30 CFR Part 780

Part 780.doc

30 CFR 780.25, 780.28, and 780.35 for Excess Spoil Final Rule

30 CFR Part 780

OMB: 1029-0128

e-CFR Data is current as of July 25, 2008

PART 870—ABANDONED MINE RECLAMATION FUND—FEE COLLECTION AND COAL PRODUCTION REPORTING

![]()

Section

Contents

§ 870.1 Scope.

§ 870.5 Definitions.

§ 870.10 Information

collection.

§ 870.11 Applicability.

§ 870.12 Reclamation

fee.

§ 870.13 Fee

rates.

§ 870.14 Determination

of percentage-based fees.

§ 870.15 Reclamation

fee payment.

§ 870.16 Production

records.

§ 870.17 Filing

the OSM–1 Form electronically.

§ 870.18 General

rules for calculating excess moisture.

§ 870.19 How

to calculate excess moisture in HIGH-rank coals.

§ 870.20 How

to calculate excess moisture in LOW-rank coals.

![]()

Authority: 28 U.S.C. 1746, 30 U.S.C. 1201 et seq., and Pub. L. 105–277.

Source: 47 FR 28593, June 30, 1982, unless otherwise noted.

§ 870.1 Scope.

This part sets out the procedures for the collection of fees for the Abandoned Mine Reclamation Fund.

§ 870.5 Definitions.

As used in part 870 through 888 of this subchapter—

Abandoned Mine Reclamation Fund or Fund means a special fund established on the books of the U.S. Treasury for the purpose of accumulating revenues designated for reclamation of abandoned mine lands and other activities authorized by Title IV of the Act.

Agency means the State agency designated by the Governor, or in the case of Indian tribes, the Tribal agency designated by the equivalent head of an Indian tribe, to administer the State/Indian tribe reclamation program and to receive and administer grants under this part.

Allocate means the administrative identification in the records of OSM of moneys in the fund for a specific purpose, e.g., identification of moneys for exclusive use by a State.

Anthracite, bituminous and subbituminous coal means all coals other than lignite coal.

Calendar quarter means a 3-month period within a calendar year. The first calendar quarter begins on January 1 of the calendar year and ends on the last day of March. The second calendar quarter begins on the first day of April and ends on the last day of June. The third calendar quarter begins on the first day of July and ends on the last day of September. The fourth calendar quarter begins on the first day of October and ends on the last day of December.

Eligible lands and water means land and water eligible for reclamation or drainage abatement expenditures which were mined for coal or which were affected by such mining, wastebanks, coal processing, or other coal mining processes and left or abandoned in either an unreclaimed or inadequately reclaimed condition prior to August 3, 1977, and for which there is no continuing reclamation responsibility. Provided, however, that lands and water damaged by coal mining operations after that date and on or before November 5, 1990, may also be eligible for reclamation if they meet the requirements specified in 30 CFR 874.12 (d) and (e). Following certification of the completion of all known coal problems, eligible lands and water for noncoal reclamation purposes are those sites that meet the eligibility requirements specified in 30 CFR 874.14. For additional eligibility requirements for water projects, see 30 CFR 874.14, and for lands affected by remining operations, see Section 404 of the Act.

Emergency means a sudden danger or impairment that presents a high probability of substantial physical harm to the health, safety, or general welfare of people before the danger can be abated under normal program operation procedures.

Excess moisture means the difference between total moisture and inherent moisture, calculated according to §870.19 for high-rank coals or the difference between total moisture and inherent moisture calculated according to §870.20 for low-rank coals.

Expended means that moneys have been obligated, encumbered, or committed for reclamation by contract by the OSM, State, or Tribe for work to be accomplished or services to be rendered.

Extreme danger means a condition that could reasonably be expected to cause substantial physical harm to persons, property, or the environment and to which persons or improvements on real property are currently exposed.

Fee compliance officer means any person authorized by the Secretary to exercise authority in matters relating to this part.

In situ coal mining means activities conducted on the surface or underground in connection with in-place distillation, retorting, leaching or other chemical or physical processing of coal. The term includes, but is not limited to, in situ gasification, in situ leaching, slurry mining, solution mining, bore hole mining, and fluid recovery mining. At this time, part 870 considers only in situ gasification.

Indian Abandoned Mine Reclamation Fund or Indian Fund means a separate fund established by an Indian tribe for the purpose of accounting for moneys granted by the Director under an approved Indian Reclamation Program and other moneys authorized by these regulations to be deposited in the Indian Fund.

Indian reclamation program means a program established by an Indian tribe in accordance with this chapter for reclamation of lands and water adversely affected by past mining, including the reclamation plan and annual applications for grants under the plan.

