Cognitive Interviews for the Survey of New Foreign Direct Investment; Usability Testing of the BRDIS Internet Reporting Application

Generic Clearence for Questionnaire Pretesting Research

OMBBE-13enc1.xls

Cognitive Interviews for the Survey of New Foreign Direct Investment; Usability Testing of the BRDIS Internet Reporting Application

OMB: 0607-0725

⚠️ Notice: This form may be outdated. More recent filings and information on OMB 0607-0725 can be found here:

Document [xlsx]

Download: xlsx | pdf

Part I - Transaction

Part II - Acquisition

Part III - Establishment

Part IV - Merger

Part V - Expansion

Part VI - Exemption

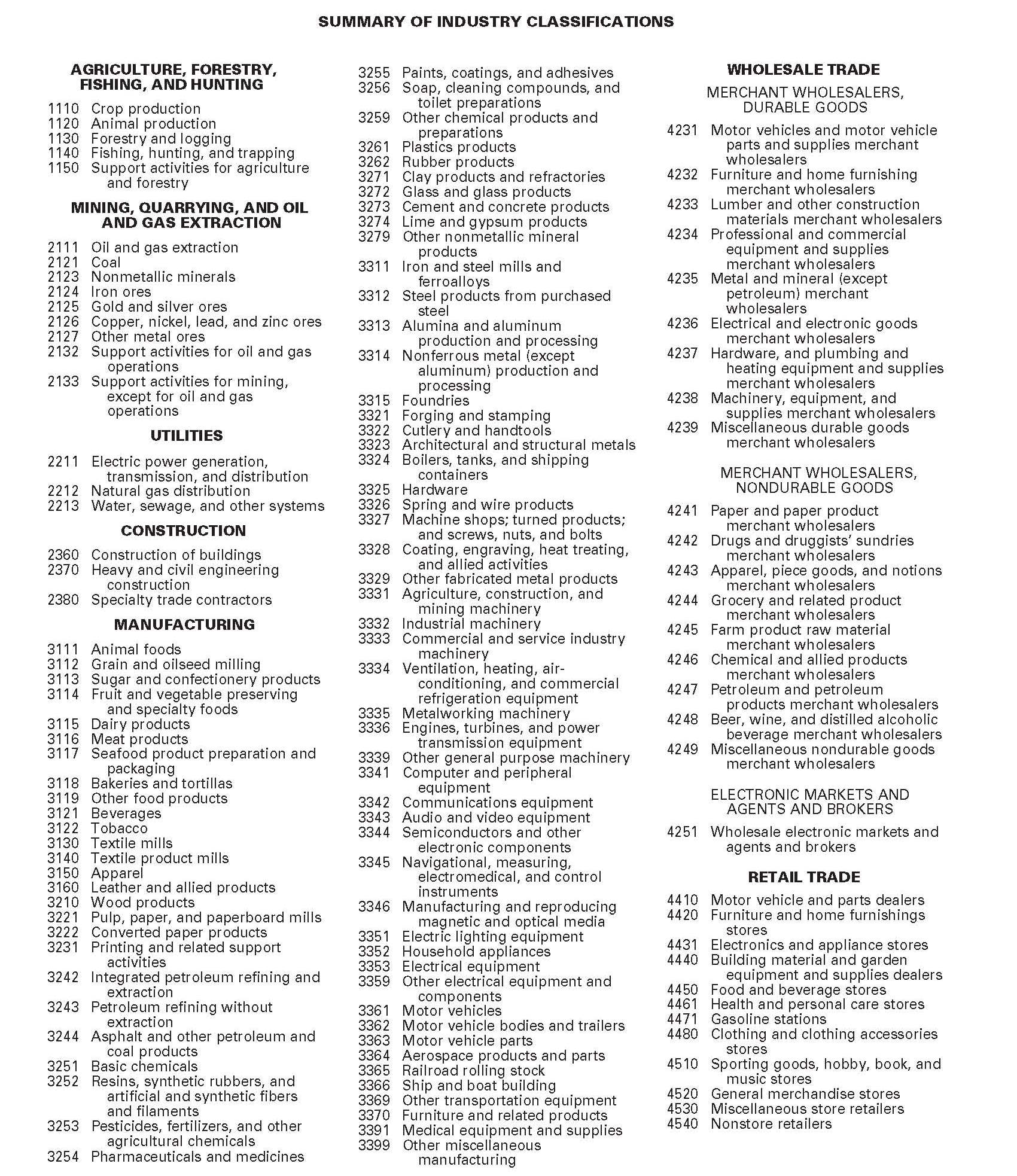

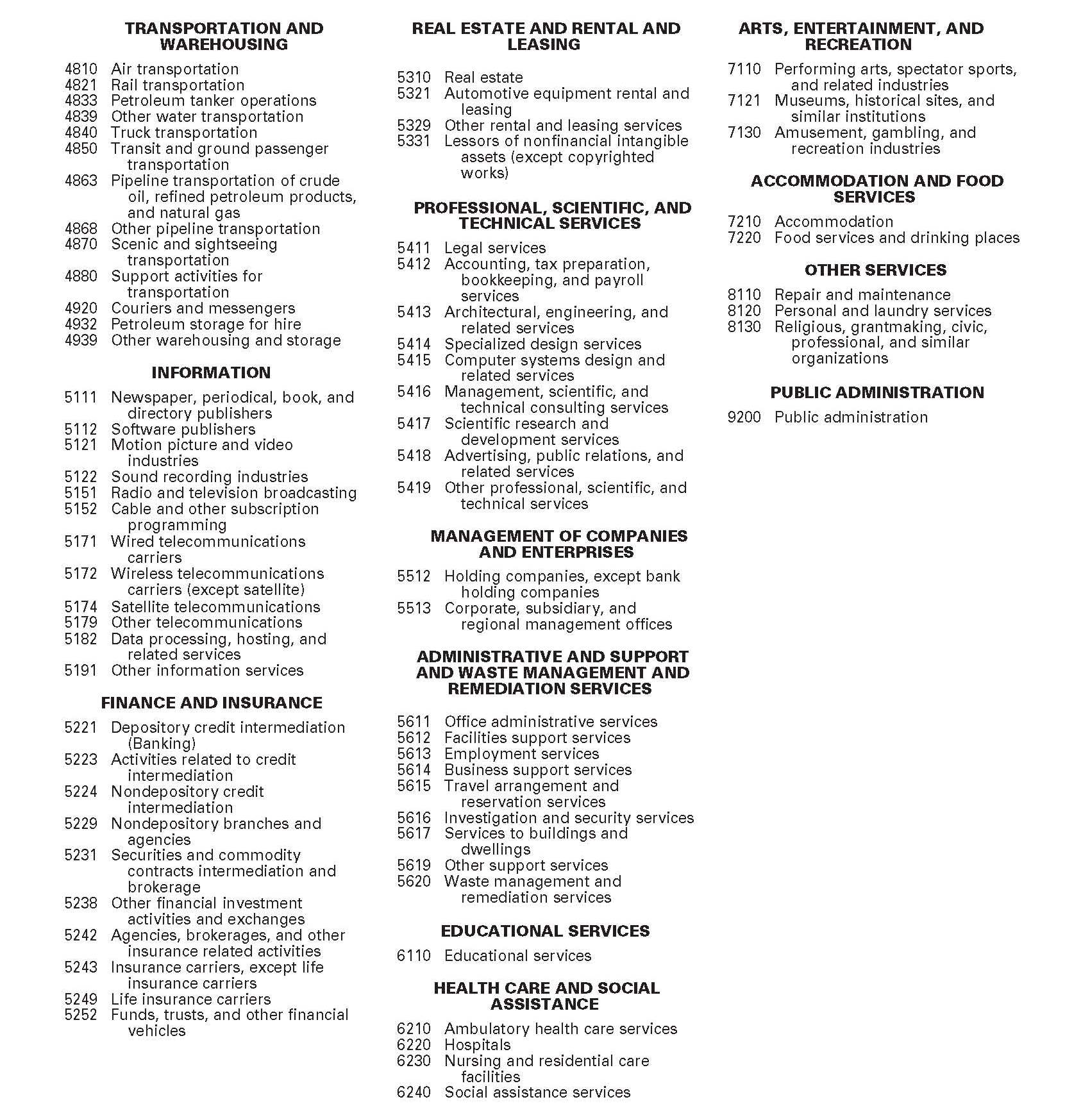

Industry codes

Definitions

Overview

Survey infoPart I - Transaction

Part II - Acquisition

Part III - Establishment

Part IV - Merger

Part V - Expansion

Part VI - Exemption

Industry codes

Definitions

Sheet 1: Survey info

| BEA LOGO | OMB Control No. 0608-0035: Approval Expires XX/XX/201X |

| SURVEY OF NEW FOREIGN DIRECT INVESTMENT IN THE UNITED STATES | |

| FORM BE-13 | |

| MANDATORY -- CONFIDENTIAL | |

| Electronic filing: | Go to www.bea.gov/efile for details |

| Mail reports to: | U.S. Department of Commerce |

| Bureau of Economic Analysis, BE-49(NI) | |

| Washington, DC 20230 | |

| Deliver reports to: | U.S. Department of Commerce |

| Bureau of Economic Analysis, BE-49(NI) | |

| Shipping and Receiving Section, M-100 | |

| 1441 L Street, NW | |

| Washington, DC 20005 | |

| Fax reports to: | (202) 606-5319 (send ONLY those pages on which information is reported) |

| Assistance: | |

| be13@bea.gov | |

| Telephone | (202) 606-5577 |

| Copies of form | www.bea.gov/fdi |

| Definitions: Underlined terms are defined on page XX. | |

| Due date: No later than 45 days after the completion of the investment transaction. | |

| Who must report: A BE-13 report is required of | |

| 1. A U.S. business enterprise when a foreign entity acquires a 10% or more voting interest (directly, or indirectly through an existing U.S. affiliate) in that enterprise; | |

| 2. A U.S. business enterprise when it is established if it has a foreign owner with 10% or more of its voting interest (directly, or indirectly through an existing U.S. affiliate); | |

| 3. An existing U.S. affiliate of a foreign parent when it acquires a U.S. business enterprise or segment that it then merges into its operations; and | |

| 4. An existing U.S. affiliate of a foreign parent when it expands its operations to include a new facility where business is conducted. | |

| Monetary values should be reported in thousands of U.S. dollars. If an amount is between positive and negative $500, enter "0." Use parentheses to indicate negative numbers. | |

| Exemption: A U.S. affiliate claiming exemption from filing a BE-13 report must complete page 2 (contact information, certification, and type of transaction) and page XX (claim for exemption). | |

| Retention of copies: Retain a copy of filed report for three years beyond the report's original due date. | |

| Purpose: This survey collects data on the acquisition or establishment of U.S. business enterprises by foreign investors and the expansion of existing U.S. affiliates of foreign companies to establish a new production facility. The data collect on the survey are used to measure the amount of new foreign direct investment in the United States, assess the impact on the U.S. economy, and based on this assessment, make informed policy decisions regarding foreign direct investment in the United States. | |

| Authority: This survey is being conducted under the International Investment and Trade in Services Survey Act (P.L. 94-472, 90 Stat. 2059, 22 U.S.C. 3101-3108, as amended), and the filing of reports is MANDATORY pursuant to Section 5(b)(2) of the Act (22 U.S.C. 3104). The implementing regulations are contained in Title 15, CFR, Part 806. | |

