73 |

9,716.88 |

|

1989 |

7.97 |

3 |

***12.41 |

106.73 |

9,637.56 |

|

1990 |

8.06 |

3 |

***12.41 |

106.73 |

9,547.83 |

|

1991 |

6.40 |

3 |

***12.41 |

106.73 |

9,446.29 |

|

1992 |

3.96 |

3 |

***12.41 |

106.73 |

9,331.56 |

|

1993 |

3.42 |

3 |

***12.41 |

106.73 |

9,201.61 |

|

1994 |

5.47 |

3 |

***12.41 |

106.73 |

9,054.72 |

|

1995 |

5.53 |

3 |

***12.41 |

106.73 |

8,888.52 |

|

1996 |

5.82 |

3 |

***12.41 |

106.73 |

8,700.37 |

|

*This is a margin we have used recently; your margin may be different.

**This interest rate reflects a 2 percentage point annual interest rate cap.

***This interest rate reflects a 5 percentage point lifetime interest rate cap.

Note: To see what your payments would have been during that period, divide your mortgage amount by $10,000; then multiply the monthly payment by that amount. (For example, in 1996 the monthly payment for a mortgage amount of $60,000 taken out in 1982 would be: $60,000÷$10,000=6; 6×$106.73=$640.38.)

• You will be notified in writing 25 days before the annual payment adjustment may be made. This notice will contain information about your interest rates, payment amount and loan balance.]

H-17(A) Debt Suspension Model Clause

Please enroll me in the optional [insert name of program], and bill my account the fee of [insert charge for the initial term of coverage]. I understand that enrollment is not required to obtain credit. I also understand that depending on the event, the protection may only temporarily suspend my duty to make minimum payments, not reduce the balance I owe. I understand that my balance will actually grow during the suspension period as interest continues to accumulate.

[To Enroll, Sign Here]/[To Enroll, Initial Here]. X __________

H-17(B) Debt Suspension Sample

Please enroll me in the optional [name of program], and bill my account the fee of $200.00. I understand that enrollment is not required to obtain credit. I also understand that depending on the event, the protection may only temporarily suspend my duty to make minimum payments, not reduce the balance I owe. I understand that my balance will actually grow during the suspension period as interest continues to accumulate.

To Enroll, Initial Here. X __________

Appendix I to Part 1026—[Reserved]

| File Type | application/msword |

| Author | Paul |

| Last Modified By | Whitney Patross |

| File Modified | 2011-10-27 |

| File Created | 2011-10-27 |

© 2026 OMB.report | Privacy Policy