Inherent moisture means moisture that exists as an integral part of the coal seam in its natural state, including water in pores, but excluding that present in macroscopically visible fractures, as determined according to §870.19(a) or §870.20(a).

Left or abandoned in either an unreclaimed or inadequately reclaimed condition means lands and water:

(a) Which were mined or which were affected by such mining, wastebanks, processing or other mining processes prior to August 3, 1977, or between August 3, 1977 and November 5, 1990, as authorized pursuant to Section 402(g)(4) of the Act, and on which all mining has ceased;

(b) Which continue, in their present condition, to degrade substantially the quality of the environment, prevent or damage the beneficial use of land or water resources, or endanger the health and safety of the public; and

(c) For which there is no continuing reclamation responsibility under State or Federal Laws, except as provided in Sections 402(g)(4) and 403(b)(2) of the Act.

Lignite coal means consolidated lignite coal having less than 8,300 British thermal units per pound, moist and mineral-matter-free. Moist, mineral-matter free British thermal units per pound are determined by Parr's formula, equation 3, on page 222 of “Standard Specification for Classification of Coals by Rank,” in American Society for Testing and Materials ASTM D 388–77 (Philadelphia, 1977). Parr's formula follows:

Moist, Mn-Free Btu=

(Bu−50S)/[100−(1.08A+0.55S)]×100

where:

Mn = Mineral matter

Btu = British thermal units per pound (calorific value)

A = percentage of ash, and

S = percentage of sulfur

“Moist” refers to coal containing its natural inherent or bed moisture, but not including water adhering to the surface of the coal.

Mineral owner means any person or entity owning 10 percent or more of the mineral estate for a permit. If no single mineral owner meets the 10 percent rule, then the largest single mineral owner shall be considered to be the mineral owner. If there are several persons who have successively transferred the mineral rights, information shall be provided on the last owner(s) in the chain prior to the permittee, i.e. the person or persons who have granted the permittee the right to extract the coal.

OSM means the Office of Surface Mining Reclamation and Enforcement.

Permanent facility means any structure that is built, installed or established to serve a particular purpose or any manipulation or modification of the surface that is designed to remain after the reclamation activity is completed, such as a relocated stream channel or diversion ditch.

Project means a delineated area containing one or more abandoned mine land problems. A project may be a group of related reclamation activities with a common objective within a political subdivision of a State or within a logical, geographically defined area, such as a watershed, conservation district, or county planning area.

Qualified hydrologic unit means a hydrologic unit:

(a) In which the water quality has been significantly affected by acid mine drainage from coal mining practices in a manner that adversely impacts biological resources; and

(b) That contains lands and waters which are:

(1) Eligible pursuant to Section 404 and include any of the first three priorities stated in Section 403(a); or

(2) Proposed to be the subject of the expenditures by the State (from amounts available from the forfeiture of a bond required under Section 509 or from other State sources) to mitigate acid mine drainage.

Reclaimed coal means coal recovered from a deposit that is not in its original geological location, such as refuse piles or culm banks or retaining dams and ponds that are or have been used during the mining or preparation process, and stream coal deposits. Reclaimed coal operations are considered to be surface coal mining operations for fee liability and calculation purposes.

Reclamation activity means the reclamation, abatement, control, or prevention of adverse effects of past mining.

Reclamation plan means a plan submitted and approved under part 884 of this chapter.

State Abandoned Mine Reclamation Fund or State Fund means a separate fund established by a State for the purpose of accounting for moneys granted by the Director under an approved State Reclamation Program and other moneys authorized by these regulations to be deposited in the State Fund.

State reclamation program means a program established by a State in accordance with this chapter for reclamation of lands and water adversely affected by past mining, including the reclamation plan and annual applications for grants.

Surface coal mining means the extraction of coal from the earth by removing the materals over the coal seam before recovering the coal and includes auger coal mining. For purposes of subchapter R, reclaiming coal operations are considered surface coal mining.

Ton means 2,000 pounds avoirdupois (0.90718 metric ton).

Total moisture means the measure of weight loss in an air atmosphere under rigidly controlled conditions of temperature, time and air flow, as determined according to either §870.19(a) or §870.20(a).

Underground coal mining means the extraction of coal from the earth by developing entries from the surface to the coal seam before recovering the coal by underground extraction methods, and includes in situ mining.

Value means gross value at the time of initial bona fide sale, transfer of ownership, or use by the operator, but does not include the reclamation fee required by this part.