| Penalties: Whoever fails to report may be subject to a civil penalty of not less than $2,500, and not more than $25,000, and to injunctive relief commanding such person to comply, or both. Whoever willfully fails to report shall be fined not more than $10,000 and, if an individual, may be imprisoned for not more than one year, or both. Any officer, director, employee, or agent of any corporation who knowlingly participates in such violation, upon conviction, may be punished by a like fine, imprisonment, or both. (22 U.S.C. 3105) | |

| Notwithstanding any other provision of the law, no person is required to respond to, nor shall any person be subject to a penalty for failure to comply with, a collection of information subject to the requirements of the Paperwork Reduction Act, unless that collection of information displays a currently valid OMB Control Number. | |

| Respondent burden: Public reporting burden for this collection of information is estimated to average 1.5 hours per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing burdent, to: Director, Bureau of Economic Analysis (BE-1), U.S. Department of Commerce, Washington, DC 20230; and to the Office of Management and Budget, Paperwork Reduction Project 0608-0035, Washington, DC 20503. | |

| Confidentiality: The Act provides that your report to this Bureau is CONFIDENTIAL and may be used only for analytical or statistical purposes. Without your prior written permission, the information filed in your report CANNOT be presented in a manner that allows it to be individually identified. Your report CANNOT be used for purposes of taxation, investigation, or regulation. Copies retained in your files are immune from legal process. | |

Sheet 2: Part I - Transaction

| Person to Consult Concerning Questions about this Report | ||||

| Name | ||||

| Address | ||||

| Telephone number | ||||

| Fax number | ||||

| E-mail address | ||||

| May e-mail and/or fax be used in correspondence between your enterprise and BEA, including faxed reports, and/or to discuss questions relating to this survey that may contain confidential information about your company? | ||||

| Note: The internet and telephone systems are not secure means of transmitting confidential information unless it is encrypted. If you choose to communicate with BEA via fax or electronic mail, BEA cannot guarantee the security of the information during transmission, but will treat information we receive as confidential in accordance with Section 5(c) of the International Investment and Trade in Services Survey Act. | ||||

| Email: | Fax: | |||

| Yes | Yes | |||

| No | No | |||

| Certification | ||||

| The undersigned official certifies that this report has been prepared in accordance with the applicable instructions, is complete, and is substantially accurate except that, in accordance with the instructions, estimates may have been provided where data are not available from customary accounting records or precise data could not be obtained without undue burden. | ||||

| Authorized official's signature and date | Print or type name and title | |||

| Part I - Type of Transaction | ||||

| 1 | Which of the following statements best describes the new foreign investment for which this BE-13 report is being filed: | |||

| a. Acquisition of U.S. business enterprise…………………………….Complete Part II, beginning on page XX. | ||||

| A foreign entity acquires a 10% or more voting interest (directly, or indirectly through an existing U.S. affiliate) in a U.S. business enterprise. | ||||

| INCLUDE | ||||

| Purchase of U.S. real estate for the purpose of conducting real estate business. | ||||