[47 FR 28593, June 30, 1982, as amended at 53 FR 19726, May 27, 1988; 59 FR 28168, May 31, 1994; 60 FR 9980, Feb. 22, 1995; 62 FR 60142, Nov. 6, 1997]

Effective Date Note: At 59 FR 60318, Nov. 23, 1994, in §870.5, “The definition of Qualified hydrologic unit is suspended in so far as it does not require a hydrologic unit to be both:

(1) Eligible pursuant to Section 404 and include any of the first three priorities stated in Section 403(a), and

(2) Proposed to be the subject of expenditures by the State (from amounts available from the forfeiture of a bond required under Section 509 or from other State sources) to mitigate acid mine drainage in order to be considered a qualified hydrologic unit.”

§ 870.10 Information collection.

The collections of information contained in part 870 and the Form OSM–1 have been approved by the Office of Management and Budget under 44 U.S.C. 3501 et seq. and assigned clearance numbers 1029–0090 and 1029–0063 respectively. The information will be used by the Office of Surface Mining Reclamation and Enforcement to determine whether coal mine operators are reporting accurate production figures and paying proper fees. Response is mandatory in accordance with Public Law 95–87. Public reporting burden for this collection of information is estimated to average 2 hours (1029–0090) and 16 minutes (1029–0063) per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing the burden, to the Office of Surface Mining Reclamation and Enforcement, Information Collection Clearance Officer, room 640 N.C., 1951 Constitution Avenue NW., Washington, DC 20240 and the Office of Management and Budget, Paperwork Reduction Project (1029–0063) or (1029–0090), Washington, DC 20503.

[59 FR 28169, May 31, 1994]

§ 870.11 Applicability.

The regulations in this part apply to all surface and underground coal mining operations except—

(a) The extraction of coal by a landowner for his own noncommercial use from land owned or leased by him;

(b) The extraction of coal for commercial purposes by surface coal mining operations which affects two acres or less during the life of the mine;

(c) The extraction of coal as an incidental part of Federal, State, or local government-financed highway or other construction;

(d) The extraction of coal incidental to the extraction of other minerals where coal does not exceed 162/3percent of the total tonnage of coal and other minerals removed for commercial use or sale

(1) In accordance with part 702 of this chapter for Federal program States and on Indian lands or

(2) In any twelve consecutive months in a State with an approved State program until counterpart regulations pursuant to part 702 of this chapter have been incorporated into the State program and in accordance with such counterpart regulations, thereafter; and

(e) The extraction of less than 250 tons of coal within twelve consecutive months.

[47 FR 28593, June 30, 1982, as amended at 54 FR 52123, Dec. 20, 1989; 54 FR 52123, Dec. 20, 1989]

Effective Date Note: At 52 FR 21229, June 4, 1987, in §870.11 paragraph (b) was suspended insofar as it excepts from the applicability of 30 CFR part 870:

(1) Any surface coal mining operations commencing on or after June 6, 1987; and

(2) Any surface coal mining operations conducted on or after November 8, 1987.

§ 870.12 Reclamation fee.

(a) The operator shall pay a reclamation fee on each ton of coal produced for sale, transfer, or use, including the products of in situ mining.

(b) The fee shall be determined by the weight and value at the time of initial bona fide sale, transfer of ownership, or use by the operator.

(1) The initial bona fide sale, transfer of ownership, or use shall be determined by the first transaction or use of the coal by the operator immediately after it is severed, or removed from a reclaimed coal refuse deposit.

(2) The value of the coal shall be determined F.O.B. mine.

(3) The weight of each ton shall be determined by the actual gross weight of the coal.

(i) Impurities that have not been removed prior to the time of initial bona fide sale, transfer of ownership, or use by the operator, excluding excess moisture for which a reduction has been taken pursuant to §870.18, shall not be deducted from the gross weight.

(ii) Operators selling coal on a clean coal basis shall retain records that show run-of-mine tonnage, and the basis for the clean coal transaction.

(iii) Insufficient records shall subject the operator to fees based on raw tonnage data.

(c) If the operator combines surface mined coal, including reclaimed coal, with underground mined coal before the coal is weighed for fee purposes, the higher reclamation fee shall apply, unless the operator can substantiate the amount of coal produced by surface mining by acceptable engineering calculations or other reports which the Director may require.

(d) The reclamation fee shall be paid after the end of each calendar quarter beginning with the calendar quarter starting October 1, 1977.

[47 FR 28593, June 30, 1982, as amended at 53 FR 19726, May 27, 1988; 59 FR 28169, May 31, 1994; 69 FR 56130, Sept. 17, 2004]

§ 870.13 Fee rates.

(a) Fees for coal produced for sale, transfer, or use through September 30, 2004 . (1) Surface mining fees. The fee for anthracite, bituminous, and subbituminous coal, including reclaimed coal, is 35 cents per ton unless the value of such coal is less than $3.50 per ton, in which case the fee is 10 percent of the value.