| b. Establishment of new U.S. affiliate………………………………...Complete Part III, beginning on page XX. | ||||

| A foreign entity or an existing U.S. affiliate of a foreign entity establishes a new legal entity in the United States. The foreign entity owns 10% or more of the new business enterprise's voting interest (directly or indirectly). | ||||

| INCLUDE | ||||

| Creation of a new legal entity whether incorporated or unincorporated, including a branch. | ||||

| Creation of a new real estate business when it involves construction. | ||||

| Creation of a new legal entity even if it does not have physical operations. | ||||

| EXCLUDE | ||||

| Creation of a new real estate business when its assets were acquired rather than constructed by the foreign entity (directly or indirectly). | ||||

| c. Merger of Existing U.S. Affiliate with Newly Acquired Entity…Complete Part IV, beginning on page XX. | ||||

| An existing U.S. affiliate of a foreign parent acquires a U.S. business enterprise or segment that it then merges into its operations. | ||||

| d. Expansion of Existing U.S. Affiliate……………………………….Complete Part V, beginning on page XX. | ||||

| An existing U.S. affiliate of a foreign parent when it expands its operations to include a new facility where business is conducted. | ||||

| INCLUDE | ||||

| Construction or lease of a new facility by an existing U.S. affiliate. | ||||

| Construction of a facility that is intended for lease or sale. | ||||

| EXCLUDE | ||||

| Transfer of existing operations from one location to another. | ||||

| Replacement or upgrade of an existing facility. | ||||

| Expansion of an existing facility if it does not involve a separate structure from the existing operations. | ||||

Sheet 3: Part II - Acquisition

| Part II - Acquisition of U.S. Business Enterprise | ||||||

| 2 | What was the date that the acquisition took place? | _ _ / _ _ / _ _ _ _ | ||||

| 3 | What is the name and address of the new U.S. affiliate? | |||||

| Name | ||||||

| Address | ||||||

| 4 | What is the primary employer identification number to be used by the new U.S. affiliate to file income and payroll taxes? | _ | ||||

| 5 | How many U.S. affiliates are fully consolidated in this report? | NEED INSTRUCTIONS | ||||

| Ownership Information | ||||||

| 6 | What percent of the voting stock of the U.S. affiliate is held DIRECTLY by | |||||

| All foreign parents? | _ _ _ . _ % | |||||

| All U.S. affiliates of foreign parents? | _ _ _ . _ % | |||||

| Other foreign persons? | _ _ _ . _ % | |||||

| Other U.S. persons? | _ _ _ . _ % | |||||

| 100.0% | ||||||

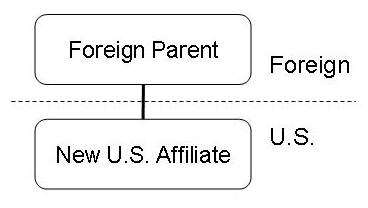

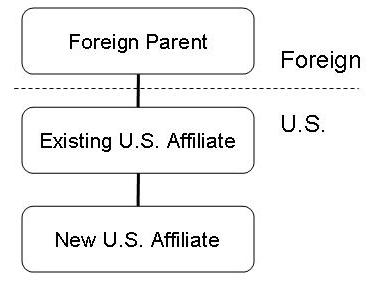

| 7 | Was the U.S. affiliate acquired directly by the foreign parent or by an existing U.S. affiliate of the foreign parent? | |||||

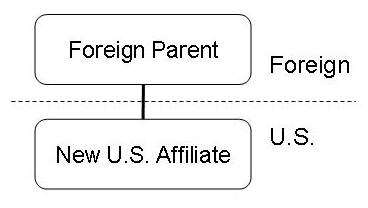

| Foreign parent (see example 1) - SKIP to item 11 | ||||||

| U.S. affiliate of foreign parent (see example 2) | ||||||

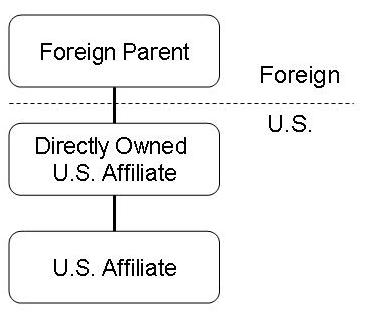

Example 1 - Foreign Parent Dirctly Owns New U.S. Affiliate

|

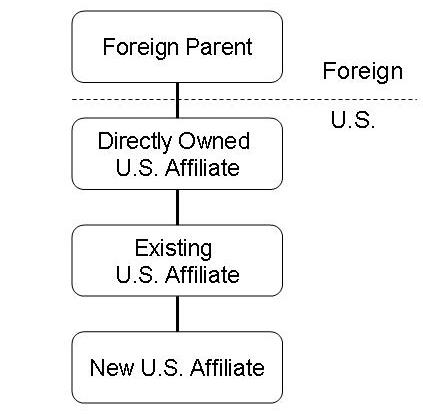

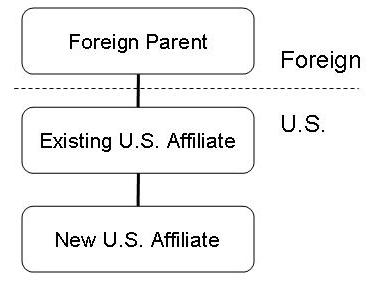

Example 2 - Foreign Parent Indirectly Owns New U.S. Affiliate through Existing U.S. Affiliate

|

|||||

| 8 | If the new U.S. affiliate was acquired by an existing U.S. affiliate of the foreign parent, what is the name and address of the existing affiliate? | |||||

| Name | ||||||

| Address | ||||||

| 9 | If the new U.S. affiliate was acquired by an existing U.S. affiliate of the foreign parent, is that existing U.S. affiliate DIRECTLY owned by the foreign parent? | |||||

| Yes - SKIP to item 11 | ||||||

| No (see example 3) | ||||||

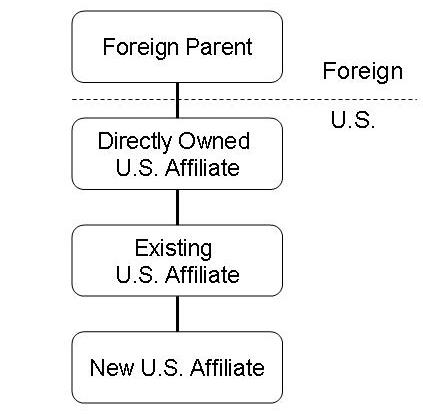

Example 3 - Existing U.S. affiliate that acquired the new U.S. affiliate is not owned directly by foreign parent

|

||||||

| 10 | If the answer to item 9 is "no," what is the name and address of the U.S. affiliate that is DIRECTLY owned by the foreign parent and the percent of voting ownership held by the foreign parent? | |||||

| Name | ||||||

| Address | ||||||

| Percent of voting ownership | _ _ _ . _ % | |||||

| 11 | What is the name, country, and industry of the foreign parent holding a direct or indirect voting interest in the U.S. affiliate? | |||||

| Name | ||||||

| Country | ||||||

| Industry - Enter 2-digit code (see page XX for industry codes) | _ _ | |||||

| 12 | Is the foreign parent also the ultimate beneficial owner (UBO)? | |||||

| Yes (see example 4) - SKIP to item 14 | ||||||

| No (see example 5) | ||||||

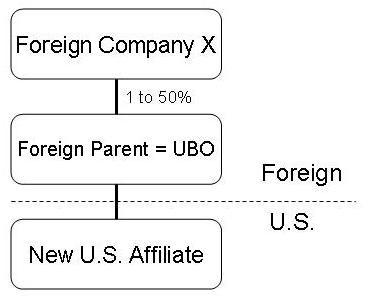

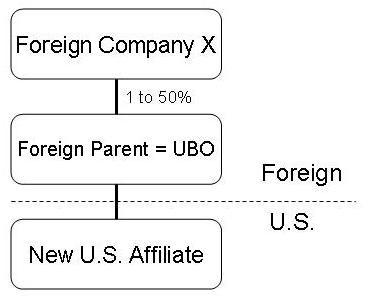

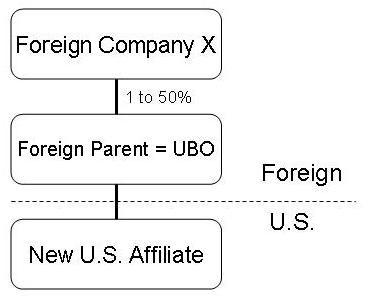

Example 4 - Foreign parent is UBO

|

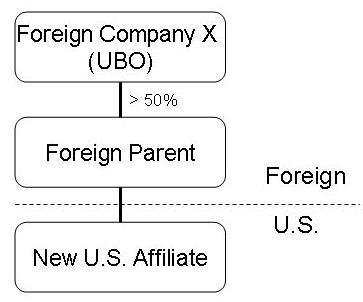

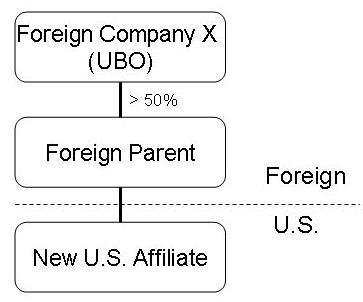

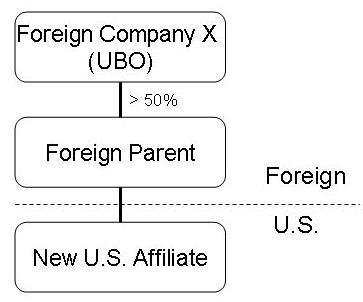

Example 5 - Foreign parent is not UBO

|

|||||

| 13 | What is the name, country, and industry of the ultimate beneficial owner? | |||||

| If the UBO is an individual, enter "individual" instead of the individual's name. | ||||||

| Name | ||||||

| Country | ||||||

| Industry - Enter 2-digit code (see page XX for industry codes) | _ _ | |||||

| 14 | Will data for the new U.S. affiliate be fully consolidated with data for the existing, or another U.S. affiliate in other international investment survey reports filed with this Bureau? | |||||

| Yes | ||||||

| No - SKIP to item 16 | ||||||

| 15 | If the answer to item 14 is "yes," What is the name of the U.S. business enterprise that files the consolidated report? | |||||

| Name | ||||||

| Transaction Information | ||||||

| 16 | Did the foreign parent or existing U.S. affiliate hold a direct ownership interest in the new U.S. affiliate immediately prior to the date of acquisition listed in item 2? | |||||

| Yes | ||||||

| No - SKIP to item 17 | ||||||

| 17 | If the answer to item 16 is "yes," what was the ownership interest (in percentage terms) that the new foreign parent or existing U.S. affiliate previously held in the new U.S. affiliate, the cost of such investment, and the date(s) acquired? | |||||

| (Exclude the cost of the transaction that qualified the U.S. business enterprise as a U.S. affiliate.) | ||||||

| Ownership interest | _ _ _ . _ % | |||||

| Cost of investment | $ 000 | |||||

| Date acquired | _ _ / _ _ / _ _ _ _ | |||||

| 18 | What is the name and address of the entity from whom the new affiliate was acquired? | |||||

| Name | ||||||

| Address | ||||||

| 19 | What was the cost of the acquisition? | |||||

| Include the cost of all voting and non-voting equity interests, but exclude cost, if any, reported in item 17. Equals sum of items 20 and 21. | $ 000 | |||||

| 20 | What was the portion of the cost in item 19 provided by an existing U.S. affiliate of the foreign parent? | $ 000 | ||||

| 21 | What was the portion of the cost in item 19 provided by foreign parent(s) and foreign affiliate(s) of the foreign parent(s), including funds they borrowed in the United States or abroad? Equals sum of items 22 and 23. | $ 000 | ||||

| 22 | What was the equity portion of the foreign funding in item 21? | $ 000 | ||||

| 23 | What was the debt portion of the foreign funding in item 21? | $ 000 | ||||

| Financial and Operating Information | ||||||

| 24 | What is the end date for the fiscal year that these financial and operating data are for? | _ _ / _ _ / _ _ _ _ | ||||

| 25 | What are the total assets of the new U.S. affiliate? | $ 000 | ||||

| 26 | What are the sales, or gross operating revenues, of the new U.S. affiliate? | $ 000 | ||||

| 27 | What is the net income (loss) of the U.S. affiliate after provision for U.S. Federal, state, and local income taxes? | $ 000 | ||||

| 28 | What is the total number of employees of the new U.S. affiliate? INCLUDE part time employees but EXCLUDE contract employees | |||||

| 29 | How many acres of U.S. land are owned by the affiliate (whether carried in a fixed asset, investment, or other asset account)? | |||||

| 30 | What are the major activities of the fully consolidated U.S. affiliate that was acquired? | |||||

| Check all that apply. | ||||||

| Producer of goods | ||||||

| Seller of goods you do not produce | ||||||

| Producer or distributor of information | ||||||

| Provider of services | ||||||

| Real estate | ||||||

| Other (specify) ---------------------------------> | ||||||

| 31 | What are the major product(s) and/or services involved in this activity? | |||||

| If a product, also state what is done to it, i.e., whether it is mined, manufactured, sold at wholesale, transported, packaged, etc. | ||||||

| 32 | What is the U.S. affiliate's four-digit industry code (based on sales or gross operating revenues)? (see page XX for industry codes) | _ _ _ _ | ||||

| 33 | Will research and development activities be conducted by the new U.S. affiliate? | |||||

| Yes | ||||||

| No | ||||||

Sheet 4: Part III - Establishment

| Part III - Establishment of New U.S. Affiliate | ||||||

| 2 | What was the date that the U.S. business enterprise was established? | _ _ / _ _ / _ _ _ _ | ||||

| 3 | What is the name and address of the new U.S. affiliate? | |||||

| Name | ||||||

| Address | ||||||

| 4 | What is the primary employer identification number to be used by the new U.S. affiliate to file income and payroll taxes? | _ | ||||

| 5 | How many U.S. affiliates are fully consolidated in this report? | |||||

| Ownership Information | ||||||

| 6 | What percent of the voting stock of the U.S. affiliate is held DIRECTLY by | |||||