(2) Underground mining fees. The fee for anthracite, bituminous, and subbituminous coal is 15 cents per ton unless the value of such coal is less than $1.50 per ton, in which case the fee is 10 percent of the value.

(3) Surface and underground mining fees for lignite coal. The fee for lignite coal is 10 cents per ton unless the value of such coal is less than $5.00 per ton, in which case the fee charged is 2 percent of the value.

(4) In situ coal mining fees. The fee for in situ mined coal, except lignite coal, is 15 cents per ton based on Btu's per ton in place equated to the gas produced at the site as certified through analysis by an independent laboratory. The fee for in situ mined lignite is 10 cents per ton based on the Btu's per ton of coal in place equated to the gas produced at the site as certified through analysis by an independent laboratory.

(b) Fees for coal produced for sale, transfer, or use after September 30, 2004. In this paragraph (b), “we” refers to OSM, “Combined Fund” refers to the United Mine Workers of America Combined Benefit Fund established under section 9702 of the Internal Revenue Code of 1986 (26 U.S.C. 9702), and “unassigned beneficiaries premium account” refers to the account established under section 9704(e) of the Internal Revenue Code of 1986 (26 U.S.C. 9704(e)).

(1) Fees to be set annually. We will establish the fee for each ton of coal produced for sale, transfer, or use after September 30, 2004, on an annual basis. The fee per ton is based on the total fees required to be paid each fiscal year, as determined under paragraph (b)(2) of this section, allocated among the estimated coal production categories, as provided in paragraph (b)(3) of this section. We will publish the fees for each fiscal year after Fiscal Year 2005 in theFederal Registerat least 30 days before the start of that fiscal year. Once we publish the fees, they will not change for that fiscal year and they will apply to all coal produced during that fiscal year.

(2) Calculation of the total fee collections needed. The total amount of fee collections needed for any fiscal year is the amount that must be transferred from the Fund to the Combined Fund under section 402(h) of the Act (30 U.S.C. 1232(h)) for that fiscal year, with any necessary adjustments for the amount of any fee overcollections or undercollections in prior fiscal years. We will calculate the amount of total fee collections needed as follows:

(i) Step one. We will determine the smallest of the following numbers:

(A) The estimated net interest earnings of the Fund during the fiscal year;

(B) $70 million; or

(C) The most recent estimate provided by the trustees of the Combined Fund of the amount that will be debited against the unassigned beneficiary premium account for that fiscal year (“the Combined Fund's needs”).

(ii) Step two. We will increase or decrease, as appropriate, the amount determined under step one by the amount of any adjustments to previous transfers to the Combined Fund resulting from a difference between estimated and actual interest earnings or the estimated and actual Combined Fund's needs. This paragraph (b)(2)(ii) applies only to adjustments to transfers for prior fiscal years beginning on or after October 1, 2004, and only to those adjustments that have not previously been taken into account in establishing fees for prior years.

(iii) Step three. We will adjust the amount determined under steps one and two of this section by an amount equal to the difference between the fees actually collected (based on estimated production) and the amount that should have been collected (based on actual production) for any prior fiscal year beginning on or after October 1, 2004, if the difference has not previously been taken into account in establishing fees for prior years.

(3) Establishment of fees. We will use the following procedure to establish the per-ton fees for each fiscal year:

(i) Step one. We will estimate the total tonnage of coal that will be produced during that fiscal year and for which a fee payment obligation exists, categorized by the types of coal and mining methods described in paragraph (b)(3)(ii) of this section.

(ii) Step two. We will allocate the total fee collection needs determined under paragraph (b)(2) of this section among the various categories of estimated coal production under paragraph (b)(3)(i) of this section to establish a per-ton fee based upon the following parameters:

(A) The per-ton fee for anthracite, bituminous or subbituminous coal produced by underground methods will be 43 percent of the rate for the same type of coal produced by surface methods.

(B) Regardless of the method of mining, the per-ton fee for lignite coal will be 29 percent of the rate for other types of coal mined by surface methods.

(C) The per-ton fee for in situ mined coal will be the same as the fees set under paragraphs (b)(3)(ii)(A) and (B) of this section, depending on the type of coal mined. The fee will be based upon the quantity and quality of gas produced at the site, converted to Btu's per ton of coal upon which in situ mining was conducted, as determined by an analysis performed and certified by an independent laboratory.

[47 FR 28593, June 30, 1982, as amended at 69 FR 56130, Sept. 17, 2004]

§ 870.14 Determination of percentage-based fees.

(a) If the operator submits a fee based on a percentage of the value of coal, the operator shall include, with his fee and production report, documentation supporting the alleged coal value. Based on this information and any additional documentation; including examination of the operator's books and records, that the Director may require, the Director may accept the valuation submitted by the operator, or may otherwise determine the value of the coal.

(b) If the Director determines that a higher fee shall be paid, the operator shall submit the additional fee together with interest computed under §870.15(c).

§ 870.15 Reclamation fee payment.

(a) Each operator shall pay the reclamation fee based on calendar quarter tonnage no later than thirty days after the end of each calendar quarter.

(b) Each operator must use mine report Form OSM–1 (or any approved successor form) to report the tonnage of coal sold, used, or transferred. The report must also include the name and address of any person or entity who, in a given quarter, is the owner of 10 percent or more of the mineral estate for a given permit, and any entity or individual who, in a given quarter, purchases ten percent or more of the production from a given permit during the applicable quarter. The operator can file a report under this section either in paper format or in electronic format as specified in §870.17. If no single mineral owner or purchaser meets the 10 percent rule, then the largest single mineral owner and purchaser shall be reported. If several persons have successively transferred the mineral rights, information shall be provided on the last owner(s) in the chain prior to the permittee, i.e. the person or persons who have granted the permittee the right to extract the coal. At the time of reporting, a submitter may designate such information as confidential.

(c) As of April 1, 1983, delinquent reclamation fee payments are subject to interest at the rate established quarterly by the U.S. Department of the Treasury for use in applying late charges on late payments to the Federal Government, pursuant to Treasury Fiscal Requirements Manual 6–8020.20. The Treasury current value of funds rate is published by the Fiscal Service in the Notices section of theFederal Register.Interest on unpaid reclamation fees shall begin to accure on the 31st day following the end of the calendar quarter for which the fee payment is owed and will run until the date of payment. OSM will bill delinquent operators on a monthly basis and initiate whatever action is necessary to secure full payment of all fees and interest. All operators who receive a Coal Sales and Reclamation Fee Report (Form OSM–1), including those with zero sales, uses, or transfers, must submit a completed Form OSM–1, as well as any fee payment due. Fee payments postmarked later than thirty days after the calendar quarter for which the fee was owed will be subject to interest.

(d)(1) An operator who owes total quarterly reclamation fees of $25,000 or more for one or more mines shall:

(i) Use an electronic fund transfer mechanism approved by the U.S. Department of the Treasury;

(ii) Forward its payments by electronic transfer;

(iii) Include the applicable Master Entity No.(s) (Part 1—Block 4 on the OSM–1 form), and OSM Document No.(s) (Part 1—upper right corner of the OSM–1 form) on the wire message; and

(iv) Use OSM's approved form or approved electronic form to report coal tonnage sold, used, or for which ownership was transferred, to the address indicated in the Instructions for Completing the OSM–1 Form.

(2) An operator who owes less than $25,000 in quarterly reclamation fees for one or more mines may:

(i) Forward payments by electronic transfer in accordance with the procedures specified in paragraph (d)(1) of this section; or

(ii) Submit a check or money order payable to the Office of Surface Mining Reclamation and Enforcement, in the same envelope with OSM's approved form to: Office of Surface Mining Reclamation and Enforcement, P.O. Box 360095M, Pittsburgh, Pennsylvania 15251.

(3) An operator who submits a payment of more than $25,000 by a method other than an electronic fund transfer mechanism approved by the U.S. Department of the Treasury shall be in violation of the Surface Mining Control and Reclamation Act of 1977, as amended.

(e) Failure to pay overdue reclamation fees, including interest on late payments or underpayments, failure to maintain adequate records, or failure to provide access to records of a surface coal mining operation may result in one or more of the following actions: (1) Initiation of litigation; (2) reporting to the Internal Revenue Service; (3) reporting to State agencies responsible for taxation; (4) reporting to credit bureaus; or (5) referral to collection agencies. Such remedies are not exclusive.

(f) When a reclamation fee debt is greater than 91 days overdue, a 6 percent per annum penalty shall begin to accure on the amount owed for fees and will run until the date of payment. This penalty is in addition to the interest described in paragraph (c) of this section.

(g)(1) For all delinquent fees, interest and any penalties, the debtor will be required to pay a processing and handling charge which shall be based upon the following components:

(i) For debts referred to a collection agency, the amount charged to OSM by the collection agency;

(ii) For debts processed and handled by OSM, a standard amount set annually by OSM based upon similar charges by collection agencies for debt collection;

(iii) For debts referred to the Solicitor, Department of the Interior, but paid prior to litigation, the estimated average cost to prepare the case for litigation as of the time of payment;

(iv) For debts referred to the Solicitor, Department of the Interior, and litigated, the estimated cost to prepare and litigate a debt case as of the time of payment; and

(v) If not otherwise provided for, all other administrative expenses associated with collection, including, but not limited to, billing, recording payments, and follow-up actions.