| All foreign parents? | _ _ _ . _ % | |||||

| All U.S. affiliates of foreign parents? | _ _ _ . _ % | |||||

| Other foreign persons? | _ _ _ . _ % | |||||

| Other U.S. persons? | _ _ _ . _ % | |||||

| 100.0% | ||||||

| 7 | Was the U.S. affiliate established directly by the foreign parent or by an existing U.S. affiliate of the foreign parent? | |||||

| Foreign parent (see example 1) - SKIP to item 11 | ||||||

| U.S. affiliate of foreign parent (see example 2) | ||||||

Example 1 - Foreign Parent Dirctly Owns New U.S. Affiliate

|

Example 2 - Foreign Parent Indirectly Owns New U.S. Affiliate through Existing U.S. Affiliate

|

|||||

| 8 | If the new U.S. affiliate was established by an existing U.S. affiliate of the foreign parent, what is the name and address of the existing affiliate? | |||||

| Name | ||||||

| Address | ||||||

| 9 | If the new U.S. affiliate was established by an existing U.S. affiliate of the foreign parent, is that existing U.S. affiliate DIRECTLY owned by the foreign parent? | |||||

| Yes - SKIP to item 11 | ||||||

| No (see example 3) | ||||||

Example 3 - Existing U.S. affiliate that acquired the new U.S. affiliate is not owned directly by foreign parent

|

||||||

| 10 | If the answer to item 10 is "no," what is the name and address of the U.S. affiliate that is DIRECTLY owned by the foreign parent and the percent of voting ownership held by the foreign parent? | |||||

| Name | ||||||

| Address | ||||||

| Percent of voting ownership | _ _ _ . _ % | |||||

| 11 | What is the name, country, and industry of the foreign parent holding a direct or indirect voting interest in the U.S. affiliate? | |||||

| Name | ||||||

| Country | ||||||

| Industry - Enter 2-digit code (see page XX for industry codes) | _ _ | |||||

| 12 | Is the foreign parent also the ultimate beneficial owner (UBO)? | |||||

| Yes (see example 4) - SKIP to item 14 | ||||||

| No (see example 5) | ||||||

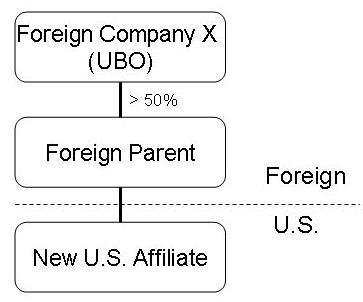

Example 4 - Foreign parent is UBO

|

Example 5 - Foreign parent is not UBO

|

|||||

| 13 | What is the name, country, and industry of the ultimate beneficial owner? | |||||

| If the UBO is an individual, enter "individual" instead of the individual's name. | ||||||

| Name | ||||||

| Country | ||||||

| Industry - Enter 2-digit code (see page XX for industry codes) | _ _ | |||||

| 14 | Will data for the new U.S. affiliate be fully consolidated with data for the existing, or another U.S. affiliate in other international investment survey reports filed with this bureau? | |||||

| Yes | ||||||

| No - SKIP to item 16 | ||||||

| 15 | If the answer to item 14 is "yes," What is the name of the U.S. business enterprise that files the consolidated report? | |||||

| Name | ||||||

| Establishment Information | ||||||

| 16 | What was the cost of the investment? | NEED MORE INFORMATION ABOUT THIS | ||||

| Include the cost of all voting and non-voting equity interests. Equals sum of items 17 and 18. | $ 000 | |||||

| 17 | What was the portion of the cost in item 16 provided by foreign parent(s) and foreign affiliate(s) of the foreign parent(s), including funds they borrowed in the United States or abroad? | $ 000 | ||||

| 18 | What was the portion of the cost in item 16 provided by an existing U.S. affiliate of the foreign parent? | $ 000 | ||||

| 19 | If the new U.S. affiliate is a holding company, will the holding company be dissolved within a year of its establishment? | |||||

| Yes | ||||||

| No | ||||||

| Financial and Operating Information | ||||||

| 20 | What is the end date for the fiscal year that these financial and operating data are for? | _ _ / _ _ / _ _ _ _ | ||||

| 21 | What are the total assets of the new U.S. affiliate? | $ 000 | ||||

| 22 | What are the sales, or gross operating revenues, of the new U.S. affiliate? | $ 000 | ||||

| 23 | What is the net income (loss) of the U.S. affiliate after provision for U.S. Federal, state, and local income taxes? | $ 000 | ||||

| 24 | How many acres of U.S. land are owned by the affiliate (whether carried in a fixed asset, investment, or other asset account)? | |||||

| 25 | What are the major activities of the fully consolidated U.S. affiliate that was established? | |||||

| Check all that apply. | ||||||

| Producer of goods | ||||||

| Seller of goods you do not produce | ||||||

| Producer or distributor of information | ||||||

| Provider of services | ||||||

| Real estate | ||||||

| Other (specify) ---------------------------------> | ||||||

| 26 | What are the major product(s) and/or services involved in this activity? | |||||

| If a product, also state what is done to it, i.e., whether it is mined, manufactured, sold at wholesale, transported, packaged, etc. | ||||||

| 27 | What is the U.S. affiliate's four-digit industry code (based on sales or gross operating revenues)? (see page XX for industry codes) | _ _ _ _ | ||||

| 28 | Will research and development activities be conducted by the new U.S. affiliate? | |||||

| Yes | ||||||

| No | ||||||

| Greenfield Investment Information | ||||||

| 29 | In which U.S. state or territory is the new operation located? | |||||

| 30 | What is the current employment of the new operation? INCLUDE part time employees but EXCLUDE contract employees | |||||

| 31 | What is the projected employment of the new operation when it is operating at full capacity? | |||||

| 32 | What is the gross book value of land associated with the new operation? | $ 000 | ||||

| 33 | What is the gross book value of plant and equipment associated with the new operation? | $ 000 | ||||

| 34 | Is the new operation currently under construction? | |||||

| Yes | ||||||

| Construction has not begun | ||||||

| Construction is complete | ||||||

| 35 | What are the total expected construction expenditures for this project? | $ 000 | ||||

| 36 | What are the construction expenditures broken out by year? (attach additional sheet if you need space for more years) | Year | $ 000 | |||

| Year | $ 000 | |||||

| Year | $ 000 | |||||

| Year | $ 000 | |||||

| Year | $ 000 | |||||

Sheet 5: Part IV - Merger

| Part IV - Merger of Existing U.S. Affiliate with Newly Acquired Entity | FIX TERMINOLOGY FOR PURCHASED ENTITY | |||||

| 2 | What was the date that the acquisition took place? | _ _ / _ _ / _ _ _ _ | ||||

| 3 | What is the name and address of the newly acquired entity? | |||||

| Name | ||||||

| Address | ||||||

| Ownership Information | ||||||

| 4 | What is the name and address of the existing U.S. affiliate that merged with the newly acquired entity? | |||||

| Name | ||||||

| Address | ||||||

| 5 | Is the U.S. affiliate DIRECTLY owned by the foreign parent? | |||||

| Yes - SKIP to item 7 | ||||||

| No (see example 1) | ||||||

Example 1 - Existing U.S. affiliate that acquired the new U.S. affiliate is not owned directly by foreign parent

|

||||||

| 6 | If the answer to item 6 is "no," what is the name of the U.S. affiliate that is DIRECTLY owned by the foreign parent and the percent of voting ownership held by the foreign parent? | |||||