(2) No prejudgment interest accrues on any processing and handling charges.

(Pub. L. 95–87, 30 U.S.C. 1201 et seq.; Pub. L. 97–365, 5 U.S.C. 5514 et seq. )

[47 FR 28593, June 30, 1982, as amended at 48 FR 11100, Mar. 15, 1983; 49 FR 27499, July 5, 1984; 59 FR 14479, Mar. 28, 1994; 59 FR 28169, May 31, 1994; 66 FR 28636, May 23, 2001]

§ 870.16 Production records.

(a) Any person engaging in or conducting a surface coal mining operation shall maintain, on a current basis, records that contain at least the following information:

(1) Tons of coal produced, bought, sold or transferred, amount received per ton, name of person to whom sold or transferred, and the date of each sale or transfer.

(2) Tons of coal used by the operator and date of consumption.

(3) Tons of coal stockpiled or inventoried which are not classified as sold for fee computation purposes under §870.12.

(4) For in situ coal mining operations, total BTU value of gas produced, the BTU value of a ton of coal in place certified at least semiannually by an independent laboratory, and the amount received for gas sold, transferred, or used.

(b) OSM fee compliance officers and other authorized representatives shall have access to records of any surface coal mining operation for the purpose of determining compliance of that or any other such operation with this part.

(c) Any person engaging in or conducting a surface coal mining operation shall make available any book or record necessary to substantiate the accuracy of reclamation fee reports and payments at reasonable times for inspection and copying by OSM fee compliance officers. If the fee is paid at the maximum rate, the fee compliance officers shall not copy information relative to price. All copied information shall be protected to the extent authorized or required by the Privacy Act and the Freedom of Information Act (5 U.S.C. 552 (a), (b)).

(d) Any persons engaging in or conducting a surface coal mining operation shall maintain books and records for a period of 6 years from the end of the calendar quarter in which the fee was due or paid, whichever is later.

(e)(1) If an operator of a surface coal mining operation fails to maintain or make available the records as required in this section, OSM shall make an estimate of fee liability under this part through use of average production figures based upon the nature and acreage of the coal mining operation in question, then assess the fee at the amount estimated to be due, plus a 20 percent upward adjustment for possible error.

(2) Following an OSM estimate of fee liability, an operator may request OSM to revise the estimate based upon information provided by the operator. The operator has the burden of demonstrating that the estimate is incorrect by providing documentation acceptable to OSM, and comparable to information required in §870.16(a).

(Pub. L. 95–87, 30 U.S.C. 1201 et seq.; Pub. L. 97–365, 5 U.S.C. 5514 et seq. )

[49 FR 27500, July 5, 1984]

§ 870.17 Filing the OSM–1 Form electronically.

You, the operator, may submit a quarterly electronic OSM–1 Form in place of a quarterly paper OSM–1 Form. Submitting the OSM–1 Form electronically is optional. If you submit your form electronically, you must use a methodology and medium approved by OSM, and do one of the following:

(a) Maintain a properly notarized paper copy of the identical OSM–1 Form for review and approval by OSM's Fee Compliance auditors. (This is needed to comply with the notary requirement in the Act.); or

(b) Submit an electronically signed and dated statement made under penalty of perjury that the information contained in the OSM–1 Form is true and correct.

[66 FR 28636, May 23, 2001]

§ 870.18 General rules for calculating excess moisture.

If you are an operator who mined coal after June 1988, you may deduct the weight of excess moisture in the coal to determine reclamation fees you owe under 30 CFR 870.12(b)(3)(i). Excess moisture is the difference between total moisture and inherent moisture. To calculate excess moisture in HIGH-rank coal, follow §870.19. To calculate excess moisture in LOW-rank coal, follow §870.20. Report your calculations on the OSM–1 form, Coal Reclamation Fee Report, for every calendar quarter in which you claim a deduction. Some cautions:

(a) You or your customer may do any test required by §§870.19 and 870.20. But whoever does a test, you are to keep test results and all related records for at least six years after the test date.

(b) If OSM disallows any or all of an allowance for excess moisture, you must submit an additional fee plus interest computed according to §870.15(c) and penalties computed according to §870.15(f).

(c) The following definitions are applicable to §§870.19 and 870.20. ASTM standards D4596–93, Standard Practice for Collection of Channel Samples of Coal in a Mine; D5192–91, Standard Practice for Collection of Coal Samples from Core; and, D1412–93, Standard Test Method for Equilibrium Moisture of Coal at 96 to 97 Percent Relative Humidity and 30 °C are incorporated by reference as published in the 1994 Annual Book of ASTM Standards, Volume 05.05. The Director of the Federal Register approved this incorporation by reference in accordance with 5 U.S.C. 552(a) and 1 CFR part 51. Each applicable ASTM standard is incorporated as it exists on the date of the approval, and a notice of any change in it will be published in theFederal Register.You may obtain copies from the ASTM, 100 Barr Harbor Drive, West Conshohocken, Pennsylvania 19428. A copy of the ASTM standards is available for inspection at the Office of Surface Mining Reclamation and Enforcement, Administrative Record, Room 101, 1951 Constitution Avenue, NW., Washington, DC, or at the National Archives and Records Administration (NARA). For information on the availability of this material at NARA, call 202–741–6030, or go to: http://www.archives.gov/federal_register/code_of_federal_regulations/ibr_locations.html.

(1) As-shipped coal means raw or prepared coal that is loaded for shipment from the mine or loading facility.

(2) Blended coal means coals of various qualities and predetermined quantities mixed to control the final product.

(3) Channel sample means a sample of coal collected according to ASTM standard D4596–93 from a channel extending from the top to the bottom of a coal seam.

(4) Commingled coal means coal from different sources and/or types combined prior to shipment or use.

(5) Core sample means a cylindrical sample of coal that represents the thickness of a coal seam penetrated by drilling according to ASTM standard D5192–91.

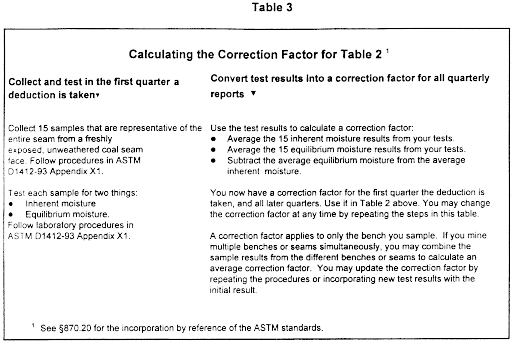

(6) Correction factor means the difference between the equilibrium moisture and the inherent moisture in low rank coals for the purpose of §870.20(a).

(7) Equilibrium moisture means the moisture in the coal as determined through ASTM standard D1412–93.

(8) High-rank coals means anthracite, bituminous, and subbituminous A and B coals.

(9) Low-rank coals means subbituminous C and lignite coals.

(10) Slurry pond means any natural or artificial pond or lagoon used for the settlement and draining of the solids from the slurry resulting from the coal washing process.

(11) Tipple coal means coal from a mine or loading facility that is ready for shipment.

[62 FR 60142, Nov. 6, 1997]

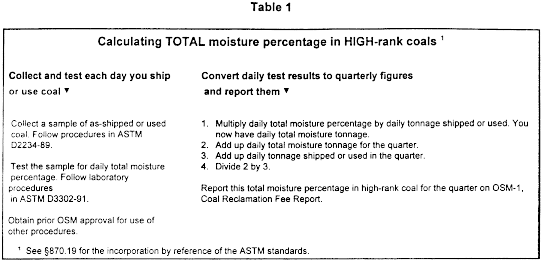

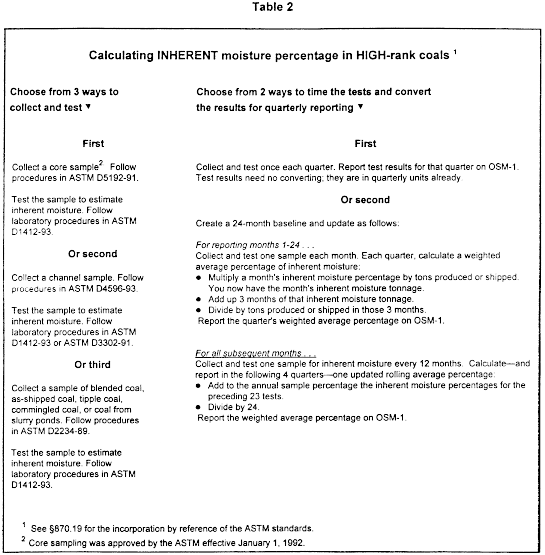

§ 870.19 How to calculate excess moisture in HIGH-rank coals.