| Name | ||||||

| Percent of voting ownership | _ _ _ . _ % | |||||

| 7 | What is the name, country, and industry of the foreign parent holding a direct or indirect voting interest in the U.S. affiliate? | |||||

| Name | ||||||

| Country | ||||||

| Industry - Enter 2-digit code (see page XX for industry codes) | _ _ | |||||

| 8 | Is the foreign parent also the ultimate beneficial owner (UBO)? | |||||

| Yes (see example 2) - SKIP to item 10 | ||||||

| No (see example 3) | ||||||

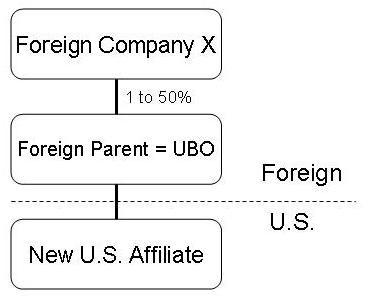

Example 2 - Foreign parent is UBO

|

Example 3 - Foreign parent is not UBO

|

|||||

| 9 | What is the name, country, and industry of the ultimate beneficial owner? | |||||

| If the UBO is an individual, enter "individual" instead of the individual's name. | ||||||

| Name | ||||||

| Country | ||||||

| Industry - Enter 2-digit code (see page XX for industry codes) | _ _ | |||||

| 10 | Will data for the new U.S. affiliate be fully consolidated with data for the existing, or another U.S. affiliate in other international investment survey reports filed with this bureau? | |||||

| Yes | ||||||

| No - SKIP to item 12 | ||||||

| 11 | If the answer to item 10 is "yes," what is the name of the U.S. business enterprise that files the consolidated report? | |||||

| Name | ||||||

| Transaction Information | ||||||

| 12 | Did the foreign parent or existing U.S. affiliate hold a direct ownership interest in the newly acquired entity immediately prior to the date of acquisition listed in item 2? | |||||

| Yes | ||||||

| No - SKIP to item 14 | ||||||

| 13 | If the answer to item 12 is "yes," what was the ownership interest (in percentage terms) that the new foreign parent or existing U.S. affiliate previously held in the newly acquired entity, the cost of such investment, and the date(s) acquired? | |||||

| (Exclude the cost of the transaction that took place on the date of acquisition listed in item 2.) | ||||||

| Ownership interest | _ _ _ . _ % | |||||

| Cost of investment | $ 000 | |||||

| Date acquired | _ _ / _ _ / _ _ _ _ | |||||

| 14 | What is the name and address of the entity from whom the newly acquired entity was purchased? | |||||

| Name | ||||||

| Address | ||||||

| 15 | What was the cost of the acquisition? Include the cost of all voting and non-voting equity interests, but exclude cost, if any, reported in item 13. | |||||

| Equals sum of items 16 and 17. | $ 000 | |||||

| 16 | What was the portion of the cost in item 15 provided by an existing U.S. affiliate of the foreign parent? | $ 000 | ||||

| 17 | What was the portion of the cost in item 15 provided by foreign parent(s) and foreign affiliate(s) of the foreign parent(s), including funds they borrowed in the United States or abroad? Equals sum of items 18 and 19. | $ 000 | ||||

| 18 | What was the equity portion of the foreign funding in item 17? | $ 000 | ||||

| 19 | What was the debt portion of the foreign funding in item 17? | $ 000 | ||||

| Financial and Operating Information | ||||||

| 20 | What is the end date for the fiscal year that these financial and operating data are for? | _ _ / _ _ / _ _ _ _ | ||||

| 21 | What are the total assets of the newly combined U.S. affiliate? | $ 000 | ||||

| 22 | What are the sales, or gross operating revenues, of the newly combined U.S. affiliate? | $ 000 | ||||

| 23 | What is the net income (loss) of the newly combined U.S. affiliate after provision for U.S. Federal, state, and local income taxes? | $ 000 | ||||

| 24 | What is the total number of employees of the newly combined U.S. affiliate? INCLUDE part time employees but EXCLUDE contract employees | |||||

| 25 | How many acres of U.S. land are owned by the newly combined U.S. affiliate (whether carried in a fixed asset, investment, or other asset account)? | |||||

| 26 | What are the major activities of the newly combined U.S. affiliate? Check all that apply. | |||||

| Producer of goods | ||||||

| Seller of goods you do not produce | ||||||

| Producer or distributor of information | ||||||

| Provider of services | ||||||

| Real estate | ||||||

| Other (specify) ---------------------------------> | ||||||

| 27 | What are the major product(s) and/or services involved in this activity? | |||||

| If a product, also state what is done to it, i.e., whether it is mined, manufactured, sold at wholesale, transported, packaged, etc. | ||||||

| 28 | What is the newly combined U.S. affiliate's four-digit industry code (based on sales or gross operating revenues)? (see page XX for industry codes) | _ _ _ _ | ||||

| 29 | Will research and development activities be conducted by the newly combined U.S. affiliate? | |||||

| Yes | ||||||

| No | ||||||

Sheet 6: Part V - Expansion

| Part V - Expansion of Existing U.S. Affiliate | |||||

| 2 | What was the date that the expansion project was begun? | _ _ / _ _ / _ _ _ _ | |||

| 3 | What is the name and address of the U.S. affiliate that is expanding its operations? | ||||

| Name | |||||

| Address | |||||

| Ownership Information | |||||

| 4 | What is the name, country, and industry of the foreign parent holding a direct or indirect voting interest in the U.S. affiliate? | ||||

| Name | |||||

| Country | |||||

| Industry - Enter 2-digit code (see page XX for industry codes) | _ _ | ||||

| 5 | Is the foreign parent also the ultimate beneficial owner (UBO)? | ||||

| Yes (see example 1) - SKIP to item 7 | |||||

| No (see example 2) | |||||

Example 1 - Foreign parent is UBO

|

Example 2 - Foreign parent is not UBO

|

||||

| 6 | What is the name, country, and industry of the ultimate beneficial owner? | ||||

| If the UBO is an individual, enter "individual" instead of the individual's name. | |||||

| Name | |||||

| Country | |||||

| Industry - Enter 2-digit code (see page XX for industry codes) | _ _ | ||||

| Greenfield Investment Information | |||||

| 7 | In which U.S. state or territory is the new operation located? | ||||

| 8 | What are the major activities of the new operation? Check all that apply. | ||||

| Producer of goods | |||||

| Seller of goods you do not produce | |||||

| Producer or distributor of information | |||||

| Provider of services | |||||

| Real estate | |||||

| Other (specify) ---------------------------------> | |||||

| 9 | What are the major product(s) and/or services involved in this activity? | ||||

| If a product, also state what is done to it, i.e., whether it is mined, manufactured, sold at wholesale, transported, packaged, etc. | |||||

| 10 | What is the U.S. affiliate's four-digit industry code (based on sales or gross operating revenues)? (see page XX for industry codes) | _ _ _ _ | |||

| 11 | What is the current employment of the new operation? | ||||

| 12 | What is the projected employment of the new operation when it is operating at full capacity? | ||||

| 13 | What is the gross book value of land associated with the new operation? | $ 000 | |||

| 14 | What is the gross book value of plant and equipment associated with the new operation? | $ 000 | |||