Here are the requirements for calculating the excess moisture in high-rank coals for a calendar quarter. ASTM standards D2234–89, Standard Test Methods for Collection of a Gross Sample of Coal ; D3302–91, Standard Test Method for Total Moisture in Coal ; D5192–91, Standard Practice for Collection of Coal Samples from Core ; D1412–93, Standard Test Method for Equilibrium Moisture of Coal at 96 to 97 Percent Relative Humidity and 30 °C ; and, D4596–93, Standard Practice for Collection of Channel Samples of Coal in a Mine are incorporated by reference as published in the 1994 Annual Book of ASTM Standards, Volume 05.05. The Director of the Federal Register approved this incorporation by reference in accordance with 5 U.S.C. 552(a) and 1 CFR part 51. Each applicable ASTM standard is incorporated as it exists on the date of the approval, and a notice of any change in it will be published in theFederal Register.You may obtain copies from the ASTM, 100 Barr Harbor Drive, West Conshohocken, Pennsylvania 19428. A copy of the ASTM standards is available for inspection at the Office of Surface Mining Reclamation and Enforcement, Administrative Record, Room 101, 1951 Constitution Avenue, NW., Washington, DC, or at the National Archives and Records Administration (NARA). For information on the availability of this material at NARA, call 202–741–6030, or go to: http://www.archives.gov/federal_register/code_of_federal_regulations/ibr_locations.html.

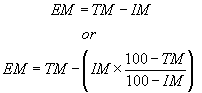

(a)(1) Calculate the excess moisture percentage using one of these equations:

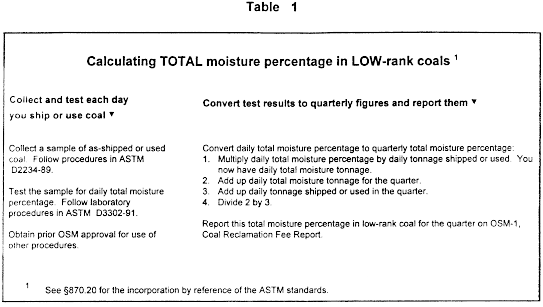

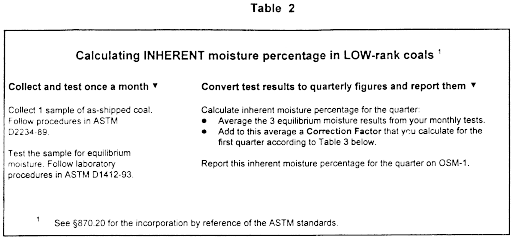

(2) EM equals excess moisture percentage. TM equals total as-shipped moisture percentage calculated according to Table 1 of this section. IM equals inherent moisture percentage calculated according to Table 2 of this section.

(b) Multiply the excess moisture percentage by the tonnage from the bonafide sales, transfers of ownership, or uses by the operator during the quarter.

[62 FR 60143, Nov. 6, 1997]

§ 870.20 How to calculate excess moisture in LOW-rank coals.

Here are the requirements for calculating the excess moisture in low-rank coals for a calendar quarter. ASTM standards D2234–89, Standard Test Methods for Collection of a Gross Sample of Coal; D3302–91, Standard Test Method for Total Moisture in Coal; and, D1412–93, Standard Test Method for Equilibrium Moisture of Coal at 96 to 97 Percent Relative Humidity and 30 °C are incorporated by reference as published in the 1994 Annual Book of ASTM Standards, Volume 05.05. The Director of the Federal Register approved this incorporation by reference in accordance with 5 U.S.C. 552(a) and 1 CFR part 51. Each applicable ASTM standard is incorporated as it exists on the date of the approval, and a notice of any change in it will be published in theFederal Register.You may obtain copies from the ASTM, 100 Barr Harbor Drive, West Conshohocken, Pennsylvania 19428. A copy of the ASTM standards is available for inspection at the Office of Surface Mining Reclamation and Enforcement, Administrative Record, Room 120, 1951 Constitution Avenue, NW., Washington, DC, or at the National Archives and Records Administration (NARA). For information on the availability of this material at NARA, call 202–741–6030, or go to: http://www.archives.gov/federal_register/code_of_federal_regulations/ibr_locations.html.

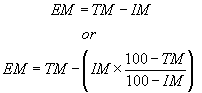

(a)(1) Calculate the excess moisture percentage using one of these equations:

(2) EM equals excess moisture percentage. TM equals total as-shipped moisture percentage calculated according to Table 1 of this section. IM equals inherent moisture percentage calculated according to Tables 2 and 3 of this section.

(b) Multiply the excess moisture percentage by the tonnage from the bona fide sales, transfers of ownership, or uses by the operator during the quarter.

[62 FR 60146, Nov. 6, 1997]

![]()

For

questions or comments regarding e-CFR editorial content, features, or

design, email ecfr@nara.gov.

For

questions concerning e-CFR programming and delivery issues, email

webteam@gpo.gov.

Section

508 / Accessibility

| File Type | application/msword |

| File Title | e-CFR Data is current as of July 25, 2008 |

| Author | JTrelease |

| Last Modified By | JTrelease |

| File Modified | 2008-07-29 |

| File Created | 2008-07-29 |

© 2026 OMB.report | Privacy Policy