| 15 | Is the new operation currently under construction? | ||||

| Yes | |||||

| Construction has not begun | |||||

| Construction is complete | |||||

| 16 | What are the total expected construction expenditures for this project? | $ 000 | |||

| 17 | What are the construction expenditures broken out by year? (attach additional sheet if you need space for more years) | Year | $ 000 | ||

| Year | $ 000 | ||||

| Year | $ 000 | ||||

| Year | $ 000 | ||||

| Year | $ 000 | ||||

| 18 | Will research and development activities be conducted by the new operation? | ||||

| Yes | |||||

| No | |||||

Sheet 7: Part VI - Exemption

| Part VI - Exemption Claim | ||

| This U.S. business enterprise is exempt from filing Form BE-13 because: | ||

| Mark (X) on of the items 1 through XXXXXX. | ||

| 1 | This U.S. business enterprise is not a U.S. affiliate of a foreign person, i.e., is nto owned to the extent of 10 percent or more, directly or indirectly, by a foreign person. | |

| 2 | This acquisition is exempt from being reported because the U.S. business enterprise, or the business segment or operating unit of a U.S. business enterprise, was acquired by an existing U.S. affiliate who then merged it into its own operations and the total cost of the acquisition was $3 million or less. | |

| What is the total cost of the acquisition? | $ 000 | |

| 3 | This acquisition is not required to be reported since it represents U.S. real estate acquired bya foreign person(s) held excludsively for personal use and not for profitmaking purposes. | |

| 4 | This U.S. business enterprise is a U.S. affiliate of a foreign perosn but is exempt because, on a fully consolidated domestic U.S. basis, total assets (not the foreign parent's or existing U.S. affiliate's share) at the time of acquisition or immediately after being established were $3 million or less. | |

| What were the U.S. affiliate's total assets (do not net out liabilities)? | $ 000 | |

| What were the U.S. affiliate's sales or gross operating revenues, excluding sales taxes? | $ 000 | |

| What was the U.S. affiliate's net income after provision for U.S. income taxes? | $ 000 | |

| What is the industry of the U.S. affiliate (based on the industry of largest sales? | ||

| See industry code list on page XX. | _ _ _ _ | |

| What is the country of the U.S. affiliate's foreign parent? | ||

| What is the country of the U.S. affiliate's ultimate beneficial owner? | ||

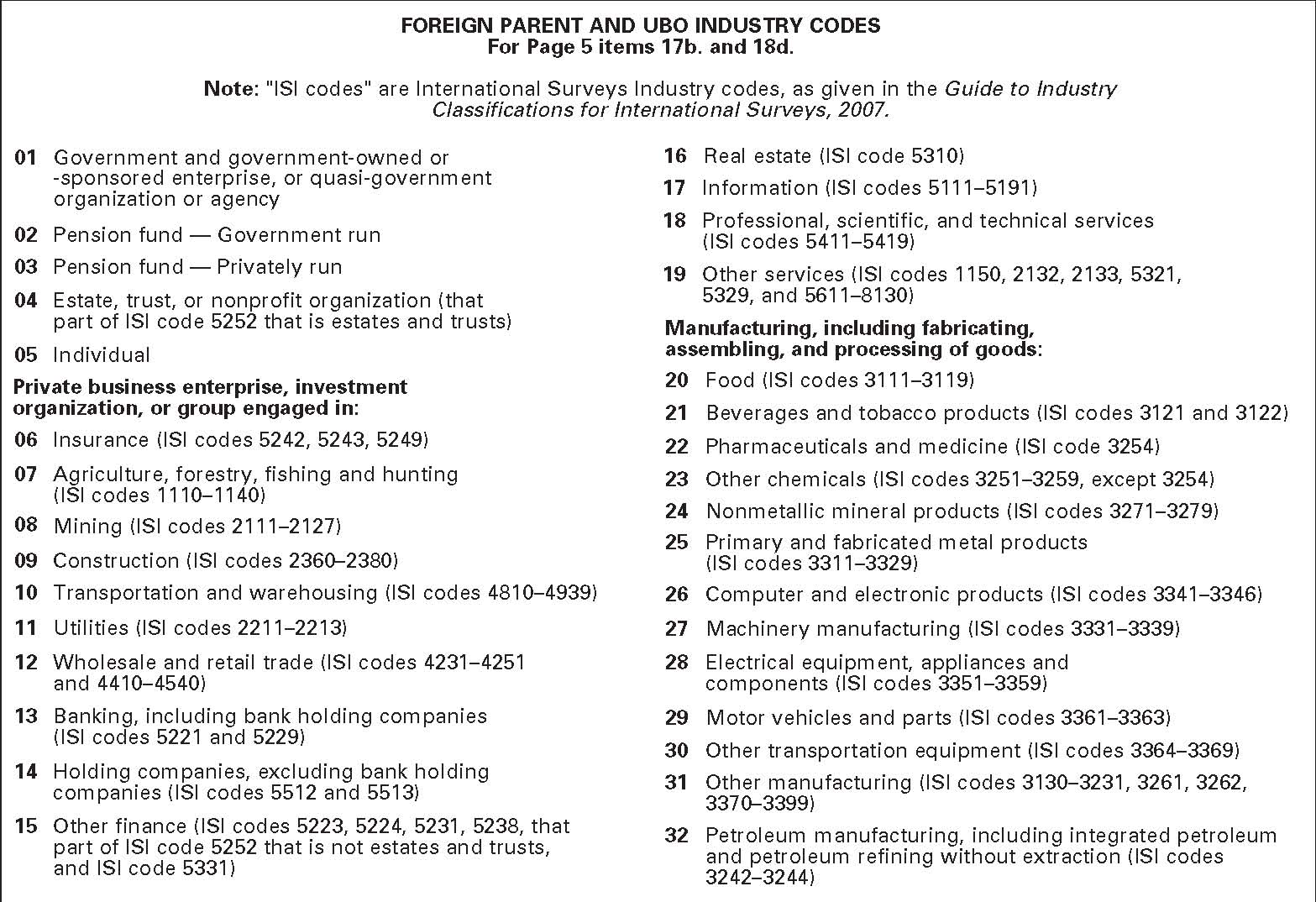

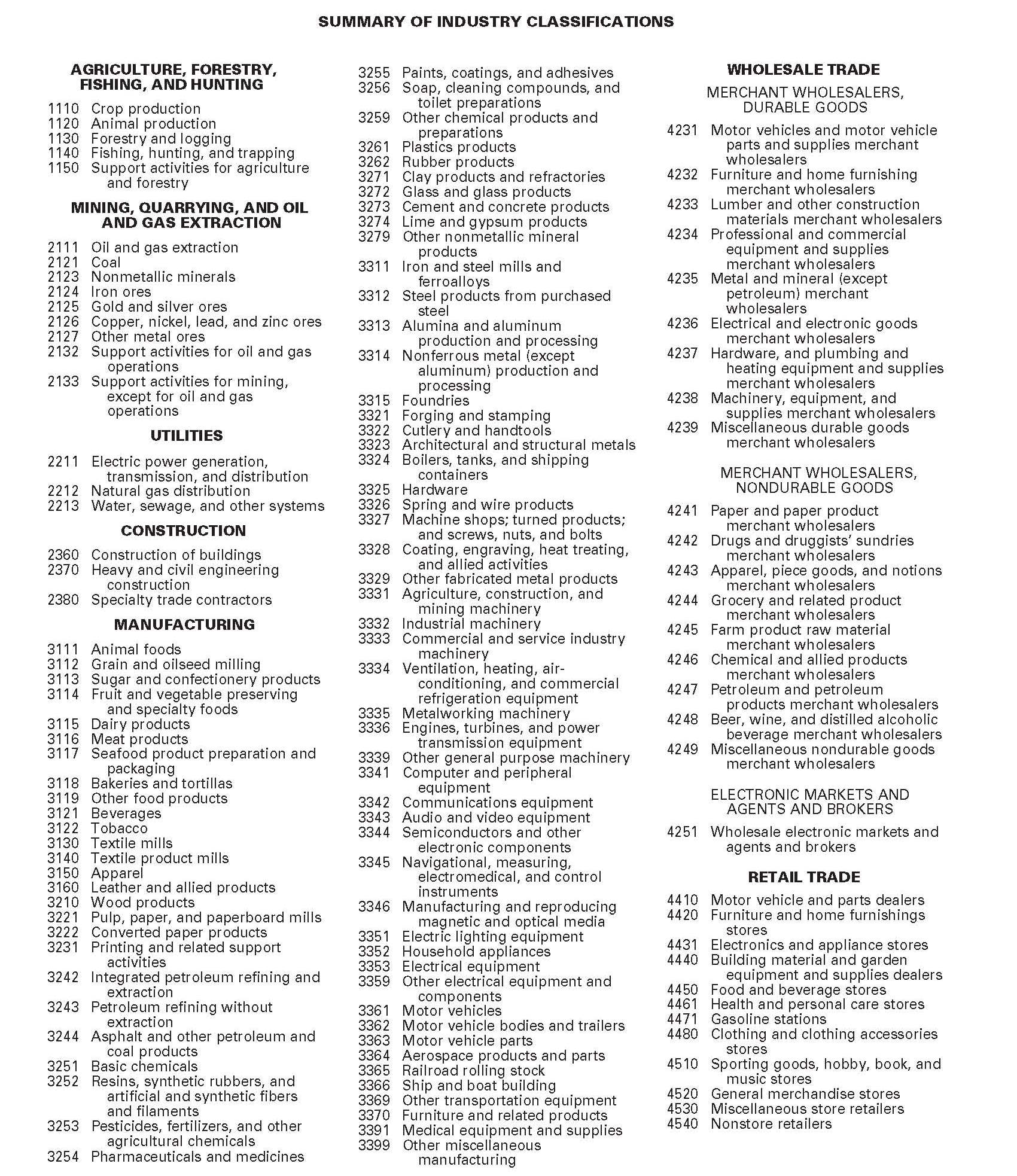

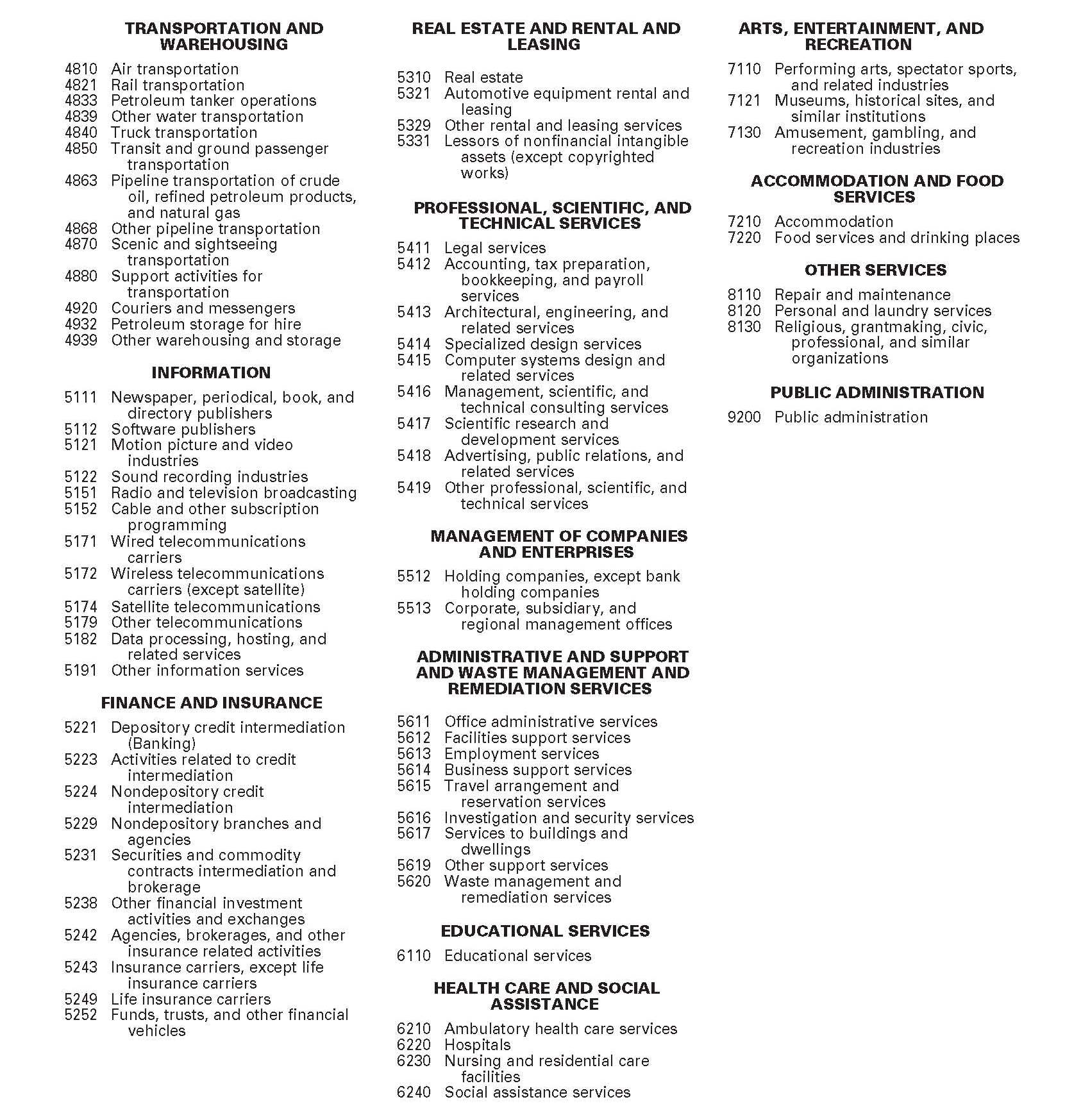

Sheet 8: Industry codes

|

||||||||||||

Sheet 9: Definitions

| Definitions |

| Acquisition |

| Affiliate |

| Direct ownership |

| Establishment |

| Foreign parent |

| Indirect ownership |

| U.S. affiliates of foreign parents |

| Ultimate beneficial owner |

| Expansion |

| Merger |

| File Type | application/vnd.ms-excel |

| Author | BEA |

| Last Modified By | mom |

| File Modified | 2009-11-06 |

| File Created | 2009-09-01 |

© 2026 OMB.report | Privacy Policy